An Integrated Approach to Pricing Catastrophe Reinsurance

Abstract

1. Introduction

- (1)

- We first model a default-risky reinsurer by employing Merton’s (1974) structural approach to endogenize default.

- –

- On the asset side, since the reinsurer holds a large proportion of fixed-income assets in the asset portfolio, we model the asset dynamics taking into account explicitly the impact of stochastic interest rates. We make a measure change from the physical pricing measure to the equivalent martingale pricing measure Q by embedding the market price of interest rate risk.

- –

- On the liability side, since the reinsurer’s non-catastrophic liability shocks are idiosyncratic and small, we apply the law of large numbers to assume away this risk premium. We also make a measure change from the physical pricing measure to the equivalent martingale pricing measure Q by embedding the market price of interest rate risk.

- (2)

- We model catastrophe arrivals. We make use of the empirical finding that catastrophe derivatives are zero-beta assets, and thus both the loss number and the amount of losses have zero risk premiums.

- (3)

- We proceed to price a default-risky reinsurance contract under the equivalent martingale pricing measure Q as a martingale.

- (4)

- Finally, we extend the pricing formula to incorporate risk load/markup to account for the observed empirical characteristics of the (re)insurance market. The interpretation of the markup is the same as in the traditional actuarial pricing approach except that (1) our expectation is taken with respect to the risk-neutralized martingale pricing measure, but in the traditional approach the expectation is taken with respect to the physical pricing measure; and (2) our markup only needs to account for market imperfections and other idiosyncratic factors, while the markup in the traditional actuarial approach accounts for both modeled and non-modeled factors.

2. Modeling Reinsurer Default with Asset, Interest Rate, Liability, and Catastrophe Loss

Dynamics

3. Pricing a Cat Reinsurance Contract and the Monte Carlo Simulation Results

4. Concluding Remarks

Author Contributions

Conflicts of Interest

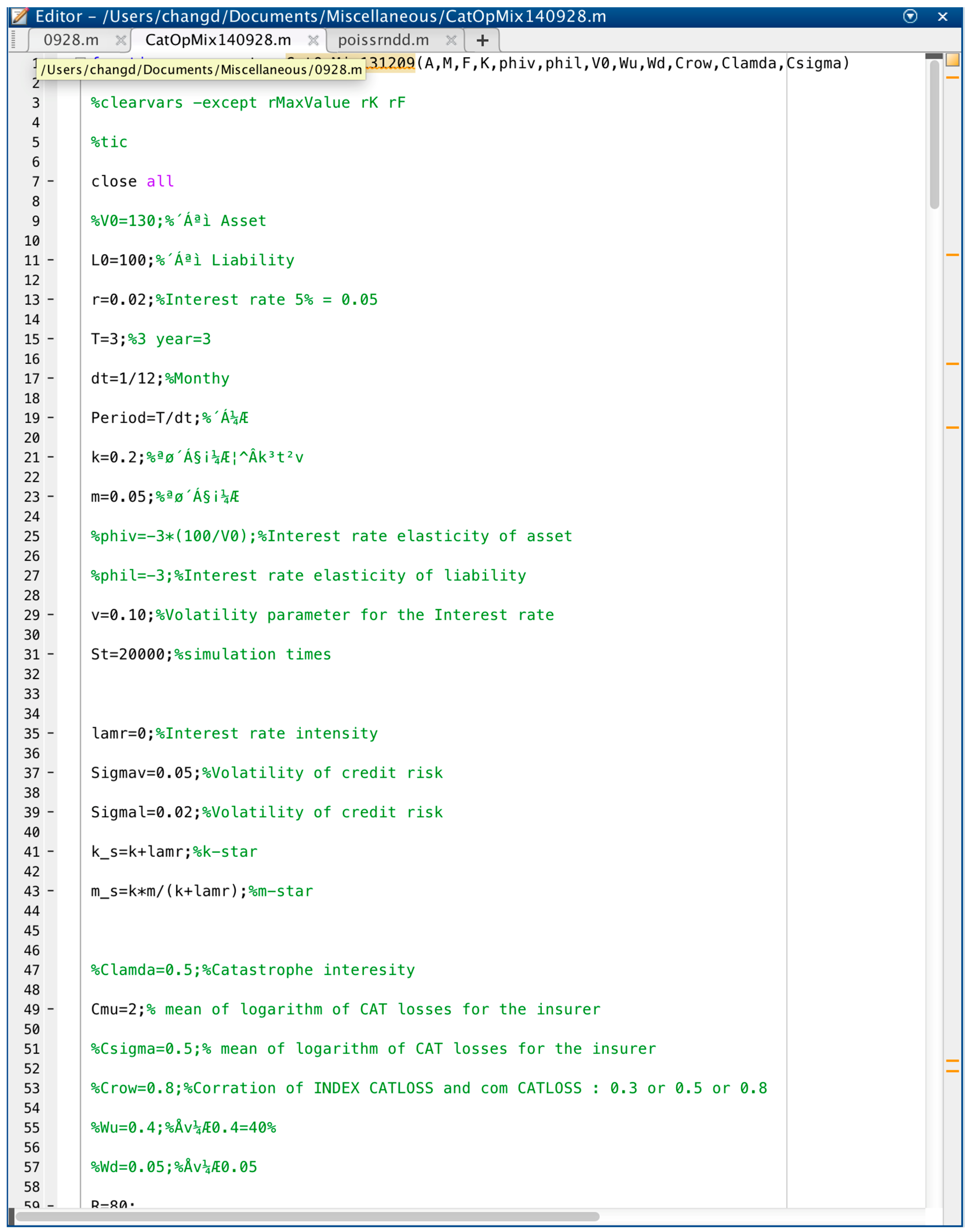

Appendix A. Procedures of the Monte Carlo Simulation Method

References

- Bollerslev, Tim, Michael Gibson, and Hao Zhou. 2011. Dynamic estimation of volatility risk premia and investor risk aversion from option-implied and realized volatilities. Journal of Econometrics 160: 235–45. [Google Scholar] [CrossRef]

- Bowers, Newton L., Hans U. Gerber, James C. Hickman, Donald A. Jones, and Cecil J. Nesbitt. 1986. Actuarial Mathematics. Itasca: Society of Actuaries. [Google Scholar]

- Carr, Peter, Helyette Geman, and Dilip B. Madan. 2001. Pricing and hedging in incomplete markets. Journal of Financial Economics 62: 131–67. [Google Scholar] [CrossRef]

- Chang, Jack S. K., C. Sherman Cheung, and Itzhak Krinsky. 1989. On the derivation of reinsurance premiums. Insurance: Mathematic and Economics 8: 137–44. [Google Scholar] [CrossRef]

- Collin-Dufresne, Pierre, Robert S. Goldstein, and Fan Yang. 2012. On the relative pricing of long-maturity index options and collateralized debt obligations. The Journal of Finance 68: 1983–2014. [Google Scholar] [CrossRef]

- Coval, Joshua D., Jakub W. Jurek, and Erik Stafford. 2009. Economic catastrophe bonds. American Economic Review 99: 628–66. [Google Scholar] [CrossRef]

- Cox, John, Jonathan Ingersoll, and Stephen Ross. 1985. The term structure of interest rates. Econometrica 53: 385–407. [Google Scholar] [CrossRef]

- Dassios, Angelos, and Ji-Wook Jang. 2003. Pricing of catastrophe reinsurance and derivatives using the cox process with shot noise intensity. Finance and Stochastics 7: 73–95. [Google Scholar] [CrossRef]

- Duan, Jin Chuan, and Min-Teh Yu. 2005. Fair insurance guaranty premia in the presence of risk-based capital regulations, stochastic interest rates and catastrophe risk. Journal of Banking and Finance 29: 2435–54. [Google Scholar] [CrossRef]

- Duan, Jin Chuan, Arthur F. Moreau, and C. W. Sealey. 1995. Deposit insurance and bank interest rate risk: Pricing and regulatory implications. Journal of Banking and Finance 19: 1091–108. [Google Scholar] [CrossRef]

- Duan, Jin-Chuan, and Jean-Guy Simonato. 1999. Estimating and Testing Exponential-Affine Term Structure Models by Kalman Filter. Review of Quantitative Finance and Accounting 13: 111–135. [Google Scholar]

- Froot, Kenneth A. 2001. The market for catastrophe risk: A clinical examination. Journal of Financial Economics 60: 529–71. [Google Scholar] [CrossRef]

- Froot, Kenneth A., and Paul G. J. O’Connell. 2008. On the pricing of intermediated risks: Theory and application to catastrophe reinsurance. Journal of Banking and Finance 32: 69–85. [Google Scholar] [CrossRef]

- Geman, Hélyette. 2005. From measure changes to time changes in asset pricing. Journal of Banking and Finance 29: 2701–22. [Google Scholar] [CrossRef]

- Gürtler, Marc, Martin Hibbelin, and Christine Winkelvos. 2012. The impact of the financial crisis and natural catastrophes on cat bonds. Working paper IF40V1, Technische Universität Braunschweig, Braunschweig, Germany. [Google Scholar]

- Harrison, John Michael, and David M. Kreps. 1979. Martingales and arbitrage in multiperiod securities markets. Journal of Economic Theory 20: 381–408. [Google Scholar] [CrossRef]

- Harrison, John Michael, and Stanley R. Pliska. 1981. Martingales and stochastic integrals in the theory of continuous trading. Stochastic Processes and their Applications 11: 215–60. [Google Scholar] [CrossRef]

- Lee, Jin Ping, and Min-The Yu. 2007. Valuation of catastrophe reinsurance with cat bonds. Insurance: Mathematics and Economics 41: 264–78. [Google Scholar]

- Merton, Robert. 1974. On the pricing of corporate debt: The risk structure of interest rates. The Journal of Finance 29: 449–70. [Google Scholar]

- Zanjani, George. 2002. Pricing and capital allocation in catastrophe insurance. Journal of Financial Economics 65: 283–305. [Google Scholar] [CrossRef]

| 1 | Traditional reinsurers tend to invest in illiquid and information-intensive financial activities, and so they charge premiums based on correlations with their own pre-existing portfolios and U.S. nationwide cat risks, rather than with any market portfolio, resulting in significantly higher cost of capital. |

| 2 | A martingale is a stochastic variable with no drift such that the current expectation of the future value of the variable is always equal to the current value of the variable. The above authors show that the absence of arbitrage is equivalent to the existence of an equivalent martingale pricing measure Q (or risk-neutral/risk-neutralized pricing measure as used by some authors) such that all normalized (with respect to a chosen numeraire) security prices are martingales and as such they can be priced by taking expectations under the measure Q. The beauty of martingale pricing is that it applies to both complete and incomplete markets as “absence of arbitrage” is the only required assumption. When markets are complete with the absence of arbitrage, martingale pricing theory guarantees that the equivalent martingale measure is unique, thus the market price of risk does not explicitly enter into the valuation process. In this context, options can be priced preference-free as if agents were risk-neutral as in the Black–Scholes model. When markets are incomplete, however, the absence of arbitrage no longer guarantees a unique martingale measure. In this case, information related to the market prices of risk that embeds the risk-aversion behavior of agents is needed to uniquely identify the equivalent martingale measure (see Geman (2005) for a review). The procedure of embedding the market price of risk to obtain such a unique measure is often called risk-neutralization. |

| 3 | Gürtler et al. (2012) show that this premium can be significant when a mega catastrophe strikes, but we assume this scenario away in this paper. |

| 4 | |

| 5 |

| Asset Parameters | ||

| Reinsurer’s assets | V/L = 1.3 | |

| Drift due to credit risk | Irreverent | |

| Interest rate elasticity of asset | −3 | |

| Volatility of credit risk | 5% | |

| Wiener process for credit shocks | ||

| Liability Parameters | ||

| Reinsurer’s liabilities | 100 | |

| Drift due to idiosyncratic risk | 0 | |

| Interest rate elasticity of liability | −3 | |

| Volatility of idiosyncratic risk | 2% | |

| Wiener process for idiosyncratic shocks | ||

| Interest Rate Parameters | ||

| r | Initial instantaneous interest rate | 2% |

| κ | Magnitude of mean-reverting force | 0.2 |

| Long-run mean of interest rate | 5% | |

| Volatility of interest rate | 10% | |

| Market price of interest rate risk | −0.01 | |

| Wiener process for interest rate shocks | ||

| Catastrophe loss Parameters for Ct | ||

| Poisson process for the arrival of catastrophes | ||

| Catastrophe arrival intensity | 0.5 | |

| Mean of the logarithm of the losses per arrival | 2 | |

| Standard deviation of the logarithm of the losses per arrival | 0.5 | |

| Other Parameters | ||

| A | Attachment level of a reinsurance contract | 10~30 |

| Cap level of loss paid by a reinsurance contract | 60~90 | |

| T | Maturity | 3 years |

| u | Reinsurance markup | 0.4 |

| Coverage | M = 60 | M = 65 | M = 70 | M = 75 | M = 80 | M = 85 | M = 90 |

|---|---|---|---|---|---|---|---|

| A = 10 | 7.26957 | 7.28648 | 7.29306 | 7.30003 | 7.30261 | 7.30284 | 7.30634 |

| A = 15 | 4.45191 | 4.46950 | 4.47824 | 4.48331 | 4.48579 | 4.48792 | 4.99274 |

| A = 20 | 2.73468 | 2.75143 | 2.76143 | 2.76739 | 2.16897 | 2.17120 | 2.17444 |

| A = 25 | 1.57234 | 1.59048 | 1.59951 | 1.60448 | 1.60706 | 1.60929 | 1.61162 |

| A = 30 | 0.93787 | 0.98590 | 1.05583 | 1.06080 | 1.06338 | 1.06561 | 1.06740 |

| (λ, ) | Reinsurance Price for Coverage Payer (90, 10) | ||

|---|---|---|---|

| V/L = 1.1 | V/L = 1.3 | V/L = 1.5 | |

| (0.5, 0.5) | 7.30634 | 7.40443 | 7.58688 |

| (1, 0.5) | 13.24426 | 13.78995 | 14.12347 |

| (2, 0.5) | 19.56788 | 19.98765 | 20.31452 |

| (0.5, 1) | 20.75633 | 21.24536 | 21.76542 |

| (1, 1) | 24.18776 | 24.35473 | 24.87682 |

| (2, 1) | 27.78653 | 28.89672 | 29.45328 |

| (0.5, 2) | 40.28763 | 41.69782 | 43.13476 |

| (1, 2) | 43.21675 | 43.87862 | 44.34724 |

| (2, 2) | 48.8976 | 49.90163 | 51.27658 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chang, C.W.; Chang, J.S.K. An Integrated Approach to Pricing Catastrophe Reinsurance. Risks 2017, 5, 51. https://doi.org/10.3390/risks5030051

Chang CW, Chang JSK. An Integrated Approach to Pricing Catastrophe Reinsurance. Risks. 2017; 5(3):51. https://doi.org/10.3390/risks5030051

Chicago/Turabian StyleChang, Carolyn W., and Jack S. K. Chang. 2017. "An Integrated Approach to Pricing Catastrophe Reinsurance" Risks 5, no. 3: 51. https://doi.org/10.3390/risks5030051

APA StyleChang, C. W., & Chang, J. S. K. (2017). An Integrated Approach to Pricing Catastrophe Reinsurance. Risks, 5(3), 51. https://doi.org/10.3390/risks5030051