The Dynamics of the S&P 500 under a Crisis Context: Insights from a Three-Regime Switching Model

Abstract

1. Introduction

2. A Tale of Two Crises

2.1. The Great Recession of 2007–2009

2.2. The COVID-19 Impact

3. Material and Methods

3.1. Data, Sources and Software

3.2. Methods

4. Results and Discussion

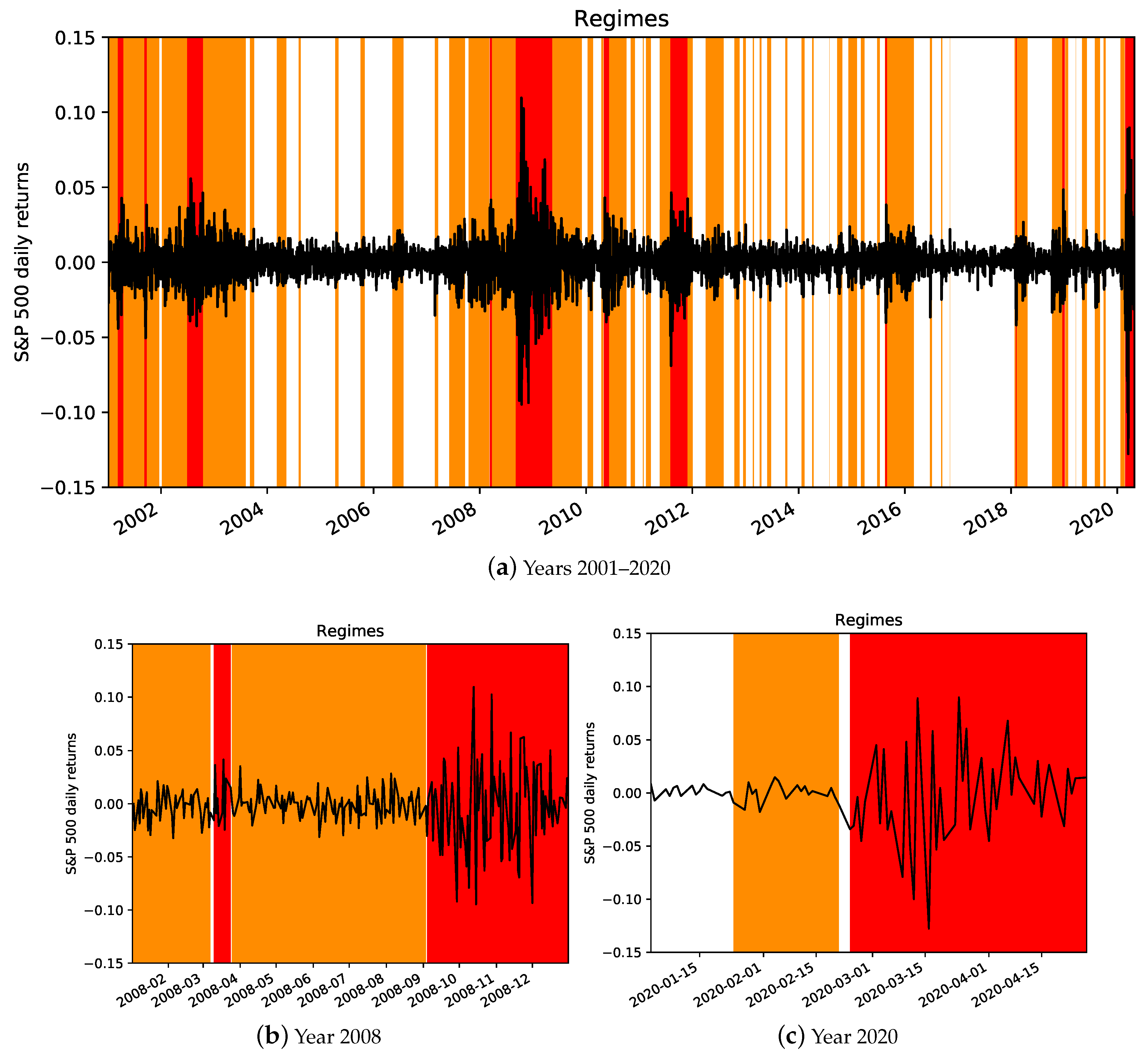

4.1. Analysis of the Dynamic of S&P 500 Index with a Three-Regime Switching Model

4.2. Explaining the Regime Occurrence

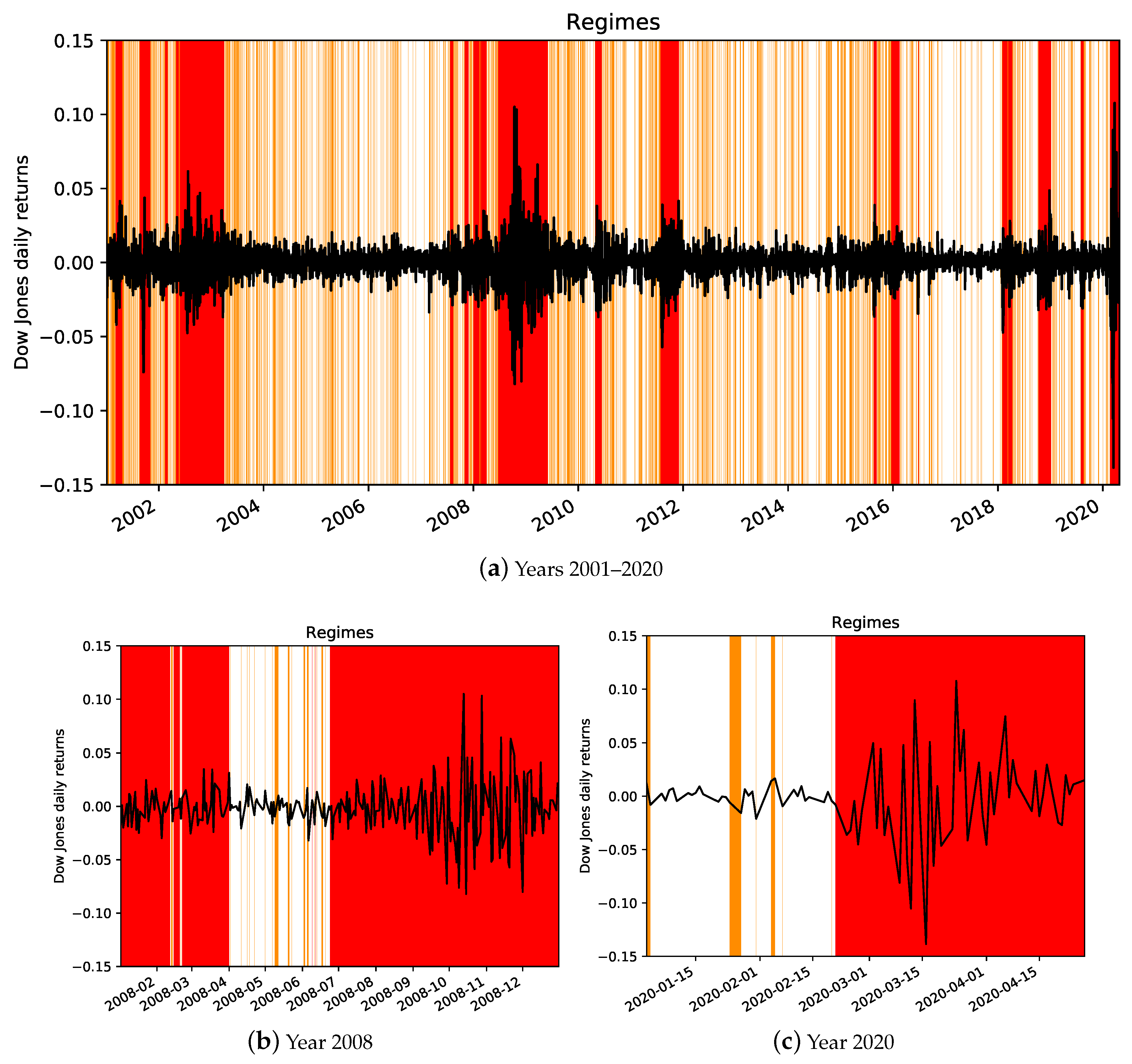

4.3. Analysis of Robustness

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Acronym | Description |

|---|---|

| DJIA | Dow Jones Industrial Average index: Stock market index comprising 30 large companies listed on the stock exchanges in the United States |

| FTSE-Mib | Financial Times Stock Exchange index of Milan (Indice di Borsa): Stock market index comprising the 40 largest and most traded companies in Italy |

| DAX | Deutscher Aktienindex: Stock market index comprising the 30 largest and most traded companies in Germany |

| WTI oil | West Texas Intermediate Oil: Type of crude oil representing the underlying commodity for futures contracts traded on the New York Mercantile Exchange |

| VIX index | Chicago Board Options Exchange (Cboe) Volatility index: Measures the expected volatility of the S&P 500 using options on the index traded at the Cboe |

| S&P 500 index | Standard & Poor 500 index: Stock market index comprising the 500 large companies listed on stock exchanges in the United States |

| Volatility | Measure of the variability of the returns of a given market index or financial security |

| Stochastic Volatility | The term refers to the fact that the volatility of financial returns varies over time in a non-deterministic way |

| Fat Tails | The term refers to the fact that returns distributions have thicker tails than the normal distribution, implying a bigger probability of large gains or losses |

| Regime-Switching Models | Econometric models designed to capture sudden changes in the structure of the data-generating process of financial or economic time series |

| Multinomial Logit Models | Econometric models that use a set of explanatory variables to predict the probabilities of the different possible outcomes of a categorical dependent variable |

References

- Algieri, Bernardina, Matthias Kalkuhl, and Nicolas Koch. 2017. A tale of two tails: Explaining extreme events in financialized agricultural markets. Food Policy 69: 256–69. [Google Scholar] [CrossRef]

- Bae, Kee-Hong, G. Andrew Karolyi, and René M. Stulz. 2003. A new approach to measuring financial contagion. Review of Financial Studies 16: 717–63. [Google Scholar] [CrossRef]

- Banerji, Gunjan. 2020. Traders Bet on Falling “Fear Gauge”. The Wall Street Journal. Available online: https://www.wsj.com/articles/traders-bet-on-falling-fear-gauge-11584466439 (accessed on 13 May 2020).

- Bartash, Jeffry. 2020. The Record Number of People Applying for Jobless Benefits Is Even Worse Than It Looks. MarketWatch. Available online: https://www.marketwatch.com/story/the-record-number-of-people-applying-for-jobless-benefits-is-even-worse-than-it-looks-2020-05-07 (accessed on 13 May 2020).

- Baur, Dirk. G., and Brian. M. Lucey. 2010. Is gold a hedge or a safe haven? An analysis of stocks, bonds and gold. Financial Review 45: 217–29. [Google Scholar] [CrossRef]

- Black, Fischer, and Myron Scholes. 1973. The pricing of options and corporate liabilities. Journal of Political Economy 81: 637–59. [Google Scholar] [CrossRef]

- Candelon, Bertrand, Jan Piplack, and Stefan Straetmans. 2008. On measuring synchronization of bulls and bears: The case of East Asia. Journal of Banking and Finance 32: 1022–35. [Google Scholar] [CrossRef]

- Center of Hellenic Studies. 2008. The State of the Nation’s Housing. Joint Center for Housing Studies of Harvard University. Available online: http://www.jchs.harvard.edu/sites/jchs.harvard.edu/files/son2008.pdf (accessed on 13 May 2020).

- Charles, Amelie, and Olivier Darné. 2014. Large shocks in the volatility of the Dow Jones Industrial Average index: 1928–2013. Journal of Banking and Finance 43: 188–99. [Google Scholar] [CrossRef]

- Chen, Shiu-Sheng. 2010. Predicting the bear stock market: Macroeconomic variables as leading indicators. Journal of Banking and Finance 33: 211–23. [Google Scholar] [CrossRef]

- Chiang, Shu-Mei. 2012. The relationships between implied volatility indexes and spot indexes. Procedia—Social and Behavioral Sciences 57: 231–35. [Google Scholar] [CrossRef]

- Christiansen, Charlotte, and Angelo Ranaldo. 2009. Extreme coexceedances in new EU member states’ stock markets. Journal of Banking & Finance 33: 1048–57. [Google Scholar]

- Coakley, Jerry, and Ana-Maria Fuertes. 2006. Valuation ratios and price deviations from fundamentals. Journal of Banking and Finance 30: 2325–46. [Google Scholar] [CrossRef]

- Croissant, Yves. 2018. mlogit: Multinomial Logit Models. R package version 0.3-0. Available online: https://CRAN.R-project.org/package=mlogit (accessed on 13 May 2020).

- Gopinath, Gita. 2019. The Great Lockdown: Worst Economic Downturn Since the Great Depression. IMFBlog. Available online: https://blogs.imf.org/2020/04/14/the-great-lockdown-worst-economic-downturn-since-the-great-depression/ (accessed on 13 May 2020).

- Giot, Pierre. 2005. Relationships Between Implied Volatility Indexes and Stock Index Returns. The Journal of Portfolio Management 31: 92–100. [Google Scholar] [CrossRef]

- Greene, William H. 2018. Econometric Analysis, 8th ed. Harlow: Pearson. [Google Scholar]

- Hamilton, James D. 1983. Oil and the macroeconomy since world war II. Journal of Political Economy 91: 228–48. [Google Scholar] [CrossRef]

- Hamilton, James D. 1989. A new approach to the economic analysis of non-stationary time series. Econometrica 57: 357–84. [Google Scholar] [CrossRef]

- Hamilton, James D. 1990. Analysis of time series subject to changes in regime. Journal of Econometrics 45: 39–70. [Google Scholar] [CrossRef]

- Hamilton, James D. 1994. Time Series Analysis. Princeton: Princeton University Press. [Google Scholar]

- Hamilton, James D. 2003. What is an oil shock? Journal of Econometrics 113: 363–98. [Google Scholar] [CrossRef]

- Hauptmann, Johannes, Anja Hoppenkamps, Aleksey Min, Franz Ramsauer, and Rudi Zagst. 2014. Forecasting market turbulence using regime-switching models. Financial Markets and Portfolio Management 28: 139–64. [Google Scholar] [CrossRef]

- Imbert, Fred. 2020. Dow Jumps More Than 250 Points to a Record. CNBC. Available online: https://www.cnbc.com/2020/02/12/us-futures-point-to-higher-open-after-stocks-hit-fresh-record-highs.html (accessed on 13 May 2020).

- Kim, Chang-Jin. 1994. Dynamic linear models with Markov-switching. Journal of Econometrics 60: 1–22. [Google Scholar] [CrossRef]

- Koch, Nicolas. 2014. Tail events: A new approach to understanding extreme energy commodity prices. Energy Economics 43: 195–205. [Google Scholar] [CrossRef]

- Maheu, John M., and Thomas H. McCurdy. 2000. Identifying bull and bear markets in stock returns. Journal of Business and Economic Statistics 18: 100–12. [Google Scholar]

- Martinez-Peria, Maria Soledad. 2002. A regime-switching approach to the study of speculative attacks: A focus on EMS crises. Empirical Economics 27: 299–334. [Google Scholar] [CrossRef]

- McLean, Rob, Laura He, and Anneken Tappe. 2020. Dow Plunges 1000 Points, Posting Its Worst Day in Two Years as Coronavirus Fears Spike. CNN Business. Available online: https://edition.cnn.com/2020/02/23/business/stock-futures-coronavirus/index.html (accessed on 13 May 2020).

- Munich Re. 2020. Quarterly Statement: Low Quarterly Profit Due to High COVID-19-Related Losses. Available online: https://www.munichre.com/content/dam/munichre/mrwebsiteslaunches/2020-q1/MunichRe-Quarterly-Statement-1-2020_en.pdf/_jcr_content/renditions/original./MunichRe-Quarterly-Statement-1-2020_en.pdf (accessed on 13 May 2020).

- Pape, Katharina, Dominik Wied, and Pedro Galeano. 2016. Monitoring multivariate variance changes. Journal of Empirical Finance 39: 54–68. [Google Scholar] [CrossRef]

- Partington, Richard, and Graeme Wearden. 2020. Global Stock Markets Post Biggest Falls Since 2008 Financial Crisis. The Guardian. Available online: https://www.theguardian.com/business/2020/mar/09/global-stock-markets-post-biggest-falls-since-2008-financial-crisis (accessed on 13 May 2020).

- Perez-Quiros, Gabriel, and Allan Timmermann. 2000. Firm size and cyclical variations in stock returns. Journal of Finance 55: 1229–62. [Google Scholar] [CrossRef]

- R Core Team. 2019. R: A Language and Environment for Statistical Computing. Vienna: R Foundation for Statistical Computing. Available online: https://www.R-project.org/ (accessed on 13 May 2020).

- Roubaud, David, and Mohamed Arouri. 2018. Oil prices, exchange rates and stock markets under uncertainty and regime-switching. Finance Research Letters 27: 28–33. [Google Scholar] [CrossRef]

- Sanchez-Espigares, Josep, and Alberto Lopez-Moreno. 2018. MSwM: Fitting Markov Switching Models. R package version 1.4. Available online: https://CRAN.R-project.org/package=MSwM (accessed on 13 May 2020).

- Schwert, G. William. 2011. Stock Volatility during the Recent Financial Crisis. European Financial Management 17: 789–805. [Google Scholar] [CrossRef]

- Schich, Sebastian. 2010. Insurance companies and the financial crisis. OECD Journal: Financial Market Trends 2009: 121–51. [Google Scholar] [CrossRef]

- The Economist. 2008. A helping hand to homeowners. Available online: https://www.economist.com/finance-and-economics/2008/10/23/a-helping-hand-to-homeowners (accessed on 13 May 2020).

| 1 | To make the contents of this paper more accessible to non-economic readers, Table A1 in the Appendix A describes all the economic indicators and acronyms we use throughout the paper. |

| 2 | See Martinez-Peria (2002) for previous applications of regime switching models. |

| 3 | Table 3 also reports the statistics about the Dow Jones Industrial Average index for the same period considered for the S&P 500 index, because it is used in Section 4.3 to provide an analysis of robustness of the proposed econometric model. |

| 4 | The multinomial logit model allows only to establish whether the variables have some explanatory power over the probability of observing a given regime (relative to the reference regime). Studying lead-lag relations between the probability of observing the volatile or turbulent regimes and the explanatory variables, while interesting, is beyond the scope of this paper. |

| Panel A: Estimated Parameters | |||

| Regime 0 | 0.001 | 0.005 | |

| Regime 1 | −3.036 | 0.012 | |

| Regime 2 | −0.002 | 0.029 | |

| Log-Likelihhod | 15,850.05 | ||

| AIC | −31,694.1 | ||

| BIC | −31,649.18 | ||

| Panel B: Transition Probabilities | |||

| Regime 0 | Regime 1 | Regime 2 | |

| Regime 0 | 0.977 | 0.023 | 4.94 |

| Regime 1 | 0.027 | 0.967 | 0.006 |

| Regime 2 | 5.23 | 0.027 | 0.973 |

| Period | Tranquil | Volatile | Turbulent |

|---|---|---|---|

| 2001–2020 | 48.91% | 41.21% | 9.88% |

| 2008 | 0.79% | 62.45% | 36.76% |

| 2020 | 17.72% | 25.32% | 56.96% |

| Panel A: Descriptive Statistics | ||||||

| S&P 500 | DJIA | VIX | GOLD | CL1 | DXY | |

| Min. | −12.765 | −13.842 | −35.059 | −9.821 | −34.542 | −2.745 |

| 1st Quartile | −0.453 | −0.443 | −3.957 | −0.497 | −1.259 | −0.296 |

| Median | 0.059 | 0.049 | −0.513 | 0.044 | 0.068 | 0.001 |

| Mean | 0.016 | 0.016 | 0.004 | 0.037 | −0.007 | −0.003 |

| 3rd Quartile | 0.564 | 0.538 | 3.310 | 0.629 | 1.265 | 0.284 |

| Max. | 10.957 | 10.764 | 76.825 | 8.643 | 31.963 | 2.362 |

| st. dev. | 1.249 | 1.198 | 7.091 | 1.151 | 2.692 | 0.508 |

| skewness | −0.392 | −0.354 | 1.001 | −0.258 | −0.569 | 0.005 |

| kurtosis | 14.882 | 17.270 | 9.626 | 8.142 | 27.087 | 4.588 |

| Panel B: Correlation Matrix | ||||||

| S&P 500 | DJIA | VIX | GOLD | CL1 | DXY | |

| S&P 500 | 1.000 | |||||

| DJIA | 0.977 | 1.000 | ||||

| VIX | −0.727 | −0.705 | 1.000 | |||

| GOLD | −0.013 | −0.023 | 0.017 | 1.000 | ||

| CL1 | 0.236 | 0.224 | −0.190 | 0.190 | 1.000 | |

| DXY | −0.068 | −0.056 | 0.031 | −0.393 | −0.173 | 1.000 |

| Estimate | Std. Error | z-Value | p-Value | |

|---|---|---|---|---|

| Regime 1: (intercept) | −0.171 | 0.030 | −5.633 | 1.77 *** |

| Regime 2: (intercept) | −1.623 | 0.051 | −31.830 | <2.2 *** |

| Regime 1: VIX | 0.012 | 0.007 | 1.744 | 0.081 * |

| Regime 2: VIX | 0.041 | 0.012 | 3.417 | 0.001 *** |

| Regime 1: GOLD | 0.011 | 0.029 | 0.373 | 0.709 |

| Regime 2: GOLD | 0.084 | 0.047 | 1.772 | 0.076 * |

| Regime 1: CL1 | −0.012 | 0.012 | −0.977 | 0.328 |

| Regime 2: CL1 | −0.070 | 0.018 | −3.789 | 1.514 *** |

| Regime 1: DXY | −0.013 | 0.066 | −0.196 | 0.845 |

| Regime 2: DXY | 0.208 | 0.107 | 1.946 | 0.052 * |

| Panel A: Estimated Parameters | |||

| Regime 0 | 0.001 | 0.005 | |

| Regime 1 | −5.466 | 0.010 | |

| Regime 2 | −0.001 | 0.022 | |

| Log-Likelihhod | 15,861.07 | ||

| AIC | −31,716.14 | ||

| BIC | −31,671.21 | ||

| Panel B: Transition Probabilities | |||

| Regime 0 | Regime 1 | Regime 2 | |

| Regime 0 | 0.643 | 0.355 | 0.002 |

| Regime 1 | 0.485 | 0.504 | 0.011 |

| Regime 2 | 0.004 | 0.019 | 0.977 |

| Period | Tranquil | Volatile | Turbulent |

|---|---|---|---|

| 2001–2020 | 58.69% | 20.57% | 20.74% |

| 2008 | 13.83% | 9.49% | 76.68% |

| 2020 | 31.25% | 11.25% | 57.50% |

| Estimate | Std. Error | z-Value | p-Value | |

|---|---|---|---|---|

| Regime 1: (intercept) | −1.069 | 0.037 | −28.514 | <2.2 *** |

| Regime 2: (intercept) | −1.044 | 0.037 | −28.243 | <2.2 *** |

| Regime 1: VIX | 0.020 | 0.005 | 3.695 | 2.2 *** |

| Regime 2: VIX | 0.048 | 0.005 | 9.034 | <2.2 *** |

| Regime 1: GOLD | 0.008 | 0.035 | 0.222 | 0.824 |

| Regime 2: GOLD | 0.050 | 0.035 | 1.414 | 0.157 |

| Regime 1: CL1 | −0.029 | 0.015 | −1.914 | 0.056 * |

| Regime 2: CL1 | −0.042 | 0.014 | −2.959 | 0.003 *** |

| Regime 1: DXY | 0.050 | 0.080 | 0.633 | 0.527 |

| Regime 2: DXY | 0.037 | 0.079 | 0.467 | 0.640 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cerboni Baiardi, L.; Costabile, M.; De Giovanni, D.; Lamantia, F.; Leccadito, A.; Massabó, I.; Menzietti, M.; Pirra, M.; Russo, E.; Staino, A. The Dynamics of the S&P 500 under a Crisis Context: Insights from a Three-Regime Switching Model. Risks 2020, 8, 71. https://doi.org/10.3390/risks8030071

Cerboni Baiardi L, Costabile M, De Giovanni D, Lamantia F, Leccadito A, Massabó I, Menzietti M, Pirra M, Russo E, Staino A. The Dynamics of the S&P 500 under a Crisis Context: Insights from a Three-Regime Switching Model. Risks. 2020; 8(3):71. https://doi.org/10.3390/risks8030071

Chicago/Turabian StyleCerboni Baiardi, Lorenzo, Massimo Costabile, Domenico De Giovanni, Fabio Lamantia, Arturo Leccadito, Ivar Massabó, Massimiliano Menzietti, Marco Pirra, Emilio Russo, and Alessandro Staino. 2020. "The Dynamics of the S&P 500 under a Crisis Context: Insights from a Three-Regime Switching Model" Risks 8, no. 3: 71. https://doi.org/10.3390/risks8030071

APA StyleCerboni Baiardi, L., Costabile, M., De Giovanni, D., Lamantia, F., Leccadito, A., Massabó, I., Menzietti, M., Pirra, M., Russo, E., & Staino, A. (2020). The Dynamics of the S&P 500 under a Crisis Context: Insights from a Three-Regime Switching Model. Risks, 8(3), 71. https://doi.org/10.3390/risks8030071