Cox-Based and Elliptical Telegraph Processes and Their Applications

Abstract

1. Introduction

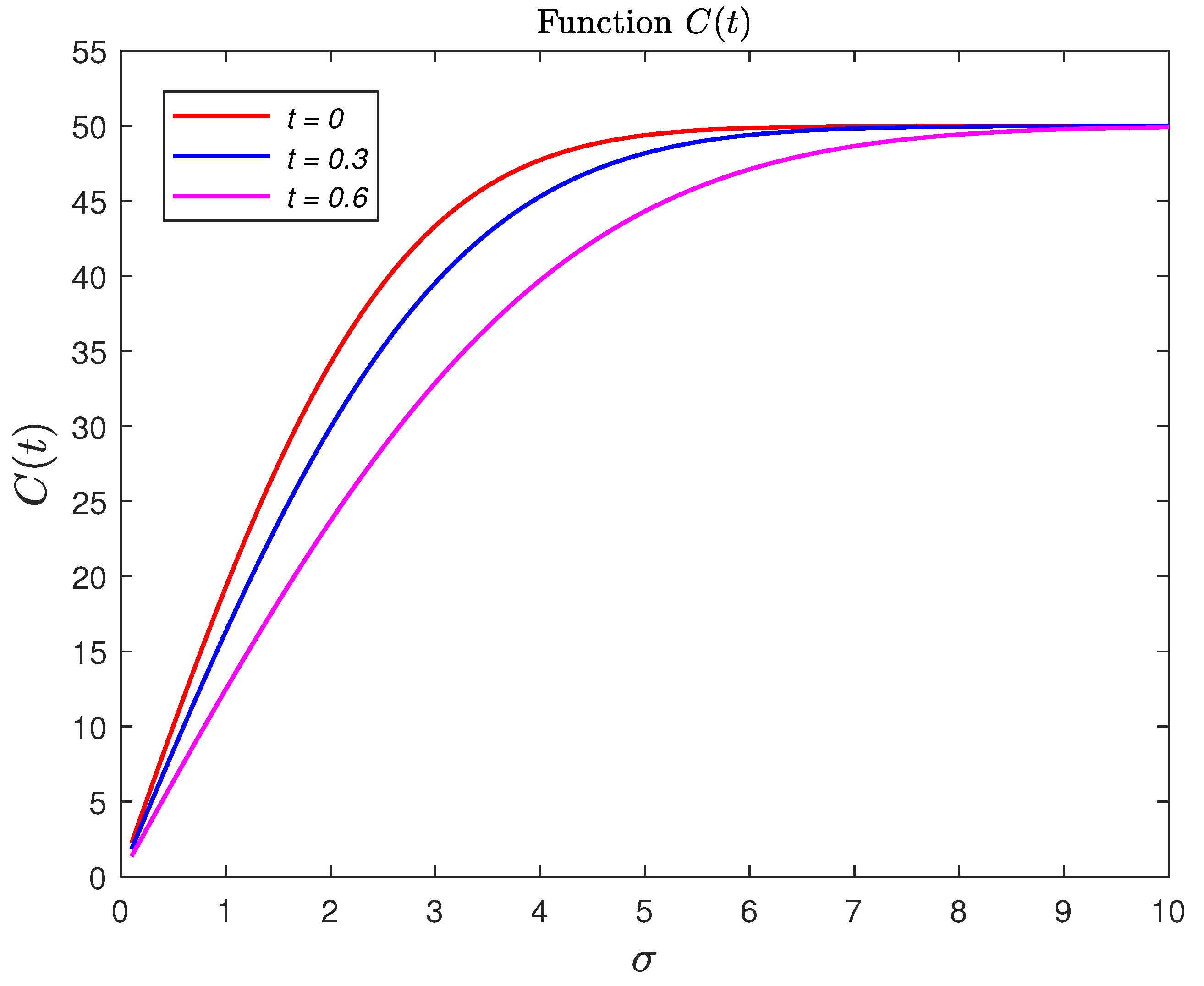

2. Characteristic Function

3. Numerical Examples: Option Pricing for Cox-Based Telegraph Process

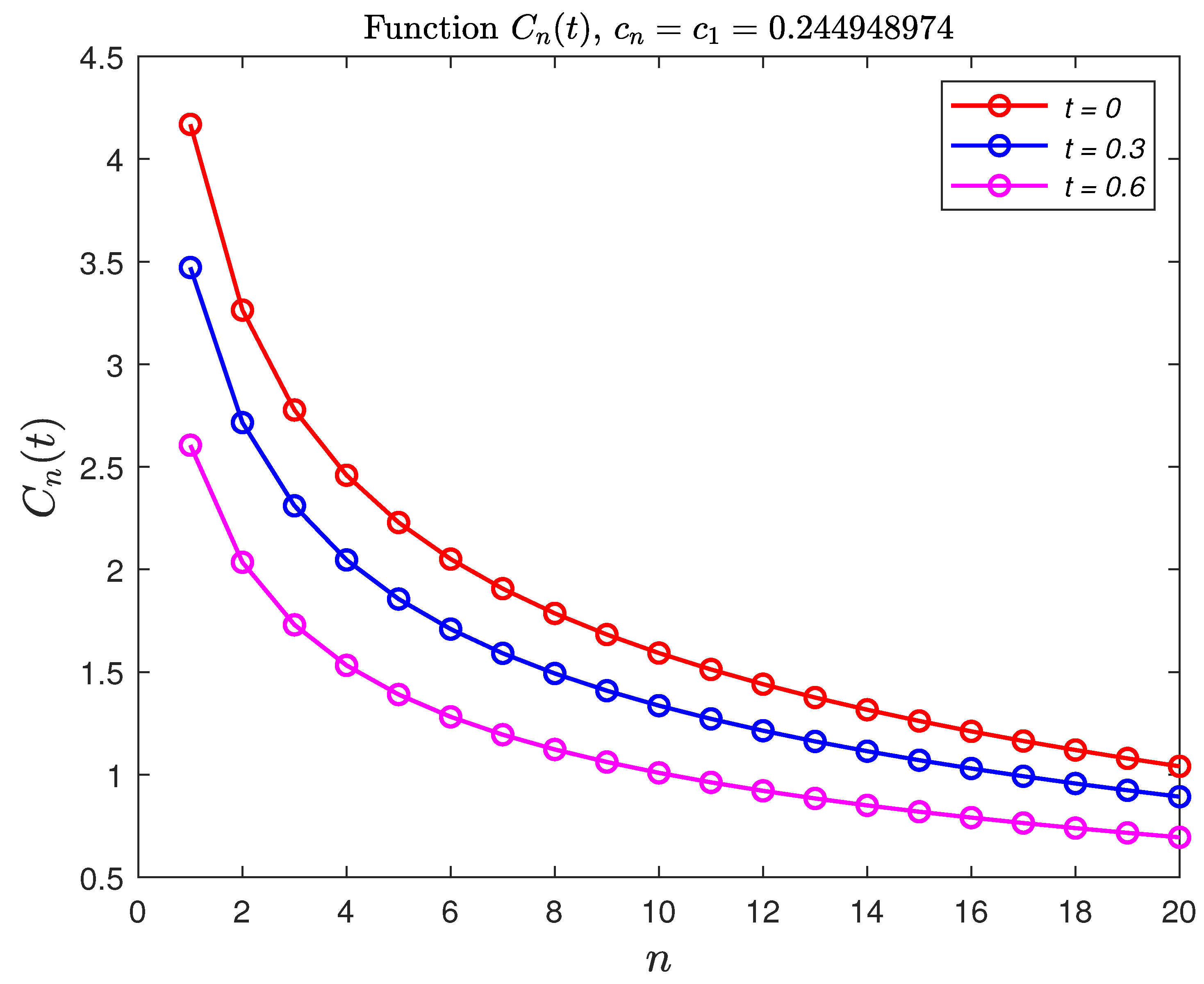

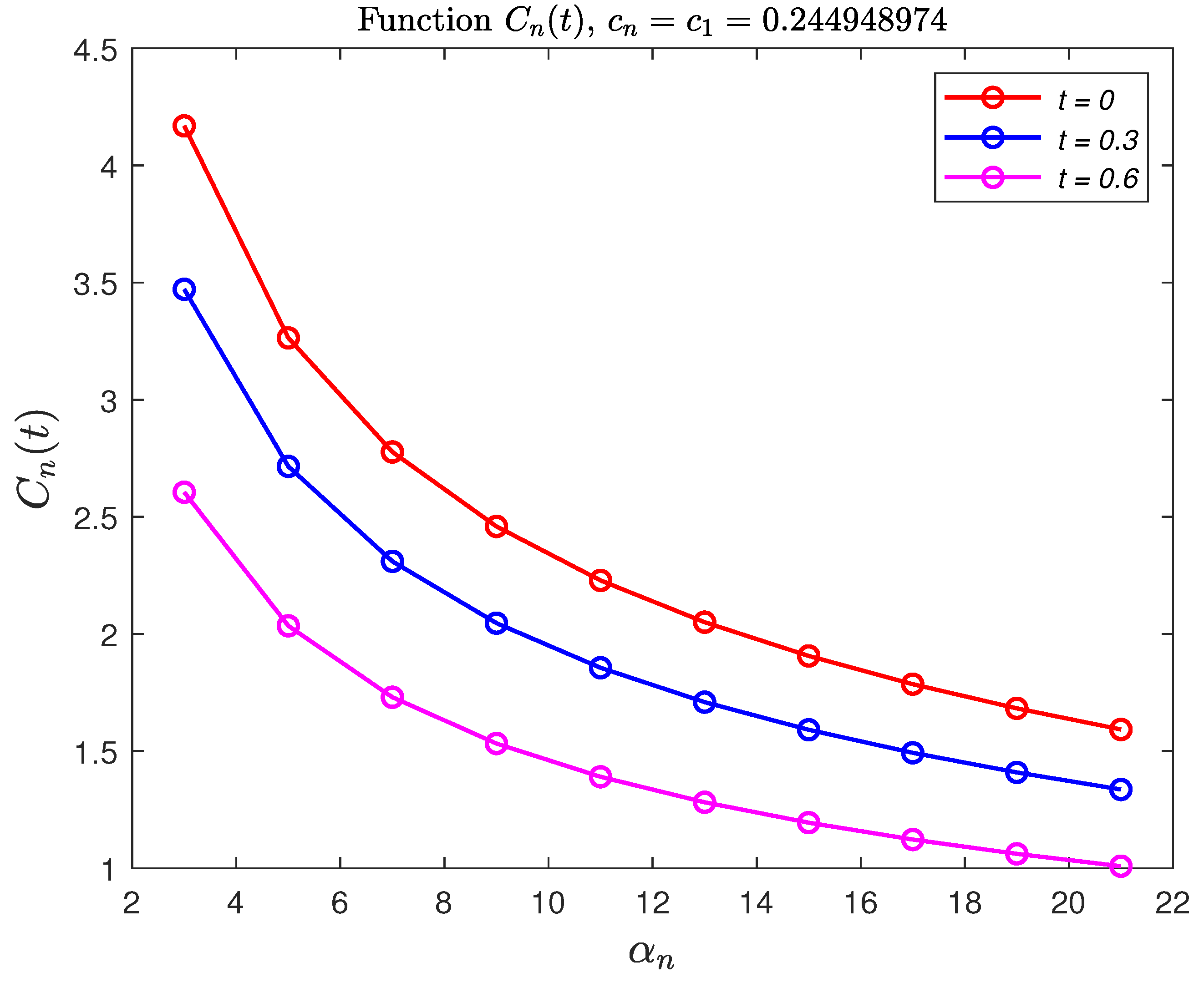

3.1. Numerical Example 1 (Black–Scholes Formula Based on Example 2)

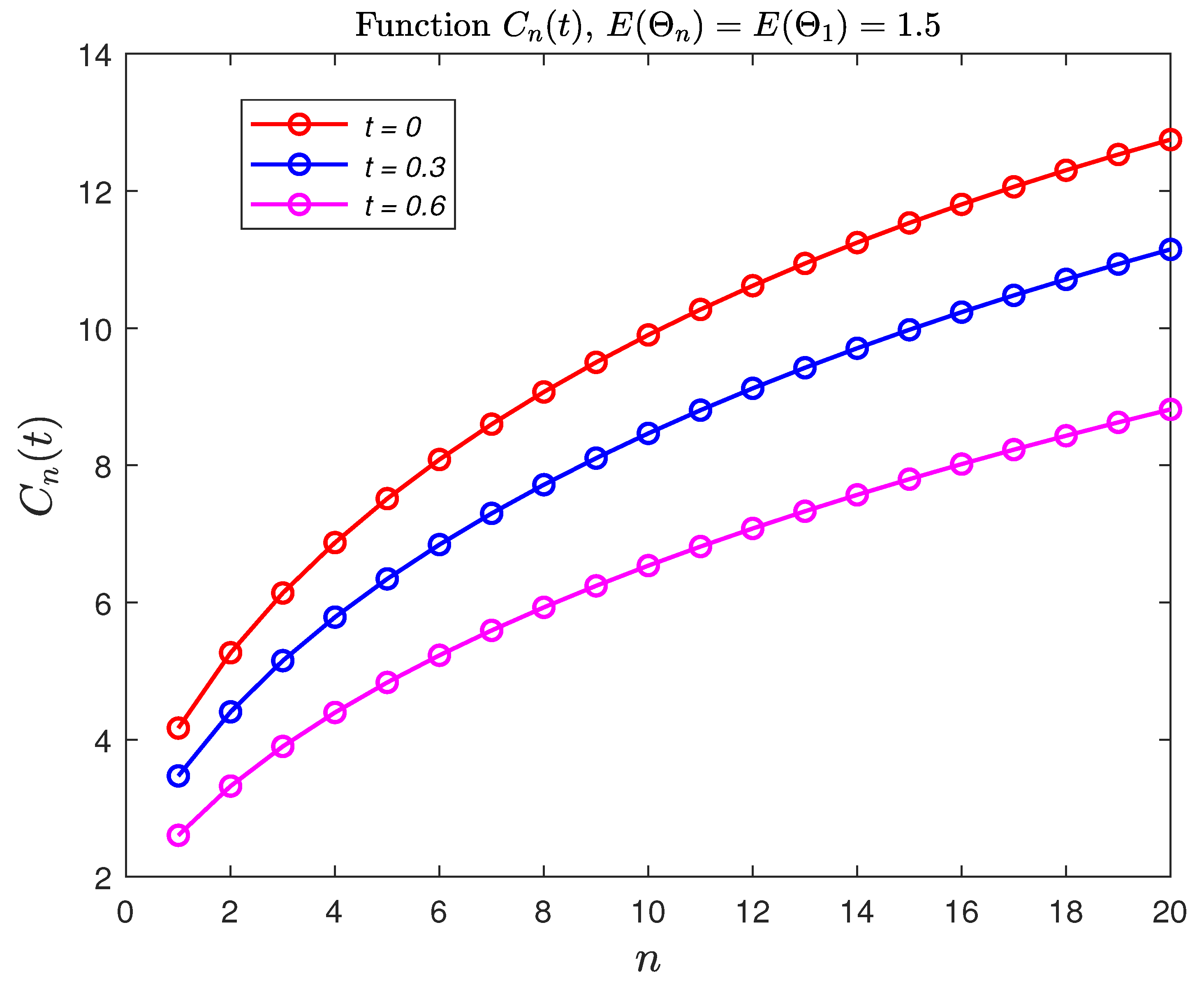

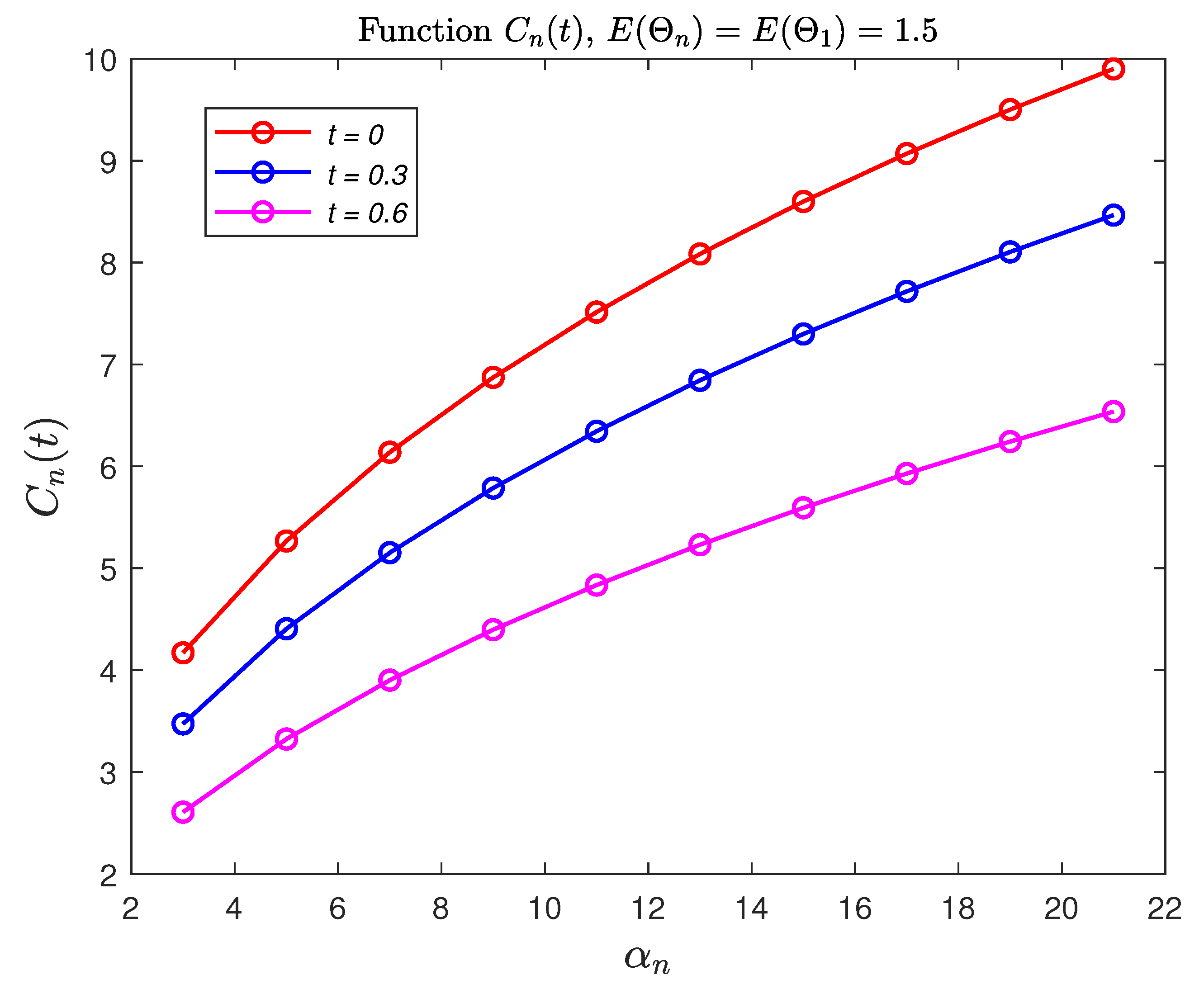

3.2. Numerical Example 2 (Black–Scholes Formula Based on Example 3)

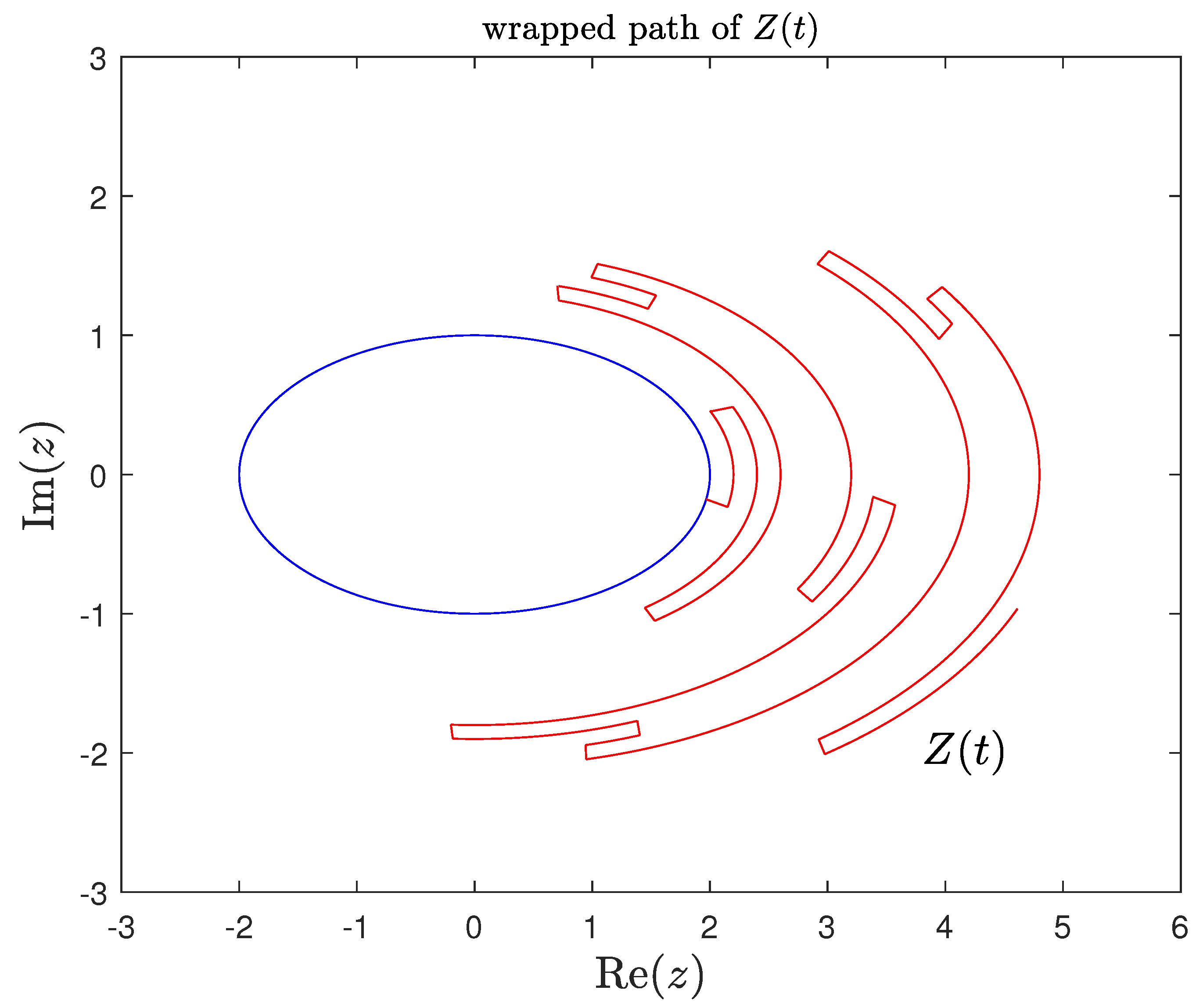

4. Telegraph Motion on an Ellipse: Elliptical Telegraph Process

- In the case where is the Poisson with parameter and constant, the characteristic function is of the following form (Pogorui et al. (2021c)):Therefore,It is easy to see that using Newton’s binomial theorem, we can calculate moments for any integer n.

- As it was shown above, in the case where , , we have . Hence,

Applications of Elliptical Telegraph Process

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Beghin, Luisa, Luciano Nieddu, and Enzo Orsingher. 2001. Probabilistic analysis of the telegrapher’s process with drift by means of relativistic transformations. Journal of Applied Mathematics & Stochastic Analysis 14: 11D25. [Google Scholar]

- Cox, David R. 1955. Some Statistical Methods Connected with Series of Events. Journal of the Royal Statistical Society: Series B (Methodological) 17: 129–57. [Google Scholar] [CrossRef]

- De Gregorio, Alessandro, and Francesco Iafrate. 2021. Telegraph random evolutions on a circle. Stochastic Processes and their Applications 141: 79–108. [Google Scholar] [CrossRef]

- Di Crescenzo, Antonio, Antonella Iuliano, and Verdiana Mustaro. 2023. On Some Finite-Velocity Random Motions Driven by the Geometric Counting Process. Journal of Statistical Physics 190: 44. [Google Scholar] [CrossRef]

- Fontbona, Joaquin, Hélène Guérin, and Florent Malrieu. 2016. Long time behavior of telegraph processes under convex potentials. Stochastic Processes and Their Applications 126: 3077–101. [Google Scholar] [CrossRef]

- Gitterman, M. 2005. Classical harmonic oscillator with multiplicative noise. Physica A 352: 309–34. [Google Scholar] [CrossRef]

- Gradshteyn, Izrail Solomonovich, and Iosif Moiseevich Ryzhik. 2007. Tables of Integrals, Series, and Products. Cambridge, MA and Amsterdam: Academic Press, Elsevier. [Google Scholar]

- Kolesnik, Alexander D., and Nikita Ratanov. 2013. Telegraph Processes and Option Pricing. Heidelberg: Springer, vol. 204. [Google Scholar]

- Orsingher, Enzo. 1990. Probability law, flow function, maximum distribution of wave-governed random motions and their connections with Kirchoff’s laws. Stochastic Processes and Their Applications 34: 49–66. [Google Scholar] [CrossRef]

- Pinsky, Mark A., and Samuel Karlin. 2011. An Introduction to Stochastic Modeling, 4th ed. Amsterdam and Cambridge, MA: Elsevier and Academic Press. [Google Scholar]

- Pogorui, Anatoliy, Anatoliy Swishchuk, and Ramón Martín Rodríguez-Dagnino. 2021a. Transformations of Telegraph Processes and Their Financial Applications. Risks 9: 147. [Google Scholar] [CrossRef]

- Pogorui, Anatoliy, Anatoliy Swishchuk, and Ramón Martín Rodríguez-Dagnino. 2021b. Random Motion in Markov and Semi-Markov Random Environment 1: Homogeneous and Inhomogeneous Random Motions. London: ISTE Ltd. & Wiley, vol. 1. [Google Scholar]

- Pogorui, Anatoliy, Anatoliy Swishchuk, and Ramón Martín Rodríguez-Dagnino. 2021c. Random Motion in Markov and Semi-Markov Random Environment 2: High-Dimensional Random Motions and Financial Applications. London: ISTE Ltd. & Wiley, vol. 2. [Google Scholar]

- Pogorui, Anatoliy, Anatoliy Swishchuk, and Ramón Martín Rodríguez-Dagnino. 2022. Asymptotic Estimation of Two Telegraph Particle Collisions and Spread Options Valuations. Mathematics 10: 2201. [Google Scholar] [CrossRef]

- Watanabe, Toitsu. 1968. Approximation of uniform transport process on a finite interval to Brownian motion. Nagoya Mathematical Journal 32: 297–314. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pogorui, A.; Swishchuk, A.; Rodríguez-Dagnino, R.M.; Sarana, A. Cox-Based and Elliptical Telegraph Processes and Their Applications. Risks 2023, 11, 126. https://doi.org/10.3390/risks11070126

Pogorui A, Swishchuk A, Rodríguez-Dagnino RM, Sarana A. Cox-Based and Elliptical Telegraph Processes and Their Applications. Risks. 2023; 11(7):126. https://doi.org/10.3390/risks11070126

Chicago/Turabian StylePogorui, Anatoliy, Anatoly Swishchuk, Ramón M. Rodríguez-Dagnino, and Alexander Sarana. 2023. "Cox-Based and Elliptical Telegraph Processes and Their Applications" Risks 11, no. 7: 126. https://doi.org/10.3390/risks11070126

APA StylePogorui, A., Swishchuk, A., Rodríguez-Dagnino, R. M., & Sarana, A. (2023). Cox-Based and Elliptical Telegraph Processes and Their Applications. Risks, 11(7), 126. https://doi.org/10.3390/risks11070126