1. Introduction

The classical Cramér–Lundberg model, or the classical compound Poisson risk model, assumes that the surplus process of an insurance company follows the dynamics:

where

is the premium rate and

is a compound Poisson process, where

is a Poisson process with intensity

and claim sizes

are i.i.d. positive random variables independent of the Poisson process with

. One central question in the ruin theory is to study the ruin probability

, where

.

In recent years, there have been a lot of studies in the insurance and finance literature on the so-called dual risk model, see, e.g., (

Afonso et al. 2013;

Avanzi et al. 2013;

Avanzi et al. 2007;

Bayraktar and Egami 2008;

Cheung 2012;

Cheung and Drekic 2008;

Ng 2009,

2010;

Rodríguez-Martínez et al. 2015;

Yang and Sendova 2014), with wealth process following the dynamics:

where

is the cost of running the company and

, is the stream of profits, where

is a Poisson process with intensity

and

are i.i.d.

valued random variables with common probability density function

,

, independent of the Poisson process. The dual risk model is used to model the wealth of a venture capital, whose profits depend on the research and development. The classical risk model (

1) is most often interpreted as the surplus of an insurance company. On the other hand, the dual risk model (

2) can be understood as the wealth of a venture capital or high-tech company. The analogue of the premium in the classical model is the running cost in the dual model, and the claims become the future profits of the company. The ruin probability and the Laplace transform of the ruin time have been well studied for the dual risk model; see, e.g.,

Afonso et al. (

2013). When there is a random delay for the innovations turned to profits, the dual risk model becomes time-inhomogeneous and the ruin probabilities and the distribution of the ruin times are studied in

Zhu (

2017).

One of the most fundamental questions in the dual risk model is the optimal dividend strategy.

Avanzi et al. (

2007) worked on optimal dividends in the dual risk model where the optimal strategy is a barrier strategy.

Avanzi et al. (

2013) studied a dividend barrier strategy for the dual risk model, whereby dividend decisions are made only periodically, but still allow ruin to occur at any time. A dual model with a threshold dividend strategy with exponential interclaim times was studied in

Ng (

2009).

Afonso et al. (

2013) also worked on dividend problem in the dual risk model, assuming exponential interclaim times. A new approach for the calculation of expected discounted dividends was presented and ruin and dividend probabilities, number of dividends, time to a dividend, and the distribution for the amount of single dividends were studied. Dividend moments in the dual risk model were considered in

Cheung and Drekic (

2008). They derived integro-differential equations for the moments of the total discounted dividends which can be solved explicitly assuming the jump size distribution has a rational Laplace transform. The expected discounted dividends assuming the profits follow a Phase Type distribution were studied in

Rodríguez-Martínez et al. (

2015). The Laplace transform of the ruin time, expected discounted dividends for the Sparre–Andersen dual model were derived in

Yang and Sendova (

2014). More recently,

Yang et al. (

2020) obtained an explicit expression of the expected discounted discounted dividends in a dual risk model with the threshold dividend strategy and the optimal threshold level were derived.

Avanzi et al. (

2020) considered the optimal periodic dividend strategies for a general class of dual risk models with fixed transaction costs. In

Fahim and Zhu (

2022), they obtained the asymptotic analysis for optimal dividends in the dual risk model.

Liu et al. (

2023) studied the optimal dividend strategy for the dual model with surplus-dependent expense.

So far, the optimization problems studied in the literature on dual risk models have been almost exclusively devoted to the optimal dividend strategy. In this paper, we consider a different type of optimization problem. For a venture capital, or a high-tech company, the investment strategy on research and development (R&D) is crucial. A decision to increase the investment on research and development will increase the running cost of the company, but that will also boost the possibility of the future profits. Therefore, we believe that it is of fundamental interest to understand the optimal investment strategy to strengthen the position of the company.

It is well known that research and development is a basic engine of economic and social growth. It is a considerable amount of spending among many leading corporations in the world. A 2014 FORTUNE article listed the top ten biggest R&D spenders worldwide in the year 2013, including Volkswagen, Samsung, Intel, Microsoft, Roche, Novartis, Toyota, Johnson & Johnson, Google and Merck, with Intel spending as much as 20.1% of their revenue on R&D, see

Casey and Hackett (

2014). Many technology giants increase their R&D spending consistently, year over year, see, e.g.,

Table 1 for the R&D and percentage of the revenues of Alphabet, Amazon, Tesla in the years 2018–2021

1. Notice that in the case of Alphabet, even though the R&D expenditure increases year by year, it increases in line with the increase of the total revenues so that as the percentage of revenues, the number does not change much. The same can be said about Amazon. For some companies, both the absolute R&D expenditure amount and the percentage as the revenues remain reasonably stable, see, e.g.,

Table 1 for Merck in the years 2018–2021, with the year of 2020 being the only exception which witnessed an unusually high R&D expenditure. For some companies, both the absolute R&D expenditure amount and the revenues can change dramatically, see, e.g.,

Table 1 for Alphabet, Amazon, Tesla in the years 2018–2021. The case of Tesla is exceptional but not unusual for a new high-tech company in the sense that the total revenues has astronomical growth and the R&D expenditure as the percentage of revenues actually declines during this period even though it had a spectacular increase in R&D expenditure in the year of 2021. Another company that has enjoyed similar phenomenal growth as Tesla is Amazon, see

Table 1. However, Amazon’s overall growth is not as fast as Tesla.

Since it is expensed rather than capitalized, cuts on research and development increase profit in the short term, but they can hurt the strength of a company in the long run, even if the detrimental impact of the cuts may not be felt for a few years. In the most recent recession, firms with revenues greater than 100 million USD reduced their research and development intensity (divided by revenue) by 5.6%, even though the advertising intensity actually increased 3.4%, see

Marie Knott (

2012). In the long run, the research and development does help the company grow and increase the value of a company. Using a measure of the so-called research quotient, a study over all publicly traded US companies from 1981 through 2006 suggested that a 10% increase in research quotient results in an increase in market value of 1.1%, see

Marie Knott (

2012). Indeed, the US government also encourages the research and development activities. The Research & Experimentation Tax Credit is a general business tax credit passed by the Congress in 1981, as a response to the concerns that research spending declines had adversely affected the country’s economic growth, productivity gains, and competitiveness within the global marketplace. According to a study by Ernst & Young, in the year 2005, 17,700 US corporations claimed 6.6 billion USD R&D tax credits on their tax returns

2.

Optimal investment problems have a long history in finance and related fields. For example,

Merton (

1969,

1971) formulated and studied the problem of optimal allocation between risky assets and a risk-free asset to maximize expected utility;

Fleming and Zariphopoulou (

1991) considered the optimal investment and consumption problem where short-selling is not allowed but borrowing is allowed.

Davis (

1990), and

Shreve and Soner (

1994) studied optimal investment and consumption with proportional transaction costs and

Morton and Pliska (

1990) considered optimal portfolio management with fixed transaction costs.

Grossman and Zhou (

1993) studied optimal investment strategies for controlling drawdowns.

Fleming and Sheu (

2000) studied the optimal investment problem to maximize the long-term growth rate of expected utility of wealth.

Hipp and Plum (

2000) studied the optimal investment for insurers.

Carr et al. (

2001) considered the problem of optimal investment in a risky asset, and in derivatives written on the price process of this asset. Finally, there are also a limited number of works on the optimal venture capital investments, see, e.g.,

Bayraktar and Egami (

2008). However, to the best of our knowledge, the optimal investment in research and development for the dual risk model has never been studied in the previous literature, and our paper is the first one that considers this problem.

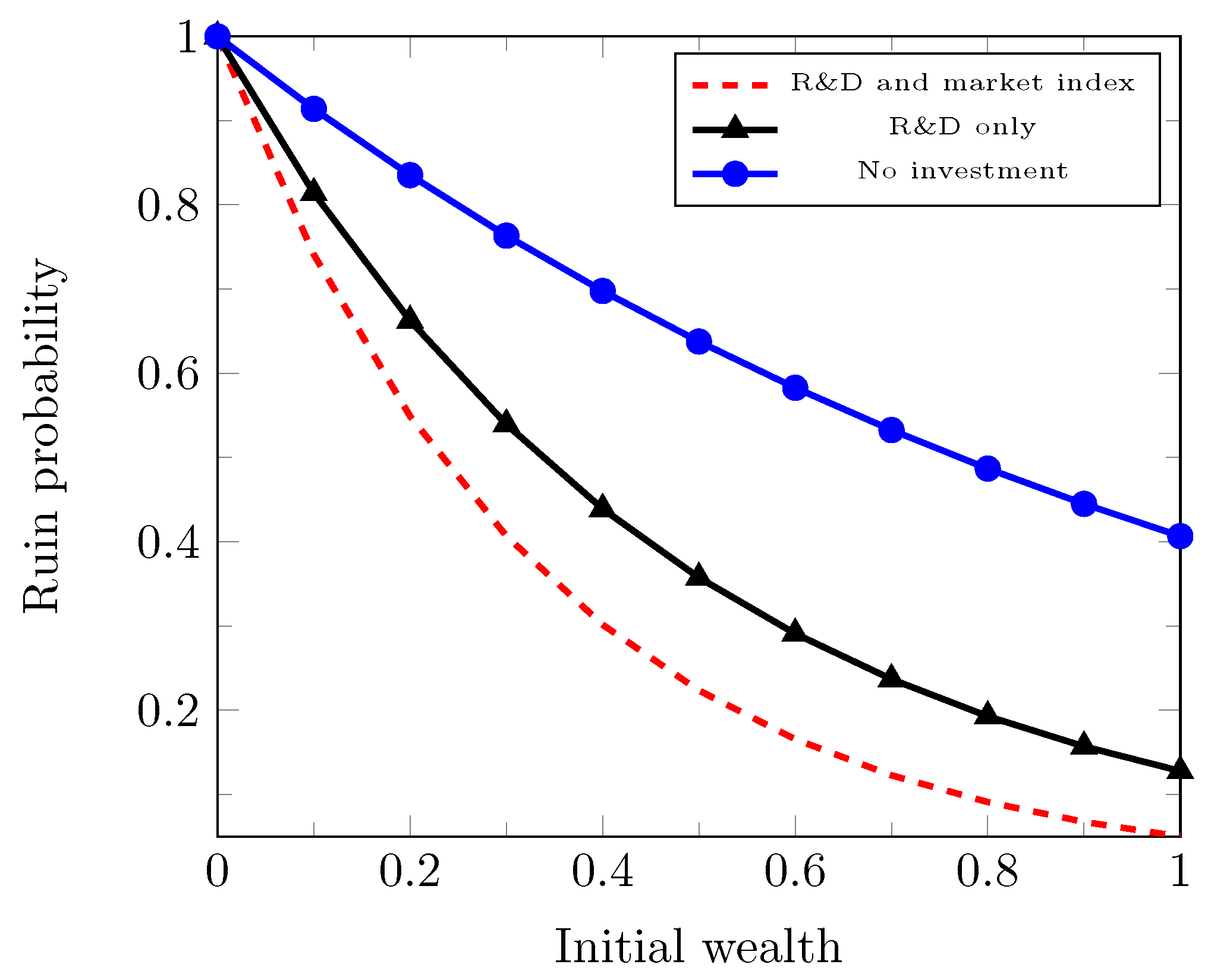

We propose to study the optimal investment strategy on research and development for the dual risk models to minimize the ruin probability of the underlying company. In addition to the investment in research and development, we will also allow the investment in a risky asset, e.g., a market index. The possibility that an insurer can invest part of the surplus into a risky asset to minimize the ruin probability was studied by

Browne (

1995) for the case that the insurance business is modeled by a Brownian motion with constant drift and the risky asset is modeled as a geometric Brownian motion. Later,

Hipp and Plum (

2000) studied the optimal investment in a market index for insurers in the classical compound Poisson risk model. We will study the optimal investment problem when both investment in research and development and investment in a risky asset are allowed. Unlike the problem of minimizing the ruin probability for an insurer in the classical risk model

Hipp and Plum (

2000), we will obtain closed-form formulas in the dual risk model.

Since the works of

Browne (

1995) and

Hipp and Plum (

2000), the optimal investment in the market for the classical risk model and related models have been extensively studied. In

Liu and Yang (

2004), they generalized the works by

Hipp and Plum (

2000) by including a risk-free asset. In

Schmidli (

2002), the optimization problem of minimizing the ruin probability for the classical risk model is studied when investment in a risky assent and proportional reinsurance are both allowed. The asymptotic ruin probability for the classical risk model under the optimal investment in a risky asset is obtained by

Gaier et al. (

2003) for large initial wealth. The asymptotics for small claim sizes were obtained in

Hipp and Schmidli (

2004). In

Yang and Zhang (

2005), they studied the optimal investment for an insurer when the risk process is compound Poisson process perturbed by a standard Brownian motion and the insurer can invest in the money market and in a risky asset. In

Gaier and Grandits (

2002), the case when the claim sizes are of regularly varying tails were studied. The results were then extended to include interest rates in

Gaier and Grandits (

2004). The case for subexponential claims was investigated in

Schmidli (

2005). In

Promislow and Young (

2005), they studied the problem of minimizing the probability of ruin of an insurer when the claim process is modeled by a Brownian motion with drift optimizing over the investment in a risky asset and purchasing quota-share reinsurance. In

Wang et al. (

2007), they adopted the martingale approach to study the optimal investment problem for an insurer when the insurer’s risk process is modeled by a Lévy process with possible investment in a security market described by the standard Black–Scholes model. When the underlying investor is an individual rather than an insurance company, the optimal investment problem of minimizing the ruin probability was studied in, e.g.,

Bayraktar and Young (

2007). In

Azcue and Muler (

2009), they studied the minimization of the ruin probability for the classical risk model with possible investment in a risky asset that follows a geometric Brownian motion under the borrowing constraints. There have been many other works in this area. For a survey, we refer to

Paulsen (

2008) and the references therein.

This paper is organized as follows. We first introduce a state-dependent dual risk model that generalizes the classical dual risk model (

Section 2). When the size of a company increases, the cost usually also increases, while the resource of income will also increase in general, which makes it natural to study a state-dependent dual risk model. Then, we study the optimal investment strategy on research and development to minimize the ruin probability of the company (

Section 3), with a further discussion of a state-dependent example in

Section 3.1. As a special case, the state-independent model is discussed in

Section 3.2, with a further discussion of a state-independent example in

Section 3.3. Next, we study the joint investment in research and development and a market index to minimize the ruin probability in

Section 4. Finally, we provide some numerical studies in

Section 5 to better understand how the minimized ruin probability and the optimal strategy depend on the parameters in the model.

2. A State-Dependent Dual Risk Model

We introduce a state-dependent dual risk model with the wealth process being defined as follows:

where

, where

is a simple point process with intensity

at time

t, and

are i.i.d. positive random variables with finite mean and independent of

, where

is the natural filtration generated by

process,

is the

i-th arrival time of

and we further assume that

are increasing functions. The state-dependent dual risk model (

3) was first introduced in

Zhu (

2015b), in which ruin probability and the Laplace transform of the ruin time were studied.

The motivation of introducing state dependence for the dual risk model is the following. First, the cost of a company usually increases as the size of the company increases. For example, the running cost of a small business and a Fortune 500 company are vastly different. Second, as the size of a company increases, the arrival intensity of the future profits might increase. It may be due to the fact that the larger a company gets, the more resources for income it will obtain. It is also well known in the finance literature that as a company gets larger and stronger, it can enjoy more benefits, e.g., net present value (NPV), which for example might be due to the opportunities brought by franchising. As we can see from

Table 1, the R&D expenditure may be far from being constant as the size of the company and the revenue of the company change. More realistically, the R&D expenditure and other costs of running the company should be state-dependent.

Let

be the ruin time of

process. The eventual ruin probability is defined as the function

to emphasize the dependence on the initial wealth

x. Note that for the state-independent dual risk model,

and

, under the assumption

, the ruin probability

is less than 1. Indeed,

, where

is the unique solution to the equation; see, e.g.,

Afonso et al. (

2013):

For the state-dependent dual risk model, there is no simple closed-form formula for the ruin probability. Nevertheless, for the special case when the jump sizes

are i.i.d. exponentially distributed, there is a closed-form expression for the ruin probability; see Theorem 1 in

Zhu (

2015b).

Finally, we notice that the

process in (

3) is an extension of the (nonlinear) marked Hawkes process with exponential kernel (see, e.g.,

Brémaud and Massoulié 1996;

Gao and Zhu 2018a,

2018b;

Hawkes 1971;

Zhu 2015a), that is,

is a simple point process with intensity

, where

where

is the

i-th arrival time of

, and

are i.i.d. positive random variables independent of

with finite mean and

are given constants, where

in (

5) satisfies the dynamics (

3) with

. When

is linear, it is called linear Hawkes process, named after

Hawkes (

1971). When

is nonlinear, the Hawkes process is said to be nonlinear which was first introduced by

Brémaud and Massoulié (

1996). Hawkes processes have wide applications in finance, neuroscience, social networks, criminology, seismology, and many other fields; see

Gao and Zhu (

2021) and the references therein. Since the

process in (

3) is an extension of the (nonlinear) marked Hawkes process with exponential kernel, our paper also contributes to the literature on the Hawkes process.

3. Minimizing the Ruin Probability

In this section, we study the optimization control problem of minimizing the ruin probability for the dual risk model. The management of the underlying company can decide whether or not to increase the capital spending on research and development to boost the future profits. Our goal is to find the optimal expenditure on research and development to minimize the probability that the company is eventually ruined.

Before we proceed, we introduce the investment on research and development

, where

is the set of all admissible strategies, defined as

Given the control

, the wealth process has the dynamics

where

is increasing and

, where

are defined same as before and

is a simple point process with intensity

at time

t, where

is measurable in

and increasing in both

x and

c and

for every

, where

is increasing.

We define

as the ruin time of the

process under the control

by

. We are interested in studying the optimization problem:

From the optimal control point of view, it is also interesting to study the state-dependent case, which adds a technical contribution to the literature of stochastic optimal control theory. We will show that the optimal strategy is in general state-dependent when the underlying dual risk model is state-dependent, and it exhibits a closed-form expression.

Theorem 1. The optimal strategy is given byprovided that the minimum exists. Proof of Theorem 1. For any control

, we have

where

, where

is a simple point process with intensity

at time

t and

are i.i.d. with probability density function

defined as before.

Let us introduce a random time change and define the random time

via:

Then, it is easy to see that

and

as

since

is bounded. It follows from (

10) that

Under the random time change (

11), we have

and

is distributed as

, where

is a standard Poisson process with intensity 1; see, e.g.,

Meyer (

1971) for the random time change for simple point processes. Therefore, we obtain

Let us also notice that

. Therefore, the optimal strategy is given by (

9) provided that the minimum exists. This completes the proof. □

In Theorem 1, we obtain the closed-form expression of the optimal strategy

. However, we do not have a closed form for the minimized ruin probability

. Next, we will show that we can obtain a closed form for the ruin probability in the special case when the jump sizes

follow exponential distributions. We first recall the following result from

Zhu (

2015b), which states that the ruin probability for a state-dependent dual risk model with the exponentially distributed

has a closed-form expression.

Theorem 2 (Theorem 1 in

Zhu (

2015b))

. Consider the dual risk model: , where , , where are exponential random variables with the probability density function , , and is a simple point process with intensity at time t, where are increasing functions. Then, As a corollary of Theorems 1 and 2, we obtain the closed form for the minimized ruin probability when the jump sizes are i.i.d. exponentially distributed.

Proposition 1. Assume , where . Assume also the integralexists and is finite. Then, Proof of Proposition 1. The proposition follows immediately from Theorems 1 and 2. □

3.1. A State-Dependent Example

In this section, we study a state-dependent example in detail. We assume that

where

is increasing, and

. We recall that

is increasing and thus,

. Let us also assume that

. Under our assumptions,

is increasing in both

x and

c, and

.

Notice when

, for any constant strategy

, where

is sufficiently large, the ruin probability is bounded above by the ruin probability of the following process:

where

is compound Poisson with

being the Poisson process with intensity

.

By the ruin probability for state-independent dual risk model (see, e.g.,

Afonso et al. 2013), the ruin probability of the

process defined in (

17) is given by

, where

is the unique positive solution to the equation:

We can rewrite this equation as:

The right-hand side of the above equation is bounded between 0 and 1. In the left-hand side of the above equation, , which implies that as . Hence, and the minimized ruin probability is trivially zero.

Therefore, in the rest of this section, we only consider two cases: (i) ; (ii) .

3.1.1. The Case

Under the assumption that

, it is easy to see from Theorem 1 that the optimal strategy

is the strategy that minimizes the drift:

It is easy to compute from (

20) that the optimal strategy satisfies

Therefore, for any

, the optimal strategy

satisfies

It is clear that the optimal strategy

is a function of

and we denote it as

. Then, under the optimal strategy,

where

, where

has intensity

at time

t.

When the probability density function of jump sizes is exponential, it follows from Proposition 1 that we have the following result:

Proposition 2. Assume , where . Assume also the integralexists and is finite. Then, Proof of Proposition 2. The proposition follows immediately from Proposition 1. □

Next, in the following example, we show that with particular model specifications, the optimal

and the minimized ruin probability

in (

24) admit a simpler closed-form formula.

Example 1. Let , , and , where are positive constants. Then, the optimal investment rate is a constant , where is the unique positive solution to the equation:Hence, the minimized ruin probability in (24) can be computed as:where is the error function and is the complementary error function and , , and 3.1.2. The Case

When , it follows from Theorem 1 that the optimal satisfies in the region where and the “optimal” in the region where .

Remark 1. If we impose a research and development budget constraint by , the maximum capacity, then the admissible set of controls is given by . Then, the above analysis implies that in the region and in the region .

Next, in the following example, we show that with particular model specifications, the optimal the minimized ruin probability admit simpler closed-form formulas.

Example 2. Let , , and , where are positive constants. We further assume that . Then, the optimal is given by:Let us define:Then, we can compute that for any ,and for any ,Therefore, for , we haveand for , we haveHence, we conclude that for , we haveand for , we have 3.2. The State-Independent Case

In this section, we consider the state-independent case, that is,

and

where

and

is increasing. Under the assumptions (

36) and (

37), we have the following result, which is a corollary of Theorem 1 and the ruin probability for the state-independent dual risk model (Equation (

4)).

Theorem 3. The optimal strategy is constant, given byprovided that the minimum exists and the minimized ruin probability is , where Proof of Theorem 3. Under the assumptions (

36) and (

37), it follows from Theorem 1 that the optimal strategy

is constant, which is given by

. With the optimal

, we have

where

is compound Poisson, where

is Poisson with intensity

.

By the formula for the ruin probability for the state-independent dual risk model, see, e.g., Equation (

4), we have

, where

satisfies the equation (

39). This completes the proof. □

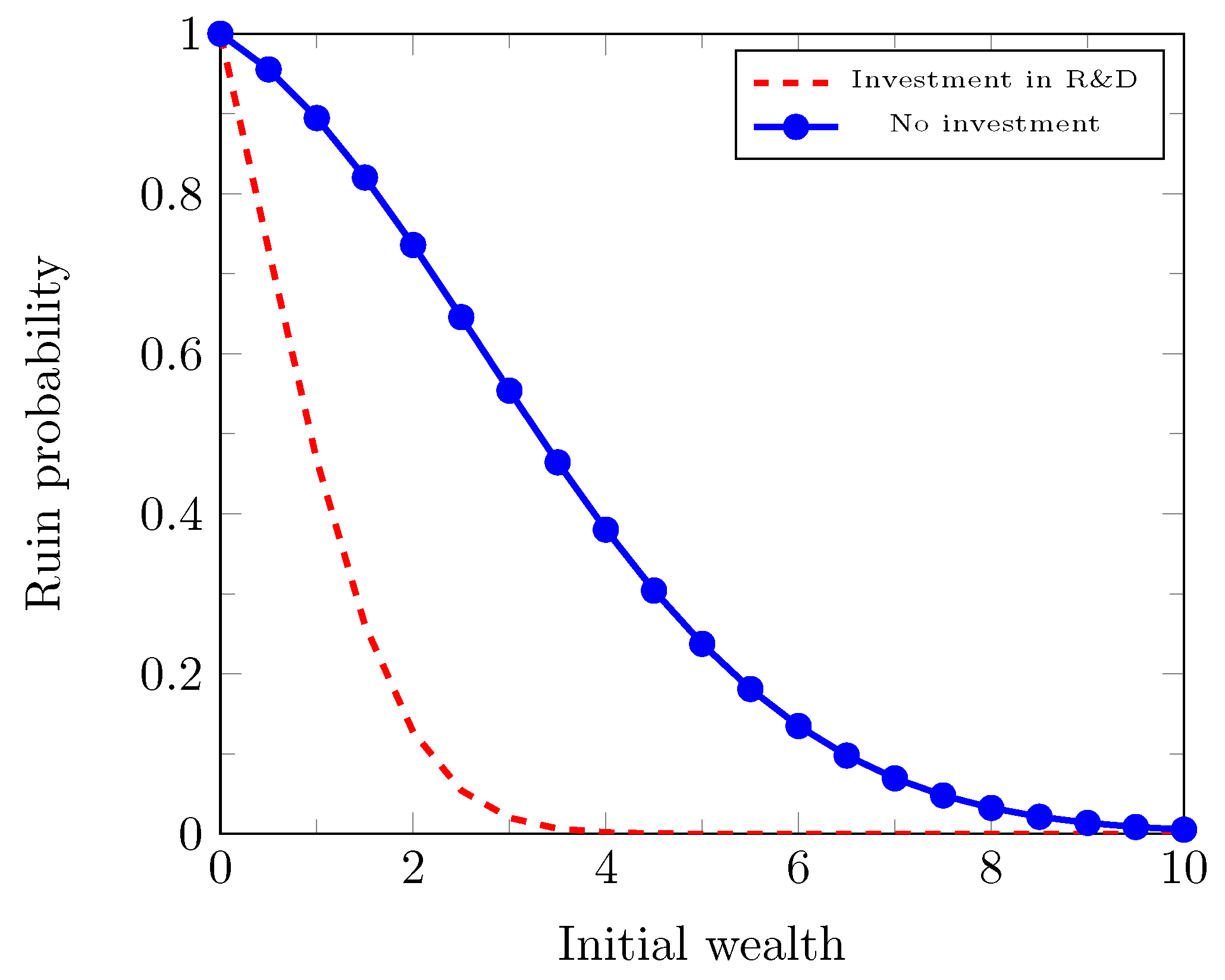

3.3. A State-Independent Example

In this section, we consider a state-independent example, that is,

and

In this special case, by Theorem 3, the optimal strategy

is constant and given by

By following the discussions in the more general state-dependent case in

Section 3.1, the case

is trivial and in the rest we only consider the cases

and

.

3.3.1. The Case

We first consider the case that . In this case, the intensity is a concave and increasing function of . What this indicates is that the initial investment of research and development can boost the prospect of future profits, but the margin decreases with the increase of the investment.

When it is allowed to invest in research and development, we will see later that the condition

is sufficient to guarantee that

. Note that this is weaker than the usual condition

for the dual risk model. We have the following result.

Proposition 3. Under the assumption (44),where β is the unique positive value that satisfies the equation:and the optimal strategy is given bywhich also satisfies the following equation: Proof of Proposition 3. It follows from Theorem 3 that the optimal strategy is given by

and the minimized ruin probability

satisfies Equation (

46).

To show that (

46) has a unique positive solution, it is equivalent to show that

has a unique positive solution where

and

It is easy to compute that for

,

Let , . Then, and as . Moreover, for . Thus, for any and therefore, for any and is a decreasing function of .

Note that

for

if and only if

for

, where

Note that by L’Hôpital’s rule,

. Therefore,

On the other hand, as ; therefore, as . Since is a decreasing function in and , it follows that is increasing in . Hence, we conclude that has a unique positive solution. This completes the proof. □

In the following example, we show that when are exponentially distributed, we are able to compute out and in simple closed forms.

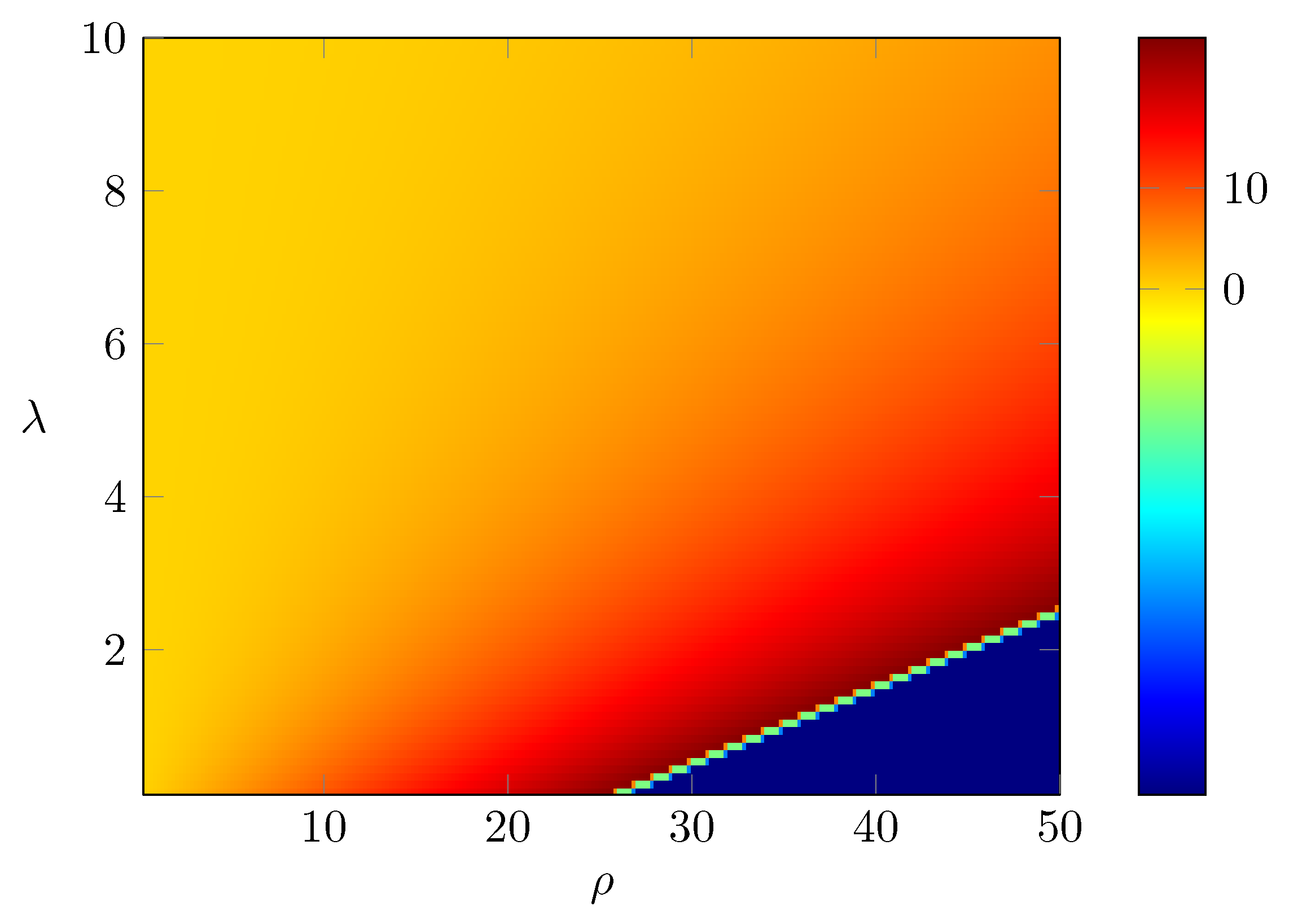

Example 3. When , , β satisfieswhich implies that In particular, when , we obtain , which implies , and thus, the optimal is given by Remark 2. We have already shown in Proposition 3 that , where β is the unique positive solution to Equation (46) and that it is equivalent towhere is defined in (51). Now, let us discuss how the value β (and hence the value function ) and the optimal investment rate depend on the parameters ρ, λ and δ. By (58), we have the following observations: (i) As ρ increases, increases. Since is decreasing in β, we conclude that β decreases as ρ increases. Intuitively, this means that as the fixed running cost for research and investment increases, the ruin probability increases. Asymptotically, as , . When , since , we must have . Therefore, by (58), as , we have . From the definition of , we have as . Hence, we conclude that , as . Therefore, the optimal satisfies (ii) As δ increases, decreases. Since is decreasing in β, we conclude that β increases as δ increases. Intuitively, this indicates that if the prospect of future profits given the investment in research and development increases, then the ruin probability decreases. Asymptotically, as , we have , and thus, , which implies that as , we have . Since as , we conclude that , as . Moreover, the optimal satisfies:Now, if , then . Therefore, as , , where we recall that α is the unique positive value so that , which is the same as defined in (4). Moreover, the optimal satisfiesIntuitively, it says that as , there is no value investing in research and development. (iii) Similarly, as λ increases, β increases, and the ruin probability decreases. As , we have . Thus, , and . Since as , we conclude that , as . Moreover, the optimal satisfies: (iv) Assume that the parameters are chosen so that Then, it follows that and . More precisely, as , if , and (58) becomesas . Then, it follows thatas . Hence, we conclude that Moreover, the optimal satisfies: Remark 3. The value function and the optimal investment rate also depend on the parameter γ. We will study the case in details later. For the moment, let us try to understand the asymptotic behavior of the value function and the optimal investment rate as . We will also obtain the asymptotics as . Let us recall that the optimal satisfies the equation: Thus, we have which implies that . Thus, as . Note that . Therefore, we can check thatNow, let us consider the limit. Let us rewrite that Equation (68) aswhere . Let us first consider the case . Notice first that . First, D cannot go to 0 as , because otherwise, the left-hand side of (70) goes to λ and as D goes to 0, and , so the right-hand side of (70) is greater than . Then, in the limit as , we obtain , which is a contradiction. Second, D cannot go to ∞ as . To see this, notice that as , the left hand side of (70) goes to ∞ and in the right-hand side of (70), for large D, and and hence, the right-hand side is less than , which is a contradiction. Therefore, if , D converges to a positive constant, which from (70) we can see that the limit is , and we have If , then the optimal as . To see this, notice that if , then in (68), we have and , which is a contradiction since . If , then for , we have from (68) that , which is again a contraction. Hence, we must have . Since , , and thus If , the optimal satisfies the equation: Assume that is fixed, then by L’Hôpital’s rule, Therefore, as , converges to the unique positive solution to the equation: .

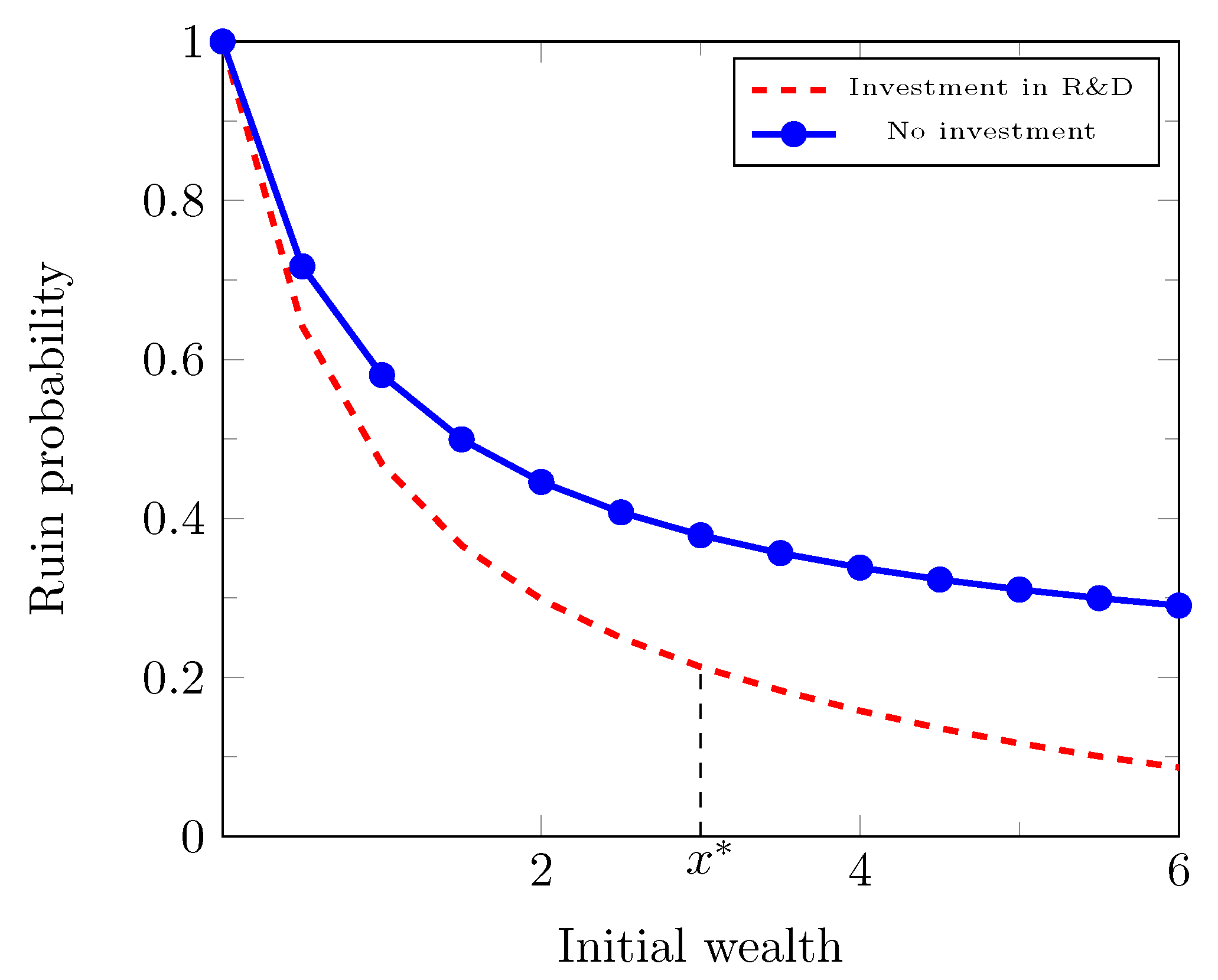

3.3.2. The Case

When

, it follows from Theorem 3 that the optimal strategy

is constant and it is given by

When

, then

and the optimal strategy is

. In this case, the value function

, where

When

, then

. Additionally, for any

and

, the strategy

is more optimal than

C. The “optimal strategy” is

. Let us also assume that

. In this case, the value function

, where

When , in terms of ruin probability, it does not make a difference whether the company decides to invest in research and development or not.

Remark 4. When , , where β satisfies (77) that is independent of ρ and λ. Asymptotically, when , it is easy to see that . Example 4. In the special case that , when , then the optimal and , and when and , then the optimal and .

4. Investing in a Market Index

We have already studied the optimal investment in research and development for a venture capital or high-tech company in the dual risk model in

Section 3, and now, let us also add the possibility of the alternative investment in a risky asset in the market, which is a capital market index modeled by a geometric Brownian motion.

For simplicity, we restrict our discussions to the state-independent case as in

Section 3.3:

where

and

Let us assume that the market index

follows a geometric Brownian motion:

where

and

is a standard Brownian motion.

Assume that at time

t, the company can invest

shares of the market index

and

in research and development. Thus, the wealth process of the company satisfies the dynamics:

The invested amount in the market index is at time t.

We are interested in finding optimal investment strategies to minimize the probability of ruin:

where

is the same as defined before and

is the admissible strategies for investment in the market index, defined as:

For any given and , we write to emphasize the dependence on C and A.

With additional investment in a market index, the random time change argument in the analysis in

Section 3 no longer applies. Instead, we rely on the stochastic optimal control theory (see, e.g.,

Fleming and Soner 1993), which suggests that the Hamilton–Jacobi–Bellman equation for

is given by

with boundary condition

.

Similar to the case in

Section 3, the case

leads to triviality and for the rest, we consider two cases:

and

.

4.1. The Case

In this section, we consider the case. We start with the following technical lemma.

Lemma 1. is a solution to the Hamilton–Jacobi–Bellman Equation (84), where is the unique solution to the equation: Given and let Proof of Lemma 1. Assume that

and

, then the optimal

C and

A are given respectively by

and the Hamilton–Jacobi–Bellman equation becomes

We can see that

, where

is the unique solution to the equation:

Recall the definition

and we want to show that the equation

has a unique positive solution. It is easy to see that

and

. Thus,

as

and

as

. We have already proved that

is decreasing in

. Moreover,

is also decreasing in

. Therefore,

is increasing in

and hence, there exists a unique positive value

so that

.

Finally, we can compute that the optimal

and

are given by (

87). This completes the proof. □

A Verification Theorem

Let us recall from (

84) that the Hamilton–Jacobi–Bellman equation is given by

with boundary condition

.

Theorem 4 (Vertification)

. If is a solution of (92) with , such that for any and then, . In addition, ifare such thathas a solution and and , then . Proof of Theorem 4. We follow the supermartingale argument presented in (

Rogers 2013, Theorem 1.1). Since

w is bounded and continuously differentiable with bounded derivative, by Itô lemma for jump processes, we have

for any

and

. Therefore,

is a submartingale. Let

be the first time that the

process hits

. Since

w is uniformly bounded, by optional stopping theorem,

It follows from (

93) and monotone convergence theorem that the right-hand side above converges to

as

and thus,

By taking infimum over and , we obtain . All the above inequalities change to equality for and . This completes the proof. □

Corollary 1. with β defined in (85) satisfies (93) and thus, . Proof of Corollary 1. We already showed, in Lemma 1, that

w is a classical solution of the boundary value problem (

92). Moreover, since

and

defined by (

86) are admissible controls (constants). By Theorem 4 and because (

93) trivially holds, we have

. The proof is complete. □

Next, we provide some asymptotic analysis.

Remark 5. As in Remark 2, let us discuss the dependence of , β and hence, on the parameters ρ, λ and δ. Since the results are similar to Remark 2, we omit the details and only summarize the results here. Note that β satisfieswhere is defined in (51). (i) As , we have , and .

(ii) As , we have , and . As , we have , where α is the unique positive value so that Moreover, as , we have .

(iii) As , we have , and .

Remark 6. Here, we investigate the asymptotic behavior of the value function and the optimal investment rate as and . Note that the optimal and β satisfyand (i) As , for some and for some . It is easy to check that satisfy and . Thus (ii) Next, let us consider .

If , then there exists a unique value such that . Assume further that . Then, we have and as , where .

If , the optimal as and and as . We can check that satisfy the equations and . As , we have .

If , then, as , we have that converges to the unique positive solution to the equation .

4.2. The Case

Consider the case where

, i.e., for

. Then, we have a singular control problem on

(see, e.g.,

Fleming and Soner 1993) and the value function

satisfies the Hamilton–Jacobi–Bellman equation:

with boundary condition

. Optimizing over

A, it reduces to the following equation:

with boundary condition

.

For

, we define

(ii) On

,

w satisfies

(iii) .

Lemma 2. is a classical solution of (101) where is the unique positive solutions of and is the unique positive solution of if it exists or zero otherwise. Here, F and G are given by Proof of Lemma 2. If

, then

and

. This implies that

. By straightforward calculations,

If

and

, then

and we have

. Similar to the previous paragraph, we obtain that

w is a classical solution. If

and

, then

and we have

. Thus,

The proof is complete. □

A Verification Theorem

Theorem 5 (Verification)

. .

Let be a decreasing classical solution of problem (101) such that condition (93) holds. Then, , where is the value function of the ruin probability minimization problem with investment.In addition, if , then .

Proof of Theorem 5. Let

be an admissible strategy and

be a non-decreasing singular function, i.e.,

where

is a non-negative measure. Then,

where

where

is a simple point process with compensator

. Then, by Itô’s formula for

functions, we have

Here,

where

is the continuous part of

C and

is the pure jump part of

. Notice that by the definition of classical solution, (

102) holds and therefore, the first two terms inside the expectation above are non-negative. In addition, since

w is non-increasing, we have

. Thus,

and

is a submartingale. Similar to the arguments in the proof of Theorem 4, (

93) implies that

. By taking the infimum over

, we obtain

.

Now, assume that

and set

. It follows from the definition of

and Itô’s formula that

In the above, satisfies . If we let , we obtain where is the ruin time for process . The proof is complete. □

Corollary 2. The classical solution of boundary value problem (92) satisfies the assumption of the verification and thus, . Proof of Corollary 2. First, the condition (

93) trivially holds. Therefore, if

, then

and

is followed by Theorem 5. It remains to show the result for the case that when

, i.e.,

. For

, let

with

with

. Then, immediately, we obtain

. We want to show that

as

. Notice that

satisfies the equation

with the boundary condition

. The unique bounded solution of the above equation is given by

where

satisfies

Notice that for any

,

is uniquely determined and is continuous on

c. In addition, straightforward calculations show that

is increasing, i.e.,

Thus,

exists and

and after dividing (

103) by

c and taking limit when

, we obtain

Since G has a unique positive solution, we must have and therefore, we obtain . This completes the proof. □