Abstract

This study investigates the impact of financial technology (Fintech) on bank stability in the Middle East and North Africa (MENA). Utilizing panel data from 94 banks in 10 countries over a 13-year period from 2011 to 2023, this research employs panel GMM regression to examine the relationship between the level of Fintech adoption, as measured by the Fintech index, and a bank’s stability. This paper controls for bank characteristics (efficiency, profitability, size, liquidity risk, and dividend payout ratio) and macroeconomic variables (GDP growth and inflation). The Fintech index is calculated using data text mining from the banks’ annual reports. This research contributes to the existing literature by providing empirical evidence of the positive effects of Fintech adoption in the MENA banking sector. The positive findings underscore the transformative impact of Fintech on banking stability, highlighting the importance of technological integration in MENA’s financial institutions for growth, stability, and effective strategies. The robustness of the results regression confirmed that our findings hold.

1. Introduction

The fast expansion of financial technology (Fintech) is transforming the global banking industry, offering both prospects and obstacles for financial stability (Serbulova 2021). In the MENA region, Fintech adoption has accelerated due to heightened digitalization, legislative reforms, and an escalating demand for novel financial services (Murinde et al. 2022). Fintech provides improved efficiency, financial inclusion, and economical solutions; yet it also disrupts conventional banking structures, prompting concerns regarding effects on banking stability. Although Fintech fosters financial inclusion and enhances operational efficiency, its growth may introduce systemic hazards, especially in underdeveloped financial systems (Deng et al. 2021). The disintermediation of conventional banks, the emergence of alternative lending platforms, and the increasing dependence on digital payment systems may undermine banks’ profitability, heighten competition, and present new dangers, including cybersecurity concerns and regulatory issues (Banna et al. 2021). Simultaneously, Fintech solutions, including blockchain technology and artificial intelligence, provide banks with instruments to augment risk management, bolster financial resilience, and adjust to changing market dynamics (Liang et al. 2023).

Considering these divergent consequences, comprehending the influence of Fintech on the stability of MENA banks is essential for policymakers, regulators, and financial institutions. Since the MENA region is experiencing financial change driven by technological advancements, Fintech is a crucial area for banks’ risk-taking. Federal authorities, supervisory agencies, and financial institutions must deal with the emerging impacts of Fintech integration to design appropriate rules, improve assessment, and guarantee sustainable financial health. Since Fintech is penetrating and redefining the banking industry, examining Fintech’s impact on bank risk-taking becomes more compelling. Therefore, the following is the research question: does Fintech affect the level of risk-taking by Middle Eastern and North African banks?

This paper seeks to analyze the impact of Fintech and its consequences on bank risk-taking in the MENA region. This research examines the effects of the Fintech index, controlling for bank characteristics (bank efficiency, profitability, size, liquidity risk, and dividend) and macroeconomic variables (GDP and inflation) on banks’ risk-taking in the Middle East and North Africa. By employing panel GMM regression, this study captures the complex role of Fintech.

The uniqueness of this empirical research is its concentration on a largely unexplored domain at the intersection of financial technology (Fintech) and financial institution behavior, particularly in the Middle East and North Africa (Kharrat et al. 2023). This paper provides a fresh perspective by analyzing how the emergence of Fintech affects the risk-taking behaviors of banks in a region with distinct economic and cultural dynamics. Although previous studies by Banna et al. (2021), Febriana (2022), and Fang et al. (2023) have primarily focused on the effects of Fintech on financial inclusion, efficiency, and innovation in global or more developed markets, this research explores a different aspect by focusing on bank stability and risk-taking. This investigation fills an important gap by offering useful insights to banks, policymakers, and researchers through an analysis of how the adoption of Fintech affects financial stability and risk management in MENA banks. This contributes to a deeper understanding of how Fintech is reshaping the financial environment in emerging markets.

More specifically, this study offers essential insights for bank managers and financial institutions on adapting to Fintech innovations while maintaining financial stability. Banks that successfully incorporate Fintech into their operations can augment risk management, operational efficiency, and client engagement, thereby enhancing their competitive standing. In addition, this study is essential for regulators and central banks in formulating Fintech-friendly rules while protecting the financial system from emerging risks, including cybersecurity threats, fraud, and credit instability. As numerous MENA nations continue to advance their digital financial infrastructure, the results can inform the development of regulatory frameworks that reconcile innovation with risk management. Finally, this research contributes to the expanding literature on Fintech and financial stability by examining an overlooked region. Although current research predominantly examines Fintech’s influence in developed economies, the MENA region offers a distinctive scenario owing to its heterogeneous legislative framework, disparate degrees of digital penetration, and economic obstacles. This paper addresses significant research and provides novel insights into the impact of Fintech on banking stability in emerging nations.

The structure of the paper is as follows: Section 2 provides the previous studies and hypothesis development and discusses the theoretical background. Then, Section 3 highlights the selected sample, sampling procedure, variables, and the model used to investigate this relationship. Section 4 provides the results and analysis, and Section 5 concludes the research paper with the key findings and potential implications.

2. Literature Review

2.1. Theoretical Background

2.1.1. Financial Intermediation Theory

The financial intermediation theory holds that financial institutions, especially banks, are central to facilitating an adequate flow of funds from savers to borrowers (Allen and Santomero 1997). In this context, banks have traditionally acted as facilitators, managing the inherent risks associated with this process (Freixas and Rochet 2008). The banking sector in the Middle East and North Africa is at a crossroads, threatened by the existence of financial technology. The banking sector is disrupted by Fintech, which provides methods and techniques that could enhance processes and introduce new risks. Following Uddin et al. (2022), microfinance institutions complete the role of traditional banking institutions by providing loans without requiring physical collateral. Therefore, this theory helps explain Fintech’s influence on conventional banking systems and changes risk behaviors (Trapanese and Lanotte 2023). This research paper employs the concept of financial intermediation theory to analyze how the shift in the functions of Fintech distorts the major roles of the banking sector in the MENA region. However, it specifically focuses on shifts in risk-management practices and the implications for financial stability (Thakor 2020). The expected impact of Fintech, based on the theory, on the performance of banks is positive, as Fintech helps to reduce risks and costs and improve efficiency, which results in better financial stability (Lu 2016).

2.1.2. Innovative Diffusion Theory

Rodger’s innovation diffusion theory explains that the diffusion of innovation occurs incrementally within an industry or society (Jamshidi and Kazemi 2020). This theory provides a personalized approach to investigating Fintech’s influence on banks’ risky portfolios in the MENA region. Previously, companies in the MENA region have exhibited varying degrees of technology utilization in their businesses, including banks (Saygili and Ercan 2021). Leading organizations can affect risk strategies by adapting them for their own benefit if they are early adopters of Fintech development; however, those who fall behind in the industry may have a problem catching up (Tarawneh et al. 2024). The theory allows for further analysis of the effects of extending Fintech innovations on the risk aspect of the banking sector in the MENA region, as per Jamshidi and Kazemi (2020), and analyzing phases of Fintech adoption among banks in Bahrain, Jordan, Kuwait, Oman, Qatar, Saudi Arabia, the United Arab Emirates, Egypt, Morrocco, and Tunisia for comprehending risk-taking behavior. Thus, by applying innovation diffusion theory, this research enhances its precision and expands on the multi-faceted dynamics of Fintech adoption and the influence that these dynamics exert on bank risk-taking in the context of the MENA region (Greenhalgh et al. 2004). Table 1 below summarizes the theories and provides the expected impact of Fintech on bank stability based on the supported theoretical framework.

Table 1.

Expected impact of Fintech on bank performance based on the related theories.

2.2. Previous Studies and Hypothesis Development

Fintech and Bank Stability

Fintech has significantly impacted financial stability via markets and transformed company models, fostering an innovative evolution in the global financial environment (Naz et al. 2022). In industrialized economies like Singapore, the UK, and the USA, the convergence of technology and finance has facilitated sophisticated financial solutions and generated regulatory frameworks that adapt to and promote the growth of novel financial technologies (Yu 2024). In contrast, in emerging and developing economies, Fintech has been instrumental in advancing financial development by facilitating access to essential financial services such as investment, credit, and insurance, particularly for consumers and micro-enterprises, thereby tackling widespread financial inclusion challenges (Ochenge 2023). Moreover, it profoundly influences the decisions of customers and producers by improving accessibility and offering innovative, customer-focused financial goods and services (Zhao et al. 2023). Furthermore, Fintech fosters the transformative and sustainable advancement of enterprises by utilizing technological innovations to develop scalable and efficient financial solutions, thereby enabling financial institutions to enhance their service offerings, reach a broader clientele, and adeptly navigate the intricate and dynamic global economic landscape (Banna et al. 2021).

The MENA region has swiftly advanced its financial institutions, establishing itself as a notable participant in the world market, supported by strong policies and a well-organized financial framework (Hussain and Rasheed 2023). This advancement not only reinforces its competitive stance but also allows it to exhibit resilience in the complex landscape of the global market (He et al. 2023). The scope of technical innovations in finance is extensive, encompassing automated trading systems, blockchain, digital wallets, and robo-advisors (Liu and Jiang 2017). Consequently, comprehending the impact of these technological advancements on financial stability is crucial, as doing so may transform conventional banking systems, affect consumer behaviors, and alter regulatory frameworks, ensuring that the MENA financial sector not only maintains its stability but also flourishes in an ever-evolving digital landscape (Liang et al. 2023).

On the other hand, Kirilenko and Lo (2013) highlighted the potential for Fintech to impair financial contagion, procyclicality, and market volatility, consequently jeopardizing the stability of a financial system (Banna et al. 2022). Algorithmic trading, a significant component of Fintech, was recognized as a cause of contagion and susceptibility in financial markets. Mild et al. (2015) contended that lenders in peer-to-peer markets inadequately evaluated the creditworthiness of borrowers. Moreover, in contrast to banks, they lack the capability to precisely assess default risk (Hu et al. 2022). Pantielieieva et al. (2018) emphasized the evolution of conventional financial intermediation principles and models because of global Fintech trends. Their discussion centered on the dangers arising from escalating compliance costs for conventional financial institutions, resulting in partnerships with Fintech companies that brought regulatory complications and diminished accountability (Wang et al. 2020). The diminished regulatory requirements of Fintech, its interconnection, vulnerability to cyberattacks, operational failures, and the possibility of AI-induced disruptions exacerbate threats to financial stability (Fang et al. 2023).

The literature indicates the disruptive influence of Fintech on the financial sector, as observed by He et al. (2023), Liao (2018), and Banna and Alam (2021). Although Fintech advances enhance services, they also obscure traditional boundaries among providers and complicate entry hurdles, presenting regulatory issues that may undermine stability and trust in the financial system (Ni et al. 2023). Li et al. (2020) conducted a study examining risk spillovers between Fintech companies and conventional financial institutions, particularly during bearish market situations. Their findings revealed that risk spillover was significantly more pronounced during periods of swift technological advancements, indicating an elevated probability of adverse effects on the conventional financial sector. Furthermore, a positive correlation exists between risk spillover from Fintech entities and the augmented systemic risk for conventional financial institutions, highlighting Fintech’s potential role in exacerbating financial instability and underscoring the necessity for vigilant oversight and regulation in this dynamic environment (Li et al. 2022a; Wang et al. 2022). For example, Nguyen and Dang (2022) expanded this discourse to emerging markets, illustrating that Fintech development may negatively impact financial stability in situations where diminished bank stability and heightened state ownership can intensify these detrimental effects.

The extensive research continually indicates that Fintech significantly influences various facets of financial stability (Chen et al. 2021; Febriana 2022; Sajid et al. 2023; Wu et al. 2023; Jafar et al. 2024), including the methods via which financial inclusion is promoted, traditional market structures are modified, accurate financial reporting is established, decentralization is realized, and institutional vulnerability is adequately mitigated (Guo and Shen 2016). Financial technology (Fintech) is crucial and essential in the contemporary financial environment (Lu 2016). Daud et al. 2022 examines the relationship between financial stability and Fintech adoption across various countries, revealing that the implementation of Fintech, including utilizing artificial intelligence, cloud computing, and data technology, enhances financial stability, a phenomenon further influenced by a concurrent concentration of banks. Table 1 provides the expected impact of Fintech on the performance of MENA banks based on the previous discussion.

3. Methodology

3.1. Sample Used

The sample for this study consists of seven Middle Eastern and three North African countries within the MENA region, as evident in Table 2. The data have been collected from the Refinitiv Eikon Platform (LSEG), the World Bank Database, and the annual reports of the selected sample banks, which were obtained from the companies’ websites or from stock exchange information about the banks. The data cover the years ranging from 2011 to 2023.

Table 2.

Sampling procedure.

3.2. Model Development

3.2.1. Dependent Variable: Bank Stability

Bank stability data is frequently employed to evaluate the resilience of banks to shocks and their capacity to operate without encountering hardship or insolvency (Deng et al. 2021). Bank stability, as a dependent variable, reflects the general soundness and durability of a bank’s operations, notwithstanding internal inefficiencies, or external economic disturbances (Ozili 2019). It indicates the probability of a bank maintaining solvency over time, especially during periods of financial instability or macroeconomic distress (Febriana 2022). The z-score is a prominent proxy for assessing bank stability in the academic literature (He et al. 2023). The z-score integrates metrics of profitability, leverage, and volatility to assess the proximity to insolvency (Liang et al. 2023). An elevated z-score signifies enhanced bank stability, indicating increased profitability, superior capitalization, and reduced volatility, thereby diminishing the likelihood of insolvency. A diminished z-score indicates an increased likelihood of distress. The z-score is especially advantageous in cross-country and regional analyses, such as the MENA region, as it offers a standardized and comparable metric of bank stability among institutions of varying sizes and structures (Diaconu and Oanea 2014).

3.2.2. Independent Variable: Fintech Index

Financial technology (Fintech) has revolutionized the conventional banking sector by providing innovative services such as mobile payments, digital loans, blockchain transactions, and AI-enhanced consumer solutions (Kharrat et al. 2023). These innovations may enhance bank stability by enhancing operational efficiency, broadening consumer access, decreasing transaction costs, and stimulating risk-management systems (Deng et al. 2021). Nonetheless, Fintech may also provide new vulnerabilities, including cybersecurity threats, regulatory obstacles, and competitive pressures from non-bank Fintech entities Sajid et al. (2023). Consequently, comprehending the overall impact of Fintech adoption on banking stability is essential, particularly in regions such as the Middle East and North Africa (MENA), where digital transformation is rapidly advancing, although regulatory frameworks and technological infrastructures differ markedly among nations (Liang et al. 2023).

To empirically assess this relationship, we adopt a Fintech index as a proxy for the degree of Fintech adoption within banks. The index is constructed using a content analysis approach informed by machine-learning techniques. Based on prior literature, ten key Fintech-related terms were identified, as provided in Table 3 below. We then analyzed the annual reports of banks in the MENA region using natural language processing (NLP) to determine the frequency of these keywords. The Fintech index is then calculated as the ratio of the total frequency of these selected Fintech words to the total number of words in the report, providing a standardized indicator of how prominently Fintech features in a bank’s strategic and operational discourse (Ktit and Abu Khalaf 2024). This proxy is especially suitable for the MENA context, where Fintech adoption may not always be directly disclosed through quantitative measures. By leveraging textual analysis, we capture indirect yet meaningful signals of digital transformation embedded in narrative disclosures, enabling a robust assessment of its impact on bank stability.

Table 3.

Fintech keywords.

To validate the Fintech Index, formulated by the ratio of Fintech-related word occurrences to the total word count in annual reports, we reference previous research in text-based data analysis. Saiz and Simonsohn (2013) established that data mining, text mining, and content analysis supply researchers with a substantial and novel source of quantitative data by utilizing decentralized text databases, including the internet and digital archives that include billions of documents. Their research revealed that the frequency of discourse on certain themes might convey significant information and provide insights into fundamental economic behaviors. In a similarly comparable manner, Scott et al. (2016) created the renowned Economic Policy Uncertainty (EPU) Index by analyzing the frequency of newspaper coverage, demonstrating that text-based metrics can adeptly encapsulate intricate real-world events. Their validation procedure involved human analysis of more than 12,000 newspaper items, yielding robust evidence that their index accurately monitors fluctuations in policy-related economic uncertainty. Building on this empirical framework, our Fintech Index quantifies the prevalence of Fintech-related terminology in corporate annual reports, providing a reliable and transparent indicator of organizations’ strategic emphasis on financial technology. This methodology not only mirrors the self-reported technological disposition of institutions but also corresponds with an expanding volume of literature that acknowledges the effectiveness of text-based indicators in empirical research.

Furthermore, Abedifar et al. (2017) highlighted the effectiveness of data text-mining techniques in identifying latent components and producing dependable proxies for intricate variables, especially within finance and economics. They contended that by examining the frequency and context of keywords or phrases in company filings or media texts, researchers might derive significant indicators that represent firm behavior, market mood, or innovation trends. Similarly, Babaei et al. (2023) corroborated this perspective by illustrating that content analysis and textual data mining can be employed to develop indices that include firm-level or market-level phenomena, such as technological adoption or ESG orientation. Their research has shown that utilizing natural language processing (NLP) technologies on yearly reports facilitated the creation of a comprehensive index that correlates effectively with conventional quantitative metrics, hence augmenting the analytical explanatory power and practical significance. Both studies substantiate the idea that systematically analyzed textual data constitute a significant and novel resource for developing valid and generalizable proxies in empirical research. Additionally, several researchers have argued the importance of using data text mining in developing indexes, such as (Hand 2009; Finlay 2011; Djeundje et al. 2021; Liu et al. 2022).

In addition, the developed Fintech Index has been validated through discussions with 21 bank managers from diverse financial institutions in the MENA region, held between January 5 and March 6. The consultations sought to guarantee that the chosen keywords for the index construction appropriately represent actual Fintech adoption and discussions in the banking sector. The participating managers were selected from a variety of countries: Bahrain (1), Jordan (3), Kuwait (1), Saudi Arabia (2), Oman (1), Qatar (3), the United Arab Emirates (3), Egypt (3), Morocco (2), and Tunisia (2). Their cumulative feedback validated the relevance, clarity, and appropriateness of the selected keywords, enhancing the index’s legitimacy and its alignment with practical Fintech advancements in the region. This procedure offers qualitative validation that enhances the quantitative text-mining method, reinforcing the index’s reliability as a measure of Fintech involvement in the MENA banking sector.

3.2.3. Control Variables (Bank Characteristics)

Bank Efficiency

Bank efficiency serves as a crucial control variable in analyzing the correlation between Fintech adoption and bank stability. In this context, bank efficiency is represented by the ratio of overhead costs to total income, indicating how well a bank manages its operational expenses in relation to its revenue (Sajid et al. 2023). A diminished ratio signifies enhanced efficiency, indicating that the bank can produce greater income with fewer operational expenses, a characteristic that generally fosters financial stability. Integrating bank efficiency as a control variable is crucial in the MENA region, as banks exhibit considerable disparities in their cost structures, technology proficiencies, and strategic objectives (Alshaiba and Abu Khalaf 2024). As banks in the region progressively implement Fintech solutions, their efficiency levels may temper the stability effects linked to this adoption. A bank that has effectively integrated Fintech tools to optimize operations, automate services, or diminish reliance on physical infrastructure is likely to see enhanced efficiency, hence potentially bolstering its resilience and stability (Chepngenoh and Muriu (2020)).

Profitability

Return on assets (ROA) serves as an indicator of profitability, reflecting the bank’s capacity to earn profits from its assets. Return on assets (ROA) is a commonly recognized metric of a bank’s financial performance, illustrating the efficiency with which a bank employs its assets to produce earnings (Deng et al. 2021). In the MENA region, characterized by diverse financial markets and swift technological advancement, ROA is a crucial indicator for evaluating a bank’s fundamental financial health, which might affect its stability. In assessing the influence of Fintech adoption on bank stability, profitability is a crucial factor in mitigating this relationship (Febriana 2022; El Chaarani et al. 2024). Banks exhibiting more profitability, as seen by a higher return on assets (ROA), are typically more capable of mitigating the risks linked to the implementation of new technologies such as Fintech. These banks may possess greater resources to allocate towards Fintech developments, including digital banking infrastructure or AI-driven risk-management systems, while sustaining robust capital reserves. Consequently, increased profitability may bolster a bank’s stability by enabling it to manage technological disruptions more adeptly (Febriana 2022).

Bank Size

The size of a bank, commonly proxied by the natural logarithm of total assets, is a crucial determinant of bank stability. Institutions with more total assets typically exhibit more diversified activities, enhanced capital reserves, and superior access to financial resources, all of which foster increased financial stability (Abu Khalaf 2022b). In the MENA region, where the banking system comprises both large, established banks and smaller, regional institutions, the correlation between bank size and stability is notably significant. Major banks frequently capitalize on economies of scale, allowing them to distribute operational expenses across a broader asset base (Al-Kubaisi and Abu Khalaf 2023). This can promote efficiency, mitigate risk, and bolster financial resilience during economic disruptions or financial crises. Moreover, larger banks tend to possess superior access to capital markets, enhanced ties with regulators, and a heightened capacity to absorb risks, all of which can enhance stability (Liang et al. 2023).

Liquidity Risk

Liquidity risk, assessed by the ratio of total loans to total deposits, is a key determinant of bank stability. This ratio essentially indicates the bank’s capacity to fulfill its short-term financial obligations utilizing its most liquid assets (i.e., deposits) (He et al. 2023). An elevated ratio signifies that a greater proportion of the bank’s deposits is allocated to loans, thereby augmenting short-term profitability while simultaneously heightening the danger of liquidity deficits during periods of financial distress. A lower ratio may suggest that the bank has a more conservative lending approach and retains a greater reserve of liquid assets, which could mitigate liquidity risk while also constraining profits. In the MENA region, where banks function under dynamic economic conditions, liquidity risk is essential in influencing financial stability. Banks in the MENA region may encounter issues stemming from political instability, economic swings, and susceptibility to oil price volatility, all of which can affect liquidity availability (Chepngenoh and Muriu 2020).

Dividend

The dividend policy, typically represented by the dividend payout ratio (the percentage of earnings distributed as dividends to shareholders), significantly impacts bank stability, especially within the MENA region (Hussain and Rasheed 2023). The dividend payout ratio indicates the proportion of profit a bank elect to distribute compared to that which it retains for reinvestment or capital enhancement (Abu Khalaf 2022a). An elevated dividend payout ratio may indicate financial robustness and optimism about future earnings, thus encouraging investor confidence and market perception (Banna et al. 2021). Nonetheless, persistently elevated payouts may restrict a bank’s capacity to preserve earnings and accumulate capital buffers, which are essential for mitigating shocks and guaranteeing long-term stability, particularly in the highly regulated and risk-sensitive banking industry (Tran 2021). In the MENA region, where banks frequently function amid political instability, economic volatility, and variable oil income, sustaining adequate internal capital is crucial for stability (Diaconu and Oanea 2014). Banks distributing substantial amounts of their income may encounter difficulties in fulfilling capital adequacy standards or in investing in technology and risk-management systems that bolster resilience. In times of economic distress, such as during regional conflicts, a high payout strategy may diminish flexibility, deplete a bank’s resources, and heighten exposure to shocks (Liang et al. 2023).

3.2.4. Control Variables (Macroeconomic Variables)

GDP

Gross domestic product (GDP) is a fundamental macroeconomic metric that signifies the comprehensive economic performance of a nation. In the MENA region, GDP growth significantly impacts the stability of banks (Kharrat et al. 2023). Growing GDP often indicates a robust economic climate characterized by heightened consumer confidence, company expansion, and increased job levels (Abu Khalaf 2024). These conditions enhance bank operations by reducing default rates and fostering heightened credit demand and robust revenue growth from both interest and non-interest income streams (Liang et al. 2023).

Inflation

Inflation presents a complicated and critical influence on the stability of banks, especially in the MENA region, where inflationary pressures can differ distinctly among nations due to varying economic structures, monetary policies, and political dynamics. Moderate inflation can enhance banking stability by encouraging economic activity, enabling borrowers to repay debts more readily as nominal incomes increase (Banna et al. 2021). Nevertheless, elevated, or fluctuating inflation frequently compromises bank stability by diminishing the real value of assets, distorting interest rates, and amplifying uncertainty regarding credit risk and investment choices. In high-inflation contexts, banks may find it challenging to precisely price loans and deposits, resulting in discrepancies in maturity and risk that impact profitability and capital sufficiency (Deng et al. 2021).

Table 4 below provides the measurements of the variables included in the model to empirically investigate the impact of Fintech adoption on the stability of banks in the MENA region.

Table 4.

Summary of variable measurements.

3.3. Model

This research employs the modified model below for the MENA banking sector, as recommended by Banna et al. (2021), incorporating control variables (bank characteristics and macroeconomic variables) to isolate the impact of the Fintech Index on the stability of banks while ensuring the precision and validity of the results. The following model has been estimated using the panel GMM regression to control for endogeneity:

where

- BStability stands for bank stability and is measured using the z-score.

- Fintech Index is measured through data text mining (content analysis).

- BEff stands for bank efficiency and is measured by the ratio of overheads to total income.

- Prof stands for profitability and is measured by the return on assets.

- BSize is bank size and is measured by the natural logarithm of total assets.

- LiqRisk stands for liquidity risk and is measured by the total loans divided by the total deposits.

- Div stands for the dividend and is measured by the dividend payout ratio.

- GDP is gross domestic product and is measured by growth in domestic production.

- Inf is inflation and is measured by growth in the consumer price index.

4. Results and Analysis

4.1. Descriptive Statistics

Table 5 highlights a summary of the descriptive statistics. The descriptive statistics offer significant insights into the variability of essential factors in the examination of MENA banks. The standard deviation of bank stability, as indicated by the z-score, is 2.374, signifying a considerable degree of heterogeneity in the stability of banks within the region. This indicates that although certain banks in the MENA region exhibit considerable stability, others encounter substantial risk or instability, potentially attributable to variations in governance structures, regulatory frameworks, or risk-management strategies. The standard deviation of Fintech-related word counts in annual reports is 104.954, indicating significant variability in the engagement and reporting practices of banks in the MENA region on Fintech. This broad variation indicates that although many banks are particularly aggressive in embracing and disseminating information about Fintech developments, others are less involved or fall behind in this domain. This fluctuation can affect competitiveness, innovative potential, and eventually, financial stability.

Table 5.

Descriptive statistics.

Finally, the average profitability, indicated by return on assets (ROA), is 1.3 percent, signifying low earnings in relation to total assets. This degree of profitability indicates that, on average, banks in the region maintain a conservative or stable financial margin. Nonetheless, when considered in conjunction with the elevated standard deviation in stability, it may indicate structural problems or inefficiencies in specific banking systems within the region that impact both profitability and risk exposure. These patterns underscore the necessity for a comprehensive examination of how Fintech adoption and other control variables affect bank performance and stability within a varied and dynamic financial environment.

4.2. Statistical Validation of Fintech Index for the MENA Region: Islamic Versus Conventional Banks

The constructed Fintech Index’s validity and reliability are further substantiated by ANOVA analysis, which examined variations in Fintech adoption among different categories of financial institutions. The findings indicate a statistically significant disparity, showing that conventional banks exhibit a greater and more accelerated adoption of Fintech than Islamic banks. This result not only strengthens the index’s discriminatory capability but also corresponds with theoretical and empirical anticipations concerning institutional innovation dynamics. The index’s capacity to reflect significant differences among various banking models offers compelling support for its construct validity. Furthermore, the statistical consistency among various bank categories bolsters the index’s usefulness as a strong instrument for assessing Fintech activity. These findings validate that the index is based on precise keyword representation and effectively differentiates between various patterns of Fintech adoption in the MENA banking sector. Conventional banks, on average, implement Fintech tools more extensively than Islamic banks, as demonstrated in Table 6 below.

Table 6.

ANOVA results—Fintech Index by bank type (N = 94).

The ANOVA analysis indicates a statistically significant difference (p = 0.010 < 0.05) in the average Fintech Index scores between Islamic and conventional banks. Traditional banks in the MENA region generally embrace Fintech advances more rapidly than do Islamic banks.

4.3. Correlation Matrix

Table 7 provides the correlation matrix between Fintech adoption and the stability of banks, while controlling for bank characteristics (bank efficiency, profitability, size, liquidity risk, and dividends) and macroeconomic variables (GDP and inflation).

Table 7.

Correlation matrix.

The correlation analysis demonstrates significant links between the principal variables and banking stability in the MENA region. The results indicate that all variables—including profitability (ROA), bank size, liquidity, dividend payout ratio, GDP, inflation, and Fintech adoption—exhibit a positive correlation with bank stability. This indicates that as these elements are enhanced, the overall stability of banks generally improves. For example, more profitability and larger bank size typically indicate enhanced financial stability and superior risk absorption capability, fostering a more stable banking environment (Tran 2021). Increased Fintech usage, indicated by the prevalence of related terminology in annual reports, may denote innovation and competitiveness, hence improving operational efficiency and stability (Febriana 2022).

Conversely, bank efficiency, indicated by the ratio of bank overhead to total income, exhibits a negative link with bank stability. Banks with elevated overhead costs in relation to their income are generally less stable. This adverse correlation may signify deficiencies in cost management or operational procedures, thereby undermining profitability and diminishing a bank’s capacity to withstand financial disruptions (Liang et al. 2023). Inefficient banks may exhibit reduced agility in adopting Fintech solutions or executing risk-management measures, further jeopardizing their stability (Kharrat et al. 2023).

4.4. Panel GMM Regression Results

Table 8 provides the results of the panel GMM regression that investigated the impact of Fintech adoption using the Fintech index on the stability of MENA banks during the period of 2011–2023. The significant and positive effect of Fintech adoption on the stability of banks in the MENA region highlights the transformative influence of technology on the financial services industry (Liang et al. 2023). Fintech empowers banks to elevate the client experience, optimize operational efficiency, broaden financial inclusion, and reinforce risk-management frameworks (Deng et al. 2021). These enhancements can directly foster more stable financial institutions by mitigating and augmenting transparency, default risk, and data-informed decision-making (Liang et al. 2023).

Table 8.

Panel GMM regression results.

In the MENA region, characterized by diverse banking infrastructures and ongoing financial inclusion disparities, Fintech offers an innovative approach to modernizing conventional systems and accessing underbanked demographics, hence strengthening the sector’s resilience (Febriana 2022). The effectiveness of Fintech adoption varies, as implementation costs, cybersecurity dangers, and regulatory uncertainties may refute potential stability benefits (Sajid et al. 2023). Furthermore, larger, well-capitalized banks may be more adept at utilizing Fintech, thus impairing performance disparities and distorting competition (Chepngenoh and Muriu 2020). Therefore, although the favorable connection is promising, it should be understood within the structural, regulatory, and institutional framework of the MENA region (Banna et al. 2021).

According to financial intermediation theory, banks serve as intermediaries between savers and borrowers, and their effectiveness in this function is essential for the stability of the financial system (Li et al. 2022b). Fintech augments this intermediary function by expanding access to financial services, reducing transaction costs, and upgrading information asymmetry via enhanced data analytics (Abu Khalaf et al. 2024). Consequently, banks that implement Fintech tools can more efficiently allocate funds and mitigate risks, thereby enhancing stability. Conversely, innovation diffusion theory clarifies the mechanism by which innovative technologies are adopted within organizations (Al-Kubaisi and Abu Khalaf 2023). Banks in the MENA region who adopt Fintech early may gain competitive advantages, including increased client retention, enhanced efficiency, and more innovative product offers, ultimately leading to greater financial stability (Diaconu and Oanea 2014). This approach emphasizes the significance of contextual elements, including cultural receptiveness to change, regulatory endorsement, and internal organizational preparedness, which can either promote or obstruct successful Fintech adoption (Fang et al. 2023).

On the other hand, the result that bank efficiency, measured as overhead relative to total income, adversely and significantly affects bank stability in the MENA region, reveals a sound outcome. Efficiency is anticipated to strengthen stability by minimizing expenses and optimizing resource distribution (Deng et al. 2021). In this instance, a higher efficiency ratio, which signifies elevated expenditures in relation to income, may indicate operational inefficiencies, managerial deficiencies, or imprudent risk-taking in the quest for cost reductions (Kharrat et al. 2023). This may jeopardize a bank’s capacity to withstand shocks, ultimately diminishing its financial stability. In the MENA setting, various reasons may clarify this adverse correlation. Banks may prioritize short-term cost savings over long-term investments in compliance, risk management, or digital infrastructure, thereby jeopardizing stability (Sajid et al. 2023). Moreover, the efficiency of certain MENA banks may be superficially enhanced by cost-reduction strategies that compromise internal controls, personnel capabilities, or innovation. This indicates that what seems to be “efficiency” in theory may instead reflect underinvestment (Febriana 2022). Financial intermediation theory theorizes that in the MENA region, if banks prioritize efficiency over effective intermediation processes, they may incur reduced confidence and raised credit risk.

Furthermore, profitability, as exposed by return on assets, exerts a favorable and considerable influence on the stability of banks in the MENA region, aligning with the theoretical framework (Hassan et al. 2022). Profitability strengthens a bank’s capacity to absorb losses, accumulate capital reserves, and invest in risk-management systems, thereby fostering financial stability (He et al. 2023). Banks function within varied and occasionally unstable economic contexts; elevated profitability might provide a financial buffer against external disruptions (Abu Khalaf 2022a). According to financial intermediation theory, profitability reflects the value that banks derive from executing their intermediary function (El-Chaarani et al. 2023). A more profitable bank generally demonstrates superior lending processes, precise credit evaluations, and enhanced portfolio diversity, all of which foster systemic stability (Ktit and Abu Khalaf 2024).

In addition, the significant and positive association between bank size and bank stability in the MENA region indicates that larger banks are more stable. This finding supports the assertion that larger banks receive advantages from enhanced diversification, economies of scale, and robust capital buffers (Saygili and Ercan 2021). In the MENA region, major banks are often more established, exhibiting greater geographic and product variety. These characteristics diminish their exposure to market fluctuations and unique disturbances, therefore improving their stability (Jamshidi and Kazemi 2020). Innovation diffusion theory hypothesizes that larger institutions frequently assume a critical role in the acceptance, dissemination, and expansion of innovations, including financial technology (Ni et al. 2023). The size of a bank boosts its ability to adapt and integrate new technologies and innovations, thereby improving operational efficiency, monitoring capabilities, and customer service, all of which contribute to increased stability (Ozili 2019).

Moreover, primarily, the significant and positive connection between liquidity risk (quantified as the ratio of total loans to total deposits) and bank stability seems inconsistent. A larger loans-to-deposits ratio typically signifies elevated liquidity risk, as banks possess a greater proportion of illiquid assets (loans) compared to their liquid financing sources (deposits) (Abu Khalaf et al. 2024). In the MENA setting, this link may imply an alternative interpretation. An elevated ratio may indicate effective financial intermediation, wherein banks are adeptly directing deposits into productive lending, typically signifying the robustness and trust of the banking industry (Chepngenoh and Muriu 2020). The financial diffusion theory posits that the dissemination of financial innovations (such as digital lending platforms) among institutions improves banks’ capacity to manage risk more efficiently. Banks with elevated liquidity exposure may gain advantages by implementing cultured tools that enable them to optimize liquidity positions and swiftly address funding challenges (Deng et al. 2021).

Lastly, the finding that GDP and inflation have a positive and significant influence on the stability of banks in the MENA region provides valuable insight into regional economic dynamics and the resilience of the banking sector. A raised GDP, typically linked to economic growth, enhances the demand for banking services such as lending, deposits, and investment products (Lu 2016). This may result in increased bank revenues and profitability, strengthening capital buffers and overall stability (Liao 2018). The beneficial impact of inflation on bank stability may indicate a context-dependent understanding. Moderate and predictable inflation can elevate nominal interest rates and enhance the value of interest-generating assets such as loans (Hussain and Rasheed 2023). This can improve bank profitability, particularly when deposit rates are controlled. Financial intermediation theory suggests that a robust economy, evidenced by an ascending GDP, enhances the financial intermediation process by augmenting both the supply and demand for capital (Abu Khalaf 2022b). In these situations, banks can more efficiently execute their intermediary roles, diminish non-performing loans, and enhance profits, resulting in improved financial stability. The theory posits that banks modify their intermediation tactics in response to macroeconomic variables like inflation. If inflation is expected and controlled, banks can appropriately price their financial products, sustain positive, real returns, and protect their capital adequacy (Liang et al. 2023).

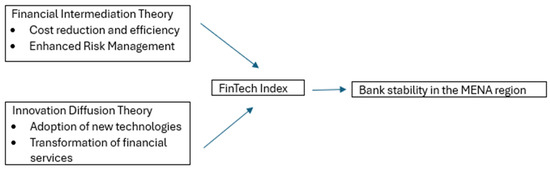

Based on the previously reported results, the following Figure 1 relates the theoretical background to the main variables under investigation:

Figure 1.

Conceptual framework linking financial theories to empirical findings. Source: Authors’ Analysis.

Finally, this empirical model has been tested using Arellano–Bond tests for autocorrelation in the first-differenced errors to evaluate the validity of the dynamic panel GMM model. The test for first-order autocorrelation, AR (1), produced an insignificant p-value (0.254 > 0.10), signifying the absence of substantial first-order autocorrelation in the differenced residuals. Likewise, the AR (2) test, which is crucial for validating the GMM estimator, yielded an inconsequential result, with an insignificant p-value (0.296 > 0.10). This indicates the lack of second-order serial correlation in the error terms, hence affirming the validity of the instruments employed in the model. The insignificance of both the AR(1) and AR(2) tests validates the model specification and the moment conditions, hence enhancing the trustworthiness of the computed coefficients.

Also, the Sargan–Hansen test for overidentifying limitations has been used to evaluate the validity of the instruments employed in the GMM estimate. The p-value of 0.315 significantly exceeds traditional significance levels, suggesting that we do not reject the null hypothesis regarding the validity of the instruments. In other words, there is no evidence indicating that the instruments are correlated with the error term, hence validating the suitability of the selected instruments in the model. This insignificant outcome bolsters the credibility of the GMM estimates and indicates that the model is free from issues pertaining to instrument overidentification.

To further confirm the suitability of the instruments employed in our dynamic panel model, we performed the Sargan test for overidentifying limitations. The test yielded a p-value of 0.316, which is not statistically significant. This insignificant outcome suggests that we do not reject the null hypothesis regarding the validity of the instruments and their lack of correlation with the error term. Consequently, the results indicate that the instruments employed in the GMM estimation are suitable, and the model is free from problems associated with instrument overidentification. This reinforces the overall validity and robustness of the estimation method.

5. Robustness of Results

Table 9 presents the robustness of results check using the panel GMM regression while incorporating different proxies for the selected variables, more specifically, the ratio of nonperforming loans to total loans as a proxy of bank stability. Also, the Fintech Index has been proxied through content analysis, utilizing the count of selected words and return on equity as a proxy for profitability. In addition, the natural logarithm of market capitalization is used as a proxy for bank size. Dividend yield is a proxy for dividends, noninterest expenses over total assets is a proxy for bank efficiency, and cash and cash equivalents over total assets are used as a proxy for liquidity risk.

Table 9.

Panel GMM regression results.

Based on the results reported in Table 9, the results remain constant across the robustness check, affirming the dependability and stability of the findings in explaining the relationship between the major variables and bank stability in the MENA region.

6. Limitations and Future Studies

This study provides significant insights into the relationship between financial technology adoption and bank stability in the MENA region; however, it is constrained by several limitations. The research is geographically restricted to MENA countries, which, while significant, constrains the applicability of the findings to other regions with distinct financial systems, legal frameworks, and levels of technical preparedness. Future research may broaden its reach by performing a comparative analysis across various regions or concentrating on sub-regions within MENA to elucidate intra-regional variability. In addition, the study exclusively utilizes secondary quantitative data obtained from publicly accessible annual reports and databases. This facilitates extensive coverage and objectivity while constraining the depth of contextual comprehension that qualitative insights could offer. Future studies may employ a mixed-methods approach, integrating interviews with bank managers, policymakers, and Fintech developers to clarify the mechanisms by which Fintech influences bank stability. Moreover, two other constraints are worthy of attention. The Fintech index employed in the study, however unique, relies on content analysis of term frequencies, which may inadequately reflect the depth or significance of real technological implementation. Future research may investigate more precise or detailed metrics of digital adoption, such as targeted investments in Fintech or the quantity of digital banking users. Also, the report fails to consider the regulatory framework and policy measures that could impact both Fintech advancement and banking stability. Integrating regulatory variables or indices of institutional quality may enhance model robustness and explanatory capacity in subsequent research.

7. Implications

This study’s findings offer significant practical implications for bank management, policymakers, and regulators in the MENA region. The favorable and significant connection between Fintech adoption and bank stability underscores the importance of integrating digital innovation into the banking industry. Bank executives must prioritize investments in financial technology, including digital banking platforms, to bolster operational resilience and mitigate systemic risks. Fintech serves as both a competitive advantage and a stabilizing force, enhancing consumer engagement. Secondly, the findings underscore the significance of profitability, bank size, and macroeconomic factors (GDP and inflation) in reinforcing stability. Managers must prioritize sustainable growth methods that enhance profitability while ensuring capital sufficiency and liquidity, as these internal and external elements critically influence a bank’s capacity to bear financial shocks. Furthermore, the findings indicate that regulators should foster the Fintech ecosystem by implementing balanced rules that promote innovation while ensuring financial stability. Investment in digital infrastructure can foster an atmosphere conducive to technology-driven growth. Finally, the detrimental effect of banking inefficiency on stability highlights the necessity for operational improvements. Managers must prioritize enhancing cost management, optimizing operations, and minimizing overheads to bolster their stability.

8. Conclusions

This empirical evidence provides a comprehensive analysis of the impact of Fintech adoption on bank stability in the MENA region, utilizing panel data from 94 banks across 10 countries over a 13-year period from 2011 to 2023, controlling for bank characteristics (size, profitability, efficiency, dividends, and liquidity risk) and controlling for macroeconomic variables (GDP and inflation). Employing panel GMM regression, this study’s findings provide significant insights into the correlation between financial technology (Fintech) adoption and the stability of banks in the MENA region. The analysis demonstrates a substantial and favorable effect of Fintech adoption on bank stability, indicating that technological progress is essential for enhancing the resilience of the financial industry. Moreover, critical internal characteristics like profitability and bank size were identified as positively impacting stability, whereas bank inefficiency adversely affects it. Among macroeconomic variables, GDP and inflation demonstrate a positive correlation with stability, underscoring the significance of an advantageous economic environment. These findings highlight the crucial influence of digital innovation in improving financial systems, especially in emerging countries. They emphasize the significance of effective management practices and economic vitality in fostering financial stability. The findings together underscore the complicated character of bank stability and advocate for consistent policies that integrate technological innovation, operational efficiency, and conducive regulatory and economic frameworks. Finally, based on the robustness check, our results hold.

Author Contributions

Conceptualization—A.M.A., B.A.K., M.S.A.-N. and E.S.; methodology—A.M.A., B.A.K., M.S.A.-N. and E.S.; software—A.M.A. and B.A.K.; validation—A.M.A., B.A.K., M.S.A.-N. and E.S.; formal analysis—A.M.A., B.A.K., M.S.A.-N. and E.S.; resource—A.M.A., B.A.K., M.S.A.-N. and E.S.; writing—original draft—A.M.A., B.A.K., M.S.A.-N. and E.S.; writing—review & editing—A.M.A., B.A.K., M.S.A.-N. and E.S.; supervision—A.M.A. and B.A.K. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The data that support the findings of this study are available from Refinitiv Eikon Platform (LSEG), but restrictions apply to the availability of these data, which were used under subscription for the current study and so are not publicly available. The data are, however, available from the authors upon reasonable request and with the permission of LSEG.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Abedifar, Pejman, Paolo Giudici, and Shatha Qamhieh Hashem. 2017. Heterogeneous market structure and systemic risk: Evidence from dual banking systems. Journal of Financial Stability 33: 96–119. [Google Scholar] [CrossRef]

- Abu Khalaf, Bashar. 2022a. An empirical investigation of the impact of firm characteristics on the smoothness of dividend. Corporate Governance and Organizational Behavior Review 6: 122–33. [Google Scholar] [CrossRef]

- Abu Khalaf, Bashar. 2022b. The impact of board diversity on the performance of banks. Corporate Governance and Organizational Behavior Review 6: 275–83. [Google Scholar] [CrossRef]

- Abu Khalaf, Bashar. 2024. Impact of board characteristics on the adoption of sustainable reporting practices. Cogent Business & Management 11: 1–22. [Google Scholar] [CrossRef]

- Abu Khalaf, Bashar, Antoine B. Awad, and Scott Ellis. 2024. The Impact of Non-Interest Income on Commercial Bank Profitability in the Middle East and North Africa (MENA) Region. Journal of Risk and Financial Management 17: 103. [Google Scholar] [CrossRef]

- Abu Khalaf, Bashar, Maryam Al-Naimi, and Mohamad Ktit. 2025. The moderating influence of firm size in the relation between gender balance in board rooms and capital structure. Journal of Infrastructure, Policy and Development 9: 11378. [Google Scholar] [CrossRef]

- Ahmed, Omnia, and Bashar Abu Khalaf. 2025. The Impact of ESG on Firm Value: The Moderating Role of Cash Holdings. Heliyon 11: e41868. [Google Scholar] [CrossRef]

- Al-Kubaisi, Mohammed K., and Bashar Abu Khalaf. 2023. Does Green Banking Affects Banks Profitability? Journal of Governance and Regulation 12: 157–64. [Google Scholar] [CrossRef]

- Allen, Franklin, and Anthony M. Santomero. 1997. The theory of financial intermediation. Journal of Banking & Finance 21: 1461–85. [Google Scholar] [CrossRef]

- Alshaiba, Saeed, and Bashar Abu Khalaf. 2024. The impact of board gender diversity on the Gulf Cooperation Council’s reporting on sustainable development goals. Corporate Board: Role, Duties and Composition 20: 33–41. [Google Scholar] [CrossRef]

- Babaei, Golnoosh, Paolo Giudici, and Emanuela Raffinetti. 2023. Explainable FinTech lending. Journal of Economics and Business 125–126: 106126. [Google Scholar] [CrossRef]

- Banna, Hasanul, and Rabiul Alam. 2021. Does Digital Financial Inclusion Matter For Bank Risk-Taking? Evidence From The Dual-Banking System. Journal of Islamic Monetary Economics and Finance 7: 401–30. [Google Scholar] [CrossRef]

- Banna, Hasanul, M. Kabir Hassan, and Mamunur Rashid. 2021. Fintech-based financial inclusion and bank risk-taking: Evidence from OIC countries. Journal of International Financial Markets, Institutions, and Money 75: 101447. [Google Scholar] [CrossRef]

- Banna, Hasanul, Md Aslam Mia, Mohammad Nourani, and Larisa Yarovaya. 2022. Fintech-based Financial Inclusion and Risk-taking of Microfinance Institutions (MFIs): Evidence from Sub-Saharan Africa. Finance Research Letters 45: 102149. [Google Scholar] [CrossRef]

- Chen Xihui, Xuyuan You, and Victor Chang. 2021. FinTech and commercial banks’ performance in China: A leap forward or survival of the fittest? , Technological Forecasting and Social Change 166: 120645. [Google Scholar] [CrossRef]

- Chepngenoh, Florence, and Peter W. Muriu. 2020. Does Risk-Taking Behaviour Matter for Bank Efficiency? Journal of Economics and Business 3: 1549–57. [Google Scholar] [CrossRef]

- Deng, Liurui, Yongbin Lv, Ye Liu, and Yiwen Zhao. 2021. Impact of Fintech on Bank Risk-Taking: Evidence from China. Risks 9: 99. [Google Scholar] [CrossRef]

- Diaconu, Raluca-Ioana, and Dumitru-Cristian Oanea. 2014. The Main Determinants of Bank’s Stability. Evidence from Romanian Banking Sector. Procedia Economics and Finance 16: 329–35. [Google Scholar] [CrossRef]

- Djeundje, Viani B., Jonathan Crook, Raffaella Calabrese, and Mona Hamid. 2021. Enhancing credit scoring with alternative data. Expert Systems with Applications 163: 113766. [Google Scholar] [CrossRef]

- El-Chaarani, Hani, Jeanne Laure Mawad, Nouhad Mawad, and Danielle Khalife. 2023. Psychological and demographic predictors of investment in cryptocurrencies during a crisis in the MENA region: The case of Lebanon. Journal of Economic and Administrative Sciences, ahead-of-print. [Google Scholar] [CrossRef]

- El Chaarani, Hani, Zouhour EL Abiad, and Sam El Nemar. 2024. Factors affecting the adoption of cryptocurrencies for financial transactions. EuroMed Journal of Business 19: 46–61. [Google Scholar] [CrossRef]

- Fang, Yi, Qi Wang, Fan Wang, and Yang Zhao. 2023. Bank Fintech, liquidity creation, and risk-taking: Evidence from China. Economic Modelling 127: 106445. [Google Scholar] [CrossRef]

- Febriana, Ristiana Dewi. 2022. Financial Technology development and bank risk taking behavior. Asian Journal of Accounting and Finance 4: 15–31. [Google Scholar]

- Finlay, Steven. 2011. Multiple classifier architectures and their application to credit risk assessment. European Journal of Operational Research 210: 368–78. [Google Scholar] [CrossRef]

- Freixas, Xavier, and Jean-Charles Rochet. 2008. Microeconomics of Banking. Cambridge: MIT Press. [Google Scholar]

- Gharios, Robert, and Bashar Abu Khalaf. 2024. Digital Marketing’s Effect on Middle East and North Africa (MENA) Banks’ Success: Unleashing the Economic Potential of the Internet. Sustainability 16: 7935. [Google Scholar] [CrossRef]

- Greenhalgh, Trisha, Glenn Robert, Fraser Macfarlane, Paul Bate, and Olivia Kyriakidou. 2004. Diffusion of Innovations in service Organizations: Systematic review and recommendations. Milbank Quarterly 82: 581–629. [Google Scholar] [CrossRef]

- Guo, Pin, and Yue Shen. 2016. The impact of Internet finance on commercial banks’ risk taking: Evidence from China. China Finance and Economic Review 4: 16. [Google Scholar] [CrossRef]

- Hand, David J. 2009. Measuring classifier performance: A coherent alternative to the area under the ROC curve. Machine Learning 77: 103–23. [Google Scholar] [CrossRef]

- Hassan, M. Kabir, Ammar Jreisat, Mustafa Raza Rabbani, and Somar Al-Mohamed. 2022. Islamic Fintech and Bahrain: An opportunity for global financial services. In Fintech in Islamic Financial Institutions: Scope, Challenges, and Implications in Islamic Finance. Cham: Palgrave Macmillan, pp. 65–87. [Google Scholar] [CrossRef]

- He, Miao, Ge Song, and Qianqian Chen. 2023. Fintech adoption, internal control quality and bank risk taking: Evidence from Chinese listed banks. Finance Research Letters 57: 104235. [Google Scholar] [CrossRef]

- Hu, Debao, Sibo Zhao, and Fujun Yang. 2022. Will Fintech development increase commercial banks risk-taking? Evidence from China. Electronic Commerce Research 24: 37–67. [Google Scholar] [CrossRef]

- Hussain, Shahid, and Abdul A. Rasheed. 2023. Financial inclusion based on financial technology and risky behaviour of micro-finance institutes: Evidence from South Asian micro-finance banks. Digital Policy, Regulation and Governance 25: 480–89. [Google Scholar] [CrossRef]

- Jafar, Syed Hasan, Shakeb Akhtar Hemachandran k, Parvez Alam Khan, and Hani El-Chaarani. 2024. The Adoption of FinTech Using Technology for Better Security, Speed, and Customer Experience in Finance. Evolution of FinTech in the Financial Sector: Recent Trends and Future Perspectives. Park Forest: Productivity Press. [Google Scholar]

- Jamshidi, Dariyoush, and Fazlollah Kazemi. 2020. Innovation diffusion theory and customers’ behavioral intention for Islamic credit card: Implications for awareness and satisfaction. Journal of Islamic Marketing 11: 1245–75. [Google Scholar] [CrossRef]

- Khan, Muhammad Saifuddin, Harald Scheule, and Eliza Wu. 2017. Funding liquidity and bank risk taking. Journal of Banking & Finance 82: 203–16. [Google Scholar] [CrossRef]

- Kharrat, Hana, Yousra Trichilli, and Boujelbène Abbes. 2023. Relationship between Fintech index and bank’s performance: A comparative study between Islamic and conventional banks in the MENA region. Journal of Islamic Accounting and Business Research 15: 172–95. [Google Scholar] [CrossRef]

- Kirilenko, Andrei A., and Andrew W. Lo. 2013. Moore’s Law versus Murphy’s Law: Algorithmic Trading and Its Discontents. Journal of Economic Perspectives 27: 51–72. [Google Scholar] [CrossRef]

- Ktit, Mohamad, and Bashar Abu Khalaf. 2024. Assessing the environmental, social, and governance performance and capital structure in Europe: A board of directors’ agenda. Corporate Board: Role, Duties and Composition 20: 139–48. [Google Scholar] [CrossRef]

- Liang, Fang, Pu Zhao, and Zhuo Huang. 2023. Financial technology, macroeconomic uncertainty, and commercial banks’ proactive risk-taking in China. China Economic Quarterly International 3: 77–87. [Google Scholar] [CrossRef]

- Liao, Wenlin. 2018. Research on the impact of internet finance on risk level of commercial banks. American Journal of Industrial and Business Management 8: 992–1006. [Google Scholar] [CrossRef]

- Li, Chengming, Si He, Yuan Tian, Shiqi Sun, and Lu Ning. 2022a. Does the bank’s Fintech innovation reduce its risk-taking? Evidence from China’s banking industry. Journal of Innovation & Knowledge 7: 100219. [Google Scholar] [CrossRef]

- Li, Gang, Ehsan Elahi, and Liangliang Zhao. 2022b. Fintech, Bank Risk-Taking, and Risk-Warning for commercial banks in the era of digital technology. Frontiers in Psychology 13: 934053. [Google Scholar] [CrossRef]

- Li, Jianping, Jingyu Li, Xiaoqian Zhu, Yinhong Yao, and Barbara Casu. 2020. Risk spillovers between FinTech and traditional financial institutions: Evidence from the U. S., International Review of Financial Analysis 71: 101544. [Google Scholar] [CrossRef]

- Liu, M., and W. Jiang. 2021. Does FinTech Exacerbate or Reduce the Risk-Taking of Commercial Banks: Empirical Evidence from the Chinese Banking Industry. Business Research 5: 63–74. [Google Scholar]

- Liu, Wanan, Hong Fan, and Meng Xia. 2022. Credit scoring based on tree-enhanced gradient boosting decision trees. Expert Systems with Applications 189: 116034. [Google Scholar] [CrossRef]

- Lu, Zhonglu. 2016. Research on the Impact of Internet Finance on Risk Taking of Commercial Banks. Finance and Trade Economics 4: 71–85. [Google Scholar]

- Mild, Andreas, Martin Waitz, and Jürgen Wöckl. 2015. How low can you go?—Overcoming the inability of lenders to set proper interest rates on unsecured peer-to-peer lending markets. Journal of Business Research 68: 1291–1305. [Google Scholar] [CrossRef]

- Murinde, Victor, Efthymios Rizopoulos, and Markos Zachariadis. 2022. The impact of the Fintech revolution on the future of banking: Opportunities and risks. International Review of Financial Analysis (Online)/International Review of Financial Analysis 81: 102103. [Google Scholar] [CrossRef]

- Naz, Farah, Sitara Karim, Asma Houcine, and Muhammad Abubakr Naeem. 2022. Fintech growth during COVID-19 in MENA region: Current challenges and future prospects. Electronic Commerce Research 24: 371–92. [Google Scholar] [CrossRef]

- Nguyen Quang Khai, Van Cuong Dang. 2022. The effect of FinTech development on financial stability in an emerging market: The role of market discipline. Research in Globalization 5: 100105. [Google Scholar] [CrossRef]

- Ni, Qing, Li Zhang, and Chengsong Wu. 2023. Fintech and commercial bank risks—The moderating effect of financial regulation. Finance Research Letters 58: 104536. [Google Scholar] [CrossRef]

- Ochenge, Rogers Ondiba. 2023. The Effect of Fintech Development on Bank Risk-Taking: Evidence from Kenya (No. 72). KBA Centre for Research on Financial Markets and Policy Working Paper Series; Nairobi: Kenya Bankers Association (KBA). Available online: http://hdl.handle.net/10419/271533 (accessed on 25 March 2025).

- Ozili, Peterson K. 2019. Non-performing loans and financial development: New evidence. The Journal of Risk Finance 20: 59–81. [Google Scholar] [CrossRef]

- Pantielieieva, Natalia, Sergii Krynytsia, Myroslava Khutorna, and Liudmyla Potapenko. 2018. FinTech, transformation of financial intermediation and financial stability. Paper presented at 2018 International Scientific-Practical Conference Problems of Infocommunications. Science and Technology (PIC S&T), Kharkiv, Ukraine, October 9–12; Piscataway: IEEE, pp. 553–59. [Google Scholar]

- Saiz, Albert, and Uri Simonsohn. 2013. Proxying for Unobservable Variables with Internet Document-Frequency. Journal of the European Economic Association 11: 137–65. [Google Scholar] [CrossRef]

- Sajid, Rabbia, Huma Ayub, Bushra F. Malik, and Abida Ellahi. 2023. The Role of Fintech on Bank Risk-Taking: Mediating Role of Bank’s Operating Efficiency. Human Behavior and Emerging Technologies 2023: 7059307. [Google Scholar] [CrossRef]

- Saygili, Ebru E., and Tuncay Ercan. 2021. An overview of international Fintech instruments using innovation diffusion Theory adoption Strategies. In Advances in Finance, Accounting, and Economics Book Series. Hershey: IGI Global, pp. 46–66. [Google Scholar] [CrossRef]

- Scott, Baker R., Nicholas Bloom, and Steven J. Davis. 2016. Measuring Economic Policy Uncertainty. The Quarterly Journal of Economics 131: 1593–636. [Google Scholar] [CrossRef]

- Serbulova, Natalia. 2021. Fintech as a transformation driver of global financial markets. In E3S Web of Conferences. Les Ulis: EDP Sciences, vol. 273, p. 08097. [Google Scholar] [CrossRef]

- Tarawneh, Adey, Aisyah Abdul-Rahman, Syajarul Imna Mohd Amin, and Mohd Fahmi Ghazali. 2024. A Systematic Review of Fintech and Banking Profitability. International Journal of Financial Studies 12: 3. [Google Scholar] [CrossRef]

- Thakor, Anjan V. 2020. Fintech and banking: What do we know? Journal of Financial Intermediation 41: 100833. [Google Scholar] [CrossRef]

- Tran, Dung Viet. 2021. BankStability and Dividend Policy. Cogent Economics & Finance 9: 1982234. [Google Scholar] [CrossRef]

- Trapanese, Maurizio, and Michele Lanotte. 2023. Financial intermediation and new technology: Theoretical and regulatory implications of digital financial markets. In Bank of Italy Occasional Paper (758). Rome: Bank of Italy, Economic Research and International Relations Area. [Google Scholar] [CrossRef]

- Uddin, Md Hamid, Shabiha Akter, Sabur Mollah, and Masnun Al Mahi. 2022. Differences in bank and microfinance business models: An analysis of the loan monitoring systems and funding sources. Journal of International Financial Markets, Institutions, and Money 80: 101644. [Google Scholar] [CrossRef]

- Wang, Rui, Jiangtao Liu, and Hang Luo. 2020. Fintech development and bank risk taking in China. The European Journal of Finance 27: 397–418. [Google Scholar] [CrossRef]

- Wang, Wenli, Cong Feng, Zijun Xie, and Tribhuwan Kumar Bhatt. 2022. Fintech, Market competition and Small and Medium-Sized Bank Risk-Taking. In Springer eBooks. Cham: Springer, pp. 207–26. [Google Scholar] [CrossRef]

- Wu, Xin, Tianhe Jin, Keng Yang, and Hanying Qi. 2023. The impact of bank Fintech on commercial banks’ risk-taking in China. International Review of Financial Analysis 90: 102944. [Google Scholar] [CrossRef]

- Yu, Jingjing. 2024. Stabilizing leverage, financial technology innovation, and commercial bank risks: Evidence from China. Economic Modelling 131: 106599. [Google Scholar] [CrossRef]

- Zhao, Yang, John W. Goodell, Yong Wang, and Mohammad Zoynul Abedin. 2023. Fintech, macroprudential policies and bank risk: Evidence from China. International Review of Financial Analysis 87: 102648. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).