Climate Policy Uncertainty and Sovereign Credit Risk: A Multivariate Quantile on Quantile Regression Analysis

Abstract

1. Introduction

2. Literature Review

3. Data Description and Research Methodology

3.1. Data Description

3.2. Research Methodology

3.2.1. BDS Nonlinearity Test

3.2.2. Quantile-on-Quantile Regression (QQR)

3.2.3. Multivariate Quantile-on-Quantile Regression (MQQR)

4. Empirical Results

4.1. Pre-Test Diagnostics

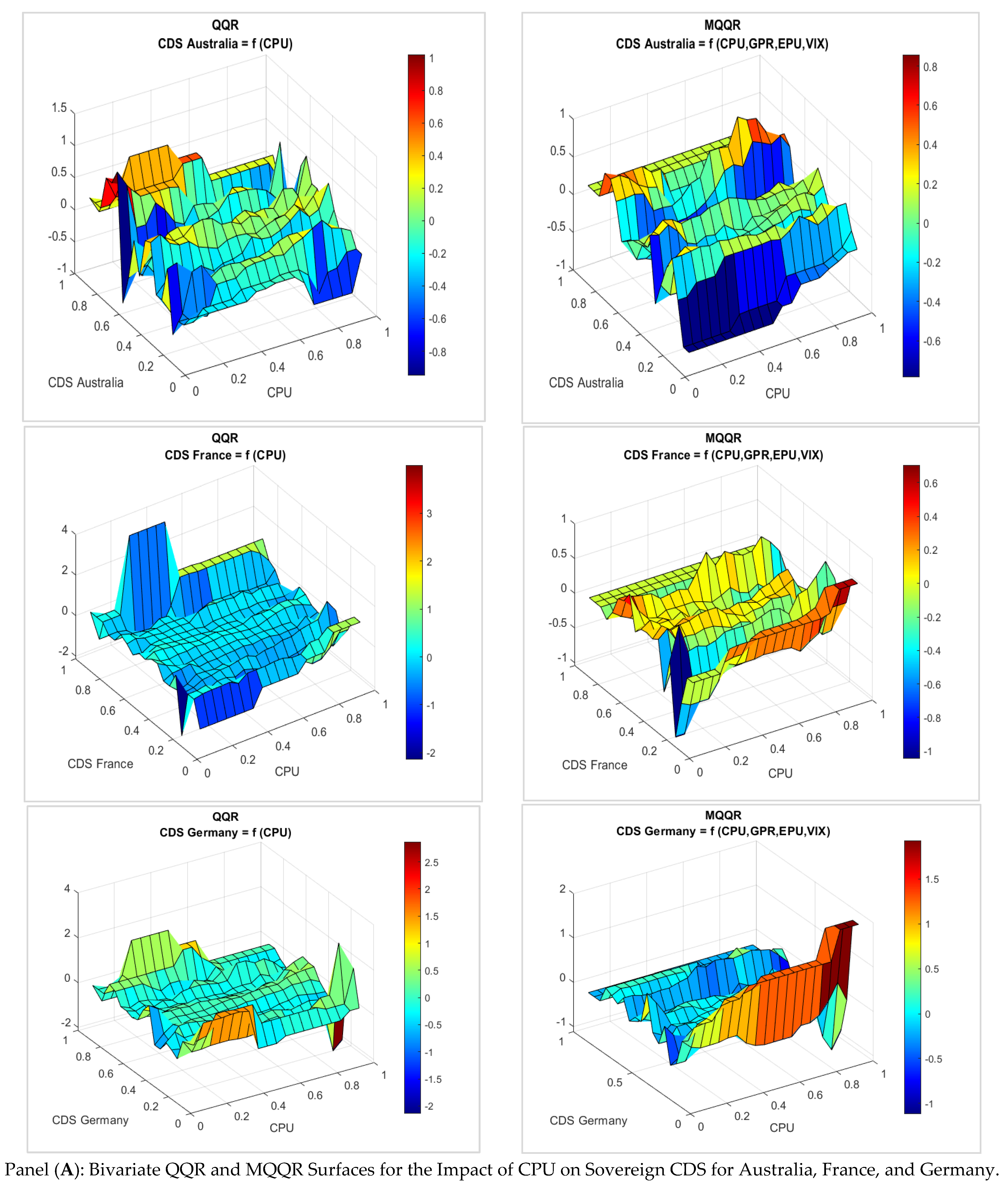

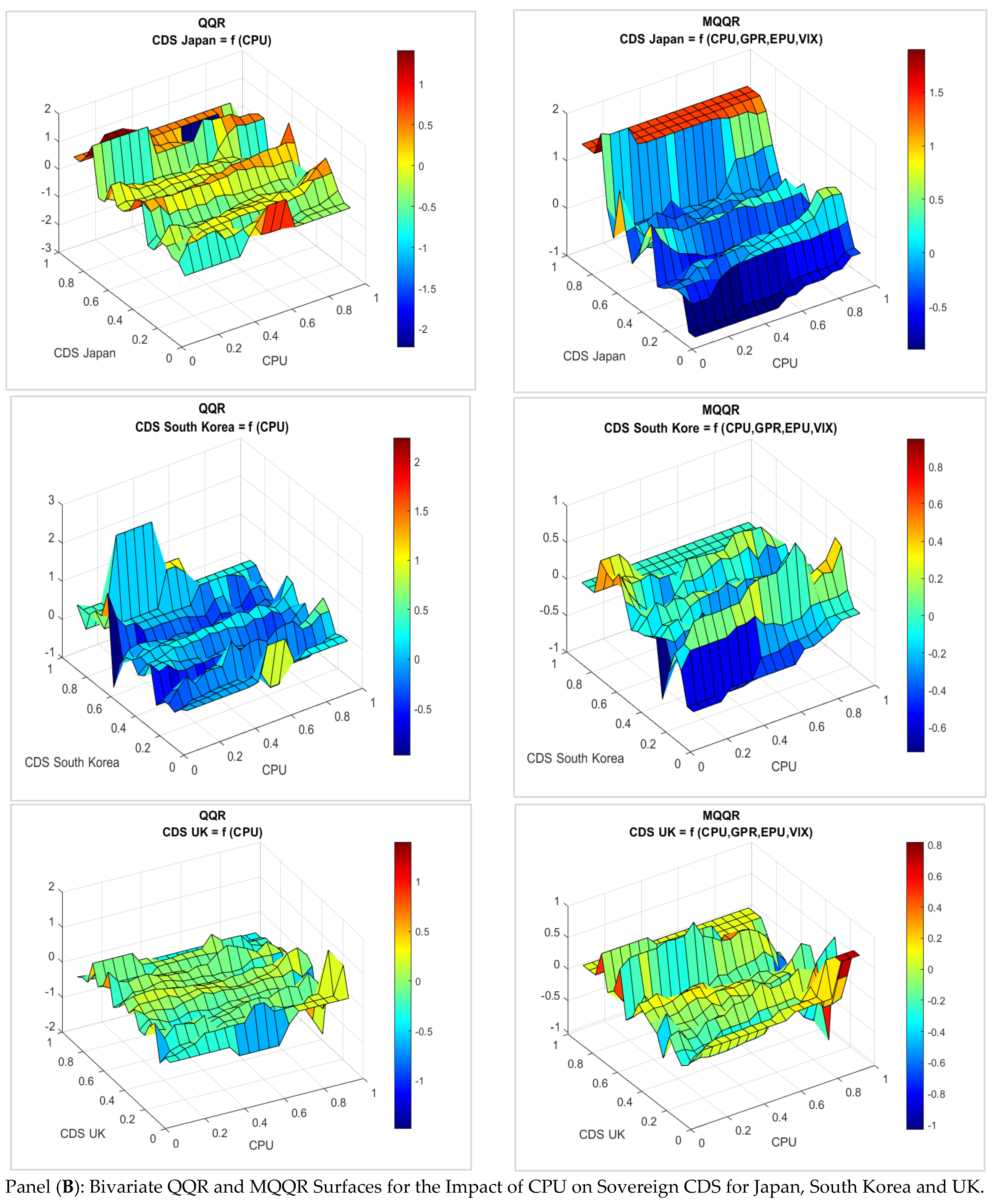

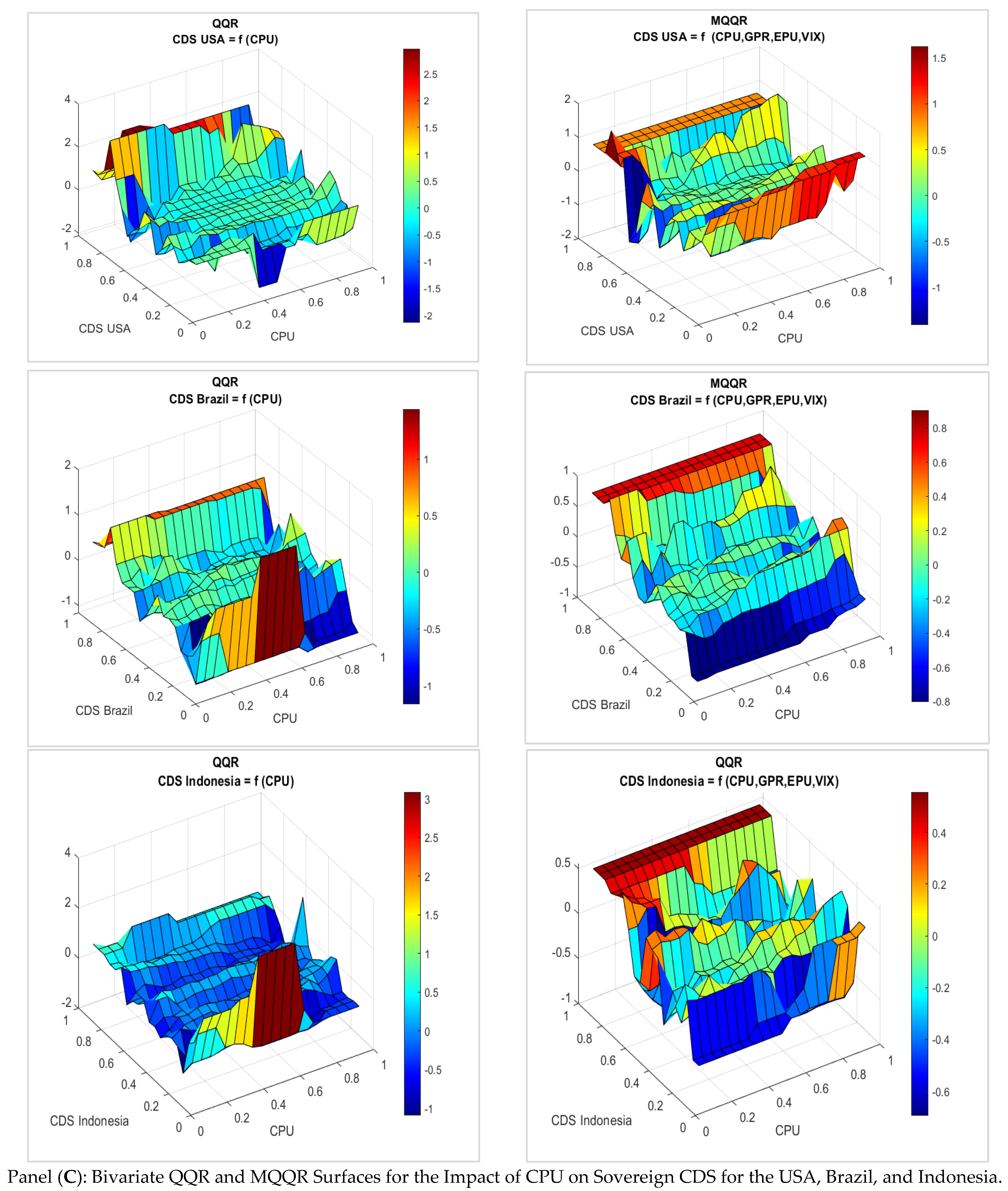

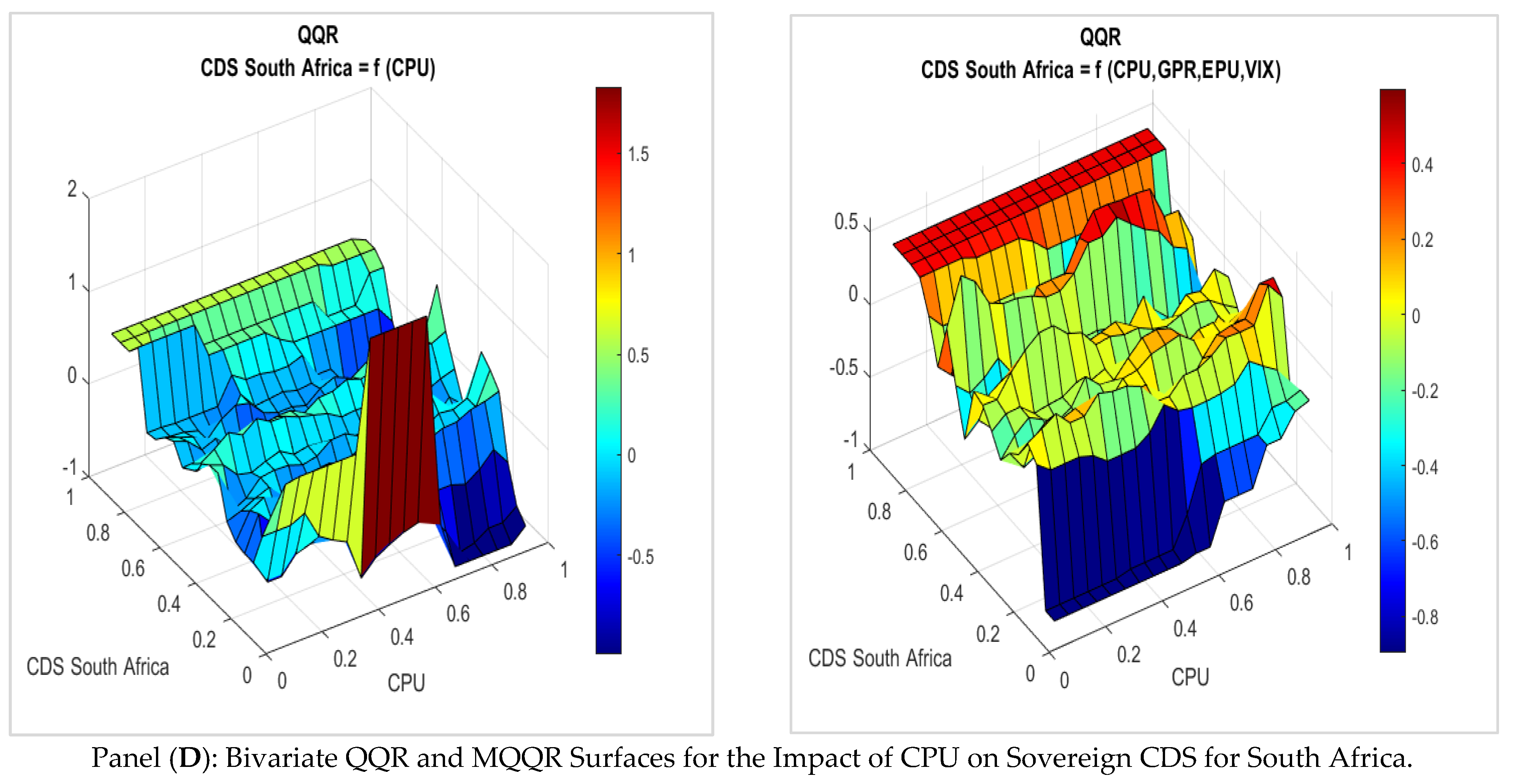

4.2. Multivariate Quantile-on-Quantile Regression

5. Conclusions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| 1 | Our initial dataset included sixteen countries: Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, Mexico, Russia, Saudi Arabia, South Africa, the United Kingdom, and the United States. Following the application of the BDS test for nonlinearity in CDS returns, ten countries exhibited statistically significant nonlinear dynamics. They were retained for further analysis: Australia, France, Germany, Japan, South Korea, the United Kingdom, the United States, Brazil, Indonesia, and South Africa. |

References

- Afonso, António, José Alves, and Sofia Monteiro. 2024. Beyond borders: Assessing the influence of Geopolitical tensions on sovereign risk dynamics. European Journal of Political Economy 83: 102550. [Google Scholar] [CrossRef]

- Aljarba, Shumok, Nader Naifar, and Khalid Almeshal. 2024. Volatility spillovers among sovereign credit default swaps of emerging economies and their determinants. Risks 12: 71. [Google Scholar] [CrossRef]

- Arellano, C. 2008. Default risk and income fluctuations in emerging economies. American Economic Review 98: 690–712. [Google Scholar] [CrossRef]

- Bajaj, Vimmy, Pawan Kumar, and Vipul Kumar Singh. 2023. Systemwide directional connectedness from crude oil to sovereign credit risk. Journal of Commodity Markets 30: 100272. [Google Scholar] [CrossRef]

- Beirne, John, Nuobu Renzhi, and Ulrich Volz. 2021. Feeling the heat: Climate risks and the cost of sovereign borrowing. International Review of Economics & Finance 76: 920–36. [Google Scholar] [CrossRef]

- Blommestein, Hans, Sylvester Eijffinger, and Zongxin Qian. 2016. Regime-Dependent Determinants of Euro Area Sovereign CDS Spreads. Journal of Financial Stability 22: 10–21. [Google Scholar] [CrossRef]

- Boitan, Iustina Alina, and Katarzyna Marchewka-Bartkowiak. 2022. Climate Change and the Pricing of Sovereign Debt: Insights from European Markets. Research in International Business and Finance 62: 101685. [Google Scholar] [CrossRef]

- Boumparis, Periklis, Costas Milas, and Theodore Panagiotidis. 2017. Economic Policy Uncertainty and Sovereign Credit Rating Decisions: Panel Quantile Evidence for the Eurozone. Journal of International Money and Finance 79: 39–71. [Google Scholar] [CrossRef]

- Bratis, Theodoros, Georgios P. Kouretas, Nikolaos T. Laopodis, and Prodromos Vlamis. 2024. Sovereign Credit and Geopolitical Risks during and after the EMU Crisis. International Journal of Finance & Economics 29: 3692–712. [Google Scholar]

- Capasso, Giusy, Gianfranco Gianfrate, and Marco Spinelli. 2020. Climate Change and Credit Risk. Journal of Cleaner Production 266: 121634. [Google Scholar] [CrossRef]

- Choi, Sangyup. 2018. The Impact of US Financial Uncertainty Shocks on Emerging Market Economies: An International Credit Channel. Open Economies Review 29: 89–118. [Google Scholar] [CrossRef]

- Collender, Sierra, Brian Gan, Christos S. Nikitopoulos, Kelly A. Richards, and Laura Ryan. 2023. Climate Transition Risk in Sovereign Bond Markets. Global Finance Journal 57: 100868. [Google Scholar] [CrossRef]

- Demir, Ender, and Gamze Ozturk Danisman. 2021. The Impact of Economic Uncertainty and Geopolitical Risks on Bank Credit. The North American Journal of Economics and Finance 57: 101444. [Google Scholar] [CrossRef]

- Demiralay, Sercan, Samer Kaawach, Enes Kilincarslan, and Andrey Semeyutin. 2024. Geopolitical Tensions and Sovereign Credit Risks. Economics Letters 236: 111609. [Google Scholar] [CrossRef]

- De Wet, Milan Christian. 2023. Geopolitical Risks and Yield Dynamics in the Australian Sovereign Bond Market. Journal of Risk and Financial Management 16: 144. [Google Scholar] [CrossRef]

- Eaton, Jonathan, and Mark Gersovitz. 1981. Debt with Potential Repudiation: Theoretical and Empirical Analysis. The Review of Economic Studies 48: 289–309. [Google Scholar] [CrossRef]

- Galariotis, Emilios C., Panagiota Makrichoriti, and Spyros Spyrou. 2016. Sovereign CDS Spread Determinants and Spill-Over Effects during Financial Crisis: A Panel VAR Approach. Journal of Financial Stability 26: 62–77. [Google Scholar] [CrossRef]

- Gilchrist, Simon, Bin Wei, Vivian Z. Yue, and Egon Zakrajšek. 2022. Sovereign Risk and Financial Risk. Journal of International Economics 136: 103603. [Google Scholar] [CrossRef]

- Guo, Nannan, Shanghui Jia, and Yingke Liu. 2025. Climate Policy Uncertainty and Its Impact on Sovereign Borrowing Costs. Environment, Development and Sustainability, 1–32. [Google Scholar] [CrossRef]

- Huang, Yin-Siang. 2025. When Geopolitical Risks Hit the Supply Chain: Impacts on Credit Default Swap Market. Finance Research Letters 82: 107622. [Google Scholar] [CrossRef]

- Inoguchi, Masahiro. 2025. The Impact of Global Shocks on Sovereign Risk: Role of Domestic Factors. Economic Systems 49: 101277. [Google Scholar] [CrossRef]

- International Monetary Fund. 2023. World Economic Outlook: Navigating Global Divergences (October 2023). International Monetary Fund. Available online: https://www.imf.org/en/Publications/WEO/Issues/2023/10/10/world-economic-outlook-october-2023 (accessed on 4 June 2025).

- Julio, Brandon, and Youngsuk Yook. 2012. Political Uncertainty and Corporate Investment Cycles. The Journal of Finance 67: 45–83. [Google Scholar] [CrossRef]

- Klusak, Patrycja, Madhur Agarwala, Marshall Burke, Moritz Kraemer, and Kamiar Mohaddes. 2023. Rising Temperatures, Falling Ratings: The Effect of Climate Change on Sovereign Creditworthiness. Management Science 69: 7468–91. [Google Scholar] [CrossRef]

- Mallucci, Enrico. 2022. Natural Disasters, Climate Change, and Sovereign Risk. Journal of International Economics 139: 103672. [Google Scholar] [CrossRef]

- Nagy, Olivér, and Gábor Neszveda. 2025. Assessing Geopolitical Risk: Sovereign CDS Insights from the Russo-Ukrainian War. Economic Analysis and Policy 85: 1995–2006. [Google Scholar] [CrossRef]

- Naifar, Nader. 2023. Does climate change affect sovereign credit risk? International evidence. Borsa Istanbul Review 23: S84–S95. [Google Scholar] [CrossRef]

- Naifar, Nader. 2024. Spillover among sovereign credit risk and the role of climate uncertainty. Finance Research Letters 61: 104935. [Google Scholar] [CrossRef]

- Naifar, Nader, and Shumokh Aljarba. 2023. Does Geopolitical Risk Matter for Sovereign Credit Risk? Fresh Evidence from Nonlinear Analysis. Journal of Risk and Financial Management 16: 148. [Google Scholar] [CrossRef]

- Naifar, Nader, Syed Jawad Hussain Shahzad, and Shawkat Hammoudeh. 2020. Dynamic Nonlinear Impacts of Oil Price Returns and Financial Uncertainties on Credit Risks of Oil-Exporting Countries. Energy Economics 88: 104747. [Google Scholar] [CrossRef]

- Pan, Wei-Fong, Xun Wang, Guojun Wu, and Wei Xu. 2021. The COVID-19 Pandemic and Sovereign Credit Risk. China Finance Review International 11: 287–301. [Google Scholar] [CrossRef]

- Pan, Wei-Fong, Xun Wang, Yidan Xiao, Wei Xu, and Jian Zhang. 2024. The Effect of Economic and Political Uncertainty on Sovereign CDS Spreads. International Review of Economics & Finance 89: 143–55. [Google Scholar]

- Pástor, Ľuboš, and Pietro Veronesi. 2013. Political Uncertainty and Risk Premia. Journal of Financial Economics 110: 520–45. [Google Scholar] [CrossRef]

- Ramírez-Rondán, Nelson R., Renato M. Rojas-Rojas, and Julio A. Villavicencio. 2023. Political Institutions, Economic Uncertainty and Sovereign Credit Ratings. Finance Research Letters 53: 103656. [Google Scholar] [CrossRef]

- Sarwar, Ghulam, and Walayet Khan. 2017. The Effect of US Stock Market Uncertainty on Emerging Market Returns. Emerging Markets Finance and Trade 53: 1796–811. [Google Scholar] [CrossRef]

- Smales, Lee A. 2022. Spreading the Fear: The Central Role of CBOE VIX in Global Stock Market Uncertainty. Global Finance Journal 51: 100679. [Google Scholar] [CrossRef]

- Stolbov, Mikhail. 2017. Determinants of Sovereign Credit Risk: The Case of Russia. Post-Communist Economies 29: 51–70. [Google Scholar] [CrossRef]

- Subramaniam, Sowmya. 2022. Geopolitical Uncertainty and Sovereign Bond Yields of BRICS Economies. Studies in Economics and Finance 39: 311–30. [Google Scholar] [CrossRef]

- Sun, Xiaolei, Yifan Shen, Kaixin Guo, and Qiang Ji. 2023. Sovereign Ratings Change under Climate Risks. Research in International Business and Finance 66: 102040. [Google Scholar] [CrossRef]

- Tekin, Bilgehan. 2025. Do Economic Uncertainty and Political Risk Steer CDS Dynamics? An Analysis of the Türkiye CDS. International Journal of Islamic and Middle Eastern Finance and Management 18: 249–70. [Google Scholar] [CrossRef]

- Yang, Lu, and Shigeyuki Hamori. 2023. Modeling the Global Sovereign Credit Network under Climate Change. International Review of Financial Analysis 87: 102618. [Google Scholar] [CrossRef]

- Zenios, Stavros A. 2022. The Risks from Climate Change to Sovereign Debt. Climatic Change 172: 30. [Google Scholar] [CrossRef]

| Australia | France | Germany | Japan | South Korea | UK | USA | |

|---|---|---|---|---|---|---|---|

| Mean | −0.007 | −0.002 | −0.006 | −0.008 | −0.006 | −0.008 | 0.001 |

| Median | −0.003 | −0.001 | −0.024 | −0.01 | −0.021 | −0.017 | −0.003 |

| Min | −0.462 | −0.507 | −0.717 | −0.429 | −0.451 | −0.611 | −0.541 |

| Max | 0.515 | 0.753 | 0.787 | 0.555 | 0.581 | 0.82 | 0.832 |

| Std_Dev | 0.143 | 0.165 | 0.163 | 0.142 | 0.154 | 0.161 | 0.204 |

| Skewness | 0.396 | 0.73 | 0.778 | 0.382 | 0.418 | 1.054 | 1.052 |

| Kurtosis | 4.536 | 6.018 | 8.315 | 4.266 | 4.071 | 9.169 | 6.87 |

| Jarque_Bera | 22.524 *** | 84.773 *** | 231.276 *** | 16.475 *** | 13.93 *** | 320.53 *** | 146.332 *** |

| Brazil | Indonesia | South Africa | CPU | GPR | EPU | VIX | |

| Mean | 0.002 | −0.003 | 0.002 | 0.012 | 0.004 | 0.009 | 0.001 |

| Median | −0.009 | −0.011 | 0.002 | −0.008 | −0.009 | −0.001 | −0.009 |

| Min | −0.309 | −0.487 | −0.242 | −0.944 | −0.6 | −0.5 | −0.614 |

| Max | 0.676 | 0.797 | 0.647 | 1.233 | 0.696 | 0.628 | 0.853 |

| Std_Dev | 0.141 | 0.163 | 0.125 | 0.366 | 0.203 | 0.18 | 0.238 |

| Skewness | 0.84 | 0.784 | 0.818 | 0.094 | 0.448 | 0.378 | 0.306 |

| Kurtosis | 5.072 | 6.035 | 5.78 | 3.213 | 4.176 | 4.083 | 3.657 |

| Jarque_Bera | 53.644 *** | 88.027 *** | 78.477 *** | 0.61 | 16.495 *** | 13.162 *** | 6.08 ** |

| Australia | France | Germany | Japan | South Korea | UK | USA | |

|---|---|---|---|---|---|---|---|

| M2 | 2.8389 *** | 4.0052 *** | 3.0982 *** | 3.0031 *** | 3.1542 *** | 1.8368 * | 2.747 *** |

| M3 | 3.5574 *** | 4.3108 *** | 3.6419 *** | 2.853 *** | 3.4137 *** | 1.8813 * | 2.6168 *** |

| M4 | 3.4454 *** | 4.3246 *** | 3.6858 *** | 3.3994 *** | 3.7681 *** | 2.1246 ** | 2.606 *** |

| M5 | 3.3793 *** | 4.1365 *** | 3.4465 *** | 3.2688 *** | 3.6561 *** | 1.9652 ** | 2.5566 ** |

| M6 | 3.1959 *** | 3.9491 *** | 3.2794 *** | 3.0761 *** | 3.8943 *** | 2.1738 ** | 2.3485 ** |

| Brazil | Indonesia | South Africa | CPU | GPR | EPU | VIX | |

| M2 | 1.9366 * | 3.4551 *** | 2.8046 *** | 3.9663 *** | 2.6965 *** | 1.2001 | 6.5066 *** |

| M3 | 2.1715 ** | 4.0212 *** | 3.6088 *** | 3.8913 *** | 2.7102 *** | 1.6935 * | 6.6413 *** |

| M4 | 1.8147 * | 3.9345 *** | 3.344 *** | 3.9721 *** | 2.6063 *** | 1.8022 * | 6.8474 *** |

| M5 | 1.491 | 3.9036 *** | 2.8865 *** | 3.4972 *** | 2.6753 *** | 1.6439 | 6.5223 *** |

| M6 | 2.099 ** | 3.7814 *** | 2.8933 *** | 3.1047 *** | 2.8727 *** | 1.3255 | 6.1866 *** |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Naifar, N. Climate Policy Uncertainty and Sovereign Credit Risk: A Multivariate Quantile on Quantile Regression Analysis. Risks 2025, 13, 181. https://doi.org/10.3390/risks13090181

Naifar N. Climate Policy Uncertainty and Sovereign Credit Risk: A Multivariate Quantile on Quantile Regression Analysis. Risks. 2025; 13(9):181. https://doi.org/10.3390/risks13090181

Chicago/Turabian StyleNaifar, Nader. 2025. "Climate Policy Uncertainty and Sovereign Credit Risk: A Multivariate Quantile on Quantile Regression Analysis" Risks 13, no. 9: 181. https://doi.org/10.3390/risks13090181

APA StyleNaifar, N. (2025). Climate Policy Uncertainty and Sovereign Credit Risk: A Multivariate Quantile on Quantile Regression Analysis. Risks, 13(9), 181. https://doi.org/10.3390/risks13090181