In this section, we present the main analytical results devoted to the problem of the joint ruin probability of the two-dimensional risk process given by (

1). Firstly, we recall certain geometric properties of the considered model that were presented in

Avram et al. (

2008a), which allow us to reduce the complexity of the problem. Secondly, using stochastic arguments, we derive an explicit analytical solution for the ruin probability (

3) for claims following the exponential law. Finally, taking advantage of the numerical experiments available for our solution together with Monte Carlo simulations, we correct the result presented in

Avram et al. (

2008a).

2.1. Problem Reduction

Let us observe that due to the specific construction of the considered two-dimensional risk process, in which we assume that each claim is split between the insurer and reinsurer with the proportions

a and

, respectively, the two-dimensional problem can be reduced to the one-dimensional (cf.

Avram et al. (

2008a)). First, let us notice that the ruin probability of the system

is equal to the ruin probability of the system

:

We now distinguish between the two cases:

- (i)

and

- (ii)

.

Observe that for (i) each trajectory of the process,

is above the corresponding trajectory of the process

; therefore, the here-considered joint ruin event (

4) occurs only when the ruin happens for the process

and consequently

Clearly, that observation reduces the two-dimensional case to the purely one-dimensional problem with exponential claims for which the the formula is well-known in the literature (see, e.g.,

Asmussen and Albrecher (

2010);

Rolski et al. (

1999)).

For (ii), there exists a time point

before which the ruin of process (

1) can be triggered by the insurer; after this point, it can only be triggerd by the reinsurer. This is a solution of the equation:

. Hence,

Then, we can verify that for any

, the relation

holds; for

, the opposite is true. This asserts that for (ii), the two-dimensional problem can also be reduced to the one-dimensional case. Namely, using the Markovian property of the system, we formulate the problem in the following way. Observe that non-ruin in the infinite time horizon is equivalent to the event where the insurer will avoid ruin up to time

T, ending with some positive capital, which will be the initial capital for the reinsurer, and then the reinsurer will never go bankrupt. This allows us to write the following equation, which was also presented in

Avram et al. (

2008a):

where

is the ruin probability in infinite time for the reinsurer and

denotes the joint probability that the insurer avoids ruin until

T and reaches the level

z.

Equation (

8) can be rewritten as

In the next part of this work, we derive analytical formulas for the ruin probability considered here using Formula (

10) for claims distributed according to the exponential law.

2.2. Ruin Probability for Exponential Claims

If the claims for the insurer–reinsurer model given in Equation (

1) are exponentially distributed, then the ruin probability defined in Equation (

10) can be given explicitly. Taking advantage of the elementary formula for the ruin probability

for the exponential distribution, we can reduce the integral in (

10) to a quantity that is proportional (up to some deterministic factor) to the probability of ruin for the Cramér-Lundberg model in finite time. The following theorem presents the final form of the joint ruin probability formula for the two-dimensional risk process with exponential claims.

Theorem 1. Let , and be exponentially distributed with mean . Then, if , the joint ruin probability specified in Equation (10) of the risk process defined in Equation (1) has the following form:where , andwith Proof. First, for case (i), as discussed in

Section 2.1, the ruin probability for the two-dimensional model simplifies to the one-dimensional problem for the reinsurer risk process with claims exponentially distributed with mean

, the intensity of the Poisson process

, and initial capital

. Therefore, the result for this part follows directly from the well-known formula for the ruin probability in infinite time

Asmussen and Albrecher (

2010).

Second, for case (ii), the first factor

in Formula (

10) is a ruin probability for the process

in the finite time interval

and its explicit form is known, see

Asmussen (

1984), with several misprints pointed out by

Barndorff-Nielsen and Schmidli (

1995), see also

Asmussen and Albrecher (

2010);

Burnecki and Teuerle (

2011). By combining that formula and the known formula for the ruin probability in infinite time

, we obtain the following expression:

where

corresponds to the ruin probability in finite time

T of the one-dimensional risk process with initial capital

u, safety loading

, Poisson arrival intensity

, and exponential claims with mean

, and has the following form (see

Asmussen and Albrecher (

2010)):

with

,

and

as in Equations (

12)–(

14).

The integral in Equations (

10) and (

15) can be rewritten (up to a constant) as

and can be interpreted, see Formula (

9), as the Laplace transform of the random variable

at point

, given the process

is non-negative up to the time point

T and

; namely, we obtain

The process

is a standard Cramér–Lundberg process with initial capital

, safety loading

, Poisson process with intensity

, and exponential claims with mean

. Therefore, the Laplace transform (

18) is equal to:

In the next step, we introduce the following change in measure with respect to natural filtration

generated by the process

:

where

denotes the measure on the natural filtration generated by the process

and

denotes the new measure. Now, we are able to write Equation (

19) as:

Now observe that the process

under the new measure

is also a Cramér–Lundberg process but with a modified intensity and claim amount distribution. To see this, let us calculate the moment generating function of

under the new measure

:

where the equality

follows from the moment-generating function of the process

under the natural measure having the following form:

By comparing the final form of Equation (

22) and the moment-generating function transform of the original model (

23), we deduce that after the change in measure, the process

is a Cramér–Lundberg process with initial capital

, safety loading

(which is positive based on the assumptions), Poisson process with intensity

, and claims

, which are exponentially distributed with mean

.

Since the new safety loading is positive, we can apply the finite-time ruin probability for the exponential claims and obtain

Finally, for case (ii), we have

which concludes the proof. □

Finally, let us comment on the assumption that was made at the beginning of our considerations: . We note that the case can be treated as equivalent to the problem of calculating the ruin probability for being a reinsurer and being an insurer (the processes swap their roles and the probabilistic approach can be repeated). If the safety loadings are equal, the situation becomes trivial; namely, after dividing the process by a and by , the trajectories differ only by a constant, so the joint ruin probability reduces to the ruin probability of the lower process.

2.3. Comparison with Other Results

The formula for the ruin probability presented in Theorem 1 in case (ii) is consistent with the results obtained for the spectrally negative Lévy process in

Avram et al. (

2008b), where a similar two-dimensional system was considered but there was no closed-form formula for the exponential claims. Our result is simple to use and therefore might be easily used in applications and in approximations of ruin probabilities for models with general claim amount distributions, see

Burnecki et al. (

2019).

Our result corresponds to the second case of Theorem 2 in

Avram et al. (

2008a), which was obtained by the inversion of the double Laplace transform. However, in that work, limits of the integral in the final formula should be inverted (this mistake is present throughout the text). This leads to the following corrected formulation of the second case of Theorem 2:

where

, , ,

, , and .

In the work of

Badescu et al. (

2011), a more general model than (

1) was investigated. It allows, in addition to the insurer–reinsurer quota share mechanism, another source of claims for the insurer, which was modeled by an independent compound Poisson process with an arbitrary claim size distribution. Nevertheless, the obtained results seem to be less numerically tractable.

Finally, a similar ruin probability problem was discussed by

Foss et al. (

2017), where the initial reserves of both companies tended to infinity and the generic claim size was heavy-tailed, namely, subexponential.

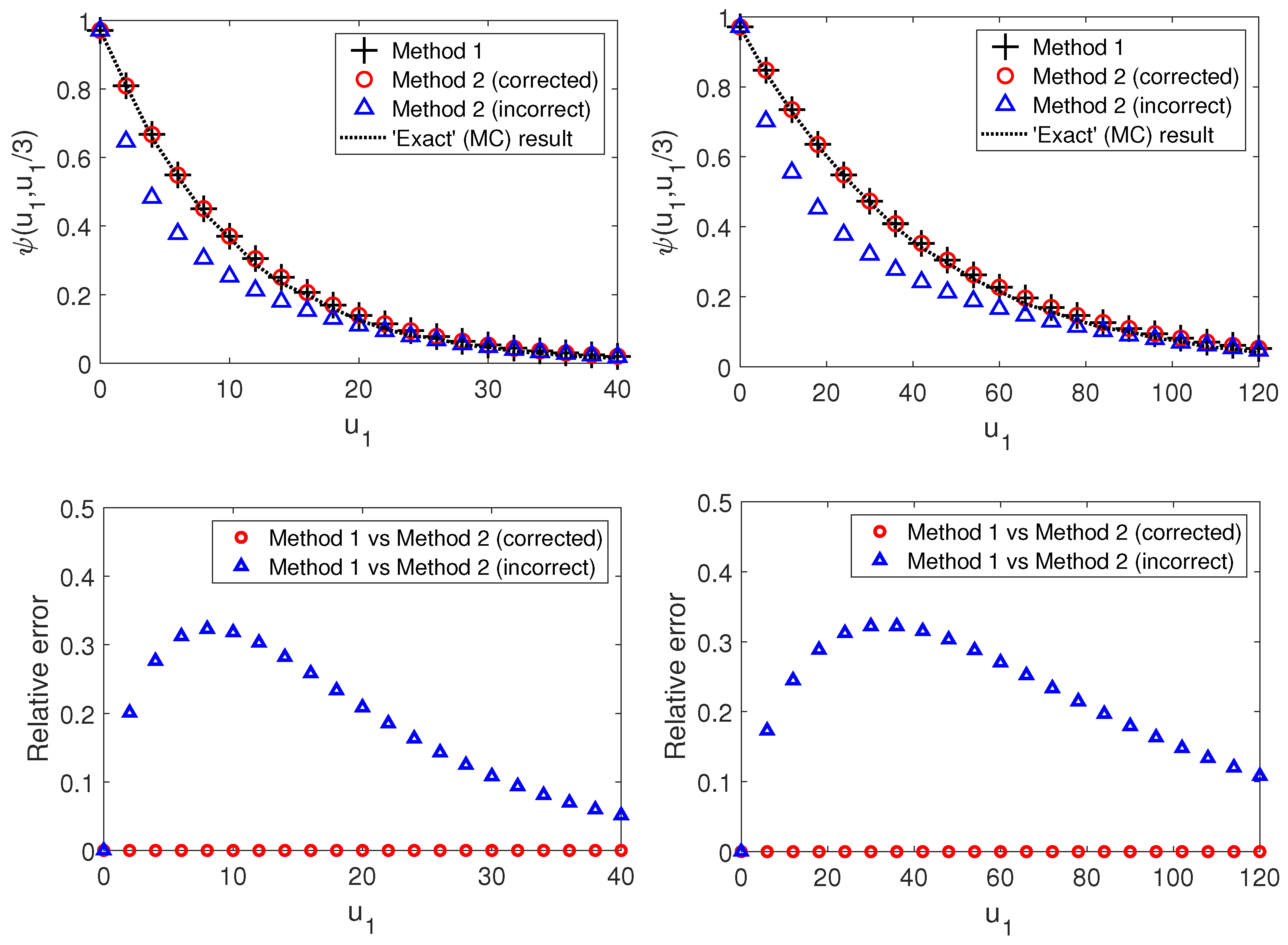

In

Figure 1, we illustrate that both formulas, Equation (

11) of Theorem 1 and the corrected version of the second case of Theorem 2 of

Avram et al. (

2008a) given by Formula (

26), lead to the same results for the ruin probability (

3) of the insurer–reinsurer model (

1). Moreover, they coincide with the results obtained by Monte Carlo simulations for the finite time with a sufficiently long horizon. We also show that the original version of Theorem 2 of

Avram et al. (

2008a) leads to significant relative errors with a maximum around 30% (see both bottom panels). This also confirms the relevance of our findings.

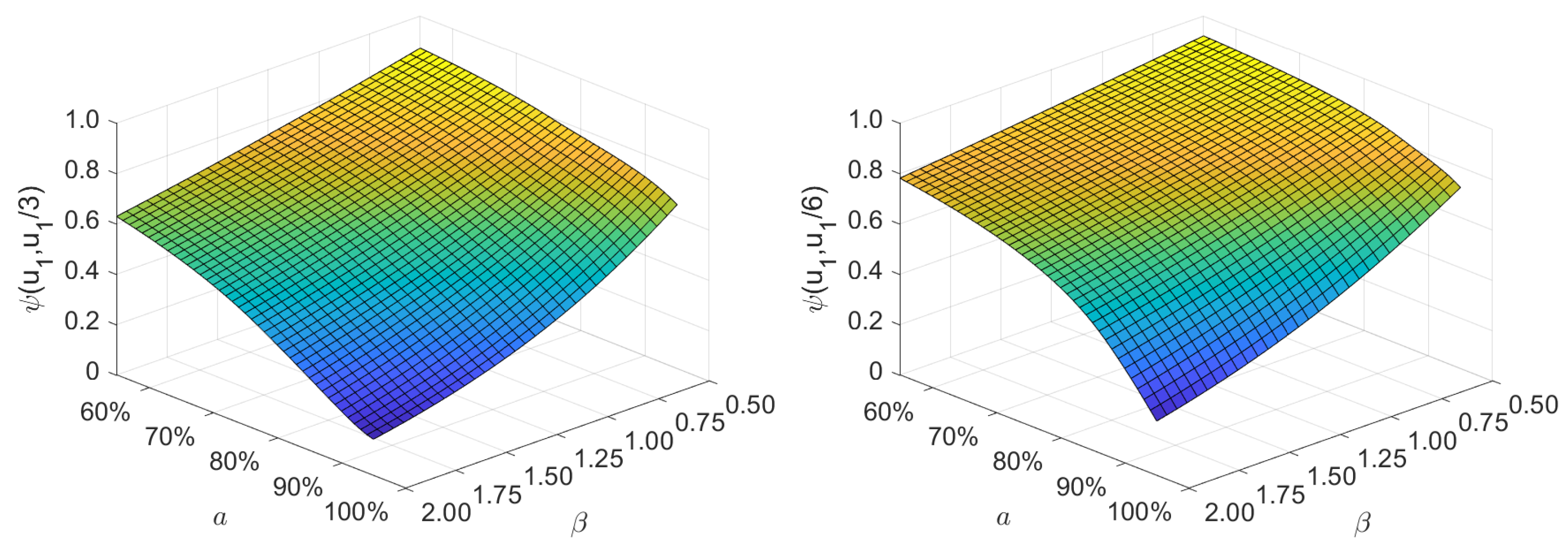

We also performed a numerical analysis in which we checked how the joint ruin probability of the insurer–reinsurer model is affected by the change in selected model parameters’ values. The results presented in

Figure 2 were obtained for the insurer–reinsurer model using Theorem 1 with

,

,

, and

for various values of the

parameter of the exponential claim amount random variable,

, and for various values of the

a parameter of the quota-share contract proportion,

. Moreover, the analysis was performed for two initial capitals of the reinsurer: in the left panel of

Figure 2, we have

, while in the right panel, it is

. We can observe that despite the different values of the reinsurer’s initial capital, the considered ruin probability decreases as the mean

decreases, and increases as the quota-share’s proportion parameter of the insurer

a decreases. The lower initial capital of the reinsurer results in (generally) lower values of the ruin probability (

3) in the considered parameter space

.

Figure 3 illustrates the values of safety loadings

that fulfil the assumption of Theorem 1:

. This corresponds to the second case of Theorem 2 in

Avram et al. (

2008a). To the best of our knowledge, an analogue of the first case of Theorem 2, namely, a result for the region

, cannot be obtained with the use of the probabilistic approach presented in this work. This is due to, in this case, the change in measure presented in the proof of Theorem 1 not leading to a proper Cramér–Lundberg model. Namely, when

, after the change in measure, the safety loading of the model is

, which is negative; therefore, the result for the ruin probability in finite time horizon in (

15) cannot be used.