Development and Validation of a Model for Assessing Potential Strategic Innovation Risk in Banks Based on Data Mining-Monte-Carlo in the “Open Innovation” System

Abstract

1. Introduction

2. Literature Review

3. Method

3.1. Study of the Terminology Applied to Characterize Innovation Activitiesin Banks

3.2. Assessment of Innovations in Banks: Threts and Opportunities

- -

- Thus, the net profit by phases of the economic cycle is recognized as an important qualitative indicator for the assessment of the financial performance of innovative activities in commercial banks. In our opinion, the commission income may represent the level of innovations’ efficiency in the banks’ financial performance, and its preferable generation is justified with the following: it is the most stable source of obtaining financial results, it is resistant to market fluctuations, it is used to diversify risks provided by unfavorable market conditions are anticipated;

- -

- The growing demand for remote banking services and non-credit transactions in the environment of products and services digitization, created ecosystems and expanded side business services;

- -

- An increase in borrowers’ debt burden aggravated with the enhanced premiums to loan risk ratios;

- -

- The expansion of the income base without increasing the share of risky assets;

- -

- Additional income generation;

- -

- The improvement of banks’ profit indicators without pressure on capital;

- -

- The creation of partnerships of the banks and financial technical companies in financial bank ecosystem.

- PJSC Sberbank is a large financial bank ecosystem, a leading bank with state capital support (Sberbank 2021);

- Post Bank JSC is a medium-sized bank with state capital support (Pochtabank 2021);

- PJSC “Stavropolpromstroybank” is a regional bank (Stavropolpromstroybank 2021).

3.3. Development and Validation of Assessment Model for Potential Strategic Innovative Risk in Banks Based on Adapted Data Mining–Monte Carlo Method and Special Software

- -

- Adequately sensitive interest of financial technologies’ consumers to the market changes, including those initiated by the regulator; low loyalty of consumers to specific financial and technical services can be a reason for them to easily discard certain financial and technical products when new ones come up or various regulatory state restrictions are introduced, etc.;

- -

- Dynamism of offers, i.e., constant emergence of new operations, products and services;

- -

- Level of uncertainty and risk at the heart of strategic choice;

- -

- Uncertainty of the actual situation for taking strategic decisions.

- -

- Its high volatility from period to period, which proves its exceeding permissible value;

- -

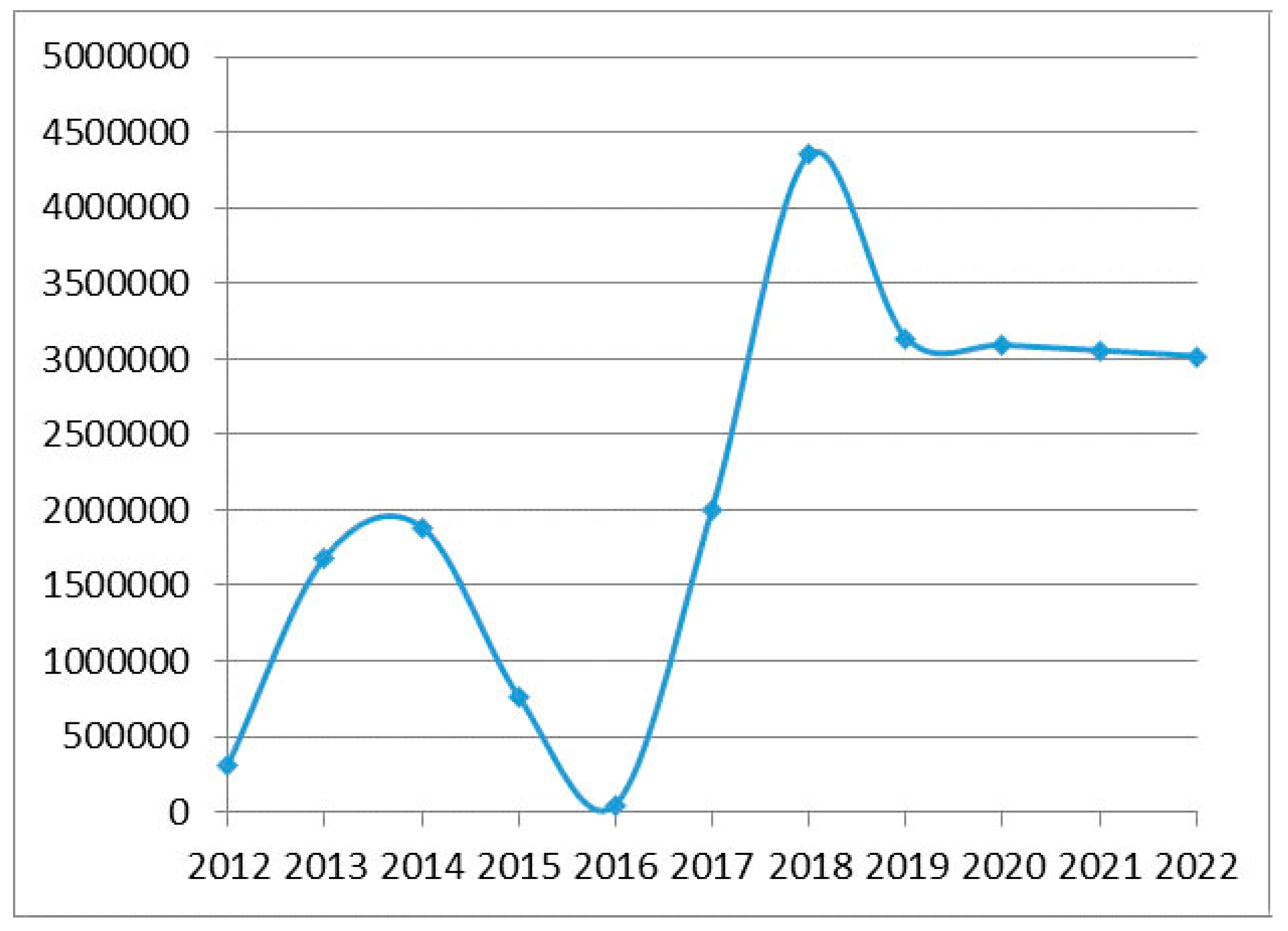

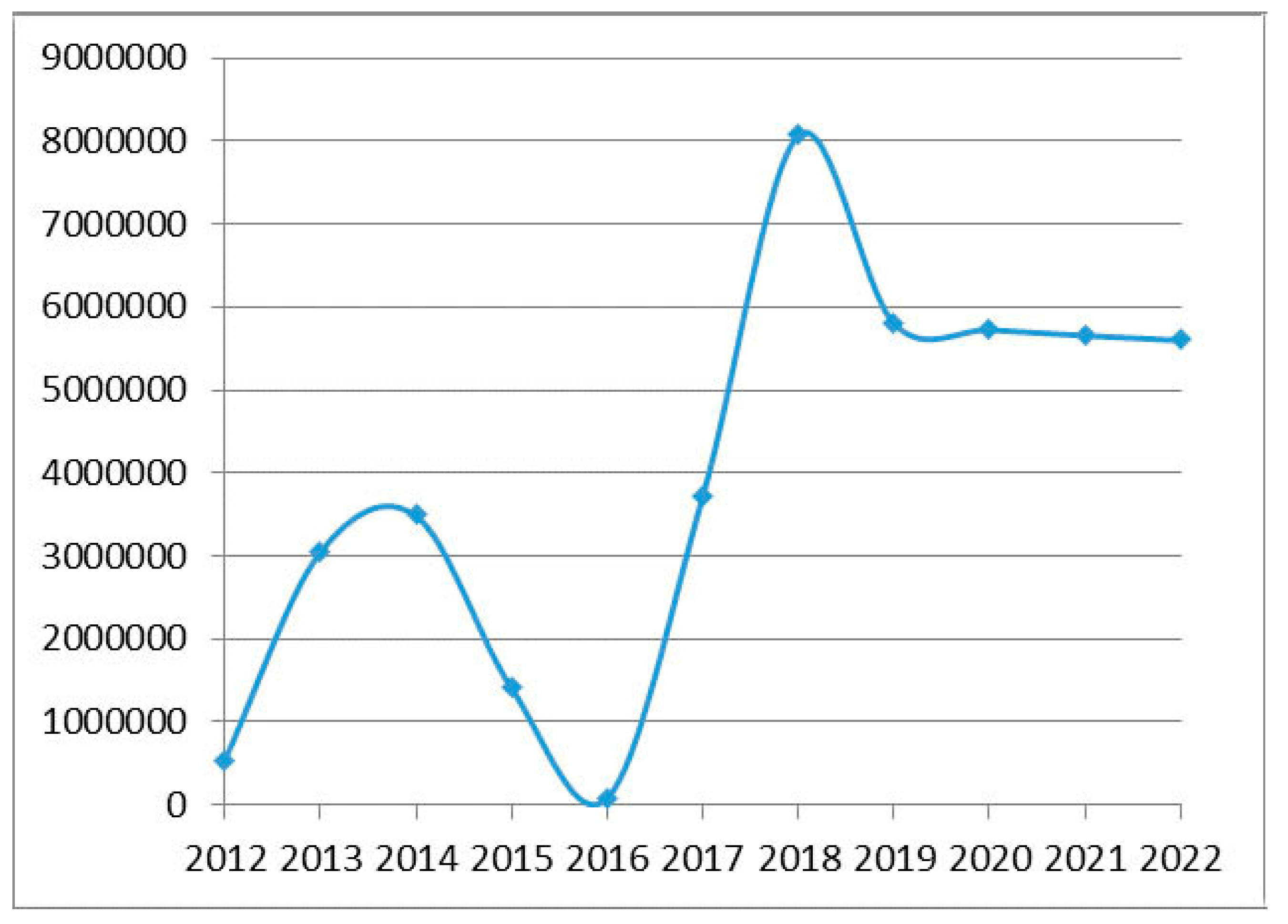

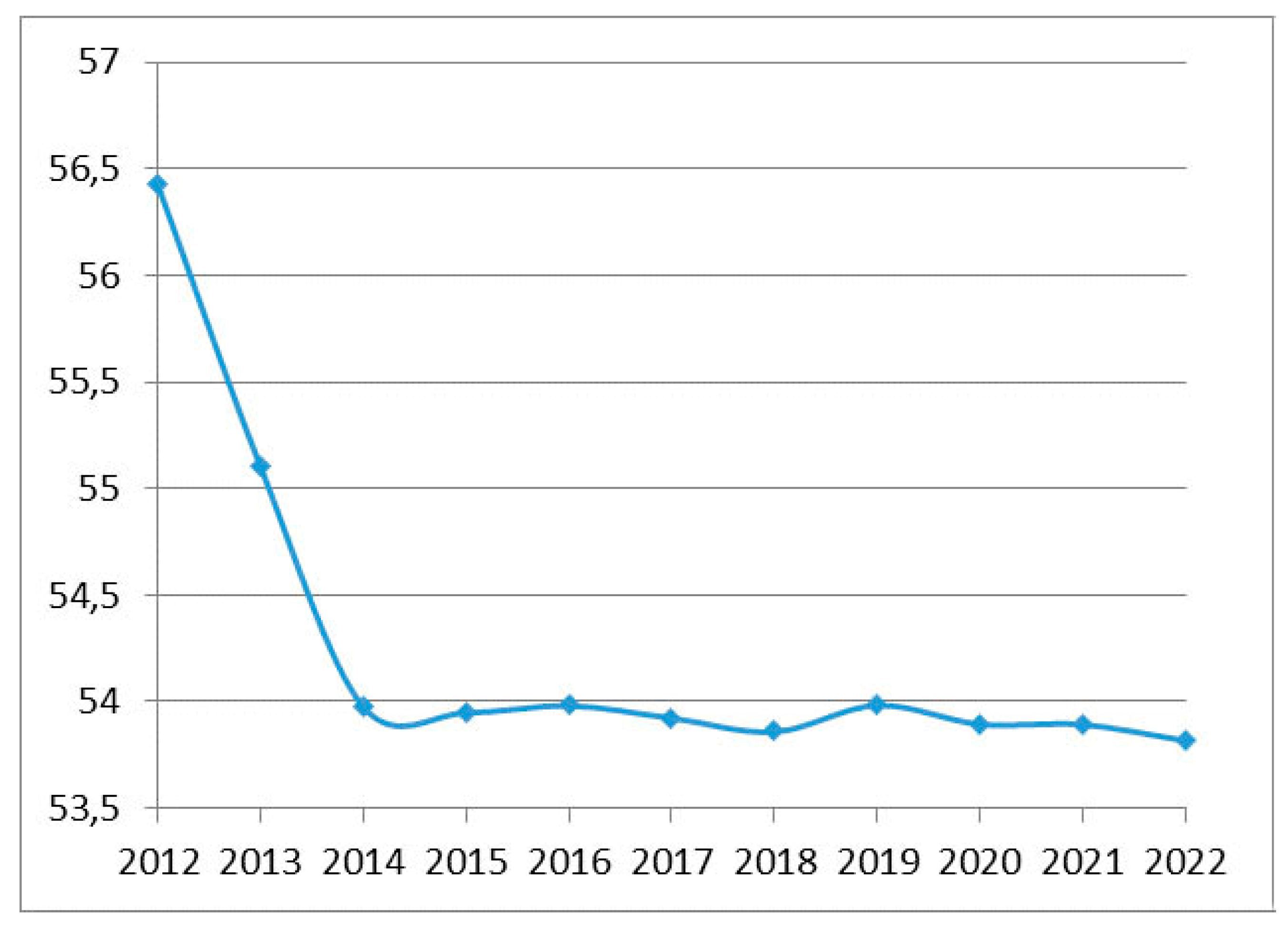

- The main development trend emerging in terms of commission income amount during the researched period, specifically in Post Bank;

- -

- Random fluctuations of the commission income values, and the commission income share in the net profit.

4. Results

4.1. In Theoretical Block of the Research

- -

- Hierarchical order was proposed for the concepts: “banking innovation”, “economic effect of innovational activities”, “financial and innovative strategy”, and “innovation risk” that will establish a foundation for the development of an unbiased tool for innovation activity assessment;

- -

- The link between innovative and strategic management in commercial banks was identified, proving that innovations in banks cannot be carried out without a strategy, the selection of which should be based on the analysis of the external and internal banking environment; the implementation of innovations in banks should be followed with a positive strategic economic effect.

4.2. In Practical Block of the Research

- -

- It is determined that the input and implementation of innovations is influenced by the cyclical nature of economy, which requires the regulation of innovation activity profit according to the economic cycle phases;

- -

- It was stipulated that in Russia, financial technologies make a significant contribution to the fulfillment of the UN sustainable development goal 9: “Industrialization, Innovation and Infrastructure”; notable activities are carried out to ensure the execution of the sustainable development goal: “Decent Work and Economic Growth”;

- -

- It is proved that the evaluation of the financial performance of banks’ innovative activities in terms of commission income is more preferable. It can be reasoned as follows: it is the most stable source for obtaining financial results, it is resistant to market fluctuations, is applied to diversify risks in unfavorable market conditions; it is justified with growing demand for the remote services and non-credit transactions in the context of the digitization of products and services, emerging ecosystems and the expansion of non-core services; enhanced clients’ debt burden, aggravated with an increase in interest related to loans risk ratios; expanding income base without increasing the share of risky assets; participation in additional income generation; the improvement of bank’s profit indicators without pressure on capital;

- -

- The potential financial performance of bank financial and innovative strategy was assessed in the context of the economic cycle phases (provided that the introduced innovations ensure future commission income), in accordance with the nature of income (commission income share, net interest income in bank net profit, commission and net income ratio), which contributes to a rapid implementation of new projects arising from dynamic factor changes in the external and internal innovation environment.

4.3. In Methodological Block of the Research

- -

- Practical value was proved for the banks’ potential strategic innovative risk assessment model, based on the adapted data mining–Monte Carlo method with a proprietary software product.

- -

- It was determined that banks’ profit from innovational activity is prone to volatility, that is expressed by the selective interest of financial technologies consumers to the market changes (including those initiated by the regulator); the dynamism of offers; uncertainty and risk levels incorporated into strategic choice; the uncertainty of the environment from the standpoint of strategic decision making;

- -

- The main elements of future profit are highlighted and considered in the adapted data mining–Monte Carlo method; they include profits from current activities adjusted to the cyclical nature of the economy, types of business activity, bank risks as well as bank innovation profits;

- -

- The best combination of the adapted data mining method of financial and innovative Big Data technology and Monte Carlo simulation (data mining–Monte Carlo) was proved when it was applied to the forecasting and assessment of the potential strategic innovative risk of banks expressed in the following: the array of the Big Data determines a forecast accuracy; Monte Carlo demonstrates predictive analytics retrospectively and for the future periods, and the intervallic nature of the optimum indicator values limits, which makes it possible to establish their values by the economic cycle phases, etc.;

- -

- It was determined that a potential strategic innovation risk parameter means the comparison of the simulated and actual interrelated values of the variable, i.e., commission income, relative value–commission income share in the net profit, which may come up in business as a result of the introduction of innovations in banks;

- -

- It was found that the adapted data mining–Monte Carlo method can be recognized as a formalized tool of banks’ financial and innovative strategy, which is applied for innovative activity modeling and evaluation;

- -

- Universal application areas for the combined adapted data mining–Monte Carlo method were indicated, which include: the promotion of the promising financial and innovative Big Data technology; the creation of predictive analytics; the automation of the strategic forecasting processes and potential strategic innovation risks assessments; a range of alternative strategic innovative solutions; the consideration of external conditions’ influence on financial and innovative strategy development and implementation; application in research on banks’ financial performance in different situations; desired indicators’ values are applied in creation of the “bank of the future” conception, and the identification of the trends based on data mining–Monte Carlo.

5. Discussion

6. Conclusions

- -

- A glossary tool was compiled based on the study of the hierarchical order of the concepts: “banking innovation”, “economic effect of innovational activities”, “financial and innovative strategy”, and “innovation risk”, serving as a basis for the development and promotion of a potential strategic bank innovation risk assessment tool;

- -

- The concept of “innovative risk” in banks was interpreted as a probability of wrong choices and the implementation of financial and innovative strategy that excludes dynamic opportunities and flexibility in making strategic innovative decisions, that served as methodological grounds for the development of tools for risk regulation and evaluation;

- -

- An assessment method was suggested for the financial performance of the financial and innovative strategy of banks by the economic cycle phases, which includes partiality of the commission income generation under the condition of instability, assuming the determination of a bank’s income nature in financial totals, the ratio between commission and net interest incomes based on the expert professional judgment, the implementation of which would reveal potentials for banks’ innovative activities development that ensure the receipt of a positive strategic economic effect in the context of instability;

- -

- A promising model was developed for the assessment of a potential strategic innovation risk of banks based on the adapted data mining–Monte Carlo toolkit with a software product, which describes modified strategic values of commission income, the commission income share in the net profit, deviations of the strategic and actual values; the application of the model allows for the selection of alternative strategic innovative solutions considering economic cycle phases, and forming possible scenarios for the development of the “bank of the future”.

- -

- The determination of the trends for intellectual capital development in the context of economic processes digitization; a certain study of intellectual capital in corporations was carried out by Galazova et al. (2017);

- -

- The development of the toolkit for the regulation, assessment and forecasting of banks’ risks based on Big Data financial technology: Voronova et al. (2016);

- -

- The development of the technology for assessment methods of potential strategic innovative risk in banks within an innovation system, Kulagina et al. (2019).

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Apak, Sudi, Güngör Tuncer, Erhan Atay, and Naime İrem Koşan. 2012. Insights From Knowledge Management to Radical Innovation: “Internet Banking Applications in the European Union”. Procedia Social and Behavioral Sciences 41: 45–50. [Google Scholar] [CrossRef][Green Version]

- Barras, Richard. 1986. Towards a Theory of Innovation in Services. Research Policy 15: 161–73. [Google Scholar] [CrossRef]

- Bezdudny, Felix, Galina Smirnova, and Olga Nechaeva. 1998. Essence of Innovation Conception and Its Classification. Innovations 2: 3–13. [Google Scholar]

- Bloomchain. 2019. Fintech. Annual Survey of Financial Technology Market in Russia. Available online: https://bloomchain-cdn.s3.amazonaws.com/uploads/wp-content/pdf/Fintech2019.pdf (accessed on 4 March 2021).

- Cooke, Ian Ian Ernest, and Paul Mayes. 1996. Introduction to Innovation and Technology Transfer. Boston: Artech House, Inc. [Google Scholar]

- Deloitte. 2018. Certain Financial Technologies as a Tool for Sustainable Business Development in Russia and Kazakhstan. Financial Technology Market Trends. Deloitte CIS Research Center. Available online: https://www2.deloitte.com/ru/ru/pages/research-center/articles/chastnye-finansovye-tekhnologii-kak-instrument-ustojchivogo-razvitiya-biznesa-rossii-kazahstane.html (accessed on 4 March 2021).

- Desyatnichenko, D. Yu., O. Yu. Desyatnichenko, V. S. Bodienkova, and E. S. Kondyukova. 2017. Electronic Innovation in Banking. Journal of Economy and Business 1: 41–48. [Google Scholar]

- Dodgson, Mark. 2000. The Management of Technological Innovation. Oxford: Oxford University Press. [Google Scholar]

- Doliatovskiy, L. V. 2011. Enterprise Development Strategy Based on Innovations Introduction. Innovations Management 4: 328–36. [Google Scholar]

- Drucker, P. F. 2009. Business and Innovation. Moscow: ID Williams. [Google Scholar]

- Dundon, E. 2006. Innovations: How to Identify Trends and Capitalize On. Moscow: Vershina. [Google Scholar]

- Eroshkin, Yu. V. 2013. Methodological Support for Strategic Risk Assessment of Innovative Activities in Commercial Bank. Forestry Journal 4: 177–85. [Google Scholar]

- Fatkhutdinov, R. A. 2014. Innovation Management, 6th ed. St. Petersburg: Peter. [Google Scholar]

- Fontin, Jean-Raymond, and Shi-Woei Lin. 2019. Comparison of banking innovation in low-income countries: A meta-frontier approach. Journal of Business Research 97: 198–207. [Google Scholar] [CrossRef]

- Galazova, Svetlana Sergeevna, Viktoriya Valeryevna Manuylenko, Boris Temirbolatovich Morgoev, Nina Vladimirovna Lipchiu, and Madina Alexandrovna Biganova. 2017. Formation of Stakeholders’ Client Capital of Trade Institutions. European Research Studies Journal 20: 398–411. [Google Scholar] [CrossRef]

- Garther. 2021. Official Website of Garther. Available online: https://garther.com (accessed on 4 March 2021).

- Hansen, Morten T., and Julian Birkinshaw. 2007. Inovations alue chain. Harvard Business Review 85: 121–30. [Google Scholar]

- Hong, Tan Lay, Chew Boon Cheong, and Hamid Syaiful Rizal. 2016. Service Innovation in Malaysian Banking Industry towards Sustainable Competi-tive Advantage through Environmentally and Socially Practices. Procedia Social and Behavioral Sciences 224: 52–59. [Google Scholar] [CrossRef]

- INSEAD. 2021. Global Innovation Index. Centre for Human Technologies. Available online: https://gtmarket.ru/ratings/global-innovation-index (accessed on 4 March 2021).

- Johnson, Kimberly. 2018. Risk Management for Sustainable Growth in Innovation Age. 2018 Risk at a Glance Study Series. PwC. Available online: https://www.pwc.ru/ru/publications/risk-in-review-2018.html (accessed on 4 March 2021).

- Klyton, Aaron, Juan Fernando Tavera-Mesías, and Wilson Castaño-Muñoz. 2021. Innovation resistance and mobile banking in rural Colombia. Journal of Rural Studies 81: 269–80. [Google Scholar] [CrossRef]

- Kokh, L. V., E. N. Smolyaninova, and V. S. Prosalova. 2009. Innovations in the Banking Business. St. Petersburg: Polytechnic University. [Google Scholar]

- Koshevenko, S. V. 2018. Digital Transformation of the World Economy. Economic Journal 3. Available online: https://cyberleninka.ru/article/n/tsifrovaya-transformatsiya-mirovoy-ekonomiki-1 (accessed on 4 March 2021).

- KPMG. 2019. Digital Technologies in Russian Companies. Available online: https://assets.kpmg/content/dam/kpmg/ru/pdf/2019/01/ru-ru-digital-technologies-in-russian-companies.pdf (accessed on 4 March 2021).

- Kulagina, N. A., O. V. Mikheenko, and D. G. Rodionov. 2019. Technologies for the Development of Methods for Evaluating an Innovative System. International Journal of Recent Technology and Engineering 8: 5083–91. [Google Scholar] [CrossRef]

- Kurakov, L. P. 2012. Brief Dictionary: Innovative Economy and Economic Security. Moscow: Publishing house IAEP. [Google Scholar]

- Lavrushin, O. I. 2016. Banking; under Edition of O. I. Lavrushin, 12th ed. Moscow: KNORUS. [Google Scholar]

- Management School at Northwestern University. 2021. Official Site of J.L. Kellogg Management School at Northwestern University. Available online: https://www.kellogg.northwestern.edu (accessed on 4 March 2021).

- Manuylenko, V. V., and A. I. Borlakova. 2020. Software for Determining Potential Strategic Innovation Risk in Commercial Banks (Software). 2020619715, issued 2020. [Google Scholar]

- McKinsey Global Institute. 2011. Big Data: The next Frontier for Innovation, Competition and Productivity. Available online: https://bigdatawg.nist.gov/pdf/MGI_big_data_full_report.pdf (accessed on 4 March 2021).

- McKinsey Global Institute. 2016. Digital Europe: Pushing the Frontier, Capturing the Benefits. Available online: https://www.mckinsey.com/~/media/mckinsey/business%20functions/mckinsey%20digital/our%20insights/digital%20europe%20pushing%20the%20frontier%20capturing%20the%20benefits/digital-europe-full-report-june-2016.ashx (accessed on 4 March 2021).

- Mensh, G. O. 1971. Theory of innovations. Berlin: Intenational Management Institute. [Google Scholar]

- Muravyova, A. V. 2005. Bank Innovations: World’s Best Experience and Russian Practice. Moscow: MGUP (IPK MGUP). [Google Scholar]

- Naseer, Saima, Kausar Fiaz Khawaja, Shadab Qazi, Fauzia Syed, and Fatima Shamim. 2021. How and when information proactiveness leads to operational firm performance in the banking sector of Pakistan? The roles of open innovation, creative cognitive style, and climate for innovation. International Journal of Information Management 56: 102260. [Google Scholar] [CrossRef]

- Nazarenko, N. V. 2014. Bank Innovations as a Result of Innovative Banking in Competitive Environment. Financial Research 2: 66–75. [Google Scholar]

- Omarini, A. 2017. The Digital Transformation in Banking and the Role of FinTechs in the New Financial Intermediation Scenario. Available online: https://www.bis.org/review/r151113d.htm (accessed on 24 May 2021).

- Pertseva, S. Yu. 2018. Digital Transformation of Financial Sector. Innovations in Management 18: 48–52. [Google Scholar]

- Pochtabank. 2021. Official Site of Post Bank JSC. Available online: https://www.pochtabank.ru (accessed on 4 March 2021).

- Podlozhenov, I. M. 2010. Theory Specifics of Innovative Activity in Service Sector (Commercial Banks). Modern Trends in Economics and Management: A New Look 3: 133–38. [Google Scholar]

- Popova, T. Yu. 2010. Indicators and Criteria System for Efficient Financial Innovations in Banking Sector. Financial Analytics: Problems and Solutions 18: 59–66. [Google Scholar]

- Prosalova, V. S., and A. A. Nikolaeva. 2014. Modern Approach to Bank Innovations. Finance and Credit 22: 13–22. [Google Scholar]

- Rodin, D. Ya. 2013. Development of Bank Innovations Based on Optimization of Business Processes in Commercial Banks. Financial Analytics: Problems and Solutions 32: 2–10. [Google Scholar]

- Rose, P. S. 1995. Banking Management. Moscow: Delo LTD, pp. 448–71. [Google Scholar]

- Santo, B. A. 1990. Innovation as a Means of Economic Development. Moscow: Progress. [Google Scholar]

- Sberbank. 2021. Official Site of PJSC ‘Sberbank’. Available online: https://www.sberbank.ru (accessed on 4 March 2021).

- Sinkey, J. 2016. Commercial Bank Financial Management in the Financial-Services. Moscow: Alpina Business Books. [Google Scholar]

- Sokolov, D. V., A. B. Titov, and M. M. Shabanova. 1997. Preconditions for Analysis and Creation of Innovation Policy. St. Petersburg: Publishing House of St. Petersburg State University of Economics and Finance. [Google Scholar]

- Stavropolpromstroybank. 2021. Official Site of PJSC ‘Stavropolpromstroybank’. Available online: https://www.psbst.ru (accessed on 4 March 2021).

- Sundbo, Jon, and Faïz Gallouj. 2001. Innovation as a Loosely Coupled System in Services. In Innovation Systems in the Service Economy: Measurement and Case Study Analysis. Boston, Dordrecht and London: Academic Publishers. [Google Scholar]

- Tadviser. 2019. Russian Market of Bank Informatization. Available online: www.tadviser.ru/index.php/C%D1%82a%D1%82%D1%8C%D1%8F:P%D0%BEcc%D0%B8%D0%B9c%D0%BA%D0%B8%D0%B9_p%D1%8B%D0%BD%D0%BE%D0%BA_%D0%B1a%D0%BD%D0%BA%D0%BE%D0%B2c%D0%BA%D0%BE%D0%B9_%D0%B8%D0%BD%CF%86%D0%BEp%D0%BCa%D1%82%D0%B8%D0%B7a%D1%86%D0%B8%D0%B8 (accessed on 4 March 2021).

- Tucker, R. B. 2006. Innovations as Growh Formula. New Future for the Leading Companies. Moscow: ZAO Olimp Business. [Google Scholar]

- Ustyugova, Elena. 2019. Digital Technologies in Russian Companies. January. Available online: kpmg.ru (accessed on 2 June 2021).

- Vodachek, L., and O. Vodachkova. 1989. Strategic Management over Innovations at Enterprise. Moscow: Economics. [Google Scholar]

- Voronova, Natal’ya Stepanovna, Ol’ga Sergeevna Miroshnichenko, and Anna Nikolaevna Tarasova. 2016. Determinants of the Russian Banking Sector Development as the Drivers of Economic Growth. Economic and Social Changes: Facts, Trends, Forecast 4: 165–83. [Google Scholar] [CrossRef]

- Vykupov, V. S. 2001. Innovative Activity of Credit Institutions. Management in Russia and Abroad 1: 79–89. [Google Scholar]

- White, P. 1982. Research and Innovations Management. Moscow: Economics. [Google Scholar]

- Wright, Gilly. 2017. World’s Best Digital Banks Conference|Can Banks Deliver With Data. Global Finance Magazine. Available online: http://www.gfmag.com/magazine/december-2017/worlds-best-digital-banks-2017-can-banks-deliver-data (accessed on 4 March 2021).

- Zverev, O. A. 2008. Innovation Policy of Commercial Banks. Moscow: Russian Academy of Economics after G.V. Plekhanov. [Google Scholar]

| Features | Management | |

|---|---|---|

| Strategic | Innovative | |

| Purpose | Strategy implementation | Innovation implementation |

| Implementation period | Over 3 years | Within 3 years |

| Bank engagement level | All bank divisions | Divisions engaged in innovation processes/product/service |

| Implementation stages | Management stages | |

| Risk level | Minimum risks due to lengthy implementation period | High |

| Analyzed resources | External, internal | |

| Organizational process opportunities | Due to lengthy implementation period are maximally structured and arranged | Due to prompt sales are less arranged and adjusted |

| Regulatory Body | Bank management, including top management | |

| Period | Economic Cycle Phases | Share in Net Profit. % | Commission and Net Interest Income Ratio. % | |||

|---|---|---|---|---|---|---|

| Net Interest Profit | Commission Income | Other Types of Profit | Net Profit | |||

| PJSC “Sber” | ||||||

| 01.01.2013 | Expansion | 56.2 | 231.3 | −187.5 | 100 | 24.3 |

| 01.01.2014 | Trough | 57.8 | 216.9 | −174.7 | 100 | 26.7 |

| 01.01.2015 | 89.8 | 242.3 | −232.1 | 100 | 37.1 | |

| 01.01.2016 | 116.6 | 248.9 | −265.5 | 100 | 46.8 | |

| 01.01.2017 | 32.2 | 223.5 | −155.7 | 100 | 14.4 | |

| 01.01.2018 | Growth | 57.0 | 171.6 | −128.6 | 100 | 33.2 |

| 01.01.2019 | Growth | 63.0 | 155.7 | −118.7 | 100 | 40.4 |

| 01.01.2020 | Trough | 74.0 | 167.8 | −141.8 | 100 | 44.1 |

| Post Bank JSC | ||||||

| 01.01.2013 | Expansion | 16.5 | 0.8 | 82.7 | 100 | 4.8 |

| 01.01.2014 | Trough | 13.8 | 26.1 | 60.1 | 100 | 188.7 |

| 01.01.2015 | −37.0 | 104.7 | 32.3 | 100 | −283.1 | |

| 01.01.2016 | −317.4 | 423.8 | −6.4 | 100 | −133.5 | |

| 01.01.2017 | 3284.2 | 14,495.4 | −17,679.6 | 100 | 441.4 | |

| 01.01.2018 | Growth | 571.5 | 596.4 | −1067.9 | 100 | 104.3 |

| 01.01.2019 | Growth | 420.2 | 407.7 | −727.9 | 100 | 97.0 |

| 01.01.2020 | Trough | 277.3 | 589.5 | −766.8 | 100 | 212.6 |

| PJSC “Stavropolpromstroybank” | ||||||

| 01.01.2013 | Expansion | 138.0 | 250.6 | −288.6 | 100 | 55.1 |

| 01.01.2014 | Trough | 447.7 | 889.6 | −1237.3 | 100 | 50.3 |

| 01.01.2015 | 192.0 | 281.9 | −373.9 | 100 | 68.1 | |

| 01.01.2016 | 165.5 | −56.3 | −209.2 | −100 | −294.1 | |

| 01.01.2017 | 807.8 | 1222.8 | −1930.6 | 100 | 66.1 | |

| 01.01.2018 | Growth | 3522.5 | 4771.1 | −8193.6 | 100 | 73.8 |

| 01.01.2019 | Growth | 354.0 | 477.0 | −931.0 | −100 | 74.2 |

| 01.01.2020 | Trough | 2957.3 | 3201.8 | −6259.1 | −100.0 | 92.4 |

| YY | Commission Income | Commission Income Share in Net Profit. % | ||||

|---|---|---|---|---|---|---|

| Actual. Thousand Rubles | Modeled. Thousand Rubles | Modeled/Actual. % | Actual | Modeled | Modeled—Actual Values | |

| Russian Sberbank | ||||||

| 2012 | 177,669,005 | 166,243,080 | 93.6 | 56.2 | 52.54563522 | −3.7 |

| 2013 | 223,458,204 | 202,653,270 | 90.7 | 57.8 | 52.4529953 | −5.3 |

| 2014 | 282,599,928 | 165,480,271 | 58.6 | 89.8 | 52.59234619 | −37.2 |

| 2015 | 343,075,422 | 154,729,372 | 45.1 | 116.6 | 52.57389069 | −64.0 |

| 2016 | 160,618,710 | 262,077,386 | 163.2 | 32.2 | 52.59541321 | +20.4 |

| 2017 | 463,506,297 | 427,083,885 | 92.1 | 57.0 | 52.55768585 | −4.4 |

| 2018 | 568,113,707 | 473,776,727 | 83.4 | 63.0 | 52.51610184 | −10.5 |

| 2019 | 641,849,562 | 455,974,751 | 71.0 | 74.0 | 52.59677505 | −21.4 |

| 2020 strateg. | 431,729,639 | 52.53921509 | ||||

| 2021 strateg. | 410,940,127 | 52.53772354 | ||||

| 2022 strateg. | 392,104,358 | 52.48858261 | ||||

| Pochta Bank | ||||||

| 2012 | 4253 | 302,031 | 7101.6 | 0.8 | 56.42550021 | +55.6 |

| 2013 | 795,151 | 1,680,194 | 211.3 | 26.1 | 55.10329319 | +29.0 |

| 2014 | 3,657,100 | 1,885,110 | 51.5 | 104.7 | 53.9784596 | −50.7 |

| 2015 | 6,004,516 | 764,350 | 12.7 | 423.8 | 53.95013704 | −369.8 |

| 2016 | 12,202,365 | 45,444 | 0.4 | 14,495.4 | 53.98316681 | −14,441.4 |

| 2017 | 22,180,864 | 2,005,679 | 9.0 | 596.4 | 53.92526674 | −542.5 |

| 2018 | 32,926,753 | 4,349,565 | 13.2 | 407.7 | 53.86145116 | −353.8 |

| 2019 | 34,223,999 | 3,134,361 | 9.2 | 589.5 | 53.98525683 | −535.5 |

| 2020 strateg. | 3,088,019 | 53.89692085 | ||||

| 2021 strateg. | 3,051,827 | 53.89463022 | ||||

| 2022 strateg. | 3,015,548 | 53.8192169 | ||||

| Stavropolpromstroybank | ||||||

| 2012 | 318,598 | 121,318 | 38.1 | 138.0 | 52.54563522 | −85.5 |

| 2013 | 290,201 | 33,997 | 11.7 | 447.7 | 52.4529953 | −395.2 |

| 2014 | 319,705 | 87,568 | 27.4 | 192.0 | 52.59234619 | −139.4 |

| 2015 | 385,815 | −146,608 | −38.0 | 165.5 | 62.88008264 | −102.6 |

| 2016 | 350,040 | 27,294 | 7.8 | 807.8 | 62.98778174 | −744.8 |

| 2017 | 378,101 | 6741 | 1.8 | 3522.5 | 62.79898886 | −3459.7 |

| 2018 | 334,870 | −92,902 | −27.7 | 354.0 | 98.1988815 | −255.8 |

| 2019 | 321,720 | −40,365 | −12.5 | 2957.3 | 371.0360806 | −2586.3 |

| 2020 strateg. | −52,098 | 118.7778163 | ||||

| 2021 strateg. | −63,027 | 86.66780425 | ||||

| 2022 strateg. | −72,300 | 73.49400201 | ||||

| Adapted Data Mining Method–Monte Carlo in the Moment of Time and Further | Big Data Perspectives |

|---|---|

| Promotion of promising financial and innovative technology Big Data, creating information support for innovation | Predetermines the development of predictive banking in terms of strategic value of the commission income, which is at inception level in Russia and around the world |

| Establishment of predictive analytics (past and predictive performance of commission income) | The creation of a forecasting model for credit risks to suggest individual clients offers, efficiently allocating resources (as a way of the rational supply of a region with a branches network or ATMs, taking into account dynamic modeling and the assessment of customer flows) |

| Automation of the strategic forecasting process and of potential strategic innovation risk assessment | More accurate client evaluation, which may minimize loan risks |

| The sselection of alternative strategic innovative solutions | The increase in forecasting accuracy with scoring models of credit risks forecast |

| Consideration of external conditions’ influence on the development and implementation of financial and innovation strategy | The administration of liquidity regulation platforms, demanding that banks build new data accumulation systems—“business sensors” at customers’ ecosystems levels, the creation of efficient ecosystems and availability of their status Big Data, which minimizes portfolio risks by means of “risk forward looking” systems |

| Applied for the assessment of banks’ financial dynamics in different situations (availability of large arrays of client data allows the bank to have the best knowledge of their customers and offer them the best financial solutions); | |

| desired indicators’ values are applied for the development of the “bank of the future” conception | |

| Identification of trends based on data mining–Monte Carlo |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Manuylenko, V.V.; Borlakova, A.I.; Milenkov, A.V.; Bigday, O.B.; Drannikova, E.A.; Lisitskaya, T.S. Development and Validation of a Model for Assessing Potential Strategic Innovation Risk in Banks Based on Data Mining-Monte-Carlo in the “Open Innovation” System. Risks 2021, 9, 118. https://doi.org/10.3390/risks9060118

Manuylenko VV, Borlakova AI, Milenkov AV, Bigday OB, Drannikova EA, Lisitskaya TS. Development and Validation of a Model for Assessing Potential Strategic Innovation Risk in Banks Based on Data Mining-Monte-Carlo in the “Open Innovation” System. Risks. 2021; 9(6):118. https://doi.org/10.3390/risks9060118

Chicago/Turabian StyleManuylenko, Viktoriya Valeryevna, Aminat Islamovna Borlakova, Alexander Vladimirovich Milenkov, Olga Borisovna Bigday, Elena Andreevna Drannikova, and Tatiana Sergeevna Lisitskaya. 2021. "Development and Validation of a Model for Assessing Potential Strategic Innovation Risk in Banks Based on Data Mining-Monte-Carlo in the “Open Innovation” System" Risks 9, no. 6: 118. https://doi.org/10.3390/risks9060118

APA StyleManuylenko, V. V., Borlakova, A. I., Milenkov, A. V., Bigday, O. B., Drannikova, E. A., & Lisitskaya, T. S. (2021). Development and Validation of a Model for Assessing Potential Strategic Innovation Risk in Banks Based on Data Mining-Monte-Carlo in the “Open Innovation” System. Risks, 9(6), 118. https://doi.org/10.3390/risks9060118