Abstract

The aim of this study is to synthesize the rapidly increasing literature on privacy and security risk of digital payment. By reviewing 591 studies, the literature on this topic was evaluated using a bibliographical approach to highlight the intellectual development of the field and recommend potential research directions in this still-emerging field. According to our assessment, academics have continued to focus on perceived privacy and security, while more multigroup analyses based on subdimensions of risk are needed. In addition, the vast majority of studies have not considered the inter-relationship between risk attributes. We analyse the potential causes of the lack of research diversity and provide additional suggestions to improve digital payment research in the future. This study will be valuable for academics, analysts, regulators, practitioners, and investors.

1. Introduction

The term “digital payment” refers to a paying technique in which payment data and instructions are transmitted via digital devices, such as a personal digital assistant or cellular phone. Global acceptance of digital payments has been increasing in the last year. The internet’s development in recent years has aided in the spread of this payment instrument, as new financial needs have been created by electronic commerce which were unable to be fulfilled effectively by the existing traditional payment systems. The growth can also be attributed to the economic and technological advancements of the internet, the expansion of social networking, the growth of mobile phone users, the expanded usage of electronic money, and the growing service of credit cards [1,2,3]. Due to the pervasiveness of smartphones today, consumers benefit from the simplicity and ease of paying for products and services via this kind of payment channel, which lowers transaction costs. Customers can also access and control their transactions remotely via the web-based user interface.

However, mobile payments are underutilised in several countries, such as China, India, Singapore, and Malaysia, where consumers choose to pay for goods and services with traditional methods [2]. According to Schierz et al. [4], only one percent of mobile phone users have used a mobile payment system. This lack of adoption could be attributed to security and privacy concerns among users. Risks of digital payment could be linked to service risk, device risk, network risk, and platform risk. For example, it has been suggested that the risk perceived among consumers of online shopping is one of the main factors that hinder its development [5]. Although digital payment services have become established and widely used in many nations, including Japan, Singapore, and Korea, digital payments are still in their infancy on a global scale, especially in Europe [6].

Even in smart cities, the adoption of such innovative technology is still low. For example, Kumar et al. [7] reported that in the smart city Coimbatore, only 74.3% of the population uses mobile payments. The slow or low adoption of digital payment technologies could be linked to a variety of factors, including security considerations, privacy issues, usage barriers, value barriers [8], a lack of security, system complexity, and privacy concerns [9,10]. In addition, Kartika et al. [11] argued that in smart cities, it is important to improve the security and confidentiality of information in noncash financial transactions in order to promote such services. Yang et al. [12] observed that due to regulatory shortcomings in data protection, customers find it increasingly difficult to enforce their rights in e-commerce. Customers’ privacy and financial worries are heightened as a result of regulatory ambiguity around mobile payments. El Haddad et al. [13] suggested that despite technology improvements, e-commerce still faces a considerable concern in terms of trust and perceived risk and their relationships with user satisfaction.

Much research has examined digital payment from a technical and user acceptance standpoint. Researchers have a diverse range of interests, including the antecedents and determinants of users’ satisfaction [14,15], network operators [16], consumer acceptance [17,18], continued use behaviour [17,18], and stakeholders’ expectations [19] of a variety of services, such as mobile payment, quick response code payment [20], mobile and electronic wallets [21,22], internet and mobile banking [23,24], and digital payment [25]. The study indicates that the number of authors and publications on digital payments has expanded over the past two decades. Despite the vast number of studies on digital payment variability, research on the antecedents of digital payment has produced conflicting findings [2]. It has been suggested that additional, in-depth studies on the adoption process of these tools are essential, as is active monitoring of the effects of various financial solutions on customers’ perceptions and daily lives [3]. As such, it is critical to conduct a review of the existing body of knowledge.

Despite the growing number of studies on digital payments, there seems to be a scarcity of peer-reviewed research on risk perception of digital payment. A review of the existing studies on digital payment proves the presence of a variety of previously explored research themes, and the prior review studies either focus on specific aspects of digital payment, such as customer adoption behaviour [2], digital payment utilisation persistence [26], and mobile payment adoption [27]; or a specific context, such as golf counties [28], Sub-Saharan Africa [29], and Thailand [30]. Thus, this study provides an overview of the available literature and contributes to the field’s enrichment and the development of future research areas. To accomplish this, a bibliometric approach is used to analyse the present state of the literature on digital payment security and privacy. This offers a thorough synthesis of the literature in this field and discusses future research directions and consequences for digital payment providers and policymakers.

Based on all of the above, the rest of the article is organised as follows. First, the research method and sample literature collection are presented. This is followed by the analysis, findings, and future research discussions. The research concludes with the limitations of our study in Section 5.

2. Materials and Methods

We thoroughly analysed digital payment literature, encompassing articles published over 22 years. The field was mapped using a systematic review that combined qualitative and quantitative methodologies [31,32]. Systematic reviews are a frequently used technique for organizing and synthesising research results. They are especially beneficial when dealing with vast and complicated research bodies, such as those in digital payment.

While narrative approaches may be beneficial, they have been criticised for their high degree of subjectivity and lack of generalizability [33,34], while systematic reviews have defined methodologies for conducting a complete literature review. The fundamental ideas of systematic reviews are as follows: specific objectives, reproducibility, a wide and comprehensive search based on merit, hence minimising reviewer bias, and the incorporation of a synthesised technique to organise the literature [35,36,37,38,39].

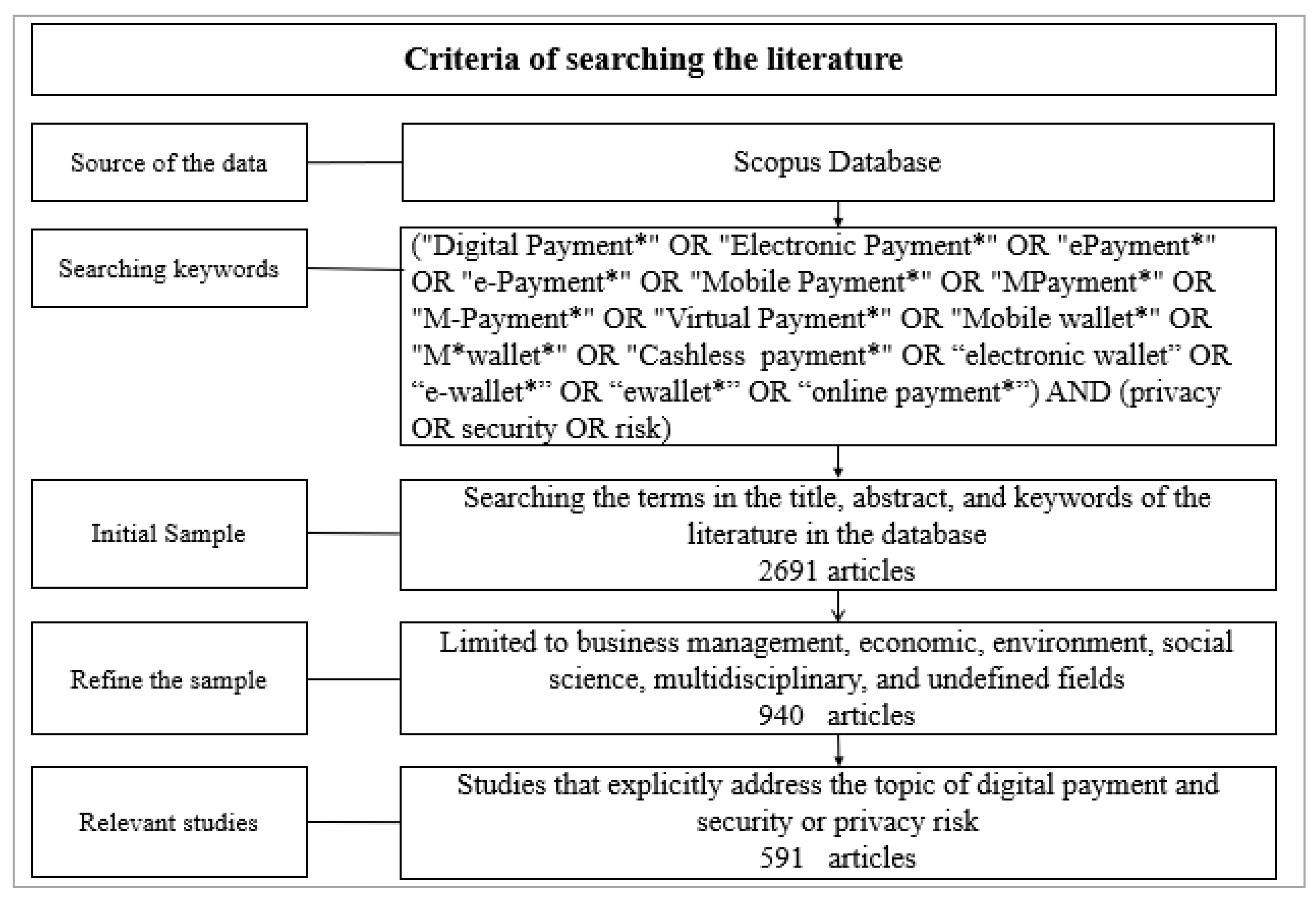

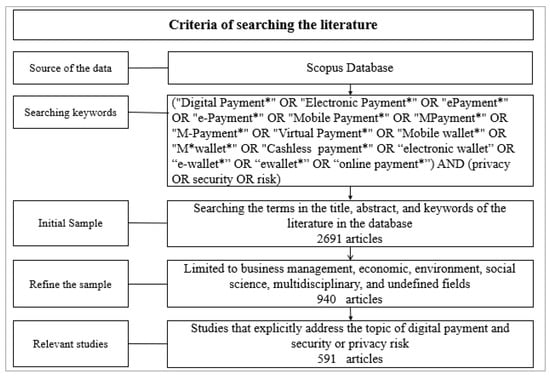

The systematic review approach utilised in this research consisted of five steps: (1) identification of keywords and terms, (2) identification of articles, (3) quality evaluation, (4) data extraction, and (5) data synthesis. The data mining keywords were chosen based on comparable evaluations on behavioural finance [40]. Given that the purpose of this study is to perform a systematic evaluation of security and privacy issues in digital payment, phrases such as “digital payment”, “Electronic payment”, “Mobile payment”, and “Security” OR “Privacy” were used (see Figure 1). To discover all published research in the field, data mining was performed using the Scopus database. This database is often regarded as the most comprehensive, including research from a wide variety of subjects compared to other databases (i.e., Web of Science). Massaro et al. [41] suggested that Scopus is one of the largest abstract and citation databases of peer-reviewed literature. Rasel and Win [42] used Scopus database because of its broader coverage of relevant and quality publications. This database allows a search for publications with prespecified keywords, for example, in the title, abstracts, or keywords. At this point, the sample size was 2691 papers.

Figure 1.

The flow chart of collecting the literature. Note: The asterisks such as in ‘payment*’ are used to find all derivatives of the word payment.

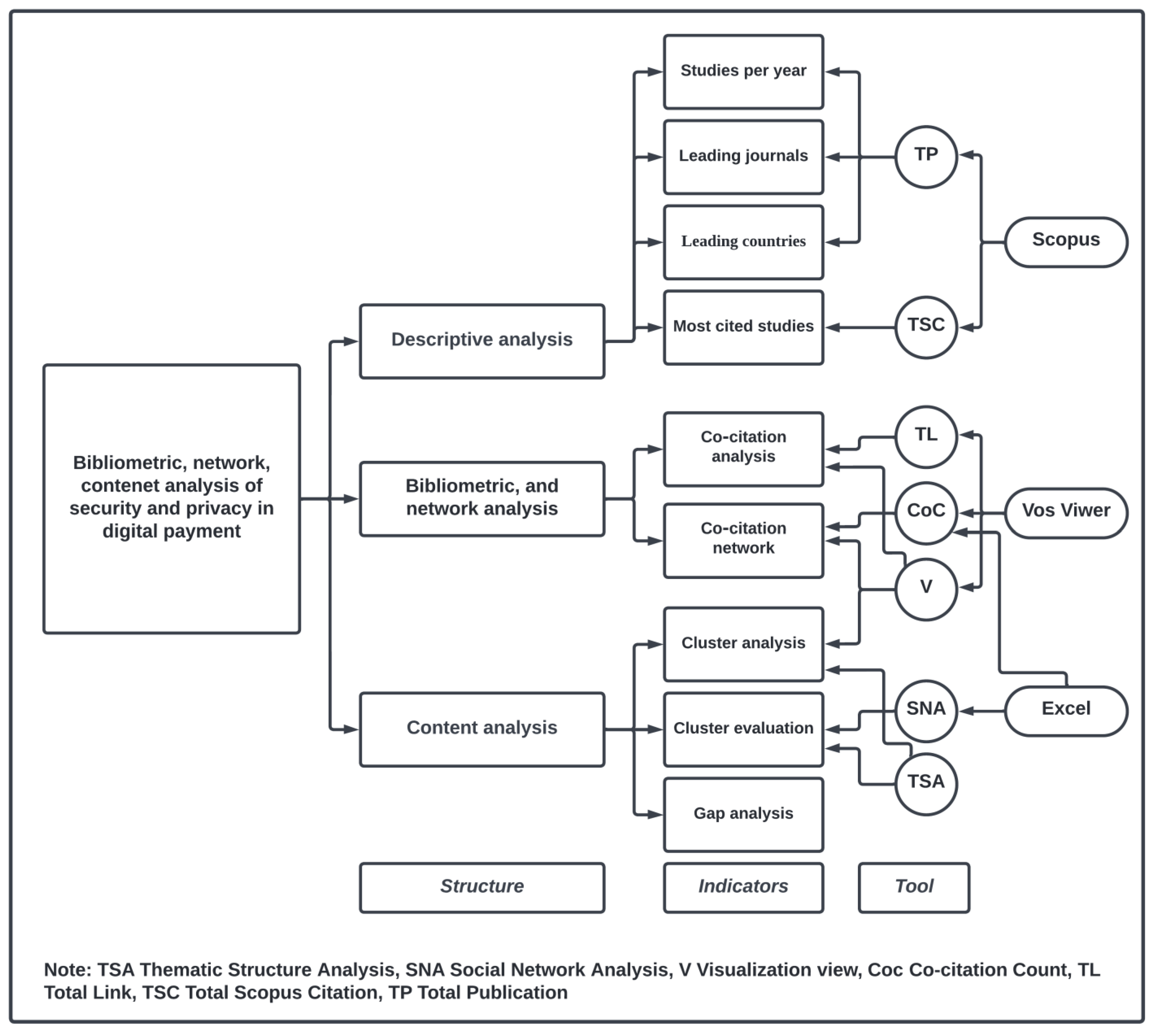

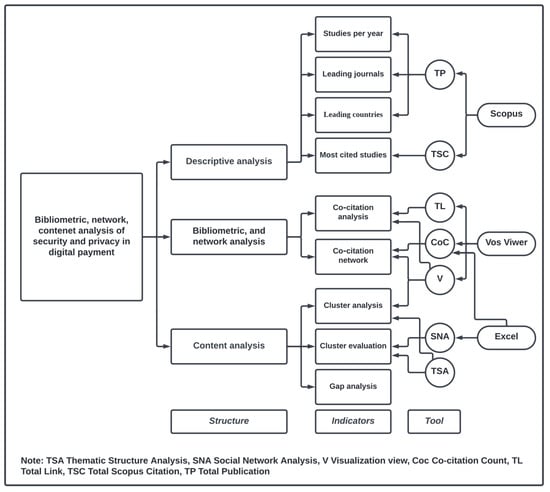

At this stage, any studies that were deemed irrelevant were removed from the original sample. By focusing on certain fields, namely, business management, finance, economics, environment, and social science, the number of sample studies decreased to 940 studies that fell within these fields. Titles and abstracts of these studies were screened for irrelevant research. Only studies that clearly addressed digital payment and security or privacy risk were included. Final sample included in this study is 591 documents. The sample literature was evaluated following an approach that is widely applied in similar review research [31,43,44]. The methods used in the analytical structure of this study are presented in Figure 2.

Figure 2.

The analytic structure of this paper.

3. Results and Discussion

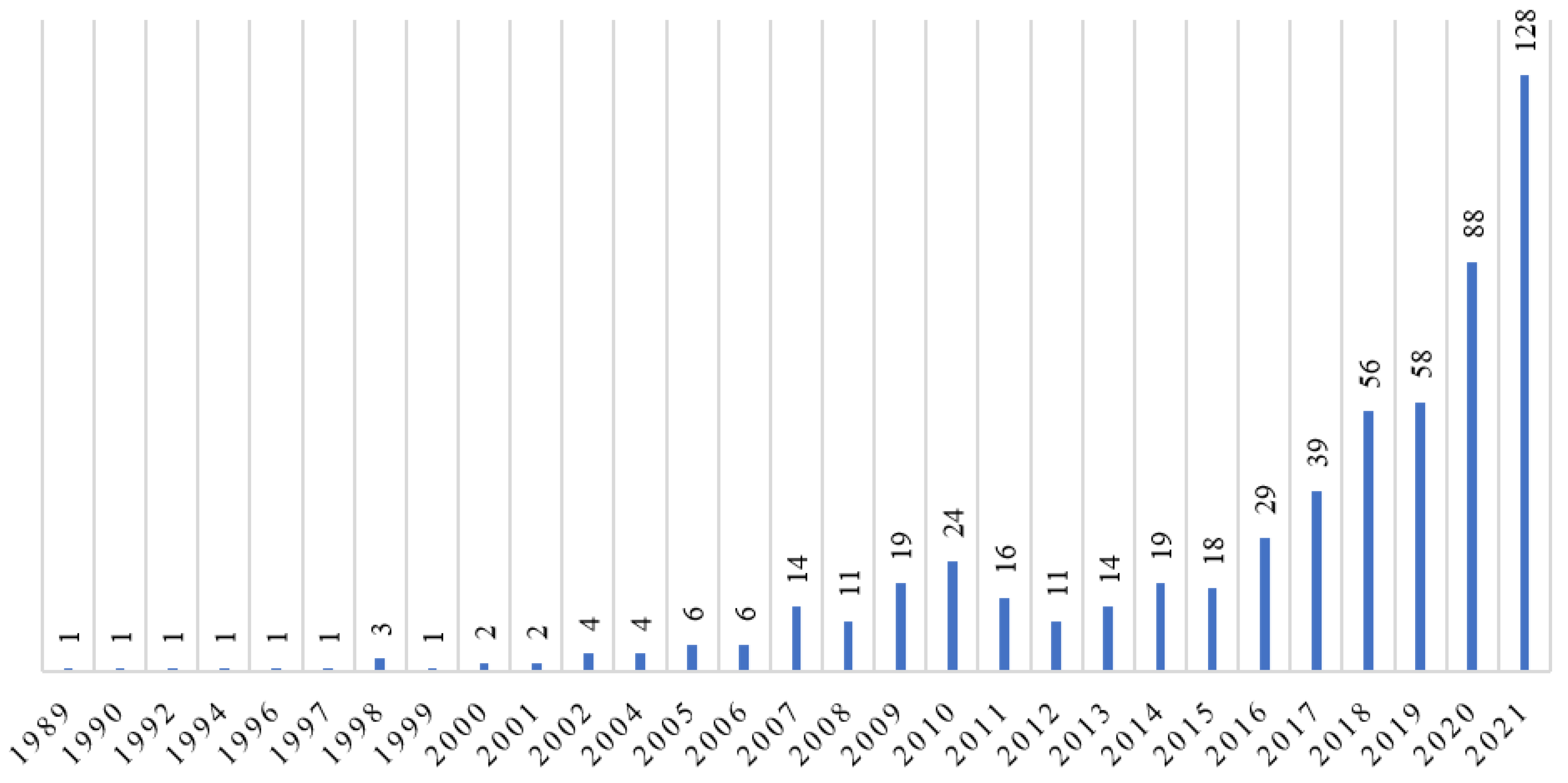

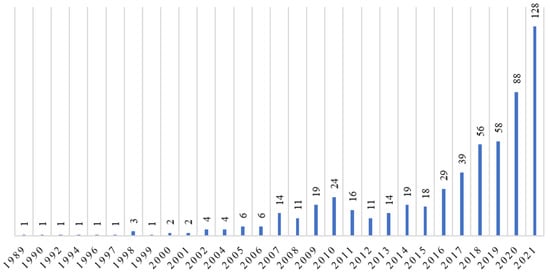

To determine the basic continuous pattern of publication on this topic, a descriptive analysis of 591 publications was conducted. The publication trend was examined in terms of total publications by journal, country, area, and year. The yearly pattern of articles shows that the interest in studying this subject has increased over the last decade as a result of technological advancements that enable more dependable, user-friendly, adaptable, and functionally rich mobile payment systems. In our sampled literature, the earliest document goes all the way back to 1989, when Bürk and Pfitzmann [45] compared the security and degrees of unobservability of different digital payment systems. Indeed, before 2016, there was limited published research, with an average of less than 10 studies each year (Figure 3). Following this, the amount of research investigating the security and privacy of digital payment steadily increased each year. The year 2021 had the most publications, with 128 articles (about 22% of publications on this topic).

Figure 3.

The number of studies per year.

3.1. Leading Countries

Table 1 summarises the contribution of existing digital payment literature by subject area (coauthored papers have been considered at multiple geographic locations). The sample studies were conducted in 80 different countries, with 48 countries contributing less than five studies and 19 countries contributing just one study. The table lists countries with more than five documents, the average year of publication, and the total citations. The results reveal that developed countries, such as China, India, and the United States, contributed the most. The average year of publication for these countries was before 2015–2018, indicating that they were the drivers of interest in investigating this topic. The growing interest in these markets was due to the continuous development of digital payment applications. For example, the development of facial recognition payment in China has led the world. However, despite the economic size of these countries and the existence of various types of digital payments, they remain mostly cash-based markets. This triggers scholars’ interest in better understanding the security and privacy concerns related to digital payment technology. It should be noted that China has contributed the most to the prevalent literature on digital payment, while African countries have contributed the least. Additionally, further work may concentrate on comparing samples from various nations based on customers’ perceptions of the adoption of various payment approaches [21].

Table 1.

Countries contributed to the field of digital payment.

3.2. Leading Journals

Between 1982 and 2021, 591 articles appeared in approximately 370 journals and conference proceedings. However, 353 of them had fewer than five publications, while 276 had only one. Two aspects of each journal were analysed: first, the number of publications and citations, and the average year of publication; and second, the journals’ quality as defined by the Academic Journal Guidance (AJG) 2021. Table 2 depicts the list of the top ten active journals based on the number of publications in the area of digital payment during this period. The table also provides some material inputs, such as total citations, average citations, and average publication year. International Journal of Bank Marketing is the most productive journal based on total publications, i.e., 16 with a total of 471 citations and 29 average citations per article, followed by Electronic Commerce Research and Applications with 14 publications, 2070 citations, and 147 average citations. This indicates that citation number is based on quality rather than the number of publications. For example, with about seven publications, International Journal of Information Management had an average of 72 citations per document. Other quality journals in the list include Sustainability, Journal of Payments Strategy and Systems, and International Journal of Bank Marketing.

Table 2.

Influential journals in the field of digital payment.

The AJG 2021 was also used to assess the studies’ quality. It assigns a quality rating to business and management journals and ranks them as 1, 2, 3, 4, and 4*. Four with asterisk (4*) represents the highest-quality journal, while 1 represents the lowest. The AJG rating is a critical factor in researchers’ advancement in management and finance areas, and it is frequently used by researchers [31,43]. The result in Table 3 indicates that the overwhelming majority of studies on digital payment privacy and security has been published in not-ranked journals (401 studies). Surprisingly, only two studies were published in Grade 4* journals out of 591 documents. As shown in the table, scholars have been more interested in Grades 1 and 2 journal outlets.

Table 3.

The rating of sample studies based on Academic Journal Guide (AJG) 2021.

3.3. Most-Cited Studies

In this section, the citation trends of the sample literature were analysed. Citation analysis is a widely used technique for determining the significance of existing literature. Citation analysis determines the popularity of an individual publication in the body of existing literature based on the number of citations of that publication from other published studies. The initial citation analysis revealed that out of 591 documents, 134 studies had more than ten citations and 39 studies had over 50 citations. As shown in Table 4, we found that the most popular studies within sample literature had more than 150 global citations, including Schierz et al. [4] and Mallat [46], who were cited by the majority of researchers in this field. Citation analysis demonstrates the overall thematic trend in research on this topic.

Table 4.

The most influential studies based on citation number.

After examining these articles, we reach the conclusion that the thematic assessment that has developed in the field of digital payment research is narrow and focuses on perceived privacy and perceived security risks as determinants of consumer adoption of mobile payments [4,46]. It has been stated that privacy risk and security are significant subdimensions of the overall perceived risk toward digital payment. In this regard, a major gap is found to be the scarcity of studies on the antecedents of digital payment security and privacy risks.

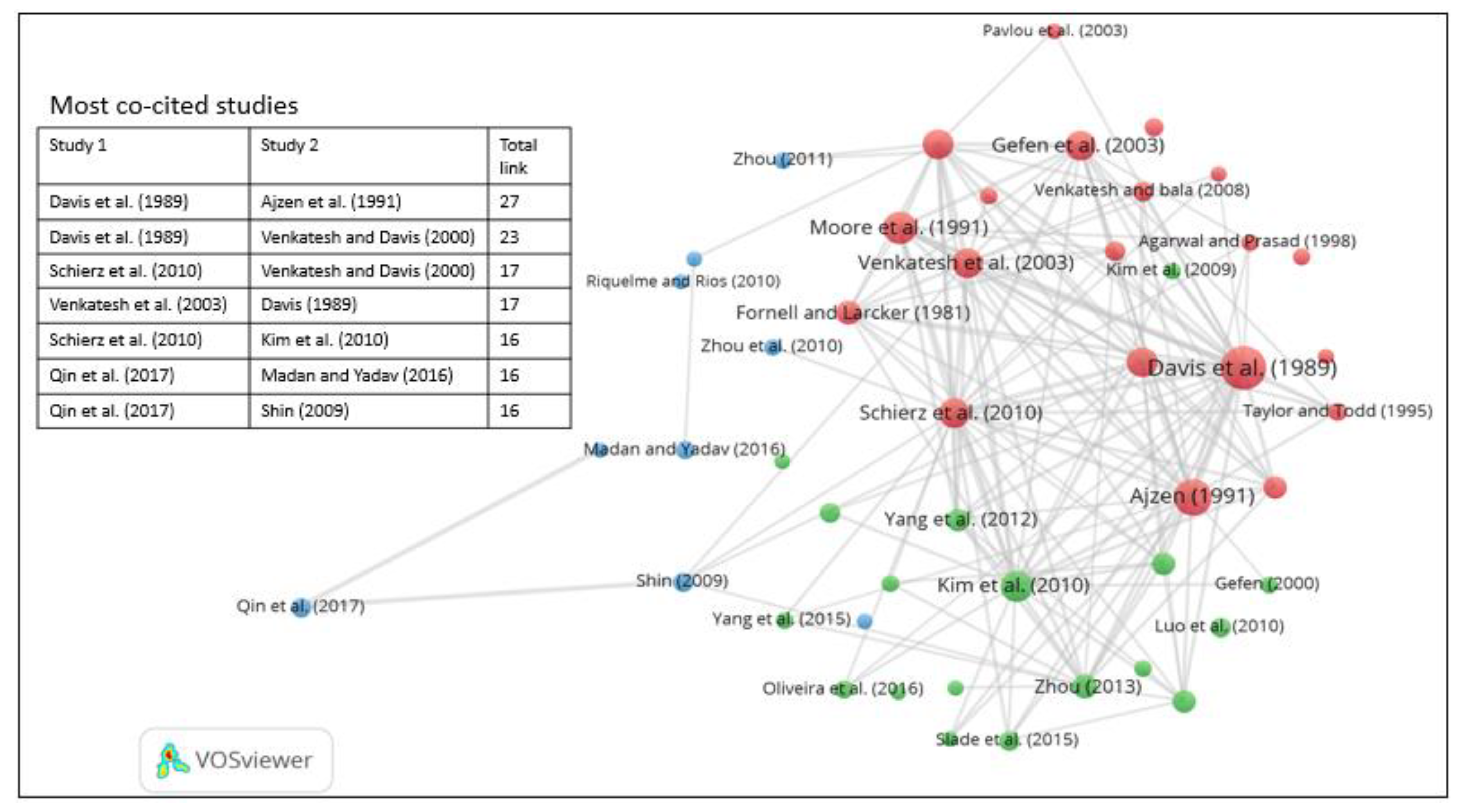

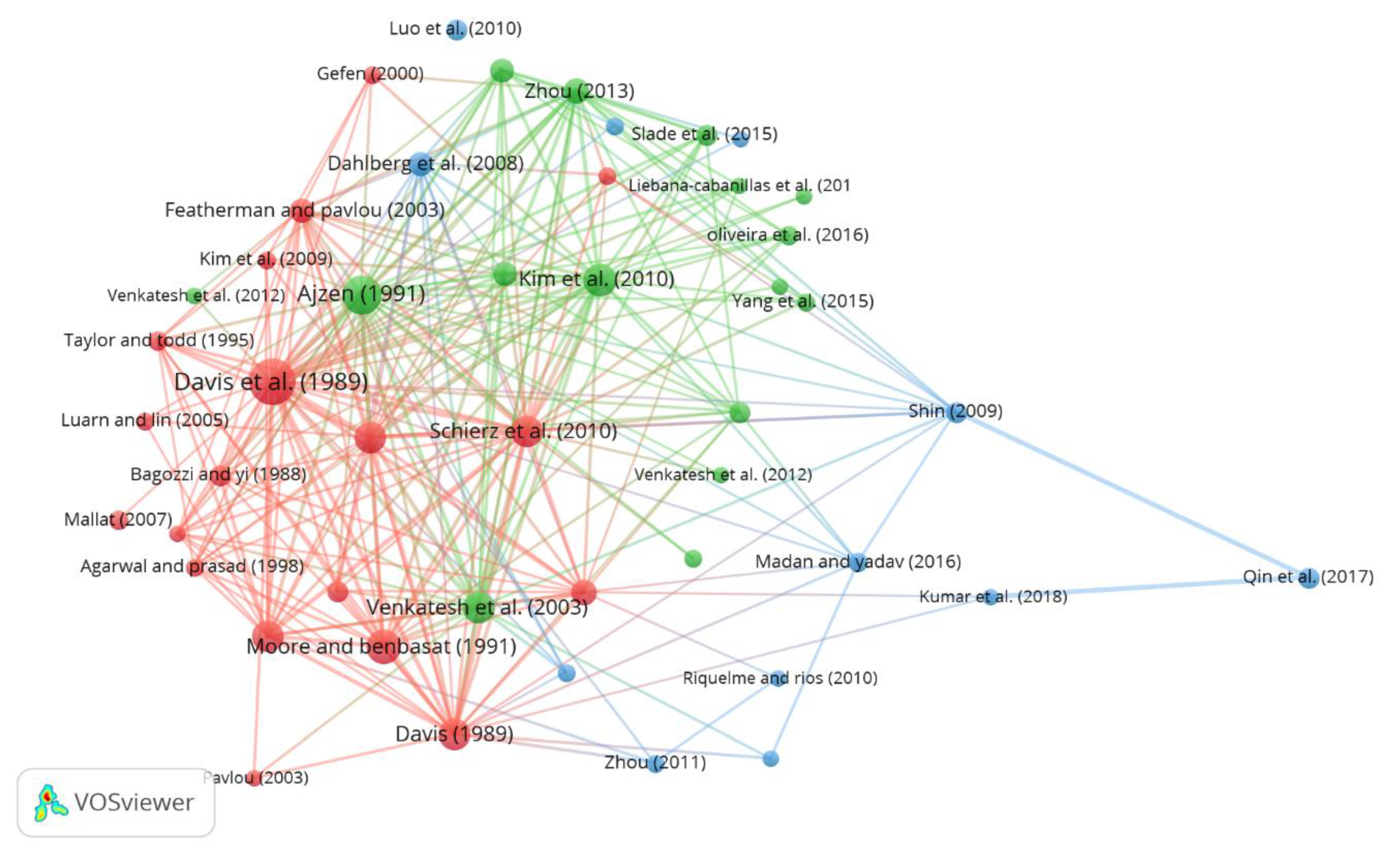

3.4. Co-Citation Analysis

Bibliographic coupling is defined as the connection between two referencing documents when they refer to the same work. When two works share a large number of citations, this indicates a strong coupling. Additionally, bibliographic coupling denotes the subject matters’ similarity. If the list of references contains commonly cited research, the two authors are bibliographically associated. While there are several techniques for reviewing the intellectual structure of a field, such as co-citation and citation assessment, these methods fall short of identifying emerging themes [31,43]. Bibliometric coupling overcomes this constraint by identifying contemporary topics within a domain. The presence of two publications in an article’s reference list more than once can indicate a degree of similarity in the theory, methodology, or empirical discipline of each. The link strength between two documents, supplied by VoSviewer, was used to quantify the connectivity between pair references. Van Eck and Waltman [56] suggested that this metric quantifies the strength of the connection between each pair of connected references.

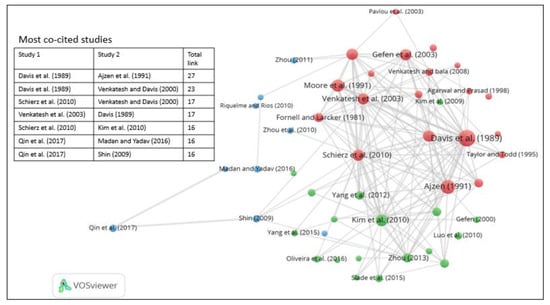

The co-citation analysis revealed that there are 166 pairs of documents that have been cited together at least ten times and only 105 pairs that have been cited together more than twenty times.

As illustrated in Figure 4, the strongest co-citation relationship exists between Chen and Yang [57] and Davis et al. [58]; the link strength between these publications is 27. The former introduced the planned behaviour theory, while the latter applied it in understanding the antecedents of digital payment adoption, including perceived risk and security. As shown in the figure, the second most powerful co-citation relationship exists between Davis et al. [58] and Venkatesh et al. [59], followed by Schierz et al. [4] and Venkatesh et al. [58]. These studies mainly evaluated factors influencing the intention to utilize mobile payment [60,61,62] as well as a mobile wallet [63,64], based on the unified theory of acceptance and use of technology (UTAUT) [24,48], the technology acceptance model (TAM) [65,66], and the planned behaviour theory [53,67].

Figure 4.

Document pairs with high link strengths.

4. Co-Citation Network

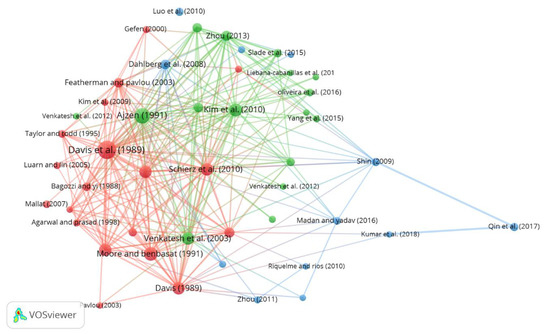

We analysed the evolution of clusters over time to improve our comprehension of the evolution of studies on digital payment. The evolution of clusters demonstrates the emergence and development of research subthemes in the area. Figure 5 demonstrates the number of articles published in each cluster over time. It can be deduced that earlier research was more concentrated on cluster 1 (red). We examined the references of prior research (591 studies) and discovered that the sample literature cited 23,116 unique references. The number of articles cited more than once locally was 1304, and 47 studies were cited more than ten times. The term “locally cited” refers to the number of times a reference was cited within our sample of literature. This investigation exemplifies the thematic trend in research on the security and privacy of digital payment.

Figure 5.

The co-citation network analysis.

Following an assessment of these works, we conclude that the theme series that has emerged in the area of digital payment literature is rather small, focusing on the UTAUT and the TAM developed by [58,59,68]. The research developed from the TAM was introduced by Davis et al. [58]. In this regard, it was found that there is a scarcity of theorical lenses on the cultural aspect of digital payment users. As a result, we argue that the ontological and theoretical frameworks in the current literature do not adequately address the intricacies and complexity of digital payment. The full map was too complicated to be understood; therefore, we followed Khatib et al. [31] and limited the map to the most influential studies in each cluster based on the average number of citations. More in-depth evaluation of these clusters is presented in the following sections.

4.1. Cluster 1 (Red)

As illustrated in Table 5, this cluster is the largest within the digital payment community, with studies focusing on two primary areas: the technology acceptance model (TAM) [58,69,70] and structural equation modelling [71,72,73]. The TAM illustrates the relationship between perceived ease of use, attitudes, and perceived usefulness toward technological innovation and acceptance behaviour [58,69]. This model received widespread support from the literature. Pavlou [74] argued in favour of the TAM as a way to increase consumer acceptance of electronic commerce. Additionally, the TAM was enhanced by incorporating subjective norms, individual mobility, and compatibility, which were statistically significant in the model [4]. Luarn and Lin [18] provided compelling evidence that the extended TAM is effective at forecasting users’ intentions to adopt mobile banking. Researchers advanced the technology acceptance model by introducing TAM2 [59] and TAM3 [70]. It has been suggested that the TAM explained only 40–60% of customer behaviour intention, leaving nearly half of the relative factors unaccounted for.

Table 5.

Summary of studies in cluster one.

However, the TAM focuses on the positive aspects of a consumer’s perspective when it comes to adopting new technology, and there are several factors (i.e., emotional, external, or environmental factors) ignored by this model and its extensions. Legris et al. [81] claimed that earlier research on this model is not entirely consistent and clear, and that crucial components are not included in the model; they must be incorporated into a bigger one that includes variables relating to both individual and social transformation processes. Similarly, Chuttur [82] concluded that the model lacks sufficient and rigorous research and that, despite its widespread use, there is disagreement about its theoretical assumptions and practical usefulness. Other user qualities (emotional, cognitive, and demographic elements) have been proposed to be taken into account as well, since they may function as a moderator of the link between TAM variables and technology acceptance.

4.2. Cluster 2 (Green)

Cluster 2 addresses the theme of digital payment adoption from a planning and behaviour perspective introduced by Ajzen [57], who proposed that perceived behavioural control and attitudes toward the behaviour subjective norms can predict intentions to perform different behaviours and that these intentions, in combination with perceptions of behavioural control, account for a substantial amount of variation in actual behaviour. As presented in Table 6, studies in this cluster have primarily evaluated the trust and risk that formulated the attitude of technology users addressed in the planned behaviour theory. Based on the framework of this theory, Venkatesh et al. [83] developed the unified theory of acceptance and use of technology model; it comprises four primary drivers of intention and usage and four important relationship moderators. This trend of studies highlights the same gap in the literature: customers’ attitudes toward digital payment may be significantly influenced by individual cultural differences. The UTAUT2 was introduced by extending the unified theory of acceptance and use of technology [84], while other scholars evaluated the consumer acceptance of mobile wallets [64], mobile payment [50,85], and mobile banking [23] to predict the acceptance, adoption, and use of information technologies.

Table 6.

Summary of studies in cluster 2.

Similar to the findings of the cluster 1 studies, researchers in this cluster concentrated on customer acceptance of digital payments, while paying less attention to merchant adoption. Nonetheless, consumer adoption (as defined by the aforementioned models) has remained a highly-researched area of study. However, the publications’ findings on certain variables remain equivocal. According to Oliveira et al. [91], all factors of social impact, innovativeness, performance expectations, perceived technology security, and compatibility exert a substantial indirect and direct effect on mobile payment uptake and the desire to suggest this technology. However, in a ground-breaking study conducted by Kim et al. [88], all respondents said that compatibility was not the key factor in their decision to use mobile payment. Additionally, reputation of the platform and firm is a strong predictor of customer trust in digital payments [93], although Kim et al. [78] observed that reputation as a corporate trait did not attract individuals to mobile banking. This inconsistency may be explained by the fact that the needs and expectations of adopters differ significantly across user groups. As a result, scholars must strive to balance the varied interests of various groups of individuals. Hence, service providers can tailor their offerings to fit the task requirements of various groups, hence increasing user adoption of technology innovation [23]. Furthermore, adoption models may need to be adjusted to account for country-specific differences [94]. Kim et al. [78] reported that an individual’s disposition to trust is shaped by their cultural upbringing. Countries’ successes or failures in adopting mobile payments vary according to their infrastructure, urban–rural disparities, and regulatory synthesis between the banking and telecommunications sectors.

4.3. Cluster 3 (Blue)

Cluster 3 is the smallest one in the sample literature that takes the research a step further by focusing on security and privacy risks [10,95,96,97]. Customer privacy and security are essential factors in digital payment applications which aim to give customers confidence in the application company by maintaining privacy and security on every element of the customer. Consumers face substantial vulnerabilities in online settings, including identity theft and information exploitation. For example, businesses may utilise consumers’ data for marketing reasons without their agreement or even disclosure. This is unsurprising, given that a person’s online distinctive and valued identity is comprised of a combination of financial and personal data. Risk perception is a significant predictor of acceptance of novel technologies. It has commonly held in the literature that perceived security and privacy are both expected to have a major indirect and direct effect on mobile payment acceptance and the intention to use this technology [91,95,97,98,99]. Khalilzadeh et al. [100] argued that risk and security have the most substantial impact on the behavioural intention of customers toward digital payments. Luo et al. [96] found that eight different risk facets, including privacy and security, are salient antecedents to innovative technology acceptance. However, short message service, rapid response code, magnetic security transmission, and near-field communication systems can be employed for digital payment. The question remains whether risk perception toward different payment systems are different. For example, Ghezzi et al. [101] suggested that mobile payment solutions must deal with more privacy and security issues than in e-commerce and electronic payment.

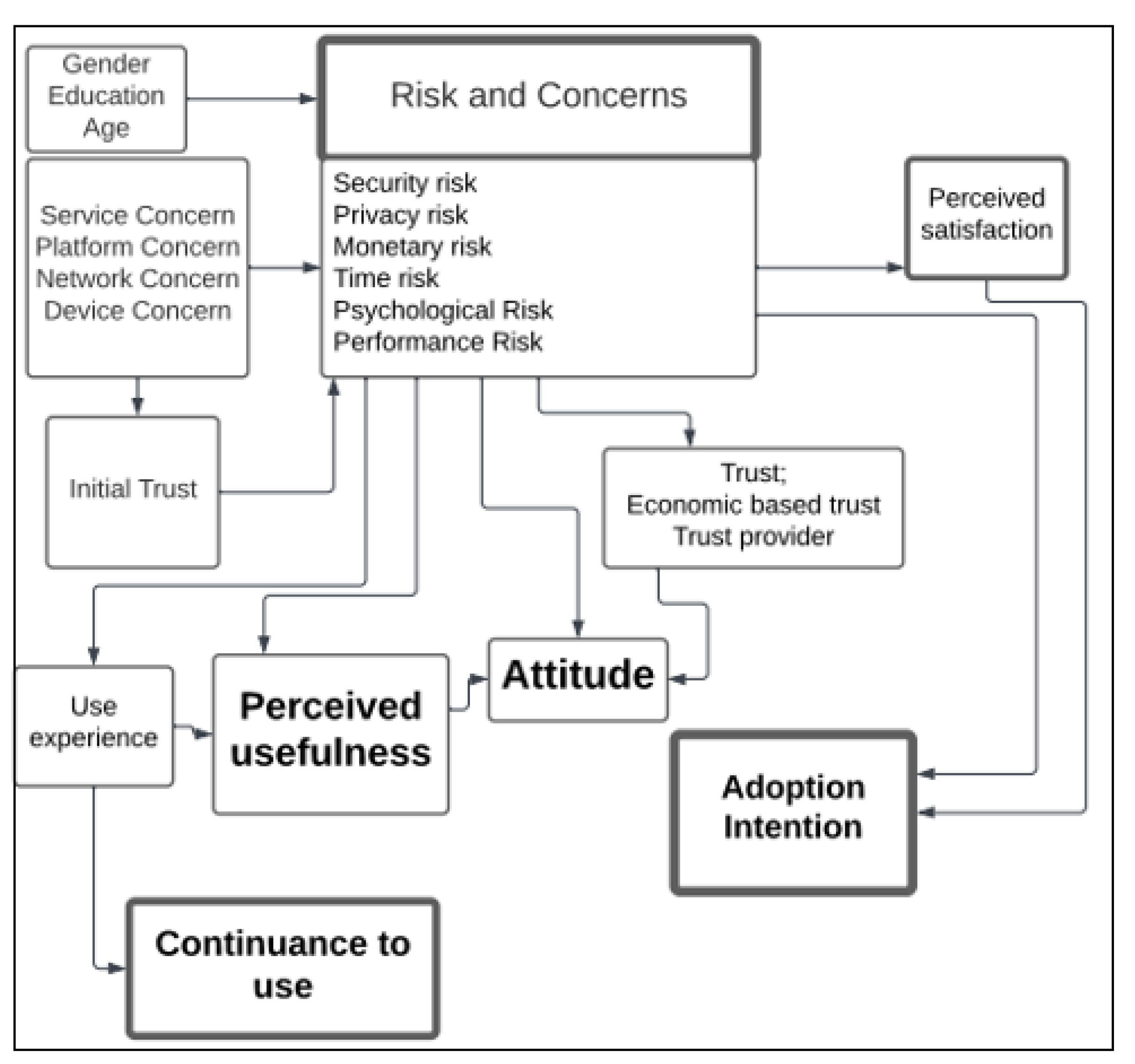

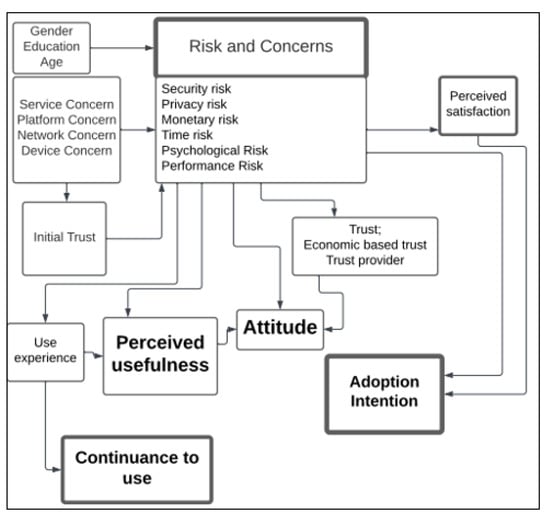

Regarding security and privacy, as shown in Figure 6, various research works have approached it from the behavioural aspect of customers and it has been found to have significant impact (direct/indirect) on intentions to use and recommend digital technologies [91,102]. As past studies have demonstrated, trust can thrive and is necessary via the internet while dealing with an unpredictable and unsafe environment. In retail situations, trust between the trustor (a customer) and the trustee (a seller) is a significant incentive, since it improves repurchase intention and minimises perceived risk. In general, users are comfortable sharing generic and nonspecific information such as preferences but are less comfortable supplying sensitive information, such as account or credit card details. Additionally, whether or not clients transfer personal and financial data online is contingent upon their faith in a particular online supplier.

Figure 6.

The determinants and consequences of risk.

As summarised in Table 7, researchers in this cluster have examined a variety of issues affecting mobile payment service markets [47,101], developing frameworks that take into account all players [51]. Academia appears to be restricted in terms of what technological benefits it can provide practitioners, except firms engage academic researchers aggressively. According to the report, confidence in a payment vendor, service provider, institutional context, and technology component has a significant role in forming trust in services [76,103]. Diverse payment scenarios previously required physical tokens and their combinations, network traffic algorithms based on software, trust, and creation of various securities. This is perhaps the most fertile ground for collaboration and academic study. Lu et al. [103] established a model of client decision making based on trust in the setting of nonindependent third-party mobile payment services.

Table 7.

Summary of studies in cluster 3.

5. Discussion and Future Research

This section provides critical discussion on the topic and provides suggestions for future research. A large number of studies on digital payment have discussed it from the technical and user acceptance and adoption standpoints, with some attention to perceived security and privacy risks. In line with the common theories (i.e., the TAM and the UTAUT), it has been reported that perceived security has a positive effect on behavioural intention [102], while the effect is negative for perceived privacy [13,102]. Despite this contradiction in the direction of the relationship between subattributes of risk, some studies used risk as a general construct in their research model [102,107,108,109]. Hence, future work might extend the existing models through multigroup analyses based on subdimensions of risk, including service-related risk, platform-related risk, network-related risk, and device-related risk. Additionally, cultural differences could be another driver of contradictory findings of prior studies. Kim et al. [78] reported that an individual’s disposition to trust is shaped by their cultural upbringing. Dahlberg et al. [47] also suggested that social and cultural variables might have a significant effect on digital payments adoption. In this regard, customers who espouse cultural values of uncertainty avoidance would have a strong intention to use digital payments services, reducing the uncertainty of the usage of digital payment services, which would also reduce the fear of information security breaches. Moreover, consumers from low-uncertainty-avoidance cultures are likely to take more risks compared to individuals from high-uncertainty-avoidance cultures. According to several studies, culture plays an important role in the adoption of new technologies [25].

In addition, individuals in smart cities are reported to have limited adoption of digital payment for security and confidentiality concerns [11]; future research, therefore, could evaluate the security assurance and confidentiality of financial technology transactions as they are proportional to the user’s convenience and the availability of the service itself. Furthermore, the complex inter-relationship between risk attributes that consequently influence individual behaviour is still unclear. For instance, Morosan and DeFranco [52] reported that perceived security influences the general privacy perception, while El Haddad et al. [13] reported this association through perceived financial fears. In addition, other studies [102,107,108] did not consider the inter-relationship between risk attributes. We therefore argue that understanding the inter-relationship between risk attributes can be another area of interest in further research.

Moreover, some prior studies evaluated the antecedents of digital payment risk, such as quality [109], ease of use [13], technology risk [110], software awareness [110], financial incentives [108], and Fintech service knowledge [111]. There are several factors that influence risk perception yet to be examined, such as reputation, as users may depend on belief indicators such as reputation to establish their initial trust in digital payment providers, and the consideration of financial transaction service providers to explore models of service improvements that comply with government rules or international standards to enhance compliance and information security culture. Furthermore, whilst the majority of studies concentrated on retail, concern and risk will differ depending on the industry. This is a critical topic for future research.

6. Conclusions

Globally, the proliferation of mobile phones has paved the way for digital mobility systems that benefit a variety of organisations. To strengthen the field of digital payments security and privacy, it was necessary to conduct a literature assessment and become aware of knowledge gaps, thereby defining an agenda for researchers and practitioners. Thus, this study updates a previous review of the literature published in Scopus-indexed journals to assess the field’s intellectual development. The investigation adds to the literature by making the following significant findings: (1) China contributed the most to the prevalent literature on digital payment risk, while African countries contributed the least. (2) Because digital payment research has primarily focused on the unified theory of acceptance and use of technology and the technology acceptance model, these findings highlight a research gap in that there are few theories addressing the cultural aspects of digital payment users. Thus, we conclude that the theoretical and ontological frameworks available in the current literature do not adequately address the nuances and complexities of digital payment. (3) Numerous studies have examined digital payment from both a technical and user acceptance standpoint. Researchers have a plethora of topics to choose from when it comes to the antecedents and determinants of digital payment risk.

For practitioners, our study summarises and organises existing research findings according to a set of criteria. We also offer a comprehensive framework for digital payment risk, highlighting the factors that must be taken into consideration when developing digital payment services. According to our review, practitioners should direct technical development toward increased collaboration with consumers and merchants. Additionally, our findings indicate that in order for mobile payment services to flourish, their business models must develop away from exclusive proprietary solutions and toward cooperative and standardised solutions. Newly added technological drivers draw the attention of merchants toward the influence of technology and its skilful usage on adoption behaviour. Newly added strategic activities of addressing security and privacy concerns makes a case for the importance of innovative-technology-related risk in customers’ adoption.

Author Contributions

Conceptualization, A.M.S. and S.F.A.K.; methodology, S.F.A.K.; software A.F.A. and K.Z.; validation, A.M.S., A.F.A. and S.F.A.K.; formal analysis, A.M.S. and K.Z.; investigation, S.F.A.K.; resources, A.M.S. and K.Z.; data curation, A.F.A.; writing—original draft preparation, A.M.S. and S.F.A.K.; writing—review and editing, S.F.A.K. and H.A.A.; visualization, A.M.S.; supervision, H.K. and K.Z.; project administration, H.K. and H.A.A.; funding acquisition, A.M.S. and A.F.A. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Teoh, W.M.Y.; Chong, S.C.; Lin, B.; Chua, J.W. Factors affecting consumers’ perception of electronic payment: An empirical analysis. Internet Res. 2013, 23, 465–485. [Google Scholar] [CrossRef]

- Sahi, A.M.; Khalid, H.; Abbas, A.F.; Khatib, S.F.A. The evolving research of customer adoption of digital payment: Learning from content and statistical analysis of the literature. J. Open Innov. Technol. Mark. Complex. 2021, 7, 230. [Google Scholar] [CrossRef]

- De Luna, I.R.; Liébana-Cabanillas, F.; Sánchez-Fernández, J.; Muñoz-Leiva, F. Mobile payment is not all the same: The adoption of mobile payment systems depending on the technology applied. Technol. Forecast. Soc. Chang. 2019, 146, 931–944. [Google Scholar] [CrossRef]

- Schierz, P.G.; Schilke, O.; Wirtz, B.W. Understanding consumer acceptance of mobile payment services: An empirical analysis. Electron. Commer. Res. Appl. 2010, 9, 209–216. [Google Scholar] [CrossRef]

- Aljawder, M.; Abdulrazzaq, A. The effect of awareness, trust, and privacy and security on students’ adoption of contactless payments: An empirical study. Int. J. Comput. Digit. Syst. 2019, 8, 669–676. [Google Scholar] [CrossRef]

- Duane, A.; O’Reilly, P.; Andreev, P. Realising M-Payments: Modelling consumers’ willingness to M-pay using Smart Phones. Behav. Inf. Technol. 2014, 33, 318–334. [Google Scholar] [CrossRef]

- Kumar, A.S.; Arun Palanisamy, Y. Examining the consumers’ preference towards adopting the mobile payment system. Int. J. Electron. Financ. 2019, 9, 268–286. [Google Scholar] [CrossRef]

- Sorkin, D.E. Payment methods for consumer to consumer online transactions. Akron Law Rev. 2001, 35, 1–30. [Google Scholar]

- Hwang, J.J.; Yeh, T.C.; Li, J. Bin Securing on-line credit card payments without disclosing privacy information. Comput. Stand. Interfaces 2003, 25, 119–129. [Google Scholar] [CrossRef]

- Qin, Z.; Sun, J.; Wahaballa, A.; Zheng, W.; Xiong, H.; Qin, Z. A secure and privacy-preserving mobile wallet with outsourced verification in cloud computing. Comput. Stand. Interfaces 2017, 54, 55–60. [Google Scholar] [CrossRef]

- Kartika, H.; Fatimah, Y.A.; Supangkat, S.H. Secure Cashless Payment Governance in Indonesia: A Systematic Literature Review. In Proceedings of the 2018 International Conference on ICT for Smart Society (ICISS), Semarang, Indonesia, 10–11 October 2018; pp. 1–4. [Google Scholar] [CrossRef]

- Yang, Y.; Liu, Y.; Li, H.; Yu, B. Understanding perceived risks in mobile payment acceptance. Ind. Manag. Data Syst. 2015, 115, 253–269. [Google Scholar] [CrossRef]

- El Haddad, G.; Aimeur, E.; Hage, H. Understanding Trust, Privacy and Financial Fears in Online Payment. In Proceedings of the 2018 17th IEEE International Conference On Trust, Security And Privacy In Computing And Communications/12th IEEE International Conference On Big Data Science And Engineering (TrustCom/BigDataSE), New York, NY, USA, 1–3 August 2018; pp. 28–36. [Google Scholar] [CrossRef]

- Bagla, R.K.; Sancheti, V. Gaps in customer satisfaction with digital wallets: Challenge for sustainability. J. Manag. Dev. 2018, 37, 442–451. [Google Scholar] [CrossRef]

- Kar, A.K. What Affects Usage Satisfaction in Mobile Payments? Modelling User Generated Content to Develop the “Digital Service Usage Satisfaction Model”. Inf. Syst. Front. 2021, 23, 1341–1361. [Google Scholar] [CrossRef] [PubMed]

- Grover, P.; Kar, A.K. User engagement for mobile payment service providers—introducing the social media engagement model. J. Retail. Consum. Serv. 2020, 53, 101718. [Google Scholar] [CrossRef]

- Rahi, S.; Abd.Ghani, M.; Hafaz Ngah, A. Integration of unified theory of acceptance and use of technology in internet banking adoption setting: Evidence from Pakistan. Technol. Soc. 2019, 58, 101120. [Google Scholar] [CrossRef]

- Luarn, P.; Lin, H.H. Toward an understanding of the behavioral intention to use mobile banking. Comput. Hum. Behav. 2005, 21, 873–891. [Google Scholar] [CrossRef]

- Apanasevic, T.; Markendahl, J.; Arvidsson, N. Stakeholders’ expectations of mobile payment in retail: Lessons from Sweden. Int. J. Bank Mark. 2016, 34, 37–61. [Google Scholar] [CrossRef]

- Liu, R.; Wu, J.; Yu-Buck, G.F. The influence of mobile QR code payment on payment pleasure: Evidence from China. Int. J. Bank Mark. 2021, 39, 337–356. [Google Scholar] [CrossRef]

- Singh, N.; Srivastava, S.; Sinha, N. Consumer preference and satisfaction of M-wallets: A study on North Indian consumers. Int. J. Bank Mark. 2017, 35, 944–965. [Google Scholar] [CrossRef]

- Uduji, J.I.; Okolo-Obasi, E.N. Young rural women’s participation in the e-wallet programme and usage intensity of modern agricultural inputs in Nigeria. Gend. Technol. Dev. 2018, 22, 59–81. [Google Scholar] [CrossRef] [Green Version]

- Zhou, T.; Lu, Y.; Wang, B. Integrating TTF and UTAUT to explain mobile banking user adoption. Comput. Hum. Behav. 2010, 26, 760–767. [Google Scholar] [CrossRef]

- Rahi, S.; Abd.Ghani, M. Investigating the role of UTAUT and e-service quality in internet banking adoption setting. TQM J. 2019, 31, 491–506. [Google Scholar] [CrossRef]

- Al-Okaily, M.; Lutfi, A.; Alsaad, A.; Taamneh, A.; Alsyouf, A. The Determinants of Digital Payment Systems’ Acceptance under Cultural Orientation Differences: The Case of Uncertainty Avoidance. Technol. Soc. 2020, 63, 101367. [Google Scholar] [CrossRef]

- Putri, M.F.; Purwandari, B.; Hidayanto, A.N. What do affect customers to use mobile payment continually? A systematic literature review. In Proceedings of the 2020 Fifth International Conference on Informatics and Computing (ICIC), Gorontalo, Indonesia, 3–4 November 2020. [Google Scholar] [CrossRef]

- Pramana, E. The Mobile Payment Adoption: A Systematic Literature Review. In Proceedings of the 2021 3rd East Indonesia Conference on Computer and Information Technology (EIConCIT), Surabaya, Indonesia, 9–11 April 2021; pp. 265–269. [Google Scholar] [CrossRef]

- Alkhowaiter, W.A. Digital payment and banking adoption research in Gulf countries: A systematic literature review. Int. J. Inf. Manag. 2020, 53, 102102. [Google Scholar] [CrossRef]

- Boateng, R.; Sarpong, M.Y.P. A Literature Review of Mobile Payments in Sub-Saharan Africa; Springer International Publishing: Berlin/Heidelberg, Germany, 2019; Volume 558, ISBN 9783030206703. [Google Scholar]

- Wonglimpiyarat, J. Competition and challenges of mobile banking: A systematic review of major bank models in the Thai banking industry. J. High Technol. Manag. Res. 2014, 25, 123–131. [Google Scholar] [CrossRef]

- Khatib, S.F.A.; Abdullah, D.F.; Hendrawaty, E.; Elamer, A.A. A bibliometric analysis of cash holdings literature: Current status, development, and agenda for future research. Manag. Rev. Q. 2021; 1–38, ahead of print. [Google Scholar] [CrossRef]

- Hazaea, S.A.; Zhu, J.; Al-Matari, E.M.; Senan, N.A.M.; Khatib, S.F.A.; Ullah, S. Mapping of internal audit research in China: A systematic literature review and future research agenda. Cogent Bus. Manag. 2021, 8, 1938351. [Google Scholar] [CrossRef]

- Zamil, I.A.; Ramakrishnan, S.; Jamal, N.M.; Hatif, M.A.; Khatib, S.F.A. Drivers of corporate voluntary disclosure: A systematic review. J. Financ. Report. Account. 2021; ahead of print. [Google Scholar] [CrossRef]

- Hazaea, S.A.; Zhu, J.; Khatib, S.F.A.; Bazhair, A.H.; Elamer, A.A. Sustainability assurance practices: A systematic review and future research agenda. Environ. Sci. Pollut. Res. 2022, 29, 4843–4864. [Google Scholar] [CrossRef]

- Block, J.H.; Fisch, C. Eight tips and questions for your bibliographic study in business and management research. Manag. Rev. Q. 2020, 70, 307–312. [Google Scholar] [CrossRef]

- Khatib, S.F.A.; Abdullah, D.F.; Elamer, A.A.; Abueid, R. Nudging toward diversity in the boardroom: A systematic literature review of board diversity of financial institutions. Bus. Strateg. Environ. 2021, 30, 985–1002. [Google Scholar] [CrossRef]

- Abbas, A.F.; Jusoh, A.B.; Masod, A.; Ali, J. Market Maven and Mavenism: A Bibliometrics Analysis using Scopus Database. Int. J. Manag. 2020, 11, 31–45. [Google Scholar] [CrossRef]

- Abbas, A.F.; Jusoh, A.; Mas’od, A.; Alsharif, A.H.; Ali, J. Bibliometrix analysis of information sharing in social media. Cogent Bus. Manag. 2022, 9, 2016556. [Google Scholar] [CrossRef]

- Khatib, S.; Abdullah, D.F.; Elamer, A.; Hazaea, S.A. The Development of Corporate Governance Literature in Malaysia: A Systematic Literature Review and Research Agenda. Corp. Gov. Int. J. Bus. Soc. 2022; ahead of print. [Google Scholar] [CrossRef]

- Taylor, E. Mobile payment technologies in retail: A review of potential benefits and risks. Int. J. Retail Distrib. Manag. 2016, 44, 159–177. [Google Scholar] [CrossRef]

- Massaro, M.; Dumay, J.; Guthrie, J. On the shoulders of giants: Undertaking a structured literature review in accounting. Account. Audit. Account. J. 2016, 29, 767–801. [Google Scholar] [CrossRef]

- Rasel, M.A.; Win, S. Microfinance governance: A systematic review and future research directions. J. Econ. Stud. 2020, 47, 1811–1847. [Google Scholar] [CrossRef]

- Khatib, S.F.A.; Abdullah, D.F.; Elamer, A.; Yahaya, I.S.; Owusu, A. Global trends in board diversity research: A bibliometric view. Meditari Account. Res. 2021; ahead of print. [Google Scholar] [CrossRef]

- Khatib, S.F.A.; Abdullah, D.F.; Al Amosh, H.; Bazhair, A.H.; Kabara, A.S. Shariah auditing: Analyzing the past to prepare for the future auditing. J. Islam. Account. Bus. Res. 2022; ahead of print. [Google Scholar] [CrossRef]

- Bürk, H.; Pfitzmann, A. Value exchange systems enabling security and unobservability. Comput. Secur. 1990, 9, 715–721. [Google Scholar] [CrossRef]

- Mallat, N. Exploring consumer adoption of mobile payments—A qualitative study. J. Strateg. Inf. Syst. 2007, 16, 413–432. [Google Scholar] [CrossRef]

- Dahlberg, T.; Mallat, N.; Ondrus, J.; Zmijewska, A. Past, present and future of mobile payments research: A literature review. Electron. Commer. Res. Appl. 2008, 7, 165–181. [Google Scholar] [CrossRef] [Green Version]

- Slade, E.L.; Dwivedi, Y.K.; Piercy, N.C.; Williams, M.D. Modeling Consumers’ Adoption Intentions of Remote Mobile Payments in the United Kingdom: Extending UTAUT with Innovativeness, Risk, and Trust. Psychol. Mark. 2015, 32, 860–873. [Google Scholar] [CrossRef]

- Kim, C.; Tao, W.; Shin, N.; Kim, K.S. An empirical study of customers’ perceptions of security and trust in e-payment systems. Electron. Commer. Res. Appl. 2010, 9, 84–95. [Google Scholar] [CrossRef]

- Thakur, R.; Srivastava, M. Adoption readiness, personal innovativeness, perceived risk and usage intention across customer groups for mobile payment services in India. Internet Res. 2014, 24, 369–392. [Google Scholar] [CrossRef]

- Au, Y.A.; Kauffman, R.J. The economics of mobile payments: Understanding stakeholder issues for an emerging financial technology application. Electron. Commer. Res. Appl. 2008, 7, 141–164. [Google Scholar] [CrossRef]

- Morosan, C.; DeFranco, A. It’s about time: Revisiting UTAUT2 to examine consumers’ intentions to use NFC mobile payments in hotels. Int. J. Hosp. Manag. 2016, 53, 17–29. [Google Scholar] [CrossRef]

- De Kerviler, G.; Demoulin, N.T.M.; Zidda, P. Adoption of in-store mobile payment: Are perceived risk and convenience the only drivers? J. Retail. Consum. Serv. 2016, 31, 334–344. [Google Scholar] [CrossRef]

- Von Solms, S.; Naccache, D. On blind signatures and perfect crimes. Comput. Secur. 1992, 11, 581–583. [Google Scholar] [CrossRef]

- Slade, E.; Williams, M.; Dwivedi, Y.; Piercy, N. Exploring consumer adoption of proximity mobile payments. J. Strateg. Mark. 2015, 23, 209–223. [Google Scholar] [CrossRef]

- Van Eck, N.J.; Waltman, L. Manual for VOSviewer version 1.6.8; Univeristeit Leiden: Leiden, The Netherlands, 2018; pp. 1–51. [Google Scholar]

- Ajzen, I. The theory of planned behavior. Organ. Behav. Hum. Decis. Process. 1991, 50, 179–211. [Google Scholar] [CrossRef]

- Davis, F.D.; Bagozzi, R.P.; Warshaw, P.R. User Acceptance of Computer Technology: A Comparison of Two Theoretical Models. Manag. Sci. 1989, 35, 982–1003. [Google Scholar] [CrossRef] [Green Version]

- Venkatesh, V.; Davis, F.D.; College, S.M.W. A theoretical extension of the technology acceptance model: Four longitudinal field studies. Manag. Sci. 2000, 46, 186–204. [Google Scholar] [CrossRef] [Green Version]

- Phonthanukitithaworn, C.; Sellitto, C.; Fong, M. User intentions to adopt mobile payment services: A study of early adopters in Thailand. J. Internet Bank. Commer. 2015, 20, 1–29. [Google Scholar]

- Aslam, W.; Ham, M.; Arif, I. Consumer behavioral intentions towards mobile payment services: An empirical analysis in Pakistan. Market-Trziste 2017, 29, 161–176. [Google Scholar] [CrossRef] [Green Version]

- Liébana-Cabanillas, F.J.; Sánchez-Fernández, J.; Muñoz-Leiva, F. Role of gender on acceptance of mobile payment. Ind. Manag. Data Syst. 2014, 114, 220–240. [Google Scholar] [CrossRef]

- Chawla, D.; Joshi, H. Consumer attitude and intention to adopt mobile wallet in India—An empirical study. Int. J. Bank Mark. 2019, 37, 1590–1618. [Google Scholar] [CrossRef]

- Shin, D.H. Towards an understanding of the consumer acceptance of mobile wallet. Comput. Hum. Behav. 2009, 25, 1343–1354. [Google Scholar] [CrossRef]

- Pham, T.T.T.; Ho, J.C. The effects of product-related, personal-related factors and attractiveness of alternatives on consumer adoption of NFC-based mobile payments. Technol. Soc. 2015, 43, 159–172. [Google Scholar] [CrossRef]

- Madan, K.; Yadav, R. Understanding and predicting antecedents of mobile shopping adoption: A developing country perspective. Asia Pacific J. Mark. Logist. 2018, 30, 139–162. [Google Scholar] [CrossRef]

- Zhang, J.; Luximon, Y. A quantitative diary study of perceptions of security in mobile payment transactions. Behav. Inf. Technol. 2021, 40, 1579–1602. [Google Scholar] [CrossRef]

- Venkatesh, V. Determinants of Perceived Ease of Use: Integrating Control, Intrinsic Motivation, and Emotion into the Technology Acceptance Model. Inf. Syst. Res. 2000, 11, 342–365. [Google Scholar] [CrossRef] [Green Version]

- Davis, F.D. Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Q. Manag. Inf. Syst. 1989, 13, 319–339. [Google Scholar] [CrossRef] [Green Version]

- Venkatesh, V.; Bala, H. Technology acceptance model 3 and a research agenda on interventions. Decis. Sci. 2008, 39, 273–315. [Google Scholar] [CrossRef] [Green Version]

- Fornell, C.; Larcker, D.F. Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Anderson, J.C.; Gerbing, D.W. Structural Equation Modeling in Practice: A Review and Recommended Two-Step Approach. Psychol. Bull. 1988, 103, 411–423. [Google Scholar] [CrossRef]

- Bagozzi, R.P.; Yi, Y. On the evaluation of structural equation models. J. Acad. Mark. Sci. 1988, 16, 74–94. [Google Scholar] [CrossRef]

- Pavlou, P.A. Consumer Acceptance of Electronic Commerce: Integrating Trust and Risk with the Technology Acceptance Model. Int. J. Electron. Commer. 2003, 7, 101–134. [Google Scholar]

- Agarwal, R.; Prasad, J. A Conceptual and Operational Definition of Personal Innovativeness in the Domain of Information Technology. Inf. Syst. Res. 1998, 9, 204–215. [Google Scholar] [CrossRef]

- Gefen, D. E-commerce: The role of familiarity and trust. Omega 2000, 28, 725–737. [Google Scholar] [CrossRef] [Green Version]

- Featherman, M.S.; Pavlou, P.A. Predicting e-services adoption: A perceived risk facets perspective. Int. J. Hum. Comput. Stud. 2003, 59, 451–474. [Google Scholar] [CrossRef] [Green Version]

- Kim, G.; Shin, B.; Lee, H.G. Understanding dynamics between initial trust and usage intentions of mobile banking. Inf. Syst. J. 2009, 19, 283–311. [Google Scholar] [CrossRef]

- Moore, G.C.; Benbasat, I. Development of an instrument to measure the perceptions of adopting an information technology innovation. Inf. Syst. Res. 1991, 2, 192–222. [Google Scholar] [CrossRef] [Green Version]

- Taylor, S.; Todd, P.A. Understanding information technology usage: A test of competing models. Inf. Syst. Res. 1995, 6, 144–176. [Google Scholar] [CrossRef]

- Legris, P.; Ingham, J.; Collerette, P. Why do people use information technology? A critical review of the technology acceptance model. Inf. Manag. 2003, 40, 191–204. [Google Scholar] [CrossRef]

- Chuttur, M.Y. Overview of the technology acceptance model: Origins, developments and future directions. Work. Pap. Inf. Syst. 2009, 9, 9–37. [Google Scholar]

- Venkatesh, V.; Morris, M.G.; Davis, G.B.; Davis, F.D. User acceptance of information technology: Toward a unified view. MIS Q. Manag. Inf. Syst. 2003, 27, 425–478. [Google Scholar] [CrossRef] [Green Version]

- Venkatesh, V.; Thong, J.Y.L.; Xu, X. Consumer acceptance and use of information technology: Extending the unified theory of acceptance and use of technology. MIS Q. Manag. Inf. Syst. 2012, 36, 157–178. [Google Scholar] [CrossRef] [Green Version]

- Yang, S.; Lu, Y.; Gupta, S.; Cao, Y.; Zhang, R. Mobile payment services adoption across time: An empirical study of the effects of behavioral beliefs, social influences, and personal traits. Comput. Hum. Behav. 2012, 28, 129–142. [Google Scholar] [CrossRef]

- Oliveira, T.; Thomas, M.; Baptista, G.; Campos, F. Mobile payment: Understanding the determinants of customer adoption and intention to recommend the technology. Comput. Hum. Behav. 2016, 61, 404–414. [Google Scholar] [CrossRef]

- Kim, C.; Mirusmonov, M.; Lee, I. An empirical examination of factors influencing the intention to use mobile payment. Comput. Hum. Behav. 2010, 26, 310–322. [Google Scholar] [CrossRef]

- Shao, Z.; Zhang, L.; Li, X.; Guo, Y. Antecedents of trust and continuance intention in mobile payment platforms: The moderating effect of gender. Electron. Commer. Res. Appl. 2019, 33, 100823. [Google Scholar] [CrossRef]

- Qasim, H.; Abu-Shanab, E. Drivers of mobile payment acceptance: The impact of network externalities. Inf. Syst. Front. 2016, 18, 1021–1034. [Google Scholar] [CrossRef]

- Dahlberg, T.; Guo, J.; Ondrus, J. A critical review of mobile payment research. Electron. Commer. Res. Appl. 2015, 14, 265–284. [Google Scholar] [CrossRef]

- Alalwan, A.A.; Dwivedi, Y.K.; Rana, N.P. Factors influencing adoption of mobile banking by Jordanian bank customers: Extending UTAUT2 with trust. Int. J. Inf. Manag. 2017, 37, 99–110. [Google Scholar] [CrossRef]

- Liébana-Cabanillas, F.; Sánchez-Fernández, J.; Muñoz-Leiva, F. Antecedents of the adoption of the new mobile payment systems: The moderating effect of age. Comput. Hum. Behav. 2014, 35, 464–478. [Google Scholar] [CrossRef]

- Liébana-Cabanillas, F.; Sánchez-Fernández, J.; Muñoz-Leiva, F. The moderating effect of experience in the adoption of mobile payment tools in Virtual Social Networks: The m-Payment Acceptance Model in Virtual Social Networks (MPAM-VSN). Int. J. Inf. Manag. 2014, 34, 151–166. [Google Scholar] [CrossRef]

- Zhou, T. An empirical examination of continuance intention of mobile payment services. Decis. Support Syst. 2013, 54, 1085–1091. [Google Scholar] [CrossRef]

- Kumar, A.; Adlakaha, A.; Mukherjee, K. The effect of perceived security and grievance redressal on continuance intention to use M-wallets in a developing country. Int. J. Bank Mark. 2018, 36, 1170–1189. [Google Scholar] [CrossRef]

- Luo, X.; Li, H.; Zhang, J.; Shim, J.P. Examining multi-dimensional trust and multi-faceted risk in initial acceptance of emerging technologies: An empirical study of mobile banking services. Decis. Support Syst. 2010, 49, 222–234. [Google Scholar] [CrossRef]

- Martins, C.; Oliveira, T.; Popovič, A. Understanding the internet banking adoption: A unified theory of acceptance and use of technology and perceived risk application. Int. J. Inf. Manag. 2014, 34, 1–13. [Google Scholar] [CrossRef]

- Johnson, V.L.; Kiser, A.; Washington, R.; Torres, R. Limitations to the rapid adoption of M-payment services: Understanding the impact of privacy risk on M-Payment services. Comput. Hum. Behav. 2018, 79, 111–122. [Google Scholar] [CrossRef]

- Riquelme, H.E.; Rios, R.E. The moderating effect of gender in the adoption of mobile banking. Int. J. Bank Mark. 2010, 28, 328–341. [Google Scholar] [CrossRef]

- Khalilzadeh, J.; Ozturk, A.B.; Bilgihan, A. Security-related factors in extended UTAUT model for NFC based mobile payment in the restaurant industry. Comput. Hum. Behav. 2017, 70, 460–474. [Google Scholar] [CrossRef]

- Ghezzi, A.; Renga, F.; Balocco, R.; Pescetto, P. Mobile payment applications: Offer state of the art in the Italian market. Info 2010, 12, 3–22. [Google Scholar] [CrossRef]

- Liu, Z.; Ben, S.; Zhang, R. Factors affecting consumers’ mobile payment behavior: A meta-analysis. Electron. Commer. Res. 2019, 19, 575–601. [Google Scholar] [CrossRef]

- Lu, Y.; Yang, S.; Chau, P.Y.K.; Cao, Y. Dynamics between the trust transfer process and intention to use mobile payment services: A cross-environment perspective. Inf. Manag. 2011, 48, 393–403. [Google Scholar] [CrossRef]

- Madan, K.; Yadav, R. Behavioural intention to adopt mobile wallet: A developing country perspective. J. Indian Bus. Res. 2016, 8, 227–244. [Google Scholar] [CrossRef]

- Ondrus, J.; Pigneur, Y. Towards a holistic analysis of mobile payments: A multiple perspectives approach. Electron. Commer. Res. Appl. 2006, 5, 246–257. [Google Scholar] [CrossRef]

- Zhou, T. An empirical examination of initial trust in mobile banking. Internet Res. 2011, 21, 527–540. [Google Scholar] [CrossRef]

- Kalinic, Z.; Marinkovic, V.; Molinillo, S.; Liébana-Cabanillas, F. A multi-analytical approach to peer-to-peer mobile payment acceptance prediction. J. Retail. Consum. Serv. 2019, 49, 143–153. [Google Scholar] [CrossRef]

- Zhao, H.; Anong, S.T.; Zhang, L. Understanding the impact of financial incentives on NFC mobile payment adoption: An experimental analysis. Int. J. Bank Mark. 2019, 37, 1296–1312. [Google Scholar] [CrossRef]

- Francisco, L.C.; Francisco, M.L.; Juan, S.F. Payment systems in new electronic environments: Consumer behavior in payment systems via SMS. Int. J. Inf. Technol. Decis. Mak. 2015, 14, 421–449. [Google Scholar] [CrossRef]

- Gupta, S.; Xu, H. Examining the relative influence of risk and control on intention to adopt risky technologies. J. Technol. Manag. Innov. 2010, 5, 22–37. [Google Scholar] [CrossRef] [Green Version]

- Lim, S.H.; Kim, D.J.; Hur, Y.; Park, K. An Empirical Study of the Impacts of Perceived Security and Knowledge on Continuous Intention to Use Mobile Fintech Payment Services. Int. J. Hum. Comput. Interact. 2019, 35, 886–898. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).