1. Introduction

In this paper, we analyze the optimal excess-of-loss reinsurance problem from the insurer’s point of view, under the criterion of maximizing the expected utility of the terminal wealth. It is well known that the reinsurance policies are very effective tools for risk management. In fact, by means of a risk sharing agreement, they allow the insurer to reduce unexpected losses, to stabilize operating results, to increase business capacity and so on. Among the most common arrangements, the proportional and the excess-of-loss contracts are of great interest. The former was intensively studied in

Irgens and Paulsen (

2004);

Liu and Ma (

2009);

Liang et al. (

2011);

Liang and Bayraktar (

2014);

Zhu et al. (

2015);

Brachetta and Ceci (

2019) and references therein. The latter was investigated in these articles: in

Zhang et al. (

2007) and

Meng and Zhang (

2010), the authors proved the optimality of the excess-of-loss policy under the criterion of minimizing the ruin probability, with the surplus process described by a Brownian motion with drift; in

Zhao et al. (

2013) the Cramér-Lundberg model is used for the surplus process, with the possibility of investing in a financial market represented by the Heston model; in

Sheng et al. (

2014) and

Li and Gu (

2013) the risky asset is described by a Constant Elasticity of Variance (CEV) model, while the surplus is modelled by the Cramér-Lundberg model and its diffusion approximation, respectively; finally, in

Li et al. (

2018) the authors studied a robust optimal strategy under the diffusion approximation of the surplus process.

The common ground of the cited works is the underlying risk model, which is the Cramér-Lundberg model (or its diffusion approximation)

1. In the actuarial literature it is of great importance, because it is simple enough to perform calculations. In fact, the claims arrival process is described by a Poisson process with constant intensity (or a Brownian motion, in the diffusion model). Nevertheless, as noticed by many authors (e.g.,

Grandell (

1991);

Hipp (

2004)), it needs generalization in order to take into account the so called

size fluctuations and

risk fluctuations, i.e., variations of the number of policyholders and modifications of the underlying risk, respectively.

The main goal of our work is to extend the classical risk model by modelling the claims arrival process as a marked point process with dual-predictable projection affected by an exogenous stochastic process Y. More precisely, both the intensity of the claims arrival process and the claim size distribution are influenced by Y. Thanks to this environmental factor, we achieve a reasonably realistic description of any risk movement. For example, in automobile insurance Y may describe weather conditions, road conditions, traffic volume and so on. All these factors usually influence the accident probability as well as the damage size.

Some noteworthy attempts in that direction can be found in

Liang and Bayraktar (

2014) and

Brachetta and Ceci (

2019), where the authors studied the optimal proportional reinsurance. In the former, the authors considered a Markov-modulated compound Poisson process, with the (unobservable) stochastic factor described by a finite state Markov chain. In the latter, the stochastic factor follows a general diffusion. In addition, in

Brachetta and Ceci (

2019) the insurance and the reinsurance premia are not evaluated by premium calculation principles (see

Young (

2006)), because they are stochastic processes depending on

Y. In our paper, we extend further the risk model, because the claim size distribution is influenced by the stochastic factor, which is described by a diffusion-type stochastic differential equation (SDE). In addition, we study a different reinsurance contract, which is the excess-of-loss agreement.

To the best of our knowledge stochastic risk factor models in insurance have not been considered so far. This is in contrast with financial literature where risky asset dynamics affected by exogenous stochastic factors have been largely considered, see for instance

Ceci (

2009);

Ceci and Gerardi (

2009,

2010);

Zariphopoulou (

2009) and

Ceci (

2012).

In our model the insurer is also allowed to lend or borrow money at a given interest rate

r. During recent years, negative interest rates drew the attention of many authors. For example, since June 2016 the European Central Bank (ECB) fixed a negative Deposit facility rate, which is the interest banks receive for depositing money within the ECB overnight. Presently, it is

. As a consequence, in our framework

. We point out that there is no loss of generality due to the absence of a risky asset, because as long as the insurance and the financial markets are independent (which is a standard hypothesis in non-life insurance), the optimal reinsurance strategy turns out to depend only on the risk-free asset (see

Brachetta and Ceci (

2019) and references therein). As a consequence, the optimal investment strategy can be eventually obtained using existing results in the literature.

The paper is organized as follows: in

Section 2, we formulate the model assumptions and describe the maximization problem; in

Section 3 we derive the Hamilton-Jacobi-Bellman (HJB) equation; in

Section 4, we investigate the candidate optimal strategy, which is suggested by the HJB derivation; in

Section 5, we provide the verification argument with a probabilistic representation of the value function; finally, in

Section 6 we perform some numerical simulations.

2. Model Formulation

Let be a complete probability space endowed with a filtration which satisfies the usual conditions, where is the insurer’s time horizon. We model the insurance losses through a marked point process with local characteristics influenced by an environment stochastic factor . Here, the sequence describes the claim arrival process and the corresponding claim sizes. Precisely, , , are stopping times such that a.s. and , , are -random variables such that , is -measurable.

The stochastic factor

Y is defined as the unique strong solution to the following SDE:

where

is a standard Brownian motion on

. We assume that the following conditions hold true:

We will denote by the natural filtration generated by the process Y.

The random measure corresponding to the losses process

is given by

where

denotes the Dirac measure located at point

. We assume that its

-dual predictable projection

has the form

where

is such that , is a distribution function, with ;

is a strictly positive measurable function.

In the sequel, we will assume the following integrability conditions:

and

According to the definition of dual predictable projection, for every nonnegative,

-predictable and

-indexed process

we have that

2In particular, choosing

with

any nonnegative

-predictable process

i.e., the claims arrival process

is a point process with stochastic intensity

.

Now we give the interpretation of

as conditional distribution of the claim sizes

3.

Proposition 1. and the following equality holds:where is the strict past of the σ-algebra generated by the stopping time : This means that in our model both the claim arrival intensity and the claim size distribution are affected by the stochastic factor

Y. This is a reasonable assumption; for example, in automobile insurance

Y may describe weather, road conditions, traffic volume, and so on. For a detailed discussion of this topic see also

Brachetta and Ceci (

2019).

Remark 1. Let us observe that for any -predictable and -indexed process such thatthe processturns out to be an -martingale. If in additionthen is a square integrable -martingale and Moreover, the predictable covariation process of is given bythat is is an -martingale4.

In this framework we define the cumulative claims up to time

as follows

and the insurer’s reserve process is described by

where

is the initial wealth and

is a nonnegative

-adapted process representing the gross insurance risk premium. In the sequel we assume

, for a suitable function

such that

. Let us notice that Equation (

7) implies that

Now we allow the insurer to buy an excess-of-loss reinsurance contract. By means of this agreement, the insurer chooses a retention level

and for any future claim the reinsurer is responsible for all the amount which exceeds that threshold

(e.g.,

means full reinsurance). For any dynamic reinsurance strategy

, the insurer’s surplus process is given by

where

is a nonnegative

-adapted process representing the reinsurance premium rate. In addition, we suppose that the following assumption holds true.

Assumption 1. (Excess-of-loss reinsurance premium) Let us assume that for any reinsurance strategy the corresponding reinsurance premium process admits the following representation:where is a continuous function in α, with continuous partial derivatives in , such that - 1.

for all , since the premium is increasing with respect to the protection level;

- 2.

, because the cedant is not allowed to gain a profit without risk.

In the rest of the paper, should be intended as a right derivative. Moreover, we assume that Assumption 1 formalizes the minimal requirements for a process

to be a reinsurance premium. In the next examples we briefly recall the most famous premium calculation principles, because they are widely used in optimal reinsurance problems solving. In

Appendix B the reader can find a rigorous derivation of the formulas (

10) and (

11) below.

Example 1. The most famous premium calculation principle is the expected value principle (abbr. EVP)5. The underlying conjecture is that the reinsurer evaluates her premium in order to cover the expected losses plus a load which depends on the expected losses. In our framework, under the EVP the reinsurance premium is given by the following expression:for some safety loading .

Example 2. Another important premium calculation principle is the variance premium principle (abbr. VP). In this case, the reinsurer’s loading is proportional to the variance of the losses. More formally, the reinsurance premium admits the following representation:for some safety loading .

Furthermore, the insurer can lend or borrow money at a fixed interest rate . More precisely, every time the surplus is positive, the insurer lends it and earns interest income if (or pays interest expense if ); on the contrary, when the surplus becomes negative, the insurer borrows money and pays interest expense (or gains interest income if ).

Under these assumptions, the total wealth dynamic associated with a given strategy

is described by the following SDE:

It can be verified that the solution to (

12) is given by the following expression:

Our aim is to find the optimal strategy

in order to maximize the expected exponential utility of the terminal wealth, that is

where

is the risk-aversion parameter and

is the set of all admissible strategies as defined below.

Definition 1. We denote by the set of all admissible strategies, that is the class of all nonnegative -predictable processes . With the notation we refer to the same class, restricted to the strategies starting from .

Remark 3. We need additional integrability conditions in order to ensure that under (full reinsurance) and (null reinsurance) the expected utility is finite. Precisely, under conditionwe get thatand underwith K given in (14), we have that In the next proposition we give a sufficient condition for Equation (

17).

Proposition 2. Assume that there exists an integrable function such thatwhere the constant K is given in (14). Then Equation (17) is fulfilled.

Proof. Since

is a pure-jump process, we have that

Taking the expectation, by Equation (

8) we get that

Applying Gronwall’s lemma we obtain that

□

As usual in stochastic control problems, we focus on the corresponding dynamic problem:

where

denotes the insurer’s wealth process starting from

evaluated at time

T.

3. HJB Formulation

In order to solve the optimization problem (

19), we introduce the

value function associated with it, that is

This function, if sufficiently regular, is expected to solve the Hamilton-Jacobi-Bellman (HJB) equation:

where

denotes the Markov generator of the couple

associated with a constant control

. In what follows, we denote by

the class of all bounded functions

, with

, with bounded first order derivatives

and bounded second order derivatives with respect to the spatial variables

.

Lemma 1. Let be a function in . The Markov generator of the stochastic process for all constant strategies is given by the following expression: Proof. For any

, applying Itô’s formula to the stochastic process

, we get the following expression:

where

is defined in (

22) and

In order to complete the proof, we have to show that

is an

-martingale. For the first term, we observe that

because the partial derivative is bounded and using the assumption (

2). For the second term, it is sufficient to use the boundedness of

f and the condition (

6). □

Remark 4. Since the couple is a Markov process, any Markovian control is of the form , where denotes a suitable function. The generator associated with a general Markovian strategy can be easily obtained by replacing α with in (

22).

In order to simplify our optimization problem, we present a preliminary result.

Remark 5. Let be an integrable function such that . For any , the following equation holds true:where . In fact, by integration by parts we get that Now let us consider the ansatz , which is motivated by the following proposition.

Proposition 3. Let us suppose that there exists a function solution to the following Cauchy problem:with final condition , , where Then the functionsolves the HJB problem given in (21).

Proof. From the expression (

26) we can easily verify that

By Remark 5, taking

, we can rewrite the last integral in this more convenient way:

Now we define

by means of the Equation (

25), obtaining the following equivalent expression:

Taking the infimum over

, by (

24) we find out the PDE in (

21). The terminal condition in (

21) immediately follows by definition. □

The previous result suggests to focus on the minimization of the function (

25), that is the aim of the next section.

4. Optimal Reinsurance Strategy

In this section, we study the following minimization problem:

where

is defined in (

25).

In particular, we provide a complete characterization of the optimal reinsurance strategy. In the sequel we assume .

Proposition 4. Let us suppose that is strictly convex in and let us define the set as follows: If the equationadmits at least one solution in for any , denoted by , then the minimization problem (27) admits a unique solution given by Proof. The function

is continuous in

by definition (see Assumption 1) and for any

its derivative is given by the following expression:

Since is convex in by hypothesis, if then , and , because the derivative is increasing in and there is no stationary point in . Else, if then , and coincides with the unique stationary point of , which is . Let us notice that it exists by hypothesis and it is unique because is strictly convex. □

By the previous proposition, we observe that is an important threshold for the insurer: as long as the marginal cost of the full reinsurance falls in the interval , the optimal choice is full reinsurance.

Unfortunately, it is not always easy to check whether

is strictly convex in

or not. In the next result such an hypothesis is relaxed, while the uniqueness of the solution to (

29) is required.

Proposition 5. Suppose that Equation (29) admits a unique solution for any . Moreover, let us assume that Then the minimization problem (27) admits a unique solution given by (

30).

Proof. Recalling the proof of Proposition 4, if

then

and

. For any

, by hypothesis there exists a unique stationary point

. By simple calculations, using (

32) we notice that

hence

is the unique minimizer and this completes the proof. □

The next result deals with the existence of a solution to (

29). In particular, it is sufficient to require that the claim size distribution is heavy-tailed, which is a relevant case in non-life insurance (see

Rolski et al. (

1999), chp. 2), plus a technical condition for the reinsurance premium.

Proposition 6. Let us assume that the reinsurance premium is such that6and the claim size distribution is heavy-tailed in this sense: Then, for any , the Equation (29) admits at least one solution in .

Proof. The following property of heavy-tailed distributions is a well known implication of our assumption:

Hence, by Equation (

31), for any

On the other hand, we know that

As a consequence, being continuous in , there exists such that . □

Now we turn the attention to the other crucial hypothesis of Proposition 4, which is the convexity of . The reader can easily observe that the reinsurance premium convexity plays a central role.

Proposition 7. Suppose that the reinsurance premium is convex in and for some function such that . Then the function defined in (25) is strictly convex in .

Proof. Recalling the expression (

25), it is sufficient to prove the convexity of the following term:

For this purpose, let us evaluate its second order derivative:

Now the term in brackets is

The proof is complete. □

By Proposition 1, the hypothesis on the claim sizes distribution above may be read as assuming that the claims are exponentially distributed conditionally to Y.

4.1. Expected Value Principle

Now we investigate the special case of the expected value principle introduced in Example 1.

Proposition 8. Under the EVP (see Equation (10)), the optimal reinsurance strategy is given by Proof. Using Remark 5, we can rewrite the Equation (

10) as follows:

As a consequence, we have that

For

, we have that

hence

and by Proposition 4 the minimizer belongs to

. Now we look for the stationary points, i.e., the solutions to the Equation (

29), that in this case reads as follows:

Solving this equation, we obtain the unique solution given by (

33). In order to prove that it coincides with the unique minimizer to (

27), it is sufficient to show that

For this purpose, observe that

The proof is complete. □

Remark 6. Formula (33) was found by Zhao et al. (2013) (see eq. 3.31, p. 508). We point out that it is a completely deterministic strategy. This fact is crucially related to the use of the EVP rather than the underlying model; in fact, in Zhao et al. (2013) the authors considered the Cramér-Lundberg model under the EVP7.

From the economic point of view, by Equation (

33) it is easy to show that the optimal retention level is decreasing with respect to the interest rate and the risk-aversion; on the contrary, it is increasing with respect to the reinsurer’s safety loading. In addition, the sensitivity with respect to the time-to-maturity depends on the sign of

r.

Another relevant aspect of (

33) is that it is independent of the claim size distribution. To the authors this result seems quite unrealistic. In fact, any subscriber of an excess-of-loss contract is strongly worried about possibly extreme events, hence the claims distribution is expected to play an important role.

4.2. Variance Premium Principle

This subsection is devoted to derive an optimal strategy under the variance premium principle (see Example 2).

Proposition 9. Let us suppose that is strictly convex in andfor some (eventually ).

Under the VP (see Equation (11)) the optimal reinsurance strategy is the unique solution to the following equation: Proof. The proof is based on Proposition (4). By Equation (

11) we get its derivative:

It is clear that the set

defined in (

28) is empty, because for any

Hence the minimizer should coincide with the unique stationary point of

, i.e., the solution to (

36). In order to prove it, we need to ensure the existence of a solution to (

36). For this purpose, we notice that on the one hand

On the other hand, for

, by (

35) we get

As a consequence, by the continuity of there exists a point such that . Such a solution is unique because is strictly convex by hypothesis. □

Conversely to Proposition 8, the optimal retention level given in Proposition 9 is still dependent on the stochastic factor Y. Such a dependence is spread through the claim size distribution.

Remark 7. We observe that any heavy-tailed distribution (see the proof of Proposition 6) satisfies the condition (35) with .

Now we specialize the variance premium principle to conditionally exponentially distributed claims.

Proposition 10. Under the VP, suppose that for some function such that . The optimal reinsurance strategy is given by Proof. By the proof of Proposition 9, we know that under VP

. Now, under our hypotheses, by Equation (

31) we readily get

The equation

admits a unique solution, given by Equation (

37). At this point

, the function

is strictly convex, because

It follows that

is the unique minimizer by Proposition

30. □

Contrary to Equation (

33), the explicit formula (

37) keeps the dependence on the stochastic factor

Y. In addition, the following result holds true.

Remark 8. Suppose that for some function such that . We consider two different reinsurance safety loadings , referring to the EVP and VP, respectively. Moreover, let us denote by and the optimal retention level under the EVP and VP, given in Equations (33) and (37), respectively. It is easy to show that From the practical point of view, as long as the stochastic factor fluctuations result in a rate parameter higher than the threshold , the optimal retention level evaluated through the expected value principle turns out to be larger than the variance principle.

6. Numerical Results

In this section, we show some numerical results, mostly based on Propositions 8 and 10. We assumed the following dynamic of the stochastic factor

Y for performing simulations:

The

-dual predictable projection

(see Equation (

5)) is determined by these functions:

The parameters are set according to

Table 1 below.

The SDEs are approximated through a classical Euler’s scheme with steps length , while the expectations are evaluated by means of Monte Carlo simulations with parameter M.

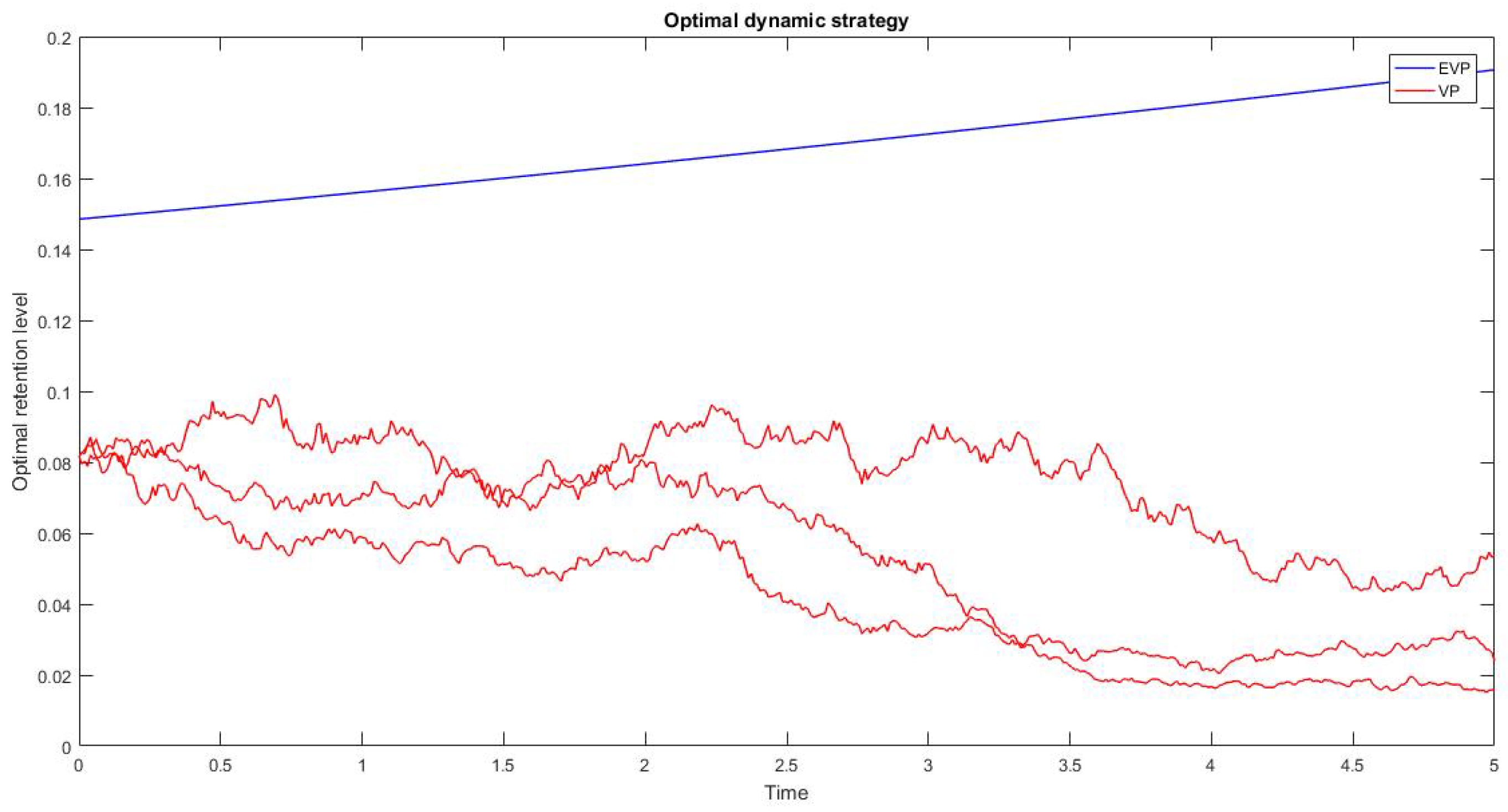

In

Figure 1 we show the dynamic strategies under EVP and VP, computed by the Equations (

33) and (

37), respectively.

In

Figure 2 we start the sensitivity analysis investigating the effect of the risk aversion parameter on the optimal strategy at time

. As expected, there is an inverse relationship. Notice that for high values of

the two strategies tend to the same level.

Figure 3 refers to the sensitivity analysis with respect to the reinsurance safety loading

. When

the strategies coincide (because the premia coincide), then they diverge for increasing values of

.

In

Figure 4 we observe that the distance between the retention levels in the two cases is larger when

and it decreases as long as

r increases. Nevertheless, even for positive values of the risk-free interest rate the distance is not negligible (see the pictures above, with

).

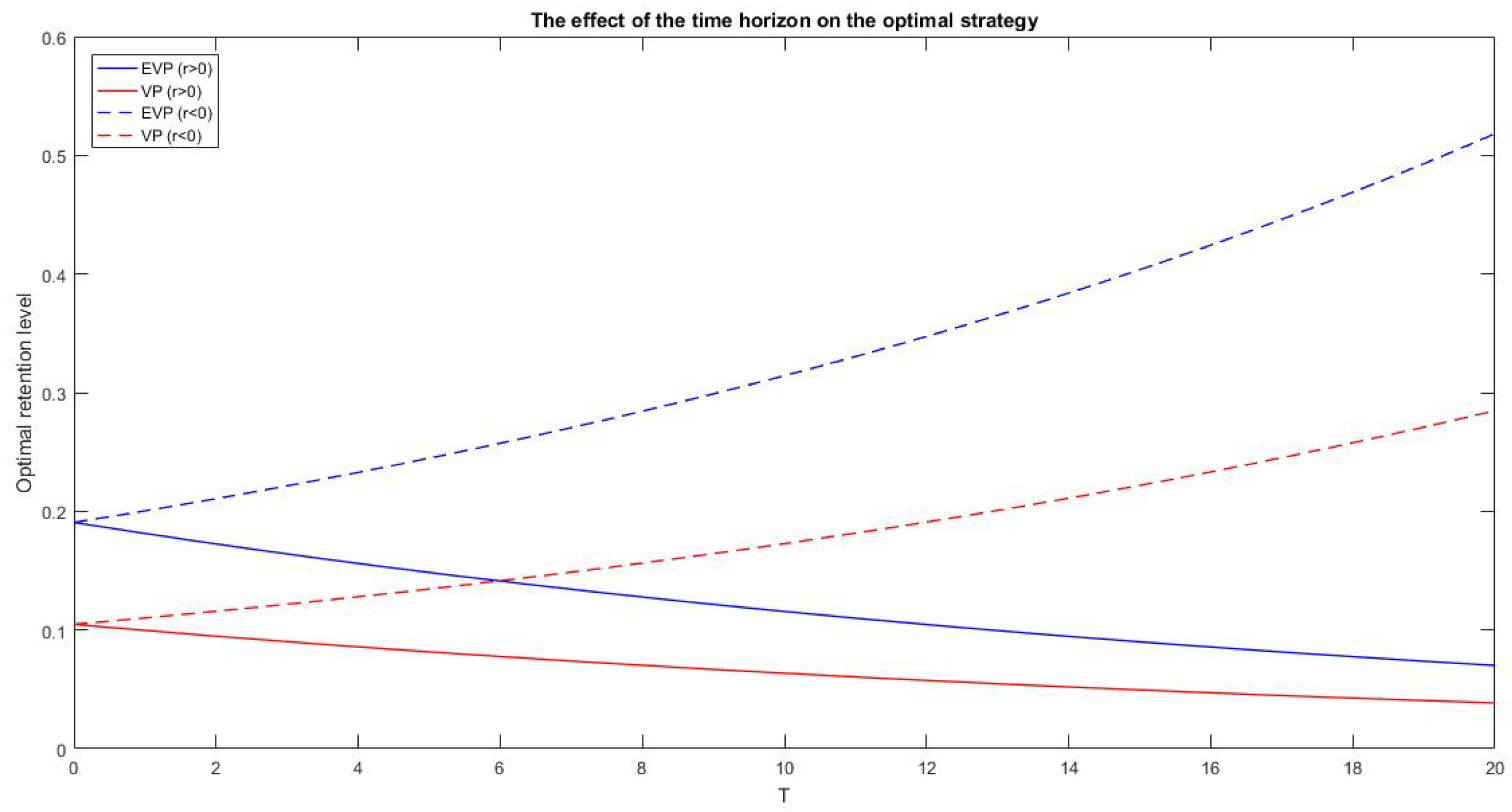

In

Figure 5 we study the response of the optimal strategy to variations of the time horizon. The two cases exhibit the same behavior, which is strongly influenced by the sign of the interest rate. In fact, if

the retention level increases with the time horizon, while if

the optimal strategy decreases with

T.

Finally, thanks to Proposition 11 we are able to numerically approximate the value function by simulating the trajectories of

Y. The graphical result (under VP) is shown in

Figure 6 below.