Gerber–Shiu Function in a Class of Delayed and Perturbed Risk Model with Dependence

Abstract

1. Introduction

2. Risk Model

2.1. Definition of the Risk Model

- the time arrival of the first claim has density function given by:

- The time between the second and the third claim, , is exponentially distributed with parameter ;

- are independent;

- the subsequent claims inter-occurrence times are exponentially distributed with parameter , i.e., ;

- are independent and are distributed as the generic X;

- and are dependent and jointed by FGM copulas with parameter , such that for ;

- are mutually independent; and

- the standard Brownian motion is independent of the aggregate claim process.

2.2. The Dependence

3. Generalized Lundberg-Type Equation

4. Results

4.1. Integro-Differential Equation

4.2. Laplace Transform of the Gerber–Shiu Functions

4.3. The Defective Renewal Equation

- 1.

- The Gerber–Shiu function caused by claims satisfies the defective renewal equation:

- 2.

- The Gerber–Shiu function when ruin is caused by oscillations satisfies the defective renewal equation:

- 1.

- The Gerber–Shiu function caused by claims satisfies the defective renewal equation:

- 2.

- The Gerber–Shiu function when ruin is caused by oscillations satisfies the defective renewal equation:where the Laplace transform of are given by:

4.4. Representation of the Solution

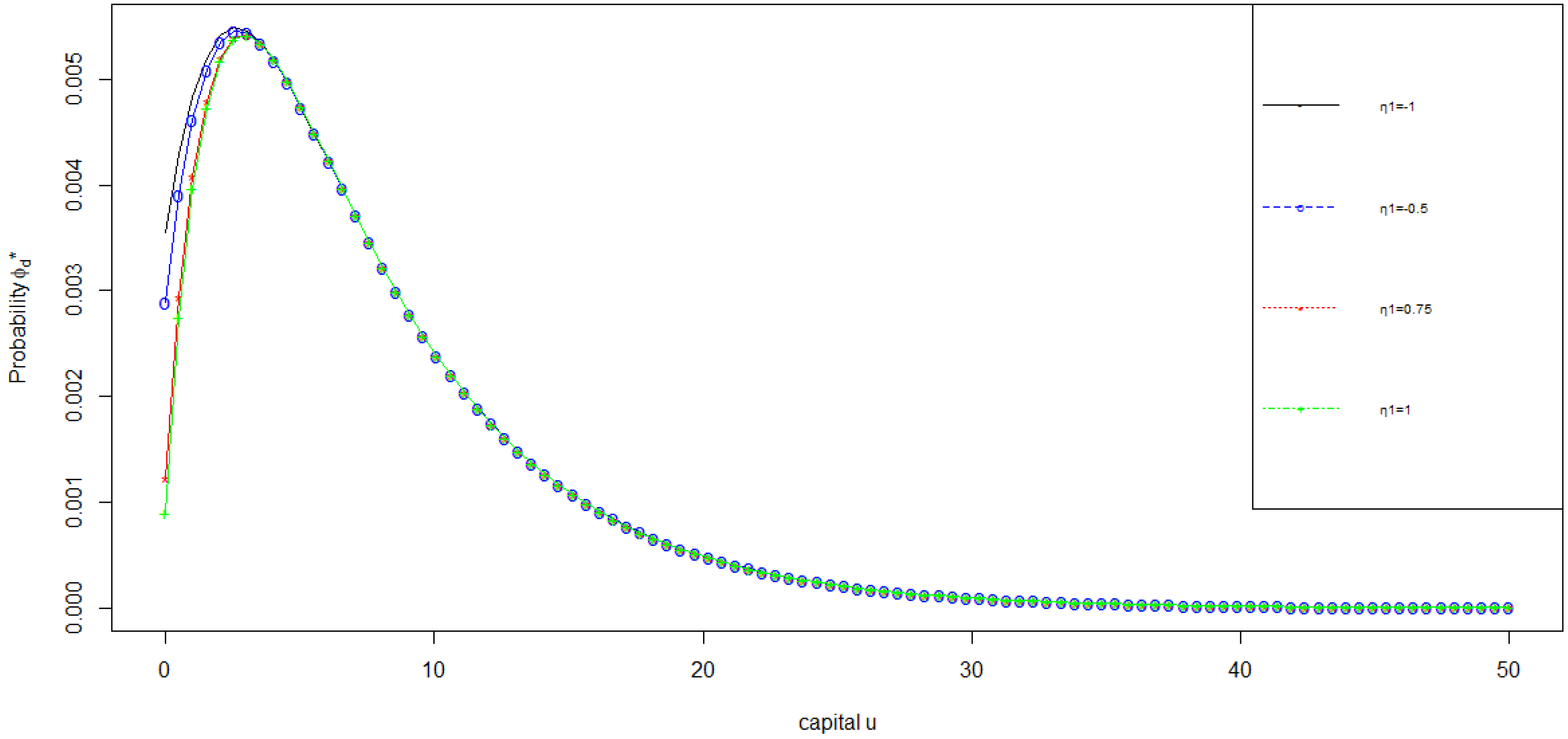

5. Numerical Illustration

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Borodin, Andrei N., and Paavo Salminen. 2002. Handbook of Brownian Motion-Facts and Formulae. Basel: Birkhäuser. [Google Scholar]

- Cai, Jun. 2007. On the time value of absolute ruin with debit interest. Advances in Applied Probability 39: 343–59. [Google Scholar] [CrossRef]

- Cai, Jun, Runhuan Feng, and Gordon E. Willmot. 2009. The compound poisson surplus model with interest and liquid reserves: Analysis of the gerber–shiu discounted penalty function. Methodology and Computing in Applied Probability 11: 401–23. [Google Scholar] [CrossRef]

- Chadjiconstantinidis, Stathis, and Spyridon Vrontos. 2014. On a renewal risk process with dependence under a farlie–gumbel–morgenstern copula. Scandinavian Actuarial Journal 2014: 125–58. [Google Scholar] [CrossRef]

- Cheung, Eric C. K., and Runhuan Feng. 2013. A unified analysis of claim costs up to ruin in a markovian arrival risk model. Insurance: Mathematics and Economics 53: 98–109. [Google Scholar] [CrossRef]

- Cheung, Eric C. K., David Landriault, Gordon E. Willmot, and Jae-Kyung Woo. 2010. Structural properties of gerber–shiu functions in dependent sparre andersen models. Insurance: Mathematics and Economics 46: 117–26. [Google Scholar] [CrossRef]

- Cossette, Héléne, Etienne Marceau, and Fouad Marri. 2010. Analysis of ruin measures for the classical compound poisson risk model with dependence. Scandinavian Actuarial Journal 2010: 221–45. [Google Scholar] [CrossRef]

- Dufresne, Francois, and Hans U. Gerber. 1991. Risk theory for the compound poisson process that is perturbed by diffusion. Insurance: Mathematics and Economics 10: 51–59. [Google Scholar] [CrossRef]

- Gao, Jianwei, and Liyuan Wu. 2014. On the gerber–shiu discounted penalty function in a risk model with two types of delayed-claims and random income. Journal of Computational and Applied Mathematics 269: 42–52. [Google Scholar] [CrossRef]

- Gerber, Hans U., and Bruno Landry. 1998. On the discounted penalty at ruin in a jump-diffusion and the perpetual put option. Insurance: Mathematics and Economics 22: 263–76. [Google Scholar] [CrossRef]

- Gerber, Hans U., and Elias S. W. Shiu. 1998. On the time value of ruin. North American Actuarial Journal 2: 48–72. [Google Scholar] [CrossRef]

- Kyprianou, Andreas E. 2006. Introductory Lectures on Fluctuations of Lévy Processes with Applications. Berlin: Springer Science & Business Media. [Google Scholar]

- Landriault, David, and Gordon Willmot. 2008. On the gerber–shiu discounted penalty function in the sparre andersen model with an arbitrary interclaim time distribution. Insurance: Mathematics and Economics 42: 600–8. [Google Scholar] [CrossRef]

- Lee, Wing Yan, and Gordon E. Willmot. 2014. On the moments of the time to ruin in dependent sparre andersen models with emphasis on coxian interclaim times. Insurance: Mathematics and Economics 59: 1–10. [Google Scholar] [CrossRef]

- Lin, X. Sheldon, and Gordon E. Willmot. 2000. The moments of the time of ruin, the surplus before ruin, and the deficit at ruin. Insurance: Mathematics and Economics 27: 19–44. [Google Scholar] [CrossRef]

- Nelsen, Roger B. 2006. An introduction to Copulas. Berlin: Springer Science & Business Media. [Google Scholar]

- Pavlova, Kristina P., and Gordon E. Willmot. 2004. The discrete stationary renewal risk model and the gerber–shiu discounted penalty function. Insurance: Mathematics and Economics 35: 267–77. [Google Scholar] [CrossRef]

- Schmidli, Hanspeter. 2010. On the gerber–shiu function and change of measure. Insurance: Mathematics and Economics 46: 3–11. [Google Scholar] [CrossRef]

- Schmidli, Hanspeter. 2014. A note on gerber–shiu functions with an application. In Modern Problems in Insurance Mathematics. Cham: Springer, pp. 21–36. [Google Scholar]

- Tan, Ken Seng, Pengyu Wei, Wei Wei, and Sheng Chao Zhuang. 2020. Optimal dynamic reinsurance policies under a generalized denneberg’s absolute deviation principle. European Journal of Operational Research 282: 345–62. [Google Scholar] [CrossRef]

- Tsai, Cary Chi-Liang, and Gordon E. Willmot. 2002. A generalized defective renewal equation for the surplus process perturbed by diffusion. Insurance: Mathematics and Economics 30: 51–66. [Google Scholar] [CrossRef]

- Wang, Guojing. 2001. A decomposition of the ruin probability for the risk process perturbed by diffusion. Insurance: Mathematics and Economics 28: 49–59. [Google Scholar] [CrossRef]

- Willmot, Gordon E. 2004. A note on a class of delayed renewal risk processes. Insurance: Mathematics and Economics 34: 251–57. [Google Scholar] [CrossRef]

- Willmot, Gordon E. 2007. On the discounted penalty function in the renewal risk model with general interclaim times. Insurance: Mathematics and Economics 41: 17–31. [Google Scholar] [CrossRef]

- Willmot, Gordon E., and David C. M. Dickson. 2003. The gerber–shiu discounted penalty function in the stationary renewal risk model. Insurance: Mathematics and Economics 32: 403–11. [Google Scholar] [CrossRef]

- Willmot, Gordon E., X. Sheldon Lin, and X. Sheldon Lin. 2001. Lundberg Approximations for Compound Distributions with Insurance Applications. Berlin: Springer Science & Business Media, vol. 156. [Google Scholar]

- Zhang, Zhimin, and Hu Yang. 2011. Gerber–shiu analysis in a perturbed risk model with dependence between claim sizes and interclaim times. Journal of Computational and Applied Mathematics 235: 1189–204. [Google Scholar] [CrossRef]

- Zhang, Zhimin, Shuanming Li, and Hu Yang. 2009. The gerber–shiu discounted penalty functions for a risk model with two classes of claims. Journal of Computational and Applied Mathematics 230: 643–55. [Google Scholar] [CrossRef]

- Zhou, Ming, and Jun Cai. 2009. A perturbed risk model with dependence between premium rates and claim sizes. Insurance: Mathematics and Economics 45: 382–92. [Google Scholar] [CrossRef]

- Zou, Wei, and Jie-hua Xie. 2012. On the gerber–shiu discounted penalty function in a risk model with delayed claims. Journal of the Korean Statistical Society 41: 387–97. [Google Scholar] [CrossRef]

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Adékambi, F.; Takouda, E. Gerber–Shiu Function in a Class of Delayed and Perturbed Risk Model with Dependence. Risks 2020, 8, 30. https://doi.org/10.3390/risks8010030

Adékambi F, Takouda E. Gerber–Shiu Function in a Class of Delayed and Perturbed Risk Model with Dependence. Risks. 2020; 8(1):30. https://doi.org/10.3390/risks8010030

Chicago/Turabian StyleAdékambi, Franck, and Essodina Takouda. 2020. "Gerber–Shiu Function in a Class of Delayed and Perturbed Risk Model with Dependence" Risks 8, no. 1: 30. https://doi.org/10.3390/risks8010030

APA StyleAdékambi, F., & Takouda, E. (2020). Gerber–Shiu Function in a Class of Delayed and Perturbed Risk Model with Dependence. Risks, 8(1), 30. https://doi.org/10.3390/risks8010030