Assessing the Integrated Role of IT Governance, Fintech, and Blockchain in Enhancing Sustainability Performance and Mitigating Organizational Risk

Abstract

1. Introduction

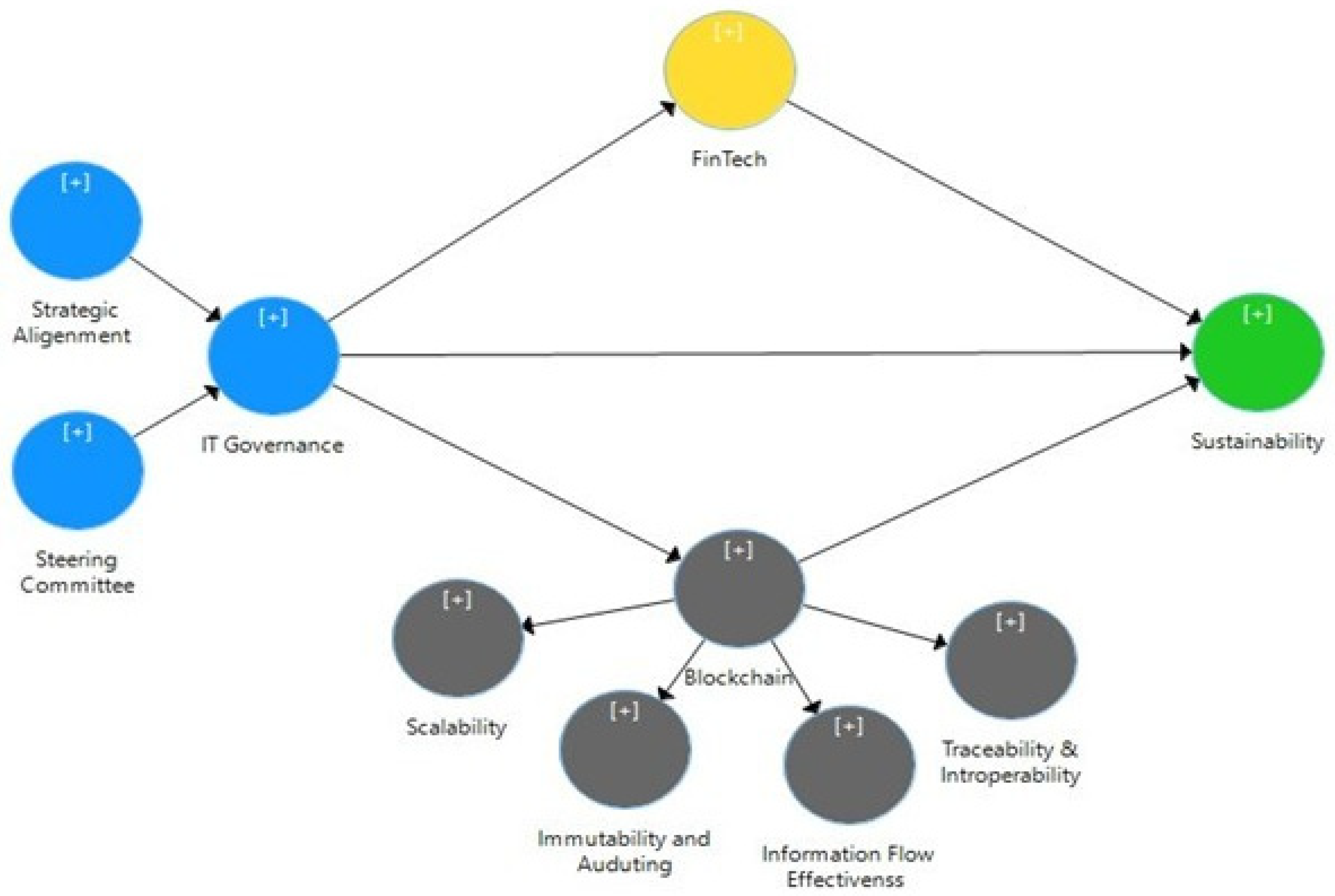

2. Literature Review and Hypotheses Development

2.1. The Impact of IT Governance on Sustainability Performance

2.2. The Impact of IT Governance on Fintech Adoption

2.3. The Impact of IT Governance on Blockchain Technologies

2.4. The Relationship Between IT Governance and the Adoption of Fintech and Blockchain Technologies and Their Impact on Sustainability Performance

3. Methodology

3.1. Research Design

3.2. Data Collection

3.3. Sampling

3.4. Statistical Tools and Analysis

4. Analysis and Discussion

4.1. Respondents File

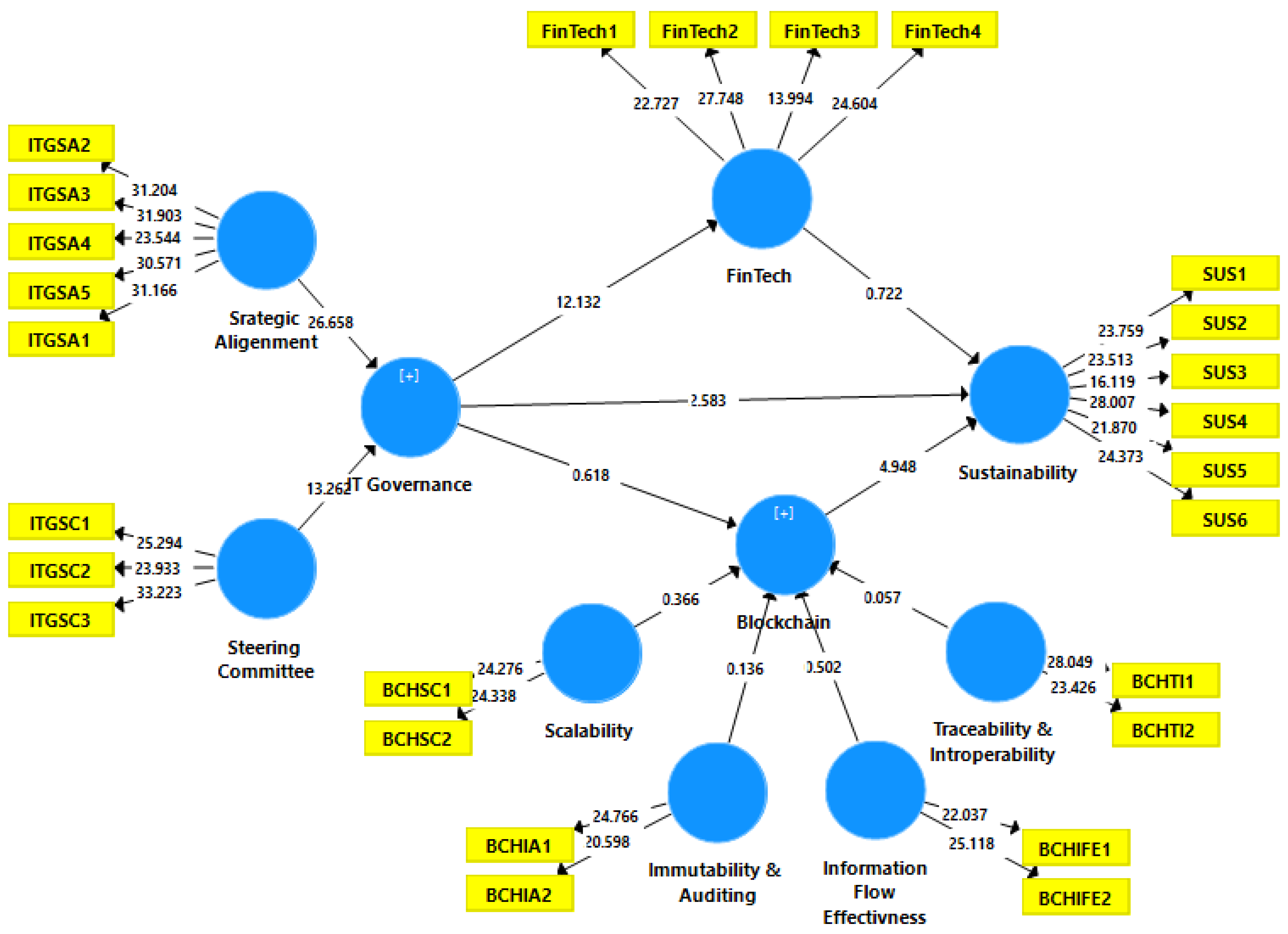

4.2. Reliability and Validity

4.3. Results Estimation

5. Implications

5.1. Implications for Policymakers and Regulators

5.2. Managerial Implications

5.3. Implications for Academicians

6. Conclusions and Opportunities for Future Research

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Akter, Nazma, Abu Bakkar Siddik, and Md. Saheb Ali Mondal. 2017. Sustainability Reporting on Green Financing: A Study of Listed Private commercial banks in Bangladesh. Sustainability Journal of Business and Technology 12: 14–27. [Google Scholar]

- Ali, Syaiful, and Peter Green. 2012. Effective information technology (IT) governance mechanisms: An IT outsourcing perspective. Information Systems Frontiers 14: 179–93. [Google Scholar] [CrossRef]

- Ali, Syaiful, Peter Green, and Alastair Robb. 2015. Information technology investment governance: What is it and does it matter? International Journal of Accounting Information Systems 18: 1–25. [Google Scholar] [CrossRef]

- Almaqtari, Faozi A. 2024a. The moderating role of IT governance on the relationship between FinTech and sustainability performance. Journal of Open Innovation: Technology, Market, and Complexity 10: 100267. [Google Scholar] [CrossRef]

- Almaqtari, Faozi A. 2024b. The Role of IT Governance in the Integration of AI in Accounting and Auditing Operations. Economies 12: 199. [Google Scholar] [CrossRef]

- Almaqtari, Faozi A., Najib H. S. Farhan, Ali T. Yahya, Borhan Omar Ahmad Al-Dalaien, and Mohd Shamim. 2022. The mediating effect of IT governance between corporate governance mechanisms, business continuity, and transparency & disclosure: An empirical study of COVID-19 Pandemic in Jordan. Information Security Journal: A Global Perspective 32: 39–57. [Google Scholar] [CrossRef]

- Almaqtari, Faozi A., Sheena Rehman, Sadichha Nigam, and Mohsin Khan. 2025. The Impact of Board Structure, IT Governance, and Fintech on Green Finance and Sustainability: An Integrated Model. Strategic Change 34: 337–57. [Google Scholar] [CrossRef]

- Alreemy, Zyad, Victor Chang, Robert Walters, and Gary Wills. 2016. Critical success factors (CSFs) for information technology governance (ITG). International Journal of Information Management 36: 907–16. [Google Scholar] [CrossRef]

- Al-Sartawi, Abdalmuttaleb M. A. Musleh. 2020. Information technology governance and cybersecurity at the board level. International Journal of Critical Infrastructures 16: 150. [Google Scholar] [CrossRef]

- Al Shanti, Ayman Mohammad, and Mohammad Salim Elessa. 2023. The impact of digital transformation towards blockchain technology application in banks to improve accounting information quality and corporate governance effectiveness. Cogent Economics & Finance 11: 2161773. [Google Scholar] [CrossRef]

- Ang, Lyndon, Robert Clark, Bronwyn Loong, and Anders Holmberg. 2025. An empirical comparison of methods to produce business statistics using non-probability data. Journal of Official Statistics 41: 3–34. [Google Scholar] [CrossRef]

- Anshari, Muhammad, Mohammad Nabil Almunawar, Masairol Masri, Mahani Hamdan, Mia Fithriyah, and Annisa Fitri. 2021. Digital Wallet in Supporting Green FinTech Sustainability. Paper presented at Third International Sustainability and Resilience Conference: Climate Change, Virtual Conference, November 15–17. [Google Scholar]

- Arner, Douglas W., Ross P. Buckley, Dirk A. Zetzsche, and Robin Veidt. 2020. Sustainability, FinTech and Financial Inclusion. European Business Organization Law Review (EBOR) 21: 7–35. [Google Scholar] [CrossRef]

- Atayah, Osama F., Khakan Najaf, Hakim Ali, and Hazem Marashdeh. 2023. Sustainability, market performance and FinTech firms. Meditari Accountancy Research 32: 317–45. [Google Scholar] [CrossRef]

- Avotra, Ny, Andrianarivo Andriandafiarisoa Ralison, Ye Chengang, Tsimisaraka Raymondo Sandra Marcelline, Ali Asad, and Yang Yingfei. 2021. Examining the Impact of E-Government on Corporate Social Responsibility Performance: The Mediating Effect of Mandatory Corporate Social Responsibility Policy, Corruption, and Information and Communication Technologies Development During the COVID era. Frontiers in Psychology 12: 737100. [Google Scholar] [CrossRef]

- Ayan, Büşra, Elif Güner, and Semen Son-Turan. 2022. Blockchain Technology and Sustainability in Supply Chains and a Closer Look at Different Industries: A Mixed Method Approach. Logistics 6: 85. [Google Scholar] [CrossRef]

- Aysan, Ahmet Faruk, and Fadoua Bergigui. 2021. Sustainability, Trust and Blockchain Applications: Best Practices and Fintech Prospects. Social Science Research Network. [Google Scholar] [CrossRef]

- Azarenkova, Galyna, Iryna Shkodina, Borys Samorodov, Maksym Babenko, and Iryna Onishchenko. 2018. The influence of financial technologies on the global financial system stability. Investment Management and Financial Innovations 15: 229–38. [Google Scholar] [CrossRef]

- Bai, Chunguang, and Joseph Sarkis. 2020. A supply chain transparency and sustainability technology appraisal model for blockchain technology. International Journal of Production Research 58: 2142–62. [Google Scholar] [CrossRef]

- Bai, Chunguang, James Cordeiro, and Joseph Sarkis. 2020. Blockchain technology: Business, strategy, the environment, and sustainability. Business Strategy and the Environment 29: 321–22. [Google Scholar] [CrossRef]

- Balcerzak, Adam P., Elvira Nica, Elżbieta Rogalska, Miloš Poliak, Tomáš Klieštik, and Oana-Matilda Sabie. 2022. Blockchain Technology and Smart Contracts in Decentralized Governance Systems. Administrative Sciences 12: 96. [Google Scholar] [CrossRef]

- Baltes, Sebastian, and Paul Ralph. 2022. Sampling in software engineering research: A critical review and guidelines. Empirical Software Engineering 27: 94. [Google Scholar] [CrossRef]

- Battisti, Enrico, Niccolò Nirino, and Michael Christofi. 2023. Guest editorial: Financial innovation (FinTech) and sustainability: New tools for sustainable achievements. Qualitative Research in Financial Markets 15: 553–56. [Google Scholar] [CrossRef]

- Bello, Gabriel, and Alfredo J. Perez. 2019. Adapting Financial Technology Standards to Blockchain Platforms. Paper presented at ACMSE 2019—Proceedings of the 2019 ACM Southeast Conference, Kennesaw, GA, USA, April 18–20; pp. 109–16. [Google Scholar] [CrossRef]

- Callsen, Georg, Vincent Guillaumin, Sebastian Utermarck, Rupert Varrall, and Oguzhan Altun. 2021. FinTech and Sustainable Bond Markets. Available online: https://www.semanticscholar.org/paper/f8217c2943846c486ac7a2da3c54899b394c2ad1 (accessed on 21 January 2025).

- Castelo-Branco, Isabel, Tiago Oliveira, Pedro Simões-Coelho, Jorge Portugal, and Irina Filipe. 2022. Measuring the fourth industrial revolution through the Industry 4.0 lens: The relevance of resources, capabilities and the value chain. Computers in Industry 138: 103639. [Google Scholar] [CrossRef]

- Cho, Oh Hyun. 2024. Analysis of the Impact of Artificial Intelligence Applications on the Development of Accounting Industry. Nanotechnology Perceptions 20: 74–83. [Google Scholar] [CrossRef]

- Dawson, Gregory S., James S. Denford, Clay K. Williams, David Preston, and Kevin C. Desouza. 2016. An Examination of Effective IT Governance in the Public Sector Using the Legal View of Agency Theory. Journal of Management Information Systems 33: 1180–208. [Google Scholar] [CrossRef]

- De Filippi, Primavera, and Xavier Lavayssière. 2020. Blockchain Technology: Toward a DecentralizedGovernance of Digital Platforms? In The Great Awakening: New Modes of Life amidst Capitalist Ruins. Santa Barbara: Punctum Book, pp. 185–222. [Google Scholar]

- de Haes, Steven, and Wim van Grembergen. 2009. An Exploratory Study into IT Governance Implementations and its Impact on Business/IT Alignment. Information Systems Management 26: 123–37. [Google Scholar] [CrossRef]

- Deng, Xiang, Zhi Huang, and Xiang Cheng. 2019. FinTech and Sustainable Development: Evidence from China Based on P2P Data. Sustainability 11: 6434. [Google Scholar] [CrossRef]

- Di Vaio, Assunta, Rosa Palladino, Rohail Hassan, and Octavio Escobar. 2020. Artificial intelligence and business models in the sustainable development goals perspective: A systematic literature review. Journal of Business Research 121: 283–314. [Google Scholar] [CrossRef]

- Downes, Lauren, and Chris Reed. 2020. Distributed Ledger Technology for Governance of Sustainability Transparency in the Global Energy Value Chain. Global Energy Law and Sustainability 1: 55–100. [Google Scholar] [CrossRef]

- Elazhary, Moustafa, Aleš Popovič, Paulo Henrique de Souza Bermejo, and Tiago Oliveira. 2022. How Information Technology Governance Influences Organizational Agility: The Role of Market Turbulence. Information Systems Management 40: 148–68. [Google Scholar] [CrossRef]

- El Khatib, Mounir, Asma Al Mulla, and Wadha Al Ketbi. 2022. The Role of Blockchain in E-Governance and Decision-Making in Project and Program Management. Advances in Internet of Things 12: 88–109. [Google Scholar] [CrossRef]

- Erasmus, Wikus, and Carl Marnewick. 2021. An IT governance framework for IS portfolio management. International Journal of Managing Projects in Business 14: 721–42. [Google Scholar] [CrossRef]

- Esmaeilian, Behzad, Joe Sarkis, Kemper Lewis, and Sara Behdad. 2020. Blockchain for the future of sustainable supply chain management in Industry 4.0. Resources, Conservation and Recycling 163: 105064. [Google Scholar] [CrossRef]

- Ferguson, Colin, Peter Green, Ravi Vaswani, and Gang (Henry) Wu. 2013. Determinants of Effective Information Technology Governance. International Journal of Auditing 17: 75–99. [Google Scholar] [CrossRef]

- Franks, Patricia C. 2020. Implications of blockchain distributed ledger technology for records management and information governance programs. Records Management Journal 30: 287–99. [Google Scholar] [CrossRef]

- Giang, Nguyen Phu, and Hoang Thi Tam. 2023. Impacts of Blockchain on Accounting in the Business. Sage Open 13: 1–13. [Google Scholar] [CrossRef]

- Gopal, Prc, Punitha Kadari, Jitesh J. Thakkar, and Bimal Kumar Mawandiya. 2022. Key performance factors for integration of Industry 4.0 and sustainable supply chains: A perspective of Indian manufacturing industry. Journal of Science and Technology Policy Management 15: 93–121. [Google Scholar] [CrossRef]

- Grybauskas, Andrius, Alessandro Stefanini, and Morteza Ghobakhloo. 2022. Social sustainability in the age of digitalization: A systematic literature Review on the social implications of industry 4.0. Technology in Society 70: 101997. [Google Scholar] [CrossRef]

- Huang, Rui, Robert W. Zmud, and R. Leon Price. 2010. Influencing the effectiveness of IT governance practices through steering committees and communication policies. European Journal of Information Systems 19: 288–302. [Google Scholar] [CrossRef]

- Joshi, Anant, Laury Bollen, Harold Hassink, Steven De Haes, and Wim Van Grembergen. 2018. Explaining IT governance disclosure through the constructs of IT governance maturity and IT strategic role. Information & Management 55: 368–80. [Google Scholar] [CrossRef]

- Kamble, Sachin S., Angappa Gunasekaran, and Shradha A. Gawankar. 2018. Sustainable Industry 4.0 framework: A systematic literature review identifying the current trends and future perspectives. Process Safety and Environmental Protection 117: 408–25. [Google Scholar] [CrossRef]

- Kandpal, Vinay, Deep Chandra, Narendra N. Dalei, and Jatinder Handoo. 2023. Expanding Financial Inclusion Through Fintech and E-Governance. Cham: Springer, pp. 103–29. [Google Scholar] [CrossRef]

- Karake, Zeinab A. 1995. The management of information technology, governance, and managerial characteristics. Information Systems Journal 5: 271–84. [Google Scholar] [CrossRef]

- Katsamakas, Evangelos. 2024. From Digital to AI Transformation for Sustainability. Sustainability 16: 3293. [Google Scholar] [CrossRef]

- Kendall, Carl, Ligia R. F. S. Kerr, Rogerio C. Gondim, Guilherme L. Werneck, Raimunda Hermelinda Maia Macena, Marta Kerr Pontes, Lisa G. Johnston, Keith Sabin, and Willi McFarland. 2008. An Empirical Comparison of Respondent-driven Sampling, Time Location Sampling, and Snowball Sampling for Behavioral Surveillance in Men Who Have Sex with Men, Fortaleza, Brazil. AIDS and Behavior 12: 97–104. [Google Scholar] [CrossRef] [PubMed]

- Khalil, Sabine, and Maksim Belitski. 2020. Dynamic capabilities for firm performance under the information technology governance framework. European Business Review 32: 129–57. [Google Scholar] [CrossRef]

- Khamees, Basheer Ahmad. 2023. Information Technology Governance and Bank Performance: A Situational Approach. International Journal of Financial Studies 11: 44. [Google Scholar] [CrossRef]

- Kouhizadeh, Mahtab, Sara Saberi, and Joseph Sarkis. 2021. Blockchain technology and the sustainable supply chain: Theoretically exploring adoption barriers. International Journal of Production Economics 231: 107831. [Google Scholar] [CrossRef]

- Kshetri, Nir. 2021. Blockchain and sustainable supply chain management in developing countries. International Journal of Information Management 60: 102376. [Google Scholar] [CrossRef]

- Le, Minh T. 2021. Examining factors that boost intention and loyalty to use Fintech post-COVID-19 lockdown as a new normal behavior. Heliyon 7: e07821. [Google Scholar] [CrossRef]

- Leng, Jiewu, Guolei Ruan, Pingyu Jiang, Kailin Xu, Qiang Liu, Xueliang Zhou, and Chao Liu. 2020. Blockchain-empowered sustainable manufacturing and product lifecycle management in industry 4.0: A survey. Renewable and Sustainable Energy Reviews 132: 110112. [Google Scholar] [CrossRef]

- Liu, Yue, Qinghua Lu, Guangsheng Yu, Hye-Young Paik, and Liming Zhu. 2022. Defining blockchain governance principles: A comprehensive framework. Information Systems 109: 102090. [Google Scholar] [CrossRef]

- Lopes de Sousa Jabbour, Ana Beatriz, Charbel Jose Chiappetta Jabbour, Moacir Godinho Filho, and David Roubaud. 2018. Industry 4.0 and the circular economy: A proposed research agenda and original roadmap for sustainable operations. Annals of Operations Research 270: 273–86. [Google Scholar] [CrossRef]

- Lunardi, Guilherme Lerch, and António Carlos Gastaud Maçada. 2009. The Financial Impact of IT Governance Mechanisms Adoption: An Empirical Analysis with Brazilian Firms. Paper presented at the 42nd Hawaii International Conference on System Sciences, Big Island, HI, USA, January 5–9; pp. 1–10. [Google Scholar]

- Lunardi, Guilherme Lerch, Antonio Carlos G. Macada, and Joao Luiz Becker. 2014. IT Governance Effectiveness and Its Antecedents: An Empirical Examination in Brazilian Firms. Paper presented at Annual Hawaii International Conference on System Sciences, Big Island, HI, USA, January 5–8; pp. 4376–85. [Google Scholar] [CrossRef]

- Macchiavello, Eugenia, and Michele Siri. 2022. Sustainable Finance and Fintech: Can Technology Contribute to Achieving Environmental Goals? A Preliminary Assessment of ‘Green Fintech’ and ‘Sustainable Digital Finance’. European Company and Financial Law Review 19: 128–74. [Google Scholar] [CrossRef]

- Meiryani, Monika Sujanto, Asl Lindawati, Arif Zulkarnain, and Suryadiputra Liawatimena. 2021. Auditor’s Perception on Technology Transformation: Blockchain and CAATs on Audit Quality in Indonesia. International Journal of Advanced Computer Science and Applications 12: 526–33. [Google Scholar] [CrossRef]

- Milian, Eduardo Z., Mauro de M. Spinola, and Marly M. de Carvalho. 2019. Fintechs: A literature review and research agenda. Electronic Commerce Research and Applications 34: 100833. [Google Scholar] [CrossRef]

- Mishra, Lokanath, and Vaibhav Kaushik. 2023. Application of blockchain in dealing with sustainability issues and challenges of financial sector. Journal of Sustainable Finance & Investment 13: 1318–33. [Google Scholar] [CrossRef]

- Moro-Visconti, Roberto, Salvador Cruz Rambaud, and Joaquín López Pascual. 2023. Artificial intelligence-driven scalability and its impact on the sustainability and valuation of traditional firms. Humanities and Social Sciences Communications 10: 795. [Google Scholar] [CrossRef]

- Mutamimah, and Robiyanto Robiyanto. 2021. E-integrated corporate governance model at the peer to peer lending fintech corporation for sustainability performance. Kasetsart Journal of Social Sciences 42: 239–44. [Google Scholar] [CrossRef]

- Oliveira, Thays A., Miquel Oliver, and Helena Ramalhinho. 2020. Challenges for Connecting Citizens and Smart Cities: ICT, E-Governance and Blockchain. Sustainability 12: 2926. [Google Scholar] [CrossRef]

- Özcan, Ece Çevik, and Bulent Akkaya. 2020. The Effect of Industry 4.0 on Accounting in Terms of Business Management. In Agile Business Leadership Methods for Industry 4.0. Leeds: Emerald Publishing Limited, pp. 139–54. [Google Scholar] [CrossRef]

- Parmentola, Adele, Antonella Petrillo, Ilaria Tutore, and Fabio De Felice. 2022. Is blockchain able to enhance environmental sustainability? A systematic review and research agenda from the perspective of Sustainable Development Goals (SDGs). Business Strategy and the Environment 31: 194–217. [Google Scholar] [CrossRef]

- Rais, M., G. Napoleon, and Noerlina. 2023. Systematic literature review of Fintech: Implementation to create sustainability in enterprise of developing countries. AIP Conference Proceedings 2776: 100012. [Google Scholar] [CrossRef]

- Rambaud, Salvador Cruz, and Ariana Expósito Gázquez. 2022. A RegTech approach to Fintech sustainability: The case of Spain. European Journal of Risk Regulation 13: 333–49. [Google Scholar] [CrossRef]

- Raza, Syed Ali, Amna Umer, Muhammad Asif Qureshi, and Abdul Samad Dahri. 2020. Internet banking service quality, e-customer satisfaction and loyalty: The modified e-SERVQUAL model. The TQM Journal 32: 1443–66. [Google Scholar] [CrossRef]

- Ren, Yi-Shuai, Chao-Qun Ma, Xun-Qi Chen, Yu-Tian Lei, and Yi-Ran Wang. 2023. Sustainable finance and blockchain: A systematic review and research agenda. Research in International Business and Finance 64: 101871. [Google Scholar] [CrossRef]

- Sabbaghi, Asghar, and Gopal Vaidyanathan. 2012. Green Information Technology and Sustainability: A Conceptual Taxonomy. Issues in Information Systems 13: 26–32. [Google Scholar] [CrossRef]

- Sahoo, Poonam, Pavan Kumar Saraf, and Rashmi Uchil. 2022a. Identification of critical success factors for leveraging Industry 4.0 technology and research agenda: A systematic literature review using PRISMA protocol. Asia-Pacific Journal of Business Administration 16: 457–81. [Google Scholar] [CrossRef]

- Sahoo, Saumyaranjan, Satish Kumar, Uthayasankar Sivarajah, Weng Marc Lim, J. Christopher Westland, and Ashwani Kumar. 2022b. Blockchain for sustainable supply chain management: Trends and ways forward. Electronic Commerce Research 24: 1563–618. [Google Scholar] [CrossRef]

- Samagaio, António, and Tiago Andrade Diogo. 2022. Effect of Computer Assisted Audit Tools on Corporate Sustainability. Sustainability 14: 705. [Google Scholar] [CrossRef]

- Santos, Leonel Cerqueira, and Carlos Denner dos Santos. 2017. A study on the impact of non-operational mechanisms on the effectiveness of public information technology governance. Revista de Administração 52: 256–67. [Google Scholar] [CrossRef]

- Schinckus, Christophe. 2020. The good, the bad and the ugly: An overview of the sustainability of blockchain technology. Energy Research & Social Science 69: 101614. [Google Scholar] [CrossRef]

- Shan, Shaonan, Xia Duan, Ying Zhang, Ting Ting Zhang, and Hui Li. 2021. Research on Collaborative Governance of Smart Government Based on Blockchain Technology: An Evolutionary Approach. Discrete Dynamics in Nature and Society 2021: 1–23. [Google Scholar] [CrossRef]

- Siddik, Abu Bakkar, Li Yong, and Nafizur Rahman. 2023. The role of Fintech in circular economy practices to improve sustainability performance: A two-staged SEM-ANN approach. Environmental Science and Pollution Research 30: 107465–86. [Google Scholar] [CrossRef] [PubMed]

- Singh, Harman Preet, and Hilal Nafil Alhulail. 2023. Information Technology Governance and Corporate Boards’ Relationship with Companies’ Performance and Earnings Management: A Longitudinal Approach. Sustainability 15: 6492. [Google Scholar] [CrossRef]

- Sirisomboonsuk, Pinyarat, Vicky Ching Gu, Ray Qing Cao, and James R. Burns. 2018. Relationships between project governance and information technology governance and their impact on project performance. International Journal of Project Management 36: 287–300. [Google Scholar] [CrossRef]

- Tiwana, Amrit, Benn Konsynski, and N. Venkatraman. 2013. Special Issue: Information Technology and Organizational Governance: The IT Governance Cube. Journal of Management Information Systems 30: 7–12. [Google Scholar] [CrossRef]

- Tiwari, Kamlesh, and Mohammad Shadab Khan. 2020. Sustainability accounting and reporting in the industry 4.0. Journal of Cleaner Production 258: 120783. [Google Scholar] [CrossRef]

- Tsai, Wen-Hsien, Yu-Wei Chou, Jun-Der Leu, Der Chao Chen, and Tsen-Shu Tsaur. 2015. Investigation of the mediating effects of IT governance-value delivery on service quality and ERP performance. Enterprise Information Systems 9: 139–60. [Google Scholar] [CrossRef]

- Tseng, Cheng-Te, and Shari S. C. Shang. 2021. Exploring the Sustainability of the Intermediary Role in Blockchain. Sustainability 13: 1936. [Google Scholar] [CrossRef]

- Tsolakis, Naoum, Roman Schumacher, Manoj Dora, and Mukesh Kumar. 2023. Artificial intelligence and blockchain implementation in supply chains: A pathway to sustainability and data monetisation? Annals of Operations Research 327: 157–210. [Google Scholar] [CrossRef]

- Turel, Ofir, Peng Liu, and Chris Bart. 2017. Board-Level Information Technology Governance Effects on Organizational Performance: The Roles of Strategic Alignment and Authoritarian Governance Style. Information Systems Management 34: 117–36. [Google Scholar] [CrossRef]

- Udeagha, Maxwell Chukwudi, and Edwin Muchapondwa. 2023. Green finance, fintech, and environmental sustainability: Fresh policy insights from the BRICS nations. International Journal of Sustainable Development and World Ecology 30: 633–49. [Google Scholar] [CrossRef]

- Udeagha, Maxwell Chukwudi, and Nicholas Ngepah. 2023. The drivers of environmental sustainability in BRICS economies: Do green finance and fintech matter? World Development Sustainability 3: 100096. [Google Scholar] [CrossRef]

- Valerio, Melissa A., Natalia Rodriguez, Paula Winkler, Jaime Lopez, Meagen Dennison, Yuanyuan Liang, and Barbara J. Turner. 2016. Comparing two sampling methods to engage hard-to-reach communities in research priority setting. BMC Medical Research Methodology 16: 146. [Google Scholar] [CrossRef] [PubMed]

- Vejseli, Shkëlqim, Dardan Proba, Alexander Rossmann, and Jens Reinhard. 2018. The agile strategies in IT governance: Towards a framework of agile IT governance in the banking industry. Paper presented at the Twenty-Sixth European Conference on Information Systems (ECIS2018), Portsmouth, UK, June 23–28; pp. 1–17. [Google Scholar]

- Venkatesh, V. G., Kai Kang, Bill Wang, Ray Y. Zhong, and Abraham Zhang. 2020. System architecture for blockchain based transparency of supply chain social sustainability. Robotics and Computer-Integrated Manufacturing 63: 101896. [Google Scholar] [CrossRef]

- Vergara, Cristina Chueca, and Luis Ferruz Agudo. 2021. Fintech and Sustainability: Do They Affect Each Other? Sustainability 13: 7012. [Google Scholar] [CrossRef]

- Vugec, Danijel S., Maja Spremić, and Milija P. Bach. 2014. IT Governance Adoption in Banking and Insurance Sector: Longitudinal Case Study of Cobit. International Journal for Quality Research 11: 691–716. [Google Scholar]

- Wahab, Iis Hamsir Ayub, and Assaf Arief. 2015. An integrative framework of COBIT and TOGAF for designing IT governance in local government. Paper presented at 2nd International Conference on Information Technology, Computer, and Electrical Engineering (ICITACEE), Semarang, Indonesia, October 16–18; pp. 36–40. [Google Scholar] [CrossRef]

- Wang, Fanlin, Jianing Lv, and Xiaoyang Zhao. 2022. How do information strategy and information technology governance influence firm performance? Frontiers in Psychology 13: 1023697. [Google Scholar] [CrossRef]

- Wang, Jing. 2021. “The Party Must Strengthen Its Leadership in Finance!”: Digital Technologies and Financial Governance in China’s Fintech Development. The China Quarterly 247: 773–92. [Google Scholar] [CrossRef]

- Wang, Jing. 2022. Performative innovation: Data governance in China’s fintech industries. Big Data & Society 9. [Google Scholar] [CrossRef]

- Wiedenhöft, Guilherme C., Edimara M. Luciano, and Gabriela V. Pereira. 2020. Information Technology Governance Institutionalization and the Behavior of Individuals in the Context of Public Organizations. Information Systems Frontiers 22: 1487–504. [Google Scholar] [CrossRef]

- Wilkin, Carla L., Paul K. Couchman, Amrik Sohal, and Ambika Zutshi. 2016. Exploring differences between smaller and large organizations’ corporate governance of information technology. International Journal of Accounting Information Systems 22: 6–25. [Google Scholar] [CrossRef]

- World Economic Forum. 2024. The Future of Global Fintech: Towards Resilient and Inclusive Growth. Geneve: World Economic Forum. [Google Scholar]

- Wu, Susie Ruqun, Gabriela Shirkey, Ilke Celik, Changliang Shao, and Jiquan Chen. 2022. A Review on the Adoption of AI, BC, and IoT in Sustainability Research. Sustainability 14: 7851. [Google Scholar] [CrossRef]

- Yoon, Sora. 2020. A Study on the Transformation of Accounting Based on New Technologies: Evidence from Korea. Sustainability 12: 8669. [Google Scholar] [CrossRef]

- Yusuf, Muhammad, Luqman Hakim, Joni Hendra, Karnawi Kamar, Wiwi Idawati, Eddy Winarso, Carmel Meiden, and Mochammad Fahlevi. 2023. Blockchain technology for corporate governance and IT governance: A financial perspectiv. International Journal of Data and Network Science 7: 927–32. [Google Scholar] [CrossRef]

- Zhang, Xin, Zhihui Wang, Xiaobing Zhong, Shouzhi Yang, and Abu Bakkar Siddik. 2022. Do Green Banking Activities Improve the Banks’ Environmental Performance? The Mediating Effect of Green Financing. Sustainability 14: 989. [Google Scholar] [CrossRef]

- Zhang, Yingying, Feng Xiong, Yi Xie, Xuan Fan, and Haifeng Gu. 2020. The Impact of Artificial Intelligence and Blockchain on the Accounting Profession. IEEE Access 8: 110461–77. [Google Scholar] [CrossRef]

- Zhang, Yufei, Jiayin Chen, Yi Han, Mengxi Qian, Xiaona Guo, Ruishan Chen, Di Xu, and Yi Chen. 2021. The contribution of Fintech to sustainable development in the digital age: Ant forest and land restoration in China. Land Use Policy 103: 105306. [Google Scholar] [CrossRef]

- Zheng, Guang-Wen, and Abu Bakkar Siddik. 2023. The effect of Fintech adoption on green finance and environmental performance of banking institutions during the COVID-19 pandemic: The role of green innovation. Environmental Science and Pollution Research 30: 25959–71. [Google Scholar] [CrossRef]

- Zheng, Guang-Wen, Abu Bakkar Siddik, Mohammad Masukujjaman, and Nazneen Fatema. 2021. Factors Affecting the Sustainability Performance of Financial Institutions in Bangladesh: The Role of Green Finance. Sustainability 13: 10165. [Google Scholar] [CrossRef]

- Zwitter, Andrej, and Jilles Hazenberg. 2020. Decentralized Network Governance: Blockchain Technology and the Future of Regulation. Frontiers in Blockchain 3: 12. [Google Scholar] [CrossRef]

| Construct | Indicator | Symbol | Items | Synthesized Literature Review |

|---|---|---|---|---|

| IT Governance | Strategic Alignment | STRA | 5 | (Ali and Green 2012; Alreemy et al. 2016; Castelo-Branco et al. 2022) |

| Steering Committee | STCM | 3 | (Ali et al. 2015; Ferguson et al. 2013) | |

| Fintech | Fintech | FINT | 4 | (Le 2021; Almaqtari 2024a) |

| Blockchain | Scalability | SCAL | 2 | Azarenkova et al. (2018), Bello and Perez (2019), and Milian et al. (2019) |

| Immutability and Auditing | AUDT | 2 | ||

| Information Flow Effectiveness | INFF | 2 | ||

| Traceability and Interoperability | TRAC | 2 | ||

| Sustainability Performance | Sustainability Performance | SUSP | 6 | (Akter et al. 2017; Almaqtari 2024a; Zheng et al. 2021) |

| Demographics | Frequency | Percent | |

|---|---|---|---|

| Qualification | Diploma or Less | 59 | 29% |

| Bachelor | 109 | 53% | |

| PG | 37 | 18% | |

| Total | 205 | 100% | |

| Experience | 5 Years or Less | 33 | 16% |

| 6 to 10 Years | 48 | 23% | |

| 11 to 15 Years | 52 | 25% | |

| More Than 15 Years | 72 | 35% | |

| Total | 205 | 100% | |

| Industry | Financial Institutions | 94 | 46% |

| Service Companies (Other Than Financial Institutions) | 13 | 6% | |

| Commercial Companies | 37 | 18% | |

| Industrial Companies | 61 | 30% | |

| Total | 205 | 100% | |

| Constructs | Indicators | Items | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | Min. | Max. | Mean | Stdev. | Skewness | Kurtosis |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Blockchain | Scalability (1) | BCHIA1 | 0.843 | 1 | 5 | 3.661 | 0.879 | −0.616 | 0.409 | |||||||

| BCHIA2 | 0.865 | |||||||||||||||

| Immutability and Auditing (2) | BCHIFE1 | 0.857 | 1 | 5 | 3.746 | 0.863 | −0.687 | 0.669 | ||||||||

| BCHIFE2 | 0.835 | |||||||||||||||

| Information Flow Effectiveness | BCHSC1 | 0.844 | 1 | 5 | 3.632 | 0.919 | −0.738 | 0.527 | ||||||||

| BCHSC2 | 0.876 | |||||||||||||||

| Traceability and Interoperability (4) | BCHTI1 | 0.864 | 1 | 5 | 3.700 | 0.873 | −0.619 | 0.307 | ||||||||

| BCHTI2 | 0.832 | |||||||||||||||

| BCH | 1 | 5 | 3.685 | 0.827 | −0.645 | 0.610 | ||||||||||

| Fintech | Fintech (5) | Fintech1 | 0.827 | 1 | 5 | 3.609 | 0.888 | −0.675 | 0.533 | |||||||

| Fintech2 | 0.874 | |||||||||||||||

| Fintech3 | 0.804 | |||||||||||||||

| Fintech4 | 0.838 | |||||||||||||||

| IT Governance | Strategic Alignment (6) | ITGSA1 | 0.823 | 1 | 5 | 3.721 | 0.840 | −0.752 | 0.420 | |||||||

| ITGSA2 | 0.827 | |||||||||||||||

| ITGSA3 | 0.820 | |||||||||||||||

| ITGSA4 | 0.781 | |||||||||||||||

| ITGSA5 | 0.804 | |||||||||||||||

| Steering Committee (7) | ITGSC1 | 0.828 | 1 | 5 | 3.608 | 0.855 | −0.643 | 0.370 | ||||||||

| ITGSC2 | 0.837 | |||||||||||||||

| ITGSC3 | 0.862 | |||||||||||||||

| ITG | 1 | 5 | 3.665 | 0.798 | −0.661 | 0.650 | ||||||||||

| Sustainability Performance | Sustainability Performance (8) | SUS1 | 0.849 | 1 | 5 | 3.682 | 0.807 | −0.543 | 0.347 | |||||||

| SUS2 | 0.834 | |||||||||||||||

| SUS3 | 0.788 | |||||||||||||||

| SUS4 | 0.840 | |||||||||||||||

| SUS5 | 0.806 | |||||||||||||||

| SUS6 | 0.849 | |||||||||||||||

| Constructs | Cronbach’s Alpha | rho_A | Composite Reliability | Average Variance Extracted (AVE) |

|---|---|---|---|---|

| Blockchain | 0.954 | 0.954 | 0.954 | 0.722 |

| Fintech | 0.903 | 0.903 | 0.903 | 0.698 |

| IT Governance | 0.931 | 0.932 | 0.931 | 0.628 |

| Immutability and Auditing | 0.834 | 0.835 | 0.834 | 0.716 |

| Information Flow_Effectivness | 0.850 | 0.851 | 0.850 | 0.740 |

| Scalability | 0.843 | 0.843 | 0.843 | 0.729 |

| Srategic Aligenment | 0.905 | 0.906 | 0.906 | 0.658 |

| Steering Committee | 0.880 | 0.881 | 0.880 | 0.710 |

| Sustainability | 0.929 | 0.929 | 0.929 | 0.686 |

| Traceability and Interoperability | 0.836 | 0.837 | 0.836 | 0.719 |

| Constructs | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) |

|---|---|---|---|---|---|---|---|---|

| Fintech (1) | 0.914 | |||||||

| Immutability and Auditing (2) | 0.836 | 0.891 | ||||||

| Information Flow_Effectiveness (3) | 0.849 | 0.831 | 0.860 | |||||

| Scalability (4) | 0.907 | 0.808 | 0.838 | 0.884 | ||||

| Srategic Alignment (5) | 0.776 | 0.707 | 0.653 | 0.688 | 0.861 | |||

| Steering Committee (6) | 0.823 | 0.809 | 0.776 | 0.776 | 0.817 | 0.843 | ||

| Sustainability (7) | 0.808 | 0.846 | 0.762 | 0.872 | 0.720 | 0.784 | 0.828 | |

| Traceability and Interoperability (8) | 0.875 | 0.791 | 0.782 | 0.780 | 0.699 | 0.761 | 0.702 | 0.848 |

| Path | β | STDEV | T-Stat. | p-Values | Hypothesis | Result |

|---|---|---|---|---|---|---|

| IT Governance -→Sustainability | −0.196 | 0.240 | 0.818 | 0.414 | H1 | Not Supported |

| Strategic Alignment → Sustainability | 0.059 | 0.132 | 0.442 | 0.658 | H1 | Not Supported |

| Steering Committee → Sustainability | 0.037 | 0.085 | 0.430 | 0.667 | H1 | Not Supported |

| Srategic Alignment → Fintech | 0.561 | 0.052 | 10.793 | 0.000 | H2 | Supported |

| Steering Committee → Fintech | 0.350 | 0.037 | 9.363 | 0.000 | H2 | Supported |

| Srategic Alignment → Blockchain | −0.055 | 0.089 | 0.622 | 0.534 | H3 | Not Supported |

| Steering Committee → Blockchain | −0.034 | 0.057 | 0.605 | 0.546 | H3 | Not Supported |

| Immutability and Auditing → Sustainability | 0.134 | 0.880 | 0.152 | 0.879 | H4 | Not Supported |

| Information Flow_Effectiveness → Sustainability | 0.369 | 0.706 | 0.523 | 0.601 | H4 | Not Supported |

| Scalability → Sustainability | 0.376 | 0.995 | 0.378 | 0.706 | H4 | Not Supported |

| Traceability and Interoperability → Sustainability | 0.044 | 0.733 | 0.060 | 0.952 | H4 | Not Supported |

| Paths | β | STDEV | T-Stat. | p-Values | Hypothesis | Result |

|---|---|---|---|---|---|---|

| Steering Committee → IT Governance → Fintech | 0.350 | 0.037 | 9.363 | 0.000 | H2 | Supported |

| Srategic Alignment → IT Governance → Fintech | 0.561 | 0.052 | 10.793 | 0.000 | H2 | Supported |

| Steering Committee → IT Governance → Blockchain | −0.034 | 0.057 | 0.605 | 0.546 | H3 | Not Supported |

| Srategic Alignment → IT Governance → Blockchain | −0.055 | 0.089 | 0.622 | 0.534 | H3 | Not Supported |

| IT Governance → Blockchain → Sustainability | −0.067 | 0.107 | 0.626 | 0.531 | H4 | Not Supported |

| Strategic Alignment → IT Governance → Fintech → Sustainability | −0.088 | 0.128 | 0.690 | 0.491 | H4 | Not Supported |

| IT Governance → Fintech → Sustainability | −0.129 | 0.191 | 0.678 | 0.498 | H4 | Not Supported |

| Steering Committee → IT Governance → Fintech → Sustainability | −0.055 | 0.084 | 0.653 | 0.514 | H4 | Not Supported |

| Strategic Alignment → IT Governance → Sustainability | 0.192 | 0.074 | 2.580 | 0.010 | H4 | Supported |

| Steering Committee → IT Governance → Sustainability | 0.120 | 0.048 | 2.479 | 0.014 | H4 | Supported |

| Strategic Alignment → IT Governance → Blockchain → Sustainability | −0.045 | 0.072 | 0.630 | 0.529 | H4 | Not Supported |

| Steering Committee → IT Governance → Blockchain → Sustainability | −0.028 | 0.046 | 0.611 | 0.541 | H4 | Not Supported |

| Immutability and Auditing → Blockchain → Sustainability | 0.134 | 0.880 | 0.152 | 0.879 | H4 | Not Supported |

| Information Flow_Effectiveness → Blockchain → Sustainability | 0.369 | 0.706 | 0.523 | 0.601 | H4 | Not Supported |

| Scalability → Blockchain → Sustainability | 0.376 | 0.995 | 0.378 | 0.706 | H4 | Not Supported |

| Traceability and Interoperability → Blockchain → Sustainability | 0.044 | 0.733 | 0.060 | 0.952 | H4 | Not Supported |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Almaqtari, F.A.; Yahya, A.T.; Al-Maskari, N.; Farhan, N.H.S.; Al-Aamri, A.-M.Y.Y. Assessing the Integrated Role of IT Governance, Fintech, and Blockchain in Enhancing Sustainability Performance and Mitigating Organizational Risk. Risks 2025, 13, 105. https://doi.org/10.3390/risks13060105

Almaqtari FA, Yahya AT, Al-Maskari N, Farhan NHS, Al-Aamri A-MYY. Assessing the Integrated Role of IT Governance, Fintech, and Blockchain in Enhancing Sustainability Performance and Mitigating Organizational Risk. Risks. 2025; 13(6):105. https://doi.org/10.3390/risks13060105

Chicago/Turabian StyleAlmaqtari, Faozi A., Ali Thabit Yahya, Nahad Al-Maskari, Najib H. S. Farhan, and Al-Muaayad Yaqoob Yahya Al-Aamri. 2025. "Assessing the Integrated Role of IT Governance, Fintech, and Blockchain in Enhancing Sustainability Performance and Mitigating Organizational Risk" Risks 13, no. 6: 105. https://doi.org/10.3390/risks13060105

APA StyleAlmaqtari, F. A., Yahya, A. T., Al-Maskari, N., Farhan, N. H. S., & Al-Aamri, A.-M. Y. Y. (2025). Assessing the Integrated Role of IT Governance, Fintech, and Blockchain in Enhancing Sustainability Performance and Mitigating Organizational Risk. Risks, 13(6), 105. https://doi.org/10.3390/risks13060105