Abstract

This paper aimed to investigate the effects of government borrowing banks’ capital structure using a sample of banks registered in South Africa from 2012 to 2021. Despite the extensive literature on this association, few prominent researchers have studied this phenomenon in the banking sector. Applying the generalised method of moments (GMM) model, the study established a positive but significant effect on the South African banks’ capital structure from total government borrowing, local government borrowing and foreign government borrowing, and capital structure. Contrary to the crowding-out effects detected, the results revealed a positive and significant relationship between government borrowing and banks’ capital structure. The crowding-in effect better explains these results, where government borrowing stimulates the local market for goods and services, motivating banks to borrow more in order to meet the demand for loans. Future research should test the cointegrating and causality relationship between government borrowing and bank capital structure. Also, given that the banking sector is constrained by Basel III’s capital adequacy requirement, controlling for this factor is critical in future research.

1. Introduction

The literature has examined several theoretical and empirical factors that determine capital structure. These factors that determine capital structure include risk, size, profitability, the tangibility of assets, growth potential, and debt versus non-debt tax shielding. The two main underlying theories to explain these determinants include the trade-off theory (Kraus and Litzenberger 1973) and the pecking order theory (Myers and Majluf 1984). According to the trade-off hypothesis, firms balance the costs and benefits of debt and adjust toward an optimal debt ratio (Kraus and Litzenberger 1973). In the pecking order theory, it is argued that the information asymmetry amongst managers and shareholders affects the cost of financing (Myers and Majluf 1984). However, government borrowing is a new factor deemed to influence company leverage (Akkoyun 2018; Demirci et al. 2019; Gao et al. 2022).

However, government borrowing (GB) can play an essential part in dealing with the economic crisis in the short term. Yet, it may crowd out private investment in the long run (Ayturk 2017). An escalation in government debt supply might decrease investors’ demand for a firm’s debt compared to equity. Meanwhile, government debt is a better substitute for a firm’s debt than equity (Demirci et al. 2019). Hence, firms might regulate the capital structure and decrease their leverage. Friedman (1978) argued that if investors have an inadequate supply of funds and have favourites for the precise kinds of securities, for example, long-term versus short-term, government debt could affect a firm’s financing.

Prior research on global capital structure examines the association between GB and capital structure; however, the empirical studies have contradictory findings. For instance, Bahal et al. (2018) explored whether public investment remained excessive or insufficient before 1980. Utilising investment project data from the CapEx-CMIE, they also created a new data set of average public and private investment in India from 1996 to 2015. Their findings suggest that public investment may have crowded out commercial investment in India from 1950 to 2012. Yet, from 1980 to 2012, their results supported crowding in capital funding. Furthermore, their analysis revealed that crowding is confirmed by their quarterly model, which uses investment project datasets from CapEx-CMIE from 1996 to 2015.

Similarly, Ayturk (2017) looked into the connection between GB and corporate finance choices in 15 major European nations from 1989 to 2014. Using a country-level aggregate and a fixed-effects panel data model with aggregate flow data, they found a robust negative relationship between GB and company debt in advanced European countries. Furthermore, research revealed that the long-term debt of major credit-worthy enterprises is more complex than government debt in comparison to small, economically hampered firms. This suggests that long-term corporate debt issued by creditworthy companies is a better substitute for government bonds (Ayturk 2017).

Graham et al. (2014) studied the effect of government debt on commercial financing and investment in the United States. Their study discovers an insignificant link between government debt and company equity regulations. Nonetheless, they find a substantial positive link between government debt, corporate cash, and other short-term cash reserves, such as treasuries. Ayturk (2017) explored only a simple connection between GB and corporate funding. Yet, Graham et al. (2014) evaluated the impact of government debt on commercial financing and investments. What is not clear at the present moment is whether the transmission mechanism occurs when GB reduces the money supply, raises interest rates, and finally affects capital structure. Therefore, the study aims to determine the effect of GB on the capital structure of South Africa from 2012 to 2021.

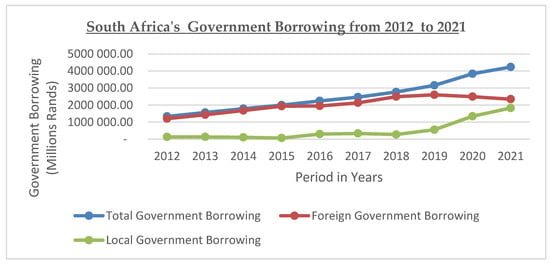

In this paper, total government borrowing (TGB), local government borrowing (LGB), and foreign government borrowing (FGB) were utilised to measure GB. As a result, Figure 1 examines the trends in South Africa’s average government borrowings from 2012 to 2021.

Figure 1.

Source: author’s own compilation based on the data extracted from SARB.

TGB rose from R1,334,110 in 2012 to R4,230,630 in 2021, based on Figure 1. FGB has increased from R1,202,942 in 2012 to R2,343,843 in 2021. Similarly, borrowing by local governments rose from R1,311,680 in 2012 to R1,827,764 in 2008. Previous research on global capital structure investigates the link between GB and capital structure (Gao et al. 2022; Demirci et al. 2019; Akkoyun 2018; Ayturk 2017; Graham et al. 2014). However, they found contradictory results. Friedman (1978) argued that it is vital to appreciate one probable impact of GB on corporate financing, denoted as financial crowding-out. In contrast, public capital is possibly utilised by increasing productive ability, a crowding effect. Yet, public capital typically complements private capital in the production and distribution of private output; a crowding-in effect. Although its impact has been studied, no consensus has been reached on its reality, primarily because of the empirical identification problems. Hence, this study investigates the effect of GB on bank capital structure in South Africa from 2012 to 2021.

The research hypothesis in this paper is explained as follows: H1: Does government borrowing influence banks’ capital structure?

FGB constitutes 80 percent of the GDP, while local government constitutes 20 percent of the GDP. Eighty percent of FGB implies that the government borrows 80 percent from foreign borrowings, and as FGB does not crowd out a local market, this condition may result in a crowding-in effect. Yet, 20 percent of the LCB implies that the government borrows 20 percent from domestic companies. This study contributes to the existing empirical literature on the relationship between GB and the capital structure of banks, using data drawn from registered banks in South Africa, as the capital structure of banks differs from that of non-financial firms. Previous studies focused on the determinants of capital structure have excluded financial firms (see, for example, scholars such as Jaworski and Czerwonka 2021; Kuč and Kaličanin 2021; Gharaibeh and Saqer 2020; Shahzad et al. 2021). The reason for excluding financial enterprises from capital structure research has been either because they are governed firms or because they have inherent key variables, like having charges or deposits as additional sources of funding (Sibindi 2018). However, few studies have focused on financial firms in South Africa (Sibindi 2018; Sibindi and Makina 2018). While the effect of GB has been studied in developed countries, little is known in developing countries about this issue, particularly in South Africa. Hence, the current paper differs from the papers mentioned above, since this paper focused on the effect of GB on South African banks’ capital structure. Bank leverage is strongly regulated through the Basel III regulations, explicitly focusing on the capital adequacy ratio. The rest of this paper is structured as follows: the next section presents a review of the existing literature on the effect of GB on firms’ capital structure. This is followed by the methodology that describes our econometric approach in depth. The findings are presented and discussed, and the discussion ends with a conclusion and recommendations.

2. Literature Review

In the literature, extensive research has been carried out to understand what factor influences the capital structure of companies, both technically as well as empirically. Modigliani and Miller (1958) (M&M) pioneered current work on capital structure theory. They demonstrate that the capital structure of a corporation determines its worth. Furthermore, M&M (Modigliani and Miller 1963) presented a revision to their prior study, stating that the firm’s worth is independent of its capital structure; however, a gap is created by finance costs on debt. They explain that the discrepancy is attributable to interest payments being taxable income in various nations according to income tax laws. As a result, other academics produced capital structure theories, such as trade-off, pecking order, signalling, market, agency cost, and free cash flow theories.

In their research that establishes the theoretical basis of the static trade-off theory in the future, Kraus and Litzenberger (1973) showed that optimal leverage implies a trade-off between the tax benefits of debt and the burden costs of bankruptcy. Myers (1984) refined it in his static trade-off model, proposing that corporations establish a goal debt-to-value ratio and begin moving towards it, like how companies alter dividends to move towards a target payout ratio. A company’s funding options are essentially two: debt and equity. Sibindi and Makina (2018) argued that in a trade-off framework, the company would take on additional debt to take advantage of the debt interest tax shield until the accruals exceed the present value of the interest tax shield. Myers and Majluf (1984), who developed the pecking order theory of capital structure, contend that giving safe assets over risky assets is generally preferable. Myers (1984) supports this argument by claiming that the corporation will indeed internally choose external financing and debt to equity if it can provide the security. As a result of the hypothesis, debt will climb for corporations when investment exceeds internal financing, whereas indebtedness will fall once the asset becomes less valuable than carefully chosen finances.

The notion of the pecking order is also known as the asymmetric information theory. Information asymmetry emerges because management (internal stakeholders) has more information than investors (outsiders), whom they utilise to their benefit (Sibindi and Makina 2018). The signalling hypothesis stems from asymmetry ideas, which may be traced back to Ross’ work (Ross 1977). According to the author, if managers have access to internal information, they can choose between a managerial incentive system and a financial structure that sends data to the market and confirms the significance of the signals in a team balance (Ross 1977). Although market time theory is a subset of the information theory, it has contributed to the creation of the signalling theory. Market time theory, likewise, ignores the concept of optimal capital structure, which has departed from the work of Baker and Wurgler (2002). They contend that managers time their stock offerings with the expectation of issuing fresh shares when the share price is recognised to be higher. They will, in contrast, acquire shares when they are believed to be lower.

However, the crowding-out effect idea can be explained using the neoclassical and Keynesian approaches. The neoclassical approach favours full employment and free markets over government action. According to the neoclassical loanable fund hypothesis, the interest rate system will respond to the equilibrium of savings. For instance, a rise in government spending raises interest rates, pushing the capital market back into balance and crowding out private investment (Arrow and Kruz 1970). This view was supported by David and Scadding (1974), who argued that an increase in government bond issuance crowded out an equivalent percentage of private capital, because deficit finance is considered public capital and the latter serves for private capital investment.

Yet, Keynes (1936) established the impetus for the idea that government expenditure does not crowd out private spending. It is assumed that government expenditure enhances private investment due to the positive impact of government spending on share prices; thus, crowding occurs. Carlson and Spencer (1975) stated that while the Keynesians constructed multiple models, they were never tested as interrelated components. Friedman (1978) proposes a portfolio crowding-out strategy based on the substitutability of public debt and many other assets in shareholders’ portfolios, which could result in either the crowding-out or crowding-in of capital funding. This researcher sharply criticises the widespread mistaken notion that the negative effect of the wealth portfolio effect on private investment is the only way to solve the model.

The effect of GB on the firm capital structure has been studied in developed countries by Graham et al. (2014), Ayturk (2017), Akkoyun (2018), and Demirci et al. (2019). However, nothing has been done in developing countries regarding this issue, particularly in South Africa. Graham et al. (2014) investigated the impact of government debt on corporate financing and investment in the United States. Based on the findings, federal government debt issuance in the United States has a considerable impact on corporate financial policy. Furthermore, the study’s findings demonstrate a high negative association between corporate debt, investment, and government debt, but a strong positive connection with firm liquidity. They contended that these relationships are clearer in larger- and lower-risk corporations and that debt is a faster alternative for treasuries.

Ayturk (2017) employed a country-level aggregate and fixed-effects panel data model, using aggregate flow data to analyse data in a study on the association between government borrowing and corporate financing decisions in 15 developed European nations from 1989 to 2014. The study discovers a substantial inverse link between government borrowing and company debt, yet no significant relationship between government indebtedness and equity. The study’s findings contradict Graham et al. (2014), who found a strong negative link between company debt, investment, and government debt, yet a substantial positive connection with company liquidity. Contrary to those mentioned above, this study focused on the effect of government borrowing on a bank’s capital structure.

Akkoyun (2018) examined a study on the impact of government debt on firm financing in the United States of America (USA) during World War 1. The study focuses on the war period because the status of the economy, the manner of corporate security of aid, and the alternative financing strategy of the United States government provide a suitable empirical context to identify the effect. Yet, our research focuses on how government debt impacts the capital structure of South African registered banks. The analysis found that long-term government bond issues had a negative impact on long-term company bonds with a life expectancy of more than five years, common stocks, and preferred stocks.

To investigate the impact of government debt on company capital structure selection, Demirci et al. (2019) used data from 40 nations from 1990 to 2014 and measured government debt using domestic government debt-to-GDPt-1 and external government debt-to-GDPt-1. After adjusting for the nation and year-fixed effects and country-level controls, the researchers discovered a negative effect on government borrowing and company leverage in both levels and variations of debt. They also found that the crowding-out effect is more substantial for superior and higher-returning enterprises, and companies in markets with more developed equity markets or lower bank dependence.

Utilising a sample of state-owned enterprises (SOEs) and non-SOEs, Liang et al. (2017) investigated the impact of local government debt on firm leverage in China from 2005 to 2007 and from 2011 to 2013. As a result, they eliminated 2008 to 2010 due to a lack of data. They tested the effects of crowding out and crowding in the impact of local government debt on company leverage using a benchmark econometric model. According to the findings of their analysis, China’s domestic government debt has a considerable crowding-out impact on non-SOE’s force, while being crowded in that of SOEs. Furthermore, the effect differed among industries and sectors.

Other empirical investigations have demonstrated a negative connection between government borrowing and capital structure (for instance, Gao et al. 2022; Cheema 2021; Orangian et al. 2021; Xia et al. 2021). An upsurge in government debt, the availability of surplus public debt, is absorbed by corporate investors seeking to impose a raise of the returns on borrowing, which could additionally end in less disbursement of lending; thus, corporate debt would crowd out public debt (Cheema 2021) because of increased government borrowing and firm leverage, and debt ratios may fall.

Emerging patterns, through a review of previous academic research, indicated that despite extensive research on the effect of GB on firm capital structure, there is still uncertainty and no consensus on which proxies GB should use. This has manifested in some discrepancies in in-country studies on the topic. In comparison with other studies, this article used TGB, FGB, and LGB indicators. Foreign government borrowing and local government borrowing were put into perspective since each type of borrowing has its strategic advantages and disadvantages. Therefore, this article accounts for the several factors that are considered when borrowing, including risk assessment, currency consideration, interest rates, regulations, and investor perceptions. The following section discusses the paper’s methodology.

3. Materials and Methods

3.1. Data, Samples, and Variables

The population of this paper comprises all 16 registered domestic banks in South Africa. However, a sample of the paper consists of 11 registered banks in South Africa in the period from 2012 to 2021. These 11 registered banks in South Africa include First Rand Bank Limited, Absa Bank Ltd., Nedbank Ltd., Investec Bank Ltd., Capitec Bank Ltd., Standard Bank of South Africa, Grindrod Bank Ltd., Bidvest Bank Limited, Albaraka Bank Ltd., Sasfin Bank Ltd. and HBZ Bank Ltd. Five small banks, namely African Bank Limited, Deutsche Bank AG, Ubank LIimited, Grobank Limited, and Habib Overseas Bank Ltd., were excluded because of the difficulties in accessing financial data for the period of the study. These firms are considered sufficiently illustrative of the registered banks’ population in South Africa from 2012 to 2021. The monthly and annual financial and economic data were extracted from the iress database, the South African Reserve Bank (SARB) and Bankscope-Bureau van Dijk. These registered banks’ sample size consists of 11 banks over a period of 10 years, leading to 110 observations for the banking sample. While the selection of the registered banks in South Africa is identified for this research, it is acknowledged that there were differences in the sampled registered banks’ procedures, as mentioned earlier.

This paper used three measures of capital structure, namely total debt ratio (TDR), long-term debt ratio (LTDR), and short-term debt ratio (STDR), as dependent variables following other scholars (Saif-Alyousfi et al. 2020). According to Rajan and Zingales (1995), short-term, long-term, and total debt over total assets ratios are much more adequate indicators of financial leverage than the ratio of liabilities to total assets, since they provide a more precise sense as to whether the company is at the probability of insolvency in the near future and present a much more realistic assessment of previous sources of finance. In contrast, GB was used as an independent variable. Graham et al. (2014) state that GB practices play a significant part in enlightening the continuously improving inclination of companies to use leverage in unregulated sectors. Table 1 below shows the details of the dependent and independent variables and data sources.

Table 1.

Summary of variables and proxies.

3.2. Model Specification

We use the dynamic generalised method of moments (GMM) model. The study used Arellano and Bond (1991) and Arellano and Bover (1995)’s endogeneity robust generalised method of moments (GMM) to ascertain the impact of government borrowing and bank capital structure. The use of GMM was motivated by its ability to account for the persistence of bank capital structure, simultaneity, and time-invariant omitted variables. Furthermore, GMM considers cross-country variation in the model specification and accounts for small sample biases (Asongu et al. 2018). The model has the following form:

where

represents the book value of the leverage measures for banks i in time t; is the vector of the independent variable for banks and assets managers firms i for time t, representing the banks and assets managers’ firm-specific variable; denotes a constant term; β is the elasticity of the explanatory variables, i.e., slope of variables; denotes fixed effects in banks and assets managers firms; is a random error term, the subscript i denotes the cross-section and t represents the time-series dimension. The panel data regression analysis was then used to analyse the relationship between government borrowing and banks’ capital structure.

Our paper was based in South Africa; therefore, a single-country data approach was utilised. The objective to examine the critical determinants of leverage in South African commercial banks was achieved by regressing the leverage-dependent variables (TDRB, STDR, and LTDR) against the determinants in the following equations. Specifically, the relationship between capital structure and the explanatory variables of bank-specific determinants/macroeconomic determinants was expressed quantitatively in Equations (2)–(4) for empirical analysis.

where

represents total debt ratio at book value for banks i in time t, measured by the ratio of book value of total debt/book value of total assets, represents the total debt ratio for banks i in time t, measured by short-term/ book total assets, represents the long-term debt ratio for banks i in time t, measured by long-term/total assets, donates government debt to GDP ratio for bank i in time t, measured by total government debt as a percentage of gross domestic product (GDP) in-country, is the percentage of gross domestic product (GDP) used to determine local government debt, is the foreign government debt-to-GDP ratio, referring to government debt due to non-residents, is the current ratio measured by the current assets over current liabilities, is the size of the ith banks on year t measured by the natural logarithm of total assets, is a panel of macroeconomic control variable measurements at the end, which includes interest rates and inflation rates. represents the GDP growth of South Africa in year t, is the error term, α is the auto-regression coefficient, and β is a coefficient which represents the slope of variables.

4. Results

Banks may keep up to 26% of their weaknesses as short-term debt. The average total government borrowing (TGB) is 2,537,683 billion, with a standard deviation of 916,717.60. The minimum TGB was 1,334,110,000,000.00, and the maximum TGB was 4,230,630 billion. TGB relative to GDP reached a maximum of 0.78 percent. The situation is good, given that the country has financed roughly 78 percent of its GDP. According to the descriptive data, the average local government borrowing (LGB) throughout the period under review was 506,517 billion. LGB was 20% on average. This means that the government borrows 20% of its financing from domestic companies. Yet, the minimum LBG was 64,746.00, and the maximum LBG was 1,827,764.00. In local banks, the more expensive the LGB, the more the debt cost. Foreign government borrowing (FGB) averaged 2,031,165 billion. The average FGB in relation to GDP was 80%. This means that the government borrows roughly 80% of its financing from international markets. The minimum and maximum FGBs were 1,202,942.00 and 2,602,757 billion, respectively. The higher the FGB, the lower the debt cost in domestic banks. This means that an upsurge in the FGB triggers bank crowding in South Africa. Yet, the minimum current ratio (CR) of 0.01 indicates that the South African bank had the lowest CR of 1% during the investigation period. In Table 2, the maximum CR was 2.56, which means that banks can pay up to 2.56% of their short-term debt. The greater a bank’s total CR, the lower its short-term obligations on its current assets.

Table 2.

Descriptive statistics.

The average bank size (total assets) was 424 billion, with a standard deviation of 508 billion. The bank’s size ranged from 2,997,923 billion to 1660 billion. With a standard deviation of 0.85 percent, the inflation rate averaged 4.60 percent. The minimum and maximum INF were 3.10 and 5.60, respectively. A larger scale implies consumer price uncertainty, which is particularly costly to the poor and small businesses as they lack a hedging strategy toward unexpected developments.

Likewise, the mean IR value was 3.89, with a standard deviation of 1.09. The minimum IR was 2.31, and the maximum was 5.89. Finally, the average rate of gross domestic product growth (GDPG) was 0.95 percent, with a standard deviation of 2.77 percent. Despite this, the minimum GDPG was −6.43, and the maximum GDPG was 4.90.

There is skewness and excess kurtosis in all of the variables under consideration. Because the variables are not evenly distributed, Jarque–Bera supports the results obtained on the standard typical evaluation.

As shown in Table 3, the correlation analysis illustrates the correlations between dependent and independent variables used in the banking sector. The total debt ratio (TDR) was found to be positively correlated with the long-term debt ratio (LTDR), whereas the inflation rate (INF) was found to be negatively though strongly linked to the total debt ratio (TDR). Nevertheless, the inflation rate (INF) was found to be significantly negatively associated with the long-term debt ratio (LTDR).

Table 3.

Correlation.

To capture the endogeneity of the lagged dependent variable and independent variables in this analysis, a matrix of internal instruments is built using the GMM estimator (see Arellano and Bond 1991; Arellano and Bover 1995; and Blundell and Bond 1998). The instruments were lag-dependent variables. A diagnostic estimate was used to test for the stationarity of the series and a correlation analysis in accordance with time-series and cross-sectional investigations. In line with Pesaran (2021), cross-section dependence was also examined because there is a chance of endogeneity in the explanatory factors. The Sargan test was used to confirm the validity of the instruments (Sargan 1958). The results of the overidentifying constraints test agreed with Hansen (1982). Using the Arellano–Bond test (AR1) and (AR2), the correlation of the error terms—which ensures the suitability of the estimated results—was examined (see Arellano and Bond 1991; Roodman 2009). One further benefit of the system GMM is that it does not require the use of external instruments in addition to the variables that are already present.

Nevertheless, in Table 4 there is a positive but not significant link between IR and LTDR. However, there is a negative but insignificant relationship between IR and TDR and STDR. In addition, TDR and STDR show a negative yet insignificant connection with bank size. In terms of the macroeconomic parameter GDPG, there was a positive and significant effect on GDPG and capital structure. The results support the trade-off theory, which holds that quicker growth in the economy is linked to the greater proclivity of a firm to use debt to fund capital expenditure, since that facilitates greater tax benefits for debt financing (Guizani 2020). In a similar vein, the results support the pecking order theory, which contends that growth in the economy and capital structure are positively related (Guizani 2020).

Table 4.

Determinant’s capital structure: Effects of TGB and CR.

There was a positive and significant impact on INF with capital structure. These findings contradict Almanaseer’s (2019) contention that throughout times of elevated inflation, banks strengthen their regulations to try to mitigate the effect of inflation on interest rates, thus decreasing borrowing. Furthermore, these findings contradict the findings of Bilgin and Dinc (2019), who discovered a negative yet significant connection between INF and capital structure. Finally, COVID-19 had a negative yet significant link with all capital structure. The results are consistent with Mohammad’s (2021) discovery of a negative connection between COVID-19 and capital structure. This implies that the global outbreak had a negative effect on capital structure. Due to the ambiguity, banks may have turned to more secure capital.

In Table 5, there is a positive and significant link between TDR, LTDR, and the legged values of TDR and LTDR. Aremu et al. (2013) discovered a positive and insignificant connection between all bank capital structure metrics. However, there is a positive but insignificant link between STDR and its lagged worth.

Table 5.

Determinant’s capital structure: effects of LGB and CR.

The interaction between EV and all capital structure measures was positive and significant. The findings back up the pecking order belief that EV and capital structure have a positive nexus. The results, nevertheless, oppose the trading-off theory’s assertion of a negative association between EV and capital structure (Assfaw 2020). The findings are in line with the findings of Assfaw (2020), who discovered a positive yet statistically significant connection between earnings volatility and bank capital structure.

Regarding growth opportunity (GO), there existed a positive and statistically significant connection between GO and TDR, LDTR, and SDTR. The results back up the pecking order theory, which holds that there is a positive link between the development of GO and capital structure.

For LGB as an indicator of government borrowing, there was a positive insignificant nexus between LGB and TDR, LTDR, and STDR. However, a negative and insignificant link existed between size, interest rate (IR), and TDR, LTDR, and STDR. GDPG had a positive and statistically significant association with TDR, LTDR, and STDR. The findings are equivalent to those addressed in Table 4.

A positive and significant connection exists between CR and TDR, LTDR, and STDR. The larger the total ratio, the greater the probability an entity is to be able to pay its costs. As a result, a larger ratio is more advantageous from the standpoint of the lender. However, from the standpoint of an investor, this has not been the case. Since current assets frequently have lower displayed yields than capital assets, shareholders ought to believe that current assets consume the bare minimum of the company’s capital. The results correspond to the findings reported by Rao et al. (2017). The latter found a link between financial leverage and the current ratio.

The annual inflation rate (INF) shows a positive association between INF and TDR, and LTDR. According to Bilgin and Dinc (2019), as inflation falls, firms enhance their financial obligation level; however, as inflation rises, firms reduce their debt level. The findings contradict those of Almanaseer (2019), who discovered a negative link between INF and bank capital structure. Nevertheless, there was a positive yet not significant connection between INF and STDR.

In terms of COVID-19, there was a positive connection between COVID-19 and TDR. The findings contradict Mohammad’s (2021) finding of a negative link between COVID-19 and capital structure. However, COVID-19 had a positive yet non-significant interaction with the LTDR and STDR.

Table 6 demonstrates a positive yet insignificant link between TDR and LTDR, which lags at capital structure values. Nevertheless, STDR and its lagged capital structure values have a negative yet insignificant connection. Similarly, there is an insignificant connection between size, GDPG, IR, COVID-19, and capital structure. There was a positive and insignificant connection between EV and TDR, and LTDR. On the other hand, there is a positive but not statistically significant link between EV and STDR. The findings support the pecking order theory, which states that EV and capital structure have a positive link. However, the findings go against the trading-off theory prediction of a negative link between EV and capital structure (Assfaw 2020).

Table 6.

Determinant’s capital structure: Effects of FGB and CR.

A negative and significant connection exists between GO, TDR, and LTDR. Nevertheless, the study found a positive and statistically significant association between GO and STDR. Guizani (2020) contends that when internal funds are scarce, banks with more investment options increase their reliance on financing through debt. The findings are consistent with the pecking order theory’s expectation of a positive association between GO and capital structure (Myers and Majluf 1984).

Similarly, there was a negative statistically significant link between FGB and STDR. This suggests that because the government has borrowed foreign currency, the private sector is now borrowing short-term to buy the cheap foreign currency that the government would have borrowed to maintain the exchange rate. The findings are consistent with those of Demirci et al. (2019), who discovered a negative significant link between FGB and capital structure. Nevertheless, this study found a negative and significant link between FGB and STDR.

The current ratio and results are comparable to those in Table 5. All capital structure measures have a positive and significant connection with CR. In terms of the inflation rate (INF), there is a positive yet statistically significant link between INF and TDR, and LDTR. According to Anarfo (2015), when banks are able to anticipate the level of the rate, they may adjust their interest rate and reduce their burden of spending. However, as central banks monitor inflation and adjust interest rates in response to it, greater inflation will result in higher interest rates, leading banks to borrow less and increase their level of equity (Smaoui et al. 2020). Almanaseer (2019) discovered a negative relationship between INF and bank capital structure, which contradicts the results of this study. Nevertheless, INF and STDR have a negative yet not significant connection. On the other hand, there was a positive correlation between COVID-19 and TDR and LTDR. The result contradicts Mohammad’s (2021) finding of a negative connection between COVID-19 and capital structure. However, there was a negative yet not significant link between COVID-19 and STDR.

5. Conclusions

The article aimed to investigate the effects of government borrowing on ‘banks’ capital structure. This was done in a bid to put the crowding-out effect theory into perspective. A system GMM approach was employed, and the results were intriguing. Contrary to the crowding-out effects, the results revealed a positive and significant relationship between government borrowing and capital structure. Intuitively, government borrowing would crowd out the domestic market, but this is not the case in South Africa. In South Africa, the greater the government’s borrowing, the greater the banks’ leverage. Unlike Demirci et al.’s (2019) argument that a rise in government debt supply might decrease investors’ demand for corporate debt compared to equity because government debt is a superior alternative for company debt to equity, banks in South Africa seem not to be constrained by this. Moreover, the results are inconsistent with the findings of Liang et al. (2017) and Wang et al. (2020), who find a negative association between LGB and capital structure.

Since government borrowing by all measurements did not crowd out a local market, this condition could be explained by the crowding-in effect. Further analysis indicated that foreign borrowing accounts for around 80% of overall government borrowing and does not crowd out domestic private companies. Demirci et al. (2019) argued that if resources are underutilised, public expenditure might promote investment and boost private spending, resulting in a “crowding in” effect.

Therefore, there is a need to strike a balance between government borrowing and the stimulation of the banking environment. The crowding-in effect implies that as long as the government can still provide services, they can continue to borrow, as this does not affect the banking sector. On the other hand, as long as the government seems to be borrowing more foreign than local, the bank should not be worried about the crowding-out effect. Therefore, they can still increase their debt ratios without any problems. Future research should test the cointegrating and causality relationship between government borrowing and bank capital structure. Also, given that the banking sector is constrained by Basel III’s capital adequacy requirement, controlling for this factor is critical in future research.

Author Contributions

Conceptualisation: N.Z.M. and G.M.; methodology: N.Z.M.; software: N.Z.M.; validation: N.Z.M. and G.M.; formal analysis: N.Z.M.; investigation: N.Z.M.; resources: N.Z.M.; data curation: N.Z.M.; writing—original draft preparation: N.Z.M.; writing—review and editing: G.M.; supervision: G.M.; project administration: N.Z.M.; funding acquisition: N.Z.M. and G.M. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding. The APC was funded by the University of South Africa.

Data Availability Statement

Data are available upon reasonable request made to the corresponding.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Ahmad, Saeed, Muhammad Aamir, and Muhammad Umer Quddoos. 2020. Does the internal borrowing of the Pakistan government affect corporate leverage? Journal of Economic Studies 3: 149–63. [Google Scholar]

- Akkoyun, Huseyin Cagrı. 2018. How does government debt affect corporate financing? Evidence from Ware Finance. Job Market Paper, 1–56. [Google Scholar]

- Almanaseer, S. Radwan. 2019. Determinants of capital structure: Evidence from Jordan. Accounting and Finance Research 8: 186–98. [Google Scholar] [CrossRef]

- Anarfo, Ebenezer Bugri. 2015. Determinants of capital structure of banks: Evidence from Sub-Sahara Africa. Asian Economic and Financial Review 5: 624–40. [Google Scholar] [CrossRef]

- Arellano, Manuel, and Olympia Bover. 1995. Another look at the instrumental variable estimation of error-components models. Journal of Econometrics 68: 29–51. [Google Scholar] [CrossRef]

- Arellano, Manuel, and Stephen Bond. 1991. Some Tests of specification for panel data: Monte Carlo Evidence and an application to employment equations. The Review of Economic Studies 58: 277–97. [Google Scholar] [CrossRef]

- Aremu, Mukaila Ayanda, Imoh Christopher Ekpo, Adeniyi Mudashiru Mustapha, and Salami Isaac Adedoyin. 2013. Determinants of capital structure in Nigerian banking sector. International Journal of Academic Research in Economics and Management Sciences 2: 27. [Google Scholar]

- Arrow, Kenneth J., and Mordecai Kruz. 1970. Public Investment, the Rate of Return, and Optimal Fiscal Policy. Baltimore: The Johns Hopkins Press. [Google Scholar]

- Asongu, Simplice A., Jacinta C. Nwachukwu, and Aqsa Aziz. 2018. Determinants of mobile phone penetration: Panel threshold evidence from Sub-Saharan Africa. Journal of Global Information Technology Management 21: 81–110. [Google Scholar] [CrossRef]

- Assfaw, Abdu Mohammed. 2020. The determinants of capital structure in Ethiopian Private commercial banks: A panel data approach. Journal of Economics, Business, and Accountancy Ventura 23: 108–24. [Google Scholar] [CrossRef]

- Ayturk, Yusuf. 2017. The effects of government borrowing on corporate financing: Evidence from Europe. Finance Research Letters 20: 96–103. [Google Scholar] [CrossRef]

- Bahal, Girish, Mehdi Raissi, and Volodymyr Tulin. 2018. Crowding-out or crowding-in? Public and private investment in India. World Development 109: 323–33. [Google Scholar] [CrossRef]

- Baker, Malcolm, and Jeffrey Wurgler. 2002. Market timing and capital structure. The Journal of Finance 57: 1–32. [Google Scholar] [CrossRef]

- Bandyopadhyay, Arindam, and Nandita Malini Barua. 2016. Factors determining the capital structure and corporate performance in India: Studying the business cycle effects. The Quarterly Review of Economics and Finance 61: 160–72. [Google Scholar] [CrossRef]

- Bilgin, Rumeysa, and Yusuf Dinc. 2019. Factoring as a determinant of capital structure for large firms: Theoretical and empirical analysis. Borsa Istanbul Review 19: 273–81. [Google Scholar] [CrossRef]

- Blundell, Richard, and Stephen Bond. 1998. Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics 87: 115–43. [Google Scholar] [CrossRef]

- Carlson, Keith M., and Roger W. Spencer. 1975. Crowding out and its critics. Federal Reserve Bank of St. Louis Review, December 1. [Google Scholar]

- Cheema, Sadia Munir. 2021. Government Debt and Corporate Leverage: Sectoral Analysis of Pakistan. Empirical Economic Review 4: 81–120. [Google Scholar]

- David, Paul A., and John L. Scadding. 1974. Private savings: Ultrarationality, aggregation, and Denison’s Law. Journal of Political Economy 82: 225–49. [Google Scholar] [CrossRef]

- Demirci, Irem, Jennifer Huang, and Clemens Sialm. 2019. Government debt and corporate leverage: International evidence. Journal of Financial Economics 133: 337–56. [Google Scholar] [CrossRef]

- Frank, Murray Z., and Vidhan K. Goyal. 2009. Capital structure decisions: Which factors are reliably important? Financial Management 38: 1–37. [Google Scholar] [CrossRef]

- Friedman, Benjamin M. 1978. Crowding out or crowding in? Economic consequences of financing government deficits. Brookings Papers on Economic Activity, 593–641. [Google Scholar] [CrossRef]

- Gao, Ge, Jichang Dong, and Xiuting Li. 2022. Local government debt, real estate investment, and Corporate Investment: Evidence from China. Sustainability 14: 12353. [Google Scholar] [CrossRef]

- Gharaibeh, Omar K., and AL-Tahat Saqer. 2020. Determinants of capital structure: Evidence from Jordanian service companies. Investment Management and Financial Innovations 17: 364–76. [Google Scholar] [CrossRef]

- Graham, John, Mark T. Leary, and Michael R. Roberts. 2014. How Does Government Borrowing Affect Corporate Financing and Investment? (No. w20581). Boston: National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Guizani, Moncef. 2020. The determinants of capital structure of Islamic and conventional banks: An autoregressive distributed lag approach. Journal of Islamic Accounting and Business Research 12: 131–47. [Google Scholar] [CrossRef]

- Handoo, Anshu, and Kapil Sharma. 2014. A study on determinants of capital structure in India. IIMB Management Review 26: 170–82. [Google Scholar] [CrossRef]

- Hanousek, Jan, and Anastasiya Shamshur. 2011. A stubborn persistence: Is the stability of leverage ratios determined by the stability of the economy. Journal of Corporate Finance 17: 1360–76. [Google Scholar] [CrossRef]

- Hansen, Lars Peter. 1982. Large sample properties of generalized method of moments estimators. Econometrica Journal of the Econometric Society 50: 1029–54. [Google Scholar] [CrossRef]

- Harris, Christopher, and Scott Roark. 2019. Cash flow risk and capital structure decisions. Finance Research Letters 29: 393–97. [Google Scholar] [CrossRef]

- Jaworski, Jacek, and Leszek Czerwonka. 2021. Determinants of enterprises capital structure in the energy industry: Evidence from European Union. Energies 14: 1871. [Google Scholar] [CrossRef]

- Jõeveer, Karin. 2013. Firm, country and macroeconomic determinants of capital structure: Evidence from transition economies. Journal of Comparative Economics 41: 294–308. [Google Scholar] [CrossRef]

- Karpavičius, Sigitas, and Fan Yu. 2017. The impact of interest rates on firm financing policies. Journal of Corporate Financing 45: 262–93. [Google Scholar] [CrossRef]

- Keynes, John Maynard. 1936. The General Theory of Employment, Interest and Money, 1st ed. London: Macmillan and Co., Limited. [Google Scholar]

- Kraus, Alan, and Robert H. Litzenberger. 1973. A state preference model of optimal capital financial leverage. The Journal of Finance 28: 911–22. [Google Scholar] [CrossRef]

- Kuč, Vukašin, and Đorđe Kaličanin. 2021. Determinants of capital structure of large companies: Evidence from Serbia. Economic Research-Ekonomska Istrazivanja 34: 1590–607. [Google Scholar] [CrossRef]

- Liang, Yousha, Kang Shi, Lisheng Wang, and Juanyi Xu. 2017. Local government debt and firm leverage: Evidence from China. Asian Economic Policy Review 12: 210–32. [Google Scholar] [CrossRef]

- Modigliani, Franco, and Merton H. Miller. 1958. The cost of capital, corporation finance, and the theory of investment. The American Economic Review 48: 261–97. [Google Scholar]

- Modigliani, Franco, and Merton H. Miller. 1963. Corporate income taxes and the cost of capital: A correction. The American Economic Review 53: 433–43. [Google Scholar]

- Mohammad, Khalil Ullah. 2021. How bank capital structure decision-making change in recessions: COVID-19 from Pakistan. Asian Journal of Economics and Banking 6: 255–69. [Google Scholar] [CrossRef]

- Myers, Stewart C. 1984. The capital structure puzzle. The Journal of Finance 39: 574–92. [Google Scholar] [CrossRef]

- Myers, Stewart C., and Nicholas S. Majluf. 1984. Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics 13: 187–221. [Google Scholar] [CrossRef]

- Orangian, Alireza, Mohammad Nadiri, and Mohsen Ansari. 2021. Government Borrowing, Capital Structure, and Liquidity Policies: Evidence from Iran. Journal of Management Technology 21: 33–48. [Google Scholar]

- Palacín-Sánchez, María José, Luis M. Ramírez-Herrera, and Filippo Di Pietro. 2013. Capital structure of SMEs in Spanish regions. Small Business Economics 41: 503–19. [Google Scholar] [CrossRef]

- Pesaran, M. Hashem. 2021. General diagnostic tests for cross-sectional dependence in panels. Empirical Economics 60: 13–50. [Google Scholar] [CrossRef]

- Rajan, Raghuram G., and Luigi Zingales. 1995. What Do We Know about Capital Structure Some Evidence from International Data. Journal of Finance 50: 1421–60. [Google Scholar] [CrossRef]

- Rao, KT Vigneswara, Bhavesh Prakash Joshi, and Ishita Khurana. 2017. Capital Structure Determinants: Empirical Evidence from Listed Manufacturing Firms in India. Pacific Business Review International 10: 17–21. [Google Scholar]

- Roodman, David. 2009. How to do xtabond2: An introduction to difference and system GMM in Stata. The Stata Journal 9: 86–136. [Google Scholar] [CrossRef]

- Ross, Stephen A. 1977. The determination of financial structure: The incentive signalling approach. The Bell Journal of Economics 8: 23–40. [Google Scholar] [CrossRef]

- Saif-Alyousfi, Abdulazeez Y., Rohani Md-Rus, Kamarun Nisham Taufil-Mohd, Hasniza Mohd Taib, and Hanita Kadir Shahar. 2020. Determinants of capital structure: Evidence from Malaysian firms. Asia-Pacific Journal of Business Administration 12: 283–326. [Google Scholar] [CrossRef]

- Sargan, John D. 1958. The estimation of economic relationships using instrumental variables. Econometrica Journal of the Econometric Society 26: 393–415. [Google Scholar] [CrossRef]

- Shahzad, Aamer, Muhammad Azeem, Mian Sajid Nazir, Xuan Vinh Vo, and Nguyen T. M. Linh. 2021. The determinants of capital structure: Evidence from SAARC countries. International Journal of Finance and Economics 26: 6471–87. [Google Scholar] [CrossRef]

- Sibindi, Athenia Bongani. 2018. Determinants of bank capital structure: Evidence from South Africa. Acta Universitatis Danubius 14: 108–26. [Google Scholar]

- Sibindi, Athenia Bongani, and Daniel Makina. 2018. Are the determinants of bank’s and insurer’s capital structure homogeneous? Evidence using South African data. Cogent Economics and Finance 6: 1. [Google Scholar] [CrossRef]

- Smaoui, Houcem, Ines Ben Salah, and Boubacar Diallo. 2020. The determinants of capital ratios in Islamic banking. The Quarterly Review of Economics and Finance 77: 186–94. [Google Scholar] [CrossRef]

- Tesfaye, Tseganesh. 2012. Determinants of Banks Liquidity and Their Impact on Financial Performance: An Empirical Study on Commercial Banks in Ethiopia. Unpublished. Ph.D. dissertation, Addis Ababa University, Addis Ababa, Ethiopia. [Google Scholar]

- Vo, Xuan Vinh. 2017. The determinant of capital structure in emerging markets: Evidence from Vietnam. Research in International Business and Finance 40: 105–13. [Google Scholar] [CrossRef]

- Wang, Jinxiang, Shinong Wu, and Yuhui Wu. 2020. The effect of local government debt on firm leverage: Empirical evidence from the city-level of China. Journal of Finance and Economics 46: 111–25. [Google Scholar] [CrossRef]

- Xia, Xiaomiao, Jingyue Liao, and Zitang Shen. 2021. The crowd-out effect of government debt on firm leverage. E3S Web of Conferences 235: 01023. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).