Financial Mechanisms of Corporate Bankruptcy: Are They Different or Similar Across Crises?

Abstract

1. Introduction

2. Literature Review of Early Warning Systems

3. Methodology of Bankruptcy Analysis

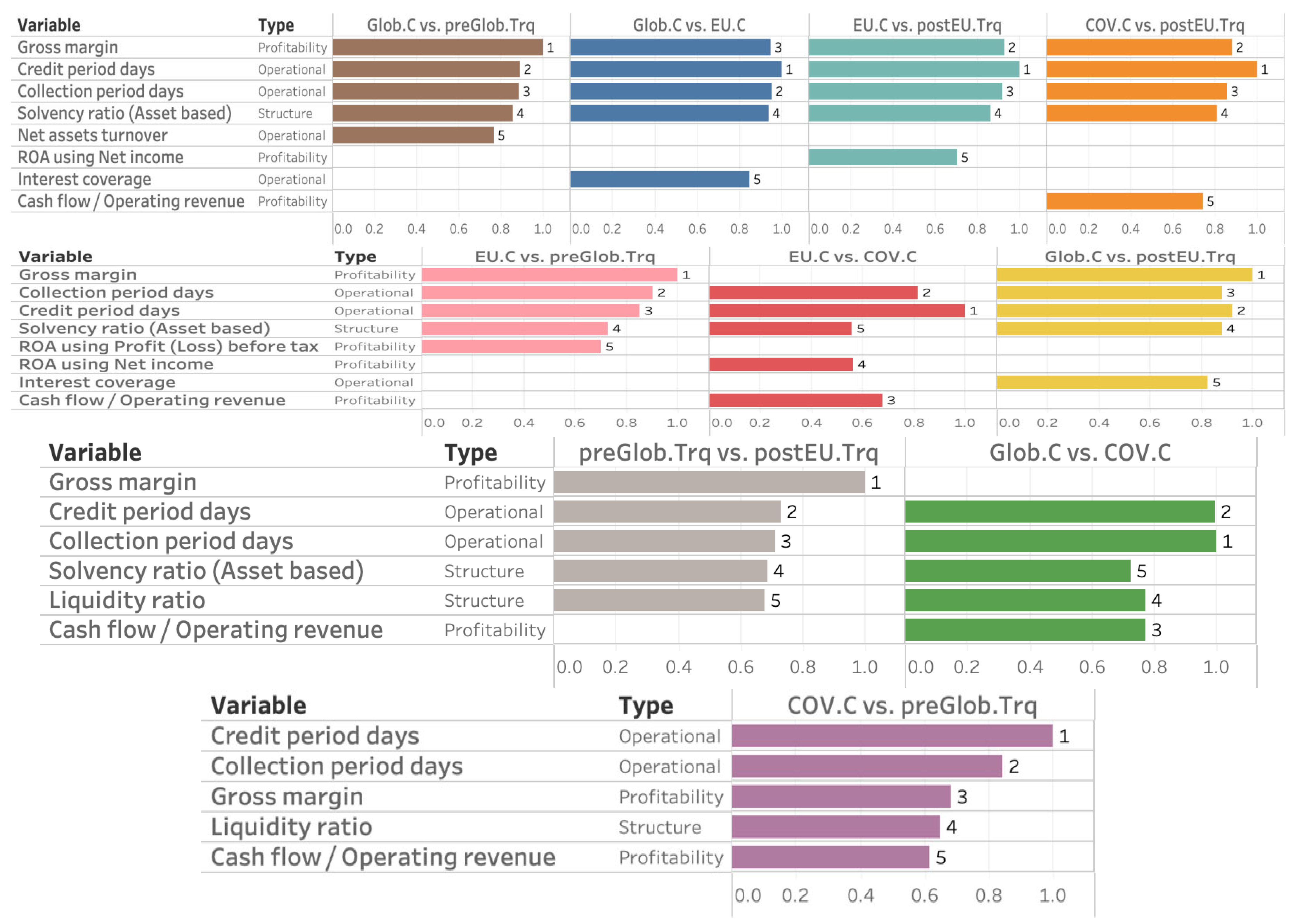

- We analyze whether the financial behavior associated with corporate bankruptcy differs across the three crises by employing random forest models. Specifically, we construct three binary classification models to distinguish between the following crisis pairs: Glob.C vs. EU.C, Glob.C vs. COV.C, and EU.C vs. COV.C. Intuitively, if the financial factors contributing to bankruptcy during two different crises are distinct, this should be reflected in model accuracy, as it implies that the random forest model can detect identifiable differences in the data. Therefore, higher model accuracy would indicate greater differences in the financial factors or mechanisms of bankruptcy between crises, suggesting that these bankruptcies occurred for different reasons.

- We conduct a similar analysis to examine how the financial behavior of bankrupt firms during crises differs from that during tranquil periods. We define two tranquil periods: pre-Glob.C (2002–2006, hereafter preGlob.Trq) and post-EU.C (2013–2018, hereafter postEU.Trq). For each crisis, we build two models (crisis vs. each tranquil period), resulting in a total of six models.

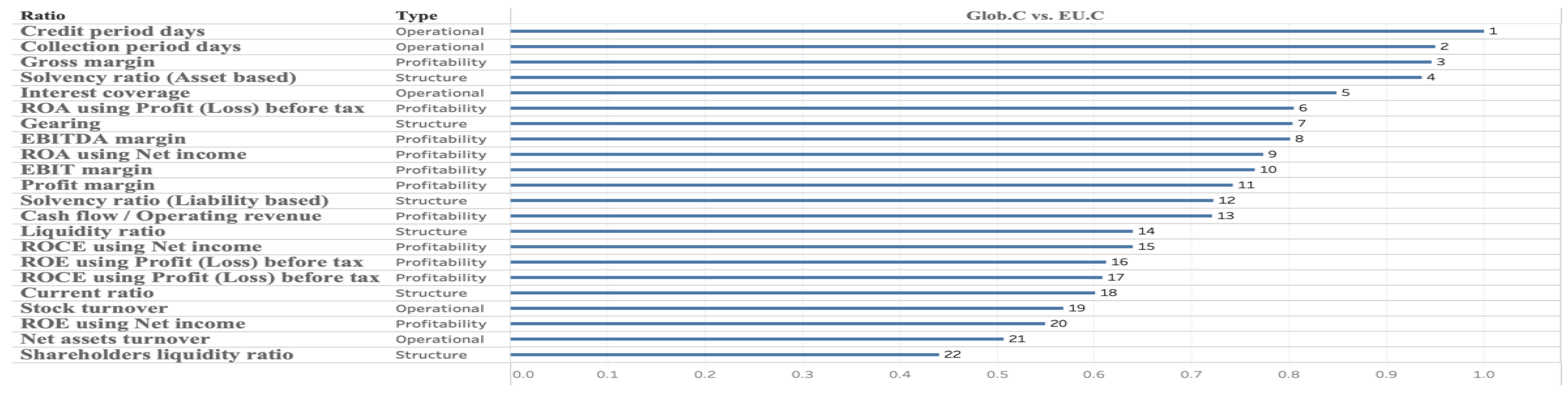

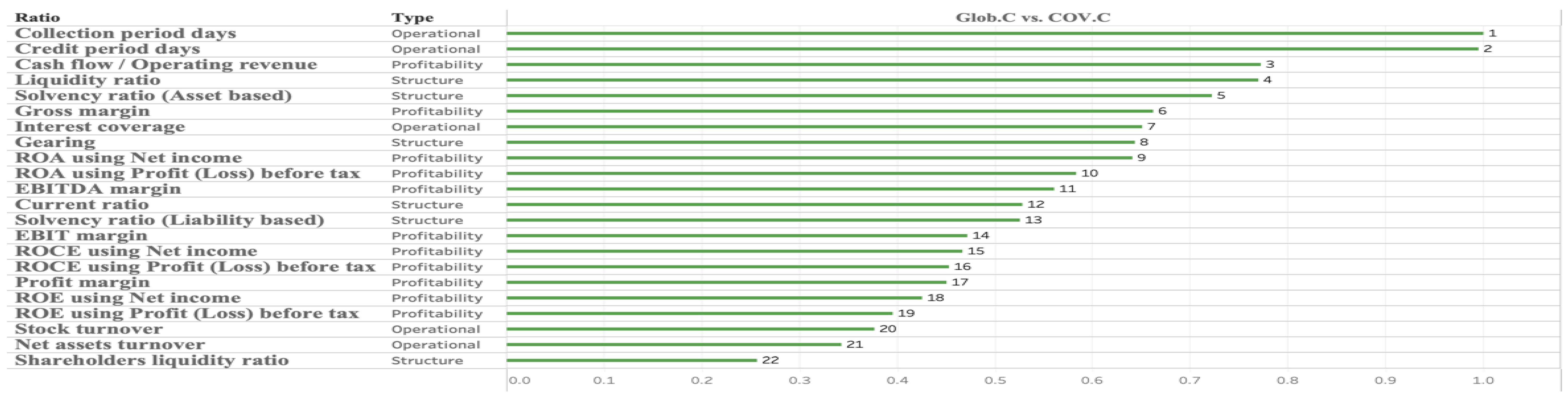

- We analyze the important variables identified by each random forest model to assess the differences in financial indicators that contribute to bankruptcy across periods.

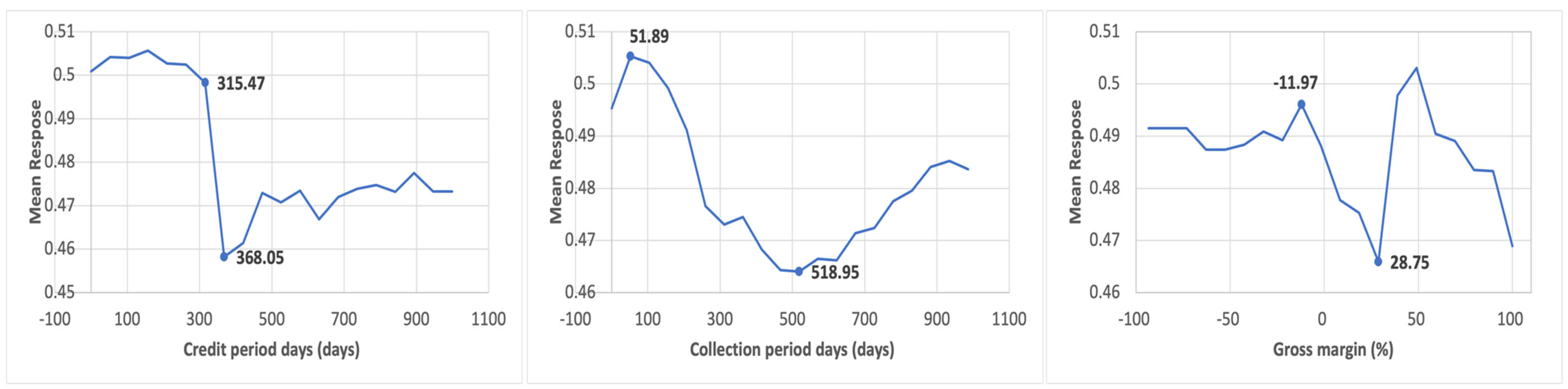

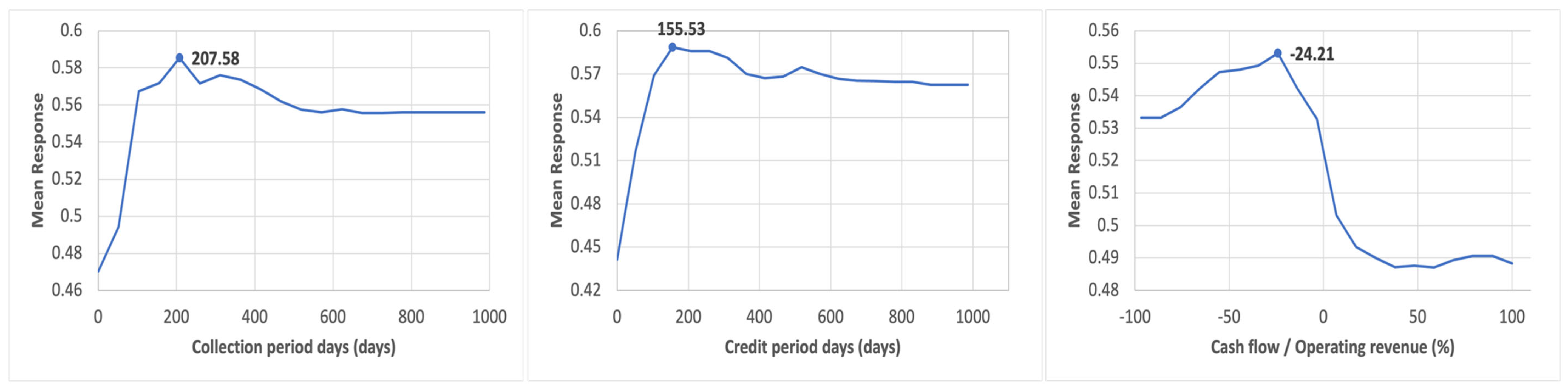

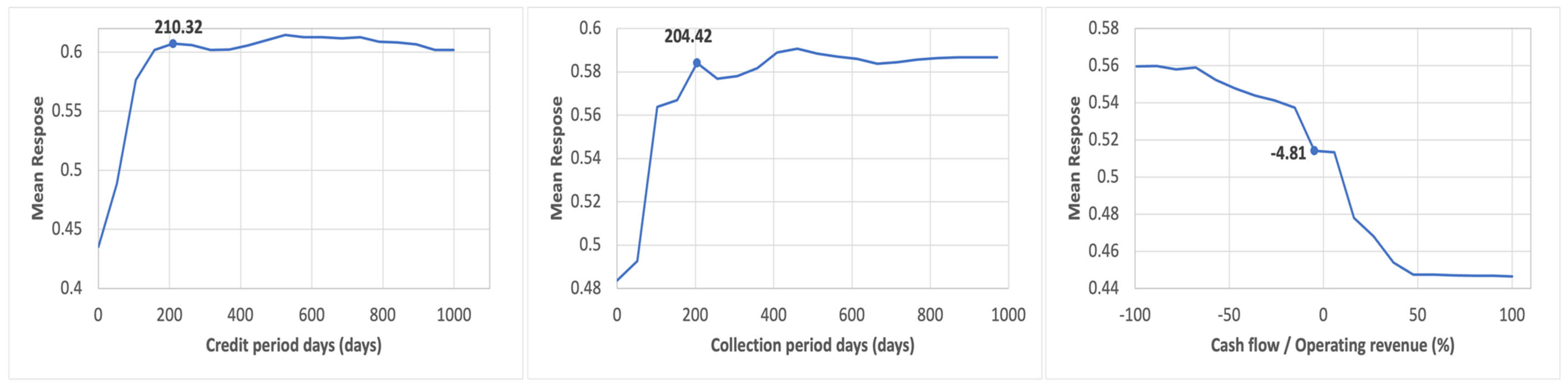

- We further investigate the top three most important variables in each model using partial dependence analysis—a technique that helps interpret machine learning models by providing detailed insights into the marginal effect of individual predictors on the outcome.

3.1. Data

- Status: Bankruptcy or Dissolved (due to bankruptcy).

- Size classification: Large, Very large.

- Entity type: Corporate.

- Consolidation code:

- ➢

- C1 (consolidated accounts with no unconsolidated companion).

- ➢

- C2 (consolidated accounts with an unconsolidated companion).

- ➢

- U1 (unconsolidated accounts with no consolidated companion).

- ➢

- U2 (unconsolidated accounts with a consolidated companion).

- World region/Country/Region in country: OECD.

3.2. Modeling

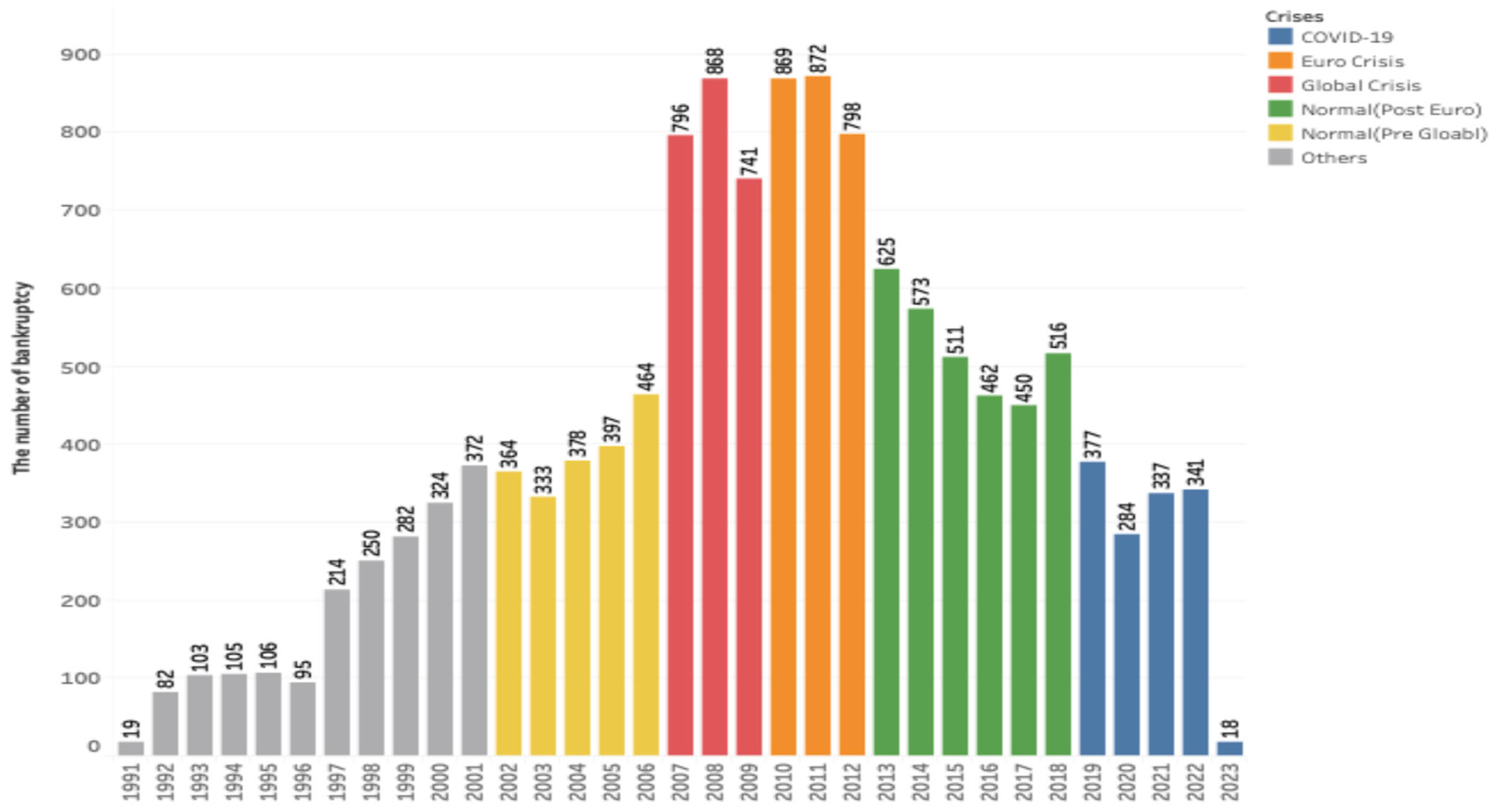

3.2.1. Definition of Crisis Events

- Global Financial Crisis (Glob.C), 2007–2009: The collapse of the U.S. housing market bubble caused a multinational financial crisis spillover due to the interconnectedness of the global financial system. This crisis caused extreme damage to global financial markets and banking systems. This was one of the worst recessions in recent decades. It is also said to be the worst economic crisis since the 1929 Wall Street crash.

- European debt crisis (EU.C), 2010–2012: The Great Recession of the Glob.C weakened the economies of European Union countries and created a foreign capital cash flow problem for countries dependent on foreign lending, exposing vulnerabilities in the Eurozone’s structure. Hence, the EU.C was caused by worsening the countries that had substantial current account deficits and triggered high government debt and institutional failures.

- The COVID-19 crisis (COV.C), 2019–2023: While the Glob.C and EU.C are economic crises that occurred in the financial system, the COV.C is an economic crisis triggered by the pandemic. During the early stage of the COVID pandemic, a large portion of the world was under some form of lockdown, which caused serious damage to the stock market and global supply chain. This incident literally stopped the global economy and led to a sharp contraction in economic activity, triggering a deep economic recession. To obtain a reasonable amount of data, for this research, the COV.C period was set as 2019 to 2023. It is also considered to be one of the worst recessions in recent decades.

- Tranquil before Glob.C (preGlob.Trq), 2002–2006: The tranquil period prior to the Global Financial Crisis.

- Tranquil after EU.C (postEU.Trq), 2013–2018: The tranquil period after the European debt crisis.

3.2.2. Building Models

- It is simple but has strong predictive accuracy, has been well studied in the EWS literature, and reportedly outperforms conventional EWS approaches.

- The hyperparameter setting is extremely simple; it only requires a number of trees to construct the model, but it works with a large dataset as well as high-dimensional data efficiently and effectively.2

- It also has the convenience of dealing with multicollinearity, which causes interpretability problems owing to feature dependence in conventional methods such as logit, and tree models with univariate feature splits in general do not cause havoc, as each split is independent.

- Random forest also provides variable importance by measuring the relative contribution of variables to the prediction, which helps to identify and assess the criteria distinguishing different crises.

- Draw a subset of training data with random sampling by replacement (bootstrap).

- Train a decision tree using a subset of the training data. At each node of the tree, choose the best split of a variable from only the randomly selected m variables, rather than all variables.

- Repeat steps 1 and 2 to produce d decision trees.

- Make predictions for new data by voting for (or taking the average of) the most popular class from among all the outputs of d decision trees.

3.3. Evaluation

3.3.1. By Model Performance

3.3.2. By Variable Importance

3.3.3. By Partial Dependency

- Choose the target variable for which to create the partial dependence plot.

- Vary the value of the target variable while fixing the other values of the variables to create m datasets.

- Make a prediction output of each m dataset by model constructed.

- Plot the mean predicted value of each dataset of the target variable.

4. Experimental Results

4.1. Analyzing Corporate Bankruptcy Differences Among Crises

4.1.1. Glob.C Versus EU.C

4.1.2. Glob.C Versus COV.C

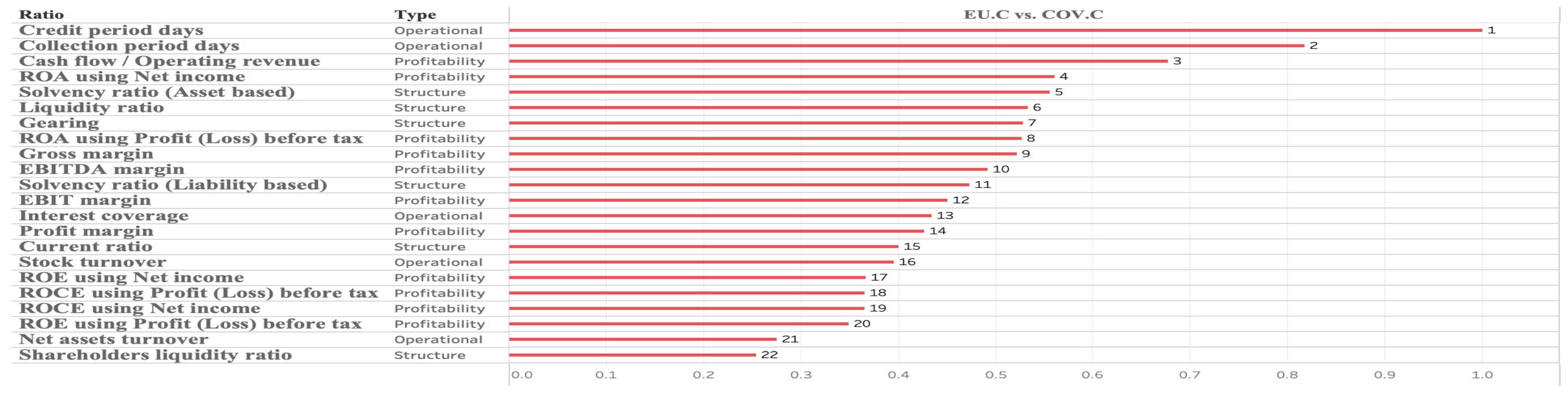

4.1.3. EU.C Versus COV.C

4.2. Analyzing Corporate Bankruptcy Differences Among Crises and Tranquil Periods in Chronological Order

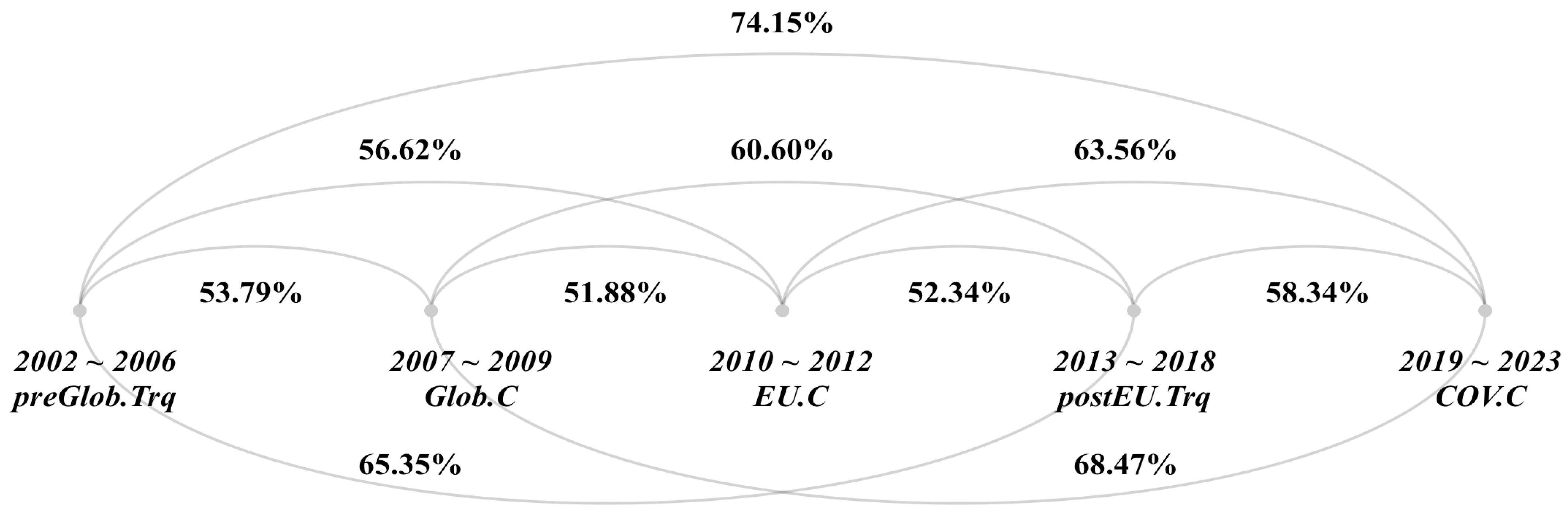

- Model accuracies for adjacent events are only slightly above 50%—marginally better than random guessing—except for the postEU.Trq versus COV.C model, which is nearly 60%. This suggests that the financial behavior associated with bankruptcy in adjacent events does not vary markedly from the preGlob.Trq to postEU.Trq models, whereas the COV.C bankruptcy mechanism exhibits more distinguishable characteristics than in previous events.

- In contrast, model accuracy for the every-other-event comparisons was consistently around 60%. These results imply that bankruptcy-related financial behavior changes after certain events and becomes more pronounced between more distant events. Because corporate activity is closely related to overall economic activity, our results may reflect structural changes in the economy over 2002–2023. It is not certain whether each event changes bankruptcy-related financial behavior, economic conditions, and/or firms’ financial management policies; further investigation is required and left for future research.

- The results indicate that COV.C has a distinct bankruptcy mechanism compared with previous events, as evidenced by the ability to construct a high-accuracy model. “Cash flow/Operating revenue” is a key distinguishing factor between COV.C and the other events—namely, the Glob.C, EU.C, preGlob.Trq, and postEU.Trq. Further investigation is required to determine whether this variable is also a key factor in other crises.

- Because linear models cannot adequately distinguish such disparities in financial mechanisms—the logit approach, in particular, yields low-accuracy models—it is crucial to consider nonlinear methods, such as our random forest framework, when analyzing distinctions across crises.

- Irrespective of chronological distance, the four most important variables distinguishing crisis from tranquil periods are extremely similar: “Credit period days,” “Gross margin,” “Collection period days,” and “Solvency ratio (asset-based).” In particular, “Gross margin” may be a key indicator for monitoring transitions between tranquil and crisis periods, as it does not appear among the top variables in the EU.C–COV.C and Glob.C–COV.C models. Notwithstanding the overall accuracy figures, some models perform only about as well as random guessing. Although these factors can detect crisis versus tranquil periods, predictive accuracy varies with their relative contributions; hence, their contribution is the key driver of accuracy.7

- Hence, even when adjacent events show little difference over a given period, it remains important to monitor preceding events because the bankruptcy mechanism can change abruptly, as in the COV.C. More importantly, our results demonstrate the value of monitoring the bankruptcy behavior of the event immediately preceding the latest event.

- Furthermore, Credit period day, Collection period day, and Cashflow/Operating revenue are repeatedly identified as important indicators.8 These factors represent the liquidity at hand and a liquidity condition not reflected in the Profit and Loss statement or Balance Sheet. For instance, phenomena such as surplus bankruptcy are suggested by three indicators. This study found that the differences in liquidity depletion within a company may indicate the difference. Specifically, this study suggests that the bankruptcy mechanisms of the global and European financial crises, as well as the economic crisis caused by the COVID pandemic, are not due to insolvency but rather to factors related to liquidity. The depletion of liquidity within a company can indicate the severity of a crisis.

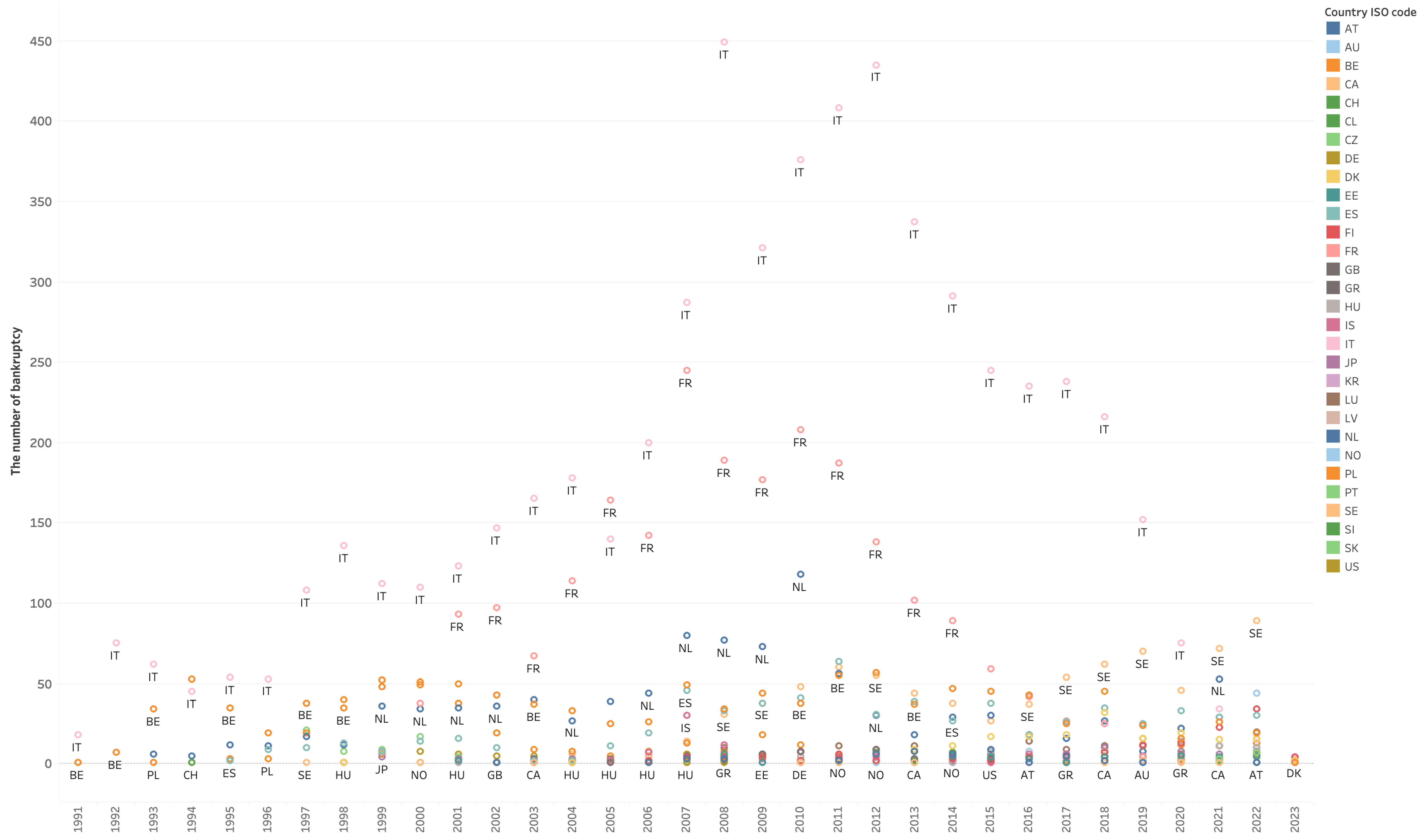

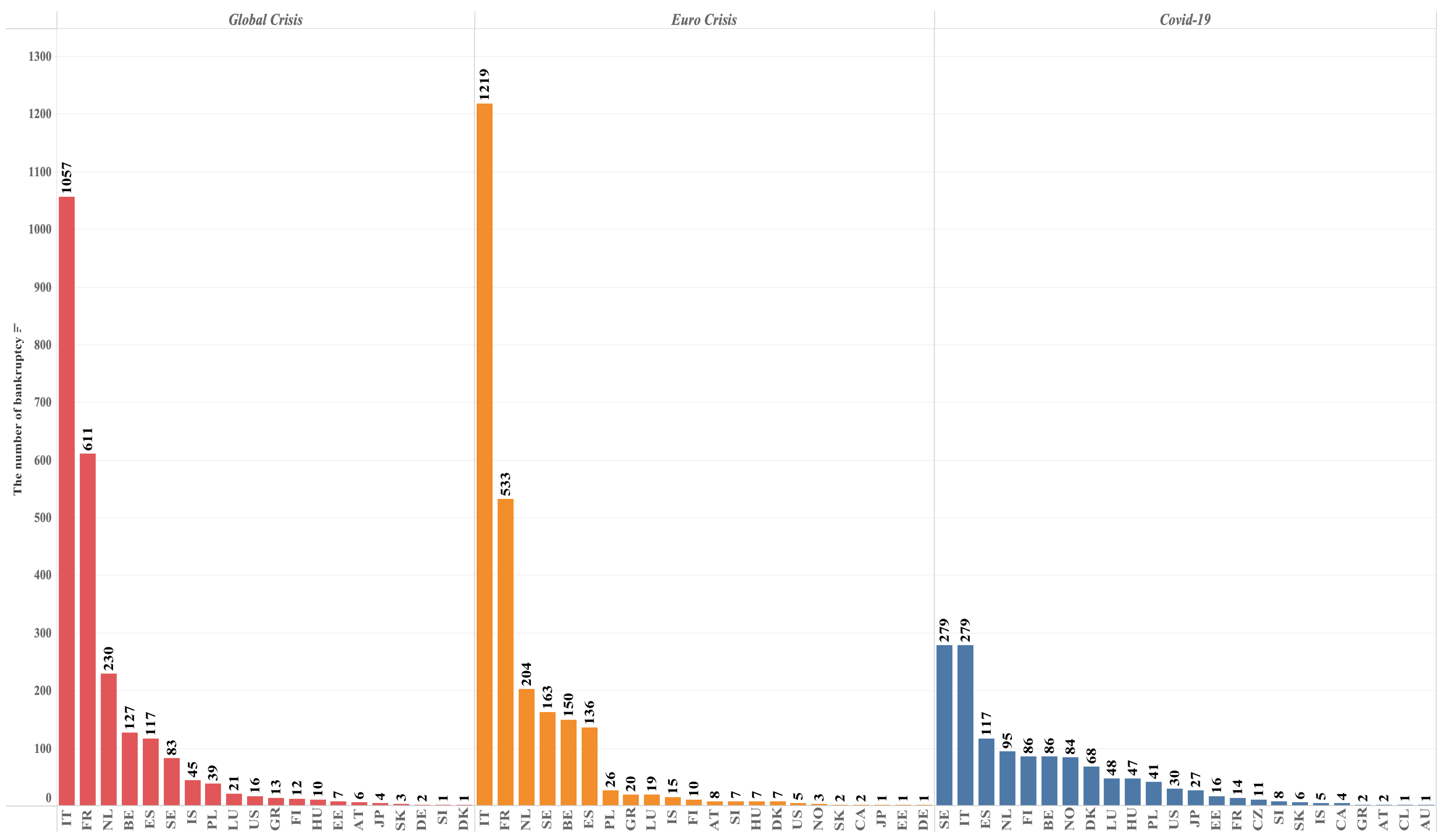

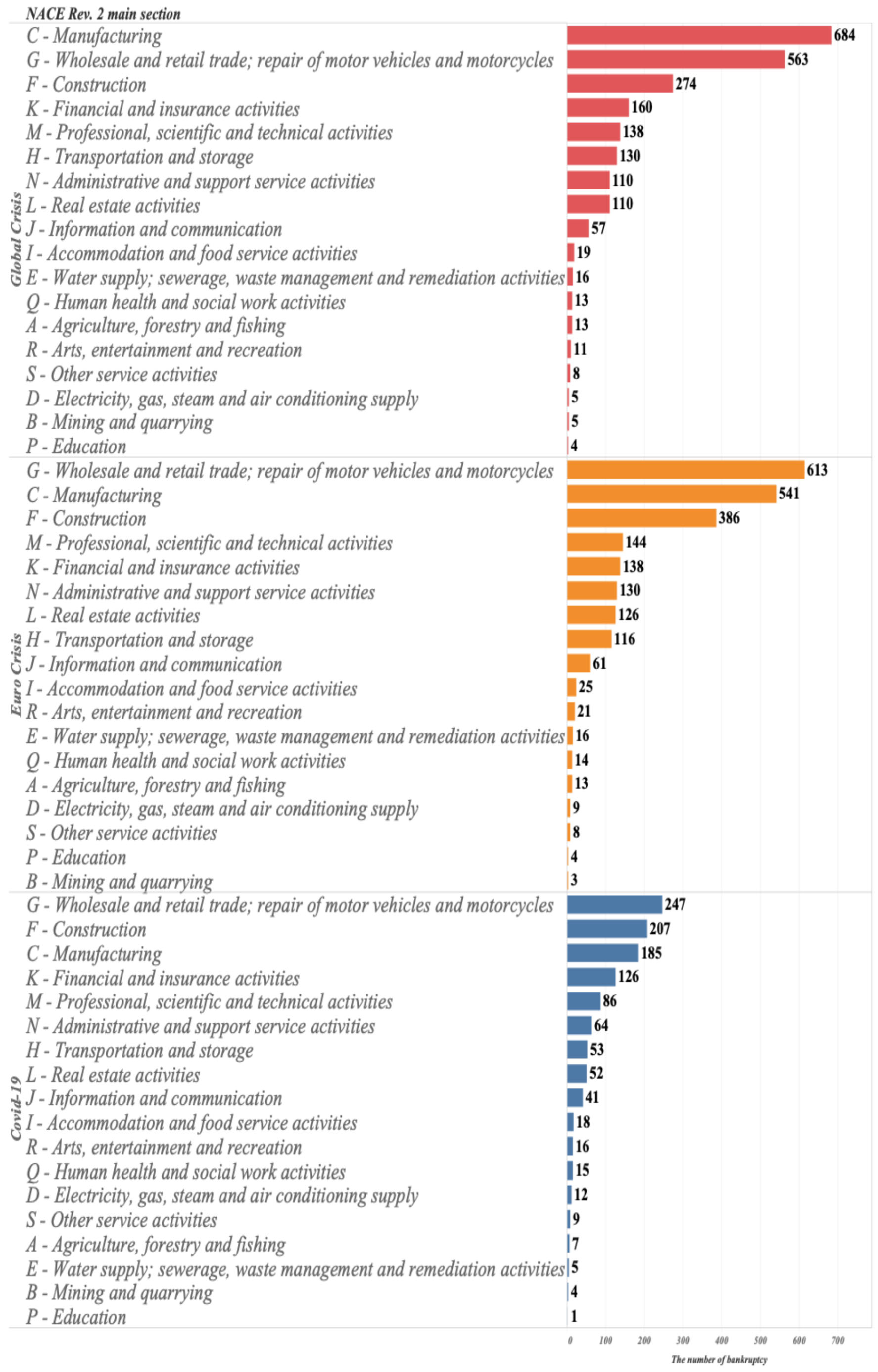

- Our models are built on a crisis-focused dataset and are therefore influenced by the Global Financial Crisis (Glob.C), the European debt crisis (EU.C), and the COVID-19 crisis (COV.C). They are also affected by the distribution of bankruptcies across countries and industries in the dataset; for example, countries such as Italy, France, and the Netherlands, and industries such as C—Manufacturing and G—Wholesale and Retail Trade; Repair of Motor Vehicles and Motorcycles, show relatively high numbers of bankruptcies. Despite these context-specific factors, our analytical framework enables us to identify differences in bankruptcy mechanisms across crises—something that simple bankrupt versus nonbankrupt analyses cannot achieve. Accordingly, it may serve as an alternative early warning system.

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

Appendix B

| EU.C | COVI.C | preGlob.Trq | postEU. Trq | ||

|---|---|---|---|---|---|

| rf | Glob.C | 64.65% | 81.73% | 65.38% | 72.87% |

| EU.C | 78.00% | 71.92% | 69.03% | ||

| COV.C | 81.96% | 77.27% | |||

| glm | Glob.C | 48.93% | 55.59% | 52.53% | 50.67% |

| EU.C | 54.26% | 53.12% | 54.78% | ||

| COV.C | 55.13% | 52.34% |

| 1 | https://www.bvdinfo.com/en-gb/our-products/data/international/orbis (accessed on 23 June 2024). |

| 2 | Hyperparameter tuning is often extremely tedious and laborious work in machine learning, particularly deep learning. |

| 3 | Gross margin (%), Enterprise value/EBITDA, Market cap/Cash flow from operations, Export revenue/Operating revenue (%), and R&D expenses/Operating revenue are removed from indicators. |

| 4 | Usually, one or two variables, due to the limitations of visualization. |

| 5 | The averaging hides some effects of individual responses. The representation of plotting such effects is called an individual effect plot (ICE). |

| 6 | The H2O machine learning library used for this paper assigns levels (classes) in lexical order and considers the highest value level as a “positive” class. The partial dependence plot shows the probability of being a positive class. In our case, the positive classes are Glob.C, Glob.C, and EU.C, for Glob.C versus EU.C, Glob.C versus COV.C, and EU.C versus COV.C, respectively. |

| 7 | Notably, all models have “Credit period days” and “Collection period days” as key distinguishing factors between the two events. |

| 8 | Cashflow/Operating Revenue is an indicator that shows how efficiently a company generates cash flow from its sales activities compared to its sales in its primary business. It is used to assess the quality of cash flow. The higher this ratio, the more cash is being obtained from sales, indicating sound management. Conversely, if there are sales but there is little cash, there may be collection problems or overspending. Credit Period Day and Collection Period Day are the cornerstones of working capital management. The longer the number of Credit period days, the more time companies will have to postpone payments and increase their cash flow. The shorter the number of Collection period days, the faster the company is able to recover cash, indicating good cash flow. |

References

- Acharya, Viral V., Lasse H. Pedersen, Thomas Philippon, and Matthew Richardson. 2017. Measuring Systemic Risk. The Review of Financial Studies 30: 2–47. [Google Scholar] [CrossRef]

- Alpaydin, Ethem. 2014. Introduction to Machine Learning. Cambridge, MA: The MIT Press. [Google Scholar]

- Altman, Edward I. 1968. Financial Ratios, Discriminant Analysis and the Prediction of Corporate Bankruptcy. The Journal of Finance 23: 589–609. [Google Scholar] [CrossRef]

- Altman, Edward I. 1984. The Success of Business Failure Prediction Models: An International Survey. Journal of Banking & Finance 8: 171–98. [Google Scholar]

- Altman, Edward I. 1993. Corporate Financial Distress and Bankruptcy: A Complete Guide to Predicting and Avoiding Distress and Profiting from Bankruptcy, Wiley Finance ed. New York: Wiley, vol. 18.3. [Google Scholar]

- Altman, Edward I., Giancarlo Marco, and Franco Varetto. 1994. Corporate Distress Diagnosis: Comparisons Using Linear Discriminant Analysis and Neural Networks (the Italian Experience). Journal of Banking & Finance 18: 505–29. [Google Scholar] [CrossRef]

- Altman, Edward I., Małgorzata Iwanicz-Drozdowska, Erkki K. Laitinen, and Arto Suvas. 2017. Financial Distress Prediction in an International Context: A Review and Empirical Analysis of Altman’s z-Score Model. Journal of International Financial Management & Accounting 28: 131–71. [Google Scholar]

- Barboza, Flavio, Herbert Kimura, and Edward Altman. 2017. Machine Learning Models and Bankruptcy Prediction. Expert Systems with Applications 83: 405–17. [Google Scholar] [CrossRef]

- Beaver, William H. 1966. Financial Ratios as Predictors of Failure. Journal of Accounting Research 4: 71–11. [Google Scholar] [CrossRef]

- Berger, Allen N., and Christa H. S. Bouwman. 2013. How Does Capital Affect Bank Performance During Financial Crises? Journal of Financial Economics 109: 146–76. [Google Scholar] [CrossRef]

- Beutel, Johannes, Sophia List, and Gregor von Schweinitz. 2019. Does Machine Learning Help Us Predict Banking Crises? Journal of Financial Stability 45: 100693. [Google Scholar] [CrossRef]

- Bitetto, Alessandro, Paola Cerchiello, and Charilaos Mertzanis. 2023. Measuring Financial Soundness Around the World: A Machine Learning Approach. International Review of Financial Analysis 85: 102451. [Google Scholar] [CrossRef]

- Breiman, Leo. 2001. Random Forests. Machine Learning 45: 5–32. [Google Scholar] [CrossRef]

- Breiman, Leo, Jerome Friedman, Charles J. Stone, and Richard A. Olshen. 1984. Classification and Regression Trees. In Monterey: Wadsworth. London: Chapman & Hall. [Google Scholar]

- Brédart, Xavier. 2014. Bankruptcy Prediction Model: The Case of the United States. International Journal of Economics and Finance 6: 1–7. [Google Scholar] [CrossRef]

- Brownlees, Christian, and Robert F. Engle. 2016. SRISK: A Conditional Capital Shortfall Measure of Systemic Risk. The Review of Financial Studies 30: 48–79. [Google Scholar] [CrossRef]

- Bussiere, Matthieu, and Marcel Fratzscher. 2006. Towards a New Early Warning System of Financial Crises. Journal of International Money and Finance 25: 953–73. [Google Scholar] [CrossRef]

- Campbell, John Y., Jens Hilscher, and Jan Szilagyi. 2008. In Search of Distress Risk. The Journal of Finance 63: 2899–939. [Google Scholar] [CrossRef]

- Chakraborty, Sumit, and Sushil K. Sharma. 2007. Prediction of Corporate Financial Health by Artificial Neural Network. International Journal of Electronic Finance 1: 442–59. [Google Scholar] [CrossRef]

- Chava, Sudheer, and Robert A. Jarrow. 2004. Bankruptcy Prediction with Industry Effects. Review of Finance 8: 537–69. [Google Scholar] [CrossRef]

- Chawla, Nitesh V., Kevin W. Bowyer, Lawrence O. Hall, and W. Philip Kegelmeyer. 2002. SMOTE: Synthetic Minority Over-sampling Technique. Journal of Artificial Intelligence Research 16: 321–57. [Google Scholar] [CrossRef]

- Chen, Tianqi, and Carlos Guestrin. 2016. XGBoost: A Scalable Tree Boosting System. Paper presented at KDD ’16: 22nd ACM SIGKDD International Conference on Knowledge Discovery and Data Mining, San Francisco, CA, USA, August 13–17; New York: Association for Computing Machinery, pp. 785–94. [Google Scholar]

- Claessens, Stijn, and Neeltje van Horen. 2015. The Impact of the Global Financial Crisis on Banking Globalization. DNB Working Papers 459. Amsterdam: Netherlands Central Bank, Research Department. [Google Scholar]

- Cleary, Sean, and Greg Hebb. 2016. An Efficient and Functional Model for Predicting Bank Distress: In and Out of Sample Evidence. Journal of Banking & Finance 64: 101–11. [Google Scholar] [CrossRef]

- Climent, Francisco, Alexandre Momparler, and Pedro Carmona. 2019. Anticipating Bank Distress in the Eurozone: An Extreme Gradient Boosting Approach. Journal of Business Research 101: 885–96. [Google Scholar] [CrossRef]

- Demirguc-Kunt, Asli, Enrica Detragiache, and Ouarda Merrouche. 2013. Bank Capital: Lessons from the Financial Crisis. Journal of Money Credit and Banking 45: 1147–64. [Google Scholar] [CrossRef]

- Drehmann, Mathias, and Mikael Juselius. 2014. Evaluating Early Warning Indicators of Banking Crises: Satisfying Policy Requirements. International Journal of Forecasting 30: 759–80. [Google Scholar] [CrossRef]

- Drehmann, Mathias, and Nikola Tarashev. 2013. Measuring the Systemic Importance of Interconnected Banks. Journal of Financial Intermediation 22: 586–607. [Google Scholar] [CrossRef]

- Einav, Liran, and Jonathan Levin. 2014. The Data Revolution and Economic Analysis. Innovation Policy and the Economy 14: 1–24. [Google Scholar] [CrossRef]

- Frankel, Jeffrey A., and Andrew K. Rose. 1996. Currency crashes in emerging markets: An empirical treatment. Journal of International Economics 41: 351–66. [Google Scholar] [CrossRef]

- Frankel, Jeffrey A., and George Saravelos. 2010. Are Leading Indicators of Financial Crises Useful for Assessing Country Vulnerability? Evidence from the 2008 Global Crisis. Working Paper 16047. Working Paper Series; Cambridge, MA: National Bureau of Economic Research. [Google Scholar]

- Frankel, Jeffrey A., and Shang-Jin Wei. 2004. Managing Macroeconomic Crises. Working Paper 10907. Working Paper Series; Cambridge, MA: National Bureau of Economic Research. [Google Scholar]

- Frankel, Jeffrey, and George Saravelos. 2012. Can Leading Indicators Assess Country Vulnerability? Evidence from the 2008–09 Global Financial Crisis. Journal of International Economics 87: 216–31. [Google Scholar] [CrossRef]

- Friedman, Jerome H. 2001. Greedy Function Approximation: A Gradient Boosting Machine. Annals of Statistics 29: 1189–23. [Google Scholar] [CrossRef]

- Geron, Aurelien. 2022. Hands-On Machine Learning with Scikit-Learn, Keras, and TensorFlow: Concepts, Tools, and Techniques to Build Intelligent Systems, 3rd ed. Sebastopol: O’Reilly Media, Inc. [Google Scholar]

- Ghosh, Swart R., and Atish R. Ghosh. 2002. Structural Vulnerabilities and Currency Crises. IMF Working Papers 02/9. Washington, DC: International Monetary Fund. [Google Scholar]

- Hillegeist, Stephen A., Elizabeth K. Keating, Donald P. Cram, and Kyle G. Lundstedt. 2004. Assessing the Probability of Bankruptcy. Review of Accounting Studies 9: 5–34. [Google Scholar] [CrossRef]

- Holopainen, Markus, and Peter Sarlin. 2017. Toward Robust Early-Warning Models: A Horse Race, Ensembles and Model Uncertainty. Quantitative Finance 17: 1933–63. [Google Scholar] [CrossRef]

- Jayasekera, Ranadeva. 2018. Prediction of Company Failure: Past, Present and Promising Directions for the Future. International Review of Financial Analysis 55: 196–208. [Google Scholar] [CrossRef]

- Joy, Mark, Marek Rusnák, Kateřina Šmídková, and Bořek Vašíček. 2017. Banking and Currency Crises: Differential Diagnostics for Developed Countries. International Journal of Finance & Economics 22: 44–67. [Google Scholar]

- Kim, Choong Nyoung, Kyung Hoon Yang, and Jaekyung Kim. 2008. Human Decision-Making Behavior and Modeling Effects. Decision Support Systems 45: 517–27. [Google Scholar] [CrossRef]

- Kristóf, Tamás, and Miklós Virág. 2022. EU-27 Bank Failure Prediction with C5.0 Decision Trees and Deep Learning Neural Networks. Research in International Business and Finance 61: 101644. [Google Scholar] [CrossRef]

- Lennox, Clive. 1999. Identifying Failing Companies: A Re-Evaluation of the Logit, Probit and DA Approaches. Journal of Economics and Business 51: 347–64. [Google Scholar] [CrossRef]

- Liu, Jiaming, Chengzhang Li, Peng Ouyang, Jiajia Liu, and Chong Wu. 2023. Interpreting the Prediction Results of the Tree-Based Gradient Boosting Models for Financial Distress Prediction with an Explainable Machine Learning Approach. Journal of Forecasting 42: 1112–37. [Google Scholar] [CrossRef]

- Martin, Daniel. 1977. Early Warning of Bank Failure: A Logit Regression Approach. Journal of Banking & Finance 1: 249–76. [Google Scholar]

- Messier, William F., and James V. Hansen. 1988. Inducing Rules for Expert System Development: An Example Using Default and Bankruptcy Data. Management Science 34: 1403–15. [Google Scholar] [CrossRef]

- Oet, Mikhail V., Timothy Bianco, Dieter Gramlich, and Stephen J. Ong. 2013. SAFE: An Early Warning System for Systemic Banking Risk. Journal of Banking & Finance 37: 4510–13. [Google Scholar] [CrossRef]

- Ohlson, James A. 1980. Financial Ratios and the Probabilistic Prediction of Bankruptcy. Journal of Accounting Research 18: 109. [Google Scholar] [CrossRef]

- Rose, Andrew K., and Mark M. Spiegel. 2011. Cross-country causes and consequences of the crisis: An update. European Economic Review 55: 309–24. [Google Scholar] [CrossRef]

- Shirata, Cindy. 2003. Predictors of Bankruptcy After Bubble Economy in Japan: What Can You Learn from Japan Case? Paper presented at 15th Asian-Pacific Conference on International Accounting Issues, Bangkok, Thailand, November 24. [Google Scholar]

- Shumway, Tyler. 2001. Forecasting Bankruptcy More Accurately: A Simple Hazard Model. The Journal of Business 74: 101–24. [Google Scholar] [CrossRef]

- Silva, Walmir, Herbert Kimura, and Vinicius Amorim Sobreiro. 2017. An Analysis of the Literature on Systemic Financial Risk: A Survey. Journal of Financial Stability 28: 91–114. [Google Scholar] [CrossRef]

- Stewart, Jones, Johnstone David, and Wilson Roy. 2017. Predicting Corporate Bankruptcy: An Evaluation of Alternative Statistical Frameworks. Journal of Business Finance & Accounting 44: 3–34. [Google Scholar]

- Tanaka, Katsuyuki, Takuji Kinkyo, and Shigeyuki Hamori. 2016. Random Forests-Based Early Warning System for Bank Failures. Economics Letters 148: 118–21. [Google Scholar] [CrossRef]

- Tanaka, Katsuyuki, Takuji Kinkyo, and Shigeyuki Hamori. 2018. Financial Hazard Map: Financial Vulnerability Predicted by a Random Forests Classification Model. Sustainability 10: 1530. [Google Scholar] [CrossRef]

- Tanaka, Katsuyuki, Takuo Higashide, Takuji Kinkyo, and Shigeyuki Hamori. 2019. Analyzing Industry-Level Vulnerability by Predicting Financial Bankruptcy. Economic Inquiry 57: 2017–34. [Google Scholar] [CrossRef]

- Tian, Shaonan, and Yan Yu. 2017. Financial Ratios and Bankruptcy Predictions: An International Evidence. International Review of Economics & Finance 51: 510–26. [Google Scholar] [CrossRef]

- Tola, Albi, and Sebastien Waelti. 2018. Financial Crises, Output Losses, and the Role of Structural Reforms. Economic Inquiry 56: 761–98. [Google Scholar] [CrossRef]

- Varian, Hal R. 2014. Big Data: New Tricks for Econometrics. Journal of Economic Perspectives 28: 3–28. [Google Scholar] [CrossRef]

- Vazquez, Francisco, and Pablo Federico. 2015. Bank Funding Structures and Risk: Evidence from the Global Financial Crisis. Journal of Banking & Finance 61: 1–14. [Google Scholar] [CrossRef]

- Ward, Felix. 2017. Spotting the Danger Zone: Forecasting Financial Crises with Classification Tree Ensembles and Many Predictors. Journal of Applied Econometrics 32: 359–78. [Google Scholar] [CrossRef]

| Event | preGlob.Trq | Glob.C | EU.C | postEU.Trq | COV.C |

|---|---|---|---|---|---|

| Period | 2002–2006 | 2007–2009 | 2010–2012 | 2013–2018 | 2019–2023 |

| Data size | 1694 | 2059 | 2202 | 2575 | 1021 |

| Type of Ratio | Ratios | 1st Qu. | Median | Mean | 3rd Qu. |

|---|---|---|---|---|---|

| Profitability | ROE using Profit (Loss) before tax | −11.33 | 2.03 | −19.08 | 12.71 |

| Ratios | ROCE using Profit (Loss) before tax | −10.47 | 2.28 | −12.33 | 12.28 |

| ROA using Profit (Loss) before tax | −14.94 | −1.89 | −8.76 | 1.50 | |

| ROE using Net income | −11.33 | 0.58 | −27.41 | 6.34 | |

| ROCE using Net income | −9.70 | 2.11 | −15.38 | 9.75 | |

| ROA using Net income | −14.30 | −1.79 | −9.40 | 0.72 | |

| Profit margin | −9.93 | −1.10 | −7.53 | 0.91 | |

| Gross margin | 34.98 | 44.40 | 47.10 | 54.52 | |

| EBITDA margin | −4.75 | 0.67 | −1.90 | 3.65 | |

| EBIT margin | −8.53 | −0.28 | −5.55 | 2.12 | |

| Cash flow/Operating revenue | −5.57 | 0.05 | −4.54 | 1.60 | |

| Operational | Net assets turnover | 2.49 | 5.57 | 21.16 | 12.30 |

| Ratios | Interest coverage | −5.15 | −0.46 | 5.13 | 1.50 |

| Stock turnover | 4.91 | 8.76 | 36.57 | 18.93 | |

| Collection period days | 24.00 | 59.00 | 90.71 | 113.00 | |

| Credit period days | 29.00 | 61.50 | 93.81 | 109.00 | |

| Structure | Current ratio | 0.74 | 1.01 | 1.43 | 1.24 |

| Ratios | Liquidity ratio | 0.43 | 0.70 | 1.04 | 1.00 |

| Shareholders liquidity ratio | −0.02 | 0.47 | 7.92 | 1.94 | |

| Solvency ratio (asset-based) | 0.01 | 7.23 | 6.65 | 19.89 | |

| Solvency ratio (liability-based) | 8.22 | 13.14 | 17.52 | 19.09 | |

| Gearing | 95.53 | 134.58 | 185.82 | 181.84 |

| EU.C | COV.C | preGlob.Trq | postEU.Trq | ||

|---|---|---|---|---|---|

| rf | Glob.C | 51.88% | 68.47% | 53.79% | 60.60% |

| EU.C | 63.56% | 57.62% | 52.34% | ||

| COV.C | 74.15% | 58.34% | |||

| glm | Glob.C | 50.65% | 56.79% | 51.23% | 51.42% |

| EU.C | 54.89% | 52.03% | 50.90% | ||

| COV.C | 56.46% | 53.92% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tanaka, K.; Higashide, T.; Kinkyo, T.; Hamori, S. Financial Mechanisms of Corporate Bankruptcy: Are They Different or Similar Across Crises? Risks 2025, 13, 158. https://doi.org/10.3390/risks13080158

Tanaka K, Higashide T, Kinkyo T, Hamori S. Financial Mechanisms of Corporate Bankruptcy: Are They Different or Similar Across Crises? Risks. 2025; 13(8):158. https://doi.org/10.3390/risks13080158

Chicago/Turabian StyleTanaka, Katsuyuki, Takuo Higashide, Takuji Kinkyo, and Shigeyuki Hamori. 2025. "Financial Mechanisms of Corporate Bankruptcy: Are They Different or Similar Across Crises?" Risks 13, no. 8: 158. https://doi.org/10.3390/risks13080158

APA StyleTanaka, K., Higashide, T., Kinkyo, T., & Hamori, S. (2025). Financial Mechanisms of Corporate Bankruptcy: Are They Different or Similar Across Crises? Risks, 13(8), 158. https://doi.org/10.3390/risks13080158