Firm’s Credit Risk in the Presence of Market Structural Breaks

Abstract

1. Introduction

2. Our Modeling Approach and Related Literature

3. A Modulated Semi-Markov Model

3.1. Information Filtration

3.2. Conventional Models for Firms’ Rating Transition Intensities

3.3. Our Specification for Firms’ Rating Transition Intensities

3.4. Dynamics of Market Structural Breaks

- (A1)

- The number of jumps in follows a Poisson process with rate and are independent of .

- (A2)

- If a jump occurs at time t, the post-change value of is independent of its pre-change value, in particular, denote , where are independent and identically distributed (i.i.d.) normal random vectors with mean and covariance .

4. Inference Procedure

4.1. Inference When No Structural Breaks Exist

4.2. Mixed Estimating Equations

4.3. Estimation of Informative Prior

5. An Empirical Study

5.1. Data Description

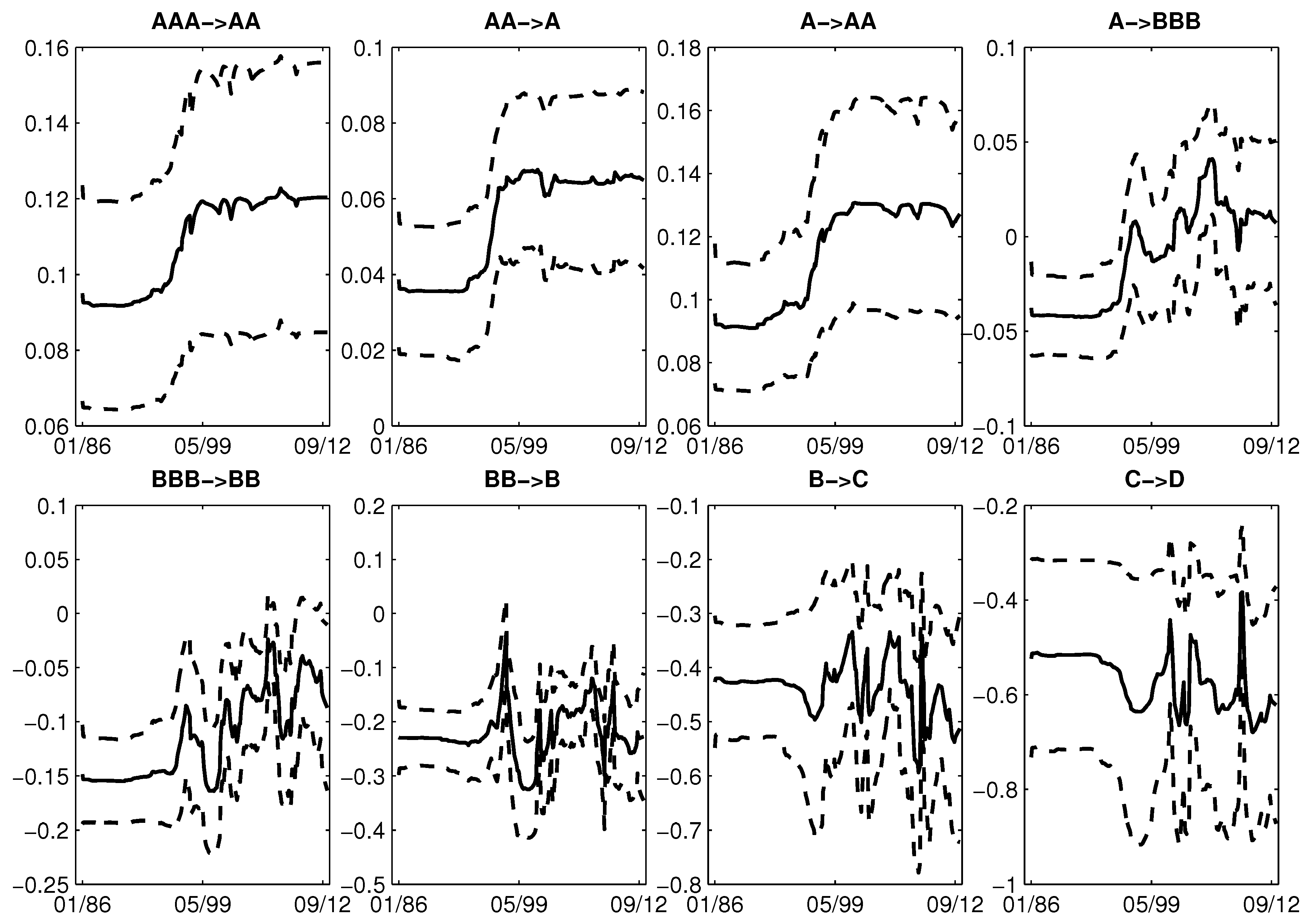

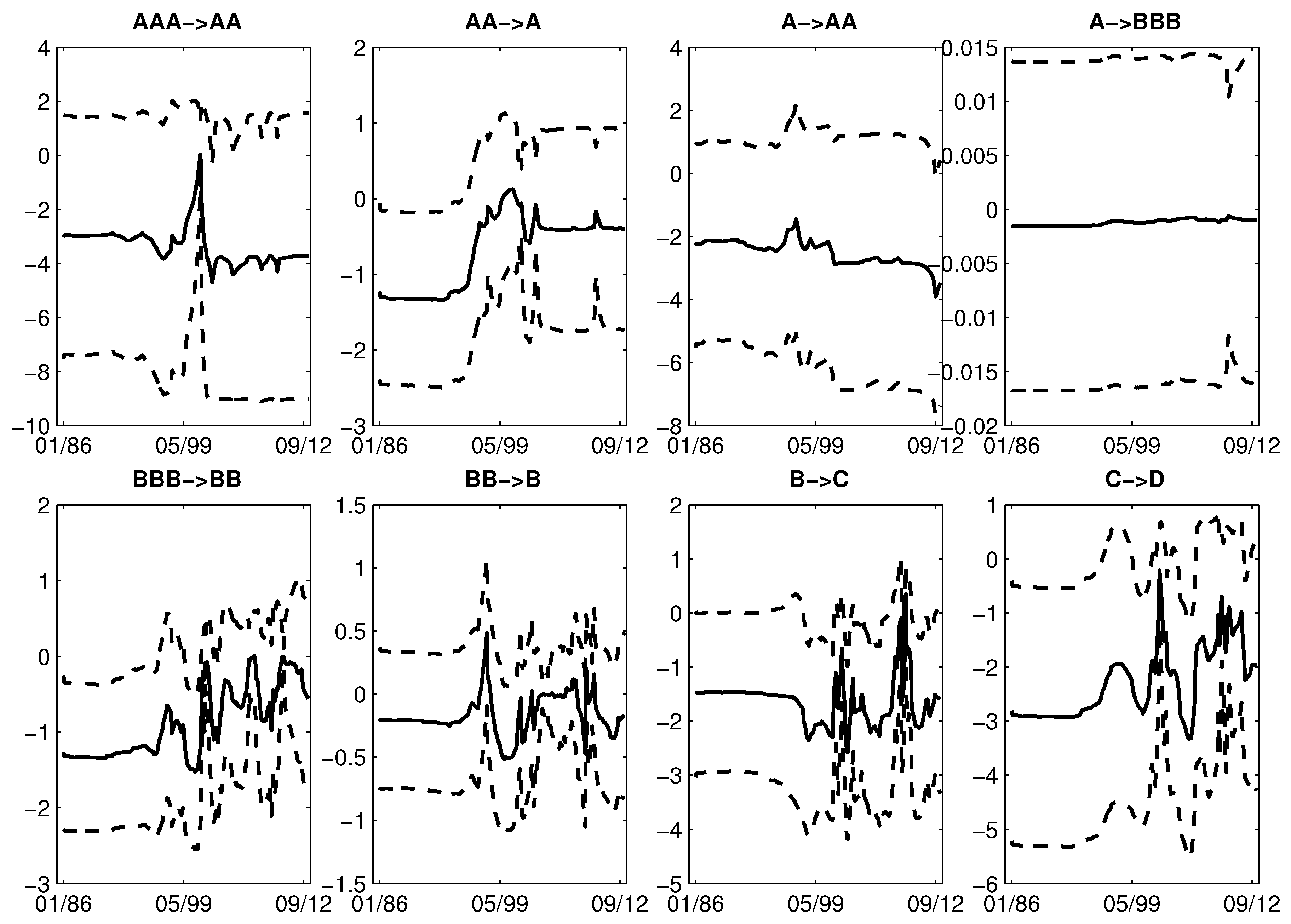

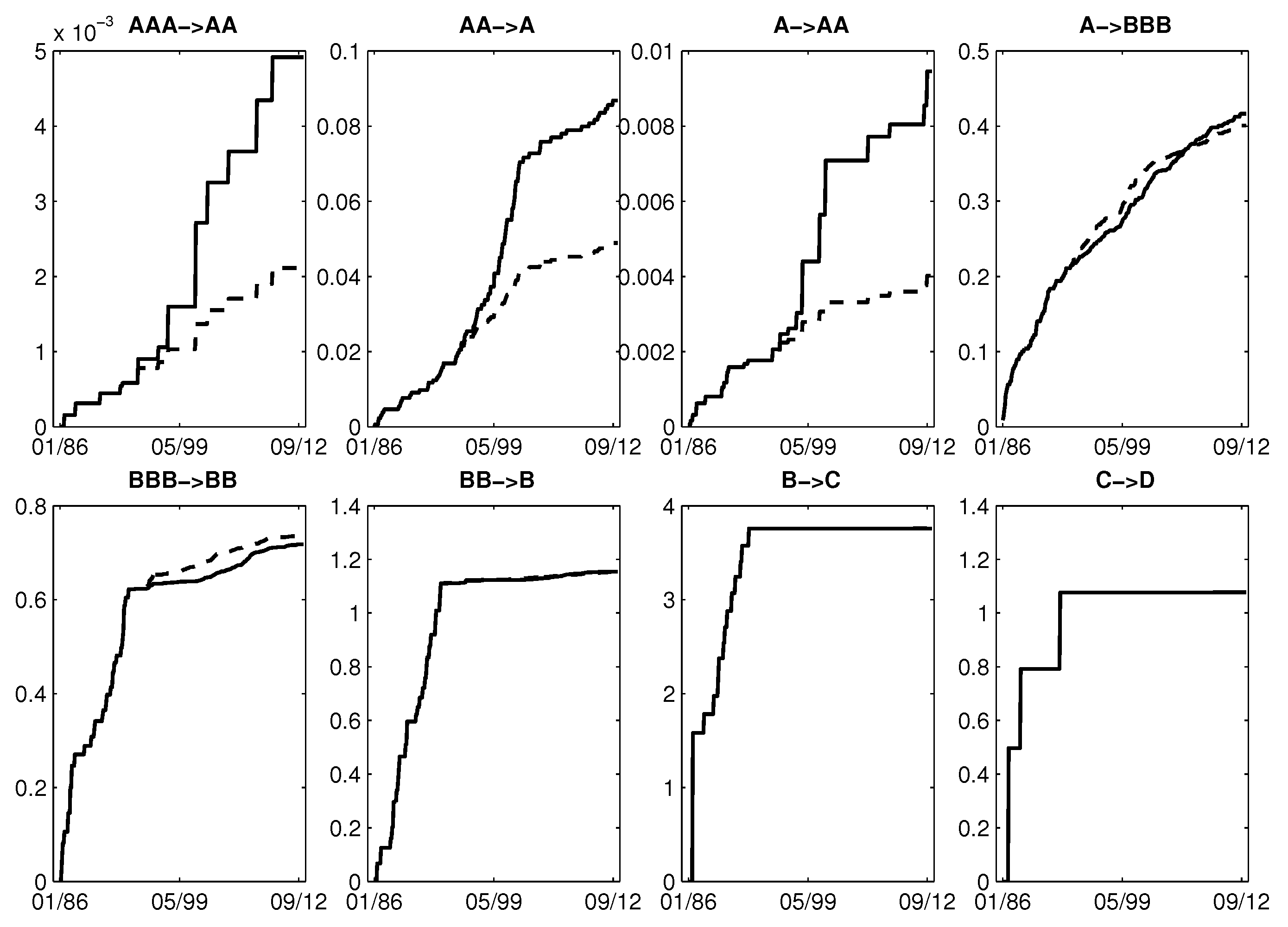

5.2. Effect of Firm-Specific Variables on Firms’ Credit Risk and Baseline Cumulative Intensities

5.3. Firms’ Rating Transition Intensities and Probabilities

6. Concluding Remarks

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A. A Quasi-EM Approach to Estimate Hyperparameters

- (a)

- .

- (b)

- .

- (c)

- .

References

- Altman, Edward I. 1968. Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. Journal of Finance 23: 589–609. [Google Scholar] [CrossRef]

- Andersen, Per K., and Richard D. Gill. 1982. Cox’s regression model for counting processes: A large sample study. Annals of Statistics 10: 1100–20. [Google Scholar] [CrossRef]

- Beaver, William H. 1968. The information content of annual earnings announcements. Journal of Accounting Research 6: 67–92. [Google Scholar] [CrossRef]

- Black, Fischer, and John C. Cox. 1976. Valuing corporate securities: Some effects of bond indenture provisions. Journal of Finance 31: 351–67. [Google Scholar] [CrossRef]

- Black, Fischer, and Myron Scholes. 1973. The pricing of options and corporate liabilities. Journal of Political Economy 81: 637–59. [Google Scholar] [CrossRef]

- Briys, Eric, and François De Varenne. 1997. Valuing risky fixed rate debt: An extension. Journal of Financial and Quantitative Analysis 32: 239–48. [Google Scholar] [CrossRef]

- Buonocore, Aniello, Amelia G. Nobile, and Luigi M. Ricciardi. 1987. A new integral equation for the evaluation of first-passage-time probability densities. Advances in Applied Probability 19: 784–800. [Google Scholar] [CrossRef]

- Chava, Sudheer, and Robert A. Jarrow. 2004. Bankruptcy prediction with industry effects. Review of Finance 8: 537–69. [Google Scholar] [CrossRef]

- Collin-Dufresne, Pierre, and Robert S. Goldstein. 2001. Do credit spreads reflect stationary leverage ratios? Journal of Finance 56: 1929–57. [Google Scholar] [CrossRef]

- Dionne, Georges, Geneviѐve Gauthier, Khemais Hammami, Mathieu Maurice, and Jean-Guy Simonato. 2011. A reduced form model of default spreads with Markov-switching macroeconomic factors. Journal of Banking and Finance 35: 1984–2000. [Google Scholar] [CrossRef]

- Duffie, Darrell, and David Lando. 2001. Term structures of credit spreads with incomplete accounting information. Econometrica 69: 633–64. [Google Scholar] [CrossRef]

- Duffie, Darrell, Leandro Saita, and Ke Wang. 2007. Multi-period corporate default prediction with stochastic covariates. Journal of Financial Economics 83: 635–65. [Google Scholar] [CrossRef]

- Duffie, Darrell, Andreas Eckner, Guillaume Horel, and Leandro Saita. 2009. Frailty correlated default. Journal of Finance 64: 2089–123. [Google Scholar] [CrossRef]

- Fisher, Edwin O., Robert Heinkel, and Josef Zechner. 1989. Dynamic capital structure choice: Theory and tests. Journal of Finance 44: 19–40. [Google Scholar] [CrossRef]

- Hilberink, Bianca, and Chris L. Rogers. 2002. Optimal capital structure and endogenous default. Finance and Stochastics 6: 237–63. [Google Scholar] [CrossRef]

- Hillegeist, Stephen A., Elizabeth K. Keating, Donald P. Cram, and Kyle G. Lundstedt. 2004. Assessing the probability of bankruptcy. Review of Accounting Studies 9: 5–34. [Google Scholar] [CrossRef]

- Kalbfleisch, John D., and Ross L. Prentice. 2002. The Statistical Analysis of Failure Time Data. New York: Weily. [Google Scholar]

- Koopman, Siem J., André Lucas, and André Monteiro. 2008. The multi-state latent factor intensity model for credit rating transitions. Journal of Econometrics 142: 399–424. [Google Scholar] [CrossRef]

- Koopman, Siem J., André Lucas, and Bernd Schwabb. 2010. Macro, Frailty and Contagion Effects in Defaults: Lessons from the 2008 Credit Crisis. Working pape. Amsterdam, The Netherlands: University of Amsterdam. [Google Scholar]

- Lee, Suk Hun, and Jorge L. Urrutia. 1996. Analysis and prediction of insolvency in the property-liability insurance industry: A comparison of logit and hazard models. Journal of Risk and Insurance 63: 121–30. [Google Scholar] [CrossRef]

- Leland, Hayne E. 1994. Corporate debt value, bond covenants, and optimal capital structure. Journal of Finance 49: 1213–52. [Google Scholar] [CrossRef]

- Lin, Danyu, Lee-Jen Wei, I. Yang, and Zhiliang Ying. 2000. Semiparametric regression for the mean and rate functions of recurrent events. Journal of the Royal Statistical Society: Series B 62: 711–30. [Google Scholar] [CrossRef]

- McDonald, Cynthia G., and Linda M. Van de Gucht. 1999. High-yield bond default and call risks. Review of Economics and Statistics 81: 409–19. [Google Scholar] [CrossRef]

- Merton, Robert C. 1974. On the pricing of corporate debt: The risk structure of interest rates. Journal of Finance 29: 449–70. [Google Scholar]

- Minsky, Hayman P. 1982. Can It Happen Again? Armonk: ME Sharpe. [Google Scholar]

- Minsky, Hayman P. 1986. Stabilizing an Unstable Economy. New Haven: Yale University Press. [Google Scholar]

- Shumway, Tyler. 2001. Forecasting bankrupcty more accurately: A simple hazard model. Journal of Business 74: 101–24. [Google Scholar] [CrossRef]

- Xing, Haipeng, and Ying Chen. 2018. Dependence of structural breaks in rating transition dynamics on economic and market variations. Review of Economics and Finance 11: 1–18. [Google Scholar]

- Xing, Haipeng, and Zhiliang Ying. 2012. A semiparametric change-point regression model for longitudinal observations. Journal of the American Statistical Association 107: 1625–37. [Google Scholar] [CrossRef]

- Xing, Haipeng, Ning Sun, and Ying Chen. 2012. Credit rating dynamics in the presence of unknown structural breaks. Journal of Banking and Finance 36: 78–89. [Google Scholar] [CrossRef]

| January 1986–September 2012 (without structural break assumption) | ||||||||

| 0.9993 | 7 × 10 | 3 × 10 | 2 × 10 | 2 × 10 | 2 × 10 | 1 × 10 | 2 × 10 | |

| 1 × 10 | 0.9927 | 7 × 10 | 9 × 10 | 8 × 10 | 1 × 10 | 9 × 10 | 1 × 10 | |

| 9 × 10 | 0.0012 | 0.9742 | 0.0241 | 3 × 10 | 5 × 10 | 5 × 10 | 1 × 10 | |

| 3 × 10 | 6 × 10 | 0.0098 | 0.9577 | 0.0274 | 0.0043 | 6 × 10 | 2 × 10 | |

| 1 × 10 | 4 × 10 | 9 × 10 | 0.0183 | 0.9173 | 0.0552 | 0.0087 | 2 × 10 | |

| 7 × 10 | 3 × 10 | 8 × 10 | 2 × 10 | 0.0219 | 0.7215 | 0.2463 | 0.0100 | |

| 3 × 10 | 1 × 10 | 5 × 10 | 2 × 10 | 3 × 10 | 0.0208 | 0.9066 | 0.0722 | |

| October 1994–March 2001 (with structural break assumption) | ||||||||

| 0.9998 | 2 × 10 | 3 × 10 | 6 × 10 | 2 × 10 | 1 × 10 | 2 × 10 | 5 × 10 | |

| 2 × 10 | 0.9968 | 0.0031 | 1 × 10 | 5 × 10 | 3 × 10 | 5 × 10 | 2 × 10 | |

| 3 × 10 | 3 × 10 | 0.9933 | 0.0063 | 4 × 10 | 2 × 10 | 6 × 10 | 2 × 10 | |

| 4 × 10 | 7 × 10 | 0.0041 | 0.9944 | 0.0013 | 8 × 10 | 3 × 10 | 9 × 10 | |

| 5 × 10 | 1 × 10 | 1 × 10 | 0.0055 | 0.9935 | 0.0010 | 4 × 10 | 1 × 10 | |

| 3 × 10 | 9 × 10 | 1 × 10 | 8 × 10 | 0.0028 | 0.9971 | 8 × 10 | 2 × 10 | |

| 2 × 10 | 7 × 10 | 1 × 10 | 1 × 10 | 6 × 10 | 4 × 10 | 0.9999 | 4 × 10 | |

| April 2007–January 2010 (with structural break assumption) | ||||||||

| 0.9999 | 1 × 10 | 1 × 10 | 7 × 10 | 3 × 10 | 3 × 10 | 5 × 10 | 9 × 10 | |

| 7 × 10 | 0.9998 | 0.0002 | 2 × 10 | 1 × 10 | 1 × 10 | 2 × 10 | 4 × 10 | |

| 9 × 10 | 3 × 10 | 0.9981 | 0.0018 | 2 × 10 | 1 × 10 | 4 × 10 | 8 × 10 | |

| 4 × 10 | 1 × 10 | 0.0011 | 0.9972 | 0.0017 | 2 × 10 | 6 × 10 | 1 × 10 | |

| 2 × 10 | 1 × 10 | 1 × 10 | 0.0023 | 0.9967 | 9 × 10 | 4 × 10 | 8 × 10 | |

| 7 × 10 | 5 × 10 | 7 × 10 | 2 × 10 | 0.0016 | 0.9984 | 8 × 10 | 2 × 10 | |

| 1 × 10 | 8 × 10 | 2 × 10 | 6 × 10 | 7 × 10 | 9 × 10 | 0.9999 | 1 × 10 | |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xing, H.; Yu, Y. Firm’s Credit Risk in the Presence of Market Structural Breaks. Risks 2018, 6, 136. https://doi.org/10.3390/risks6040136

Xing H, Yu Y. Firm’s Credit Risk in the Presence of Market Structural Breaks. Risks. 2018; 6(4):136. https://doi.org/10.3390/risks6040136

Chicago/Turabian StyleXing, Haipeng, and Yang Yu. 2018. "Firm’s Credit Risk in the Presence of Market Structural Breaks" Risks 6, no. 4: 136. https://doi.org/10.3390/risks6040136

APA StyleXing, H., & Yu, Y. (2018). Firm’s Credit Risk in the Presence of Market Structural Breaks. Risks, 6(4), 136. https://doi.org/10.3390/risks6040136