A Survey on AI Implementation in Finance, (Cyber) Insurance and Financial Controlling

Abstract

1. Introduction

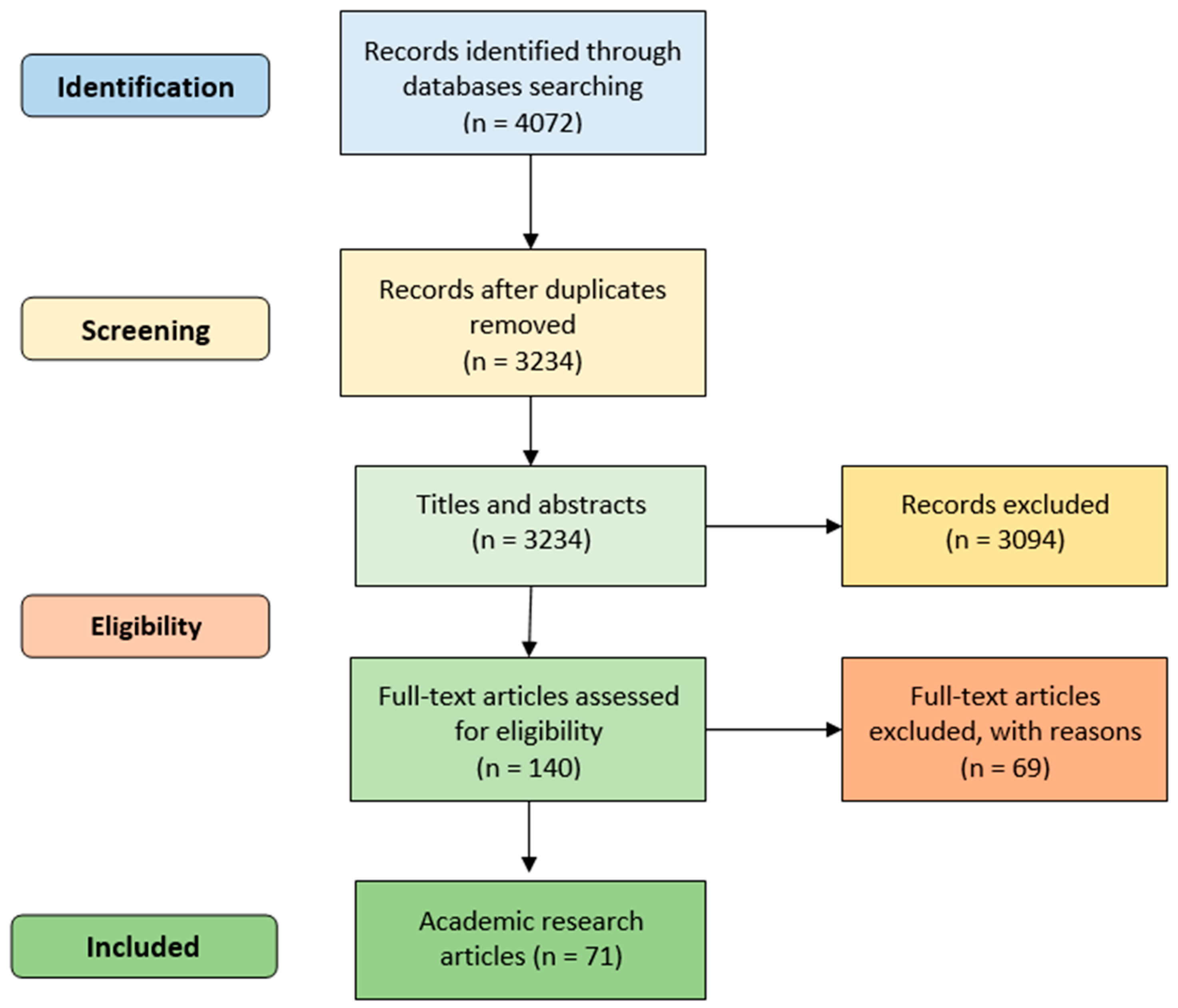

2. Overview of the Implementation of AI in Finance, (Cyber) Insurance, and Financial Control

3. Data and Methodology

4. Results

4.1. Implementation of AI in Finance

4.2. AI Implementation in Cyber Insurance and Cyber Security

4.3. Artificial Intelligence and Financial Control in the Fight against Financial Crime

5. Discussion

6. Conclusions

Limitations and Future Work

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Agarwal, Sumit, and Jian Zhang. 2020. FinTech, lending and payment innovation: A review. Asia-Pacific Journal of Financial Studies 49: 353–67. [Google Scholar] [CrossRef]

- Alameda, Teresa. 2020. Data, AI and Financial Inclusion: The Future of Global Banking—Responsible Finance Forum. Available online: https://responsiblefinanceforum.org/data-ai-financial-inclusion-future-global-banking (accessed on 10 March 2023).

- Allianz Global Corporate and Specialty. 2022. Allianz Global Corporate & Specialty. Business Insurer. News & Insights. Reports. Allianz Risk Barometer 2022. April 22. Available online: https://www.agcs.allianz.com/news-and-insights/reports/allianz-risk-barometer.html (accessed on 10 March 2023).

- AL-Rawashdeh, Ghada Hammad, and Rabiei Bin Mamat. 2019. Comparison of four email classification algorithms using WEKA. International Journal of Computer Science and Information Security (IJCSIS) 17: 42–54. [Google Scholar]

- Arner, Douglas. W., Janos Nathan Barberis, and Ross P. Buckley. 2015. The Evolution of Fintech: A New Post-Crisis Paradigm? UNSW Law Research 47: 1271. [Google Scholar] [CrossRef]

- Bansal, Sukriti, Phill Bruno, Olivier Denecker, and Marc Niederkorn. 2019. Global Payments Report 2019: Amid Sustained Growth, Accelerating Challenges Demand Bold Actions. McKinsey Global Payment USA Reports. September 2019, Copyright © McKinsey & Company. Available online: https://www.mckinsey.com (accessed on 10 March 2023).

- Barracchini, Carla, and M. Elena Addessi. 2014. Cyber risk and insurance coverage: An actuarial multistate approach. Review of Economics Finance 4: 57–69. Available online: http://www.bapress.ca/ref/v4-1/1923-7529-2014-04-57-13.pdf (accessed on 10 March 2023).

- Beldiman, Camelia Madalina. 2022. Efficiency and Advantages of Preventive Financial Control versus Internal Control in a Public Entity. Jurnalul De Studii Juridice 17: 134–47. [Google Scholar] [CrossRef]

- Boyer, M. Martin. 2020. Cyber insurance demand, supply, contracts and cases. The Geneva Papers on Risk and Insurance—Issues and Practice volume 45: 559–63. Available online: https://link.springer.com/article/10.1057/s41288-020-00188-1 (accessed on 10 March 2023). [CrossRef]

- Braun, Virginia, and Victoria Clarke. 2006. Using thematic analysis in psychology. Qualitative Research in Psychology 3: 77–101. [Google Scholar] [CrossRef]

- Cao, Longbing, Qiang Yang, and Philip S. Yu. 2020. Data science and AI in FinTech: An overview. General Finance 12: 81–99. [Google Scholar] [CrossRef]

- Chornovol, Alla, Julia Tabenska, Tetiana Tomniuk, and Liudmyla Prostebi. 2020. Public finance management system in modern conditions. Investment Management and Financial Innovations 17: 402–10. [Google Scholar] [CrossRef]

- Cybersecurity Ventures. 2020. Special Report: Cyberwarfare in the C-Suite. Edited by Steve Morgan. Available online: https://cybersecurityventures.com/cybercrime-damages-6-trillion-by-2021/ (accessed on 10 March 2023).

- Dambra, Savino, Leyla Bilge, and Davide Balzarotti. 2020. SoK: Cyber insurance–technical challenges and a system security roadmap. Presented at 2020 IEEE Symposium on Security and Privacy (SP), San Francisco, CA, USA, May 18–21; pp. 1367–83. [Google Scholar] [CrossRef]

- Deloitte. 2018. The Case for Artificial Intelligence in Combating Money Laundering and Terrorist Financing: A Deep Dive into the Application of Machine Learning Technology. Available online: https://www2.deloitte.com/content/dam/Deloitte/sg/Documents/finance/sea-fas-deloitte-uob-whitepaper-digital.pdf (accessed on 6 January 2023).

- Du, Meijie, Baifang Liu, and Haoyun Zhou. 2022. Construction of financial early warning model based on machine learning technology. Paper presented at International Conference on Multi-Modal, Huhehaote, China, April 22–23; pp. 75–83. [Google Scholar]

- Eling, Martin, and Jingjing Zhu. 2018. Which Insurers Write Cyber Insurance? Evidence from the U.S. Property and Casualty Insurance Industry. Journal of Insurance Issues 41: 22–56. Available online: http://www.jstor.org/stable/26441191 (accessed on 10 March 2023).

- Eling, Martin, and Werner Schnell. 2016. What do we know about cyber risk and cyber risk insurance? The Journal of Risk Finance. Available online: https://www.emerald.com/insight/content/doi/10.1108/JRF-09-2016-0122/full/html (accessed on 10 March 2023).

- Eluwole, Opeoluwa Tosin, and Segun Akande. 2022. Artificial Intelligence in Finance: Possibilities and Threats. Presented at 2022 IEEE International Conference on Industry 4.0, Artificial Intelligence, and Communications Technology (IAICT), Bali, Indonesia, July 28–30; pp. 268–73. [Google Scholar] [CrossRef]

- Encyclopaedia Britannica. 2022. Editors of Encyclopaedia. Computer Security. November 18. Available online: https://www.britannica.com/technology/computer-security (accessed on 10 March 2023).

- European Union Agency for Cybersecurity (ENISA). 2020. Publications/Report-Files/Ncaf-Translations/National-Capabilities-Assessment-Framework. Athens: European Union Agency for Cybersecurity (ENISA). [Google Scholar]

- European Union Agency for Cybersecurity (ENISA). 2022. Home. News. Is the EU Healthcare Sector Cyber Healthy? The Conclusions of Cyber Europe 2022. Athens: European Union Agency for Cybersecurity. Available online: https://www.enisa.europa.eu/news/is-the-eu-healthcare-sector-cyber-healthy-the-conclusions-of-cyber-europe-2022 (accessed on 10 March 2023).

- Fletcher, John. 2018. Deepfakes, artificial intelligence, and some kind of dystopia: The new faces of online post-fact performance. Theatre Journal 70: 455–71. [Google Scholar] [CrossRef]

- FSB. 2017. Artificial Intelligence and Machine Learning in Financial Services. Available online: https://www.fsb.org/wp-content/uploads/P011117.pdf (accessed on 10 March 2023).

- Fuji, Masaru, Nakazawa Katsuhido, and Hiroaki Yoshida. 2020. “Trustworthy and Explainable AI” Achieved Through Knowledge Graphsand Social Implementation. Fujitsu Scientific & Technical Journal 56: 39–45. [Google Scholar]

- Geer, Dan, Eric Jardine, and Eireann Leverett. 2020. On market concentration and cybersecurity risk. Journal of Cyber Policy 5: 9–29. [Google Scholar] [CrossRef]

- Grimes, Roger A. 2022. Cybersecurity Insurance. In Ransomware Protection Playbook. Hoboken: Wiley Data and Cybersecurity, pp. 85–112. [Google Scholar]

- How, Meng-Leong, Sin-Mei Cheah, Aik Cheow Khor, and Yong Jiet Chan. 2020. Artificial Intelligence-Enhanced Predictive Insights for Advancing Financial Inclusion: A Human-Centric AI-Thinking Approach. Big Data and Cognitive Computing 4: 8. [Google Scholar] [CrossRef]

- Hoxell, Amanda. 2020. Observable Cyber Risk and Market Concentration. Examination Paper in Mathematics, 30 hp. Handledare: Ulrik Franke, RISE Ämnesgranskare: Erik Ekstrom Examiner: Julian Külshammer, October 2020. Available online: https://www.diva-portal.org/smash/get/diva2:1477820/FULLTEXT01.pdf (accessed on 10 March 2023).

- Hsiao, Ming-Hsiung. 2020. Mobile payment services as a facilitator of value co-creation: A conceptual framework. Journal of High Technology Management Research, Science Observation 15: 79–80. [Google Scholar] [CrossRef]

- Hwang, Sewong S., and Jonghyuk Kim. 2021. Toward a Chatbot for Financial Sustainability. Sustainability 13: 3173. [Google Scholar] [CrossRef]

- Joint Technical Committee ISO/IEC JTC1. 2013. Subcommittee SC 27. Available online: https://www.iso.org/standard/54534.html (accessed on 10 March 2023).

- Kesan, Jay P., and Linfeng Zhang. 2020. Analysis of cyber incident categories based on losses. ACM Transactions on Management Information Systems (TMIS) 11: 1–28. [Google Scholar] [CrossRef]

- King, Thomas C., Nikita Aggarwal, Mariarosaria Taddeo, and Luciano Floridi. 2020. Artificial Intelligence Crime: An Interdisciplinary Analysis of Foreseeable Threats and Solutions. Science and Engineering Ethics 26: 89–120. [Google Scholar] [CrossRef]

- Kostova, Silviya. 2013. Audit Procedures for Disclosure of Errors and Fraud In Financial Statements of Bulgarian Companies. Scientific Annalsof the “Alexandru Ioan Cuza” University of IaşiEconomic Sciences 59: 49–66. [Google Scholar] [CrossRef]

- Kulchev, Krasimir. 2021. Tools of Economic Analysis When Researching the Tourism Market. Business Management 2: 21–37. [Google Scholar]

- Kumar, Naman, Jayant Dev Srivastava, and Harshit Bisht. 2019. Artificial intelligence in insurance sector. Journal of the Gujarat Research Society 21: 79–91. [Google Scholar]

- Lee, In, and Yong Jae Shin. 2018. Fintech: Ecosystem, business models, investment decisions, and challenges. Business Horizons 61: 35–46. [Google Scholar] [CrossRef]

- Levite, Ariel E., Scott Kannry, and W. Wyatt Hoffman. 2018. Addressing the Private Sector Cybersecurity Predicament: The Indispensable Role of Insurance. Washington, DC: Carnegie Endowment for International Peace. [Google Scholar]

- Lewis, James. 2018. Economic Impact of Cybercrime—No Slowing Down. Available online: https://csis-website-prod.s3.amazonaws.com/s3fs-public/publication/economic-impact-cybercrime.pdf (accessed on 7 January 2023).

- LexisNexis. 2019. LexisNexis Risk Solutions. Retrieved 2023. Available online: https://risk.lexisnexis.com/insights-resources/research/us-ca-true-cost-of-fraud-study (accessed on 10 March 2023).

- Liao, L. 2020. Mobile payment and online to offline retail business models. Journal of Retailing and Consumer Services Popular Science and Technology 22: 6–8. [Google Scholar] [CrossRef]

- Longbing, Cao. 2022. AI in Finance: Challenges, Techniques, and Opportunitie. ACM Computing Surveys 55: 38. [Google Scholar] [CrossRef]

- Macdonald, S. 2015. Text, Cases and Materials on Criminal Law. Harlow: Pearson Education Limited. [Google Scholar]

- Malali, Anil B., and S. Gopalakrishnan. 2020. Application of Artificial Intelligence and Its Powered Technologies in the Indian Banking and Financial Industry: An Overview. IOSR Journal of Humanities And Social Science 25: 55–60. [Google Scholar]

- Manjaly, Joel, Ranjana Mary Varghese, and Philip Varughese. 2021. Artificial Intelligence in the Banking Sector—A Critical Analysis. Shanlax International Journal of Management 8: 210–16. [Google Scholar] [CrossRef]

- Marria, Vishal. 2018. Is Artificial Intellegence Replacing Jobs in Banking? Available online: https://www.forbes.com/sites/vishalmarria/2018/09/26/is-artificial-intelligence-replacing-jobs-in-banking/?sh=625de1253c55 (accessed on 6 January 2023).

- Martincevic, Ivana, Sandra Crnjevic, and Igor Klopotan. 2022. Novelties and benefits of fintech in the financial industry. International Journal of E-Services and Mobile Applications. [Google Scholar] [CrossRef]

- Mhalaga, David. 2020. Industry 4.0 in finance: The impact of artificial intelligence (ai) on digital financial inclusion. International Journal of Financial Studies 8: 45. [Google Scholar]

- Mirete-Ferrer, Pedro M., Alberto Garcia-Garcia, Juan Baixauli-Soler, and Maria A. Prats. 2022. Review on Machine Learning for Asset Management. Risks 10: 84. [Google Scholar] [CrossRef]

- Moher, David, Alessandro Liberati, Jennifer Tetzlaff, and Douglas G. Altman. 2009. The PRISMA Group (2009). Pre-ferred Reporting Items for Systematic Reviews and Meta-Analyses: The PRISMA Statement. PLoS Medicine 6: e1000097. [Google Scholar] [CrossRef]

- Moro-Visconti, Roberto, Salvador Cruz Rambaud, and Joaquín López Pascual. 2020. Sustainability in FinTechs: An Explanation through Business Model Scalability and Market Valuation. Sustainability 12: 10316. [Google Scholar] [CrossRef]

- Muneeza, Aishath, Asma Tajul Arifin ’, and Nur Aishah Arshad. 2018. The Application of Blockchain Technology in Crowdfunding: Towards Financial Inclusion via Technology. International Journal of Management and Applied Research 5: 82–98. [Google Scholar] [CrossRef]

- Munich Re. 2022. Munich Re Global Cyber Risk and Insurance Survey 2022. Available online: https://www.munichre.com/landingpage/en/global-cyber-risk-and-insurance-survey-2022.html#download (accessed on 10 March 2023).

- Nelloh, Liza Agustina Maureen, Adhi Setyo Santoso, and Mulyadi Wiguna Slamet. 2019. Will users keep using mobile payment? it depends on trust and cognitive perspectives. Procedia Computer Science 161: 1156–64. [Google Scholar] [CrossRef]

- nibusinessinfo.co.uk. n.d. Home. Guides. IT. IT Security and Risks. IT Risk Management. What Is IT Risk? Available online: https://www.nibusinessinfo.co.uk/content/what-it-risk (accessed on 10 March 2023).

- Okuda, Takuma, and Sanae Shoda. 2018. AI-based chatbot service for financial industry. Fujitsu Scientific and Technical Journal 54: 4–8. Available online: https://www.fujitsu.com/global/documents/about/resources/publications/fstj/archives/vol54-2/paper01.pdf (accessed on 10 March 2023).

- Peric, Kosta. 2015. Digital financial inclusion. Journal of Payments Strategy & Systems 9: 212–14. Available online: https://www.ingentaconnect.com/content/hsp/jpss/2015/00000009/00000003/art00001 (accessed on 10 March 2023).

- Piper, Jason, and Alex Metcalfe. 2020. Economic Crime in a Digital Age. Ernst & Young Report. Available online: https://assets.ey.com/content/dam/ey-sites/ey-com/en_gl/topics/assurance/assurance-pdfs/ey-economic-crime-digital-age.pdf (accessed on 6 January 2023).

- PRISMA. 2023. Transparent Reporting of Systematic Reviews and Meta-Analyses. Available online: http://prisma-statement.org/ (accessed on 10 March 2023).

- Prove. 2021. Risk Management: The Most Important Application of AI in the Fnancial Sector. Available online: https://www.prove.com/blog/risk-management-most-important-application-of-ai-in-financial-sector (accessed on 6 January 2023).

- Puławska, Karolina, Wojciech Strzelczyk, and Arkadiusz Orzechowski. 2022. Cyber Insurance and Information Sharing as Prevention from Cyber-Attacks—Pilot Study. Available online: https://ssrn.com/abstract=4260821 (accessed on 10 March 2023).

- Qin, Jing, and Qun Qin. 2021. Cloud platform for enterprise financial budget management based on artificial intelligence. Wireless Communications and Mobile Computing 2021: 8038433. [Google Scholar] [CrossRef]

- Rahman, Md Sabizu, Yan Li, Mahabubur Rahman Miraj, Tariqul Islam, Md Kawsar Ahmed, and Mir Abdur Rob. 2022. Artificial Intelligence (AI) for Energizing the E-Commerce. Available online: https://www.researchgate.net/publication/359919374_Artificial_Intelligence_AI_for_Energizing_the_E-commerce/citations (accessed on 6 January 2023).

- Raut, Jelena, Mitrović-Veljković Slavica, Melović Boban, and Vidicki Predrag. 2022. The influence of the entrepreneurial ecosystem on the initiation and development of innovation processes. Serbian Journal of Engineering Management 7: 8–13. [Google Scholar] [CrossRef]

- Schanz, Kai-Uwe. 2018. Understanding and Addressing Global Insurance Protection Gaps. Available online: https://www.genevaassociation.org/sites/default/files/research-topics-document-type/pdf_public/understanding_and_addressing_global_insurance_protection_gaps.pdf (accessed on 10 March 2023).

- Schatz, Daniel, Rabih Bashroush, and J. Julie Wall. 2017. Towards a More Representative Definition of. Journal of Digital Forensics, Security and Law 12: 8. [Google Scholar] [CrossRef]

- Schroer, Alyssa. 2022. 28 Examples of AI in Finance: AI has Revolutionized the Finance Industry. Available online: https://builtin.com/artificial-intelligence/ai-finance-banking-applications-companies (accessed on 6 January 2023).

- Serban, Iulian V., Chinnadhurai Sankar, Mathieu Germain, Saizheng Zhang, Zhouhan Lin, Sandeep Subramanian, Taesup Kim, Michael Pieper, Sarath Chandar, Nan Rosemary Ke, and et al. 2017. A deep reinforcement learning chatbot. arXiv arXiv:arXiv:1709.02349. [Google Scholar] [CrossRef]

- Tsai, Sang-Bing, Youzhi Xue, Jianyu Zhang, Quan Chen, Yubin Liu, Jie Zhou, and Weiwei Dong. 2017. Models for forecasting growth trends in renewable energy. Renewable and Sustainable Energy Reviews 77: 1169–78. [Google Scholar] [CrossRef]

- Xie, Xiaoying, Charles Lee, and Martin Eling. 2020. Cyber insurance offering and performance: An analysis of the U.S. cyber insurance market. The Geneva Papers on Risk and Insurance—Issues and Practice 45: 690–736. [Google Scholar] [CrossRef]

- Xu, Xiaoling, and Jianghao Song. 2021. Enterprise financial leverage and risk assessment based on mobile payment under artificial intelligence. Mobile Information Systems 2021: 5468397. [Google Scholar] [CrossRef]

- Yadav, Hitesha, Arpan K. Kar, and Smita Kashiramka. 2022. Artificial Intelligence Adoption for FinTech Industries—An Exploratory Study about the Disruptions, Antecedents and Consequences. In The Role of Digital Technologies. Edited by Savvas Papagiannidis, Eleftherios Alamanos, Suraksha Gupta, Yogesh K. Dwivedi, Matti Mäntymäki and Ilias O. Pappas. Cham: Springer, p. 13454. [Google Scholar] [CrossRef]

- Yeoh, Peter. 2019. Rtificial intelligence: Accelerator or panacea for financial crime? Journal of Financial Crime 26: 634–46. [Google Scholar] [CrossRef]

- Yu, Shi, Yuxin Chen, and Hussain Zaidi. 2020. A Financial Service Chatbot based on Deep Bidirectional Transformers. arXiv arXiv:2003.04987. Available online: https://arxiv.org/abs/2003.04987 (accessed on 6 January 2023). [CrossRef]

- Zahariev, Andrey, Petko Angelov, and Silvia Zarkova. 2022. Estimation of Bank Profitability Using Vector Error Correction Model ans Support Vector Regression. Economic Alternatives 2: 157–70. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Aleksandrova, A.; Ninova, V.; Zhelev, Z. A Survey on AI Implementation in Finance, (Cyber) Insurance and Financial Controlling. Risks 2023, 11, 91. https://doi.org/10.3390/risks11050091

Aleksandrova A, Ninova V, Zhelev Z. A Survey on AI Implementation in Finance, (Cyber) Insurance and Financial Controlling. Risks. 2023; 11(5):91. https://doi.org/10.3390/risks11050091

Chicago/Turabian StyleAleksandrova, Aleksandrina, Valentina Ninova, and Zhelyo Zhelev. 2023. "A Survey on AI Implementation in Finance, (Cyber) Insurance and Financial Controlling" Risks 11, no. 5: 91. https://doi.org/10.3390/risks11050091

APA StyleAleksandrova, A., Ninova, V., & Zhelev, Z. (2023). A Survey on AI Implementation in Finance, (Cyber) Insurance and Financial Controlling. Risks, 11(5), 91. https://doi.org/10.3390/risks11050091