Abstract

This paper analyzes the volatility relationship between the Romanian BET index and the U.S. SFT-500 index during the period 2019–2024, with a particular focus on the impact of political and geopolitical shocks. The study investigates whether financial markets in emerging economies react symmetrically or asymmetrically to external shocks originating from mature markets, especially during periods of political uncertainty. The research period includes four major systemic events: the COVID-19 pandemic, the military conflict in Ukraine, the 2024 U.S. presidential elections, and the 2024 Romanian elections, all of which generated significant volatility in global markets. The methodological approach combines time series econometrics with the Impulse Indicator Saturation (IIS) technique to identify structural breaks and outliers, without imposing exogenous assumptions about the timing of events. The econometric model includes autoregressive and lagged exogenous variables to estimate the influence of the SFT-500 index on the BET index, while IIS variables capture unanticipated political and economic shocks. Additionally, a Fractionally Integrated GARCH (FIGARCH) specification is applied to model the persistence of volatility over time, capturing the long-memory behavior often observed in emerging markets like Romania. The results confirm a statistically significant but partial synchronization between the two markets, with lagged and contemporaneous effects from the SFT-500 index on the BET index. Volatility in Romania is markedly higher and longer-lasting during domestic political episodes, confirming that local factors are a primary source of market instability. For investors, this underscores the need to embed political risk metrics into emerging market portfolios. For policymakers, it highlights how stronger institutions and transparent governance can dampen election- and crisis-related turbulence.

1. Introduction

Financial market volatility is deeply influenced by economic, geopolitical, and political factors (Endicott 2022; Gao 2024). Understanding these influences is especially relevant given the recent period of unprecedented instability (2019–2024) marked by overlapping global crises (Khan et al. 2024; Lacava et al. 2020.) While many studies have examined volatility contagion across markets, most focus on either ordinary times or single events (Khan et al. 2023; Ullah et al. 2023a). In contrast, our study looks at an emerging market (Romania) and a developed market (U.S.) simultaneously through multiple extreme events, offering new insights into market interconnections under stress. We investigate how major political and geopolitical events affect volatility in these two markets, probing whether global shocks transmit uniformly and how local conditions might alter the outcome. By doing so, this research sheds light on a classic issue in finance—cross-market spillovers—but in a novel setting that includes back-to-back crises and an emerging market perspective often underrepresented in the contagion literature.

Romania serves as a compelling case study for emerging European markets due to its unique blend of rapid economic transition, increasing financial market integration with the Eurozone, and susceptibility to both global and domestic political shocks. Its capital market, while smaller than some Western counterparts, exhibits characteristics common to many developing economies in the region, including evolving regulatory frameworks, a growing investor base, and a sensitivity to geopolitical events (Pascal 2020; Munteanu et al. 2024). Analyzing volatility spillovers in Romania thus offers valuable insights applicable to a wider array of emerging European economies facing similar dynamics.

The analysis is constructed based on a comparative approach, using daily time series covering the period 2019–2024, for the stock market indices the BET (representative of the Bucharest Stock Exchange) and the SFT-500 (a composite proxy of the U.S. market). The analyzed interval includes several events having international and national relevance. The period 2019–2024 is characterized by three major shocks that profoundly disrupted global financial markets (Khan et al. 2024; Lacava et al. 2020): (1) the COVID-19 pandemic (March 2020 onward), which triggered simultaneous health, economic, and financial crises with global spillovers, including sudden capital withdrawals from emerging markets; (2) the Russia–Ukraine conflict (February 2022 onward), which had a direct geopolitical impact on Eastern Europe, generating heightened risk perceptions and uncertainty in regional markets such as Romania; and (3) the 2024 U.S. presidential elections (November 2024), a politically charged event with global implications for investor sentiment, trade policy, and monetary outlook.

Table 1 compiles the major events analyzed in our study, categorizes each as a global or local shock, and provides the date (or date range) and a brief description of its significance. In addition to these global events, the study also incorporates the 2024 Romanian Elections, a local political event that, while not a global systemic shock, significantly influenced domestic market volatility and is crucial for a comprehensive understanding of the BET index’s behavior.

Table 1.

Key political and geopolitical events (2019–2024).

These shocks are relevant not only due to their global nature but also because they affect investor behavior, capital flows, and risk pricing differently across market types. The relationship between the BET (as a proxy for an emerging European market) and the SFT-500 (a proxy for the mature U.S. market) is examined to understand the extent and nature of volatility transmission under such conditions. This comparison provides a real-time lens into financial synchronization versus decoupling, and into how internal political conditions (e.g., Romania’s own 2024 elections) may amplify or mitigate external influences (Pastor and Veronesi 2012).

We employ the SFT-500 fund as a proxy for the U.S. market instead of the official S&P 500 index because it replicates the S&P 500’s performance while providing a more convenient scale and a complete daily dataset for 2019–2024 (as detailed in the Data Section). This choice facilitates a more direct and robust analysis of volatility spillovers within the specific framework of this research.

Through the distinct geographical, political, and economic positioning of the two countries under analysis, Romania and the U.S., the paper provides insight into how the relationship between East and West is reflected in investor behavior and financial volatility under conditions of increased uncertainty and geopolitical tension.

This study aims to achieve two primary objectives: first, to empirically investigate the presence and characteristics of volatility spillovers between the U.S. and Romanian financial markets; second, to analyze how these spillovers are influenced by significant global political events, specifically, the COVID-19 crisis, the Ukraine conflict, and the U.S. presidential election. To this end, we address the following research questions: (1) Is there evidence of significant volatility transmission from the U.S. to the Romanian market? (2) How do major political events impact the magnitude and direction of these volatility spillovers?

This study’s primary goal is to determine how volatility is transmitted from a mature market (U.S.) to an emerging market (Romania) under conditions of political uncertainty. By explicitly comparing these two markets during major recent events, our work aims to fill a gap in the financial contagion literature.

The four hypotheses formulated in this study are motivated by ongoing debates in the literature; thus, the hypotheses are not only empirically testable but also theoretically rooted in the frameworks of market synchronization theory, policy uncertainty, and asymmetric volatility transmission.

To achieve these objectives, the research was guided by the following hypotheses:

H1:

There is a positive correlation between the BET and SFT-500 indices, reflecting the global connectedness of capital markets and the convergent behavior of investors in times of uncertainty.

H2:

The Romanian stock market reacts with a systematic delay to the shocks in the U.S. market due to differences in the degree of liquidity, transparency, and informational efficiency.

H3:

Major political and geopolitical events (e.g., pandemics, military conflicts, elections) cause significant outliers in the BET returns series, statistically observable by applying the IIS method.

H4:

The volatility experienced by the BET index is higher and more persistent compared to the SFT-500, reflecting the specific vulnerability of emerging markets to internal and regional political instability.

The study makes several original contributions: it (i) offers a rare comparative analysis of an emerging vs. a developed market during the same political shocks, (ii) introduces an innovative use of the IIS technique for detecting volatility breaks without pre-specifying events, and (iii) combines IIS with a FIGARCH model to capture both sudden shocks and persistent volatility.

These questions are particularly relevant in the post-2019 period, marked by systemic shocks that simultaneously impacted both developed and emerging markets. Romania, an EU member with a small, open economy and developing financial infrastructure, offers a compelling case for understanding the limitations of integration and the specific vulnerabilities of emerging markets.

In order to address the formulated objectives and test the proposed hypotheses, the research adopts a quantitative approach based on econometric methods applied to financial time series. The use of daily data related to the BET (Romania) and SFT-500 (U.S.) indices over the period 2019–2024 allow for a high-resolution view of market reactions to political, economic, and geopolitical shocks.

As a first step, the stationarity properties of the series are tested by applying the ADF, KPSS, and Ng–Perron tests, the last being appreciated for its enhanced robustness under serially correlated errors and optimal lag selection criteria (Ng and Perron 2001). A central methodological element is the integration of Impulse Indicator Saturation (IIS), a technique developed to automatically detect outliers and significant local shocks without introducing ex ante restrictive assumptions (Castle et al. 2012, 2015). This approach, based on General-to-Specific (GETS) algorithms, allows robust model estimation in the presence of structural shocks. The Fractionally Integrated GARCH (FIGARCH) model is used because it captures long-memory behavior in volatility, allowing for a more gradual decay of shock effects over time. This is a feature relevant for emerging markets like Romania, where political and geopolitical events tend to generate persistent market reactions.

An extended regression model is also estimated, which captures the influence of the SFT-500 index on the BET return, controlling the effects of outliers by including IIS variables. Thus, the methodology combines the rigor of classical tests with the flexibility of modern data screening techniques, ensuring the statistical validity and economic relevance of the conclusions.

The study makes several original contributions, both in terms of the theoretical perspective adopted and the methodological tools used. First, the paper proposes a comparative approach between an emerging and a mature market—Romania and the United States—in analyzing stock market reactions to major political and geopolitical events. This analytical framework is rare in the literature, which usually treats these markets separately. By bringing them into a single comparative framework and applying it to the 2019–2024 period, marked by global crises, regional instability, and relevant electoral cycles, the study contributes to a better understanding of how volatility is asymmetrically transmitted between global financial centers and frontier markets.

An important new feature is the integration of the Impulse Indicator Saturation (IIS) technique to analyze the relationship between the two indices. This method allows the automatic and non-parametric identification of extreme observations—without assuming the exact timing of shocks in advance—thus providing a more faithful representation of market reactions to unexpected events. In contrast to other approaches based on explicit dummies, the IIS provides flexibility and robustness, especially in the context of the high volatility that characterizes emerging markets (Castle et al. 2015; Jiao and Pretis 2022).

What sets this study apart from the existing literature is not only the selection of the BET and SFT-500 indices but the methodological design and the political context in which this analysis is embedded. First, we apply the Impulse Indicator Saturation (IIS) method to a cross-market volatility model, an approach rarely used in comparative analyses between mature and emerging markets. Second, the period analyzed (2019–2024) includes three globally relevant political shocks: the COVID-19 pandemic, the war in Ukraine, and the 2024 U.S. presidential elections. These are not treated as dummy variables but are endogenously detected via IIS, allowing for non-arbitrary and replicable identification of outliers. Third, the use of Jiao–Pretis statistical tests to validate these outliers adds a robustness layer rarely applied in political–financial studies. Fourth, by estimating daily-based dynamic models that incorporate both autoregressive and lagged exogenous terms, we capture the asymmetric and delayed reactions of the Romanian stock market, offering insights into how institutional characteristics affect volatility transmission, a dimension often overlooked in high-frequency emerging market studies.

With these elements, the paper not only advances the literature on volatility transmission but also provides a framework with concrete implications for stock market risk analysis, addressed to both investors and economic authorities in emerging markets.

2. Literature Review

2.1. Volatility Spillovers in Emerging Markets

The volatility of financial markets is one of the most studied dimensions of applied economic analysis, being essential for understanding investor behavior, assessing risk, and formulating economic policy decisions. The literature has covered multiple theoretical and empirical approaches to the determinants of stock market volatility, with a focus on the influences exerted by fundamental factors, external shocks, and, in particular, political and geopolitical events. General analyses, such as the one by Endicott (2022), show that political decisions and global events directly influence stock market reactions, especially during periods of uncertainty. A substantial number of research has shown that political events—such as elections, government instability, international conflicts, or significant legislative changes—can generate additional volatility in financial markets through mechanisms such as decision uncertainty, adjustment of investors’ expectations, or capital reallocation based on risk perceptions. Recent Bayesian Network models provide a complementary approach, exploring the interaction between policy variables and market dynamics in a probabilistic and relational framework (Gao 2024). In particular, the literature on emerging markets emphasizes that they are more susceptible to policy shocks compared to developed markets due to institutional vulnerability and lower liquidity (Bekaert and Harvey 1997; Pastor and Veronesi 2012). This body of literature, particularly concerning the susceptibility of emerging markets to external shocks and the mechanisms of volatility transmission (Bekaert and Harvey 1997; Pastor and Veronesi 2012), directly informs and provides the theoretical foundation for Hypothesis 1 (H1) regarding market correlation and Hypothesis 2 (H2) concerning delayed reactions in emerging markets.

2.2. Impact of Political Uncertainty on Financial Market

In this research, the focus is on the interaction between political uncertainty and volatility in equity markets, comparing an emerging economy (Romania) with an advanced economy (U.S.). Thus, we integrate two major strands of the literature: (i) studies on cross-market shock transmission (addressing our hypothesis on market synchronization) and (ii) studies on locally specific factors that amplify or attenuate those effects (addressing our hypothesis on asymmetry due to domestic conditions).

Also, an important focus of the analysis is the impact of presidential elections on the volatility of financial markets. This phenomenon is closely related to the concept of political uncertainty, frequently analyzed in the literature as a direct determinant of stock market volatility (Fulgence et al. 2023). Although applied studies on the Romanian market are limited, the behavior of emerging markets in an election context suggests an increased sensitivity to political changes, comparable to that observed in other transition economies. This observation is also supported by recent research that provides a systematic overview of how political crises and election periods influence equity market returns (Sarkar and Roy 2024).

In the case of the United States, the empirical literature has emphasized an increase in stock market volatility in pre-election periods, especially in the case of early elections, and this is closely related to or has a high potential to change the direction of economic policy. It has also been observed that markets react differently depending on the anticipated winning party, and the level of volatility gradually decreases after the results are announced once uncertainty dissipates (Bouoiyour and Selmi 2016; Bouoiyour and Selmi 2017; Morales et al. 2021).

These findings can be extrapolated to the Romanian case, given common emerging-market characteristics (e.g., lower liquidity, higher sensitivity to political risk). This insight supports our hypothesis that domestic political events (like elections) will cause significant volatility outliers in Romania (H3), analogous to patterns observed in other markets.

Thus, the integration of political uncertainty into volatility modeling, both through explicit variables and impulse indicators (EIs), becomes important for a coherent comparative analysis between a mature (U.S.) and an emerging (Romania) financial market, in the context of electoral cycles and recent geopolitical tensions.

The insights from these studies, emphasizing the heightened sensitivity of emerging markets to political changes and the observed volatility patterns during election periods in both developed and transition economies (Fulgence et al. 2023; Sarkar and Roy 2024; Bouoiyour and Selmi 2016, 2017; Morales et al. 2021), directly underpin the formulation of Hypothesis 3 (H3), which posits that major political and geopolitical events cause significant outliers in the BET returns series.

2.3. Political Outcomes Anticipation and Market Volatility

A key element in analyzing the relationship between elections and market volatility is investors’ perceptions of anticipated political outcomes. Contrary to some intuitive assumptions, some studies show that the anticipation of a Democratic victory in the U.S. is associated with a reduction in market volatility, suggesting a perception of stability and predictability on the part of market players (Leblang and Mukherjee 2004). This result is supported by GARCH and EGARCH models, which capture asymmetric volatility changes in the pre- and post-election period.

Furthermore, the market reaction is not uniform across sectors but varies significantly depending on the specifics of the policies promoted. Thus, certain sectors, such as health or defense, may experience gains depending on the government’s policy stance, while technology or utilities may be negatively affected by potential regulations (DeHaven et al. 2024). This sectoral volatility contributes to an increase in overall uncertainty during election periods (Bouoiyour and Selmi 2017; Arin et al. 2022; Ma et al. 2024), which justifies differentiated approaches in econometric models.

For emerging markets, such as Romania, the literature highlights varying levels of informational efficiency, but also the ability of these markets to absorb electoral shocks, relatively quickly reflected in asset prices. Although these markets are generally more vulnerable to political instability, they can exhibit similar behaviors to developed markets in terms of their reaction to elections, especially when information is transparent and well disseminated (Hashim and Mosallamy 2020; Sonenshine and Hosn 2023; Souffargi and Boubaker 2024; Nazir et al. 2014).

Moreover, in industries that are sensitive to regulatory changes—such as those with export dependence, public contracts, or frequent government intervention—volatility during election periods is exacerbated by investors’ perceived risk. Such sectors are more exposed to uncertainties related to the outcome of elections and thus react more sensitively to changes in the political landscape (Boutchkova et al. 2008). Moreover, volatility may be accentuated by the specific information flow associated with geopolitical events, as highlighted by recent research using EGARCH models to capture asymmetric market reactions to news about foreign conflicts (Gheorghe and Panazan 2023).

Hence, the literature suggests that volatility driven by election cycles is not just an aggregate phenomenon, but is differentiated across sectors, economies, and institutional regimes, which are key to a nuanced understanding of how U.S. and Romanian markets respond to political events.

Although the U.S. financial market is characterized by a mature institutional structure and a high degree of informational efficiency, which allows for a relatively stable volatility pattern in relation to political cycles, the situation differs significantly for emerging markets such as Romania. Differences in the level of market development, political stability, as well as the degree of transparency and institutional credibility, may generate distinct patterns of reaction to political events. Strengthening corporate governance, especially among SMEs, has been identified as a key factor in improving financial resilience and investor trust in Romania’s market context (Gheorghiu et al. 2017).

Thus, in emerging markets, the uptake of political news may be slower or more erratic, and market reactions may reflect both immediate uncertainty and a lack of effective adjustment mechanisms. In this regard, the literature emphasizes that the impact of elections on volatility is not solely determined by the winning political party but should be understood in the broader context of economic conditions, investor perceptions, and market sentiment (Santa-Clara and Valkanov 2023; Schwartz et al. 2008; Panazan et al. 2024; Maraoui et al. 2022). These findings support the idea that stock market reactions to political events are difficult to predict in the absence of a multifactor analysis.

The nuanced understanding of how political outcomes, information efficiency, and institutional structures differentiate market reactions, especially in emerging economies (Hashim and Mosallamy 2020; Sonenshine and Hosn 2023; Souffargi and Boubaker 2024; Nazir et al. 2014), provides further empirical and theoretical support for Hypothesis 3 (H3) regarding event-driven outliers and contributes to the rationale for Hypothesis 4 (H4) concerning the higher and more persistent volatility in emerging markets.

2.4. Economic Policies in Shaping the Volatility of Financial Markets

The literature also emphasizes the incredible role played by economic policies in shaping the volatility of financial markets. In Romania, the market is influenced both by internal economic policies—taxation, government spending, monetary measures of the NBR—and by decisions taken at the European or international level, in the Euro area and the United States. The stability of financial markets is directly dependent on the consistency and predictability of macroeconomic policies, and instability in this respect can amplify systemic risks (Gong 2024). In contrast, in the case of the U.S., numerous studies (Wu et al. 2024; Xue and Wang 2023) have shown that Economic Policy Uncertainty (EPU) is a central determinant of stock market volatility. These context-dependent dynamics have also been captured by Markov Switching models, which allow the identification of volatility regimes associated with policy events, as analyzed by Khalid and Rajaguru (2010).

The increase in UPE is correlated with an increase in investors’ perceived uncertainty, which leads to reluctance to allocate capital, portfolio adjustments, and reduced consumption, all of which reflect negatively on market performance (Smales 2019; Adeloye et al. 2024; Gherghina et al. 2021). Therefore, the analysis of financial volatility needs to consider the interplay between policy shocks, economic uncertainty, and investors’ behavioral reactions to outline a complete explanatory framework. This relationship has also been demonstrated in previous studies on the impact of political and catastrophic events on stock market returns, highlighting the increased sensitivity of markets to unexpected uncertainties (Taimur and Khan 2014).

An important aspect in understanding financial market volatility is the international dimension of economic policies, particularly the impact of U.S. monetary policy decisions. Changes in the Federal Reserve’s orientation, such as reducing quantitative ease programs or raising interest rates, have been shown to generate increased volatility not only in the internal market, but also in emerging markets, including Eastern Europe. These effects are amplified by capital outflows and exchange rate adjustments that reflect the reorientation of international investment flows (Chirila and Chirila 2018).

This global influence of U.S. economic policy is accentuated in periods of high political uncertainty, when investors engage in defensive behaviors, thereby increasing cross-border volatility (Smales 2019). Thus, the Romanian market, although under a different economic and institutional regime, is not isolated from these spillovers.

On the other hand, internal macroeconomic factors significantly influence the behavior of the Romanian stock market: industrial production, fiscal policies, public debt, and the level of interest rates are among the main determinants of local financial stability. In addition, the literature points to a stronger link between Romania and the Euro area than between Romania and the U.S., with a more pronounced impact of European systemic financial stress on the Romanian real economy and monetary policy (Saman 2016; Clichici and Iordachi 2017). Similarly, the analysis of the impact of the conflict in Ukraine on the Russian financial market has revealed asymmetric and intense reactions, confirmed by TVP-VAR and Quantile-VAR models, relevant also for other nearby emerging markets (Ullah et al. 2023a).

Another factor of potential instability is indicated by exchange rate fluctuations, as the national currency and local stock markets are particularly sensitive to external shocks. Investor behavior thus becomes a key channel through which political and economic uncertainties are transmitted to the market (Pascal 2020). This transmission channel of political risk on stock market volatility has also been observed in other emerging regions, such as the MENA region, where studies show a clear link between political uncertainty, crises, and increased financial volatility (Talbi et al. 2021).

Although economic policies in Romania and the U.S. produce distinct effects on stock market volatility, it is essential to consider the broader framework of global economic interdependence. In an interconnected financial system, policy decisions in a major economy, such as the U.S., can generate spillover effects that affect the stability of other markets, including emerging markets (Lacava et al. 2020). This complexity of financial market dynamics, in which economic and political factors interact, emphasizes the need for flexible–adaptive policy frameworks that can respond effectively to risks and ensure market resilience (Mishra and Debata 2020; Kumar et al. 2024).

Therefore, understanding this interlinked web of relationships between economic policy, political events, and financial volatility becomes indispensable for both policy makers and international investors, who must navigate a financial landscape marked by recurrent uncertainties and exogenous shocks.

This comprehensive review of the interplay between economic policies, political events, and financial volatility, particularly the amplified effects of U.S. monetary policy on emerging markets and the influence of internal macroeconomic factors (Smales 2019; Chirila and Chirila 2018; Pascal 2020), collectively reinforces the theoretical basis for Hypothesis 4 (H4), which addresses the higher and more persistent volatility in the BET index due to emerging market vulnerabilities.

2.5. Methodological Approaches to Volatility

In line with this, the literature on conditional volatility, pioneered by Engle (1982) and extended by GARCH models (Bollerslev 1986), has provided a robust framework for estimating the dynamics of variance in the presence of repeated or persistent shocks. This approach has recently been extended in the analysis of stock market volatility during the COVID-19 pandemic, using GARCH models to capture market reactions to global health shocks (Khan et al. 2023). More recently, techniques such as Indicator Saturation have been introduced to enable the automatic detection of outliers and their integration into regression models, thereby increasing the precision of estimates and the relevance of interpretations in contexts marked by unexpected events Complementarily. Other work has used quantile regression to capture asymmetric volatility variations during the COVID-19 pandemic, highlighting the extreme reactions of financial markets (Ullah et al. 2023b). The FIGARCH (Fractionally Integrated GARCH) model, initially introduced by Baillie et al. (1996), extends the traditional GARCH framework by incorporating long memory in the conditional variance, allowing for a more gradual decay of volatility shocks over time compared to the exponential decay assumed in standard GARCH models. This feature makes FIGARCH particularly suitable for modeling persistent volatility commonly observed in financial markets. More recent applications, such as that by Contreras-Reyes et al. (2024), demonstrate the effectiveness of FIGARCH in capturing the volatility dynamics of emerging stock markets, highlighting its robustness in contexts with structural uncertainty and prolonged market reactions.

Recent advances in econometric methodology have introduced powerful tools for detecting structural breaks and outliers in time series data without relying on exogenous assumptions about timing. One such technique is Impulse Indicator Saturation (IIS), which enables the automatic identification of extreme values or regime shifts within a general-to-specific modeling framework. Castle et al. (2012) introduced a foundational model selection strategy to address multiple structural breaks, providing a robust basis for further innovations in this area. Subsequently, Castle et al. (2015) refined the approach through step-indicator saturation, demonstrating how location shifts can be systematically identified and incorporated into econometric models. These methodological developments are particularly relevant for high-frequency financial data, where political or geopolitical events may induce sudden and short-lived volatility that traditional dummy variable approaches fail to capture.

This study is grounded in several interconnected theoretical frameworks. First, financial market integration theory suggests that capital markets across countries become increasingly interdependent due to globalization, institutional investments, and technological advancement (Bekaert and Harvey 1995). This underpins the expectation of synchronization between the BET and SFT-500 indices. Second, contagion theory explains how financial shocks in one market can be transmitted to others through investor behavior, capital flow reallocation, and correlated risk perception (Forbes and Rigobon 2002). Third, the theory of political uncertainty and asset pricing posits that political events, such as elections or geopolitical crises, can cause risk premiums to rise, leading to increased market volatility (Pastor and Veronesi 2012). Finally, we draw on the information asymmetry and market inefficiency hypothesis to explain the delayed and asymmetric response of the BET index compared to the SFT-500, highlighting institutional and structural differences between emerging and developed markets (Bekaert et al. 2003).

While previous studies have examined political shocks in either developed or emerging markets, there is limited research comparing their simultaneous effects across structurally different systems. This absence represents not only a gap in the literature but also a challenge in designing methodologies that remain robust across such divergent contexts. To address this, the present study adopts a flexible and transparent econometric strategy by combining daily market data, dynamic regression, and the Impulse Indicator Saturation (IIS) technique. This is done to endogenously detect structural breaks and quantify volatility transmission without relying on pre-established assumptions. This approach allows us to work around the incomplete theoretical modeling of dual-market political contagion by generating data-driven insight, even in contexts where the literature is still evolving.

Although some studies address the impact of political risk on emerging versus developed markets (e.g., Ben Ghozzi and Chaibi 2021), they often rely on low-frequency data or predefined event dummies, limiting their capacity to detect real-time volatility patterns. Moreover, few analyses explicitly focus on recent systemic shocks, such as the COVID-19 pandemic, regional conflicts, or election cycles, in a high-frequency comparative framework. The integration of advanced techniques like Impulse Indicator Saturation (IIS) and dynamic daily regressions in this study allows for an endogenous and replicable identification of political and geopolitical shocks. By applying these methods to the BET and SFT-500 index data for 2019–2024, the study fills a clear gap in understanding how global uncertainty and local political dynamics interact to shape volatility in both emerging and mature markets. The hypotheses proposed in this paper are directly derived from this gap and are designed to test the synchronization, asymmetry, and persistence of market responses to political, geopolitical and systemic shocks.

The frameworks of financial market integration (Bekaert and Harvey 1995), contagion theory (Forbes and Rigobon 2002), political uncertainty and asset pricing (Pastor and Veronesi 2012), and information asymmetry (Bekaert et al. 2003), combined with advanced econometric techniques like Impulse Indicator Saturation (IIS) and Fractionally Integrated GARCH (FIGARCH), directly inform the methodological design for testing all four hypotheses: H1 (synchronization), H2 (asymmetry/delay), H3 (event-driven outliers), and H4 (volatility persistence).

3. Data and Methodology

This study employs a quantitative econometric approach, using high-frequency financial data. The two indices analyzed are the BET (Romania) and the SFT-500 (U.S.), selected as proxies for emerging and mature markets respectively. The variable selection is intentionally minimalist but targeted: daily returns for the BET and SFT-500 indices serve as proxies for national market sentiment, while the Impulse Indicator Saturation (IIS) method allows the detection of structural breaks without assuming exogenous dates or event categories. Unlike studies that rely on manually selected political event dummies or machine learning black boxes, our model preserves interpretability while capturing high-frequency market dynamics. The integration of autoregressive terms, lagged exogenous variables, and endogenous break detection provides a hybrid framework capable of identifying both systematic co-movements and idiosyncratic shocks.

The methodology is designed to test four specific hypotheses regarding market synchronization, lagged reactions, structural breaks, and volatility persistence. The aim is to estimate how the Romanian stock market reacts to internal and external shocks, using a combination of time series techniques and impulse indicator detection. The findings are interpreted in light of the hypotheses formulated in the introduction and contextualized with reference to existing studies on market volatility, political uncertainty, and contagion effects. The section also outlines the limitations of the methodology and provides a foundation for future extensions.

3.1. Data

The empirical analysis in this research is based on daily time series of the BET (for Romania) and SFT-500 (for the United States) stock indices, covering the period 1 January 2019–31 December 2024. Data were collected from official financial sources (Invesitng.com and BVB.ro), ensuring a complete coverage for the analyzed interval. The analysis focuses on three significant political events that have impacted global financial markets: the onset of the COVID-19 pandemic (March 2020 onwards), the beginning of the Ukraine conflict (February 2022 onwards), and the U.S. Presidential Election (November 2024), and one local event (parliamentary and presidential elections in Romania). These specific timeframes are important for identifying structural breaks and analyzing their impact on volatility spillovers.

The BET (Bucharest Exchange Trading) index is the main indicator of the Bucharest Stock Exchange and reflects the evolution of the 20 most liquid listed companies, excluding financial institutions such as banks and investment funds. This index is considered an essential barometer for the performance of the Romanian stock market and is frequently used by investors, analysts, and economists to assess the general direction and trends of the market. BET is composed of companies selected on the basis of trading liquidity and adjusted market capitalization and is updated quarterly to maintain a true picture of the market. Each company’s weight in the index is calculated on the basis of free-float-adjusted market capitalization, i.e., the number of shares effectively available for public trading.

In the context of analyzing the impact of political factors on financial markets in Romania, the BET index plays a key role. It reacts quickly to political events, such as elections, government changes, legislative changes, or fiscal policies, providing a clear picture of how investors perceive political risks. The volatility of this index can be an indication of increased uncertainty in the economy and is an important indicator of systemic risk.

For investors, the BET provides a valuable benchmark for decision making, as it provides a summarized reflection of confidence in the stock market. At the same time, the performance of the companies included in the index is directly influenced by the economic policies adopted by the government, which links the evolution of the BET to the political climate and the stability of government decisions. Thus, the analysis of this index becomes a relevant tool to understand the relationship between political dynamics and the reactions of the Romanian financial market.

The SFT-500 Index is a composite stock market benchmark for the U.S. stock market, consisting of an extensive portfolio of 500 companies listed on the main U.S. stock exchanges, such as the New York Stock Exchange (NYSE) and NASDAQ. The index is designed to reflect the aggregate performance of the U.S. economy through the largest and most liquid listed companies operating in sectors as diverse as technology, energy, industrials, healthcare, financial services, communications, and consumer. The SFT-500 is calculated on the basis of free-float-adjusted market capitalization, which means that each company contributes to the index in proportion to its share of freely tradable shares in the market. This methodology ensures a realistic representation of the influence of companies on overall market developments. The structure of the index is revised periodically to reflect changes in the U.S. corporate landscape, so that it remains a relevant benchmark for investors, analysts, and regulators.

In terms of its analytical role, the SFT-500 is often used as a barometer of the U.S. economy, providing summary information on macroeconomic trends, business cycles, and investor sentiment. It is frequently compared to other major indices, such as the Dow Jones Industrial Average or the S&P 500, but has the advantage of wider diversification through an increased number of components. Throughout this research, the name “SFT-500” refers to the SFT Index 500 Fund—Class 2 (ISIN code: 0P0000003BN2), a mutual fund managed by Securian Funds Trust, which tracks the performance of the S&P 500 index. Although not a stock market index in the strict sense, the fund is used as a relevant proxy for the dynamics of the U.S. equity market, as it replicates the structure and behavior of the companies included in the S&P 500.

Throughout this research, SFT-500 refers to the SFT Index 500 Fund—Class 2 (a mutual fund tracking the S&P 500 index). The choice of this proxy instead of the official S&P 500 index is based on two considerations. First, the SFT-500 fund’s price level is similar to that of the BET index, which facilitates direct graphical comparison and interpretation of results without additional scaling transformations. Second, the Class 2 fund provides a more stable and complete daily data series for 2019–2024 than the official S&P 500 (or the Class 1 fund), ensuring consistency in our sample. In practice, the SFT-500’s returns move in lockstep with the S&P 500’s returns. Thus, using this fund does not alter the substantive results; it simply improves data comparability.

The series used in the analysis were submitted to a pre-processing process that included, first of all, the logarithmic transformation, applied in order to reduce the relative heteroscedasticity and to normalize the percentage variations of the data. Subsequently, first-order differencing was applied in order to obtain the stationarity required for the econometric models. The stationarity resulting from the transformations was confirmed using the standard Augmented Dickey–Fuller (ADF), Kwiatkowski–Phillips–Schmidt–Shin (KPSS), and Ng–Perron tests.

3.2. Methodology

The analysis of the relationship between the BET and SFT-500 indices was conducted in order to capture the degree of synchronization and influence between a mature market (U.S.), and an emerging market (Romania) in contexts characterized by volatility and political uncertainty. The working hypothesis underlying this research was that, in the context of international financial integration and the convergent behavior of global investors, the BET index reflects to some extent the dynamics of the SFT-500 index, with common manifestations in periods dominated by major external shocks.

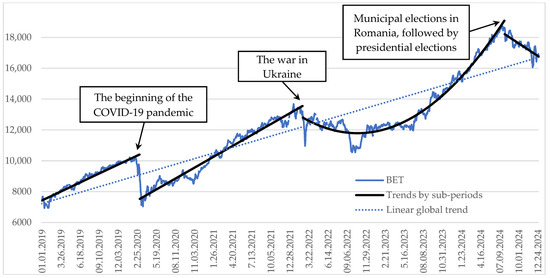

As a preliminary step to analyzing the time series, and to validate the visually identified breakpoints in Figure 1 (for BET) the Chow Breakpoint Test was applied. This test formally assesses the presence of structural breaks at specified dates, confirming the stability or instability of coefficients across different sub-periods. The results of the Chow test, presented in Table 2 and Figure 1 for BET, statistically corroborate the existence of significant structural shifts in the data, thus justifying the sub-period analysis and the subsequent use of methods capable of endogenously detecting such breaks, like Impulse Indicator Saturation (IIS).

Figure 1.

BET index, 2019–2024. Source: EViews 12 calculations, based on BVB data. Note: breakpoints of the time series, visible in the figure (i.e., 8 March 2020, 24 February 2022, 1 August 2024), were confirmed by the Chow Breakpoint Test.

Table 2.

Stability diagnostic for BET.

To address H1 and H2, we constructed an extended dynamic regression model. In this model, the daily return of the BET index (after differencing to ensure stationarity) is explained by several factors: (i) the BET’s own previous-day returns (to capture momentum), (ii) the current and lagged returns of the SFT-500 index (to capture immediate and delayed spillover effects from the U.S. market), and (iii) an additional term for extreme observations using impulse indicators. The inclusion of these impulse indicator variables (selected via the IIS algorithm) allows the model to account for sudden shocks (e.g., crash days) without pre-specifying their dates.

This latter component, based on the Impulse Indicator Saturation (IIS) technique, was automatically introduced into the model according to the Schwartz Criterion (SIC) to control for unobservable exogenous unobservable influences associated with significant political and economic events.

To test H3, the utilization of the IIS technique, developed within the GETS (General-to-Specific) algorithms according to the methodologies proposed by Hoover and Perez (1999) and Sucarrat and Escribano (2012), allows the automatic identification and integration of outliers, without arbitrarily introducing calendar dates or assuming the nature of shocks in advance. Thus, the resulting model manages to effectively capture both structural dynamics and unexpected or exogenous influences on the BET index.

where εt is the error term; d is differentiated operator; ai, aj capture the autoregressive and distributed lag components, respectively; and (IIS = SIC) are the Impulse Indicators Saturation, automatically selected through Schwartz Information Criterion (SIC). The statistical validity of these extreme observations was evaluated through the Jiao–Pretis Count and Jiao–Pretis Proportion tests (Jiao and Pretis 2022).

The proposed methodology allows the simultaneous capture of cross-national interactions between capital markets and exceptional local factors, providing a rigorous representation of stock market dynamics in a tensioned geopolitical and uncertain economic context. This creates a robust empirical framework for a differentiated interpretation of the behavior of emerging versus developed markets in the presence of major political events.

The estimation approach focuses on the dynamic impact of the SFT-500 index (mature market) on the BET index (emerging market), modeled through both contemporaneous and lagged returns. This structure implicitly reflects an assumed unidirectional causality, grounded in theoretical and empirical studies which argue that emerging markets tend to absorb and reflect the volatility of global financial centers (Bekaert and Harvey 1997; Pastor and Veronesi 2012). The inclusion of lagged SFT-500 returns allows us to account for delayed transmission effects, while the autoregressive term for BET controls for internal momentum. While our model identifies strong correlations and time-lagged influence, it does not explicitly test for causality in the Granger sense. Future research could integrate Granger causality testing, Toda–Yamamoto procedures, or VECM frameworks to formally assess the directionality and long-term co-movements between the indices, particularly in the presence of cointegration.

To test the robustness of the model, we built a Fractionally Integrated Generalized AutoRegressive Conditionally Heteroskedastic (FIGARCH) model with Generalized Error Distribution (GED). Unlike standard GARCH or EGARCH models, which assume either short-term persistence or asymmetric effects, FIGARCH allows for a fractional integration parameter d = 1, that captures the slow decay of the autocorrelation function of squared returns. This property is essential for accurately modeling the persistent nature of volatility in financial markets, where shocks can have long-lasting effects. While EGARCH is effective in capturing asymmetric responses to positive and negative shocks, it does not inherently account for long memory. Therefore, FIGARCH provides a more appropriate framework for analyzing the enduring impact of political and economic events on market volatility, offering a more nuanced understanding of contagion dynamics. This model is also used to test hypothesis H4. Economic intuition led to these possible variants:

- ✓

- GARCH: shocks affect short-term volatility (short memory),

- ✓

- IGARCH: shocks affect indefinitely (total persistence),

- ✓

- FIGARCH: compromise between the two → shocks fade slowly over time (long-memory volatility), which better reflects reality in many financial series.

The conditional dispersion equation in the FIGARCH(p, d, q) model is:

Equivalent in explicit form:

where

—conditional dispersion at the time t;

ω > 0—the constant, is the base value around which volatility oscillates;

εt—the errors in the regression equation (εt = ztσt);

L—delay operator;

(1 − L)d—is the factional differentiation operator, where 0 < d < 1.

β(L) = 1 − β1L − … − βpLp,

φ(L) = 1 − φ1L − … − φqLq

In the particular case, p = q = 1, the model FIGARCH(1, d, 1) is:

Equivalent in explicit form:

where β ≥ 0 is the autoregressive coefficient (associated with the GARCH component), and φ ≥ 0 is the moving average coefficient (associated with the ARCH component).

In the construction of the model, we considered the Generalized Error Distribution (GED). The advantage of GED is that it allows modeling processes with thicker tails than the normal distribution (if the shape parameter, ν, is ν < 2, a situation encountered in the presence of multiple, large shocks), or thinner tails (if the parameter ν > 2, a situation encountered when there are few elements of extreme volatility). If the parameter ν of the distribution is equal to 2, then GED is identical to the normal distribution, which led us not to explicitly consider a separate variant starting from the normal error distribution (we considered it as a particular case of GED).

4. Results

This section presents the empirical findings derived from our econometric analysis, structured to explicitly address the hypotheses formulated in Section 1. Introduction. We first detail the preliminary data characteristics for both the BET and SFT-500 indices. Subsequently, we present the results from our extended dynamic regression model and FIGARCH model, directly linking the findings to the evidence supporting Hypotheses H1, H2, H3, and H4.

4.1. BET Index Analysis

To highlight the general trend, as well as the specific sub-period variations of the BET index, daily time series for the 2019–2024 interval were used, graphically illustrated in Figure 1. The initial stage of the econometric analysis involved the examination of the properties of the BET series, both at the level of the entire period analyzed (2019–2024) and by time segments delimited following the interpretation of the graphical evolution presented. The breakpoints of the time series, visible in Figure 1 (i.e., 8 March 2020, 24 February 2022, 1 August 2024), were confirmed by the Chow Breakpoint Test (Table 2).

Complementary econometric tests were applied to analyze the stationarity of the BET series over the entire period and sub-intervals: the Augmented Dickey–Fuller (ADF) test, which assumes the null hypothesis of a unit root, and the Kwiatkowski–Phillips–Schmidt–Shin (KPSS) test, which assumes the stationarity of the series. Both tests were applied both in the model including the constant as an exogenous variable and in the model including the constant plus linear trend.

In cases where the results of the Augmented Dickey–Fuller (ADF) and Kwiatkowski–Phillips–Schmidt–Shin (KPSS) tests were inconsistent, the Ng–Perron optimal point tests were used as an additional test. For additional confirmation, we also applied another second-generation unit root test, namely, the Elliott–Rothenberg–Stock Point-Optimal (ERS) unit root test. The results of applying these additional tests are presented in Table 3.

Table 3.

BET series stationarity analysis.

According to the results presented in Table 3, both the full series of the BET index and the sub-series corresponding to the delimited intervals present non-stationarity characteristics. As a result, the series were subjected to the differencing process. For the series thus obtained, the Augmented Dickey–Fuller (ADF) unit root tests and the Elliott–Rothenberg–Stock Point-Optimal (ERS) unit root tests rejected the null hypothesis of the presence of a unit root, while the Kwiatkowski–Phillips–Schmidt–Shin (KPSS) test did not reject the null hypothesis of stationarity. On the basis of these results, it was accepted that the differenced series are stationary, i.e., integrated of the first order (I (1)). The same behavior was observed for the transformed series by applying the natural logarithm.

Since both the BET and the logarithmic ln (BET) series present first-order integration (I (1)), Table 4 includes the descriptive analysis for the differentiated variants of these series.

Table 4.

Elements of descriptive analysis for the BET series.

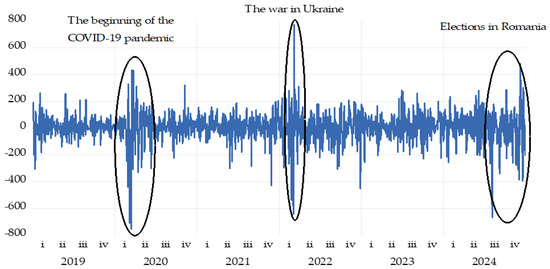

The evolution of the differentiated series of the BET index, denoted d(BET), is illustrated in Figure 2, highlighting the daily variations resulting from the differential transformation applied to obtain a stationary series, as required by the econometric analysis.

Figure 2.

d(BET) series. Source: EViews calculations based on BVB data. Note: breakpoints of the time series, visible in the figure (i.e., Beginning Pandemic, Beginning Ukraine War, Elections in Romania), were confirmed by visual inspection.

Figure 2 shows the evolution of the differentiated series of the BET index, denoted d(BET), reflecting its daily variations over the analyzed period. Visually, the series does not show any deterministic trends, indicating the absence of a systematic short-term upward or downward trend. The oscillations of the series are around an average slightly above zero, which may suggest a weak positive trend in returns but is statistically insignificant in the absence of a clear deterministic component.

The variability of the series remains relatively constant over the analyzed interval, with the exception of some episodes of increased volatility, which may be associated with cyclical factors or external shocks. The areas of high volatility have been econometrically identified using the technique of automatic detection of impulse indicators. The impulse type indicators (Indicators Saturation), IIS, are selected by GETS (general-to-specific modeling) algorithms (Hoover and Perez 1999; Sucarrat and Escribano 2012). Three areas of concentration of outliers were identified (Akaike Information Criterion):

- 28 February–9 April 2020 (with minimum points on 9 March and 16 March)—period coinciding with the beginning of the COVID-19 crisis;

- February–March 2022 (with minimum points on 24 February and 4 March)—period marking the beginning of the war in Ukraine;

- 15 November–the end of 2024 (with minimum moments on 3, 18, and 19 December)—interval that overlaps with the Romanian electoral period, i.e., the cancellation of the presidential elections.

The Jiao–Pretis Proportion and Jiao–Pretis Count tests (Jiao and Pretis 2022) rejected, at thresholds below <0.0001, the hypothesis that the number and proportion of outliers do not differ from values that might occur by chance.

These preliminary analyses establish the necessary statistical properties of the BET series, providing the foundation for its inclusion in the econometric models used to test our hypotheses.

4.2. Analysis of the SFT Index

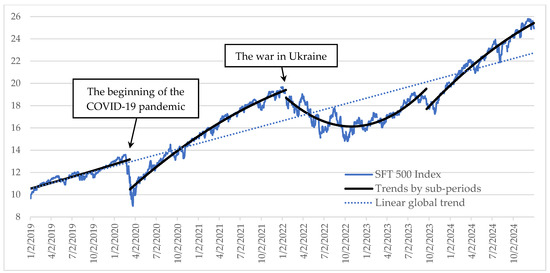

The evolution of the SFT series, constructed based on daily data for the period 2019–2024, is illustrated in detail in the graph in Figure 3. The graph provides a clear picture of the dynamics of this series over the medium term, highlighting both daily fluctuations and any trends or regularities that can be visually identified. Through this graphical representation, it is possible to observe the rising and falling phases of the series, periods of relative stability, as well as episodes characterized by high volatility. This preliminary visualization is an essential starting point for further statistical and econometric analysis, allowing the identification of possible structural changes, seasonal behaviors, or specific characteristics of the variable under analysis in the context of market developments in the mentioned timeframe.

Figure 3.

SFT-500 Index, 2019–2024. Source: EViews calculations, based on data from Invesitng.com. Note: breakpoints of the time series, visible in the figure (i.e., March 2020, February 2022, and September 2023), were confirmed by the Chow Breakpoint Test (Wald statistic = 12,235.32, prob. chi-square < 0.001).

The graph in Figure 3 provides a detailed representation of the evolution of the SFT-500 index based on daily data from 2019 to 2024. The solid blue line captures the daily changes in the index, while the dashed line represents the global linear trend, and the black curves highlight the local trends, computed on distinct sub-periods.

Visual analysis indicates a general upward trend in the index, reflected by the rising linear trend line. However, the actual behavior of the series is more complex and does not perfectly align with this overall trajectory, which justifies the segmentation into sub-periods. Thus, four distinct phases are identified: a first phase of moderate growth (2019–early 2020), followed by a sharp decline in the context of the COVID-19 pandemic. Subsequently, the index experiences an accelerated recovery (2020–2022), followed by a phase of correction and relative stagnation (2022–2023). From the first part of 2023, a resumption of the upward trend is observed, which has been accentuated in the last quarters.

Volatility is present throughout the period but appears more pronounced in the intervals associated with trend changes, which may reflect market reactions to economic, political, or geopolitical factors. The presence of distinct local trends underlines the nonlinear nature of developments and methodologically justifies a sub-period approach to complement the global perspective.

The statistical characteristics of the time series directly condition the selection of appropriate econometric methods for the analysis. In this context, the stationarity of the SFT-500 index was tested, both for the entire 2019–2024 period and for the sub-periods identified following the graphical interpretation presented in Figure 3. Like the approach applied on the BET series, the complementary Augmented Dickey–Fuller (ADF) tests have as the null hypothesis the presence of a unit root, and the Kwiatkowski–Phillips–Schmidt–Shin (KPSS) tests assume as the null hypothesis the stationarity of the series. Both tests were applied in two configurations: with an intercept (exogenous constant) and with an intercept and linear trend. Where the results of the ADF and KPSS tests proved inconsistent, the analysis was completed by applying the Ng–Perron tests, which allowed the identification of stationarity based on the determination of an optimal point. For additional confirmation, we also applied another second-generation unit root test, namely, the Elliott–Rothenberg–Stock Point-Optimal (ERS) unit root test. The results obtained from these tests are presented in Table 5.

Table 5.

SFT-500 series stationarity analysis.

The results presented in Table 5 indicate that the global series of the SFT-500 index does not present stationarity properties. The exception is the sub-series for the interval 9 March 2020–14 January 2022, which has been identified as stationary in the linear trend model setup. On the other hand, all the other sub-series analyzed were classified as non-stationary, which required the application of the differential transformation to ensure compatibility with econometric methods that assume stationarity.

For the series obtained by differencing, the Augmented Dickey–Fuller (ADF) and Elliott–Rothenberg–Stock Point-Optimal (ERS) unit root tests rejected the null hypothesis of the presence of a unit root, while the Kwiatkowski–Phillips–Schmidt–Shin (KPSS) test did not reject the null hypothesis of stationarity. These convergent results led to the conclusion that the differenced series are stationary and, implicitly, that the initial series is first-order integrated, symbolically denoted by I(1). The same property was also observed for the series transformed by applying the natural logarithm, ln(SFT-500), indicating a structural stability in the behavior of the data, regardless of the transformation applied.

Based on these findings, Table 6 presents the descriptive analysis of the differenced series, providing additional information needed for further steps of the econometric modeling.

Table 6.

Descriptive analysis elements for the SFT-500 series.

The differentiated series of the SFT-500 index, denoted d(SFT-500), resulting from the application of the first-order transformation to ensure stationarity, is plotted in Figure 4, providing a detailed picture of the daily changes in returns over the period analyzed.

Figure 4.

Series d(SFT-500). Source: Calculations in EViews, based on data from Invesitng.com.

The graph shown in Figure 4 provides a visual representation of the differentiated series of the BET index, denoted d(SFT-500), and reflects the dynamics of daily returns over the period 2019–2024. By applying first-order differencing, the series has been brought into a stationary form, eliminating the deterministic trend and thus allowing a rigorous analysis of the volatility behavior.

Figure 4 shows an apparently random variation of returns around a mean close to zero, which is a typical feature of stationary series. However, the presence of episodes of increased volatility is clearly noticeable, graphically highlighted by the applied circles. Econometrically, the existence of these atypical intervals is confirmed by the technique of automatic detection of momentum indicators. The impulse type indicators (Indicators Saturation), IIS, are selected by GETS (general-to-specific modeling) algorithms (Hoover and Perez 1999; Sucarrat and Escribano 2012). Three areas of concentration of atypical values have been identified (Akaike Information Criterion), corresponding to moments of significant economic and geopolitical instability:

- The first interval, at the beginning of 2020, is associated with the health and economic crisis caused by the COVID-19 pandemic, which generated brutal and strong reactions in financial markets. This phase is characterized by large amplitudes of daily fluctuations and a substantial increase in uncertainty.

- The second episode, localized in 2022, coincides with the start of the war in Ukraine, an event with a global geopolitical impact, which amplified systemic risks and led to a sharp increase in risk aversion among investors. This period is marked by increased daily fluctuations and more chaotic market movements.

- The third interval of high volatility, observable in the second half of 2024, can be linked to the political uncertainties associated with the electoral process in the United States, an event that traditionally has significant effects on global markets, including emerging markets such as Romania.

Similarly, the stationarity of the SFT-500 series, confirmed through these tests, enables its robust application as an explanatory variable in our models designed to investigate volatility spillovers and test our hypotheses.

4.3. Analysis of the BET–SFT-500 Relationship

This subsection presents the core empirical results from our econometric models, directly aligning them with the specific hypotheses (H1–H4) proposed in this study. We detail the findings from the extended dynamic regression model (Equation (6)) and the Fractionally Integrated GARCH (FIGARCH) model, providing quantitative evidence for market synchronization, lagged reactions, the impact of political events, and volatility persistence.

4.3.1. Evidence for H1 and H2: Market Synchronization and Lagged Reactions

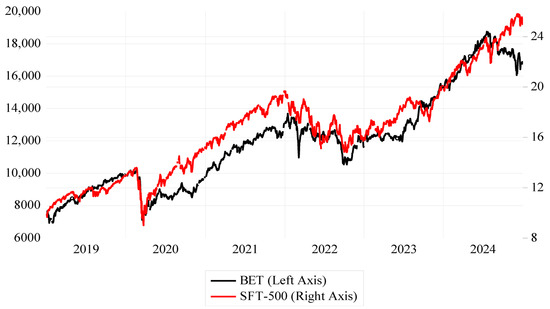

Based on recent developments in capital markets, the extent to which the BET (Romania) and SFT-500 (U.S.) indices exhibit common dynamics was estimated by analyzing the degree of correlation between them. The working hypothesis was formulated based on the theoretical and empirical premises according to which the BET index tends to exhibit a positive correlation with major stock market indices, such as the SFT-500, as a result of the increasingly pronounced interconnection of international financial markets. This link is supported by the significant influence exerted by the U.S. capital market on global capital flows and on the behavior of institutional investors.

However, the Romanian capital market, classified as an emerging market, remains strongly influenced by internal factors, such as monetary and fiscal policies, the dynamics of the national economy, the internal political context (including electoral periods), as well as regional events, especially those related to geopolitical instability in the vicinity. At the same time, the investment decisions of international funds, which manage geographically diversified portfolios, contribute to the transmission of external effects to local markets, through mechanisms such as flight to quality or flight to safety, activated in periods of global uncertainty.

In this context, Figure 5 illustrates the comparative evolution of the BET and SFT-500 indices, visually suggesting periods of synchronized movement, especially during major external shocks, which provides an initial visual indication supporting H1.

Figure 5.

BET (Left Axis) and SFT-500 (Right Axis) Series. Source: Calculations in EViews, based on BVB and SFT-500 data.

During the period 2019–2024, the time series of the BET and SFT-500 indices recorded broadly comparable trajectories, reflecting the influence of large external shocks. Both series capture two major episodes of volatility: the crisis induced by the COVID-19 pandemic (starting with March 2020) and the impact of the war in Ukraine (starting with February 2022). However, Figure 5 also suggests the existence of separate dynamics. First, the SFT-500 marks a stronger growth compared to the BET after the COVID-19 crisis. Second, the BET is influenced by political events in Romania but also in the U.S., recorded at the end of 2024. Also, after the end of the pandemic crisis, the SFT-500 index records a more pronounced recovery and a more robust upward trajectory compared to the BET index, suggesting a superior recovery capacity of the U.S. market. In contrast, the evolution of the BET index is additionally affected by endogenous factors, specific to the Romanian capital market, in particular, by internal political events, such as those that took place in the last quarter of 2024, marked by uncertainties associated with the electoral process. At the end of the last quarter of 2024, the evolutions of the analyzed indices follow opposite directions: the BET index highlights a downward trend, a sign of a climate of pessimism among investors, while the SFT-500 index indicates an optimistic outlook, reflected by an upward evolution.

To analyze the relationship between the BET and the SFT-500, we constructed the following econometric model:

where BET stands for the BET Index, SFT is the SFT-500 index, and ε is the error term. The coefficient a1 evaluates the autoregressive behavior, and a2 and a3 are the impact parameters of the SFT-500 on the BET (contemporary and lagged impact, respectively). The impulse indicators term selected according to the Schwartz criterion (SIC) allows controlling for possible extreme observations (outliers) or exogenous shocks.

d(BETt) = a0 + a1d(BETt−1) + a2d(SFTt) + a3d(SFTt−1) + (impulse indicators = SIC) + εt,

To highlight the particularities over time, the estimated model was extended by including impulse indicators (Impulse Indicator Saturation—IIS), automatically identified according to the Schwartz criterion (SIC). This approach is based on general-to-specific (GETS) algorithms, according to the methodologies proposed by Hoover and Perez (1999), respectively, Sucarrat and Escribano (2012). The use of IIS allows capturing the effects of extreme observations or exogenous shocks that are not explained by traditional explanatory variables. The results obtained from the estimation are presented in Equation (7) (under estimators, in parentheses, standard error).

The statistically significant positive coefficients for (contemporary impact) and (lagged impact) provide strong empirical support for H1, confirming a positive correlation and global connectedness between the BET and SFT-500 indices. Furthermore, the significance of specifically validates H2, demonstrating that the Romanian stock market reacts with a systematic delay to shocks originating in the U.S. market, consistent with differences in liquidity and informational efficiency.

4.3.2. Evidence for H3: Outliers and Political Events

To test Hypothesis 3 (H3), which posits that major political and geopolitical events cause significant outliers in the BET returns series, the Impulse Indicator Saturation (IIS) technique was utilized. From a technical point of view, all the coefficients included in the model, including those corresponding to the IIS (Impulse Indicator Saturation) indicators, are statistically significant at a confidence level of 1%. The analysis of the residuals does not indicate the presence of autocorrelation, an aspect confirmed by both the Durbin–Watson statistic, whose value is 1.90, and the Breusch–Godfrey test for serial autocorrelation, which provides an associated probability of 0.2013 (for a number of lags corresponding to seasonality). In addition, the introduction of dummy variables identified by the IIS contributes to stabilizing the variance of the residuals, a fact supported by the results of the Breusch–Pagan–Godfrey test for heteroscedasticity, whose p-value is 0.9663, indicating the absence of significant heteroscedasticity in the model.

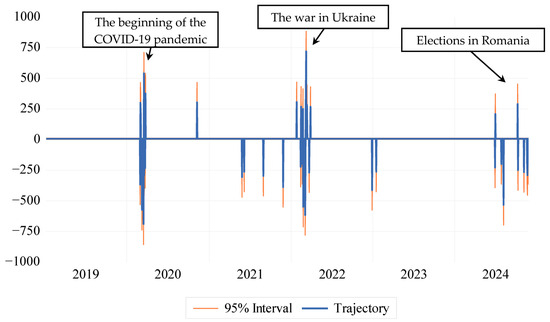

Following the application of the Impulse Indicator Saturation (IIS) procedure, 50 impulse indicators were identified, representing approximately 3% of the total 1561 observations. The detected outliers show a non-uniform distribution over time, concentrating in three significant intervals, highlighted in Figure 6:

- March 2020, a period corresponding to the onset of the health and economic crisis caused by the COVID-19 pandemic.

- February–March 2022, an interval associated with the onset of the military conflict in Ukraine.

- December 2024, a period overlapping the presidential elections in the United States, marked by increased political uncertainty.

The statistical validity of the presence of these extreme observations was confirmed by applying the Jiao–Pretis Proportion and Jiao–Pretis Count tests (Jiao and Pretis 2022), both rejecting the null hypothesis that the number and proportion of outliers do not differ significantly from those generated randomly, at a significance level of 0.0039.

Figure 6.

Impulse indicators for the link model between the BET and the SFT-500. Source: Calculations in EViews, based on BVB and SFT-500 data.

Although both the BET index series and the SFT-500 index series record common episodes of increased volatility and the presence of outliers in the intervals of March 2020 (associated with the onset of the COVID-19 pandemic), February–March 2022 (corresponding to the beginning of the conflict in Ukraine), and the end of 2024 (electoral context in the U.S. and Romania), the detailed analysis highlights specific peculiarities in the behavior of the BET index. These differences are manifested by distinct responses to external shocks and, above all, by the additional influence of local factors, difficult to capture through the SFT-500 index.

This aspect is formally reflected in the regression equation by the high statistical significance of the impulse indicators (IIS) included in the model. The presence of these significant coefficients indicates that a considerable part of the variation of the BET series cannot be explained exclusively by the exogenous influences transmitted by the dynamics of the SFT-500 index. More precisely, these indicators capture the effects of idiosyncratic shocks, specific to the Romanian capital market, including amplified reactions to internal political events, fiscal uncertainties, or increased sensitivity to regional risks. The impulse indicator terms show that Romania’s stock market reacts to its own political and fiscal shocks, even when global markets remain calm. Relying on a world benchmark like the SFT-500 to gauge BET risk therefore leaves investors and regulators blind, just when local tensions spike. Any risk model or policy response needs a domestic-shock layer; otherwise, volatility will be systematically underestimated at the very moments it matters most.

Therefore, even if there is a partial correlation and temporal synchronization between the developments of the two indices, the econometric model signals that the external impact (exerted by the SFT-500) is modulated and filtered by endogenous factors specific to the emerging market in Romania, which justifies the integration of IIS in the estimated model. Hypothesis 3 (H3) holds, demonstrating that major political and geopolitical events indeed cause statistically significant outliers in the BET returns series.

4.3.3. Evidence for H4: Volatility Persistence and Characteristics

In this subsection, H4, which states that the volatility experienced by the BET index is higher and more persistent compared to the SFT-500, reflecting the specific vulnerability of emerging markets to internal and regional political instability, was tested. In order to do so, and also test the robustness of the model described above, we additionally built a Fractionally Integrated Generalized AutoRegressive Conditionally Heteroskedastic (FIGARCH) model with Generalized Error Distribution (GED).

The technique used to solve the FIGARCH model (Maximum Likelihood ARCH—Generalized Error Distribution) rejects the IIS variables in the mean equation (the coefficients attached to the respective variables are not significant at the standard thresholds). Under these conditions, we included three plateau variables in the model (variable equal to 1 if the observation lies between two dates, and 0 otherwise).

The equation on mean is (under estimators, in parentheses, standard error):

where dumCOVID19 is a dummy variable equal to 1 if the observation lies from 9 March 2020 to 16 March 2020, and 0 otherwise; dumUKR is a dummy variable equal to 1 if the observation lies from 24 February 2022 to 16 March 2020, and 0 otherwise; and dumElect is a dummy variable equal to 1 if the observation lies from 19 November 2024 to 31 December 2024, and 0 otherwise. The estimators in the above Equation (8) are identical in sign, and close in values, to those calculated using Equation (7), which argues for the robustness of the analysis.

The conditional variance equation in the FIGARCH(0, d, 2) model is, in GARCH shorthand (under estimators, in parentheses, standard error):

In the previous equations, L is the lag operator, εt is the error from the mean equation, and νt is the error component in the variance equation.

The parameters in Equations (8) and (9) are statistically significant (according to the two-sided t-Student test), at a threshold of 0.10 for the coefficients of d(BETt-1) and GARCH(-1), i.e., , and a threshold < 0.001 for the others. The Engle–Ng Sign-Bias Tests found no leverage effects in standardized residuals.

The GED distribution parameter is 1.239, which means that the residuals distribution has thicker tails than the normal distribution, which suggests the possibility of the existence of extreme values in the conditional variance equation. Also, the fractional differentiation parameter d = 0.572 (statistically significant at 0.0001), located in the interval 0.5 ≤ d < 1, suggests the existence of a strong long memory in volatility and the fact that the process is non-stationary in covariance but mean-reverting (shocks to the conditional variance, although slowly absorbed, are not persistent to infinity). The estimators of the GARCH parameters are 0.2659 and 0.1527 (so that β1 + β2 < 1), which reflects the long-term persistence of shocks in the conditional variance. The big negative dummy coefficients reveal that short, event-driven episodes (COVID-19, Ukraine, elections) can overwhelm the otherwise tight link to global markets; so, hedging and policy buffers need explicit event triggers rather than steady-state rules.

This indicates that shocks to the conditional variance, although slowly absorbed, are not persistent to infinity; yet, their effects decay gradually over time. This finding directly supports H4, confirming the persistent nature of volatility in the Romanian market, a characteristic often observed in emerging economies.

5. Discussions