Identification of Going-Concern Risks in CSR and Integrated Reports of Polish Companies from the Construction and Property Development Sector

Abstract

1. Introduction

2. CSR and Integrated Reporting Regulations in Poland

3. Review of Empirical Research Literature

4. Methodology and Data

4.1. Content Analysis

4.2. Data Description

- CSR and integrated reports of companies from the industry in question, submitted for the best CSR report competition and made available on the organizer’s website in 2011–2020 (www.raportyspoleczne.pl, accessed on 30 September 2020).

- Reports available on the websites of other GPW-listed companies’ indices as of 30 October 2020 from the industry in question (www.bankier.pl, accessed on 30 October 2020).

- Industry 140 (Companies in the property development industry), which is part of sector 100 (Finance),

- Industry 410 (Companies in the construction industry), which is part of sector 400 (Industrial, construction and assembly production).

- RQ1:

- Do CSR reports contain the basic financial data and financial performance indicators?

- RQ2:

- Do stakeholders have to look for information on going-concern risks in other annual reports, for example financial statements?

- RQ3:

- Does the CSR reporting model currently used in Poland sufficiently disclose financial information, with particular emphasis on information regarding going-concern risks?

- RQ4:

- On the basis of the analysis, what system-level changes should be proposed, if any?

5. Descriptive Results

5.1. Length and Type of the Analysed Reports

5.2. A Closer Look at How the Analysed Companies Approach Their Stakeholders

- Health and safety first,

- Greater competitiveness and diversified portfolio of products, services, and solutions,

- Possibility to develop business in new segments in both emerging and developed markets,

- Improved business model profitability,

- Increased environmental value of land managed by the company,

- Lower and predictable cost of fuel, energy and water,

- General acceptance of and understanding for the company’s activity,

- Being the best neighbour who supports the development of the local community,

- Being an important employment and economic growth driver in the local community,

- Greater role of the company’s business in social development,

- Reinforced role of ethics, compliance, and transparency in business,

- Improved reputation of a more sustainable company,

- Satisfied customers improving the company’s profitability and responsible suppliers reducing its operating risks,

- Diversified and more involved staff.

5.3. Scope of Disclosures of the Analysed Companies

- Are there any ongoing legal actions brought against the company undertaken by other stakeholders?

- Are there any ongoing administrative procedures against the company by local government bodies responsible for the investment area?

- Are there any ongoing protests against the company, organised by local communities or environmentalists and relating to any nuisance caused to local residents and/or the environment?

5.4. Discussion for Quality of CSR and Integrated Reports of the Analysed Companies

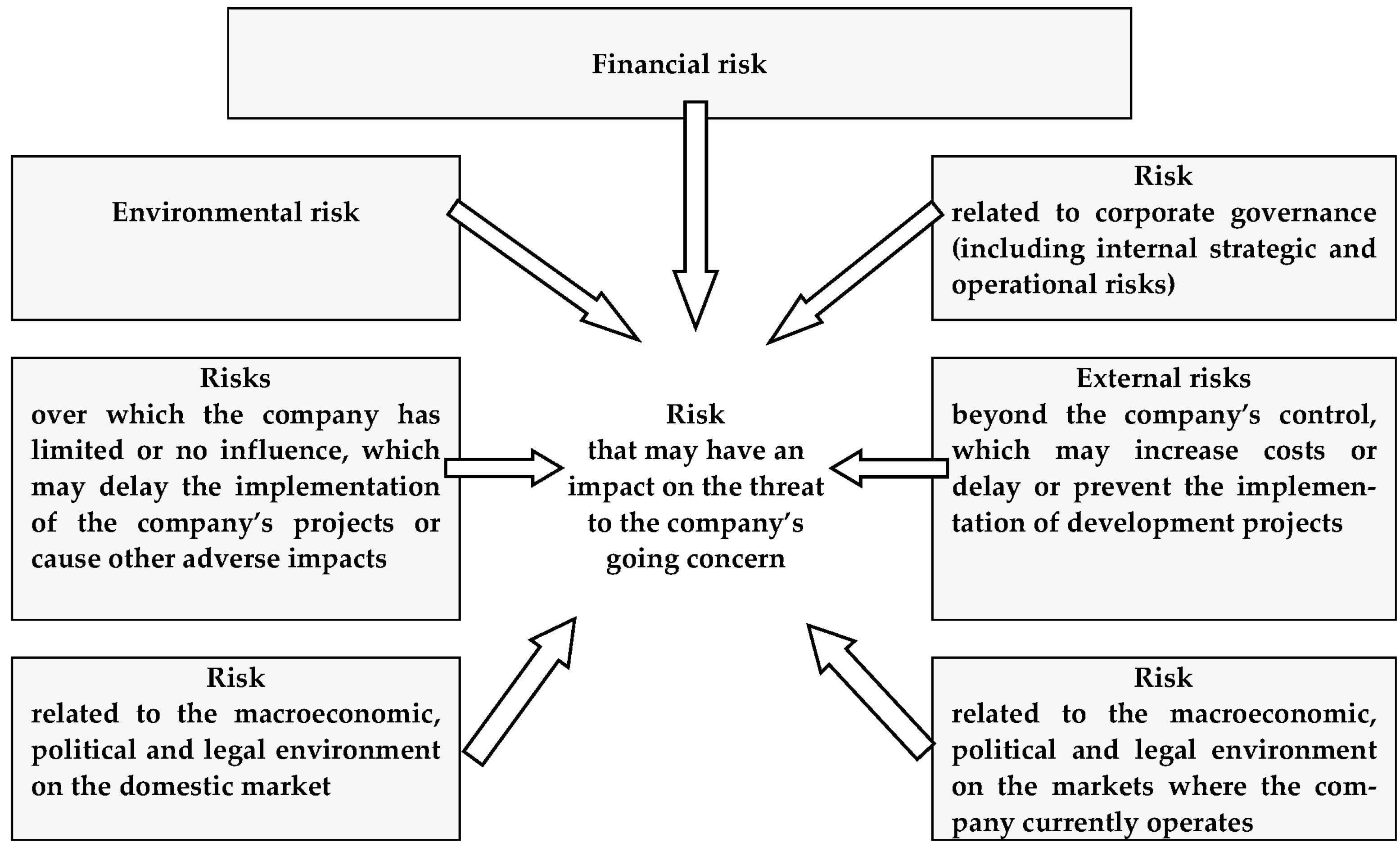

5.5. A Conceptual Model for Disclosures on Financial and Going-Concern Risks in CSR and Integrated Reports

- Risk of rising prices of building materials,

- Risk of increased costs of subcontracting services,

- Financial risk,

- Risk of increased competition on the construction and assembly services and real estate market,

- Risk of lengthy public procurement procedures due to appeals submitted by unsuccessful bidders,

- Risk of slower pace of investment processes.

6. Conclusions

- The quality level of CSR reporting has been growing over the years (for example: Budimex Group reports 2010–2019),

- All analysed enterprises have implemented sustainable development concepts,

- All analysed enterprises have implemented and operate environmental management systems and use GRI 4 indicators,

- All analysed enterprises operate quality management systems,

- Some analysed enterprises operate ethics management systems,

- Only some analysed enterprises have implemented and operate risk management systems,

- Only some analysed enterprises internally disclose their financial and non-financial impacts.

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Edition | Number of Entrants from the Construction and Property Development Industry | Company Name | Number of Editions Attended by the Company | Was the Company’s Report Awarded/Mentioned in the Open Category? |

|---|---|---|---|---|

| 2011 | 2 | CEMEX Polska Sp. z o.o. | 1 | Yes |

| Budimex Group | 1 | - | ||

| 2012 | 1 | Budimex Group | 2 | Yes |

| 2013 | 1 | CEMEX Polska Sp. z o.o. | 2 | Yes |

| 2014 | 1 | Budimex Group | 3 | - |

| 2015 | 1 | CEMEX Polska Sp. z o.o | 3 | Yes |

| 2016 | 3 | Budimex Group | 4 | - |

| Górażdże Cement Group | 1 | Yes | ||

| Velux Group | 1 | - | ||

| 2017 | 5 | CEMEX Polska Sp. z o.o | 4 | Yes |

| Budimex Group | 5 | Yes | ||

| Unibep Group | 1 | - | ||

| Lafarge Polska | 1 | Yes | ||

| PORTA KMI POLAND Sp. z o.o. | 1 | - | ||

| 2018 | 4 | Budimex Group | 6 | - |

| Górażdże Cement Group | 2 | - | ||

| Velux Group | 2 | - | ||

| Mostostal Warszawa Group | 1 | - | ||

| 2019 | 3 | Budimex Group | 7 | - |

| Lafarge Polska | 2 | - | ||

| Pekabex Group | 1 | - | ||

| 2020 | 5 | Erbud Group | 1 | - |

| Velux Group | 3 | - | ||

| Ceetrus Polska Sp. z o.o. | 1 | - | ||

| Budimex Group | 8 | - | ||

| Pekabex Group | 2 | - |

| Company Name | Reported Year | Number of Stakeholder Categories | Volume of Information (Pages) about Stakeholder Engagement, Including: | Declaration of Ethics (Code, System) | ||

|---|---|---|---|---|---|---|

| Identification and Selection of Stake Holders | Stakeholder Engagement | Stakeholders’ Topics and Organisation’s Response | ||||

| Budimex Group | 2010 | 22 | 1 | 1 | 1 | None |

| Budimex Group | 2011 | 26 | 1 | 1 | 1 | Code of Ethics |

| Budimex Group | 2012 | 26 | 1 | 1 | 1 | Code of Ethics, Ethics Committee |

| Budimex Group | 2013 | 26 | 1 | 1 | 1 | |

| Budimex Group | 2015 | 26 | 1 | 2 | 3 | |

| Budimex Group | 2016 | 26 | 1 | 2 | 3 | |

| Budimex Group | 2017 | 26 | 1 | 2 | 3 | |

| Budimex Group | 2018 | 26 | 1 | 2 | 3 | |

| Budimex Group | 2019 | 26 | 1 | 2 | 3 | |

| CEMEX Polska Sp.zo.o | 2010 | 6 | 1 | 2 | 2 | Code of Ethics, Ethics Management System, Ethics Committee |

| CEMEX Polska Sp. z o.o | 2011–2012 | 12 | 1 | 2 | 2 | |

| CEMEX Polska Sp. z o.o | 2013–2014 | 12 | 2 | 2 | 2 | |

| CEMEX Polska Sp. z o.o | 2015–2016 | 12 | 2 | 2 | 2 | |

| Górażdże Cement Group | 2014–2015 | 6 | 1 | 1 | 1 | Code of Ethics |

| Górażdże Cement Group | 2016–2017 | 6 | 1 | 1 | 1 | |

| Velux Group | 2015 | 10 | 1 | 0 | 1 | Code of Ethics |

| Velux Group | 2016–2017 | 12 | 1 | 0 | 1 | |

| Velux Group | 2018–2019 | 12 | 1 | 0 | 1 | |

| Unibep Group | 2016 | 27 | 1 | 0 | 1 | Principles of ethics |

| Lafarge Polska | 2016 | 12 | 1 | 2 | 1 | Principles of ethics |

| Lafarge Polska | 2017–2018 | 10 | 1 | 1 | 1 | |

| PORTA KMI POLAND Sp. z o.o. | 2016 | 12 | 1 | 4 | 3 | None |

| Mostostal Warszawa Group | 2016–2017 | 6 | 1 | 0 | 1 | Code of Ethics |

| Pekabex Group | 2018 | 7 | 1 | 0 | 0 | Principles of ethics |

| Pekabex Group | 2019 | 7 | 1 | 0 | 0 | |

| Erbud Group | 2019 | 9 | 2 | 1 | 1 | Code of Ethics |

| Ceetrus Polska Sp. z o.o. | 2019 | 7 | 1 | 0 | 0 | Code of Ethics |

| Company Name | Reported Year | Basic Financial Indicators | Financial Statement | Activity Report (or Management Commentary) | Opinion and Report of a Chartered Accountant |

|---|---|---|---|---|---|

| Budimex Group | 2010 | No | No | No | No |

| Budimex Group | 2011 | No | No | No | No |

| Budimex Group | 2012 | Yes | Yes | Yes | Yes |

| Budimex Group | 2013 | Yes | Yes | Yes | Yes |

| Budimex Group | 2014 | Yes | Yes | Yes | Yes |

| Budimex Group | 2015 | Yes | Yes | Yes | Yes |

| Budimex Group | 2016 | Yes | Yes | Yes | Yes |

| Budimex Group | 2017 | Yes | Yes | Yes | Yes |

| Budimex Group | 2018 | Yes | Yes | Yes | Yes |

| Budimex Group | 2019 | Yes | Yes | Yes | Yes |

| CEMEX Polska Sp. z o.o. | 2010 | No | No | No | No |

| CEMEX Polska Sp. z o.o. | 2011 | No | No | No | No |

| CEMEX Polska Sp. z o.o. | 2012 | No | No | No | No |

| CEMEX Polska Sp. z o.o. | 2013 | No | No | No | No |

| CEMEX Polska Sp. z o.o. | 2014 | No | No | No | No |

| CEMEX Polska Sp. z o.o. | 2015 | No | No | No | No |

| CEMEX Polska Sp. z o.o. | 2016 | No | No | No | No |

| Górażdże Cement Group | 2015 | No | No | No | No |

| Górażdże Cement Group | 2016 | No | No | No | No |

| Górażdże Cement Group | 2017 | No | No | No | No |

| Velux Group | 2015 | No | No | No | No |

| Velux Group | 2016 | No | No | No | No |

| Velux Group | 2017 | No | No | No | No |

| Velux Group | 2018 | No | No | No | No |

| Velux Group | 2019 | No | No | No | No |

| Unibep Group | 2015 | Yes | Yes | Yes | Yes |

| Unibep Group | 2016 | Yes | Yes | Yes | Yes |

| Lafarge Polska | 2016 | Yes | No | No | No |

| Lafarge Polska | 2017 | No | No | No | No |

| Lafarge Polska | 2018 | No | No | No | No |

| PORTA KMI POLAND Sp. z o.o. | 2016 | No | No | No | No |

| Mostostal Warszawa Group | 2017 | Yes | Yes | Yes | Yes |

| Pekabex Group | 2018 | Yes | Yes | Yes | Yes |

| Pekabex Group | 2019 | Yes | Yes | Yes | Yes |

| Erbud Group | 2019 | Yes | Yes | Yes | Yes |

| Ceertus Polska Sp. z o.o. | 2019 | No | No | No | No |

References

- Albu, Catalin Nicolae, Cagnur Kaytmaz Balsari, and Joanna Krasodomska. 2016. Introduction to the Special issue on Corporate Social Reporting in Central and Eastern Europe. Accounting and Management Information Systems 15: 193–205. Available online: https://www.researchgate.net/publication/309566265_Introduction_to_the_Special_issue_on_Corporate_Social_Reporting_in_Central_and_Eastern_Europe (accessed on 25 October 2016).

- Albu, Nadia, Catalin Nicolae Albu, and Andrei Filip. 2017. Corporate Reporting in Central and Eastern Europe: Issues, Challenges and Research Opportunities. Accounting in Europe 14: 249–60. [Google Scholar] [CrossRef]

- Albu, Catalin Nicolae, and Karol Marek Klimczak. 2017. Editorial. Small and Medium-sized Entities Reporting in Central and Eastern Europe. Accounting and Management Information Systems 16: 221–28. [Google Scholar] [CrossRef]

- Allini, Alessandra, Francesca Manes Rossi, and Khaled Hussainey. 2016. The board’s role in risk disclosure: An exploratory study of Italian listed state-owned enterprises. Journal Public Money & Management 36: 113–20. [Google Scholar] [CrossRef]

- Alzead, Ramzi, and Khaled Hussainey. 2017. Risk disclosure practice in Saudi non-financial listed companies. Corporate Ownership and Control 14: 262–75. [Google Scholar] [CrossRef]

- Amran, Azlan, Abdul Manaf Rosli Bin, and Mohd Hassan Che Haat. 2008. Risk reporting—An exploratory study on risk management disclosure in Malaysian annual reports. Managerial Auditing Journal 24: 39–57. [Google Scholar] [CrossRef]

- Arraiano, Irene, and Camelia Daniela Hategan. 2019. The Stage of Corporate Social Responsibility in EU-CEE Countries. European Journal of Sustainable Development 8: 340–53. [Google Scholar] [CrossRef]

- Avetisyan, Emma, and Michael Ferrary. 2013. Dynamics of Stakeholders’ Implications in the Institutionalization of the CSR Field in France and in the United States. Journal of Business Ethics 115: 115–33. [Google Scholar] [CrossRef]

- Beretta, Sergio, and Saverio Bozzolan. 2004. Framework for the analysis of firm risk communication. The International Journal of Accounting 39: 265–88. [Google Scholar] [CrossRef]

- Bilan, Yuriy. 2013. Sustainable Development of a Company: Building of New Level Relationship with the Consumers of XXI Century. Amfiteatru Economic Journal 15: 687–701. Available online: https://www.amfiteatrueconomic.ro/temp/Article_1234.pdf (accessed on 30 September 2017).

- Boiral, Olivier. 2013. Sustainability reports as simulacra? A counter-account of A and A+ GRI reports. Accounting, Auditing & Accountability Journal 26: 1036–71. [Google Scholar] [CrossRef]

- Baviera-Puig, Amparo, Tomas Gómez-Navarro, Mónika García-Melón, and Gabriel García-Martínez. 2015. Assessing the communication quality of CSR reports. A case study on four spanish food companies. Sustainability 7: 11010–31. [Google Scholar] [CrossRef]

- Bravo, Francisco. 2017. Are risk disclosures an effective tool to increase firm value? Managerial and Decision Economics 38: 1116–24. [Google Scholar] [CrossRef]

- Cabedo, David J., and José Miguel Tirado. 2003. The disclosure of risk in financial statements. Journal Accounting Forum 28: 181–200. [Google Scholar] [CrossRef]

- Carini, Cristian, and Elisa Chiaf. 2015. The relationship between annual and sustainability, environmental and social reports. Corporate Ownership & Control 13: 979–93. [Google Scholar] [CrossRef]

- Carroll, Archie. 1991. The pyramid of corporate social responsibility: Toward the moral management of organizational stakeholders. Business Horizons 34: 39–48. [Google Scholar] [CrossRef]

- Commission Recommendation (CR). 2014. Commission Recommendation 2014/208/EU of 9 April 2014 on the Quality of Corporate Governance Reporting (‘Comply or Explain’) 2014. Available online: http://data.europa.eu/eli/reco/2014/208/oj (accessed on 30 September 2020).

- De Villiers, Charl, Pei-Chi Kelly Hsiao, and Warren Maroun. 2017. Developing a conceptual model of influences around integrated reporting, new insights, and directions for future research. Meditari Accountancy Research 25: 450–60. [Google Scholar] [CrossRef]

- Demina, Irina, and Elena Dombrovskaya. 2020. Generating risk-based financial reporting. In Digital Science. Edited by T. Antipova and Á. Rocha. Available online: https://www.researchgate.net/search.Search.html?type=publication&query=Generating%20risk-based%20financial%20reporting.%20In%20Digital%20Science.%20Edited%20by%20T.%20Antipova%20and%20%C3%81.%20Rocha (accessed on 30 October 2020).

- Demir, Gönenc, Melisa Nihal Cagle, and Ali Fatih Dalkılıç. 2016. Corporate Social Responsibility and Regulatory Initiatives in Turkey: Good Implementation Examples. Accounting and Management Information Systems 15: 372–400. [Google Scholar]

- Directive 2013/34/EU. 2013. Available online: https://eur-lex.europa.eu/legal-content/pl/TXT/?uri=CELEX%3A32013L0034 (accessed on 25 October 2020).

- Directive 2014/95/EU. 2014. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32014L0095 (accessed on 25 October 2020).

- Dyduch, Justyna, and Joanna Krasodomska. 2017. Determinants of Corporate Social Responsibility Disclosure: An Empirical Study of Polish Listed Companies. Sustainability 9: 1934. [Google Scholar] [CrossRef]

- European Commission (EC). 2011. A Renewed EU Strategy 2011-14 for Corporate Social Responsibility. Brussels: European Commission. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex%3A52011DC0681 (accessed on 25 October 2020).

- Fijałkowska, Justyna, Beata Zyznarska-Dworczak, and Przemysław Garsztka. 2018. Corporate Social-Environmental Performance versus Financial Performance of Banks in Central and Eastern European Countries. Sustainability 10: 772. [Google Scholar] [CrossRef]

- Freeman, Edward. 1984. Strategic Management: A Stakeholder Approach. Boston: Pitman Publishing. [Google Scholar]

- G4 Sustainability Reporting Guidelines. 2013. Available online: https://www.globalreporting.org/information/g4/Pages/default.aspx (accessed on 30 September 2017).

- Gabbi, Giampaolo, Michele Giammarino, and Massimo Matthias. 2020. Die Hard: Probability of Default and Soft Information. Risks 8: 46. [Google Scholar] [CrossRef]

- Gamerschlag, Ramin, Klaus Möller, and Frank Verbeeten. 2010. Determinants of voluntary CSR disclosure:empirical evidence from Germany. Review of Managerial Science 5: 233–62. [Google Scholar] [CrossRef]

- Garriga, Elisabeth, and Domenec Melé. 2004. Corporate Social Responsibility Theories: Mapping the Territory. Journal of Business Ethics 53: 51–71. [Google Scholar] [CrossRef]

- Gong, Guangming, Si Xu, and Xun Gong. 2018. On the value of corporate social responsibility disclosure: An empirical investigation of corporate bond issues in China. Journal of Business Ethics 150: 227–58. [Google Scholar] [CrossRef]

- Global Reporting Initiative (GRI). 2013. The Sustainability Content of Integrated Reports—A Survey of Pioneers. Available online: https://www.globalreporting.org/resourcelibrary/GRI-IR.pdf (accessed on 25 May 2017).

- Główny Urząd Statystyczny (GUS). 2019. Mały Rocznik Statystyczny Polski 2019; Warszawa: Główny Urząd Statystyczny. Available online: https://stat.gov.pl/obszary-tematyczne/roczniki-statystyczne/roczniki-statystyczne/maly-rocznik-statystyczny-polski-2019,1,18.html# (accessed on 30 September 2019).

- Hąbek, Patrycja. 2014. Evaluation of sustainability reporting practices in Poland. Quality & Quantity 48: 1739–52. [Google Scholar] [CrossRef]

- Hąbek, Patrycja, and Radosław Wolniak. 2016. Assessing the quality of corporate social responsibility reports: The case of reporting practices in selected European Union member states. Quality & Quantity 50: 399–420. [Google Scholar] [CrossRef]

- Harrison, Jeffrey, Freeman Edward, and Mônica Cavalcanti Sá de Abreu. 2015. Stakeholder theory as an ethical approach to effective management: Applying the theory to multiple contexts. Review of Business Management 17: 858–69. [Google Scholar] [CrossRef]

- Hoffman, Christian, and Christian Fieseler. 2011. Investor relations beyond financials. Non-financial factors and capital market image building. Corporate Communications: An International Journal 17: 138–55. [Google Scholar] [CrossRef]

- Horváth, Péter, Judith Pütter, Lina Dagilienè, Dzineta Dimante, Toomas Haldma, Cezary Kochalski, Bohumil Král, Davor Labaš, Kertu Lääts, Nidžara Osmanagić Bedenik, and et al. 2017. Status Quo and Future Development of Sustainability Reporting in Central and Eastern Europe. Journal of East European Management Studies 22: 221–43. [Google Scholar] [CrossRef]

- Huang, Winifred, and Khelifa Mazouz. 2018. Excess cash, trading continuity, and liquidity risk. Journal of Corporate Finance 48: 275–91. [Google Scholar] [CrossRef]

- International Integrated Reporting Council (IIRC). 2013a. The International <IR> Framework. London: IIRC. Available online: https://integratedreporting.org/wp-content/uploads/2013/12/13-12-08-THEINTERNATIONAL-IR-FRAMEWORK-2-1.pdf (accessed on 25 October 2016).

- International Integrated Reporting Council (IIRC). 2013b. IIRC Pilot Programme Business Network. Available online: http://integratedreporting.org/wp-content/uploads/2013/11/IIRC-Pilot-Programme-Business-Network-backgrounder-October-2013.pdf (accessed on 24 February 2017).

- International Integrated Reporting Council (IIRC). 2015. Creating Value. Value for Investors. Available online: http://integratedreporting.org/wp-content/uploads/2015/04/Creating-Value-Investors.pdf (accessed on 8 October 2016).

- Jeffery, Claire, Jade Tenwick, and Ginevra Bicciolo. 2017. Comparing the Implementation of the EU Non-Financial Reporting Directive in the UK, Germany, France and Italy. Kraków: Frank Bold. [Google Scholar]

- Jo, Hoje, Hakkon Kim, and Kwangwoo Park. 2015. Corporate environmental responsibility and firm performance in the financial services sector. Journal of Business Ethics 131: 257–84. [Google Scholar] [CrossRef]

- Kamela-Sowińska, Aldona. 2014. Dalsze zmiany w ustawie o rachunkowości—Dyrektywa UE o ujawnianiu informacji niefinansowych. In XX Lat Ustawy o Rachunkowości. Stan Obecny i Kierunki Zmian. Poznań: SKwP, pp. 39–47. [Google Scholar]

- Kacprzak, Jacqueline, and Anam Liliana. 2017. Raportowanie Niefinansowe. Podręcznik dla Raportujących. Available online: https://www.csrinfo.org/wp-content/uploads/2016/06/Raportowanie-niefinansowe_poradnik-dla-raportuja%CC%A8cych.pdf (accessed on 30 September 2020).

- Khlif, Hichem, and Khaled Hussainey. 2014. The association between risk disclosure and firm characteristics: A meta-analysis. Journal of Risk Research 19: 181–211. [Google Scholar] [CrossRef]

- Kim, Hanna, Won-Moo Hur, and Junsang Yeo. 2015. Corporate Brand Trust as a Mediator in the Relationship between Consumer Perception of CSR, Corporate Hypocrisy, and Corporate Reputation. Sustainability 7: 3683–94. [Google Scholar] [CrossRef]

- Kohv, Keijo, and Oliver Lukason. 2021. What Best Predicts Corporate Bank Loan Defaults? An Analysis of Three Different Variable Domains. Risks 9: 29. [Google Scholar] [CrossRef]

- Kowalczyk, Rafał. 2019. How do stakeholder pressure influence on CSR-Practices in Poland? The construction industry case. Journal of EU Research in Business 2019: 102392. [Google Scholar] [CrossRef]

- KPMG. 2011. KPMG Integrated Reporting: Performance Insight through Better Business Reporting. Amsterdam: KPMG. Available online: https://www.kpmg.com/Global/en/IssuesAndInsights/ArticlesPublications/Documents/road-to-integrated-reporting.pdf (accessed on 30 September 2017).

- Krasodomska, Joanna. 2010. Informacje niefinansowe jako element rocznego raportu spółki. Zeszyty Naukowe/Uniwersytet Ekonomiczny w Krakowie 816: 45–57. [Google Scholar]

- Krasodomska, Joanna. 2015. CSR disclosures in the banking industry. Empirical evidence from Poland. Social Responsibility Journal 11: 406–23. [Google Scholar] [CrossRef]

- Lajili, Kaouthar, and Daniel Zeghal. 2005. A content analysis of risk management disclosures in Canadian annual reports. Canadian Journal of Administrative Sciences 22: 125–42. [Google Scholar] [CrossRef]

- Lev, Baruch. 2018. The deteriorating usefulness of financial report information and how to reverse it. Accounting and Business Research 48: 465–93. [Google Scholar] [CrossRef]

- Linsley, Philip, and Philip Shrives. 2006. Risk Reporting: A Study of Risk Disclosures in the Annual Reports of UK Companies. The British Accounting Review 38: 387–404. [Google Scholar] [CrossRef]

- Masztalerz, Marek. 2016. Kreatywna sprawozdawczość 2.0—Czyli o zarządzaniu wrażeniem w raportach. Studia i Prace Kolegium Zarządzania i Finansów SGH 152: 41–51. (In Polish). [Google Scholar]

- Miihkinen, Antti. 2012. What drives quality of firm risk disclosure? The impact of a national disclosure standard andreporting incentives under IFRS. The International Journal of Accounting 47: 437–68. [Google Scholar] [CrossRef]

- Mishra, Supriti, and Damodar Suar. 2010. Does corporate social responsibility influence firm performance of Indian companies? Journal of Business Ethics 95: 571–601. [Google Scholar] [CrossRef]

- Mitchell, Clyde, and Trevor Raymond Hill. 2010. An exploratory analysis of stakeholders’ expectations and perceptions of corporate social and environmental reporting in South Africa. South African Journal of Accounting Research 24: 49–78. [Google Scholar] [CrossRef]

- Moneva, Jose, Pablo Archel, and Carmen Correa. 2006. GRI and the camouflaging of corporate unsustainability. Accounting Forum 30: 121–37. [Google Scholar] [CrossRef]

- National Accounting Standard 9 (NAS 9). 2018. Krajowy Standard Rachunkowości nr 9 “Sprawozdanie z Działalności” 2018. Available online: https://www.gov.pl/web/finanse/krajowe-standardy-rachunkowosci (accessed on 30 September 2020).

- Park, Byung Il, and Pervez Ghauri. 2015. Determinants influencing CSR practices in small and medium sized MNE subsidiaries: A stakeholder perspective. Journal of World Business 50: 192–204. [Google Scholar] [CrossRef]

- du Plessis, Jean. 2016. Disclosure of Non-Financial Information: A Powerful Corporate Governance. Available online: https://www.researchgate.net (accessed on 30 September 2020).

- Raufflet, Emmanuel, Luciano Barin Cruz, and Luc Bres. 2014. An assessment of corporate social responsibility practices in the mining and oil and gas industries. Journal of Cleaner Production 84: 256–70. [Google Scholar] [CrossRef]

- Raulinajtis-Grzybek, Monika, and Gertruda Świderska. 2017. Practical use of the integrated reporting framework—An analysis of the content of integrated reports of selected companies. Zeszyty Teoretyczne Rachunkowości 94. [Google Scholar] [CrossRef]

- Roca, Laurence Clement, and Cory Searcy. 2012. An analysis of indicators disclosed in corporate sustainability reports. Journal of Cleaner Production 20: 103–18. [Google Scholar] [CrossRef]

- Romolini, Alberto, Silvia Fissi, and Elena Gori. 2017. Exploring integrated reporting research: Results and perspectives. International Journal of Accounting and Financial Reporting 7: 32–59. [Google Scholar] [CrossRef]

- Roszkowska, Patrycja. 2011. Rewolucja w Raportowaniu Biznesowym. Interesariusze, Konkurencyjność, Społeczna Odpowiedzialność. Warszawa: Difin. [Google Scholar]

- Ryan, Stephen. 2012. Risk reporting quality: Implications of academic research for financial reporting policy. Journal Accounting and Business Research 42: 295–324. [Google Scholar] [CrossRef]

- Samelak, Janusz. 2013. Zintegrowane Sprawozdanie Przedsiębiorstwa Społecznie Odpowiedzialnego. Poznań: Wydawnictwo Uniwersytet Ekonomiczny w Poznaniu. [Google Scholar]

- Shrivastav, Santish Kumar, and Janaki Ramudu. 2020. Bankruptcy Prediction and Stress Quantification Using Support Vector Machine: Evidence from Indian Banks. Risks 8: 52. [Google Scholar] [CrossRef]

- SIN. 2017. Polish Non-Financial Reporting Standard (SIN). Available online: https://odpowiedzialnybiznes.pl/publikacje/standard-informacji-niefinansowych-sin-2017/ (accessed on 30 September 2020).

- Sofian, Ioana Neacsu, and Madalina Dumitru. 2017. The Compliance of the Integrated Reports Issued by European Financial Companies with the International Integrated Reporting Framework. Sustainability 9: 1319. [Google Scholar] [CrossRef]

- Souabni, Sami. 2011. Predicting an Uncertain Future: Narrative Reporting and Risk Information. London: The Association of Chartered Certified Accountants. [Google Scholar]

- Soyka, Peter. 2013. The International Integrated Reporting Council (IIRC) Integrated Reporting Framework: Toward better sustainability reporting and (way) beyond. Environmental Quality Management 23: 1–14. [Google Scholar] [CrossRef]

- Stolowy, Herve, and Luc Paugam. 2018. The expansion of non-financial reporting: An exploratory study. Accounting and Business Research 48: 525–48. [Google Scholar] [CrossRef]

- Strouhal, Jiri, Natalja Gurvits, Monika Nikitina-Kalamäe, and Emilia Startseva. 2015. Finding the link between CSR reporting and corporate financial performance: Evidence on Czech and Estonian listed companies. Central European Business Review 4: 48–59. [Google Scholar] [CrossRef]

- Szadziewska, Arleta. 2012. Environmental reporting by large companies in Poland. Zeszyty Teoretyczne Rachunkowości 68: 97–119. [Google Scholar]

- Szadziewska, Arleta. 2014. Rachunkowość jako źródło informacji na temat realizacji strategii społecznej odpowiedzialności biznesu. Zeszyty Teoretyczne Rachunkowości 75: 95–123. [Google Scholar] [CrossRef]

- Szczepankiewicz, Elżbieta Izabela. 2012. Management Commentary jako nowe źródło informacji o działalności jednostki gospodarczej. Zeszyty Teoretyczne Rachunkowości 66: 191–203. Available online: https://www.ceeol.com/search/article-detail?id=138241 (accessed on 25 May 2017). (In Polish).

- Szczepankiewicz, Elżbieta Izabela. 2013a. Definiowanie zakresu, zasięgu i jakości zintegrowanego sprawozdania. Research Papers of Wrocław University of Economics, 174–86. Available online: http://www.dbc.wroc.pl/dlibra/docmetadata?id=28092&from=publication (accessed on 25 May 2017).

- Szczepankiewicz, Elżbieta Izabela. 2013b. Informacje tworzące wartość rynkową w raportowaniu biznesowym. Kwartalnik Nauk o Przedsiębiorstwie 3: 33–42. Available online: https://polona.pl/item/informacje-tworzace-wartosc-rynkowa-w-raportowaniu-biznesowym,NDgzMzY3NDk/0/#item (accessed on 25 May 2017).

- Szczepankiewicz, Elżbieta Izabela. 2013c. Ryzyka ujawniane w zintegrowanym sprawozdaniu przedsiębiorstwa społecznie odpowiedzialnego. Ekonomika i Organizacja Przedsiębiorstwa 5: 71–82. Available online: http://www.orgmasz.nazwa.pl/sklep/sklep/ekonomika-i-organizacja-przedsiebiorstwa/rocznik-2013/ekonomika-i-organizacja-przedsiebiorstw-nr-05-2013-r-detail.html (accessed on 25 May 2017). (In Polish).

- Szczepankiewicz, Elżbieta Izabela. 2013d. Propozyzycja identyfikacji i klasyfikacji zagrożeń w ocenie zasadności przyjęcia założenia o kontynuacji działalności w jednostkach. Zeszyty Teoretyczne Rachunkowości 73: 113–30. Available online: http://yadda.icm.edu.pl/yadda/element/bwmeta1.element.ekon-element-000171275207 (accessed on 25 May 2017). (In Polish). [CrossRef]

- Szczepankiewicz, Elżbieta Izabela. 2013e. Przyjęcie założenia o kontynuacji działalności jednostki według krajowych i międzynarodowych regulacji. Studia Oeconomica Posnaniensia 8: 57–65. Available online: http://soep.ue.poznan.pl/jdownloads/Wszystkie%20numery/Rok%202013/05_szczepankiewicz.pdf (accessed on 25 May 2017). (In Polish).

- Szczepankiewicz, Elżbieta Izabela. 2014a. Ewolucja sprawozdawczości przedsiębiorstw—Problemy zapewnienia porównywalności zintegrowanych raportów z zakresu zrównoważonego rozwoju i CSR. Finanse Rynki Finansowe. Ubezpieczenia 71: 135–48. Available online: http://www.wneiz.pl/nauka_wneiz/frfu/71-2014/FRFU-71-135.pdf (accessed on 30 September 2017). (In Polish).

- Szczepankiewicz, Elżbieta Izabela. 2014b. Zintegrowane sprawozdanie przedsiębiorstwa jako narzędzie komunikacji z interesariuszami. Prace Naukowe Uniwersytetu Ekonomicznego we Wrocławiu 329: 271–81. [Google Scholar] [CrossRef]

- Szczepankiewicz, Elżbieta Izabela, and Przemysław Mućko. 2016. CSR reporting practices of Polish energy and mining companies. Sustainability 8: 126. [Google Scholar] [CrossRef]

- Tahat, Yasean, Theresa Dunne, Suzanne Fifield, and David Power. 2019. Risk-related disclosure: A review of the literature and an agenda for future research. Journal Accounting Forum 43: 193–219. [Google Scholar] [CrossRef]

- The Accounting Act. 2020. Poland. Available online: https://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU19941210591/U/D19940591Lj.pdf (accessed on 10 April 2021).

- Vitolla, Filippo, Nicola Raimo, and Michele Rubino. 2018. Appreciations, criticisms, determinants, and effects of integrated reporting: A systematic literature review. Corporate Social Responsibility and Environmental Management 26: 518–28. [Google Scholar] [CrossRef]

- Wilburn, Kathleen, and Ralph Wilburn. 2013. Using Global Reporting Initiative indicators for CSR programs. Journal of Global Responsibility 4: 62–75. [Google Scholar] [CrossRef]

- Zyznarska-Dworczak, Beata. 2018. The Development Perspectives of Sustainable Management Accounting in Central and Eastern European Countries. Sustainability 10: 1445. [Google Scholar] [CrossRef]

- Zyznarska-Dworczak, Beata. 2020. Sustainability Accounting—Cognitive and Conceptual Approach. Sustainability 12: 9936. [Google Scholar] [CrossRef]

| Company Name | Year | Revenues (PLN Million) | No. of Employees | Covered Period (Years) | Type of Report (CSR or Integrated Report (IR) | Volume (Pages) | No. of Pages with Financial Data | External Verification of the Report |

|---|---|---|---|---|---|---|---|---|

| Budimex Group | 2010 | 4520 | 4644 | 1 | CSR | 64 | 1 | Full |

| Budimex Group | 2011 | 5516 | 5393 | 1 | CSR | 61 | 1 | Full |

| Budimex Group | 2013 | 4995 | 3392 | 1 | CSR | 92 | 1 | Full |

| Budimex Group | 2015 | 5202 | 4354 | 1 | CSR | 105 | 3 | Full |

| Budimex Group | 2016 | 5572 | 5416 | 1 | IR | 122 | 9 | Full |

| Budimex Group | 2017 | 6369 | 6539 | 1 | IR | 106 | 10 | Full |

| Budimex Group | 2018 | 7387 | 6873 | 1 | IR | 104 | 11 | Full |

| Budimex Group | 2019 | 7570 | 7474 | 1 | IR | 89 | 12 | Full |

| CEMEX Polska Sp. z o.o | 2010 | 999 | 1327 | 1 | CSR | 80 | 1 | Full |

| CEMEX Polska Sp. z o.o. | 2012 | No data | 1289 | 2 | CSR | 70 | 0 | Full |

| CEMEX Polska Sp. z o.o. | 2014 | 985 | 1137 | 2 | CSR | 112 | 2 | Full |

| CEMEX Polska Sp. z o.o. | 2016 | 1007 | 1146 | 2 | CSR | 116 | 2 | Full |

| Górażdże Cement Group | 2014–2015 | 1137 | 1153 | 2 | CSR | 104 | 1 | No |

| Górażdże Cement Group | 2016–2017 | 1094 | 1247 | 2 | CSR | 104 | 1 | No |

| Velux Group | 2015 | 1520 | 3504 | 1 | CSR | 48 | 1 | No |

| Velux Group | 2016–2017 | 1601 | 4250 | 2 | CSR | 65 | 1 | No |

| Velux Group | 2018–2019 | 1670 | 4320 | 2 | CSR | 93 | 1 | No |

| Unibep Group | 2016 | 1063 | 1292 | 1 | CSR | 46 | 1 | No |

| Lafarge Polska | 2016 | No data | 1532 | 1 | CSR | 68 | 0 | No |

| Lafarge Polska | 2017–2018 | No data | 1458 | 2 | CSR | 71 | 0 | No |

| PORTA KMI POLAND Sp.zo.o. | 2016 | 365 | 1870 | 1 | CSR | 35 | 1 | No |

| Mostostal Warszawa Group | 2016–2017 | 881 | 530 | 2 | CSR | 49 | 2 | No |

| Pekabex Group | 2018 | 886 | 1993 | 1 | IR | 154 | 3 | No |

| Pekabex Group | 2019 | 772 | 2013 | 1 | IR | 156 | 12 | No |

| Erbud Group | 2019 | 2313 | 2475 | 1 | IR | 201 | 12 | No |

| Ceetrus Polska Sp. z o.o. | 2019 | No data | No Data | 1 | CSR | 60 | 0 | No |

| Company Name | Financial Statement | Activity Report (or Management Commentary) | Volume (Pages) of Activity Report | No. of Pages with Risk Data | CSR Report or Integrated Report (IR) | Volume (Pages) of CSR Report or IR | No. of Pages with Financial Data |

|---|---|---|---|---|---|---|---|

| Globe Trade Centre S.A. | Full data | Yes | 173 | 18 | No | - | - |

| Dom Development S.A. | Full data | Yes | 43 | 2 | No | - | - |

| Dewelia Group | Full data | Yes | 51 | 0 | No | - | - |

| Echo Investment Group | Full data | Yes | 153 | 5 | No | - | - |

| MLP Group | Full data | Yes | 57 | 6 | No | - | - |

| Atal Group | Full data | Yes | 51 | 12 | No | - | - |

| Polski Holding Nieruchomości Group | Full data | Yes | 62 | 12 | No | - | - |

| Archikom Group | Full data | Yes | 110 | 9 | No | - | - |

| Capital Park Group | Full data | No | - | - | No | - | - |

| Polimex Mostostal Group | Full data | Yes | 33 | 5 | No | - | - |

| Mirbud Group | Full data | Yes | 67 | - | No | - | - |

| Instal Kraków Group | Full data | Yes | 49 | 3 | No | - | - |

| Unibep Group | Full data | Yes | 82 | 10 | CSR * (only 2016, 2017) | - | - |

| Mostostal Warszawa Group | Full data | Yes | 36 | 3 | CSR ** (only 2017) | - | - |

| Erbud Group | Full data | Yes | 118 | 8 | IR *** | 201 | 12 |

| Budimex Group | Full data | Yes | 43 | 3 | IR *** | 89 | 12 |

| Pekabex Group | Full data | Yes | 160 | 11 | IR *** | 156 | 12 |

| Company Name | Reported Year | Balance Sheet or Statement of Financial Position | Profit and Loss Account (or Comprehensive Income Statement) | Statement of Changes in Equity | Cash flow Statement | Additional Notes to the Financial Part |

|---|---|---|---|---|---|---|

| Budimex Group | 2010 | Basic data | Basic data | No | No | No |

| Budimex Group | 2011 | Basic data | Basic data | No | No | No |

| Budimex Group | 2013 | No | Basic data | No | No | No |

| Budimex Group | 2015 | Basic data | Basic data | No | No | No |

| Budimex Group | 2016 | Full data | Full data | No | Full data | Basic data |

| Budimex Group | 2017 | Full data | Full data | No | Full data | Basic data |

| Budimex Group | 2018 | Full data | Full data | No | Full data | Basic data |

| Budimex Group | 2019 | Full data | Full data | No | Full data | Basic data |

| CEMEX Polska Sp. z o.o. | 2010 | No | Basic data | No | No | No |

| CEMEX Polska Sp. z o.o. | 2011–2012 | No | No | No | No | No |

| CEMEX Polska Sp. z o.o. | 2013–2014 | No | Basic data | No | No | No |

| CEMEX Polska Sp. z o.o. | 2015–2016 | No | Basic data | No | No | No |

| Górażdże Cement Group | 2014–2015 | No | Basic data | No | No | No |

| Górażdże Cement Group | 2016–2017 | No | Basic data | No | No | No |

| Velux Group | 2015 | No | No | No | No | No |

| Velux Group | 2016–2017 | No | No | No | No | No |

| Velux Group | 2018–2019 | No | No | No | No | No |

| Unibep Group | 2016 | No | No | No | No | No |

| Lafarge Polska | 2016 | No | No | No | No | No |

| Lafarge Polska | 2017–2018 | No | No | No | No | No |

| PORTA KMI POLAND Sp. z o.o. | 2016 | No | No | No | No | No |

| Mostostal Warszawa Group | 2017 | Basic data | No | No | No | No |

| Pekabex Group | 2018 | Basic data | Basic data | No | No | No |

| Pekabex Group | 2019 | Basic data | Basic data | No | No | No |

| Erbud Group | 2019 | Full data | Full data | Full data | Full data | Basic data |

| Ceetrus Polska Sp. z o.o. | 2019 | No | No | No | No | No |

| Company Name | Reported Year | Basic Financial Indicators | Overview of Financial Risks | Overview of Non-Financial Risks | Overview of CSR Risks | Overview of Risk Management System |

|---|---|---|---|---|---|---|

| Budimex Group | 2010 | No | Yes | Yes | Yes | Integrated Management System |

| Budimex Group | 2011 | No | Yes | Yes | Yes | |

| Budimex Group | 2013 | No | Yes | Yes | Yes | |

| Budimex Group | 2015 | No | Yes | Yes | Yes | |

| Budimex Group | 2016 | Yes | Yes | Yes | Yes | |

| Budimex Group | 2017 | Yes | Yes | Yes | Yes | |

| Budimex Group | 2018 | Yes | Yes | Yes | Yes | |

| Budimex Group | 2019 | Yes | Yes | Yes | Yes | |

| CEMEX Polska Sp. z o.o. | 2010 | No | Yes | Yes | Yes | Integrated Quality Management System |

| CEMEX Polska Sp. z o.o. | 2011–2012 | No | Yes | Yes | Yes | |

| CEMEX Polska Sp. z o.o | 2013–2014 | No | Yes | Yes | Yes | |

| CEMEX Polska Sp. z o.o | 2015–2016 | No | Yes | Yes | Yes | |

| Górażdże Cement Group | 2014–2015 | No | No | No | Yes | Environmental Management System (ISO 14001) |

| Górażdże Cement S.A. | 2016–2017 | No | No | No | Yes | |

| Velux Group | 2015 | No | No | No | No | ISO 9001, Quality Management System |

| Velux Group | 2016–2017 | No | No | No | No | ISO 9001 ISO 14001 ISO 50001 |

| Velux Group | 2018–2019 | No | No | No | Yes | ISO 9001 ISO 14001 ISO 45001 ISO 50001 |

| Unibep Group | 2016 | No | No | No | Yes | Integrated Occupational Health and Safety Management System |

| Lafarge Polska | 2016 | No | No | No | Yes | Efficient organisation management system |

| Lafarge Polska | 2017–2018 | No | No | No | Yes | |

| PORTA KMI POLAND Sp. z o.o. | 2016 | No | No | No | Yes | ISO 9001, Quality Management System |

| Mostostal Warszawa Group | 2017 | No | Yes | Yes | Yes | ISO 9001 ISO 14001 ISO 18001 |

| Pekabex Group | 2018 | Yes | Yes | Yes | Yes | Integrated Management System |

| Pekabex Group | 2019 | Yes | Yes | Yes | Yes | |

| Erbud Group | 2019 | Yes | Yes | Yes | Yes | Integrated Management System |

| Ceertus Polska Sp. z o.o. | 2019 | No | No | No | No | No |

| Risk Group | Risk Types |

|---|---|

| Risk related to the macroeconomic, political and legal environment on the markets where the company currently operates (e.g., emerging market CEE and SEE countries) | Risk of economic decline or continued economic crisis in countries where the company operates |

| Risk caused by the diversity of regulations in CEE and SEE countries in such areas as environmental protection, fire safety, labour law and land use limitations | |

| Risk of diverse land ownership registration systems in CEE and SEE countries (for instance, purchased property may be subject to reprivatisation claims) | |

| Risk related to legislative changes in CEE and SEE countries | |

| Risk related to entering new CEE and SEE markets | |

| Political risk in Eastern European markets (e.g., Ukraine or Belarus) | |

| Risk related to the macroeconomic, political and legal environment on the domestic market | Risk related to the cyclical nature of the property market—the number of completed projects depends on a number of things, including macroeconomic factors, demographic changes, availability of funding and market prices |

| Risk of delayed or denied zoning permit / construction permit | |

| Regional risk—the locations where the company owns land may become less attractive (e.g., a city council’s decision to build a wastewater treatment plant, waste incineration plant, airport or another problematic facility) | |

| Risk of growing competition in the property lease market (e.g., the company competes against other owners, property managers and commercial developers) | |

| Risk of higher property purchase prices (strong competition from other property buyers) | |

| Risk of illegal, selective or arbitrary behaviour of public administration (e.g., reducing the company’s capability to sign contracts/agreements or to obtain permits) | |

| Risk related to taxation, customs and administrative legal changes, or changes in interpretation of existing laws | |

| Risk related to liability under environmental protection regulations | |

| Risk of challenging the company’s legal title to investment properties and development projects (e.g., if the related permits have been issued in violation of applicable laws) | |

| Risk of discontinuation of operations or poor financial performance of private public partnerships | |

| Risk related to corporate governance (including internal strategic and operational risks) | Risk of inability to pursue the company’s strategy: (1) risk of losing contracts of key importance for the company’s growth, (2) risk of limited or no access to public contracts, (3) risk of losing the trust of key trade partners, (4) risk of failure to contract reliable and trusted subcontractors, (5) risk of failure to deliver economic and financial plans, (6) risk of building a new contract portfolio and risk of contract termination, (7) risk of competitive imbalance, (8) legal risk related to lengthy and expensive court procedures |

| Risk related to launching new segments as part of the existing business model in the current markets | |

| Risk of losing the ability to actively manage assets | |

| Risk of losing the ability to purchase attractive income-generating rental properties | |

| Risk of effective management of the company’s property portfolio | |

| Risk of completion of selected projects | |

| Risk of inability to obtain relevant information about risks related to purchasing properties in the future; risk of inadequate assessment of such information | |

| Risk related to partners (in case of projects depending on partners and joint investment agreements | |

| Risk of operations and knowledge of the company’s key officers | |

| Risk related to the company’s shareholding structure and corporate governance | |

| Risk of losing / unavailability of skilled managers and workers possessing the necessary knowledge, experience and licenses | |

| Risk of ineffective or inadequate internal control and risk management systems | |

| Operating risks related to: (1) valuation of long-term construction contracts, (2) changes in demand for specialist services, (3) price volatility (key commodities and specialist services), (4) loss of resources, (5) loss of qualified workforce (e.g., site managers), (6) project delivery, including the risk of obtaining partners possessing the necessary know-how as well as the risk of penalties (e.g., for delays caused by weather conditions), (7) warranty reserves covering claims made under historical contracts, (8) negative cash flow from contracts, (9) IT risk. | |

| Risks over which the company has limited or no influence, which may delay the implementation of the company’s projects or cause other adverse impacts | Risk of rising cost of materials, employment or other costs, as a result of the project becomes economically unviable Risk of natural phenomena—unfavourable weather conditions, earthquakes and floods that may damage or slow down projects Risk of industrial accidents, unfavourable ground conditions (e.g., groundwater presence) and potential liability under other legal regulations, such as handling of archaeological findings or unexploded ordnances Risk of terrorism, riots, rebellions, strikes, social unrest, environmental protests Risk of construction law violations (e.g., due to the use of construction materials found to be harmful to human health) Risk of changes in applicable laws, regulations or standards implemented after the planning stage or project start date, exposing the company to additional cost or delaying the completion; or Risk of applying incorrect construction methods Risk of defective building materials Risk of higher cost, project delay or termination if: (1) the company fails to secure general contractors on economically viable terms or at all, or (2) if the general contractors fail to complete the project in line with generally accepted standards, on time and on budget |

| External risks beyond the company’s control, which may increase costs or delay or prevent the implementation of development projects | Risk of additional construction costs exceeding the amount originally agreed on with the general contractor Risk of liability to subcontractors in case of bankruptcy of the general contractor Risk of changes in regulations or their interpretation or application (e.g., higher VAT rate on the sale of apartments) Risk of actions taken by central and/or local government bodies, resulting in unforeseeable changes in zoning plans and architectural requirements Risk of possible defects in or limitations to the legal title to land or buildings purchased by the company, caused by administrative decisions Risk of inability to secure funding on favourable terms (or at all) for individual projects or groups of projects Risk of potential liabilities related to acquired land, buildings or entities owning land or buildings, in case of which the company’s right of recourse may be limited or non-existent Risk of difficulties in vacating the land by its previous occupants Risk of inability to obtain a building permit for an investment Risk that the as-built surface area may differ from the planned surface area Risk related to environmental protection and cultural heritage in Poland and other countries where the company operates Climate risks—heat waves, drought, floods Risk of non-adherence to the terms of an agreement signed with the client (untimely order/project delivery); Risk related to product/service quality (risk of defects or their untimely removal) Risk of losing the ability to deliver the contract by a product/service supplier Risk of non-authorization of additional expenses by the client Risk of contract suspension by the client Risk related to liability for physical defects under statutory or contractual warranty |

| Environmental risk | Risk of land contamination Risk of water contamination Risk of atmospheric pollution Risk of production-related nuisance (noise, vibrations) Risk of use of natural resources Risk of harmful substances in construction products Risk of generating waste, including hazardous waste Other risks arising from the specific conditions at the construction site |

| Financial risk | Price risks Risk management associated with financial instruments Credit risk—cross-border and country risk Market risk—foreign exchange risk Interest rate risk Equity price risk and liquidity risk Trade credit risk |

| Risk of legal disputes (e.g., activities related to purchase, lease, sale and management of real estate, including under cooperation agreements) | |

| Risk of loss of assets (e.g., missing or insufficient insurance policies) | |

| Risk of liability towards buyers and third parties after the project is sold (e.g., the company may be required to provide statements, guarantees and liability for damages). | |

| Risk of higher costs of contracting new workforce or specialists | |

| The risk of an increase in the company’s indebtedness and the related costs may: (1) make the company more vulnerable to a slowdown in its operations or to general adverse trends in the industry and in economy; (2) reduce the company’s ability to obtain financing for future projects, capital expenditure, seizing opportunities, acquisitions or other general corporate purposes and increase the cost of future financing; (3) cause the need to sell property in order to timely pay liabilities, including those under loan agreements; (4) cause the need to allocate a significant part of the company’s operating cash flow to repayment of principal and interest; (5) reduce the company’s flexibility in planning or responding to changes in its business, competitive environment and real estate market; (6) make the company less competitive than other companies whose debts are lower. | |

| Risk of significant losses if the company defaults on its loan agreements | |

| Risk that loans will not be renewed or refinanced at maturity or will be available on less favourable terms | |

| Risk of underestimation of contract delivery costs | |

| Warranty risk | |

| Risk related to penalties for non-delivery or late delivery of contracts | |

| Risk of performance bonds (e.g., limited availability of bank and insurance guarantees) | |

| Credit risk faced by the other party to the transaction | |

| Risk of obtaining additional funding on less favourable terms | |

| Risk of changes in tax regulations or their interpretation | |

| Risk of related party transactions within the capital group being challenged by tax authorities | |

| Risk concerning the valuation of the company’s real estate—such valuation is inherently uncertain, may be imprecise and fluctuating | |

| Risk of asset valuation in the company’s financial statements—valuation is subject to significant changes due to real estate fair value fluctuations | |

| Risk of rental income falling below the originally assumed level | |

| Risk of losing key tenants (e.g., termination of lease agreements) | |

| Risk of failure to achieve the originally assumed return on projects | |

| Risk of inability to quickly sell real estate | |

| Risk of damage due to latent defects or external factors | |

| Risk of exposure to claims regarding construction defects (such claims negatively affect the company’s image and competitive position) | |

| The risk of the holding company’s ability to pay dividends depends on the ability of its subsidiaries to pay dividends and transfer funds | |

| Risk that the company’s future offerings of debt or equity securities may adversely affect the market price of shares and dilute the existing shares | |

| Performance bond risk (including the risk of limited access to new bonds and the risk of accumulation of payments under bank and insurance bonds) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Szczepankiewicz, E.I. Identification of Going-Concern Risks in CSR and Integrated Reports of Polish Companies from the Construction and Property Development Sector. Risks 2021, 9, 85. https://doi.org/10.3390/risks9050085

Szczepankiewicz EI. Identification of Going-Concern Risks in CSR and Integrated Reports of Polish Companies from the Construction and Property Development Sector. Risks. 2021; 9(5):85. https://doi.org/10.3390/risks9050085

Chicago/Turabian StyleSzczepankiewicz, Elżbieta Izabela. 2021. "Identification of Going-Concern Risks in CSR and Integrated Reports of Polish Companies from the Construction and Property Development Sector" Risks 9, no. 5: 85. https://doi.org/10.3390/risks9050085

APA StyleSzczepankiewicz, E. I. (2021). Identification of Going-Concern Risks in CSR and Integrated Reports of Polish Companies from the Construction and Property Development Sector. Risks, 9(5), 85. https://doi.org/10.3390/risks9050085