Pricing of Averaged Variance, Volatility, Covariance and Correlation Swaps with Semi-Markov Volatilities

Abstract

:1. Introduction

2. Basic Definitions and Literature Review

2.1. Variance, Volatility, Covariance, Correlation Swaps: Basic Definitions

2.1.1. Variance and Volatility Swaps

2.1.2. Covariance and Correlation Swaps

2.2. Semi-Markov Process and Some Properties

3. Methods for Pricing Averaged Variance, Volatility, Covariance and Correlations Swaps

3.1. Variance and Volatility Swaps for Financial Markets with Semi-Markov Stochastic Volatilities

3.1.1. Pricing of Variance Swaps

3.1.2. Pricing of Volatility Swaps

3.1.3. Approximations of Variance and Volatility Swaps with Semi-Markov Volatility

3.2. Covariance and Correlation Swaps for Financial Markets with Semi-Markov Stochastic Volatilities

3.2.1. Pricing of Covariance Swaps

3.2.2. Pricing of Correlation Swaps

3.2.3. Approximations of Covariance and Correlation Swaps with Semi-Markov Stochastic Volatility

3.3. Averaged Prices of the Variance, Volatility, Covariance and Correlation Swaps with Semi-Markov Volatilities

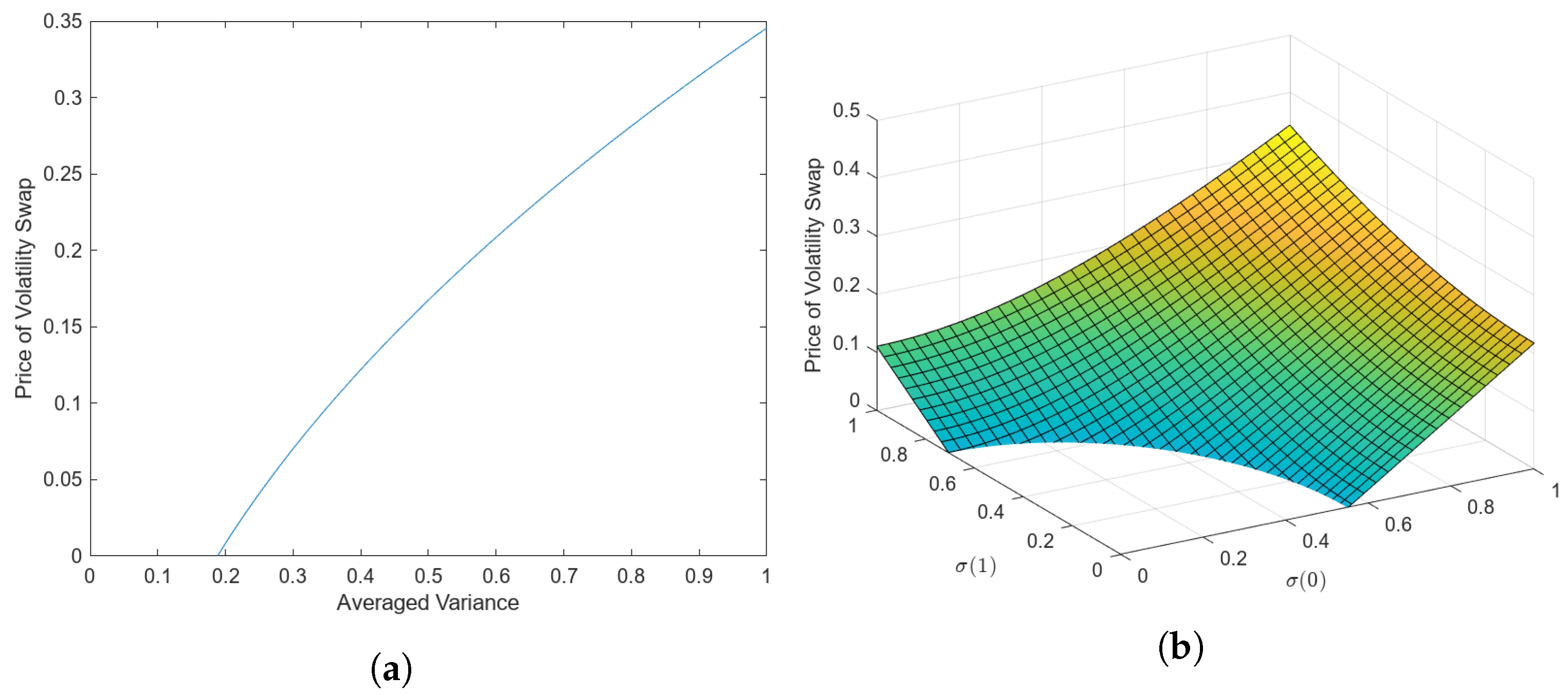

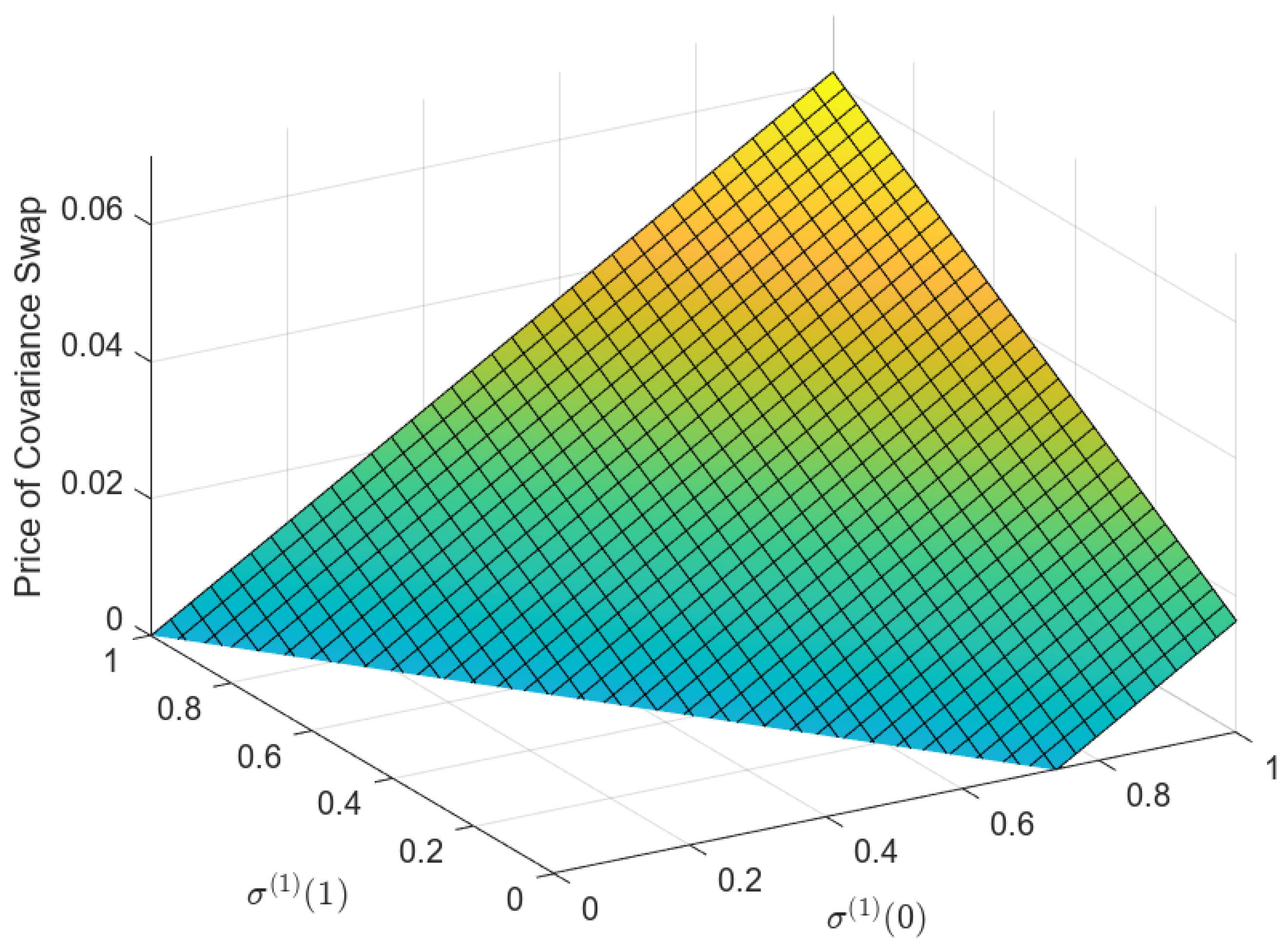

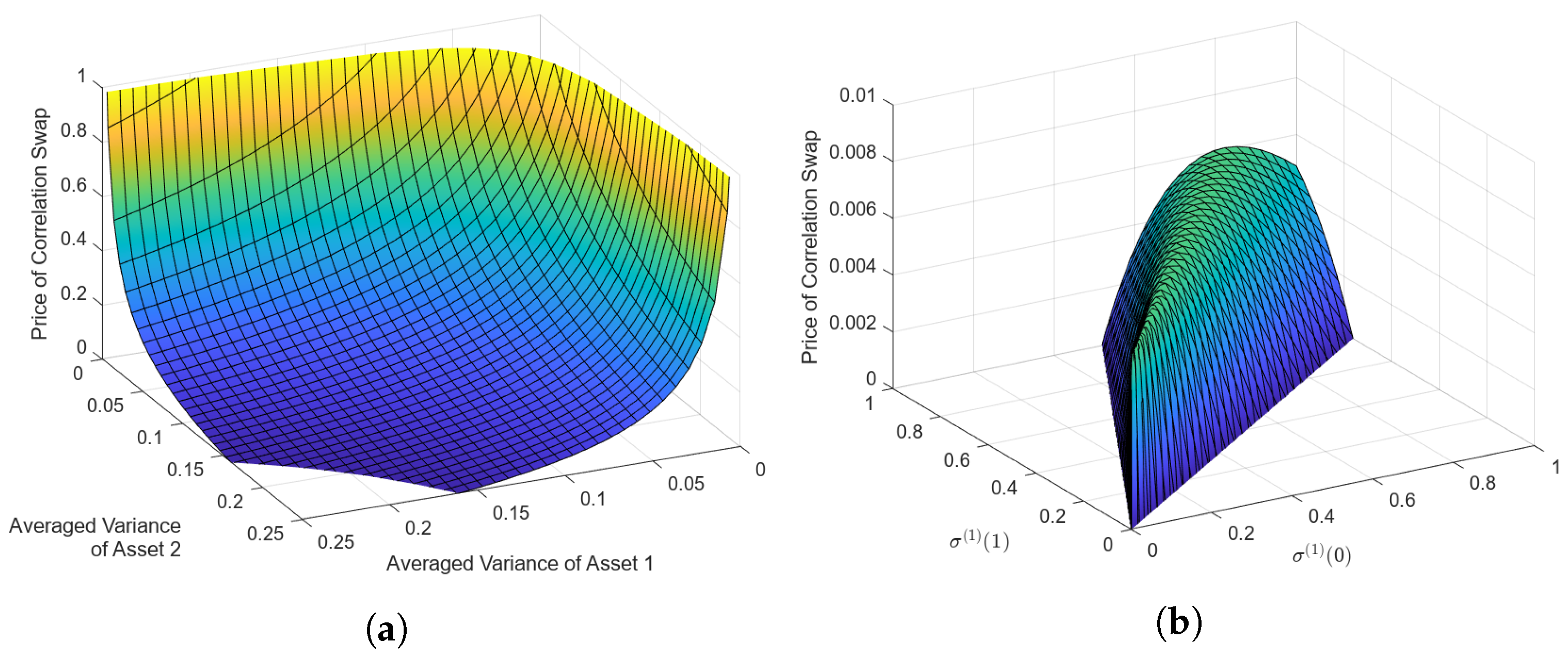

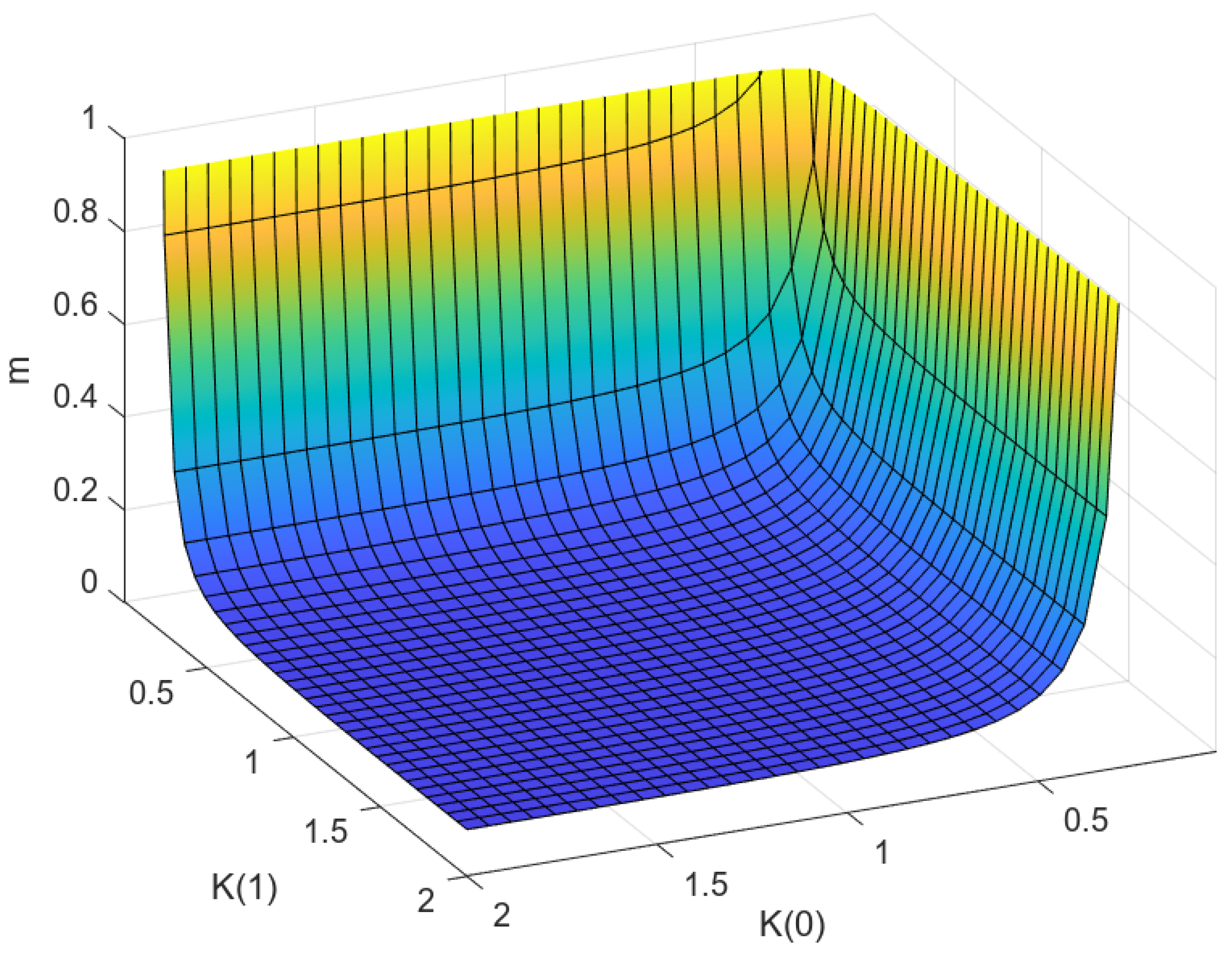

4. Numerical Example: A Semi-Markov Process with Two States

4.1. Defining the Values for Volatilities

4.2. Defining the Values for the Volatilities

4.3. Formulas for the Prices of Averaged Variance, Volatility, Covariance and Correlation Swaps

4.4. Numerical Toy Example

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| MDPI | Multidisciplinary Digital Publishing Institute |

| S&P 500 | Standard and Poor’s 500 |

| CBOE | Chicago Board Options Exchange |

| VIX | CBOE Volatility Index |

| VXN | CBOE NASDAQ-100 Volatility Index |

| SDE | Stochastic Differential Equation |

| GBM | Geometric Brownian Motion |

| Var | Variance |

| Vol | Volatility |

| Cov | Covariance |

| Corr | Correlation |

| Cf | Confer |

| NSERC | Natural Sciences and Engineering Research Council of Canada |

| HFT | High-Frequency Trading |

Appendix A. Realized Correlation: First Order Correction

References

- Badescu, Andrei, Anatoliy Swishchuk, Raymond Cheng, Stephan Lawi, Hammouda Mekki, Asrat Gashaw, Yuanyuan Hua, Marat Molyboga, Tereza Neocleous, and Yuri Petratchenko. 2002. Price Pseudo-Variance, Pseudo-Covariance, Pseudo-Volatility, and Pseudo-Correlation Swaps-In Analytical Closed-Forms. Paper presented at the Sixth PIMS Industrial Problems Solving Workshop, University of British Columbia, Vancouver, BC, Canada, May 24–31; pp. 45–55. [Google Scholar]

- Benth, Fred Espen, Martin Groth, and Rodwell Kufakunesu. 2007. Valuing Volatility and Variance Swaps for a Non-Gaussian Ornstein–Uhlenbeck Stochastic Volatility Model. Applied Mathematical Finance 14: 347–63. [Google Scholar] [CrossRef]

- Bossu, Sébastien. 2005. Arbitrage Pricing of Equity Correlation Swaps. Working Paper. London: JPMorgan Equity Derivatives Group. [Google Scholar]

- Bossu, Sebastien. 2007. A New Approach for Modelling and Pricing Correlation Swaps. Working Paper. London: Equity Structuring—ECD. [Google Scholar]

- Broadie, Mark, and Ashish Jain. 2008a. The Effect of Jumps and Discrete Sampling on Volatility and Variance Swaps. International Journal of Theoretical and Applied Finance 11: 761–97. [Google Scholar] [CrossRef]

- Broadie, Mark, and Ashish Jain. 2008b. Pricing and Hedging Volatility Derivatives. The Journal of Derivatives 15: 7–24. [Google Scholar] [CrossRef]

- Brockhaus, Oliver, and Douglas Long. 2000. Volatility Swaps Made Simple. Risk-London Magazine Limited 13: 92–96. [Google Scholar]

- Carr, Peter, Hélyette Geman, Dilip B. Madan, and Marc Yor. 2005. Pricing options on realized variance. Finance and Stochastics 9: 453–75. [Google Scholar] [CrossRef]

- Carr, Peter, and Roger Lee. 2007. Realized Volatility and Variance: Options via Swaps. Technical Report. Chicago: Bloomberg LP and University of Chicago. [Google Scholar]

- Carr, Peter, and Roger Lee. 2009. Volatility Derivatives. Annual Review of Financial Economics 1: 319–39. [Google Scholar] [CrossRef]

- Carr, Peter, and Dilip Madan. 1999. Introducing the Covariance Swap: Techniques for hedging by using the correlation between two currency pairs. Risk 12: 47–51. [Google Scholar]

- Da Fonseca, José, Martino Grasselli, and Florian Ielpo. 2011. Hedging (Co)Variance Risk with Variance Swaps. International Journal of Theoretical and Applied Finance 14: 899–943. [Google Scholar] [CrossRef]

- Demeterfi, Kresimir, Emanuel Derman, Michael Kamal, and Joseph Zou. 1999. A Guide to Volatility and Variance Swaps. The Journal of Derivatives 6: 9–32. [Google Scholar] [CrossRef]

- Derman, Emanuel, Iraj Kani, and Michael Kamal. 1997. Trading and hedging local volatility. Journal of Financial Engineering 6: 233–68. [Google Scholar]

- Driessen, Joost, Pascal J. Maenhout, and Grigory Vilkov. 2009. The Price of Correlation Risk: Evidence from Equity Options. The Journal of Finance 64: 1377–406. [Google Scholar] [CrossRef]

- Dupire, Bruno. 1993. Model Art. Risk 6: 118–24. [Google Scholar]

- Dupire, Bruno. 1996. A unified theory of volatility. In Derivatives Pricing: The Classic Collection. London: Risk Books, pp. 185–96. [Google Scholar]

- Elliott, Robert J., Tak Kuen Siu, and Leunglung Chan. 2007. Pricing Volatility Swaps Under Heston’s Stochastic Volatility Model with Regime Switching. Applied Mathematical Finance 14: 41–62. [Google Scholar] [CrossRef]

- Elliott, Robert J., Tak Kuen Siu, Leunglung Chan, and John W. Lau. 2007. Pricing Options Under a Generalized Markov-Modulated Jump-Diffusion Model. Stochastic Analysis and Applications 25: 821–43. [Google Scholar] [CrossRef]

- Elliott, Robert J., and Anatoliy V. Swishchuk. 2007. Pricing Options and Variance Swaps in Markov-Modulated Brownian Markets. In Hidden Markov Models in Finance. Edited by Rogemar S. Mamon and Robert J. Elliott. Series Title: International Series in Operations Research & Management Science; Boston: Springer US, vol. 104, pp. 45–68. [Google Scholar] [CrossRef]

- Heath, David, Robert Jarrow, and Andrew Morton. 1992. Bond pricing and the term structure of interest rates: A new methodology for contingent claims valuation. Econometrica: Journal of the Econometric Society 60: 77–105. [Google Scholar] [CrossRef]

- Howison, Sam, Avraam Rafailidis, and Henrik Rasmussen. 2004. On the pricing and hedging of volatility derivatives. Applied Mathematical Finance 11: 317–46. [Google Scholar] [CrossRef]

- Javaheri, Alireza, Paul Wilmott, and Espen Haug. 2002. GARCH and Volatility swaps. Quantitative Finance 4: 589–595. [Google Scholar] [CrossRef]

- Krishnamoorthy, Kalimuthu. 2006. Handbook of Statistical Distributions with Applications. Number 188 in Statistics, a Series of Textbooks & monographs; Boca Raton: Chapman & Hall/CRC. [Google Scholar]

- Neuberger, Anthony. 1994. The Log Contract. The Journal of Portfolio Management 20: 74–80. [Google Scholar] [CrossRef]

- Pogorui, Anatoliy, Anatoliy Swishchuk, and Ramón M. Rodríguez-Dagnino. 2021. Random Motions in Markov and Semi-Markov Random Environments 2: High-dimensional Random Motions and Financial Applications, 2nd ed. New York: John Wiley & Sons. [Google Scholar]

- Salvi, Giovanni, and Anatoliy Swishchuk. 2014. Covariance and Correlation Swaps for Financial Markets with Markov-Modulated Volatilities. International Journal of Theoretical and Applied Finance 17: 1–23. [Google Scholar] [CrossRef]

- Salvi, Giovanni, and Anatoliy V. Swishchuk. 2012. Modeling and Pricing of Covariance and Correlation Swaps for Financial Markets with Semi-Markov Volatilities. arXiv arXiv:1205.5565. doi:10.48550/ARXIV.1205.5565. [Google Scholar] [CrossRef]

- Sepp, Artur. 2008. Pricing options on realized variance in heston model with jumps in returns and volatility. Journal of Computational Finance 11: 33–70. [Google Scholar] [CrossRef]

- Swishchuk, Anatoliy. 1992. Limit theorems for stochastic differential equations with semi-Markov switchings. Paper presented at the the International School-Evolution of Stochastic Systems: Theory and Applications, Ukraine, Crimea, May 3; pp. 3–4. [Google Scholar]

- Swishchuk, Anatoly. 1997. Random Evolutions and Their Applications. Number 408. Dordrechts: Kluwer Academic Publishers. [Google Scholar]

- Swishchuk, Anatoliy. 2004. Modeling of Variance and Volatility Swaps for Financial Markets with Stochastic Volatilities. Wilmott Magazine 2: 64–72. [Google Scholar]

- Swishchuk, Anatoliy. 2013. Pricing of Variance and Volatility Swaps with Semi-Markov Volatilities. Singapore: World Scientific Publishing Co. Pte. Ltd., pp. 173–87. [Google Scholar]

- Windcliff, Heath, Peter Forsyth, and Ken Vetzal. 2006. Pricing methods and hedging strategies for volatility derivatives. Journal of Banking & Finance 30: 409–31. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Swishchuk, A.; Franco, S. Pricing of Averaged Variance, Volatility, Covariance and Correlation Swaps with Semi-Markov Volatilities. Risks 2023, 11, 162. https://doi.org/10.3390/risks11090162

Swishchuk A, Franco S. Pricing of Averaged Variance, Volatility, Covariance and Correlation Swaps with Semi-Markov Volatilities. Risks. 2023; 11(9):162. https://doi.org/10.3390/risks11090162

Chicago/Turabian StyleSwishchuk, Anatoliy, and Sebastian Franco. 2023. "Pricing of Averaged Variance, Volatility, Covariance and Correlation Swaps with Semi-Markov Volatilities" Risks 11, no. 9: 162. https://doi.org/10.3390/risks11090162

APA StyleSwishchuk, A., & Franco, S. (2023). Pricing of Averaged Variance, Volatility, Covariance and Correlation Swaps with Semi-Markov Volatilities. Risks, 11(9), 162. https://doi.org/10.3390/risks11090162