The Role of Digital Financial Services in Narrowing the Gender Gap in Low–Middle-Income Economies: A Bayesian Machine Learning Approach

Abstract

1. Introduction

2. Review of the Existing Literature

2.1. Theoretical Frameworks

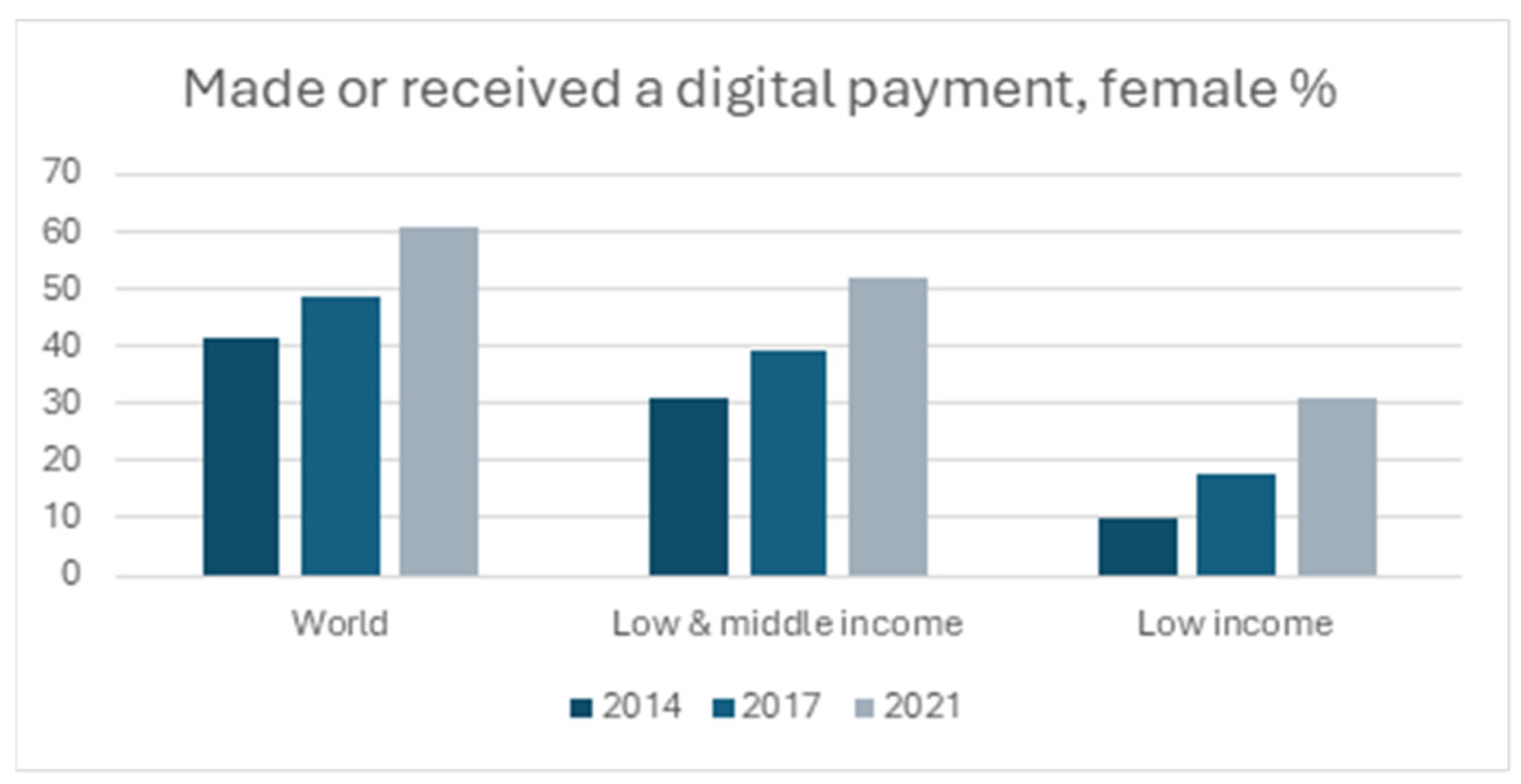

2.2. Gender Gap in Emerging Economies

3. Methodology

3.1. Data Source and Sample Selection

3.2. Variables

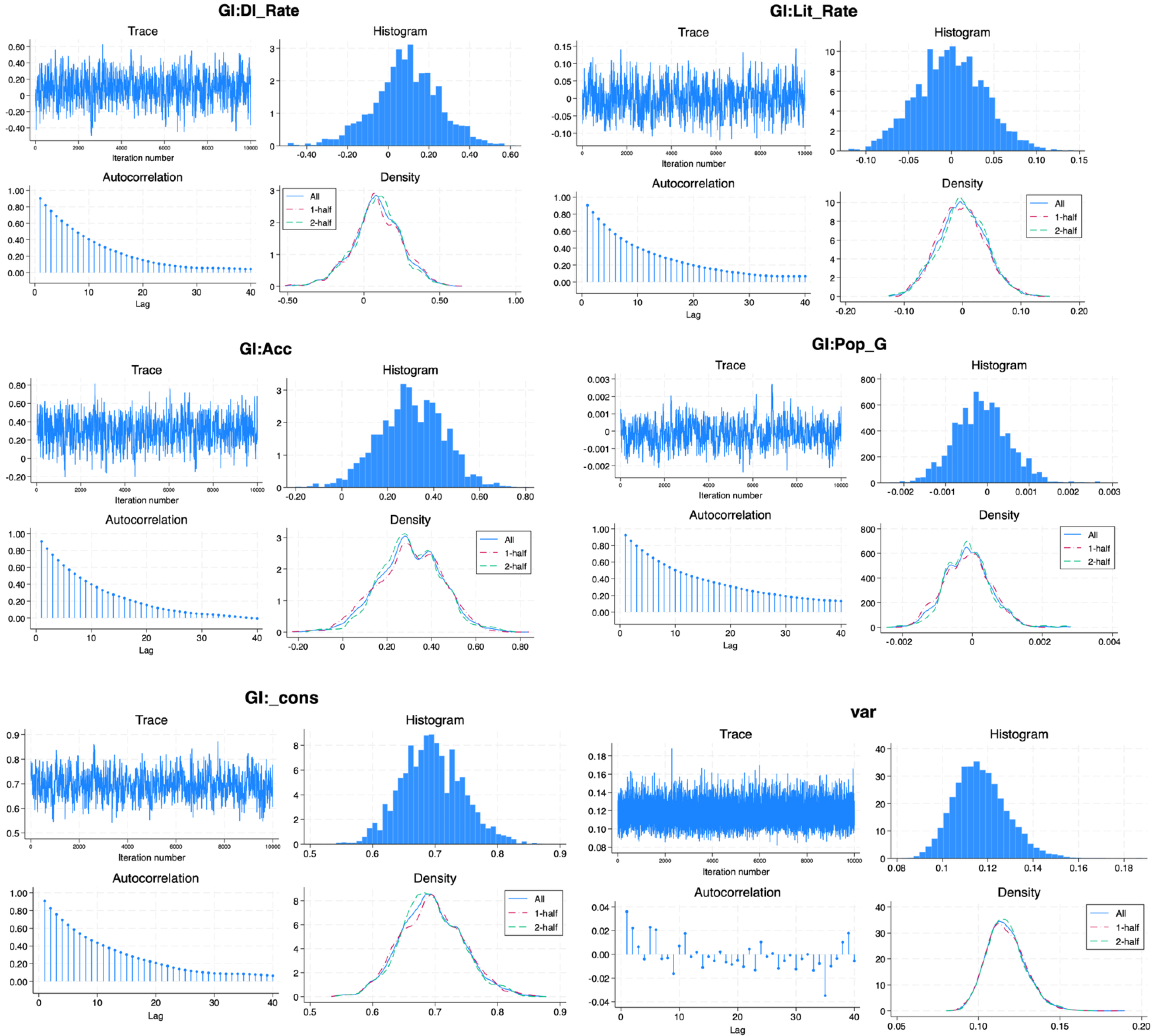

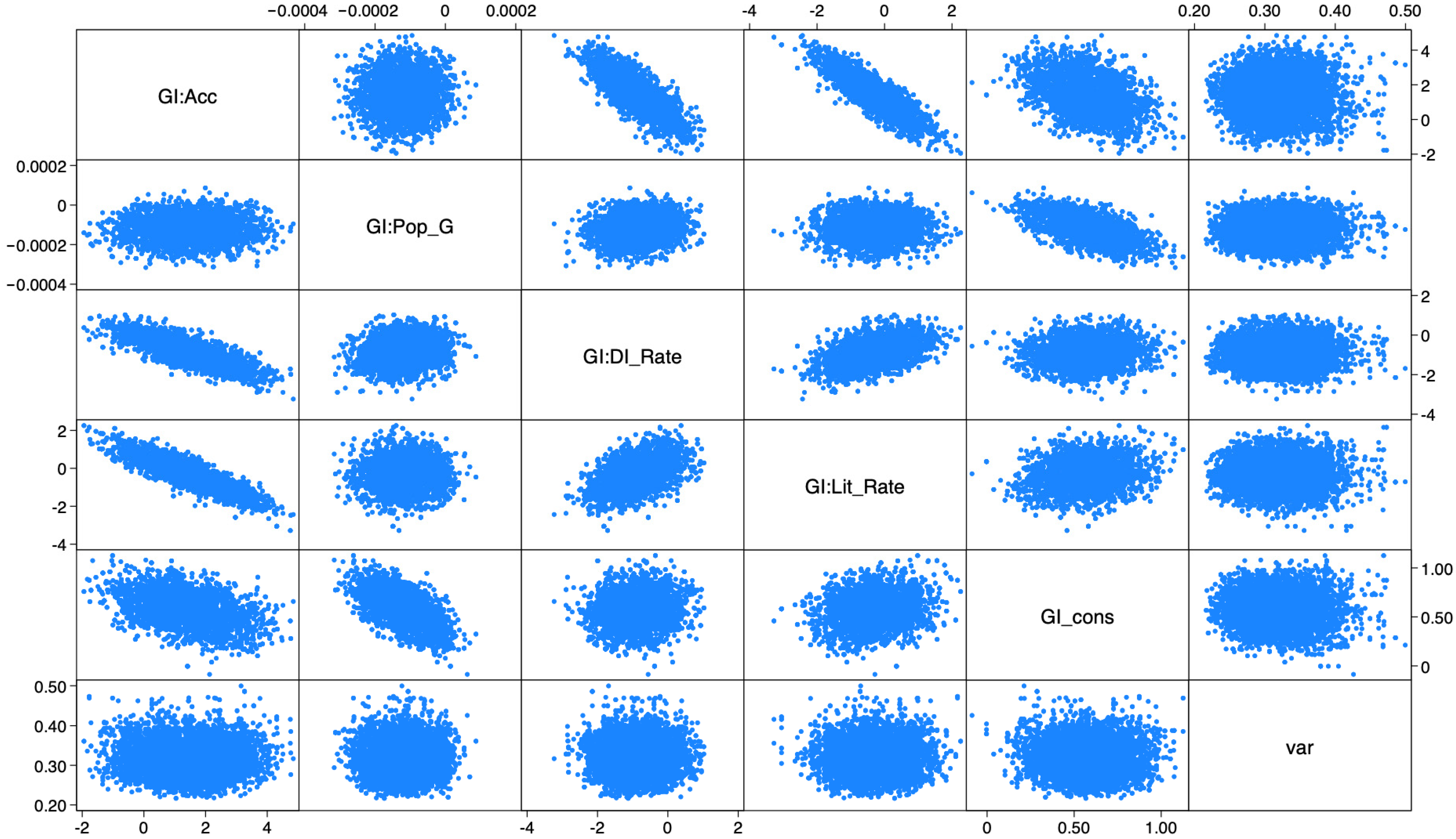

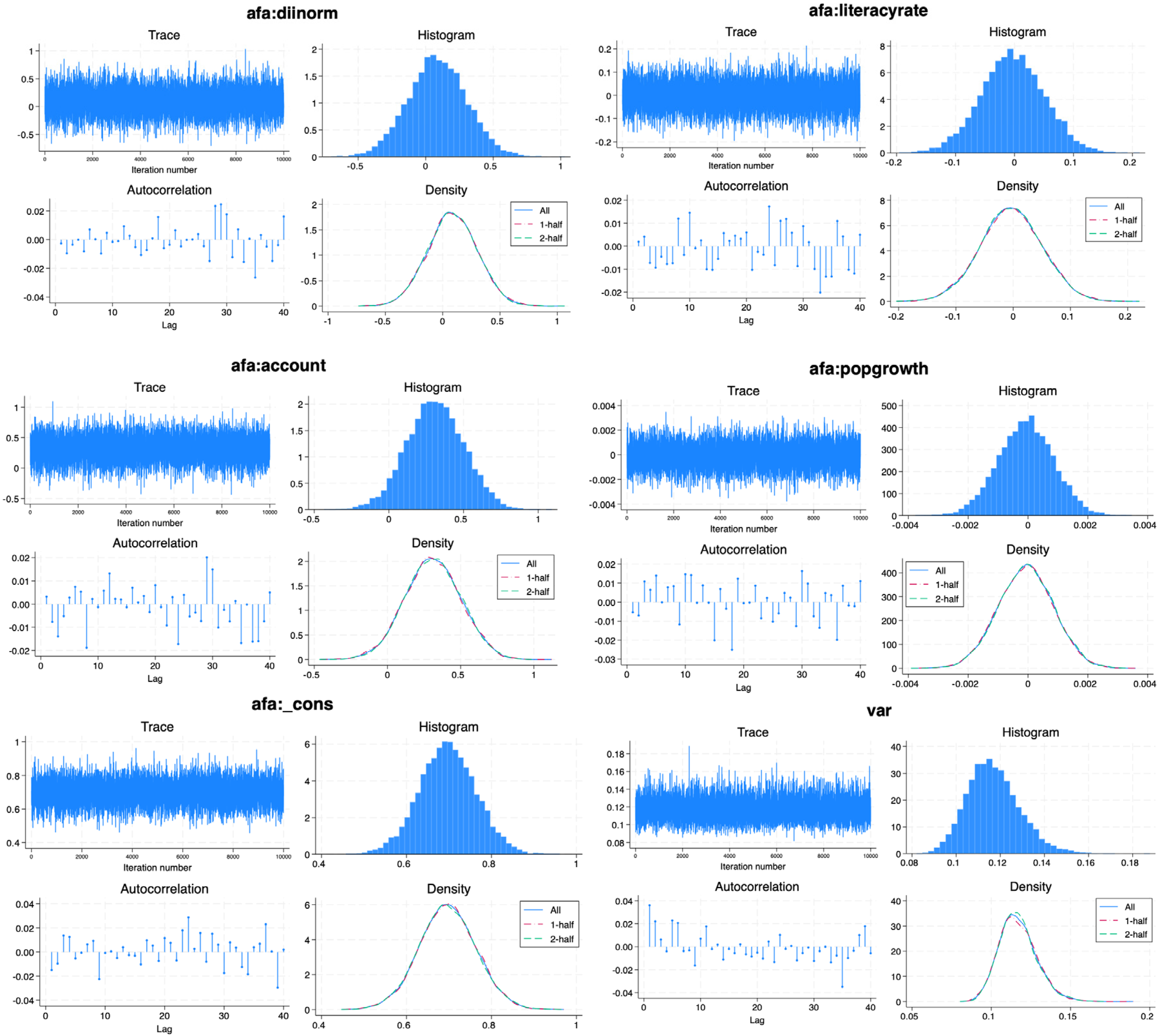

3.3. Method

- {afa:account} ~ zellnersg(6,182,0,{var})

- {afa:diinorm} ~ zellnersg(6,182,0,{var})

- {afa:literacyrate} ~ zellnersg(6,182,0,{var})

- {afa:popgrowth} ~ zellnersg(6,182,0,{var})

- {afa:_cons} ~ zellnersg(6,182,0,{var})

4. Empirical Results

5. Discussion

6. Conclusions

- a.

- Promote financial literacy initiatives integrated with gender empowerment strategies.

- b.

- Design inclusive digital financial products that reflect women’s needs.

- c.

- Strengthen the capacity of financial institutions to support gender-inclusive digital services.

- d.

- Expand gender-sensitive technological infrastructure in underserved regions.

- e.

- Align national digital financial inclusion strategies with gender equality goals.

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

| 1 | A prior distribution is conjugate for a family of likelihood distributions if the prior and posterior distributions belong to the same family of distributions. For example, the gamma distribution is a conjugate prior to the Poisson likelihood. Conjugacy may provide an efficient way of sampling from posterior distributions and is used in Gibbs sampling (Stata 2023). |

References

- Adegbite, Olayinka, and Charles. L. Machethe. 2020. Bridging the financial inclusion gender gap in smallholder agriculture in Nigeria: An untapped potential for sustainable development. World Development 127: 104755. [Google Scholar] [CrossRef]

- Ahang, Mohammadreza. 2014. The impact of gender inequality on economic growth in developed countries. Advances in Environmental Biology 8: 508–13. [Google Scholar]

- Aker, Jenny C., Richard Boumnijel, Amanda McClelland, and Niall Tierney. 2016. Payment mechanisms and antipoverty programs: Evidence from a mobile money cash transfer experiment in Niger. Economic Development and Cultural Change 65: 1–37. [Google Scholar] [CrossRef]

- Altuzarra, Amaia, Catalina Gálvez-Gálvez, and Ana González-Flores. 2021. Is gender inequality a barrier to economic growth? A panel data analysis of developing countries. Sustainability 13: 367. [Google Scholar] [CrossRef]

- Andaregie, Adino, Gumataw Kifle Abebe, Prashant Gupta, Gardachew Worku, Hideyuki Matsumoto, Tessema Astatkie, and Isao Takagi. 2024. Exploring individuals’ socioeconomic characteristics and digital infrastructure determinants of digital payment adoption in Ethiopia. Digital Business 4: 100092. [Google Scholar] [CrossRef]

- Armand, Alex, Orazio Attanasio, Pedro Carneiro, and Valérie Lechene. 2020. The effect of gender-targeted conditional cash transfers on household expenditures: Evidence from a randomized experiment. The Economic Journal 130: 1875–97. [Google Scholar] [CrossRef]

- Bali Swain, Ranjula, and Aloys Nsabimana. 2024. Financial inclusion and nutrition among rural households in Rwanda. European Review of Agricultural Economics 51: 506–32. [Google Scholar] [CrossRef]

- Baliamoune-Lutz, Mina. 2007. Globalisation and gender inequality: Is Africa different? Journal of African Economies 16: 301–48. [Google Scholar] [CrossRef]

- Balliester Reis, Tatiana. 2022. Socio-economic determinants of financial inclusion: An evaluation with a microdata multidimensional index. Journal of International Development 34: 587–611. [Google Scholar] [CrossRef]

- Becker, Gary S. 1962. Investment in human capital: A theoretical analysis. Journal of Political Economy 70: 9–49. [Google Scholar] [CrossRef]

- Binsuwadan, Jameel, Mohammed Elhaj, Jamal Bousrih, Fatma Mabrouk, and Huda Alofaysan. 2024. The Relationship between Financial Inclusion and Women’s Financial Worries: Evidence from Saudi Arabia. Sustainability 16: 8317. [Google Scholar] [CrossRef]

- Biswas, Sutapa. 2021. Effect of mobile financial services on financial behavior in developing economies-Evidence from India. Working Paper arXiv arXiv:2109.07077. [Google Scholar]

- Canton, Helen. 2021. United Nations entity for gender equality and the empowerment of women—UN women. In The Europa Directory of International Organizations 2021. London: Routledge, pp. 185–88. [Google Scholar]

- Chirwa, Gowokani Chijere, and Lucky Chiwaula. 2022. Socioeconomic inequalities in household resilience capacity in the context of COVID-19 in the fisheries sector in Malawi. Agrekon 61: 266–81. [Google Scholar] [CrossRef]

- Cicchiello, Cicchiello, Antonella Fiorella, Amir Kazemikhasragh, Simona Monferrá, and Alicia Girón. 2021. Financial inclusion and development in the least developed countries in Asia and Africa. Journal of Innovation and Entrepreneurship 10: 1–13. [Google Scholar] [CrossRef]

- Cuberes, David, and Marc Teignier. 2014. Gender inequality and economic growth: A critical review. Journal of International Development 26: 260–76. [Google Scholar] [CrossRef]

- Demirgüç-Kunt, Asli, Leora Klapper, Dorothe Singer, and Saniya Ansar. 2022. The Global Findex Database 2021: Financial Inclusion, Digital Payments, and Resilience in The Age of COVID-19. Washington, DC: World Bank Publications. [Google Scholar]

- Donovan, Kevin P. 2012. Mobile money for financial inclusion. In Information and Communications for Development 2012: Maximizing Mobile. Washington, DC: The World Bank, pp. 61–73. [Google Scholar] [CrossRef]

- Duvendack, Maren, Lina Sonne, and Supriya Garikipati. 2023. Gender inclusivity of India’s digital financial revolution for attainment of SDGs: Macro achievements and the micro experiences of targeted initiatives. The European Journal of Development Research 35: 1369–91. [Google Scholar] [CrossRef]

- Eagly, Alice H., and Steven J. Karau. 2002. Role congruity theory of prejudice toward female leaders. Psychological Review 109: 573. [Google Scholar] [CrossRef]

- Ebong, Justine, and Babu George. 2021. Financial inclusion through digital financial services (dfs): A study in uganda. Journal of Risk and Financial Management 14: 393. [Google Scholar] [CrossRef]

- Gelfand, Alan E., and Adrian F. M. Smith. 1990. Sampling based approaches to calculating marginal densities. Journal of the American Statistical Association 85: 398–409. [Google Scholar] [CrossRef]

- Gelman, Andrew, John B. Carlin, Hal S. Stern, Donald B. Dunson, Aki Vehtari, and Donald B. Rubin. 2013. Bayesian Data Analysis, 3rd ed. Boca Raton: CRC Press. [Google Scholar]

- Ghosh, Saibal. 2022. Gender and financial inclusion: Does technology make a difference? Gender, Technology and Development 26: 195–213. [Google Scholar] [CrossRef]

- Ghosh, Chandreyee, and Ranjan Hom Chaudhury. 2022. Determinants of digital finance in India. Innovation and Development 12: 343–62. [Google Scholar] [CrossRef]

- Goel, Abhishek. 2023. Trends and reforms of financial inclusion in India. International Review of Applied Economics 37: 275–85. [Google Scholar] [CrossRef]

- Greco, Salvatore, Alexis Ishizaka, Maria Tasiou, and Giuseppe Torrisi. 2019. On the methodological framework of composite indices: A review of the issues of weighting, aggregation, and robustness. Social Indicators Research 141: 61–94. [Google Scholar] [CrossRef]

- Gujarati, Damodar N. 2002. Basic Econometrics, 4th ed. Available online: https://zalamsyah.staff.unja.ac.id/wp-content/uploads/sites/286/2019/11/7-Basic-Econometrics-4th-Ed.-Gujarati.pdf (accessed on 10 January 2025).

- Hasler, Andrea, and Annamaria Lusardi. 2017. The Gender Gap in Financial Literacy: A Global Perspective. Washington, DC: Global Financial Literacy Excellence Center, The George Washington University School of Business, pp. 2–16. [Google Scholar]

- Hastings, W. Keith. 1970. Monte Carlo Sampling Methods Using Markov Chains and Their Applications. Biometrika 57: 97–109. [Google Scholar] [CrossRef]

- Hoff, Peter. 2009. A First Course in Bayesian Statistical Methods. New York: Springer, vol. 580. [Google Scholar]

- Jack, William, and Tavneet Suri. 2014. Risk sharing and transactions costs: Evidence from Kenya’s mobile money revolution. American Economic Review 104: 183–223. [Google Scholar] [CrossRef]

- Jain, Yogendra Kuma, and Santosh Kumar Bhandare. 2011. Min max normalization based data perturbation method for privacy protection. International Journal of Computer and Communication Technology 2: 45–50. [Google Scholar] [CrossRef]

- Kazemikhasragh, Amir, Antonella F. Cicchiello, Simona Monferrá, and Alicia Girón. 2022. Gender inequality in financial inclusion: An exploratory analysis of the Middle East and North Africa. Journal of Economic Issues 56: 770–81. [Google Scholar] [CrossRef]

- Khare, Shweta, Vikas Bharti, and Pooja Jain. 2024. Impact Of Digital Financial Inclusion on Women Empowerment: A Study of Satna District. Educational Administration: Theory and Practice 30: 5849–59. [Google Scholar]

- Khera, Purva, Megumi S. Ogawa, and Ratna Sahay. 2021. Is Digital Financial Inclusion Unlocking Growth? Washington, DC: International Monetary Fund. [Google Scholar]

- Klasen, Stephan, and Claudia Wink. 2003. “Missing women”: Revisiting the debate. Feminist Economics 9: 263–99. [Google Scholar] [CrossRef]

- Kruschke, John K. 2015. Doing Bayesian Data Analysis: A Tutorial with R, JAGS, and Stan, 2nd ed. Cambridge, MA: Academic Press. [Google Scholar]

- Le Quoc, Duy. 2024. The relationship between digital financial inclusion, gender inequality, and economic growth: Dynamics from financial development. Journal of Business and Socio-Economic Development 4: 370–88. [Google Scholar] [CrossRef]

- Lee, Jean N., Jonathan Morduch, Saravana Ravindran, Abu Shonchoy, and Hussain Zaman. 2021. Poverty and migration in the digital age: Experimental evidence on mobile banking in Bangladesh. American Economic Journal: Applied Economics 13: 38–71. [Google Scholar] [CrossRef]

- McElreath, Richard. 2020. Statistical Rethinking: A Bayesian Course with Examples in R and Stan, 2nd ed. Boca Raton: CRC Press. [Google Scholar]

- Metropolis, Nicholas, Arianna W. Rosenbluth, Marshall N. Rosenbluth, Augusta H. Teller, and Edward Teller. 1953. Equations of state calculations by fast computing machines. Journal of Chemical Physics 21: 1087–92. [Google Scholar] [CrossRef]

- Muchandigona, Anthony K., and Benjamin M. Kalema. 2023. The catalytic role of mobile banking to improve financial inclusion in developing countries. International Journal of E-Services and Mobile Applications (IJESMA) 15: 1–21. [Google Scholar] [CrossRef]

- Mukong, Anthony K., and Emma M. Amadhila. 2021. Financial inclusion and household wellbeing in Namibia. Southern African Business Review 25: 1–21. [Google Scholar] [CrossRef]

- Oanh, Tran Thi Kim. 2024. Digital financial inclusion in the context of financial development: Environmental destruction or the driving force for technological advancement. Borsa Istanbul Review 24: 292–303. [Google Scholar] [CrossRef]

- Oanh, Tran Thi Kim, and Le Quang Dinh. 2024. Digital financial inclusion, financial stability, and sustainable development: Evidence from a quantile-on-quantile regression and wavelet coherence. Sustainable Development 32: 6324–38. [Google Scholar] [CrossRef]

- Odeniran, Solomon O., and Emmanuel A. Udeaja. 2010. Financial sector development and economic growth: Empirical evidence from Nigeria. Economic and Financial Review 48: 91–124. [Google Scholar]

- OECD. 2008. Handbook on Constructing Composite Indicators: Methodology and User Guide. Paris: OECD Publishing. [Google Scholar] [CrossRef]

- Osei-Tutu, Frederick, and Laurent Weill. 2021. Sex, language and financial inclusion. Economics of Transition and Institutional Change 29: 369–403. [Google Scholar] [CrossRef]

- Ozili, Peterson K. 2018. Impact of digital finance on financial inclusion and stability. Borsa Istanbul Review 18: 329–40. [Google Scholar] [CrossRef]

- Peng, Xiaoyan, Yuhan Fu, and Xinyi Zou. 2024. Gender equality and green development: A qualitative survey. Innovation and Green Development 3: 100089. [Google Scholar] [CrossRef]

- Reynolds, Travis W., Paul E. Biscaye, Leigh Anderson, Cally O’Brien-Carelli, and Jennifer Keel. 2023. Exploring the gender gap in mobile money awareness and use: Evidence from eight low and middle income countries. Information Technology for Development 29: 228–55. [Google Scholar] [CrossRef]

- Roberts, Gareth O., and Jeffrey S. Rosenthal. 2001. Optimal scaling for various Metropolis-Hastings algorithms. Statistical Science 16: 351–67. [Google Scholar] [CrossRef]

- Rosen, Sherwin. 1976. A theory of life earnings. Journal of political Economy 84 (Part 2): S45–S67. [Google Scholar] [CrossRef]

- Ross, Stephen A. 2004. Compensation, incentives, and the duality of risk aversion and riskiness. The Journal of Finance 59: 207–25. [Google Scholar] [CrossRef]

- Roy, Pratibha, and Bibhunandini Patro. 2022. Financial inclusion of women and gender gap in access to finance: A systematic literature review. Vision 26: 282–99. [Google Scholar] [CrossRef]

- Schumpeter, Joseph A. 1912. The Theory of Economic Development. Cambridge, MA: Harvard University Press. [Google Scholar]

- Seguino, Stephanie, and Maria S. Floro. 2003. Does gender have any effect on aggregate saving? An empirical analysis. International Review of Applied Economics 17: 147–66. [Google Scholar]

- Sen, Amartya. 1995. Gender inequality and theories of justice. In Women, Culture and Development: A Study of Human Capabilities. Oxford: Clarendon Press, pp. 259–73. [Google Scholar] [CrossRef]

- Shephard, Ronald. W. 1970. Proof of the law of diminishing returns. Zeitschrift für Nationalökonomie 30: 7–34. [Google Scholar] [CrossRef]

- Siwela, Gift, and Tauya Njaya. 2021. Opportunities and challenges for digital financial inclusion of females in the informal sector through mobile phone technology: Evidence from Zimbabwe. International Journal of Economics, Commerce and Management 9: 60–78. [Google Scholar]

- Suri, Tavneet, and William Jack. 2016. The long-run poverty and gender impacts of mobile money. Science 354: 1288–92. [Google Scholar] [CrossRef]

- Trung, Nguyen Duc, and Nguyen Thi Ngoc Quynh. 2022. The Determinants of Financial Inclusion in Asia—A Bayesian Approach. Paper presented at International Econometric Conference of Vietnam, Ho Chi Minh City, Vietnam, January 10–12; Cham: Springer International Publishing, pp. 531–46. [Google Scholar]

- UN Women. 2024. Facts and Figures: Women’s Leadership and Political Participation. Available online: https://www.unwomen.org/en/what-we-do/leadership-and-political-participation/facts-and-figures#_edn2 (accessed on 10 January 2025).

- Van de Schoot, Rens, and Sarah Depaoli. 2014. Bayesian analyses: Where to start and what to report. European Health Psychologist 16: 75–84. [Google Scholar]

- Van de Schoot, Rens, Sarah Depaoli, Ruth King, Bernd B. Kramer, Krista Märtens, Mulugeta G. Tadesse, Marina Vannucci, Andrew Gelman, Don Veen, Janneke Willemsen, and et al. 2021. Bayesian Statistics and Modelling. Nature Reviews Methods Primers 1: 1–26. [Google Scholar] [CrossRef]

- Women’s World Banking. 2017. Accelerating Women’s Opportunity: Women’s World Banking’s 2016 Annual Report. Available online: https://www.womensworldbanking.org/insights/accelerating-womens-opportunity-womens-world-bankings-2016-annual-report/ (accessed on 10 January 2025).

- World Bank Group. 2014. Digital Financial Inclusion. Available online: https://www.worldbank.org/en/topic/financialinclusion/publication/digital-financial-inclusion (accessed on 10 January 2025).

- World Bank Group. 2024. CPIA Database. Interactive Data. World Bank Group. Available online: http://www.worldbank.org/ida (accessed on 1 November 2024).

- Zellner, Arnold. 1986. On Assessing Prior Distributions and Bayesian Regression Analysis with g-Prior Distributions. The American Statistician 49: 327–35. [Google Scholar]

| Income Classification | Country | CPIA Gender Equality Rating | Literacy Rate |

|---|---|---|---|

| Low income | Afghanistan Burkina Faso Burundi Central African Republic Chad Congo, Dem. Rep. Ethiopia Gambia Guinea Liberia Madagascar Malawi Mali Mozambique Niger Rwanda Sierra Leone Somalia South Sudan Sudan Syrian Arab Republic Togo Uganda Yemen, Rep. Nigeria Pakistan Philippines Senegal Sri Lanka Tajikistan Tanzania Tunisia Ukraine Uzbekistan Vietnam West Bank and Gaza Zambia Zimbabwe | 2.97 | 0.91 |

| Lower-Middle income | Algeria Angola Bangladesh Belize Benin Bhutan Bolivia Cambodia Cameroon Comoros Congo, Rep. Cote d’Ivoire Djibouti Egypt, Arab Rep. El Salvador Eswatini Ghana Haiti Honduras India Indonesia Iran, Islamic Rep. Kenya Kyrgyz Republic Lao PDR Lesotho Mauritania Mongolia Morocco Myanmar Nepal Nicaragua | 3.42 | 0.96 |

| Variable | Symbol | Measurements | Studies | Data Source |

|---|---|---|---|---|

| Gender Inclusion | GI | Female Account per total Account (%) | Binsuwadan et al. (2024) Ghosh (2022) Kazemikhasragh et al. (2022) | Global Findex Database |

| Digital Financial Services | DI_Rate | data | Khera et al. (2021) Oanh (2024) | |

| (+) Mobile money account | Store money using a mobile money account (% age 15+) | Global Findex Database | ||

| (+) Store money in Financial Institutions | Store money using a financial institution or a mobile money account (% age 15+) | |||

| (+) Internet access | Number of respondents who have access to the Internet (% age 15+) | Duvendack et al. (2023) | Global Findex Database | |

| (+) Mobile phone owned | Number of respondents who report having a mobile phone (% age 15+) | Adegbite and Machethe (2020) | Global Findex Database | |

| (+) Savings | Number of respondents to report saved any money (% age 15+) | Global Findex Database | ||

| (+) Savings in Financial Institutions | Saved at a financial institution (% age 15+) | Global Findex Database | ||

| (+) Made or received a digital payment | Number of respondents who report using a mobile phone to make an in-store purchase (% age 15+) | Global Findex Database | ||

| (+) Mobile phone or Internet for buying | Number of respondents who report using a mobile phone or the Internet to buy something online (% age 15+) | Global Findex Database | ||

| Literacy Rate-GPI | Lit_Rate | Female youth literacy rate by male youth literacy rate (%) | Dinh Le Quoc (2024) | Global Findex Database/UNESCO UIS |

| Account | Acc | The percentage of respondents who report having an account (% age 15+) | Osei-Tutu and Weill (2021) | Global Findex Database |

| Population Growth | Pop_G | Growth rate of population (%) | Khera et al. (2021) | Global Findex Database |

| Variable | Mean | St. Dev | Min | Max |

|---|---|---|---|---|

| GI | 0.8470523 | 0.1532126 | 0.2592067 | 1.269537 |

| DI_Rate | 0.3416872 | 0.2008907 | 0 | 0.99 |

| Lit_Rate | 0.358656 | 0.4674435 | 0 | 1.12797 |

| Acc | 0.3425926 | 0.2080077 | 0.02 | 0.98 |

| Pop_G | 4.235292 | 4.235292 | −0.9992877 | 277.0795 |

| Variable | GI | DI_Rate | Lit_Rate | Acc | Pop_G |

|---|---|---|---|---|---|

| GI | 1 | ||||

| DI_Rate | 0.4337 | 1 | |||

| Lit_Rate | 0.0075 | 0.0195 | 1 | ||

| Acc | 0.5139 | 0.7505 | 0.0391 | 1 | |

| Pop_G | −0.0073 | −0.0802 | 0.0316 | 0.0262 | 1 |

| Variable | Mean | DI_Rate | MCSE | Median | Equal-Tailed [95% Cred. Interval] |

|---|---|---|---|---|---|

| GI | |||||

| DI_Rate | 0.0919953 | 0.1621634 | 0.004319 | 0.0953441 | −0.2319634 0.4024003 |

| Lit_Rate | −0.0043291 | 0.0387926 | 0.001162 | −0.0041637 | −0.0820125 0.0714688 |

| Acc | 0.3021888 | 0.1394391 | 0.003894 | 0.2970842 | 0.0446531 0.5884508 |

| Pop_G | −0.0000594 | 0.0006883 | 0.000019 | −0.000055 | −0.001413 0.0012678 |

| _cons | 0.6941485 | 0.0490471 | 0.001263 | 0.6950046 | 0.5979605 0.7879403 |

| var | 0.0632917 | 0.0067135 | 0.000088 | 0.0628543 | 0.0514982 0.0776233 |

| Acceptance rate | 0.2956 | ||||

| Efficiency: min | 0.03715 | ||||

| Max Gelman–Rubic Rc | 1.004 |

| Variable | Mean | Std. dev. | MCSE | Median | Equal-Tailed [95% Cred. Interval] |

|---|---|---|---|---|---|

| GI | |||||

| DI_Rate | 0.0880905 | 0.0802286 | 0.000465 | 0.088698 | −0.0702587 0.245884 |

| Lit_Rate | −0.0033275 | 0.0199937 | 0.000115 | −0.0033316 | −0.0425002 0.0356738 |

| Acc | 0.3083626 | 0.0704196 | 0.000409 | 0.3085798 | 0.1699415 0.445755 |

| Pop_G | −0.0000469 | 0.0003459 | 0.000002 | −0.0000464 | −0.0007282 0.0006282 |

| _cons | 0.6971572 | 0.024634 | 0.000144 | 0.6970453 | 0.6491998 0.7457561 |

| var | 0.015837 | 0.0017085 | 0.00001 | 0.0157286 | 0.0128338 0.0195375 |

| Acceptance rate | 1 | ||||

| Efficiency: min | 0.9482 | ||||

| Max Gelman–Rubic Rc | 1 |

| Variable | Mean | Std. dev. | MCSE | Median | Equal-Tailed [95% Cred. Interval] |

|---|---|---|---|---|---|

| GI | |||||

| DI_Rate | 0.0872083 | 0.080806 | 0.000467 | 0.0871589 | −0.0718764 0.2457907 |

| Lit_Rate | −0.003545 | 0.0200914 | 0.000116 | −0.0035696 | −0.0430178 0.0361962 |

| Acc | 0.3083626 | 0.0704196 | 0.000409 | 0.3085798 | 0.1699415 0.445755 |

| Pop_G | −0.0000491 | 0.0003431 | 0.000002 | −0.0000496 | −0.0007276 0.0006253 |

| _cons | 0.6971409 | 0.0248132 | 0.000143 | 0.6970774 | 0.6486775 0.7460495 |

| var | 0.0158275 | 0.0017006 | 0.00001 | 0.0157097 | 0.0128278 0.0195195 |

| T | Mean | St. Dev | E(T_obs) | P(T > = T_obs) |

|---|---|---|---|---|

| mean | 0.8513027 | 0.0131687 | 0.8470523 | 0.6268333 |

| ymin | 0.4660853 | 0.0592368 | 0.2592067 | 0.9965 |

| ymax | 1.267583 | 0.0670759 | 1.269537 | 0.4440333 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Galindo-Manrique, A.F.; Rojas-Vargas, N.P. The Role of Digital Financial Services in Narrowing the Gender Gap in Low–Middle-Income Economies: A Bayesian Machine Learning Approach. Risks 2025, 13, 96. https://doi.org/10.3390/risks13050096

Galindo-Manrique AF, Rojas-Vargas NP. The Role of Digital Financial Services in Narrowing the Gender Gap in Low–Middle-Income Economies: A Bayesian Machine Learning Approach. Risks. 2025; 13(5):96. https://doi.org/10.3390/risks13050096

Chicago/Turabian StyleGalindo-Manrique, Alicia Fernanda, and Nuria Patricia Rojas-Vargas. 2025. "The Role of Digital Financial Services in Narrowing the Gender Gap in Low–Middle-Income Economies: A Bayesian Machine Learning Approach" Risks 13, no. 5: 96. https://doi.org/10.3390/risks13050096

APA StyleGalindo-Manrique, A. F., & Rojas-Vargas, N. P. (2025). The Role of Digital Financial Services in Narrowing the Gender Gap in Low–Middle-Income Economies: A Bayesian Machine Learning Approach. Risks, 13(5), 96. https://doi.org/10.3390/risks13050096