1. Introduction

Crude oil is a critical input for modern economies, shaping production costs, trade balances, and national energy security. It is a vital input for economic development, and its pricing plays a central role in global financial stability. Given its strategic importance, fluctuations in international spot prices have posed significant economic hazards for both governments and markets. In response to these risks, futures markets were established to enhance price discovery, manage volatility, and provide greater transparency. A major institutional development in this regard was the launch of crude oil futures contracts by the New York Mercantile Exchange (NYMEX) in 1983 and the London Intercontinental Exchange in 1988 (

Tian and Lai 2019). Notably, the NYMEX contract, introduced in March 1983 (

Gülen 1998), specified physical delivery at Cushing, Oklahoma, and became benchmarked primarily against West Texas Intermediate (WTI), which has since evolved into a global reference price for crude oil. Today, most crude oil is traded through futures markets, where derivatives often have a greater influence on price discovery than physical transactions. Since oil is priced in U.S. dollars, fluctuations in exchange rates—especially dollar depreciation—can significantly affect oil prices. These dynamics highlight the interconnected nature of energy and currency markets and the strategic importance of futures trading in managing volatility and economic risk (

Sun et al. 2022).

Natural gas, like crude oil, plays a vital role in the global energy system due to its cleaner combustion and lower greenhouse gas emissions. Its growing use across residential, industrial, and power sectors, along with its rising share in global energy demand, underscores its strategic importance alongside oil in both national energy policies and international markets. According to the International Energy Agency, natural gas consumption grew by 4.6% in 2018, accounting for nearly half of the global increase in energy demand, and projections show current levels increasing by 2040, with natural gas continuing to outperform coal and oil (

IEA 2019). These trends highlight why natural gas and crude oil remain central to discussions on energy security, economic development, and environmental transition. With the rise of financial globalization, understanding how returns and volatility are transmitted across capital markets has become increasingly important. Fluctuations in natural gas, crude oil, and electricity indices have to be investigated to unveil the risk and value of investment portfolios (

Zhang et al. 2020).

However, the widespread use of crude oil has also contributed significantly to global CO

2 emissions and environmental degradation, prompting growing concern among policy-makers. In response, international agreements such as the Paris Agreement have emerged, aiming to curb greenhouse gas emissions and accelerate the transition to cleaner energy sources. The Kyoto Protocol required industrialized countries to reduce greenhouse gas emissions by about 5% below 1990 levels during 2008–2012. To support this goal, it introduced three international cooperation mechanisms, including carbon trading (

Wei and Lin 2016). One key tool was the Emission Trading Scheme (ETS), targeting energy-intensive sectors and households. Within this system, polluting industries received tradable carbon emission rights known as European Union Allowances (EUAs), allowing them to emit a set amount of CO

2 annually. The carbon market responds to overall energy market developments; as a result, it could serve as a hedge or a safe haven tool against U.S. climate policy uncertainty (CPU). A weak (strong) hedge occurs when an asset is uncorrelated (positively correlated) with U.S. climate policy uncertainty, and a weak (strong) safe haven exists when an asset is uncorrelated (positively correlated) with U.S. CPU during periods of market stress (

Hoque and Batabyal 2022). Furthermore,

Shaton et al. (

2020) finds that clean energy stocks significantly offset the downside risks associated with dirty energy stocks, and this protective effect persists even during times of market movements. Natural gas is often introduced as a transitional energy source in climate policy discussions. One of its main advantages is its potential to reduce greenhouse gas (GHG) emissions, as burning an equivalent energy unit of natural gas emits roughly half the CO

2 compared to coal or oil (

Shaton et al. 2020). Although it still represents a continued reliance on fossil fuels, natural gas is expected to contribute to emission reductions over the coming decades (

Pacala and Socolow 2004;

Howarth et al. 2011). In light of these considerations, this study focuses on carbon emissions futures, crude oil WTI futures, European Union Allowance (EUA) futures, and natural gas futures, as they represent key instruments for examining safe haven theory between dirty and green assets in the context of carbon and energy futures markets.

This study is guided by the following research question: Can green energy futures serve as safe havens for dirty energy futures under extreme market conditions? To address this, we test two hypotheses:

H1. Green assets act as safe havens during extreme downturns.

H2. Green assets reduce portfolio tail risk when allocated above certain thresholds.

This study treats carbon emissions futures as a dirty asset indicator and EUA futures as a green asset. While carbon emissions futures primarily reflect the financialization of pollution without enforcing actual reductions, EUA futures are embedded in the EU’s binding cap-and-trade system, designed to drive emissions down. Accordingly, these variables are considered within the analytical framework to reflect opposing signals: one aligned with speculative pollution trading, the other with regulatory decarbonization efforts. Additionally, crude oil futures are considered a dirty asset indicator, while natural gas futures are treated as a green asset. Crude oil futures are linked to high carbon intensity and are widely associated with substantial CO2 emissions, reflecting continued dependence on carbon-intensive energy sources. In contrast, natural gas futures are viewed as relatively cleaner due to their lower carbon output per energy unit, positioning them as part of the transition toward less polluting energy alternatives.

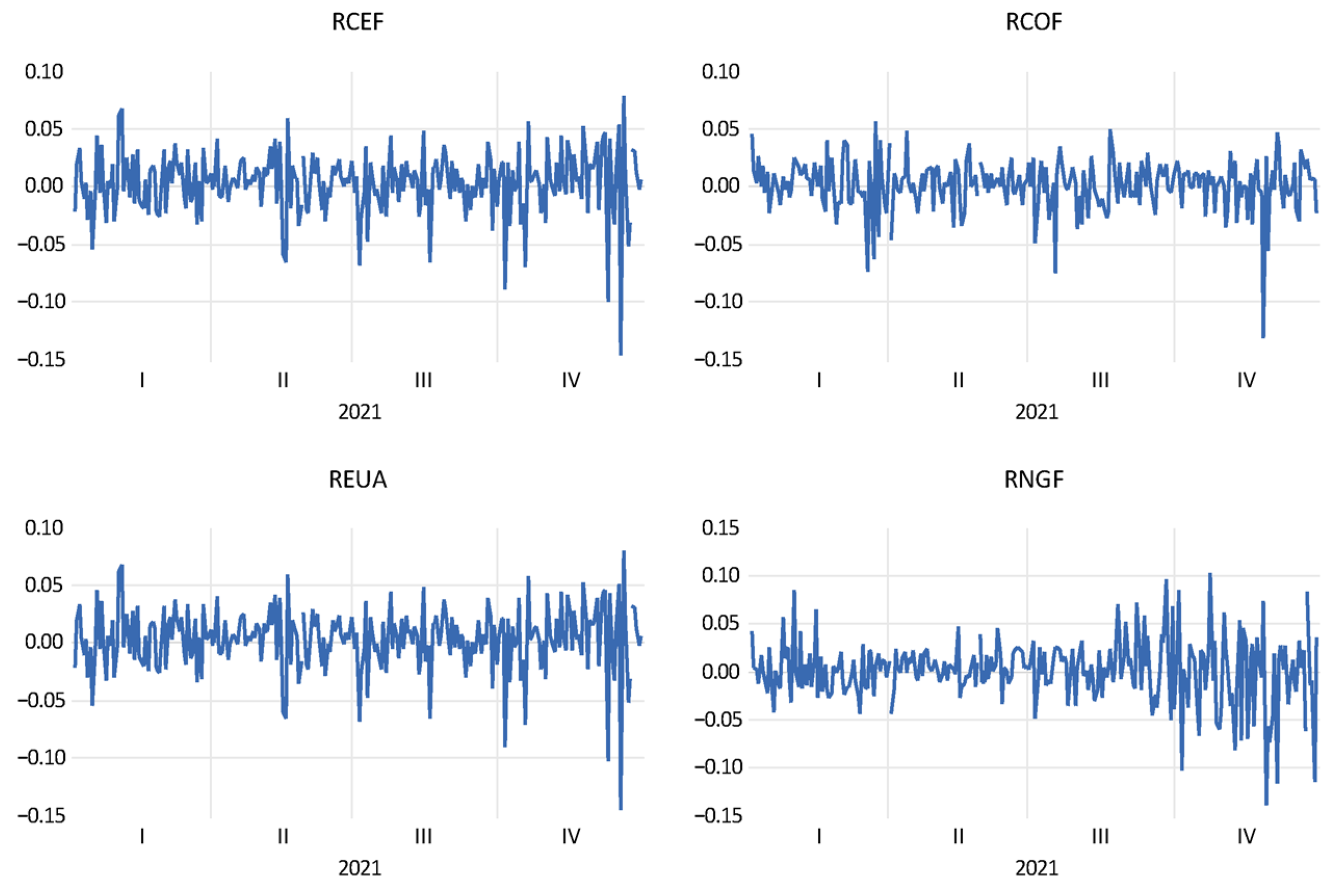

The data set spans from 1 April 2021 to 25 June 2025 and includes assets from both European and U.S. markets. Specifically, EUA futures and carbon credits represent the European segment, while clean energy ETFs and natural gas futures are sourced from U.S. exchanges. This cross-regional selection enables a broader assessment of green asset dynamics across major energy and carbon markets.

These assets are widely utilized as investment instruments in financial markets, offering exposure to the energy and environmental sectors. However, due to their sensitivity to geopolitical events, regulatory changes, and macroeconomic dynamics, they are often subject to considerable price volatility. In response to such fluctuations, investors may seek safe haven assets to protect their portfolios during periods of heightened uncertainty. In this context, some market participants might perceive one of the four futures contracts examined in this study as a potential safe haven relative to another. To test the safe haven properties, we followed the methodological steps employed by

Kuang (

2021). In that study, Kuang investigated the safe haven relationship between clean and dirty cryptocurrencies by applying a model based on the dynamic conditional correlation (DCC) values, originally developed by

Baur and Lucey (

2010).

Among the four we used, two are classified as “clean futures” and grouped under the broader category of “green assets,” while the remaining two are considered “dirty futures” and labeled as “dirty assets.” This study investigates whether green assets can serve as safe havens for dirty assets. The classification into “dirty” and “green” is based on the environmental impact of the underlying assets, specifically their potential to either contribute to or mitigate pollution.

Although the literature includes numerous studies investigating the safe haven properties of various assets, including stocks, commodities, and cryptocurrencies, using different methodologies, as will be detailed in the following section, there is a notable gap in the research specifically examining the safe haven relationship between futures contracts linked to CO2-intensive assets and those associated with pollution mitigation. Based on my comprehensive review of the existing literature, it was found that while a few studies have explored safe haven dynamics involving environmentally relevant financial instruments, no prior research has directly investigated the safe haven potential between these particular categories of futures contracts.

Therefore, this study aims to fill a notable gap in the literature by examining the safe haven dynamics between environmentally contrasting futures contracts. The study contributes to the literature in several ways. This understudied dynamic is crucial amid rising climate concerns and energy shifts. As natural gas becomes a key transitional energy with lower emissions than coal or oil, and carbon markets such as EUA futures aim to reduce emissions, understanding the risk between these “green” and “dirty” assets is vital for decision-making. These assets, used as investments, are highly sensitive to geopolitical, regulatory, and economic changes, causing significant price volatility and increasing the need for safe havens assets. First, this study extends the application of safe haven theory to the context of environmental futures markets, offering new insights into how these instruments behave under market stress. Second, it provides empirical evidence on whether green assets can serve as hedging tools against the volatility of dirty assets. Third, the study introduces a novel classification framework based on environmental impact by distinguishing between “dirty” and “green” futures. This study offers practical insights for investors, policy-makers, and portfolio designers. While green assets may not consistently serve as safe havens, their ability to mitigate tail risk under certain conditions makes them valuable tools for risk-sensitive portfolio strategies and regulatory design.

The remainder of this paper is organized as follows.

Section 2 and

Section 3 provide a literature review and methodology of the paper, respectively.

Section 4 presents the data and results of the empirical application and then discusses the results.

Section 5 provides the concluding remarks and discussion.

2. Literature Review

This section aims to review studies that examine the relationship between carbon and energy futures, particularly those that analyze volatility spillovers, return dependencies, and safe haven or hedge behavior involving these variables. As previously noted, no prior study has employed the exact same set of variables in conjunction with the

Baur and McDermott’s (

2010) framework, making this analysis methodologically unique. Accordingly, the literature is organized into four thematic categories to reflect both the empirical and conceptual diversity in the field. First, studies are presented that explore the relationship between energy markets and carbon markets, with particular attention to volatility spillovers, price co-movements, and return dependencies. Second, research studies that explicitly apply

Baur and McDermott’s (

2010) methodology to assess hedge and safe haven properties across various asset classes are highlighted, especially in the context of green finance. Third, a summary of broader investigations of individual assets’ hedge or safe haven characteristics using alternative approaches is given. Finally, studies are presented that are not centered on hedge or safe haven testing but instead utilize one or more of the variables adopted in this study, with relevant contextual insights also given.

In recent years, several studies have examined the relationship between energy markets and carbon markets, focusing on volatility spillovers, price dependencies, and risk transmission.

Reboredo (

2013) employs copula models using daily data from the Phase II EU ETS and Brent crude oil between 2008 and 2011. He finds positive average dependence but tail independence, and shows that including EUAs in oil portfolios enhances downside risk protection and improves performance, with Gaussian copula performing best.

Bunnag (

2015) investigates daily data from 2009 to 2014 using VECH, BEKK, and CCC-GARCH models on crude oil, gasoline, heating oil, and carbon emissions futures, finding that oil volatility spills over to carbon prices, with BEKK capturing both short- and long-term dynamics.

Wei and Lin (

2016) analyze EUA carbon futures, WTI oil futures, and Dow Jones futures from 2005 to 2013 using a trivariate BEKK-GARCH model, and show that carbon volatility is significantly influenced by oil and stock market shocks, while oil is the most independent and exogenous asset.

Hoque and Batabyal (

2022) apply a GARCH(1,1) model and a quantile regression framework to monthly data from August 2005 to March 2021 to test whether EUA carbon futures and S&P Global Clean Energy stocks serve as hedges or safe havens against U.S. CPU. They find that carbon futures behave as strong safe havens in extreme bearish regimes (90–95% CPU quantiles), while clean energy stocks only serve that role in extreme bullish scenarios (99% quantile).

Hoque et al. (

2023) analyze daily and weekly return data on climate change futures and EUA carbon futures using VAR-DCC-GARCH and ADCC-GARCH models. Their results show that daily data reveal a unidirectional positive spillover from carbon to climate markets, whereas weekly data show bidirectional and negative return spillovers. Finally,

Conrad et al. (

2012) apply a FIAPGARCH model to high-frequency EUA futures data and document that EU allowance prices are highly sensitive to macroeconomic announcements and regulatory decisions, with volatility exhibiting long memory and significant asymmetries.

Building on the hedge and safe haven framework proposed by Baur and McDermott in 2010, several studies extend their approaches to sustainable assets. While the methodological foundation of this study draws on

Kuang (

2021,

2025), it is important to emphasize that this framework has been applied across a diverse range of asset classes beyond cryptocurrencies. For instance, Kuang’s approach has been used to examine the safe haven properties of green bonds against WTI crude oil during crisis periods (

Huang et al. 2022), clean energy equity indices in relation to both clean and dirty cryptocurrencies (

Ren and Lucey 2022a), and the interactions between green and non-green cryptocurrencies and equity markets (

Ali et al. 2024). This cross-sectoral application demonstrates the methodological flexibility and relevance of the framework in analyzing assets with varying market structures. In our study, we extend this approach to energy futures, which unlike cryptocurrencies are influenced by regulatory mechanisms, physical delivery constraints, and commodity-specific volatility dynamics. By explicitly incorporating these contextual differences, we argue that the adaptation is both methodologically sound and empirically justified. The inclusion of EUA futures and natural gas futures, for example, reflects the unique role of regulatory compliance and transitional energy strategies in shaping market behavior, thereby reinforcing the relevance of the safe haven framework in the energy domain. In their foundational study, Baur and McDermott define hedges and safe havens using DCC-GARCH combined with quantile dummy regressions and find that gold acts as a strong safe haven for developed equity markets during extreme downturns.

Huang et al. (

2022) assess green bonds as hedges and safe havens for WTI crude oil during major crisis events (e.g., COVID-19, the Russia–Ukraine war), using DCC-GARCH and Baur–McDermott quantile regression. They conclude that green bonds function both as strong hedges and strong safe havens, whereas gold only qualifies as a weak safe haven.

Ren and Lucey (

2022a) explore whether clean energy equity indices act as safe havens for clean and dirty cryptocurrencies by applying the same methodological framework. Their results show that these indices become weak to strong safe havens for dirty cryptos at extreme lower quantiles, particularly during negative tail events.

Ali et al. (

2024) test ten green and non-green cryptocurrencies against major equity markets using DCC-GARCH and quantile regressions, concluding that while none serve as strong hedges or safe havens, most act as weak safe havens in times of financial distress. Finally,

Kuang (

2025) investigates clean versus dirty cryptocurrencies and their intra-sector safe haven properties using DCC-GARCH and the Baur–McDermott approach, emphasizing that clean cryptocurrencies provide rare but meaningful downside protection in tail risk scenarios.

A broader set of studies investigates whether certain assets function as hedges or safe havens without directly applying the Baur and McDermott methodology.

Baur and McDermott (

2010) use quantile regressions to show that gold serves as a hedge and a short-lived (≈15 trading days) safe haven for developed-market equities, although not for bonds.

Bredin et al. (

2017) use a four-moment modified value-at-risk approach on spot, futures, and ETF data (1980–2014) to test gold, silver, and platinum, and find that all reduce equity downside risk over short horizons, with gold being most consistent.

Elie et al. (

2019) evaluate gold and crude oil as safe havens for clean energy stock indices using mixed copula models, showing only weak and index-specific safe haven behavior.

Liu et al. (

2020) assess oil as a hedge and safe haven for seven major currencies using ADCC-GARCH and quantile regressions, concluding that oil provides strong protection for most currencies except the Japanese yen.

Kuang (

2021) compares green bonds and clean energy stocks to dirty energy assets and broad equities using risk-based metrics (standard deviation, max drawdown, VaR, CVaR) and finds that green bonds consistently act as safe havens, while clean energy stocks only help hedge dirty energy portfolios.

Ming et al. (

2023) use a multilateral price GARCH(1,1) model to evaluate gold and major currencies as safe havens for crude oil, showing that the Swiss franc, U.S. dollar, and euro outperform gold in providing downside protection across quantiles.

Dias et al. (

2023) analyze the safe haven potential of clean energy equity indices (ECO, QGREEN) against dirty cryptocurrencies using Gregory–Hansen cointegration and volatility spillover models, concluding that these indices function as effective safe havens during market turmoil such as the 2022 crypto crash.

Zhang et al. (

2020) review the macroeconomic effects of the EU ETS during phase I and show through simulation and regression that over-allocation caused price collapse, and while the system raised marginal electricity costs, it had minimal effect on GDP, inflation, employment, or innovation.

Gülen (

1998) examines WTI crude oil futures’ forecasting ability from 1983 to 1995, finding that futures prices are cointegrated with spot prices and perform better than posted prices in unbiasedness tests.

While not directly focused on hedge or safe haven behavior, several additional studies use key variables from the present analysis and offer complementary insights.

Ren and Lucey (

2022b) apply DCC-GARCH and Diebold–Yilmaz connectedness models to study return transmission between clean energy indices and cryptocurrencies, finding increased connectedness during market stress, although no consistent safe haven properties. This study illustrates how cross-market volatility and dynamic linkages can complement more traditional correlation-based approaches.

The methodology aims to assess safe haven properties by employing the relative risk ratio of CVaR, in combination with the dynamic conditional correlation regression framework of

Baur and McDermott (

2010), following the procedural steps outlined by

Kuang (

2021). Safe haven theory is based on modern portfolio theory (MPT), which was originally proposed by

Markowitz (

1952), which posits that investors can mitigate risk by diversifying their portfolios. However, the extent of risk reduction depends on the nature of the assets included.

Baur and Lucey (

2010) further elaborate on asset roles by distinguishing between safe havens, hedges, and diversifiers. According to their definitions, a safe haven is an asset that remains uncorrelated with others during periods of market distress, a hedge is one that is either uncorrelated or negatively correlated with other assets on average, and a diversifier is characterized by a positive, yet imperfect, correlation with other portfolio components under normal market conditions.

3. Methodology

As mentioned above, here part of the methodology of

Kuang (

2025) is used, which is constructed on previous studies (

Baur and Lucey 2010;

Baur and McDermott 2010;

Ren and Lucey 2022a;

Bredin et al. 2017).

Kuang (

2025) empirical application can be split into four parts: a safe haven analysis, relative risk ratio analysis, unconditional optimization, and conditional optimization for crypto portfolios. In this paper, we will apply a safe haven analysis and relative risk ratio analysis. The decision to focus exclusively on these two methods is grounded in both the economic function of the instruments under study and the practical limitations associated with portfolio-based optimization techniques. Unlike traditional financial assets or cryptocurrencies, the instruments analyzed in this paper are not primarily designed for speculative investment or portfolio construction.

For instance, EUA futures and carbon emissions futures are used by firms to comply with regulatory obligations under emissions trading schemes such as the EU ETS. These contracts allow companies to hedge against future carbon price volatility and manage compliance costs, but they are not typically held in long-only portfolios for return maximization. Given this context, the application of unconditional or conditional portfolio optimization models may not be the most suitable or necessary approach for the instruments under study, as their primary function lies outside traditional investment portfolio frameworks. In contrast, safe haven analyses assess whether these futures contracts provide protection during periods of extreme market stress, while relative risk ratio analyses quantify their contribution to tail risk mitigation when combined with other exposures. The timeliness of this understudied dynamic is crucial given the escalating global concerns about climate change and the accelerating transition towards cleaner energy sources. As carbon markets evolve with instruments such as EUA futures designed to reduce emissions, and as financial markets increasingly integrate environmental considerations, understanding the risk dynamics between “green” and “dirty” assets becomes essential for informed decision-making. These assets are widely used in investment portfolios, yet their sensitivity to geopolitical events, regulatory shifts, and macroeconomic volatility makes them prone to significant price fluctuations—highlighting the need to identify potential safe haven instruments.

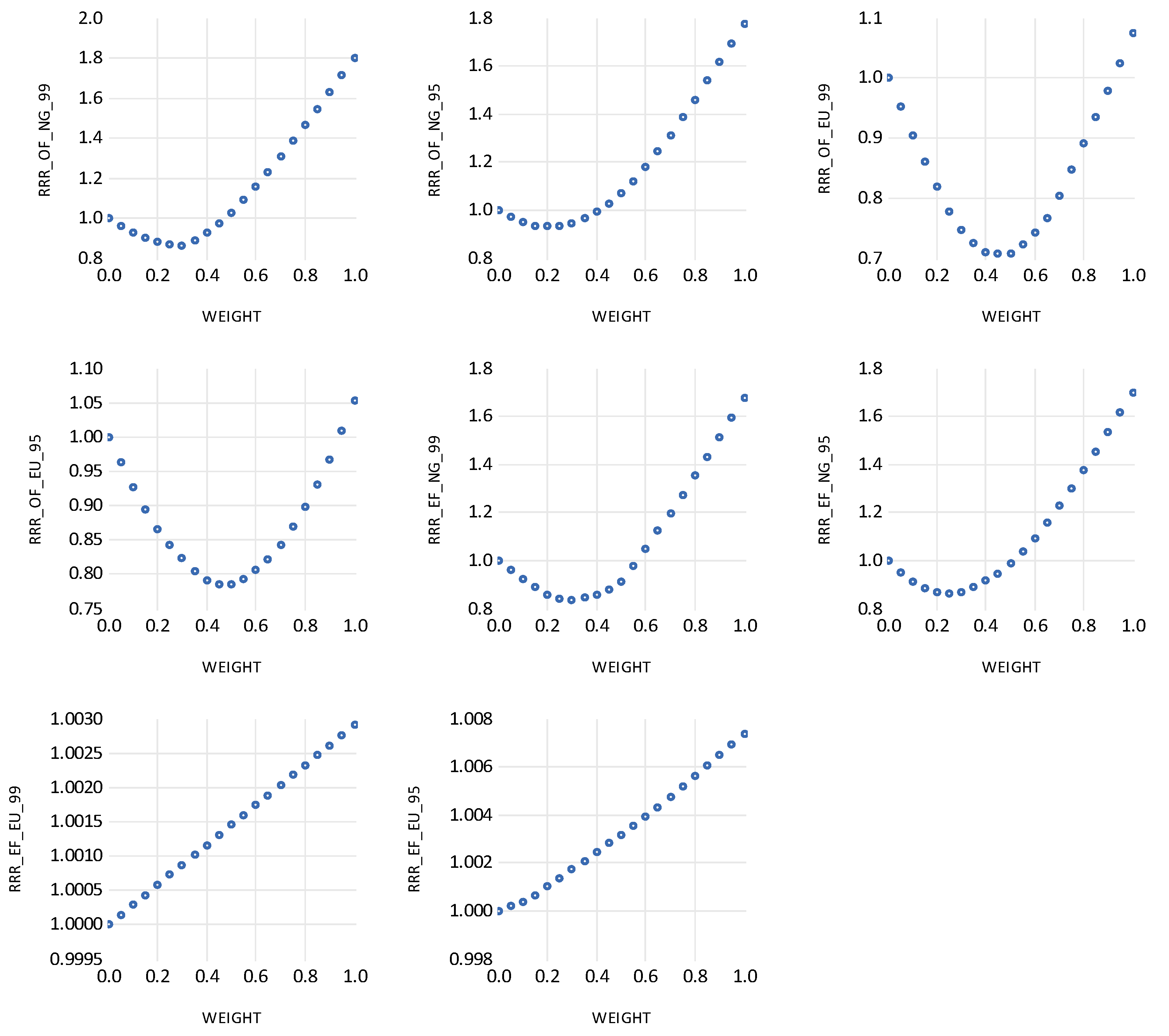

Therefore, we can split this paper’s methodology into two parts: the relative risk ratio analysis and safe haven analysis. While the relative risk ratio analysis applies mathematical calculations, the safe haven analysis applies econometric methods. The relative risk ratio (RRR), calculated based on the modified CVaR, which was proposed by

Bredin et al. (

2017), is presented in Equation (1).

If

is less than one, it indicates that the inclusion of clean cryptocurrencies reduces the portfolio’s exposure to extreme downside risk, suggesting a potential safe haven effect. In contrast, a ratio close to or greater than one implies limited or no tail risk reduction. This metric offers a clear and practical framework for quantifying the extent to which clean cryptocurrencies enhance portfolio resilience during periods of market stress, providing valuable insights for sustainability-oriented investment strategies. Here,

is calculated as:

Here,

and

represent the portfolio weights of the dirty and green assets, respectively. This formulation allows us to assess how the inclusion of green instruments affects the overall tail risk of the portfolio. In the study by

Kuang (

2025), two CVaRs are calculated for each cryptocurrency; thus, two RRRs are computed for each cryptocurrency. These two CVaRs are CVaR

95 and CVaR

99, which represent the expected loss beyond the 95% and 99% value-at-risk thresholds, respectively. The general specification is as follows:

The modified value-at-risk (VaR) at a given confidence level α is computed using the

Cornish and Fisher (

1938)’s method, which adjusts the standard normal quantile to account for skewness and kurtosis in the return distribution. The adjusted quantile

) is calculated as follows:

This leads to the modified VaR expression:

Here, , , , and represent the mean, standard deviation, skewness, and excess kurtosis of the returns, respectively.

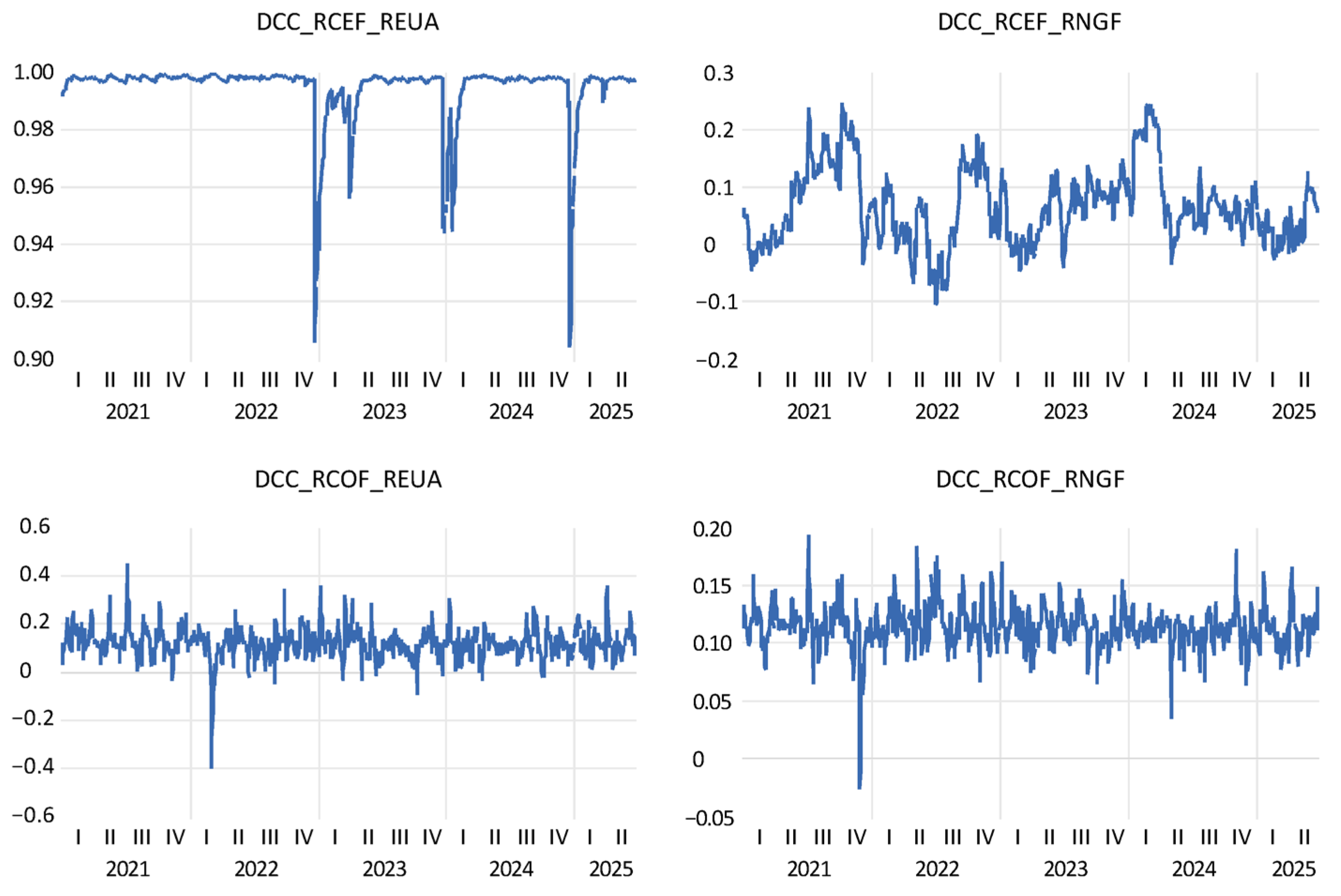

For the second approach (econometric method), we estimate the simple linear regression, where the dependent variable is the dynamic conditional correlation (DCC) coefficients of dirty assets and green assets pairs, and the independents are dummy variables, which show quantiles of returns, as follows:

Here, , , and shows dummy variables. takes 1 if the return of the dirty cryptocurrency is less than the 10% quantile of the data set and 0 otherwise, takes 1 if the return of the dirty cryptocurrency is less than the 5% quantile of the data set and 0 otherwise, and takes 1 if the return of the dirty cryptocurrency is less than the 1% quantile of the data set and 0 otherwise. In the regression model, represents the average correlation between clean and dirty cryptocurrencies. Specifically, the return series were first sorted in ascending order, and threshold values corresponding to the 10th, 5th, and 1st percentiles of the empirical distribution were identified. These thresholds were then used to construct dummy variables. A significantly positive implies a diversifier role, while a value close to zero suggests a weak hedge. If is negative, it indicates a strong hedge. The coefficients , , and capture the responses of clean cryptocurrencies during extreme downturns in dirty assets at the 10%, 5%, and 1% quantiles, respectively. Significantly negative values for these coefficients suggest safe haven behavior under market stress. Significantly negative values for these coefficients suggest safe haven behavior under market stress, meaning that clean cryptocurrencies tend to decouple from dirty ones during extreme downturns, thereby offering protection against sharp losses in dirty cryptocurrency portfolios.

5. Discussion and Conclusions

Among the investigated futures, natural gas stands out as the most volatile, displaying the widest range of daily returns and the most significant exposure to extreme losses. Its sensitivity to market shocks underscores the importance of cautious allocation. In contrast, crude oil futures demonstrate more stable behavior with relatively limited downside risk. While less volatile than natural gas, renewable energy ETFs still carry minor tail risk, suggesting their defensive qualities might be limited during severe stress. These findings emphasize the critical role of asset selection in managing downside risk within energy-focused portfolios.

A further analysis of the risk ratios highlights the complex relationship between clean and dirty assets. This non-linear relationship underscores the importance of optimal allocation strategies when combining environmentally sustainable assets with more volatile, energy-intensive ones. Conversely, some clean assets exhibit a U-shaped risk profile, initially reducing tail risk at low allocations but increasing it beyond a certain threshold.

The DCC analysis demonstrates meaningful time-varying relationships among asset pairs. Most models show statistically significant, stable correlation dynamics, suggesting that conditional correlations tend to be mean-reverting and responsive to market conditions. Although limited short-term volatility transmission can be observed in some cases, the DCC framework effectively captures evolving dependence structures, especially when assessing safe haven behavior under uncertainty. These results are consistent with findings by

Ren and Lucey (

2022b), who discovered predominantly positive, yet relatively low, dynamic conditional correlations between clean energy indices and dirty and clean cryptocurrencies, implying limited hedging potential. Similarly,

Ali et al. (

2024) found that green cryptocurrency correlations with equity indices are generally lower and more diverse than those of non-green cryptocurrencies, indicating better diversification prospects under normal conditions.

In light of the findings, H1 is not supported, as green assets do not consistently exhibit safe haven behavior under stress. However, H2 is partially confirmed, with tail risk mitigation observed when green asset weights exceed 40%, particularly for natural gas futures. These results underscore the conditional utility of green assets in portfolio risk management.

Finally, the hedge and safe haven analysis provides key insights into the interaction between green and dirty assets. Statistically significant hedge coefficients suggest co-movement under typical market conditions, but largely insignificant safe haven coefficients imply that green assets offer limited protection during extreme downturns, although some may mitigate tail risk when their portfolio weight exceeds 40%. This challenges the notion that environmentally sustainable assets inherently act as effective defensive tools. Instead, the data suggest they contribute to diversification in stable periods but tend to decouple during stressed market phases.

Kuang (

2025) supports this view, finding insignificant safe haven coefficients for clean cryptocurrencies, which indicates limited protection during downturns.

Ren and Lucey (

2022b) observe similar patterns with clean energy indices, and

Ali et al. (

2024) report that green and non-green cryptocurrencies generally do not serve as strong safe havens during market stress, as their coefficients at extreme quantiles largely lack significance. In contrast,

Bredin et al. (

2017) note that while precious metals like gold can reduce downside risk in the short term, they do not consistently function as safe havens in the long run, often sacrificing risk-adjusted returns for protection.

This study highlights the complex and evolving dynamics between clean and dirty energy assets in portfolio construction. While certain clean assets can reduce tail risk beyond specific allocation thresholds, their effectiveness as safe havens remains limited, particularly during periods of extreme market stress. The non-linear patterns observed in relative risk ratios and time-varying correlations captured through the DCC analysis emphasize the importance of strategic asset allocation and continuous risk monitoring. Overall, the findings challenge simplistic assumptions about asset defensiveness and underscore the need for data-driven approaches to managing risk in energy-focused portfolios.

While green assets are often perceived as defensive due to their ESG profile, our findings suggest that structural factors undermine their safe haven potential. Regulatory shocks—such as abrupt changes in carbon pricing or subsidy schemes—can trigger volatility in green markets. Illiquidity in green futures, especially during stress periods, amplifies price swings. Moreover, macroeconomic co-movement with broader energy indices reduces their decoupling capacity. Rather than investor sentiment alone, these structural dynamics explain why green assets consistently fail to act as safe havens.

These findings suggest that while certain green assets may offer protection against extreme downside risk, particularly in the lower tail of the return distribution, they do not consistently exhibit the negative correlation or crisis resilience typically associated with safe haven assets. This distinction underscores the nuanced role of green assets in portfolio risk management and highlights the importance of separating tail risk mitigation from broader safe haven behavior.

The observed tail risk mitigation effects suggest that while not serving as traditional safe havens, green assets can still act as effective downside buffers in diversified portfolios, especially when allocated within certain threshold ranges. These findings highlight the need for developing regulatory frameworks that acknowledge the risk of mitigating the potential of green financial instruments, even if they do not meet strict safe haven standards. Tail risk resilience could be a useful additional metric in green finance assessments. Portfolio construction strategies aiming to align environmental goals with risk management might benefit from including green assets not for their safe haven status but for their conditional tail risk behavior. Optimization models could be adjusted to account for this nuanced approach.

For further robustness, future extensions could apply the same quantile-based framework to the pre-2008 and 2020 COVID crisis periods, testing whether the economic significance of our RRR dynamics persists across multiple market shock regimes. Policy-makers designing carbon and energy markets may benefit from incorporating liquidity buffers and dynamic regulatory thresholds to avoid abrupt regime shifts that destabilize green asset behavior.