RMB Exchange Rates and Volatility Spillover across Financial Markets in China and Japan

Abstract

1. Introduction

2. Literature Review

2.1. RMB Internationalisation

2.2. Dynamic Correlation and Volatility Spillover Effects

2.3. Research Hypotheses

3. Econometric Methodology

3.1. The Diagonal BEKK Model

3.2. Alternative Volatility Spillover Model

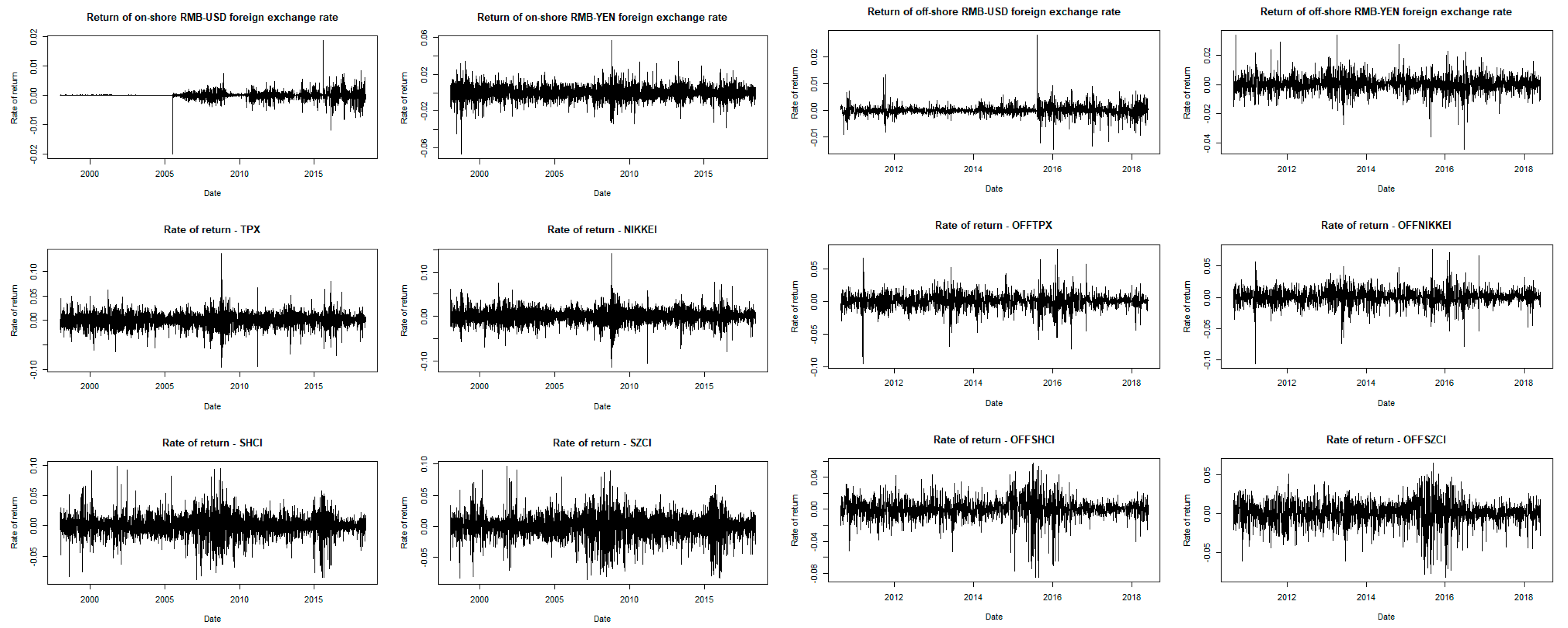

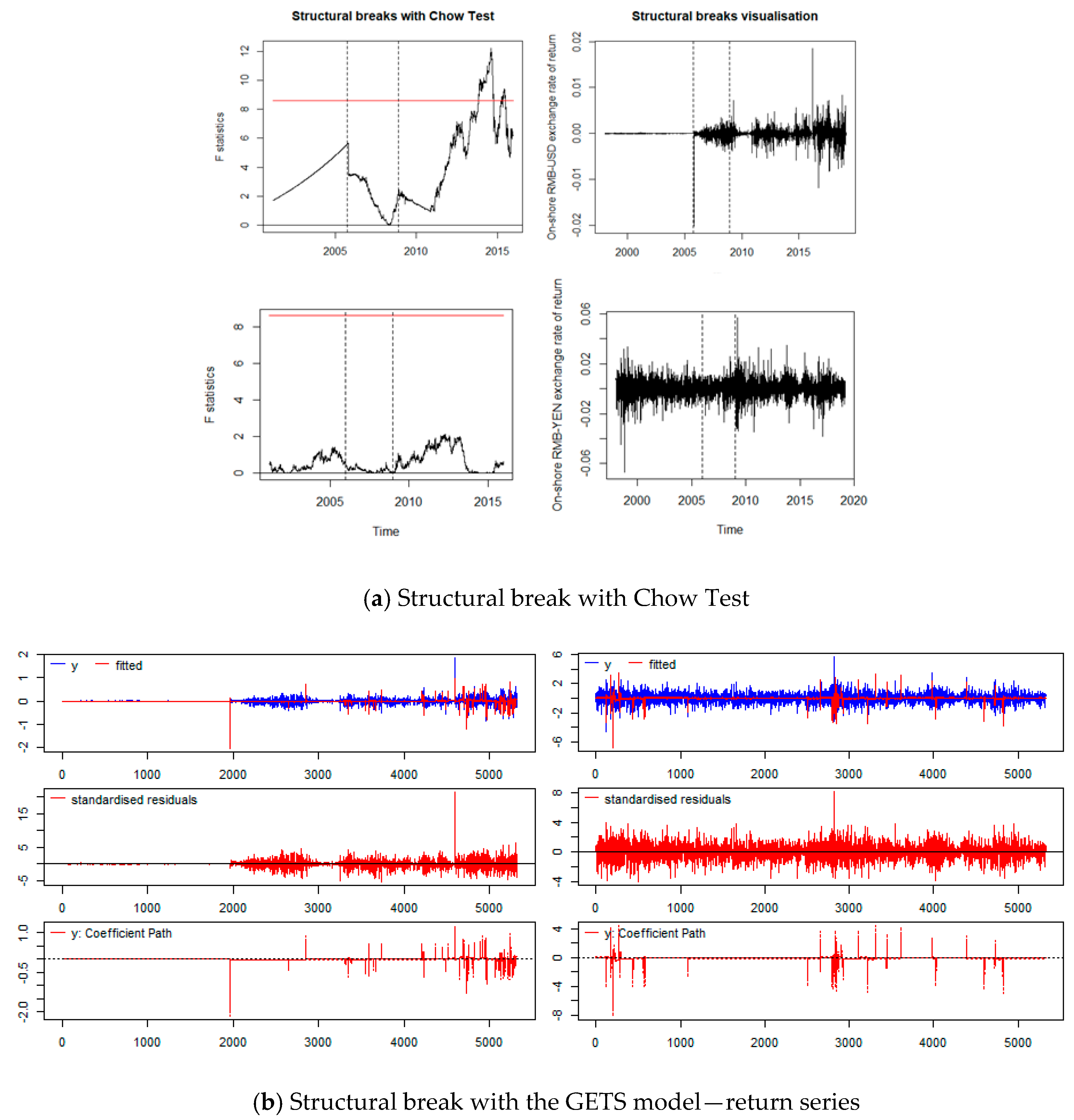

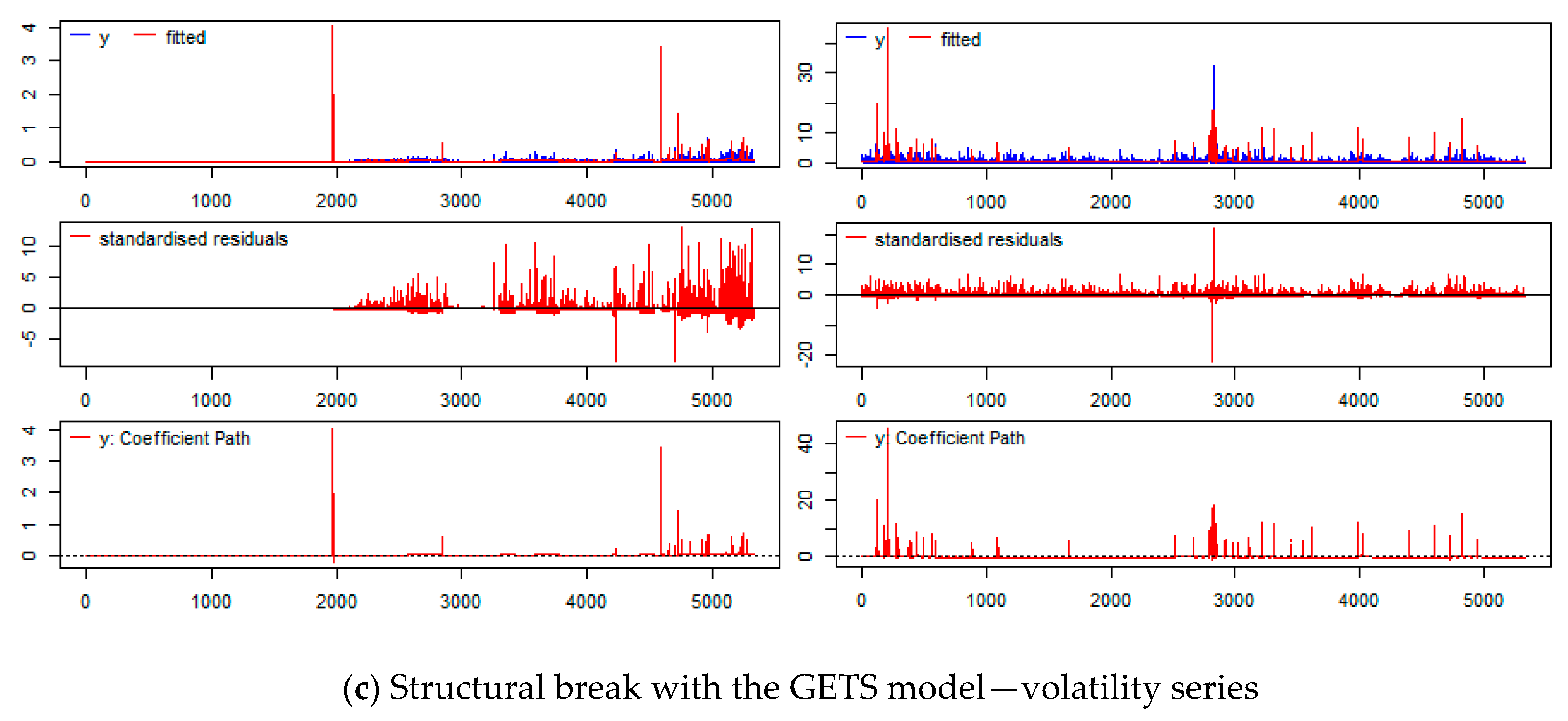

4. Data and Descriptive Statistics

5. Empirical Findings

5.1. The Diagonal Baba-Engle-Kraft-Kroner GARCH-M Models

5.2. Robustness Test with Vector Autoregression

6. Discussion and Limitation

7. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Abdalla, Issam SA, and Victor Murinde. 1997. Exchange rate and stock price interactions in emerging financial markets: evidence on India, Korea, Pakistan and the Philippines. Applied Financial Economics 7: 25–35. [Google Scholar] [CrossRef]

- Ahmed, Amira A., and Rania I Naguib. 2017. DCCs among Sector Indexes and Dynamic Causality between Foreign Exchange and Equity Sector Volatility: Evidence from Egypt. Applied Economics and Finance 5: 14–28. [Google Scholar] [CrossRef]

- Ajayi, Richard A., and Mbodja Mougouė. 1996. On the dynamic relation between stock prices and exchange rates. Journal of Financial Research 19: 193–207. [Google Scholar] [CrossRef]

- Apostolakis, George. 2016. Spreading crisis: Evidence of financial stress spillovers in the Asian financial markets. International Review of Economics & Finance 43: 542–51. [Google Scholar]

- Baker, Malcolm, and Jeffrey Wurgler. 2007. Investor sentiment in the stock market. Journal of Economic Perspectives 21: 129–52. [Google Scholar] [CrossRef]

- Black, Stanley W. 2015. The Portfolio Theory of Exchange Rates—Then and Now. Review of International Economics 23: 379–86. [Google Scholar] [CrossRef]

- Bollerslev, Tim. 1986. Generalized autoregressive conditional heteroskedasticity. Journal of Econometrics 31: 307–27. [Google Scholar] [CrossRef]

- Bollerslev, Tim. 1990. Modelling the coherence in short-run nominal exchange rates: A multivariate generalized ARCH model. The Review of Economics and Statistics 72: 498–505. [Google Scholar] [CrossRef]

- Boyer, Brian H., Tomomi Kumagai, and Kathy Yuan. 2006. How do crises spread? Evidence from accessible and inaccessible stock indices. The Journal of Finance 61: 957–1003. [Google Scholar] [CrossRef]

- Cao, Lanlan, Jyoti Navare, and Zhongqi Jin. 2018. Business model innovation: How the international retailers rebuild their core business logic in a new host country. International Business Review 27: 543–62. [Google Scholar] [CrossRef]

- Caporin, Massimiliano, and Michael McAleer. 2012. Do we really need both BEKK and DCC? A tale of two multivariate GARCH models. Journal of Economic Surveys 26: 736–51. [Google Scholar] [CrossRef]

- Carpenter, Jennifer N., and Robert F. Whitelaw. 2017. The development of China’s stock market and stakes for the global economy. Annual Review of Financial Economics 9: 233–57. [Google Scholar] [CrossRef]

- Chang, Chia-Lin, Michael McAleer, and Roengchai Tansuchat. 2010. Analyzing and forecasting volatility spillovers, asymmetries and hedging in major oil markets. Energy Economics 32: 1445–55. [Google Scholar] [CrossRef]

- Chang, Chia-Lin, and Michael McAleer. 2018. The fiction of full BEKK: Pricing fossil fuels and carbon emissions. Finance Research Letters. [Google Scholar] [CrossRef]

- Chang, Chia-Lin, Michael McAleer, and Yu-Ann Wang. 2018. Modelling volatility spillovers for bio-ethanol, sugarcane and corn spot and futures prices. Renewable and Sustainable Energy Reviews 81: 1002–18. [Google Scholar] [CrossRef]

- Chang, Ting-Huan, and Hsin-Mei Su. 2010. The substitutive effect of biofuels on fossil fuels in the lower and higher crude oil price periods. Energy 35: 2807–13. [Google Scholar] [CrossRef]

- Chen, Shiyi, and Chun Liu. 2008. The volatility spillover between Chinese and major international stock markets: new evidence from a causality-in-variance approach. World Economic Papers 5: 30–44. [Google Scholar]

- Chkili, Walid. 2016. Dynamic correlations and hedging effectiveness between gold and stock markets: Evidence for BRICS countries. Research in International Business and Finance 38: 22–34. [Google Scholar] [CrossRef]

- Diebold, Francis X., and Kamil Yilmaz. 2009. Measuring financial asset return and volatility spillovers, with application to global equity markets. The Economic Journal 119: 158–71. [Google Scholar] [CrossRef]

- Diebold, Francis X., and Kamil Yilmaz. 2012. Better to give than to receive: Predictive directional measurement of volatility spillovers. International Journal of Forecasting 28: 57–66. [Google Scholar] [CrossRef]

- Dobson, Wendy, and Paul R Masson. 2009. Will the renminbi become a world currency? China Economic Review 20: 124–35. [Google Scholar] [CrossRef]

- Dornbusch, Rudiger, and Stanley Fischer. 1980. Exchange rates and the current account. The American Economic Review 70: 960–71. [Google Scholar]

- Engle III, Robert F., Takatoshi Ito, and Wen-Ling Lin. 1988. Meteor showers or heat waves? Heteroskedastic intra-daily volatility in the foreign exchange market. National Bureau of Economic Research 58: 525–42. [Google Scholar]

- Engle, Robert. 2002. Dynamic conditional correlation: A simple class of multivariate generalized autoregressive conditional heteroskedasticity models. Journal of Business & Economic Statistics 20: 339–50. [Google Scholar]

- Engle, Robert F. 1982. Autoregressive conditional heteroscedasticity with estimates of the variance of United Kingdom inflation. Econometrica: Journal of the Econometric Society, 987–1007. [Google Scholar] [CrossRef]

- Engle, Robert F., and Kenneth F. Kroner. 1995. Multivariate simultaneous generalized ARCH. Econometric Theory 11: 122–50. [Google Scholar] [CrossRef]

- Funke, Michael, Chang Shu, Xiaoqiang Cheng, and Sercan Eraslan. 2015. Assessing the CNH-CNY pricing differential: Role of fundamentals, contagion and policy. Journal of International Money and Finance 59: 245–62. [Google Scholar] [CrossRef]

- Granger, Clive W. J., Bwo-Nung Huangb, and Chin-Wei Yang. 2000. A bivariate causality between stock prices and exchange rates: Evidence from recent Asianflu. The Quarterly Review of Economics and Finance 40: 337–54. [Google Scholar] [CrossRef]

- Ho, Kin-Yip, Yanlin Shi, and Zhaoyong Zhang. 2017. Does news matter in China’s foreign exchange market? Chinese RMB volatility and public information arrivals. International Review of Economics & Finance 52: 302–21. [Google Scholar]

- Ho, Kin-Yip, Yanlin Shi, and Zhaoyong Zhang. 2018. Public information arrival, price discovery and dynamic correlations in the Chinese renminbi markets. The North American Journal of Economics and Finance. [Google Scholar] [CrossRef]

- Hong, Harrison, and Jeremy C. Stein. 2003. Differences of opinion, short-sales constraints, and market crashes. The Review of Financial Studies 16: 487–525. [Google Scholar] [CrossRef]

- Hussain, Huzaimi, and Venus Khim-Sen Liew. 2005. Causal Relationships between Exchange Rates and Stock Prices in Malaysia and Thailand during the 1997 Currency Crisis Turmoil. Economic Bulletin 7: 1–13. [Google Scholar]

- Ito, Takatoshi, Satoshi Koibuchi, Kiyotaka Sato, and Junko Shimizu. 2016. Exchange Rate Exposure and Risk Management: The Case of Japanese Exporting Firms. Journal of the Japanese and International Economies 41: 17–29. [Google Scholar] [CrossRef]

- Jayasinghe, Prabhath, Albert K. Tsui, and Zhaoyong Zhang. 2014. New estimates of time-varying currency betas: A trivariate BEKK approach. Economic Modelling 42: 128–39. [Google Scholar] [CrossRef]

- Jorion, Philippe. 1990. The exchange-rate exposure of US multinationals. Journal of Business, 331–45. [Google Scholar] [CrossRef]

- Kesik, Akmet, Mehmet Canakci, and Halil Tunali. 2016. Analyzing impact of non-residents’ holdings of equities on bist (istanbul stock exchange) 100 index. Journal of Economics Finance and Accounting 3: 166–79. [Google Scholar] [CrossRef]

- Khalfaoui, Rabeh, M. Boutahar, and H. Boubaker. 2015. Analyzing volatility spillovers and hedging between oil and stock markets: Evidence from wavelet analysis. Energy Economics 49: 540–49. [Google Scholar] [CrossRef]

- Kim, Ki-ho. 2003. Dollar exchange rate and stock price: Evidence from multivariate cointegration and error correction model. Review of Financial Economics 12: 301–13. [Google Scholar] [CrossRef]

- Kodres, Laura E., and Matthew Pritsker. 2002. A rational expectations model of financial contagion. The Journal of Finance 57: 769–99. [Google Scholar] [CrossRef]

- Lien, Donald, Chongfeng Wu, Li Yang, and Chunyang Zhou. 2013. Dynamic and Asymmetric Dependences Between Chinese Yuan and Other Asia-Pacific Currencies. Journal of Futures Markets 33: 696–723. [Google Scholar] [CrossRef]

- Ling, Shiqing, and Michael McAleer. 2003. Asymptotic theory for a vector ARMA-GARCH model. Econometric Theory 19: 280–310. [Google Scholar] [CrossRef]

- Liow, Kim Hiang, Wen-Chi Liao, and Yuting Huang. 2018. Dynamics of international spillovers and interaction: Evidence from financial market stress and economic policy uncertainty. Economic Modelling 68: 96–116. [Google Scholar] [CrossRef]

- Maghyereh, Aktham I., Basel Awartani, and Panagiotis Tziogkidis. 2017. Volatility spillovers and cross-hedging between gold, oil and equities: Evidence from the Gulf Cooperation Council countries. Energy Economics 68: 440–53. [Google Scholar] [CrossRef]

- McAleer, Michael. 2005. Automated inference and learning in modeling financial volatility. Econometric Theory 21: 232–61. [Google Scholar] [CrossRef]

- McAleer, Michael, and Marcelo C Medeiros. 2008. A multiple regime smooth transition heterogeneous autoregressive model for long memory and asymmetries. Journal of Econometrics 147: 104–19. [Google Scholar] [CrossRef]

- McAleer, Michael, Suhejla Hoti, and Felix Chan. 2009. Structure and asymptotic theory for multivariate asymmetric conditional volatility. Econometric Reviews 28: 422–40. [Google Scholar] [CrossRef]

- McAleer, Michael, and Christian M Hafner. 2014. A one line derivation of EGARCH. Econometrics 2: 92–97. [Google Scholar] [CrossRef]

- Morales-Zumaquero, Amalia, and Simón Sosvilla-Rivero. 2018. Volatility spillovers between foreign exchange and stock markets in industrialized countries. The Quarterly Review of Economics and Finance. [Google Scholar] [CrossRef]

- Nishimura, Yusaku, Yoshiro Tsutsui, and Kenjiro Hirayama. 2018. Do international investors cause stock market spillovers? Comparing responses of cross-listed stocks between accessible and inaccessible markets. Economic Modelling 69: 237–48. [Google Scholar] [CrossRef]

- Perron, Pierre. 1989. The great crash, the oil price shock and the unit root hypothesis. Econometrica 57: 1361–401. [Google Scholar] [CrossRef]

- Rafiq, Sara, and Liu Hai Yun. 2017. An Empirical Investigation on the Effect of FDI on Foreign Trade of Pakistan. Global Journal of Economic and Business-Vol 3: 301–11. [Google Scholar] [CrossRef]

- Rashid, Abdul. 2007. Stock prices and trading volume: An assessment for linear and nonlinear Granger causality. Journal of Asian Economics 18: 595–612. [Google Scholar] [CrossRef]

- Reboredo, Juan C. 2018. Green Bond and Financial Markets: Co-Movement, Diversification and Price Spillover Effects. Energy Economics 74: 38–50. [Google Scholar] [CrossRef]

- Ren, Yinghua, Lin Chen, and Ye Liu. 2018. The Onshore-Offshore Exchange Rate Differential, Interest Rate Spreads, and Internationalization: Evidence from the Hong Kong Offshore Renminbi Market. Emerging Markets Finance and Trade 54: 3100–16. [Google Scholar] [CrossRef]

- Rojec, Matija, and Mark Knell. 2018. Why is there a lack of evidence on knowledge spillovers from foreign direct investment? Journal of Economic Surveys 32: 579–612. [Google Scholar] [CrossRef]

- Sato, Kiyotaka, and Junko Shimizu. 2018. International Use of the Renminbi for Invoice Currency and Exchange Risk Management: Evidence from the Japanese Firm-Level Data. Available online: http://www.rieti.go.jp/jp/publications/dp/16e033.pdf (accessed on 11 October 2018).

- Spantig, Kristina. 2015. International monetary policy spillovers—Can the RMB and the euro challenge the hegemony of the US dollar? Asia Europe Journal 13: 459–78. [Google Scholar] [CrossRef]

- Umar, Zaghum, and Tahir Suleman. 2017. Asymmetric return and volatility transmission in conventional and Islamic equities. Risks 5: 22. [Google Scholar] [CrossRef]

- Wang, Ping, Aying Liu, and Peijie Wang. 2004. Return and risk interactions in Chinese stock markets. Journal of International Financial Markets, Institutions and Money 14: 367–83. [Google Scholar] [CrossRef]

- Wong, Chin-Yoong, and Yoke-Kee Eng. 2017. International spillovers of China’s structural reforms. The Journal of International Trade & Economic Development 26: 955–78. [Google Scholar]

- Wu, Feng, Zhengfei Guan, and Robert J. Myers. 2011. Volatility spillover effects and cross hedging in corn and crude oil futures. Journal of Futures Markets 31: 1052–75. [Google Scholar] [CrossRef]

- Xiang, Jia. 2018. Does the environmental campaign in China enhance or impede firm innovation? Advances in Management and Applied Economics 8: 1. [Google Scholar]

- Xie, Chi, Yingying Zhou, Gangjin Wang, and Xinguo Yan. 2017. Analyzing the cross-correlation between onshore and offshore rmb exchange rates based on multifractal detrended cross-correlation analysis (mf-dcca). Fluctuation and Noise Letters 16: 1750004. [Google Scholar] [CrossRef]

- Xu, Hai-Chuan, Wei-Xing Zhou, and Didier Sornette. 2017. Time-dependent lead-lag relationship between the onshore and offshore Renminbi exchange rates. Journal of International Financial Markets, Institutions and Money 49: 173–83. [Google Scholar] [CrossRef]

- Yao, Daqing, and John Whalley. 2016. The China (Shanghai) pilot free trade zone: Background, developments and preliminary assessment of initial impacts. The World Economy 39: 2–15. [Google Scholar] [CrossRef]

- Yarovaya, Larisa, Janusz Brzeszczyński, and Chi Keung Marco Lau. 2017. Asymmetry in spillover effects: Evidence for international stock index futures markets. International Review of Financial Analysis 53: 94–111. [Google Scholar] [CrossRef]

- Yau, Hwey-Yun, and Chien-Chung Nieh. 2006. Interrelationships among stock prices of Taiwan and Japan and NTD/Yen exchange rate. Journal of Asian Economics 17: 535–52. [Google Scholar] [CrossRef]

- Yuan, Kathy. 2005. Asymmetric price movements and borrowing constraints: A rational expectations equilibrium model of crises, contagion, and confusion. The Journal of Finance 60: 379–411. [Google Scholar] [CrossRef]

- Zhang, Fan, Miaojie Yu, Jiantuo Yu, and Yang Jin. 2017. The effect of RMB internationalization on belt and road initiative: Evidence from bilateral swap agreements. Emerging Markets Finance and Trade 53: 2845–57. [Google Scholar] [CrossRef]

- Zhao, Hua. 2010. Dynamic relationship between exchange rate and stock price: Evidence from China. Research in International Business and Finance 24: 103–12. [Google Scholar] [CrossRef]

| 1 | The off-shore RMB-USD and RMB-YEN datasets are also tested. We found the results from the off-shore series show identical indications as the on-shore RMB exchange rates series. For space conversation, the extensive regression results from the diagonal BEKK GARCH-M models from group 9 to 16 are not reported but are available upon request. |

| 2 | Interestingly we found strong positive average co-volatility led by the return shock from the off-shore RMB-USD exchange rate, which means that OFFRU is less useful as a suitable hedging instrument to TPX/NIK and SHCI/SCZI because negative covariance and correlation in the co-volatility is essential to insure losses in one market which can be moderated by the positive returns in the hedging instrument. This also provide theoretical indication in favour of the fundamental hypothesis, because the data for the off-shore exchange rates are collected after 2010. Literature shows that financial market integration is more effective after GFC (Nishimura et al. 2018). On average the post-GFC co-volatility spillover shows better capital flow with closer links between the market, but negative associations still exist in the spillover from the stock markets to the foreign exchange market. This further suggests that the integration is progressive but not completed. |

| Var. | Mean | Median | Max. | Min. | Std. Dev. | Skew. | Kurt. | Obs. |

|---|---|---|---|---|---|---|---|---|

| RUt | −0.0047 | 0.0000 | 1.8334 | −2.0322 | 0.1108 | −0.5978 | 46.8882 | 5325 |

| RYt | 0.0037 | 0.0000 | 5.6708 | −6.7010 | 0.6737 | −0.2760 | 5.4318 | 5325 |

| TPXt | 0.0077 | 0.0000 | 12.8646 | −10.0071 | 1.3351 | −0.3204 | 9.2529 | 5325 |

| NIKt | 0.0073 | 0.0000 | 13.2346 | −12.1110 | 1.4694 | −0.3511 | 9.4246 | 5325 |

| SHCIt | 0.0176 | 0.0000 | 9.4009 | −9.2561 | 1.5253 | −0.3349 | 8.4486 | 5325 |

| SZCIt | 0.0290 | 0.0000 | 9.2435 | −8.9303 | 1.6903 | −0.5179 | 7.0147 | 5325 |

| OFFRUt | −0.0021 | −0.0076 | 2.7853 | −1.4604 | 0.2117 | 0.8324 | 20.4311 | 2029 |

| OFFRYt | 0.0164 | 0.0145 | 3.3399 | −4.4238 | 0.5934 | −0.1043 | 4.4867 | 2029 |

| OFFTPXt | 0.0445 | 0.0090 | 8.0207 | −9.4727 | 1.2212 | −0.4316 | 6.6657 | 2029 |

| OFFNIKt | 0.0524 | 0.0000 | 7.7089 | −10.5539 | 1.3045 | −0.4580 | 6.0365 | 2029 |

| OFFSHCIt | 0.0164 | 0.0000 | 5.7636 | −8.4909 | 1.3247 | −0.8993 | 6.8442 | 2029 |

| OFFSZCIt | 0.0344 | 0.0066 | 6.5244 | −8.2414 | 1.5797 | −0.7938 | 3.6677 | 2029 |

| ADF Test | PP Test | Perron (1989) Breakpoint Test | ||||||

|---|---|---|---|---|---|---|---|---|

| Var. | D.F | p-Value | alpha | p-Value | BP-2005 | AIC | BP-2008 | AIC |

| RU | −15.377 *** | 0.01 | −5515.5 *** | 0.01 | 0.2457 *** | −1.5759 | 0.2396 *** | −1.5770 |

| RY | −17.522 *** | 0.01 | −5308.3 *** | 0.01 | −0.0509 * | 2.0497 | −0.0513 * | −1.8416 |

| TPX | −17.392 *** | 0.01 | −4857.1 *** | 0.01 | −0.1320 *** | 3.4117 | −0.1371 *** | 3.4111 |

| NIK | −17.509 *** | 0.01 | −5212.9 *** | 0.01 | −0.1285 *** | 3.6033 | −0.1283 *** | 3.6031 |

| SHCI | −15.535 *** | 0.01 | −5394.8 *** | 0.01 | 0.1587 *** | 3.6729 | 0.1742 *** | 3.6736 |

| SZCI | −15.791 *** | 0.01 | −5233.0 *** | 0.01 | 0.1074 *** | 3.8743 | 0.1179 *** | 3.8754 |

| OFFRU | −11.795 *** | 0.01 | −1822.2 *** | 0.01 | – | – | – | – |

| OFFRY | −12.214 *** | 0.01 | −1979.2 *** | 0.01 | – | – | – | – |

| OFFTPX | −13.480 *** | 0.01 | −1990.4 *** | 0.01 | – | – | – | – |

| OFFNIK | −13.460 *** | 0.01 | −2219.2 *** | 0.01 | – | – | – | – |

| OFFSHCI | −11.800 *** | 0.01 | −1943.0 *** | 0.01 | – | – | – | – |

| OFFSZCI | −11.583 *** | 0.01 | −1910.0 *** | 0.01 | – | – | – | – |

| Group No. | Variables |

|---|---|

| 1 | RU, TPX, SHCI |

| 2 | RU, TPX, SZCI |

| 3 | RU, NIK, SHCI |

| 4 | RU, NIK, SZCI |

| 5 | RY, TPX, SHCI |

| 6 | RY, TPX, SZCI |

| 7 | RY, NIK, SHCI |

| 8 | RY, NIK, SZCI |

| 9 | OFFRU, OFFTPX, OFFSHCI |

| 10 | OFFRU, OFFTPX, OFFSZCI |

| 11 | OFFRU, OFFNIK, OFFSHCI |

| 12 | OFFRU, OFFNIK, OFFSZCI |

| 13 | OFFRY, OFFTPX, OFFSHCI |

| 14 | OFFRY, OFFTPX, OFFSZCI |

| 15 | OFFRY, OFFNIK, OFFSHCI |

| 16 | OFFRY, OFFNIK, OFFSZCI |

| Group | Var. | RU(−1) | RY(−1) | TPX(−1) | NIK(−1) | SHCI(−1) | SZCI(−1) | D2005 | D2008 |

|---|---|---|---|---|---|---|---|---|---|

| 1 | RU | −0.1140 *** (0.0000) | 0.0001 (0.3141) | −0.0000 (0.6489) | −0.0022 *** (0.0000) | −0.0000 (0.3595) | |||

| TPX | 0.0439 (0.6946) | 0.0335 ** (0.0229) | −0.0258 ** (0.0237) | 0.0014 (0.4295) | 0.0002 (0.8640) | ||||

| SHCI | 0.2359 ** (0.0193) | 0.0022 (0.8588) | 0.0119 (0.3947) | 0.0082 (0.2692) | 0.0039 *** (0.0031) | ||||

| 2 | RU | −0.1150 *** (0.0000) | 0.0001 (0.3531) | −0.0000 (0.5729) | −0.0022 *** (0.0000) | −0.0000 (0.3908) | |||

| TPX | 0.0718 (0.5040) | 0.0039 ** (0.0212) | −0.0209 ** (0.0400) | 0.0012 (0.4630) | 0.0002 (0.8375) | ||||

| SZCI | 0.3863 ** (0.0115) | 0.0012 (0.9296) | 0.0398 ** (0.0072) | 0.0080 (0.3444) | 0.0045 *** (0.0003) | ||||

| 3 | RU | −0.1121 *** (0.0000) | 0.0000 (0.3265) | −0.0000 (0.6134) | −0.0022 *** (0.0000) | 0.0000 (0.7066) | |||

| NIK | 0.1212 (0.3371) | −0.0245 * (0.0768) | −0.0244 ** (0.0442) | 0.0021 * (0.0778) | −0.0047 (0.1606) | ||||

| SHCI | 0.2322 *** (0.0222) | 0.0034 (0.7584) | 0.0110 (0.4307) | 0.0047 (0.2679) | 0.0026 *** (0.0041) | ||||

| 4 | RU | −0.1146 *** (0.0000) | 0.0004 (0.3707) | −0.0000 (0.5229) | −0.0022 *** (0.0000) | 0.0000 (0.6918) | |||

| NIK | 0.1476 (0.2254) | −0.0250 * (0.0708) | −0.0196 * (0.0715) | 0.0017 (0.3588) | −0.0041 (0.2300) | ||||

| SZCI | 0.3725 ** (0.0144) | 0.0046 (0.7033) | 0.0387 *** (0.0092) | 0.0081 (0.3397) | 0.0035 *** (0.0008) | ||||

| 5 | RY | −0.0675 *** (0.0000) | 0.0028 (0.6943) | −0.0076 (0.1646) | 0.0020 (0.3113) | −0.0080 (0.1619) | |||

| TPX | 0.3126 *** (0.0000) | 0.0051 (0.7131) | −0.0192 * (0.0765) | 0.0000 (0.7955) | 0.0005 (0.6164) | ||||

| SHCI | −0.0061 (0.7968) | 0.0087 (0.5138) | 0.0138 (0.3187) | 0.0063 (0.2144) | 0.0033 ** (0.0141) | ||||

| 6 | RY | −0.0677 *** (0.0000) | 0.0028 (0.6934) | −0.0086 * (0.0643) | 0.0022 (0.2996) | −0.0007 (0.2100) | |||

| TPX | 0.3116 *** (0.0000) | 0.0033 (0.8149) | −0.0133 (0.1642) | 0.0002 (0.8878) | 0.0006 (0.5996) | ||||

| SZCI | −0.0264 (0.3325) | 0.0059 (0.6908) | 0.0381 *** (0.0080) | 0.0057 (0.3327) | 0.0039 *** (0.0029) | ||||

| 7 | RY | −0.0651 *** (0.0000) | 0.0001 (0.9911) | −0.0068 (0.2079) | 0.0019 (0.3331) | −0.0008 (0.1476) | |||

| NIK | 0.3701 *** (0.0000) | −0.0532 *** (0.0001) | −0.0187 (0.1002) | 0.0009 (0.5810) | 0.0009 (0.4367) | ||||

| SHCI | −0.0050 (0.8353) | 0.0098 (0.4066) | 0.0118 (0.3907) | 0.0063 (0.2202) | 0.0033 ** (0.0142) | ||||

| 8 | RY | −0.0651 *** (0.0000) | 0.0001 (0.9861) | −0.0079 * (0.0912) | 0.0021 (0.3231) | −0.0007 (0.1974) | |||

| NIK | 0.3705 *** (0.0000) | −0.0562 *** (0.0000) | −0.0130 (0.1969) | 0.0007 (0.6910) | 0.0009 (0.4269) | ||||

| SZCI | −0.0250 (0.3564) | 0.0069 (0.5839) | 0.0361 ** (0.0117) | 0.0057 (0.3407) | 0.0039 *** (0.0032) |

| Group | C | A | B | ||||||

|---|---|---|---|---|---|---|---|---|---|

| 1 | RU | TPX | SHCI | RU | TPX | SHCI | RU | TPX | SHCI |

| RU | 0.0000 (0.9970) | 0.3426 * (0.0001) | 0.9395 * (0.0000) | ||||||

| TPX | −0.0007 (0.8594) | 0.0015 (0.4593) | 0.2209 * (0.0001) | 0.9695 * (0.000) | |||||

| SHCI | −0.0009 (0.4481) | 0.0001 (0.6487) | 0.0009 * (0.0000) | 0.1730 * (0.0000) | 0.9829 * (0.0000) | ||||

| Log. lik. | 68,401.708 | ||||||||

| 2 | RU | TPX | SZCI | RU | TPX | SZCI | RU | TPX | SZCI |

| RU | 0.0000 (0.9926) | 0.3368 * (0.0001) | 0.9416 * (0.0000) | ||||||

| TPX | −0.0008 (0.4795) | 0.0014 (0.0826) | 0.2196 * (0.0000) | 0.9694 * (0.0000) | |||||

| SZCI | −0.0012 (0.0203) | −0.0006 (0.6341) | 0.0007 (0.5659) | 0.1975 * (0.0000) | 0.9762 * (0.0000) | ||||

| Log. lik. | 67,908.906 | ||||||||

| 3 | RU | NIK | SHCI | RU | NIK | SHCI | RU | NIK | SHCI |

| RU | 0.0000 (0.9936) | 0.3498 * (0.0001) | 0.9368 * (0.0000) | ||||||

| NIK | 0.0003 (0.9744) | 0.0014 (0.4156) | 0.1984 * (0.0000) | 0.9769 * (0.0000) | |||||

| SHCI | 0.0001 (0.8852) | 0.0001 (0.8597) | 0.0009 * (0.0000) | 0.1714 * (0.0000) | 0.9833 * (0.0000) | ||||

| Log. lik. | 67,908.906 | ||||||||

| 4 | RU | NIK | SZCI | RU | NIK | SZCI | RU | NIK | SZCI |

| RU | 0.0000 (0.9970) | 0.3426 * (0.0001) | 0.9395 * (0.0000) | ||||||

| NIK | −0.0007 (0.8594) | 0.0015 (0.4593) | 0.2209 * (0.0000) | 0.9695 * (0.0000) | |||||

| SZCI | −0.0001 (0.4481) | 0.0001 (0.6487) | 0.0009 (0.0000)* | 0.1730 * (0.0000) | 0.9829 * (0.0000) | ||||

| Log. lik. | 68,401.708 | ||||||||

| 5 | RY | TPX | SHCI | RY | TPX | SHCI | RU | TPX | SHCI |

| RY | 0.0005 * (0.0000) | 0.1543 * (0.0000) | 0.9852 * (0.0000) | ||||||

| TPX | 0.0003 (0.0126) | 0.0015 * (0.0000) | 0.2476 * (0.0000) | 0.9628 * (0.0000) | |||||

| SHCI | −0.0000 (0.9768) | 0.0001 (0.0932) | 0.0013* (0.0000) | 0.2211* (0.0000) | 0.9715 * (0.0000) | ||||

| Log. lik. | 51,658.425 | ||||||||

| 6 | RY | TPX | SZCI | RY | TPX | SZCI | RU | TPX | SZCI |

| RY | 0.0005 * (0.0000) | 0.1503 * (0.0000) | 0.9859 * (0.0000) | ||||||

| TPX | 0.0003 (0.0139) | 0.0014 * (0.0000) | 0.2352 * (0.0000) | 0.9661 * (0.0000) | |||||

| SZCI | −0.0000 (0.9739) | 0.0002 (0.1851) | 0.0022 * (0.0000) | 0.2601 * (0.0000) | 0.9570 * (0.0000) | ||||

| Log. lik. | 50,920.307 | ||||||||

| 7 | RY | NIK | SHCI | RY | NIK | SHCI | RU | NIK | SHCI |

| RY | 0.0005 * (0.0000) | 0.1538 * (0.0000) | 0.9854 * (0.0000) | ||||||

| NIK | 0.0003 (0.0149) | 0.0014 * (0.0000) | 0.2265 * (0.0000) | 0.9699 * (0.0000) | |||||

| SHCI | 0.0000 (0.9555) | 0.0001 (0.1655) | 0.0013* (0.0000) | 0.2219 * (0.0000) | 0.9714 * (0.0000) | ||||

| Log. lik. | 51,192.707 | ||||||||

| 8 | RY | NIK | SZCI | RY | NIK | SZCI | RU | NIK | SHCI |

| RY | 0.0005 * (0.0000) | 0.1498 * (0.0000) | 0.9861 * (0.0000) | ||||||

| NIK | 0.0003 (0.0169) | 0.0013 * (0.0000) | 0.2166 * (0.0000) | 0.9723 * (0.0000) | |||||

| SZCI | −0.0000 (0.9415) | 0.0002 (0.2125) | 0.0022 * (0.0000) | 0.2631 * (0.0000) | 0.9562 * (0.0000) | ||||

| Log. lik. | 50,451.703 | ||||||||

| Market | Average Return Shocks |

|---|---|

| RU | −0.0005 |

| RY | −0.0117 |

| TPX | −0.0441 |

| NIK | −0.0450 |

| SHCI | −0.0080 |

| SZCI | −0.0328 |

| OFFRU | 0.0499 |

| OFFRY | −0.0282 |

| OFFTPX | −0.0470 |

| OFFNIK | −0.0395 |

| OFFSHCI | −0.0209 |

| OFFSZCI | −0.0605 |

| Group | Market | Average Co-Volatility Spillover |

|---|---|---|

| 1 | i = RU, j = TPX, k = SHCI | −0.000006 (0.3246*0.2209*0.1730*(−0.0005)) |

| i = TPX, j = RU, k = SHCI | −0.000547 (0.3246*0.2209*0.1730*(−0.0441)) | |

| i = SHCI, j = TPX, j = RU | −0.000099 (0.3246*0.2209*0.1730*(−0.0080)) | |

| 2 | i = RU, j = TPX, k = SZCI | −0.000007 (0.3368*0.2196*0.1975*(−0.0005)) |

| i = TPX, j = RU, k = SZCI | −0.000644 (0.3368*0.2196*0.1975*(−0.0441)) | |

| i = SZCI, j = TPX, k = RU | −0.000479 (0.3368*0.2196*0.1975*(−0.0328)) | |

| 3 | i = RU, j = NIK, k = SHCI | −0.000006 (0.3498*0.1984*0.1714*(−0.0005)) |

| i = NIK, j = RU, k = SHCI | −0.000535 (0.3498*0.1984*0.1714*(−0.0450)) | |

| i = SHCI, j = NIK, k = RU | −0.000095 (0.3498*0.1984*0.1714*(−0.0080)) | |

| 4 | i = RU, j = NIK, k = SZCI | −0.000007 (0.3426*0.2209*0.1730*(−0.0005)) |

| i = NIK, j = RU, k = SZCI | −0.000589 (0.3426*0.2209*0.1730*(−0.0450)) | |

| i = SZCI, j = NIK, k = RU | −0.000429 (0.3426*0.2209*0.1730*(−0.0328)) | |

| 5 | i = RY, j = TPX, k = SHCI | −0.000098 (0.1543*0.2476*0.2211*(−0.0117)) |

| i = TPX, j = RY, k = SHCI | −0.000373 (0.1543*0.2476*0.2211*(−0.0441)) | |

| i = SHCI, j = TPX, j = RY | −0.000068 (0.1543*0.2476*0.2211*(−0.0080)) | |

| 6 | i = RY, j = TPX, k = SZCI | −0.000108 (0.1503*0.2352*0.2601*(−0.0117)) |

| i = TPX, j = RY, k = SZCI | −0.000405 (0.1503*0.2352*0.2601*(−0.0441)) | |

| i = SZCI, j = TPX, k = RY | −0.000302 (0.1503*0.2352*0.2601*(−0.0328)) | |

| 7 | i = RY, j = NIK, k = SHCI | −0.000090 (0.1538*0.2265*0.2219*(−0.0117)) |

| i = NIK, j = RY, k = SHCI | −0.000348 (0.1538*0.2265*0.2219*(−0.0450)) | |

| i = SHCI, j = NIK, k = RY | −0.000062 (0.1538*0.2265*0.2219*(−0.0080)) | |

| 8 | i = RY, j = NIK, k = SZCI | −0.000100 (0.1498*0.2166*0.2631*(−0.0117)) |

| i = NIK, j = RY, k = SZCI | −0.000384 (0.1498*0.2166*0.2631*(−0.0450)) | |

| i = SZCI, j = NIK, k = RY | −0.000280 (0.1498*0.2166*0.2631*(−0.0328)) |

| To Group 1 | From | To Group 2 | From | ||||||

|---|---|---|---|---|---|---|---|---|---|

| RU | TPX | SHCI | Contribution from Others | RU | TPX | SZCI | Contribution from Others | ||

| RU | 99.7 | 0.1 | 0.2 | 0.3 | RU | 99.6 | 0.1 | 0.3 | 0.4 |

| TPX | 0.1 | 99.6 | 0.2 | 0.4 | TPX | 0.1 | 99.6 | 0.2 | 0.4 |

| SHCI | 0.4 | 3.8 | 95.8 | 4.2 | SZCI | 0.4 | 2.7 | 96.9 | 3.1 |

| Contribution to others | 0.6 | 3.9 | 0.4 | 4.9 | 0.6 | 2.8 | 0.5 | 3.9 | |

| Contribution including own | 100.3 | 103.6 | 96.2 | 1.6% * | 100.1 | 102.5 | 97.4 | 1.3% * | |

| Group 3 | RU | NIK | SHCI | Contribution from Others | Group 4 | RU | NIK | SZCI | Contribution from Others |

| RU | 99.7 | 0.1 | 0.2 | 0.3 | RU | 99.6 | 0.1 | 0.3 | 0.4 |

| NIK | 0.2 | 99.6 | 0.3 | 0.4 | NIK | 0.2 | 99.6 | 0.2 | 0.4 |

| SHCI | 0.4 | 3.9 | 95.6 | 4.4 | SZCI | 0.4 | 2.8 | 96.8 | 3.2 |

| Contribution to others | 0.6 | 4.0 | 0.4 | 5.1 | 0.6 | 2.9 | 0.5 | 4.0 | |

| Contribution including own | 100.3 | 103.6 | 96.1 | 1.7% * | 100.2 | 102.5 | 97.3 | 1.3% * | |

| Group 5 | RY | TPX | SHCI | Contribution from Others | Group 6 | RY | TPX | SZCI | Contribution from Others |

| RY | 99.3 | 0.4 | 0.3 | 0.7 | RY | 99.3 | 0.4 | 0.3 | 0.7 |

| TPX | 6.1 | 93.7 | 0.2 | 6.3 | TPX | 6.1 | 93.7 | 0.2 | 6.3 |

| SHCI | 0.4 | 3.7 | 95.9 | 4.1 | SZCI | 0.2 | 2.7 | 97.1 | 2.9 |

| Contribution to others | 6.5 | 4.1 | 0.5 | 11.1 | 6.2 | 3.2 | 0.5 | 9.9 | |

| Contribution including own | 105.8 | 97.8 | 96.4 | 3.7% * | 105.5 | 96.9 | 97.6 | 3.2% * | |

| Group 7 | RY | NIK | SHCI | Contribution from Others | Group 8 | RY | NIK | SZCI | Contribution from Others |

| RY | 99.3 | 0.4 | 0.3 | 0.7 | RY | 99.3 | 0.4 | 0.3 | 0.7 |

| NIK | 5.8 | 93.9 | 0.3 | 6.1 | NIK | 5.8 | 94.0 | 0.2 | 6.0 |

| SHCI | 0.4 | 3.8 | 95.8 | 4.2 | SZCI | 0.2 | 2.8 | 97.0 | 3.0 |

| Contribution to others | 6.2 | 4.2 | 0.6 | 11.0 | 6.0 | 3.2 | 0.6 | 9.7 | |

| Contribution including own | 105.6 | 98.1 | 96.3 | 3.7% * | 105.3 | 97.2 | 97.6 | 3.2% * | |

| To Group 1 | From | To Group 2 | From | ||||||

|---|---|---|---|---|---|---|---|---|---|

| RU | TPX | SHCI | Contribution from Others | RU | TPX | SZCI | Contribution from Others | ||

| RU | 99.8 | 0.1 | 0.1 | 0.2 | RU | 99.8 | 0.1 | 0.2 | 0.2 |

| TPX | 0.4 | 99.4 | 0.2 | 0.6 | TPX | 0.4 | 99.4 | 0.2 | 0.6 |

| SHCI | 1.0 | 1.1 | 97.9 | 2.1 | SZCI | 0.9 | 0.8 | 98.3 | 1.7 |

| Contribution to others | 1.5 | 1.1 | 0.3 | 2.9 | 1.3 | 0.8 | 0.4 | 2.5 | |

| Contribution including own | 101.3 | 100.5 | 98.2 | 1.0% * | 101.1 | 100.2 | 98.7 | 0.8% * | |

| Group 3 | RU | NIK | SHCI | Contribution from Others | Group 4 | RU | NIK | SZCI | Contribution from Others |

| RU | 99.8 | 0.1 | 0.1 | 0.2 | RU | 99.8 | 0.1 | 0.2 | 0.2 |

| NIK | 0.2 | 99.6 | 0.3 | 0.4 | NIK | 0.2 | 99.6 | 0.2 | 0.4 |

| SHCI | 1.0 | 0.8 | 98.1 | 1.9 | SZCI | 0.9 | 0.7 | 98.4 | 1.6 |

| Contribution to others | 1.2 | 0.9 | 0.4 | 2.4 | 1.1 | 0.7 | 0.4 | 2.1 | |

| Contribution including own | 101.0 | 100.4 | 98.5 | 0.8% * | 100.8 | 100.3 | 98.8 | 0.7% * | |

| Group 5 | RY | TPX | SHCI | Contribution from Others | Group 6 | RY | TPX | SZCI | Contribution from Others |

| RY | 98.6 | 1.3 | 0.1 | 1.4 | RY | 98.6 | 1.3 | 0.1 | 1.4 |

| TPX | 4.2 | 95.6 | 0.2 | 4.4 | TPX | 4.2 | 95.6 | 0.2 | 4.4 |

| SHCI | 0.5 | 1.0 | 98.4 | 1.6 | SZCI | 0.3 | 0.8 | 98.9 | 1.1 |

| Contribution to others | 4.8 | 2.3 | 0.3 | 7.4 | 4.6 | 2.1 | 0.3 | 6.9 | |

| Contribution including own | 103.4 | 97.9 | 98.8 | 2.5% * | 103.1 | 97.7 | 99.2 | 2.3% * | |

| Group 7 | RY | NIK | SHCI | Contribution from Others | Group 8 | RY | NIK | SZCI | Contribution from Others |

| RY | 98.3 | 1.6 | 0.1 | 1.7 | RY | 98.2 | 1.6 | 0.1 | 1.8 |

| NIK | 5.1 | 94.7 | 0.2 | 5.3 | NIK | 5.1 | 94.7 | 0.2 | 5.3 |

| SHCI | 0.6 | 0.7 | 98.7 | 1.3 | SZCI | 0.3 | 0.6 | 99.1 | 0.9 |

| Contribution to others | 5.7 | 2.3 | 0.4 | 8.3 | 5.4 | 2.2 | 0.3 | 7.9 | |

| Contribution including own | 103.9 | 97.0 | 99.1 | 2.8% * | 103.6 | 96.9 | 99.4 | 2.6% * | |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Qin, F.; Zhang, J.; Zhang, Z. RMB Exchange Rates and Volatility Spillover across Financial Markets in China and Japan. Risks 2018, 6, 120. https://doi.org/10.3390/risks6040120

Qin F, Zhang J, Zhang Z. RMB Exchange Rates and Volatility Spillover across Financial Markets in China and Japan. Risks. 2018; 6(4):120. https://doi.org/10.3390/risks6040120

Chicago/Turabian StyleQin, Fengming, Junru Zhang, and Zhaoyong Zhang. 2018. "RMB Exchange Rates and Volatility Spillover across Financial Markets in China and Japan" Risks 6, no. 4: 120. https://doi.org/10.3390/risks6040120

APA StyleQin, F., Zhang, J., & Zhang, Z. (2018). RMB Exchange Rates and Volatility Spillover across Financial Markets in China and Japan. Risks, 6(4), 120. https://doi.org/10.3390/risks6040120