ESG-Washing in the Mutual Funds Industry? From Information Asymmetry to Regulation

Abstract

:1. Introduction

2. Literature Review

2.1. Information Asymmetry between Asset Managers and Investors

2.2. From a Lack of Transparency to Greenwashing

3. Data

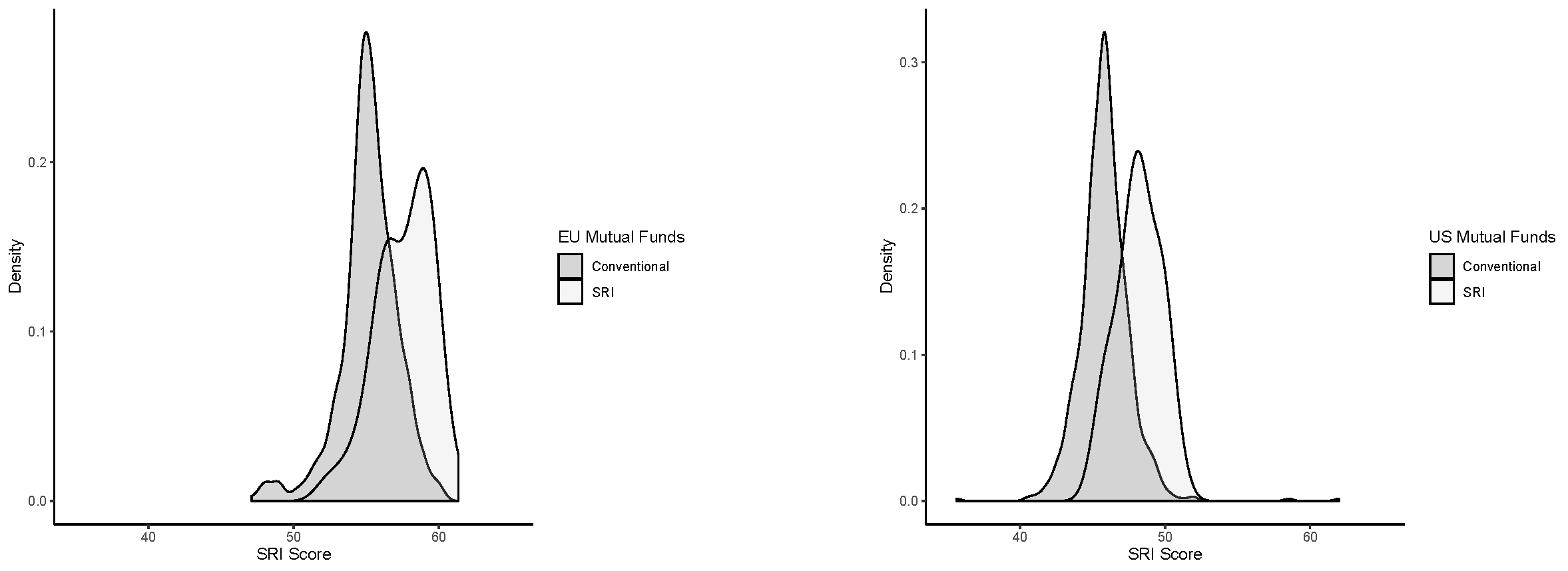

3.1. De Facto SRI: Using the Morningstar and MSCI Databases

3.2. De Jure SRI: A New Classification from Mutual Funds’ Names and ESG Labels

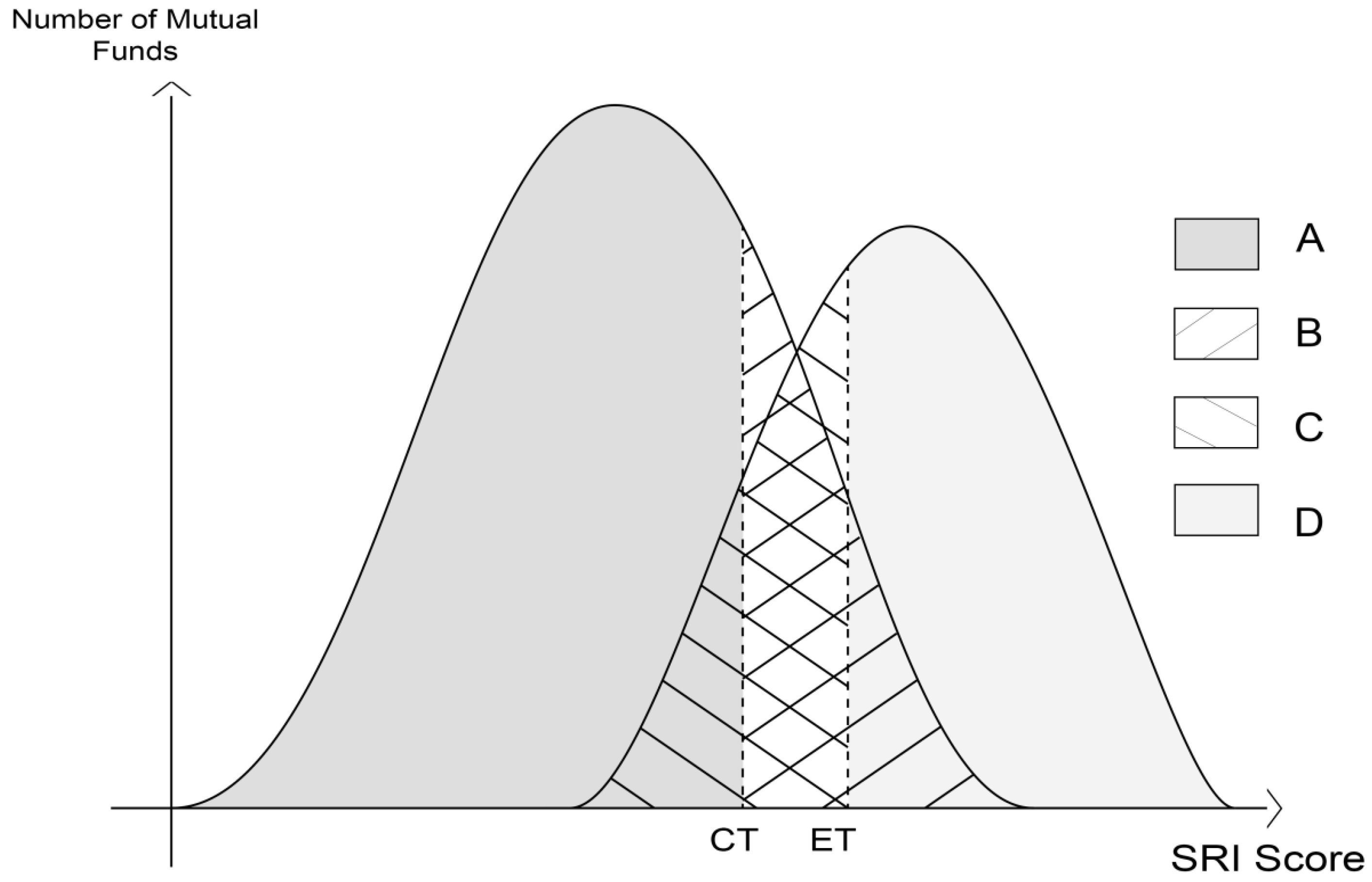

4. “ESG-Washing”: Asset Managers Signals vs. Third-Party Ratings

5. Impact of Information Asymmetry on the Evaluation of Financial Performances

5.1. A Preliminary Analysis of Mutual Funds Performance

5.2. Revisiting the Performance of Socially Responsible Mutual Funds

5.2.1. Method

5.2.2. Empirical Results

5.2.3. Robustness Checks

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| SRI | Socially Responsible Investment |

| ESG | Environmental, Social and corporate Governance |

Appendix A. Description of Morningstar Sustainability Rating

Appendix B. Description of MSCI ESG Fund Metrics

Appendix C. Panel Version of Carhart’s Model with Dummy De Jure (Labels)

| Europe | ||

|---|---|---|

| Estimates | ||

| −0.0027 | 0.0067 | |

| 0.9765 *** | 0.0192 | |

| 0.1754 *** | 0.0492 | |

| −0.0170 | 0.0234 | |

| 0.0045 | 0.0250 | |

| 0.0012 | 0.0068 | |

| 0.7668 | ||

| Fixed Effects: | ||

| Fund | Yes | |

| Time | Yes | |

| Obs | 40,602 | |

Appendix D. Survivor Bias

| 1 | The use of the Morningstar Sustainability Rating and MSCI ESG Fund Metrics databases is a novelty in the literature. To the best of our knowledge, only Hartzmark and Sussman (2019) use fund-level data from Morningstar, showing that investors widely refer to Morningstar Sustainability Rating. However, they are working with pre-categorization SRI ratings (called “globes”), whereas we instead consider continuous ratings (underlying these “globes”). Our choice is motivated by the desire of avoiding potential nonlinear effects in the model. If MSCI ESG Research and MSCI ESG KLD STATS are widely used firm-level databases in the literature (e.g., El Ghoul and Karoui (2017)), the introduction and use of MSCI ESG Fund Metrics is an innovation. Compared to other data providers, Morningstar and MSCI are the only ones that provide fund-level and historical SRI and ESG scores. |

| 2 | A description of the rating methodology developed by Morningstar is presented in Appendix A. |

| 3 | A description of the rating methodology developed by MSCI is presented in Appendix B. |

| 4 | Terminology available at https://www.ussif.org/sribasics—accessed on 4 November 2021. |

| 5 | See Princeton University “About WordNet.” WordNet. Princeton University. 2010. |

| 6 | |

| 7 | When considering the management fees of the mutual funds, we do not observe significant differences across categories. Instead, mutual funds holding a sustainable fund label are associated with significantly higher management fees, suggesting that asset managers charge investors for the certification by non-financial rating agencies. Considering our data sample, we find that mutual funds holding the Novethic label are associated with fees being on average 39.78% higher than the other socially responsible mutual funds. |

| 8 | |

| 9 | The overall () is the sum of the full-sample () and the specific to socially responsible funds () such that = . |

| 10 | The score ranges from 0, which means no controversy, to 5, which indicates high controversy. |

| 11 | We slightly modify the normalization of MSCI ESG score to scale the rating between 0 and 100 instead of 0 and 10 to make the interpretation of the coefficients easier. See Appendixes Appendix A and Appendix B. |

| 12 | http://www.sustainalytics.com—accessed on 4 November 2021. |

| 13 | |

| 14 | See Hanke et al. (2018) on the causes of the non-comparability of different databases such as CRSP and Morningstar. |

References

- Adrian, Tobias, and Markus K Brunnermeier. 2016. Covar. The American Economic Review 106: 1705. [Google Scholar] [CrossRef]

- Akerlof, George. 1970. The market for “lemons”: Quality uncertainty and the market mechanism. Quarterly Journal of Economics 84: 488–500. [Google Scholar] [CrossRef]

- Ando, Tomohiro, and Jushan Bai. 2015. Asset pricing with a general multifactor structure. Journal of Financial Econometrics 13: 556–604. [Google Scholar] [CrossRef]

- Argyropoulos, Christos, Bertrand Candelon, Jean-Baptiste Hasse, and Ekaterini Panopoulou. 2020. Toward a Macroprudential Regulatory Framework for Mutual Funds. Technical report. Louvain-La-Neuve: Université Catholique de Louvain, Louvain Finance (LFIN). [Google Scholar]

- Armstrong, Will J., Egemen Genc, and Marno Verbeek. 2019. Going for gold: An analysis of morningstar analyst ratings. Management Science 65: 2310–27. [Google Scholar]

- Bauer, Rob, Kees Koedijk, and Roger Otten. 2005. International evidence on ethical mutual fund performance and investment style. Journal of Banking & Finance 29: 1751–67. [Google Scholar]

- Berg, Florian, Julian F. Koelbel, and Roberto Rigobon. 2019. Aggregate confusion: The Divergence of ESG Ratings. Cambridge: MIT Sloan School of Management. [Google Scholar]

- Berrone, Pascual, Andrea Fosfuri, and Liliana Gelabert. 2017. Does greenwashing pay off? understanding the relationship between environmental actions and environmental legitimacy. Journal of Business Ethics 144: 363–79. [Google Scholar] [CrossRef]

- Blomquist, Johan, and Joakim Westerlund. 2013. Testing slope homogeneity in large panels with serial correlation. Economics Letters 121: 374–78. [Google Scholar] [CrossRef]

- Bollen, Nicolas P. B. 2007. Mutual fund attributes and investor behavior. Journal of Financial and Quantitative Analysis 42: 683–708. [Google Scholar] [CrossRef] [Green Version]

- Borgers, Arian, Jeroen Derwall, Kees Koedijk, and Jenke Ter Horst. 2015. Do social factors influence investment behavior and performance? evidence from mutual fund holdings. Journal of Banking & Finance 60: 112–26. [Google Scholar]

- Brown, Stephen J., and William Goetzmann. 1994. Attrition and mutual fund performance. Journal of Finance 49: 57–82. [Google Scholar]

- Brown, Stephen J., William Goetzmann, Roger G. Ibbotson, and Stephen A. Ross. 1992. Survivorship bias in performance studies. The Review of Financial Studies 5: 553–80. [Google Scholar] [CrossRef] [Green Version]

- Carhart, Mark M. 1997. On persistence in mutual fund performance. The Journal of Finance 52: 57–82. [Google Scholar] [CrossRef]

- Cooper, Michael J., Huseyin Gulen, and P. Raghavendra Rau. 2005. Changing names with style: Mutual fund name changes and their effects on fund flows. The Journal of Finance 60: 2825–58. [Google Scholar] [CrossRef] [Green Version]

- Driscoll, John C., and Aart C. Kraay. 1998. Consistent covariance matrix estimation with spatially dependent panel data. Review of Economics and Statistics 80: 549–60. [Google Scholar] [CrossRef]

- El Ghoul, Sadok, and Aymen Karoui. 2017. Does corporate social responsibility affect mutual fund performance and flows? Journal of Banking & Finance 77: 53–63. [Google Scholar]

- El Ghoul, Sadok, and Aymen Karoui. 2020. Fund names vs. family names: Implications for mutual fund flows. Family Names: Implications for Mutual Fund Flows, April 7. [Google Scholar]

- El Ghoul, Sadok, and Aymen Karoui. 2021. What’s in a (green) name? the consequences of greening fund names on fund flows, turnover, and performance. Finance Research Letters 39: 101620. [Google Scholar] [CrossRef]

- Ellison, Glenn, and Sara Fisher Ellison. 2009. Search, obfuscation, and price elasticities on the internet. Econometrica 77: 427–52. [Google Scholar]

- Elton, Edwin J., Martin J. Gruber, and Christopher R. Blake. 1996. Survivor bias and mutual fund performance. The Review of Financial Studies 9: 1097–120. [Google Scholar] [CrossRef]

- Espenlaub, Susanne, Imtiaz ul Haq, and Arif Khurshed. 2017. It’s all in the name: Mutual fund name changes after sec rule 35d-1. Journal of Banking & Finance 84: 123–34. [Google Scholar]

- Fama, Eugene F., and Kenneth R. French. 1993. Common risk factors in the returns on stocks and bonds. Journal of Financial Economics 33: 3–56. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 2007. Disagreement, tastes, and asset prices. Journal of Financial Economics 83: 667–89. [Google Scholar] [CrossRef]

- Fellbaum, Christiane. 1998. A semantic network of english verbs. WordNet: An electronic Lexical Database 3: 153–78. [Google Scholar]

- Flammer, Caroline. 2021. Corporate green bonds. Journal of Financial Economics 142: 499–516. [Google Scholar] [CrossRef]

- Goldreyer, Elizabeth F., and J. David Diltz. 1999. The performance of socially responsible mutual funds: Incorporating sociopolitical information in portfolio selection. Managerial Finance 25: 23–36. [Google Scholar] [CrossRef]

- Green, T. Clifton, and Russell Jame. 2013. Company name fluency, investor recognition, and firm value. Journal of Financial Economics 109: 813–34. [Google Scholar] [CrossRef]

- Grinblatt, Mark, and Sheridan Titman. 1989. Mutual fund performance: An analysis of quarterly portfolio holdings. Journal of Business 62: 393–416. [Google Scholar] [CrossRef]

- Hamilton, Sally, Hoje Jo, and Meir Statman. 1993. Doing well while doing good? the investment performance of socially responsible mutual funds. Financial Analysts Journal 49: 62–66. [Google Scholar] [CrossRef]

- Hanke, Bernd, Aneel Keswani, Garrett Quigley, and Maxim Zagonov. 2018. Survivorship bias and comparability of uk open-ended fund databases. Economics Letters 172: 110–14. [Google Scholar] [CrossRef]

- Hansen, Bruce E. 2000. Sample splitting and threshold estimation. Econometrica 68: 575–603. [Google Scholar] [CrossRef] [Green Version]

- Hartzmark, Samuel M., and Abigail B. Sussman. 2019. Do investors value sustainability? a natural experiment examining ranking and fund flows. The Journal of Finance 74: 2789–837. [Google Scholar] [CrossRef]

- Jacobs, Heiko, and Alexander Hillert. 2016. Alphabetic bias, investor recognition, and trading behavior. Review of Finance 20: 693–723. [Google Scholar] [CrossRef]

- Lyon, Thomas P., and John W. Maxwell. 2011. Greenwash: Corporate environmental disclosure under threat of audit. Journal of Economics & Management Strategy 20: 3–41. [Google Scholar]

- Lyon, Thomas P., and A. Wren Montgomery. 2015. The means and end of greenwash. Organization & Environment 28: 223–49. [Google Scholar]

- Malkiel, Burton G. 1995. Returns from investing in equity mutual funds 1971 to 1991. The Journal of Finance 50: 549–72. [Google Scholar] [CrossRef]

- Marquis, Christopher, Michael W. Toffel, and Yanhua Zhou. 2016. Scrutiny, norms, and selective disclosure: A global study of greenwashing. Organization Science 27: 483–504. [Google Scholar] [CrossRef]

- Miller, George A. 1995. Wordnet: A lexical database for english. Communications of the ACM 38: 39–41. [Google Scholar] [CrossRef]

- Nofsinger, John, and Abhishek Varma. 2014. Socially responsible funds and market crises. Journal of Banking & Finance 48: 180–93. [Google Scholar]

- Pesaran, M. Hashem, and Takashi Yamagata. 2008. Testing slope homogeneity in large panels. Journal of Econometrics 142: 50–93. [Google Scholar] [CrossRef] [Green Version]

- Petersen, Mitchell A. 2009. Estimating standard errors in finance panel data sets: Comparing approaches. The Review of Financial Studies 22: 435–80. [Google Scholar] [CrossRef] [Green Version]

- Renneboog, Luc, Jenke Ter Horst, and Chendi Zhang. 2008. The price of ethics and stakeholder governance: The performance of socially responsible mutual funds. Journal of Corporate Finance 14: 302–22. [Google Scholar] [CrossRef]

- Riley, John G. 1979. Informational equilibrium. Econometrica: Journal of the Econometric Society 47: 331–59. [Google Scholar] [CrossRef]

- Schwartz, Mark S. 2003. The “ethics” of ethical investing. Journal of Business Ethics 43: 195–213. [Google Scholar] [CrossRef]

- Schwert, G. William. 2003. Anomalies and market efficiency. Handbook of the Economics of Finance 1: 939–74. [Google Scholar]

- Spence, M. 1973. Job market signaling. The Quarterly Journal of Economics 87: 355–74. [Google Scholar] [CrossRef]

- Statman, Meir. 2000. Socially responsible mutual funds (corrected). Financial Analysts Journal 56: 30–39. [Google Scholar] [CrossRef]

- Statman, Meir, and Denys Glushkov. 2016. Classifying and measuring the performance of socially responsible mutual funds. The Journal of Portfolio Management 42: 140–51. [Google Scholar] [CrossRef]

| Nofsinger and Varma (2014) | Extended Dictionary |

|---|---|

| Baptist | Baptist |

| Christian | blue |

| environment | carbon |

| ethical | Catholic |

| ethics | Christian |

| faith | climate |

| green | community |

| Islam | durable |

| Lutheran | environment |

| religion | ESG |

| Social | ethical |

| socially | faith |

| sustainable | governance |

| sustainability | green |

| human rights | |

| impact | |

| Islam | |

| Lutheran | |

| mission | |

| moral | |

| peace | |

| philosophy | |

| religion | |

| responsible | |

| social | |

| solidarity | |

| subsidiarity | |

| sustainable | |

| sustainability | |

| values |

| Europe | |||

|---|---|---|---|

| Conventional funds | de jure SR funds | Total | |

| Number | 554 | 52 | 606 |

| 55.18 | 57.61 | 55.39 | |

| 1.996 | 1.953 | 2.103 | |

| The United States | |||

| Conventional funds | de jure SR funds | Total | |

| Number | 862 | 25 | 887 |

| 45.85 | 48.19 | 45.92 | |

| 1.725 | 1.500 | 1.761 | |

| Europe | ||

|---|---|---|

| Conventional Real. | Ethical Real. | |

| Conventional Obj. | A n = 276 (49.82%) | B n = 278 (50.18%) |

| Ethical Obj. | C n = 23 (44.23%) | D n = 29 (55.77%) |

| The United States | ||

| Conventional Real. | Ethical Real. | |

| Conventional Obj. | A n = 510 (59.16%) | B n = 352 (40.84%) |

| Ethical Obj. | C n = 9 (36.00%) | D n = 16 (64.00%) |

| Europe | ||||

|---|---|---|---|---|

| AB | CD | AC | BD | |

| Fund Return () | ||||

| Fund Risk () | ||||

| Sharpe () | 0.615 | 0.713 | 0.641 | 0.606 |

| The United States | ||||

| AB | CD | AC | BD | |

| Fund Return () | ||||

| Fund Risk () | ||||

| Sharpe () | 1.285 | 1.310 | 1.309 | 1.251 |

| Europe | US | |||

|---|---|---|---|---|

| Estimates | Estimates | |||

| −0.0018 | 0.0135 | −0.0017 | 0.0011 | |

| 0.980 3 *** | 0.0185 | 1.0068 *** | 0.0084 | |

| 0.1996 *** | 0.0465 | 0.0711 *** | 0.0158 | |

| −0.0268 | 0.0215 | −0.0470 ** | 0.0210 | |

| 0.0031 | 0.0239 | 0.0207 | 0.0217 | |

| 0.7599 | 0.8466 | |||

| Fixed Effects: | ||||

| Fund | Yes | Yes | ||

| Time | Yes | Yes | ||

| Obs | 40,602 | 59,429 | ||

| Europe | US | |||

|---|---|---|---|---|

| Estimates | Estimates | |||

| −0.0018 | 0.0069 | −0.0017 | 0.0010 | |

| 0.9803 *** | 0.0185 | 1.0068 *** | 0.0084 | |

| 0.1996 *** | 0.0465 | 0.0711 *** | 0.0158 | |

| −0.0268 | 0.0215 | −0.0470 ** | 0.0210 | |

| 0.0031 | 0.0239 | 0.0207 | 0.0217 | |

| 0.0011 | 0.0073 | 0.0041 | 0.0020 | |

| 0.7545 | 0.8464 | |||

| Fixed Effects: | ||||

| Fund | Yes | Yes | ||

| Time | Yes | Yes | ||

| Obs | 40,602 | 59,429 | ||

| Europe | US | |||

|---|---|---|---|---|

| Estimates | Estimates | |||

| Full Sample | ||||

| 0.0088 ** | 0.0035 | 0.0094 *** | 0.0028 | |

| 0.9638 *** | 0.0178 | 1.0218 *** | 0.0141 | |

| 0.1136 *** | 0.0312 | 0.0896 *** | 0.0259 | |

| −0.0953 *** | 0.0315 | −0.0361 | 0.0271 | |

| −0.0192 | 0.0145 | −0.0006 | 0.0140 | |

| de jure Socially Responsible Mutual Funds | ||||

| −0.0013 *** | 0.0003 | −0.0004 * | 0.0003 | |

| 0.0181 | 0.0175 | −0.0154 | 0.0143 | |

| 0.0940 *** | 0.0336 | −0.0190 | 0.0261 | |

| 0.0750 ** | 0.0345 | −0.0112 | 0.0283 | |

| 0.0244 | 0.0188 | 0.0219 * | 0.0116 | |

| de facto SRI Score | ||||

| −0.0118 ** | 0.0000 | −0.0170 *** | 0.0000 | |

| 0.7528 | 0.8418 | |||

| Fixed Effects: | ||||

| Fund | Yes | Yes | ||

| Time | Yes | Yes | ||

| Obs | 40,602 | 59,429 | ||

| Europe | US | |||

|---|---|---|---|---|

| Estimates | Estimates | |||

| Full Sample | ||||

| 0.0129 | 0.0127 | 0.0266 | 0.0275 | |

| 0.8951 *** | 0.0316 | 0.9625 *** | 0.0121 | |

| −0.0549 | 0.0607 | −0.0243 | 0.0244 | |

| −0.1095 ** | 0.0165 | −0.0696 | 0.0759 | |

| 0.1086 *** | 0.0368 | −0.0152 | 0.0608 | |

| de jure Socially Responsible Mutual Funds | ||||

| −0.0007 | 0.0007 | −0.0014 | 0.0011 | |

| 0.0367 | 0.0240 | 0.0066 | 0.0088 | |

| 0.1379 *** | 0.0277 | −0.0123 | 0.0119 | |

| 0.0727 ** | 0.0287 | 0.0943 | 0.0720 | |

| 0.0463 * | 0.0229 | 0.1012 | 0.0501 | |

| de facto SRI Score | ||||

| −0.0213 *** | 0.0001 | −0.0524 ** | 0.0001 | |

| 0.7566 | 0.8381 | |||

| Fixed Effects: | ||||

| Fund | Yes | Yes | ||

| Time | Yes | Yes | ||

| Obs | 7,878 | 11,531 | ||

| Europe | US | |||

|---|---|---|---|---|

| Estimates | Estimates | |||

| Full Sample | ||||

| 0.0118 | 0.0145 | 0.0071 | 0.0065 | |

| 0.9083 *** | 0.0326 | 0.9277 *** | 0.0331 | |

| −0.0496 | 0.0620 | 0.0100 | 0.0394 | |

| −0.0989 *** | 0.0172 | −0.0358 | 0.0580 | |

| 0.1085 *** | 0.0381 | −0.0271 | 0.0357 | |

| de jure Socially Responsible Mutual Funds | ||||

| −0.0006 | 0.0007 | −0.0003 | 0.0008 | |

| 0.0174 | 0.0221 | 0.0127 | 0.0340 | |

| 0.1348 *** | 0.0293 | −0.0140 | 0.0415 | |

| 0.0659 ** | 0.0281 | 0.0876 | 0.0607 | |

| 0.0496 * | 0.0231 | 0.0986 | 0.0385 | |

| de facto SRI Score | ||||

| −0.0196 *** | 0.0001 | −0.0154 *** | 0.0001 | |

| 0.7515 | 0.7980 | |||

| Fixed Effects: | ||||

| Fund | Yes | Yes | ||

| Time | Yes | Yes | ||

| Obs | 7,878 | 11,531 | ||

| Europe | US | |||

|---|---|---|---|---|

| Estimates | Estimates | |||

| Full Sample | ||||

| 0.0121 *** | 0.0004 | 0.0083 *** | 0.0020 | |

| 0.9638 *** | 0.0178 | 1.0218 *** | 0.0141 | |

| 0.1136 *** | 0.0312 | 0.0896 *** | 0.0267 | |

| −0.0953 *** | 0.0315 | −0.0361 | 0.0297 | |

| −0.0192 | 0.0145 | −0.0007 | 0.0119 | |

| de jure Socially Responsible Mutual Funds | ||||

| −0.0012 *** | 0.0003 | −0.0002 | 0.0002 | |

| 0.0181 | 0.0175 | −0.0154 | 0.0144 | |

| 0.0940 *** | 0.0336 | −0.0190 | 0.0261 | |

| 0.0750 ** | 0.0345 | −0.0112 | 0.0283 | |

| 0.0244 | 0.0188 | 0.0220 * | 0.0116 | |

| de facto SRI Score | ||||

| −0.0139 *** | 0.0001 | 0.0000 | 0.0000 | |

| −0.0215 *** | 0.0001 | −0.0130 *** | 0.0000 | |

| 0.7527 | 0.8416 | |||

| Fixed Effects: | ||||

| Fund | Yes | Yes | ||

| Time | Yes | Yes | ||

| Obs | 40,602 | 59,429 | ||

| Europe | US | |||||||

|---|---|---|---|---|---|---|---|---|

| Morningstar | MSCI | Morningstar | MSCI | |||||

| Estimates | Estimates | Estimates | Estimates | |||||

| Full Sample | ||||||||

| 0.0240 *** | 0.0043 | 0.0096 *** | 0.0019 | 0.0549 ** | 0.0239 | 0.0079** | 0.0036 | |

| 0.9859 *** | 0.0052 | 0.9859 *** | 0.0052 | 1.0127 *** | 0.0043 | 1.0127 *** | 0.0043 | |

| 0.1327 *** | 0.0219 | 0.1327 *** | 0.0219 | 0.0799 *** | 0.011 | 0.0799 *** | 0.0110 | |

| −0.1067 *** | 0.0218 | −0.1067 *** | 0.0218 | −0.0541 *** | 0.0138 | −0.0541 *** | 0.0138 | |

| −0.0381 *** | 0.0087 | −0.0381 *** | 0.0087 | 0.0196 | 0.0142 | 0.0196 | 0.0142 | |

| de jure Socially Responsible Mutual Funds | ||||||||

| −0.0022 *** | 0.0008 | −0.0043 *** | 0.0012 | −0.0010 | 0.0008 | −0.0047 *** | 0.0015 | |

| 0.0108 *** | 0.0037 | 0.0108 *** | 0.0037 | −0.0043 * | 0.0024 | −0.0043 * | 0.0024 | |

| 0.0599 *** | 0.0145 | 0.0599 *** | 0.0145 | −0.0095 ** | 0.0047 | −0.0095 ** | 0.0047 | |

| 0.0287 *** | 0.0084 | 0.0287 *** | 0.0084 | −0.0073 | 0.0101 | −0.0073 | 0.0101 | |

| 0.0554 *** | 0.0053 | 0.0554 *** | 0.0053 | 0.0073 * | 0.0042 | 0.0073 * | 0.0042 | |

| de facto SRI Score | ||||||||

| −0.0340 *** | 0.0062 | −0.0104 *** | 0.0020 | −0.0993 ** | 0.0442 | −0.0089 * | 0.0053 | |

| 0.7569 | 0.7569 | 0.8478 | 0.8478 | |||||

| Fixed Effects: | ||||||||

| Fund | Yes | Yes | Yes | Yes | ||||

| Time | Yes | Yes | Yes | Yes | ||||

| Obs | 14,606 | 14,606 | 42,478 | 42,478 | ||||

| Europe | US | |||

|---|---|---|---|---|

| Estimates | Estimates | |||

| Full Sample | ||||

| 0.0088 *** | 0.0024 | 0.0094 *** | 0.0020 | |

| 0.9638 *** | 0.0103 | 1.0218 *** | 0.0088 | |

| 0.1136 *** | 0.0215 | 0.0896 *** | 0.0129 | |

| −0.0953 *** | 0.0145 | −0.0361 | 0.0144 | |

| −0.0192 | 0.0147 | −0.0006 | 0.0122 | |

| de jure Socially Responsible Mutual Funds | ||||

| −0.0013 *** | 0.0003 | −0.0004 * | 0.0002 | |

| 0.0181 * | 0.0108 | −0.0154 * | 0.0090 | |

| 0.0940 *** | 0.0256 | −0.0190 | 0.0132 | |

| 0.0750 ** | 0.0152 | −0.0112 | 0.0149 | |

| 0.0244 | 0.0154 | 0.0219 * | 0.0126 | |

| de facto SRI Score | ||||

| −0.0118 *** | 0.0000 | −0.0170 *** | 0.0000 | |

| 1.43 *** | 3.91 *** | |||

| Fixed Effects: | ||||

| Fund | Yes | Yes | ||

| Time | Yes | Yes | ||

| Obs | 40,602 | 59,429 | ||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Candelon, B.; Hasse, J.-B.; Lajaunie, Q. ESG-Washing in the Mutual Funds Industry? From Information Asymmetry to Regulation. Risks 2021, 9, 199. https://doi.org/10.3390/risks9110199

Candelon B, Hasse J-B, Lajaunie Q. ESG-Washing in the Mutual Funds Industry? From Information Asymmetry to Regulation. Risks. 2021; 9(11):199. https://doi.org/10.3390/risks9110199

Chicago/Turabian StyleCandelon, Bertrand, Jean-Baptiste Hasse, and Quentin Lajaunie. 2021. "ESG-Washing in the Mutual Funds Industry? From Information Asymmetry to Regulation" Risks 9, no. 11: 199. https://doi.org/10.3390/risks9110199

APA StyleCandelon, B., Hasse, J.-B., & Lajaunie, Q. (2021). ESG-Washing in the Mutual Funds Industry? From Information Asymmetry to Regulation. Risks, 9(11), 199. https://doi.org/10.3390/risks9110199