1. Introduction

The parametric accelerated failure time (AFT) model has been well established in medical statistics and other applications (

Kalbfleisch and Prentice 2002) for decades. The aim of this paper is to introduce a nonparametric generalization of the one-dimensional AFT model for right-truncated data and apply it to estimate the number of outstanding claims in non-life insurance.

Given a covariate

and given no failure has occurred until time

t, the AFT specifies that the probability of a failure between time

t and

equals

with

for an underlying hazard rate

and a deterministic vector

. More formally, this model is expressed through the conditional hazard rate

Its interpretation is straightforward, for example, in a medical context where failure time

T describes the amount of time for a tumor to reach a critical stage. For each individual

i, the value of

depends on its covariate

(the patient’s medical data). A value of

, for instance, means that the development of the tumor happens twice as fast for a patient and

means 10% slower development than usual. This is in contrast to the proportional hazard model

, where the interpretation of

is non-trivial (

Cox 1972). For the statistical analysis in the AFT model, one can transform the observed failure times through

(if one knows

). The transformed survival time

follows the same distribution for all individuals and is independent of the covariate

.

This article focuses on the one-dimensional case and provides a nonparametric generalization of the parametric AFT model above assuming . We estimate nonparametrically and impose no structural assumption. In a finance or insurance context, the unknown function is often called operational time and it can accelerate or slow down the survival time T. However, with our definition, has the same effect as in the AFT model, i.e., the effect is reversed. We can transform observed survival times and covariates via to obtain identically distributed survival times that are independent of their covariates as in the AFT model. In our application of non-life reserving, X is the accident date of an insurance claim and T is its settlement delay which can be affected by calendar effects, seasonal effects or a trend in the speed of claims finalization over time, e.g., due to new organizational structures in the insurance company, more efficient IT systems, or changes in legislation. The latter trends over time are captured by our operational time function . We estimate and the marginal hazard rate of . Together, they yield an estimate of the conditional hazard rate of T given X, which contains full information of the distribution of T given X. This hazard rate is used to estimate outstanding claim numbers through extrapolation with a chain-ladder type algorithm. The proposed algorithm in this article detects the effects of operational time and adjusts for them. If there is no operational time present, the algorithm still estimates smoothed chain-ladder development factors for an optimal bandwidth that is selected through cross-validation.

The algorithm in this paper is an alternative to the most widely used algorithm in non-life reserving, the chain-ladder method. The difference is that, in chain-ladder, it is assumed that accident date and settlement delay are independent, and thus chain-ladder does not account for calendar time effects like court rulings, emergence of latent claims, or changes in operational time. The first stochastic model around the chain-ladder method was introduced in

Mack (

1993). Chain-ladder is still widely used in the insurance industry and as a benchmark for new methods in research as explained in overviews of reserving methods in

England and Verrall (

2002) and, more recently,

Taylor (

2019). Based on the idea of chain-ladder, different multiplicative models with independent effects of accident date and settlement delay were introduced in

Kremer (

1982);

Kuang et al. (

2009);

Renshaw and Verrall (

1998), and

Verrall (

1991).

Aside from these publications, the greater part of the research on claims reserving can be summarized into two streams: a Poisson process approach and a two-dimensional kernel estimation approach for truncated data. The first (older and more extensive) stream of research focuses on Poisson process models in

Antonio and Plat (

2014);

Avanzi et al. (

2016);

Huang et al. (

2015);

Jewell (

1989,

1990);

Larsen (

2007), and

Norberg (

1993,

1999). Extensions that investigate dependent covariates or marked Cox processes include

Zhao and Zhou (

2010);

Zhao et al. (

2009), or

Badescu et al. (

2016), respectively. A semiparametric approach very similar to operational time is given in

Crevecoeur et al. (

2019), in which the authors allow time on weekends and public holidays to pass faster in order to make up for less claim reports on these days while ensuring a continuous distribution of reporting delay.

The approach in this present paper fits into the second stream of reserving research based on “continuous chain-ladder” (

Hiabu et al. (

2016);

Lee et al. 2015,

2017;

Martínez-Miranda et al. (

2013)). In a broader statistical context, the problem was introduced as “in-sample forecasting” (

Mammen et al. 2015) and said papers applied their results to forecasting problems beyond actuarial research. These articles have in common that no distributional assumptions are made and that kernel estimation is performed under the assumption of a structural model for the joint density or conditional hazard rate. In the operational time model,

Lee et al. (

2017) assume the nonparametric factor

, i.e.,

, and estimate

as well as the two marginal densities of accident year and settlement delay. The latter is the closest approach to this present paper; however, we estimate a conditional hazard rate instead of a multivariate density. The advantage of our approach is that we only estimate two functions (

and

) instead of three, and then extrapolate claim numbers to estimate the number of outstanding claims. This extrapolation is analogous to the algorithm in the chain-ladder method. Since our estimated conditional hazard rates are similar to chain-ladder development factors (

Hiabu 2017), we consider it more natural to extrapolate in a hazard framework than to perform extrapolation with density functions. Therefore, we only forecast the effect of the accident date

X and do not estimate its distribution. All mentioned continuous chain-ladder publications including this present paper focus on claim numbers instead of payment amounts. Recently,

Bischofberger et al. (

2019) have shown how to extend the models and estimators for payment amounts. This extension is also feasible for our approach; however, adding extensive additional technicalities is beyond the scope of this paper.

In traditional statistical learning, learning problems are classified as “supervised” and “unsupervised” (

Hastie et al. 2008). For supervised learning algorithms, the goal is to predict an outcome measure for a given input. For this purpose, the algorithm trains on paired data consisting of (input, output) and then applies the learned structure to predict an output from a new input. On the other hand, in unsupervised learning, there is no output in the data and the goal of the algorithm is often to find patterns in the data minimizing a loss criterion. Nonparametric kernel estimation is used in both approaches: for nonparametric regression in supervised learning and for kernel density estimation in unsupervised learning (

Hastie et al. 2008). The new forecasting procedure in this article can be classified as an unsupervised machine learning technique. Although the goal is to give an estimate of the number of outstanding claims from past data, our algorithm cannot be trained on a data set of input and output (in form of past claims and future claims) and then applied to a new input. The presented algorithm estimates the conditional distribution of settlement delay given the accident date that is specific for the data set it is used on. This estimation involves kernel hazard estimators and the minimization of a loss function.

Very recently, following a trend in applied statistics, various other machine learning approaches to claims reserving that do not belong to any of the previous streams have arisen. Soon these articles may constitute a third big stream of research. Useful machine learning techniques for reserving include regression trees (

Baudry and Robert 2019;

Wüthrich 2018) and neural networks (

Kuo 2019) among others. These approaches also take dependence between accident date and delay into account and are thus more flexible than many of the aforementioned models. In contrast to the algorithm in this article, they are all based on supervised learning. A neural network architecture based on classical chain-ladder literature, into which the over-dispersed Poisson reserving model of

Renshaw and Verrall (

1998) is embedded, has been introduced in

Gabrielli et al. (

2019).

This article is structured as follows. The underlying mathematical model is introduced in

Section 2.

Section 3 explains an algorithm to estimate operational time and the baseline hazard.

Section 4 illustrates how to estimate outstanding liabilities from an operational time and a baseline hazard estimate. A data-driven bandwidth selection procedure is introduced in

Section 5 and

Section 6 containing an illustration for a real data set.

3. Estimation of Baseline Hazard and Operational Time

In this section, we show how to estimate the components and and then combine the estimators into a structured estimator of the conditional hazard. We want to recall that the whole estimation procedure is done in reversed time instead of T for the reporting delay. Hence, the following estimators are defined for and . This technical difficulty is necessary because of the right-truncation described in the last section. However, it does not constitute an issue since, once the components are estimated, we can evaluate all functions at to get the results for t. We also want to remark again that the underwriting date X is always considered in “forward time”. In the following, we see the conditional hazard as a function of two arguments and denote its estimators by . The unstructured hazard estimator in step 1 is analogously denoted by .

The proposed estimation procedure is as follows. The necessary expressions (

7) and (

10), and the loss criterion (

11) will be introduced below:

Note that the first conditional estimator

in step 1 is unstructured, which means that, in general, it does not satisfy Equation (

3). We also want to remark that the final estimator

is used to extrapolate claim numbers in the next section. Despite being more intuitive, it does not occur in a well-defined model because of the right-truncation

.

All estimators , , are defined via integrated quadratic loss criteria and the hazard estimators , have closed form representations as local linear kernel estimators.

3.1. Pre-Step: Unstructured Conditional Hazard

We start with the unstructured conditional hazard estimator. Let

and

to simplify the notation. For convenience, we will also write

. For any

, the local linear kernel hazard estimator

is defined as the first component

minimizing the loss function

for

. Moreover, we use a two-dimensional kernel

K and bandwidth

for

as well as the common notation

. The term

is needed to make the expression well-defined. The loss criterion

L results in the closed form solution

for occurrence and exposure estimators

where the components of the two-dimensional vector

are

and the entries

of the

-dimensional matrix

are given by

The closed form solution

has been derived in

Nielsen (

1998). This paper focusses on the local linear kernel estimator because of its good performance at boundaries. The simpler and more intuitive (Nadaraya–Watson type) local constant hazard estimator is given in

Appendix A as an alternative. However, on bounded support, it is known to suffer from bias at boundaries (

Nielsen 1998;

Nielsen and Tanggaard 2001).

3.2. Estimation of Baseline Hazard Given Operational Time

Starting with the pilot estimator

, we calculate the first iteration

and then recursively update

making use of

. For the

r-th iteration, we define

as the hazard rate

minimizing the loss

for operational time

and the conditional hazard estimate

. The loss function reflects the principle of minimizing a chi-square criterion (

Berkson 1980) in which a least squares criterion is weighted by an estimate of the inverse of the asymptotic variance of

, here

. The function

w is a weighting function, which is used to ensure that the resulting hazard estimator is a ratio between an occurrence estimator and an exposure estimator. It will be specified later. The minimization of (

9) has the analytic solution

where

for

. The derivation is analogous to

Linton et al. (

2011). Now, setting the weighting

results in

The transformation adds the effect of operational time to occurrence and exposure estimators that were constructed with respect to . The function is the estimate of in the r-th iteration. Hence, we evaluate and at x but at the value of t that was corrected with the operational time effect.

It is worth pointing out that we do not get two marginal one-dimensional hazard estimator despite X and the cleared delay being independent. This makes the implementation quite involved.

3.3. Estimation of Operational Time Given Baseline Hazard

To estimate

in the

r-th iteration, we minimize the loss function in Equation (

9) in

given the baseline hazard

and the conditional hazard estimate

. Since there is no closed form solution to this problem (

Linton et al. 2011), one has to minimize it numerically point-wise in

x. Moreover, we set

with the last estimator

of

as above. Hence, for every

, we minimize

numerically for values

. The values

have to be chosen manually. We define

to be the function minimizing (

11) point-wise in

x. For unique identification of

and

, we set the normalization

.

Since there is no closed form solution of

and the occurrence and exposure estimators

and

in Equation (

10) depend on both

t and

x, asymptotic theory of our results is not straightforward and thus beyond the scope of this present paper. These difficulties arise due to the time-reversion that was necessary to derive estimators for right-truncated data. Asymptotic properties for analogous estimators on observations that are not right-truncated have been derived in

Linton et al. (

2011) in a non-parametric regression context. The fact that we cope with both right-truncation as present in run-off triangles and operational time distinguishes this present paper from preceding work. For a straightforward derivation of asymptotic properties of

with standard counting process arguments as in

Andersen et al. (

1993), one would have to make further assumptions. A feasible approach would be to assume that

can be estimated at a parametric

-rate, which is possible for instance in a finite parametrization. Being against the distribution-free nature of this paper (and its benchmark the chain-ladder method), we decided against this simplification.

A modification of the proposed hazard estimator

that has been proved efficient for large sample sizes would be a two-step multiplicative bias correction, which has been introduced for local linear kernel hazard estimators in

Nielsen and Tanggaard (

2001). Since this paper aims at explaining a new model and estimation procedure, and a bias correction method would add a lot of notation and complexity that might distract from our new idea, such an extension is left for future research.

4. Estimating Outstanding Claim Amounts

We use our hazard estimator to forecast outstanding claim amounts in a similar way development factors are used in the chain-ladder method. In chain-ladder with yearly aggregated data, the j-th development factor is effectively the ratio between claims whose payments are up to years delayed and those whose payments are up to j years delayed. For each claim, this yields an estimate of the probability that the payment will be years delayed given it has not been made within the first j years. Certainly, for more granular data, the time periods are shorter, but the principle stays the same.

In order to formally define development factors, one must first introduce the way data are aggregated in run-off triangles (

England and Verrall 2002). The data are given as

,

, for the triangle

. The accident date

is given in days from the beginning of data collection and settlement delay

is given in days. The last day of data collection

is also expressed in days since day 0, and it is implicitly assumed to be the largest possible delay. The last assumption is commonly made in industry for data sets covering large enough time periods (usually if

years or

years). It is then said that the triangle

is “fully run off”.

We adopt the notation of

England and Verrall (

2002) to introduce development factors. Suppose our data have been aggregated into

bins with edge length

. In the

-matrix

C, we count the number of observations per bin. Its entries

are defined as the number of claims

i for which

is in bin

j and

is in bin

k. In another matrix

D, the cumulative numbers of events with respect to

T are given by

for

. The triangle

represents the future and therefore contains no claim counts. This is the part we want to forecast. Now, the development factors

are defined as

For the calculation of

, the last available entry with claims that were delayed

years (

in row

) is omitted, which can be seen as scaling by exposure. In the chain-ladder method, the development factors

are then used to extrapolate the claim numbers in the cumulative matrix

D into the future via

and for

. The total number of outstanding claims is then given by the last column of the estimated cumulative aggregated data

We now link development factors to hazard estimation.

Hiabu (

2017) has proved the asymptotic relationship

for

being a histogram-type hazard estimator of the delay in reversed time,

the

j-th bin of the aggregated data, and

the bin width that satisfies

for

. However, this relationship was introduced under the assumption that accident date and settlement delay are independent. As an alternative for our Model (

1), we define granular time-dependent development factors as

where

is the

j-th bin for the delay and

the

k-th one for accident date for

. Then, we use our time-dependent development factors to forecasts reserves from a granular cumulative triangle

D via

and for

. The difference to chain-ladder is that our development factors additionally depend on the row

k and that we calculate them on a finer grid, i.e., smaller

, larger

m, and more granular matrices

C and

D. In the application in

Section 6, we use monthly aggregated data for the operational time hazard estimator and quarterly aggregated data for chain-ladder. Ideally, daily or even more granular data should be used for the proposed hazard estimator; however, this was practically computationally infeasible in our application. Analogously to chain-ladder, our final estimate for the number of outstanding payments is the last column in the estimated cumulative triangle

.

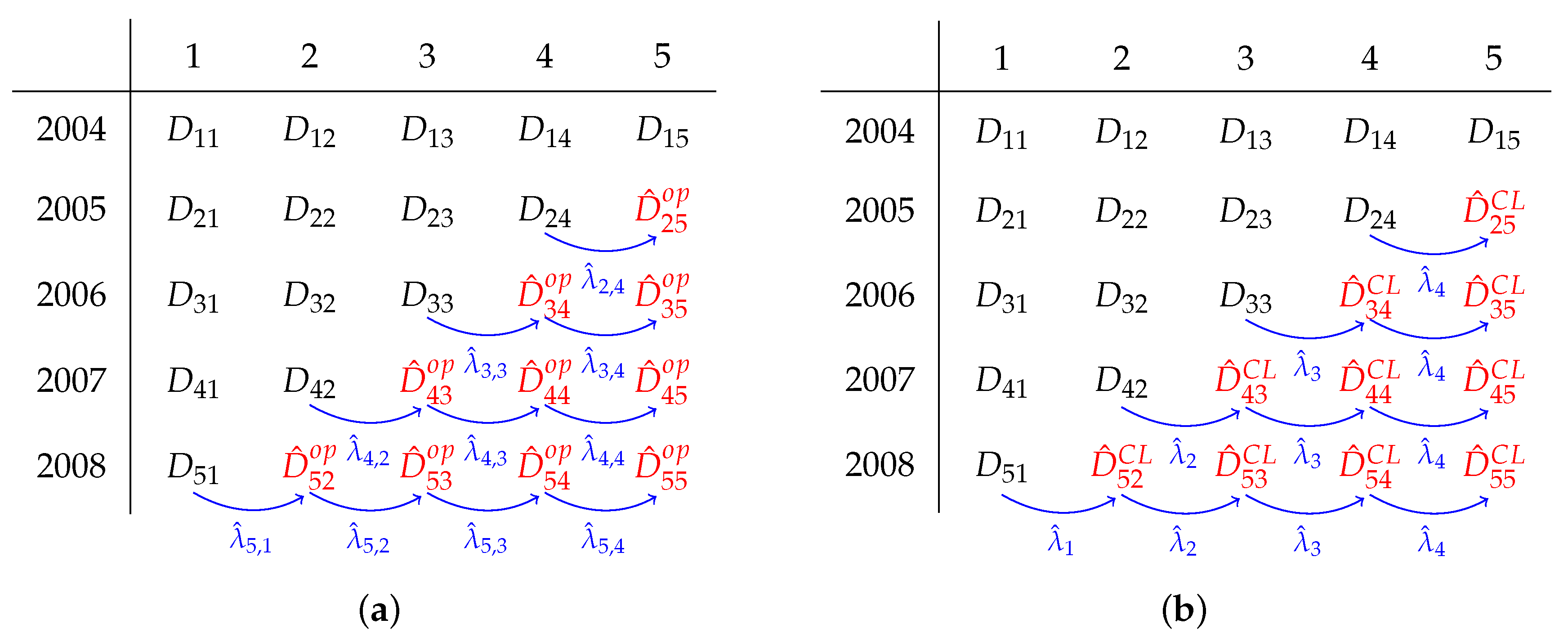

Figure 2 illustrates how development factors are used for extrapolation. The cumulated data is given in black, forecasts are in red and all development factors are given in blue. Our proposed time-dependent development factors can be used like traditional development factors but vary for different rows of the cumulative triangle. The illustration in

Figure 2 does not show the fact that our time-dependent development factors are computed on a finer scale than for chain-ladder. Moreover, the shift

x-direction through operational time

cannot be seen in the illustration.

6. Application: Estimation of Outstanding Liabilities

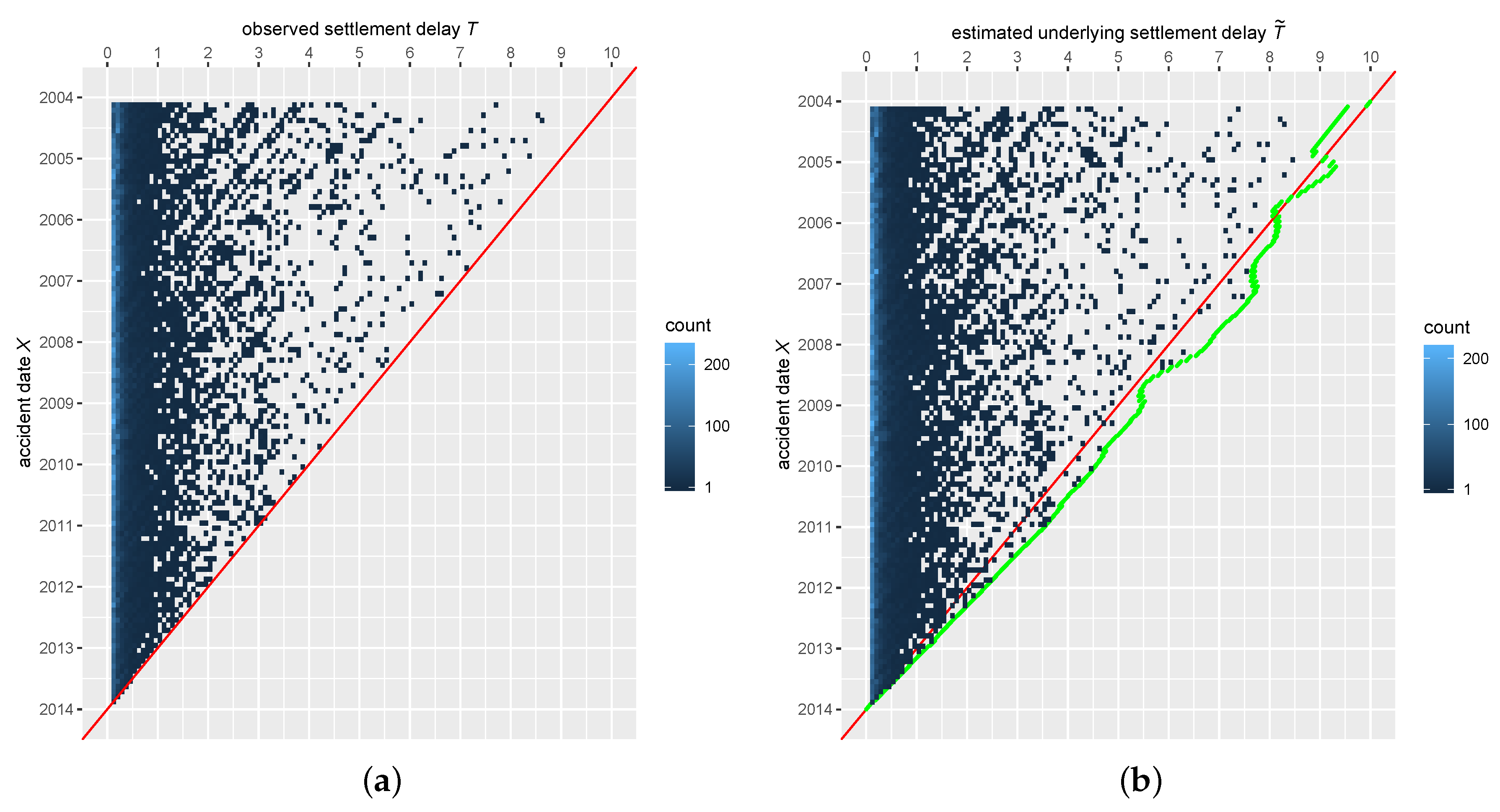

We apply our estimation procedure on a data set from a Cypriot motor insurance business line. This data set contains

n = 51,216 paid claims that were recorded between 1 January 2004 and 31 December 2013. First, we estimate operational time

and the baseline hazard

on the data set. Making use of the resulting structured conditional hazard estimate

, we estimate outstanding liabilities through the approach with time-dependent development factors

illustrated in

Section 4.

For each claim

, the data set contains the accident date and the payment date. Instead of the settlement date, we define the settlement delay as the difference between payment date and accident date. Afterwards, we normalize the data such that the accident date

and settlement delay

take values in

. Now, the data are arranged on a triangular shaped support

for

days with accident date

x and settlement delay

t as described in

Section 2.2. For computational reasons, the data are aggregated into a monthly run-off triangle

on which

and

are estimated. As the kernel function, we choose a multiplicative kernel

with

k being the Epanechnikov kernel

. The data-driven bandwidth selection procedure in

Section 5 leads to the optimal bandwidths

months and

months for delay and accident date, respectively. For the estimation of

, we minimize the loss functions (

11) in the interval

for every

in every iteration of the algorithm.

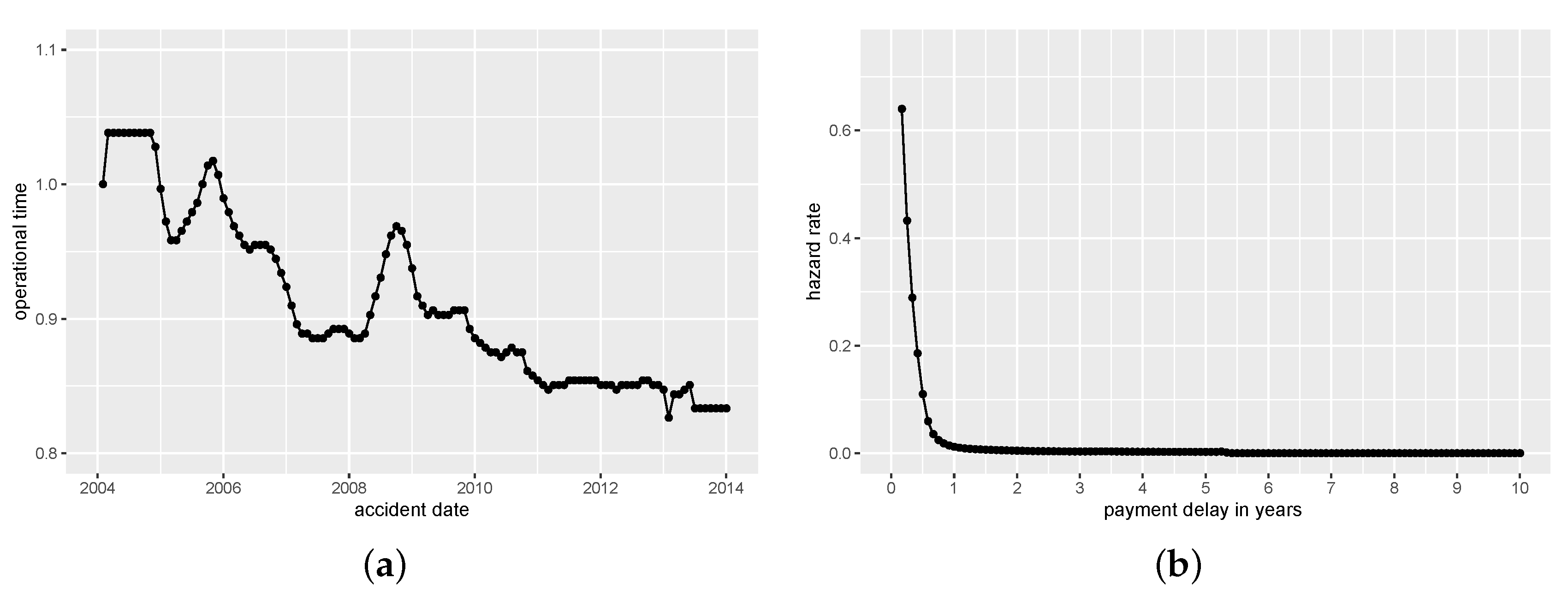

The estimated baseline hazard and operational time are shown in

Figure 3. For the operational time estimate

in

Figure 3a, the settlement delay at 1 January 2004 is used as benchmark and claim settlement for most accident dates between February 2004 and December 2005 is slightly slower than this benchmark. In November 2004, the operational time estimator catches a trend towards faster settlement of claims despite short declines in 2005 and 2009. This phenomenon is most likely due to the improved use of technology in the insurance company and has also been observed on the same data set in

Lee et al. (

2017). The decrease of speed in claims finalization at the end of 2005 and 2009 could be due to new employees in the reserving department who are training in their first months. The average accident that happened after January 2006 was settled faster than our benchmark with the value of the operational time estimate

being below 1 for this period. After 2010, our model shows the fastest processing and payments of claims. Due to high variation in the estimation of

in the lower corner of the run-off triangle, we recommend to set

to the value of the previous month for the last five months (about the last

of the support of

). Note that this adjustment is still in the spirit of our approach to improve in the estimation by chain-ladder (and even multiplicative nonparametric methods as in

Martínez-Miranda et al. (

2013) and

Hiabu et al. (

2016)) because a constant operational time value corresponds to the case where

T and

X are independent and we still allow for dependency through operational time for

of the accident dates. We want to remark that this issue does not occur if un-truncated data (on a squared support instead of a triangular one) is given. The baseline hazard estimate

of the payment delay (in forward time) in

Figure 3b has the expected shape with a steep decrease for short delays and a value close to zero for delays larger than 1.5 years. This shape indicates that the vast majority of the claims in this data set were paid off within the first year as can be seen in

Figure 1.

The estimated outstanding liabilities by accident year and by payment year are given in

Table 1. The results from the chain-ladder method with quarterly aggregated data are used as a benchmark. The shift through operational time yields less claims than chain-ladder for all payment years except for 2016. Since the value of the operational time estimate (

Figure 3a) is below the benchmark 1 for all claims with accident year later than 2005, these claims were settled faster than older claims. These claims constitute the majority of outstanding claims since most claims are estimated to be settled within one and a half years (

Figure 3b). Hence, most claims are expected to be paid out earlier than estimated through average payment delay in the chain-ladder method. The same effect can be seen with respect to accident years. On 31 December 2013, the date of data collection, our operational time estimator forecasts old claims from accidents before 2009 to be paid off since their settlement delay is expected to be shorter than average settlement. On the other hand, chain-ladder still estimates a few claims from accidents between 2005 and 2008. In total, for this data set, the estimated number of outstanding payments by operational time is lower (1054) than the reserve estimate by quarterly chain-ladder (1414).

Although the comparison might seem unfair at first due to different levels of aggregation, more granular aggregation for chain-ladder would not improve the quality of its estimates. As shown in a simulation study in

Baudry and Robert (

2019), even when enough data are available for monthly aggregation, chain-ladder reserve estimates based on monthly data show very high variance, making them effectively unreliable in practice; however, monthly data are necessary for chain-ladder if one is interested, for instance, in the estimation of monthly cash-flows. This phenomenon has been confirmed in a simulation in

Bischofberger et al. (

2019), in which kernel estimators picked larger bandwidths while still being able to yield monthly cash-flow predictions. Furthermore, chain-ladder is typically used on at least quarterly aggregated data to prevent columns that contain only zeros in the run-off triangle. Where the chain-ladder algorithm cannot handle this issue, our operational time hazard estimator can cope with it.

In an independence test based on Conditional Kendall’s tau for truncated data (

Austin and Betensky 2014;

Martin and Betensky 2005), the hypothesis of independent settlement delay

T and accident date

X was rejected. Hence, the assumptions of the chain-ladder model of

Mack (

1993) are violated (

Hiabu 2017) and one cannot rely on its estimate in this data set. Since the chain-ladder model with independent variables is nested within our prosed operational time Model (

1), we recommend our model—although inference for our operational time structure has not been carried out. With the hazard Model (

3) being rather involved, the theory for a hypothesis test for the operational time structure is beyond the scope of this article.

Choices of bandwidths with higher validation scores can lead to unrealistic reserve estimates that differ from the chain-ladder estimate by up to 100%. On the one hand, the operational time hazard estimator is sensitive to the choice of bandwidth. On the other hand, the result obtained through cross-validation is stable with four bandwidth choices close to the optimal validation score resulting in very similar estimates of the number of outstanding claims.

7. Conclusions

We introduced a new hazard model that allows for operational time in right-truncated data as present in run-off triangles. In a structured hazard model, the conditional hazard rate of the settlement delay given the accident date is expressed through operational time (a function of the accident date) and the baseline hazard of the settlement delay (cleared of effects from accident date). Minimizing an integrated squared loss, we define nonparametric estimators of operational time and the baseline hazard. These estimators are calculated through an iterative algorithm that updates the estimates of operational time and the baseline hazard in each iteration until it converges. If no right-truncation is present, our hazard model is a nonparametric extension of the accelerated failure model with a one-dimensional covariate.

Our estimation procedure detects operational time in the data and corrects for it in the estimation process. Therefore, it can be classified as an unsupervised machine learning technique. Since operational time is a common source of dependence between accident date and settlement date in the data, we recommend the approach illustrated here if one cannot prove independent covariates in the date through hypothesis testing (and other structural dependencies like seasonal effects can be ruled out). Even if the accident date and settlement are independent, our estimator works and estimates operational time . However, in the latter case or if independence is not rejected by a statistical test, estimation via chain-ladder tends to be more stable than our operational time hazard estimates and should be considered.

In an application in a real data set of paid claims, we forecast the number of outstanding claims for a motor insurance business line. For this purpose, we suggested to transform our operational time and baseline hazard estimators into time-dependent development factors. These are then used to extrapolate the claim numbers in the data set analogously to what is done in the chain-ladder method.

The downsides of the approach illustrated here are computational complexity and numerical instability of the operational time estimator on the data in the last 5–10% of accident dates, i.e., in the lower corner of the run-off triangle. The latter issue also arises in many other approaches to non-life claims reserving. Our suggested way to deal with it in our model is to set the value of operational time to the last stable value for the affected dates, which corresponds to the assumption of independent accident date and settlement delay on the most recent accident dates. Therefore, our approach still corrects for operational time on more than 90–95% of the data and in the remaining data it is as good as kernel hazard methods that assume independent variables.