Recycling Strategies in a Collector-Led Remanufacturing Supply Chain under Blockchain and Uncertain Demand

Abstract

1. Introduction

- (1)

- Does the manufacturer have the incentive to participate and record the demand information in blockchain?

- (2)

- What are the effects of different blockchain scenarios on recycling decisions?

- (3)

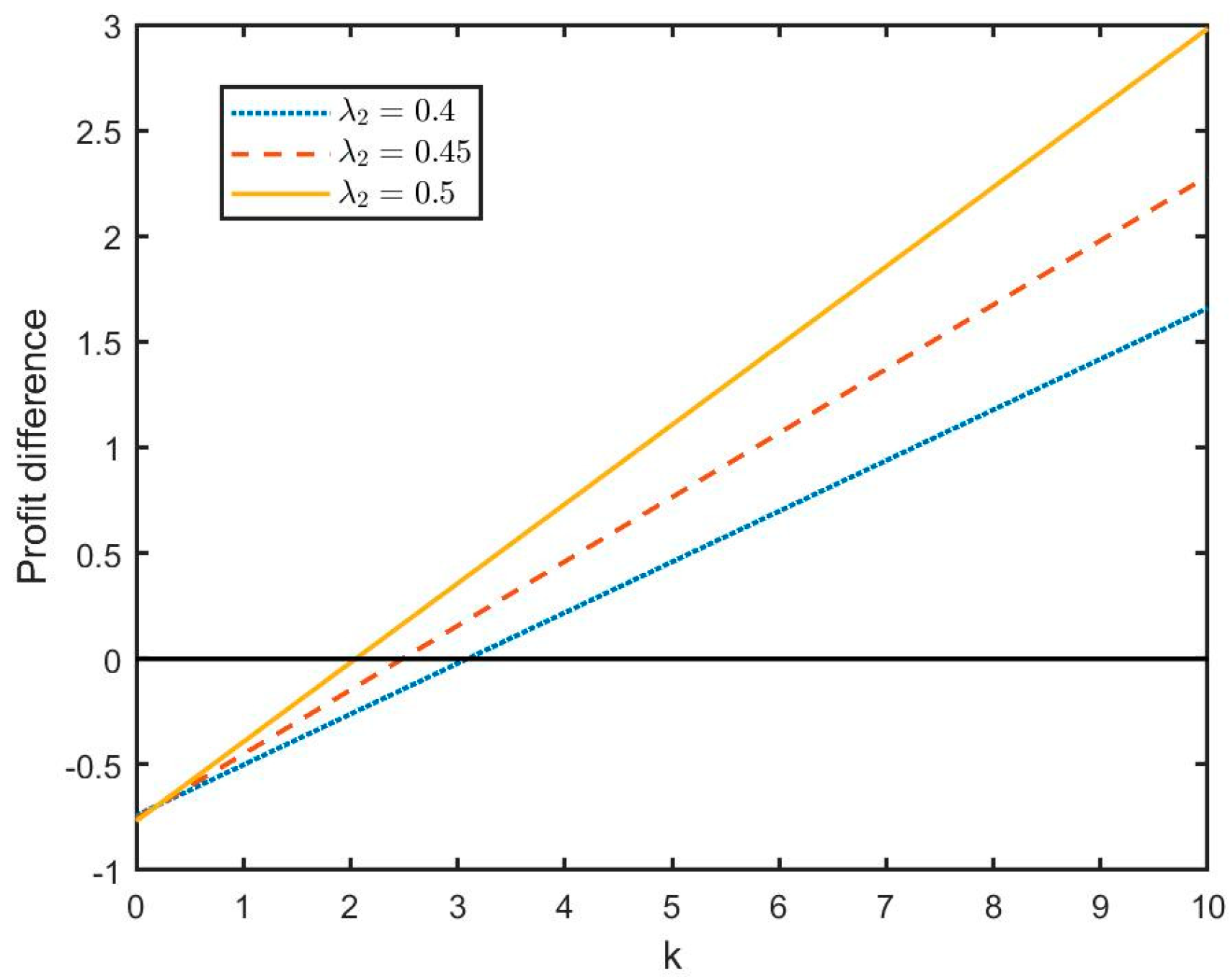

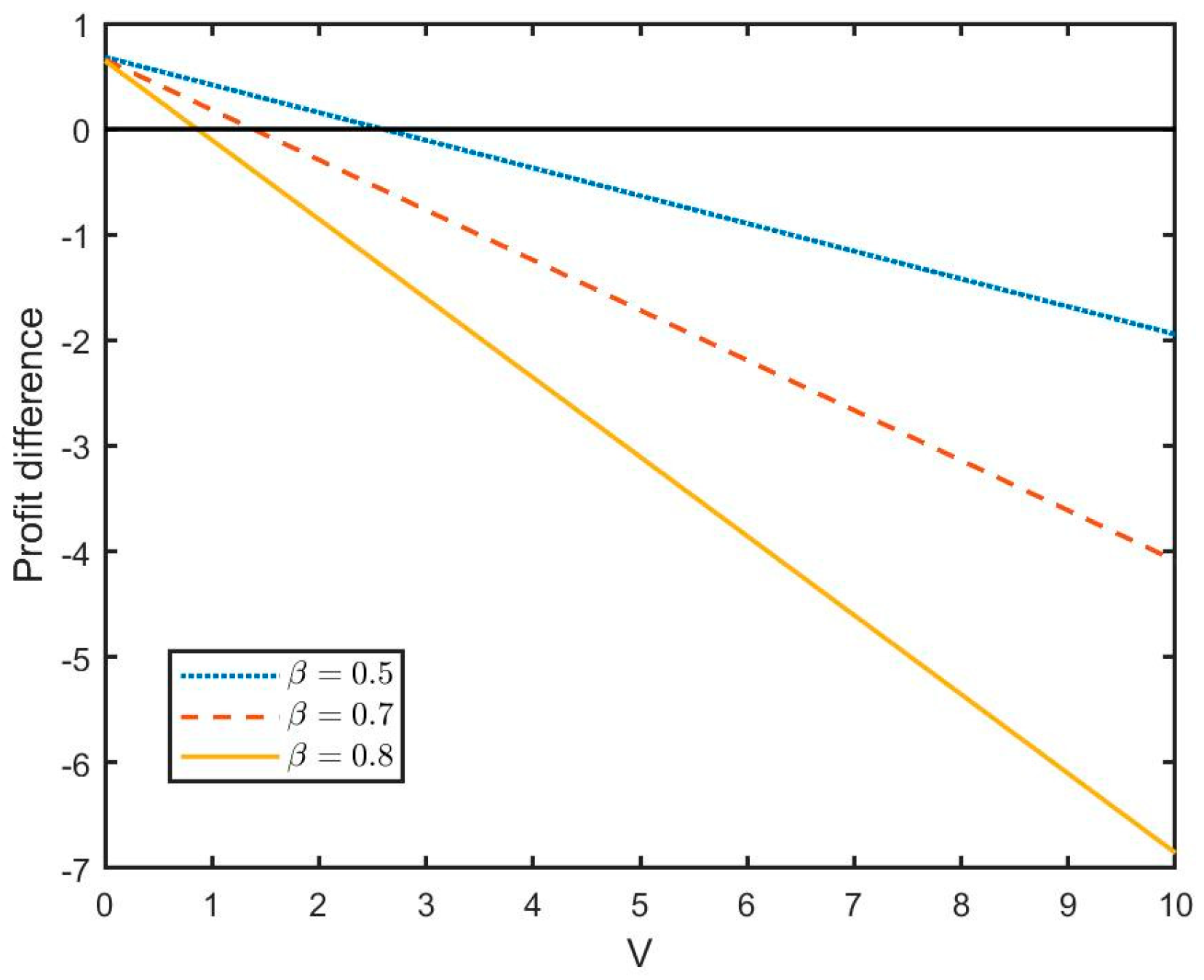

- How do demand variance and collection investment costs affect optimal decision-making in a collector-led remanufacturing supply chain?

2. Literature Review

2.1. Blockchain Adoption in Supply Chains

2.2. Demand Uncertainty in Supply Chains

2.3. Remanufacturing Collection Modes

3. Model

3.1. Problem Formulation

3.2. Collector-Led Supply Chain Models

- (1)

- In-house collection without blockchain (Model AN)

- (2)

- External collection without blockchain (Model BN)

- (3)

- In-house collection with blockchain (Model AB)

- (4)

- External collection with blockchain (Model BB)

4. Analyses

4.1. Comparison of Different Recycling Strategies

4.2. Comparison of Different Blockchain Adoption

5. Consumer Surplus

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

References

- Yang, L.; Gao, M.; Feng, L. Competition versus cooperation? Which is better in a remanufacturing supply chain considering blockchain. Transp. Res. E-Logist. Transp. Rev. 2022, 165, 102855. [Google Scholar] [CrossRef]

- Han, X.; Yang, Q.; Shang, J.; Pu, X. Optimal strategies for trade-old-for-remanufactured programs: Receptivity, durability, and subsidy. Int. J. Prod. Econ. 2017, 193, 602–616. [Google Scholar] [CrossRef]

- Wu, X.; Zhou, Y. The optimal reverse channel choice under supply chain competition. Eur. J. Oper. Res. 2017, 259, 63–66. [Google Scholar] [CrossRef]

- Savaskan, R.C.; Van Wassenhove, L.N. Reverse Channel Design: The Case of Competing Retailers. Manag. Sci. 2006, 52, 1–14. [Google Scholar] [CrossRef]

- Cai, K.; Zhang, Y.; Lou, Y.; He, S. Information sharing in a collectors-led closed-loop supply chain. RAIRO-Oper. Res. 2022, 56, 2329–2350. [Google Scholar] [CrossRef]

- Yang, F.; Wang, M.; Ang, S. Optimal remanufacturing decisions in supply chains considering consumers’ anticipated regret and power structures. Transp. Res. E-Logist. Transp. Rev. 2021, 148, 102267. [Google Scholar] [CrossRef]

- Krikke, H.; Hofenk, D.; Wang, Y. Revealing an invisible giant: A comprehensive survey into return practices within original (closed-loop) supply chains. Resour. Conserv. Recycl. 2013, 73, 239–250. [Google Scholar] [CrossRef]

- Ovchinnikov, A. Revenue and Cost Management for Remanufactured Products. Prod. Oper. Manag. 2011, 20, 824–840. [Google Scholar] [CrossRef]

- Aydin, R.; Mansour, M. Investigating sustainable consumer preferences for remanufactured electronic products. J. Eng. Res. 2023, 11, 100008. [Google Scholar] [CrossRef]

- Yue, X.; Liu, J. Demand forecast sharing in a dual-channel supply chain. Eur. J. Oper. Res. 2006, 174, 646–667. [Google Scholar] [CrossRef]

- Huang, Y.; Wang, Z. Information sharing in a closed-loop supply chain with technology licensing. Int. J. Prod. Econ. 2017, 191, 113–127. [Google Scholar] [CrossRef]

- Choi, T.M. Blockchain-technology-supported platforms for diamond authentication and certification in luxury supply chains. Transp. Res. E-Logist. Transp. Rev. 2019, 128, 17–29. [Google Scholar] [CrossRef]

- Yanikoglu, I.; Denizel, M. The value of quality grading in remanufacturing under quality level uncertainty. Int. J. Prod. Res. 2021, 59, 839–859. [Google Scholar] [CrossRef]

- Abbey, J.D.; Kleber, R.; Souza, G.C.; Voigt, G. Remanufacturing and consumers’ risky choices: Behavioral modeling and the role of ambiguity aversion. J. Oper. Manag. 2019, 65, 4–21. [Google Scholar] [CrossRef]

- Gong, B.; Zhang, H.; Gao, Y.; Liu, Z. Blockchain adoption and channel selection strategies in a competitive remanufacturing supply chain. Comput. Ind. Eng. 2023, 175, 108829. [Google Scholar] [CrossRef]

- Niu, B.; Xu, H.; Chen, L. Creating all-win by blockchain in a remanufacturing supply chain with consumer risk-aversion and quality untrust. Transp. Res. E-Logist. Transp. Rev. 2022, 163, 102778. [Google Scholar] [CrossRef]

- Zhang, T.Y.; Dong, P.W.; Chen, X.F.; Gong, Y. The impacts of blockchain adoption on a dual-channel supply chain with risk-averse members. Omega-Int. J Manag. Sci. 2023, 114, 102747. [Google Scholar] [CrossRef]

- Cui, Y.; Hu, M.; Liu, J.C. Value and Design of Traceability-Driven Blockchains. MSom-Manuf. Serv. Oper. Manag. 2023, 1–18, Article in advance. [Google Scholar] [CrossRef]

- Zheng, Y.; Xu, Y.Q.; Qiu, Z.G. Blockchain Traceability Adoption in Agricultural Supply Chain Coordination: An Evolutionary Game Analysis. Agriculture 2023, 13, 184. [Google Scholar] [CrossRef]

- Wang, C.F.; Chen, X.F.; Xu, X.; Jin, W. Financing and operating strategies for blockchain technology-driven accounts receivable chains. Eur. J. Oper. Res. 2023, 304, 1279–1295. [Google Scholar] [CrossRef]

- Huang, Y.D.; Widyadana, G.A.; Wee, H.M.; Blos, M.F. Revenue and risk sharing in view of uncertain demand during the pandemics. Rairo-Oper. Res. 2022, 56, 1807–1821. [Google Scholar] [CrossRef]

- Ji, C.Y.; Liu, X.X. Design of risk sharing and coordination mechanism in supply chain under demand and supply uncertainty. Rairo-Oper. Res. 2022, 56, 123–143. [Google Scholar] [CrossRef]

- Garai, T.; Paul, A. The effect of supply disruption in a two-layer supply chain with one retailer and two suppliers with promotional effort under random demand. J. Manag. Anal. 2022, 10, 22–37. [Google Scholar] [CrossRef]

- Li, Y.C.; Saldanha-da-Gama, F.; Liu, M.; Yang, Z.L. A risk-averse two-stage stochastic programming model for a joint multi-item capacitated line balancing and lot-sizing problem. Eur. J. Oper. Res. 2023, 304, 353–365. [Google Scholar] [CrossRef]

- Pei, H.L.; Liu, Y.K.; Li, H.L. Robust Pricing for a Dual-Channel Green Supply Chain Under Fuzzy Demand Ambiguity. IEEE Trans. Fuzzy Syst. 2023, 31, 53–66. [Google Scholar] [CrossRef]

- Liu, W.J.; Liu, W.; Shen, N.N.; Xu, Z.T.; Xie, N.M.; Chen, J.; Zhou, H.Y. Pricing and collection decisions of a closed-loop supply chain with fuzzy demand. Int. J. Prod. Econ. 2022, 245, 108409. [Google Scholar] [CrossRef]

- Zheng, B.R.; Wen, K.; Jin, L.; Hong, X.P. Alliance or cost-sharing? Recycling cooperation mode selection in a closed-loop supply chain. Sustain. Prod. Consum. 2022, 32, 942–955. [Google Scholar] [CrossRef]

- Long, X.F.; Ge, J.L.; Shu, T.; Liu, Y. Analysis for recycling and remanufacturing strategies in a supply chain considering consumers’ heterogeneous WTP. Resour. Conserv. Recycl. 2019, 148, 80–90. [Google Scholar] [CrossRef]

- Yi, P.X.; Huang, M.; Guo, L.J.; Shi, T.L. Dual recycling channel decision in retailer oriented closed-loop supply chain for construction machinery remanufacturing. J. Clean. Prod. 2016, 137, 1393–1405. [Google Scholar] [CrossRef]

- Huang, M.; Yi, P.X.; Shi, T.L. Triple Recycling Channel Strategies for Remanufacturing of Construction Machinery in a Retailer-Dominated Closed-Loop Supply Chain. Sustainability 2017, 9, 2167. [Google Scholar] [CrossRef]

- Zhang, W.S.; Zhang, T. Recycling channel selection and financing strategy for capital-constrained retailers in a two-period, closed-loop supply chain. Front. Environ. Sci. 2022, 10, 1–16. [Google Scholar] [CrossRef]

- He, Q.D.; Wang, N.M.; Browning, T.R.; Jiang, B. Competitive collection with convenience-perceived customers. Eur. J. Oper. Res. 2022, 303, 239–254. [Google Scholar] [CrossRef]

- Guo, Y.; Wang, M.M.; Yang, F. Joint emission reduction strategy considering channel inconvenience under different recycling structures. Comput. Ind. Eng. 2022, 169, 108159. [Google Scholar] [CrossRef]

- Wan, N.A. Impacts of sales mode and recycling mode on a closed-loop supply chain. Int. J. Syst. Sci. 2023, 54, 1–22. [Google Scholar] [CrossRef]

- Cao, H.Q.; Ji, X.F. Optimal Recycling Price Strategy of Clothing Enterprises based on Closed-loop Supply Chain. J. Ind. Manag. Optim. 2023, 19, 1350–1366. [Google Scholar] [CrossRef]

- Yang, T.J.; Li, C.M.; Yue, X.P.; Zhang, B.B. Decisions for Blockchain Adoption and Information Sharing in a Low Carbon Supply Chain. Mathematics 2022, 10, 2233. [Google Scholar] [CrossRef]

- Niu, B.Z.; Dong, J.; Liu, Y.Q. Incentive alignment for blockchain adoption in medicine supply chains. Transp. Res. E-Logist. Transp. Rev. 2021, 152, 32. [Google Scholar] [CrossRef]

- Shi, C.-l.; Geng, W.; Sheu, J.-B. Integrating dual-channel closed-loop supply chains: Forward, reverse or neither? J. Oper. Res. Soc. 2020, 72, 1844–1862. [Google Scholar] [CrossRef]

- Yang, X.D.; Cai, G.S.; Ingene, C.A.; Zhang, J.H. Manufacturer Strategy on Service Provision in Competitive Channels. Prod. Oper. Manag. 2020, 29, 72–89. [Google Scholar] [CrossRef]

- Shen, B.; Zhu, C.; Li, Q.; Wang, X. Green technology adoption in textiles and apparel supply chains with environmental taxes. Int. J. Prod. Res. 2020, 59, 4157–4174. [Google Scholar] [CrossRef]

| Notation | Definition |

|---|---|

| Unit production cost of producing a new product with raw/used materials | |

| Unit saving cost of remanufacturing, | |

| The competition coefficient between the two products | |

| The coefficient of collection investment costs | |

| Random part of market potential for product , = 1, 2 | |

| The variance of the random variable | |

| The deterministic market potential without/with blockchain | |

| The collection rate of product , = 1, 2 | |

| Retail price of the product , = 1, 2 | |

| The profit functions of supply chain members | |

| Decision Variables | |

| Selling quantity of the product , = 1, 2 | |

| Unit transfer price of used product 𝑖 decided by collector , = 1, 2 | |

| Model AN (i = 1, 2) |

|---|

| Model BN (i = 1, 2) |

|---|

| Model AB (i = 1, 2) |

|---|

| Model BB (i = 1, 2) |

|---|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yang, T.; Li, C.; Bian, Z. Recycling Strategies in a Collector-Led Remanufacturing Supply Chain under Blockchain and Uncertain Demand. Processes 2023, 11, 1426. https://doi.org/10.3390/pr11051426

Yang T, Li C, Bian Z. Recycling Strategies in a Collector-Led Remanufacturing Supply Chain under Blockchain and Uncertain Demand. Processes. 2023; 11(5):1426. https://doi.org/10.3390/pr11051426

Chicago/Turabian StyleYang, Tianjian, Chunmei Li, and Zijing Bian. 2023. "Recycling Strategies in a Collector-Led Remanufacturing Supply Chain under Blockchain and Uncertain Demand" Processes 11, no. 5: 1426. https://doi.org/10.3390/pr11051426

APA StyleYang, T., Li, C., & Bian, Z. (2023). Recycling Strategies in a Collector-Led Remanufacturing Supply Chain under Blockchain and Uncertain Demand. Processes, 11(5), 1426. https://doi.org/10.3390/pr11051426