1. Introduction

Spread options are popular derivatives in the commodity markets. The European spread options on two assets have a payoff in the form

, where

corresponds to call/put spread options. See

Carmona and Durrleman (

2003) for an overview with discussions of their practical applications.

Several approximations and numerical methods have been proposed for their pricing under various assumptions for the distributional properties of the underlying assets (). We summarize briefly a few of these methods below, distinguishing between methods that assume correlated log-normally distributed assets and methods that allow for components’ smiles.

The simplest setting assumes that

are correlated log-normals. This arises, for example, when the underlying assets are assumed to follow correlated geometric Brownian motions (2 GBMs). Several pricing formulae have been proposed for this case. The simplest approach is the Kirk approximation (

Kirk 1995), which assumes that the spread follows a displaced log-normal distribution.

Shimko (

1994) uses the Bachelier model for the spread and applies a correction, which approximates the true distribution of the spread using the Edgeworth expansion in terms of its skewness and kurtosis, following the Jarrow–Rudd approach. The Shimko approach has been extended to spread options on three assets by Schaefer (

Schaefer 2002).

In relaxing the log-normal assumption for the underlying assets (

), several methods have been proposed for pricing spread options.

Alexander and Scourse (

2004) assume that the components have a bivariate log-normal mixture distribution. If the joint characteristic function of

is known,

Caldana and Fusai (

2013) reduce the spread-pricing problem to the evaluation of one-dimensional integrals. Their method was extended to spread options on multiple assets by

Pellegrino (

2016). Copula-based methods have been discussed by

Herath et al. (

2011) and

Berton and Mercuri (

2024).

In financial practice, the prices of spread options are often quoted in terms of the Bachelier volatility. The Bachelier volatility is appropriate for this case, as the underlying of the spread options can take either sign. As an illustration, we show in

Figure 1 the Bachelier implied volatilities of exchange-traded 1-month Calendar Spread Options (CSOs) on WTI crude oil futures, obtained from settlement prices on 12 March 2025 from the CME Group.

1 The 1-month CSO payoff is linked to the difference (

) between consecutive futures contracts at maturity.

In the spread options literature, the focus has been on computing the prices of these options. We show, here, that there are advantages to working instead with the Bachelier implied volatility of the spread options, which is more tractable in certain respects. Specifically, assuming that the underlying assets follow correlated local volatility models, we show that the expansion of the spread-implied volatility around the at-the-money strike is simply related to the corresponding expansion of the single-asset-implied volatilities in log-moneyness. This is important for spread options on assets with implied volatility smiles, as it gives a simple way to include smile effects in pricing the spread option.

We assume that the assets follow correlated local volatility models. The local volatility model (

Dupire 1994;

Gatheral 2006) is the simplest dynamic model, which is consistent with observed implied volatility smiles for each underlying asset. From this point of view, our modeling choice is parsimonious. However, we note that more complex models are available:

Piterbarg (

2006) and

Hagan et al. (

2020) include stochastic volatility in pricing spread options. The local correlation model used for basket options, see, for example,

Guyon and Henry-Labordere (

2014) (Chapter 12), can also be applied for spread options. Jump-diffusion models could also be considered. All these models would introduce additional parameters, which require calibration. On the other hand, under the model assumed here, we derive analytical approximations for spread options, which depend only on observable parameters for the underlying assets, and their correlation.

Specifically, we assume that the asset prices follow the process

This formulation of the local volatility model is appropriate for cases when the asset prices (

) are strictly positive, as in equities, FX, and certain futures on positive definite assets. For this case, it is natural to quote implied volatilities as Black–Scholes (log-normal) volatilities.

We use short-maturity asymptotic methods to derive the ATM level and skew of the Bachelier-implied volatility of the spread option. The main result is stated in Proposition 1. An analytical result for the spread convexity is given in Proposition 2 for the case of spread options on log-normally distributed assets. The method of the proof is similar to that used in

Pirjol (

2023) to extract the ATM skew of a basket option from the short-maturity asymptotic results for basket options in

Avellaneda et al. (

2002). The result is also similar in spirit to those in

Durrleman and El Karoui (

2007), which gave analytical results for the ATM volatility, skew, and convexity of FX spread options.

For certain applications, it is convenient to relax the positivity assumption for the

asset prices, for example, when these assets are interest rates. The model (

1) must be modified by replacing

.

2 For this case, it is natural to express the ATM spread volatility and skew in terms of the Bachelier ATM volatility and skews of the individual names. The result is given in Proposition 3 and reproduces the result of

Piterbarg (

2006).

The theoretical predictions for the spread-implied volatility are tested in

Section 3 for spread options on log-normally distributed assets, compared with direct spread-option pricing by numerical integration. Similar tests are presented in

Section 4 for spread options on two assets with an implied volatility smile, by comparing with a Monte Carlo simulation.

2. Spread Options’ Bachelier-Implied Volatility

Consider spread options on the spread between two assets (

), which follow correlated local volatility models with local volatility functions (

):

The initial conditions are

.

We consider spread options on these two assets. The call and put spread options have prices

The underlying for spread options is the spread , which can take either sign. Therefore, the appropriate volatility quotation is in terms of the Bachelier-implied volatility.

Recall the Bachelier call option pricing formula for the (undiscounted) price of an option on an asset with forward price

:

where

is the so-called normal or Bachelier-implied volatility. The Bachelier price depends only on

and

.

The Bachelier-implied volatility of a spread option (

) is defined in terms of the spread option price (

) as

where

is the forward spread, expressed in terms of the forwards of the two spread components (

).

One unusual feature of the Bachelier-implied volatility is that it is bounded from above, in contrast to the usual Black–Scholes (log-normal)-implied volatility, which may take arbitrarily high values. As

increases, the Bachelier price (

5) increases monotonically and can exceed the Merton bound (

). This bound holds only if an explicit upper bound on

is enforced. However, this is not expected to be an issue for spread options for which there is no analog of the Merton upper bound on prices.

The implied volatility of the spread option (

) is expanded around the ATM point as follows (we drop the dependence on

T for simplicity):

where the ATM spread option volatility is

, and the higher-order coefficients are the ATM spread skew (

) and convexity (

).

Assume that the Black–Scholes (log-normal)-implied volatilities of the single-name options on are known. This is the case for equities, FX, and futures, which can take only positive values. The analogous result for the case when the single-name Bachelier implied volatilities are known is given below in Proposition 3.

Denote

as the implied volatility of an option on asset

with log-moneyness

. The first two terms in the expansion of

in powers of log-moneyness give the ATM level and skew of the asset’s implied volatility.

The following result gives the short-maturity asymptotics for the ATM spread volatility () and skew () in terms of the single-name parameters () and the correlation (). Recall that the ATM point for the spread option corresponds to strike . Since we work in the short-maturity limit, all maturity T dependence disappears, and we drop, for simplicity, the maturity argument (T) in all the quantities involved.

Proposition 1. Assume that the two assets () follow correlated local volatility models (1). The implied spread parameters () are expressed in terms of the components’ Black–Scholes-implied volatilities and skews (), defined as in (8), as follows: The ATM-implied Bachelier volatility of the spread option is The ATM skew of the spread-implied volatility iswhere Remark 1. Assume that the two assets follow correlated Black–Scholes models (). In the limiting case of assets with the same forward price (), the ATM spread level and skew becomeThe ATM skew vanishes at the equal volatility limit, regardless of the correlation. The result of Proposition 1 is easily extended also to the ATM convexity of the implied spread volatility. This results in lengthy formulae, so we give, here, only the result for the spread option on correlated Black–Scholes assets.

Proposition 2. The convexity of the Bachelier spread option implied volatility in the Black–Scholes model has the formwhere the coefficients are given in Appendix C. Spread Options on Assets Described by Bachelier Volatility

In some cases, the individual assets (

) can take either sign. This can happen, for example, with spread options on interest rates. For this case, the appropriate implied volatility for single-name options is the Bachelier (normal)-implied volatility. Denote the single-name Bachelier-implied volatilities as

. They are expanded in powers of the differences (

) as

with

and

as the ATM level and skew of the Bachelier-implied volatility.

The following result gives the ATM Bachelier level and skew of the implied spread volatility, expressed in terms of and .

Proposition 3. Assume that the Bachelier single-name ATM volatilities () and skews () are given.

Then, the ATM spread Bachelier volatility is The ATM skew of the spread-implied volatility is Proof. The proof is a simple modification of the proof of Proposition 1 and is omitted. □

Remark 2. Results (16) and (17) can be recovered from Proposition 6.2 in Piterbarg (2006) by taking the local volatility limit in that result—by setting the stochastic volatility factor . The relation between the notations of Piterbarg (2006) and those used here isand is analogous for the spread quantities (). Substituting and into the expressions for p and q in Piterbarg (2006) yields the same results as (16) and (17). In the limiting case, when the two assets follow Bachelier models and, thus, have vanishing skews (), the spread skew also vanishes. This is intuitively clear, since the difference of two normally distributed random variables is also normally distributed.

3. Numerical Tests in the Black–Scholes Model

We present, in this section, a few numerical tests for the predictions of this paper, considering spread options on two correlated Black–Scholes assets. The valuation of the spread options for this case can be performed numerically by integration over the bivariate normal distribution. For convenience, we summarize the relevant formulae in the

Appendix A.

Test 1. Correlation dependence. In the first test, we compare the short-maturity predictions for the ATM level and skew of the spread-implied volatility against exact numerical evaluations by varying the correlation () at fixed .

Consider a spread option on two Black–Scholes assets with parameters

The short-maturity spread ATM volatility and skew given in (

9) and (

10) are shown as the solid curves in

Figure 2 as functions of the correlation

. The left plot shows the ATM Bachelier spread volatility from the short-maturity result (

9) (solid curve) and from a numerical evaluation of the spread option (red dots) by numerical integration over the bivariate joint distribution. The right plot shows the ATM spread skew, evaluated by central finite differences (

) with

.

In a previous paper

Pirjol (

2023), we showed that the ATM skew of a basket of correlated Black–Scholes assets is non-negative in the short-maturity limit for any volatilities and correlation structure. From (

10), we see that this does not hold for the ATM skew of a spread option. As

, the term

becomes negative and approaches

. This shows that for

values sufficiently low, the ATM spread skew may become negative in the BS model.

Test 2. Strike dependence. In the second test, we compare the exact Bachelier spread-implied volatility () obtained by numerical integration against the short-maturity asymptotic result, constructed using the ATM level and skew given by Proposition 1 and the convexity from Proposition 2.

Using the analytical predictions for the ATM spread volatility, skew, and convexity (

,

, and

), we can construct a linear and a quadratic approximation for the spread volatility, defined as

These parameters are given explicitly in terms of the Black–Scholes parameters of the underlyings by Proposition 1 (with

) and by Proposition 2.

Assume the same forward prices for the two assets as in the previous test , , which corresponds to a spread forward of .

We consider several scenarios:

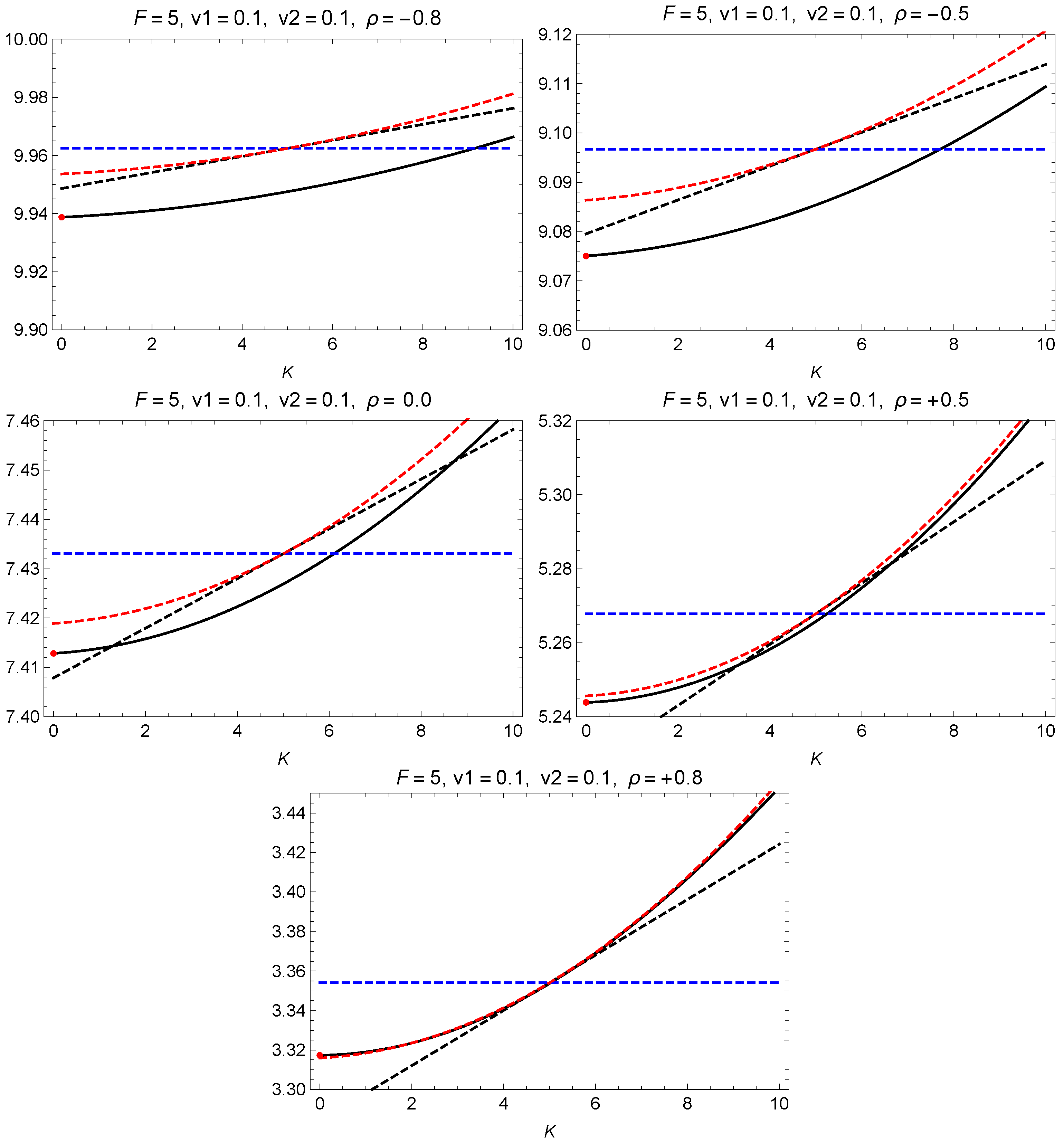

Scenario (i): The two assets have the same volatility (

). The total spread Bachelier volatility (

) is shown in

Figure 3 as the solid black curve for several choices of the correlation.

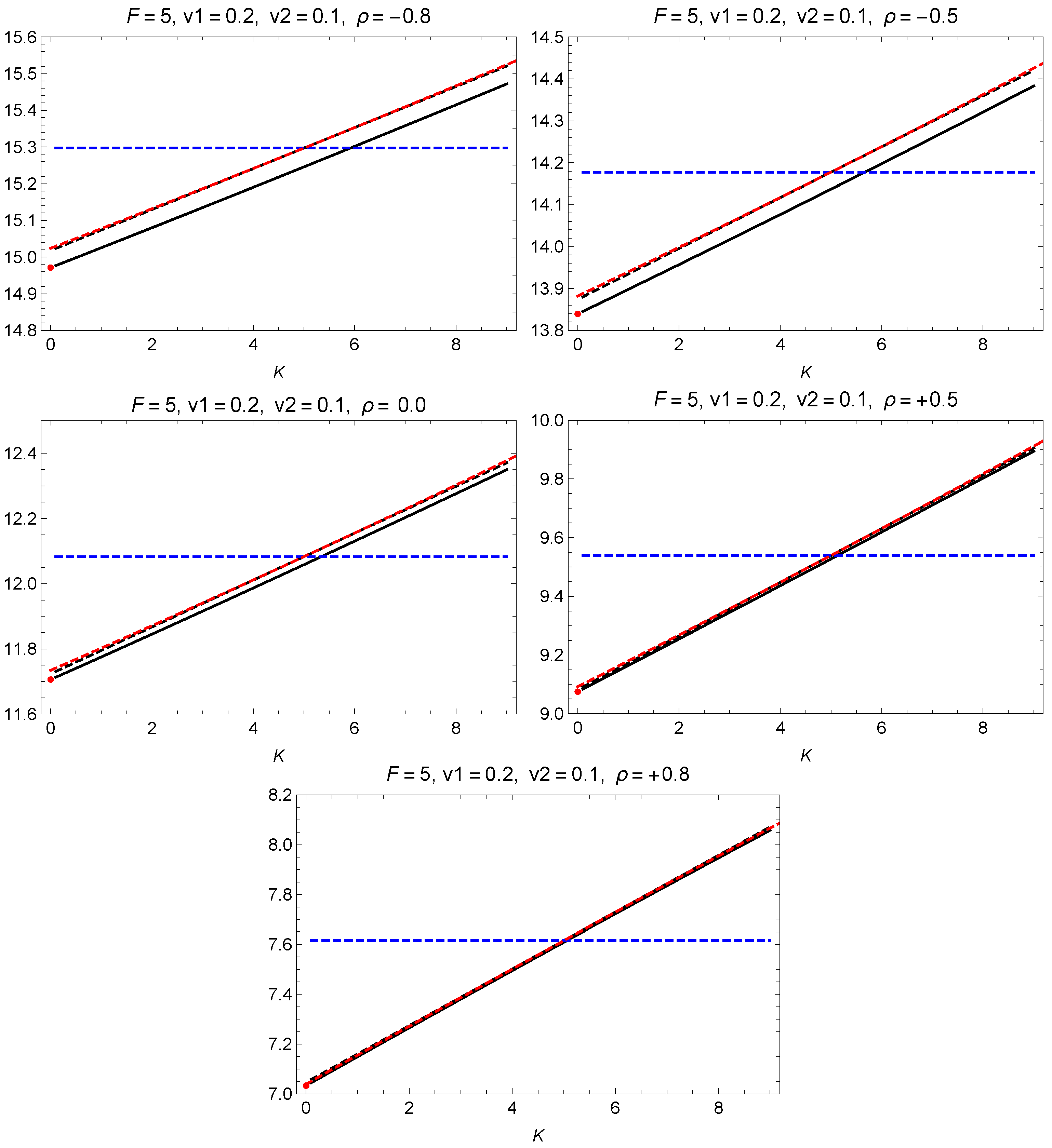

Scenario (ii): The two assets have different volatilities (

and

). The total spread Bachelier volatility (

) is shown in

Figure 4 as the solid black curves for several choices of the correlation.

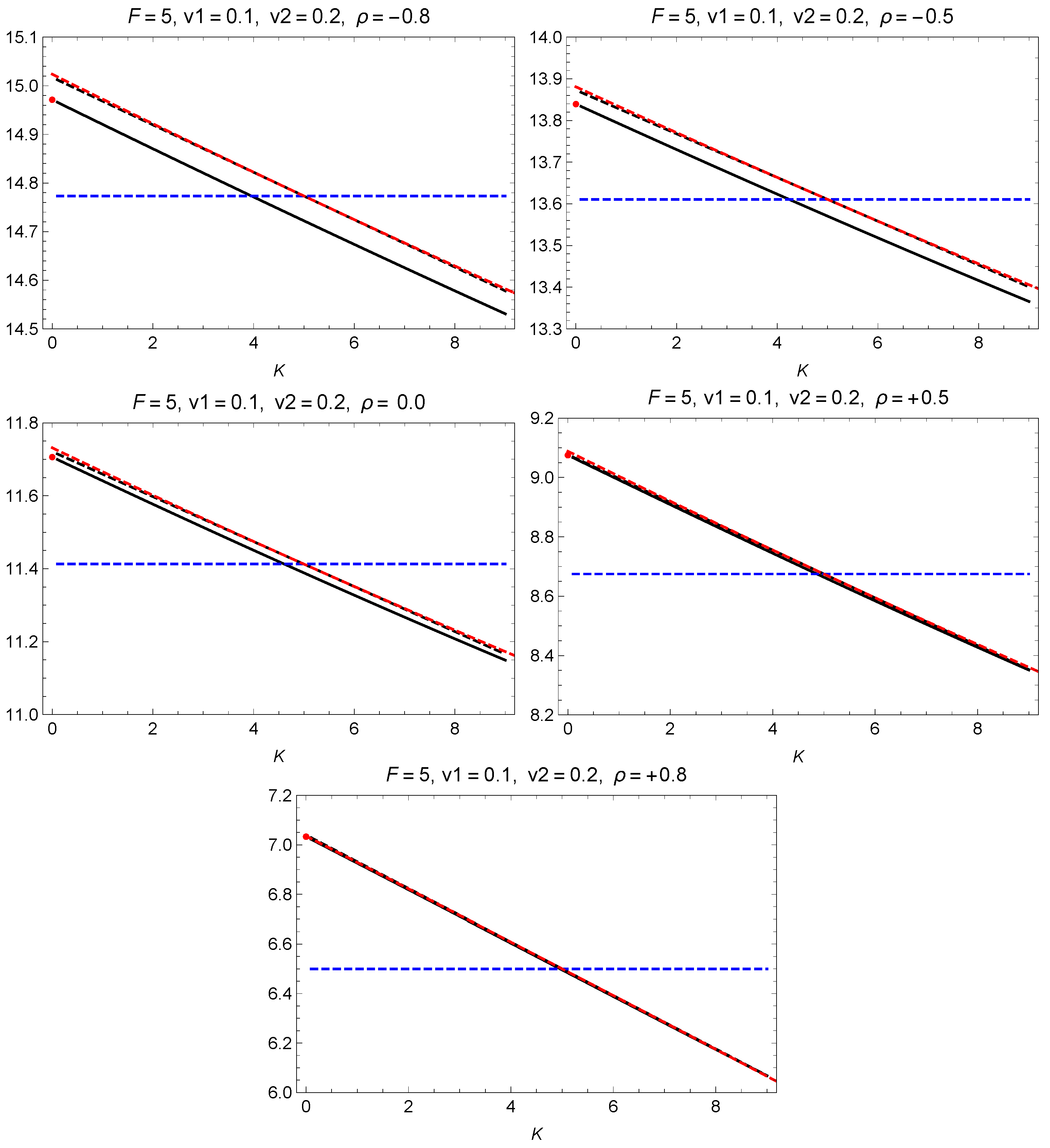

Scenario (iii): The same as in (i) and (ii) but with

and

. The total spread Bachelier volatility (

) is shown in

Figure 5 as solid black curves for several choices of the correlation. For this scenario, the ATM spread skew is negative.

The spread option prices with zero strike (

) are known exactly in the Black–Scholes model from the Margrabe formula (

Margrabe 1978):

with

.

For each scenario, the red dot shows the exactly known value of the spread volatility (

) from the Margrabe formula (

22). Agreement with this value is a test for the quality of the numerical integration over the bivariate normal distribution used to obtain

, shown as the solid black curve.

The linear approximation (

20) is shown as the black dashed line and the quadratic approximation as the red dashed curve. The horizontal dashed blue line shows the ATM spread volatility (

). The linear and quadratic approximations reproduce well the trend of the actual spread volatility around the ATM point, although there is a gap, which is due to subleading

corrections. The agreement of the linear and quadratic approximations with the numerical valuation improves markedly for large positive correlations for all the scenarios considered.

Test 3. Option maturity sensitivity tests. We present, here, tests for the accuracy of the asymptotic result for the Bachelier volatility of the spread options for several option maturities (T). The tests use the same parameters as above: and , with corresponding to scenarios (ii) and (iii). We compare the exact spread volatility computed by numerical integration with the asymptotic result.

The results are shown in

Table 1 and

Table 2. The tables show the exact Bachelier-implied volatility of an ATM spread option (

) obtained by numerical integration, and the analytical asymptotic result, for several maturities. The two tables correspond to scenarios (ii) and (iii), which have higher volatility than scenario (i) and are, thus, more conservative. The second row for each maturity shows the relative error of the asymptotic result. In all the cases considered with maturity

T up to 1 year, the relative error of the asymptotic result is less than 0.4%. The error is much smaller for large and positive correlations (

), which is often relevant in practical applications of spread options on futures contracts.

Test 4. Spread option pricing tests. We also give performance tests of the linear approximation (

20) for pricing spread options. For this test, we use the same parameters as those in

Bjerksund and Stensland (

2014). Consider a spread option on two assets with maturity

. The spot prices, volatilities, and dividend yields of the two assets are

The short rate is

. The forward prices are

Table 3 shows the exact (first row) and linear approximation (second row) results for the spread option prices with several strikes and correlations. The third row shows the relative error of the linear approximation. For

, we also show the exact result from the Margrabe formula as a check on the exact evaluation by numerical integration.

The relative error of the linear approximation is less than 1% in almost all the cases (except for and , which have larger errors due to the low option prices). This suggests that the linear approximation could be useful for fast spread option valuation when the desired accuracy is below the 1% level.

4. Numerical Tests for Spread Options on Assets with Smiles

This section presents the numerical tests of our predictions for spread options on assets with non-zero skew. For this test, we assume that the underlyings follow correlated local volatility models (

) with local volatility

The function

is the short-maturity limit of the local volatility of the log-normal SABR model (

Hagan et al. 2014) with spot volatility

, vol-of-vol

, and correlation

. The short-maturity asymptotic volatility of this local volatility model coincides with the short-maturity limit of the implied volatility in the stochastic SABR model (

Hagan et al. 2002)

with

. The ATM-implied volatility level and skew in this model are

Numerical tests. For the numerical tests, we choose the parameters

,

, and

, as in

Table 4. The risk-free interest rate is

. The spot volatility values (

) correspond to those in Scenario (i) for the Black–Scholes testing.

Figure 6 shows the BS-implied volatility of the options on the two spread components obtained by MC simulation with

paths (red) for maturity

, compared with the short-maturity asymptotics (

26) (black). The dashed line is a linear approximation with coefficients given by (

27)

Consider, now, a spread call option with payoff

, where

follow correlated local volatility models with

in (

25) and correlation

. We computed the Bachelier-implied volatility of the spread option by MC simulation with

paths and

time steps. The option maturity is

years.

The ATM spread skew can be estimated by MC simulation using the exact relation

where

is the digital call option with payoff

.

Proof. The option price can be written in terms of the Bachelier spread implied volatility (

) as

Taking the derivative with respect to the strike and setting

, we get

The left-hand side is expressed in terms of the digital call option as

, which reproduced the stated result (

29). □

Table 5 shows the ATM (

) and skew (

) of the Bachelier spread implied volatility obtained by MC simulation. These are compared with the analytical results for the ATM level and skew (

) and skew (

) given by Proposition 1, see Equation (

27), for several values of

. The theoretical result reproduces (within errors) the results of the MC simulation.