Abstract

We present a stochastic simulation forecasting model for stress testing that is aimed at assessing banks’ capital adequacy, financial fragility, and probability of default. The paper provides a theoretical presentation of the methodology and the essential features of the forecasting model on which it is based. Also, for illustrative purposes and to show in practical terms how to apply the methodology and the types of outcomes and analysis that can be obtained, we report the results of an empirical application of the methodology proposed to the Global Systemically Important Banks (G-SIB) banks. The results of the stress test exercise are compared with the results of the supervisory stress tests performed in 2014 by the Federal Reserve and EBA/ECB.

Keywords:

capital adequacy; economic capital; financial fragility; liquidity risk; Monte Carlo simulation; probability of default; Solvency risk; SREP; stochastic simulation; stress testing JEL Classification:

C15; C63; G21; G28; G32

1. Introduction

The aim of this paper is to propose a new approach to banks stress testing and assessment of a bank’s financial fragility that overcomes some of the limitations of current methodologies. In consideration of the surging relevance that stress tests are assuming in determining the banks capital endowment, it is extremely important that this kind of exercises will be performed through a methodological approach that is capable of effectively catching the overall degree of a bank’s financial fragility.

We reject the idea that it is possible to adequately measure banks’ financial fragility degree by looking at one adverse scenario (or a very limited number of them), being solely driven by macroeconomic assumptions, and by assessing capital impact through a building block approach made up of a set of different silos based single risk models (i.e., simply aggregating risk measures obtained from distinct models run separately). Current stress testing methodologies are designed to indicate the potential capital impact of one specific predetermined scenario, but they fail in adequately measuring banks’ degree of forward looking financial fragility, providing poor indications in this regard, especially when the cost in terms of time and effort required is considered1.

We present a stochastic model to develop multi-period forecasting scenarios in order to stress test banks’ capital adequacy with respect to all of the relevant risk factors that may affect capital, liquidity, and regulatory requirements. All of the simulation impacts are simultaneously determined within a single model, overcoming dependence on a single macroeconomic scenario and providing coherent results on the key indicators in all periods and in a very large number of different possible scenarios, being characterized by different level of severity and covering extreme tail events as well. We show how the proposed approach enables a new kind of solution to assess banks’ financial fragility, given by the estimated forward-looking probability of breach of regulatory capital ratios, probability of default and probability of funding shortfall.

The stochastic simulation approach that is proposed in this paper is based on our previous research, initially developed to assess corporate probability of default2 and then extended to the particular case of financial institutions.3 In the present work, we have further developed and tested the modeling within a broader banking stress testing framework.

We begin in Section 2 with a brief overview of the main limitations and shortcomings of current stress testing methodologies; then, in Section 3, we describe the new methodology, the key modeling relations necessary to implement the approach and the stochastic simulation outputs. Afterwards, in Section 4 and Section 5, we present an empirical application of the stress testing methodology proposed for G-SIB banks; the exercise is essentially intended to show how the method can be practically applied, although in a very simplified way, and does not represent to any extent a valuation on the capital adequacy of the banks considered; rather, it is to be considered solely as an example for illustrative purposes, and the specific assumptions adopted must be considered as only one possible sensible set of assumptions, and not as the only or best implementation paradigm. In this section, we also compare the results of our stress test with those from the supervisory stress test performed on United Stated (US) banks by the Federal Reserve (published in March 2014) and those from the EBA/ECB stress test on European Union (EU) banks (published in October 2014). Furthermore, we also provide some preliminary back-testing evidence on the reliability of new proposed approach, by applying it to a few famous banks default cases and by comparing the results obtained with market dynamics. Section 6 ends the paper with some conclusive considerations and remarks. Appendix A and Appendix B contains all of the assumptions related to the empirical exercise performed, while further results and outputs of the exercise are reported in Appendix C.

2. The Limitations of Current Stress Testing Methodologies: Moving towards a New Approach

Before beginning to discuss stress testing, it is worth clarifying what we mean by bank stress testing, and what purposes in our opinion this kind of exercise should serve. In this work, we focus solely on bank-wide stress testing aimed at assessing the overall capital adequacy of a bank, and in this regard, we define stress testing as an analytical technique designed to assess a bank’s capital and liquidity degree of fragility against “all” potential future adverse scenarios, with the aim of supporting supervisory authorities and/or management to evaluate the bank’s forward looking capital adequacy in relation to a preset level of risk.

Current bank capital adequacy stress testing methodologies are essentially characterized by the following key features:4

- The consideration of only one deterministic adverse scenario (or at best a very limited number, 2, 3, … scenarios), limiting the exercise’s results to one specific set of stressed assumptions.

- The use of macroeconomic variables as stress drivers (GDP, interest rate, exchange rate, inflation rate, unemployment, etc.), which must then be converted into bank-specific micro risk factor impacts (typically credit risk and market risk impairments, net interest income, regulatory requirement) by recurring to satellite models (generally based on econometric modeling).

- The total stress test capital impact is determined by adding up through a building block framework the impacts of the different risk factors, each of which is estimated through specific and independent silo-based satellite models.

- The satellite models are often applied with a bottom-up approach (especially for credit and market risk), i.e., using a highly granular data level (single client, single exposure, single asset, etc.) to estimate the stress impacts and then adding up all of the individual impacts.

- In supervisory stress tests, the exercise is performed by the banks and not directly by supervisors, the latter setting the rules and assumptions and limiting their role in checking oversight and challenging how banks apply the exercise rules.

This kind of stress testing approach presents the following shortcomings:

- The exclusive focus of the stress testing exercise on one single or very few worst-case scenarios is probably the main limit of the current approach and precludes its use to adequately assess banks’ financial fragility in broader terms; the best that can be achieved is to verify whether a bank can absorb losses related to that specific set of assumptions and level of stress severity. But, a bank can be hit by a potentially infinite number of different combinations of adverse dynamics in all of the main micro and macro variables that affect its capital. Moreover, a specific worst-case scenario can be extremely adverse for some banks particularly exposed to those risk factors stressed in the scenario, but not for other banks that are less exposed to those factors, but this does not mean that the former banks are, in general, more fragile than the latter; the reverse may be true in other worst-case scenarios. This leads to the thorny issue of how to establish the adverse scenario. What should the relevant adverse set of assumptions be? Which variables should be stressed, and what severity of stress should be applied? This issue is particularly relevant for supervisory authorities when they need to run systemic stress testing exercises, with the risk of setting a scenario the may be either too mild or excessively adverse. Since we do not know what will happen in the future, why should we check for just one single combination of adverse impacts? The “right worst-case scenario” simply does not exist, the ex-ante quest to identify the financial system’s “black swan event” can be a difficult and ultimately useless undertaking. In fact, since banks are institutions in a speculative position by their very nature and structure,5 there are many potential shocks that may severely hit them in different ways. In this sense, the black swan is not that rare, so to focus on only one scenario is too simplistic and intrinsically biased.

- Another critical issue that is related to the “one scenario at a time” approach is that it does not provide the probability of the considered stress impact’s occurrence, lacking the most relevant and appropriate measure for assessing the bank’s capital adequacy and default risk: Current stress test scenarios do not provide any information about the assigned probabilities; this strongly reduces the practical use and interpretation of the stress test results. Why are probabilities so important? Imagine that some stress scenarios are put into the valuation model. It is impossible to act on the result without probabilities: in current practice, such probabilities may never be formally declared. This leaves stress testing in a statistical purgatory. We have some loss numbers, but who is to say whether we should be concerned about them?6 In order to make a proper and effective use of stress test results, we need an output that is expressed in terms of probability of infringing the preset capital adequacy threshold.

- The general assumption that the main threat to banking system stability is typically due to exogenous shock stemming from the real economy can be misleading. In fact, historical evidence and academic debate make this assumption quite controversial.7 Most of the recent financial crises (including the latest) were not preceded (and therefore not caused) by a relevant macroeconomic downturn; generally, quite the opposite was true, i.e., endogenous financial instability caused a downturn in the real economy.8 Hence, the practice of using macroeconomic drivers for stress testing can be misleading because of the relevant bias in the cause-effect linkage, but on closer examination, it also turns out to be an unnecessary additional step with regard to the test’s purpose. In fact, since the stress test ultimately aims to assess the capital impact of adverse scenarios, it would be much better to directly focus on the bank-specific micro variables that affect its capital (revenues, credit losses, non-interest expenses, regulatory requirements, etc.). Working directly on these variables would eliminate the risk of potential bias in the macro-micro translation step. The presumed robustness of the model and the safety net of having an underlying macroeconomic scenario within the stress test fall short, while considering that: (a) we do not know which specific adverse macroeconomic scenario may occur in the future; (b) we have no certainty about how a specific GDP drop (whatever the cause) affects net income; (c) we do not know/cannot consider all other potential and relevant impacts that may affect net income beyond those that are considered in the macroeconomic scenario. Therefore, it is better to avoid expending time and effort in setting a specific macroeconomic scenario from which all impacts should arise, and to instead try to directly assess the extreme potential values of the bank-specific micro variables. Within a single-adverse-scenario approach, the macro scenario definition has the scope of ensuring comparability in the application of the exercise to different banks and to facilitate the stress test storytelling rationale for supervisor communication purposes.9 However, within the multiple scenarios approach that is proposed, which no longer needs to exist, there are other ways to ensure comparability in the stress test. Of course, the recourse to macroeconomic assumptions can also be considered in the stochastic simulation approach proposed, but as we have explained, it can also be avoided; in the illustrative exercise presented below, we avoided modeling stochastic variables in terms of underlying macro assumptions, to show how we can dispense with the false myth of the need for a macro scenario as the unavoidable starting point of the stress test exercise.

- Recourse to a silo-based modeling framework to assess the risk factor capital impacts with aggregation through a building block approach does not ensure a proper handling of risk integration10 and is unfit to adequately manage the non-linearity, path dependence, feedback and cross-correlation phenomena that strongly affects capital in “tail” extreme events. This kind of relationships assumes a growing relevance with the extension of the stress test time horizon and severity. Therefore, a necessary step to properly capture the effects of these phenomena in a multi-period stress test is to abandon the silo-based approach and to adopt an enterprise risk management (ERM) model, which, within a comprehensive unitary model, allows for us to manage the interactions among the fundamental variables, integrating all risk factors and their impacts in terms of P&L-liquidity-capital-requirements11.

- The bottom-up approach to stress test calculations generally entails the use of satellite econometric models in order to translate macroeconomic adverse scenarios into granular risk parameters, and internal analytical risk models to calculate impairments and regulatory requirements. The highly granular data level employed and the consequent use of the linked modeling systems makes stress testing exercises extremely laborious and time-consuming. The high operational cost that is associated with this kind of exercise contributes to limiting analysis to one or few deterministic scenarios. In addition, the high level of fragmentation of input data and the long calculation chain increases the risk of operational errors and makes the link between adverse assumptions and final results less clear. The bottom-up approach is well suited for current-point-in-time analysis characterized by a short-term forward-looking risk analysis (e.g., one year for credit risk); the extension of the bottom-up approach into forecasting analysis necessarily requires a static balance sheet assumption, otherwise the cumbersome modeling systems would lack the necessary data inputs. But, the longer the forecasting time horizon considered (2, 3, 4, … years), the less sense that it makes to adopt a static balance sheet assumption, compromising the meaningfulness of the entire stress test analysis. The bottom-up approach loses its strength when these shortcomings are considered, generating a false sense of accuracy with considerable unnecessary costs.

- In consideration of the use of macroeconomic adverse scenario assumptions and the bottom-up approach that is outlined above, supervisors are forced to rely on banks’ internal models to perform stress tests. Under these circumstances, the validity of the exercise depends greatly on how the stress test assumptions are implemented by the banks in their models, and on the level of adjustments and derogations they applied (often in an implied way). Clearly, this practice leaves open the risk of moral hazard in stress test development and conduct, and it also affects the comparability of the results, since the application of the same set of assumptions with different models does not ensure a coherent stress test exercise across all of the banks involved.12 Supervisory stress testing should be performed directly by the competent authority. In order to do so, they should adopt an approach that does not force them to depend on banks for calculations.13

The stress testing approach proposed in this paper aims to overcome the limits of current methodologies and practices highlighted above.

3. Analytical Framework

3.1. Stochastic Simulation Approach Overview

In a nutshell, the proposed approach is based on a stochastic simulation process (generated using the Monte Carlo method), applied to an enterprise-based forecasting model, which generates thousands of different multi-period random scenarios, in each of which coherent projections of the bank’s income statement, balance sheet and regulatory capital are determined. The random forecast scenarios are generated by modeling all of the main value and risk drivers (loans, deposits, interest rates, trading income and losses, net commissions, operating costs, impairments and provisions, default rate, risk weights, etc.) as stochastic variables. The simulation results consist of distribution functions of all the output variables of interest: capital ratios, shareholders equity, CET1 (Common Equity Tier 1), net income and losses, cumulative losses related to a specific risk factor (credit, market, ...), etc. This allows for us to obtain estimates of the probability of occurrence of relevant events, such as breach of capital ratios, default probability, CET1 ratio below a preset threshold, liquidity indicators above or below preset thresholds, etc.

The framework is based on the following features:

- Multi-period stochastic forecasting model: a forecasting model to develop multiple scenario projections for income statement, balance sheet and regulatory capital ratios, capable of managing all of the relevant bank’s value and risk drivers in order to consistently ensure:

- a dividend/capital retention policy that reflects regulatory capital constraints and stress test aims;

- the balancing of total assets and total liabilities in a multi-period context, so that the financial surplus/deficit generated in each period is always properly matched to a corresponding (liquidity/debt) balance sheet item; and,

- the setting of rules and constraints to ensure a good level of intrinsic consistency and correctly manage potential conditions of non-linearity. The most important requirement of a stochastic model lies in preventing the generation of inconsistent scenarios. In traditional deterministic forecasting models, consistency of results can be controlled by observing the entire simulation development and set of output. However, in stochastic simulation, which is characterized by the automatic generation of a very large number of random scenarios, this kind of consistency check cannot be performed, and we must necessarily prevent inconsistencies ex-ante within the model itself, rather than correcting them ex-post. In practical terms, this entails introducing into the model rules, mechanisms and constraints that ensure consistency, even in stressed scenarios.14

- Forecasting variables expressed in probabilistic terms: the variables that represent the main risk factors for capital adequacy are modeled as stochastic variables and defined through specific probability distribution functions in order to establish their future potential values, while interdependence relations among them (correlations) are also set. The severity of the stress test can be scaled by properly setting the distribution functions of stochastic variables.

- Monte Carlo simulation: this technique allows us to solve the stochastic forecast model in the simplest and most flexible way. The stochastic model can be constructed using a copula-based or other similar approaches, with which it is possible to express the joint distribution of random variables as a function of the marginal distributions.15 Analytical solutions—assuming that it is possible to find them—would be too complicated and strictly bound to the functional relation of the model and of the probability distribution functions adopted, so that any changes in the model and/or probability distribution would require a new analytical solution. The flexibility provided by the Monte Carlo simulation, however, allows for us to very easily modify stress severity and the stochastic variable probability functions.

- Top-down comprehensive view: the simulation process set-up utilizes a high level of data aggregation, in order to simplify calculation and guarantee an immediate view of the causal relations between input assumptions and results. The model setting adheres to an accounting-based structure, aimed at simulating the evolution of the bank’s financial statement items (income statement and balance sheet) and regulatory figures and related constraints (regulatory capital, RWA–Risk Weighted Assets, and minimum requirements). An accounting-based model has the advantage of providing an immediately-intelligible comprehensive overview of the bank that facilitates the standardization of the analysis and the comparison of the results.16

- Risk integration: the impact of all the risk factors is determined simultaneously, consistently with the evolution of all of the economics within a single simulation framework.

In the next section, we will describe in formal terms the guidelines to follow in developing the forecasting model and the risk factor modeling in the stress test. The empirical exercise that is presented in the following section will clarify how to practically handle these issues.

3.2. The Forecasting Model

Here, we formally present the essential characteristics of a multi-period forecasting model that is suited to determine the consistent dynamics of a bank’s capital and liquidity excess/shortfall. This requires prior definition of the basic economic relations that rule the capital projections and the balancing of the bank’s financial position over a multi-period time horizon. We develop a reduced-form model that is aimed at straightforwardly presenting the rationale according to which these key features must be modeled.

The Equity Book Value represents the key figure for determining a bank’s solvency and in each period, it is a function of its value in the previous period, Net Income/losses and dividend payout. We consider Net Income to be conditioned by some elements of uncertainty, the dynamics of which can be described through a series of stochastic processes with discrete parameters, of which we assume that the information necessary to define them is known. In the following Section 3.3, we provide a brief description of the stochastic variables considered in the model. Of course, the Net Income dynamic will also affect, through the Equity Book Value, liabilities, and assets in the bank’s balance sheet; here below, we provide a description of the main accounting relationships that rule the forecasting model. We consider that a bank’s abridged balance sheet can be described by the following identity:

The equity book value represents the amount of equity and reserve available to the bank to cover its capital needs. Therefore, in order to model the evolution of equity book value we must first determine the bank’s regulatory capital needs, and in this regard, we must consider both capital requirements (i.e., all regulatory risk factors: credit risk, market risk, operational risk, and any other additional risk requirements) and all of those regulatory adjustments that must be applied to equity book value in order to determine regulatory capital in terms of common equity tier 1, or common equity tier 1 adjustments (i.e., intangible assets, IRB shortfall of credit risk adjustments to expected losses), regulatory filters, deductions, etc.).

We can define the target level of common equity tier 1 capital (CET1) as a function of regulatory requirements and the target capital ratio through the following formula:

where represents the risk weight factor and is the common equity tier 1 ratio target, the latter depending on the minimum regulatory constraint (the minimum capital threshold that by law the bank must hold), plus a capital buffer set according to market/shareholders/management risk appetite.

Now, we can determine the equity book value that the bank must hold in order to reach the regulatory capital ratio target set in Equation (2) as:

Equation (3) sets a capital constraint expressed in terms of equity book value necessary to achieve the target capital ratio; as we shall see later on, this constraint determines the bank’s dividend/capital retention policy.

In each forecasting period, the model has to ensure a financial balance, which means a matching between cash inflow and outflow. We assume for the sake of simplicity that the asset structure is exogenously determined in the model, and thus that financial liabilities change accordingly in order to balance as plug-in variables.17 Assuming that there are no capital transactions (equity issues or buy-backs), the bank’s funding needs—additional funds needed (AFN)—represents the financial surplus/deficit generated by the bank in each period and is determined by the following expression:

A positive value represents the new additional funding necessary in order to finance all assets at the end of the period, while a negative value represents the financial surplus that is generated in the period. The forward-looking cash inflow and outflow balance constraint can be defined as:

Equation (5) expresses a purely financial equilibrium constraint, which is capable of providing a perfect match between total assets and total liabilities.18

The basic relations necessary to develop balance sheet projections within the constraints set in (3) and (5) can be expressed in a reduced form as:

Equation (6) represents the bank’s excess capital, or the equity exceeding target capital needs and thus available for paying dividends to shareholders. The bank has a capital shortfall in relation to its target capital ratio whenever Equation (3) is not satisfied, or:

The outlined capital retention modeling allows for us to project consistent forecasting financial statements in a multi-period context; this is a necessary condition for unbiased long term stress test analysis, especially within a stochastic simulation framework. In fact, consider that, while for short-term analysis, the simple assumption of setting a zero-dividend distribution can be considered as reasonable and unbiased, in a multi-period analysis we cannot assume that the bank will never pay any dividend during the positive years if there is available excess capital; and, of course, any distribution reduces the capital available afterward to face adverse scenarios. An incorrect modeling of dividend policy rules may bias the results; for example, assuming within a stochastic simulation a fixed payout not linked to net income and capital requirements may generate inconsistent scenarios, in which the bank pays dividends under conditions that would not allow for any distribution.

3.3. Stochastic Variables and Risk Factors Modeling

Not all of the simulation’s input variables need to be explicitly modeled as stochastic variables; some variables can also be functionally determined within of the forecasting model, by being linked to the value of other variables (for example, in terms of relationship to or percentage of a stochastic variable), or expressed in terms of functions of a few key figures or simulation outputs.19

Generally speaking, the stochastically-modeled variables will be those with the greatest impact on the results and those of which the future value is most uncertain. For the purposes of the most common types of analysis, stochastic variables will certainly include those that characterize the typical risks of a bank and be considered within prudential regulation (credit risk on loans, market and counterparty risk on securities held in trading and banking book, operational risk).

The enterprise-based approach adopted allows for us to manage the effects of the overall business dynamics of the bank, including those impacts not considered as Pillar I risk factors, and depending on variables, such as swing in interest rates and spreads, volume change in deposits and loans, swing in net commissions, operating costs, and non-recurring costs. The dynamics of all these Pillar II risk factors are managed and simulated jointly with the traditional Pillar I risk factors (market and credit) and other additional risk factors (e.g., reputational risk,20 strategic risk, compliance risk, etc.).

Table 1 shows the main risk factors of a bank (both Pillar I and II), highlighting the corresponding variables that impact income statement, balance sheet, and RWA. For each variable, the variables that best sum up their representation and modeling are highlighted, and alongside them, possible modeling breakdown and/or evolution. For example, the dynamics of credit risk impacts on loans can be viewed at the aggregate (total portfolio) level, acting on a single stochastic variable representing total credit adjustments, or can be managed by one variable for each sufficiently-large portfolio characterized by specific risk, based on the segmentation most suited to the situation under analysis; for example, the portfolio can be breakdown by type of: client (retail, corporate, SME, etc.); product (mortgages, short-term uses, consumer, leasing, etc.); geographic area; subsidiaries; and, etc. The modeling of loan-loss provisions and regulatory requirements can be handled in a highly simplified way—for example, using an accounting-based loss approach (i.e., loss rate, charge-off and recovery) and a simple risk weight—or a more sophisticated one—for example, through an expected loss approach as a function of three components: PD, LGD, and EAD; for further explanations, see Appendix A.

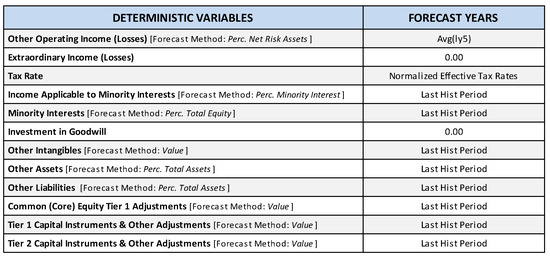

Table 1.

Stress test framework: risk factor modeling.

The probability distribution function must be defined for each stochastic variable in each simulation forecast period—in essence, a path of evolution of the range of possible values the variable can take on over time must be defined.

By assigning appropriate ranges of variability to the distribution function, we can calibrate the severity of the stress test according to the aims of our analysis. Developing several simulations that are characterized by increasingly levels of severity can provide a more complete picture of a bank’s capital adequacy, as it helps us to better understand the effects in the tail of the simulation and to verify how conditions of non-linearity impact the bank’s degree of financial fragility.

A highly effective and rapid way to further concentrate the generation of random scenarios within a pre-set interval of stress is to limit the distribution functions of stochastic variables to an appropriate range of values. In fact, the technique of truncation function allows for us to restrict the domain of probability distributions to within the limits of values comprised between a specific pair of percentiles. We can thus develop simulations that are characterized by a greater number of scenarios generated in the distribution tails, and therefore with more robust results under conditions of stress.

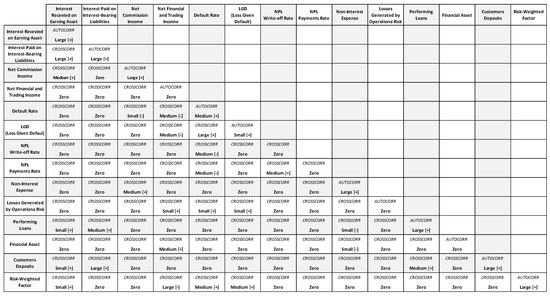

Once the distribution functions of the stochastic variables have been defined, we must then specify the correlation coefficients between variables (cross correlation) and over time (autocorrelation). In order to set these assumptions, we can turn to historical estimates of relationships of variables over time, and to direct forecasts based on available information and on the possible types of relationships that can be foreseen in stressed conditions. However, it is important to remember that correlation is a scalar measure of the dependency between two variables, and thus cannot tell us everything about their dependence structure.21 Therefore, it is preferable that the most relevant and strongest relationships of interdependence be directly expressed—to the highest degree possible—within the forecast model, through the definition of appropriate functional relationships among variables. This in itself reduces the need to define relationships of dependency between variables by means of correlation coefficients, or at least change the terms of the problem.

For a few concrete examples of how the necessary parameters can be set to define the distribution functions of various stochastic variables and the correlation matrix, see Appendix A.

3.4. Results of Stochastic Simulations

The possibility of representing results in the form of a probability distribution notably augments the quantity and quality of information that is available for analysis, allowing for us to develop new solutions to specific problems that could not be obtained with traditional deterministic models. For example, we can obtain an ex-ante estimate of the probability that a given event, such as the triggering of a relevant capital ratio threshold, or a default, will occur. In stress testing for capital adequacy purposes, the distribution functions of all capital ratios and regulatory capital figures will be of particular importance. Here below we provide a brief description of some solutions that could be particularly relevant with regard to stress testing for capital and liquidity adequacy purposes.

3.4.1. Probability of Regulatory Capital Ratio Breach

On the basis of the capital ratio probability distribution simulated, we can determine the estimated probability of triggering a preset threshold (probability of breach), such as the minimum regulatory requirement or the target capital ratio. The multi-period context allows for us to estimate cumulated probabilities according to the relevant time period (one year, two years, …. n years), thus the CET1 ratio probability of breach in each period can be defined as:

where is the preset threshold.

Each probability addendum—the sum of which defines the probability of breach for each period—can be defined as the conditioned probability of breach, i.e., the probability that the breach event will occur in that period, given that it has not occurred in one of the previous periods. To further develop the analysis we can evaluate three kinds of probability:

- Yearly Probability: indicates the frequency of scenarios with which the breach event occurs in a given period. It thus provides a forecast of the bank’s degree of financial fragility in that specific period. [P(CET1t < MinCET1t)]

- Marginal Probability: represents a conditional probability, and it indicates the frequency with which the breach event will occur in a certain period, but only in cases in which said event has not already occurred in previous periods. It thus provides a forecast of the overall risk increase for that given year. [P(CET1t < MinCET1t|CET11 > MinCET11, …, CET1t−1 > MinCET1t−1)]

- Cumulated Probability: provides a measure of overall breach risk within a given time horizon, and is given by the sum of marginal breach probabilities, as in (9). [P(CET11 < MinCET11) + … +P(CET1t < MinCET1t|CET11 > MinCET11, …, CET1t−1 > MinCET1t−1)]

3.4.2. Probability of Default Estimation

Estimation of probability of default with the proposed simulative forecast model depends on the frequency of scenarios in which the event of default occurs, and is thus very much contingent on which definition of bank default one chooses to adopt. In our opinion, two different solutions can be adopted, the first based on a logic we could define as accounting-based, in which the event of default is in relation to the bank’s capital adequacy, and the second based on a logic we can call value-based, in which default derives directly from the shareholders’ payoff profile.

- Accounting-Based: In the traditional view, a bank’s risk of default is set in close relation to the total capital held to absorb potential losses and to guarantee debt issued to finance assets held. According to this logic, a bank can be considered in default when the value of capital (regulatory capital, or, alternatively, equity book value) falls beneath a pre-set threshold. This rationale also underlies the Basel regulatory framework, on the basis of which a bank’s financial stability must be guaranteed by minimum capital ratio levels. In consideration of the fact that this threshold constitutes a regulatory constraint on the bank’s viability and also constitutes a highly relevant market signal, we can define the event of default as a common equity tier 1 ratio level below the minimum regulatory threshold, which is currently set at 4.5% (7% with the capital conservation buffer) under Basel III regulation. An interesting alternative to utilizing the CET1 ratio is to use the leverage ratio as an indicator to define the event of default, since, not being related to RWA, it has the advantage of not being conditioned by risk weights, which could alter comparisons of risk estimates between banks in general and/or banks pertaining to different countries’ banking systems.22 The tendency to make the leverage ratio the pivotal indicator is confirmed by the role that is envisaged for this ratio in the new Basel III regulation, and by recent contributions to the literature proposing the leverage ratio as the leading bank capital adequacy indicator within a more simplified regulatory capital framework.23 Therefore, the probability of default (PD) estimation method entails determining the frequency with which, in the simulation-generated distribution function, CET1 Ratio (or leverage ratio) values below the set threshold appear. The means for determining cumulated PD at various points in time are those we have already described for probability of breach.

- Value-Based: This method essentially follows in the footsteps of the theoretical presuppositions of the Merton approach to PD estimation,24 according to which a company’s default occurs when its enterprise value is inferior to the value of its outstanding debt; this equates to a condition in which equity value is less than zero:25

In classic Merton-type models that are based on the options theory, the solution of the model, that is, the estimation of the probability distribution of possible future equity values, is obtained on the basis of current market prices and their historical volatility. In the approach that we describe, on the other hand, when considering that from a financial point of view, the value of a bank’s equity can be obtained by discounting to the cost of equity shareholders’ cash flows (free cash flow to equity model—FCFE26), the probability distribution of possible future values of equity can be obtained by applying a DCF (discounted cash flow) model in each simulated scenario generated; PD is the frequency of scenarios in which the value of equity is null.

The underlying logic of the approach is very similar to that of option/contingent models; both are based on the same economic relationship identifying the event of default, but are differentiated in terms of how equity value and its possible future values are determined, and consequently, different ways of configuring the development of default scenarios.27

In the accounting-based scenario, the focus is on developing a probability distribution of capital value that captures the capital generation/destruction that has occurred up to that period. In the value-based approach, however, thanks to the equity valuation the event of default also captures the future capital generation/destruction that would be generated after that point in time; the capital value at the time of forecasting is only the starting point. Both of the approaches thus obtain PD estimates by verifying the frequency of the occurrence of a default event in future scenarios, but they do so from two different perspectives.

Of course, because of the different underlying default definitions, the two methods may lead to different PD estimates. Specifically, the lower the minimum regulatory threshold set in the accounting-based method relative to the target capital ratio (which affects dividend payout and equity value in the value-based method), the lower the accounting-based PD estimates would be relative to the value-based estimates.

It is important to highlight how the value-based method effectively captures the link between equity value and regulatory capital constraint: in order to keep the level of capital adequacy high (low default risk), a bank must also maintain a good level of profitability (capital generation), otherwise capital adequacy deterioration (default risk increase) would entail an increase in the cost of equity and thus a reduction in the equity value. There is a minimum profitability level that is necessary to sustain the minimum regulatory capital threshold over time. In this regard, the value-based method could be used to assess in advance the effects of changes in regulation and capital thresholds on default risk from the shareholders’ perspective, in particular, regarding regulations that are aimed at shifting downside risk from taxpayers to shareholders.28

3.4.3. Economic Capital Distribution (Value at Risk, Expected Shortfall)

Total economic capital is the total sum of capital to be held in order to cover losses originating from all the risk factors at a certain confidence level. The stochastic forecast model described, through the net losses probability distribution generated by the simulation, allows for us to obtain an estimate of economic capital for various time horizons and at any desired confidence level.

Setting, xt = Net Incomet, we can define the cumulated losses as:

To obtain the economic capital estimate at a given confidence interval, we need only select the value that was obtained from Equation (11), corresponding to the distribution function percentile related to the desired confidence interval. Based on the distribution function of cumulative total losses, we can thus obtain measures of VaR and expected shortfall at the desired time horizon and confidence interval.

It is also possible to obtain estimates of various components that contribute to overall economic capital, so as to obtain estimates of economic capital relative to various risk factors (credit, market, etc.). In practice, to determine the distribution function of the economic capital of specific risk factors, we must select all of the losses associated with the various risk factors in relation to each total economic capital value generated in the simulation at the desired confidence interval, and then aggregate said values in specific distribution functions relative to each risk factor. To carry out this type of analysis, it is best to think in terms of expected shortfall.29

3.4.4. Potential Funding Shortfalls: A Forward-Looking Liquidity Risk Proxy

The forecasting model that we describe and the simulation technique that we propose also lend themselves to stress test analyses and estimations of banks’ degree of exposure to funding liquidity risk. As we have seen, the system of Equations (6)–(8) implicitly sets the conditions of financial balance defined in Equation (5). This structure facilitates definition of the bank’s potential new funding needs in various scenarios. In fact, considering a generic time t, by cumulating all AFN values, as defined in Equation (4), from the current point in time to t, we can define the funding needs generated in the period under consideration as:

Equation (12) thus represents the new funding required to maintain the overall balance of the bank’s expected cash inflow and outflow in a given time period. From a forecasting point of view, Equation (12) represents a synthesis measure of the bank’s funding risk, as positive values provide the measure of new funding needs that the bank is expected to generate during the considered time period, to be funded through the issuing of new debt and/or asset disposal. Analogously, negative values signal the expected financial surplus available as liquidity reserve and/or for additional investments.

However, Equation (12) implicitly hypothesizes that outstanding debt, to the extent that sufficient resources to repay it are not created, is constantly renewed (or replaced by new debt), and thus it does not consider contractual obligations that are linked to the repayment of debt matured in the given period. If we consider this type of need as well, we can integrate Equation (12) in such a way as to make it comprise the total effective funding shortfall:

To obtain an overall liquidity risk estimate, we would also need to consider the assets that could be readily liquidated if necessary (counterbalancing capacity), as well as their assumed market value. However, we must consider that a forecast estimate of this figure is quite laborious and problematic, as it requires the analytical modeling of the various financial assets held, according to maturity and liquidity, as well as a forecast of market conditions in the scenario assumed and their impact on the asset disposal. In mid-term and long-term analysis and under conditions of stress (especially if linked to systemic factors), this type of estimate is highly affected by unreliable assumptions; in fact, in such conditions, for example, even assets that are normally considered as liquid can quickly become illiquid, with highly unpredictable non-linear effects on asset disposal values. Therefore, in our opinion, for purposes of mid-term and long-term stress testing analysis, it is preferable to evaluate liquidity risk utilizing only simple indicators, like funding shortfall, which, albeit partial, nonetheless offer an unbiased picture of the amount of potential liquidity needs a bank may have in the future in relation to the scenarios simulated, and thus disregarding the effects of counterbalancing.

To estimate the overall forecast level of bank’s liquidity, in our opinion, it seems sufficient to consider only the bank’s available liquidity at the beginning of the considered time period (Initial Cash Capital Position), that is, cash and other readily marketable assets, net of short term liabilities. Equation (13) can thus be modified, as follows:

A positive value of this indicator highlights the funding that needs to be covered: the higher it is the higher the liquidity risk, while a negative value indicates financial surplus available. The condition (15) below shows a particular condition in which the bank has no liquidity for the repayment of debt matured; under these circumstances, debt renewal is a necessary condition in order to keep a bank in a covered position (i.e., liquidity balance):

The condition (16) below shows a more critical condition in which the bank has no liquidity, even to pay interest on outstanding debt:

Liquidity shortfall conditions defined in the conditions (15) and (16) greatly increase the bank’s risk of default, because financial leverage will tend to increase, making it even harder for the bank to gain liquidity by either asset disposal or new funding debt. This kind of negative feedback links the bank’s liquidity and solvency conditions, thus increasing liquidity shortfall is connected to the lowering of the bank’s funding capacity.30

Within the simulative approach proposed, the determination of liquidity indicator distribution functions permits us to estimate the bank’s liquidity risk in probabilistic terms, thus providing in a single modeling framework the possibility of assessing the likelihood that critical liquidity conditions may occur jointly with the corresponding capital adequacy conditions, and this can be estimated both at a single financial institution level or at the banking system level.31

Funding liquidity risk indicators can be also analyzed in relative terms, or in terms of ratios, by dividing them to total assets or to equity book value; this extends their signaling relevance, allowing for comparison between banks and benchmarking.

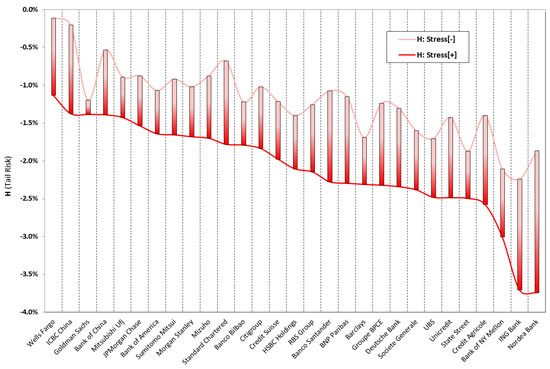

3.4.5. Heuristic Measure of Tail Risk

The “Heuristic Measure of Tail Risk” (H) is an indicator that was developed by Nassim Taleb that has recently been applied for bank stress testing analysis and is well suited for ranking banks according to their degree of financial fragility.32 It is a simple but quite effective measure that is designed to capture fragility arising from non-linear conditions in the tails of risk distributions. In consideration of the degree of error and uncertainty characterizing stress tests, we can consider H as a second-order stress test indicator geared towards enriching and strengthening the results by determining the convexity of the distribution tail, which allows for us to assess the degree of fragility related to the most extreme scenarios. The simulative stress testing approach that we present fits well with this indicator, since its outputs are probability distributions.

In the stress testing exercise reported in Section 5 we calculated the heuristic measure of tail risk in relation to CET1 ratio, according to the following formula:

Strongly negative H values intensify the occurrence of non-linear conditions increasing the fragility in the tail of the distribution, because small changes in risk factors can determine additional, progressively greater losses. With H values tending towards zero, the tail relationship becomes more linear and thus the fragility of the tail decreases.

4. Stress Testing Exercise: Framework and Model Methodology

Although this paper has a theoretical focus that is aimed at presenting a new methodological approach to bank stress testing, we also present an application of the method to help readers understand the methodology, the practical issues that are related to modeling the stochastic simulation and how the results obtained can be used in changing the way banks’ capital adequacy is analyzed.

We performed a stress test exercise on the sample of 29 international banks belonging to the G-SIBs group identified by the Financial Stability Board.33

This stress test exercise has been developed exclusively for illustrative purposes and it does not represent, to any extent, a valuation on the capital adequacy of the banks considered. The specific modeling and set of assumptions applied in the exercise have been kept as simple as possible to facilitate description of the basic characteristic of the approach; furthermore, the lack of publicly available data for some key variables (such as PDs and LGDs) necessitated the use of some rough proxy estimates and benchmark data; both issues may have affected the results. Therefore, the specific set of assumptions that was adopted for this exercise must be considered strictly as an example of application of the stochastic simulation methodology proposed, and absolutely not as the only or best way to implement the approach. Depending on the information available and the purposes of the analysis, more accurate assumptions and more evolved forecast models can easily be adopted.

The exercise time horizon is 2014–2016, when considering 2013 financial statement data as the starting point. Simulations have been performed in July 2014 and thus are based on the information available at that time. Given the length of the period considered, we performed a very severe stress test, in that the simulations consider the worst scenarios generated in three consecutive years of adverse market conditions.

To eliminate bias due to derivative netting and guarantee a fair comparison within the sample, we reported gross derivative exposures for all banks (according to IFRS accounting standards adopted by most of the banks in the sample, except US and Japanese banks), thus market risk stress impacts have been simulated on gross exposures. This resulted in an adjustment of derivative exposures for banks reporting, according to US GAAP, which allows for a master netting agreement to offset contracts with positive and negative values in the event of a default by a counterpart. For the largest US banks, derivative netting reduces gross exposures of more than 90%.

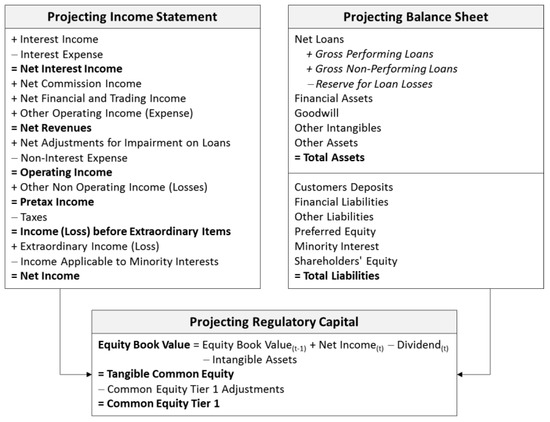

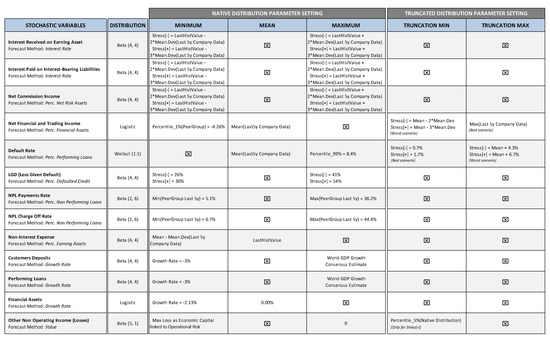

In Figure 1, we report the set of variables used in modeling for this exercise. For the sake of simplicity, we considered a highly aggregated view of accounting variables deployed in the model; of course, a more disaggregated set of variables can be adopted. Also, while we do not consider off-balance sheet items in the exercise, these types of exposures can certainly be easily modeled in.

Figure 1.

Projecting Income Statement, Balance Sheet and Regulatory Capital.

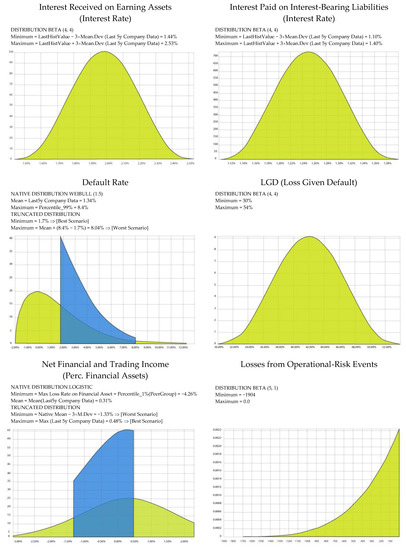

The simulations were performed considering fourteen stochastic variables, covering all the main risk factors of a bank. Stochastic variable modeling was done according to a standard setting of rules, which was applied uniformly to all of the banks in the sample. Detailed disclosure on the modeling and all of the assumptions adopted in the exercise is provided in Appendix A. Here below, we briefly describe the general approach adopted to model Pillar I risk factors:

- Credit risk: modeling in through the item loan losses; we adopted the expected loss approach, through which yearly loan loss provisions are estimated as a function of three components: probability of default (PD), loss given default (LGD), and exposure at default (EAD).

- Market risk: modeling in through the item trading and counterparty gains/losses, which includes mark-to market gains/losses, realized and unrealized gains/losses on securities (AFS/HTM) and counterparty default component (the latter is included in market risk because it depends on the same driver as financial assets). The risk factor is expressed in terms of losses/gains rate on financial assets.

- Operational risk: modeling in through the item other non-operating income/losses; this risk factor has been directly modeled, making use of the corresponding regulatory requirement record reported by the banks (considered as maximum losses due to operational risk events); for those banks that did not report any operational risk requirement, we used as proxy the G-SIB sample’s average weight of operational risk over total regulatory requirements.

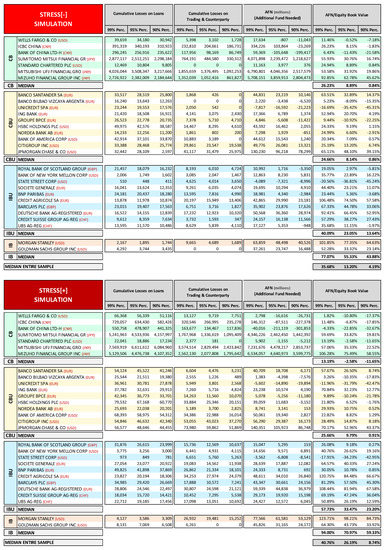

The exercise includes two sets of simulations of increasing severity: the “Stress[−]” simulation is characterized by a lower severity, while the “Stress[+]” simulation presents a higher severity. Both stress scenarios have been developed in relation to a baseline scenario, used to set the mean values of the distribution functions of the stochastic variables, which for most of the variables, are based on the bank’s historical values. The severity has been scaled by properly setting the variability of the key risk factors, through parameterization of the extreme values of the distribution functions obtained on the basis of the following data set:

- Bank’s track record (latest five years).

- Industry track record, based on a peer group sample made up of 73 banks from different geographic areas comparable with the G-SIB banks.34

- Benchmark risk parameters (PD and LGD) based on Hardy and Schmieder (2013).

For the most relevant stochastic variables, we adopted truncated distribution functions, in order to concentrate the generation of random scenarios within the defined stress test range, restricting samples drawn from the distribution to values between a specified pair of percentiles.

To better illustrate the methodology that is applied for stochastic variable modeling, and in particular, the truncation function process, we report the distributions for some of the main stochastic variables that are related to Credit Agricole in Appendix B.

5. Stress Testing Exercise: Results and Analysis

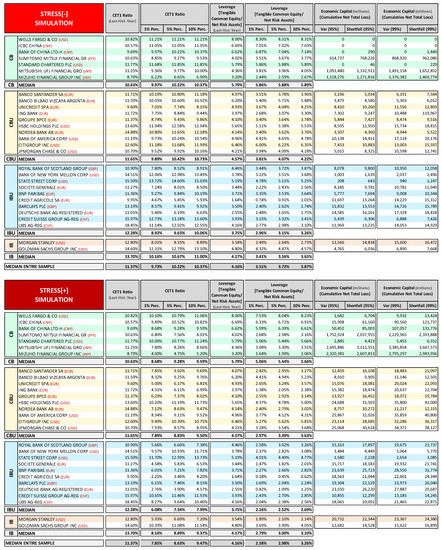

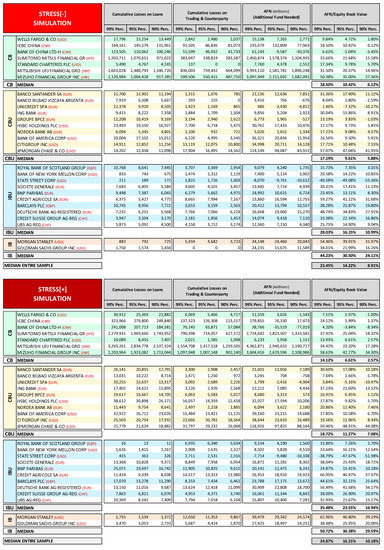

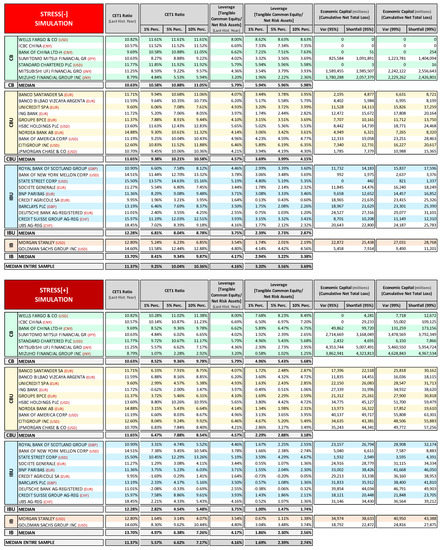

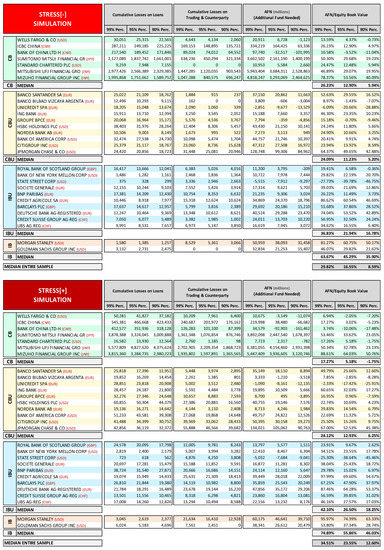

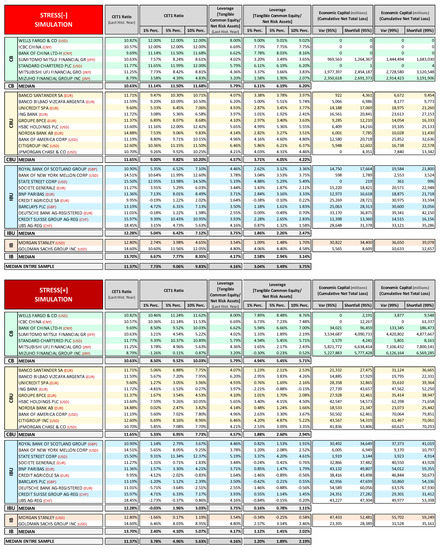

In this section, we report some of the main results of the stress test exercise that was performed in relation to both Stress[−] and Stress[+] simulations; in addition, we also report in Section 5.1 and Section 5.2, a comparison with the results—disclosed in 2014—of the Federal Reserve/Dodd-Frank act stress test for US G-SIB banks and the EBA/ECB comprehensive assessment stress test for EU G-SIB banks. In Appendix C, a more comprehensive set of records is reported.

The exercise does not represent, to any extent, a valuation of the capital adequacy of the banks considered; stress test results should not be considered as the banks’ expected or most likely figures, but rather should be considered as potential outcomes that are related to the severely adverse scenarios assumed. In the tables, in order to facilitate comparison among the banks that are considered in the analysis, the sample has been clustered into four groups, according to their business model35: IB = Investment Banks; IBU = Investment Banking-Oriented Universal Banks; CB = Commercial Banks; and, CBU = Commercial Banking-Oriented Universal Banks.

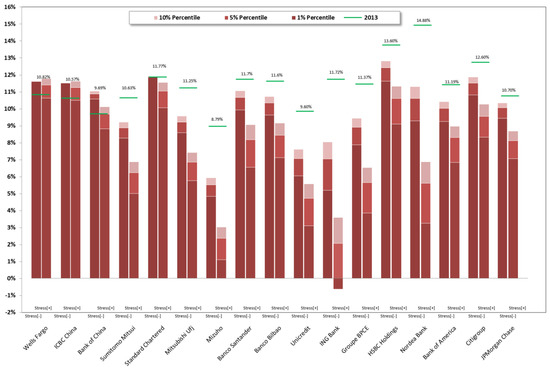

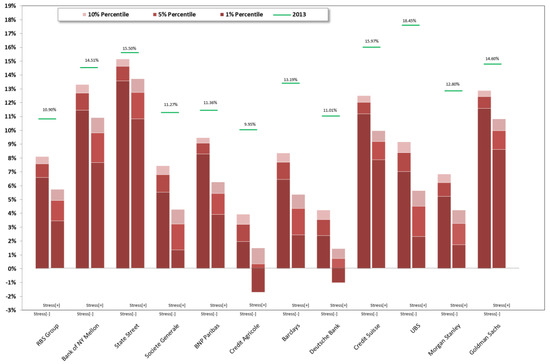

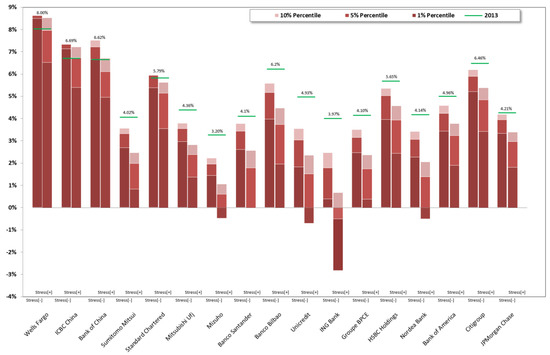

The stochastic simulation stress test shows considerable differences in degree of financial fragility among the banks in the sample. These differences are well captured by the CET1 probability of breach records for the three different threshold tested: 8%, 7%, and 4.5%, as reported in Figure 6. For some banks, breach probabilities are very high, while others show very low or even null probabilities. For example, Wells Fargo, ICBC China, Standard Chartered, Bank of China, and State Street show a great resilience to the stress test for all of the years considered and in both Stress[−] and Stress[+] simulations, thanks to their capacity to generate a solid volume of net revenues that are capable of absorbing credit and market losses. Those cases presenting a sharp increase in breach probabilities between Stress[−] and Stress[+] denote relevant non-linear risk conditions in the distribution tail. IB and IBU banks show on average higher probabilities of breach than CB and CBU banks.

Some of the main elements that explain these differences are:

- Current capital base level: banks with higher capital buffers in 2013 came through the stress test better, although this element is not decisive in determining the bank’s fragility ranking.

- Interest income margin: banks with the highest net interest income are the most resilient to the stress test.

- Leverage: banks with the highest leverage are among the most vulnerable to stressed scenarios.36

- Market risk exposures: banks that are characterized by significant financial asset portfolios tend to be more vulnerable to stressed conditions.

In looking at the records, consider that the results were obviously affected by the specific set of assumptions that are adopted in the exercise for the stochastic modeling of many variables. In particular, some of the main risk factor modeling (interest income and expenses, net commissions, credit and market risk) was based on banks’ historical data (the last five years), therefore these records influenced the setting of the distribution functions of the related stochastic variables, with better performance in reducing the function’s variability and extreme negative impacts, and worse performance, increasing the likelihood and magnitude of extreme negative impacts.

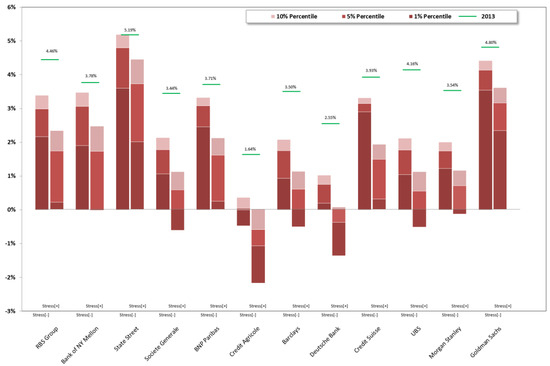

The graphs below (Figure 2 and Figure 3) report CET1 ratios and (Figure 4 and Figure 5) report leverage ratio (calculated as: Tangible Common Equity/Net Risk Assets) resulting from the stress test stochastic simulation performed: histograms show first, fifth, and tenth percentiles recorded; last historical (2013). Both of the ratios (CET1 ratios and leverage ratios) are indicated by a green dash, providing a reference point to understand the impact of the stress test; records are shown for 2015 and for both Stress[−] and Stress[+] simulations.

Figure 2.

Stressed CET1 ratio 2015 vs. CET1 ratio 2013. CB & CBU.

Figure 3.

Stressed CET1 ratio 2015 vs. CET1 ratio 2013. IB & IBU.

Figure 4.

Stressed leverage ratio 2015 vs. leverage 2013. CB & CBU.

Figure 5.

Stressed leverage ratio 2015 vs. leverage 2013. IB & IBU.

In Figure 6, we report the probability of breach of CET1 ratio for three different thresholds (8%; 7%; 4.5%) in both Stress[−] and Stress[+] simulations.

Figure 6.

CET1 ratio probability of breach.

Figure 7 shows the banks’ financial fragility rankings, as provided by the heuristic measure of tail risk (H), determined on the basis of 2015 CET1 ratios. The histograms highlight the range of values determined while considering Stress[−] and Stress[+] simulations. Banks are reported from the most resilient to the most fragile, according to the Stress[+] simulation. The breadth of the range shows the rise in non-linearity conditions in the tail of the distribution due to the increase in the severity of the stress test. The H ranking supports the evidence commented in relation to the previous results.

Figure 7.

Heuristic measure of tail risk (CET1 ratio—2015).

5.1. Supervisory Approach to SREP Capital Requirement

The simulation output enables the supervisors to adopt a new forward-looking approach in setting bank-specific minimum capital requirements within the SREP (Supervisory Review and Evaluation Process) process, which can take full advantage of the full depth of the stochastic analysis while insuring an effective level playing field among all of the banks under supervision. The approach would be based on a common minimum capital ratio (trigger of the simulation) and a common level of confidence (probability of breach of the capital ratio in simulation), both set by the supervisors; and, a simulation run by the supervisors. More specifically, supervisors can:

- Set a common predetermined minimum capital ratio “trigger” (α%); of course, this can be done by considering regulatory prescriptions, for example, 4.5% of CET1 ratio, or 7% of CET1 ratio while considering the capital conservation buffer as well.

- Set a common level of confidence “probability threshold” (x%); this probability should be fixed according to the supervisor’s “risk appetite” and also considering the trigger level: the higher the trigger, the lower the probability threshold can be set, since there are higher chances of hitting a high trigger.

- Run a stochastic simulation for each single financial institution with a common standard methodological paradigm.

- Look, for each bank, at the CET1 ratio probability distribution that is generated through the simulation in order to determine the CET1 ratio at the percentile of the distribution that corresponds to the probability threshold (CET1 Ratiox%).

- Compare the value of CET1 Ratiox% to the trigger (α%) in order to see if there is a capital shortfall (−) or excess (+) at that confidence interval (CET1 Ratiox% − α% = ±Δ%); this difference can be transformed into a capital buffer equivalent by multiplying it by the RWA generated in the scenario that corresponds to the percentile threshold (±Δ%·RWAx%).

- Calculate the SREP capital requirement by adding the buffer to the capital position held by the bank at time t0 in the case of capital shortfall at the percentile threshold, or by subtracting the buffer in the case of excess capital; the capital requirement can also be expressed in terms of a ratio by dividing the above capital requirement by the outstanding RWA at t0 or by the leverage exposure if the relevant capital ratio that is considered is the leverage ratio37.

The outlined approach would enable the supervisor to assess in advance the bank-specific capital endowment to be held in order to ensure its adequacy to meet the preset minimum capital ratio at a percentile corresponding to the confidence interval established, throughout the entire time horizon that is considered in the simulation. With a regulatory capital that matches the SREP capital requirement, the bank’s estimated probability of breach of the minimum capital ratio would be equal to the probability threshold and in line with the supervisor risk appetite.

An alternative (to points d, f), simpler way to quantify through the simulative approach the SREP capital requirement entails looking at the probability distribution of economic capital. The economic capital distribution function provides the total cumulated losses that are generated through the simulation at the percentile threshold x%; by adding to that amount the product of the capital ratio trigger and the RWA generated in the percentile threshold scenario (Economic Capitalx% + α%·RWAx%), we obtain a bank’s regulatory capital endowment38 at t0 adequate to cover all of the losses that are estimated through the simulation at the preset confidence interval, while still leaving a capital position that allows for the bank to respect the minimum regulatory capital ratio (trigger)39.

The advantage here is that under a common structured approach for all banks (same probability threshold, regulatory capital trigger, methodological paradigm, etc.), capital requirements could be determined on a bank-specific basis, when considering the impact of all the risk factors that are included in the simulation under an extremely high number of different scenarios, characterized by different levels of severity. This kind of approach is also flexible, allowing for the supervisor, for instance, to address the too big to fail issue in a different way. In fact, rather than setting arbitrary additional capital buffer for G-SII banks, supervisors may assume a lower risk appetite by simply setting a stricter probability threshold for these kinds of institutions (i.e., a higher confidence interval) that are aimed at minimizing their risk of default, and then assessing through a structured simulation process the effective capital endowment that they need to respect the minimum capital ratio at higher confidence intervals.

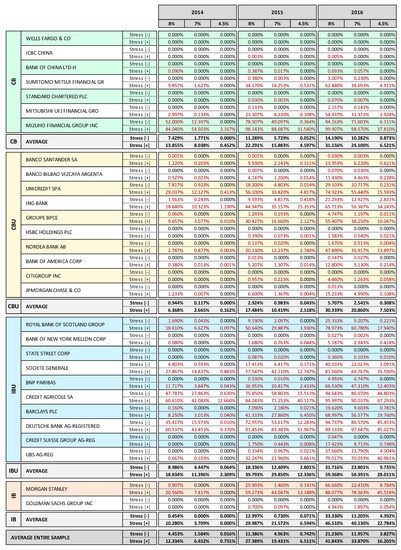

5.2. Stochastic Simulations Stress Test vs. Fed Supervisory Stress Test

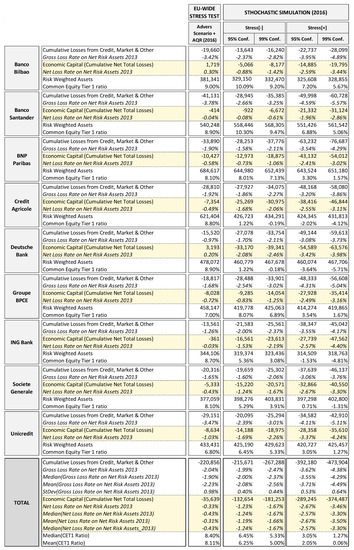

In Figure 8, we report a comparison between the results that were obtained in our stress test exercise and those reported by the Federal Reserve stress test (performed in March 2014) on the US banks of our sample. For the purposes of comparison, we report only results relative to 2015 for both of the stress test exercises. For each bank we report the cumulative losses generated in the stressed conditions simulated distinguished by risk factor and differentiating between gross losses and net losses; gross losses being the stress test impacts associated with the credit and market/counterparty risk factors (i.e., the increase in loans losses provisions and the net financial and trading losses), while net losses are the final net income overall impact of the stress test that affected the capital ratio. The amount of cumulated net losses (Economic Capital) indicates the effective severity of the stress test; conventionally, we indicate with negative Economic Capital figures net losses and with positive Economic Capital figures a net income. We report the stress test total impact also in relative terms with respect to 2013 Net Risk Assets, i.e., the cumulated gross losses on 2013 Net Risk Assets ratio and the net losses on 2013 Net Risk Assets ratio. We also report for each bank RWA and CET1 ratio records. All the records are reported for the two different adverse scenarios that are considered in the Fed stress test (adverse and severely adverse) and for two different confidence intervals (95% and 99%) of the Stress[−] and Stress[+] stochastic simulations performed.

Figure 8.

2015 Stochastic simulation stress test vs. 2015 Federal Reserve stress test. (Data in USD millions/%). (Source of Dodd-Frank Act Stress Test: Federal Reserve 2013a).

Overall, the stochastic simulation stress test exercise provided results that were generally in line with those that were obtained from the Federal Reserve stress test, albeit with some differences. With regard to economic capital, we see that the 99% Stress[−] simulation figures are generally in the range of Fed Adv.–Sev. Adv. scenarios results, while the 99% Stress[+] simulation results show a higher impact than the Fed Sev. Adv. scenario (with the exception of Wells Fargo, which shows very low losses even in extreme scenarios). In the Fed stress test, the range [Adv. 63 bln–Sev. Adv. 207 bln] of the sample’s total amount of economic capital is about the same as the 99th percentile corresponding records range Stress[−] 90 bln–Stress[+] 239 bnl, (see bottom total line Figure 8). It is worth mentioning that while Bank of New York Mellon and State Street reported no losses in the Fed stress test, they show some losses (albeit very low) at the 99th percentile in both Stress[−] and Stress[+] simulations.

Loan losses tend to be quite similar in our exercise to those in the Fed stress test. For some banks (Goldman Sachs, Bank of New York Melon and Morgan Stanley), Stress[+] simulation reported considerably higher impacts than the Fed stress test; this is because we assumed a minimum loss rate in the distribution function that was equal for all banks.

Trading and counterparty losses in our exercise present more differences than in the Fed stress test, due, in part, to the very simplified modeling that is adopted and in part to the role that average historical results on trading income played in our assumptions, which makes the stress less severe for those banks that experienced better trading performances in the recent past (such as Goldman Sachs and Wells Fargo), relative to those that had bad performances (see in particular JPMorgan and Citigroup).

Overall, the median and mean stressed CET1 ratio results of the Fed stress test are in line with those from our stress test exercise, although the Stress[−] simulation shows a slightly lower impact. Also, the total economic capital that is reported in the two stress test exercises are similar, with the total net losses of Fed Adv. Scenario within the range 95–99% of the Stress[−]simulation and the total net losses of Fed Sev. Adv. Scenario within the range 95–99% of the Stress[+] stochastic simulation.

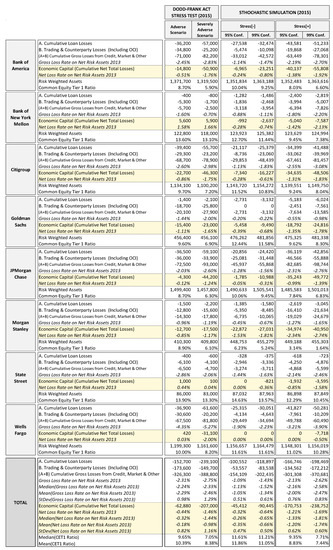

5.3. Stochastic Simulations Stress Test vs. EBA/ECB Supervisory Stress Test

In Figure 9, we report a comparison between the results that were obtained in our stress test exercise and those from the EBA/ECB stress test on the EU banks in our sample—banks that represent more than one-third of the total assets of all the 123 banks that were considered within the supervisory stress test exercise. For the purposes of comparison, we report in Figure 9 only cumulated results for 2016, the last year considered in both exercises.

Figure 9.

2016 Stochastic simulation stress test vs. 2016 EBA/ECB comprehensive assessment. (Data in EUR millions/%). (Source of EU-Wide Stress Test: EBA and ECB 2014).

The EBA/ECB stress test results regard the adverse scenario and include the impacts of AQR and join-up and the progressive phasing-in of the more conservative Basel 3 rules for the calculation of CET1 during the 2014–2016 time period of the exercise. These elements contribute to further enhance the adverse impact on CET1 of the EBA/ECB stress test when compared to our simulation, which could not embed the AQR/join-up effects and (being based on 31 December 2013 Basel 2.5 capital ratios) the Basel 3 phasing-in effects. Therefore, the most appropriate way to compare the impact of the two stress tests is to look at the income statement net losses rather than the CET1 drop.

If we look at gross losses, in terms of both average and total values, we can see that the EBA/ECB stress test has a similar impact to Stress[−] simulation, while the Stress[+] simulation shows a notably higher gross impact. It is interesting to note that, when we shift from gross losses to net losses, the EBA/ECB stress test highlights a sharp decrease in its impact, of more than 80%, which effectively reduces the loss rates to very low levels. Looking at individual banks’ results, we can note that, with the exception of Unicredit, all banks have net loss rates well below 1%; in some cases (Banco Bilbao and Deutsche Bank) the overall impact of the stress test and AQR does not determine any net loss at all, but only reduced capital generation. On average, the 95% Stress[−] simulation net loss impact is four times higher than EBA/ECB stress test and the 95% Stress[+] simulation net loss impact is eight times higher. If we compare EBA/ECB to the Fed stress test, notwithstanding the fact that the Fed stress test covers only two years of adverse scenario while EBA/ECB covers three years, we note that, although the Fed stress test reported higher gross losses, impacts are still around the same order of magnitude, 389 billion USD (about 305 billion EUR) of total cumulated gross losses in the Fed stress test with a gross loss rate on net risk assets of 2.75%, against 221 billion EUR total cumulated gross losses in the EBA/ECB stress test with a gross loss rate on net risk assets of 2.04%.40 But, if we look at net losses, we see that in the Fed Sev. Adv. scenario stress test, mitigation in switching to net losses is much lower (−45%, slightly more than the tax effect), 207 billion USD (about 163 billion EUR) of total cumulated net losses with a 1.46% net loss rate, against 36 billion EUR total cumulated net losses in the EBA/ECB stress test with a 0.33% net loss rate, about one-fourth of the Fed net loss rate.

The comparison analysis highlights that the Fed stress test and the stochastic simulation are characterized by a much higher severity than the EBA/ECB stress test, which presents a low effective impact (on average, the 2016 impact is due more to the Basel 3 phasing-in than to the adverse scenario).41 If the EU banks in the sample had all been hit by a net loss rate of 1.5% of net risk assets, equal to the average net loss rate that is recorded in the Fed Sev. Adv. scenario stress test, six of them would not have reached the 5.5% CET1 threshold.42

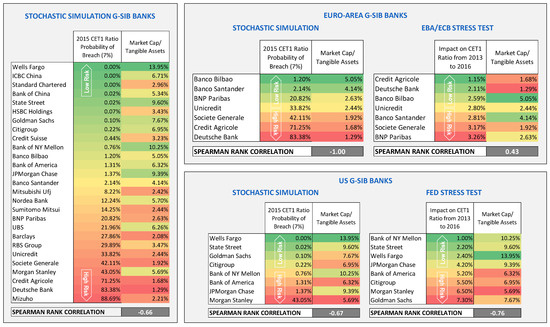

5.4. Relationship between Stress Test Risk and Market Valuation

With the following analysis, we put bank stress tests results in relation with market value dynamics; the idea is that there should be a certain level of consistency between the effective risk of a bank assessed through a sound forward-looking stress test exercise (performed ex-ante) and the subsequent market evolution of the bank’s stock price. In other words, if the stress testing approach effectively captures the real level of risk, banks with an estimated high risk should be characterized by a lower market appraisal than low risk banks.

We ranked the banks in the sample according to their financial fragility (risk), as measured by their probability of breaching a CET1 ratio threshold of 7% in 2015. The higher the probability of breach, the higher the risk in the ranking. Then, we considered the ratio between market capitalization and tangible assets as a relative synthetic proxy of the market appreciation of the risk embedded in the bank’s assets. We calculated this indicator for each bank at February 2016, about two years after 2013 financial statements (which represent the starting point of all the stress testing exercises) had been made publicly available, a time lapse that we consider long enough for the market to fully incorporate the risk perception that should have been assessed ex-ante with the forward-looking stress test. For a sound stress testing approach, we should expect a negative and significant relation between the riskiness assessed in the 2014 stress test and the subsequent market value dynamic; i.e., the higher the risk assessed through stress testing, the lower the market cap ratio.

Figure 10 reports the results of the correlation analysis between the stochastic simulation stress test and the market cap ratio dynamics; it highlights a significant negative correlation between the stress testing ranking and the market ranking. Each record has also been associated with a color, according to its position in the ranking, ranging from green (low risk) to red (high risk), in order to facilitate the visualization of the matching between the two rankings. Then, we made a similar ranking of the results provided by the two supervisory stress tests. Since probabilities of breach were not estimated in those exercises, we measured the risk in terms of impact of the adverse scenario, i.e., decrease in CET1 ratio during the overall exercise period.

Figure 10.

Stochastic Stress Test Analysis vs. Subsequent Market Dynamic. (Source of Market Data: Bloomberg).

We split the results into two tables in order to compare them among the two groups of banks: Euro area and US. The analysis shows that, also, in the case of the Fed Stress test results, there is a significant negative correlation, while the EBA/ECB stress test shows a positive and non-significant correlation, indicating that the market ex-post had evaluated the level of risk of those banks differently than European supervisors. Of course, from this simple analysis, we cannot draw definitive conclusions, when considering the limited sample size (especially the two sub-samples) and given the fact that the market often fails to appreciate risk and fair value of companies

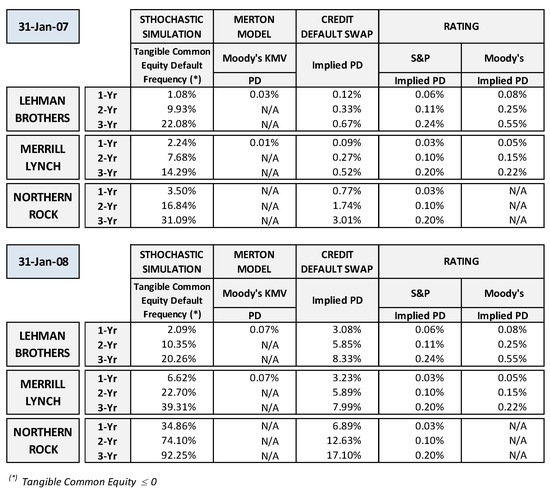

6. Stochastic Simulation Approach Comparative Back-Testing Analysis

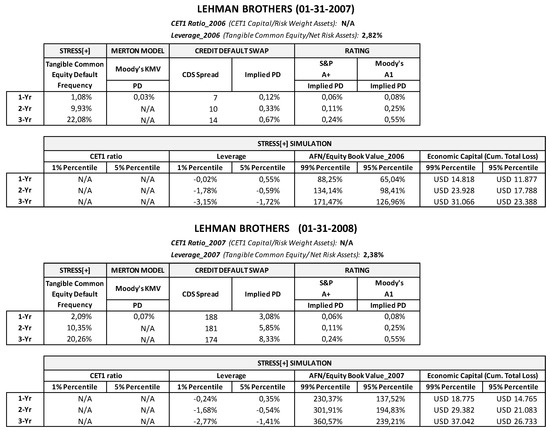

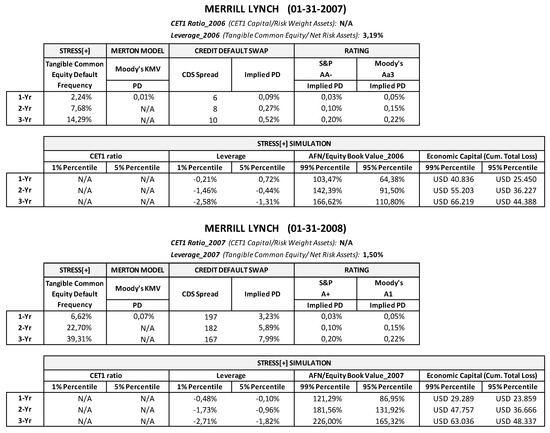

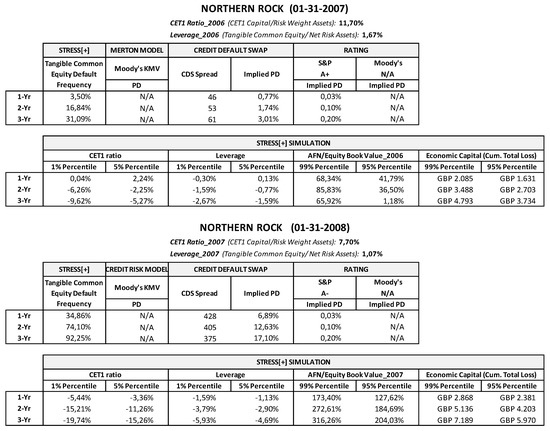

In this section, we tried to obtain some preliminary evidence on the reliability of the stochastic simulation approach in assessing the risk of financial institutions when compared to other methodologies. We first back-tested the proposed approach in assessing the PDs of some famous default cases, when comparing the results with other credit risk assessments. In this case, the model’s quality is quite easy to check, since, for defaulted banks, the interpretation of the back-testing results is straightforward: the model that provides the highest PD estimate earlier in time can be considered that which has the best default predictive power.

Since the ultimate goal of stress testing is to assess banks’ financial fragility, we tried to apply the proposed methodology to three well-known cases of financial distress: Lehman Brothers, Merrill Lynch, and Northern Rock. The aim was to see what kind of insights might have been achieved by assessing the risk of default through the stochastic simulation approach, placing ourselves in a time period preceding the default. Therefore, for each financial institution, we performed two simulations based on the data available at the moment at which they were assumed to have been run. One simulation was set two years before default/bailout (31 January 2007) and based on 2006 financial statement records as the starting point; the other was set about one year before default (3 January 2008) and based on 2007 financial statement.43