Inter-Market Mean and Volatility Spillover Dynamics Between Cryptocurrencies and an Emerging Stock Market: Evidence from Thailand and Sectoral Analysis

Abstract

1. Introduction

2. Literature Review

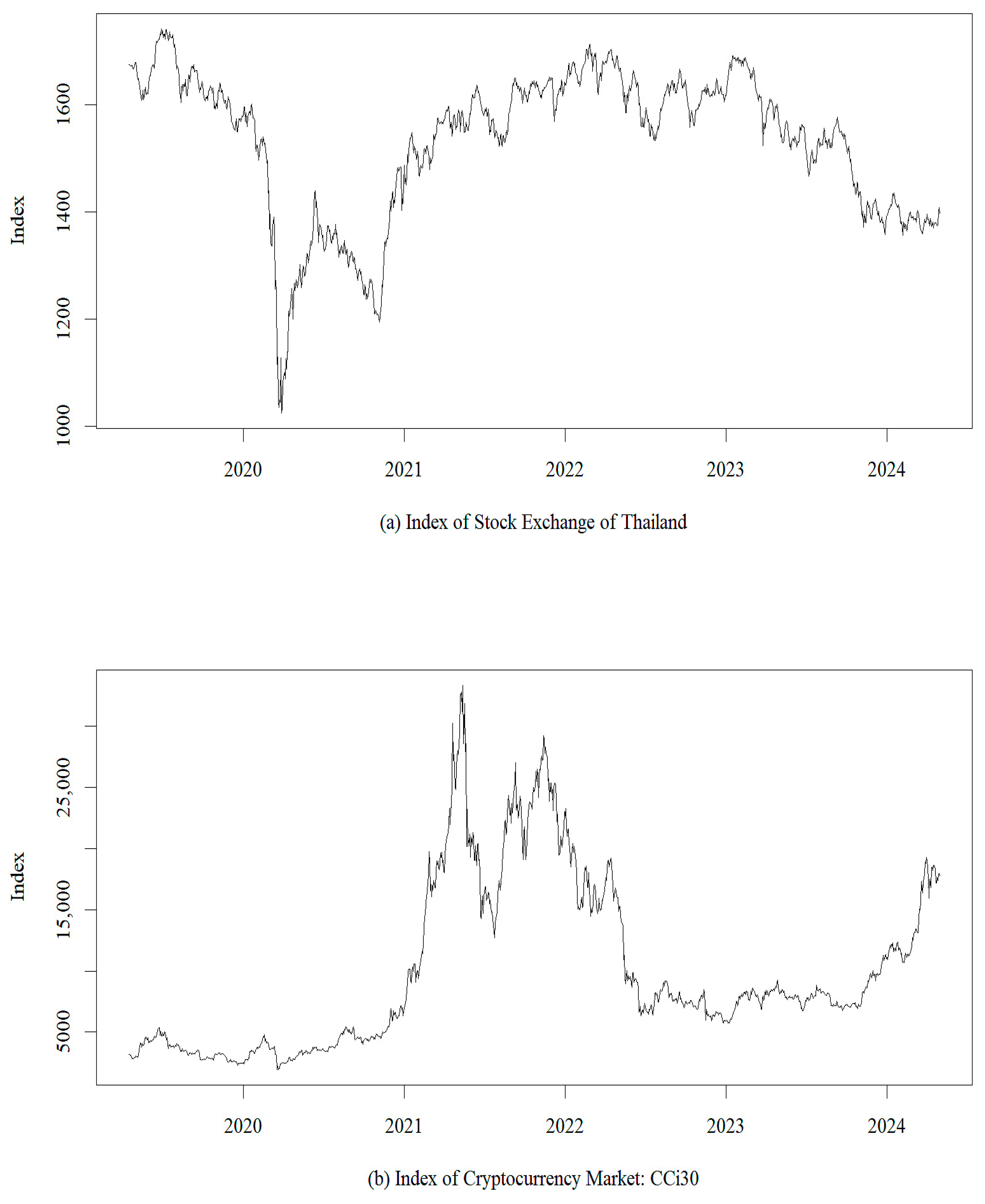

3. Results

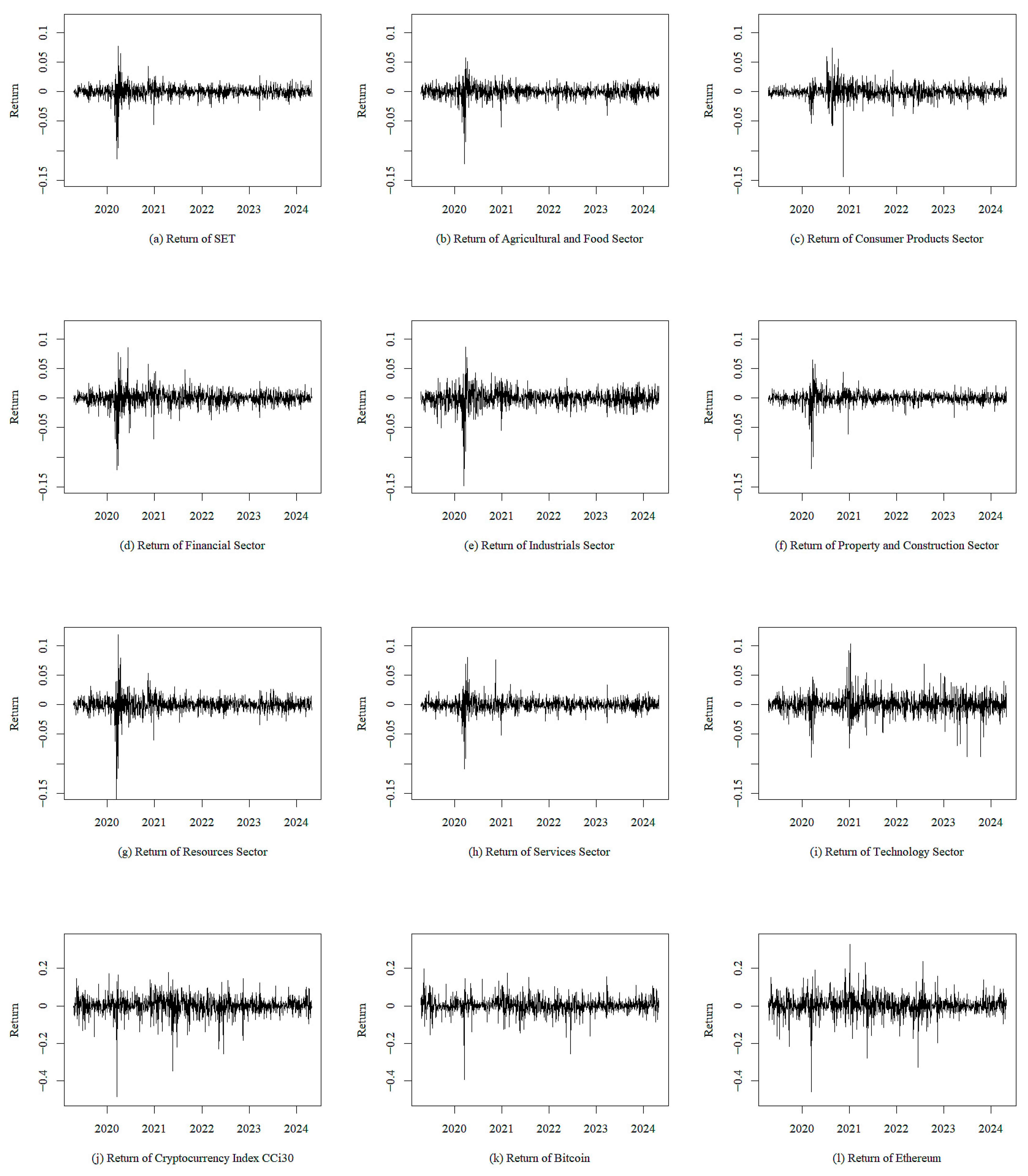

3.1. Descriptive Statistics

3.2. Mean Spillover Effect Between Thai Stocks and Cryptocurrencies

3.3. Volatility Spillover Between Thai Stocks and Cryptocurrencies

4. Materials and Methods

4.1. Data

4.2. Bivariate Vector Autoregressive Model—VAR (1) Model

4.3. BEKK GARCH Model with Asymmetry

5. Discussion

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Alkan, Buket, and Serkan Çiçek. 2020. Spillover effect in financial markets in Turkey. Central Bank Review 20: 53–64. [Google Scholar] [CrossRef]

- Anamika, Madhumita Chakraborty, and Sowmya Subramaniam. 2021. Does Sentiment Impact Cryptocurrency? Journal of Behavioral Finance 24: 202–18. [Google Scholar] [CrossRef]

- Antonakakis, Nikolaos, Ioannis Chatziantoniou, and David Gabauer. 2019. Cryptocurrency market contagion: Market uncertainty, market complexity, and dynamic portfolios. Journal of International Financial Markets Institutions and Money 61: 37–51. [Google Scholar] [CrossRef]

- Aydoğan, Berna, Gülin Vardar, and Caner Taçoğlu. 2022. Volatility spillovers among G7, E7 stock markets and cryptocurrencies. Journal of Economic and Administrative Sciences 40: 364–87. [Google Scholar] [CrossRef]

- Bouri, Elie, Ladislav Kristoufek, and Nehme Azoury. 2022. Bitcoin and SandP500: Co-movements of high-order moments in the time-frequency domain. PLoS ONE 17: e0277924. [Google Scholar] [CrossRef]

- Bouri, Elie, Mahamitra Das, Rangan Gupta, and David Roubaud. 2018. Spillovers between Bitcoin and other assets during bear and bull markets. Applied Economics 50: 5935–49. [Google Scholar] [CrossRef]

- Cao, Guangxi, and Wenhao Xie. 2022. Asymmetric dynamic spillover effect between cryptocurrency and China’s financial market: Evidence from TVP-VAR based connectedness approach. Finance Research Letters 49: 103070. [Google Scholar] [CrossRef]

- Choi, Sun-Yong. 2022. Volatility spillovers among Northeast Asia and the US: Evidence from the global financial crisis and the COVID-19 pandemic. Economic Analysis and Policy 73: 179–93. [Google Scholar] [CrossRef]

- Corbet, Shaen, Andrew Meegan, Charles Larkin, Brian Lucey, and Larisa Yarovaya. 2018. Exploring the dynamic relationships between cryptocurrencies and other financial assets. Economics Letters 165: 28–34. [Google Scholar] [CrossRef]

- Diebold, Francis X., and Kamil Yilmaz. 2012. Better to give than to receive: Predictive directional measurement of volatility spillovers. International Journal of Forecasting 28: 57–66. [Google Scholar] [CrossRef]

- Elsayed, Ahmed H., Giray Gozgor, and Chi Keung Marco Lau. 2022. Risk transmissions between bitcoin and traditional financial assets during the COVID-19 era: The role of global uncertainties. International Review of Financial Analysis 81: 102069. [Google Scholar] [CrossRef]

- Engle, Robert F., and Kenneth F. Kroner. 1995. Multivariate Simultaneous Generalized ARCH. Econometric Theory 11: 122–50. [Google Scholar] [CrossRef]

- Forbes, Kristen J., and Roberto Rigobon. 2002. No contagion, only interdependence: Measuring stock market comovements. Journal of Finance 57: 2223–61. [Google Scholar] [CrossRef]

- Gaies, Brahim, Mohamed Sahbi Nakhli, Jean Michel Sahut, and Khaled Guesmi. 2021. Is Bitcoin rooted in confidence? Unraveling the determinants of globalized digital currencies. Technological Forecasting and Social Change 172: 121038. [Google Scholar] [CrossRef]

- He, Pinglin, Yulong Sun, Ying Zhang, and Tao Li. 2021. COVID-19’s impact on stock prices across different sectors—An event study based on the Chinese stock market. Emerging Markets Finance and Trade 56: 2198–212. [Google Scholar] [CrossRef]

- Hsu, Shu-Han, Chwen Sheu, and Jiho Yoon. 2021. Risk spillovers between cryptocurrencies and traditional currencies and gold under different global economic conditions. The North American Journal of Economics and Finance 57: 101443. [Google Scholar] [CrossRef]

- Joshi, Prashant, Jinghua Wang, and Michael Busler. 2022. A Study of the Machine Learning Approach and the MGARCH-BEKK Model in Volatility Transmission. Journal of Risk and Financial Management 15: 116. [Google Scholar] [CrossRef]

- Koutmos, Dimitrios. 2018. Return and volatility spillovers among cryptocurrencies. Economics Letters 173: 122–27. [Google Scholar] [CrossRef]

- Kroner, Kenneth F., and Victor K. Ng. 1998. Modeling Asymmetric Comovements of Asset Returns. Review of Financial Studies 11: 817–44. [Google Scholar] [CrossRef]

- Kurka, Josef. 2019. Do cryptocurrencies and traditional asset classes influence each other? Finance Research Letters 31: 38–46. [Google Scholar] [CrossRef]

- Lehnert, Thorsten. 2022. Flight-to-safety and retail investor behavior. International Review of Financial Analysis 81: 102142. [Google Scholar] [CrossRef]

- Maharana, Narayana, Ashok Kumar Panigrahi, and Suman Kalyan Chaudhury. 2024. Volatility persistence and spillover effects of Indian market in the global economy: A pre-and post-pandemic analysis using VAR-BEKK-GARCH model. Journal of Risk and Financial Management 17: 294. [Google Scholar] [CrossRef]

- Malhotra, Nidhi, and Saumya Gupta. 2019. Volatility spillovers and correlation between cryptocurrencies and Asian equity market. International Journal of Economics and Financial 9: 208–15. [Google Scholar] [CrossRef]

- Markowitz, Harry. 1952. Modern portfolio theory. Journal of Finance 7: 77–91. [Google Scholar]

- Özdemir, Ferda Nur, and Abdulbaki Bilgiç. 2023. Determining the short and long term volatility spillovers between wheat, cotton and corn prices in Turkey using the asymmetric BEKK-GARCH-mean equation model. Scientific Papers Series Management, Economic Engineering in Agriculture & Rural Development 23: 475–90. [Google Scholar]

- Polkuamdee, Nuntawun. 2021. Thai Traders Surge into Crypto Market. Bangkok Post. Available online: https://www.bangkokpost.com/business/2178707/thai-traders-surge-into-crypto-market (accessed on 12 March 2024).

- Stock Exchange of Thailand. 2024a. Investor Types (SET). Available online: https://www.set.or.th/en/market/statistics/investor-type?market=SET (accessed on 10 April 2024).

- Stock Exchange of Thailand. 2024b. Trading and Statistics Historical Data. Available online: https://www.set.or.th/en/services/connectivity-and-data/data/historical (accessed on 10 May 2024).

- Stock Exchange of Thailand. 2025. Market Capitalization (Sep 1988 to Present). Available online: https://www.set.or.th/en/market/statistics/market-statistics/main (accessed on 10 February 2025).

- Symitsi, Efthymia, and Konstantinos J. Chalvatzis. 2018. Return, volatility and shock spillovers of Bitcoin with energy and technology companies. Economics Letters 170: 127–30. [Google Scholar] [CrossRef]

- Tangwattanarat, Natnicha. 2017. A Study of the Perception of Thai Cryptocurrency Investors Towards Digital Currency Market. Ph.D. dissertation, Thammasat University, Bangkok, Thailand. [Google Scholar]

- Thailand Board of Investment. 2024a. Thailand’s Advantages. Available online: https://www.boi.go.th/index.php?page=thailand_advantages (accessed on 15 November 2024).

- Thailand Board of Investment. 2024b. Thailand’s Rankings. Available online: https://www.boi.go.th/index.php?page=thailand_rankings (accessed on 15 November 2024).

- Tjondro, Elisa, Saarce Elsye Hatane, Retnaningtyas Widuri, and Josua Tarigan. 2023. Rational versus Irrational Behavior of Indonesian Cryptocurrency Owners in Making Investment Decision. Risks 11: 17. [Google Scholar] [CrossRef]

- Trabelsi, Nader. 2018. Are There Any Volatility Spill-Over Effects among Cryptocurrencies and Widely Traded Asset Classes? Journal of Risk and Financial Management 11: 66. [Google Scholar] [CrossRef]

- Uddin, Md Akther, Md Hakim Ali, and Mansur Masih. 2020. Bitcoin—A hype or digital gold? Global evidence. Australian Economic Papers 59: 215–31. [Google Scholar] [CrossRef]

- Uzonwanne, Godfrey. 2021. Volatility and return spillovers between stock markets and cryptocurrencies. The Quarterly Review of Economics and Finance 82: 30–36. [Google Scholar] [CrossRef]

- Vardar, Gulin, and Berna Aydogan. 2019. Return and volatility spillovers between Bitcoin and other asset classes in Turkey. EuroMed Journal of Business 14: 209–20. [Google Scholar] [CrossRef]

- Wang, Gangjin, Yanping Tang, Chi Xie, and Shou Chen. 2019. Is bitcoin a safe haven or a hedging asset? Evidence from China. Journal of Management Science and Engineering 4: 173–88. [Google Scholar] [CrossRef]

- Wang, Jia, Huang Xun, and Wang Xu. 2023. Risk spillovers and hedging in the Chinese stock market: An asymmetric VAR-BEKK-AGARCH analysis. Acadlore Transactions on Applied Mathematics and Statistics 1: 111–29. [Google Scholar] [CrossRef]

- Yasir, Muhammad, Muhammad Attique, Khalid Latif, Ghulam Mujtaba Chaudhary, Sitara Afzal, Kamran Ahmed, and Farhan Shahzad. 2020. Deep-learning-assisted business intelligence model for cryptocurrency forecasting using social media sentiment. Journal of Enterprise Information Management 36: 718–33. [Google Scholar] [CrossRef]

- Yousaf, Imran, Afsheen Abrar, and John W. Goodell. 2022. Connectedness between travel and tourism tokens, tourism equity, and other assets. Finance Research Letters 53: 103595. [Google Scholar] [CrossRef]

- Yousaf, Imran, and Larisa Yarovaya. 2021. Spillovers between the Islamic gold-backed cryptocurrencies and equity markets during the COVID-19: A sectorial analysis. Pacific-Basin Finance Journal 71: 101705. [Google Scholar] [CrossRef]

- Yu, Lean, Rui Zha, Dimitrios Stafylas, Kaijian He, and Jia Liu. 2020. Dependences and volatility spillovers between the oil and stock markets: New evidence from the copula and VAR-BEKK-GARCH models. International Review of Financial Analysis 68: 101280. [Google Scholar] [CrossRef]

| Assets | SET | SETAgro | SETCon | SETFin | SETIndu | SETProp | SETRes | SETSer | SETTech |

|---|---|---|---|---|---|---|---|---|---|

| Mean | 0.000 | 0.000 | −0.001 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| Std. Dev. | 0.011 | 0.011 | 0.012 | 0.014 | 0.014 | 0.010 | 0.014 | 0.011 | 0.017 |

| Max | 0.077 | 0.057 | 0.074 | 0.085 | 0.086 | 0.064 | 0.118 | 0.080 | 0.102 |

| Min | −0.114 | −0.123 | −0.143 | −0.122 | −0.148 | −0.119 | −0.175 | −0.108 | −0.089 |

| Skewness | −1.914 | −2.013 | −1.377 | −1.185 | −1.446 | −2.170 | −1.954 | −0.829 | −0.002 |

| Kurtosis | 25.217 | 20.332 | 21.952 | 15.515 | 16.275 | 27.490 | 34.337 | 19.460 | 6.121 |

| ARCHLM | 295.017 | 244.690 | 25.364 | 264.664 | 252.440 | 317.265 | 297.338 | 233.346 | 169.492 |

| p-value of ARCHLM | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| Jarque–Bera | 32,920 | 21,740 | 24,770 | 12,468 | 13,829 | 39,191 | 60,427 | 19,304 | 1899 |

| p-value of Jarque–Bera | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| ADF | −8.620 | −9.185 | −9.847 | −9.273 | −8.208 | −9.167 | −8.396 | −9.812 | −9.304 |

| p-value of ADF | 0.010 | 0.010 | 0.010 | 0.010 | 0.010 | 0.010 | 0.010 | 0.010 | 0.010 |

| Assets | CI | BTC | ETH |

|---|---|---|---|

| Mean | 0.001 | 0.002 | 0.003 |

| Std. Dev. | 0.049 | 0.040 | 0.052 |

| Max | 0.177 | 0.198 | 0.329 |

| Min | −0.485 | −0.392 | −0.457 |

| Skewness | −1.577 | −0.922 | −0.748 |

| Kurtosis | 12.410 | 10.998 | 10.031 |

| ARCHLM | 32.898 | 36.803 | 37.909 |

| p-value of ARCHLM | 0.000 | 0.000 | 0.000 |

| Jarque–Bera | 8299 | 6296 | 5207 |

| p-value of Jarque–Bera | 0.000 | 0.000 | 0.000 |

| ADF | −9.615 | −9.656 | −9.76 |

| p-value of ADF | 0.010 | 0.010 | 0.010 |

| Panel A: Return of SET index and cryptocurrencies | ||||||

| SET-CI | SET-BTC | SET-ETH | ||||

| Estimate | p-value | Estimate | p-value | Estimate | p-value | |

| Mean | Model (SET) | Model (SET) | Model (SET) | |||

| β11 | 0.044 | 0.145 | 0.054 | 0.056 | 0.056 | 0.060 |

| β12 | 0.014 | 0.003 | 0.011 | 0.044 | 0.013 | 0.002 |

| a01 | 0.000 | 0.147 | 0.000 | 0.179 | 0.000 | 0.108 |

| Mean | Model (CI) | Model (BTC) | Model (ETH) | |||

| β21 | 0.012 | 0.925 | −0.092 | 0.453 | −0.116 | 0.450 |

| β22 | 0.009 | 0.792 | 0.056 | 0.118 | 0.025 | 0.391 |

| a02 | 0.002 | 0.175 | 0.002 | 0.053 | 0.002 | 0.182 |

| Panel B: Return of agricultural and food sector and cryptocurrencies | ||||||

| SETAgro-CI | SETAgro-BTC | SETAgro-ETH | ||||

| Estimate | p-value | Estimate | p-value | Estimate | p-value | |

| Mean | Model (SETAgro) | Model (SETAgro) | Model (SETAgro) | |||

| β11 | −0.005 | 0.860 | 0.004 | 0.889 | 0.013 | 0.651 |

| β12 | 0.001 | 0.907 | −0.006 | 0.308 | 0.002 | 0.613 |

| a01 | 0.000 | 0.186 | 0.000 | 0.201 | 0.000 | 0.178 |

| Mean | Model (CI) | Model (BTC) | Model (ETH) | |||

| β21 | 0.114 | 0.400 | −0.007 | 0.953 | −0.104 | 0.451 |

| β22 | 0.009 | 0.775 | 0.054 | 0.163 | 0.019 | 0.527 |

| a02 | 0.001 | 0.277 | 0.002 | 0.114 | 0.002 | 0.092 |

| Panel C: Return of consumer products sector and cryptocurrencies | ||||||

| SETCon-CI | SETCon-BTC | SETCon-ETH | ||||

| Estimate | p-value | Estimate | p-value | Estimate | p-value | |

| Mean | Model (SETCon) | Model (SETCon) | Model (SETCon) | |||

| β11 | 0.023 | 0.492 | 0.027 | 0.323 | 0.033 | 0.241 |

| β12 | 0.014 | 0.009 | 0.011 | 0.086 | 0.012 | 0.006 |

| a01 | −0.001 | 0.001 | −0.001 | 0.007 | −0.001 | 0.002 |

| Mean | Model (CI) | Model (BTC) | Model (ETH) | |||

| β21 | 0.020 | 0.855 | −0.138 | 0.144 | −0.127 | 0.259 |

| β22 | 0.010 | 0.749 | 0.071 | 0.022 | 0.013 | 0.654 |

| a02 | 0.002 | 0.176 | 0.002 | 0.065 | 0.002 | 0.051 |

| Panel D: Return of financial sector and cryptocurrencies | ||||||

| SETFin-CI | SETFin-BTC | SETFin-ETH | ||||

| Estimate | p-value | Estimate | p-value | Estimate | p-value | |

| Mean | Model (SETFin) | Model (SETFin) | Model (SETFin) | |||

| β11 | 0.058 | 0.039 | 0.060 | 0.048 | 0.069 | 0.013 |

| β12 | 0.015 | 0.013 | 0.010 | 0.175 | 0.012 | 0.036 |

| a01 | 0.000 | 0.414 | 0.000 | 0.177 | 0.000 | 0.145 |

| Mean | Model (CI) | Model (BTC) | Model (ETH) | |||

| β21 | −0.052 | 0.392 | −0.105 | 0.173 | −0.096 | 0.352 |

| β22 | 0.018 | 0.495 | 0.062 | 0.065 | 0.028 | 0.358 |

| a02 | 0.002 | 0.226 | 0.002 | 0.027 | 0.002 | 0.138 |

| Panel E: Return of industrials sector and cryptocurrencies | ||||||

| SETIndu-CI | SETIndu-BTC | SETIndu-ETH | ||||

| Estimate | p-value | Estimate | p-value | Estimate | p-value | |

| Mean | Model (SETIndu) | Model (SETIndu) | Model (SETIndu) | |||

| β11 | 0.052 | 0.038 | 0.060 | 0.038 | 0.049 | 0.079 |

| β12 | 0.032 | 0.000 | 0.025 | 0.001 | 0.023 | 0.000 |

| a01 | −0.001 | 0.006 | −0.001 | 0.097 | −0.001 | 0.029 |

| Mean | Model (CI) | Model (BTC) | Model (ETH) | |||

| β21 | 0.079 | 0.367 | −0.041 | 0.657 | −0.066 | 0.500 |

| β22 | 0.028 | 0.429 | 0.056 | 0.095 | 0.017 | 0.553 |

| a02 | 0.002 | 0.152 | 0.002 | 0.188 | 0.002 | 0.169 |

| Panel F: Return of property and construction sector and cryptocurrencies | ||||||

| SETProp-CI | SETProp-BTC | SETProp-ETH | ||||

| Estimate | p-value | Estimate | p-value | Estimate | p-value | |

| Mean | Model (SETProp) | Model (SETProp) | Model (SETProp) | |||

| β11 | 0.062 | 0.054 | 0.069 | 0.022 | 0.068 | 0.021 |

| β12 | 0.013 | 0.004 | 0.011 | 0.029 | 0.011 | 0.008 |

| a01 | 0.000 | 0.061 | 0.000 | 0.061 | 0.000 | 0.039 |

| Mean | Model (CI) | Model (BTC) | Model (ETH) | |||

| β21 | 0.025 | 0.869 | −0.071 | 0.546 | −0.081 | 0.597 |

| β22 | 0.007 | 0.839 | 0.051 | 0.110 | 0.020 | 0.497 |

| a02 | 0.002 | 0.111 | 0.002 | 0.059 | 0.002 | 0.122 |

| Panel G: Return of resources sector and cryptocurrencies | ||||||

| SETRes-CI | SETRes-BTC | SETRes-ETH | ||||

| Estimate | p-value | Estimate | p-value | Estimate | p-value | |

| Mean | Model (SETRes) | Model (SETRes) | Model (SETRes) | |||

| β11 | 0.062 | 0.034 | 0.066 | 0.027 | 0.066 | 0.027 |

| β12 | 0.018 | 0.003 | 0.016 | 0.024 | 0.017 | 0.003 |

| a01 | 0.000 | 0.206 | 0.000 | 0.252 | 0.000 | 0.149 |

| Mean | Model (CI) | Model (BTC) | Model (ETH) | |||

| β21 | 0.089 | 0.413 | −0.013 | 0.899 | 0.047 | 0.713 |

| β22 | 0.012 | 0.693 | 0.060 | 0.107 | 0.028 | 0.363 |

| a02 | 0.002 | 0.162 | 0.002 | 0.081 | 0.002 | 0.114 |

| Panel H: Return of services sector and cryptocurrencies | ||||||

| SETSer-CI | SETSer-BTC | SETSer-ETH | ||||

| Estimate | p-value | Estimate | p-value | Estimate | p-value | |

| Mean | Model (SETSer) | Model (SETSer) | Model (SETSer) | |||

| β11 | 0.032 | 0.303 | 0.046 | 0.119 | 0.050 | 0.090 |

| β12 | 0.008 | 0.124 | 0.008 | 0.202 | 0.013 | 0.006 |

| a01 | 0.000 | 0.436 | 0.000 | 0.190 | 0.000 | 0.195 |

| Mean | Model (CI) | Model (BTC) | Model (ETH) | |||

| β21 | 0.117 | 0.355 | −0.060 | 0.529 | −0.076 | 0.578 |

| β22 | 0.030 | 0.344 | 0.047 | 0.152 | 0.029 | 0.341 |

| a02 | 0.001 | 0.557 | 0.002 | 0.074 | 0.002 | 0.248 |

| Panel I: Return of technology sector and cryptocurrencies | ||||||

| SETTech-CI | SETTech-BTC | SETTech-ETH | ||||

| Estimate | p-value | Estimate | p-value | Estimate | p-value | |

| Mean | Model (SETTech) | Model (SETTech) | Model (SETTech) | |||

| β11 | −0.114 | 0.000 | −0.099 | 0.001 | −0.094 | 0.001 |

| β12 | 0.026 | 0.002 | 0.017 | 0.042 | 0.024 | 0.003 |

| a01 | 0.001 | 0.100 | 0.001 | 0.117 | 0.001 | 0.108 |

| Mean | Model (CI) | Model (BTC) | Model (ETH) | |||

| β21 | −0.104 | 0.161 | −0.104 | 0.141 | −0.042 | 0.555 |

| β22 | 0.012 | 0.707 | 0.066 | 0.037 | −0.002 | 0.938 |

| a02 | 0.002 | 0.145 | 0.002 | 0.018 | 0.003 | 0.023 |

| Panel A: Return of set index and cryptocurrencies | ||||||

| SET-CI | SET-BTC | SET-ETH | ||||

| Estimate | p-value | Estimate | p-value | Estimate | p-value | |

| c11 | 0.001 | 0.000 | 0.001 | 0.000 | 0.001 | 0.000 |

| c21 | −0.002 | 0.458 | 0.001 | 0.815 | 0.001 | 0.699 |

| c22 | 0.010 | 0.000 | 0.021 | 0.000 | 0.004 | 0.080 |

| a11 | 0.157 | 0.000 | 0.154 | 0.000 | 0.163 | 0.000 |

| a12 | 0.404 | 0.000 | 0.397 | 0.001 | −0.004 | 0.972 |

| a21 | −0.008 | 0.121 | −0.007 | 0.324 | 0.005 | 0.274 |

| a22 | 0.299 | 0.000 | 0.435 | 0.000 | 0.217 | 0.000 |

| g11 | 0.945 | 0.000 | 0.948 | 0.000 | 0.949 | 0.000 |

| g12 | −0.079 | 0.066 | 0.060 | 0.385 | −0.084 | 0.001 |

| g21 | 0.004 | 0.088 | −0.003 | 0.700 | 0.000 | 0.766 |

| g22 | 0.922 | 0.000 | 0.732 | 0.000 | 0.973 | 0.000 |

| d11 | 0.331 | 0.000 | 0.329 | 0.000 | 0.321 | 0.000 |

| d12 | 0.623 | 0.001 | 0.294 | 0.201 | 0.673 | 0.000 |

| d21 | −0.013 | 0.053 | −0.005 | 0.644 | −0.011 | 0.136 |

| d22 | −0.145 | 0.040 | 0.033 | 0.865 | −0.038 | 0.478 |

| H0: a21 = g21 = d21 = 0 | 7.317 | 0.062 | 6.151 | 0.104 | 3.643 | 0.303 |

| H0: a12 = g12 = d12 = 0 | 26.029 | 0.000 | 19.714 | 0.000 | 25.016 | 0.000 |

| Panel B: Return of agricultural and food sector and cryptocurrencies | ||||||

| SETAgro-CI | SETAgro-BTC | SETAgro-ETH | ||||

| Estimate | p-value | Estimate | p-value | Estimate | p-value | |

| c11 | 0.002 | 0.000 | 0.002 | 0.000 | 0.001 | 0.000 |

| c21 | −0.005 | 0.166 | −0.009 | 0.010 | 0.001 | 0.444 |

| c22 | 0.022 | 0.000 | 0.017 | 0.000 | 0.000 | 1.000 |

| a11 | 0.099 | 0.026 | 0.116 | 0.015 | 0.027 | 0.659 |

| a12 | 0.697 | 0.000 | 0.472 | 0.000 | −0.375 | 0.008 |

| a21 | −0.023 | 0.003 | −0.030 | 0.002 | 0.009 | 0.045 |

| a22 | 0.387 | 0.000 | 0.413 | 0.000 | 0.196 | 0.000 |

| g11 | 0.942 | 0.000 | 0.935 | 0.000 | 0.958 | 0.000 |

| g12 | 0.120 | 0.129 | 0.130 | 0.066 | −0.082 | 0.000 |

| g21 | 0.005 | 0.278 | 0.014 | 0.058 | −0.002 | 0.114 |

| g22 | 0.742 | 0.000 | 0.752 | 0.000 | 0.977 | 0.000 |

| d11 | 0.338 | 0.000 | 0.369 | 0.000 | 0.347 | 0.000 |

| d12 | 0.280 | 0.344 | 0.384 | 0.088 | 0.638 | 0.000 |

| d21 | −0.002 | 0.716 | −0.025 | 0.005 | −0.010 | 0.266 |

| d22 | 0.360 | 0.000 | −0.154 | 0.093 | 0.039 | 0.611 |

| H0: a21 = g21 = d21 = 0 | 12.471 | 0.006 | 27.932 | 0.000 | 7.108 | 0.069 |

| H0: a12 = g12 = d12 = 0 | 24.476 | 0.000 | 26.022 | 0.000 | 63.574 | 0.000 |

| Panel C: Return of consumer products sector and cryptocurrencies | ||||||

| SETCon-CI | SETCon-BTC | SETCon-ETH | ||||

| Estimate | p-value | Estimate | p-value | Estimate | p-value | |

| c11 | 0.001 | 0.009 | 0.001 | 0.001 | 0.001 | 0.007 |

| c21 | 0.004 | 0.189 | 0.001 | 0.840 | 0.002 | 0.572 |

| c22 | 0.009 | 0.000 | 0.014 | 0.000 | 0.006 | 0.000 |

| a11 | 0.224 | 0.000 | 0.226 | 0.000 | 0.231 | 0.000 |

| a12 | 0.132 | 0.174 | 0.060 | 0.538 | 0.025 | 0.769 |

| a21 | 0.011 | 0.020 | 0.005 | 0.409 | 0.011 | 0.024 |

| a22 | 0.258 | 0.000 | 0.311 | 0.000 | 0.235 | 0.000 |

| g11 | 0.973 | 0.000 | 0.974 | 0.000 | 0.971 | 0.000 |

| g12 | −0.043 | 0.084 | −0.012 | 0.708 | −0.023 | 0.234 |

| g21 | −0.003 | 0.092 | −0.002 | 0.639 | −0.002 | 0.182 |

| g22 | 0.922 | 0.000 | 0.855 | 0.000 | 0.958 | 0.000 |

| d11 | 0.045 | 0.316 | 0.031 | 0.549 | −0.061 | 0.152 |

| d12 | 0.673 | 0.000 | 0.688 | 0.001 | −0.680 | 0.000 |

| d21 | 0.003 | 0.696 | 0.001 | 0.846 | 0.000 | 0.953 |

| d22 | 0.196 | 0.001 | 0.215 | 0.007 | −0.098 | 0.017 |

| H0: a21 = g21 = d21 = 0 | 5.477 | 0.140 | 0.805 | 0.848 | 5.737 | 0.125 |

| H0: a12 = g12 = d12 = 0 | 21.159 | 0.000 | 13.733 | 0.003 | 53.816 | 0.000 |

| Panel D: Return of financial sector and cryptocurrencies | ||||||

| SETFin-CI | SETFin-BTC | SETFin-ETH | ||||

| Estimate | p-value | Estimate | p-value | Estimate | p-value | |

| c11 | 0.001 | 0.104 | 0.001 | 0.000 | 0.001 | 0.000 |

| c21 | 0.001 | 0.951 | −0.007 | 0.227 | −0.001 | 0.533 |

| c22 | 0.024 | 0.000 | 0.019 | 0.000 | 0.005 | 0.014 |

| a11 | 0.257 | 0.000 | 0.195 | 0.000 | 0.182 | 0.000 |

| a12 | 0.052 | 0.802 | 0.405 | 0.001 | 0.015 | 0.858 |

| a21 | 0.005 | 0.458 | −0.002 | 0.814 | 0.011 | 0.054 |

| a22 | 0.264 | 0.000 | 0.417 | 0.000 | 0.235 | 0.000 |

| g11 | 0.960 | 0.000 | 0.961 | 0.000 | 0.964 | 0.000 |

| g12 | 0.026 | 0.721 | 0.040 | 0.449 | −0.041 | 0.014 |

| g21 | −0.009 | 0.193 | 0.000 | 0.998 | −0.001 | 0.567 |

| g22 | 0.719 | 0.000 | 0.741 | 0.000 | 0.968 | 0.000 |

| d11 | 0.177 | 0.003 | −0.258 | 0.000 | 0.254 | 0.000 |

| d12 | 1.061 | 0.000 | −0.050 | 0.818 | 0.425 | 0.001 |

| d21 | 0.005 | 0.618 | 0.005 | 0.595 | −0.006 | 0.396 |

| d22 | 0.440 | 0.000 | 0.128 | 0.320 | −0.052 | 0.296 |

| H0: a21 = g21 = d21 = 0 | 1.886 | 0.596 | 0.437 | 0.933 | 7.355 | 0.061 |

| H0: a12 = g12 = d12 = 0 | 24.437 | 0.000 | 16.888 | 0.001 | 12.586 | 0.006 |

| Panel E: Return of industrials sector and cryptocurrencies | ||||||

| SETIndu-CI | SETIndu-BTC | SETIndu-ETH | ||||

| Estimate | p-value | Estimate | p-value | Estimate | p-value | |

| c11 | 0.002 | 0.000 | 0.001 | 0.000 | 0.001 | 0.000 |

| c21 | −0.006 | 0.188 | 0.003 | 0.589 | 0.000 | 0.772 |

| c22 | 0.021 | 0.000 | 0.021 | 0.000 | 0.001 | 0.818 |

| a11 | 0.236 | 0.000 | 0.203 | 0.000 | 0.165 | 0.000 |

| a12 | −0.070 | 0.677 | −0.153 | 0.267 | 0.027 | 0.765 |

| a21 | −0.006 | 0.337 | −0.007 | 0.447 | 0.010 | 0.012 |

| a22 | −0.338 | 0.000 | 0.292 | 0.000 | 0.199 | 0.000 |

| g11 | 0.948 | 0.000 | 0.963 | 0.000 | 0.967 | 0.000 |

| g12 | 0.046 | 0.497 | 0.006 | 0.908 | −0.056 | 0.000 |

| g21 | 0.001 | 0.858 | −0.001 | 0.881 | −0.001 | 0.315 |

| g22 | 0.751 | 0.000 | 0.747 | 0.000 | 0.979 | 0.000 |

| d11 | 0.233 | 0.000 | 0.206 | 0.000 | 0.243 | 0.000 |

| d12 | 0.734 | 0.000 | 0.674 | 0.000 | 0.486 | 0.000 |

| d21 | 0.005 | 0.571 | −0.012 | 0.357 | −0.010 | 0.052 |

| d22 | 0.375 | 0.000 | 0.263 | 0.001 | −0.040 | 0.233 |

| H0: a21 = g21 = d21 = 0 | 2.887 | 0.409 | 4.435 | 0.218 | 7.277 | 0.064 |

| H0: a12 = g12 = d12 = 0 | 12.489 | 0.006 | 20.644 | 0.000 | 43.110 | 0.000 |

| Panel F: Return of property and construction sector and cryptocurrencies | ||||||

| SETProp-CI | SETProp-BTC | SETProp-ETH | ||||

| Estimate | p-value | Estimate | p-value | Estimate | p-value | |

| c11 | 0.001 | 0.000 | 0.001 | 0.030 | 0.001 | 0.000 |

| c21 | 0.003 | 0.461 | 0.007 | 0.264 | 0.001 | 0.396 |

| c22 | 0.020 | 0.000 | 0.020 | 0.000 | 0.005 | 0.009 |

| a11 | 0.154 | 0.000 | 0.166 | 0.000 | 0.157 | 0.000 |

| a12 | 0.566 | 0.002 | 0.196 | 0.169 | −0.011 | 0.933 |

| a21 | −0.004 | 0.596 | 0.009 | 0.312 | 0.011 | 0.004 |

| a22 | 0.391 | 0.000 | 0.432 | 0.000 | 0.228 | 0.000 |

| g11 | 0.957 | 0.000 | 0.953 | 0.000 | 0.957 | 0.000 |

| g12 | 0.048 | 0.598 | 0.044 | 0.575 | −0.066 | 0.020 |

| g21 | −0.006 | 0.204 | −0.017 | 0.013 | −0.002 | 0.057 |

| g22 | 0.786 | 0.000 | 0.721 | 0.000 | 0.970 | 0.000 |

| d11 | 0.286 | 0.000 | 0.309 | 0.000 | 0.282 | 0.000 |

| d12 | 0.128 | 0.665 | 0.317 | 0.188 | 0.537 | 0.001 |

| d21 | 0.009 | 0.100 | 0.012 | 0.143 | −0.005 | 0.413 |

| d22 | 0.269 | 0.012 | 0.195 | 0.031 | −0.013 | 0.817 |

| H0: a21 = g21 = d21 = 0 | 4.288 | 0.232 | 7.778 | 0.051 | 8.586 | 0.035 |

| H0: a12 = g12 = d12 = 0 | 12.097 | 0.007 | 7.407 | 0.060 | 12.856 | 0.005 |

| Panel G: Return of resources sector and cryptocurrencies | ||||||

| SETRes-CI | SETRes-BTC | SETRes-ETH | ||||

| Estimate | p-value | Estimate | p-value | Estimate | p-value | |

| c11 | 0.001 | 0.000 | 0.001 | 0.001 | 0.001 | 0.000 |

| c21 | −0.002 | 0.341 | −0.002 | 0.720 | 0.000 | 0.873 |

| c22 | 0.011 | 0.000 | 0.018 | 0.000 | 0.008 | 0.000 |

| a11 | 0.169 | 0.000 | 0.183 | 0.000 | 0.161 | 0.000 |

| a12 | 0.332 | 0.000 | 0.323 | 0.000 | 0.177 | 0.029 |

| a21 | −0.010 | 0.065 | −0.019 | 0.014 | −0.001 | 0.928 |

| a22 | 0.301 | 0.000 | 0.351 | 0.000 | 0.251 | 0.000 |

| g11 | 0.951 | 0.000 | 0.951 | 0.000 | 0.955 | 0.000 |

| g12 | −0.068 | 0.011 | −0.032 | 0.472 | −0.058 | 0.013 |

| g21 | 0.005 | 0.031 | 0.011 | 0.099 | 0.001 | 0.725 |

| g22 | 0.920 | 0.000 | 0.816 | 0.000 | 0.956 | 0.000 |

| d11 | 0.326 | 0.000 | 0.292 | 0.000 | 0.302 | 0.000 |

| d12 | 0.391 | 0.003 | 0.145 | 0.409 | 0.312 | 0.022 |

| d21 | −0.021 | 0.008 | −0.001 | 0.923 | 0.005 | 0.520 |

| d22 | −0.122 | 0.035 | −0.030 | 0.849 | 0.044 | 0.464 |

| H0: a21 = g21 = d21 = 0 | 14.553 | 0.002 | 6.180 | 0.103 | 0.863 | 0.834 |

| H0: a12 = g12 = d12 = 0 | 42.256 | 0.000 | 20.029 | 0.000 | 14.075 | 0.003 |

| Panel H: Return of services sector and cryptocurrencies | ||||||

| SETSer-CI | SETSer-BTC | SETSer-ETH | ||||

| Estimate | p-value | Estimate | p-value | Estimate | p-value | |

| c11 | 0.002 | 0.000 | 0.001 | 0.000 | 0.001 | 0.000 |

| c21 | −0.009 | 0.068 | −0.002 | 0.610 | 0.002 | 0.281 |

| c22 | 0.023 | 0.000 | 0.020 | 0.000 | 0.003 | 0.178 |

| a11 | 0.243 | 0.000 | −0.015 | 0.812 | −0.039 | 0.311 |

| a12 | −0.329 | 0.103 | 0.375 | 0.003 | −0.534 | 0.000 |

| a21 | −0.018 | 0.003 | −0.014 | 0.078 | 0.012 | 0.016 |

| a22 | 0.195 | 0.003 | 0.426 | 0.000 | 0.187 | 0.000 |

| g11 | 0.935 | 0.000 | 0.955 | 0.000 | 0.961 | 0.000 |

| g12 | 0.190 | 0.081 | 0.137 | 0.057 | −0.073 | 0.001 |

| g21 | 0.003 | 0.607 | −0.002 | 0.814 | −0.003 | 0.002 |

| g22 | 0.729 | 0.000 | 0.736 | 0.000 | 0.972 | 0.000 |

| d11 | 0.261 | 0.000 | 0.371 | 0.000 | 0.338 | 0.000 |

| d12 | 0.771 | 0.002 | 0.270 | 0.215 | 0.348 | 0.022 |

| d21 | 0.000 | 0.999 | −0.009 | 0.350 | 0.006 | 0.323 |

| d22 | 0.495 | 0.000 | 0.228 | 0.012 | 0.144 | 0.000 |

| H0: a21 = g21 = d21 = 0 | 9.314 | 0.025 | 8.223 | 0.042 | 10.810 | 0.013 |

| H0: a12 = g12 = d12 = 0 | 17.722 | 0.001 | 16.387 | 0.001 | 49.222 | 0.000 |

| Panel I: Return of technology sector and cryptocurrencies | ||||||

| SETTech-CI | SETTech-BTC | SETTech-ETH | ||||

| Estimate | p-value | Estimate | p-value | Estimate | p-value | |

| c11 | 0.006 | 0.000 | 0.005 | 0.000 | 0.005 | 0.000 |

| c21 | 0.000 | 0.892 | 0.006 | 0.032 | −0.005 | 0.221 |

| c22 | 0.022 | 0.000 | 0.020 | 0.000 | 0.027 | 0.000 |

| a11 | 0.421 | 0.000 | 0.408 | 0.000 | 0.389 | 0.000 |

| a12 | 0.070 | 0.570 | 0.210 | 0.028 | −0.146 | 0.205 |

| a21 | −0.026 | 0.109 | −0.021 | 0.202 | −0.007 | 0.538 |

| a22 | 0.217 | 0.000 | 0.281 | 0.000 | 0.217 | 0.001 |

| g11 | 0.815 | 0.000 | 0.846 | 0.000 | 0.848 | 0.000 |

| g12 | −0.139 | 0.308 | −0.254 | 0.001 | 0.128 | 0.326 |

| g21 | 0.015 | 0.358 | −0.004 | 0.813 | 0.009 | 0.539 |

| g22 | 0.772 | 0.000 | 0.727 | 0.000 | 0.695 | 0.000 |

| d11 | 0.144 | 0.025 | 0.206 | 0.002 | 0.149 | 0.021 |

| d12 | 0.676 | 0.000 | 0.674 | 0.000 | 1.168 | 0.000 |

| d21 | 0.022 | 0.174 | 0.026 | 0.136 | 0.013 | 0.365 |

| d22 | 0.459 | 0.000 | 0.383 | 0.000 | 0.362 | 0.000 |

| H0: a21 = g21 = d21 = 0 | 6.669 | 0.083 | 5.331 | 0.149 | 2.387 | 0.496 |

| H0: a12 = g12 = d12 = 0 | 15.982 | 0.001 | 21.890 | 0.000 | 35.257 | 0.000 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, Y.; Lo, S.-t.; Sutthiphisal, D. Inter-Market Mean and Volatility Spillover Dynamics Between Cryptocurrencies and an Emerging Stock Market: Evidence from Thailand and Sectoral Analysis. Risks 2025, 13, 77. https://doi.org/10.3390/risks13040077

Zhang Y, Lo S-t, Sutthiphisal D. Inter-Market Mean and Volatility Spillover Dynamics Between Cryptocurrencies and an Emerging Stock Market: Evidence from Thailand and Sectoral Analysis. Risks. 2025; 13(4):77. https://doi.org/10.3390/risks13040077

Chicago/Turabian StyleZhang, Yanjia, Shih-tse Lo, and Dhanoos Sutthiphisal. 2025. "Inter-Market Mean and Volatility Spillover Dynamics Between Cryptocurrencies and an Emerging Stock Market: Evidence from Thailand and Sectoral Analysis" Risks 13, no. 4: 77. https://doi.org/10.3390/risks13040077

APA StyleZhang, Y., Lo, S.-t., & Sutthiphisal, D. (2025). Inter-Market Mean and Volatility Spillover Dynamics Between Cryptocurrencies and an Emerging Stock Market: Evidence from Thailand and Sectoral Analysis. Risks, 13(4), 77. https://doi.org/10.3390/risks13040077