1. Introduction

The domain of fiscal responsibility is not only an area of profound lack in terms of positive experiences regarding the accountability of policymakers’ decisions but also a field for experiencing the new public management style and the design of mechanisms for coordinating fiscal policy in the European Union (EU) and the entire world. Based on governments’ behavior from the last years, the search for mechanisms to escape from fiscal populism has intensified. This is a strategy usually used for winning elections or retaining public office and a mechanism built to strengthen a new framework to maintain the sustainability of public finances. Implicitly, this activity leads to the enforcement of fiscal responsibility laws (FRL) legislation. The first objective of our paper is to identify a possible statute of FRLs at the EU level, by analyzing the existent legal framework, recent modification, and existing correlation with the public finance sustainability. Secondly, we are interested in identifying the evolution of adopted fiscal rules, analyzing countries that have implemented particular fiscal rules during the last 15 years and comparing their legal framework with respect to the recommendation of the Fiscal Councils.

For analyzing the implication of legislative framework and the implementation of responsible fiscal policy in the contemporary period, the use of instruments such as budgetary procedures (legislative fiscal rules), fiscal rules (numerical), and independent fiscal institutions (fiscal councils) is required. Fiscal-budgetary responsibility implies that a government is pursuing an appropriate level of government spending and taxes with direct implications on the sustainability of the public finances, maintaining adequate levels of public investment and ensuring an optimal economic growth rate.

The search for an efficient fiscal regime, capable of improving the status of public finance and to enhance fiscal credibility, implies concrete actions from governments, not only a hope that simple fiscal rules will solve the problems. The EU fiscal challenges established based on the Stability and Growth Pact (SGP), with the agreement among Member States that requires them to ensure that the budget deficit does not exceed 3% of Gross Domestic Product (GDP) and that public debt does not exceed 60% of GDP, proved to be incapable to assure the surveillance of fiscal framework and concrete responsible policymakers. Moreover, even if the Maastricht Treaty affirms that a successful European Monetary Union requires sustainable public finances, a concrete definition of sustainability is not fully consolidated, neither referring to fiscal rules or institutional mechanisms. However, the economists generally approach the same terms for defining the concept of public finance sustainability, highlighting the nature of budgetary constraints to ensure that Member States do not breach double standards of the abovementioned deficit criteria. The main purpose of this regulation is to contribute to the sustainability of public finances, to lay the basis of what fiscal governance and fiscal institutions means, to give them permission to act in order to empower the decisions policymakers and to avoid both national and regional governments irresponsible fiscal behavior.

Therefore, the usefulness of consolidation of fiscal discipline is invoked in the process of managing the public finances and the related institutional mechanisms, with the aim of increasing the transparency in the management of financial resources and assuring the correction of the public deficit and debt. The quintessence of “fiscal and budgetary responsibility” lays around the research on the transparency and accountability of long- and medium-term budgetary objectives but also in the efficiency provided by the well-defined legal framework. This need for accountability was felt during the economic crisis, which has made the issues that were previously incorporated into ordinary law to migrate to the constitutional level of regulation, eventually generating implications for international organizations’ activity.

The purpose of this paper is to approach the literature which addresses the topics of fiscal responsibility laws and challenges of Public Finance Sustainability in the EU, to retrospectively analyze the statute of fiscal responsibility legal framework at the EU level and its implications for challenges in public finance sustainability and to review the existing scientific evidence regarding European trends in fiscal governance. The methodological approach is based on the qualitative analysis of relevant documents from the topic of fiscal rules, following deductive and inductive reasoning. The research follows the qualitative sequential framework, involving empirical evidence aimed to provide coherence and validation in research design and follow as a first step, the theoretical validation regarding the importance of different types of fiscal rules. We continued with the empirical analysis of European fiscal responsibility, correlating the theoretical approach from the first stage with concrete actions revealed by the dataset and, after that, we gave an overview of the fiscal challenges facing EU governments, illustrating the score function of fiscal legal framework effectiveness (SFLFE), based on self-elaborated methodology, theoretically validated from the point of indicators used and their importance.

The remainder of the paper is organized as follows:

Section 2 summarizes representative existing studies providing the theoretical background of the fiscal responsibility legal framework, public finances sustainability and related institutional framework.

Section 3 describes the materials and methods; it presents the research design with respect to the qualitative sequential framework and review country practices, with respect to fiscal responsibility laws.

Section 4 summarizes the results of the study conducted on the EU-28, over the period 2000–2015 and

Section 5 compares the observations of other authors, relate practical implications of study results. Finally, according to the results, this paper ends with conclusions and references.

2. Literature Review

The recent literature defines fiscal responsibility by addressing those rules, regulations and procedures that influence the way budgetary policy is planned, approved, conducted and monitored, setting out three defining components with long-term impact: numerical fiscal rules; independent fiscal institutions and medium-term budgetary frameworks (

Cavallo et al. 2018). In line with this opinion,

Evangelopoulos (

2018) highlights that the main objective of fiscal responsibility should be to achieve sound budgetary positions, by removing the tendency to adopt unsustainable fiscal policies, leading to high deficits and debt growth, taking into account some mechanisms to reduce the pro-cyclicality of fiscal policies and to improve the efficiency of public spending. Explaining the same point of view,

Hallerberg et al. (

2009) analyzed the efforts to achieve the stability of public finances and described how to coordinate fiscal policy with the concept of fiscal governance and its theoretical and practical aspects. They concluded on the similar linkages between government decisions and fiscal governance frameworks.

Based on economic and moral rationale, fiscal responsibility coordinates raised in every corporation and imposed the need to perform well also from financial point of view; due to globalization and under the requirement of “optimization for fiscal authorities”, the implication of the legislative gap is revealed, allowing for example the use of bankruptcy as a strategy to limit the liability resulting from court-imposed penalties (

Rahman et al. 2017). According to

Rahman et al. (

2017), business environment and enterprise performance seem to play an important role in consolidating public finance sustainability; as economic efficiency refers to public and private sector efficiency, the authors suggest that policymakers may consider implementing policies that can promote bank competition and in line with this point of view;

Musa et al. (

2020) indicate that economic efficiency may be related to risk management and control of the banking operations. In other words, the public and private financial responsibility follows a similar context and depends on implemented policies. The research of

Prędkiewicz et al. (

2019) reveals that the structure of financing (public versus private spending) can directly affect the status of economic efficiency, but given that public finance sustainability requires the ability of the government to sustain its current spending in the long run, without threatening the government’s solvency, public spending requires legal mechanisms capable of controlling unsustainable fiscal policy.

Research results on federal government sample, such those of

Mattson and Pjesky (

2019), find that fiscal policy aligns with what the Deficit Rule predicts and contrary to this point of view

Heinemann et al. (

2018) highlight that the budgetary impact of numerical fiscal rules depends on their potential endogeneity. The endogeneity problems seem to be identified previously since, besides the potential fiscal conservatism of each country, some papers signalized the importance to create independent fiscal institutions capable of enhancing fiscal responsibility and fiscal governance overall (see

Adam 2015). It is considered in this case that the outcome of fiscal policy is primarily a high degree of tax discipline, regardless of the electoral cycle or economic fluctuations. Such discipline prevents, for example, an increase in public spending during the recession, leading to expansive (pro-cyclical) operations, which in turn can increase the deficit and may damage the structure of expenditure (

Gajewski and Skiba 2010).

In line with the difficulty to assure public finances sustainability in EU Member States, some papers highlight that it has been amplified not only by global financial crisis started in 2008, but also by the problems raised in the context of aging of the European population (

Pammolli et al. 2012;

Harper 2014). Additionally, the economist

Rajan (

2016) invokes the opinion that governments’ activities throughout the route to proper risk management are analyzed for the implication of untreated hidden fractures on the global economy. According to a study of

Lienert (

2010), the legislation and the rules in the area of fiscal responsibility are good tools to respond to the pro-cyclical actions of politicians, the legislative framework in this area is defined most often in the literature as an institutional arrangement in support of government actions to achieve responsible, sustainable and transparent fiscal policy. On the other hand, given the fact that accountability and transparency are two of the principles analyzed in the concept of good governance,

Wilkin (

2011) pointed that the determinants of good governance are the democratic state, subject to the rule of law, accountability, effectiveness, transparency, efficiency, participation and social inclusion. Accordingly, even if the evolution of legal framework in the field of fiscal responsibility and its implication on the sustainability of public finances in the EU has increased the interests of researchers, academics and policymakers, the literature is still inconclusive, approaching various methodologies to prove either the lax implementation of fiscal rules or their disciplinary effect has possible positive implications. In this context, a recent study of

Dziemianowicz and Kargol-Wasiluk (

2015) analyses the fiscal responsibility laws in EU countries and their influence on the sustainability of public finances, highlighting the differences among EU Member States in institutional models, tasks and skills, quality and efficacy. A conclusion partially supported in some studies on the stability of public finances in the years preceding the crisis (2005–2007), argues that the instability of public finances in the EU is most likely due to institutional problems and the quality of the used tools, see

Afonso and Jalles (

2014),

Krejdl (

2006),

Aristovnik and Berčič (

2007). Another similar study carried out before the global economic crisis (

Barnhill and Kopits 2003), highlights on the profile of the Latin American countries, where public finance sustainability plays a central role for the success in their stabilizing efforts.

Hagemann (

2011) found out that difficulties related to maintaining the EU fiscal coordination mechanisms are due to two important reasons. First, the difficulties are due to the short duration of being in force of the regulations introduced in 2011–2013. Second, he refers to the convergence criteria of the Maastricht Treaty and the Stability and Growth Pact regulations (1997, 2005). These rules were used before the accession of a country to the euro area and the application of sanctions for non-compliance with these rules has been de facto suspended due to conditions such as deteriorating the economic situation. In addition,

Dziemianowicz and Kargol-Wasiluk (

2015), synthesized their comprehensive overview on the topic of fiscal responsibility, from a legislative point of view, as “a level of tax policy coordination (national or local) which depends on geopolitical conditions of each EU Member State”. The need for defining the goals of the legislation on fiscal responsibility and financial sustainability and for identifying the causes of inconsistent actions by precise tax institutions in the EU Member States is emphasized. It is also noted that higher output losses and public debt increases during the financial turmoil have enhanced the need for a deeper analysis of the sustainability of public finances.

Mechler et al. (

2016) highlight that the solvency and liquidity criteria used in debt assessment have to be taking into account and the research continues with the major challenges of fiscal sustainability, fiscal context, and the importance of creating independent tax institutions, in accordance with the Fiscal Responsibility Act and supplemented by tax rules and better fiscal risk management.

According to

Hughes Hallett and Jensen (

2016),

Rieck and Schuknecht (

2016), the most well-known European tax rules, as they are included in the EU’s Stability and Growth Pact, have not adequately promoted sustainable public finances before the global financial crisis. However, it is not clear whether fiscal rules promoted in EU could impose a higher fiscal discipline than supranational SGP rules, it is certain that several European countries have appreciated that national tax rules are useful for achieving greater budgetary discipline. On the other hand, some authors found evidence that sustainable public finances in Europe can be associated with strong fiscal rules (

Asatryan et al. 2018;

Burret and Feld 2018;

Bergman et al. 2016;

Debrun and Kinda 2016;

Foremny 2014;

Afonso and Jalles 2013;

Dahan and Strawczynski 2013;

Blöchliger 2012;

Holm-Hadulla et al. 2012). Moreover,

Bergman et al. (

2016) highlight that in order to show the effects of legislative permutations on the sustainability of public finances and to determine to what extent these reforms lead to more efficient management, intergenerational engagement or consolidation of bills for future generations, it is necessary to measure not only the correlation between the rule and sustainability but also the relationship: indebted—legal restrictive framework—independent tax institutions. These opinions are supported also by

Sacchi and Salotti (

2015),

Iara and Wolff (

2014),

Mihaela et al. (

2020) who relate strong fiscal rules to lower risk rates of national debt and stabilization of the output of discretionary fiscal policy.

The entire theoretical background signals that it is improper to generalize the relationship between fiscal responsibility legal framework and challenges in public finance sustainability, especially considering the current economic context and the status of fiscal consolidation process at the European level. The interaction of national fiscal rules with the wider governmental institutional arrangements has not been fully addressed. The fiscal rules and their approach in various forms or in different combinations are not similar for all the countries and for the same country are different over time; they are related to the specificity of each country and in relationship with fiscal conservatism principles. According to

Schaechter et al. (

2012), they are based on the characteristics specific to the types of fiscal constraints. Finally, the rationale is in line with

Foremny (

2014) point of view, which suggests that fiscal rules do not completely eliminate deficit-related prejudices, unless combined with internal fiscal institution that allows pre-employment of productive public spending. The author highlights that there are important dissimilarities in public finance performance even between countries with similar economic conditions and find that may be attributed to policy mechanisms and institutional framework.

3. Materials and Methods

3.1. Research Design

As the paper aims at studying the legal aspects of EU fiscal policy, by analyzing the statute of fiscal responsibility legal framework with respect to different measures imposed in the last years by EU fiscal governance, we first approach the literature which addresses the topics of fiscal responsibility laws and challenges of Public Finance Sustainability in the EU and we have done our analyses by identifying the key definitions, concepts, advantages and disadvantages of each of the topics. The methodological approach is based on qualitative analysis of relevant documents from the topic of fiscal rules, following the deductive and inductive reasoning. We synthesized some of the key points of view and results found in the literature, presenting the statute of FRLs at the EU level and its implications for challenges of public finance sustainability. The research follows the qualitative sequential framework, involving empirical evidence aimed to provide coherence and validation in research design. Therefore, to retrospective analyze the statute of fiscal responsibility legal framework at the EU level and to reveal the different measures undertaken in the last years, we computed the score function of fiscal legal framework effectiveness (SFLFE), by following some important steps:

- Stage I.

Content analysis of existing literature on the topic of fiscal responsibility legal framework, theoretical validation regarding the importance of different types of fiscal rules.

- Stage II.

Empirical Analysis of European fiscal responsibility legal framework for the period 2000–2015 on the profile of fiscal rules and until 2017 on fiscal institutions’ background. Correlate the theoretical approach from the first stage with concrete actions revealed by the dataset.

- Stage III.

Computing the score function of fiscal legal framework effectiveness based on self-elaborated methodology, theoretically validated from the point of indicators used and their importance.

3.2. Fiscal Responsibility Laws—A New Paradigm for Fiscal Sustainability

It is well known that eligibility of each member country for the European Monetary Union is to be assessed, according to art. 109j of the Maastricht Treaty, based on some criteria such as a degree of price stability, sustainability of its public finance position, observance of fluctuations margins provided by the exchange-rate mechanism of EU monetary system and the changes in long-term interest rates. Although EU countries largely respected the first three criteria, with the exception of the case of Greece, the issue of public finance sustainability is somewhat incompletely highlighted in the Treaty and there is not an explicit reference to any accepted notion of public finance “sustainability”. It is simply stipulated in the Annex Protocol that there are two “reference values”: a public deficit/GDP ratio of 3% and a public debt/GDP ratio of 60%.

The European Commission’s 2016 Report on fiscal governance in the EU, shows that it includes numerical fiscal rules (balance, debt, expenditure, income), independent tax institutions and a medium-term budgetary framework (budgetary planning)—the so-called legislative rules. Considering this regulatory framework for fiscal responsibility at EU level, we are simultaneously talking about the Fiscal Responsibility Laws and other instruments that reinforce the whole legislative framework in this field. Thus, the EU launched in 2011 the so-called “Six Pack” and in 2013 the so-called “Two Pack”. The purpose of both these legislative acts is to maintain fiscal discipline. The “Six Pack” includes five regulations and a directive (hence the“Six Pack” or 85/2012”) aimed at introducing more robust macroeconomic surveillance. The “Two Pack” includes two regulations that aim to strengthen this oversight. In addition, in 2013, still for maintaining fiscal discipline, the European Union has continued this line of action and has signed the EU fiscal pact, for implementing budgetary discipline and preventing euro area countries from experiencing excessive deficits. At the same time, the Fiscal Pact (Treaty on Stability, Coordination, and Governance) was launched and it entered into force in January 2013 for all the 25 signatory countries. These regulations complement the previous solutions included in the Maastricht Treaty (1997) and in the Stability and Growth Pact (2005), namely the convergence criteria.

Taking into consideration the overall picture of fiscal responsibility regulation at EU level, a short history of EU Fiscal Policy Regulations includes in 1992 the principle from Treaty of Maastricht, which establishes rules for adopting the euro; deficit thresholds (3% of GDP) and government debt limits (60% of GDP). In 1997, Stability and Growth Pact (SGP) which have as legislative base the Treaty on the Functioning of the European Union, Articles 121 (preventive arm) and 126 (corrective arm) establish limits for deficit and debt, those set by the Maastricht Treaty. The first SGP revision considers the special economic conditions and country-specific attributes in line with changes on both the preventive and the corrective side. The second one is entitled“Six Pack” and includes Six Legislative Package on Economic Governance. The EU fiscal responsibility regulation continued to develop and in 2013, according to Treaty on Stability, Coordination and Governance within Economic and Monetary Union (TSCG), also known as the Fiscal Compact, it is required to respect the convergence towards the medium-term budgetary objectives (MTOs) specific to each country with a deficit limit structurally less than 0.5% of GDP, i.e., 1% for the Member States with a significant public debt below 60% of GDP. In the same year (2013) through Two Packs on Economic Governance appear a set of rules applied only to euro area countries and established economic coordination and new monitoring tools. Finally, apart from the European Semester, in 2015, new flexibility for the SGP is emphasized and is was established how the rules will apply to link structural reforms, investments and accountability tax.

The overall picture indicates that fiscal responsibility legal framework involves a tool for empowering policymakers with appropriate competences to protect fiscal responsibility, respecting transparency, accountability for decision making and stability, strengthening the importance of medium- and long-term budget planning, and driving decision makers’ “actions to global macroeconomic stability”. In other words, three important dimensions are considered in present regulation: Responsibility, Transparency and Stability. At the same time, we agree with

Herzog (

2016),

Kantorowicz (

2014),

Brzozowski and Siwińska-Gorzelak (

2010),

Crawford (

2007), who suggest that the lack of administrative capacity and political costs most often incite to breaking rules and compute the image of unsustainable public finances with specific intergenerational costs.

As far as Fiscal Responsibility Law contains constraints with direct implications on the management of finances and impact sustainability of public finances, to demonstrate the feasibility of the fiscal responsibility legal framework, we analyze the specificity of EU fiscal rules. According to the Organisation for Economic Co-operation and Development OECD, a fiscal responsibility law includes a set of rules, detailed procedures and budgetary principles that include elements such as accountability, transparency, and stability. In other words, a law (or part of a law) that aims to improve fiscal discipline by requiring governments to be a part of, and engage in, a proper fiscal policy strategy. In the same context, the fiscal budgetary strategy approach and, implicitly, the interference of fiscal responsibility with the achievement of the objectives of these strategies make possible the establishment of judiciary settlements that would meet the requirements for consolidation of pros and cons of legislative amendments in the field of fiscal responsibility. Referring to the international context,

Pollitt and Bouckaert (

2017), synthesize that four main features delineate fiscal responsibility, specifying the medium-term path of the fiscal year. First, we find medium- and long-term descriptions of the annual budget strategy and how to achieve the objectives. Second, regularly publishing reports (at least twice a year), in accordance with the tax targets and benchmarks set. Third, it is highlighted the requirement to auditing annual financial statements and to ensure the integrity of tax information. Finally, it is necessary to establish clear, transparent tax rules in line with economic reality. However, to establish the effectiveness of fiscal rules, it is not simple and implies many problems related to political cost and institutional background.

Referring to the specific situation in the European context, we first analyze the existence of fiscal rules in place, the number of fiscal rules (NFRs) used by the EU Member States as fiscal devices since 2000, the legal basis and the main types of fiscal rules used (Balanced Budget—BBR, Debt rules—DR, Expenditure Rules—ER and Revenue Rules—RR). After we establish the status of fiscal rules in place (FRLST), the methodological approach continued with qualitative analysis and consolidate the output of fiscal legal framework effectiveness, by including in the score function (SFLFE) other three components: the quality of the judiciary, scope index of fiscal institutions and fiscal rules straight index, computed as follows:

where:

represents the importance related coefficient and it is validated by theoretical insights from the topic of fiscal responsibility legal framework;

represents the indicators of fiscal legal framework effectiveness and includes the status of fiscal rules in place (FRLST), the quality of judiciary (QJ), scope index of fiscal institutions (SIFI) and fiscal rules straight index (FRSI). All the components were standardized based on

Wasi and Flaaen (

2015) point of view.

The statute of fiscal rules in place (FRLST) is assessed based on theoretical insights which highlight that the importance and effectiveness of the fiscal rules in place is linked to type of fiscal rule and legal basis. A dataset for type of fiscal rule and legal basis was provided by International Monetary Fund and following

Anderson and Minarik (

2007); following

Lienert’s (

2010,

2013) points of view, we established a score for each category above mentioned. If we talk about the existence of fiscal rules in place (ERIP), a score of 0.25 points was established. If some of that rules are Debt rules or expenditure rules (DRER), based on importance, was established a score of 0.30 points. With respect to legal basis, Constitutional legal basis (LC) indicates a score of 0.5 points, International Treaty legal basis (LIT) indicates a score of 0.4 points, Common Law legal basis (LCL) 0.3 points, Coalition agreement (LCA) 0.2 points and political commitment (LPC) 0.1 points

The quality of the judiciary (QJ) it is provided by World Bank and World Economic Forum, comprise the implication of public decision makers on promoting sound public policies and represent an important component in assessing the output of fiscal legal framework effectiveness. According to insights from the literature, the background of public policies and the quality of judiciary is linked to institutional independence to verify the quality of fiscal rules framework and fiscal responsibility law is delegated to the judiciary system (see

Ter-Minassian 2007 and

Andreula et al. 2009).

Based on the rationale that most of the literature insights reveal that rules imposed by treaties and the entire fiscal responsibility legal framework are inefficient in absence of institutional mechanisms capable guarantee the effectiveness of rules and to responsible public decision makers—see

Bethlendi and Lentner (

2018),

Kantorowicz (

2014),

Farley et al. (

2013)—we include in our analysis the scope index of fiscal institutions. Scope index of fiscal institutions (SIFI) evaluates the degree of extension of fiscal institution responsibilities under the mandate and based on information reported by these institutions themselves; it is computed based on six components, namely, Tasks (TK): (1) control of conformity with fiscal rules; (2) macroeconomic forecasting; (3) budgetary forecasting and policy costing; (4) sustainability assessment; (5) promotion of fiscal transparency; and (6) normative recommendations regarding fiscal policy. SIFI computation as fiscal rule straight index (FRSI) is based on the follow methodology developed by the Directorate General for Economic and Financial Affairs:

where:

is index for institution n at year t,

comprise the task

completed by institution n at year t,

indicate the legal force coefficient for task TK at year t and

it is weight associated to task

(h denoting the type of weighted scheme).

4. Results

Given the fact that the current research seeks to strengthen the overall picture of the fiscal responsibility legal framework at the EU level, and to corroborate the implications for challenges in public finance sustainability, we have started from some basic ideas, precisely by setting up judgments to lay the foundations of the research object. The theoretical background discussed in the previous part appears to have characterized the evolution of FRL in the European Union as an alarming signal and a working hypothesis that is consistent with the objective of our research, namely the idea that the emphasis should be placed not only on the fiscal rules but also on the consolidation of the institutional and fiscal framework. Therefore, in this study, fiscal-budgetary responsibility legal framework has become an instrument to identify some weaknesses in the management of economic policies, capable of revealing fiscal sustainability challenges and to better evaluate the public debt threshold. Considering the events that have taken place in recent years, it is clear that the major challenges of the public finance sustainability consist of creating independent fiscal institutions, fiscal responsibility laws, fiscal rules and adequate management of fiscal risks.

Table 1 shows the countries that have implemented fiscal rules during the sample period 2000–2015, at least for one year. It is noted, on the one hand, that most countries have opted for expenditure rules while very few and quite diverse countries have adopted revenue rules because this type of rule is more difficult to monitor and enforce. With the primary objective of conferring credibility on fiscal policy, some countries are operating with more than one numerical rule, strengthening enforcement mechanisms. On the other hand, even if the European governance framework throughout the Maastricht Treaty and Stability and Growth Pact implications set the applicability of fiscal legislation at national and subnational level, some countries benefits came from fiscal liability legislation whose sanctions are of a reputable nature, others of an institutional nature, thus showing the multitude of approaches and benchmarks in consolidating the responsible and transparent financing desideratum. In practice, reducing public spending and government debt imply the assumption of political costs and the adoption of fiscal rules can be formal, with insufficient institutional background capable to limit the discretionary fiscal policy.

Due to political fragmentation in the budgetary process, expenditure rules seem to be approached by EU member states in order to control the degree of budgetary flexibility. However, the theoretical insights suggest that it is not enough to control the expenditure behavior, without setting limits in terms of debt thresholds, create a fiscal legal framework and independent fiscal institutions capable to assure the compliance with these rules. The mitigating effect of expenditure rules depends on rule design in terms of legal base, independent monitoring and of course, consequences for non-compliance—see, for instance,

Manescu and Bova (

2020),

Holm-Hadulla et al. (

2012), and

Hauptmeier et al. (

2011). The Roles of Independent Legislative Fiscal Institutions emerge in unique budgeting contexts, including as a ‘coordination mechanism’ within the broader fiscal sustainability architecture.

The implications of independent tax bodies at EU level are intended to reinforce fiscal rules that had proved inadequate on their own and to ensure prudent management of public finances. It is also necessary to note in our analysis that their status differs from one country to another and the positive implications for ensuring the sustainability of public finances largely depend on the nature of the Councils’ activity. Therefore, to create a clearer picture,

Table 2 shows the start of fiscal council activity in EU countries, deficit levels in 2017 and the years spent in excessive deficit procedure. We also highlight the evolution of scope index of fiscal institutions, which trend indicates oscillating data and problems regarding legislative harmonization and their principal common features at EU level.

Most of fiscal councils have the competence to monitor fiscal performance (by checking compliance with the fiscal rules, assessing the efficiency of taxation), to advise the government on fiscal policy matters (by relating long and medium term perspectives regarding fiscal policy) and also, to analyze the stage of the fiscal policy implementation, but ex post, fiscal responsibility legal framework cant penalize political strategies which most of the time, affect the sustainability of public finances.

Concerning the implications of the SGP, it is clear that the economic governance framework plays an extremely important role in improving the sustainability of public finances; but its laxity has diminished its potential positive effects, as EU Member States they were not stimulated to comply with the rules, if they involve internal political costs (as in the case of France, which spent 11 years in excessive deficit procedure) and a very important role in defining and implementing the rules of the political factors at national and European level (see

Table 2). On the other hand, even if the SGP changes were frequent and the legislation was often amended, this is unrecognized or rarely addressed in the literature, which could point out that the fiscal responsibility laws are the result of endless reforms.

First independent fiscal institutions date back to 1936 in Belgium, and later they were similar institutions established in the Netherlands (1945), Denmark (1962), Austria (1970). Based on the experience of these first IFIs, during the 1990s, both economists and academics have increasingly emphasized the idea that good practices developed by independent central banks should also be expanded in the fiscal-budgetary field. After the global financial crisis of 2008–2009, the number of such institutions almost increased tripled (from 10 at the end of 2006 to 37 at the end of 2015), the highest increase in the European Union. In the present, all EU member states had institutions set up independent tax authorities. This is happening against the background of fiscal-budgetary reforms that took place within the EU following the crisis. However, even if the EU governments approach the importance of fiscal institutions, as can be seen in

Table 2, the results for Deficit % GDP and the years spent in excessive deficit procedure, reveal the weakness of this institutions and validate the given name of “watchdog”, which can only provide information if the governments may be tempted to distort corrections or forecasts but not to eliminate or punish the political costs and unsustainable public finances. Undoubtedly, apart from the challenges that emerged out of the legislation in the field of fiscal responsibility and along with the itinerary of maintaining the fiscal discipline, and implicitly the sustainability of the public finances, a major challenge intervenes in regard to the management of fiscal risks. According to

Aliona et al. (

2009), fiscal risks are the most important instruments to manage macroeconomic shocks, being capable to improve economic efficiency and to reduce borrowing costs. Apart from the efficiency of non-profit entities, which is considered by

Grzegorz et al. (

2018) an essential component of general social policy, reduction-borrowing costs in public sector, imply legal requirements and fiscal mechanisms, capable to determine responsible decisions and to control the level of financial risk in an environment where entities are not focused on profit. Therefore, the fiscal rules’ philosophy, confronted with its own legitimacy, faced the main vulnerability of future sustainable public finance through the irresponsible decisions that aim at giving meaning to any economic turmoil, and any pro-cyclical position raised under the pressure of political costs.

To demonstrate the feasibility of the framework, based on qualitative research design, we assessed in

Table 3 the statute of fiscal rules in place (FRLST). We selected theoretical insights which highlight that the importance and effectiveness of fiscal rules in place is linked to the type of fiscal rule and legal basis and following Anderson and

Minarik’s (

2007),

Lienert’s (

2010,

2013), points of view, we established a score for each category involved. We first analyze the existence of fiscal rules in place, the number of fiscal rules (NFRs) used by the EU Member States as fiscal devices since 2000, the legal basis and the main types of fiscal rules used (Balanced Budget—BBR, Debt rules—DR, Expenditure Rules—ER and Revenue Rules—RR). Then, based on validation of the literature, we set a score for each category: If we talk about the existence of fiscal rules in place (ERIP), a score of 0.25 points was established. If some of that rules are debt rules or expenditure rules (DRER), based on importance, was established a score of 0.30 points. With respect to legal basis, Constitutional legal basis (LC) indicates a score of 0.5 points, International Treaty legal basis (LIT) indicates a score of 0.4 points, Common Law legal basis (LCL) 0.3 points, Coalition agreement (LCA) 0.2 points and political commitment (LPC) 0.1 points.

The merit behind this framework is to integrate the regulators’ system imposed by treaties at the EU level with the real status of fiscal accountability and with respect to certain legal requirements. The results displayed in

Table 3 suggests that most of EU countries show formal respect for EU governance framework and even if numerical fiscal rules impose respect for public finances in terms of public spending or debt limitations, in practice, the assumption of political costs and the adoption of fiscal rules can be formal, with insufficient institutional background capable to avoid formal enforcement mechanisms. Few countries recorded values ranging from 1.5 to 2.2 and most of them for a short period. For instance, based on type of fiscal rules in place, in 2000–2011 Greece has expenditure rule, revenue rules, budget rule and debt rule, with Common Law legal basis in case of expenditure and budget rule and with Constitutional legal basis in case of revenue rule, results are in line with the statute of fiscal rules in place (FRLST) methodology, can record a score of 2.2. Since during 2000 and 2008 the fiscal legal framework has the same characteristics, except the presence of legal basis for budget rule (BBR), value decrease with 0.3 points and record a FRLST score of 1.9. Nevertheless, Greece spent many years in excessive deficit procedure and occurred severe difficulties in achieve public finance sustainability, which highlight that simple adoption of numerical fiscal rules does not reflect respect for fiscal governance framework, but reveal the desire of some countries to stabilize public finances. On the other hand, similar to other countries which spent over four years in excessive deficit procedure (France, Italy, Croatia), the adoption of fiscal institutions was after 2012, meaning that Fiscal Councils can be an “accountability-multiplier” and it is important to recognize the implication of independent fiscal institutions capable to assure the effectiveness of numerical fiscal rules.

To limit discretionary fiscal policy it is important the involvement of the independent fiscal institutions of the countries and most of all, it is important that these institutions to be not only a “watchdog”, but each country convergence programs to be based on this institutions previsions. Ireland has spent seven years in excessive deficit procedures and has Irish Fiscal Advisory Council since 2011. Based on results presented in

Table 3, can be seen that even if at the beginning in 00-02 recorded a score of 1.75, meaning that has adopted expenditure rule, budget rule and debt rule based on Common Law legal basis (LCL), it was not enough the formal approach of this rules; that is why, according to

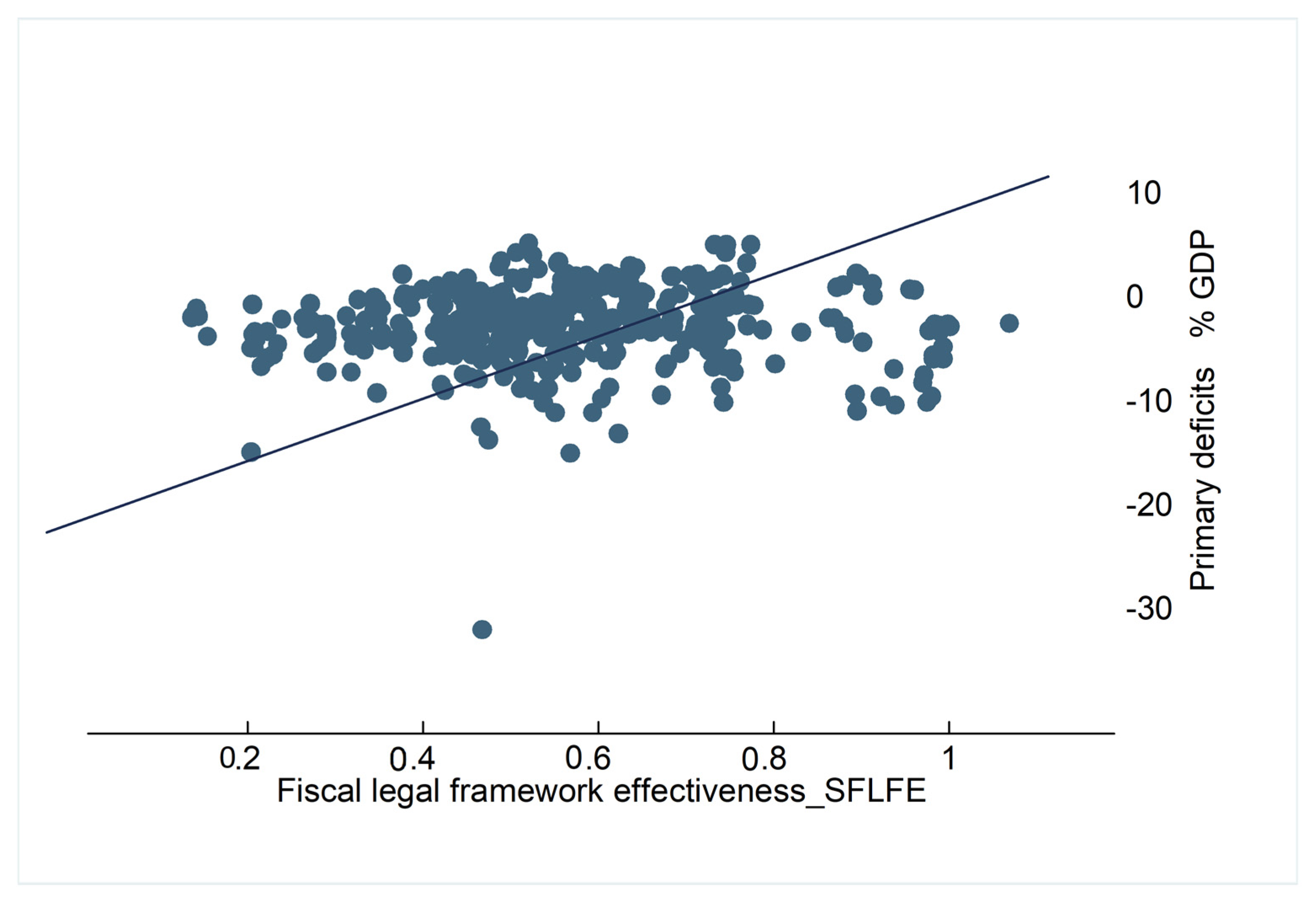

Figure 1 in 2010, we identify them as an outlier and we keep them to better understand the big picture. According to

Figure 1, in 2010, Ireland recorded an extreme primary deficit of −32.1, taking over some debts of the banks; the results show that the foundation of fiscal monitoring bodies on year later it is not random and reflect the importance of fiscal authorities guided by the sustainable fiscal objectives.

Figure 1 shows the relationship between primary deficits and fiscal legal framework effectiveness, over the period 2000–2015. Fiscal legal framework effectiveness (FRLST) was computed based on data provided by IMF fiscal rules database and following the rationale from Equation (2). The Primary deficit is expressed as a percent of GDP and was provided by Eurostat. Fiscal consolidation plans require the implementation of adequate tools capable to control the irresponsible fiscal policy and the status of the fiscal legal framework can influence public finance sustainability only if it can anticipate all the situations in which fiscal policy objectives are prior to political stakes.

The slight positive relationship between primary deficits and fiscal legal framework effectiveness indicates the need to redesign the fiscal risk management process and to recognize the importance of independent fiscal institutions. Focusing on de jure arrangements and not on what degree rules have been adhered to in practice has led to fixed targets in legislation and fiscal arrangements. Public finance sustainability framework recognizes the annual budget deficit under the consolidated fiscal program; given that institutional mechanisms do not penalize unsustainable fiscal positions, in practice, it is quite difficult to constrain the size of the deficit and therefore to control the evolution of the debt ratio.

5. Discussion

By analyzing the statute of fiscal responsibility legal framework with respect to different measures imposed in the last years by EU fiscal governance, we have applied our methodological approach to real world data and we emphasized the realistic output of fiscal responsibility legal framework at EU level and its implications for challenges of public finance sustainability. The methodological approach adds to the literature by improving the topic of research from area of fiscal responsibility legal framework, especially, the work of

Dziemianowicz and Kargol-Wasiluk (

2015),

Afonso and Jalles (

2014),

Lienert (

2010,

2013),

Hauptmeier et al. (

2011).

Table 1 shows countries that have implemented specific fiscal rules during the sample period 2000–2015 and gives a realistic output of political fragmentation in the budgetary process, which requires the control of expenditure rules. It is, of course, an overview of the degree of budgetary flexibility and demonstrates the dysfunctionalities in mitigating the effect of expenditure rules. The results are supported by theoretical insights, which indicate the importance of institutional mechanisms, arguing that the prudent management of public finances cannot be assured without setting limits in terms of debt thresholds, creating independent monitoring bodies and, not necessary the last on this list, establishing consequences for non-compliance, as we may also see in

Manescu and Bova (

2020);

Holm-Hadulla et al. (

2012);

Hauptmeier et al. (

2011).

Table 2 shows that, in responses to correct excessive deficits, the corrective arm of the Stability and Growth Pact implemented excessive deficit procedure, but its laxity has diminished its potential positive effects, as EU Member States were not stimulated to comply with the rules which involve internal political costs. The results indicate that some countries, like France, have spent 11 years in excessive deficit procedure, which means that we cannot talk about a prompt correction of excessive public deficits or excessive public debt. Instead, we have identified thatdue to frequent changes of the Stability and Growth Pact (SGP), the entire process of fiscal consolidation became the result of endless reforms. Future excessive deficit procedure mechanisms should take into considerations not only the idea of imposing sanctions, but also the necessity to create institutional mechanisms capable of monitoriong the compliance with rules and, most of all, the entire fiscal governance framework should consider an incentive-compliant banking union, with respect to interest rates; this union should recognize that inherent manipulation leeway and political cycles are decisive for the success of the SGP. The perspective presented in previous studies and in the working hypotheses, our research suggests that a further important omission of the fiscal governance framework is related to fiscal rules endogeneity, to legislative harmonization and to fundamental common features at EU level. This idea is supported by

Heinemann et al. (

2018), which highlight that the budgetary impact of numerical fiscal rules depends on their potential endogeneity and the potential fiscal conservatism of each country is important in assessing the efficiency of taxation.

Our findings suggest that fiscal responsibility legal framework has become an instrument to identify some weaknesses in the management of economic policies, capable to reveal fiscal sustainability challenges and to better evaluate country exposure to fiscal risk.

Table 3 reveals the merit behind our framework which was capable to integrate the regulators’ system imposed by treaties at the EU level with the real status of fiscal accountability and with respect to certain legal requirements. Given that countries show formal respect to the EU governance framework, the real power of numerical fiscal rules in terms of public spending or debt limitations depends on the assumption of political costs and institutional background, capable to avoid formal enforcement mechanisms. With respect to the risks of fiscal policy, it is found that unexpected changes in fiscal responsibility legal framework have major consequences on public finance sustainability and even if few countries follow well-defined rules, the results shows that, beyond accounting standards, some countries have introduced risk reporting requirements in their fiscal responsibility laws and regulation. The assumption that fiscal responsibility legal framework can improve the sustainability of public finance, reveals the EU risk of not complying with the fiscal rules, which can conduct to deviation from the sustainability objectives. With respect to this point of view, the case of Ireland which has spent seven years in excessive deficit procedure and reported at the beginning of 2000–2002 a formal respect to fiscal rules, due to extreme primary deficits of −32.1 in 2010, it started to consolidate the institutional mechanisms, to recognize the importance of independent fiscal institutions and to monitor fiscal risk. These results support the opinion presented by

Aliona et al. (

2009), which highlight that fiscal risks are the most important instruments to manage macroeconomic shocks, being capable to improve economic efficiency and to reduce borrowing costs.

6. Conclusions

The paper contributes to the fiscal responsibility legal framework literature through the expansion of the research concerning the statute of FRLs at the EU level, taking into consideration the overall picture of fiscal responsibility law and the tools for empowering policymakers, respecting transparency and accountability.

The process of strengthening the sustainability of public finances and making governments more responsible are both reality of the European Union and necessity for its members. First, we can note the progress that has taken place in Europe during the post-crisis period and beyond. Second, the need arises from the requirement to have a mobilization tool and, implicitly, to empower governments in fiscal budgeting and decision making. Similar to any other process at the European level, the process of consolidating fiscal legislation has attracted a number of criticisms, particularly on the positive implications that it is supposed to have on accountability. Still, our reviewed literature together with our analysis show that the number of disadvantages related to the development of this process is far too small compared to the benefits of deepening the process and achieving the optimal level of sustainability of the public finances. The merit behind this study is to signal the necessity to integrate the regulators’ system imposed by treaties at the EU level with the real status of national fiscal accountability and with respect to certain legal requirements.

The study highlights that fiscal responsibility framework and fiscal rules are subjects to immense interest in the EU currently, as countries explore how to ensure long-term fiscal sustainability, considering the regions’ fiscal position and debt challenges. We observed that larger output losses and increases of primary deficits manifested during financial turmoil increased the need to further analyze the public finance sustainability, starting from the implications of FRLs evaluation and continuing with the major challenges of the fiscal sustainability. Contrary to previous studies, we employ an interdisciplinary proxy for emphasizing the statute of FRLs at EU level and its implications for challenges of public finance sustainability, more exactly, we retrospective analyze the statute of fiscal responsibility legal framework and we reveal the different measures undertaken in the last years, by computing the score function of fiscal legal framework effectiveness (SFLFE).

The results indicate that there is a lack of mechanisms capable of enforcing the area of public finance sustainability; in addition, the implication of the events that created the economic conjuncture of recent years shows that the solidity of public finances has reached an impasse and it needs to be enhanced. The analyzed documents in the field of fiscal responsibility show a formal respect for the legislative framework or for the consolidation of public finance sustainability and reveal that the domain of fiscal responsibility is not only a domain of profoundly lack of positive experiences in accountability of policymakers’ decisions, but also an area for experiencing the new public management style and new design of mechanisms for coordinating fiscal policy in the European Union (EU) and entire world. Overall, we conclude that, given the lack of administrative capacity and political costs, which most often incite to breaking rules, there is still a need for deepener research in this domain. The algorithm of policymakers’ future decisions need to take into account the consolidation of independent fiscal institutions founded by Fiscal Responsibility Law framework and completed by fiscal rules, capable to ensure prudent management of public finances and to counteract pro-cyclical fiscal policies.