Risk Management in the Management Control System in Polish Local Government Units—Assumptions and Practice

Abstract

1. Introduction

2. Literature Review

2.1. Management Control in the Polish Legal System

- internal environment,

- goals and risk management,

- control mechanisms,

- information and communication,

- monitoring and evaluation (Komunikat Nr 23 Ministra Finansów 2009).

- Internal control an Integrated Framework concept and Risk Management in the Enterprise—reports prepared by the Committee of Sponsoring Organizations of the Treadway Commission (COSO),

- Guidelines on Internal Control Standards in the Public Sector—adopted in 2004 by the International Organization of Supreme Audit Institutions (INTOSAI),

- The Revised Internal Control Standard for Effective Management adopted by the European Commission in 2007 (Komunikat Nr 23 Ministra Finansów 2009).

- compliance of operations with legal regulations and internal procedures,

- effectiveness and efficiency of operations,

- credibility of reports,

- resource protection,

- adherence to and promotion of the principles of ethical conduct,

- efficiency and effectiveness of information flow,

- risk management (Ustawa z dnia 27 sierpnia 2009 roku o finansach publicznych 2009).

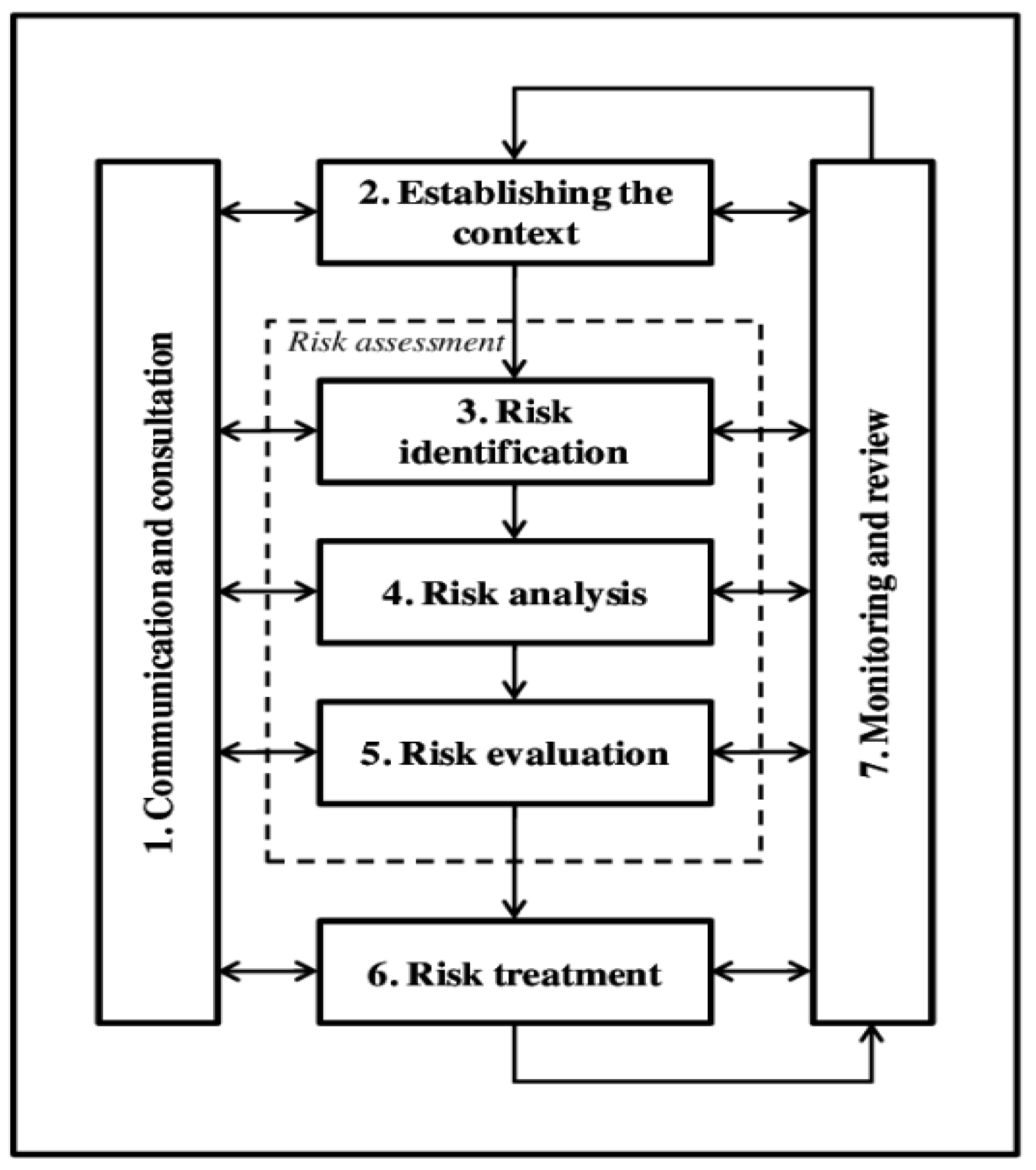

2.2. Risk and Risk Management

- senior management should manage and support activities aimed at risk management,

- risk management should be an integral part of the management process (Czerwiński 2004; quoted in: Sołtyk 2014).

- the willingness to increase the likelihood of achieving the core business objectives as a result of risk reduction,

- intention to minimize financial losses,

- intention to improve the learning processes of the organization,

- the intention to increase the organization’s resilience to crises and disruptions (Bugdol and Jedynak 2012; Domańska-Szaruga 2016).

- issuing an order concerning the introduction of a management control system;

- as part of the management control system, introducing regulations and procedures describing the risk management process;

- developing a template for the annual risk management report;

- location of risk management in the organizational unit with an indication of the scope of responsibility of individual employees (Komunikat Nr 6 Ministra Finansów 2012).

- stakeholder analysis,

- analysis of strengths, weaknesses, opportunities, threats (SWOT analysis—strengths, weaknesses, opportunities, threats),

- analysis of the political, economic, sociocultural, technological, environmental, and legislative environment (PESTEL analysis—political, economic, sociocultural, technological, environmental, legal) (Gasiński and Pijanowski 2016).

- financial (budget, fraud and theft, insurable, public procurement and outsourcing, liability),

- human resources (personnel, health, and safety),

- activities (internal regulations, organization and decision making, internal control, information, image, IT systems),

- external (infrastructural, economic, legal, political environment) (Komunikat Nr 6 Ministra Finansów 2012).

- transfer (transferring some or all the risk to another entity),

- recall (departure from risk-related activities),

- action (taking actions to reduce the risk to an acceptable level) (Komunikat Nr 6 Ministra Finansów 2012).

3. Materials and Methods

- control the functioning of the institution,

- management control is determining the cause of the difference between the actual state and the expected state,

- ongoing supervision and control over the activities carried out by the entity,

- management control factors such as who, what, where, when and at what stage things are done in the office,

- control by superiors,

- control over the functioning of the unit,

- internal control,

- audit,

- overall supervisory activities,

- control of the management method in the organization.

4. Results

- The research results show that there is a need to conduct training for employees in the field of increasing the knowledge of the principles and essence of management control and risk management. Some local government units should put more emphasis on increasing employees’ awareness of the functioning of the management control system. The dynamics of changes and the current epidemiological situation should force decision-makers to take actions aimed at active involvement of employees in the risk management and management control process.

- The management control system, an element of which is risk management, should be organized in such a way as to have a real impact on improving the effectiveness of management and of the quality of services provided. Procedures are an important and key criterion, but they must not obscure the real problems of the organization. The goal should be to improve the processes taking place in the unit.

- Improper organization of the risk management process may lead to dysfunctions, resulting in a violation of public finance discipline. Therefore, in each local government unit (regardless of its size), IT programs should be implemented to support the risk management process. It is also crucial to create organizational units or delegate people who will coordinate the risk management process.

- The management control system requires ongoing monitoring. When designing control mechanisms, one should consider the costs incurred not only for their implementation, but also for their operation. It is commonly believed that the costs of their implementation should not exceed the benefits obtained by them. In the public finance sector, it is also important due to the general rule concerning the management of public funds, which was included in the Act on Public Finance of 27 August 2009, according to which public expenditure should be made in a targeted and economical manner.

- The management control and risk management system should be perceived as a tool supporting the management process. Therefore, it is necessary to build awareness, but also a sense of responsibility in all employees.

- Building an effective management control and risk management system is not a one-off action. Local government units, based on their own experience, but also those of other entities (benchmarking), should implement new solutions or modernize those that have already been adopted, if possible. Therefore, it is recommended to create a catalog of good practices and solutions in the field of management control and risk management, which are successfully applied in other local government units. The research carried out by the author among the employees of local government units, the analysis of documents, and the reading of literature on the subject allowed for the formulation of one more conclusion, which may be a summary of the entire article. There is a concern that the management control and risk management system in Polish local government units is fragmented and insufficient—even though it is usually properly documented, it does not fit into the strategic management framework. Therefore, 11 years after the implementation of the management control system, it is worth considering the modernization of the existing system solutions. Moreover, a properly organized management control system helps to reduce strategic and operational risk, which is important for any public organization.

5. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Alvesson, Mats, and Dan Karreman. 2004. Interfaces of control; technocratic and socio-ideological control in a global management consultancy firm. Accounting, Organizations and Society 29: 423–44. [Google Scholar] [CrossRef]

- Bugdol, Marek, and Piotr Jedynak. 2012. Współczesne systemy zarządzania. Jakość. Bezpieczeństwo. Ryzyko. Gliwice: Helion, pp. 136–42. [Google Scholar]

- Creswell, John W. 2009. Editorial: Mapping the Field of Mixed Methods Research. Journal of Mixed Methods Research 3: 95–108. [Google Scholar] [CrossRef]

- Creswell, John W. 2013. Projektowanie Badań Naukowych. Metody Jakościowe, Ilościowe i Mieszane. Kraków: Wydawnictwo Uniwersytetu Jagiellońskiego. [Google Scholar]

- Czerwiński, Krzysztof. 2004. Audyt wewnętrzny. Warszawa: Info Biznes. [Google Scholar]

- Dobrowolski, Zbysław. 2017. Prolegomena Epistemologii Oraz Metodologii Kontroli Zarządczej, Monografie i Studia Instytutu Spraw Publicznych Uniwersytetu Jagiellońskiego. Kraków: Instytut Spraw Publicznych, Uniwersytet Jagielloński, pp. 45–99. Available online: https://isp.uj.edu.pl/documents/2103800/139368467/Prolegomena+epistemologii++oraz+metodologii+kontroli+zarz%C4%85dczej/7d9f033f-54f0-432d-b588-48e6cbcf62f9 (accessed on 16 January 2021).

- Dobrowolski, Zbysław. 2020. The supreme audit institutions readiness to uncertainty. Entrepreunership and Sustainability Issues 8: 513–25. [Google Scholar] [CrossRef]

- Domańska-Szaruga, Beata. 2016. Zarządzanie ryzykiem w jednostkach samorządu terytorialnego. In Samorząd Gminny w Polsce. Warszawa: Difin, pp. 40–63. [Google Scholar]

- Dyczkowski, Tomasz, and Joanna Dyczkowska. 2014. Organization of Management Control in Public Institutions in Poland. In 7th International Conference: An Enterprise Odyssey: Leadership, Innovation and Development for Responsible Economy. Edited by Lavorka Galetić, Mario Spremić and Jurica Simurina. Zagreb: University of Zagreb, pp. 926–46. Available online: https://www.researchgate.net/publication/280097100_Organization_of_management_control_in_public_institutions_in_Poland (accessed on 4 February 2021).

- Eastburn, Ronald William, and Alex Sharland. 2017. Risk management and managerial mindset. Journal of Risk Finance 18: 21–47. [Google Scholar] [CrossRef]

- Gasiński, Tomasz, and Sławomir Pijanowski. 2016. Zarządzanie Ryzykiem w Procesie Zrównoważonego Rozwoju biznesu. Available online: https://docplayer.pl/699616-Ryzykiem-w-procesie-zrownowazonego-rozwoju-biznesu-podrecznik-dla-duzych-i-srednich-przedsiebiorstw-tomasz-gasinski-slawomir-pijanowski.html (accessed on 5 February 2021).

- Gurtu, Amulya, and Jestin Johny. 2021. Supply Chain Risk Management: Literature Review. Risks 9: 16. [Google Scholar] [CrossRef]

- Hewege, Chandana Rathnasiri. 2012. A Critique of the Mainstream Management Control Theory and the Way Forward. SAGE Open. [Google Scholar] [CrossRef]

- ISO. 2009. ISO Guide 73:2009—Risk Management—Vocabulary, International Organization for Standardization, Geneva. Available online: https://www.iso.org/obp/ui/#iso:std:iso:guide:73:ed-1:v1:en (accessed on 21 January 2021).

- ISO. 2018. ISO 31000:2018(E). Risk Management—Guidelines. Geneva. Available online: https://www.iso.org/obp/ui/#iso:std:iso:31000:ed-2:v1:en (accessed on 21 January 2021).

- Jajuga, Krzysztof, ed. 2009. Teoretyczne podstawy zarządzania ryzykiem. In Zarządzanie Ryzykiem. Warszawa: Wydawnictwo Naukowe PWN, pp. 13–15. [Google Scholar]

- Johns, Rob. 2010. Likert Items and Scales. Survey Question Bank: Methods Fact Sheet. pp. 1–7. Available online: https://www.sheffield.ac.uk/polopoly_fs/1.597637!/file/likertfactsheet.pdf (accessed on 5 April 2021).

- Key Risk Indicators. 2010. Institute of Operational Risk Operational Risk Sound Practise Guidance. Available online: https://www.ior-institute.org/public/IORKRIGuidanceNov2010.pdf (accessed on 11 January 2021).

- Komunikat Nr 23 Ministra Finansów. 2009. Komunikat Nr 23 Ministra Finansów z dnia 16 grudnia 2009 r. w Sprawie Standardów Kontroli Zarządczej dla Sektora Finansów Publicznych (Dz. Urz. MF Nr 15, poz. 84). Available online: https://www.gov.pl/web/finanse/standardy-i-wytyczne-kontrola-zarzadcza (accessed on 22 January 2021).

- Komunikat Nr 3 Ministra Finansów. 2011. Komunikat Nr 3 Ministra Finansów z dnia 16 lutego 2011 r. w Sprawie Szczegółowych Wytycznych w Zakresie Samooceny Kontroli Zarządczej dla Jednostek Sektora Finansów Publicznych (Dz. Urz. MF Nr 2, poz. 11). Available online: https://www.gov.pl/web/finanse/standardy-i-wytyczne-kontrola-zarzadcza (accessed on 22 January 2021).

- Komunikat Nr 6 Ministra Finansów. 2012. Komunikat Nr 6 Ministra Finansów z dnia 6 grudnia 2012 r. w Sprawie Szczegółowych Wytycznych dla Sektora Finansów Publicznych w Zakresie Planowania i Zarządzania Ryzykiem (Dz. Urz. MF, poz. 56). Available online: https://www.gov.pl/web/finanse/standardy-i-wytyczne-kontrola-zarzadcza (accessed on 22 January 2021).

- Kowal, Witold. 2013. Skuteczność i efektywność—zróżnicowanie i aspekty interpretacji. Organizacja i Kierowanie 4: 11–23. [Google Scholar]

- Kumpiałowska, Agata. 2011. Skuteczne Zarządzanie Ryzykiem a Kontrola Zarządcza w Sektorze Publicznym. Warszawa: C.H. Beck, pp. 1–25. [Google Scholar]

- McShane, Michael. 2018. Enterprise Risk Management: History and a Design Science Proposal. The Journal of Risk Finance 19. [Google Scholar] [CrossRef]

- Nocco, Brian W., and René M. Stulz. 2006. Enterprise Risk Management: Theory and Practice. Journal of Applied Corporate Finance 18. [Google Scholar] [CrossRef]

- Oehmen, Josef, Mohamed Ben-Daya, Warren Seering, and Muhammad Al-Salamah. 2010. Risk Management in Product Design: Current State, Conceptual Model and Future Research DETC2010-28539. Paper presented at ASME 2010 International Design Engineering Technical Conference & Computers and Information in Engineering Conference IDETC/CIE 2010, Montreal, QC, Canada, August 15–18. [Google Scholar] [CrossRef]

- Orzeł, Jacek. 2012. Zarządzanie Ryzykiem Operacyjnym za Pomocą Instrumentów Pochodnych. Warszawa: Wydawnictwo Naukowe PWN, p. 16. [Google Scholar]

- Ożga, Paweł. 2016. Rachunkowość Instrumentów Pochodnych. Warszawa: Wydawnictwo C. H. Beck, pp. 1–2. [Google Scholar]

- Piaszczyk, Artur. 2017. 5 Years Standards of Management Control in Poland: Evaluation. Wrocław: Prace Naukowe Uniwersytetu Ekonomicznego We Wrocławiu, vol. 478, pp. 348–56. [Google Scholar] [CrossRef]

- Rossman, Gretchen B., and Bruce L. Wilson. 1985. Numbers and Words Combining Quantitative and Qualitative Methods in a Single Large-Scale Evaluation Study. Evaluation Review 9: 627–43. [Google Scholar] [CrossRef]

- Rowe, David. 2003. The operational Risk Pyramid. Risk 47. Available online: http://davidmrowe.com/publications/Risk%20Magazine/200308%20The%20Operational%20Risk%20Pyramid.pdf (accessed on 10 January 2021).

- Šljivić, Slavoljub, Srđan Skorup, and Predrag Vukadinović. 2015. Management control in modern organizations. International Forestry Review 3–4: 39–49. [Google Scholar] [CrossRef]

- Sołtyk, Piotr. 2013. Kontrola Zarządcza i Audyt w Jednostkach Samorządowych. Warszawa: Wydawnictwo C.H. Beck, pp. 41–106. [Google Scholar]

- Sołtyk, Piotr. 2014. Czynniki warunkujące skuteczne zarządzanie ryzykiem w gospodarce finansowej jednostki samorządu terytorialnego. Nierówności Społeczne a Wzrost Gospodarczy 40: 258–68. Available online: https://www.ur.edu.pl/storage/file/core_files/2015/1/9/5413ada3955d4f707d7314744e44fa6d/24%20So%C5%82tyk%20P.pdf (accessed on 5 February 2021).

- Sułkowski, Łukasz. 2016. Metodologia zarządzania—od fundamentalizmu do pluralizmu. In Podstawy Metodologii Badań w Naukach o Zarządzaniu. Edited by Wojciech Czakon. Warszawa: Wydawnictwo Nieoczywiste, pp. 28–48. [Google Scholar]

- Ustawa z dnia 27 sierpnia 2009 roku o finansach publicznych. 2009. (Dz.U. 2009 nr 157 poz. 1240). Available online: https://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20091571240/U/D20091240Lj.pdf (accessed on 15 December 2020).

- Winiarska, Kazimiera. 2016. Ocena realizacji celów kontroli zarządczej w jednostkach sektora finansów publicznych—wyniki badań ankietowych. Zeszyty Teoretyczne Rachunkowości 86: 53–74. Available online: https://ztr.skwp.pl/api/files/view/64705.pdf (accessed on 12 December 2020).

| The Risk Register | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Identification of Risk | Risk Analysis | Risk Response | |||||||

| No. | Field of Risk | Describe of Risk | Category | Probability of Risk Occurrence | Consequences of Risk Occurrence | Significance Factor of Risk (5 × 6) | Response Plan | Mitigation | Owner |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) |

| Aim I: Task: | |||||||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mormul, K. Risk Management in the Management Control System in Polish Local Government Units—Assumptions and Practice. Risks 2021, 9, 92. https://doi.org/10.3390/risks9050092

Mormul K. Risk Management in the Management Control System in Polish Local Government Units—Assumptions and Practice. Risks. 2021; 9(5):92. https://doi.org/10.3390/risks9050092

Chicago/Turabian StyleMormul, Katarzyna. 2021. "Risk Management in the Management Control System in Polish Local Government Units—Assumptions and Practice" Risks 9, no. 5: 92. https://doi.org/10.3390/risks9050092

APA StyleMormul, K. (2021). Risk Management in the Management Control System in Polish Local Government Units—Assumptions and Practice. Risks, 9(5), 92. https://doi.org/10.3390/risks9050092