Forward-Looking Volatility Estimation for Risk-Managed Investment Strategies during the COVID-19 Crisis

Abstract

1. Introduction

2. Materials and Methods

2.1. Literature Review

2.2. The GARCH(1,1) Process

2.3. Long Short-Term Memory Neural Network

2.4. Estimation of the Historical Realized Volatility

2.5. Proposed Hybrid Algorithm: LSTM Model Combined with the GARCH-Method

2.6. VolTarget Strategy

3. Results

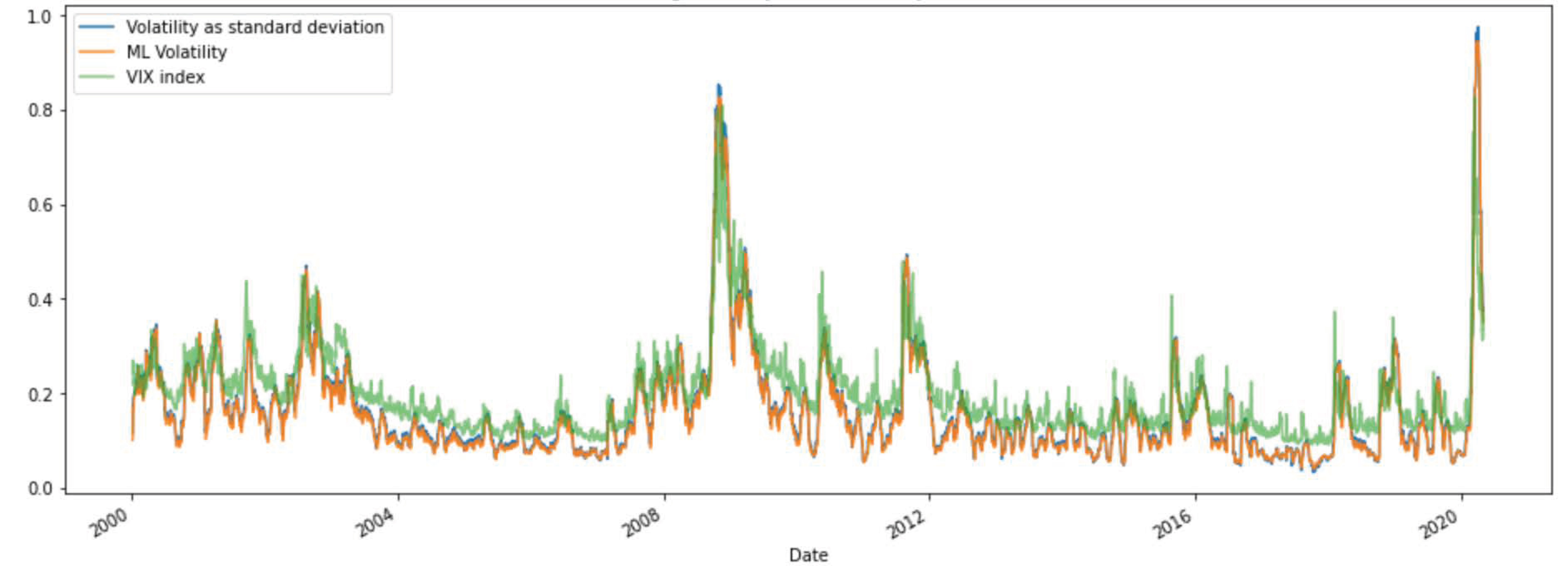

3.1. Volatility Forecasting

- January 2000–June 2020 comparing the performances of portfolios with the historical volatility and the predicted one;

- January 2020–October 2020 comparing the performance of portfolios with the historical volatility and the predicted one, which corresponds to the diffusion of COVID-19.

3.2. Monte Carlo Simulations

- the classic VolTarget with historical realized volatility computed as the standard deviation w.r.t. 21 days;

- the new approach, i.e., the ML VolTarget, computed by the combined GARCH-NN method.

- if equity markets have a volatility below , then the transaction costs are pretty low, e.g., 10 basis points (bps);

- if equity markets have an average volatility between and , the transaction costs get higher, for example 20 bps;

- if markets are getting turbulent with more than volatility, then transaction costs of 50 bps might be realistic.

3.2.1. Simulation of the Portfolio Dynamics over the Period of January 2020 to October 2020

3.2.2. Simulation of the Portfolio Dynamics over the Period of January 2000 to May 2020

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Albeverio, Sergio, Victoria Steblovskaya, and Kai Wallbaum. 2013. Investment instruments with volatility target mechanism. Quantitative Finance 13: 1519–28. [Google Scholar] [CrossRef]

- Albeverio, Sergio, Victoria Steblovskaya, and Kai Wallbaum. 2018. The Volatility Target Effect in Structured Investment Products with Capital Protection. Review of Derivatives Research 21: 201–29. [Google Scholar] [CrossRef]

- Albeverio, Sergio, and Kai Wallbaum. 2019. The volatility target effect in investment-linked products with embedded American-type derivatives. Investment Management and Financial Innovations 16: 18–28. [Google Scholar] [CrossRef]

- Anton, Sorin Gabriel. 2012. Evaluating the Forecasting Performance of GARCH Models. Evidence from Romania. Procedia-Social and Behavioral Sciences 62: 1006–10. [Google Scholar]

- Baffour, Alexander Amo, Jingchun Feng, and Evans Kwesi Taylor. 2019. A hybrid artificial neural network-GJR modeling approach to forecasting currency exchange rate volatility. Neurocomputing 365: 285–301. [Google Scholar] [CrossRef]

- Baker, Scott R., Nicholas Bloom, Steven J. Davis, Kyle Kost, Marco Sammon, and Tasaneeya Viratyosin. 2020. The unprecedented stock market reaction to COVID-19. In NBER Working Papers 26945. Cambridge: National Bureau of Economic Research, Inc. [Google Scholar]

- Bai, Zefeng, and Kai Wallbaum. 2020. Optimizing Pension Outcomes Using Target-Driven Investment Strategies: Evidence from Three Asian Countries with the Highest Old-Age Dependency Ratio. Asia-Pacific Journal of Financial Studies 49: 652–82. [Google Scholar] [CrossRef]

- Balduzzi, Pierluigi, Giuseppe Bertola, Silverio Foresi, and Leora Klapper. 1998. Interest rate targeting and the dynamics of short-term rates. Journal of Money, Credit and Banking 30: 26–50. [Google Scholar] [CrossRef][Green Version]

- Berganza, Juan Carlos, and Carmen Broto. 2012. Flexible inflation targets, forex interventions and exchange rate volatility in emerging countries. Journal of International Money and Finance 31: 428–44. [Google Scholar] [CrossRef]

- Bollerslev, Tim. 1986. Generalized autoregressive conditional heteroscedasticity. Journal of Econometrics 31: 307–27. [Google Scholar] [CrossRef]

- Boţoc, Claudiu, and Sorin Gabriel Anton. 2020. New empirical evidence on CEE’s stock markets integration. The World Economy 43: 2785–802. [Google Scholar] [CrossRef]

- Cao, Hongkai, Alexandru Badescu, Zhenyu Cui, and Sarath Kumar Jayaraman. 2020. Valuation of VIX and target volatility options with affine GARCH models. Journal of Futures Markets 40: 1880–917. [Google Scholar] [CrossRef]

- Carvalhal, Andrè, and Tulio Ribeiro. 2007. Do artificial neural networks provide better Forecasts? Evidence from Latin American stock indexes. Latin American Business Review 8: 92–110. [Google Scholar] [CrossRef]

- Chang, Bo Young, Peter Christoffersen, and Kris Jacobs. 2013. Market skewness risk and the cross section of stock returns. Journal of Financial Economics 107: 46–68. [Google Scholar] [CrossRef]

- Chicago Board Options Exchange (CBOE). 2020. VIX White Paper-CBOE Volatility Index. Available online: CBOE.com (accessed on 13 October 2020).

- Di Persio, Luca, Luca Prezioso, and Kai Wallbaum. 2019. Closed-End Formula for options linked to Target Volatility Strategies. arXiv arXiv:1902.08821. [Google Scholar]

- Donaldson, R. Glen, and Mark J. Kamstra. 2005. Volatility forecasts, trading volume, and the ARCH versus option-implied volatility trade-off. Journal of Financial Research 28: 519–38. [Google Scholar] [CrossRef]

- Duan, Jin-Chuan, and Weiqi Zhang. 2014. Forward-looking market risk premium. Management Science 60: 521–38. [Google Scholar] [CrossRef]

- Elsworth, Steven, and Stefan Güttel. 2020. Time Series Forecasting Using LSTM Networks: A Symbolic Approach. arXiv arXiv:2003.05672. [Google Scholar]

- Engle, Robert F. 1982. Autoregressive Conditional Heteroscedasticity with Estimates of the Variance of United Kingdom Inflation. Econometrica 50: 987–1007. [Google Scholar] [CrossRef]

- Guo, Zhiqiang, Huaiqing Wang, Quan Liu, and Jie Yang. 2014. A Feature Fusion Based Forecasting Model for Financial Time Series. PLoS ONE 9: e101113. [Google Scholar] [CrossRef]

- Guo, Zhiqiang, Huaiqing Wang, Jie Yang, and David J. Miller. 2015. A Stock Market Forecasting Model Combining Two-Directional Two-Dimensional Principal Component Analysis and Radial Basis Function Neural Network. PLoS ONE 10: e0122385. [Google Scholar] [CrossRef]

- Hajizadeh, Ehsan, Abbas Seifi, M.H. Fazel Zarandi, and I. B. Turksen. 2012. A hybrid modeling approach for forecasting the volatility of S&P 500 index return. Expert Systems with Applications 39: 431–36. [Google Scholar]

- Hossain, Altaf, Faisal Zaman, M. Nasser, and M. Mufakhkharul Islam. 2009. Comparison of GARCH, neural network and support vector machine in financial time series prediction. In Lecture Notes in Computer Science (Including Subseries Lecture Notes in Artificial Intelligence and Lecture Notes in Bioinformatics), 5909 LNCS. Berlin and Heidelberg: Springer, pp. 597–602. [Google Scholar]

- Hochreiter, Sepp, and Jürgen Schmidhuber. 1997. Long Short-Term Memory. Neural Computation 9: 1735–80. [Google Scholar] [CrossRef] [PubMed]

- Jawaid, Hassan. 2015. Pricing and Hedging of the European Option Linked to Target Volatility Portfolio. Available online: https://ssrn.com/abstract=2743699 (accessed on 23 July 2020). [CrossRef]

- Kim, Ha Young, and Chang Hyun Won. 2018. Forecasting the volatility of stock price index: A hybrid model integrating LSTM with multiple GARCH-type models. Expert Systems with Applications 103: 25–37. [Google Scholar] [CrossRef]

- Krein, David, and Jeffrey Fernandez. 2012. Indexing Volatility Risk Control. The Journal of Index Investing 3: 62–75. [Google Scholar] [CrossRef]

- Kristjanpoller, Werner, and Marcel C. Minutolo. 2016. Forecasting volatility of oil price using an artificial neural network-GARCH model. Expert Systems with Applications 65: 233–41. [Google Scholar] [CrossRef]

- Lahmiri, Salim. 2017. Modeling and predicting historical volatility in exchange rate markets. Physica A: Statistical Mechanics and Its Applications 471: 387–95. [Google Scholar] [CrossRef]

- Lu, Xunfa, Danfeng Que, and Guangxi Cao. 2016. Volatility Forecast Based on the Hybrid Artificial Neural Network and GARCH-type Models. Procedia Computer Science 91: 1044–49. [Google Scholar] [CrossRef]

- McDonnell, Maxwell, Isaac Faber, Nicholas Normandin, and Ryder Cleary. 2012. Comparison of historical and forward looking market data in constructing efficient portfolios. Paper presented at 62nd IIE Annual Conference and Expo, Orlando, FL, USA, May 19–23; pp. 1062–70. [Google Scholar]

- Murali, Palanichamy, Revathy Rathinasamy, S. Balamurali, and A. S. Tayade. 2020. Integration of RNN with GARCH refined by whale optimization algorithm for yield forecasting: A hybrid machine learning approach. Journal of Ambient Intelligence and Humanized Computing. [Google Scholar] [CrossRef]

- Neely, Christopher J. 1999. Target zones and conditional volatility: The role of realignments. Journal of Empirical Finance 6: 177–92. [Google Scholar] [CrossRef]

- Qiu, Jiayu, Bin Wang, and Changjun Zhou. 2020. Forecasting stock prices with long-short term memory neural network based on attention mechanism. PLoS ONE 15: e0227222. [Google Scholar] [CrossRef]

- Pathberiya, Hasanthi Anuradha, Chandima Tilakaratne, and L. L. Hansen. 2018. An intelligent system for forex trading: Hybrid ANN with GARCH and intrinsic mode functions. Paper presented at 2017 Intelligent Systems Conference, IntelliSys 2017, London, UK, September 7–8; pp. 436–45. [Google Scholar]

- Williams, Brandon. 2011. GARCH(1,1)-Models. Available online: https://math.berkeley.edu/~btw/thesis4.pdf (accessed on 23 July 2020).

- Wu, Desheng Dash, Lijuan Zheng, and David L. Olson. 2014. A decision support approach for online stock forum sentiment analysis. IEEE Transactions on Systems, Man, and Cybernetics: Systems 44: 1077–87. [Google Scholar] [CrossRef]

- Yao, Yuan, Jia Zhai, Yi Cao, Xuemei Ding, Junxiu Liu, and Yuling Luo. 2017. Data analytics enhanced component volatility model. Expert Systems with Applications 84: 232–41. [Google Scholar] [CrossRef]

- Zakamulin, Valeriy. 2013. Dynamic Asset Allocation Strategies Based on Unexpected Volatility. Journal of Alternative Investments 16: 37–50. Available online: https://ssrn.com/abstract=2357881 (accessed on 18 July 2020). [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Di Persio, L.; Garbelli, M.; Wallbaum, K. Forward-Looking Volatility Estimation for Risk-Managed Investment Strategies during the COVID-19 Crisis. Risks 2021, 9, 33. https://doi.org/10.3390/risks9020033

Di Persio L, Garbelli M, Wallbaum K. Forward-Looking Volatility Estimation for Risk-Managed Investment Strategies during the COVID-19 Crisis. Risks. 2021; 9(2):33. https://doi.org/10.3390/risks9020033

Chicago/Turabian StyleDi Persio, Luca, Matteo Garbelli, and Kai Wallbaum. 2021. "Forward-Looking Volatility Estimation for Risk-Managed Investment Strategies during the COVID-19 Crisis" Risks 9, no. 2: 33. https://doi.org/10.3390/risks9020033

APA StyleDi Persio, L., Garbelli, M., & Wallbaum, K. (2021). Forward-Looking Volatility Estimation for Risk-Managed Investment Strategies during the COVID-19 Crisis. Risks, 9(2), 33. https://doi.org/10.3390/risks9020033