Analyzing the Risks Embedded in Option Prices with rndfittool

Abstract

:1. Introduction

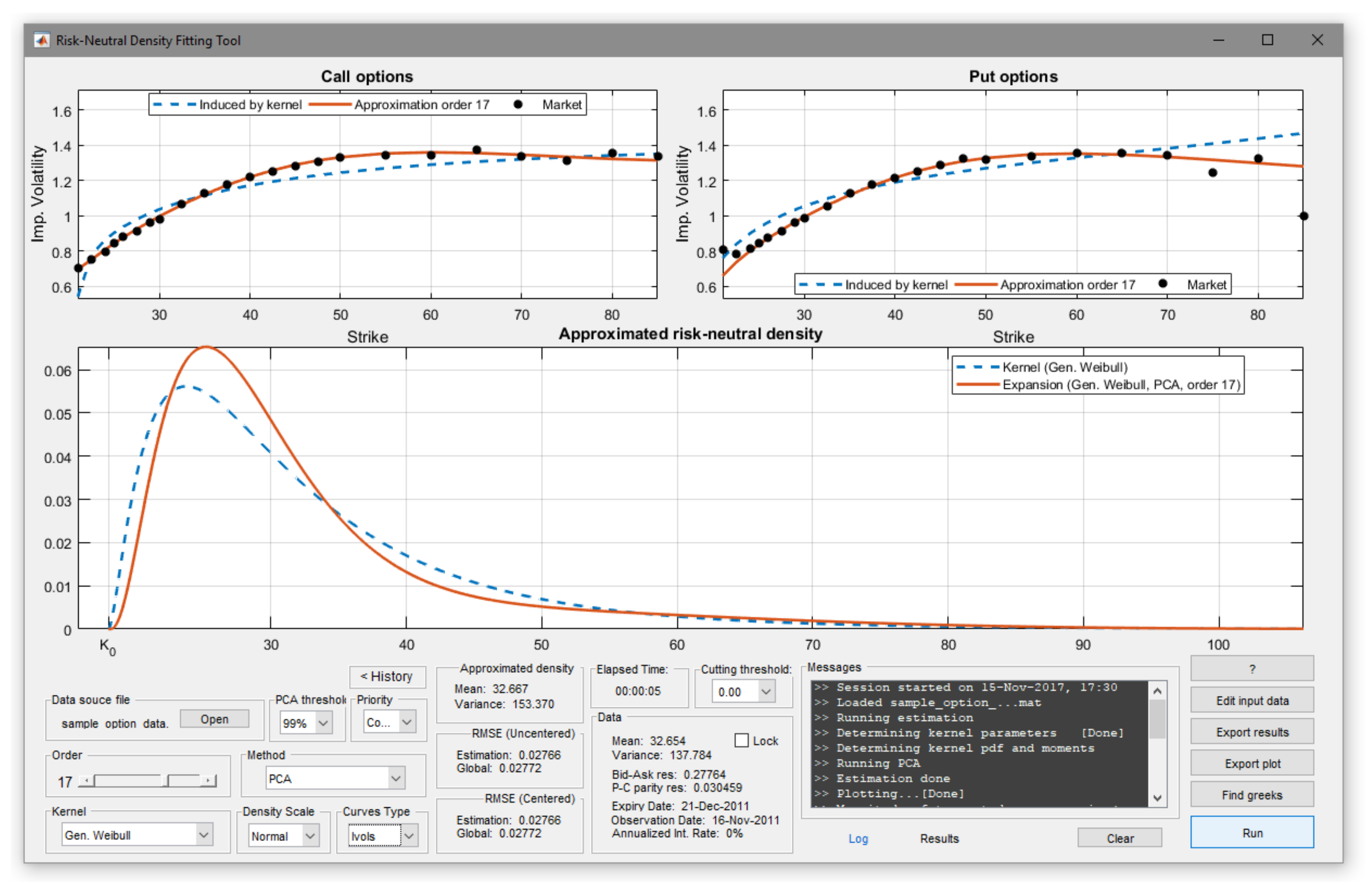

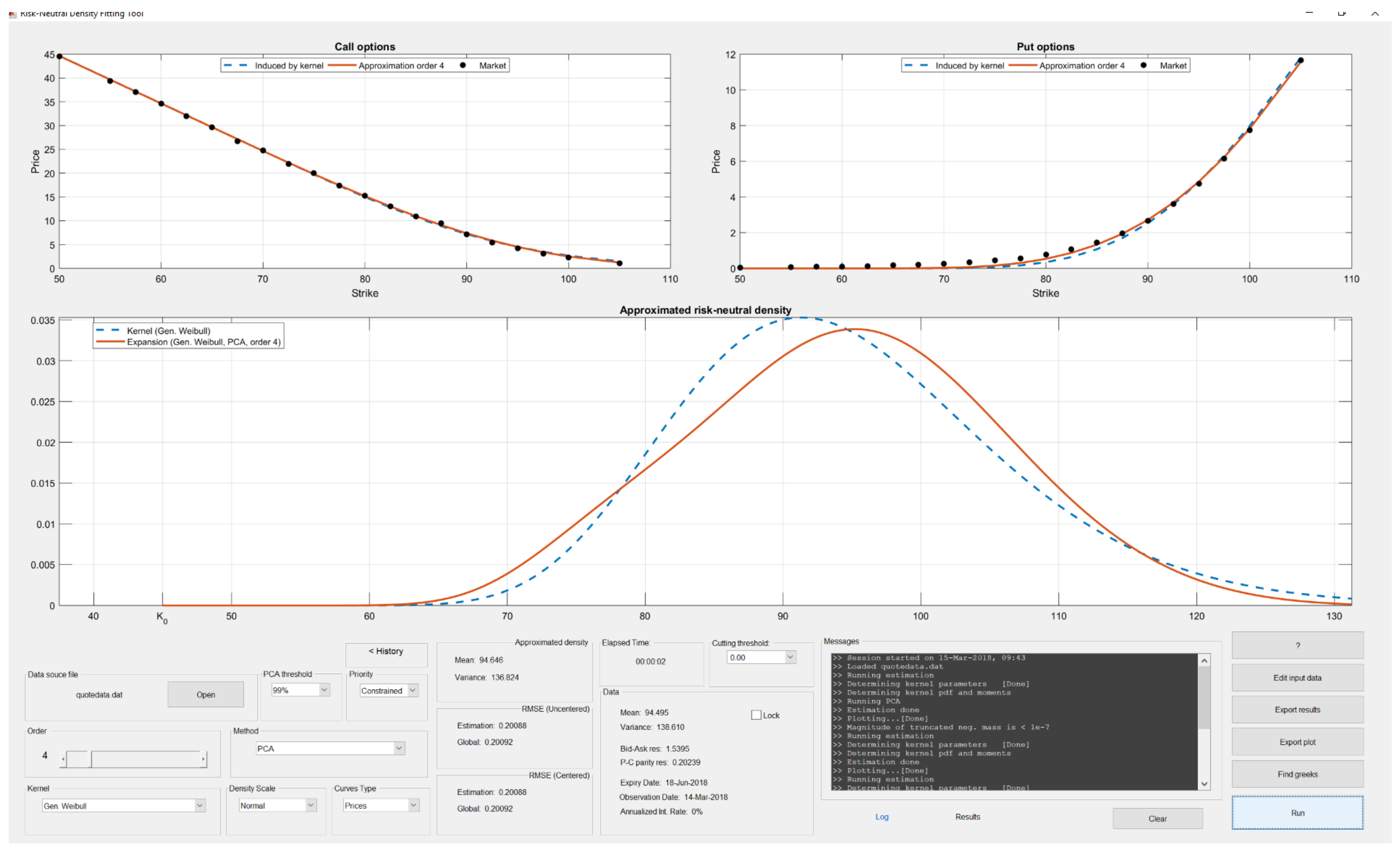

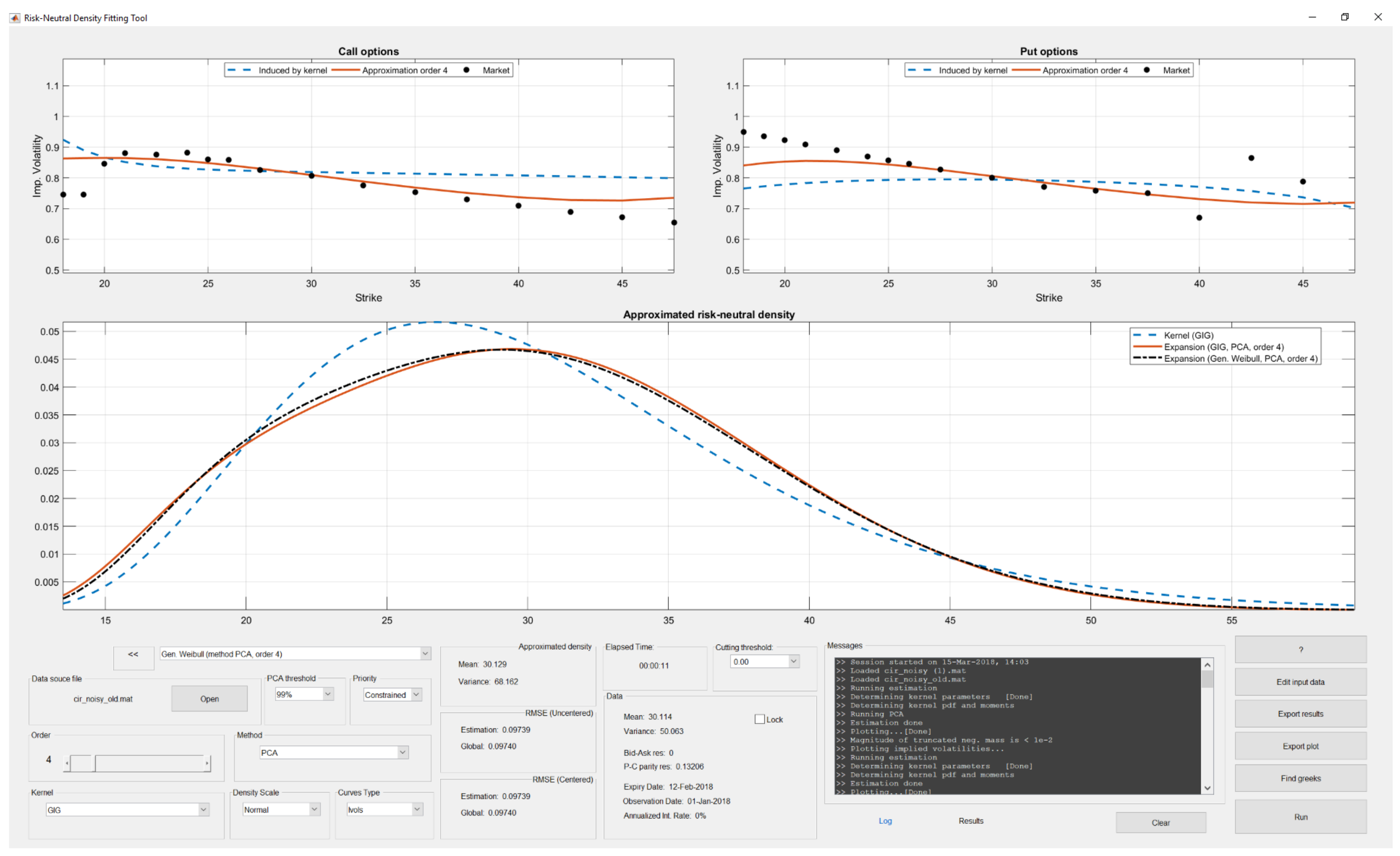

2. Option Pricing with Orthogonal Polynomial Expansions

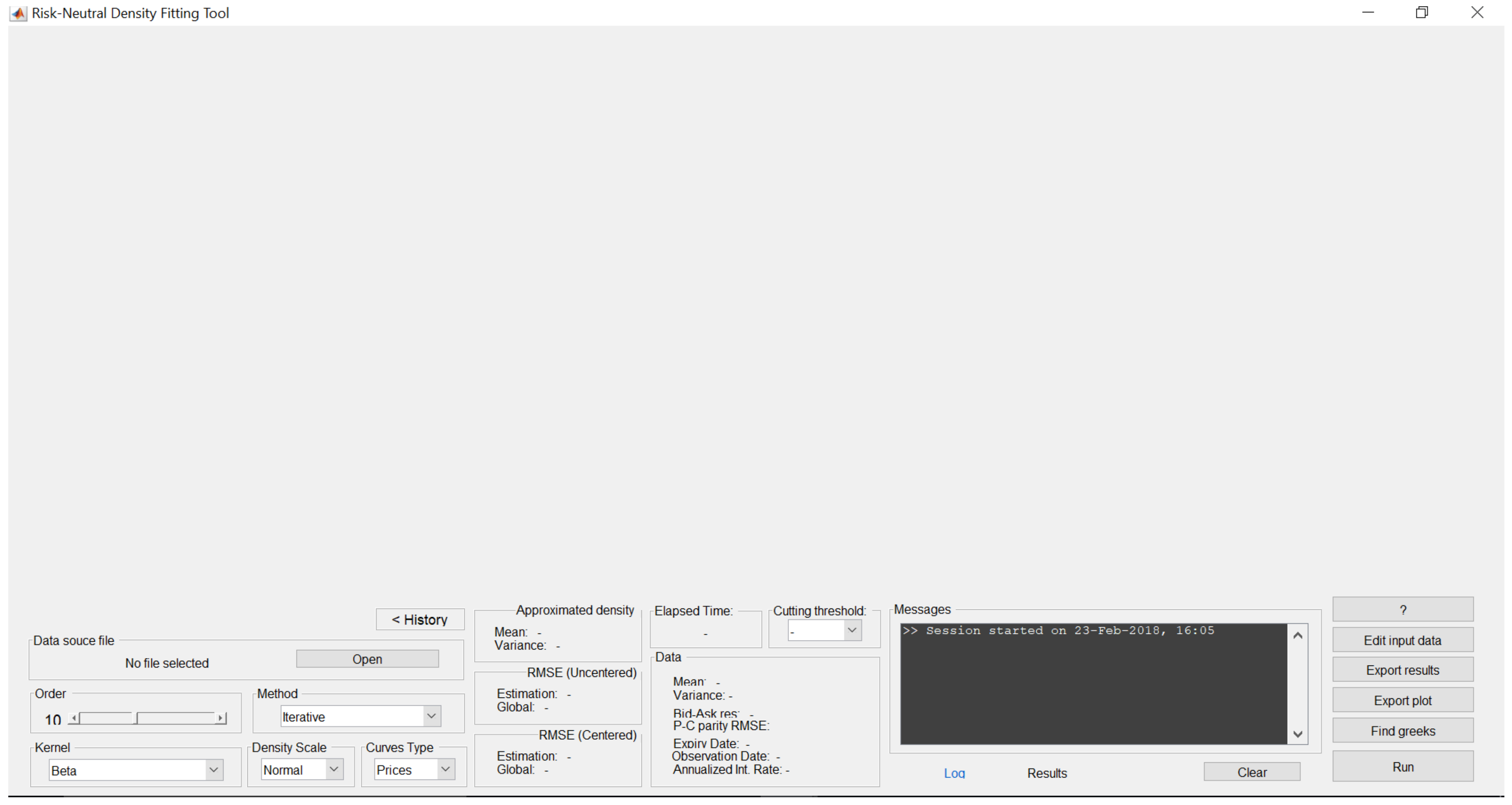

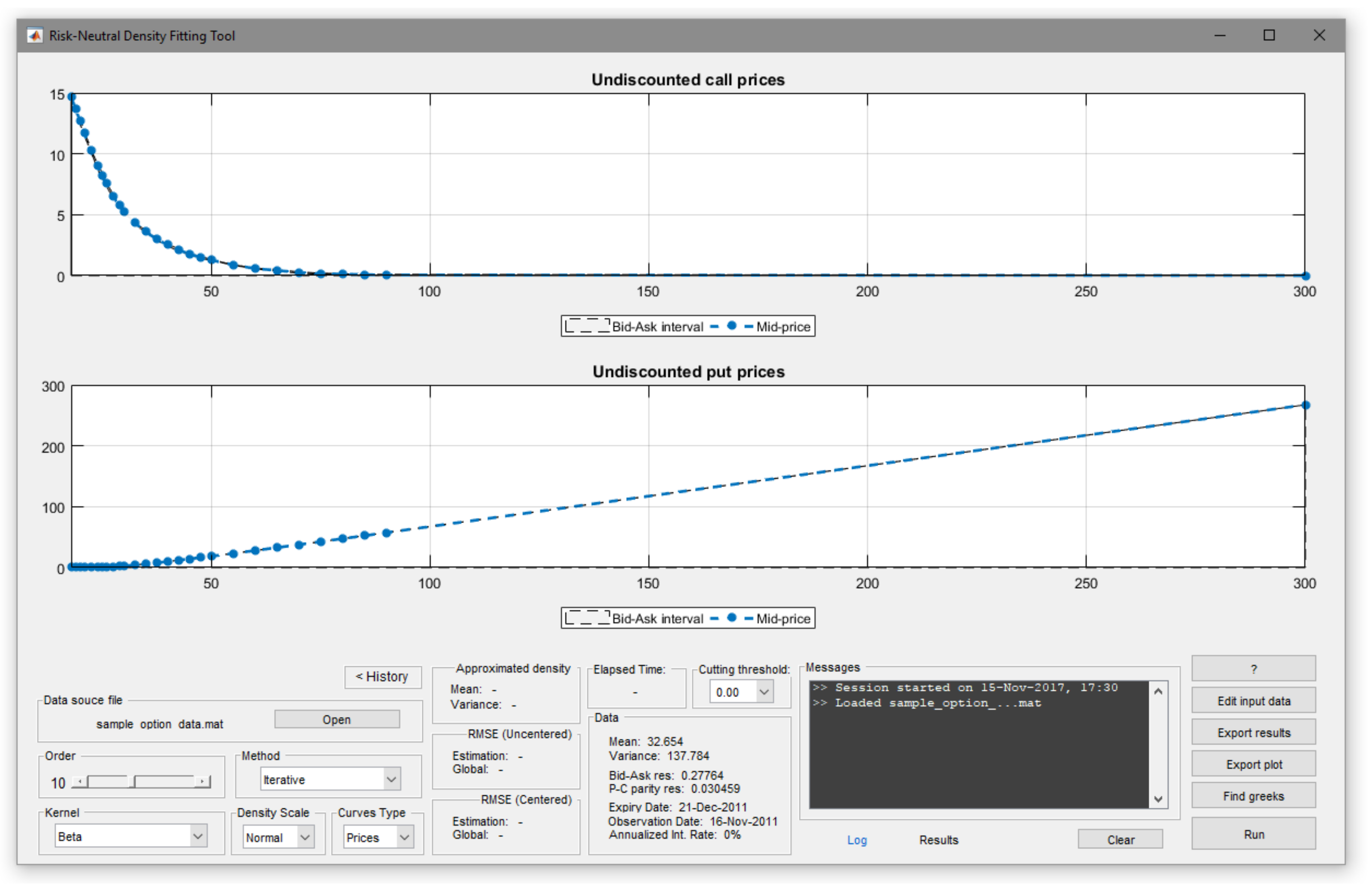

3. Using the App rndfittool

3.1. Package Overview

3.2. General Data Structure

3.2.1. OptionMetrics

3.2.2. Cboe

3.3. Analyzing Volatility Index (VIX) Options

3.3.1. Choice of the Kernel Density

- Beta; ,

- Double beta; ,

- Gamma; ,

- Generalized Inverse Gaussian (GIG); ,

- Generalized Weibull (GW); ,

- Lognormal; ,

3.3.2. Choice of the Expansion Order

- Theoretical issues: convergence conditions depend on the asymptotic behavior of . In particular, the convergence of (2) depends on assumptions relating the tail behavior of the RND to that of . These conditions might not be respected for any choice of the kernel and consequently the expansion leads to divergent results as n grows.

- Numerical issues: for large values of n high order polynomials are involved in the numerical computations, mainly of integrals and matrix inversion. Then computational issues may arise, depending on the estimation method being used and the kernel function adopted.

3.3.3. Fitting Methodology

- Iterative: by this method a coefficient-by-coefficient estimation is performed and additional stability conditions can be imposed within the procedure. This is the most stable method and should not return divergent results even for high values of n. This method might be affected by issues related to overfitting and it performs well when the input data does not display inconsistencies or violations of no-arbitrage pricing, e.g., simulated data.

- Ordinary Least Squares (OLS): by this method the estimation is made by means of the ordinary least squares approach. This is the simplest but weakest method, from both an analytical and a statistical point of view, due to multicollinearity in the orthogonal polynomials. Indeed, expansions with order higher than 5 are unlikely to provide good results with this method.

- PCA: This is the most robust method. The estimation of is made by resorting to a linear combination of the expansion polynomials obtained by PCA. This method generally proves an efficient solution to both overfitting and multicollinearity. When the estimation is made on the real data, which typically exhibit some inconsistencies, the PCA method generally provides the best performance. Optionally, the PCA can be constrained to provide price residuals centered around 0.

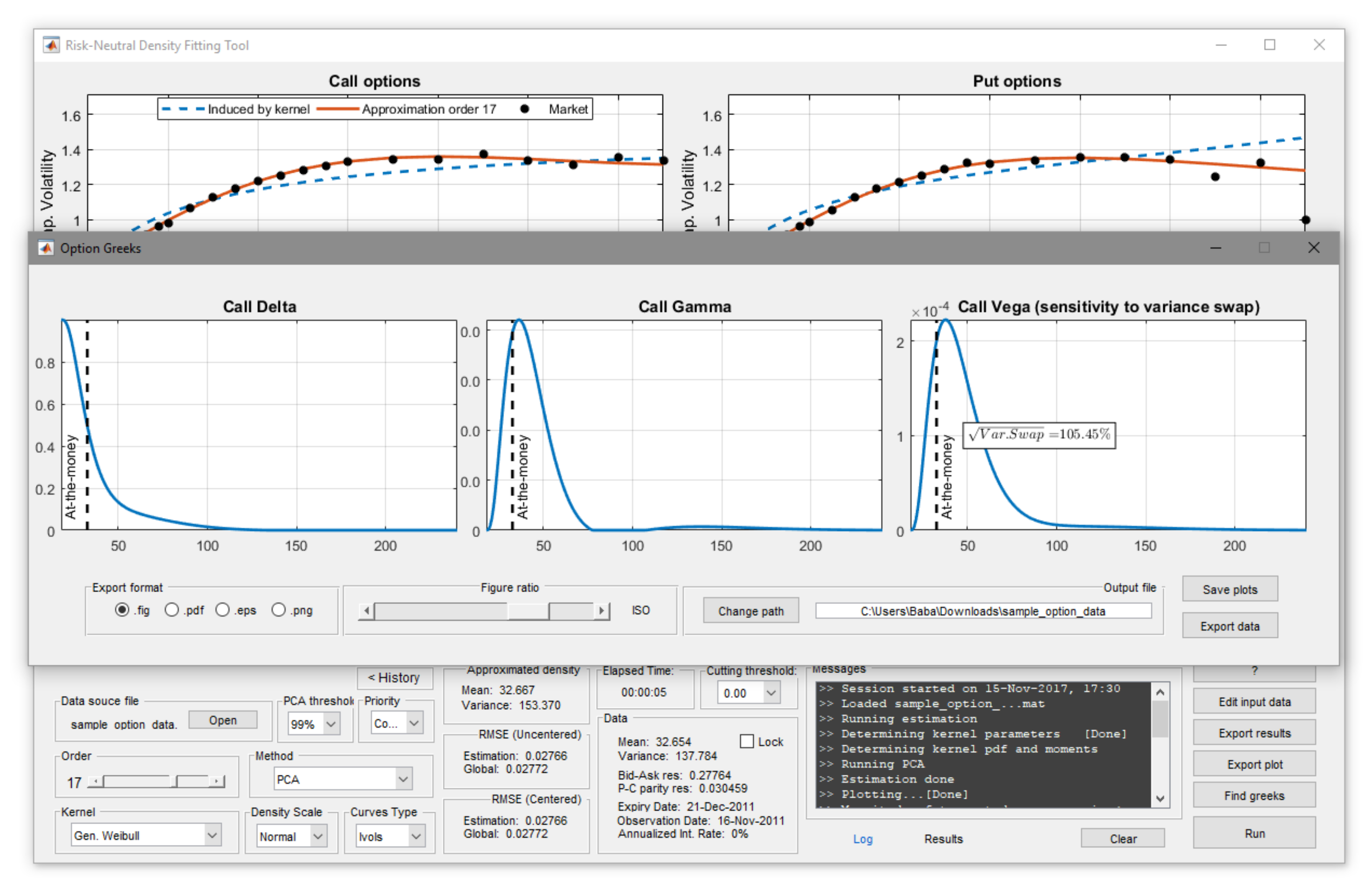

3.3.4. Output

- Exporting graphs: by “Export plot” all plots displayed in the current window will be saved into three image files. Aspect ratio and extension of the exported images can be chosen by the user.

- Exporting all output as data: by “Export results” current results will be exported into a MAT-file with the structure outlined in Table 2.

3.3.5. Other Examples

4. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Ackerer, Damien, and Damir Filipović. 2017. Option Pricing with Orthogonal Polynomial Expansions. Technical Report. Ithaca: Cornell University Library. [Google Scholar]

- Aït-Sahalia, Yacine, and Andrew W. Lo. 2000. Nonparametric risk management and implied risk aversion. Journal of Econometrics 94: 9–51. [Google Scholar] [CrossRef]

- Alexander, Carol, and Leonardo M. Nogueira. 2007. Model-free hedge ratios and scale-invariant models. Journal of Banking & Finance 31: 1839–61. [Google Scholar]

- Barletta, Andrea, and Elisa Nicolato. 2017. Orthogonal expansions for VIX options under affine jump diffusions. Forthcoming on Quantitative Finance. [Google Scholar] [CrossRef]

- Barletta, Andrea, Paolo Santucci de Magistris, and David Sloth. 2018. It Only Takes a Few Moments to Hedge. Technical Report. Rochester: SSRN. [Google Scholar]

- Barletta, Andrea, Paolo Santucci de Magistris, and Francesco Violante. 2017. A Non-Structural Investigation of VIX Risk Neutral Density. Technical Report. Rochester: SSRN. [Google Scholar]

- Bates, David S. 2005. Hedging the smirk. Finance Research Letters 2: 195–200. [Google Scholar] [CrossRef]

- Breeden, Douglas T., and Robert H. Litzenberger. 1978. Prices of state-contingent claims implicit in option prices. The Journal of Business 51: 621–51. [Google Scholar] [CrossRef]

- Carr, Peter, and Dilip Madan. 1998. Towards a theory of volatility trading. In Volatility: New Estimation Techniques for Pricing Derivatives. London: Risk Books, pp. 417–27. [Google Scholar]

- Cboe. 2018. Available online: http://www.cboe.com/ (accessed on 14 March 2018).

- Coutant, Sophie, Eric Jondeau, and Michael Rockinger. 2001. Reading PIBOR futures options smiles: The 1997 snap election. Journal of Banking & Finance 25: 1957–87. [Google Scholar]

- Cox, John, Jonathan E. Ingersoll, and Stephen A. Ross. 1985. A theory of the term structure of interest rates. Econometrica 53: 385–408. [Google Scholar] [CrossRef]

- Drimus, Gabriel G., Ciprian Necula, Anastasiia Sokko, and Walter Farkas. 2013. Closed Form Option Pricing under Generalized Hermite Expansions. Technical Report. Farkas: SSRN. [Google Scholar]

- Filipovic, Damir, Eberhard Mayerhofer, and Paul Schneider. 2013. Density approximations for multivariate affine jump-diffusion processes. Journal of Econometrics 176: 93–111. [Google Scholar] [CrossRef]

- Jarrow, Robert, and Andrew Rudd. 1982. Approximate option valuation for arbitrary stochastic processes. Journal of Financial Economics 10: 347–69. [Google Scholar] [CrossRef]

- Madan, Dilip B., and Frank Milne. 1994. Contingent claims valued and hedged by pricing and investing in a basis. Mathematical Finance 4: 223–45. [Google Scholar] [CrossRef]

- Mencía, Javier, and Enrique Sentana. 2017. Volatility-related exchange traded assets: An econometric investigation. Journal of Business & Economic Statistics 0: 1–16. [Google Scholar]

- Optionmetrics. 2018. Available online: http://www.optionmetrics.com/ (accessed on 23 January 2018).

- Xiu, Dacheng. 2014. Hermite polynomial based expansion of European option prices. Journal of Econometrics 179: 158–77. [Google Scholar] [CrossRef]

- Zhang, Jin E., and Yingzi Zhu. 2006. VIX futures. Journal of Futures Markets 26: 521–31. [Google Scholar] [CrossRef]

| Variable Name: | Size | Type | Description |

|---|---|---|---|

| K: | [M × 1 double] | Mandatory | Vector of strike values |

| call: | [M × 1 double] | Mandatory | Vector of observed call prices |

| put: | [M × 1 double] | Mandatory | Vector of observed put prices |

| m: | [2 × 1 double] | Mandatory | Vector with mean and variance of RND (can be set to []) |

| obsDate: | [1 × 6 int] | Optional | Observation date in numeric format ’yyyy mm dd’ |

| expDate: | [1 × 6 int] | Optional | Expiry date in numeric format ’yyyy mm dd’ |

| call_a: | [M × 1 double] | Optional | Vector of call ask prices |

| call_b: | [M × 1 double] | Optional | Vector of call bid prices |

| put_a: | [M × 1 double] | Optional | Vector of put ask prices |

| put_b: | [M × 1 double] | Optional | Vector of put bid prices |

| Variable Name: | Size | Description |

|---|---|---|

| K: | [M × 1 double] | Vector of strike values |

| obsCall: | [M × 1 double] | Vector of observed call prices |

| obsPut: | [M × 1 double] | Vector of observed call prices |

| c: | [1 × (n + 1) double] | Vector of estimated expansion coefficients |

| kerPar: | [1 × P double] | Estimated coefficients of the kernel |

| f: | function handle | RND as a MATLAB function handle |

| kf: | function handle | Kernel density as a MATLAB function handle |

| order: | [1 × 1 int] | Expansion order |

| kernel: | [1 × D char] | Name of the Kernel density |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Barletta, A.; Santucci de Magistris, P. Analyzing the Risks Embedded in Option Prices with rndfittool. Risks 2018, 6, 28. https://doi.org/10.3390/risks6020028

Barletta A, Santucci de Magistris P. Analyzing the Risks Embedded in Option Prices with rndfittool. Risks. 2018; 6(2):28. https://doi.org/10.3390/risks6020028

Chicago/Turabian StyleBarletta, Andrea, and Paolo Santucci de Magistris. 2018. "Analyzing the Risks Embedded in Option Prices with rndfittool" Risks 6, no. 2: 28. https://doi.org/10.3390/risks6020028

APA StyleBarletta, A., & Santucci de Magistris, P. (2018). Analyzing the Risks Embedded in Option Prices with rndfittool. Risks, 6(2), 28. https://doi.org/10.3390/risks6020028