Abstract

The global aviation sector underwent an unprecedented shock due to the COVID-19 pandemic, severely disrupting the passenger flows, flight operations, and revenues of Polish airports. In response, the government launched protective measures under the Anti-Crisis Shield and the COVID-19 Counteraction Fund. This study examines the financial impact of such public support on 12 Polish airports between 2016 and 2022, applying a two-step cointegration ECM framework with Driscoll–Kraay inference. Profitability (ROA, ROE, OM), liquidity, debt, and operational activity indicators were analysed, with particular attention to methodological distortions arising from including subsidies in operating revenues. The results indicate a material decline in profitability from 2020 to 2022, albeit with pronounced heterogeneity across airports. Larger hubs (Warsaw–Chopin, Kraków, Gdansk, Katowice, Poznan, and Wroclaw) demonstrated relative resilience, while many smaller, regionally owned airports (e.g., Bydgoszcz, Lodz, Lublin, Olsztyn-Mazury, Zielona Gora) remained structurally unprofitable despite substantial subsidies. In several cases, profitability, liquidity, and operating activity recovered by 2021–2022, yet the improvement was not uniform: for fiscally dependent airports, transfers merely masked persistent inefficiencies. Passenger volumes, flight operations, and employment emerged as the primary performance drivers, while capital expenditure, turnover of current assets, and liquidity were particularly relevant for ROE. The novelty of this research lies in disentangling the stabilising effect of subsidies from underlying profitability, revealing how non-market revenues distort standard performance metrics and accelerate short-run adjustment dynamics once netted out. The findings demonstrate asymmetric impacts of state aid across ownership structures, i.e., central state control at Warsaw versus regional self-government involvement elsewhere, and highlight structural inefficiencies that weaken systemic resilience. These insights underline the importance of subsidy-adjusted financial indicators, more selective allocation of support, and reporting standards that separate operating from non-market revenues to enhance resilience and ensure sustainable airport operations.

1. Introduction

The global air transport sector experienced an unparalleled shock in the form of the COVID-19 pandemic, which precipitated one of the most profound disruptions in the history of civil aviation. Airports across the globe experienced a significant decline in passenger volumes, with traffic decreasing by approximately 60% in 2020. This decline led to a substantial decrease in revenues and raised fundamental concerns about the industry’s viability (Lioutov 2020). By the close of 2021, airport revenue losses had escalated to above USD 108 billion, signifying a 54% decrease compared to pre-existing expectations and a 47% overall decline relative to the 2019 baseline levels (ACI World 2021b). Projections by some forecasters anticipated even more substantial financial obligations, with revenue deficits anticipated to exceed USD 111 billion, as traffic remained at only half of pre-pandemic levels (ACI World 2021a). The repercussions of the pandemic were manifold, with the threat to 46 million aviation-dependent jobs and the imposition of USD 630 billion in tourism-related GDP losses being of particular note (Airlines 2021). This illustrates the ripple effects across airports and their surrounding economies. In the context of the prevailing global turbulence, the financial ramifications of the novel Coronavirus (SARS-CoV-2) on aerodromes are of pertinence that transcends any individual case study, thereby imparting insights of extensive applicability to the aviation industry in its entirety.

The COVID-19 pandemic has caused an unprecedented crisis in the global aviation sector, forcing critical infrastructure operators, including airports, to respond quickly to radical restrictions on operations and declines in revenue. These disruptions have hit Polish regional airports particularly hard, as they have not only had to cope with a sudden drop in passenger numbers and flight operations, but also with challenges in terms of financial liquidity, fixed cost structures and the risk of losing their operational capacity. Significant systemic risks also emerged: the risk of long-term loss of market share, the risk of insufficient compensation from public funds, and the risk of inefficient allocation of aid. From a management perspective, airports also had to deal with uncertainty about the duration of restrictions and regulatory risk resulting from inconsistent government actions at the national and European levels.

In response to this situation, the Polish government introduced several protective measures as part of the so-called Anti-Crisis Shield, including the COVID-19 Counteraction Fund, aimed at stabilising the functioning of critical infrastructure. However, the effectiveness and long-term impact of these measures on the financial situation of Polish airports remains a subject of analysis and discussion, especially in the context of potential asymmetric effects and the risk of dependence on public support.

This article attempts to assess the impact of state support granted to critical infrastructure operators in Poland, with a particular focus on airports, on their financial performance in 2016–2022. The analysis covers 12 airports of various sizes and ownership structure dominated by public sector entities (self-government units and the state), based on financial and operational data and information on public support. Both profitability and liquidity ratios, debt and operating activity were considered. The panel approach allows for an analysis of the diversity of effects between airports and control of operator-specific effects. The analysis also takes into account the risk of endogeneity of some financial variables and methodological risks related to the construction of indicators that include subsidies as a component of revenue.

In the context of existing research (Abbruzzo et al. 2016; Dube et al. 2021; Graham et al. 2020), there is a need for an in-depth analysis of the diversity of airports’ financial resilience to systemic crises, particularly in light of differences in the scale of operations, business models and ownership structure. Previous studies have often been limited to a general assessment of the impact of the pandemic on the financial performance of the aviation sector, ignoring the importance of financial support as a moderating factor influencing profitability and as an element that acts asymmetrically depending on the size of the airport. Few studies only have thoroughly examined the role of public financial support as a moderating variable influencing these outcomes. For example, Martín-Domingo and Martín (2022) analysed EUR 31 billion in COVID-19-related state aid to EU airlines yet do not consider airport-level differences in subsidy effects. Similarly, research exploring investors’ perspectives found widespread resilience challenges (such as falling credit ratings) across airports following the pandemic onset (Vogel 2020). Janić (2022) develops a methodology to assess airport resilience, robustness, and vulnerability amid COVID-19 disruptions, but focuses exclusively on large international hubs (e.g., Heathrow and JFK), limiting generalisability across airport types. Finally, a study on small and medium-sized airports in China evaluates subsidy efficiency but does not address asymmetric impacts or structural inefficiencies (Song et al. 2025).

This study thus aims to fill the gap by conducting a granular, airport-level analysis, explicitly comparing profitability indicators that include and exclude COVID-19 subsidies. This enables us to test not only whether public support improved financial performance in 2021–2022, but also to uncover the complex mechanisms that drive differential effectiveness of aid, especially where persistent losses, despite subsidies, may indicate structural inefficiency or misaligned aid distribution. Accordingly, this article formulates the following research questions:

Q1: Did public financial support contribute to improving the operating profitability of Polish airports after the COVID-19 pandemic, and if so, to what extent?

Q2: Does the use of generalised financial indicators (e.g., EBIT, operating margin) risk overinterpreting results, particularly when these include subsidies as part of revenue?

Q3: Do deviations of airport profitability indicators from the long-run equilibrium undergo short-run correction, and if so, do COVID-19 subsidies modify the speed of this adjustment?

The provision of public support to airports can be interpreted through several established theoretical perspectives. Fiscal federalism theory suggests that government interventions aim to stabilise essential public services and infrastructure during economic shocks, ensuring continuity in sectors with broad societal impact (Jha 2013). Moral hazard theory highlights that financial assistance may alter organisational behaviour by reducing the immediate consequences of operational risks, which can influence strategic decision-making and risk-taking (Dionne et al. 1997). Finally, resource dependence theory emphasises that organisations rely on external resources, such as government grants, to maintain financial stability and operational resilience (Hillman et al. 2009; Lapçın and Taşcı 2024). Together, these frameworks provide a robust foundation for understanding how public subsidies during the COVID-19 pandemic contributed to the financial resilience of airports, partially offsetting the severe decline in revenues and profitability.

Demonstrating the impact of COVID-19 on the financial performance of airports is of considerable importance for several reasons. Firstly, the pandemic represented an unprecedented exogenous shock to the aviation sector, leading to a dramatic decline in air traffic volumes worldwide. Airports, whose revenue streams are predominantly dependent on passenger flows and aircraft operations, experienced an enormous collapse in income. Secondly, an in-depth assessment of the financial consequences provides justification for the extraordinary managerial and regulatory measures adopted during the pandemic, such as state aid packages, financial relief schemes, and temporary regulatory adjustments. This evidence is also critical in advocating for the development of resilience mechanisms to safeguard the sector against future disruptions. Thirdly, for investors, creditors, and other stakeholders, airports constitute strategic infrastructure with long-term economic and social significance. By quantifying the financial impact of COVID-19, one can more accurately assess investment risk, financial sustainability, and the long-term viability of airport operations. Fourthly, the pandemic exposed the vulnerability of airport business models to global mobility restrictions. The analysis of financial outcomes therefore provides essential insights for improving risk management strategies, particularly in terms of revenue diversification and cost flexibility. Finally, given the role of airports as regional economic hubs, their financial distress has had substantial spillover effects on local economies, including tourism, commerce, and transport services. Demonstrating the pandemic’s impact thus helps to contextualise the broader macroeconomic implications of the aviation crisis.

In sum, the examination of COVID-19 financial impact on airports goes beyond documenting temporary losses. It enables a deeper understanding of the structural vulnerabilities revealed by the crisis and supports evidence-based policymaking aimed at strengthening the resilience of the aviation sector in the long term.

To achieve the research objective, an empirical analysis of panel data covering the period from 2016 to 2022 for 12 Polish airports was conducted. The study draws on a set of financial indicators (profitability, liquidity, leverage, operating activity, and capital expenditure) and variables describing the scale of operations (number of passengers, number of operations, and employment). The model employs econometric methods based on fixed effects to account for airport-specific heterogeneity and potential nonlinearities associated with the pandemic period. A dummy for the COVID-19 years (2020–2022) is included to gauge the direct impact of the pandemic on financial outcomes. Methodologically, we adopt a two-step ECM/ARDL framework: first, we establish the order of integration for all series and verify panel cointegration between profitability measures and their regressors; second, conditional on cointegration, we estimate long-run relations in levels with airport fixed effects and short-run equations in first differences augmented by an error correction term. Inference in the short-run equations is based on Driscoll–Kraay standard errors, which are robust to heteroskedasticity, serial correlation, and cross-sectional dependence features that are likely present in short annual panels exposed to standard shocks, such as COVID-19.

The article is structured as follows: Section 2 provides an overview of the literature on airport financial performance and the pandemic’s impact on the aviation sector. Section 3 describes the data and sources of information used, as well as the empirical methodology. Section 4 presents the results of the model estimates and their interpretation. Section 5 concludes the article by discussing the main findings, the study’s limitations, and directions for further analysis.

2. Literature Review

Research on airport financial performance focuses primarily on the analysis of operational efficiency, scale of operations and cost structure (Bazargan and Vasigh 2003; Bezerra and Gomes 2016; Wang and Song 2020). The traditional approach mainly analyses profitability from core activities, resource utilisation ratios and the ratio of fixed costs to revenues. However, dynamic changes in the environment, and particularly the COVID-19 pandemic, have forced the research perspective to be broadened to include issues of financial resilience and risk management in conditions of extreme disruption.

Therefore, the literature is paying increasing attention to the analysis of systemic, operational and financial risks in the aviation sector. The COVID-19 pandemic has revealed the insufficient preparedness of many airports for exogenous shocks, as highlighted by (Graham et al. 2020; IATA and McKinsey & Company 2022; Serrano and Kazda 2021). Recent studies also introduce more complex approaches to resilience assessment, such as the Global Airport Resilience Index developed in 2024, which classifies airports based on their preparedness for disruptions related to pandemics, climate change, infrastructure disruptions and geopolitical risks (Wandelt et al. 2025). The recent literature shows that airports face growing pressures from uneven recovery, financial vulnerability, and external shocks, with smaller airports particularly at risk. Resilience depends on diversification, digitalisation, sustainability, and stronger stakeholder collaboration, yet existing models do not fully address volatile, uncertain, complex, ambiguous conditions. Overall, studies highlight the need for agile, airport-specific frameworks to manage ongoing uncertainty (Hiney et al. 2025). Recent policy-oriented analyses have also emphasised resilience in the post-pandemic recovery of the aviation sector. For example, (International Civil Aviation Organization 2023) highlights the importance of diversified revenue streams, digitalization, and coordinated policy responses to enhance airport resilience under volatile demand conditions.

In the context of Central and Eastern Europe, the work (Novák et al. 2024) shows that smaller airports are much more vulnerable to liquidity risks and structural inefficiencies in times of crisis. This article, based on an analysis of 24 airports in Poland and neighbouring countries, indicates that the effectiveness of public support varies greatly and depends on local ownership and organisational conditions. These findings confirm earlier observations on the effect of scale and the role of operating reserves as a risk buffer (Abbruzzo et al. 2016; Painvin 2011). The broader concept of transport resilience has also been examined. The International Transport Forum (2024) identifies key mechanisms such as redundancy, adaptability, and coordinated policy responses that enable transport systems, including airports, to recover from disruptions effectively.

At the same time, new literature draws attention to the risk of wrong investment decisions in conditions of high uncertainty. An example is the real options model presented in the work of (Li et al. 2025) which is used to plan airport infrastructure expansion in the face of volatile demand and crises such as pandemics. This article warns against the consequences of excessive expansion in the face of prolonged declines in demand and points to the need for flexible investment strategies.

Both recent empirical research and conceptual work also point to the risk of inconsistency and asymmetry in the allocation of public funds. State aid, although necessary in the first months of the pandemic, may lead to distortions of competition, moral hazard and the artificial maintenance of unprofitable entities (Colak et al. 2023; Guzman and Hessel 2022; Lucas 2020). An example of this type of controversy is the difference in the level of support between large and small ports in Poland, which has been the subject of public debate and analysis of EU case law (Court of Justice of the EU 2023).

Another critical issue, often overlooked in older literature, is the methodological risk associated with the construction of financial indicators in the context of public intervention. In 2020–2021, many airports based their operations on state subsidies, which were included as part of EBIT or OM. The literature (Graham 2009; Iyer and Jain 2019; Raghavan and Yu 2021) point out that failure to adjust such indicators for non-market revenues may lead to overinterpretation of results, overstatement of management performance and misjudgement of risk. New approaches propose dynamic approaches (Ammoury and Salman 2024) which separate sources of operating income from fiscal transfers and one-off interventions.

Financial performance indicators are commonly employed in the literature to evaluate the efficiency, stability, and resilience of airports, especially in the context of external shocks such as the COVID-19 pandemic. These indicators allow for standardised comparisons across entities and time, while also capturing different dimensions of financial health. For example, profitability ratios (such as return on assets and operating margin) measure the ability of airports to generate earnings from their asset base and core operations (Graham 2009; Halpern and Graham 2015). Liquidity measures (such as the current ratio and quick ratio) reflect the capacity of airports to meet short-term obligations, which became particularly important during the sudden revenue collapse caused by the pandemic (ACI World 2021c). Efficiency indicators, including asset turnover, assess how effectively airports utilise their resources to generate revenues (Barrett 2000). Finally, solvency and leverage measures (such as the debt-to-equity ratio) provide insights into long-term financial sustainability and exposure to structural risks (Doganis 2019).

The selection of these indicators is justified by their widespread use in both corporate finance and airport management research, as they provide a multidimensional view of financial performance. By applying these established measures, the study not only aligns with prior literature but also ensures that the analysis of Polish regional airports during COVID-19 can be meaningfully compared with findings from international contexts.

The COVID-19 pandemic has profoundly disrupted the aviation industry, exposing the financial vulnerability of airports and highlighting the importance of external support mechanisms in sustaining their operations. Airports, as critical infrastructure, faced unprecedented declines in passenger traffic, which directly translated into reduced revenues and deteriorating profitability. To mitigate these effects, public subsidies were widely introduced, yet their role in shaping financial performance remains a matter of debate. While such support helped to cushion the immediate impact of the crisis, it also raises important questions regarding the accuracy of profitability assessments when subsidies are included in operating results. Moreover, the pandemic has demonstrated that airport financial performance cannot be evaluated solely on the basis of traditional profitability indicators. The resilience of airports is influenced by multiple external risk factors such as fluctuations in demand, climate-related challenges, or geopolitical instability as well as internal factors, including organisational structures, employment levels, and investment policies (Hiney et al. 2025). These multidimensional risks determine not only the short-term outcomes but also the long-term sustainability of airport business models.

Against this backdrop, it is necessary to test whether and how public support affected airport profitability and whether the inclusion of subsidies in standard financial ratios may lead to a distorted picture of operational efficiency. Accordingly, the following research hypotheses are proposed:

H1.

The impact of public support on operating profitability was varied and strongly dependent on the scale of operations (number of passengers) and the level of employment.

H2.

Including subsidies as part of EBIT may overstate the assessment of operational efficiency and obscure the actual underlying profitability of airports, especially in small regional airports.

H3.

For the profitability indicators ROA, ROE, and OM, an operative error correction mechanism is present: the adjustment coefficient is negative and statistically significant, and the half-life of deviations from the long-run equilibrium does not exceed one year. Moreover, COVID-19-related subsidies accelerate the speed of reversion, as evidenced by a stronger adjustment mechanism in subsidy-adjusted specifications compared to unadjusted ones.

3. Data and Methodology

During the period analysed, 2016–2022, there were 15 operators of critical infrastructure (airports) in Poland with different passenger traffic volumes and, therefore, different financial performance. Our analysis includes 12 airports. Three airports were excluded from the study, namely Warsaw Radom Airport, which did not operate during the analysis period, and Olsztyn and Zielona Gora airports, which did not provide their financial statements. For our analysis, a database was created containing airport financial performance, passenger traffic data, and data on the type and amount of government financial support to the airport concerning the COVID-19 pandemic. Data was obtained from the financial statements of the airports analysed and from the Ministry of Infrastructure.

For the study, Polish operators of infrastructure can be divided into four groups according to the Airport Council International (ACI) classification (Table 1).

Table 1.

Classification of Polish airports (air traffic in 2022) according to ACI guidelines.

According to the ACI classification, Warsaw Chopin Airport held the largest share of the Polish aviation market in 2019, handling more than 18 million passengers. The airport is classified as Group II. Group III included the major regional airports of Krakow and Gdansk, which handled 8.4 and 5.3 million passengers, respectively. The remaining airports, which handled fewer than five million passengers, were classified in Group IV. In 2020, the number of passengers at Polish airports decreased by 70% compared to the previous year, and the number of flight movements fell by 61%. In April and May of that year, there were only 95 flight movements carrying 1200 passengers. In 2021, air traffic in Poland increased by 35.1% compared to 2020, though it remained 59.9% lower than in 2019 (CAA in Poland 2023).

In 2022, Polish airports handled 41 million passengers, which is 21 million more than in 2021 (a 109% increase). This indicates that air traffic has recovered to 84% of its 2019 level. Based on this data, Polish airports can be divided into three groups. The first group includes Chopin Airport in Warsaw, which is located in central Poland. It is a typical Polish hub airport that primarily serves business travellers. Most passengers travelling through Warsaw Chopin flew to major European hubs and transcontinental destinations, such as the United States. About 10% used domestic connections. According to data from the end of January 2023, Chopin Airport Warsaw is a state-owned company. The second group (ACI Group III) includes Krakow Airport, which had 7.4 million passengers. Gdansk Airport, on the other hand, fell into Group IV with 4.6 million passengers. Katowice Airport handled over four million passengers, while Modlin Airport in Warsaw handled 3.1 million. Wroclaw and Poznan airports had more than two million passengers each. The remaining seven airports did not exceed one million passengers (see Table 2).

Table 2.

Air traffic in passengers (in 10 thousands) in Poland (2016–2022) and forecast (F) until 2040.

The Polish Civil Aviation Authority (CAA) expects air traffic to reach 100 million passengers by 2040. However, the business structure of the airlines will remain the same. Currently, Warsaw Chopin Airport provides the majority of air services, including connections, destinations, and movements. Warsaw Chopin Airport is a hub for LOT Polish Airlines. Low-cost carriers (Wizz and Norwegian) have a small share of the market at Warsaw Chopin Airport—18% in 2022. In the Warsaw metropolitan area, there is Warsaw Modlin Airport, where Ryanair is the sole operator. LCCs dominate the remaining regional airports, while legacy carriers are in the vast minority. They offer domestic connections to Warsaw and between large agglomerations (e.g., Gdansk and Krakow) as well as connections to major European hubs (e.g., Munich, Frankfurt, and Amsterdam).

The formal and legal structure of regional airports stems from the various regional, city, and company stakeholders involved in airport ownership. This gives regions influence over decisions regarding airport development and financial policy approval. While these airports operate within an intra-industry competitive framework in air transport, it is important to note that the Polish Airports Enterprise (PPL) Business Group, which manages Warsaw and Zielona Gora airports, influences the management and financial policies of many regional airports. The most notable intensification of competitive processes occurs in the Warsaw metropolitan area, where traditional and low-cost air traffic are clearly divided. Similar examples can be found in other European metropolitan areas, such as Milan-Bergamo, Brussels-Charleroi, London-Heathrow, London-Luton, and London-Stansted. The distribution of traffic and the management capacity chosen by airport owners impacts financial decisions and, consequently, the financial results of airports.

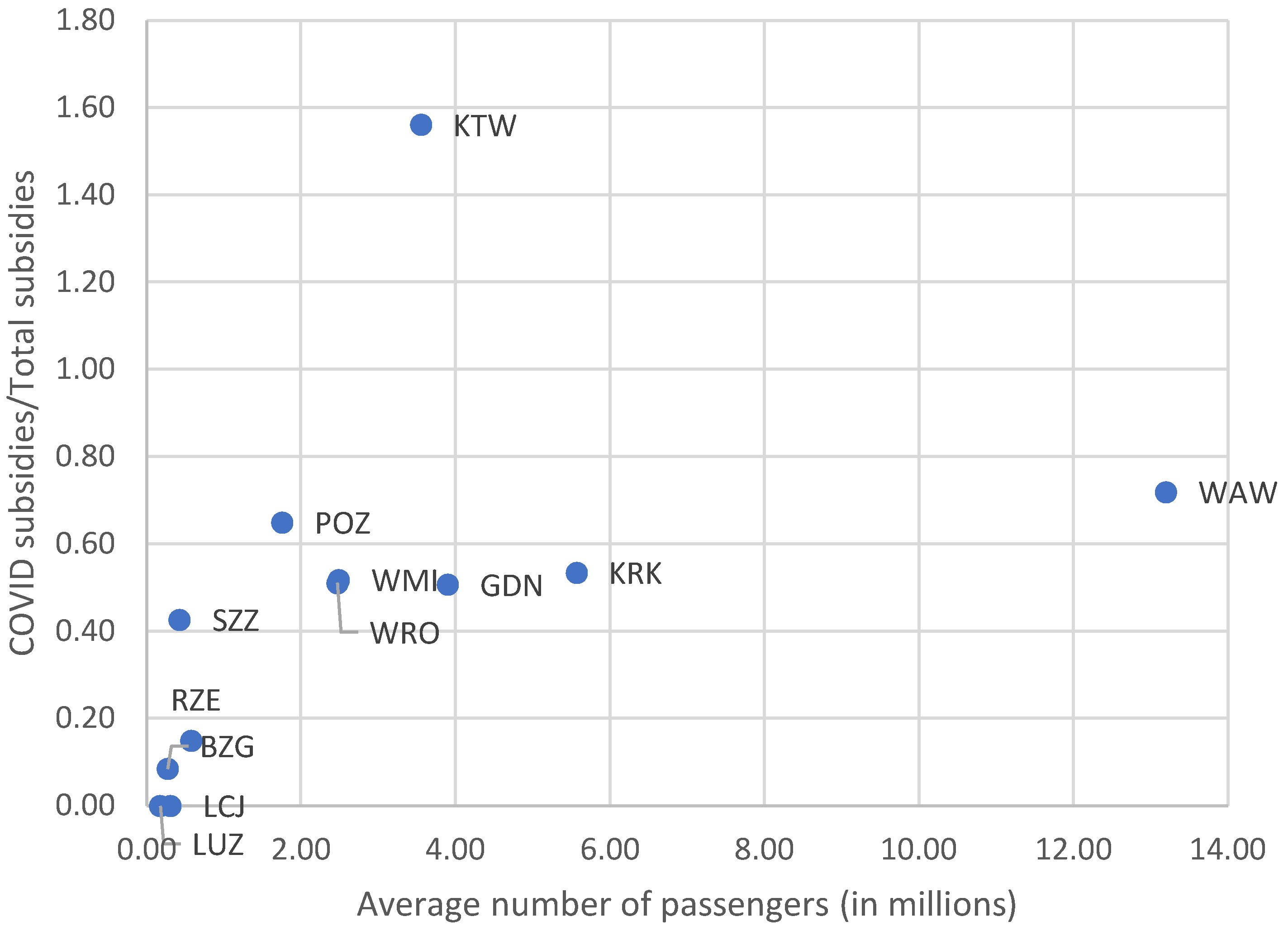

To assess the change in the financial situation of Polish airports resulting from pandemic-related restrictions on their operations, we analysed their financial performance in the period before and after the COVID-19 pandemic. The data required for the analysis were taken from the airports’ financial statements for the years 2016–2022, as published by the Ministry of Justice (2023). The financial data for the year 2023 was not yet available at the time of the analysis. The analysis indicates that the scale of passenger traffic did not directly determine the level of support received under COVID-19 assistance programs. Figure 1 depicts the relationship between the share of COVID-related funds in the total value of grants obtained by individual airports and the average number of passengers over the entire study period (2016–2022). The association is clearly non-linear and heterogeneous across airports. Alongside units with relatively high traffic intensity, we observe airports with above-average shares of support, as well as cases with the opposite. This suggests that the allocation of funds was driven not only by traffic volume but also by other factors (e.g., revenue structure, financial condition, and the eligibility criteria of the aid schemes). Among the airports analysed, Warsaw Chopin (WAW) recorded the highest average passenger numbers, whereas Katowice (KTW), despite a comparatively smaller scale of traffic, exhibited the highest share of COVID-19-related funding in total grants, further corroborating the non-linear nature of this relationship.

Figure 1.

Scatter plot of the number of passengers and COVID-19 subsidies in Poland (2016–2022). Source: own calculation.

Based on the collected financial data, the profitability ratios of the airports analysed were calculated. The analysis of the profitability of the company is considered the most important of the analyses, as it shows whether the functioning of the company is profitable from the point of view of the owners (Davies and Crawford 2014). There are many profitability indicators, but due to the large number of companies analysed and the multi-year scope of the analysis, it is not possible to present the results of the calculations for many indicators. Given the research problem formulated in our study, two selected ratios, the gross margin ratio (gross profit margin ratio) and the operating ratio, are presented below (Table 3). These two ratios are fundamental indicators of the profitability of a given industry, showing the result from its core activity that a company achieves under specific operating conditions (economic situation in a given industry, level of competition, etc.) (Vernimmen et al. 2018). The operating margin is calculated by dividing a company’s operating profit (EBIT, earnings before interest and tax) by its net turnover (net sales). To eliminate the impact of subsidies received by some airports on the profitability of companies, we have calculated the gross margin ratio, which compares a company’s gross margin (revenue less cost of goods sold) to its revenue. High and rising values of these ratios indicate effective management and the maintenance of low operating costs while generating income from core activities.

Table 3.

Gross margin and operating margin of Polish airports for the period 2016–2022.

The analysis of the indicators obtained (gross margin ratio and operating margin ratio) shows, firstly, the vast differences that exist between the airports analysed in this respect (Table 3). By far the worst financial results, even in the pre-pandemic period, were achieved by Lublin and Lodz airports. The operation of these airports has never been profitable, either at a core level or at an operational level. The airports of Bydgoszcz, Szczecin, Rzeszow and Warsaw Modlin also failed to achieve positive profitability throughout the period. However, their ratios are significantly higher than those of the two airports mentioned above. In 2016–2019 (the period before the COVID-19 pandemic), favourable profitability ratios were achieved by the airports of Warsaw Chopin, Krakow, Gdansk, Katowice and Wroclaw. It is worth noting that the profitability of these airports at the level of core operations shows an upward trend, i.e., the gross profit margin ratio increases in the following years. On the other hand, we have seen fluctuations in the operating margin ratio. This is due to the construction of this indicator, as its formula takes into account EBIT (earnings before interest and tax), which is calculated based on all the company’s operating revenues and costs, including other operating activities, such as revenues from subsidies received or the sale of assets, and, among costs, fines and penalties paid or losses on the sale or liquidation of fixed assets.

The presented data confirm the negative impact of the pandemic on the financial performance of Polish airports. In 2020, all airports experienced a significant deterioration in both indicators, which reached negative values. The only exception was the operating margin ratio for Gdansk airport. These ratios remained negative in the following year, though most airports showed improvement compared to 2020. The significantly higher operating margin ratio values reflect the aid received from public funds (subsidies are included in other operating income). Airports that were highly profitable in the pre-pandemic period, demonstrated the best financial performance. The weakest airports were Lublin, Lodz, and Szczecin.

The analysis of the financial data in 2022 shows a further improvement in the financial situation of Polish airports compared to the pandemic years. However, the gross margin ratio of only three airports (Lublin, Rzeszow, Warszawa Modlin) returned to pre-pandemic levels. In comparison, this was observed for the operating margin ratio of four airports (Katowice, Rzeszow, Szczecin, Warszawa Modlin). It is worth noting that Rzeszow Airport recorded positive margin indicators in 2022, whereas in the pre-pandemic period, these indicators showed negative values throughout the period analysed.

The analysis of Polish airports’ profitability indicators shows that the COVID-19 subsidies had a significant impact on financial results. Across almost all airports, the values of ROA, ROE, and operating margin calculated including subsidies (ROA, ROE, OM) were higher compared to the adjusted indicators excluding subsidies (ROA*, ROE*, OM*, see Table 4). This confirms that the financial support received during the pandemic partially mitigated the severe deterioration in profitability. For most airports, the removal of subsidies resulted in substantially more negative values of operating margin, indicating that subsidies played a crucial role in covering operating losses. For instance, in airports such as Bydgoszcz, Lodz, and Szczecin, the operating margin without subsidies dropped to extremely low levels, exceeding −200% in some cases. Similarly, airports like Gdansk, Krakow, Katowice, Poznan, and Wroclaw showed visibly deeper losses when subsidies were excluded.

Table 4.

Profitability indicators of Polish airports calculated at EBIT level with (ROA, ROE, and OM) and without COVID-19 subsidies (ROA*, ROE*, and OM*), 2020–2021.

An exception is Rzeszow Airport, which in 2021 achieved positive profitability indicators (ROA, ROE, and operating margin) both with and without subsidies, suggesting a relatively stronger financial position compared to other regional airports. Warsaw Chopin Airport also stands out, as its indicators improved between 2020 and 2021, and the difference between results with and without subsidies was less pronounced compared to smaller airports. This points to greater resilience of the largest airport in Poland. In the case of Lublin Airport, no subsidy-adjusted results were reported, but the operating margins were among the weakest in the sample, reaching −317.40% in 2020 and −292.87% in 2021, which signals severe financial distress.

Overall, the results indicate that without state subsidies, most Polish airports would have reported weaker profitability during the pandemic period. Subsidies not only alleviated the negative financial impact of COVID-19 but also helped maintain at least partial stability in the sector.

To highlight the differences across airports, the results can be grouped into three categories (see Table 5). Overall, the findings highlight that COVID-19 subsidies were essential in cushioning the financial performance of Polish airports during the pandemic. While some major airports such as Warsaw and Gdansk displayed greater resilience, and Rzeszow even achieved positive results in 2021, most regional airports (particularly Bydgoszcz, Lodz, Lublin, and Szczecin) remained heavily dependent on subsidies to offset substantial operational losses.

Table 5.

Comparative classification of Polish airports by profitability resilience during the COVID-19 pandemic (2020–2021).

In our research we used a non-balanced panel of 12 Polish airports for the years 2016–2022, resulting in 84 observations. The data was derived from the annual reports of the airports analysed. Based on the financial data collected, the financial ratios of the airports analysed were calculated, which characterise their profitability, liquidity and level of debt. The financial ratios, together with their definitions and symbols used in the presentation of the results in the rest of the article, are presented in Table 6.

Table 6.

Financial and operational ratios used in the analyses.

The analysis of the company’s profitability is considered to be the most important of the analyses, as it shows whether the company’s operation is profitable from the point of view of the owners (Davies and Crawford 2014). The basic indicators in the profitability analysis are ROA (return on assets) and ROE (return on equity). Net profit is usually used to calculate the values of these ratios. As we focus on the impact of subsidies received by some airports on their profitability, we have used EBIT (earnings before interest and tax), which includes subsidies and grants. We have also calculated the operating margin (OM). This indicator varies across industries and is often used as a measure to benchmark a company against similar companies in the same industry (Vernimmen et al. 2018).

The second set of ratios to analyse is liquidity ratios. Financial liquidity is the ability of a company to pay its current liabilities on time (Davies and Crawford 2014). Liquidity can be measured in several ways, but the most common is the level of current assets and liabilities on the balance sheet, resulting in the current ratio. Another liquidity indicator included in the study is the days cash on hand ratio. This shows the number of days the company would be able to operate if it had no income and only used its cash (Raghavan and Yu 2021). This indicator is important, among other things, in the case of companies with seasonal turnover, i.e., periods of very low or even zero turnover. As our analysis covers the period of the COVID-19 pandemic, when airport activity was severely restricted, it is reasonable to include this indicator.

In addition, we analysed debt ratios, also known as financial risk ratios and financial leverage ratios. By examining the level of debt, it is possible to assess the company’s financial policy in terms of its capital structure (equity and debt ratio) and the extent to which it uses financial leverage. Financial leverage is related to the use of external capital and means the multiplication of the financial result resulting from the use of debt financing and, consequently, an increase in the profitability of equity (Collier 2016; Davies and Crawford 2014). To assess the level of indebtedness of the airports analysed, we used the debt to assets ratio, which defines the extent to which the company finances its assets with borrowed capital. A high ratio indicates high financial risk. Another indicator—the financial leverage ratio—shows the extent to which the company’s assets are financed with equity and the extent to which they are funded with debt. This ratio is an indicator of the financial leverage used by the company to finance its activities (Vernimmen et al. 2018), thus it is applicable to evaluate enterprises in the same industry.

The final group of ratios analysed are efficiency ratios or financial activity ratios. We focused on the current asset turnover to analyse how airports use their current assets to generate revenue. This turnover ratio varies considerably depending on the type of business and the level of investment required. However, it can be used to compare companies within the same industry. A company with a high turnover of current assets operates more efficiently than its competitors with a lower turnover of assets (Berman et al. 2013).

Finally, we have included in our analysis the Capex (capital expenditure) value (in PLN), which allows us to examine whether companies are making investment decisions. Capex is the term for funds that companies use to improve the operational efficiency of the business, increase long-term earnings, and improve existing assets. Examples of Capex include capital expenditure on property, plant and equipment (PP&E) (office buildings, land, equipment), office infrastructure (computers, furniture and other machinery) and intangible assets (licences, copyrights and patents). Capex shows whether a company is investing in its future and is confident in its ability to generate cash flow over the long term (Berman et al. 2013).

In the analysis, the ROA/ROA*, ROE/ROE*, and OM/OM* ratios were taken as dependent variables because they represent the company’s objective function, which should align with all other areas, such as liquidity, debt, and investment. Thus, the liquidity, debt, and efficiency ratios, as well as Capex, were used as explanatory variables. Our analysis also includes information on passenger numbers (PASS), airport operations (OPER), and employment (EMPL). To assess the effect of the pandemic, we include three year-specific dummy variables: COVID2020, COVID2021, and COVID2022, each taking the value 1 in its respective year and zero otherwise. The pre-pandemic period, from 2016 to 2019, serves as the reference category, so the coefficients on these dummies capture year-by-year pandemic effects relative to the pre-COVID-19 baseline.

The analysis of the characteristics of the data-generating processes in the study carried out shows a significant variability in the values of the ROA/ROA* and ROE/ROE* indicators, and a very high dispersion in the case of the OM/OM* indicator. For all indicators, both the average and the median were negative. Similarly, other indicators exhibit significant dispersion of values over the considered period, with the median value typically lower than the average, indicating that individual indicator values for the airports considered were below the average. (see Table 7 for summary statistics).

Table 7.

Summary statistics of variables for all airports (N = 12) and unit-root tests for the period 2016–2022 (T = 7).

The final component of the analysis compares differences in ROA, ROE, and OM during the COVID-19 period, while accounting for the subsidies received. The airport-level details are reported in Table 4. To this end, we conducted t-tests of differences in mean indicators for three contrasts: (a) 2016–2019 versus 2020–2022 with the subsidy adjustment; (b) 2016–2019 versus 2020–2022 without the subsidy adjustment; and (c) within 2020–2022, with versus without the subsidy adjustment. The results in Table 8 show that profitability measured by ROA was significantly lower in 2020–2022 than in 2016–2019, both when subsidies are included (t = 2.07, p = 0.042) and when they are excluded (t = 2.55, p = 0.013). On average, ROA declined from 0.71 to −2.12 (with subsidies) and to −2.83 (without subsidies), confirming a deterioration in performance; however, the within-period difference between the “with” and “without” variants in 2020–2022 is not statistically significant (t = 0.45, p = 0.657), indicating only a directional, weakly identified mitigating effect of support. ROE exhibits a similar pattern: the decline relative to 2016–2019 is significant when subsidies are excluded (t = 2.33, p = 0.023) and marginal when they are included (t = 1.86, p = 0.067); the difference between the two variants within 2020–2022 is likewise insignificant (t = 0.45, p = 0.653). For OM, no significant differences are detected either across periods (with subsidies: t = 1.37, p = 0.174; without subsidies: t = 1.58, p = 0.121) or within 2020–2022 (t = 0.18, p = 0.855), although the average operating margin fell from −27.34 to −60.10 (with subsidies) and −65.34 (without subsidies). Taken together, these findings indicate a material deterioration in profitability during the COVID-19 period, while the subsidy effect appears to be mitigating but is statistically weak in the annual data, given the limited sample size.

Table 8.

T-test of the significance of differences in mean indicators for the periods 2016–2019 and 2020–2022.

Table 9 reports the results of panel unit-root tests using the Fisher-ADF approach. For variables in levels, we employ a specification with a constant and a linear trend, whereas in first differences, we include a constant only. Given the short time dimension, the ADF lag length is set to 1, corresponding to 7 observations in the sample period (2016–2022). In levels, the unit-root null cannot be rejected at the 5% level for any variable (p-values are high for ROA*, ROE*, OM*, EMPL, PASS, OPER, CAT, DTA, FLR, CR, and DCOH; only CAPEX and FLR provide weak evidence of stationarity at the 10% level). In first differences, the unit-root null is unambiguously rejected for all variables (p < 0.05, most often p < 0.001), indicating that the series becomes stationary after differencing. We therefore treat the variables as I(1) processes. Methodologically, this calls for verifying panel cointegration among the I(1) variables; if cointegration is confirmed, subsequent estimation proceeds within an ECM/ARDL framework, whereas in the absence of cointegration, we estimate models in first differences with time fixed effects and robust inference.

Table 9.

Fisher-type unit-root tests based on ADF tests for the period 2016–2022 (T = 7).

The next step in our analysis was to identify multicollinearity between regressors. This was due to the construction of ratios based on the same data from the financial statements. A high absolute value of the correlation coefficient indicates a strong relationship between two series and is not possible for any model’s set of regressors (see Table 10). As expected, the highest correlation coefficient was observed between the number of passengers and operations (0.97); therefore, two models will be estimated. In Model 1, the number of passengers (dPASS) will be one of the regressors. In Model 2, the number of operations (dOPER) will be one of the regressors. Another pair of highly correlated variables (r = 0.76) is dDTA and dFLR; these two variables should not be included in the same model. However, the remaining correlation coefficients are low enough to suggest that multicollinearity among the regressors in the model is unlikely to occur.

Table 10.

Regressors correlation coefficients (first differences of the ratios) for all airports for period 2016–2022.

Table 11 presents the financial ratios discussed above, categorised into dependent and independent variables. Employment levels and the number of airport operations were also included as explanatory variables. Due to observed multicollinearity among the selected regressors, each dependent variable required a tailored set of explanatory variables. These sets, corresponding to the three linear models, are detailed in Table 11. To avoid endogeneity, only financial indicators without overlapping components with the dependent variable were selected as regressors. Consequently, each model includes employment level (as a dummy variable), number of operations, current ratio, and a COVID-19 dummy variable. The debt ratio (defined as total liabilities divided by total assets) was included in the models for dROE* and dOM* but excluded from the dROA* model, since dROA* already incorporates total assets. The inclusion of other explanatory variables followed the same principle. Due to the very high correlation (r ≈ 0.97) between dPASS and dOPER, only one of these variables (OPER) will be retained in the subsequent modelling to avoid multicollinearity.

Table 11.

Sets of independent variables for dependent variables.

Given that the variables are integrated of order one I(1) (Table 9 above), we tested for cointegration between the dependent variable and each potential regressor. Owing to the limited degrees of freedom and the resulting low statistical power, the analyses were conducted on a pairwise basis. The results are in Table 12.

Table 12.

Pedroni panel’s cointegration test for the period 2016–2022.

The Pedroni test, applied to the panel data for 2016–2022 (T = 7), evaluates the null hypothesis of no cointegration between the dependent variable and a given regressor. A significantly negative test statistic (p < 0.05) indicates the presence of a long-run relationship. The results confirm cointegration for: (i) ROA* with OPER, CR, DCOH, and EMPL; (ii) ROE* with CAT, CAPEX, OPER, DTA, CR, DCOH, and EMPL; and (iii) OM* with CAT, CAPEX, OPER, FLR, CR, and EMPL (in most cases, p < 0.001). Pairs not shown were not tested/reported due to definitional constraints or sample limitations. The identified long-run relations justify subsequent estimation within an ECM/ARDL framework (a levels equation with unit effects for the long run and a first-difference equation with an error correction term for the short run). In contrast, pairs without confirmed cointegration should be modelled solely in first differences.

We adopt a two-step ECM/ARDL approach, which is suitable for short annual panels (N = 12 airports, T = 7). First, we establish the order of integration for all series. Panel unit-root tests (Fisher–ADF with a constant and, for volume variables, a linear trend; lag length = 1 given the short T; see Table 9) indicate that the variables are I(1) in levels and become stationary after first differencing.

Second, we verify panel cointegration between the profitability indicators and their regressors. Owing to the limited degrees of freedom, cointegration is tested pairwise using Pedroni statistics (Table 10). For each dependent variable, we then estimate a long-run relation in levels with airport fixed effects (no time effects), separately for subsidy-adjusted indicators and for unadjusted indicators. The long-run specification is:

where is the ratio: ROA, ROE and OM (or their subsidy-adjusted counterparts), contains the financial and operational ratios (as defined in Table 6), and captures time-invariant airport heterogeneity (Baltagi 2008; Greene 2020). To mitigate multicollinearity, we retain one traffic proxy only (either passengers or operations), given their very high correlation (Greene 2020). From each long-run regression, we obtain residuals and verify their stationarity. To verify their stationarity, the lagged residual, , serves as the error correction term (Engle and Granger 1987).

In the second step, we estimate short-run equations in first differences augmented by the error correction term:

where we have included year-specific COVID-19 dummies (COVID2020, COVID2021, COVID2022) that equal one in their respective years and zero otherwise, with 2016–2019 as the pre-pandemic reference. Inference relies on Driscoll–Kraay standard errors (Driscoll and Kraay 1998), which are robust to heteroskedasticity, serial correlation, and cross-sectional dependence in short panels exposed to common shocks; implementation follows (Hoechle 2007). The adjustment coefficient is expected to be negative, indicating convergence toward the long-run equilibrium (Pesaran et al. 1999). To assess robustness, we compare results across the two indicator groups (with and without subsidy adjustment), vary the maximum DK lag, and, where informative, contrast Driscoll–Kraay inference with two-way clustered standard errors (Baltagi 2008; Hoechle 2007).

4. Results

The analysis starts with estimating long-term relationships (Table 13). For each dependent variable, two versions are considered: one without COVID-19 subsidy adjustment (ROA, ROE, OM) and one with adjustment (ROA*, ROE*, OM*). The models exhibit high explanatory power (R2 = 0.74–0.89) and joint significance of the regressors (Wald, p < 0.001). In all cases, the coefficient on OPER is positive and statistically significant (ROA: 0.205; ROA*: 0.246; ROE: 0.283; ROE*: 0.334; OM: 0.947; OM*: 1.202), suggesting that higher operational activity links to greater long-term profitability. Employment (EMPL) has a negative and significant coefficient for ROA and ROE (ROA: −0.025, p = 0.040; ROA*: −0.029, p = 0.026; ROE: −0.049/−0.053, p ≈ 0.02), consistent with labour cost pressures; for OM, the short-term nature means statistical significance is not achieved (p ≈ 0.19–0.22). The other level ratios (CR, DCOH, CAPEX, CAT, FLR, DTA) are not consistently significant at the 5% level; however, for ROE, the DTA coefficient is negative and nearly significant (−0.225; p = 0.073).

Table 13.

Long run estimation results for the period 2016–2022.

Model diagnostics support the inferential framework. The Wooldridge serial-correlation test does not reject the null of no AR(1) correlation in some specifications (e.g., ROA, p = 0.104) but indicates autocorrelation for ROE and OM (p ≤ 0.012). The Pesaran CD test points to cross-sectional dependence in most equations (p ≤ 0.011). Residual-based unit-root tests (ADF/Fisher) on the long-run errors reject the unit-root null in all cases (p < 0.05), confirming cointegration. Accordingly, inference relies on standard errors robust to cross-sectional and serial dependence (Driscoll–Kraay). Importantly, the “starred” and “non-starred” results are qualitatively consistent: the subsidy adjustment leaves the signs of the key parameters unchanged and in several instances amplifies their magnitude (e.g., OPER increases from 0.205 to 0.246 for ROA and from 0.947 to 1.202 for OM).

The fixed effects estimated in the long-run equations capture persistent, unobserved heterogeneity across airports, conditional on the included covariates. We interpret them as unit-specific intercepts, i.e., time-invariant average levels of the indicators for a given airport. The positive values indicate above-average structural potential (higher long-run profitability/efficiency after controlling for regressors). In contrast, negative values point to persistent constraints (e.g., a higher fixed cost base, weaker local demand, or network misalignment). This representation facilitates comparisons both across airports and across indicators (ROA, ROE, OM) under a standard reference scale. In general, the signs of the fixed effects are consistent across indicators, while their magnitudes differ: OM, as an operating margin, tends to be more sensitive to the fixed cost base, whereas ROE is more responsive to the capital structure. The fixed effects are qualitatively consistent across the two groups (they retain the same signs and largely the same rank ordering), but they differ in magnitude. After the subsidy adjustment (starred indicators), fixed effects are typically lower for airports that received relatively greater support, reflecting the removal of the direct impact of transfers. For airports with a small aid share, differences are negligible. Occasional rank shifts point to cases where outcomes were more dependent on subsidies.

Table 14 reports estimates of short-run error correction equations (ECM) for changes in profitability measures (ΔROA, ΔROE, ΔOM) and their subsidy-adjusted counterparts (ΔROA*, ΔROE*, ΔOM*) over 2016–2022. The error correction term, ect−1, enters with a negative sign and is statistically significant in most specifications (for ΔROA: −0.227, p < 0.001; ΔROA*: −0.751, p = 0.021; ΔROE: −0.692, p = 0.045; ΔROE*: −0.618, p = 0.063; ΔOM: −0.698, p = 0.006; ΔOM*: −0.872, p = 0.004), confirming the presence of adjustment toward the long-run equilibrium. Notably, for two of the three indicators (ROA and OM) the speed of adjustment is greater after excluding subsidies, suggesting that subsidy-cleaned indicators revert more rapidly to their long-run trend. In the short run, operating activity affects ΔROA* positively (6.883; p = 0.013), whereas capital expenditure (ΔCAPEX) and leverage (ΔDTA) depress ΔROE/ΔROE* (e.g., ΔCAPEX: −0.217, p = 0.007; ΔDTA: −20.083, p = 0.020). Cash liquidity (ΔDCOH) improves ΔROE* (1.281; p = 0.017). The 2020 dummy effects are clearly negative for return on equity (ΔROE: p = 0.029; ΔROE*: p = 0.026) and indicate a borderline significant decline for the operating margin; in 2022, by contrast, we observe a rebound in ΔOM (23.070; p = 0.006) alongside a decline in ΔROA (−13.289; p = 0.030), indicating an uneven path out of the crisis. Inference is based on Driscoll–Kraay standard errors, which are robust to heteroskedasticity, autocorrelation, and cross-sectional dependence.

Table 14.

Short run estimation results for the period 2016–2022.

5. Discussion and Conclusions

This article assesses the impact of state aid to critical infrastructure operators in Poland’s aviation sector on their financial results from 2016 to 2022, with particular emphasis on the COVID-19 period. The evidence suggests a material decline in profitability from 2020 to 2022, albeit with pronounced heterogeneity across airports. In several cases—especially in 2021–2022 profitability, liquidity, and operating activity improved, yet this improvement was not uniform: for a number of smaller airports, the support was insufficient to restore positive operating performance or even pre-pandemic activity levels.

The effectiveness of public aid appears to depend not only on the size and scope of transfers but also on airport-specific managerial capabilities, ownership structures, and adaptive capacity factors that are harder to capture in purely quantitative models yet become pivotal under crisis conditions. The analysis suggests that mechanically replicating support schemes without regard to local conditions leads to low efficiency and limited systemic resilience.

Methodologically, we distinguish long-run relations from short-run dynamics using a two-step cointegration ECM framework on a short annual panel (12 airports, 2016–2022). Long-run fixed-effects regressions yield economically interpretable associations: operational activity is positively related to profitability in levels, whereas employment exerts downward pressure consistent with a higher fixed-cost base. Model quality is high (strong joint significance and explanatory power), and residual-based unit-root tests on the long-run errors reject the unit-root null, confirming panel cointegration and validating an error correction representation. The estimated airport-specific intercepts, reported relative to the grand mean, capture persistent, unobserved heterogeneity that remains after conditioning on observable covariates.

Short-run ECM estimates (Table 14) show that deviations from the long-run equilibrium are corrected over time: the error correction term enters with the expected negative sign and is statistically significant in most specifications. Notably, for two of the three indicators (ROA and OM), the absolute value of the adjustment coefficient is larger for the subsidy-adjusted measures (ROA*, OM*), implying faster reversion once transfers are netted out. In contemporaneous effects, operating activity raises ΔROA*, whereas capital expenditure and leverage depress ΔROE/ΔROE*, and higher cash liquidity improves ΔROE*. Year dummies corroborate a sharp negative shock in 2020 for equity returns and, by 2022, a rebound in the operating margin alongside a decline in ROA, indicating an uneven path out of the crisis. Inference relies on Driscoll–Kraay standard errors, which are robust to heteroskedasticity, autocorrelation, and cross-sectional dependence—features typical of short panels exposed to common shocks.

These econometric results refine the broader determinants identified earlier. Across specifications, changes in passenger numbers, flight operations, and employment levels are the primary drivers of profitability measures. At the same time, capital expenditure, turnover of current assets, and liquidity are particularly relevant for ROE. The estimated coefficients on the COVID-19 dummies confirm a substantial adverse effect on financial performance; this effect is statistically significant for the operating margin and return on assets, and weaker for return on equity, which is consistent with the notion that internal managerial and financing choices more strongly mediate shareholder returns than contemporaneous macroeconomic shocks.

The findings are aligned with prior research indicating that larger airports weather crises more effectively (e.g., Warsaw–Chopin, Krakow, Gdansk, Katowice, Poznan, and Wroclaw), and that, irrespective of ownership structures (state ownership at Warsaw–Chopin versus regional self-government involvement elsewhere), airports tend to improve financial performance through cost reduction and more effective capital use (Abbruzzo et al. 2016; Iyer and Jain 2019; Painvin 2011).

At the same time, the mixed effectiveness of public aid exposes structural risk factors and operational asymmetries. First is fiscal dependency: some airports operated primarily on public transfers during the period, casting doubt on their long-term capacity for self-financing. Second is accounting and methodological risk: subsidies recorded as revenue can distort profitability metrics and overstate managerial efficiency (Ammoury and Salman 2024; Graham 2009); in such instances, airports may appear financially healthy even when the core business remains unprofitable. Third is aid allocation risk: support was not always proportional to actual losses, raising concerns about fairness and the effectiveness of compensation mechanisms; overly broad, non-selective programmes may distort competition and perpetuate inefficient entities, weakening overall system resilience (Colak et al. 2023; Court of Justice of the EU 2023).

From a managerial perspective, these results argue for a re-design of financial reporting and performance measurement under extraordinary circumstances. Traditional indicators, such as EBIT, OM, and ROA, should be redefined to separate operating revenues from non-market support and to incorporate forward-looking risk assessment. Recent research emphasises dynamic approaches that integrate ex ante risk assessments and subsidy-adjusted metrics (IATA and McKinsey & Company 2022; Novák et al. 2024). The econometric evidence in this study validates the use of such adjusted indicators and reinforces the need to monitor post-crisis normalisation on that basis.

Taken together, the results answer the research question in the affirmative: deviations in airport profitability from the long-run relation undergo short-run correction, and COVID-19 subsidies modify the speed of that adjustment. The negative (and mostly significant) error correction coefficient confirms the existence of a correction mechanism. At the same time, the larger adjustment in the subsidy-adjusted specifications indicates faster convergence once transfers are removed. Accordingly, the hypotheses that (i) an operative error correction mechanism is present and (ii) subsidies affect its speed are supported by the evidence.

This study has limitations. It relies on financial reporting data that may reflect heterogeneous standards and changes in practices during the pandemic. Access to detailed aid documentation—especially the split between central and local government support—was limited. Furthermore, the focus on financial outcomes omits social, environmental, and qualitative dimensions. Fixed-effects estimation also limits external validity beyond the sampled airports. Policy implications follow: future support should be more selective and based on performance indicators adjusted for non-market influences; tools to evaluate operational resilience and strategic flexibility should be developed; uniform reporting standards for critical infrastructure entities should be introduced; and long-term financial support should be contingent on transformation plans that strengthen independence, resilience, and adaptability.

Methodologically, the two-step cointegration ECM design with Driscoll–Kraay inference is well suited to short, shock-prone panels and can serve as a template for future evaluations of critical infrastructure performance under systemic stress.

Author Contributions

Conceptualization, A.Z., M.M.-S. and D.T.; Methodology, A.Z.; Resources, M.M.-S.; Data curation, K.D.; Writing—original draft, A.Z., M.M.-S. and D.T.; Writing—review & editing, K.D. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The original contributions presented in this study are included in the article. Further inquiries can be directed to the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Abbruzzo, Antonino, Vincenzo Fasone, and Raffaele Scuderi. 2016. Operational and financial performance of Italian airport companies: A dynamic graphical model. Transport Policy 52: 231–37. [Google Scholar] [CrossRef]

- ACI Europe. 2020. European Airports Report Slower Passenger Growth & Declining Freight in 2019. Available online: https://www.aci-europe.org/media-room/235-european-airports-report-slower-passenger-growth-declining-freight-in-2019.html (accessed on 19 August 2025).

- ACI World. 2021a. Ongoing Impact of COVID-19 Weakens Aviation Recovery. Available online: https://aci.aero/2021/11/01/ongoing-impact-of-covid-19-weakens-aviation-recovery-momentum/ (accessed on 19 August 2025).

- ACI World. 2021b. Stark Impact of COVID-19 on Global Traffic Persists Amid Improving Outlook. Available online: https://aci.aero/2021/07/14/stark-impact-of-covid-19-on-global-traffic-persists-amid-improving-outlook/?utm_source=chatgpt.com (accessed on 19 August 2025).

- ACI World. 2021c. The Impact of COVID-19 on the Airport Business and the Path to Recovery. Available online: https://aci.aero/2022/02/24/the-impact-of-covid-19-on-the-airport-business-and-the-path-to-recovery-4/ (accessed on 19 August 2025).

- Airlines. 2021. The Impact of COVID-19 on Aviation. Available online: https://airlines.iata.org/2021/01/28/impact-covid-19-aviation?utm_source=chatgpt.com (accessed on 19 August 2025).

- Ammoury, Michael, and Baris Salman. 2024. Advancing Sustainability and Resilience of Airports Through Deployment of New Technologies in the Aftermath of the COVID-19 Pandemic. ASCE OPEN: Multidisciplinary Journal of Civil Engineering 2: 4024006. [Google Scholar] [CrossRef]

- Baltagi, Badi H. 2008. Econometric Analysis of Panel Data, 4th ed. New York: Wiley. [Google Scholar]

- Barrett, Sean D. 2000. Airport competition in the deregulated European aviation market. Journal of Air Transport Management 6: 13–27. [Google Scholar] [CrossRef]

- Bazargan, Massoud, and Bijan Vasigh. 2003. Size versus efficiency: A case study of US commercial airports. Journal of Air Transport Management 9: 187–93. [Google Scholar] [CrossRef]

- Berman, Karen, Joe Knight, and John Case. 2013. Financial Intelligence: A Manager’s Guide to Knowing What the Numbers Really Mean. Cambridge: Harvard Business Review Press. [Google Scholar]

- Bezerra, George Christian Linhares, and Carlos F. Gomes. 2016. Measuring airport service quality: A multidimensional approach. Journal of Air Transport Management 53: 85–93. [Google Scholar] [CrossRef]

- CAA in Poland. 2023. Liczba Obsłużonych Pasażerów Oraz Wykonanych Operacji w Ruchu Krajowym i Międzynarodowym—Regularnym i Czarterowym w Latach 2020–2022. Available online: https://www.ulc.gov.pl/_download/statystyki/2022/wg_portow_lotniczych_4kw2022.pdf (accessed on 18 August 2025).

- Colak, Ozlem, Marcus Enoch, and Craig Morton. 2023. Airport business models and the COVID-19 pandemic: An exploration of the UK case study. Journal of Air Transport Management 108: 102337. [Google Scholar] [CrossRef]

- Collier, Paul M. 2016. Accounting for Managers: Interpreting Accounting Information for Decision Making, 5th ed. Chichester: Wiley. [Google Scholar]

- Court of Justice of the EU. 2023. Press Release No. 75/23—Judgment of the General Court in Joined Cases T-34/21, Luxembourg. Available online: https://curia.europa.eu/jcms/upload/docs/application/pdf/2023-05/cp230075en.pdf (accessed on 18 August 2025).

- Davies, Tony, and Ian Crawford. 2014. Corporate Finance and Financial Strategy: Optimising Corporate and Shareholder Value. Harlow: Pearson. [Google Scholar]

- Dionne, Georges, Robert Gagné, François Gagnon, and Charles Vanasse. 1997. Debt, moral hazard and airline safety An empirical evidence. Journal of Econometrics 79: 379–402. [Google Scholar] [CrossRef]

- Doganis, Rigas. 2019. Flying off Course: Airline Economics and Marketing, 5th ed. Oxon: Routledge. [Google Scholar]

- Driscoll, John C., and Aart C. Kraay. 1998. Consistent Covariance Matrix Estimation with Spatially Dependent Panel Data. The Review of Economics and Statistics 80: 549–60. [Google Scholar] [CrossRef]

- Dube, Kaitano, Godwell Nhamo, and David Chikodzi. 2021. COVID-19 pandemic and prospects for recovery of the global aviation industry. Journal of Air Transport Management 92: 102022. [Google Scholar] [CrossRef]

- Engle, Robert F., and C. W. J. Granger. 1987. Co-Integration and Error Correction: Representation, Estimation, and Testing. Econometrica 55: 251–76. [Google Scholar] [CrossRef]

- Graham, Anne. 2009. Managing Airports, An International Perspective, 3rd ed. Amsterdam and London: Butterworth Heinemann. [Google Scholar]

- Graham, Anne, Frances Kremarik, and Willy Kruse. 2020. Attitudes of ageing passengers to air travel since the coronavirus pandemic. Journal of Air Transport Management 87: 101865. [Google Scholar] [CrossRef] [PubMed]

- Greene, William H. 2020. Econometrics Analysis, 8th ed. London: Pearson Global. [Google Scholar]

- Guzman, Luis A., and Philipp Hessel. 2022. The effects of public transport subsidies for lower-income users on public transport use: A quasi-experimental study. Transport Policy 126: 215–24. [Google Scholar] [CrossRef]

- Halpern, Nigel, and Anne Graham. 2015. Airport route development: A survey of current practice. Tourism Management 46: 213–21. [Google Scholar] [CrossRef]

- Hillman, Amy J., Michael C. Withers, and Brian J. Collins. 2009. Resource dependence theory: A review. Journal of Management 35: 1404–27. [Google Scholar] [CrossRef]

- Hiney, Noel, Marina Efthymiou, and Edgar Morgenroth. 2025. Adapting to uncertainty: Black swans, VUCA challenges and airport resilience strategies. Journal of the Air Transport Research Society 4: 100068. [Google Scholar] [CrossRef]

- Hoechle, Daniel. 2007. Robust standard errors for panel regressions with cross-sectional dependence. Stata Journal 7: 281–312. [Google Scholar] [CrossRef]

- IATA and McKinsey & Company. 2022. Understanding the Pandemic’s Impact on the Aviation Value Chain. Available online: https://www.iata.org/en/iata-repository/publications/economic-reports/understanding-the-pandemics-impact-on-the-aviation-value-chain (accessed on 18 August 2025).

- International Civil Aviation Organization. 2023. Effects of Novel Coronavirus (COVID-19) on Civil Aviation: Economic Impact Analysis Economic Development of Air Transport. Montreal: Air Transport Bureau International Civil Aviation Organization (ICAO). [Google Scholar]

- International Transport Forum. 2024. Transport System Resilience Summary and Conclusions. Paris: OECD. [Google Scholar] [CrossRef]

- Iyer, K. Chandrashekhar, and Soumya Jain. 2019. Performance measurement of airports using data envelopment analysis: A review of methods and findings. Journal of Air Transport Management 81: 101707. [Google Scholar] [CrossRef]

- Janić, M. 2022. Analysis and modelling of airport resilience, robustness, and vulnerability: Impact of COVID-19 pandemic disease. The Aeronautical Journal 126: 1924–53. [Google Scholar] [CrossRef]

- Jha, Prakash Chandra. 2013. Theory of Fiscal Federalism: An Analysis. Munich: MPRA. [Google Scholar]

- Lapçın, Hilal Tuğçe, and Deniz Taşci. 2024. An analysis of trust governance mechanism in airline-airport relationship with resource dependence theory and transaction cost theory perspectives. Transport Policy 159: 359–74. [Google Scholar] [CrossRef]

- Li, Ziyue, Qian-Wen Guo, and Paul M. Schonfeld. 2025. Joint Optimization of Capacity Expansion Timing and Increment in Airport Terminals: Addressing Stochastic Demand and Logistic Growth. SSRN. [Google Scholar] [CrossRef]

- Lioutov, Ilia. 2020. COVID-19: Rising Financial Risks in the Airport Industry. ACI World Insights. Available online: https://blog.aci.aero/airport-economics/covid-19-rising-financial-risks-in-the-airport-industry/?utm_source=chatgpt.com (accessed on 19 August 2025).

- Lucas, Patrick. 2020. The Bare Bones—The Economics of Airport Infrastructure Amidst the Pandemic. Available online: https://blog.aci.aero/airport-economics/the-bare-bones-the-economics-of-airport-infrastructure-amidst-the-pandemic/ (accessed on 2 August 2025).

- Martín-Domingo, Luis, and Juan Carlos Martín. 2022. The Effect of COVID-Related EU State Aid on the Level Playing Field for Airlines. Sustainability 14: 2368. [Google Scholar] [CrossRef]

- Ministry of Justice. 2023. Financial Document Viewer (Przeglądarka Dokumentów Finansowych). Available online: https://ekrs.ms.gov.pl/rdf/pd/search_df (accessed on 18 August 2025).

- Novák, Andrej, Alena Novák Sedláčková, Kristína Kováčiková, and Patrik Böhm. 2024. Navigating Regional Airport System Economics: Insights from Central Europe and Croatia. Systems 12: 175. [Google Scholar] [CrossRef]

- Painvin, Nicolas. 2011. Airport performance: A rating agency perspective. Journal of Airport Management 5: 298–305. [Google Scholar] [CrossRef]

- Pesaran, M. Hashem, Yongcheol Shin, and Ron P. Smith. 1999. Pooled Mean Group Estimation of Dynamic Heterogeneous Panels. Journal of the American Statistical Association 94: 621–34. [Google Scholar] [CrossRef]

- Raghavan, Sunder, and Chunyan Yu. 2021. Evaluating financial performance of commercial service airports in the United States. Journal of Air Transport Management 96: 102111. [Google Scholar] [CrossRef]

- Serrano, Francisco, and Antonín Kazda. 2021. COVID-19 Grounded Aircraft—Parking and Storing. Communications. Scientific Letters of the University of Zilina 23: A103–A115. [Google Scholar] [CrossRef]

- Song, Yongkang, Yanhua Li, Hanchen Ke, and Keyan Zhao. 2025. Study on the subsidy efficiency of small and medium-sized airports in China based on social economic impact. Journal of Air Transport Management 128: 102852. [Google Scholar] [CrossRef]

- Vernimmen, Pierre, Pascal Quiry, Yann Le Fur, Maurizio Dallocchio, and Antonio Salvi. 2018. Corporate Finance: Theory and Practice, 5th ed. Chichester: Wiley. [Google Scholar]

- Vogel, Hans-Arthur. 2020. Effects of the COVID-19 crisis on airport investment grades and implications for debt financing. Journal of Airport Management 15: 82–104. [Google Scholar] [CrossRef]

- Wandelt, Sebastian, Anming Zhang, and Xiaoqian Sun. 2025. Global Airport Resilience Index: Towards a comprehensive understanding of air transportation resilience. Transportation Research Part D: Transport and Environment 138: 104522. [Google Scholar] [CrossRef]

- Wang, Zhanwei, and Woon-Kyung Song. 2020. Sustainable airport development with performance evaluation forecasts: A case study of 12 Asian airports. Journal of Airport Management 89: 101925. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).