The Empirical Analysis of the Core Competencies of the Company’s Resource Management Risk. Preliminary Study

Abstract

1. Introduction

2. Literature Review

- (a)

- The manager is willing to take a high risk in managing the company’s resources, counting on more-than-average profit;

- (b)

- Risk neutrality, where the manager makes decisions based on the value of the expected rate of return;

- (c)

- Risk aversion, where the manager prefers to minimize uncertainty (Fehr and Rangel 2011).

3. Materials and Methods

- (a)

- (b)

- The current related to the research conducted by Schumpeter (2003), which emphasizes the manager’s entrepreneurial abilities;

- (c)

- (a)

- Several methods obtained data on the competence of the employees;

- (b)

- Interviews with respondents supplemented the results of the questionnaire tests;

- (c)

- Personal supervision of the conduct of the test procedure was ensured;

- (d)

- The principle of voluntary participation in the research was respected.

4. Results

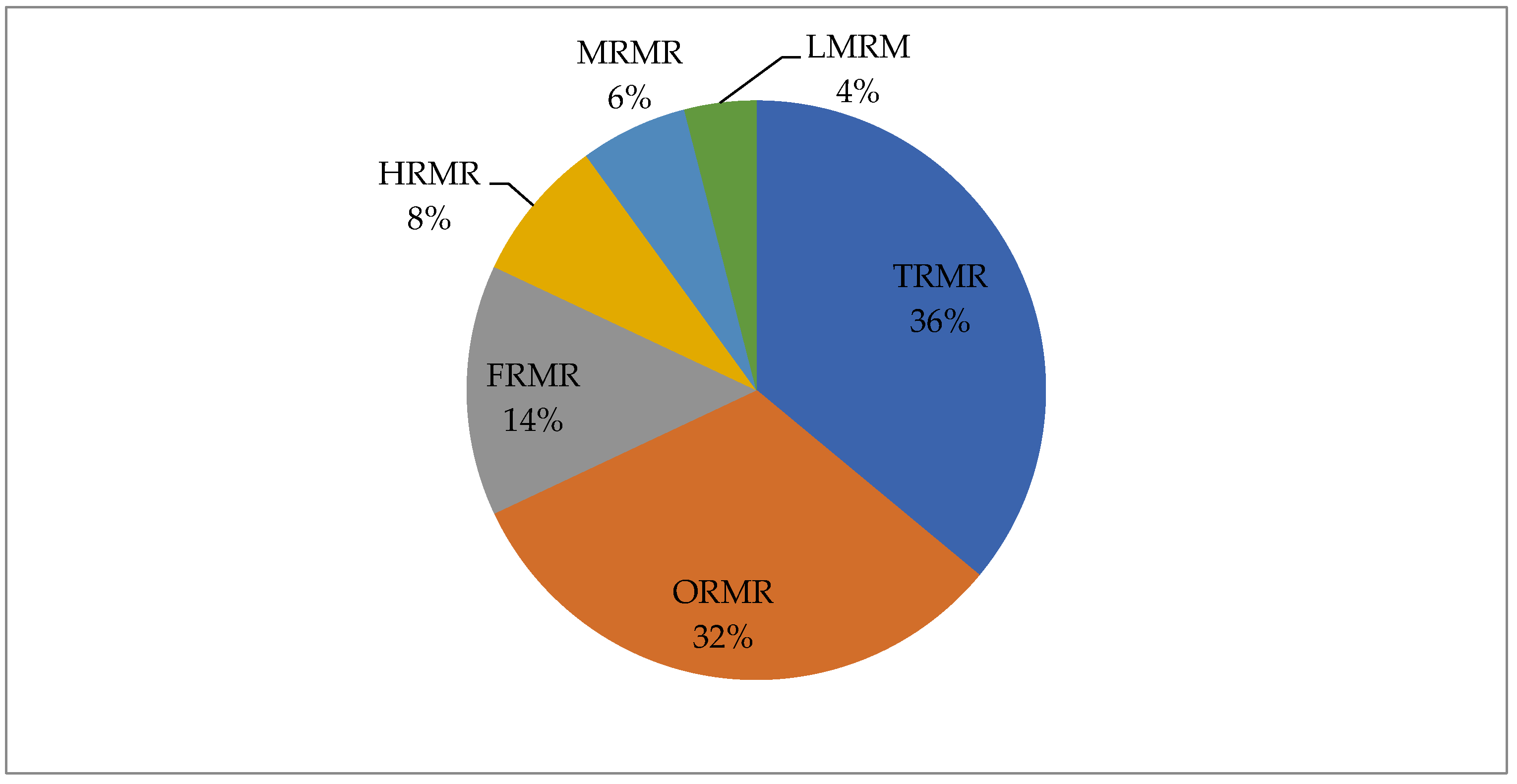

- -

- Competencies of organizational resource management risk (32%);

- -

- Competencies of financial resource management risk (14%);

- -

- Competencies of human resource management risk (8%);

- -

- Competencies of marketing resource management risk (6%);

- -

- Competencies of legal resource management risk (4%).

5. Conclusions

- The analysis of the research results showed a gradation of separate dimensions of resource management risk competence. The dominant ones were the competencies of technological resource management risk. The management risk competencies were the following: organizational resources, financial resources, human resources, marketing resources, and legal resources (Figure 1);

- From the adopted research concept, managers’ biographical characteristics were an essential parameter for characterizing the differences in the six identified areas of competence of an enterprise’s resource management risk;

- The analysis of interdependencies between the type of risk competence and biographical variables of the management team allowed for the verification of six detailed hypotheses. The presented calculations show that the positions occupied by the persons surveyed in the companies’ structures determined risk competence. As the management levels increased, organizational resource management risk increased and technological resource management risk decreased;

- Moreover, based on the performed analyses, the following was noted:

- (a)

- Sex was the feature that influenced the type of risk competencies held by the managerial staff. It was found that the competence of the company’s resource management risk in women and men in executive positions was different;

- (b)

- The ages of the surveyed persons significantly determined the risk competencies of the managers;

- (c)

- There were differences between the length of seniority in general and the possessed competencies of risk;

- (d)

- Short seniority for the managers influenced the competencies of organizational resource management risk.

- We justified the advisability of applying a scientific approach to research on company resource risk management. This allows for deepening the characteristics of managers’ work. Competence is a multidimensional concept and requires an integrated approach that helps build a managerial competence model that reflects today’s environment’s objective complexity and dynamics;

- We have shown scientific and practical evidence of the link between the business environment and managers’ risk competencies. We pointed out that it is necessary to analyze managerial risk competence dimensions in highly unstable conditions continuously;

- From the empirical point of view, we classified the individual areas of competence for managing a company’s resources. The research carried out allowed us to order the importance (levels) of the individual components of risk competence (Figure 2);

- We have shown scientific and practical evidence of the relationship between crucial risk competencies and characterizing managers’ biographical variables.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abraham, Steven. E., Lanny A. Karns, Karns Shaw, and Manuel A. Mena. 2001. Managerial competencies and the managerial performance appraisal process. Journal of Management Development 20: 842–52. [Google Scholar] [CrossRef]

- Agyapong, Ahmed, Florence Ellis, and Daniel Domeher. 2016. Competitive strategy and performance of family businesses: Moderating effect of managerial and innovative capabilities. Journal of Small Business & Entrepreneurship 28: 449–77. [Google Scholar] [CrossRef]

- Alaszewski, Andy, and Kirstie Coxon. 2008. The everyday experience of living with risk and uncertainty. Journal Health, Risk & Society 10: 413–20. [Google Scholar] [CrossRef]

- Amir, Eli, Juha Kallunki, and Henrik Nilsson. 2014. The association between individual audit partners’ risk preferences and the composition of their client portfolios. Review of Accounting Studies 19: 103–33. [Google Scholar] [CrossRef]

- Andrews, Kenneth. 1997. The Concept of Strategy. Homewood. In Resources, Firms, and Strategies: A Reader in the Resource-based Perspective. Edited by Nicolai J. Foss. New York: Oxford University Press. [Google Scholar]

- Aven, Terje, and Frederic Bouder. 2020. The COVID-19 pandemic: How can risk science help? Journal of Risk Research 23: 849–54. [Google Scholar] [CrossRef]

- Aven, Terje, and Ortwin Renn. 2010. Risk Management. In Risk Management and Governance. Risk, Governance and Society. Berlin/Heidelberg: Springer. [Google Scholar] [CrossRef]

- Aven, Terje, and Ortwin Renn. 2009. On risk defined as an event where the outcome is uncertain. Journal of Risk Research 12: 1–11. [Google Scholar] [CrossRef]

- Barney, Jay B. 2002. Gaining and Sustaining Competitive Advantage. Upper Saddle River: Prentice-Hall. [Google Scholar]

- Berber, Nemania, and Bojan Lekovic. 2018. The impact of HR development on innovative performances in central and eastern European countries. Employee Relations 40: 762–86. [Google Scholar] [CrossRef]

- Bercu, Anna-Maria, and Dan Lupu. 2020. Entrepreneurial Competencies as Strategic Tools: A Comparative Study for Eastern European Countries. Developing Entrepreneurial Competencies for Start-Ups and Small Business. [Google Scholar] [CrossRef]

- Besenyő, Janos, and Marianna Kármán. 2020. Effects of COVID-19 pandemy on African health, political and economic strategy. Insights into Regional Development 2: 630–44. [Google Scholar] [CrossRef]

- Buhaichuk, Kostiantyn, Nataliia Varenia, Vitalii Khodanovych, Maryna Kriepakova, and Valentyn Seredynskyi. 2021. Mechanism of formation of innovation security and activation of innovation activity of corporations. Entrepreneurship and Sustainability Issues 8: 402–19. [Google Scholar] [CrossRef]

- Christensen, Brant E., Steven M. Glover, and David A. Wood. 2013. Extreme estimation uncertainty in fair value estimates Implications for audit assurance, Auditing. A Journal of Practice & Theory 31: 127–46. [Google Scholar] [CrossRef]

- Cockerill, Tony, John Hunt, and Harry Schroder. 1995. Managerial Competencies: Fact or Fiction? Business Strategy Review 6: 1–12. [Google Scholar] [CrossRef]

- Cole, Gerald A. 2006. Strategic Management: Theory and Practice, 2nd ed. London: Thomson Learning. [Google Scholar]

- Cook, Roger M. 1988. Uncertainty in risk assessment: A probabilist’s manifesto. Reliability Engineering & System Safety 23: 277–83. [Google Scholar] [CrossRef]

- Dobrowolski, Zbysław. 2020a. After COVID-19: Reorientation of crisis management in crisis. Entrepreneurship and Sustainability Issues 8: 799–810. [Google Scholar] [CrossRef]

- Dobrowolski, Zbysław. 2020b. The supreme audit institutions readiness to uncertainty. Entrepreneurship and Sustainability Issues 8: 513–25. [Google Scholar] [CrossRef]

- Drozdowski, Grzegorz. 2017. Emotional components of competence among executives: An empirical study. Economic Annals-XXI 162: 89–92. [Google Scholar] [CrossRef]

- Drozdowski, Grzegorz. 2021. Economic Calculus Qua an Instrument to Support Sustainable Development under Increasing Risk. Journal of Risk and Financial Management 14: 15. [Google Scholar] [CrossRef]

- Dubois, David. 1998. Preface, The Competency Casebook: Twelve Studies in Competency-Based Performance Improvement. Amherst: HRD Press. [Google Scholar]

- Dulewicz, Victor, and Malcolm Higgs. 2005. Assessing leadership dimensions, styles and organizational context. Journal of Managerial Psychology 20: 105–23. [Google Scholar] [CrossRef]

- Dziekański, Paweł, and Piotr Prus. 2020. Financial Diversity and the Development Process: Case study of Rural Communes of Eastern Poland in 2009–2018. Sustainability 12: 6446. [Google Scholar] [CrossRef]

- Fehr, Ernest, and Antonio Rangel. 2011. Neuroeconomic foundations of economic. choice recent advances, Journal of Economic Perspectives 25: 3–30. [Google Scholar] [CrossRef]

- Feldmann-Jensen, Shirley, Steven J. Jensen, Sandy M. Smith, and Gregory Vigneaux. 2019. The next-generation core competencies for emergency management. Journal of Emergency Management 17: 17–25. [Google Scholar] [CrossRef]

- Fiedler, Fred. 1981. Leadership Effectiveness. American Behavioral Scientist 24: 619–32. [Google Scholar] [CrossRef]

- Friedlob, George T., and Lydia Schleifer. 1999. Fuzzy logic: Application for audit risk and uncertainty. Managerial Auditing Journal 14: 127–37. [Google Scholar] [CrossRef]

- Gamble, John, Arthur Thompson, and Margaret Peteraf. 2013. Essentials of Strategic Management: The Quest for Competitive Advantage. New York: McGraw-Hill/Irwin. [Google Scholar]

- González-Díaz, Romel R., Angel E. Acevedo-Duque, Santos L. G. Gómez, and Elena Cachicatari Vargas. 2021. Business counterintelligence as a protection strategy for SMEs. Entrepreneurship and Sustainability Issues 8: 340–52. [Google Scholar] [CrossRef]

- Gramling, Audrey, and Arnold Schneider. 2018. Effects of reporting relationship and type of internal control deficiency on internal auditors’ internal control evaluations. Managerial Auditing Journal 33: 318–35. [Google Scholar] [CrossRef]

- Hockemeyer, Cord, Owen Conlan, Vincent Wade, and Dietrih Albert. 2003. Applying competence prerequisite structures for elearning and skill management. Journal of Universal Computer Science 9: 1428–36. [Google Scholar]

- Johannisson, Bengt, and Morten Huse. 2010. Recruiting outside board members in the small family business: An ideological challenge. Entrepreneurship & Regional Development 12: 353–78. [Google Scholar] [CrossRef]

- Klinke, Andreas. 2020. Public understanding of risk and risk governance. Journal of Risk Research 24: 2–13. [Google Scholar] [CrossRef]

- Klinke, Andreas, and Ortwin Renn. 2019. The Coming of Age of Risk Governance. Risk Analysis, An International Journal 41: 544–57. [Google Scholar] [CrossRef]

- Knight, Frank H. 2013. The Economic Organization. London: Transaction Publishers. [Google Scholar]

- Kohnová, Lucia, Jan Papula, Zuzana Papulová, Katarina Stachová, and Zdenko Stacho. 2020. Job mismatch: The phenomenon of overskilled employees as a result of poor managerial competences. Entrepreneurship and Sustainability Issues 8: 83–102. [Google Scholar] [CrossRef]

- Kralj, Mariela. 2018. Competency Gap: Managers’ Expectations and Students’ Perceptions of the Importance of Soft Skills. Ph.D. dissertation, Rochester Institute of Technology, Dubrovink, Croatia. Available online: https://zir.nsk.hr/islandora/object/acmt%3A36 (accessed on 6 October 2020).

- Krause, Nicole M., Isabelle Freiling, Becca Beets, and Dominique Brossard. 2020. Fact-checking as risk communication: The multi-layered risk of misinformation in times of COVID-19. Journal of Risk Research 23: 1052–59. [Google Scholar] [CrossRef]

- Kuk, Linda, Braian Cobb, and Cynthia Forrest. 2007. Perceptions of competencies of entry-level practitioners in student affairs. Journal of Student Affairs Research and Practice 44: 664–91. [Google Scholar] [CrossRef]

- Le Blanc, Pascale, Vicente González-Romá, and Haijiang Wang. 2020. Charismatic Leadership and Work Team Innovative Behavior: The Role of Team Task Interdependence and Team Potency. Journal of Bussiness and Psychology 36: 333–46. [Google Scholar] [CrossRef]

- Levenson, Alec R., Wim A. Van der Stede, and Susan G. Cohen. 2006. Measuring the Relationship Between Managerial Competencies and Performance. Journal o Management 32: 360–80. [Google Scholar] [CrossRef]

- Martin, Matthew M., and Rebecca B. Rubin. 1995. A new measure of cognitive flexibility. Psychological Reports 76: 623–26. [Google Scholar] [CrossRef]

- Mintzberg, Henry, Bruce Ahlstrand, and Joseph Lampel. 2009. Strategy Safari. Your Complete Guide Through the Wilds of Strategic Management. Harlow: Prentice-Hall. [Google Scholar]

- Müller-Frommeyer, Lena C., Stephanie C. Aymans, Carina Bargmann, Simone Kauffeld, and Cristoph Herrmann. 2017. Introducing Competency Models as a Tool for Holistic Competency Development in Learning Factories: Challenges, Example and Future Application. Procedia Manufacturing 9: 307–14. [Google Scholar] [CrossRef]

- Noordegraaf, Mirko. 2000. Professional sense-makers: Managerial competencies amidst ambiguity. International Journal of Public Sector Management 13: 319–32. [Google Scholar] [CrossRef]

- Prahalad, Coimbatore K., and Gary Hamel. 1997. The Core Competence of the Corporation. In Strategische Unternehmungsplanung/Strategische Unternehmungsführung. Edited by Dietger Hahn and Bernhard Taylor. Heidelberg: Physica. [Google Scholar] [CrossRef]

- Reamer, Frederic G. 2000. The Social Work Ethics Audit: A Risk-Management Strategy. Social Work 45: 355–66. [Google Scholar] [CrossRef]

- Renn, Ortwin. 2020. New challenges for risk analysis: Systemic risks. Journal of Risk Research 24: 127–33. [Google Scholar] [CrossRef]

- Renn, Ortwin, Andreas Klinke, and Marjolein van Asselt. 2011. Coping with Complexity, Uncertainty and Ambiguity in Risk Governance: A Synthesis. AMBIO 40: 231–46. [Google Scholar] [CrossRef]

- Samson, Sundeep, James A. Reneke, and Margaret M. Wiecek. 2009. A review of different perspectives on uncertainty and risk and an alternative modelling paradigm. Reliability Engineering & System Safety 94: 558–67. [Google Scholar] [CrossRef]

- Scholes, Julie, and Ruth Endacott. 2003. The practice competency gap: Challenges that impede the introduction of national core competencies. Nursing in Critical Care 8: 68–77. [Google Scholar] [CrossRef] [PubMed]

- Schumpeter, Joseph. 2003. The Theory of Economic Development. In Joseph Alois Schumpeter. The European Heritage in Economics and the Social Sciences. Edited by J. Backhaus. Boston: Springer. [Google Scholar] [CrossRef]

- Simunic, Dan A., and Michael T. Stein. 1990. Audit risk in a client portfolio context. Contemporary Accounting Research 6: 329–43. [Google Scholar] [CrossRef]

- Smith, B., and Eric Morse. 2005. Entrepreneurial Competencies: Literature Review and Best Practices. Small Business Policy Branch. Ottawa: Industry. [Google Scholar]

- Spencer, Lyle M., and Signe M. Spencer. 1993. Competence at Work: Models for Superior Performance. New York: Wiley. [Google Scholar]

- Stevens, Gregory W. 2013. A Critical Review of the Science and Practice of Competency Modeling. Human Resource Development Review 12: 86–107. [Google Scholar] [CrossRef]

- Straka, Gerald. 2004. Measurement and evaluation of competence. In The Foundations of Evaluation and Impact Research. Third Report on Vocational Training Research in Europe: Background Report. Edited by Pascaline Descy and Manfred Tessaring. Luxembourg: Office for Official Publications of the European Communities. [Google Scholar]

- Taborsky, Barbara, and Rui F. Oliveira. 2012. Social competence: An evolutionary approach. Trends in Ecology & Evolution 27: 679–88. [Google Scholar] [CrossRef]

- Vainieri, M., Francesca Ferrè, Giorgio Giacomelli, and Sabina Nuti. 2019. Explaining performance in health care: How and when top management competencies make the difference. Health Care Manage Review 44: 306–17. [Google Scholar] [CrossRef] [PubMed]

- Winterton, Jonathan. 2019. Competence Across Europe: Highest Common Factor or Lowest Common Denominator? Journal of European Industrial Training 33: 681–700. [Google Scholar] [CrossRef]

- Wu, Chih-Wen, Wei-Wen Chen, and Chun-Hui Jen. 2020. Emotional Intelligence and Cognitive Flexibility in the Relationship Between Parenting and Subjective Well-Being. Journal of Adult Development 2: 106–15. [Google Scholar] [CrossRef]

- Wysokińska-Senkus, Aneta, and Justyna Górna. 2021. Towards sustainable development: Risk managemet for organizational security. Entrepreneurship and Sustainability Issues 8: 527–44. [Google Scholar] [CrossRef]

| Variable Tested | Risk Management Competence | Total | |||||

|---|---|---|---|---|---|---|---|

| ORMP | MRMR | TRMR | LMRM | FRMR | HRMR | ||

| Assessment of competence | 32 | 6 | 36 | 4 | 14 | 8 | 100 |

| Management Position | Risk Management Competence | Total | |||||

|---|---|---|---|---|---|---|---|

| ORMP | MRMR | TRMP | LRMR | FRMP | HRMR | ||

| Highest | 39 | 9 | 27 | 0 | 13 | 12 | 100 |

| Average | 29 | 11 | 36 | 7 | 11 | 6 | 100 |

| Lowest | 28 | 0 | 44 | 6 | 17 | 5 | 100 |

| Overall assessment | 32 | 6 | 36 | 4 | 14 | 8 | 100 |

| Sex | Risk Management Competence | Total | |||||

|---|---|---|---|---|---|---|---|

| ORMP | MRMR | TRMP | LRMR | FRMP | HRMR | ||

| Women | 34 | 8 | 30 | 5 | 12 | 11 | 100 |

| Men | 30 | 3 | 42 | 3 | 16 | 6 | 100 |

| The Age Range (Years) | Risk Management Competence | Total | |||||

|---|---|---|---|---|---|---|---|

| ORMP | MRMR | TRMP | LRMR | FRMP | HRMR | ||

| Up to 50 | 34 | 10 | 15 | 6 | 24 | 11 | 100 |

| Over 50 | 30 | 2 | 57 | 1 | 4 | 6 | 100 |

| Total Seniority (Years) | Risk Management Competence | Total | |||||

|---|---|---|---|---|---|---|---|

| ORMP | MRMR | TRMP | LRMR | FRMP | HRMR | ||

| Up to 15 | 35 | 5 | 34 | 5 | 16 | 5 | 100 |

| Over 15 | 29 | 7 | 37 | 3 | 12 | 12 | 100 |

| Management Traineeship (Years) | Risk Management Competence | Total | |||||

|---|---|---|---|---|---|---|---|

| ORMP | MRMR | TRMP | LRMR | FRMP | HRMR | ||

| Up to 10 | 32 | 9 | 27 | 4 | 20 | 8 | 100 |

| Over 10 | 31 | 3 | 45 | 4 | 8 | 9 | 100 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Drozdowski, G.; Rogozińska-Mitrut, J.; Stasiak, J. The Empirical Analysis of the Core Competencies of the Company’s Resource Management Risk. Preliminary Study. Risks 2021, 9, 107. https://doi.org/10.3390/risks9060107

Drozdowski G, Rogozińska-Mitrut J, Stasiak J. The Empirical Analysis of the Core Competencies of the Company’s Resource Management Risk. Preliminary Study. Risks. 2021; 9(6):107. https://doi.org/10.3390/risks9060107

Chicago/Turabian StyleDrozdowski, Grzegorz, Joanna Rogozińska-Mitrut, and Jacek Stasiak. 2021. "The Empirical Analysis of the Core Competencies of the Company’s Resource Management Risk. Preliminary Study" Risks 9, no. 6: 107. https://doi.org/10.3390/risks9060107

APA StyleDrozdowski, G., Rogozińska-Mitrut, J., & Stasiak, J. (2021). The Empirical Analysis of the Core Competencies of the Company’s Resource Management Risk. Preliminary Study. Risks, 9(6), 107. https://doi.org/10.3390/risks9060107