Determinants of the Effectiveness of Risk Management in the Project Portfolio in the FinTech Industry

Abstract

1. Introduction

- Defining the dimensions and determinants of the effectiveness of risk management in the project portfolio;

- Development of a universal model for assessing the effectiveness of risk management in a project portfolio;

- Providing knowledge on the impacts of individual dimensions of organizational management and risk management on the effectiveness of the risk mitigation tools adopted, with a particular emphasis on the FinTech industry;

- Closing the research gap related to the identification of connections between project management, risk management in the project portfolio, and the strategic management of the organization;

- Focusing on the effectiveness of risk management in the project portfolio and not on management instruments or the identification of risks related to projects and portfolios;

- Embedding research in the FinTech industry, which is rich in projects and project portfolios (Győri et al. 2021);

- Obtaining results on the effectiveness of risk management in the project portfolios of international FinTech organizations;

- Pproviding a replicable tool for comparative analyses of risk management in the project portfolio.

2. Background

2.1. Strategic Orientation

2.2. Organizational Context

2.3. Senior Management Involvement

2.4. Adjusting the Portfolio to the Organization’s Governance

- Organizational structure for project portfolio management (Kodukula 2014);

- Defining the standards and process of project portfolio management;

- Defined roles and responsibilities in the project portfolio management process;

- Specific escalation paths (AXELOS 2011);

- A Portfolio Office within an organization, which monitors the performance of the project portfolio (Kendall and Rollins 2003).

2.5. Portfolio Risk Management Process

3. Methods and Materials

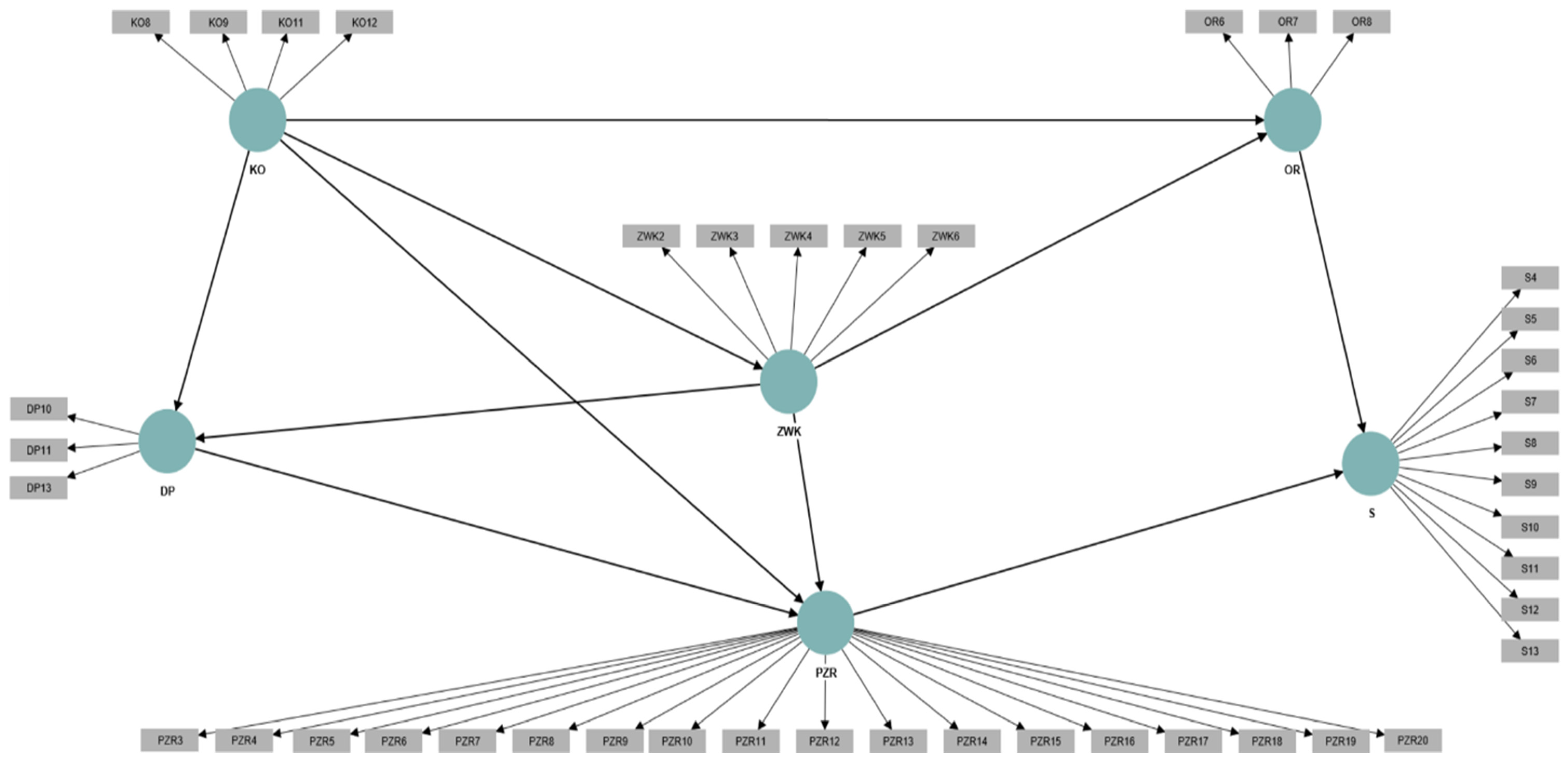

3.1. Structuring the Research Model

- Projects withheld at the initiation stage, due to the identified level of risk.

- Projects withheld at the implementation stage, due to the identified level of risk (Teller 2013).

- Identified dependencies between projects as a result of risk management at the portfolio level (De Bakker et al. 2010).

- Similar identified risks in different projects (Jonas et al. 2012).

- Decisions regarding projects in the portfolio are made based on a comprehensive picture of the risks in the portfolio (Sanchez et al. 2008).

- A portfolio balance, understood as the appropriate selection of projects in the portfolio, so that they constitute a set of initiatives with different levels of risk.

- Mitigation actions taken regarding risks identified at the portfolio level (Teller 2013).

3.2. Survey Research Process

3.3. Modeling with PLS-SEM

- A rectangle denoting observable variables;

- An ellipse, which is the marking of a latent variable;

- Arrow defining cause-and-effect relationships between dependent and independent variables. The arrow connects observable variables with latent variables and creates connections between unobservable variables. As a result of modeling, the arrows receive a specific value, understood as the strength of the relationship between the variables.

- Standardized root mean square residual (SRMR) providing a measure of model fit. A value less than 0.10 is considered a good fit (Kock 2020). The SRMR can be considered a measure of the goodness of fit for PLS-SEM, which can be used to avoid model misspecification (Henseler et al. 201);

- R2 determination coefficient, which allows for assessing the explanatory power of the model (Sagan 2015);

- For reliability analysis:

- Cronbach’s alpha coefficient, for which a level of 0.6 can be considered sufficient, >0.8 very good, and >0.9 excellent (Nunally and Bernstein 1994);

- Composite reliability (CR)—which should exceed the level of 0.7 (Hair et al. 2019);

- For convergent validity, the average variance extracted (AVE)—which should exceed the level of 0.5 (Purwanto and Sudargini 2021);

- For discriminant validity:

- Cross-loading values for individual indicators, which should have higher values in relation to the corresponding constructs in the model than all others (Ab Hamid et al. 2017);

- Fornell–Larcker criterion, according to which the square root values of AVE should be higher than the highest correlation with another construct (Kacprzak 2018);

- Heterotrait–Monotrait ratio (HTMT) criterion (Henseler et al. 2014, the value of which should not exceed 0.9. If the HTMT value is higher than this threshold, it can be concluded that there is no discriminant validity (Teo et al. 2008).

4. Results

4.1. Assessment of Model Quality and Fit

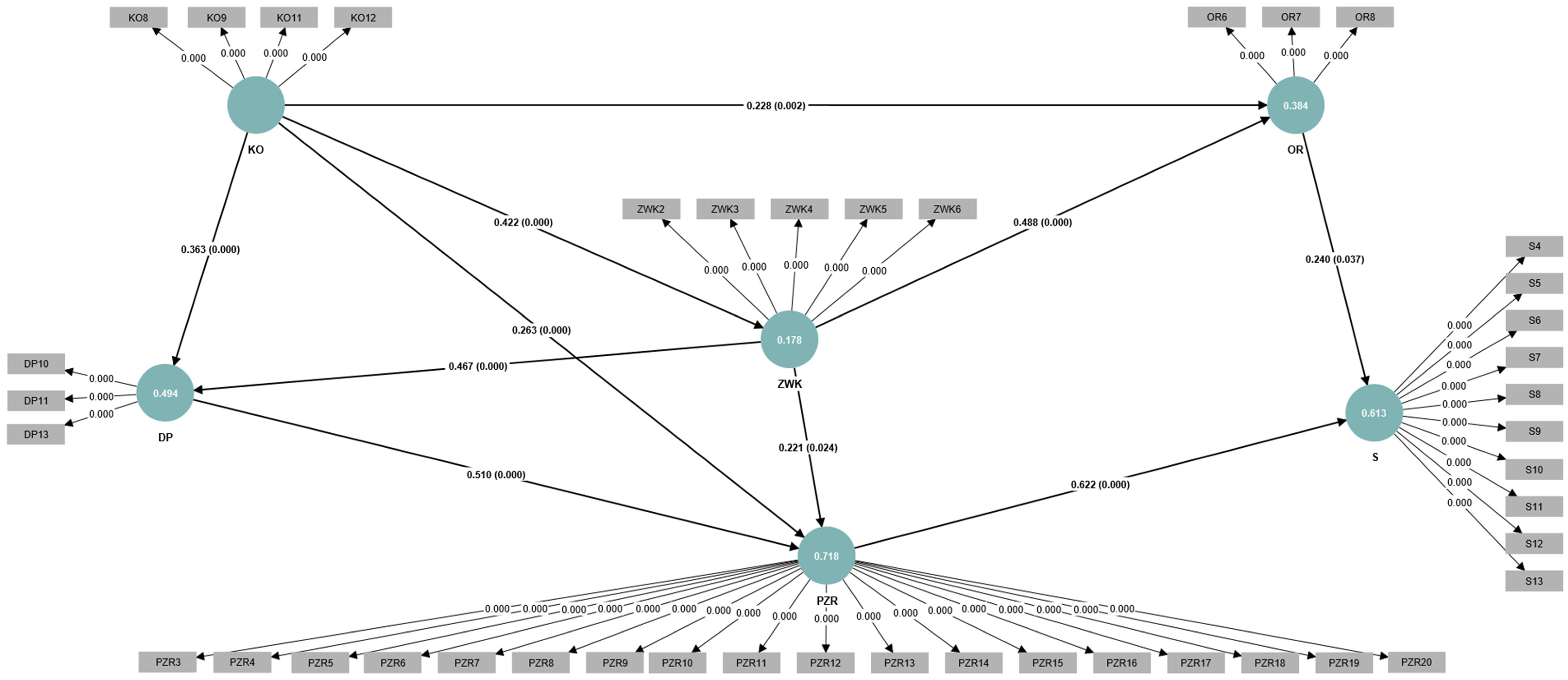

4.2. Structural Modeling Results

- Strategic orientation—3;

- Organizational context—4;

- Involvement of senior management in the risk management in the project portfolio—5;

- Adjusting the portfolio to the organization’s governance—3;

- Risk management process in the project portfolio—18;

- Risk management efficiency in the project portfolio—10.

- Selection of projects for the organization’s portfolio based on specific criteria supporting the strategy (OR6);

- Ongoing review of projects in the portfolio for alignment with the organizational strategy (OR7);

- Allocating resources in the organization to projects in the portfolio following the organization’s strategy (OR8).

- A definition of risk at the project portfolio level (PZR3);

- Clearly defined risk management steps in the project portfolio (PZR4);

- Defined roles in the project portfolio risk management process (PZR5);

- Defined responsibilities for roles in the project portfolio risk management process (PZR6);

- Defined risk management process for projects in the portfolio (PZR7);

- Defined ownership for risks identified in the portfolio (PZR8);

- Defined control process for risks identified in the portfolio (PZR9);

- Defined tolerable risk level, i.e., the level of risk the organization is willing to accept (PZR10);

- Defined level of tolerable risk, i.e., the maximum level of risk that the organization can bear in combination with factors such as reputation, capital, assets, or ability to raise additional funds (PZR11);

- Defined risk tolerance levels, i.e., risk exposure levels that can only be exceeded with the required approval (PZR12);

- Consideration of risk assessment when prioritizing projects in the portfolio (PZR13);

- Regular review of risks in the projects in the portfolio (PZR14);

- Defined dependency management process in the project portfolio management process (PZR15);

- Prepared portfolio reports for senior management (PZR16);

- Information on the level of risks in the projects included in the portfolio as part of the portfolio reports prepared for senior management (PZR17);

- Information on the level of risks across the portfolio as part of portfolio reports prepared for senior management (PZR18);

- Visualization of risks in the portfolio as an element of portfolio reports prepared for senior management, e.g., in the form of a risk matrix (PZR19);

- Linking project portfolio risk management to other risk management processes in the organization (PZR20).

- Clearly defined steps;

- Specific roles and responsibilities, including ownership of risks identified in the portfolio;

- Taking the risk into account in the process of prioritizing projects in the portfolio;

- A defined dependency management process;

- Regular portfolio risk reviews;

- How portfolio risk is communicated to senior management.

- Gathering information about risk in the organization (KO8);

- Gathering information in the organization on how the risk management process, i.e., identifying, assessing, and controlling risks, is carried out (KO9);

- Conducting market research of the organization’s environment that may affect the level of risk in the portfolio (KO11);

- Conducting benchmarking of the portfolio’s risk management processes against other organizations (KO12).

- Involvement of senior management in the reprioritization of the project portfolio (ZWK2);

- Involvement of senior management in the process of allocating resources to projects (ZWK3);

- Involvement of senior management in monitoring the progress of the project portfolio (ZWK4);

- Involvement of senior management in the portfolio risk management process (ZWK5);

- Senior management decision-making on the project portfolio based on risk analysis and assessment (ZWK6).

- Risk management as a component of portfolio project management (DP10);

- Risk management as a component of project portfolio management (DP11);

- Experience of portfolio managers in the process of portfolio risk management (DP13).

5. Discussion

- Identify and assess the coherence of implemented projects with the organization’s strategy, and therefore ensure that financial innovations are closely related to the direction of development of a given organization;

- Assess the effectiveness of the adopted risk management methods and select those assessed as the most effective;

- Strictly define risk ownership in order to identify responsibility for risk;

- Conduct periodic inspections of risk management and the effects of this process;

- Engage senior management in the risk management process, as this determines both the strategic orientation and the risk management process itself in the project portfolio.

6. Conclusions

- Extending and conducting research on a larger sample size, which raises the possibility of verifying the model using modeling based on the variance–covariance matrix (CB-SEM);

- Model verification in industries other than FinTech;

- Comparative research between two groups of organizations from different industries;

- Conducting research in FinTech start-ups that may not implement formalized risk management processes;

- Selection of other variables or modification of the proposed variables, e.g., by extending the described model;

- Application of the developed model in a FinTech enterprise;

- Verification of the methods of implementing the risk management process in project portfolios in industries other than FinTech;

- In-depth research on how to measure and understand the effectiveness of risk management in a project portfolio.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Ab Hamid, M. R., Waqas Sami, and M. Mohmad Sidek. 2017. Discriminant validity assessment: Use of Fornell & Larcker criterion versus HTMT criterion. Journal of Physics: Conference Series 890: 1–5. [Google Scholar]

- Ahmadi-Javid, Amir, Seyed Hamed Fateminia, and Hans Georg Gemünden. 2020. A Method for Risk Response Planning in Project Portfolio Management. Project Management Journal 51: 77–95. [Google Scholar] [CrossRef]

- Al Hammadi, Mohamed, Juan Antonio Jimber-Del Río, María Salomé Ochoa-Rico, Orlando Arencibia Montero, and Arnaldo Vergara-Romero. 2024. Risk Management in Islamic Banking: The Impact of Financial Technologies through Empirical Insights from the UAE. Risks 12: 17. [Google Scholar] [CrossRef]

- Almubarak, Ayth I., and Abdullah A. Aljughaiman. 2024. Corporate Governance and FinTech Innovation: Evidence from Saudi Banks. Journal of Risk and Financial Management 17: 48. [Google Scholar] [CrossRef]

- Amoah, Christopher, and Leon Pretorius. 2020. Evaluation of the impact of risk management on project performance in small construction firms in South Africa: The case study of construction systems. Journal of Engineering, Design and Technology 18: 611–34. [Google Scholar] [CrossRef]

- Archer, Norm P., and Fereidoun Ghasemzadeh. 1999. An integrated framework for project portfolio selection. International Journal of Project Management 17: 207–16. [Google Scholar] [CrossRef]

- Aritua, Bernard, Nigel J. Smith, and Denise Bower. 2009. Construction client multi-projects: A complex adaptive systems perspective. International Journal of Project Management 27: 72–79. [Google Scholar] [CrossRef]

- Association for Project Management. 2019. Portfolio Management: A Practical Guide. Buckinghamshire: Association for Project Management. [Google Scholar]

- AXELOS. 2010. Management of Risk: Guidance for Practitioners. London: TSO. [Google Scholar]

- AXELOS. 2011. Management of Portfolios. London: TSO. [Google Scholar]

- Bai, Libiao, Jieyu Bai, and Min An. 2022. A methodology for strategy-oriented project portfolio selection taking dynamic synergy into considerations. Alexandria Engineering Journal 61: 6357–69. [Google Scholar] [CrossRef]

- Balaskas, Stefanos, Maria Koutroumani, Kiriakos Komis, and Maria Rigou. 2024. FinTech Services Adoption in Greece: The Roles of Trust, Government Support, and Technology Acceptance Factors. FinTech 3: 83–101. [Google Scholar] [CrossRef]

- Bedyńska, Sylwia, and Monika Książek. 2012. Statystyczny drogowskaz 3. Praktyczny przewodnik wykorzystania modeli regresji oraz równań strukturalnych. Szkoła Warszawa: Wyższa Psychologii, pp. 163–64. [Google Scholar]

- Blichfeldt, Bodil Stilling, and Pernille Eskerod. 2008. Project portfolio management—There’s more to it than what management enacts. International Journal of Project Management 26: 357–65. [Google Scholar] [CrossRef]

- Cabała, Paweł. 2018. Proces budowy strategii portfela projektów. Zeszyt Naukowy Kolegium Zarządzania i Finansów 159: 93–106. [Google Scholar]

- Chadam, Jan, and Łukasz Kański. 2019. Projekt, Program i Portfel Projektów w Praktyce Gospodarczej. Lublin: Wydawnictwo UMCS, p. 179. [Google Scholar]

- Chatterjee, Samprit, and Ali S. Hadi. 2015. Regression Analysis by Example, 5th ed. Hoboken: John Wiley & Sons, Inc., pp. 249–51. [Google Scholar]

- Clegg, Stewart, Catherine P. Killen, Christopher Biesenthal, and Shankar Sankaran. 2018. Practices, projects and portfolios: Current research trends and new directions. International Journal of Project Management 36: 762–72. [Google Scholar] [CrossRef]

- Colombage, Sisira. 2023. Financial Technology (Fintech) and Sustainable Financing: A New Paradigm for Risk Management. Journal of Risk and Financial Management 16: 502. [Google Scholar] [CrossRef]

- Cooper, Robert G., and Elko J. Kleinschmidt. 1995. Benchmarking the firm’s critical success factors in new product development. Journal of Product Innovation Management 12: 374–91. [Google Scholar] [CrossRef]

- De Bakker, Karel, Albert Boonstra, and Hans Wortmann. 2010. Does risk management contribute to IT project success?: A meta-analysis of empirical evidence. International Journal of Project Management 28: 493–503. [Google Scholar] [CrossRef]

- De Reyck, Bert, Yael Grushka-Cockayne, Martin Lockett, Sergio Ricardo Calderini, Marcio Moura, and Andrew Sloper. 2005. The impact of project portfolio management on information technology projects. International Journal of Project Management 23: 524–37. [Google Scholar] [CrossRef]

- Deshpande, Rohit, and Frederick E. Webster. 1989. Organizational culture and marketing: Defining the research agenda. Journal of Marketing 53: 3–15. [Google Scholar] [CrossRef]

- Elonen, Suvi, and Karlos Artto. 2003. Problems in managing internal development projects in multi-project environments. International Journal of Project Management 21: 395–402. [Google Scholar] [CrossRef]

- García-Machado, Juan. 2017. Ocena łagodzącego efektu i testów zgodności modelu PLS w obrocie produktami finansowymi z wykorzystaniem Internetu. Marketing Instytucji Naukowych i Badawczych 4: 1–34. [Google Scholar]

- Ghasemi, Foroogh, Mohammad Hossein Mahmoudi Sari, Vahidreza Yousefi, Reza Falsafi, and Jolanta Tamošaitienė. 2018. Project Portfolio Risk Identification and Analysis, Considering Project Risk Interactions and Using Bayesian Networks. Sustainability 10: 1609. [Google Scholar] [CrossRef]

- Grinold, Richard. 2011. The description of Portfolios. The Journal of Portfolio Management 37: 15–30. [Google Scholar] [CrossRef]

- Guan, Dujuan, Peng Guo, Keith Hipel, and Liping Fang. 2017. Risk reduction in a project portfolio. Journal of Systems Science and Systems Engineering 26: 3–22. [Google Scholar] [CrossRef]

- Győri, Zsuzsanna, Yahya Khan, and Krisztina Szegedi. 2021. Business Model and Principles of a Values-Based Bank—Case Study of MagNet Hungarian Community Bank. Sustainability 13: 9239. [Google Scholar] [CrossRef]

- Hadjinicolaou, Nick, and Jantanee Dumrak. 2017. Investigating Association of Benefits and Barriers in Project Portfolio Management to Project Success. Procedia Engineering 182: 274–81. [Google Scholar] [CrossRef]

- Hair, Joseph Franklin, Jeffrey J. Risher, Marko Sarstedt, and Christian M. Ringle. 2019. When to use and how to report the results of PLS-SEM. European Business Review 31: 2–24. [Google Scholar] [CrossRef]

- Hair, Joseph, G. Tomas M. Hult, Christian M. Ringle, and Marko Sarstedt. 2023. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM). Thousand Oaks: SAGE Publications, Inc. [Google Scholar]

- Henseler, Jörg, Marko Sarstedt, and Christian M. Ringle. 2014. A New Criterion for Assessing Discriminant Validity in Variance-based Structural Equation Modeling. Journal of the Academy of Marketing Science 43: 115–35. [Google Scholar] [CrossRef]

- Hofman, Mariusz, Seweryn Spalek, and Grzegorz Grela. 2017. Shedding New Light on Project Portfolio Risk Management. Sustainability 9: 1798. [Google Scholar] [CrossRef]

- Hopmere, Michael, Lynn Crawford, and Michael S. Harré. 2020. Proactively Monitoring Large Project Portfolios. Project Management Journal 51: 656–69. [Google Scholar] [CrossRef]

- Hyväri, Irja. 2014. Project portfolio management in a company strategy implementation, a case study. Procedia—Social and Behavioral Sciences 119: 229–36. [Google Scholar] [CrossRef]

- Jonas, Daniel, Alexander Kock, and Hans Georg Gemuenden. 2012. Predicting Project Portfolio Success by Measuring Management Quality–A Longitudinal Study. IEEE Transactions on Engineering Management 60: 1–12. [Google Scholar] [CrossRef]

- Jonek-Kowalska, Izabela. 2019. Efficiency of enterprise risk management (ERM) systems. Comparative analysis in the fuel sector and energy sector on the basis of Central-European companies listed on the Warsaw Stock Exchange. Resource Policy 62: 405–15. [Google Scholar] [CrossRef]

- Jonek-Kowalska, Izabela. 2022. Effectiveness of Enterprise Risk Management. Determinants and Opportunities for Improvement. London: Palgrave Macmillan. [Google Scholar]

- Kacprzak, Agnieszka. 2018. Modelowanie strukturalne w analizie zachowań konsumentów: Porównanie metod opartych na analizie kowariancji (CB-SEM) i częściowych najmniejszych kwadratów (PLS-SEM). Handel Wewnętrzny 6: 247–61. [Google Scholar]

- Kendall, Gerald, and Steven Rollins. 2003. Advanced Project Portfolio Management and the PMO. Plantation: J. Ross Publishing, pp. 23–27. [Google Scholar]

- Kettunen, Janne, and Ahti Salo. 2017. Estimation of Downside Risks in Project Portfolio Selection. Production and Operations Management 26: 1839–53. [Google Scholar] [CrossRef]

- Kock, Alexander, Bastian Ekrot, and Hans Georg Gemünden. 2024. It Takes Two to Tango: The Interactive Effect of Project Portfolio Management Offices and Voice Behavior on Project Portfolio Management Quality and Business Success. Project Management Journal 1: 1–4. [Google Scholar] [CrossRef]

- Kock, Ned. 2020. Using indicator correlation fit indices in PLS-SEM: Selecting the algorithm with the best fit. Data Analysis Perspectives Journal 1: 1–4. [Google Scholar]

- Kodukula, Prasad S. 2014. Organizational Project Portfolio Management. Plantation: J. Ross Publishing. [Google Scholar]

- Kozarkiewicz, Alina. 2007. Zarządzanie portfelami projektów: Przegląd problemów i narzędzi. Przegląd Organizacji 12: 6–9. [Google Scholar] [CrossRef]

- Kozarkiewicz, Alina. 2012. Zarządzanie portfelami projektów. Wdrażanie i monitorowanie strategii organizacji za pomocą projektów. Warszawa: PWN, p. 50. [Google Scholar]

- Lee, Kun Chang, Namho Lee, and Honglei Li. 2009. A particle swarm optimization-driven cognitive map approach to analyzing information systems project risk. Journal of the American Society for Information Science and Technology 60: 1208–21. [Google Scholar]

- Lycett, Mark, Andreas Rassau, and John Danson. 2004. Programme management: A critical review. International Journal of Project Management 22: 289–99. [Google Scholar] [CrossRef]

- Malhotra, Davinder, and Srinivas Nippani. 2024. Assessing Energy Mutual Funds: Performance, Risks, and Managerial Skills. International Journal of Financial Studies 12: 20. [Google Scholar] [CrossRef]

- Martinsuo, Miia, and Päivi Lehtonen. 2007. Role of single-project management in achieving portfolio management efficiency. International Journal of Project Management 25: 56–65. [Google Scholar] [CrossRef]

- McFarlan, F. Warren. 1981. Portfolio approach to information systems. Harvard Business Review 59: 142–50. [Google Scholar]

- Micán, Camilo, Gabriela Fernandes, and Madalena Araújo. 2020. Project portfolio risk management: A structured literature review with future directions for research. International Journal of Information Systems and Project Management 8: 5. [Google Scholar] [CrossRef]

- Micán, Camilo, Gabriela Fernandes, Madalena Araújo, and Enrique Aresc. 2019. A theoretical perspective from a project portfolio risk lens. Procedia Manufacturing 41: 771–78. [Google Scholar] [CrossRef]

- Mieszajkina, Elena. 2018. Zarządzanie przedsiębiorcze w małych Firmach. Lublin: Wydawnictwo UMCS, p. 397. [Google Scholar]

- Nogalski, Bogdan. 1998. Kultura organizacyjna. Duch organizacji. Bydgoszcz: TNOiK, p. 8. [Google Scholar]

- Nunally, Jum C., and Ira H. Bernstein. 1994. Psychometric Theory. New York: McGraw-Hill, p. 182. [Google Scholar]

- Olsson, Rolf. 2008. Risk management in a multi-project environment: An approach to manage portfolio risks. International Journal of Quality & Reliability Management 25: 60–71. [Google Scholar]

- Osińska, Magdalena, Michał Bernard Pietrzak, and Mirosława Żurek. 2011. Wykorzystanie modeli równań strukturalnych do opisu psychologicznych mechanizmów podejmowania decyzji na rynku kapitałowym. Acta Universitatis Nicolai Copernici. Ekonomia XLII—Nauki Humanistyczno-Społeczne 402: 7–21. [Google Scholar] [CrossRef][Green Version]

- Praxis Standard. n.d. Available online: https://www.praxisframework.org/pl/knowledge/governance (accessed on 30 September 2023).

- Pritchard, Carl L. 2014. Risk Management: Concepts and Guidance. Palm Bay: CRC Press. [Google Scholar]

- Project Management Institute. 2017. The Standard for Portfolio Management 2017, 4th ed. Newtown Square: Project Management Institute, Inc. [Google Scholar]

- Purwanto, Agus, and Yuli Sudargini. 2021. Partial Least Squares Structural Squation Modeling (PLS-SEM). Analysis for Social and Management Research: A Literature Review. Journal of Industrial Engineering & Management Research 2: 114–23. [Google Scholar]

- Rad, Farzad Haghighi, and Seyed Mojtaba Rowzan. 2018. Designing a hybrid system dynamic model for analyzing the impact of strategic alignment on project portfolio selection. Simulation Modelling Practice and Theory 89: 175–94. [Google Scholar]

- Rajegopal, Shan, James Waller, and Philip McGuin. 2007. Project Portfolio Management: Leading the Corporate Vision. London: Springer, p. 11. [Google Scholar]

- Rakowska, Anna, and Radoslaw Macik. 2016. Zaangażowanie pracownika a satysfakcja z pracy—modelowanie zależności z wykorzystaniem PLS-SEM. Przegląd Organizacji 5: 49. [Google Scholar] [CrossRef]

- Relich, Marcin, and Pawel Pawlewski. 2016. A fuzzy weighted average approach for selecting portfolio of new product development projects. Neurocomputing 231: 19–27. [Google Scholar] [CrossRef]

- Rojas Rincón, Joan Sebastián, Andrés Mauricio Mejía Martínez, Andrés Ricardo Riveros Tarazona, and Julio César Acosta-Prado. 2024. Analysis of Systemic Risk on the Financial Performance during the COVID-19 Pandemic: The Case of the Colombian Banking Industry. Sustainability 16: 1716. [Google Scholar] [CrossRef]

- Ropponen, Janne, and Kalle Lyytinen. 2000. Components of software development risk: How to address them? A project manager survey. IEEE Transactions on Software Engineering 26: 98–112. [Google Scholar] [CrossRef]

- Sagan, Adam. 2015. Modele PLS-PM i ich zastosowania w predykcji i wyjaśnianiu zjawisk ekonomicznych. Studia i Prace Wydziału Nauk Ekonomicznych i Zarządzania 39/ 2: 127–38. [Google Scholar]

- Sanchez, Hynuk, Benoît Robert, and Robert Pellerin. 2008. A Project portfolio risk-opportunity identification framework. Project Management Journal 39: 97–109. [Google Scholar] [CrossRef]

- Sarfraz, Muddassar, Wang Qun, Li Hui, and Muhammad Ibrahim Abdullah. 2008. Environmental Risk Management Strategies and the Moderating Role of Corporate Social Responsibility in Project Financing Decisions. Sustainability 10: 2771. [Google Scholar] [CrossRef]

- Shi, Chenchen, and Jinjing Lu. 2024. Unlocking Economic Resilience: A New Methodological Approach and Empirical Examination under Digital Transformation. Land 13: 621. [Google Scholar] [CrossRef]

- Sikorski, Czesław. 2012. Kultura organizacyjna. Warszawa: C.H. Beck, p. 4. [Google Scholar]

- Strojny, Jacek, Krzysztof Witkowski, and Sebastian Wąs. 2023. Influence of Sustainable Strategic Management on Methane Projects as Exemplified by the Jastrzębska Spółka Węglowa S.A. Mining Company. Energies 16: 3680. [Google Scholar] [CrossRef]

- Surco-Guillen, Yovana Clarivel, Javier Romero, Rocío Rodríguez-Rivero, and Isabel Ortiz-Marcos. 2022. Success Factors in Management of Development Projects. Sustainability 14: 780. [Google Scholar] [CrossRef]

- Swink, Morgan. 2000. Technological innovativeness as a moderator of new product design integration and top management support. Journal of Product Innovation Management 17: 208–20. [Google Scholar] [CrossRef]

- Teller, Juliane. 2013. An empirical investigation on how portfolio risk management influences project portfolio success. International Journal of Project Management 31: 817–29. [Google Scholar] [CrossRef]

- Teo, Thompson S. H., Shirish C. Srivastava, and Li Jiang. 2008. Trust and electronic government success: An empirical study. Journal of Management Information Systems 25: 99–132. [Google Scholar] [CrossRef]

- Trzeciak, Mateusz, and Izabela Jonek-Kowalska. 2021. Monitoring and Control in Program Management as Effectiveness Drivers in Polish Energy Sector. Diagnosis and Directions of Improvement. Energies 14: 4661. [Google Scholar] [CrossRef]

- Unger, Barbara Natalie, Alexander Kock, Hans Georg Gemünden, and Daniel Jonas. 2012. Enforcing strategic fit of project portfolios by project termination: An empirical study on senior management involvement. International Journal of Project Management 30: 675–85. [Google Scholar] [CrossRef]

- Zelias, Aleksander. 1988. Problem współliniowości zmiennych w ekonometrii. Ruch Prawniczy, Ekonomiczny i Socjologiczny 3: 183–95. [Google Scholar]

| Strategic Orientation | |

|---|---|

| Symbol | Question |

| OR1 | Defined long-term strategy of the organization. |

| OR2 | Defined short-term strategy of the organization. |

| OR3 | Defined strategy for the project portfolio. |

| OR4 | Cohesiveness of the project portfolio strategy with the overall organization strategy. |

| OR5 | Integration of the portfolio management process with other processes in the organization, such as the quarterly strategy review. |

| OR6 | Selection of projects for the portfolio in the organization based on specific criteria that support the strategy. |

| OR7 | Ongoing review of projects in the portfolio for alignment with the organizational strategy. |

| OR8 | Allocating resources in the organization to projects in the portfolio following the organization’s strategy. |

| OR9 | Defined risk management strategy for the organization. |

| Organizational Context | |

|---|---|

| Symbol | Question |

| KO1 | Defined social norms, applicable in the organization. |

| KO2 | Identified key stakeholders of the project portfolio. |

| KO3 | Regular presentation of portfolio objectives to key stakeholders. |

| KO4 | Regular presentation of progress on portfolio objectives to key stakeholders. |

| KO5 | Gathering the organization’s experience in portfolio management so that it can be used in the future. |

| KO6 | Acceptance of uncertainty in the organization. |

| KO7 | Prudent approach to risk in the organization. |

| KO8 | Gathering information about risk in the organization. |

| KO9 | Gathering information in the organization on how the risk management process, i.e., identifying, assessing, and controlling risks, is carried out. |

| KO10 | Identification of regulatory requirements that may affect the level of risk in projects in the portfolio. |

| KO11 | Conducting market research of the organization’s environment that may affect the level of risk in the portfolio. |

| KO12 | Conducting benchmarking of the portfolio’s risk management processes against other organizations. |

| Senior Management Involvement | |

|---|---|

| Symbol | Question |

| ZWK1 | Involvement of senior management in the process of selecting projects for the project portfolio. |

| ZWK2 | Involvement of senior management in the reprioritization of the project portfolio. |

| ZWK3 | Involvement of senior management in the process of allocating resources to projects. |

| ZWK4 | Involvement of senior management in monitoring the progress of the project portfolio. |

| ZWK5 | Involvement of senior management in the portfolio risk management process. |

| ZWK6 | Senior management decision-making on the project portfolio based on risk analysis and assessment. |

| Adjusting the Portfolio to the Organization’s Governance | |

|---|---|

| Symbol | Question |

| DP1 | Defined organizational structure for project portfolio management. |

| DP2 | Defined process for project portfolio management. |

| DP3 | Defined roles in the project portfolio management process. |

| DP4 | Defined responsibilities for roles in the project portfolio management process. |

| DP5 | Defined escalation paths for the project portfolio. |

| DP6 | Formalized project management process. |

| DP7 | A functioning project portfolio office in the organization. |

| DP8 | Experience of Project Managers in the project management process. |

| DP9 | Experience of Portfolio Managers in the portfolio management process. |

| DP10 | Risk management as a component of portfolio project management. |

| DP11 | Risk management as a component of project portfolio management. |

| DP12 | Experience of Project Managers in the process of risk management in projects. |

| DP13 | Experience of Portfolio Managers in the process of portfolio risk management. |

| Portfolio Risk Management Process | |

|---|---|

| Symbol | Question |

| PZR1 | A defined risk management strategy. |

| PZR2 | A definition of risk at the project level. |

| PZR3 | A definition of risk. |

| PZR4 | Clearly defined risk management steps. |

| PZR5 | Defined roles in the project portfolio risk management process. |

| PZR6 | Defined responsibilities for roles in the project portfolio risk management process. |

| PZR7 | Defined risk management process for projects. |

| PZR8 | Defined ownership for risks identified. |

| PZR9 | Defined control process for risks identified. |

| PZR10 | Defined tolerable risk level, i.e., the level of risk the organization is willing to accept. |

| PZR11 | Defined level of tolerable risk. |

| PZR12 | Defined risk tolerance levels. |

| PZR13 | Consideration of risk assessment when prioritizing projects. |

| PZR14 | Regular review of risks in the projects. |

| PZR15 | Defined dependency management process. |

| PZR16 | Prepared portfolio reports for senior management. |

| PZR17 | Information on the level of risks in the projects included in the portfolio as part of the portfolio reports prepared for senior management. |

| PZR18 | Information on the level of risks across the portfolio as part of portfolio reports prepared for senior management. |

| PZR19 | Visualization of risks in the portfolio as an element of portfolio reports prepared for senior management |

| PZR20 | Linking project portfolio risk management to other risk management processes in the organization. |

| PZR21 | Collaboration between those responsible for managing risks in the project portfolio and those responsible for risk management in the organization. |

| PZR22 | Use of dedicated IT tools in the portfolio risk management process. |

| Effectiveness of the Project Portfolio Risk Management Process | |

|---|---|

| Symbol | Question |

| S1 | Risk management in the project portfolio contributes to reducing project delays. |

| S2 | When each project in the portfolio has a separate budget, risk management in the project portfolio helps avoid budget overruns of individual projects. |

| S3 | When the portfolio budget is managed holistically for all projects in the portfolio, project portfolio risk management avoids budget overruns for the entire portfolio. |

| S4 | Managing risk in a portfolio of projects reduces the likelihood that portfolio goals will not be met. |

| S5 | Portfolio risk management allows you to make decisions in a more informed manner. |

| S6 | Portfolio risk management keeps the parties involved in the portfolio informed of existing risks to the portfolio. |

| S7 | Risk management facilitates project decision-making based on a holistic view of the risks in the project portfolio. |

| S8 | Risk management facilitates the selection of projects in the portfolio, so that they represent a set of projects with variable levels of risk. |

| S9 | Portfolio risk management provides a better understanding of the projects in the portfolio |

| S10 | Portfolio risk management has a positive impact on the efficiency of the entire organization. |

| S11 | Portfolio risk management facilitates the organization’s strategic goals. |

| S12 | Risk management contributes to increasing the number of identified risks in the project portfolio. |

| S13 | Risk management contributes to mitigating actions on risks identified at the project portfolio level. |

| S14 | Risk management may contribute to the withholding of projects at the initiation stage. |

| S15 | Risk management may contribute to the withholding of projects at the implementation stage. |

| Specification | R-Square | Adjusted R-Square |

|---|---|---|

| Adjusting the portfolio to the organization’s governance | 0.494 | 0.484 |

| Strategic orientation | 0.384 | 0.372 |

| Risk management process in the project portfolio | 0.718 | 0.710 |

| Risk management efficiency in the project portfolio | 0.613 | 0.605 |

| Involvement of senior management in the risk management in the project portfolio | 0.178 | 0.170 |

| Specification | Cronbach’s Alpha Coefficient | Composite Reliability (rho_a) | Composite Reliability (rho_c) |

|---|---|---|---|

| Adjusting the portfolio to the organization’s governance | 0.867 | 0.877 | 0.919 |

| Organizational context | 0.810 | 0.815 | 0.875 |

| Strategic orientation | 0.761 | 0.762 | 0.863 |

| Risk management process in the project portfolio | 0.960 | 0.961 | 0.964 |

| Risk management efficiency in the project portfolio | 0.941 | 0.943 | 0.950 |

| Involvement of senior management in the risk management in the project portfolio | 0.864 | 0.874 | 0.902 |

| Specification | Average Variance Extracted (AVE) |

|---|---|

| Adjusting the portfolio to the organization’s governance | 0.792 |

| Organizational context | 0.637 |

| Strategic orientation | 0.679 |

| Risk management process in the project portfolio | 0.598 |

| Risk management efficiency in the project portfolio | 0.654 |

| Involvement of senior management in the risk management in the project portfolio | 0.648 |

| Specification | Adjusting the Portfolio to the Organization’s Governance | Organizational Context | Strategic Orientation | Risk Management Process in the Project Portfolio | Risk Management Efficiency in the Project Portfolio | Involvement of Senior Management in the Risk Management in the Project Portfolio |

|---|---|---|---|---|---|---|

| DP10 | 0.917 | 0.576 | 0.491 | 0.714 | 0.632 | 0.532 |

| DP11 | 0.936 | 0.531 | 0.507 | 0.741 | 0.641 | 0.615 |

| DP13 | 0.813 | 0.378 | 0.353 | 0.666 | 0.543 | 0.507 |

| KO8 | 0.340 | 0.779 | 0.300 | 0.440 | 0.372 | 0.306 |

| KO9 | 0.443 | 0.757 | 0.349 | 0.518 | 0.398 | 0.403 |

| KO11 | 0.498 | 0.847 | 0.435 | 0.550 | 0.532 | 0.301 |

| KO12 | 0.489 | 0.805 | 0.288 | 0.529 | 0.521 | 0.335 |

| OR6 | 0.438 | 0.421 | 0.858 | 0.496 | 0.504 | 0.484 |

| OR7 | 0.391 | 0.309 | 0.857 | 0.424 | 0.481 | 0.465 |

| OR8 | 0.429 | 0.337 | 0.753 | 0.480 | 0.477 | 0.492 |

| PZR3 | 0.583 | 0.520 | 0.321 | 0.753 | 0.508 | 0.350 |

| PZR4 | 0.604 | 0.571 | 0.410 | 0.735 | 0.533 | 0.421 |

| PZR5 | 0.591 | 0.594 | 0.470 | 0.773 | 0.594 | 0.444 |

| PZR6 | 0.600 | 0.560 | 0.436 | 0.751 | 0.604 | 0.460 |

| PZR7 | 0.610 | 0.526 | 0.479 | 0.754 | 0.579 | 0.470 |

| PZR8 | 0.614 | 0.362 | 0.591 | 0.744 | 0.664 | 0.593 |

| PZR9 | 0.693 | 0.441 | 0.550 | 0.839 | 0.682 | 0.518 |

| PZR10 | 0.563 | 0.519 | 0.436 | 0.799 | 0.619 | 0.450 |

| PZR11 | 0.540 | 0.483 | 0.471 | 0.757 | 0.577 | 0.506 |

| PZR12 | 0.564 | 0.458 | 0.472 | 0.747 | 0.549 | 0.484 |

| PZR13 | 0.760 | 0.499 | 0.450 | 0.834 | 0.676 | 0.607 |

| PZR14 | 0.670 | 0.467 | 0.442 | 0.753 | 0.561 | 0.604 |

| PZR15 | 0.647 | 0.518 | 0.462 | 0.755 | 0.552 | 0.620 |

| PZR16 | 0.574 | 0.433 | 0.330 | 0.720 | 0.486 | 0.499 |

| PZR17 | 0.683 | 0.489 | 0.403 | 0.840 | 0.588 | 0.555 |

| PZR18 | 0.664 | 0.429 | 0.368 | 0.824 | 0.609 | 0.571 |

| PZR19 | 0.538 | 0.520 | 0.330 | 0.768 | 0.604 | 0.409 |

| PZR20 | 0.511 | 0.582 | 0.452 | 0.756 | 0.514 | 0.417 |

| S4 | 0.465 | 0.351 | 0.390 | 0.601 | 0.697 | 0.514 |

| S5 | 0.542 | 0.425 | 0.522 | 0.632 | 0.869 | 0.469 |

| S6 | 0.605 | 0.461 | 0.553 | 0.648 | 0.874 | 0.508 |

| S7 | 0.586 | 0.476 | 0.551 | 0.570 | 0.795 | 0.486 |

| S8 | 0.460 | 0.412 | 0.443 | 0.541 | 0.818 | 0.382 |

| S9 | 0.597 | 0.509 | 0.418 | 0.606 | 0.822 | 0.501 |

| S10 | 0.597 | 0.631 | 0.465 | 0.709 | 0.810 | 0.411 |

| S11 | 0.576 | 0.596 | 0.474 | 0.667 | 0.798 | 0.490 |

| S12 | 0.529 | 0.357 | 0.513 | 0.581 | 0.790 | 0.417 |

| S13 | 0.532 | 0.398 | 0.445 | 0.535 | 0.799 | 0.342 |

| ZWK2 | 0.460 | 0.163 | 0.457 | 0.446 | 0.381 | 0.765 |

| ZWK3 | 0.416 | 0.292 | 0.446 | 0.478 | 0.305 | 0.785 |

| ZWK4 | 0.481 | 0.285 | 0.409 | 0.465 | 0.391 | 0.869 |

| ZWK5 | 0.544 | 0.532 | 0.560 | 0.598 | 0.599 | 0.839 |

| ZWK6 | 0.567 | 0.353 | 0.452 | 0.584 | 0.518 | 0.762 |

| Specification | DP | KO | OR | PZR | S | ZWK |

|---|---|---|---|---|---|---|

| Adjusting the portfolio to the organization’s governance (DP) | 0.890 | - | - | - | - | - |

| Organizational context (KO) | 0.561 | 0.798 | - | - | - | - |

| Strategic orientation (OR) | 0.510 | 0.434 | 0.824 | - | - | - |

| Risk management process in the project portfolio (PZR) | 0.795 | 0.642 | 0.568 | 0.773 | - | - |

| Risk management efficiency in the project portfolio (S) | 0.682 | 0.577 | 0.593 | 0.758 | 0.809 | - |

| Involvement of senior management in the risk management in the project portfolio (ZWK) | 0.621 | 0.422 | 0.584 | 0.649 | 0.561 | 0.805 |

| Heterotrait–Monotrait Ratio (HTMT) | |

|---|---|

| Organizational context ⇄ Adjusting the portfolio to the organization’s governance | 0.657 |

| Strategic orientation ⇄ Adjusting the portfolio to the organization’s governance | 0.623 |

| Strategic orientation ⇄ Organizational context | 0.546 |

| Risk management process in the project portfolio ⇄ Adjusting the portfolio to the organization’s governance | 0.868 |

| Risk management process in the project portfolio ⇄ Organizational context | 0.727 |

| Risk management process in the project portfolio ⇄ Strategic orientation | 0.661 |

| Risk management efficiency in the project portfolio ⇄ Adjusting the portfolio to the organization’s governance | 0.752 |

| Risk management efficiency in the project portfolio ⇄ Organizational context | 0.649 |

| Risk management efficiency in the project portfolio ⇄ Strategic orientation | 0.698 |

| Risk management efficiency in the project portfolio ⇄ Risk management process in the project portfolio | 0.791 |

| Involvement of senior management in the risk management in the project portfolio ⇄ Adjusting the portfolio to the organization’s governance | 0.707 |

| Involvement of senior management in the risk management in the project portfolio ⇄ Organizational context | 0.481 |

| Involvement of senior management in the risk management in the project portfolio ⇄ Strategic orientation | 0.712 |

| Involvement of senior management in the risk management in the project portfolio ⇄ Risk management process in the project portfolio | 0.697 |

| Involvement of senior management in the risk management in the project portfolio ⇄ Risk management efficiency in the project portfolio | 0.603 |

| Specification | DP | KO | OR | PZR | S | ZWK |

|---|---|---|---|---|---|---|

| Adjusting the portfolio to the organization’s governance (DP) | - | - | 1.975 | - | - | |

| Organizational context (KO) | 1.217 | 1.217 | 1.478 | - | 1.000 | |

| Strategic orientation (OR) | - | - | - | 1.476 | - | |

| Risk management process in the project portfolio (PZR) | - | - | - | 1.476 | - | |

| Risk management efficiency in the project portfolio (S) | - | - | - | - | - | |

| Involvement of senior management in the risk management in the project portfolio (ZWK) | 1.217 | 1.217 | 1.648 | - | - |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Khalil-Oliwa, O.; Jonek-Kowalska, I. Determinants of the Effectiveness of Risk Management in the Project Portfolio in the FinTech Industry. Risks 2024, 12, 111. https://doi.org/10.3390/risks12070111

Khalil-Oliwa O, Jonek-Kowalska I. Determinants of the Effectiveness of Risk Management in the Project Portfolio in the FinTech Industry. Risks. 2024; 12(7):111. https://doi.org/10.3390/risks12070111

Chicago/Turabian StyleKhalil-Oliwa, Oliwia, and Izabela Jonek-Kowalska. 2024. "Determinants of the Effectiveness of Risk Management in the Project Portfolio in the FinTech Industry" Risks 12, no. 7: 111. https://doi.org/10.3390/risks12070111

APA StyleKhalil-Oliwa, O., & Jonek-Kowalska, I. (2024). Determinants of the Effectiveness of Risk Management in the Project Portfolio in the FinTech Industry. Risks, 12(7), 111. https://doi.org/10.3390/risks12070111