Sampling the Multivariate Standard Normal Distribution under a Weighted Sum Constraint

Abstract

1. Introduction

2. Derivation of the Conditional Density

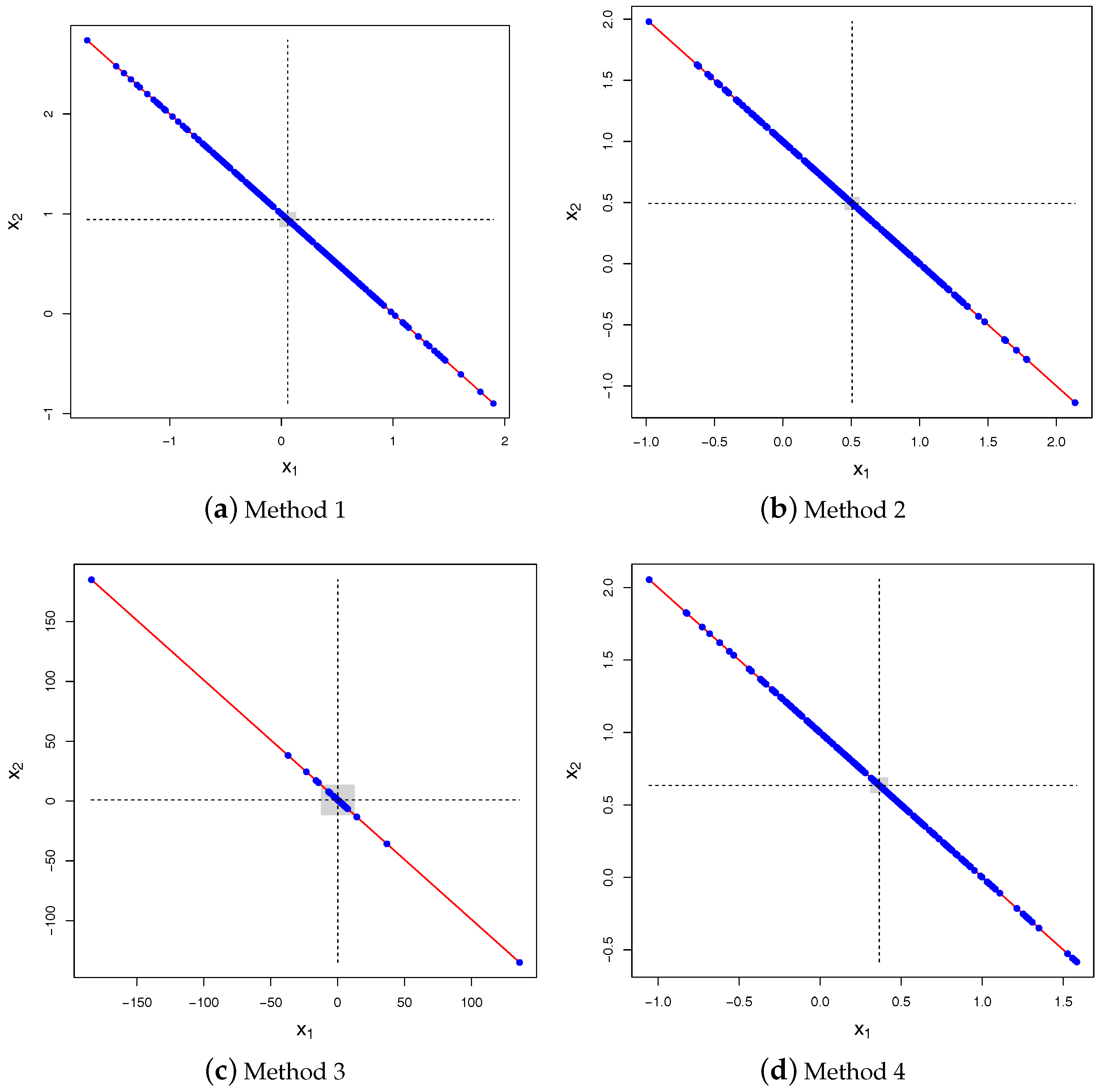

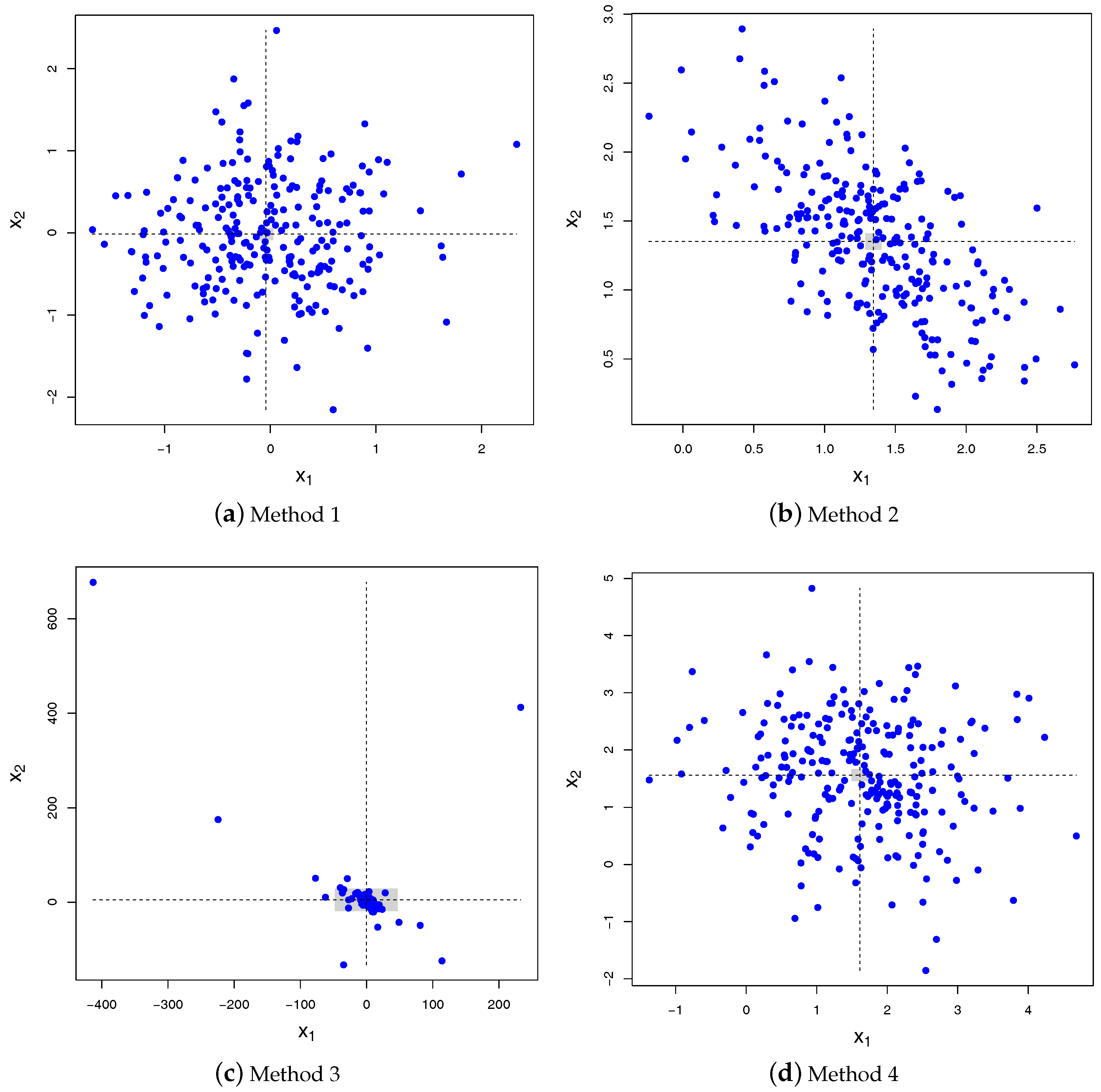

- (i)

- is positive definite;

- (ii)

- its determinant is given by

- (iii)

- the -element of the inverse is given by

3. Discussion

4. Sampling Algorithms

| Algorithm 1. Sampling of given . |

| 1. From the vector of weights and the constraint c, compute the -dimensional mean vector and symmetric matrix from (2) and (3); |

| 2. Compute the eigen decomposition of the covariance matrix ; |

| 3. Sample i.i.d. standard Normal variates ; |

| 4. Transform these variates using the mean vector and covariance matrix |

| 5. Enlarge the -dimensional vector with the n-th component to get , |

| 6. Return where for . |

| Algorithm 2. Sampling of given . |

| 1. Draw a sample u from a Uniform- distribution; |

| 2. Draw a sample from the conditional law of given : |

| 3. Apply Algorithm 1 using as constraint (i.e., ); |

| 4. Return . |

5. Applications

5.1. Conditional Portfolio Distribution

5.2. Expected Shortfall of a Defaultable Portfolio

6. Conclusions

Funding

Acknowledgments

Conflicts of Interest

Appendix A. General Expression of the Conditional Density

Appendix B. Proof of Lemma 1.

References

- Andersen, Leif B. G., and Jakob Sidenius. 2004. Extensions to the Gaussian copula: Random recovery and random factor loadings. Journal of Credit Risk 1: 29–70. [Google Scholar] [CrossRef]

- Cedilnik, Anton, Katarina Kosmelj, and Andrej Blejec. 2004. The distribution of the ratio of jointly Normal variables. Metodološki Zvezk 1: 99–108. [Google Scholar]

- Fieller, Edgar C. 1932. The distribution of the index in a normal bivariate population. Biometrika 23: 428–40. [Google Scholar] [CrossRef]

- Gentle, James E. 2007. Matrix Algebra: Theory, Computations, and Applications in Statistics. Berlin: Springer. [Google Scholar]

- Glasserman, Paul. 2010. Monte Carlo Methods in Financial Engineering. Berlin: Springer. [Google Scholar]

- Gordy, Michael B. 2003. A risk-factor model foundation for ratings-based bank capital rules. Journal of Financial Intermediation 12: 199–232. [Google Scholar] [CrossRef]

- Hull, John, and Alan White. 2004. Valuation of a CDO and an nth-to-default CDS without Monte Carlo simulation. Journal of Derivatives 12: 8–23. [Google Scholar] [CrossRef]

- Laurent, Jean-Paul, Michael Sestier, and Stéphane Thomas. 2016. Trading book and credit risk: how fundamental is the Basel review? Journal of Banking and Finance 73: 211–23. [Google Scholar] [CrossRef]

- Li, David X. 2016. On Default Correlation: A Copula Function Approach. Technical Report. Amsterdam: Elsevier. [Google Scholar]

- Meyer, Daniel W. 2018. (un)conditional sample generation based on distribution element trees. Journal of Computational and Graphical Statistics. [Google Scholar] [CrossRef]

- Pham, Dinh Tuan. 2000. Stochastic methods for sequential data assimilation in strongly nonlinear systems. Monthly Weather Review 129: 1194–207. [Google Scholar] [CrossRef]

- Pykhtin, Michael. 2004. Multifactor adjustment. Risk Magazine 17: 85–90. [Google Scholar]

- Rubinstein, Reuven Y., and Dirk Kroese. 2017. Simulation and the Monte Carlo Method. Hoboken: Wiley. [Google Scholar]

- Vasicek, Oldrich A. 1991. Limiting loan loss probability distribution. Finance, Economics and Mathematics. [Google Scholar] [CrossRef]

- Vrins, Frederic D. 2009. Double-t copula pricing of structured credit products—Practical aspects of a trustworthy implementation. Journal of Credit Risk 5: 91–109. [Google Scholar] [CrossRef]

© 2018 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Vrins, F. Sampling the Multivariate Standard Normal Distribution under a Weighted Sum Constraint. Risks 2018, 6, 64. https://doi.org/10.3390/risks6030064

Vrins F. Sampling the Multivariate Standard Normal Distribution under a Weighted Sum Constraint. Risks. 2018; 6(3):64. https://doi.org/10.3390/risks6030064

Chicago/Turabian StyleVrins, Frédéric. 2018. "Sampling the Multivariate Standard Normal Distribution under a Weighted Sum Constraint" Risks 6, no. 3: 64. https://doi.org/10.3390/risks6030064

APA StyleVrins, F. (2018). Sampling the Multivariate Standard Normal Distribution under a Weighted Sum Constraint. Risks, 6(3), 64. https://doi.org/10.3390/risks6030064