1. Introduction

For the conducted study, we chose to research a topic that is of interest both domestically and internationally. Through the literature we found many studies based on the companies that were on the verge of bankruptcy, using the concept for a long time. The accounting phenomenon occurs as a result of legislative gaps, which gives professionals the opportunity to “create” what they want to have in their financial statements. Previous studies show that the manipulation is done by those who prepare the financial statements. They can judge the situations by filtering the perception of the professional.

Once the professionals have a closer look on the financial statements, indicators can be calculated and red flags outlined in the case of financial fraud. The elements included in the financial statements, and those that can be manipulated, are incomes and expenses, part of the profit and loss account, assets and liabilities, and other elements such as equity; with these manipulations, a favorable image of the companies is presented (

Achim and Borlea 2020).

Users of financial information pursue their own interests. Creative accounting gives those who prepare the financial statements the “freedom” to manipulate the numbers in the way that their users want to see (

Groșanu 2013).

Watts and Zimmerman (

1978,

1986,

1990) approach the concept in a positive manner, especially in the conducted work on the bankruptcy issue.

The current economic and technological context is considered to be a complex, insecure one, due to the impossibility to identify the interdependencies between the elements of the financial statements (

Alzard and Sépari 2001). The economic environment is going from simple and slightly variable to a complex one under the sign of top technologies, becoming dynamic, complex, and increasingly difficult to control. These changes have led to the redefinition of companies’ objectives, by setting the following new objectives that respond to current events: increasing quality, productivity, flexibility, and profit.

Economic companies need to have current financial information to carry out the activity and to meet the needs of shareholders, by maximizing profit, and to ensure a good approach in the activities undertaken, and to try to avoid the risks they face as much as possible. Exposing this information offers competitive advantages to companies in the market. Financial statements are used for both businesses and companies, and for users of financial information, such as managers, the state, suppliers, employees, customers, banks, potential investors, and shareholders. The main purpose of the information contained in the financial statements is to be intelligible to all who read them (

Lau et al. 2013).

The economic and social environment of a company affects its strategy. These elements can be concretized in the following two concepts: culture and environment. There is ample evidence in the literature that these goals differ from country to country, and from culture to culture.

With the process of globalization, economic activity has been continuously developing, followed by the establishment of international economic relations, but this development of relations has led to inconsistencies in financial statements. To avoid such discrepancies, the European Union has implemented the standards international financial reporting system (IFRS) for all participating countries, as provided by the provisions Regulation (EC) No. 1.606/2002 of the European Parliament and of the Council of 19 July 2002. This implementation helps to standardize the financial statements. These are becoming comparable as follows: bi-accounting chain, profit and loss account, explanatory notes, etc.

The following five research questions were proposed to be answered for the current study:

Research question 1: which are the most used methods for detecting the manipulation of financial statements in the literature?

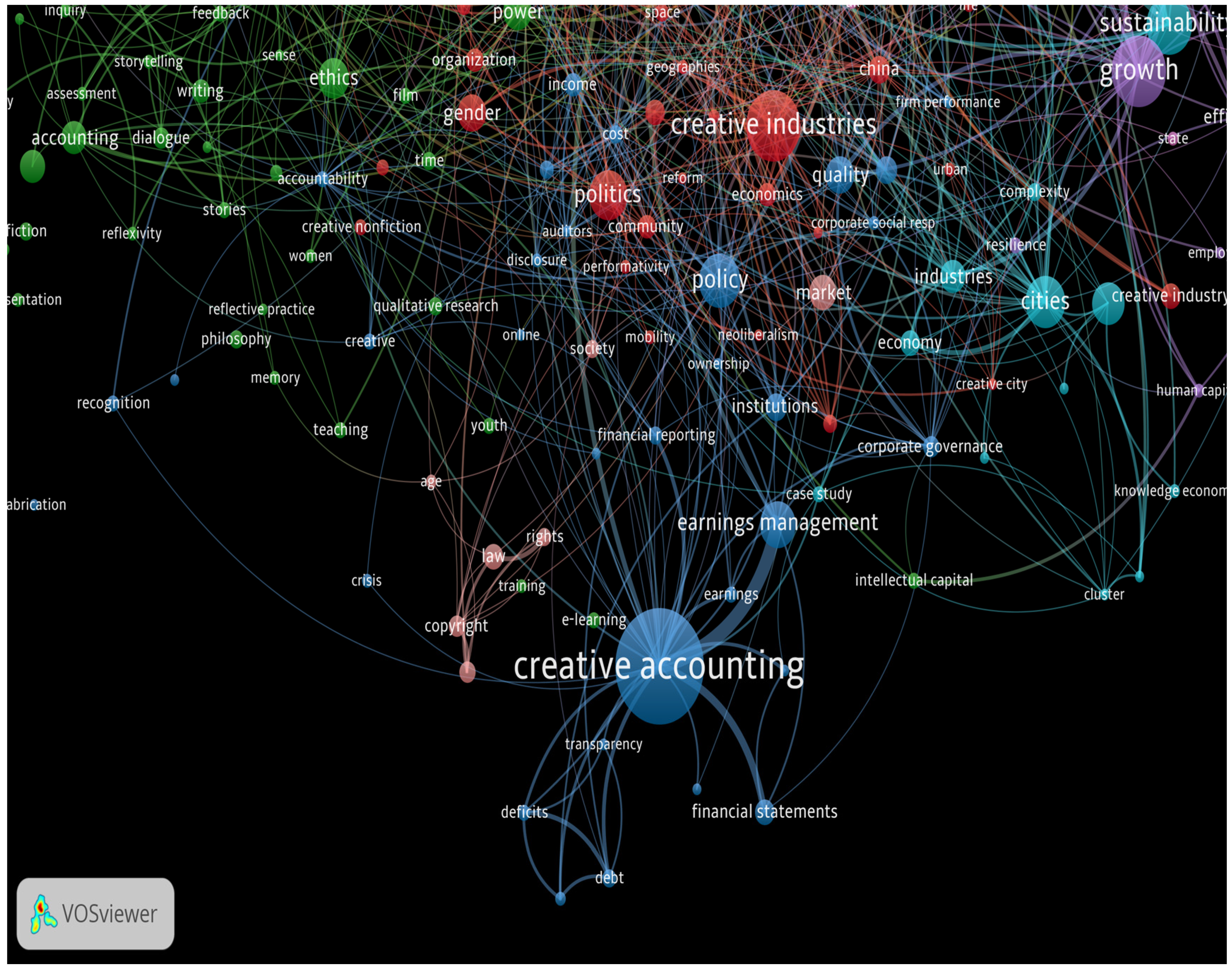

Research question 2: which are the terms that are most frequently encountered in the literature associated with “creative accounting”?

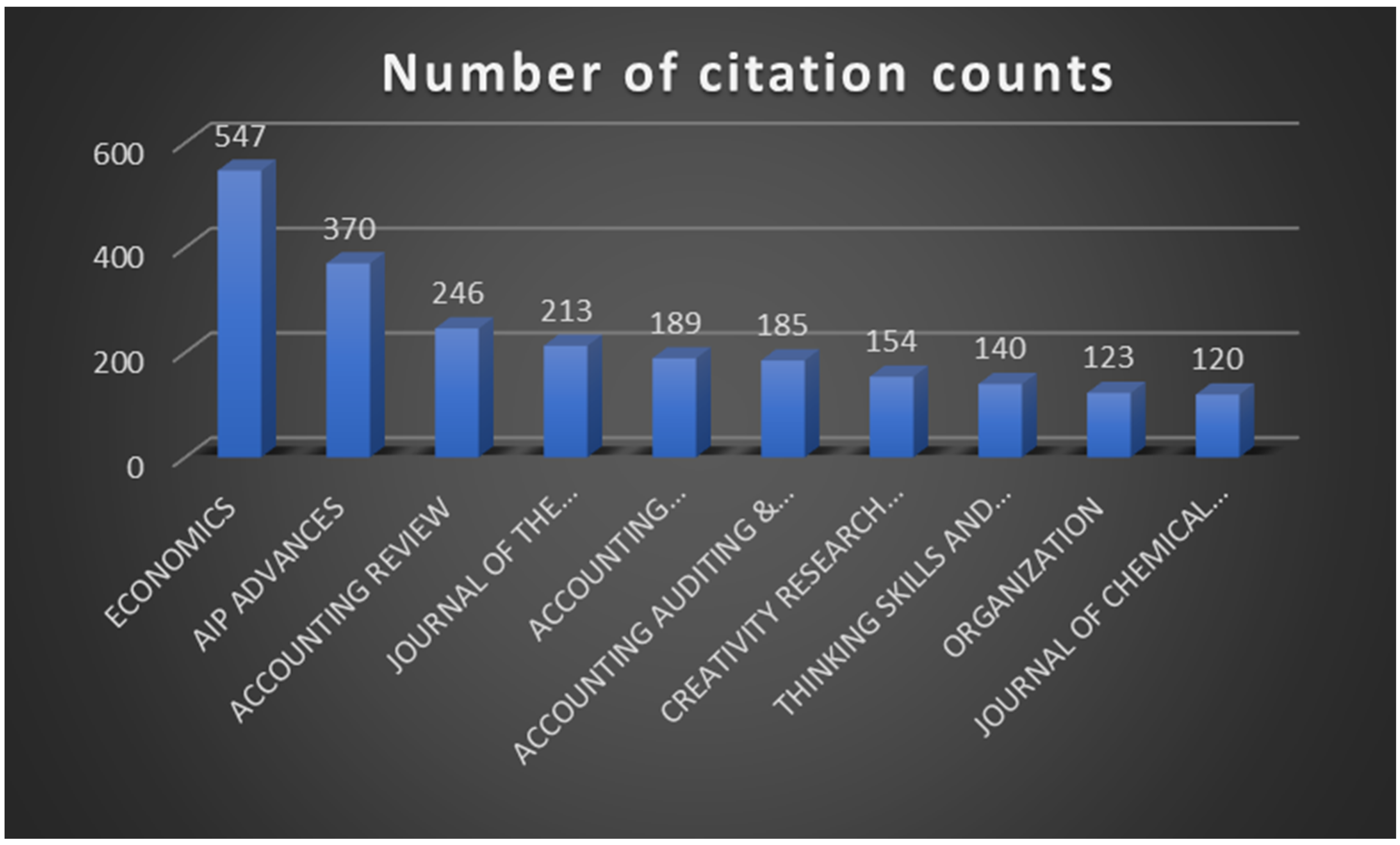

Research question 3: which are the journals that have the highest frequency of articles written on the topic “creative accounting”?

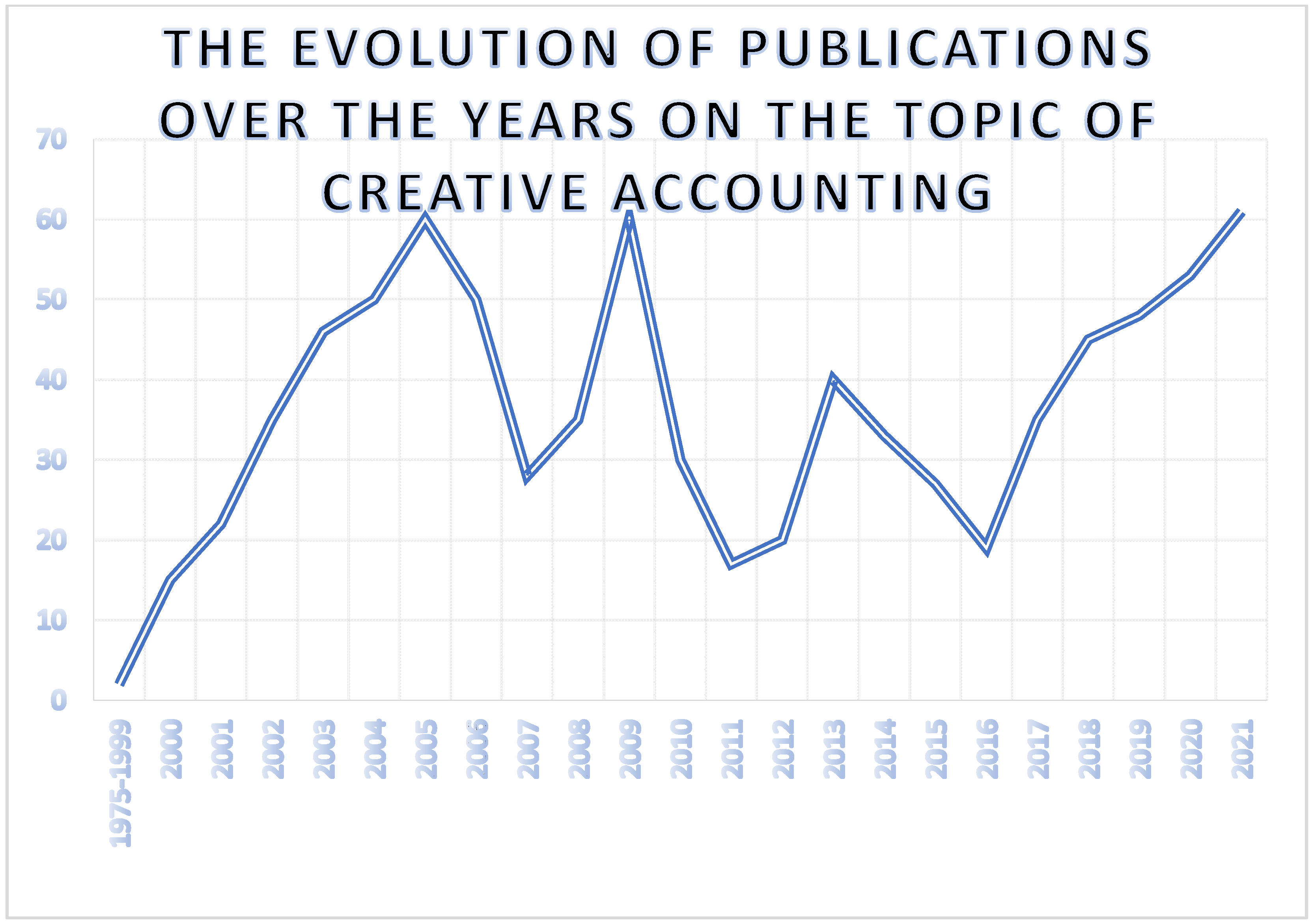

Research question 4: over time, how did research evolve in the field of creative accounting?

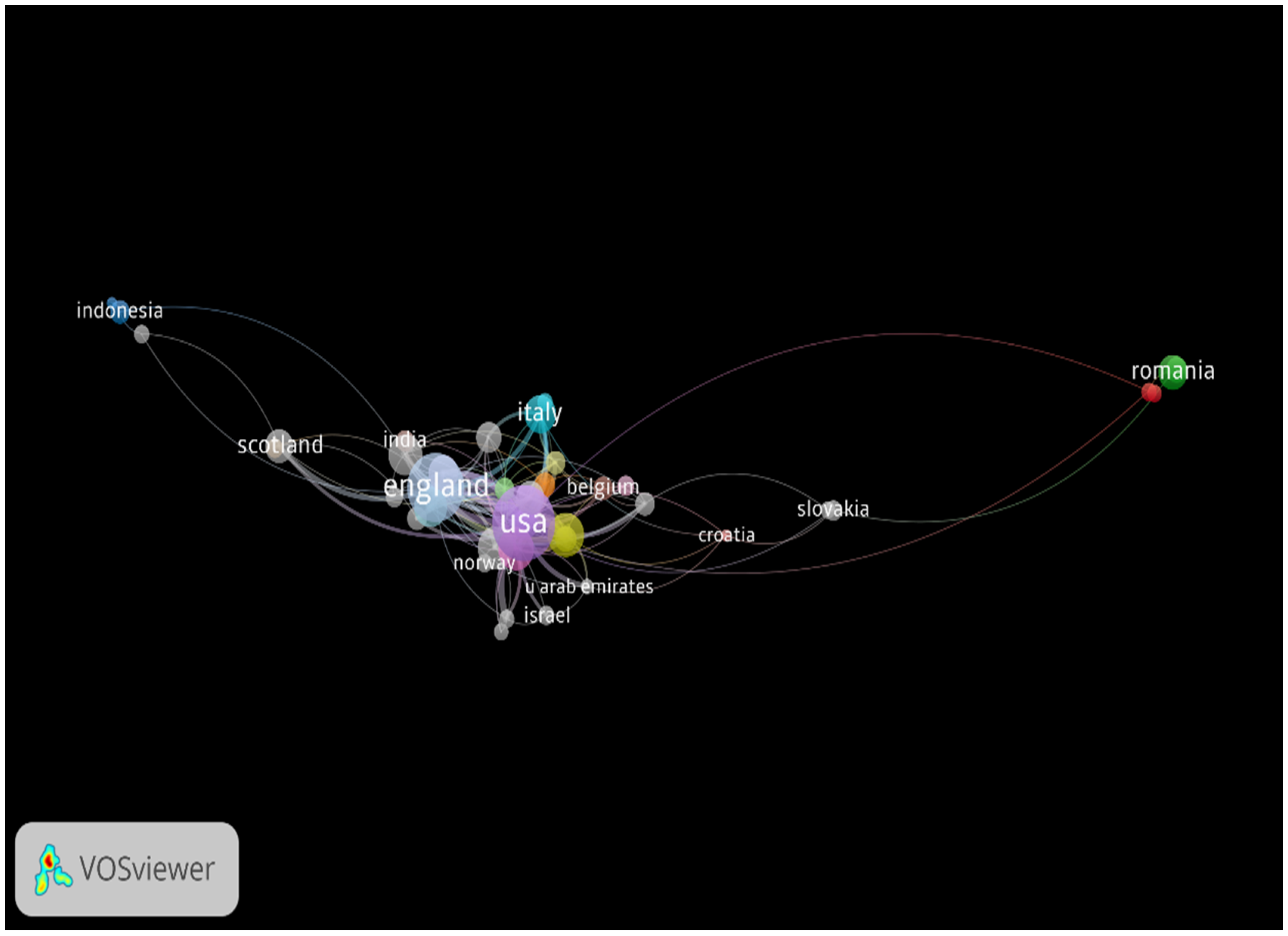

Research question 5: which countries are most preoccupied in publishing regarding this topic?

This paper follows the following organization: The literature review, in which the existing literature is presented, which refers both to the theoretical part and to the practical part of the manipulation detection models. The “Materials and Methods” section describes the working techniques and how to work with the data. The “Results and Discussions” present what we obtained from the research. In the end we focused on the “Conclusions”, through these we tried to highlight what is most important, but we also drew the main research limits.

2. Literature Review

Creative accounting is not a new notion at all; this type of practice has been discussed since the Anglo-Saxon period. The concept is very complex and nuanced. In the literature, creative accounting is presented by almost all authors as having negative values on the economic environment, due to the fact that it helps the economic participants to manipulate financial statements. This can be perceived as the process by which managers use certain gaps or ambiguities within the accounting rules, with the goal of distorting information, making the company look more attractive (

Shah 1988).

Naser (

1993) emphasizes, through his definitions, the dual character of this concept. On the one hand, his requests emphasize the fact that when there are gaps, manipulations of accounting figures occur, leading to the extreme flexibility and transformation of financial statements from what they should be to what managers exceptionally want. Another point of view is that even their structure allows the production of the desired result (

Naser 1993).

The dual character of the notion is highlighted by many researchers in the field.

Malciu (

1999) claims that “creative accounting” can be defined by “using professional judgment in order to solve problems for which there are no, at least for now, accounting standards”, but also maintains “financial engineering techniques are applied depending on the impact on the financial situation and performance of the enterprise”.

Tarba and Rusu (

2011) state that “creative accounting” describes accounting practices that derive from regulated accounting standards, explained by complex accounting creation techniques. In this process, the goal is to change the real state of a company in the desired direction. In the same way,

Lambert (

1984) mentions that by applying creative accounting, financial statements are presented incorrectly, and it aims at deception and manipulation. On the same note, Ian

Griffiths (

1986) stated that “Every company in the country earns its profits. Each set of published accounts is based on books that have been lightly cooked or completely fried. The figures, which are sent twice a year to the investing public, have been changed to protect the guilty. It is the biggest trick since the Trojan horse: It’s all legitimate. It’s creative accounting”.

Kamal Naser has an academic opinion on creative accounting, mentioning that this is the way to turn the figures from what they should be to what their management wants, this being circumvented by the existing rules and/or ignoring them completely or partially (

Oriol et al. 1999).

Creative accounting is considered to exclude fraud. It is not considered illegal because it operates under the regulatory system. Various studies state that companies that aim to use this accounting do not break the law, but only use the shortcomings of accounting to serve their own interests (

Jones 2010).

The use of creative accounting, and some fraudulent actions, is practiced when a company is in a difficult financial period (

Sabau et al. 2020).

From our perspective, creative accounting has both positive and negative aspects. Accounting options have always been available to the person preparing the financial statements, as they do not involve creativity in the negative.

Therefore, books and articles in this field present the opinions of specialists and the perspectives of this practice. The term in the literature has been assigned different definitions, the basic effect of accounting manipulation is the same.

Given that the situation of companies does not always live up to expectations, there are temptations to use creative accounting, by recording sales much higher than the real ones, so that the results rise to at least half of the expectations of managers (

Bilgin and Hakan 2019). Globally, “creative accounting” is referred to in several ways, depending on the country in which the phrase is used, as shown in

Table 1.

“Creative accounting” appears in many languages and has a high level of citation, both in the literature and in the media, depending on the country in which it is used. The term “creative accounting” is widely appreciated in many countries, and is constantly used to design unfair practices, becoming synonymous with earnings management, manipulation, and fraud.

Most likely, the term “creative accounting”, translated into different languages and now widely used in many countries, comes from English. It can even be found in publications from the early 1975s, including works dealing with corporate bankruptcy.

Argenti (

1976) argues that “creative accounting is a political intent followed by managers to deceive shareholders, creditors and themselves about the wealth and progress of the company in general and its financial difficulties in particular” (

Argenti 1976).

In the following, we will present a brief analysis of the models for the identification and measurement of creative accounting and financial fraud found in the literature.

2.1. Beneish M-Score Model

The Beneish M-score was first developed in 1999 by Professor M. Daniel Beneish, a professor of accounting at the Kelley School of Business at Indiana University Bloomington, in a paper entitled “The Detection of Earnings Manipulation”. The basic theory from which Professor Beneish starts in the development of the model is that companies could be likely to manipulate their profits if they show damaged gross margins, significantly increased expenses, and last, but not least, the increase in sales. The model consists of eight indicators that identify anomalies in the financial statements that may be the result of the manipulation of earnings or other fraudulent types.

In his paper, Beneish found that he can correctly identify 76% of manipulators earnings. Beneish also found that 17.5% of companies whose situations were financial believed that they were fair and that they were free to manipulate their earnings, and they republished the financial statements later because of these manipulationsbecause of these manipul (

Beneish,

1999).

Financial auditors consider that the correct identification percentage ensures that the information provided by the calculation of the score is reliable in terms of financial statements.

An M score higher than −2.22 suggests a higher probability of manipulating financial statements.

This model is considered a tool that helps the financial specialist not only by the fact that it offers the possibility of an overall analysis of the financial statements, but even by calculating each component of the model providing a specific control, by measuring the changes that occur from one period to another, regardless of the frequency of publication of the financial statements.

The formula of the Beneish M-score model is as follows:

where DSRP—days’ sales in a receivable index; GMI—gross margin index; AQI—asset quality index; SGI—sales growth index; DI or DEPI—depreciation index; SGAI or SGAEI—sales index, general and administrative expenses; TATA—total accruals to total assets; LI—leverage index (

Sabau et al. 2020).

2.2. Modelul Vladu

The model uses 12 independent variables to determine whether society is manipulative or non-manipulative.

The model contains the following variables: receivables index (RI); inventories index (II); gross margin index (GMI); sales growth (SG); depreciation index (DI); discretionary expenses index (DEI); leverage index (LI1); leverage index (LI2); asset quality (AQ); index—increase in net income (CFO1); index—increase income d standardized on total assets (CFO2); and sales index (SI) (

Vladu et al. 2016). Thus, the MANOVA technique was used to select those arrangements that have the greatest discriminatory power. The MANOVA technique assumes that the sample came from two possible groups, manipulative and nonmanipulative, in which each observation has different variables (accounting reports).

2.3. Q Test Model

The Q-test model is the model developed by

Putman et al. (

2005), who proposed that the Q test an easy-to-use model for quantifying the quality of earnings, which consists of five financial statements, using in their calculation financial data from the financial statements. The variables of the Q test are as follows: cash flow from operating activities, sales revenue for the accounting period and the previous period accounts receivable for the accounting period and the previous period, income before interest and taxes, income from continuing operations, net income, and total liabilities (

Putman et al. 2005).

In this model, each ratio is weighted by (0.2), having an equal “weight”. This equality of “weight” suggests that the ratios in the model have the same impact on the outcome. The value that indicates one or greater indicates a higher quality of revenue, but that less than one indicates revenue management.

The model of

Putman et al. (

2005) is presented as follows:

where CFO—cash flow from operating activities cash flow statement; S—sales income statement; IS—increase in sales from the previous year’s income statement; IAR—increase in the accounts receivable balance sheet; EBIT—earnings before the interest and taxes income statement; COI—income from the continuing operations income statement; NI—net income income statement; TL—total liabilities balance sheet (

Putman et al. 2005).

2.4. Piotroski F-Score Model (F-Score)

The Piotroski F-score was developed by accounting professor Joseph Piotroski at theUniversity of Chicago, through his work “The Use of Historical Financial Statements Information to Separate Winners from Losers” (

Piotroski 2002). The model is based on nine criteria forassessing the financial strength of the business, based entirely on the leverage of profitability, liquidity, sources of funds, and operational efficiency.

The aim of his research was to develop a model based on financial information, which would create a stronger portfolio of values, and that could have distinct performances from possible underperformances. The model is applied at the level of the financial statements of private companies as well as at the level of state-owned companies, leading to a standardization of the analysis for those who make financial analyses (financial analyst, auditor, etc.).

Based on his research, Piotroski carried out a simple analysis consisting of several stages, namely, nine, which indicate scores that may suggest a possible manipulation of the company’s overall financial situation as “hesitant” versus “energetic”.

where the following definitions apply:

ROA—net income before extraordinary items, for the fiscal year preceding portfolio formation, scaled by the total assets at the beginning of year t;

CFO—cash flow from operations, scaled by the total assets at the beginning of year t;

MARGIN—cross margin (net sales, less cost of goods sold) for the year preceding portfolio formation;

TURN—change in the firm’s asset turnover ratio between the end of year t and year t−1. The asset turnover ratio is defined as the net sales scaled by the average total assets for the year;

LEVER—change in the firm’s debt-to-assets ratio between the end of year t and year t−1. The debt-to-asset ratio is defined as the firm’s total long-term debt (including the portion of long-term debt classified as current) scaled by the average total assets;

LIQUID—change in the firm’s current ratio between the end of year t and year t−1. The current ratio is defined as the total current assets divided by the total current liabilities;

ACCRUAL—net income before extraordinary items, less cash flow from operations, scaled by the total assets at the beginning of year t;

EQ_OFFER—book value of equity at the end of the fiscal year (

Piotroski 2002).

2.5. Dechow–Dichev Model (Accumulation Quality)

This model was developed by the professors Patricia Dechow and Ilia Dichev (

Dechow and Dichev 2002) in “The quality of accumulations and gains: the role of errors in estimating accumulation”, through which we have the possibility to measure the quality of the accumulations through the cash flow from the commitments and the profit result.

Through their research we are told that where there is a low quality of accumulation, there are more indications unrelated to cash flows compared to companies with a higher commitment quality.

They also identify certain behaviors in their research on quality accumulation, respectively, as follows: a longer operating cycle decreases the buildup quality, as opposed to a short-cycle operation, which increases the quality of accumulation; the size of the company affects the quality of the accumulation, the smaller companies have a quality of lower employment; instability in sales decreases the quality of accumulation; unpredictable cash flow decreases the quality of accumulation, as unstable receipts lead to reduced storage quality. The formula for the Dechow–Dichev model is as follows:

where the following applies:

2.6. Robu Model

The Robu model was developed by the researchers Ioan-Bogdan ROBU and Mihae-la-Alina ROBU (

Robu and Robu 2013) in the paper entitled “Audit Procedures for Estimating the Fraud Risk Based on Indexes for Detection of Accounting Manipulation”. Starting from the research hypotheses based on the Beneish model, they used descrimination analysis, with the help of the classification score function of the Romanian companies.

where Z is the score associated with each firm (i), Xi are the independent variables, and βi are the coefficients of the model with (i = 1, …, n).

The classification function is represented as a linear combination of the indices proposed by Beneish, and is of the following form: estimating the risk of fraud.

For the function of discrimination, M-RiskFraud-Beneish elaborated for Romania by

Robu and Robu (

2013), the following three intervals of classification of the companies by groups of risk were obtained:

The area without the risk of financial fraud is between −2.841 and −0.355—the uncertainty interval is between −0.355 and 0.313—which is also considered a gray area; here, we also have the appearance of the audit, by applying the procedures and this leads to mitigation

The risk of fraud is indicated by the interval between 0.313 and 2.453—various methods of distorting the true image are usually used here (

Robu and Robu 2013).

The first research question was answered by identifying the most used model in the literature to identify the presence of data manipulation. For the remaining research questions, a bibliometric analysis is required. In the following chapters, the methodology and results will be presented for this issue (

Robu and Robu 2013).

3. Materials and Methods

The bibliometric analysis is based on data extracted from publications, bibliographic references, citations, and authors. With the help of this information, we can examine the historical development between individual scientific fields and the discovery of relationships between disciplines (

Noyons et al. 1999).

Previous research has focused on identifying the emerging areas using bibliometric analysis. These studies suggested the importance of citations regarding the published papers, in the sense that the choice of work is a significant indicator of the quality of the paper. The analysis of emerging domains is important for the discovery of new areas, not just the study of existing ones (

Sasaki et al. 2020).

Through bibliometric analysis the information is selected from a qualitative point view, using mathematical statistical methods and descriptive statistical methods to obtain the results from the content of the paper. The source of information for the bibliometric analysis is the records found in databases such as Web of Science, which is an online database that provides access to the following citation indexes:

Science Citation Index Expanded (SCI-E);

Social Science Citation Index (SSCI);

Arts & Humanities Citation Index (AHCI);

Index Chemicus;

Current Chemical Reaction;

Conference Proceedings Citation Index—Science (CPCI-S);

Conference Proceedings Citation Index—Social Sciences & Humanities (CPCI-SSH).

The current research has a great deal of importance, due to the conducted bibliometric analysis, which reveals the most and least approached topics correlated with creative accounting. The least used words correlated with creative accounting can reveal novel research questions. They can indicate a decreased level of published research on a certain area, with a great deal of increasing potential for future researches.

Our contribution to the literature is to identify the correlations and connections with the closest fields in the literature.

The presentation of the statistical methods used in the bibliometric analysis will be illustrated with the help of figures. The search terms applied to identify the nearest published papers include the keyword “creative accounting” on the Web of Science platform, for the period 1975–2021 According to the

Table 2. The elements that were taken into account and extracted in text format are the documents that went through the selection filter, which are formed by the following: the year of publication of the paper, the language in which the manuscript was written, the journal where it was found, the title of the paper, the author, affiliation, the most common keywords, document type, abstract and number of citations. The choice of the sample was based on the selection based on the keywords in the papers. The main sample was extracted from WOS. We chose this database because only indexed works are included and besides this, we wanted to avoid the double inclusion of journals, citations, type of works (

Staszkiewicz 2019). For example, a database such as Google Scholar allocates citations much faster and assigns all works not only indexed ones (

Elleby and Ingwersen 2010). Most of the time, high-quality journals expose new papers, as opposed to those less recent papers with a higher frequency of publication, which are disseminated in lower-level journals. In their work,

Elleby and Ingwersen (

2010) presented the impact of low-quality and high-quality works with a high frequency of publication.

To conduct the bibliometric analysis, we have selected the sample from the WOS database, in order to identify the published articles on the topic of “creative accounting” for the period 1975 to 2021.

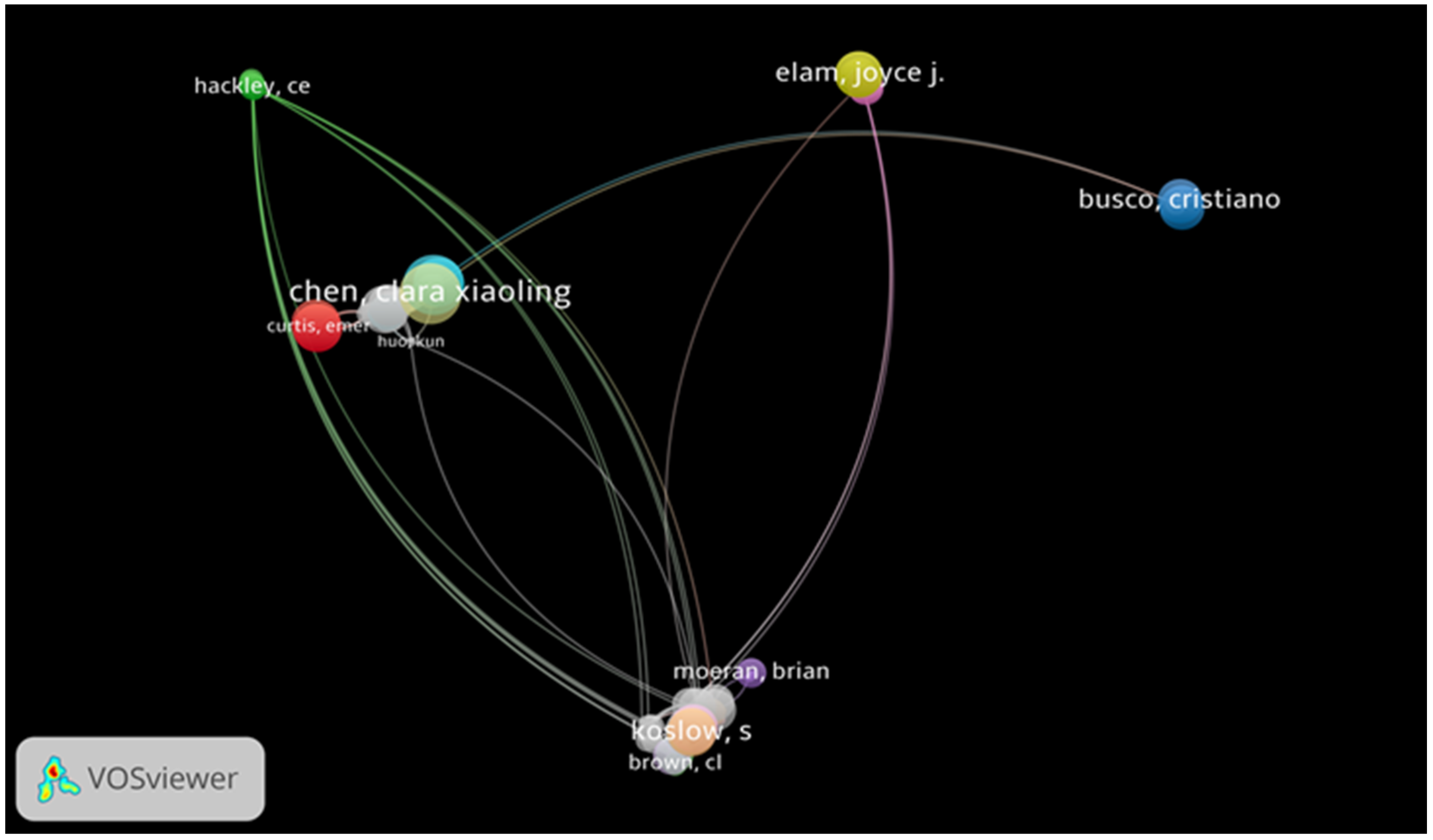

The query for the database was 1 March 2021. VOSviewer (version 1.6.16) was used to analyze co-author, co-occurrence, citation, bibliographic link, co-citations, keywords and themes. Applying attributes of standard importance, which are defined as “Link At-tribute” and “Total Link Power Attribute”.

5. Conclusions

In the context of a performant or less performant company, creative accounting or fraud should not be used, even though the results may not be as expected. The reality shows us that, in the most cases, they restore to manipulative techniques, so the numbers are as expected, or better. The motivating factor behind this technique is the personal incentive.

In this study we first presented the models used internationally by analysts, economists, and auditors to analyze the accuracy of financial statements. This presentation aimed to describe the models for determining the techniques that lead to the handling of situations and the use of creative accounting. With the help of models, we answered the first research question, which are the most used methods for detecting the manipulation of financial statements in the literature?

A qualitative analysis can be performed at the individual or global level of the company. The models presented in the paper are effective, because they all indicate the application of creative accounting and can signal fraud by significantly modifying some reports.

Through the bibliometric analysis we answered the remaining research questions, by identifying the novelty of the study, the large number of citations, which indicates that these practices are by no means recent. This is indicated by the fact that the first 100 of the most cited articles have published articles on creative accounting, and 10 have been published more than five times. In total, 85 were published. The first ten papers were published in active journals, publications from the WOS database. In total, 3671 authors participated in the publication of the works. Through the research of domestic and international literature, it is suggested that 1645 organizations have published papers related to the topic and connected with it, and 400 have over five publications.

In future studies we intend to expand our research on both the literature and the application of existing models in the literature. It is very important to evaluate the quality of a large number of works and obtain the most valuable information.