1. Introduction

Colombia is the fourth-largest producer of avocados worldwide. In the Montes de María region, in the north of the country, Creole-Antillean avocados are cultivated, characterized by their thin skin, abundant pulp, and large seed. The thinness of the skin shortens the ripening period and reduces resistance to long-distance transport, making these fruits more vulnerable to deterioration due to climatic and logistical conditions [

1]. To address this limitation, the valorization of fruits less suitable for human consumption emerges as an alternative to reduce pollution generated by the accumulation of biomass in crops, as well as to mitigate economic losses derived from the lack of marketing strategies [

2]. Although the industry currently uses the Hass variety for oil extraction, the use of the Creole-Antillean avocado is innovative, as its potential allows not only the production of oil but also the recovery of seed and peel derivatives through the application of the biorefinery concept [

3]. The use of agricultural residues is therefore projected as a strategy to reduce the environmental impacts associated with the inadequate disposal of damaged fruits while simultaneously generating economic alternatives for local producers [

4]. In Latin America, bioeconomy has been consolidated as a strategic approach aimed at productive diversification and territorial sustainability. In Colombia, the National Bioeconomy Policy recognizes the capacity of biological resources to be transformed into high-value goods and services, thus fostering economic and social development [

5]. This approach aligns with international initiatives that highlight the relevance of bioeconomy for achieving the Sustainable Development Goals (SDGs), especially in highly biodiverse countries such as Colombia [

6].

In this context, the present study proposes the integration of Marketing 3.0 with the biorefinery concept for the valorization of the Creole-Antillean avocado cultivated in the Montes de María region. The concept of Marketing 3.0, introduced by Philip Kotler, highlights the need to align business strategies with fundamental values such as sustainability, social responsibility, and emotional engagement with consumers [

7]. This evolution of marketing, which has shifted from a product-centered approach to a society-oriented one, has found increasing applications in sectors related to the bioeconomy, where the efficient use of biological resources is a priority [

8,

9,

10]. At the same time, a marketing approach grounded in bioeconomic principles fosters commercial development by incorporating environmental, economic, and social considerations [

11]. The transition toward more sustainable international markets responds to consumers who are increasingly aware of the impact of their purchasing decisions, compelling companies to transform their production and commercial models [

12]. Consequently, agriculture and agroindustrial systems face the challenge of adapting to these new demands, driving the diversification of avocado-derived products [

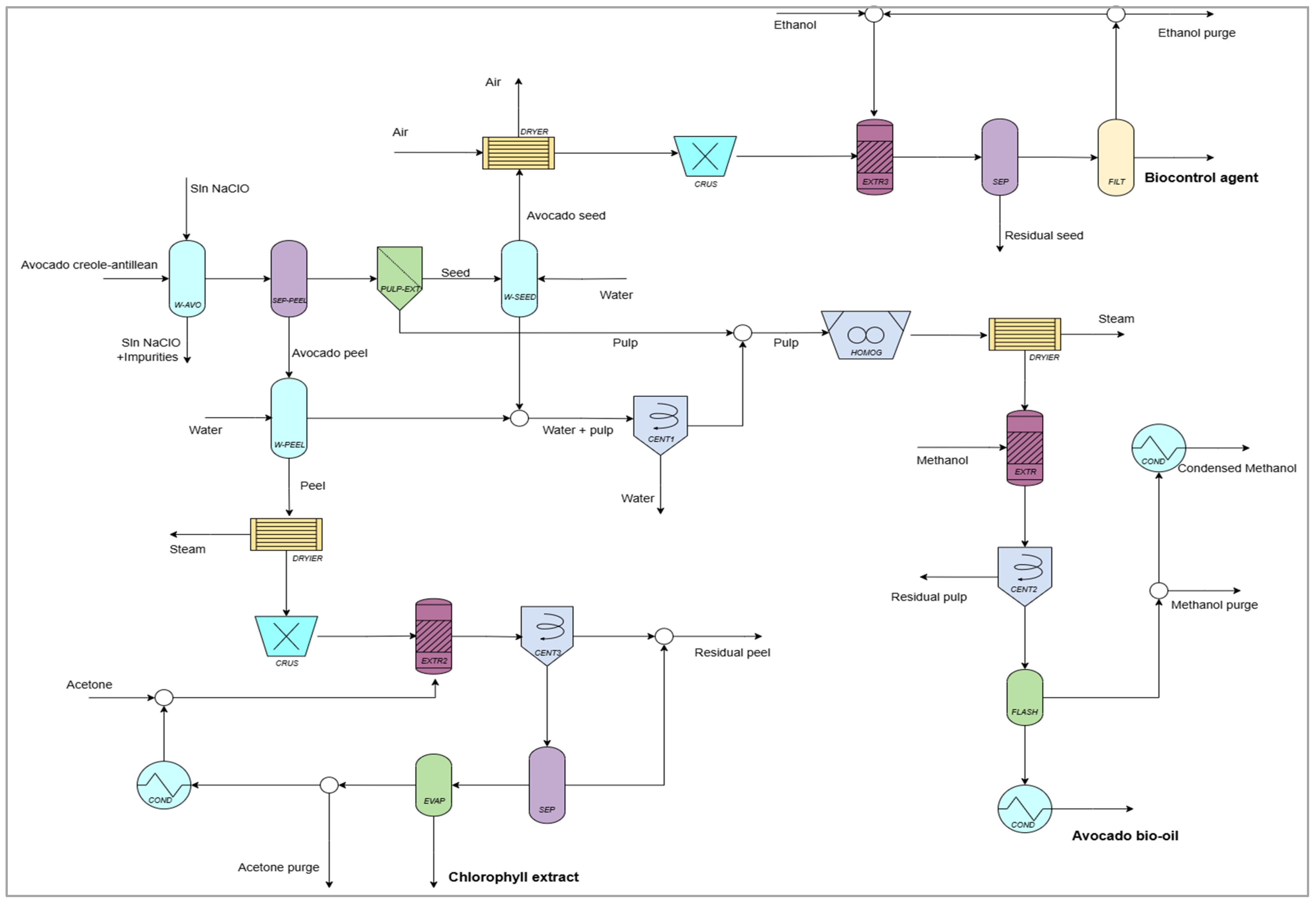

13]. Within this framework, the extractive-based avocado biorefinery seeks to maximize the utilization of the fruit through the production of bio-oil, chlorophyll, and biocontrol agents [

14,

15]. The design of a process that transforms residues or biological raw materials into value-added products or energy, while minimizing waste generation and reducing energy and resource consumption, is what defines a biorefinery [

16,

17].

Market segmentation makes it possible to identify consumer preferences and needs in relation to a specific product [

18]. In the case of avocado, this practice allows the recognition of different interested sectors, including the cosmetic, pharmaceutical, food, and agricultural industries, each with particular requirements regarding quality, characteristics, and applications. Consequently, this process supports the design of differentiated strategies that enhance marketing effectiveness and facilitate the introduction of new products into the market [

19,

20]. Furthermore, corporate social responsibility constitutes a central component of marketing strategies, as it integrates local communities within the area of influence through job creation, the hiring of local labor, and compliance with existing labor regulations [

21]. As a result, not only is the regional economy strengthened, but social inclusion and territorial development are also promoted [

22,

23,

24]. In addition, market analysis enables the identification of companies with similar activities, allowing comparisons in aspects such as pricing, quality, extraction methods, and market access. This information is therefore essential to link the biorefinery concept to the generation of higher value-added products, as well as to the implementation of strategies aimed at sustainability and community well-being [

25,

26].

In the literature, several studies address marketing applied to avocado valorization. García et al. developed a commercialization plan in the Montes de María region, specifically in the municipality of El Carmen de Bolívar, where they identified the absence of market strategies, deficiencies in post-harvest management, and low levels of technological development in productive activities. Their proposal included actions to improve competitiveness in the national market and diversify the product portfolio with items such as vacuum-packed pulp, guacamole, and oil, while also emphasizing cost reduction, quality enhancement, and producer organization [

2]. Complementarily, Muñoz and Palacio analyzed the impact of marketing strategies on Hass avocado exports to the United States. Through a methodology combining literature review and interviews with exporters, they identified the relevance of digital marketing and formulated recommendations to strengthen international commercialization [

27]. In turn, Díaz et al. explored alternative commercialization strategies for Hass avocado cultivated in the Valle del Cauca, with emphasis on the export of both fresh and processed fruit for oil production. Their study describes industrialization and post-harvest processes, including refrigeration, drying, and freeze-drying methods, as pathways to improve the crop’s competitiveness [

28].

Regarding avocado biorefineries, Solarte et al. designed different topologies in which they evaluated economic performance, processing scale, and contextual influence. In a small-scale scenario, they proposed the utilization of creole avocado to produce oil, feed, and energy, while another alternative considered guacamole and electricity production, with the former being more suitable for rural areas. At a large scale, the authors suggested the production of levulinic acid, lignin, and furfural, identifying greater economic feasibility for countries such as Colombia [

29]. Complementarily, Saratale et al. developed a biorefinery from avocado seeds, focused on the production of bioplastics and silver nanoparticles through solvent extraction. Their results showed that the bioplastic exhibits good thermal stability and that bioactive compounds coat the nanoparticles, confirming their antimicrobial activity [

30]. Similarly, Orrego and Cardona designed biorefineries based on passion fruit, orange, and avocado peels as raw materials; in the case of avocado, biogas (from peel and seed), animal feed, oil, and electricity were obtained [

31]. Likewise, Ríos et al. analyzed the establishment of an avocado oil extraction and commercialization plant for cosmetic purposes in Bogotá, leveraging proximity to companies in the sector. Taken together, these studies demonstrate significant advances in the valorization and commercialization of avocado, as well as in biorefinery development [

32]. However, no integrated application has yet been reported in the Montes de María region. It is worth noting that the literature has highlighted the potential of biorefineries to replace fossil inputs through the integral use of biomass [

33]. In this context, the present research seeks to fill a knowledge gap and contribute to the global debate on the role of bioeconomy in sustainable development [

34].

The objective of this research is to develop a bioeconomy model that integrates a marketing strategy and the biorefinery concept for the transformation of creole–Antillean avocado cultivated in Montes de María into value-added products, incorporating principles of sustainability and social responsibility. The study aims to identify market opportunities, evaluate existing competition, and establish positioning strategies that highlight the strategic advantage of this variety compared to Hass avocado, which dominates global trade. To this end, market segmentation was analyzed to determine potential consumers in the food, cosmetic, pharmaceutical, and agricultural industries, together with an assessment of trade trends in bio-oil, chlorophyll, and biocontrol agents. Furthermore, the research proposes integrating corporate social responsibility practices through the hiring of local labor and the implementation of agricultural waste management programs, ensuring socio-environmental benefits in the region. Finally, a market study is proposed to identify export opportunities and national and international trade dynamics, considering production, distribution, and demand factors. Overall, this work formulates a comprehensive strategy that combines technological innovation and commercial differentiation, aimed at consolidating a sustainable and competitive development model adapted to the specific conditions of Montes de María.

3. Results

Some studies conducted in Colombia and other countries in the Americas have focused on evaluating biorefineries from economic, environmental, or social perspectives. Sandoval et al. [

54] valorized avocado agricultural residues (peel, seed, and pulp) to obtain products such as starch, oil, bioactive compounds, fiber, and biofuels, highlighting their economic potential and contribution to the Sustainable Development Goals, although without including a detailed techno-economic analysis. Carman and Sexton [

55] analyzed how Hass avocado imports from Mexico and Chile negatively affected domestic prices and demonstrated that the implementation of collective promotion programs and marketing strategies helped counteract these effects and increase consumption in the U.S. Meanwhile, García et al. [

56] evaluated four avocado valorization scenarios in Caldas (Colombia) to produce guacamole, animal feed, bioactive compounds, oil, biogas, and fertilizers, concluding that residues allocated to bioactive compounds, biogas, fertilizers, and animal feed were the most profitable option, yielding 60–70% profits without generating significant social risks. Similarly, Rodríguez et al. [

57] proposed a seed and peel biorefinery to obtain polyphenolic extracts, pectin oligomers, and succinic acid, highlighting techno-economic feasibility and orientation toward sustainable markets. Finally, Alviz et al. [

58] simulated a cascading biorefinery in the Colombian Amazon to produce starch and bioplastics from avocado seeds, contributing to sustainability and the circular economy.

Overall, these studies show that avocado biorefineries generate economic benefits (profitability up to 70% and product diversification), environmental benefits (waste and emission reduction), and social benefits (employment and inclusive value chains), supporting their contribution to sustainability. The proposal in this work advances a step further by integrating a multi-stage approach with Marketing 3.0 strategies, targeting vulnerable territories such as Montes de María. In this way, the replicability of the model in other regions of the Global South facing exclusion, conflict, or low productive diversification is reinforced. The following section presents the results of the market study conducted using the database and social aspects related to the Montes de María region.

3.1. Avocado Bio-Oil Market

Table 3 presents five companies operating in different countries, including Colombia and Mexico. All of them use the Hass avocado variety as their primary raw material, indicating a predominant industry standard. The derived products include premium oil, crude oil, and extra virgin oil, with applications across the food, cosmetic, and pharmaceutical sectors. Additionally, some companies expand their offerings to other derivatives such as flours, starches, and vegetable olein. The predominance of Hass avocado as a raw material reflects the industry’s preference for this variety, possibly due to its greater availability and fatty acid profile, which makes it particularly attractive for oil extraction. However, this study proposes leveraging the Creole-Antillean avocado, presenting a market differentiation opportunity. From a commercial perspective, prices and extraction methods can influence product competitiveness. Companies like NBF Company offer both extra virgin oil (cold-pressed) and refined oil (chemically extracted), suggesting differentiation based on processing methods. This point is particularly relevant to the biorefinery proposal, as cold pressing is crucial to preserving nutritional properties and attracting specialized sectors such as cosmetics and pharmaceuticals. Furthermore, Colombian companies tend to have a more limited product diversification approach, whereas Mexican firms expanded their portfolios to include butter and vegetable olein [

8]. This reinforces the need for a clear commercial strategy for the Creole-Antillean avocado biorefinery process, ensuring its competitiveness through value-added attributes like sustainability and differentiation in raw material origin [

7].

The Creole-Antillean avocado variety contains a high percentage of oleic acid, a monounsaturated fatty acid present in omega-9 [

43]. In addition, this type of avocado has a composition with elevated levels of minerals, proteins, and fibers [

59]. This variety, native to the region, holds significant cultural relevance, as it involves the use of a local product to obtain various value-added goods while simultaneously addressing environmental, economic, and social challenges in the area. According to the TradeMap database, there are approximately 20 industries in Colombia dedicated to avocado oil production, whereas at the global level around 150 companies are engaged in this activity. This contrast highlights the differences in production and commercialization scales between the Colombian and international markets. In these companies, Hass avocado serves as the primary raw material; therefore, the proposed biorefinery based on the Creole-Antillean avocado introduces an approach that may generate competitive advantages and market differentiation [

9]. Colombia still has a wide margin for growth in the production and commercialization of avocado oil, since an increasing number of processes for avocado valorization are emerging, opening opportunities for the development of new businesses with sustainable and specialized approaches. Differentiation using alternative varieties and more eco-efficient extraction processes could position the country as a more competitive player in the global avocado industry [

10].

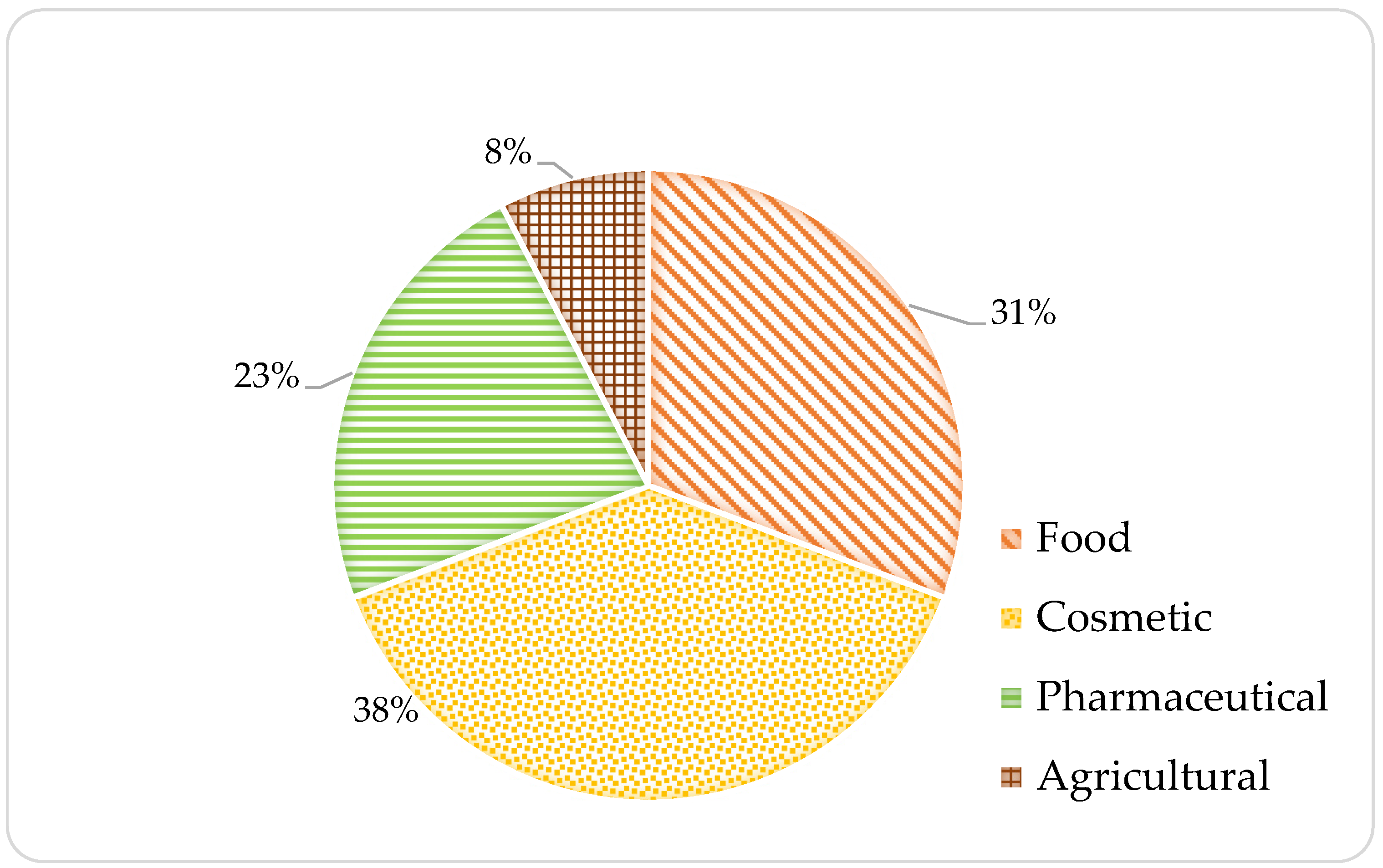

Figure 2 illustrates the primary applications of avocado oil across various industries, highlighting its role in the food, cosmetic, pharmaceutical, and agricultural sectors. The highest demand comes from the cosmetic industry, where avocado oil is widely used for skin hydration and hair care due to its rich content of essential fatty acids and vitamins [

23]. In the food sector, its stability at high temperatures makes it a healthy option for cooking and preparing dressings. Meanwhile, the pharmaceutical industry values its antioxidant properties and its potential to reduce inflammation and improve cardiovascular health. Additionally, in agriculture, avocado oil is used as an ingredient in natural fertilizers and compost mixtures, promoting sustainable practices. Its versatility and marketability across diverse industries enhance its commercial potential [

60]. By focusing on a less exploited variety such as the Creole-Antillean, this initiative may provide a sustainable and distinctive alternative, appealing to consumers concerned not only with product quality but also with environmental impact [

56].

Table 4 presents the number of exporting companies in Colombia that market edible oils and avocado-related products in 2023. The data reveals that only one company specializes in edible oil exports, while 251 companies export food products and related goods. This disparity suggests that the edible oil market is more restrictive, possibly facing higher entry barriers compared to the broader market for avocado-derived food products. The low number of oil exporters indicates that this segment requires specialized processing, strict regulations, and more specific consumer demand, making it challenging for new businesses to penetrate the industry. Conversely, the high representation of exporters in the food products category demonstrates market diversification, offering more accessible opportunities for avocado-derived product manufacturers. This outlook highlights the importance of differentiated strategies to expand the presence of avocado oil in international trade [

61]. The avocado biorefinery in Montes de María could leverage this scenario by offering specialized, high-value-added products, differentiating itself using Creole-Antillean avocado and integrating sustainable practices to enhance its acceptance in global markets [

62].

3.2. Chlorophyll Market

Table 5 presents a set of companies marketing chlorophyll, detailing their location, raw materials used, developed products, and applications. In general, Colombian companies obtain chlorophyll from conventional sources such as soy, spinach, alfalfa, and mint, while the Spanish company Flavorix Aromáticos SA offers both liquid and powdered versions for the food industry. Additionally, there are differences in the composition and final uses of these products. Some companies market liquid chlorophyll as a dietary supplement or medicinal product, while others incorporate it into cosmetic and personal care products. A key aspect of this analysis is the absence of companies producing chlorophyll from avocado peels [

14]. Furthermore, the number of companies working with chlorophyll in Colombia remains limited, indicating a potential niche for commercial expansion [

15]. Diversification of biomass sources for chlorophyll extraction could strengthen the country’s competitiveness in the natural pigment and agricultural bio-input industries [

22].

According to this study, the number of Colombian companies specialized in the production and commercialization of chlorophyll is significantly lower compared to the global market. While Colombia has between 5 and 10 companies dedicated to this sector, approximately 100 companies operate worldwide, with a notable presence in North America and Europe. This analysis helps identify a niche opportunity for diversifying chlorophyll sources in Colombia, as most national companies obtain this compound from biomass sources such as spinach, alfalfa, or mint [

63]. The proposed avocado biorefinery process in Montes de María introduces an innovative approach by utilizing avocado peels as an alternative source for chlorophyll extraction, which could position Colombia as an emerging market with a differentiated and sustainable product. The scarcity of companies in Colombia dedicated to this segment suggests that market demand has not yet been fully met, reinforcing the feasibility and potential growth of bioeconomy-oriented projects and agricultural by-product valorization [

11,

26].

Figure 3 illustrates the distribution of chlorophyll applications across the food, cosmetic, and pharmaceutical industries. The percentage corresponds to the pharmaceutical sector, accounting for 45% of total usage, indicating that chlorophyll is widely used in medications and supplements due to its antioxidant, digestive, and detoxifying properties. The food industry represents 27% of its applications, highlighting its importance as a natural colorant and nutritional additive in products such as beverages, supplements, and processed foods. Similarly, the cosmetic sector also holds a 27% share, where chlorophyll is incorporated into creams, lotions, and skincare products due to its regenerative and anti-inflammatory benefits. These insights help identify key trends in the chlorophyll market, demonstrating stronger demand in health and medical applications compared to the food and cosmetic industries [

64]. This suggests that the development of innovative chlorophyll-based products such as those derived from avocado peels proposed in the biorefinery process could attract the pharmaceutical market, given its focus on health improvement [

65]. Additionally, diversifying chlorophyll sources could represent a growth opportunity in sectors still exploring new applications for this compound [

39].

3.3. Biocontrol Agents Market

Table 6 presents a set of companies specializing in the production and commercialization of biocontrol agents, detailing their location, raw materials used, developed products, and applications. The data shows that most companies use microorganisms such as fungi and bacteria in their biocontrol agent formulations, leveraging their biological properties for pest control in agricultural crops. Regarding geographical distribution, the companies are located in Colombia, Ecuador, Switzerland, and India, reflecting the international diversity in biocontrol agent production and commercialization. The data reveal a clear trend toward the use of fungi such as

Beauveria bassiana and other beneficial microorganisms in the formulation of bioinsecticides and biofungicides, highlighting the growing adoption of environmentally friendly pest control alternatives. In this context, the proposed avocado biorefinery considers the use of avocado seeds, normally discarded as a byproduct, as a source for obtaining biocontrol agents, thereby generating added value and offering a sustainable and differentiated alternative compared to products derived from traditional sources [

19]. Additionally, the presence of companies in countries such as Switzerland and India indicate that the global market for biocontrol agents is expanding, reinforcing the feasibility of utilizing agricultural byproducts for the formulation of new biocontrol agents in Colombia [

4].

According to Trademap, 67% of biocontrol agents are used in agriculture, highlighting their crucial role in protecting crops against pests and diseases, thereby contributing to more sustainable agricultural production with a lower environmental impact. Meanwhile, the remaining 33% is used in grain storage, emphasizing their importance in food preservation after harvest by preventing deterioration caused by insects and harmful microorganisms. This balance in the applications of biocontrol agents underscores their relevance both in agricultural production and in the conservation of food supplies. The biocontrol agent market is predominantly concentrated in agriculture, likely due to the growing demand for ecological pest control solutions [

66]. However, their use in grain storage represents a strategic segment, as it ensures food quality and safety. Avocado seeds constitute an alternative raw material for obtaining bioactive compounds for pathogen control in crops, enhancing crop competitiveness and process sustainability by employing plant-based agents. The avocado biorefinery in Montes de María could leverage this trend [

67].

Figure 4 presents a bar chart depicting the number of companies exporting fungicides and insecticides in Colombia during 2023. Four main categories are identified: fungicides and bactericides, pest control products, agricultural chemicals, and agricultural supplies. The highest concentration of companies is found in the agricultural supplies category, with 214 exporting companies, followed by agricultural chemicals, with 73 companies. In contrast, pest control products and fungicides/bactericides have minimal representation, with only 3 and 1 company, respectively. This significant disparity in the commercialization of these products in the Colombian market suggests a preference for general agricultural supplies and chemicals over specialized solutions for pest and disease control. This may be attributed to the higher demand and availability of general agricultural inputs compared to specific solutions such as biocontrol agents and natural fungicides [

63,

68]. The avocado biorefinery in Montes de María could capitalize on this market gap enhancing access to sustainable alternatives for crop protection.

3.4. Avocado Exports and International Trade

Table 7 outlines the participation of various countries in the global avocado export market in 2023. Mexico dominates the industry, accounting for 39% of total exports, with 1,220,919 tons, solidifying its position as the leading global producer and exporter. The Netherlands ranks second, with a 14.9% share and 345,890 tons exported, serving as a major distribution hub in Europe. Peru follows closely in third place with a 13.2% share and 598,493 tons exported, reinforcing its role as a key player in the industry. Spain, Israel, and Chile also hold notable shares, ranging between 3.4% and 5.7%.

Colombia ranks seventh, with 2.8% market participation and 114,741 tons exported, reflecting its growing presence in international avocado production and trade. This global distribution indicates Mexico’s dominance in the market, while emerging players like Colombia and Morocco present expansion opportunities. These trends underscore the need for differentiated strategies to enhance competitiveness, particularly in the production of less commercialized avocado varieties, such as the Creole-Antillean avocado [

69].

Figure 5 presents a bar chart showing the top 10 avocado-exporting countries in 2023, indicating the value of their exports in millions of dollars. The data reveal that Mexico leads global exports, with an approximate value of 2800 million dollars, consolidating its position as the world’s largest producer and distributor of avocados. The Netherlands ranks second with exports valued at 1083 million dollars, primarily serving as a redistribution hub in Europe. Peru holds the third position, contributing 963 million dollars in exports, demonstrating its strong presence in international trade. Spain, Israel, Chile, and Colombia show smaller shares, each below 10%, reflecting their more limited influence in the global industry. Mexico’s dominance in avocado exports contrasts with the growth potential shown by countries such as Colombia [

68]. The data represented in the figure were obtained from the Trademap platform.

Figure 6 illustrates the product categories offered by avocado-exporting companies in Colombia during 2023. The most represented category is food products and related goods, with 251 companies, indicating that most avocado exports are focused on the food industry. In contrast, tropical and subtropical fruit exports as well as fruit and vegetable markets show significantly lower participation, with only 3 and 6 companies, respectively. The category of dried fruits and nuts also has a notable presence, with 68 companies, reflecting diversification in avocado-related commercial products. Colombia’s avocado export market is heavily dominated by food products, indicating strong demand in the food sector. However, the data also highlights opportunities for expansion into other categories, such as the fruit and vegetable market, which currently has low participation. This opens possibilities for developing avocado-derived products in less-explored segments, such as bioingredients and natural colorants. The avocado biorefinery could leverage this trend, expanding its product offerings and positioning itself in emerging markets [

70,

71].

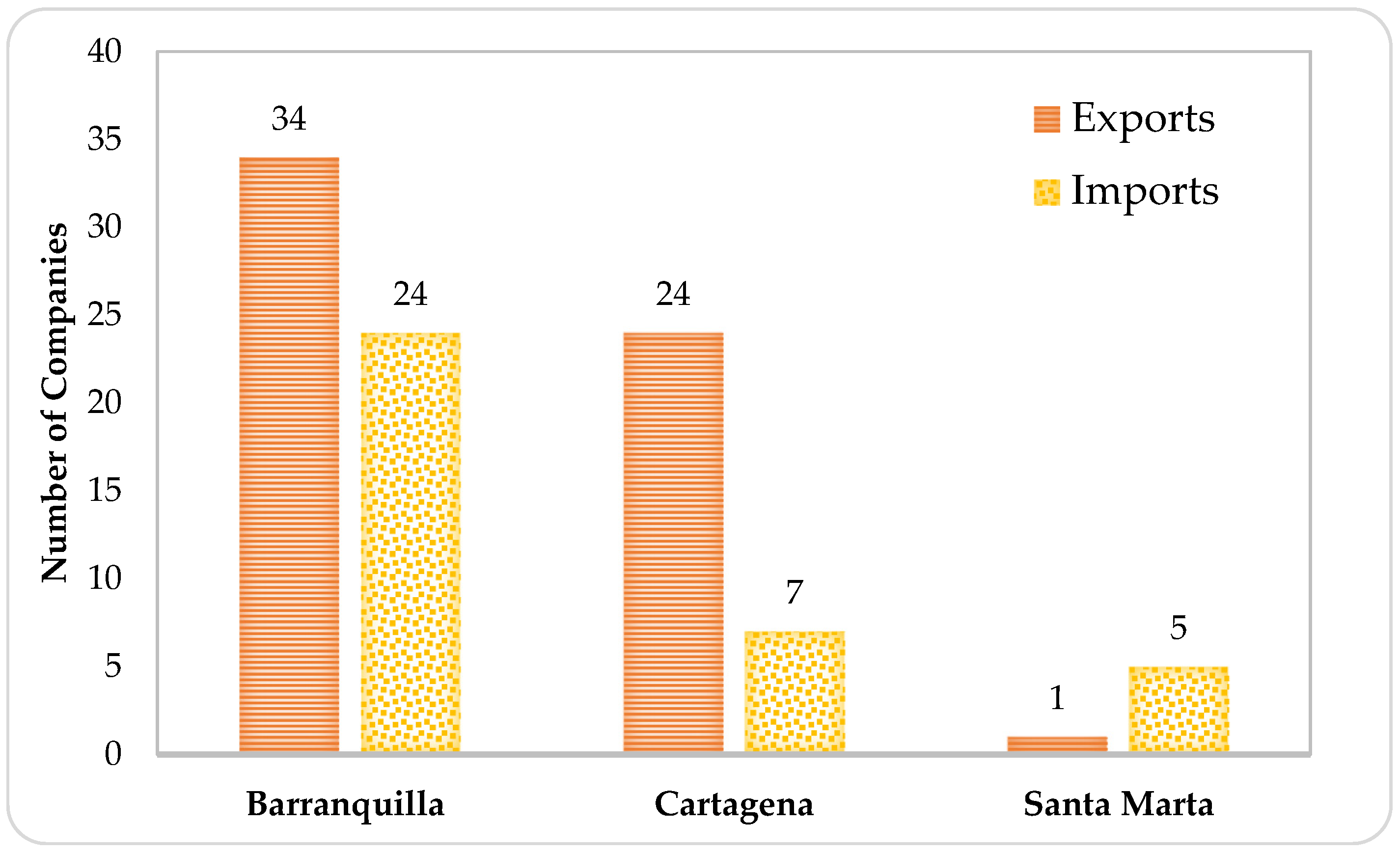

Figure 7 presents a comparison of the number of companies exporting and importing avocado-based food products in major cities along Colombia’s Caribbean coast during 2023. The data shows that Barranquilla leads both exports and imports, with 24 exporting companies and 34 importing companies, highlighting its key role in the international commercialization of avocado and its derivatives. Cartagena ranks second in commercial activity, with 7 exporting companies and 24 importing companies, suggesting its primary focus is on receiving and distributing avocado products within the national market. In contrast, Santa Marta exhibits a different pattern, with 5 exporting companies and only 1 importing company, indicating a stronger emphasis on production and international trade [

72]. The higher import activity in Barranquilla and Cartagena compared to exports may be associated with the domestic demand for avocado-based processed products. This represents a strategic opportunity for the biorefinery, enabling it to position its products in cities with consolidated commercial infrastructure, thereby facilitating access to both international markets and national consumers [

73]. Furthermore, the increase in avocado and derivative exports in the region highlights the importance of developing innovative products with high added value. These cities were considered given that Montes de María is part of the Colombian Caribbean.

3.5. Social Responsibility

3.5.1. Avocado Residue Valorization

According to recent reports, between 1.3 and 1.9 billion tons of solid waste are generated worldwide each year, and this figure is projected to reach approximately 3.5 billion tons by 2050. Of this enormous amount, around 70% is disposed of directly in landfills, 19% is recycled, and only 11% is converted into energy, generating serious environmental and health problems. In this context, the valorization of solid waste emerges as an environmentally sustainable approach, enabling the production of high-value products such as fuels, chemicals, and raw materials applicable in industrial and domestic sectors [

74]. The agricultural sector and its associated industries generate large volumes of waste annually, which in many cases are incinerated or improperly disposed of, causing negative impacts on the environment, economy, and society [

75]. Within this framework, the avocado biorefinery is proposed as a strategy to reduce pollution associated with the accumulation of this fruit, helping to mitigate public health and environmental problems. Furthermore, according to testimonies from small producers collected in regional documents from the Montes de María, these farmers face multiple difficulties in harvesting and marketing their products due to climatic factors and infrastructure limitations. The main problems reported include losses caused by droughts or extreme rainfall, product deterioration due to the lack of cold chains, and transportation restrictions resulting from poor road conditions, which are sometimes rendered impassable by natural events [

76].

3.5.2. Employment of Local Community Members

According to Contracting Law 2294 of 2023, businesses or companies are required to hire at least 50% local labor, so that the beneficiaries of investments and programs can participate in their execution, fulfilling the purpose of two-way social inclusion. This requirement is subject to the capacities of the local population and the specific needs of the companies [

77]. In this context, the avocado biorefinery represents an opportunity for job creation in the Montes de María region, both for fruit growers and for other residents trained in different professions.

3.5.3. Community Needs Assessment

As part of corporate social responsibility, activities and projects are developed to improve living conditions in areas of influence, in this case, the Montes de María region. According to regional dialogues reported by the National Planning Department (DNP), multiple community needs have been identified [

76,

78]. Priority actions include the implementation of training programs that strengthen resource management in the region, including the promotion of sustainable agricultural practices, the creation of entrepreneurial initiatives, and other productive activities.

Additionally, it is relevant to promote programs aimed at environmental improvement, such as the efficient use of water and energy, proper waste disposal, and the valorization or reuse of by-products [

79]. Simultaneously, the need for community spaces that foster recreation and social integration for children, youth, adults, and the elderly has been identified. In this regard, the construction of cultural centers, libraries, sports facilities, and parks is recognized as a strategy to strengthen social cohesion.

Structural challenges, such as limited access to potable water, the absence of sanitation systems, and poor conditions of rural roads, are also evident. Part of the social responsibility associated with the avocado biorefinery could be directed toward contributing to the installation or improvement of these systems and the upgrading of necessary road infrastructure. Accordingly, establishing an avocado biorefinery would have a positive impact on the directly affected area, not only by generating employment but also through the development of social and environmental management programs and projects that minimize project-related impacts, promote trust and cooperation, and enhance the quality of life of local communities.

6. Conclusions

Given the limited valorization of avocado by-products and the market concentration on the Hass variety, this research demonstrates that integrating a bioeconomy model with Marketing 3.0 constitutes an effective strategy to diversify the agroindustry and generate economic, social, and environmental benefits in the Montes de María region. By combining the logic of the biorefinery with marketing innovation, it is possible to transform an agricultural resource discarded for not meeting consumption standards into a diversified portfolio of high-value products, such as bio-oil, chlorophyll, and biopesticides. This approach allows for differentiated responses to the demands of the food, cosmetic, pharmaceutical, and agricultural industries while opening competitive export opportunities, particularly to international markets identified through TradeMap analysis.

The proposed model contributes to reducing agricultural waste and utilizing non-standard fruits, aligning with SDG 12 on Responsible Production and Consumption, while promoting job creation, local economic development, and the consolidation of a brand image associated with sustainability and corporate social responsibility. Furthermore, the approach helps mitigate environmental impacts related to waste management and the efficient use of resources, contributing to the objectives of SDG 13 on Climate Action. The strategic positioning of nearby cities such as Cartagena and Barranquilla strengthens the project’s feasibility and regional relevance. According to preliminary techno-economic evaluations conducted by the authors, the biorefinery shows promising profitability indicators, including an estimated discounted payback period (DPBP) of 3.24 years, a net present value (NPV) of approximately USD 635.57 million, and a positive cost–benefit ratio.

Incorporating social responsibility into the design and implementation of the biorefinery constitutes a strategic axis to ensure its social and environmental sustainability. Beyond job creation, the project can address structural needs in the region, such as access to basic services, community infrastructure, and training in sustainable practices, thereby strengthening social cohesion and promoting inclusive rural development. In this sense, the biorefinery is envisioned not only as a productive model but also as a tool for territorial transformation with comprehensive benefits for local communities. However, it is recognized that future studies should include a Social Life Cycle Assessment (S-LCA) to complement the bioeconomy-based marketing study and more precisely quantify impacts in terms of income, employment, and quality of life in the region. Additionally, further complementary studies are needed to evaluate the process holistically and to advance the development of new products derived from avocado cultivation residues.