Abstract

Financial technology (FinTech) is leading a worldwide revolution to increase financial access. Bangladesh’s financial sector is entering a new era of innovation due to the country’s rapid embrace of financial technology. Mobile FinTech service (MFS) providers achieve unattainable economic peaks every year. The growth of conventional banks’ MFS is significant. However, Islamic banks have a good market share but cannot attract more customers to use the Islamic MFS. This study aimed to determine the factors influencing Islamic bank customers to accept the Islamic MFS. This study utilized a modified UTAUT2 model. Data were collected from 310 Islamic bank customers by using online Google Forms. Structural equation modeling was employed to analyze the data by SMART PLS 3.2.9. The results revealed that social influence, facilitating conditions, price, and perceived credibility have a significant positive effect on Islamic MFS acceptance. However, performance expectancy and effort expectancy showed no impact on Islamic MFS acceptance. This research framework is helpful for academicians and researchers to investigate FinTech acceptance in developing countries. Moreover, the study results are beneficial for MFS providers and FinTech firms.

1. Introduction

The digitalization of financial services is an ultimate need for financial institution consumers in the fourth industrial revolution era. Smart automation and interconnectivity enable rapid change in financial institutions’ technology and processes. The digital transformation of the financial sector has led to more digitized business models and processes and innovative products and services (Jünger and Mietzner 2020). Financial technology (FinTech) is now an integral aspect of the banking industry. FinTech is a widely used platform by banks to improve bank efficiency and consumer experience (Hu et al. 2019). FinTech describes the interaction between technology such as cloud computing and mobile internet and financial service businesses, including payments, money transfers, and other banking services (Giglio 2021). According to McKinsey and Company (2021), the emerging market usage of digital banking has caught up to that of developed Asia–Pacific countries. From 2017 to 2021, the proportion of consumers in emerging Asia–Pacific countries actively utilizing digital banking climbed by 33 percentage points, from 54% in 2017 to 88% in 2021. Approximately 90% of established Asia–Pacific customers have adopted digital technologies.

One of the most utilized FinTech that is offered by banks and FinTech companies is mobile FinTech services. According to Hasan and Islam (2021), mobile FinTech services (MFS) refers to the access to financial services for both transactional and non-transactional purposes via a mobile phone. Customers with access to financial services can send and receive money anytime, anywhere, and from anyone by keeping money in their MFS. In Bangladesh’s finance sector, the accelerated acceptance of financial technology is ushering in a new era of inclusivity. The banking sector in Bangladesh is also adapting to the technological shift by utilizing FinTech services, especially by private commercial banks. A total of thirteen mobile FinTech services are offered by the different private commercial banks, out of which nine are by conventional banks and three by Islamic banks in Bangladesh (Bangladesh Bank n.d.). According to Bangladesh Bank data, the number of registered MFS account holders in Bangladesh is 185.06 million. The daily average transaction is 4083.7 million in Bangladeshi Taka in September 2022, which indicates a growth of 1% from August 2022. These services provided by the MFS providers are widely accepted for inward remittance, cash in, cash out, P2P transactions, salary disbursement, utility bill payment, merchant payment, government payment, and so on. However, the market share of the MFS market is largely dominated by MFS providers backed by conventional banks. Bkash operated by Brac Bank has a market share of 40.07%, Nagad operated by the Post Office of Bangladesh has a 25.39% market share, and Rocket operated by DBBL has a market share of 18.18% (Hassan 2022, June 09). The Islamic MFSs provided by Islamic Banks are less popular than those of conventional banks. The market share of these Islamic banks’ customers was 28.21% in the first quarter of 2022 (NewAge 2022, June 26). Despite having a good market share of customers in Islamic Banks, they cannot influence their customers’ intention to adopt the Islamic MFS offered by them. One of the major reasons is the perceived credibility of the service (Ehsan et al. 2019). In addition, conventional banks’ MFSs are widespread in the population because of the inclusion of more MFS agents to ensure more coverage in the country (Latifee and Tamanna 2022). This strategy helps the conventional MFS providers to attract more customers because it enables the customers to obtain the needed resources from their nearby MFS agents.

Successful businesses understand the need to remain updated with technological developments. Adopting cutting-edge tech allows businesses to be more adaptable to market shifts, improve processes, and better serve customers. The growth of the business is widely dependent on the customers’ successful adoption of the new technologies offered by the businesses. Researchers have developed different models to identify the acceptance of new technologies from the customer’s perspective. Some of the prominent models and theories are TAM by Davis et al. (1989), VAM by Kim et al. (2007), EVF by Kim et al. (2008), and UTUAT2 by Venkatesh et al. (2012). There have been some studies conducted on mobile FinTech services in Bangladesh (Akhtaruzzaman et al. 2017; Kabir et al. 2020; Yan et al. 2021). However, no prior studies have been conducted on Islamic banks’ customers’ acceptance of mobile FinTech services in Bangladesh. So, it is necessary to conduct a study on this topic to address the knowledge gap. This study’s objective is to identify the factors that can influence Islamic banks’ customers to adopt the MFS offered by Islamic banks in Bangladesh. In order to achieve the objective of the study, the UTAUT2 model was utilized as the underpinning theory because UTAUT2 indicates the most explanatory power among all the theories and models in the field of technology acceptance (Venkatesh et al. 2012). Moreover, this study employed a modified UTAUT2 research framework based on the practical problem and theoretical research gap.

The organization of the rest of the article is followed by a literature review of recent studies, the methodology used in the study, findings and analysis of the study, and conclusions including the contributions and limitations of the study.

2. Literature Review and Hypothesis Development

2.1. Islamic MFS Acceptance (IMFSA)

The acceptance of technology refers to the intention to accept or actual acceptance of a technology (Peek et al. 2014). New information resource utilization can be more accurately predicted if MFS providers can grasp the factors that influence user acceptance of emerging technologies. Earlier studies used behavioral intention to investigate the acceptance of any new or existing technology. Shaikh et al. (2020) utilized Islamic FinTech technology acceptance as the dependent variable in research conducted on Islamic bank users. Moreover, Jin et al. (2019) utilized behavioral intention to identify customers’ acceptance of FinTech products and services in Malaysia. In addition, studies related to Islamic FinTech adoption employed behavioral intention to measure the technology acceptance behavior of the consumers (Rahim et al. 2022; Usman et al. 2021; Widiatmo 2021).

2.2. Unified Theory of Acceptance and Use of Technology (UTAUT2)

One of the most prominent and widely used technological acceptance theories is the unified theory of acceptance and use of technology (UTAUT) developed by Venkatesh et al. (2003) after reviewing eight prominent theories on technology adoption. The first version of the model was focused on the organizational perspective; later, Venkatesh et al. (2012) developed the latest version of the model focusing on the individual customers’ perspective. The UTAUT2 model includes seven independent variables: performance expectancy, effort expectancy, social influence, facilitating conditions, price, habit, and hedonic motivation to measure the behavioral intention of the customers to adopt new technologies. Mansyur and Ali (2022) employed the UTAUT2 model to identify the Shariah FinTech adoption among Indonesian millennials. In addition, in a study to determine the factors affecting internet banking adoption among Malaysian consumers, the UTAUT2 model was used (Mohd Thas Thaker et al. 2021). Moreover, several studies have utilized the UTAUT2 model to measure the adoption intention or acceptance of technology (Fianto et al. 2020; Hamidi et al. 2022; Khan et al. 2022; Ratnawati et al. 2022, September). Tamilmani et al. (2021) recommended using the UTAUT2 model as the base model for technology adoption studies. So, UTAUT2 was utilized as the base model for this study. However, the UTAUT2 model did not adequately demonstrate the components that lead to enjoyment, despite the inclusion of hedonic motivation as a predictor of behavioral intention (Choi 2016). In addition, the concept of “habit” cannot be used to evaluate recent innovations in the technological marketplace (Tamilmani et al. 2018, June). In addition, Lee et al. (2003) criticized that the self-reporting of actual use is a major weakness of the UTAUT model. Moreover, several studies do not employ the moderating variables of UTAUT2 in their analysis of FinTech adoption (Gupta et al. 2019; Lin et al. 2020; Rabaa’i 2021; Mohd Thas Thaker et al. 2021). As the concept of Islamic MFS is quite new in Bangladesh, this study did not employ the moderating variables and actual usage behavior from the UTAUT2 model; rather, it was focused on identifying the predicting factors that influence the acceptance of Islamic MFSs.

Technology adoption studies have introduced different independent variables to measure behavioral intention such as perceived security, perceived trust, perceived risk, etc. However, perceived credibility can be considered one of the prominent variables to identify the influence on the new technology adoption intention behavior of the customers. Perceived credibility refers to the notion that a partner is reliable and possesses the necessary skills to perform transactions (Erdem and Swait 2004). It is evident from the previous study that customers reject the adoption of new technologies because of a lack of perceived credibility (Amin et al. 2008). According to Tarhini et al. (2016), integrating perceived credibility into the UTAUT improves the ability to predict customers’ behavioral intentions. So, this study utilized perceived credibility as an independent variable.

2.3. Performance Expectancy (PE)

The notion that the employment of a particular technology or practice will be useful or result in performance improvements for the individual is referred to as performance expectancy (Cruz-Cunha 2013). Alkhwaldi et al. (2022) studied FinTech adoption intention during COVID-19 in a developing country and found that performance expectancy was positively related to behavioral intention to accept FinTech. Similar results were found in a study of port users in Ghana to adopt financial technology (Antwi-Boampong et al. 2022). Based on the above discussion, this study proposes the following hypothesis:

H1.

Performance expectancy positively influences Islamic banks’ customers to accept Islamic MFSs.

2.4. Effort Expectancy (EE)

Effort expectancy is concerned with the consumer’s perception of the ease with which an activity can be completed (Cruz-Cunha 2013). Senyo and Osabutey (2020) determined financial inclusion through FinTech innovations. The result of the study stated that effort expectancy was positively related to behavioral intention to use mobile money services. In addition, Rabaa’i (2021) concluded that for FinTech in Kuwait, effort expectancy was positively related to accepting mobile wallet services. Based on the above discussion, this study proposes the following hypothesis.

H2.

Effort expectancy positively influences Islamic banks’ customers to accept Islamic MFSs.

2.5. Social Influence (SI)

Social influence refers to the way individuals modify their views and behaviors to conform to the expectations of a social group including friends and family (Venkatesh et al. 2012). In a study of FinTech adoption based on the case of open banking, social influence exerted a positive relation towards open banking adoption (Chan et al. 2022). Moreover, Xie et al. (2021) found similar results for adopting a FinTech platform. So, the following hypothesis is proposed below.

H3.

Social influence positively influences Islamic banks’ customers to accept Islamic MFSs.

2.6. Facilitating Conditions (FCs)

The extent to which one thinks that the current technological infrastructure can support the application of technology is referred to as the facilitating conditions (Chan et al. 2010). Sobti (2019) researched mobile payment system adoption in India and concluded that facilitating conditions had a positive and significant impact on mobile payment systems adoption. Similarly, Chawla and Joshi (2019) studied the consumer’s intentions and attitudes towards mobile wallets and found a positive relationship between facilitating conditions and the intention to adopt mobile wallets. The following hypothesis is proposed for this study.

H4.

Facilitating conditions positively influence Islamic banks’ customers to accept Islamic MFSs.

2.7. Price (P)

According to Dodds et al. (1991), the term “price” describes the mental adjustment users make between the benefits they receive from an app and the money it costs to use. When the perceived benefits of employing a technology exceed the monetary cost, the price value is positive, which has a beneficial effect on adoption rates (Venkatesh et al. 2012). In the case of online food delivery services, price plays a positive role in the behavioral intention to adopt an online app (Yeo et al. 2017). Considering the prior research, this study proposes the following hypothesis:

H5.

Price positively influences Islamic banks’ customers to accept Islamic MFSs.

2.8. Perceived Credibility (PC)

Perceived credibility can be defined as the extent to which a potential user believes the service will be secure, private, and free of threat (Wang et al. 2003). Gupta et al. (2019) found that perceived credibility strongly influenced the adoption of payment banks in India. In addition, the previous literature indicates that perceived credibility positively influences consumers’ adoption of online banking (Tarhini et al. 2016; Yuen et al. 2010). The following hypothesis is proposed for this study.

H6.

Perceived credibility positively influences Islamic banks’ customers to accept Islamic MFSs.

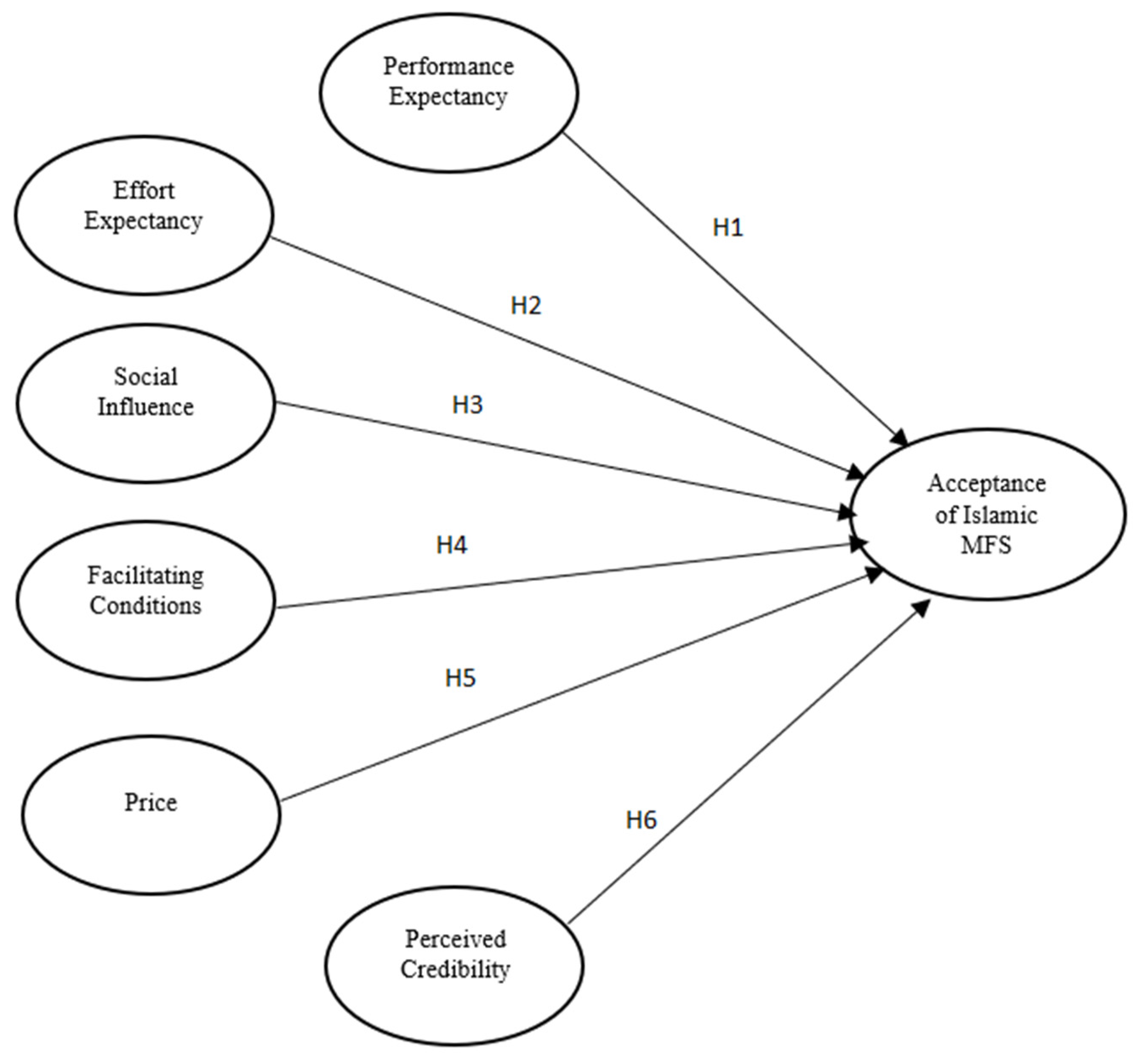

Based on the discussion in the above section, this study employed a modified UTAUT2 model to identify the factors influencing Islamic banks’ customers to accept Islamic MFS in Bangladesh. The study proposed the following research framework is represented in Figure 1.

Figure 1.

Research Framework.

3. Methodology

This study was focused on determining the crucial factors that influence Islamic banks’ customers to adopt Islamic MFS. So, it is explanatory research. The study followed the deductive approach to develop and test the hypotheses to understand the relationship among the variables. In addition, it was a cross-sectional study that was conducted only once.

3.1. Sampling and Data Collection

The research topic was focused on Islamic banks’ customers. Currently, there are 11 Islamic banks in Bangladesh. However, only three of the Islamic banks are offering MFSs. To facilitate the analysis, data were collected from these three banks’ customers. According to Barclay et al. (1995), the sample size should be ten times larger than either the formative indicators used to measure a single construct or the number of inner model paths aimed towards a single construct. So, the sample should be at least 280 according to the study framework.

To collect the data, a survey questionnaire was prepared. The study included six independent variables including performance expectancy, effort expectancy, social influence, facilitating conditions, price, and perceived credibility. The acceptance of Islamic MFSs, which is the behavioral intention to adopt Islamic MFSs, is the dependent variable. A survey questionnaire was distributed to the banks’ customers using a Google Forms link. The measurement items of the variables were derived from existing research. The measurement items for performance expectancy, effort expectancy, social influence, facilitating conditions, and the acceptance of Islamic MFSs are extracted from a study conducted on Islamic FinTech by Rahim et al. (2022). The measurement items for price were derived from Lin et al. (2020). In addition, the perceived credibility measurement items were adapted from Gupta et al. (2019). Like other research, this study used a seven-point Likert scale to rate the items, as it offers the most significant degree of variation (Eutsler and Lang 2015; Jiang et al. 2022). The survey questionnaire was distributed to the customers using the Google Forms app. Finally, a total of 310 customers responded to the survey questionnaire. The measurement instruments are available in Appendix A.

3.2. Data Analysis

This study utilized structural equation modeling as recommended in earlier studies (Hassan et al. 2022a, 2022b). The data were analyzed by SMART PLS 3.2.9 software. Hair et al. (2017) recommended using this software for small sample data analysis. A measurement assessment and structural assessment were conducted to analyze the data. The measurement model is used to evaluate the constructs’ validity and reliability, while the structural model evaluates multicollinearity issues, explanatory power, and the significance of path coefficients (Hair et al. 2019).

4. Findings and Analysis

4.1. Survey Respondents’ Demographic Profile

Table 1 illustrates the survey respondents’ demographic profile.

Table 1.

Survey Respondents’ Demographic Profile.

The survey questionnaire had two parts. In part A, questions regarding the respondents’ demographics were asked, and part B consisted of questions related to variable measurement items. Table 1 indicates that 84.5% of Islamic bank customers knew about the Islamic MFS, whereas 15.5% did not know about the service. The male and female respondents’ participation rates were 63.55% and 36.45%. Around 56.7% of the respondents were aged between 20–40 years and approximately 40% were aged between 41–60. In addition, most of the respondents’ income level ranged below Tk. 50,000 (67.1%) and approximately 33.5% of income levels were above Tk. 75,000.

4.2. Measurement Model Assessment

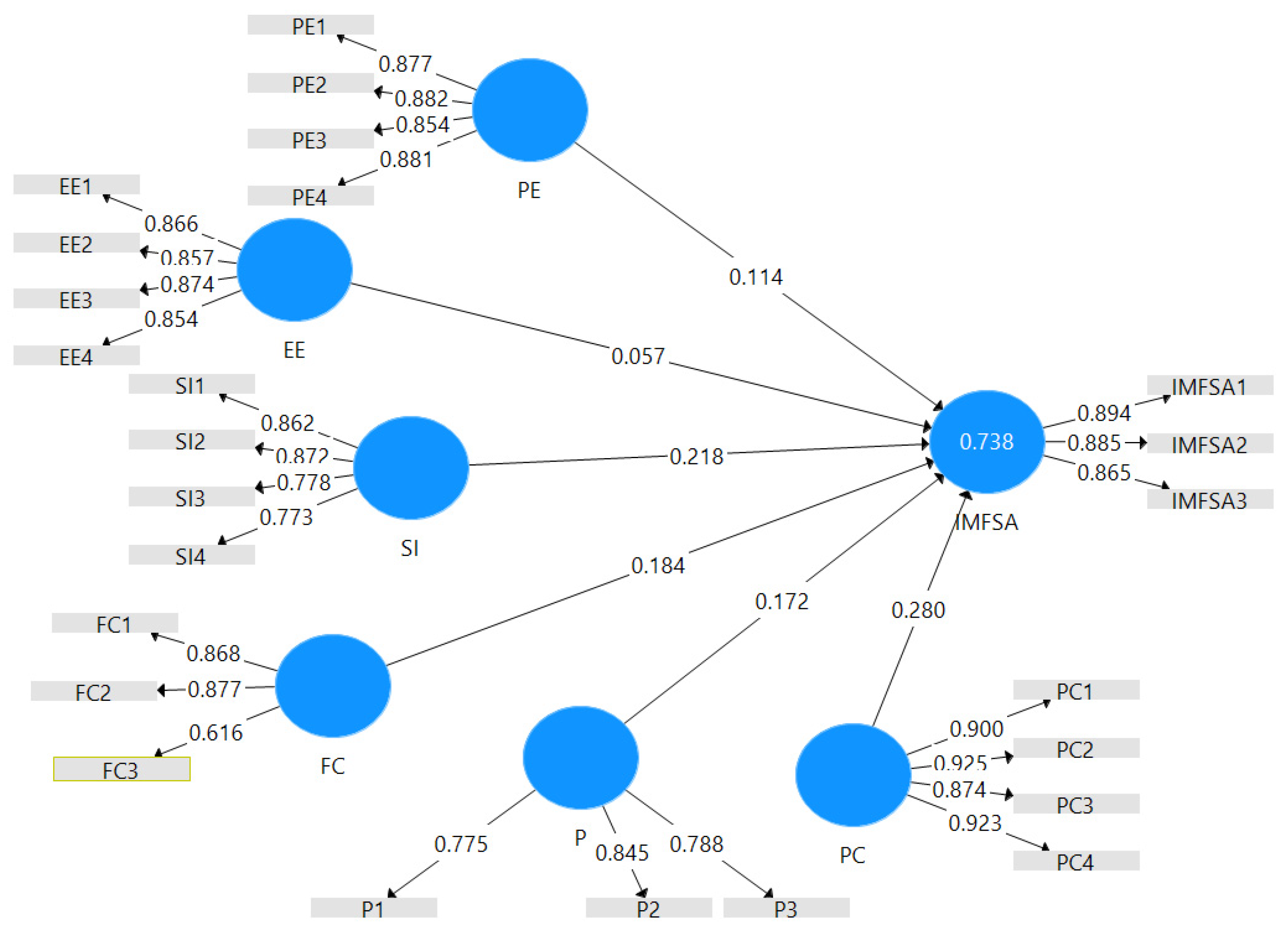

The relationship between a construct and its observable indicators is specified by the measurement model (Henseler et al. 2016). This assessment includes verifying the validity and reliability of the measurement items used in the research model. After running the PLS algorithm in the SMART PLS 3.2.9 software, it is essential to see whether the outer loadings of the constructs are above 0.708; however, values between 0.40–0.70 should only be removed if doing so increases the composite reliability and AVE by more than the recommended threshold value (Hair et al. 2019). Table 2 shows that all the values were over 0.708, other than FC3 (0.616). This study kept the FC3 construct as the removal of the construct did not increase composite reliability or AVE.

Table 2.

Outer loading values.

The next step of the measurement model is to check the reliability and validity. The reliability is checked using Cronbach’s Alpha and the composite reliability, where the threshold value should be more than 0.70 for Cronbach’s Alpha and 0.50 for the composite reliability (Hair et al. 2019). Validity is examined by using convergent validity and discriminant validity. The average variance extracted (AVE) is used to measure convergent validity, and the threshold value is more than 0.50 (Hair et al. 2019). The HTMT scores are utilized to check the discriminant validity. According to Henseler et al. (2016), the HTMT statistic’s confidence interval for all construct combinations should not contain the value 1. Table 3 represents the Cronbach’s Alpha, composite reliability, and the average variance extracted (AVE) scores, and Table 4 represents the HTMT scores. Both tables show that all the constructs met the minimum criteria.

Table 3.

Cronbach’s Alpha, Composite Reliability and AVE Scores.

Table 4.

HTMT Scores.

4.3. Structural Model Assessment

The structural model describes the links between the constructs. Before proceeding to the next step, it is crucial to check whether any multicollinearity arises among the constructs. The VIF score is a measure to verify the multicollinearity issue. According to Hair et al. (2017), the threshold value should be less than 5 for each construct to explain no multicollinearity. Table 5 shows that the VIF scores for all the constructs were less than 5, which means no multicollinearity existed in the research framework.

Table 5.

VIF Scores.

Figure 2 illustrates the R2 Value. It indicates that the value was 0.738. In general, R2 values of 0.75, 0.50, or 0.25 for the endogenous construct might be characterized as substantial, moderate, and weak, respectively. The explanatory power of the model was 73.8%, which means it can be characterized as substantial.

Figure 2.

R2 Value Result from Smart PLS.

This study utilized the bootstrapping process to assess the path coefficient’s significance. Table 6 represents the path coefficient values to test the hypotheses and results of the study. A hypothesis was accepted if the p-value was less than 0.05. Based on the Table 6 results, the hypotheses H3, H4, H5, and H6 were accepted because the p-value was less than 0.05. However, the hypotheses H1 and H2 were rejected as the p-value was more than 0.05. This result also indicates that PC had the highest significance for IMFSA, followed by FC, SI, and P.

Table 6.

Path Coefficient values.

4.4. Discussion

The use of smartphones and the internet has grown in Bangladesh, and mobile FinTech services are gaining popularity. The number of people using mobile phones has significantly increased. As of August 2021, there were 178.61 million mobile phone subscribers in Bangladesh. Bangladesh also has a 31.5% penetration rate for internet users (Statista 2021). Statista reports that, compared to 2020, the volume of FinTech transactions exclusively involving digital payments increased by 31.42% in 2022 (Statista 2022). The number of MFS account holders in Bangladesh is 185.06 million. This amply demonstrates Bangladesh’s growing reliance on mobile FinTech services.

This study aimed to identify the factors that influence Islamic banks’ customers to accept Islamic MFSs in Bangladesh. This study employed six independent variables including performance expectancy, effort expectancy, social influence, facilitating conditions, price, and perceived credibility.

The study results revealed that social influence had a significant positive impact on Islamic MFS acceptance. These results are similar to previous studies (Baabdullah 2018; Patel and Patel 2018). In Bangladesh, people are more family-oriented. They are greatly influenced by their family members’ opinions and advice. Before making any financial decision, people tend to seek advice from their families. In addition, millennials are influenced by their friends’ suggestions. Facilitating conditions showed a significant positive influence on Islamic MFS acceptance. This result is consistent with earlier studies’ findings (Chawla and Joshi 2019; Verkijika 2018). Islamic banks’ customers seek 24 h customer helpline support and offline transaction capabilities, which they can receive from conventional banks’ MFSs. Currently, offline transaction capabilities are not available for Islamic banks’ MFSs. In addition, the results showed that price value had a significant positive influence on Islamic MFS acceptance. Earlier studies also found a positive influence of price value on technology adoption behavior (Alalwan et al. 2018). Almost all the services provided by Islamic MFSs are like conventional MFSs. However, price value can be crucial to grabbing the customers’ attention. Competitive cash-out costs and lucrative cash-back bonuses for each transaction can influence Islamic banks’ customers to choose Islamic MFSs. Moreover, the study revealed that perceived credibility had a positive influence on Islamic MFS acceptance. This result is consistent with previous studies (Gupta et al. 2019; Tarhini et al. 2016). The Islamic MFS is relatively new to Islamic banks’ customers compared to conventional banks’ MFSs. So, credibility is a significant concern for the customers because of transactional risk. MFS apps ensure security, structural assurance, transparency, and consistency in performing transactions. As a result, customers will feel safe performing transactions in Islamic MFSs. Nevertheless, two dominant factors, performance expectancy and effort expectancy, showed no impact on Islamic MFS acceptance. These results are similar to earlier FinTech acceptance studies (Rahim et al. 2022; Yohanes et al. 2020). Smartphones and the internet usage rate are higher, especially in city areas. One of the reasons that PE and EE showed no impact is that most of the respondents (56.7%) belonged to the age group between 20 to 40. This age group is more involved in using technologies and software applications for their studies and office work. So, their choice of using the Islamic MFS is not impacted by the performance and user-friendliness of the MFS application. Another reason may be that the customer feels that all the MFS apps’ user interfaces are quite similar; as a result, the performance and the ease of using the app are less critical in choosing Islamic MFSs. However, most of the studies showed positive impact of PE and EE (Ivanova and Kim 2022; Win et al. 2021). These results will be helpful for the Islamic MFS providers to understand the customer expectation and concerns regarding Islamic MFS acceptance. Table 7 includes the summary of the results of the hypotheses.

Table 7.

Summary of Hypotheses.

5. Conclusions

Financial institutions today are adapting to the new technological landscape brought on by the Fourth Industrial Revolution. Bangladesh is a Muslim-majority country with around 91% of residents being Muslim. The medium-term outlook for Bangladesh’s Islamic finance sector is positive due to strong consumer demand, recent branch openings, and pro-business government regulations. Numerous traditional banks are putting more of an emphasis on Islamic products, either by opening new Islamic branches or windows or by becoming fully fledged Islamic banks. However, conventional banks’ MFSs are more popular than Islamic banks’ MFSs in Bangladesh despite customers’ demand for Islamic products and services. This study aimed to determine the factors influencing Islamic banks’ customers to accept Islamic MFSs. This study revealed that social influence, facilitating conditions, price, and perceived credibility influence the acceptance of Islamic MFSs by Islamic bank customers. The most dominating factor that influences customers is perceived credibility because customers are aware of transactional risk and more concerned about the structure, reliability, consistency, and security of the MFS application. Available customer service and usage of the MFS app, even offline, are considered necessary facilitating conditions. Moreover, the price should be more reasonable than conventional bank MFS providers. In addition, family and friends’ opinions toward Islamic MFSs also motivate customers to accept the technology. Islamic MFSs can secure a handsome market share in the MFS industry by adapting to the needs and preferences of Islamic bank customers.

5.1. Theoretical Contribution and Managerial Implications

This study proposed and operationalized a new research framework by modifying the existing UTAUT2 model. It excluded variables such as hedonic motivation and habit because hedonic motivation does not adequately demonstrate the components that lead to enjoyment. In addition, “habit” cannot be used to evaluate recent innovations in the technological marketplace. Moreover, the new research framework included perceived credibility as a predicting variable because earlier studies showed a significant positive impact on technology acceptance. This proposed framework will be helpful for academicians and researchers to test new technology acceptance behavior studies.

The study results are helpful for the Islamic and non-Islamic banks’ MFS providers and FinTech firms operating in Bangladesh. The findings have given significant importance to the credibility of the Islamic MFS apps. Banks should focus on developing MFS apps that ensure security, structural assurance, and transparency. MFS providers should emphasize providing 24 h customer help lines along with offline transaction services to ensure the available facilitating conditions to their customers. Moreover, a proper pricing strategy should be maintained to grab customers’ attention. In addition, MFS providers should promote their products and services through bank branches and social media channels and motivate bank front-line employees to promote the MFS apps. The study results will be helpful for MFS providers to understand customers’ technology acceptance behaviors, which will help them to implement a proper strategy to attract customers.

5.2. Limitations and Future Research

The main limitation of this study is the small sample size. In addition, data were collected from customers of Islamic banks residing in Bangladesh’s capital. This research extended and modified the UTAUT2 model. However, future studies can include new variables such as perceived value, perceived sacrifice, and perceived risk and can increase the sample size for the consistency of the results. In addition, they can introduce new endogenous moderating variables and use existing contextual factors such as age, gender, and experience as the moderating variables.

Author Contributions

Conceptualization, M.S.H. and M.A.I.; methodology, M.S.H.; software, M.F.b.Y.; validation, M.A.I.; formal analysis, M.S.H.; investigation, H.N; resources, H.N and N.H.; data curation, M.S.H.; writing—original draft preparation, M.S.H.; writing—review and editing, M.A.I., H.N., N.H. and M.F.b.Y.; visualization, N.H.; supervision, M.A.I. and H.N.; project administration, M.F.b.Y.; funding acquisition, M.F.b.Y. All authors have read and agreed to the published version of the manuscript.

Funding

This research is funded by Special Research Grant-Universiti Malaysia Perlis, grant number (9004-00092).

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Measurement Items of Variables.

Table A1.

Measurement Items of Variables.

| Variable | Measurement Item | Sources |

|---|---|---|

| Effort Expectancy | EE1: MFS platform is easy to use EE2: My communication with the MFS platform is strong and clear EE3: It is comfortable for me to become skilled at using the MFS platform EE4: I find the MFS app adaptable to interact with | Rahim et al. (2022) |

| Facilitating Conditions | FC1: I have the adequate knowledge and capacity to use MFS FC2: I can get help from banks’ call centers for MFS assistance FC3: I have enough experience to contentedly use MFS platforms | Rahim et al. (2022) |

| Perceived Credibility | PC1: Islamic MFS is dependable PC2: Islamic MFS providers are trustworthy PC3: Islamic MFS is secure to use PC4: Islamic MFS is reliable | Gupta et al. (2019) |

| Performance Expectancy | PE1: MFS helps me to do transactions more quickly PE2: MFS increases my efficiency PE3: MFS makes it easier for me to conduct transactions PE4: MFS improves my overall transaction performance | Rahim et al. (2022) |

| Price | P1: I think the pricing of the Islamic MFS is reasonable P2: Islamic MFS has better value than money P3: Islamic MFS is worth more than it costs | Lin et al. (2020) |

| Social Influence | SI1: People who are valuable to me expect me to use Islamic MFS SI2: Those people that influence my behavior think that I should use Islamic MFS SI3: I expect using Islamic MFS to be trendy SI4: I think that using Islamic MFS would make me look religious | Rahim et al. (2022) |

| Islamic MFS Acceptance | IMFSA1: If I have used Islamic MFS, I am willing to continue using it IMFSA2: I would like to use Islamic MFS soon IMFSA3: I will recommend Islamic MFS to my friends | Rahim et al. (2022) |

References

- Akhtaruzzaman, Md., Md. Syedul Islam, Shibli Rubayat Ul Islam, Mohammad Rakib Uddin Bhuiyan, Mohammad Tareq, and Md. Jahir Uddin Palas. 2017. An Impact Study on Mobile Financial Services (MFSs) in Bangladesh. Department of Communications and Publications, Bangladesh Bank. Retrieved September 27: 2020. [Google Scholar]

- Alalwan, Ali Abdallah, Yogesh K. Dwivedi, Nripendra P. Rana, and Raed Algharabat. 2018. Examining factors influencing Jordanian customers’ intentions and adoption of internet banking: Extending UTAUT2 with risk. Journal of Retailing and Consumer Services 40: 125–38. [Google Scholar] [CrossRef]

- Alkhwaldi, Abeer F., Esraa Esam Alharasis, Maha Shehadeh, Ibrahim A. Abu-AlSondos, Mohammad Salem Oudat, and Anas Ahmad Bani Atta. 2022. Towards an Understanding of FinTech Users’ Adoption: Intention and e-Loyalty Post-COVID-19 from a Developing Country Perspective. Sustainability 14: 12616. [Google Scholar] [CrossRef]

- Amin, Hanudin, Mohd Rizal Abdul Hamid, Suddin Lada, and Zuraidah Anis. 2008. The adoption of mobile banking in Malaysia: The case of bank Islam Malaysia Berhad. International Journal of Business and Society 9: 43–53. [Google Scholar]

- Antwi-Boampong, Ahmed, David King Boison, Musah Osumanu Doumbia, Afia Nyarko Boakye, Linda Osei-Fosua, and Kwame Owiredu Sarbeng. 2022. Factors Affecting Port Users’ Behavioral Intentions to Adopt Financial Technology (Fintech) in Ports in Sub-Saharan Africa: A Case of Ports in Ghana. FinTech 1: 362–75. [Google Scholar] [CrossRef]

- Baabdullah, Abdullah Mohammed. 2018. Consumer adoption of Mobile Social Network Games (M-SNGs) in Saudi Arabia: The role of social influence, hedonic motivation and trust. Technology in Society 53: 91–102. [Google Scholar] [CrossRef]

- Bangladesh Bank. n.d. Payment and Settlement Systems. Available online: https://www.bb.org.bd/fnansys/paymentsys/mfs_provider.pdf (accessed on 10 December 2022).

- Barclay, Donald, Christopher Higgins, and Ronald Thompson. 1995. The partial least squares (PLS) approach to casual modeling: Personal computer adoption ans use as an Illustration. Technology Studies 2: 285–309. [Google Scholar]

- Chan, Frank K. Y., James Y. L. Thong, Viswanath Venkatesh, Sue A. Brown, Paul J. H. Hu, and Kar Yan Tam. 2010. Modeling citizen satisfaction with mandatory adoption of an E-Government technology. Journal of the Association for Information Systems 11: 519–49. [Google Scholar] [CrossRef]

- Chan, Rebecca, Indrit Troshani, Sally Rao Hill, and Arvid Hoffmann. 2022. Towards an understanding of consumers’ FinTech adoption: The case of Open Banking. International Journal of Bank Marketing 40: 886–917. [Google Scholar] [CrossRef]

- Chawla, Deepak, and Himanshu Joshi. 2019. Consumer attitude and intention to adopt mobile wallet in India—An empirical study. International Journal of Bank Marketing 37: 1590–618. [Google Scholar] [CrossRef]

- Choi, Sujeong. 2016. The flipside of ubiquitous connectivity enabled by smartphone-based social networking service: Social presence and privacy concern. Computers in Human Behavior 65: 325–33. [Google Scholar] [CrossRef]

- Cruz-Cunha, Maria Manuela, ed. 2013. Handbook of Research on ICTs and Management Systems for Improving Efficiency in Healthcare and Social Care. Hershey: IGI Global, vol. 2. [Google Scholar]

- Davis, Fred D., Richard P. Bagozzi, and Paul R. Warshaw. 1989. User acceptance of computer technology: A comparison of two theoretical models. Management Science 35: 982–1003. [Google Scholar] [CrossRef]

- Dodds, William B., Kent B. Monroe, and Dhruv Grewal. 1991. Effects of Price, Brand, and Store Information on Buyers. Journal of Marketing Research 28: 307–19. [Google Scholar] [CrossRef]

- Ehsan, Zaeem-Al, Naomi Musleh, Veronica Gomes, Wasiq Ahmed, and Md Dinash Ferdous. 2019. The usage of mobile financial services in Bangladesh. MPRA. Available online: https://mpra.ub.uni-muenchen.de/109974/ (accessed on 22 January 2023).

- Erdem, Tülin, and Joffre Swait. 2004. Brand credibility, brand consideration, and choice. Journal of Consumer Research 31: 191–98. [Google Scholar] [CrossRef]

- Eutsler, Jared, and Bradley Lang. 2015. Rating scales in accounting research: The impact of scale points and labels. Behavioral Research in Accounting 27: 35–51. [Google Scholar] [CrossRef]

- Fianto, Bayu Arie, Achsania Hendratmi, and Primandanu Febriyan Aziz. 2020. Factors determining behavioral intentions to use Islamic financial technology: Three competing models. Journal of Islamic Marketing 12: 794–812. [Google Scholar] [CrossRef]

- Giglio, Ferdinando. 2021. Fintech: A literature review. European Research Studies Journal 24: 600–27. [Google Scholar] [CrossRef]

- Gupta, Kriti Priya, Rishi Manrai, and Utkarsh Goel. 2019. Factors influencing adoption of payments banks by Indian customers: Extending UTAUT with perceived credibility. Journal of Asia Business Studies 13: 173–95. [Google Scholar] [CrossRef]

- Hair, Joseph F., G. Tomas M. Hult, Christian M. Ringle, Marko Sarstedt, and Kai Oliver Thiele. 2017. Mirror on the Wall: A Comparative Evaluation of Composite-based Structural Equation Modeling Methods. Journal of the Academy of Marketing Science 45: 616–32. [Google Scholar] [CrossRef]

- Hair, Joseph F., Jeffrey J. Risher, Marko Sarstedt, and Christian M. Ringle. 2019. When to use and how to report the results of PLS-SEM. European Business Review 31: 2–24. [Google Scholar] [CrossRef]

- Hamidi, Masyhuri, Fajri Adrianto, and Bryan Trianda Ginting. 2022. Determining factor of continuous intention mobile payment: Using extending the unified theory of acceptance and use of technology (UTAUT2) model. Journal Kajian Manajemen Bisnis 11. [Google Scholar] [CrossRef]

- Hasan, Tawfiq, and Munia Islam. 2021. Mobile Financial Services in Bangladesh: Emerging through the Pandemic. Access Health International. Available online: https://fintechforhealth.sg/mobile-financial-services-in-bangladesh-emerging-through-the-pandemic/ (accessed on 19 December 2022).

- Hassan, Mehedi. 2022. bKash Dominates while Nagad Grows Fast. The Business Post. Available online: https://businesspostbd.com/front/2022-06-09/bkash-dominates-while-nagad-grows-fast-2022-06-09 (accessed on 19 December 2022).

- Hassan, Md. Sharif, Md. Aminul Islam, Farid Ahammad Sobhani, Md. Maruf Hassan, and Md. Arif Hassan. 2022a. Patients’ Intention to Adopt Fintech Services: A Study on Bangladesh Healthcare Sector. International Journal of Environmental Research and Public Health 19: 15302. [Google Scholar] [CrossRef] [PubMed]

- Hassan, Md. Sharif, Md. Aminul Islam, Farid Ahammad Sobhani, Hussen Nasir, Imroz Mahmud, and Fatema Tuz Zahra. 2022b. Drivers Influencing the Adoption Intention towards Mobile Fintech Services: A Study on the Emerging Bangladesh Market. Information 13: 349. [Google Scholar] [CrossRef]

- Henseler, Jörg, Geoffrey Hubona, and Pauline Ash Ray. 2016. Using PLS path modeling in new technology research: Updated guidelines. Industrial Management & Data Systems 116: 2–20. [Google Scholar] [CrossRef]

- Hu, Zhongqing, Shuai Ding, Shizheng Li, Luting Chen, and Shanlin Yang. 2019. Adoption intention of fintech services for bank users: An empirical examination with an extended technology acceptance model. Symmetry 11: 340. [Google Scholar] [CrossRef]

- Ivanova, Aisena, and Ju Yeon Kim. 2022. Acceptance and Use of Mobile Banking in Central Asia: Evidence from Modified UTAUT Model. The Journal of Asian Finance, Economics and Business 9: 217–27. [Google Scholar] [CrossRef]

- Jiang, Qianling, Jiangjie Chen, Yutong Wu, Chao Gu, and Jie Sun. 2022. A Study of Factors Influencing the Continuance Intention to the Usage of Augmented Reality in Museums. Systems 10: 73. [Google Scholar] [CrossRef]

- Jin, Chua Chang, Lim Chee Seong, and Aye Aye Khin. 2019. Factors affecting the consumer acceptance towards fintech products and services in Malaysia. International Journal of Asian Social Science 9: 59–65. [Google Scholar] [CrossRef]

- Jünger, Moritz, and Mark Mietzner. 2020. Banking goes digital: The adoption of FinTech services by German households. Finance Research Letters 34: 101260. [Google Scholar] [CrossRef]

- Kabir, Md Humayun, SSM Sadrul Huda, and Omar Faruq. 2020. Mobile Financial Services in the context of Bangladesh. Copernican Journal of Finance & Accounting 9: 83–98. [Google Scholar] [CrossRef]

- Khan, Mohammad Shahfaraz, Mustafa Raza Rabbani, Iqbal Thonse Hawaldar, and Abu Bashar. 2022. Determinants of Behavioral Intentions to Use Islamic Financial Technology: An Empirical Assessment. Risks 10: 114. [Google Scholar] [CrossRef]

- Kim, Hee-Woong, Hock Chuan Chan, and Sumeet Gupta. 2007. Value-based adoption of mobile internet: An empirical investigation. Decision Support Systems 43: 111–26. [Google Scholar] [CrossRef]

- Kim, Dan J., Donald L. Ferrin, and H. Raghav Rao. 2008. A trust-based consumer decision-making model in electronic commerce: The role of trust, perceived risk, and their antecedents. Decision Support Systems 44: 544–64. [Google Scholar] [CrossRef]

- Latifee, Enamul, and Mehdina Tamanna. 2022. A Review of Mobile Financial Services in Bangladesh. International Journal of Advances in Engineering and Management 4: 870–73. [Google Scholar] [CrossRef]

- Lee, Younghwa, Kenneth A. Kozar, and Kai RT Larsen. 2003. The technology acceptance model: Past, present and future. Communications of the Association for Information Systems 12: 752–80. Available online: https://aisel.aisnet.org/cais/vol12/iss1/50 (accessed on 20 December 2022).

- Lin, Wan Rung, Chun-Yueh Lin, and Yu-Heng Ding. 2020. Factors affecting the behavioral intention to adopt mobile payment: An empirical study in Taiwan. Mathematics 8: 1851. [Google Scholar] [CrossRef]

- Mansyur, Abdurrahman, and Engku Muhammad Tajuddin Engku Ali. 2022. The Adoption of Sharia Fintech Among Millenial in Indonesia: Moderating Effect of Islamic Financial Literacy on UTAUT 2. International Journal of Academic Research in Business and Social Sciences 12: 1329–43. [Google Scholar] [CrossRef]

- McKinsey and Company. 2021. Emerging Markets Leap forward in Digital Banking Innovation and Adoption Report. Available online: https://www.mckinsey.com/industries/financial-services/our-insights/emerging-markets-leap-forward-in-digital-banking-innovation-and-adoption (accessed on 19 December 2022).

- Mohd Thas Thaker, Hassanudin, Mohamed Asmy Mohd Thas Thaker, Ahmad Khaliq, Anwar Allah Pitchay, and Hafezali Iqbal Hussain. 2021. Behavioural intention and adoption of internet banking among clients of Islamic banks in Malaysia: An analysis using UTAUT2. Journal of Islamic Marketing 13: 1171–97. [Google Scholar] [CrossRef]

- NewAge. 2022. Islamic Banks’ Market Share Rises to 28.21pc in Q1. Available online: https://www.newagebd.net/article/174374/islamic-banks-market-share-rises-to-2821pc-in-q1 (accessed on 19 December 2022).

- Patel, Kiran J., and Hiren J. Patel. 2018. Adoption of internet banking services in Gujarat: An extension of TAM with perceived security and social influence. International Journal of Bank Marketing 36: 147–69. [Google Scholar] [CrossRef]

- Peek, Sebastiaan TM, Eveline JM Wouters, Joost Van Hoof, Katrien G. Luijkx, Hennie R. Boeije, and Hubertus JM Vrijhoef. 2014. Factors influencing acceptance of technology for aging in place: A systematic review. International Journal of Medical Informatics 83: 235–48. [Google Scholar] [CrossRef]

- Rabaa’i, Ahmad A. 2021. An investigation into the acceptance of mobile wallets in the FinTech era: An empirical study from Kuwait. International Journal of Business Information Systems, in press. [Google Scholar]

- Rahim, Norafni Farlina, Mohammed Hariri Bakri, Bayu Arie Fianto, Nurazilah Zainal, and Samer Ali Hussein Al Shami. 2022. Measurement and structural modelling on factors of Islamic Fintech adoption among millennials in Malaysia. Journal of Is-lamic Marketing, ahead-of-print. [Google Scholar] [CrossRef]

- Ratnawati, Suci, Yusuf Durachman, and Angga Saputra. 2022. Analyzing Factors Influencing Intention to Use and Actual Use of Mobile Fintech Applications Free Interbank Money Transfer Flip Using UTAUT 2 Model with Trust and Perceived Security. Paper presented at 2022 10th International Conference on Cyber and IT Service Management (CITSM), Yogyakarta, Indonesia, September 20–21; pp. 1–8. [Google Scholar]

- Senyo, Prince Kwame, and Ellis LC Osabutey. 2020. Unearthing antecedents to financial inclusion through FinTech innovations. Technovation 98: 102155. [Google Scholar] [CrossRef]

- Shaikh, Imran Mehboob, Muhammad Asif Qureshi, Kamaruzaman Noordin, Junaid Mehboob Shaikh, Arman Khan, and Muhammad Saeed Shahbaz. 2020. Acceptance of Islamic financial technology (FinTech) banking services by Malaysian users: An extension of technology acceptance model. Foresight 22: 367–83. [Google Scholar] [CrossRef]

- Sobti, Neharika. 2019. Impact of demonetization on diffusion of mobile payment service in India: Antecedents of behavioral intention and adoption using extended UTAUT model. Journal of Advances in Management Research 16: 472–97. [Google Scholar] [CrossRef]

- Statista. 2021. Fintech—Statistics & Facts. Available online: https://www.statista.com/statistics/893954/number-fintech-startups-by-region/ (accessed on 22 December 2022).

- Statista. 2022. Digital Markets Fintech Bangladesh. Available online: https://www.statista.com/outlook/dmo/fintech/bangladesh (accessed on 22 December 2022).

- Tamilmani, Kuttimani, Nripendra P. Rana, and Yogesh K. Dwivedi. 2018. Use of ‘habit’ is not a habit in understanding individual technology adoption: A review of UTAUT2 based empirical studies. In International Working Conference on Transfer and Diffusion of IT. Cham: Springer, pp. 277–94. [Google Scholar] [CrossRef]

- Tamilmani, Kuttimani, Nripendra P. Rana, Samuel Fosso Wamba, and Rohita Dwivedi. 2021. The extended Unified Theory of Acceptance and Use of Technology (UTAUT2): A systematic literature review and theory evaluation. International Journal of Information Management 57: 102269. [Google Scholar] [CrossRef]

- Tarhini, Ali, Mazen El-Masri, Maged Ali, and Alan Serrano. 2016. Extending the UTAUT model to understand the customers’ acceptance and use of internet banking in Lebanon: A structural equation modeling approach. Information Technology & People 29: 830–49. [Google Scholar] [CrossRef]

- Usman, Hardius, Nucke Widowati Kusumo Projo, Chairy Chairy, and Marissa Grace Haque. 2021. The exploration role of Sharia compliance in the technology acceptance model for e-banking (case: Islamic bank in Indonesia). Journal of Islamic Marketing 13: 1089–110. [Google Scholar] [CrossRef]

- Venkatesh, Viswanath, Michael G. Morris, Gordon B. Davis, and Fred D. Davis. 2003. User Acceptance of Information Technology: Toward a Unified View. MIS Quarterly 27: 425–78. [Google Scholar] [CrossRef]

- Venkatesh, Viswanath, James YL Thong, and Xin Xu. 2012. Consumer acceptance and use of information technology: Extending the unified theory of acceptance and use of technology. MIS Quarterly 36: 157–78. [Google Scholar] [CrossRef]

- Verkijika, Silas Formunyuy. 2018. Factors influencing the adoption of mobile commerce applications in Cameroon. Telematics and Informatics 35: 1665–74. [Google Scholar] [CrossRef]

- Wang, Yi-Shun, Yu-Min Wang, Hsin-Hui Lin, and Tzung-I. Tang. 2003. Determinants of user acceptance of internet banking: An empirical study. International Journal of Service Industry Management 14: 501–19. [Google Scholar] [CrossRef]

- Widiatmo, Gumilang. 2021. Technology Acceptance Model Analysis of Adoption Intention to Use Indonesian Islamic Fintech Apps Amid The COVID-19 Pandemic. TIJARI International Journal of Islamic Economics, Bussiness and Entrepreneurship 1: 80–107. [Google Scholar]

- Win, Naing Naing, Pyae Phyo Aung, and May Thu Phyo. 2021. Factors Influencing Behavioral Intention to Use and Use Behavior of Mobile Banking in Myanmar Using a Model Based on Unified Acceptance Theory. Human Behavior, Development and Society 22: 19–30. [Google Scholar]

- Xie, Jianli, Liying Ye, Wei Huang, and Min Ye. 2021. Understanding FinTech platform adoption: Impacts of perceived value and perceived risk. Journal of Theoretical and Applied Electronic Commerce Research 16: 1893–911. [Google Scholar] [CrossRef]

- Yan, Chen, Abu Bakkar Siddik, Nazma Akter, and Qianli Dong. 2021. Factors influencing the adoption intention of using mobile financial service during the COVID-19 pandemic: The role of FinTech. Environmental Science and Pollution Research, 1–19. [Google Scholar] [CrossRef]

- Yeo, Vincent Cheow Sern, See-Kwong Goh, and Sajad Rezaei. 2017. Consumer experiences, attitude and behavioral intention toward online food delivery (OFD) services. Journal of Retailing and Consumer Services 35: 150–62. [Google Scholar] [CrossRef]

- Yohanes, Kelvin, Kelvin Junius, Yonathan Saputra, Ratna Sari, Yuliana Lisanti, and Devyano Luhukay. 2020. Unified Theory of Acceptance and Use of Technology (UTAUT) model perspective to enhance user acceptance of fintech application. Paper presented at 2020 International Conference on Information Management and Technology (ICIMTech), Bandung, Indonesia, August 13–14. [Google Scholar]

- Yuen, Yee Yen, Paul HP Yeow, Nena Lim, and Najib Saylani. 2010. Internet banking adoption: Comparing developed and developing countries. The Journal of Computer Information Systems 51: 52–61. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).