Application of Diffusion Models in the Analysis of Financial Markets: Evidence on Exchange Traded Funds in Europe

Abstract

1. Introduction

- analyze financial innovation diffusion trajectories across selected European stock exchanges;

- provide long-term predictions of financial innovation development across the markets examined, in order to assess the probable path of ETF market development in Europe.

2. Theoretical Background

2.1. Basic Features of ETFs

2.2. ETFs Compared to Stock Index Derivatives

- Traditional securities: baskets of equities and ETFs;

- Symmetric derivatives: stock index futures and equity/index swaps;

- (Non-symmetric) convex instruments: stock index options.

- identical trading venues—most turnover occurs on stock exchanges,

- multiple market participants,

- intra-day pricing (on exchanges),

- high liquidity,

- minimal counterparty risk.

3. Materials and Methods

3.1. Innovation Diffusion Models

3.2. Data

4. Results

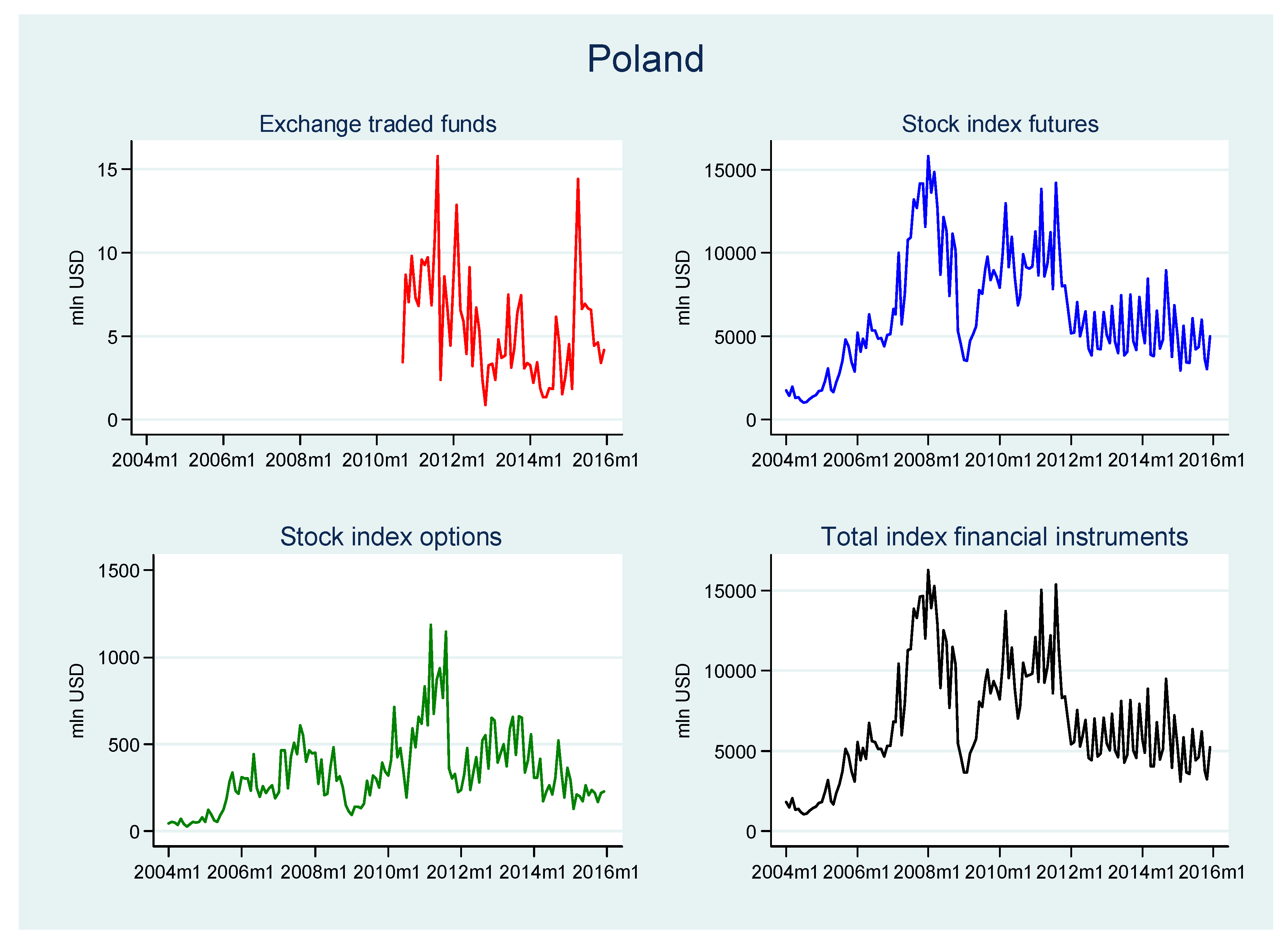

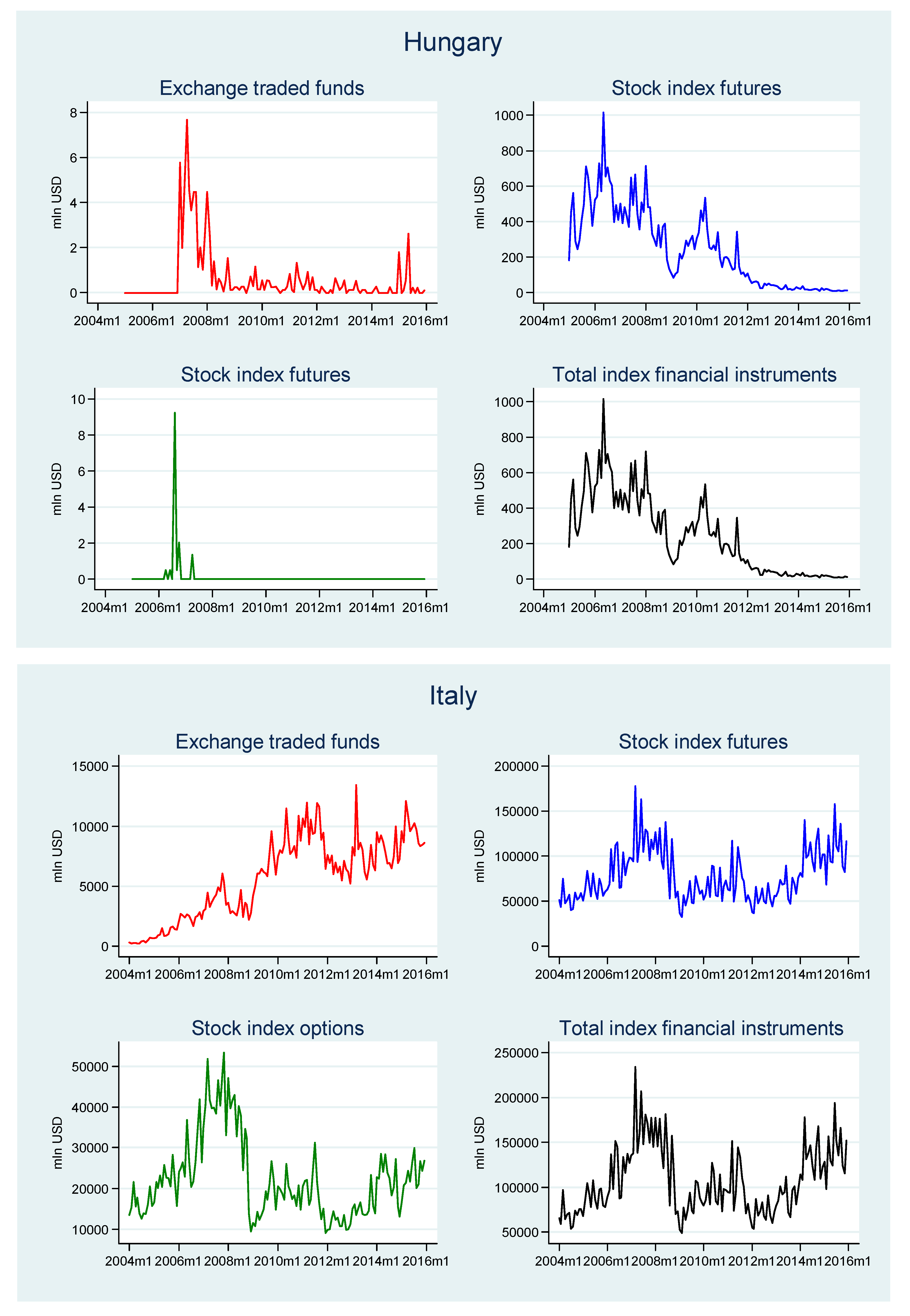

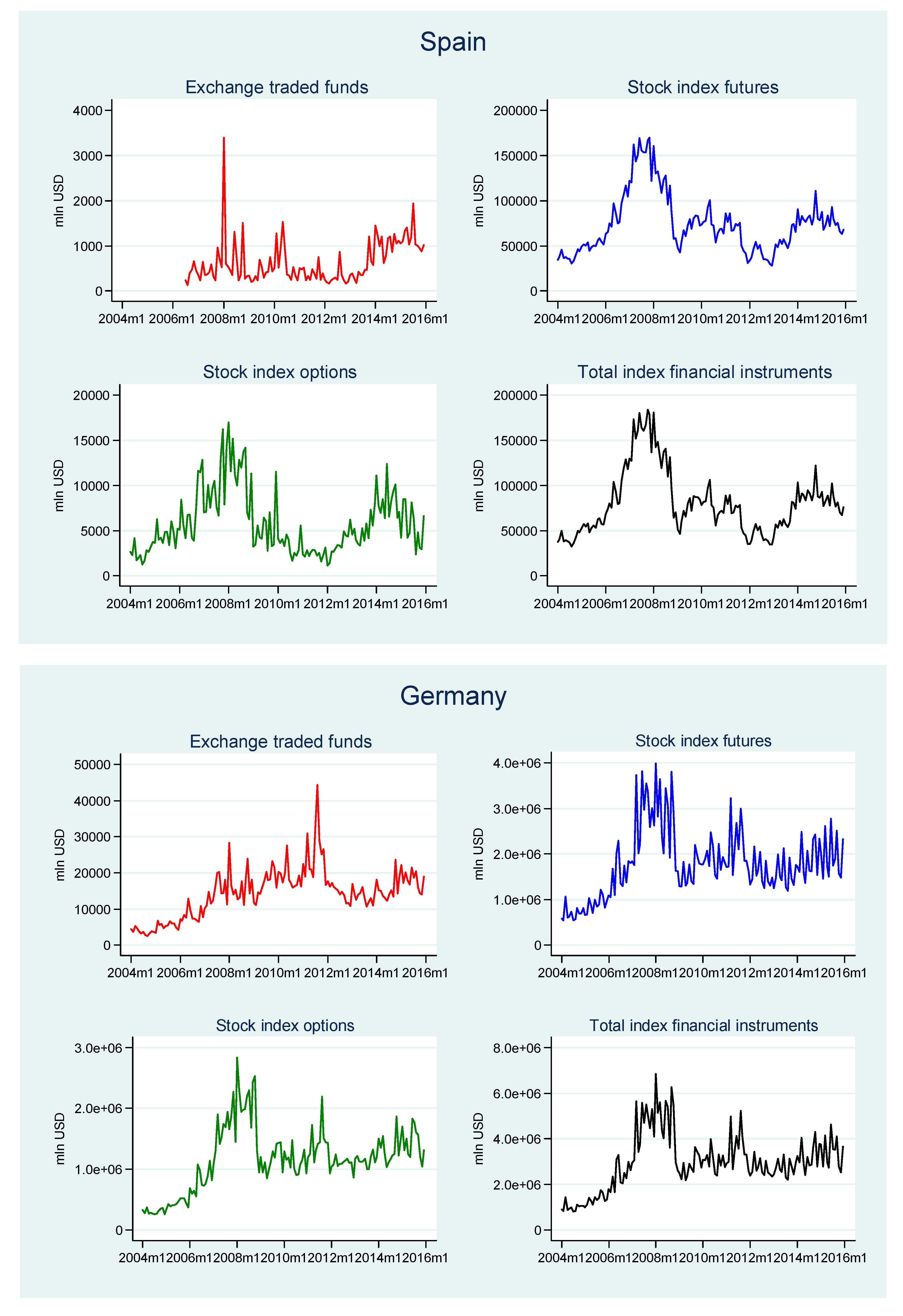

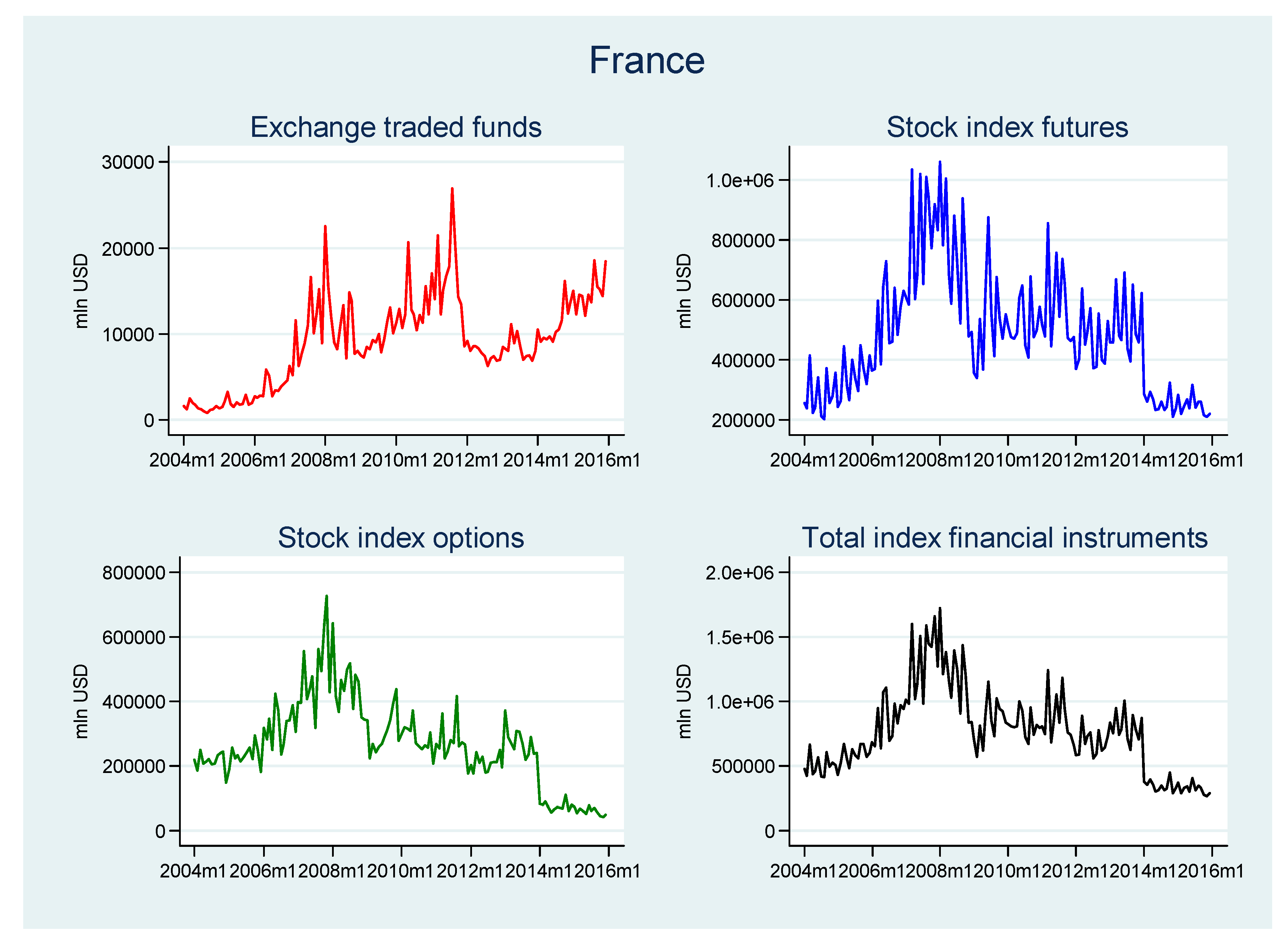

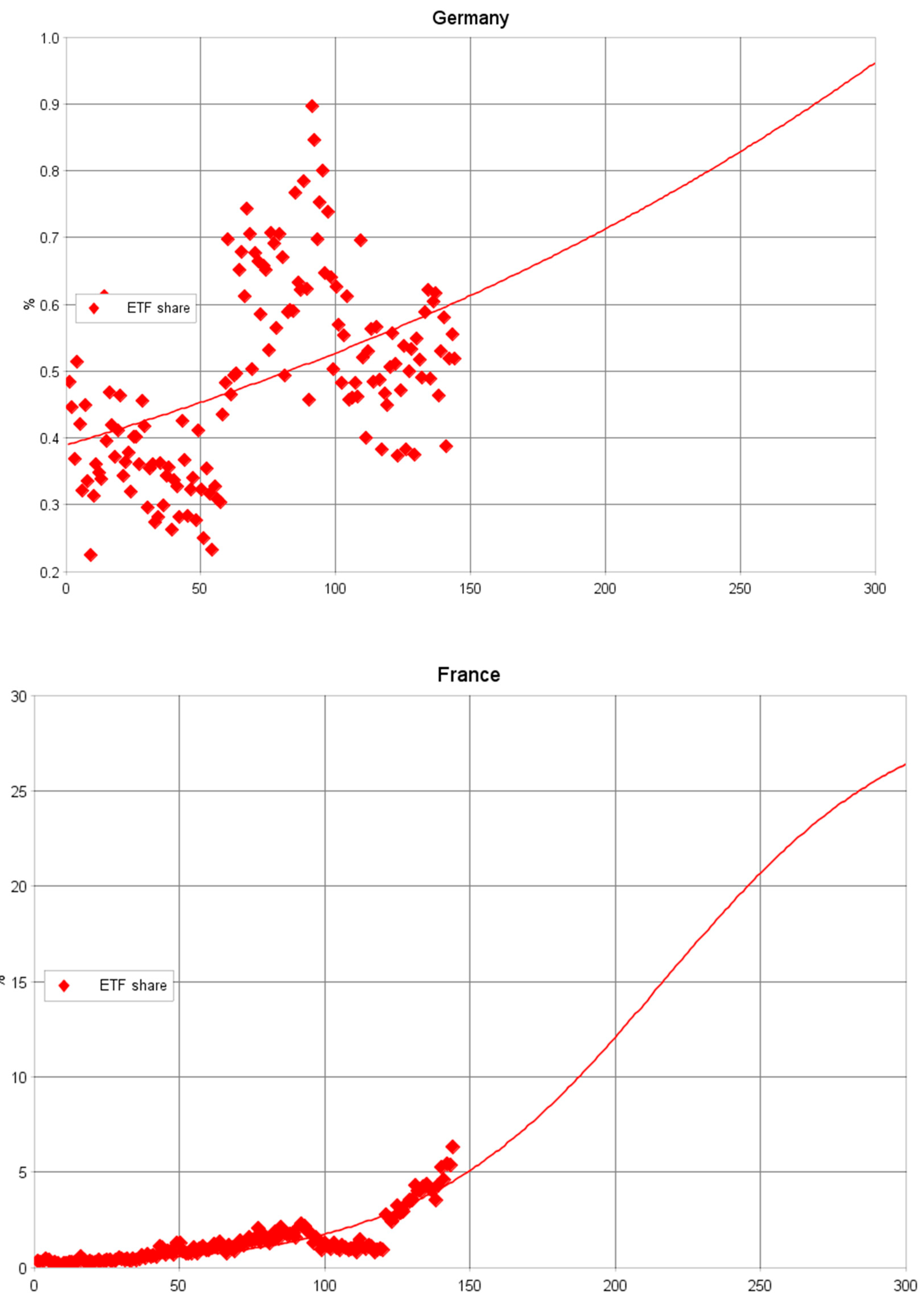

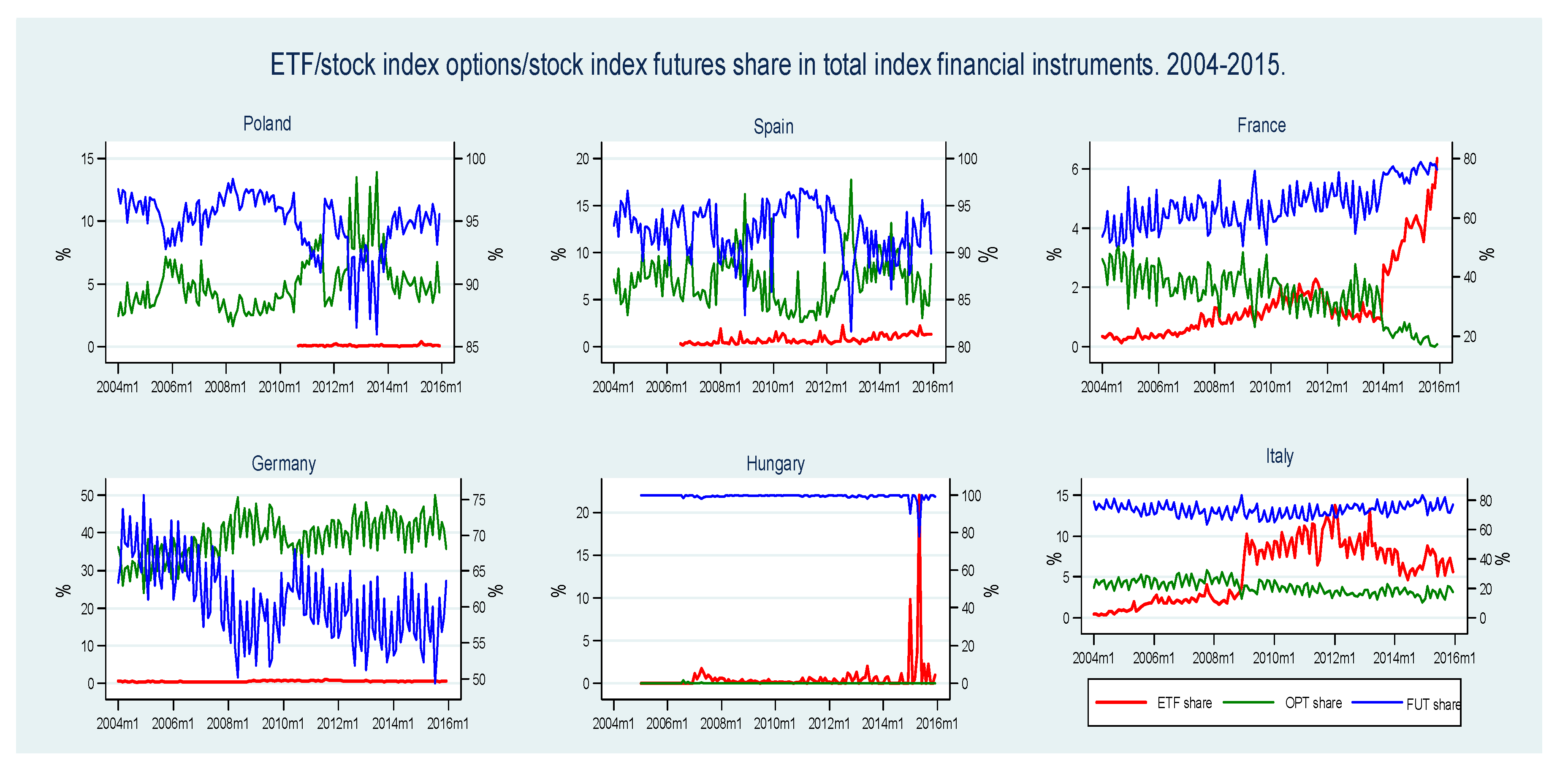

4.1. Exchange Traded Fund Market Development: Preliminary Evidence

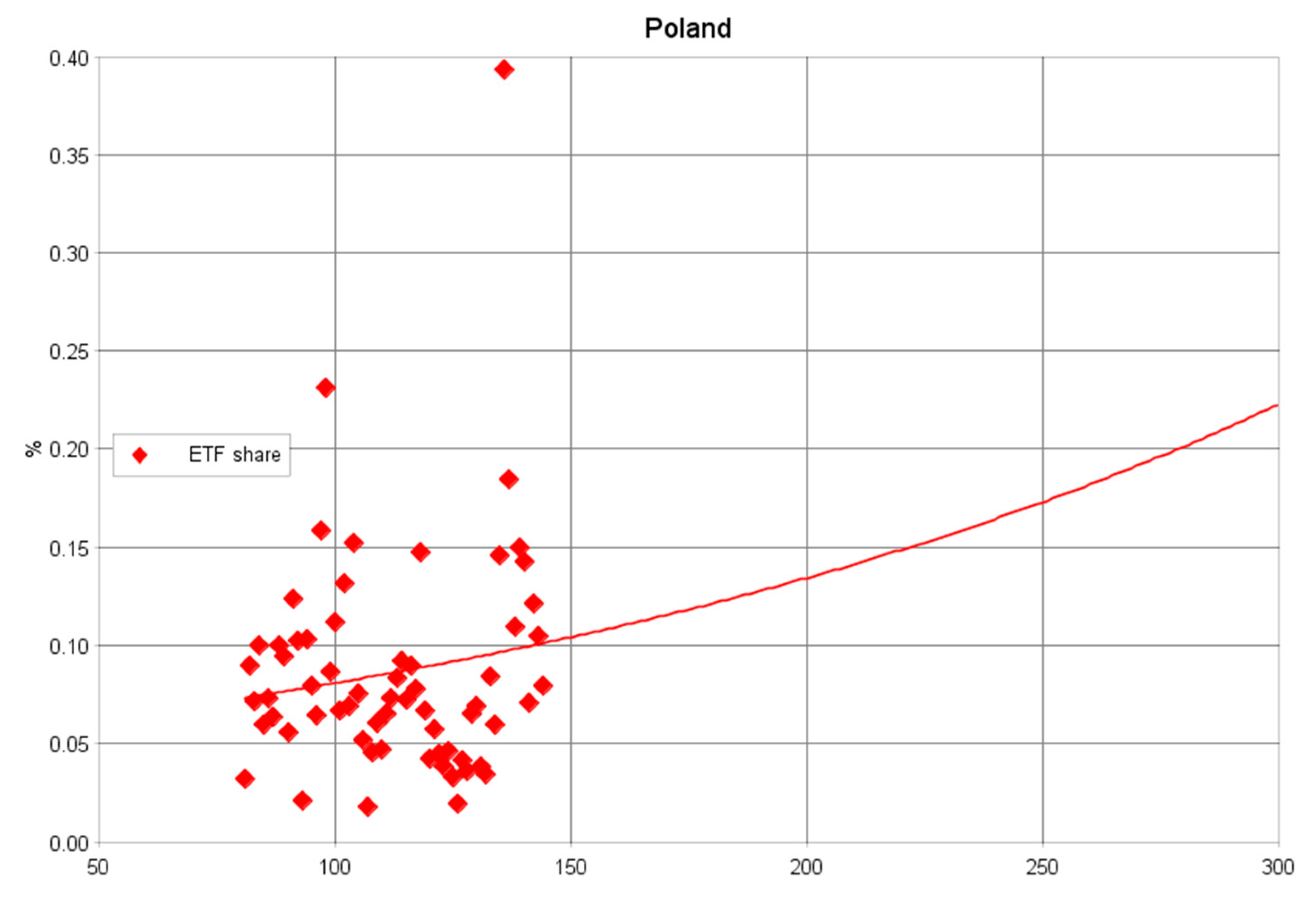

4.2. Exchange Traded Funds: Diffusion Models

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

References

- Abner, David. 2016. The ETF Handbook. How to Value and Trade Exchange-Traded Funds, 2nd ed. Hoboken: John Wiley & Sons. [Google Scholar]

- Agapova, Anna. 2011. Conventional mutual index funds versus exchange-traded funds. Journal of Financial Markets 14: 323–43. [Google Scholar] [CrossRef]

- Akhavein, Jalal, W. Scott Frame, and Lawrence J. White. 2005. The diffusion of financial innovation: An examination of the adoption of small business credit scoring by large banking organizations. Journal of Business 78: 577–96. [Google Scholar] [CrossRef]

- Alderighi, Stefano. 2020. Cross-listing in the European ETP market. Economics Bulletin 40: 35–40. [Google Scholar]

- Arnold, Matthew, and Antoine Lesné. 2015. The Changing Landscape for Beta Replication—Comparing Futures and ETFs for Equity Index Exposure. Boston: State Street Global Advisors. [Google Scholar]

- Arunanondchai, Panit, Kunlapath Sukcharoen, and David J. Leatham. 2019. Dealing with tail risk in energy commodity markets: Futures contracts versus exchange-traded funds. Journal of Commodity Markets. [Google Scholar] [CrossRef]

- Awrey, Dan. 2013. Toward a supply-side theory of financial innovation. Journal of Comparative Economics 41: 401–19. [Google Scholar] [CrossRef]

- Baltussen, Guido, Sjoerd van Bekkum, and Zhi Da. 2019. Indexing and stock market serial dependence around the world. Journal of Financial Economics 132: 26–48. [Google Scholar] [CrossRef]

- Ben-David, Itzhak, Francesco Franzoni, and Rabih Moussawi. 2017. Exchange Traded Funds. Annual Review of Financial Economics 9: 169–19. [Google Scholar] [CrossRef]

- Ben-David, Itzhak, Francesco Franzoni, and Rabih Moussawi. 2018. Do ETFs increase volatility? The Journal of Finance 73: 2471–535. [Google Scholar] [CrossRef]

- Blocher, Jesse, and Robert E. Whaley. 2016. Two-Sided Markets in Asset Management: Exchange-traded Funds and Securities Lending. Vanderbilt Owen Graduate School of Management Research Paper 2474904: 1–45. [Google Scholar] [CrossRef]

- Box, Travis, Ryan L. Davis, and Kathleen P. Fuller. 2019. ETF competition and market quality. Financial Management 48: 873–916. [Google Scholar] [CrossRef]

- Chang, Chia-Lin, Chia-Ping Liu, and Michael McAleer. 2019. Volatility spillovers for spot, futures, and ETF prices in agriculture and energy. Energy Economics 81: 779–92. [Google Scholar] [CrossRef]

- Chang, Chia-Lin, Michael McAleer, and Chien-Hsun Wang. 2018. An econometric analysis of ETF and ETF futures in financial and energy markets using generated regressors. International Journal of Financial Studies 6: 2. [Google Scholar] [CrossRef]

- CME Group. 2016. The Big Picture: A Cost Comparison of Futures and ETFs. Chicago: CME Group. [Google Scholar]

- DeMarzo, Peter, and Darrell Duffie. 1999. A liquidity-based model of security design. Econometrica 67: 65–99. [Google Scholar] [CrossRef]

- Diaz-Rainey, Ivan, and Gbenga Ibikunle. 2012. A Taxonomy of the ‘Dark Side’ of Financial Innovation: The Cases of High Frequency Trading and Exchange Traded Funds. International Journal of Entrepreneurship and Innovation Management 16: 51–72. [Google Scholar] [CrossRef]

- Dosi, Giovanni, and Richard R. Nelson. 1994. An introduction to evolutionary theories in economics. Journal of Evolutionary Economics 4: 153–72. [Google Scholar] [CrossRef]

- Eurex. 2016. Futures or ETFs?—Not as Simple as Yes or No. Eschborn: Eurex. [Google Scholar]

- Ferri, Richard A. 2009. The ETF Book: All You Need to Know about Exchange-Traded Funds. Hoboken: John Wiley & Sons. [Google Scholar]

- Frame, W. Scott, and Lawrence J. White. 2004. Empirical Studies of Financial Innovation: Lots of Talk, Little Action? Journal of Economic Literature 42: 116–44. [Google Scholar] [CrossRef]

- Frame, W. Scott, and Lawrence J. White. 2012. Technological Change, Financial Innovation, and Diffusion in Banking. In The Oxford Handbook of Banking. Edited by Allen N. Berger, Philip Molyneux and John O.S. Wilson. Oxford: Oxford University Press, pp. 486–507. [Google Scholar] [CrossRef]

- Gastineau, Gary L. 2010. The Exchange-Traded Funds Manual. Hoboken: John Wiley & Sons. [Google Scholar]

- Geroski, Paul A. 2000. Models of technology diffusion. Research Policy 29: 603–25. [Google Scholar] [CrossRef]

- Goltz, Felix, and David Schröder. 2011. Passive Investing before and after the Crisis: Investors’ Views on Exchange-Traded Funds and Competing Index Products. Bankers, Markets and Investors 110: 5–20. [Google Scholar]

- Hamid, Nizam, and Jessica Edrosolan. 2009. A comparison: Futures, swaps, and ETFs. ETFs and Indexing 1: 39–49. [Google Scholar]

- Hayashi, Fumiko, and Elizabeth Klee. 2003. Technology adoption and consumer payments: Evidence from survey data. Review of Network Economics 2: 175–90. [Google Scholar] [CrossRef][Green Version]

- Hehn, Elizabeth. 2005. Introduction. In Exchange Traded Funds: Structure, Regulation and Application of a New Fund Class. Edited by Elizabeth Hehn. Berlin/Heidelberg: Springer, pp. 1–5. [Google Scholar] [CrossRef]

- Hill, Joanne M. 2016. The evolution and success of index strategies in ETFs. Financial Analysts Journal 72: 8–13. [Google Scholar] [CrossRef]

- Hill, Joanne M., and Barbara Mueller. 2001. The appeal of ETFs. ETFs and Indexing 1: 50–65. [Google Scholar]

- Hill, Joanne M., Dave Nadig, and Matt Hougan. 2015. A Comprehensive Guide to Exchange-Traded Funds (ETFs). Charlottesville: CFA Institute Research Foundation. [Google Scholar]

- Hull, Isaiah. 2016. The development and spread of financial innovations. Quantitative Economics 7: 613–36. [Google Scholar] [CrossRef][Green Version]

- Investment Company Institute. 2017. Investment Company Fact Book 2017. Washington, DC: Investment Company Institute. [Google Scholar]

- Jiang, Tao, Si Bao, and Long Li. 2019. The linear and nonlinear lead–lag relationship among three SSE 50 Index markets: The index futures, 50ETF spot and options markets. Physica A: Statistical Mechanics and its Applications 525: 878–93. [Google Scholar] [CrossRef]

- Kovacova, Maria, Tomas Kliestik, Katarina Valaskova, Pavol Durana, and Zuzana Juhaszova. 2019. Systematic review of variables applied in bankruptcy prediction models of Visegrad group countries. Oeconomia Copernicana 10: 743–72. [Google Scholar] [CrossRef]

- Kucharavy, Dmitry, and Roland De Guio. 2011. Logistic substitution model and technological forecasting. Procedia Engineering 9: 402–16. [Google Scholar] [CrossRef]

- Kwasnicki, Witold. 2013. Logistic growth of the global economy and competitiveness of nations. Technological Forecasting and Social Change 80: 50–76. [Google Scholar] [CrossRef]

- Lechman, Ewa, and Adam Marszk. 2015. ICT technologies and financial innovations: The case of Exchange Traded Funds in Brazil, Japan, Mexico, South Korea and the United States. Technological Forecasting and Social Change 99: 355–76. [Google Scholar] [CrossRef]

- Lechman, Ewa. 2015. ICT Diffusion in Developing Countries: Towards a New Concept of Technological Takeoff. New York: Springer. [Google Scholar] [CrossRef]

- Lettau, Martin, and Ananth Madhavan. 2018. Exchange-Traded Funds 101 for Economists. Journal of Economic Perspectives 32: 135–54. [Google Scholar] [CrossRef]

- Liu, Pan, Dmitry Vedenov, and Gabriel J. Power. 2020. Commodity financialization and sector ETFs: Evidence from crude oil futures. Research in International Business and Finance 51: 101109. [Google Scholar] [CrossRef]

- Liu, Qingfu, and Yiuman Tse. 2017. Overnight returns of stock indexes: Evidence from ETFs and futures. International Review of Economics & Finance 48: 440–51. [Google Scholar] [CrossRef]

- Madhavan, Ananth, Ursula Marchioni, Wei Li, and Daphne Yan Du. 2014. Equity ETFs versus Index Futures: A Comparison for Fully Funded Investors. Institutional Investor Journal 5: 66–75. [Google Scholar] [CrossRef]

- Madhavan, Ananth. 2016. Exchange-Traded Funds and the New Dynamics of Investing. Oxford: Oxford University Press. [Google Scholar] [CrossRef]

- Mansfield, Edwin. 1961. Technical change and the rate of imitation. Econometrica: Journal of the Econometric Society 29: 741–66. [Google Scholar] [CrossRef]

- Marszk, Adam, Ewa Lechman, and Yasuyuki Kato. 2019. The Emergence of ETFs in Asia-Pacificirca. New York: Springer. [Google Scholar] [CrossRef]

- McConnell, John J., and Eduardo S. Schwartz. 1992. The origin of LYONS: A case study in financial innovation. Journal of Applied Corporate Finance 4: 40–47. [Google Scholar] [CrossRef]

- Meyer, Perrin S., Jason W. Yung, and Jesse H. Ausubel. 1999. A primer on logistic growth and substitution: The mathematics of the Loglet Lab software. Technological Forecasting and Social Change 61: 247–71. [Google Scholar] [CrossRef]

- Meyer, Perrin. 1994. Bi-logistic growth. Technological Forecasting and Social Change 47: 89–102. [Google Scholar] [CrossRef]

- Molyneux, Phil, and Nidal Shamroukh. 1996. Diffusion of Financial Innovations: The Case of Junk Bonds and Note Issuance Facilities. Journal of Money, Credit and Banking 28: 502–22. [Google Scholar] [CrossRef]

- Oztekin, A. Senol, Suchismita Mishra, Pankaj K. Jain, Robert T. Daigler, Sascha Strobl, and Richard D. Holowczak. 2017. Price discovery and liquidity characteristics for US electronic futures and ETF markets. The Journal of Trading 12: 59–72. [Google Scholar] [CrossRef][Green Version]

- Persons, John C., and Vincent A. Warther. 1997. Boom and bust patterns in the adoption of financial innovations. Review of Financial Studies 10: 939–67. [Google Scholar] [CrossRef]

- Philippas, Dionisis Th, and Costas Siriopoulos. 2012. Is the progress of financial innovations a continuous spiral process? Investment Management and Financial Innovations 9: 20–31. [Google Scholar] [CrossRef]

- Piccotti, Louis R. 2018. ETF Premiums and Liquidity Segmentation. Financial Review 53: 117–52. [Google Scholar] [CrossRef]

- Rogers, Everett M. 2010. Diffusion of Innovations, 4th ed. New York: Free Press. [Google Scholar]

- Satoh, Daisuke. 2001. A discrete bass model and its parameter estimation. Journal of the Operations Research Society of Japan-Keiei Kagaku 44: 1–18. [Google Scholar] [CrossRef]

- Srinivasan, V., and Charlotte H. Mason. 1986. Technical note—nonlinear least squares estimation of new product diffusion models. Marketing Science 5: 169–78. [Google Scholar] [CrossRef]

- Thomsett, Michael. 2016. Differences Between Stock and Future Options. InvestorGuide.com. Available online: http://www.investorguide.com/article/12605/differences-between-stock-and-future-options-wo/ (accessed on 13 February 2020).

- Wallace, Damien, Petko S. Kalev, and Guanhua Lian. 2019. The evolution of price discovery in us equity and derivatives markets. Journal of Futures Markets 39: 1122–36. [Google Scholar] [CrossRef]

- Wang, Jinzhong, Hao Kang, Fei Xia, and Guowei Li. 2018. Examining the equilibrium relationship between the Shanghai 50 stock index futures and the Shanghai 50 ETF options markets. Emerging Markets Finance and Trade 54: 2557–76. [Google Scholar] [CrossRef]

- World Federation of Exchanges. 2017. WFE Database. London: World Federation of Exchanges. [Google Scholar]

| Feature | ETFs | Stock Index Futures |

|---|---|---|

| Accessibility | Very high, due to small notional requirements. Operationally simple in most cases | Small notional requirements. Operationally complicated (e.g., pricing) |

| Product range | Very broad. Many asset classes | Most major equity indexes |

| Required capital | Full upfront payment | Only margin (a notional fraction of the investment needs to be posted) |

| Position management | Minimal (may include reinvestment of dividends) | Margin and cash flow management, contract rolling |

| Maturity | Open-ended | Predefined (usually one or three months) |

| Leverage | Only in the case of leveraged ETFs | Available, usually very high |

| Short sales of securities | May be limited (with the exception of special ETF classes, e.g., inverse ETFs) | Investors may use futures to obtain short exposure |

| Positions in foreign assets | No need to manage foreign exchange component | Foreign exchange management necessary |

| Statistics | Poland | Hungary | ||||||

|---|---|---|---|---|---|---|---|---|

| Turnover on Local Stock Exchanges (in million USD) | ||||||||

| ETFs | Stock Index Options | Stock Index Futures | Total Index Financial Instruments | ETFs | Stock Index Options | Stock Index Futures | Total Index Financial Instruments | |

| # obs. | 64 | 144 | 144 | 144 | 132 | 132 | 132 | 132 |

| Min | 0.90 | 29.14 | 1041.05 | 1070.2 | 0.0 | 0.0 | 9.2 | 10.08 |

| (2012m11) | (2004m7) | (2004m7) | (2004m7) | (2015m5) | (2015m7) | |||

| Max | 15.79 | 1187.1 | 15,820.6 | 16,274.5 | 7.6 | 9.2 | 1015.6 | 1015.6 |

| (2011m8) | (2011m3) | (2008m1) | (2008m1) | (2007m4) | (2006m8) | (2006m5) | (2006m5) | |

| Mean | 5.5 | 336.2 | 6422.6 | 6761.30 | 0.60 | 0.10 | 244.9 | 245.7 |

| Absolute change in value (pp) | 0.76 | 184.05 | 3220.6 | 3408.8 | −5.6 | 0.0 | −172.7 | −0.25 |

| Average monthly dynamic | 100.3 | 101.1 | 100.7 | 100.7 | 48.6 | 66.8 | 97.9 | 97.9 |

| Share of Total Turnover of Index Financial Instruments on Local Stock Exchanges [%] | ||||||||

| ETFs | Stock Index Options | Stock Index Futures | - | ETFs | Stock Index Options | Stock Index Futures | - | |

| # obs. | 64 | 144 | 144 | - | 132 | 132 | 132 | - |

| Min | 0.02 | 1.6 | 86.01 | − | 0.0 | 0.0 | 77.9 | - |

| (2012m11) | (2008m4) | (2008m4) | (multiple periods) | (multiple periods) | (2015m) | |||

| Max | 0.39 | 13.9 | 98.4 | − | 22.01 | 1.4 | 100 | - |

| (2015m4) | (2013m8) | (2013m8) | (2015m5) | (2006m8) | (multiple periods) | |||

| Mean | 0.08 | 5.05 | 94.9 | - | 0.55 | 0.02 | 99.4 | - |

| Absolute change in share (pp) | 0.05 | 1.9 | −2.00 | - | −0.25 | 0.0 | −0.89 | - |

| Average monthly dynamic | 101.4 | 100.4 | 99.9 | - | 39.7 | 60.7 | 99.9 | - |

| Italy | Spain | |||||||

| Turnover on Local Stock Exchanges (in million USD) | ||||||||

| ETFs | Stock Index Options | Stock Index Futures | Total Index Financial Instruments | ETFs | Stock Index Options | Stock Index Futures | Total Index Financial Instruments | |

| # obs. | 144 | 144 | 144 | 144 | 114 | 144 | 144 | 144 |

| Min | 246.4 | 9038.99 | 32,881.4 | 48,685.7 | 131.2 | 1134.1 | 28,439.7 | 32,317.4 |

| (2004m5) | (2011m12) | (2009m2) | (2009m2) | (2012m8) | (2012m1) | (2012m2) | (2004m8) | |

| Max | 13,435.2 | 53,337.8 | 178,067.9 | 234,279.7 | 3397.5 | 16,971.7 | 169,693.3 | 183,875.7 |

| (2015m3) | (2007m3) | (2007m3) | (2007m3) | (2008m1) | (2008m1) | (2007m11) | (2007m10) | |

| Mean | 5669.7 | 22,329.0 | 78,508.4 | 106,507.1 | 630.5 | 5764.6 | 74,557.7 | 80,821.5 |

| Absolute change in value (pp) | 8306.9 | 13,222.2 | 64,909.3 | 86,438.5 | 779.1 | 3950.7 | 33,361.5 | 38,333.1 |

| Average monthly dynamic | 102.3 | 100.5 | 100.6 | 100.6 | 101.3 | 100.6 | 100.4 | 100.5 |

| Share in Total Turnover of Index Financial Instruments on Local Stock Exchanges [%] | ||||||||

| ETFs | Stock Index Options | Stock Index Futures | - | ETFs | Stock Index Options | Stock Index Futures | - | |

| # obs. | 144 | 144 | 144 | 114 | 144 | 144 | - | |

| Min | 0.27 | 10.7 | 63.6 | 0.14 | 81.6 | 81.6 | - | |

| (2004m3) | (2014m12) | (2007m10) | (2007m9) | (2011m1) | (2012m12) | |||

| Max | 13.7 | 32.3 | 83.3 | 2.2 | 96.8 | 96.8 | - | |

| (2012m1) | (2007m10) | (2014m12) | (2015m7) | (2012m12) | (2011m1) | |||

| Mean | 5.6 | 20.9 | 73.4 | 0.75 | 7.1 | 92.3 | - | |

| Absolute change in share (pp) | 5.2 | −3.07 | −2.1 | 1.04 | 1.6 | −2.9 | - | |

| Average monthly dynamic | 101.7 | 99.8 | 99.9 | 101.3 | 100.1 | 99.9 | - | |

| Germany | France | |||||||

| Turnover on Local Stock Exchanges (in million USD) | ||||||||

| ETFs | Stock Index Options | Stock Index Futures | Total Index Financial Instruments | ETFs | Stock Index Options | Stock Index Futures | Total Index Financial Instruments | |

| # obs. | 144 | 144 | 144 | 144 | 144 | 144 | 144 | 144 |

| Min | 2549.1 | 259,180.4 | 550,142.9 | 823,511.8 | 810.6 | 44,421.9 | 204,785.8 | 269,320.8 |

| (2004m9) | (2004m12) | (2004m2) | (2004m7) | (2004m9) | (2015m11) | (2004m8) | (2015m11) | |

| Max | 44,323.2 | 2,830,918 | 3,993,353 | 6,852,531 | 26,980.5 | 726,885.4 | 1,059,843 | 1,725,926 |

| (2011m8) | (2008m1) | (2008m1) | (2008m1) | (2011m8) | (2007m11) | (2008m1) | (2008m1) | |

| Mean | 14,351.3 | 1,161,163 | 1,781,525 | 2,957,040 | 9170.3 | 266,211.7 | 485,718.8 | 761,100.9 |

| Absolute change in value (pp) | 14,556.7 | 979,971.1 | 1,747,945 | 2,742,473 | 16,803.99 | −168,972 | −33,997.2 | −186,165 |

| Average monthly dynamic | 101.0 | 100.9 | 100.9 | 100.9 | 101.7 | 98.9 | 99.9 | 99.6 |

| Share of Total Turnover of Index Financial Instruments on Local Stock Exchanges [%] | ||||||||

| ETFs | Stock Index Options | Stock Index Futures | - | ETFs | Stock Index Options | Stock Index Futures | - | |

| # obs. | 144 | 144 | 144 | - | 144 | 144 | 144 | - |

| Min | 0.22 | 24.06 | 49.4 | − | 0.13 | 16.5 | 49.5 | - |

| (2004m9) | (2004m12) | (2015m7) | (2004m9) | (2015m11) | (2004m8) | |||

| Max | 0.89 | 50.06 | 75.6 | − | 6.4 | 50.3 | 78.7 | - |

| (2011m7) | (2015m7) | (2004m12) | (2015m12) | (2004m8) | (2015m5) | |||

| Mean | 0.48 | 38.6 | 60.9 | - | 1.4 | 33.9 | 64.5 | - |

| Absolute change in share (pp) | 0.03 | −0.31 | 0.27 | - | 6.00 | −28.7 | 22.7 | - |

| Average monthly dynamic | 100.0 | 99.9 | 100.0 | - | 102.0 | 99.3 | 100.2 | - |

| Parameter | Poland | Hungary | Italy |

| (ceiling/upper asymptote) | 0.087 | 97,207 | 8.56 |

| ) (midpoint) | 397,133.9 | 1062 | 52.9 |

| (rate of diffusion) | −2606.7 | 0.013 | 0.113 |

| (specific duration) | −0.002 | 339.2 | 38.7 |

| R2 of the model | 0.00 | 0.075 | 0.76 |

| # of obs. | 64 | 130 (outliers excluded) | 144 |

| Parameter | Spain | Germany | France |

| (ceiling/upper asymptote) | 500,100.2 | 0.585 | 7,755,333.6 |

| ) (midpoint) | 1,175,6.2 | −3.94 | 777.3 |

| (rate of diffusion) | 0.012 | 0.026 | 0.023 |

| (specific duration) | 354.4 | 169.8 | 194.2 |

| R2 of the model | 0.411 | 0.27 | 0.789 |

| # of obs. | 114 | 144 | 144 |

| (Upper Asymptote)—Fixed | (Midpoint)—Refers to a Specific Date | Δ (Specific Duration)—Number of Months | (Rate of Diffusion) | R2 of the Model |

|---|---|---|---|---|

| Poland | ||||

| 5% | −229,626,799 | −249,867,896 | 0.00 | 0.016 |

| 7.5% | 981.7 | 857.4 | 0.005 | 0.018 |

| 10% | 1,010.6 | 859.5 | 0.005 | 0.018 |

| 15% | −258,875,673 | −220,949,493 | 0.00 | 0.016 |

| 20% | 1,181,1 | 862.7 | 0.005 | 0.018 |

| 25% | 1,225.8 | 863.3 | 0.005 | 0.018 |

| 30% | 1,262.3 | 863.8 | 0.005 | 0.018 |

| Hungary | ||||

| 5% | 282.4 (2027m6) | 319.5 | 0.014 | 0.073 |

| 7.5% | 318.3 (2030m6) | 326.0 | 0.013 | 0.073 |

| 10% | 343.2 (2032m7) | 329.3 | 0.013 | 0.073 |

| 15% | 377.4 (2035m5) | 332.6 | 0.013 | 0.074 |

| 20% | 401.2 (2037m5) | 334.2 | 0.013 | 0.074 |

| 25% | 419.4 (2038m11) | 335.2 | 0.013 | 0.074 |

| 30% | 434.2 (2040m2) | 335.9 | 0.013 | 0.074 |

| Italy | ||||

| 5% | Already achieved | |||

| 7.5% | Already achieved | |||

| 10% | Already achieved | |||

| 15% | 100.24 (2012m4) | 246.9 | 0.018 | 0.485 |

| 20% | 141.7 (2015m9) | 318.7 | 0.014 | 0.454 |

| 25% | 175.7 (2018m7) | 359.9 | 0.012 | 0.445 |

| 30% | 204.1 (2020m12) | 386.9 | 0.011 | 0.435 |

| Spain | ||||

| 5% | 211.4 (2021m7) | 300.3 | 0.015 | 0.41 |

| 7.5% | 252.4 (2024m12) | 318.2 | 0.014 | 0.41 |

| 10% | 280.6 (2027m4) | 327.2 | 0.013 | 0.41 |

| 15% | 318.9 (2030m6) | 336.3 | 0.013 | 0.41 |

| 20% | 345.4 (2032m9) | 340.8 | 0.013 | 0.41 |

| 25% | 365.6 (2034m5) | 343.5 | 0.013 | 0.41 |

| 30% | 381.7 (2035m9) | 345.4 | 0.013 | 0.41 |

| Germany | ||||

| 5% | 1,402.6 | 1426.9 | 0.003 | 0.02 |

| 7.5% | 892.6 | 1349.1 | 0.003 | 0.02 |

| 10% | 1003.8 | 1375.0 | 0.003 | 0.02 |

| 15% | 1156.0 | 1401.0 | 0.003 | 0.02 |

| 20% | 1261.3 | 1413.9 | 0.003 | 0.02 |

| 25% | 1341.7 | 1421.7 | 0.003 | 0.02 |

| 30% | 730.8 | 1297.3 | 0.003 | 0.02 |

| France | ||||

| 5% | Already achieved | |||

| 7.5% | 139.9 (2015m7) | 157.6 | 0.028 | 0.73 |

| 10% | 156.8 (2016m12) | 165.6 | 0.027 | 0.75 |

| 15% | 179.7 (2018m11) | 174.5 | 0.025 | 0.76 |

| 20% | 195.3 (2020m3) | 179.2 | 0.025 | 0.77 |

| 25% | 207.2 (2021m3) | 182.1 | 0.024 | 0.77 |

| 30% | 216.6 (2021m12) | 184.0 | 0.024 | 0.77 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Marszk, A.; Lechman, E. Application of Diffusion Models in the Analysis of Financial Markets: Evidence on Exchange Traded Funds in Europe. Risks 2020, 8, 18. https://doi.org/10.3390/risks8010018

Marszk A, Lechman E. Application of Diffusion Models in the Analysis of Financial Markets: Evidence on Exchange Traded Funds in Europe. Risks. 2020; 8(1):18. https://doi.org/10.3390/risks8010018

Chicago/Turabian StyleMarszk, Adam, and Ewa Lechman. 2020. "Application of Diffusion Models in the Analysis of Financial Markets: Evidence on Exchange Traded Funds in Europe" Risks 8, no. 1: 18. https://doi.org/10.3390/risks8010018

APA StyleMarszk, A., & Lechman, E. (2020). Application of Diffusion Models in the Analysis of Financial Markets: Evidence on Exchange Traded Funds in Europe. Risks, 8(1), 18. https://doi.org/10.3390/risks8010018