Bayesian Adjustment for Insurance Misrepresentation in Heavy-Tailed Loss Regression

Abstract

:1. Introduction

2. Heavy-Tailed Loss Models under Misrepresentation

2.1. The Misrepresentation Problem

2.2. Weibull Model with Additional Correctly-Measured Risk Factors

2.3. Lognormal Model with Multiple Risk Factors Subject to Misrepresentation

2.4. Pareto Model for Predictive Analytics on Misrepresentation Risk

3. Identifiability

- (i)

- implies ,

- (ii)

- for any , there exists some in the closure of such that for each .

- (i)

- General Weibull,

- (ii)

- Lognormal,

- (iii)

- Two-parameter Pareto.

- (i)

- For our model, the PDF of the general Weibull is given by:with the transform being the MGF of given by:

- (ii)

- The PDF of the lognormal distribution is given by:with the transform being the MGF of given by:

- (iii)

- For the two-parameter Pareto distribution used in our model, the PDF is given by:with the transform being the MGF of given by:

- (i)

- Y follows a distribution from the families of Weibull, lognormal and Pareto,

- (ii)

- corresponding to V (or any element in ) is non-zero,

- (iii)

- or for any .

4. Simulation Studies

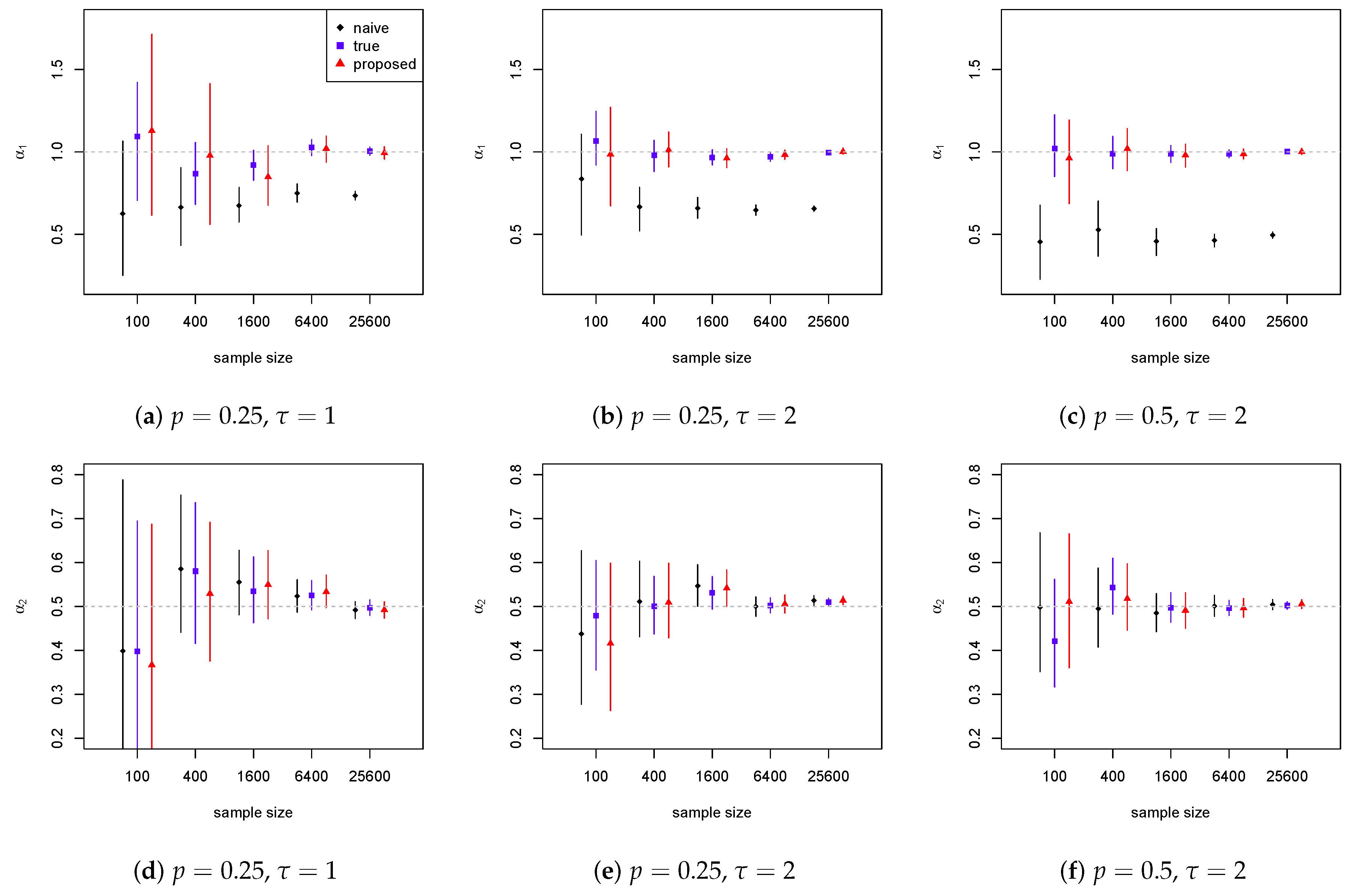

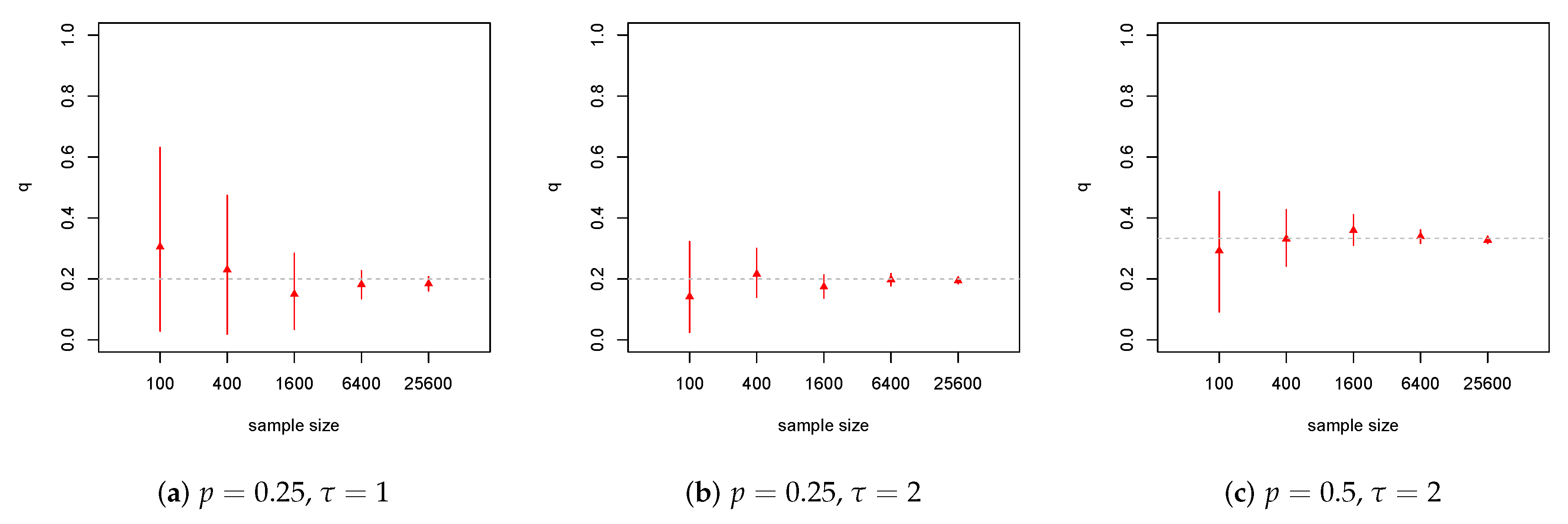

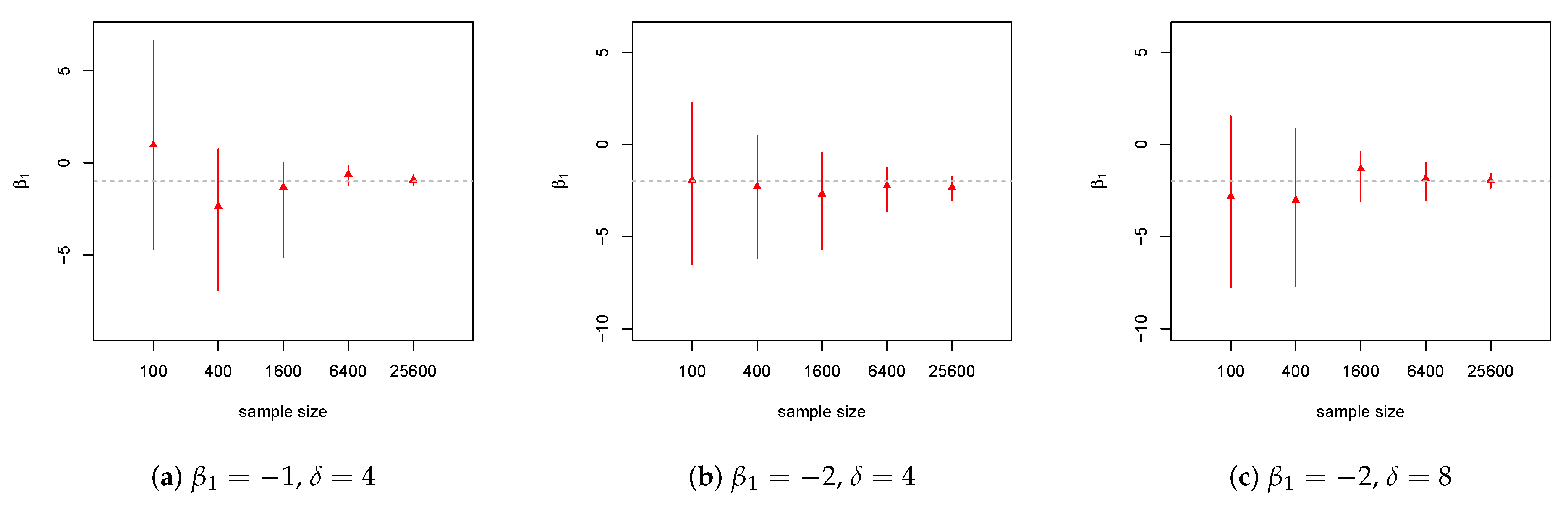

4.1. Weibull Model

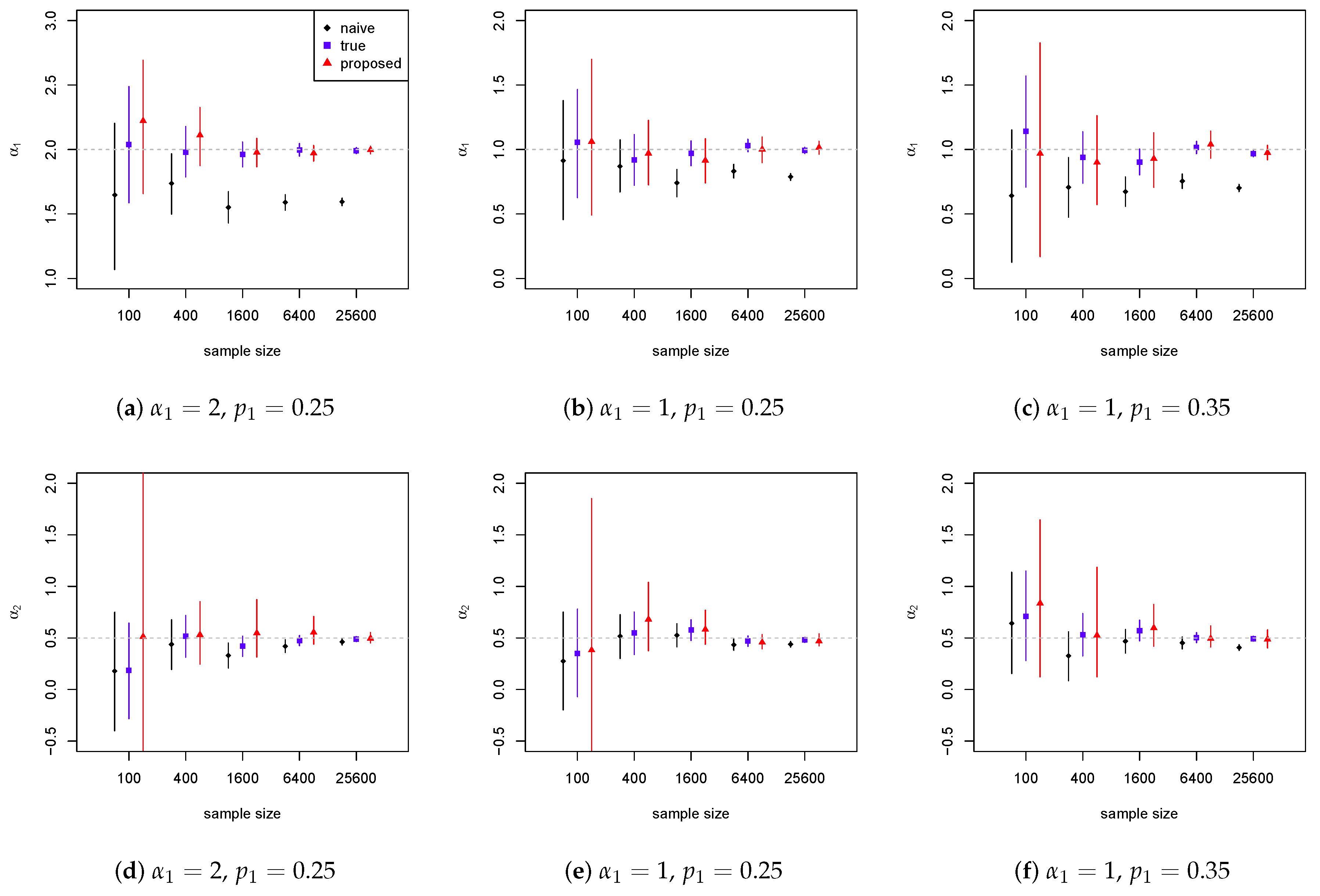

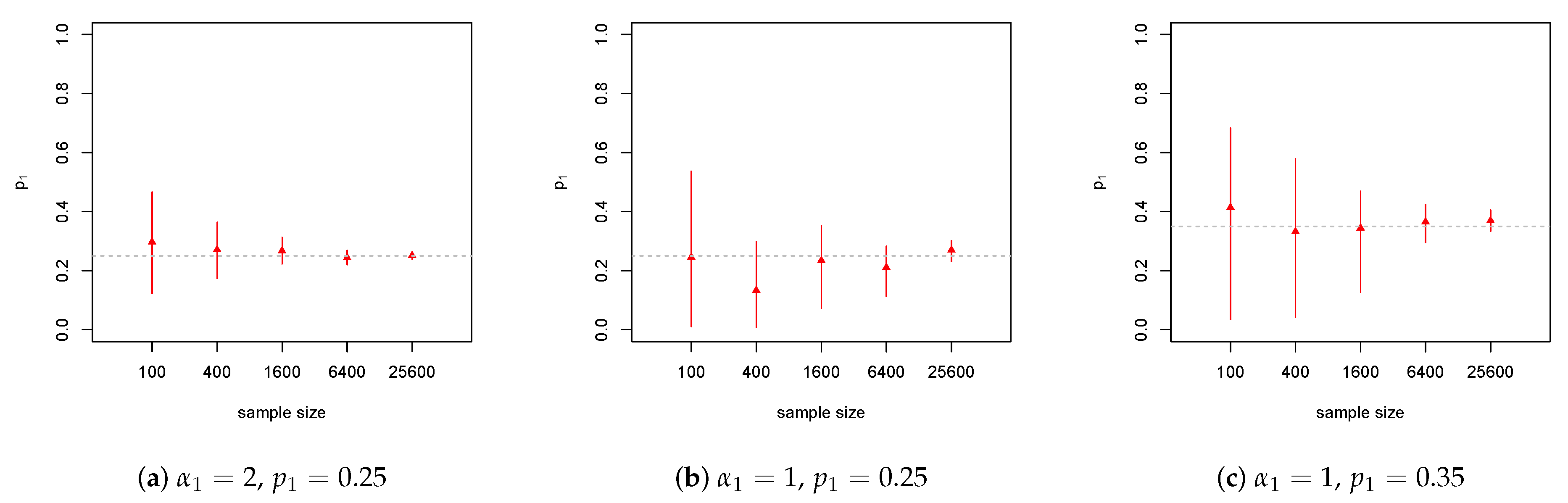

4.2. Lognormal Model

4.3. Pareto Model

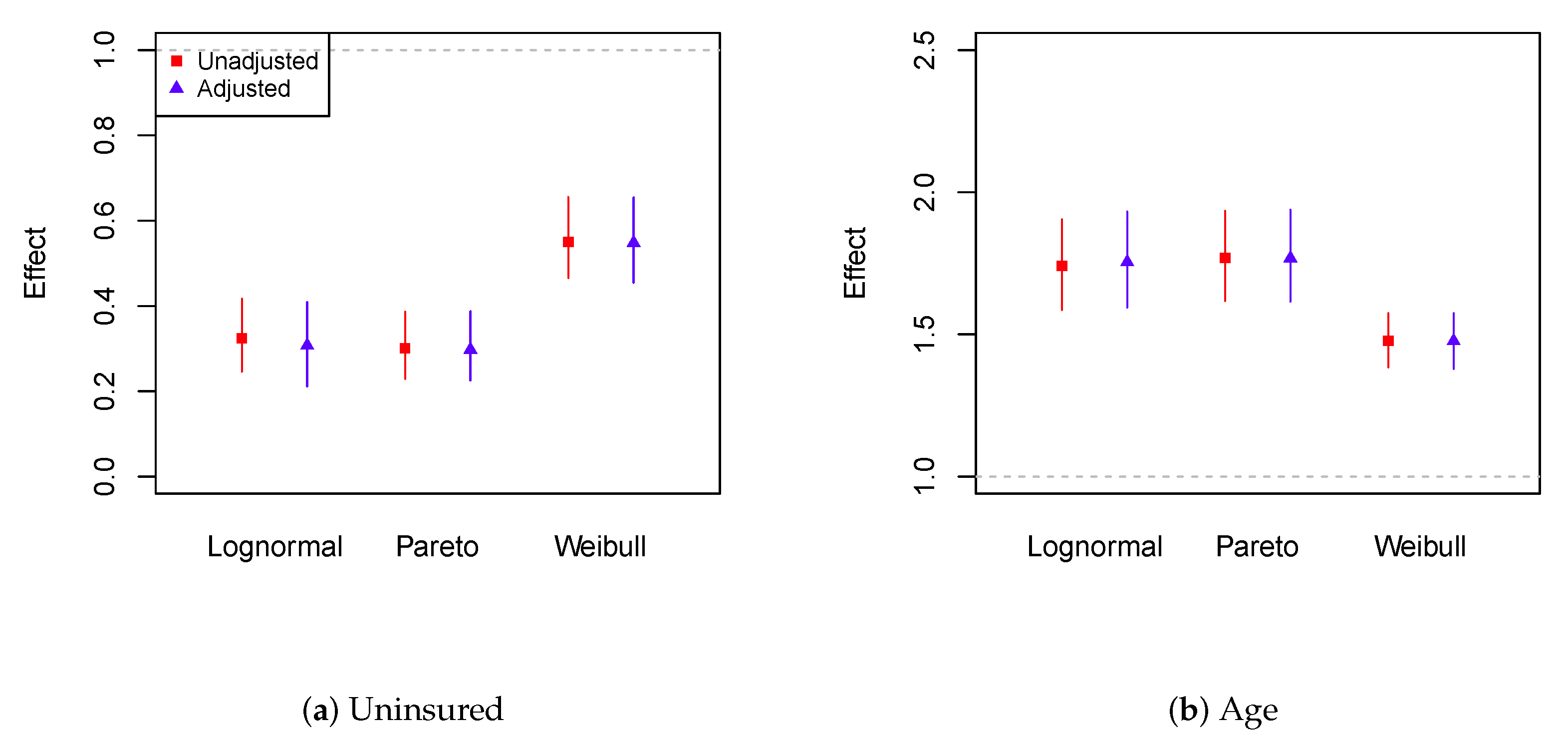

5. Loss Severity Analysis Using Medical Expenditure Data

6. Conclusions

Acknowledgments

Funding

Conflicts of Interest

Abbreviations

| GLMs | Generalized linear models |

| MLE | Maximum likelihood estimation |

| BUGS | Bayesian inference using Gibbs sampling |

| MCMC | Markov chain Monte Carlo |

| CDFs | Cumulative distribution functions |

| MGF | Moment generating function |

| Probability density function | |

| MEPS | Medical Expenditure Panel Survey |

| DIC | Deviance information criterion |

| PPACA | Patient Protection and Affordable Care Act |

| SD | Standard deviation |

References

- Ahmad, Khalaf E. 1988. Identifiability of finite mixtures using a new transform. Annals of the Institute of Statistical Mathematics 40: 261–5. [Google Scholar] [CrossRef]

- Bermúdez, Lluís, and Dimitris Karlis. 2015. A posteriori ratemaking using bivariate Poisson models. Scandinavian Actuarial Journal 2017: 148–58. [Google Scholar]

- Brockman, M.J., and T.S. Wright. 1992. Statistical motor rating: making effective use of your data. Journal of the Institute of Actuaries 119: 457–543. [Google Scholar] [CrossRef]

- Chandra, Satish. 1977. On the mixtures of probability distributions. Scandinavian Journal of Statistics 4: 105–12. [Google Scholar]

- David, Mihaela. 2015. Auto insurance premium calculation using generalized linear models. Procedia Economics and Finance 20: 147–56. [Google Scholar] [CrossRef]

- Gustafson, Paul. 2014. Bayesian statistical methodology for observational health sciences data. In Statistics in Action: A Canadian Outlook. Edited by Jerald F. Lawless. London: Chapman and Hall/CRC, pp. 163–76. [Google Scholar]

- Haberman, Steven, and Arthur E. Renshaw. 1996. Generalized linear models and actuarial science. The Statistician 45: 407–36. [Google Scholar] [CrossRef]

- Hahn, P. Richard, Jared S. Murray, and Ioanna Manolopoulou. 2016. A Bayesian partial identification approach to inferring the prevalence of accounting misconduct. Journal of the American Statistical Association 111: 14–26. [Google Scholar] [CrossRef]

- Hao, Xuemiao, and Qihe Tang. 2012. Asymptotic ruin probabilities for a bivariate lévy-driven risk model with heavy-tailed claims and risky investments. Journal of Applied Probability 49: 939–53. [Google Scholar] [CrossRef]

- Hua, Lei. 2015. Tail negative dependence and its applications for aggregate loss modeling. Insurance: Mathematics and Economics 61: 135–45. [Google Scholar] [CrossRef]

- Jiang, Wenxin, and Martin A. Tanner. 1999. On the identifiability of mixtures-of-experts. Neural Networks 12: 1253–8. [Google Scholar] [CrossRef]

- Klein, Nadja, Michel Denuit, Stefan Lang, and Thomas Kneib. 2014. Nonlife ratemaking and risk management with bayesian generalized additive models for location, scale, and shape. Insurance: Mathematics and Economics 55: 225–49. [Google Scholar] [CrossRef]

- Peng, Liang, and Yongcheng Qi. 2017. Inference for Heavy-Tailed Data: Applications in Insurance and Finance. Cambridge: Academic Press. [Google Scholar]

- Qi, Yongcheng. 2010. On the tail index of a heavy tailed distribution. Annals of the Institute of Statistical Mathematics 62: 277–98. [Google Scholar] [CrossRef]

- Scollnik, David P.M. 2001. Actuarial modeling with MCMC and BUGS. North American Actuarial Journal 5: 96–124. [Google Scholar] [CrossRef]

- Scollnik, David P.M. 2002. Modeling size-of-loss distributions for exact data in WinBUGS. Journal of Actuarial Practice 10: 202–27. [Google Scholar]

- Scollnik, David P.M. 2015. A Pareto scale-inflated outlier model and its Bayesian analysis. Scandinavian Actuarial Journal 2015: 201–20. [Google Scholar] [CrossRef]

- Sun, Liangrui, Michelle Xia, Yuanyuan Tang, and Philip G. Jones. 2017. Bayesian adjustment for unidirectional misclassification in ordinal covariates. Journal of Statistical Computation and Simulation 87: 3440–68. [Google Scholar] [CrossRef]

- Xia, Michelle, and Paul Gustafson. 2016. Bayesian regression models adjusting for unidirectional covariate misclassification. The Canadian Journal of Statistics 44: 198–218. [Google Scholar] [CrossRef]

- Xia, Michelle, and Paul Gustafson. 2018. Bayesian inference for unidirectional misclassification of a binary response trait. Statistics in Medicine 37: 933–47. [Google Scholar] [CrossRef] [PubMed]

- Xia, Michelle, Lei Hua, and Gary Vadnais. 2018. Embedded predictive analysis of misrepresentation risk in GLM ratemaking models. Variance: Advancing the Science of Risk. in press. [Google Scholar]

- Yang, Yang, Kaiyong Wang, Jiajun Liu, and Zhimin Zhang. 2018. Asymptotics for a bidimensional risk model with two geometric lévy price processes. Journal of Industrial & Management Optimization, 765–72. [Google Scholar] [CrossRef]

| Implies | t | |||

|---|---|---|---|---|

| Weibull | and | ∞ | ||

| Lognormal | and | ∞ | ||

| Pareto | and | ∞ |

| DIC | Gamma | Lognormal | Pareto | Weibull |

|---|---|---|---|---|

| Unadjusted | 16,007 | 15,860 | 15,865 | 15,934 |

| Adjusted | 16,231 | 16,357 | 15,757 | 16,008 |

© 2018 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xia, M. Bayesian Adjustment for Insurance Misrepresentation in Heavy-Tailed Loss Regression. Risks 2018, 6, 83. https://doi.org/10.3390/risks6030083

Xia M. Bayesian Adjustment for Insurance Misrepresentation in Heavy-Tailed Loss Regression. Risks. 2018; 6(3):83. https://doi.org/10.3390/risks6030083

Chicago/Turabian StyleXia, Michelle. 2018. "Bayesian Adjustment for Insurance Misrepresentation in Heavy-Tailed Loss Regression" Risks 6, no. 3: 83. https://doi.org/10.3390/risks6030083

APA StyleXia, M. (2018). Bayesian Adjustment for Insurance Misrepresentation in Heavy-Tailed Loss Regression. Risks, 6(3), 83. https://doi.org/10.3390/risks6030083