Digital Competencies for a FinTech-Driven Accounting Profession: A Systematic Literature Review

Abstract

1. Introduction

2. Theoretical Background

2.1. The Architectural Shift Driven by Financial Technology

- Key Enabling Technologies.

2.2. The Reorientation of the Accounting Professional

Impact on Core Accounting Functions

2.3. Digital Competence as a Form of Professional Capital

2.4. The Role of Professional Bodies and Regulatory Frameworks

3. Methodology

3.1. Review Protocol and Research Design

3.2. Search Strategy

3.3. Data Sources and Selection Criteria

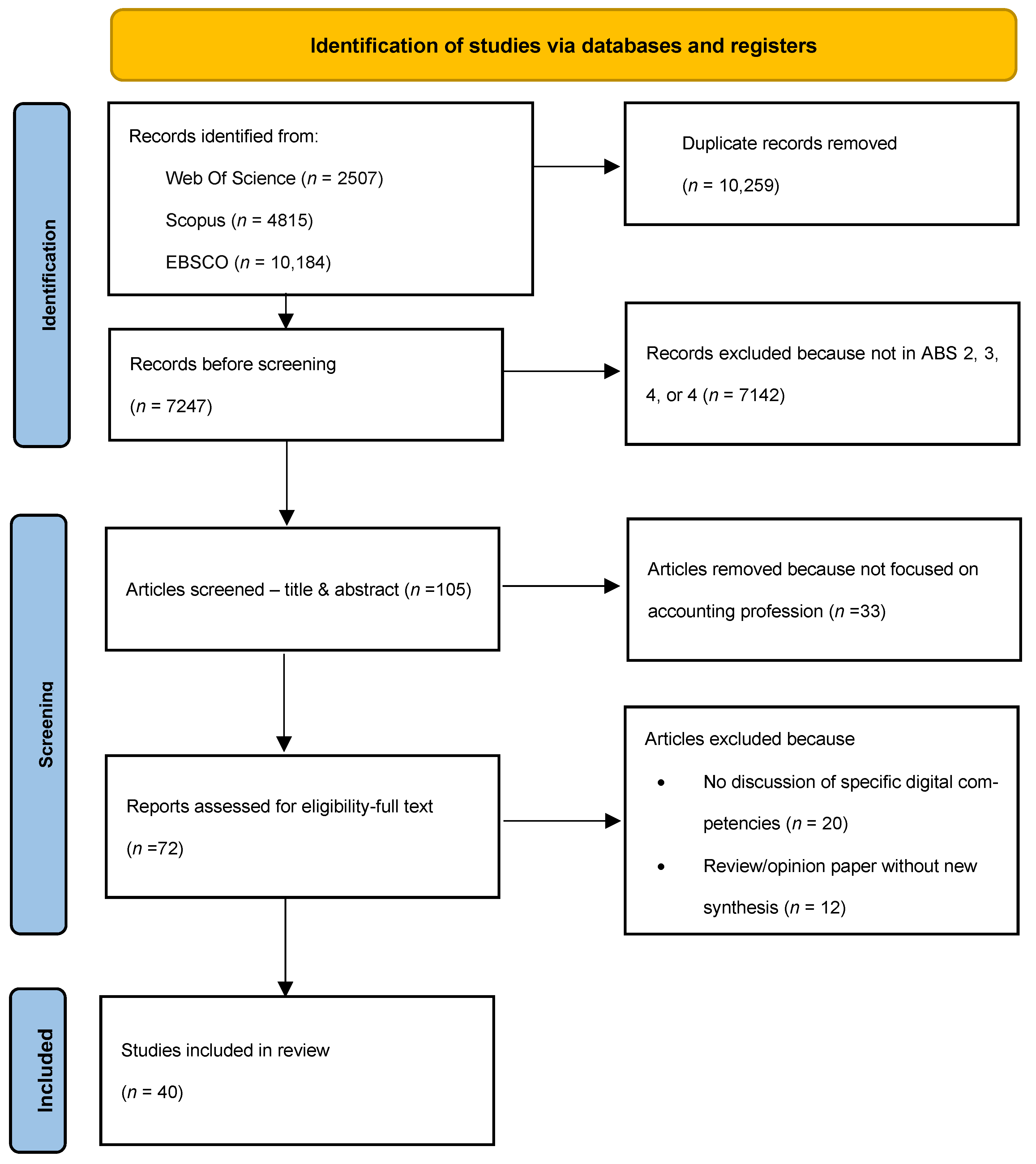

3.4. Screening and Selection Process

3.5. Data Extraction and Coding

3.6. Bibliometric and Thematic Analysis

4. Results

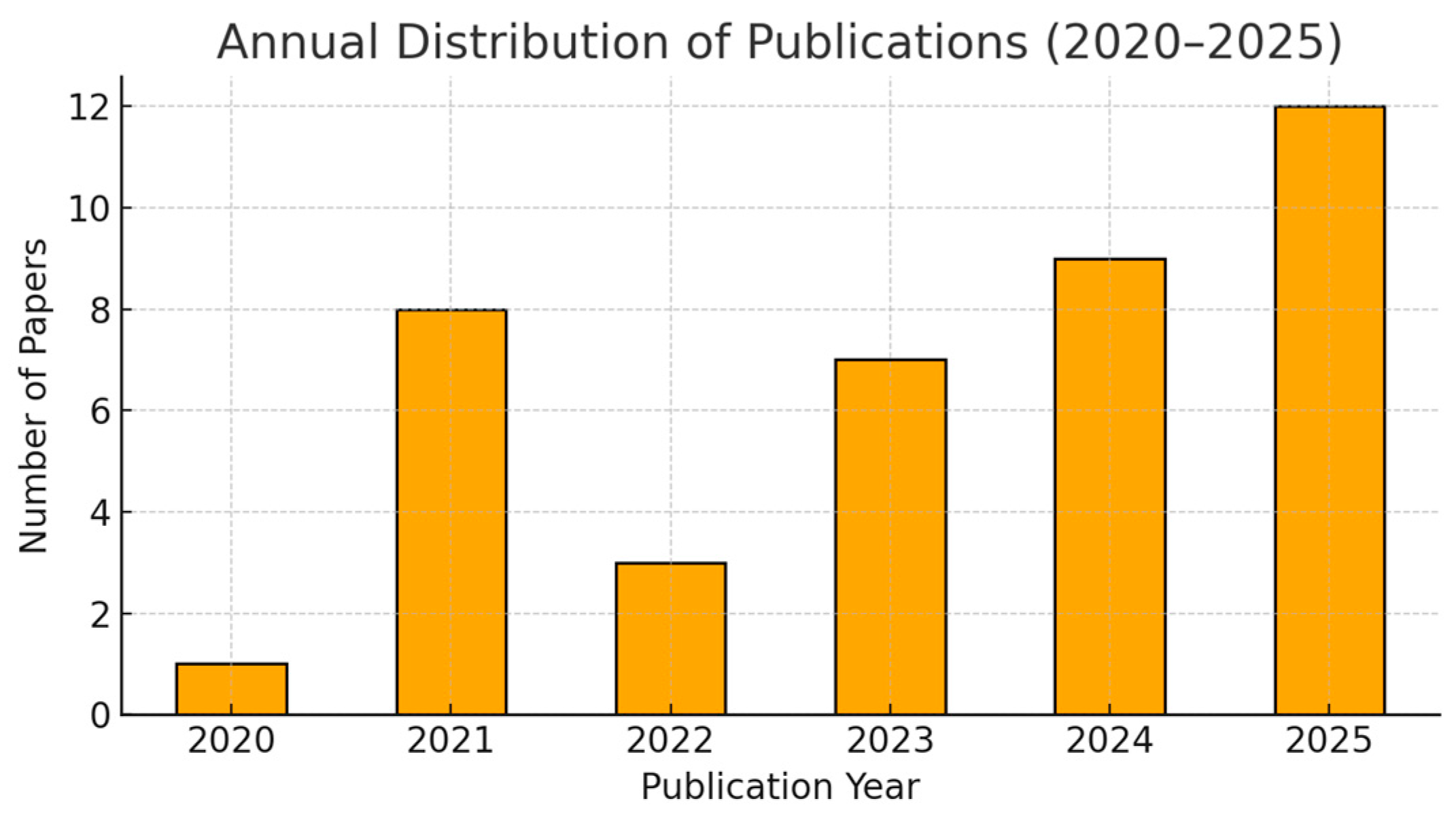

4.1. Descriptive Analysis: Quantitative Exploration

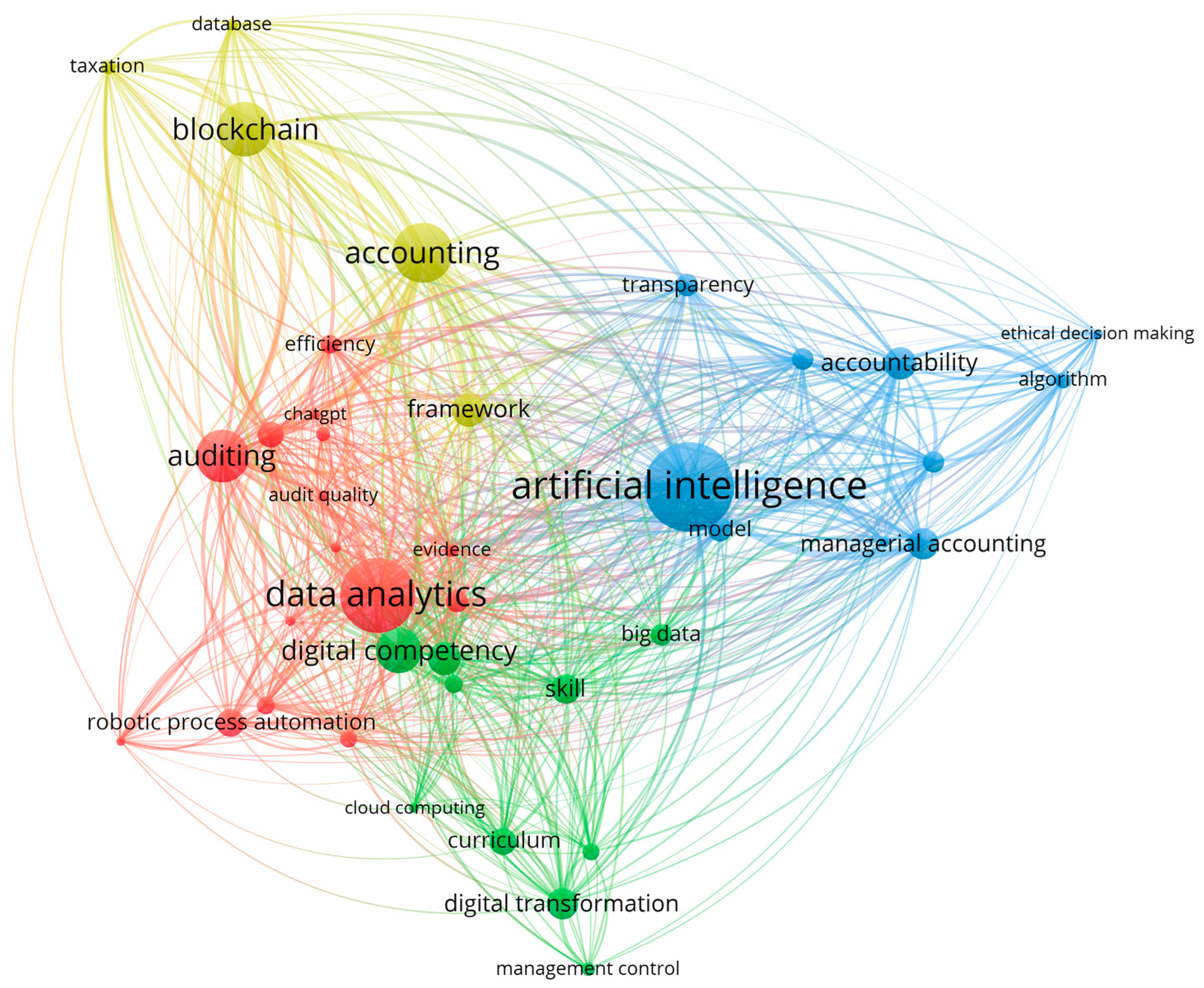

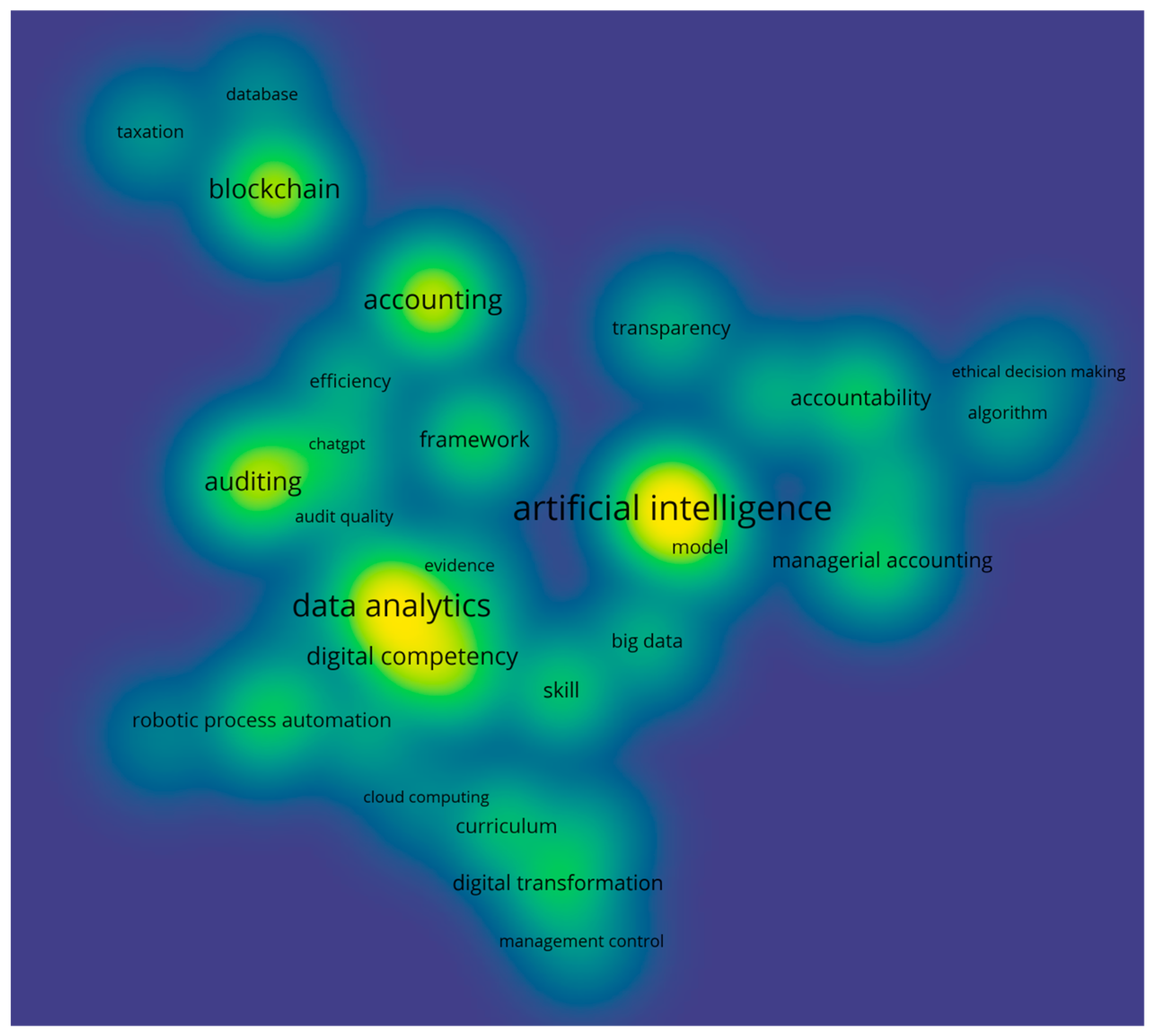

4.2. Exploratory Mapping

4.2.1. Thematic Clusters in the Literature

4.2.2. Temporal Evolution of Research Themes

4.3. Thematic Content Analysis

4.3.1. Cluster 1 (Red): The Professional Context and Digital Transformation (Bibliometric: Auditing and Data Analytics as Professional Practice Drivers)

4.3.2. Cluster 2 (Green): The Educational Response and Curriculum Development (Bibliometric: Digital Transformation and Educational Adaptation)

4.3.3. Cluster 3 (Blue): Core Competencies and Their Technological Drivers (Bibliometric: Artificial Intelligence and Professional Accountability)

4.3.4. Cluster 4 (Yellow): Blockchain, Ethics, and Professional Responsibility (Bibliometric: Blockchain and Accounting Innovation)

5. Discussion and Research Gaps

5.1. Synthesis of Findings and Answering the Research Questions

5.2. Identification of Research Gaps

5.3. Synthesis of Research Gaps

5.4. Implications for Theory and Practice

5.4.1. Theoretical Implications

5.4.2. Practical Implications

6. Conclusions and Future Research

6.1. Contributions and Limitations

6.2. Future Research

6.3. Concluding Remarks

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Database | Search String | Limitations |

|---|---|---|

| Scopus | TITLE-ABS-KEY((fintech OR “financial technolog *” OR “digital finance” OR “internet finance” OR “e-finance” OR “mobile money” OR “mobile payment *” OR “digital payment *” OR blockchain OR “distributed ledger *” OR DLT OR “smart contract *” OR “robo-advisor *” OR “open banking” OR insurtech OR regtech OR “robotic process automation” OR RPA OR “cloud accounting” OR ERP OR “machine learning” OR “artificial intelligence” OR “big data”) AND (“digital competenc *” OR “digital skill *” OR “data liter *” OR “analytics skill *” OR “technology readiness” OR “digital readiness” OR “ICT skill *” OR cybersecurity OR “data governance” OR privacy OR “ethical AI” OR “algorithmic accountability”) AND (account * OR auditor * OR “accounting profession” OR “accounting education” OR “financial reporting” OR assurance)) | Years: 2020–2025; Language: English; Source type: Journal articles; ABS ≥ 2 |

| Web of Science | TS = ((fintech OR “financial technolog *” OR “digital finance” OR “internet finance” OR “e-finance” OR “mobile money” OR “mobile payment *” OR “digital payment *” OR blockchain OR “distributed ledger *” OR DLT OR “smart contract *” OR “robo-advisor *” OR “open banking” OR insurtech OR regtech OR “robotic process automation” OR RPA OR “cloud accounting” OR ERP OR “machine learning” OR “artificial intelligence” OR “big data”) AND (“digital competenc *” OR “digital skill *” OR “data liter *” OR “analytics skill *” OR “technology readiness” OR “digital readiness” OR “ICT skill *” OR cybersecurity OR “data governance” OR privacy OR “ethical AI” OR “algorithmic accountability”) AND (account * OR auditor * OR “accounting profession” OR “accounting education” OR “financial reporting” OR assurance)) | Years: 2020–2025; Language: English; Document type: Article/Review |

| EBSCO | ((TI(fintech OR “financial technolog *” OR “digital finance” OR “internet finance” OR “e-finance” OR “mobile money” OR “mobile payment *” OR “digital payment *” OR blockchain OR “distributed ledger *” OR DLT OR “smart contract *” OR “robo-advisor *” OR “open banking” OR insurtech OR regtech OR “robotic process automation” OR RPA OR “cloud accounting” OR ERP OR “machine learning” OR “artificial intelligence” OR “big data”)) OR (AB(fintech OR “financial technolog *” OR “digital finance” OR “internet finance” OR “e-finance” OR “mobile money” OR “mobile payment *” OR “digital payment *” OR blockchain OR “distributed ledger *” OR DLT OR “smart contract *” OR “robo-advisor *” OR “open banking” OR insurtech OR regtech OR “robotic process automation” OR RPA OR “cloud accounting” OR ERP OR “machine learning” OR “artificial intelligence” OR “big data”)) OR (SU(“financial technology” OR “digital finance” OR blockchain OR “mobile payments” OR “artificial intelligence” OR “big data” OR “cloud computing”))) AND ((TI(“digital competenc *” OR “digital skill *” OR “data liter *” OR “analytics skill *” OR “technology readiness” OR”digital readiness” OR “ICT skill *” OR cybersecurity OR “data governance” OR privacy OR “ethical AI” OR “algorithmic accountability”)) OR (AB(“digital competenc *” OR “digital skill *” OR “data liter *” OR “analytics skill *” OR “technology readiness” OR “digital readiness” OR “ICT skill *” OR cybersecurity OR “data governance” OR privacy OR “ethical AI” OR “algorithmic accountability”)) OR (SU(“digital competencies” OR “digital skills” OR “data literacy” OR cybersecurity OR “technology readiness”))) AND ((TI(account * OR auditor * OR “accounting profession” OR “accounting education” OR “financial reporting” OR assurance)) OR (AB(account * OR auditor * OR “accounting profession” OR “accounting education” OR “financial reporting” OR assurance)) OR (SU(accountants OR auditing OR “accounting education” OR “financial reporting” OR assurance)) | Years: 2020–2025; Language: English; Peer-reviewed journals |

| No. | Title | Year | Cluster 1 | Cluster 2 | Cluster 3 | Cluster 4 |

|---|---|---|---|---|---|---|

| 1 | Integrating technology and data analytic skills into the accounting curriculum: Accounting department leaders’ experiences and insights | 2020 | TRUE | TRUE | FALSE | FALSE |

| 2 | Protecting a new Achilles heel: the role of auditors within the practice of data protection | 2021 | TRUE | FALSE | FALSE | TRUE |

| 3 | Accountant as digital innovator: Roles and competencies in the age of automation | 2021 | TRUE | FALSE | TRUE | FALSE |

| 4 | Robotic Process Automation (RPA) Implementation Case Studies in Accounting: A Beginning to End Perspective | 2021 | TRUE | FALSE | TRUE | TRUE |

| 5 | A Framework for Auditor Data Literacy: A Normative Position | 2021 | TRUE | FALSE | TRUE | TRUE |

| 6 | Accountant as Digital Innovator: Roles and Competencies in the Age of Automation | 2021 | FALSE | FALSE | TRUE | FALSE |

| 7 | Blockchain and Other Distributed Ledger Technologies: Where is the Accounting? | 2021 | FALSE | TRUE | FALSE | TRUE |

| 8 | Blockchain in the accounting, auditing and accountability fields: a bibliometric and coding analysis | 2021 | TRUE | FALSE | FALSE | TRUE |

| 9 | How well do audit textbooks currently integrate data analytics | 2021 | TRUE | TRUE | FALSE | FALSE |

| 10 | Artificial intelligence based decision-making in accounting and auditing: ethical challenges and normative thinking | 2022 | TRUE | FALSE | TRUE | TRUE |

| 11 | Centres of data appropriation: evidence from a Nordic hotel chain | 2022 | TRUE | FALSE | FALSE | FALSE |

| 12 | Exploring blockchain in the accounting domain: a bibliometric analysis | 2022 | FALSE | FALSE | FALSE | TRUE |

| 13 | Critical analysis of integration of ICT and data analytics into the accounting curriculum: A multidimensional perspective | 2023 | TRUE | TRUE | FALSE | TRUE |

| 14 | The Evolution of Management Accountants’ Digital Skills in Industry 4.0: A Qualitative Approach | 2023 | TRUE | FALSE | TRUE | TRUE |

| 15 | Big data and decision quality: the role of management accountants’ data analytics skills | 2023 | TRUE | FALSE | FALSE | FALSE |

| 16 | Ethical impact of artificial intelligence in managerial accounting | 2023 | FALSE | FALSE | TRUE | TRUE |

| 17 | From the abacus to enterprise resource planning: is blockchain the next big accounting tool? | 2023 | TRUE | FALSE | FALSE | TRUE |

| 18 | The impact of audit data analytics on audit quality and audit review continuity in Thailand | 2023 | TRUE | FALSE | FALSE | FALSE |

| 19 | Audit technologies used in practice and ways to implement these technologies into audit courses | 2023 | TRUE | FALSE | FALSE | FALSE |

| 20 | Enablers, barriers and strategies for adopting new technology in accounting | 2024 | FALSE | FALSE | TRUE | TRUE |

| 21 | Developing digital competencies of controllers: Evidence from the Netherlands | 2024 | TRUE | TRUE | TRUE | TRUE |

| 22 | Analytical skills for accounting students in a data-driven job market: Australian evidence | 2024 | TRUE | TRUE | FALSE | FALSE |

| 23 | Emerging digital technologies and auditing firms: Opportunities and challenges | 2024 | TRUE | FALSE | TRUE | FALSE |

| 24 | Accounting fraud detection using contextual language learning | 2024 | FALSE | FALSE | TRUE | TRUE |

| 25 | Algorithmic self-referentiality: How machine learning pushes calculative practices to assess themselves | 2024 | FALSE | FALSE | TRUE | FALSE |

| 26 | Bridging the gap in talent: A framework for interdisciplinary research on autism spectrum disorder persons in accounting and information systems | 2024 | FALSE | FALSE | FALSE | TRUE |

| 27 | Exploring accounting and AI using topic modelling | 2024 | FALSE | FALSE | TRUE | FALSE |

| 28 | The application of continuous audit and monitoring methodology: A government medication procurement case | 2024 | TRUE | FALSE | FALSE | FALSE |

| 29 | Benefits and Drawbacks of Incorporating ChatGPT in Financial Audits | 2025 | TRUE | FALSE | TRUE | FALSE |

| 30 | Evaluating the influencing factors and effects of the digitalization of management control | 2025 | FALSE | FALSE | TRUE | FALSE |

| 31 | Exploring Large Language Models in External Audits: Implications and Ethical Considerations | 2025 | TRUE | FALSE | TRUE | TRUE |

| 32 | Adaptive structural audit processes as shaped by emerging technologies | 2025 | TRUE | FALSE | TRUE | TRUE |

| 33 | Artificial intelligence auditability and auditor readiness for auditing artificial intelligence systems | 2025 | TRUE | FALSE | TRUE | TRUE |

| 34 | Balancing performance and ethics: Navigating visual recognition technology adoption in the auditing industry | 2025 | TRUE | FALSE | FALSE | TRUE |

| 35 | Bridging IT auditors and AI auditing: Understanding pathways to effective IT audits of AI-driven processes | 2025 | TRUE | FALSE | TRUE | TRUE |

| 36 | Challenges and opportunities for artificial intelligence in auditing: Evidence from the field | 2025 | TRUE | FALSE | TRUE | FALSE |

| 37 | The disruption of blockchain technology in accounting: a review of scientific progress | 2025 | FALSE | FALSE | FALSE | TRUE |

| 38 | The accounting profession in the Twilight Zone: navigating digitalisation’s sided challenges through ethical pathways for decision-making | 2025 | TRUE | FALSE | TRUE | TRUE |

| 39 | Behavioural Intention to use Artificial Intelligence (AI) among Accounting Students: Evaluating the Effect of Technology Readiness | 2025 | FALSE | FALSE | TRUE | FALSE |

| 40 | Management accounting and artificial intelligence: A comprehensive literature review and recommendations for future research | 2025 | TRUE | FALSE | TRUE | FALSE |

References

- Palmié, M.; Wincent, J.; Parida, V.; Caglar, U. The evolution of the financial technology ecosystem: An introduction and agenda for future research on disruptive innovations in ecosystems. Technol. Forecast. Soc. Change 2020, 151, 119779. [Google Scholar] [CrossRef]

- Ha, D.; Le, P.; Nguyen, D.K. Financial inclusion and fintech: A state-of-the-art systematic literature review. Financ. Innov. 2025, 11, 69. [Google Scholar] [CrossRef]

- IFAC. The Accountancy Profession—Playing a Positive Role in Fighting Corruption; IFAC: New York, NY, USA, 2020. [Google Scholar]

- Socoliuc, M.I. The Impact of Digitalization on the Accounting Profession in Romania—A Quantitative Research. J. Financ. Stud. 2022, 8, 132–154. [Google Scholar] [CrossRef]

- Yigitbasioglu, O.; Green, P.; Cheung, M.-Y.D. Digital Transformation and Accountants as Advisors. Account. Audit. Account. J. 2022, 36, 209–237. [Google Scholar] [CrossRef]

- Andreassen, R. Digital Technology and Changing Roles: A Management Accountant’s Dream or Nightmare? J. Manag. Control. 2020, 31, 209–238. [Google Scholar] [CrossRef]

- Page, M.J.; McKenzie, J.E.; Bossuyt, P.M.; Boutron, I.; Hoffmann, T.C.; Mulrow, C.D.; Shamseer, L.; Tetzlaff, J.M.; Akl, E.A.; Brennan, S.E. The PRISMA 2020 statement: An updated guideline for reporting systematic reviews. BMJ 2021, 372, 71. [Google Scholar] [CrossRef]

- Haddad, C.; Hornuf, L. The Emergence of the Global Fintech Market: Economic and Technological Determinants. Small Bus. Econ. 2018, 53, 81–105. [Google Scholar] [CrossRef]

- Frost, J. The economic forces driving fintech adoption across countries. In The Technological Revolution in Financial Services: How Banks, Fintechs, and Customers Win Together; University of Toronto Press: Toronto, ON, Canada, 2020; Volume 838, pp. 70–89. [Google Scholar]

- Belanche, D.; Casaló, L.V.; Flavián, C. Artificial Intelligence in FinTech: Understanding Robo-Advisors Adoption Among Customers. Ind. Manag. Data Syst. 2019, 119, 1411–1430. [Google Scholar] [CrossRef]

- Darmansyah, D.; Fianto, B.A.; Hendratmi, A.; Aziz, P.F. Factors Determining Behavioral Intentions to Use Islamic Financial Technology. J. Islam. Mark. 2020, 12, 794–812. [Google Scholar] [CrossRef]

- Liêm, N.T.; Tran, S.; Ho, T.H. Fintech Credit, Bank Regulations and Bank Performance: A Cross-Country Analysis. Asia-Pac. J. Bus. Adm. 2021, 14, 445–466. [Google Scholar] [CrossRef]

- Coffie, C.P.K.; Zhao, H.; Mensah, I.A.; Kiconco, R.; Emuron, A.S.O. Determinants of FinTech Payment Services Diffusion by SMEs in Sub-Saharan Africa: Evidence From Ghana. Inf. Technol. Dev. 2020, 27, 539–560. [Google Scholar] [CrossRef]

- Alkhwaldi, A.F.; Alharasis, E.E.; Shehadeh, M.; Abu-AlSondos, I.A.; Oudat, M.; Atta, A.A.B. Towards an Understanding of FinTech Users’ Adoption: Intention and E-Loyalty Post-Covid-19 From a Developing Country Perspective. Sustainability 2022, 14, 12616. [Google Scholar] [CrossRef]

- Ghobakhloo, M.; Fathi, M. Corporate Survival in Industry 4.0 Era: The Enabling Role of Lean-Digitized Manufacturing. J. Manuf. Technol. Manag. 2019, 31, 1–30. [Google Scholar] [CrossRef]

- Muryanto, Y.T.; Kharisma, D.B.; Nugraheni, A.S.C. Prospects and Challenges of Islamic Fintech in Indonesia: A Legal Viewpoint. Int. J. Law Manag. 2021, 64, 239–252. [Google Scholar] [CrossRef]

- Naz, F.; Karim, S.; Houcine, A.; Naeem, M.A. Fintech Growth During COVID-19 in MENA Region: Current Challenges and Future Prospects. Electron. Commer. Res. 2022, 24, 371–392. [Google Scholar] [CrossRef]

- Hudaefi, F.A. How Does Islamic Fintech Promote the SDGs? Qualitative Evidence From Indonesia. Qual. Res. Financ. Mark. 2020, 12, 353–366. [Google Scholar] [CrossRef]

- Kodama, W.; Morgan, P.; Azhgaliyeva, D.; Trinh, L.Q. Financial Literacy and Fintech Use in Family Business; Asian Development Bank Institute: Tokyo, Japan, 2024. [Google Scholar] [CrossRef]

- Tranfield, D.; Denyer, D.; Smart, P. Towards a methodology for developing evidence-informed management knowledge by means of systematic review. Br. J. Manag. 2003, 14, 207–222. [Google Scholar] [CrossRef]

- Chartered Association of Business Schools. Academic Journal Guide 2021; Chartered Association of Business Schools: London, UK, 2021. [Google Scholar]

- van Eck, N.J.; Waltman, L. Software survey: VOSviewer, a computer program for bibliometric mapping. Scientometrics 2010, 84, 523–538. [Google Scholar] [CrossRef]

- Birt, J.; Safari, M.; de Castro, V.B. Critical analysis of integration of ICT and data analytics into the accounting curriculum: A multidimensional perspective. Account. Financ. 2023, 63, 4037–4063. [Google Scholar] [CrossRef]

- Zhang, C.; Issa, H.; Rozario, A.; Soegaard, J.S. Robotic process automation (RPA) implementation case studies in accounting: A beginning to end perspective. Account. Horiz. 2023, 37, 193–217. [Google Scholar] [CrossRef]

- Bhattacharya, I.; Mickovic, A. Accounting fraud detection using contextual language learning. Int. J. Account. Inf. Syst. 2024, 53, 100682. [Google Scholar] [CrossRef]

- La Torre, M.; Botes, V.L.; Dumay, J.; Odendaal, E. Protecting a new Achilles heel: The role of auditors within the practice of data protection. Manag. Audit. J. 2021, 36, 218–239. [Google Scholar] [CrossRef]

- Jayasuriya, D.D.; Sims, A. From the abacus to enterprise resource planning: Is blockchain the next big accounting tool? Account. Audit. Account. J. 2023, 36, 24–62. [Google Scholar] [CrossRef]

- Wang, W.; Vasarhelyi, M.A. The application of continuous audit and monitoring methodology: A government medication procurement case. Int. J. Account. Inf. Syst. 2024, 55, 100713. [Google Scholar] [CrossRef]

- Zhang, L.; Bin Balia, S.S. Digital transformation and corporate audit risk: Mediating effects of auditor behavior. Financ. Res. Lett. 2024, 67, 105754. [Google Scholar] [CrossRef]

- Jackson, D.; Allen, C. Enablers, barriers and strategies for adopting new technology in accounting. Int. J. Account. Inf. Syst. 2024, 52, 100666. [Google Scholar] [CrossRef]

- Steens, B.; Bots, J.; Derks, K. Developing digital competencies of controllers: Evidence from the Netherlands. Int. J. Account. Inf. Syst. 2024, 52, 100667. [Google Scholar] [CrossRef]

- Abbas, K. Management accounting and artificial intelligence: A comprehensive literature review and recommendations for future research. Br. Account. Rev. 2025, 101551. [Google Scholar] [CrossRef]

- Askary, S.; Askarany, D. Analytical skills for accounting students in a data-driven job market: Australian evidence. Account. Res. J. 2024, 37, 635–654. [Google Scholar] [CrossRef]

- Blix, L.H.; Edmonds, M.A.; Sorensen, K.B. How well do audit textbooks currently integrate data analytics. J. Account. Educ. 2021, 55, 100717. [Google Scholar] [CrossRef]

- Andiola, L.M.; Masters, E.; Norman, C. Integrating technology and data analytic skills into the accounting curriculum: Accounting department leaders’ experiences and insights. J. Account. Educ. 2020, 50, 100655. [Google Scholar] [CrossRef]

- Appelbaum, D.; Showalter, D.S.; Sun, T.; Vasarhelyi, M.A. A framework for auditor data literacy: A normative position. Account. Horiz. 2021, 35, 5–25. [Google Scholar] [CrossRef]

- Secinaro, S.; Dal Mas, F.; Brescia, V.; Calandra, D. Blockchain in the accounting, auditing and accountability fields: A bibliometric and coding analysis. Account. Audit. Account. J. 2022, 35, 168–203. [Google Scholar] [CrossRef]

- Sewpersadh, N.S. Adaptive structural audit processes as shaped by emerging technologies. Int. J. Account. Inf. Syst. 2025, 56, 100735. [Google Scholar] [CrossRef]

- Otero, A.R.; Agu, M. Benefits and Drawbacks of Incorporating ChatGPT in Financial Audits. Curr. Issues Audit. 2025, 19, 1–8. [Google Scholar] [CrossRef]

- Zhang, C.; Zhu, W.; Dai, J.; Wu, Y.; Chen, X. Ethical impact of artificial intelligence in managerial accounting. Int. J. Account. Inf. Syst. 2023, 49, 100619. [Google Scholar] [CrossRef]

- Lehner, O.M.; Ittonen, K.; Silvola, H.; Ström, E.; Wührleitner, A. Artificial intelligence based decision-making in accounting and auditing: Ethical challenges and normative thinking. Account. Audit. Account. J. 2022, 35, 109–135. [Google Scholar] [CrossRef]

- Li, Y.; Goel, S. Artificial intelligence auditability and auditor readiness for auditing artificial intelligence systems. Int. J. Account. Inf. Syst. 2025, 56, 100739. [Google Scholar] [CrossRef]

- Vitali, S.; Giuliani, M. Emerging digital technologies and auditing firms: Opportunities and challenges. Int. J. Account. Inf. Syst. 2024, 53, 100676. [Google Scholar] [CrossRef]

- Kokina, J.; Blanchette, S.; Davenport, T.H.; Pachamanova, D. Challenges and opportunities for artificial intelligence in auditing: Evidence from the field. Int. J. Account. Inf. Syst. 2025, 56, 100734. [Google Scholar] [CrossRef]

- Parra-Domínguez, J.; Sanz Martín, L.; López Pérez, G.; Zafra Gómez, J.L. The disruption of blockchain technology in accounting: A review of scientific progress. J. Account. Organ. Change 2025, 21, 330–362. [Google Scholar] [CrossRef]

- Rîndaşu, S.-M.; Topor, I.D.; Ionescu-Feleagă, L. The Evolution of Management Accountants’ Digital Skills in Industry 4.0: A Qualitative Approach. Oblìk ì Fìnansi 2023, 99, 38–48. [Google Scholar]

- Felski, E. Audit technologies used in practice and ways to implement these technologies into audit courses. J. Account. Educ. 2023, 62, 100827. [Google Scholar] [CrossRef]

- Fotoh, L.E.; Mugwira, T. Exploring Large Language Models in external audits: Implications and ethical considerations. Int. J. Account. Inf. Syst. 2025, 56, 100748. [Google Scholar] [CrossRef]

- Franke, F.; Hiebl, M.R. Big data and decision quality: The role of management accountants’ data analytics skills. Int. J. Account. Inf. Manag. 2023, 31, 93–127. [Google Scholar] [CrossRef]

- Mohammed Ismail, I.H.; Abdul Hamid, F.Z. A systematic literature review of the role of big data analysis in financial auditing. Manag. Account. Rev. 2024, 23, 321–350. [Google Scholar]

- Lardo, A.; Corsi, K.; Varma, A.; Mancini, D. Exploring blockchain in the accounting domain: A bibliometric analysis. Account. Audit. Account. J. 2022, 35, 204–233. [Google Scholar] [CrossRef]

- Gietzmann, M.; Grossetti, F. Blockchain and other distributed ledger technologies: Where is the accounting? J. Account. Public Policy 2021, 40, 106881. [Google Scholar] [CrossRef]

- Free, C.; Hecimovic, A. Global supply chains after COVID-19: The end of the road for neoliberal globalisation? Account. Audit. Account. J. 2021, 34, 58–84. [Google Scholar] [CrossRef]

- Millo, Y.; Spence, C.; Xu, R. Algorithmic self-referentiality: How machine learning pushes calculative practices to assess themselves. Account. Organ. Soc. 2024, 113, 101567. [Google Scholar] [CrossRef]

- Krishnanraw, J.; Ismail, K. Behavioural intention to use artificial intelligence (AI) among accounting students: Evaluating the effect of technology readiness. Manag. Account. Rev. 2025, 24, 465–493. [Google Scholar]

- Murphy, B.; Feeney, O.; Rosati, P.; Lynn, T. Exploring accounting and AI using topic modelling. Int. J. Account. Inf. Syst. 2024, 55, 100709. [Google Scholar] [CrossRef]

- Tiron-Tudor, A.; Rodgers, W.; Deliu, D. The accounting profession in the Twilight Zone: Navigating digitalisation’s sided challenges through ethical pathways for decision-making. Account. Audit. Account. J. 2025, 38, 990–1018. [Google Scholar] [CrossRef]

- Alaskar, M.Z.; Kim, J.R.; Nguyen, T.H.; Rafique, M. Balancing performance and ethics: Navigating visual recognition technology adoption in the auditing industry. J. Int. Account. Audit. Tax. 2025, 59, 100701. [Google Scholar] [CrossRef]

- Li, Y.; Goel, S. Bridging IT auditors and AI auditing: Understanding pathways to effective IT audits of AI-driven processes. Adv. Account. 2025, 69, 100842. [Google Scholar] [CrossRef]

- Akter, M.; Kummer, T.-F.; Yigitbasioglu, O. Looking beyond the hype: The challenges of blockchain adoption in accounting. Int. J. Account. Inf. Syst. 2024, 53, 100681. [Google Scholar] [CrossRef]

- Demek, K.C.; Giunta, B.; Pinsker, R. Bridging the gap in talent: A framework for interdisciplinary research on autism spectrum disorder persons in accounting and information systems. Int. J. Account. Inf. Syst. 2024, 55, 100712. [Google Scholar] [CrossRef]

- Fullan, M.; Rincón-Gallardo, S.; Hargreaves, A. Professional Capital as Accountability. Educ. Policy Anal. Arch. 2015, 23, 15. [Google Scholar] [CrossRef]

- Falloon, G. From Digital Literacy to Digital Competence: The Teacher Digital Competency (TDC) Framework. Educ. Technol. Res. Dev. 2020, 68, 2449–2472. [Google Scholar] [CrossRef]

- Kokina, J.; Gilleran, R.; Blanchette, S.; Stoddard, D. Accountant as digital innovator: Roles and competencies in the age of automation. Account. Horiz. 2021, 35, 153–184. [Google Scholar] [CrossRef]

- Wu, T.-H.; Huang, S.Y.; Chiu, A.-A.; Yen, D.C. IT governance and IT controls: Analysis from an internal auditing perspective. Int. J. Account. Inf. Syst. 2024, 52, 100663. [Google Scholar] [CrossRef]

| Theme | Search Strings and Keywords |

|---|---|

| FinTech | fintech; “financial technolog *”; “digital finance”; “internet finance”; “e-finance”; “mobile money”; “mobile payment *”; “digital payment *”; blockchain; “distributed ledger *”; DLT; “smart contract *”; “robo-advisor *”; “open banking”; insurtech; regtech; “robotic process automation”; RPA; “cloud accounting”; ERP; “machine learning”; “artificial intelligence”; “big data”; |

| Digital Competencies | “digital competenc *”; “digital skill *”; “data liter *”; “analytics skill *”; “technology readiness”; “digital readiness”; “ICT skill *”; cybersecurity; “data governance”; privacy; “ethical AI”; “algorithmic accountability”; |

| Accounting Profession | Account *; accountant *; auditor *; “accounting profession”; “accounting education”; “financial reporting”; assurance |

| Rank | Journal | Count |

|---|---|---|

| 1 | International Journal of Accounting Information Systems | 12 |

| 2 | Accounting, Auditing and Accountability Journal | 6 |

| 3 | Accounting Horizons | 3 |

| 4 | Journal of Accounting Education | 3 |

| 5 | Journal of International Accounting, Auditing and Taxation | 2 |

| Approach | Count | % of Total |

|---|---|---|

| Empirical | 35 | 87% |

| Conceptual | 3 | 8% |

| Review/Other | 2 | 5% |

| Cluster | Dominant Keywords | Representative Themes |

|---|---|---|

| Cluster 1 (Red): Auditing and Data Analytics as Professional Practice Drivers | auditing, data analytics, audit quality, robotic process automation, efficiency, evidence | Focus on how digital tools are integrated into auditing practices. Studies highlight efficiency gains, data-driven assurance, and the role of automation in strengthening audit quality and reliability. |

| SCluster 2 (Green): Digital Transformation and Educational Adaptation | digital transformation, curriculum, digital competency, cloud computing, skill, management control | Emphasis on curriculum reform and professional development. Literature addresses embedding digital competencies in accounting education, lifelong learning, and adapting to technological change in both academia and practice. |

| Cluster 3 (Blue): Artificial Intelligence and Professional Accountability | artificial intelligence, accountability, managerial accounting, algorithm, ethical decision-making, transparency | Explores AI as a transformative force in accounting. Studies link AI to ethical concerns, governance, and professional accountability, stressing the need for competencies that balance technical literacy with judgement and transparency. |

| Cluster 4 (Yellow): Blockchain and Accounting Innovation | blockchain, accounting, database, taxation | Highlights blockchain’s potential to reshape accounting infrastructure, audit trails, and compliance. Research positions blockchain as both an opportunity and disruption, requiring accountants to build new literacies around distributed ledger technologies. |

| Bibliometric Cluster Label (4.2.1/Figure 3) | Thematic Cluster Label (4.3) |

|---|---|

| Cluster 1: Auditing and Data Analytics as Professional Practice Drivers | Cluster 1: The Professional Context and Digital Transformation |

| Cluster 2: Digital Transformation and Educational Adaptation | Cluster 2: The Educational Response and Curriculum Development |

| Cluster 3: Artificial Intelligence and Professional Accountability | Cluster 3: Core Competencies and their Technological Drivers |

| Cluster 4: Blockchain and Accounting Innovation | Cluster 4: Blockchain, Ethics, and Professional Responsibility |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Satjawisate, S.; Suriyapaiboonwattana, K.; Saramolee, A.; Hone, K. Digital Competencies for a FinTech-Driven Accounting Profession: A Systematic Literature Review. Informatics 2025, 12, 121. https://doi.org/10.3390/informatics12040121

Satjawisate S, Suriyapaiboonwattana K, Saramolee A, Hone K. Digital Competencies for a FinTech-Driven Accounting Profession: A Systematic Literature Review. Informatics. 2025; 12(4):121. https://doi.org/10.3390/informatics12040121

Chicago/Turabian StyleSatjawisate, Saiphit, Kanitsorn Suriyapaiboonwattana, Alisara Saramolee, and Kate Hone. 2025. "Digital Competencies for a FinTech-Driven Accounting Profession: A Systematic Literature Review" Informatics 12, no. 4: 121. https://doi.org/10.3390/informatics12040121

APA StyleSatjawisate, S., Suriyapaiboonwattana, K., Saramolee, A., & Hone, K. (2025). Digital Competencies for a FinTech-Driven Accounting Profession: A Systematic Literature Review. Informatics, 12(4), 121. https://doi.org/10.3390/informatics12040121