Abstract

The aim of the paper is to identify groups of banks with similar environmental commitment, taking into account their direct environmental impact. The study, which employs the aggregation method, reveals that small banks with a relatively worse financial standing are characterised by the lowest level of disclosures within pro-ecological initiatives. At the same time, large international banks belong to clusters defined by the highest or the lowest disclosure rates. The above-mentioned phenomenon results from the dichotomy of integrating environmental policy into their strategies and business models. This study is the first comparative analysis of the extent to which all listed (and at the same time the biggest) banks operating in Poland have taken initiatives to reduce the negative environmental impact of their activities.

1. Introduction

According to the (IPCC 2019) report, anthropogenic global warming is currently about 1.0 °C above pre-industrial levels. If this state of affairs continues, global warming is likely to reach 1.5 °C between 2030 and 2052. This is a border at which the catastrophic consequences of this phenomenon for the biosphere and humanity are likely to be unavoidable. Although it is difficult to clearly link specific weather events to global warming, their frequency and rapidity require radical climate action. (Eckstein et al. 2021) point out that between 2000 and 2019 over 475,000 people lost their lives as a direct result of more than 11,000 extreme weather events globally, and losses amounted to around USD 2.56 trillion. It is not surprising that the annual Global Risks Report ranks climate action failure and extreme weather in the first two places of the most severe risks on a global scale over the next 10 years (WEF 2022).

Commercial banks play a key role in the implementation of environmental and climate protection initiatives undertaken by international organisations, in particular the European Union (EU). (Carney et al. 2019) even stress that the financial sector must be at the heart of tackling climate change. In accordance with the recommendations of the Network for Greening the Financial System for central banks and supervisors these institutions shall: (i) integrate climate-related risks into financial stability monitoring and micro-supervision; (ii) integrate sustainability factors into own-portfolio management; (iii) share data that is relevant to Climate Risk Assessment (CRA) and, whenever possible, make this publicly available in a data repository; (iv) build awareness and intellectual capacity as well as encouraging technical assistance and knowledge sharing (NGFS 2019).

The European Central Bank (ECB) notes that none of the 112 directly supervised European banks are able to meet all prudential expectations, although the banks have taken initial steps to address climate risks (ECB 2021). According to the ECB, banks perform best in the areas of: management bodies, risk appetite and operational risk management, and internal reporting, market and liquidity risk management and stress testing. Half of the banks have not planned concrete measures to integrate climate and environmental risks into their business strategies, and less than a fifth have developed Key Risk Indicators to monitor them. The ECB has also committed to gradually integrating climate and environmental risks into its SREP methodology, which will ultimately have an impact on the capital requirements under Pillar II.

The actions of central banks and supervisory authorities should therefore be transferred to commercial banks. (Bernardelli et al. 2022) point out that commercial banks can influence their environment in three ways. Firstly, there is the traditional allocation function, which allows funds to flow from less efficient economic sectors to more efficient ones. Banks can play an important role in reducing the financing of borrowers with environmentally and climate-damaging activities by providing the necessary knowledge and management of credit risks. This area also includes bank products aimed at reducing climate risks (e.g., thermal modernisation loans, photovoltaic loans, climate risk investment funds, green bonds, etc.). Secondly, it involves the bank’s ecological education among its stakeholders. Thirdly, it is about minimising one’s own impact on the environment by managing the consumption of electricity, natural gas, water, heating, fuel, typical office supplies and the reduction of municipal waste and air pollution. This article precisely focuses on the last point.

The objective of this article is to assess the activities of banks operating in the Polish banking sector in terms of their direct impact on the environment and climate change, and to identify clusters of banks with similar environmental commitment, taking into account only initiatives that are part of their day-to-day operations. The Polish banking sector was the largest among those of the ten countries joining the EU (EU 10) in 2004. The study is based on data of the 12 biggest banks that manage their activities in the Polish banking sector and are listed on the Warsaw Stock Exchange (on the main market for public companies, or on the Catalyst market which is applicable for bonds issuers). The survey is conducted on a sample of banks with total assets accounting for 84.00% of the assets of the Polish banking sector (standalone figures). The above mentioned estimation does not cover the state-owned Bank Gospodarstwa Krajowego (BGK), which—due to a different legal basis of operation and other (not only business) objectives—is not treated in this paper as a commercial bank. Unlisted commercial banks (the market share of the largest of them, Credit Agricole Bank Polska SA, is less than 1.30%) and 530 cooperative banks were not included in the study. The surveyed banks account for 92.00% of the balance sheet total of Polish commercial banks (BFG 2022). The choice of the Polish banking sector is mainly due to the fact that fossil fuels (largely coal and lignite from domestic sources) account for up to 83% of the Polish energy mix (Agora Energiewende 2021) and this share is highest in the EU as a whole. Thus, corporates and banks that finance them (operating in the same legal environment as their peers in other EU countries) are heavily dependent on coal, gas and oil. Having the above mentioned issue in mind and the fact that the Polish government’s participation in the banking sector is amongst the highest in the EU (around 45% at the beginning of 2021), the authors consider the real commitment of commercial banks to climate protection to be interesting and important. On the one hand, pro-environmental activity is in line with the values of the EU and banks’ investors, and on the other hand, banks must take into account the specificities of corporate clients and the interests of the state, i.e., they must not unduly discriminate against a carbon-intensive economy. The integration of environmental aspects into the company’s own operations is a kind of expression of the institution’s attitude towards environmental issues. In this context, the position of the largest Polish commercial banks, two of which are controlled by the Treasury, seems particularly interesting. In addition to these aspects, the study differs from previous studies on the environmental impact of the banking sector by focusing also on the operational activity (as opposed to lending or investment) and by attempting to identify differences in banks’ commitment to climate protection, given dissimilarities in size, shareholder structure and business model.

The research employs cluster analysis and is based on disclosures on the bank’s direct environmental and climate impact presented in the banks’ annual reports for 2020.

It fills a research gap defined as a lack of tools and analyses to compare the involvement of commercial banks in environmental initiatives. From an axiological point of view, this issue is also relevant to the coherence of two paradigms: the declared commitment to environmental protection—the actual (announced) commitment to environmental protection in day-to-day operations, and the reduction of the negative environmental impact of banking operations—and the implementation of climate policy in banks’ credit procedures.

2. Literature Review

Climate risk in a bank is the risk of a bank’s income or value loss due to the increased frequency and intensity of extreme weather events as a result of climate change. This includes direct and indirect climate protection risks (de Netto A.C. Schneider et al. 2020). The first component relates to aspects of a banking institution’s business, such as the energy intensity of bank branches, the consumption of water, fuel, plastics and paper, the extent of recycling and the carbon footprint left behind. Indirect climate risk is related to the impact of climate change and the regulation counteracting it on the standing of bank customers and companies owned by the bank, and consequently to the financial performance of the bank as well. Indirect climate risks are decomposed into physical and transition risks. The physical risk is associated with the effects of severe events (e.g., cyclones, floods, droughts, fires) on performance (profitability, capital adequacy and liquidity), the value of the bank’s assets and the value of collateral of granted loans or assets essential to the business of the bank’s clients. Physical risks are long-term and relate to the effects of negative and mostly irreversible changes, such as sea level rise, changes in the chemical composition of marine waters, increases in air temperature, damage to the ozone layer, loss of biodiversity or decrease in the proportion of biologically active surfaces (Bernstein et al. 2019; Batten et al. 2016; Bunten and Kahn 2014). Physical risks can be divided into two components: (i) an acute physical risk (e.g., heat waves or floods) or (ii) a chronic physical risk, such as limited water availability or sea level rise (EBA 2020). Transition risk has a crucial regulatory basis. Introducing a CO2 tax or boosting the price of greenhouse gas emission allowances will dramatically increase costs for companies in the carbon-intensive economy, which will affect their creditworthiness and market value. High-emission sectors of the economy (in particular those based on the production and use of fossil fuels) also face the problem of limited availability of funding, which results mainly from the tightening of credit and investment policies, as manifested in defining a timetable to move away from financing a carbon-intensive economy. The effect of transition risk may be the creation of stranded assets, i.e., assets that become economically ineffective due to regulatory changes or are excluded from use due to stricter environmental requirements (Makower 2019; McGlade and Ekins 2015). An example of a climate-related stranded asset could be a coal-fired fossil-fuel power station, since the tightening of the mechanism of determining prices of CO2 emission allowances may lead to a loss of profitability of such a power generator. If such collateral is indirectly owned by the bank or secures credit risk, it may be lost or its value may be diminished prior to the final settlement of the transaction concluded with the client and may therefore result in the value of the collateral not being kept at a level that ensures adequate coverage of the bank’s claims. There are strong relationships between physical and transition risks. Strengthening regulation to mitigate climate change, i.e., increasing the risk of transition, contributes to reducing physical risks. However, the introduction of radical measures to promote a rapid reduction in greenhouse gas emissions may lead to an escalation of transition risk, a deterioration of the banks’ credit and investment portfolios and subsequent stagnation or recession (Pereira da Silva 2019).

Prudential regulations make it clear that climate risks shall be integrated into the bank’s risk management system (Zegadło 2021). Climate risk not only increases credit risk (BIS 2021), it also has an effect on market risk when assets are sold forcibly due to regulatory climate protection changes impacting the projected market value of the respective issuer. Liquidity risk affects banks that have a significant credit and investment portfolio consisting of assets that are sensitive to physical or transition risks. This is liquidity understood as the ability to raise funds at a cost that guarantees the profitability of the business, i.e., funding liquidity. Operational risk, on the other hand, exists when a certain portion of the bank’s assets is excluded from coverage due to increasing physical risks. Climate risk may also manifest itself through negative impact on the bank’s operational processes (Bolton et al. 2020). In addition, it deals with situations in which the risk of banking transactions increases due to new legal and regulatory requirements. Against this backdrop, the results of the study by (Beirne et al. 2021), who show the importance of the relationship between the cost of issuing debt securities and climate risk, are not surprising.

Most studies suggest that climate risk has not yet been quantified and reflected in the ratings of bank-financed companies and the ratings of the banks themselves (Grippa et al. 2019). The immutability of this state in the context of increasing climate protection risks (especially transition risks) is referred to as the “carbon bubble” (Dafermos et al. 2018). According to (Alessi et al. 2019), the realisation of climate risk assessment would result in losses for European Systematically Important Financial Institutions (SIFIs) of around USD 30 billion, exclusively from the investment portfolio, i.e., excluding write-downs for credit losses. Although the impact of weather disasters is currently significant in only a few countries, it is expected that the problem will worsen in the future as the frequency of climate-related disasters continues to grow (Giuzio et al. 2019). This phenomenon must be then confronted with a potential threat to financial stability (Noth and Schüwer 2018).

(Giglio et al. 2021) reviewed the relevant literature and examined how climate risks can be integrated and measured in macroeconomic models. They point out that climate risks can influence the prices of different types of assets either positively or negatively. (Lamperti et al. 2021) investigated the impact of policy measures to strengthen the resilience of the financial system to climate risks. In their view, tighter prudential regulation increases the impact of climate shocks on the economy, while the negative effect of climate change on the real economy makes the banking sector more vulnerable to crises. (Roncoroni et al. 2021) explored the influence of the interactions between transition risk and market parameters, such as recovery rate and stock price volatility, on financial stability. This suggests a framework for climate stress tests to investigate the impact of climate risks on the stability of the financial system. The question of whether climate risk must be taken into account when calculating banks’ capital requirements is examined by (Schoenmaker and Van Tilburg 2016). (Dafermos and Nikolaidi 2021) stressed that “green differentiated capital requirements” (GDCRs) can reduce the pace of global warming and thereby decrease physical financial risks.

Another stream of research is related to studies on the effects of climate risks on the profitability of banks and the materialisation of risks. Even if the results of research dedicated to profitability are not clear, most of them underline the positive impact of environmental performance on financial standing in the banking industry. (Caby et al. 2022) proved a positive association between climate risk management and financial performance of banks both from emerging and developed countries during the period 2011–2019. However, they stress that banks seem to be aware of the impact of climate change on their business, that banks’ business models are changing only slowly. In the analysis of a sample of banks from Canada over the period 1988–2019, (Salah et al. 2021) gave evidence for the significant impact of weather catastrophes on the performance of Canadian banks. At the same time, these authors point out that such phenomena contribute to lowering the level of risk appetite and improvement of financial stability. Nevertheless, (Hosono et al. 2016) came to different conclusions and found that severe weather events can put borrowers in trouble, weaken their creditworthiness and solvency, which could lead to a reduction in bank interest income. (Mourouzidou-Damtsa et al. 2019) added that extreme weather phenomena also bring about changes in the bank’s asset and liability structure, as damage-suffering clients not only borrow money but also withdraw their deposits to cover incurred losses and maintain liquidity. (Klomp 2014) pointed to the problems of small banks in connection with natural disasters. With data from more than 160 countries and 6000 natural disasters worldwide for the period 1997–2010, he notes that the financial consequences of natural disasters can significantly worsen the bank’s standing and increase the probability of insolvency. In addition, the impact of a natural disaster depends on the size and scope of the catastrophe, the rigorousness of financial regulation and supervision, and the level of financial and economic development of a particular country. (Faiella and Natoli 2018) pointed out that banks can select and discriminate against their borrowers through their catastrophic risk exposure. (Ouazad and Kahn 2021) argued that sudden weather conditions can paradoxically favour lending, as special assistance programmes are often set up to finance damage-suffering companies, and additional opportunities for asset securitisation are created. In their analysis of Austrian banks, (Battiston et al. 2020) gave evidence that large banks are more resilient to climate risk. The proportion of carbon-intensive exposures in their portfolios is lower than that of medium-sized and small banks. (Haug et al. 2021) investigated the proportion of loans that Norwegian banks lend to companies exposed to climate risk and the impact of the materialisation of climate risk on the value of a collateral, particularly real estate. This exposure is considered moderate by the authors mentioned above, while stressing the growing importance of the physical risks associated with sea level rise. They also point out that a lack of full knowledge regarding the consequences of climate change could make it difficult to adequately reflect this risk in banks’ balance sheets. Several studies also investigated the effect of climate risk in credit markets and the pricing of bank products and services. For example, (Javadi and Masum 2021) showed that firms in locations with higher exposure to climate change pay significantly higher credit margins on their bank loans. However, they stress that their research results primarily concern loan spreads of long-term loans of poorly rated firms, but not for other loans. (Jo et al. 2015) underlined that implementing measures to reduce environmental costs takes at least 1 or 2 years before enhancing return on assets in the financial services sector. They also found that companies in well-developed financial markets perform much better. (Bătae et al. 2021) came to very similar conclusions, when analysing data for 39 European banks for the period 2010–2019. They find a positive relationship between emission and waste reduction and bank profitability.

Another issue is reporting on measures to support and promote climate protection solutions. (Ilhan et al. 2020) believe that climate risk reporting is at least as important as financial reporting, and that climate risk reporting should be mandatory and standardised. (Reghezza et al. 2021) investigate the impact of climate policy on European banks’ lending to environmentally damaging companies. These authors conclude that exposures to the representative companies have decreased in comparison to the situation prior to the entry into force of the Paris Agreement. Moreover, banks with poorer credit quality, lowered yields, and higher equity responded comparatively faster to the new climate regulations. The current and planned EU climate risk reporting legislation stems from the 2015 Paris Agreement. Directive 2014/95/EU (NFRD) plays an important role in the development of non-financial reporting. In April 2021, the European Commission (EC) published a proposal for a new Corporate Sustainability Reporting Directive to replace the NFRD. In February 2020, the President of the ECB took the view that climate risks should be seen as one of the biggest challenges facing the banking sector and the economy. Climate risk is also recognised by the ECB in the Single Supervisory Mechanism risk map as a key risk factor to be adequately addressed by supervised institutions. In addition, in May 2020, the ECB published guidelines on the disclosure and management of climate risks. Another problem is the disclosure of climate protection risks and their management. In her study of European, American, Japanese and Chinese banks, (Nieto 2019) argued that the disclosure of environmental risks is particularly important for banks that issue securities traded on organised markets. The author stresses the need for harmonisation of reporting, including standardisation of credit registers and taxonomy. The ECB also pointed out in its 2021 report that, while supervised banks are making progress in integrating climate risk into the bank’s governance systems, adequate reporting remains a major challenge. (Niedziółka 2020) compared Polish commercial banks with regard to published disclosures and ESG measures, in particular referring to climate protection risks. The results of this study suggest a stronger involvement of foreign banks in ESG risk management participating in international emission reduction agreements. In contrast, (Khan et al. 2021) pointed to a positive correlation between value added creation and climate and credit risk disclosures, which weakens in line with the increase in portfolio share of non-performing loans.

Based on this literature review, it is hypothesised that large banks with relatively good financial performance belong to the group of institutions reporting the highest level of engagement in initiatives having a positive direct impact on the environment. The study thus fills the research gap due to the lack of tools and comparative analyses to assess the direct environmental impacts of banks.

3. Sample, Dataset and Methods

The study is carried out on a sample of 12 commercial banks operating in the Polish banking sector (Table 1) and listed on the Warsaw Stock Exchange. 11 of the sampled banks are listed on the main market of the Warsaw Stock Exchange and are public entities. Simultaneously, one (C_11) is listed on the Catalyst market, which is applicable for bond issuers. However, this bank is still a public interest entity and has disclosure duties in the scope of non-financial information. The total assets of the sampled banks correspond to 78.00% of the assets of Polish commercial banks as of 31.12.2020 (KNF 2021). Key financial data, credit risk and ESG ratings, as well as information on shareholders’ origin and the business model of the sampled banks, are presented in Table 2. Apart from bank C_11, which provides services only for the retail sector, the other banks have a universal profile and offer products dedicated both for retail and corporate clients. The authors also present the major shareholders’ origin. In the case of domestic banks, the major shareholder is an individual (however, applicable only for the C_2 bank), the State Treasury or an entity controlled by the State Treasury. Although the research refers to 2020, the authors decided to also provide comparative financial data referring to 2021 in order to allow readers to have a better insight into the banks’ standings.

Table 1.

List of commercial banks analysed in the study.

Table 2.

Key information about the sampled banks, as of 31 December 2021 and 31 December 2022.

In the analysed period, one of the most significant factors having impact on the Polish banks’ results was the cost of provisions for legal risk associated with mortgage loans indexed or denominated in convertible currencies (CHF in practice). This risk refers to pending or potential court proceedings to determine the invalidity of the above-mentioned loan agreements, mostly in the light of the CJEU rulings. Due to its material impact on the results and uncertainties accompanying the provisions’ calculations, including unknown future judgments of Polish courts, the authors decided to present chosen financial results excluding the costs (see Table 2).

As a first step in performing the comparative analysis of the banks, the structural differentiation of the concerned banks is analysed using a numerical technique called cluster analysis, in which the objects are grouped into meaningful and relatively homogeneous classes. In the literature, there may be found various cluster definitions (for instance provided by Gatnar and Walesiak 2004 or Everitt et al. 2011). According to (Figueiredo Filho et al. 2014): “the main purpose of the technic is to group cases according to their degree of similarity” and “observations within a specific cluster are more homogeneous than observations between clusters”. This method assumes separating clusters containing the most similar elements of the considered chosen characteristics, which simultaneously differ as much as possible from the other elements (Cymerman and Cymerman 2017).

The clusters are created based on the objects’ mutual proximity (also distances or similarities), which may be estimated in many ways. The steps to be followed are data and variable selection, establishing the similarity measure, determining the cluster building method, selecting the clusters, and validating the results. (Figueiredo Filho et al. 2014) indicated the three most common methods used in cluster analysis, which are correlation measures, distance measures (especially the Euclidean distance and its variants, such as squared distances) and association measures applicable for non-quantitative variables. In general, proximities may be determined directly or indirectly (more common due to Everitt et al. 2011). To calculate the distance, it is recommended to scale the data so that it falls into an interval 0–1 or is expressed as a percentage. There are various techniques to calculate the distances for binary and non-binary data having more value levels.

Additionally, there are three main approaches to form clusters: hierarchical (applicable when there is no prior knowledge on how many clusters should be established), non-hierarchical (when the researcher knows the number of clusters, k-means are used) and a two-steps method (combined), where the number of clusters is determined using the first approach and then the outliers are assigned to given clusters using the second approach.

Using a matrix of distances between the analysed elements, similarity-based clustering may be performed with the aim of grouping similar objects in one cluster and putting dissimilar objects in different ones (Christian et al. 2015). (Everitt et al. 2011) emphasised the useful role of graphical presentations, which may suggest containing clusters of the observed data. Most commonly, histograms or scatterplots may be used.

To form clusters, the authors applied the hierarchical approach, as the entry number of clusters was not known. After the number had been determined, the authors calculated the clusters’ centers and distances of each element to the center in order to reclassify the elements, if necessary. The cluster’s element should be reclassified if the distance of this element to its cluster’s center is bigger than to another cluster’s center (Gatnar and Walesiak 2004). The optimal grouping does not require any further reclassification. The initial grouping (subject to further reclassification) may be even arbitrary due to the post-checks.

For this research, the (Ward 1963) method is used, which entails the analysis of variance approach. It is one of the hierarchical approaches to clustering where the distance between clusters is calculated as the Euclidean distance between their centroids (Młodak 2020). Its goal is to minimise an increase in the total within-cluster error sum of squares, which is proportional to the squared Euclidean proximities between the centres of the formed clusters (Everitt et al. 2011). In this method the objects are combined to form one cluster containing all the analysed elements. If a merger of clusters minimises the increase in the total within-cluster error sum of squares, they are put together. To receive optimal clusters, the distance between the combined clusters should exceed an arbitrarily established threshold, which is the end of the cluster-combining procedure (Młodak 2020). This method is considered effective if the number of objects is not large (Stanisz 2007; Cymerman and Cymerman 2017). The distance between the objects is calculated using the Euclidean norm:

where:

xik—value of the k variable in the i-th object;

xjk—value of the k variable in the j-th object;

k—number of characteristics examined;

m—number of diagnostic variables.

The clustering is based on a criterion that summarises the scope of disclosed information on the bank’s direct environmental and climate impacts reported in the banks’ annual reports for 2020. All disclosed categories of the bank’s direct environmental and climate impact as reported in the audited institutions’ annual reports for 2020 are selected for the analysis. They are assigned to three criteria (Table 3).

Table 3.

Bank’s direct environmental and climate impacts considered in the study.

Information sharing is a dummy variable that equals 1 if the factor occurs directly in the respective bank’s reporting and 0 otherwise.

A bank’s direct environmental and climate impacts, divided into 3 categories, were used to classify and separate homogenous subsets of objects in the analysed sample of banks. Based on the analysis of data derived from audited annual reports of the sampled banks as of 31 December 2020, the authors performed a qualitative evaluation of particular variables.

Two methods are used for the hierarchical concentration analysis of quantitative weights for the attributes:

A system of w1 representing equal weighting for all variables:

A system of w2 representing particular weights which are determined according to the expert method, where the highest weights are assigned to diagnostic features (in) −0.50, and the other characteristics, (w) and (i). are assigned weights of 0.25 and 0.20, respectively. This approach is assumed according to the following formulae:

The proposed index includes all categories of the bank’s direct environmental and climate impacts as reported in the audited institutions’ annual reports for 2020 (the latest available audited figures). They are grouped into three criteria, giving priority to initiatives announced by the banks aimed at reducing the given bank’s negative impact on the environment. Within this index component (in), the CO2 reduction declaration is weighted with 50%. The other 14 initiatives received an equal weighting of 3.57%. The approach described above is an expert approach and the reason for the large weight differentiation is that all initiatives ultimately aim at reducing CO2 emissions and carbon footprints.

Two weighting variants (equal weights and weights hierarchised using an expert approach based on the initiative’s impact on the reduction of carbon footprint) to verify the extent to which the cluster content depends on the chosen weighting are determined. The verification of the results on the basis of different weighting systems is carried out inter alia by (Grigore et al. 2016).

To assess the activities of banks operating in the Polish banking sector in terms of their direct impact on the environment and climate change, the Ward method and Statistica ver. 13.3 software by StatSoft Polskaare were used for calculations.

4. Results

The Ward method applied in this study selects, at each stage of the analysis, from among all combinable aggregate pairs the one that results in a focus on minimal differentiation as a result of fusion (Table 4, Table 5, Table 6 and Table 7).

Table 4.

Euclidean distances for equal weights for all variables.

Table 5.

Euclidean distances for scales determined by the expert method.

Table 6.

Agglomeration pattern for equal weights for all variables.

Table 7.

Agglomeration pattern for weighing instruments determined by the expert method.

The distance matrices (Table 4 and Table 5) contain figures indicating distances between the analysed and grouped banks, while Table 6 and Table 7 present sheets describing the agglomeration process. The first column of the tables present the distances of bindings, based on which the respective clusters were formed. In other rows the authors provided the names of objects forming new clusters.

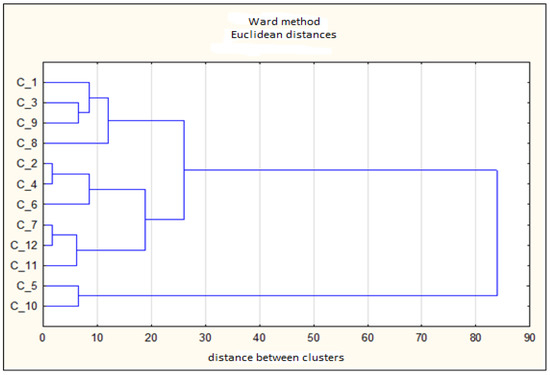

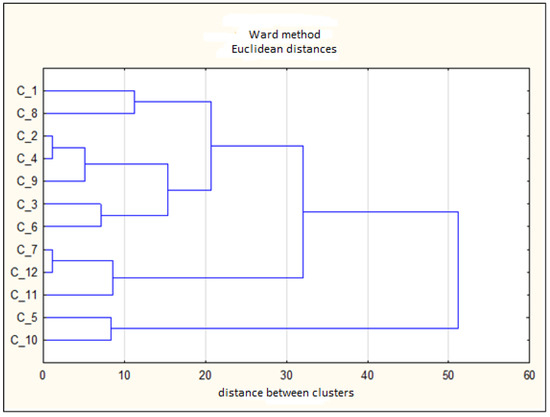

The results are presented synthetically in the form of dendrograms that illustrate the hierarchical structure of a group of objects due to the decreasing similarity between them (Figure 1 and Figure 2).

Figure 1.

Dendrogram for equal weights for all variables.

Figure 2.

Dendrogram for scales determined according to the expert method.

When analysing the dendrograms with regard to the differences between the individual nodes, four main clusters can be identified, in which clusters III (banks C_7, C_11 and C_12) and IV (banks C_5 and C_10) are identical for both methods. Although concentrations I and II involve different banks under both methods, the differences arise only from the various positions of the same banks. The biggest discrepancy between cluster IV and other aggregates means that this cluster is far from the other ones. In addition, one can identify close distances between banks C_2 and C_4, as well as banks C_7 and C_12.

5. Discussion

Banks C_5 and C_10, which form cluster IV with regard to both methods, are featured by the highest values of the IBRK index. It is therefore a group of entities that have taken the greatest number of initiatives to reduce the negative impact of their operations on the environment. Both banks recorded relatively better business results than their competitors in 2020. This conclusion is in line with the results achieved by (Birindelli et al. 2022). At the same time, they are global banks owned by strategic investors, from France and the Netherlands, leading global initiatives to reduce CO2 emissions. Parent banks of objects forming cluster IV are also at the forefront of developing regulatory proposals aimed at integrating climate protection aspects into banks’ credit and investment policies. These banks are founders or members of climate agreements, such as CCCA or TCFD (Niedziółka 2021). Both banks have stable financial standings and are well-capitalised (Table 2). It also should be noted that they scored the top values of ROE indicators (original and adjusted).

Cluster III covers banks C_2 and C_4, as well as C_7, C_11 and C_12. These are the banks that are rated worst in this study. Although they belong to the same group, there are two different reasons for the low IBRK index, which subsequently allows them to be separated into two further subgroups. The first one consists of smaller banks with below-average financial performance. In this case, the poor evaluation is linked to budget cuts for the implementation of environmental initiatives. The benefits of the employment of environmental and climate protection measures (e.g., reduced operating costs, reputation) must be preceded by appropriate investments. At the same time, the above-mentioned banks have not made any statements in their annual reports to limit their direct and indirect (through credit policy) negative impact on the environment so far. One of the reasons for this approach is that the share of energy- and carbon-intensive industries in the credit portfolios of large banks is relatively lower than that of medium-sized and small banks (Battiston et al. 2020). These banks are owned by Polish private investors or the Polish Treasury. The second subgroup consists of banks with a universal or retail profile that are involved in climate change initiatives, have good financial standings, and are better capitalised than the first group. In this case, however, the bank’s environmental approach focuses mainly on credit policy, with relatively less emphasis on initiatives to reduce their own negative environmental impact.

The basis of separating cluster III was mainly the variables from the group Intensity (I). Apart from bank C12, which disclosed data concerning Waste or materials consumption per employee (i3), none of the other banks presented any disclosures in this area. Disclosures for the third group (Initiatives) to reduce negative environmental impacts (in) were also poor, especially in the scope of the following variables: in1, in3 and in15, which were unreleased. The banks aimed at presenting only data being satisfactory for shareholders and potential investors. Consequently, the following data was relatively well disclosed: Electricity, heat and fuel consumption (w1) and Reduction of paper consumption and digitisation (in5), which represent basic general cost categories subject to being minimised.

It is noteworthy that these two groups do not include the largest Polish banks in terms of assets: C_8 and C_9. So far, they do not seem to have exhausted all ESG possibilities. However, it should be noted that 2020 was a very specific year for banking due to the ongoing COVID-19 pandemic (Zaleska 2021; Kozińska 2021). State-owned banks, which had the largest loan corporate and retail portfolios, were forced to fundamentally reorient their business as a result of the materialisation of the credit risk, i.e., increase in Non-Performing Loans (NPL) ratio resulting from disruptions in supply chains and lockdowns’ negative consequences for many industries and individuals. Their situation can therefore be expected to improve in the coming years.

At this point, it should also be noted that the authors’ investigation is exclusively concerned with the banks’ reporting on environmental measures. A narrow reporting area does not necessarily mean that a bank marginalises the environmental aspect in its operations. On the other hand, a wide range of climate initiatives do not have to automatically lead to a significant reduction in the bank’s carbon footprint. At the same time, one has to stress that the banks’ environmental impact is not regarded as the most important factor as far as it concerns their potential contribution to climate change. The real and important positive contribution can be achieved if climate goals are built in the operating, credit and investment regulations and if these policies are genuinely enforced.

Environmental initiatives implemented by banks to reduce the negative environmental impact of their operations have a further objective. It is a reduction in operating costs by reducing energy, paper, water, office space costs and time consumption. This process requires pre-investments followed by appropriate reporting. For this reason, it can be said that the banks with the weakest financial results are paradoxically unable to afford savings.

Emphasising the bank’s indirect impact on the environment and climate change (by taking climate risk into account in lending policy) and marginalising the environmental impact of its operations (or lack of appropriate disclosure of these issues) create an axiologically inconsistent message which could have a negative impact on the enforcement of environmental behaviour vis-à-vis bank stakeholders in the future.

The possible regulatory effects of the achieved results are also worth mentioning. So far, only the inclusion of climate risk associated with a credit exposure in the determinant list of the capital requirement has been considered (Pyka and Nocoń 2021). The quantification of the direct (operational) environmental impact of a bank as proposed in this article could serve as a basis for determining an adjustment factor for the capital requirement or the level of the bank levy. Another application of the measure of a bank’s direct environmental commitment is its use in the credit or ESG rating process. In summary, the Polish banking sector, being an example of the continental model of the banking sector, consists mainly of universal banks, which means that they—compared to Anglo-Saxon schemes, where investment banks play a significant role—exhibit a relatively greater commitment to environmental protection. At the same time, investment banks are involved relatively more in underwriting companies responsible for major environmental misconduct (Urban and Wójcik 2019).

6. Conclusions

The analysis of bank reports describing their environmental impact allows for drawing some conclusions. Firstly, every commercial bank listed on the Warsaw Stock Exchange declares to monitor the consumption of electricity and other media. Secondly, each of these institutions offers a range of initiatives to reduce its carbon footprint. Thirdly, most of the measures are either cost-cutting or cost-neutral, making it very difficult to categorise them clearly as initiatives demonstrating the bank’s commitment to mitigating climate change. Fourthly, some initiatives impose additional burdens, in particular on banking stakeholders (employees, office landlords, counterparties). In certain cases, it is also impossible to determine who bore the costs of eco-oriented investments (e.g., switching the lighting system to energy-saving lamps or renewing the vehicle fleet). Lastly, none of the investigated banks identified a specific way to reduce carbon dioxide emissions or consumption of electricity, heat, fuels, water, paper, plastics, or other raw materials. Therefore, no quantifiable commitments were made.

Our investigation showed that small banks characterised by relatively worse financial performance disclosed less information relating to pro-ecological initiatives, while large international banks are among those with both the highest and the lowest disclosure rates. The reason of the above-mentioned discrepancy in the case of large banks is related to the dichotomy of integrating environmental policy into their strategies and business models. The first model is based on the coherence of a bank’s commitment to reducing its carbon footprint and its lending and investment activity. The second approach focuses on pro-ecological lending policy while disclosures in the area of direct environmental impacts of the bank are low.

The results of this study are addressed to the stakeholders of the banks, in particular their customers. This is because the discrepancy between the clients’ values and the values represented by the bank or the actual commitment to achieving the stated objectives may be a reason for the client to change bank.

The analysis is based on the information provided by the banks to their stakeholders. A scenario in which not all ongoing initiatives are included in the non-financial reporting or where specific objectives are not explicitly mentioned is therefore conceivable. The IBRK index thus essentially reflects the extent of non-financial reporting and does not address the question of how the bank’s direct activities affect or change the environment. The clusters separated in the course of the conducted research reflect the banks’ attitudes towards climate risk management in the light of their financial standings and major shareholders’ origin, which the authors perceive as a material explanation for the observed differences. Foreign banks with an outstanding financial condition were classified as banks representing the highest level of the IBRK index. However, the direct impact is small compared to the indirect impact, which can only be assessed on the basis of the reports for subsequent financial years, when the credit portfolio is classified on the basis of a standardised carbon footprint taxonomy. The above-mentioned limitations, including the lack of consistency in the presentation of portfolio structures depending on CO2 emissions and the expert method for weighting the IBRK index, also create directions for further research, including the identification of the characteristics of banks belonging to the same clusters based on the total (direct and indirect) impact on the environment.

Author Contributions

Conceptualization, Z.K., P.N. and M.Z.; methodology, Z.K., P.N. and M.Z.; software, Z.K., P.N. and M.Z.; validation, Z.K., P.N. and M.Z.; formal analysis, Z.K., P.N. and M.Z.; investigation, Z.K., P.N. and M.Z.; resources, Z.K., P.N. and M.Z.; data curation, Z.K., P.N. and M.Z.; writing—original draft preparation, Z.K., P.N. and M.Z.; writing—review and editing, Z.K., P.N. and M.Z.; visualization, Z.K., P.N. and M.Z.; supervision, Z.K., P.N. and M.Z.; project administration, Z.K., P.N. and M.Z.; funding acquisition, Z.K., P.N. and M.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Agora Energiewende. 2021. The European Power Sector in 2020. Available online: https://static.agora-energiewende.de/fileadmin/Projekte/2021/2020_01_EU-Annual-Review_2020/A-EW_202_Report_European-Power-Sector-2020.pdf (accessed on 12 May 2022).

- Alessi, Lucia, Elisa Ossola, and Roberto Panzica. 2019. The Greenium Matters: Evidence on the Pricing of Climate Risk. European Commission. JRC 116108. Available online: https://publications.jrc.ec.europa.eu/repository/bitstream/JRC116108/jrc116108_alessiossolapanzica_july2019_jrcwp.pdf (accessed on 9 November 2021).

- Bătae, Oana Marina, Voicu Dan Dragomir, and Liliana Feleagă. 2021. The relationship between environmental, social, and financial performance in the banking sector: An European Study. Journal of Cleaner Production 290: 125791. [Google Scholar] [CrossRef]

- Batten, Sandra, Rhiannon Sowerbutts, and Misa Tanaka. 2016. Let’s Talk about the Weather: The Impact of Climate Change on Central Banks. Bank of England Staff Working Paper 603: 1–37. [Google Scholar] [CrossRef] [Green Version]

- Battiston, Stefano, Martin Guth, Irene Monasterolo, Benjamin Neudorfer, and Wolfgang Pointner. 2020. Austrian Banks’ Exposure to Climate-Related Transition Risk. Oesterreichische Nationalbank, Financial Stability Report 40: 31–45. Available online: https://www.researchgate.net/profile/Martin-Guth/publication/346390232_Austrian_banks’_exposure_to_climate-related_transition_risk/links/5fbf715392851c933f5d405b/Austrian-banks-exposure-to-climate-related-transition-risk.pdf (accessed on 2 March 2022).

- Beirne, John, Nuobu Renzhi, and Ulrich Volz. 2021. Feeling the heat: Climate risks and the cost of sovereign borrowing. International Review of Economics and Finance 76: 920–36. [Google Scholar] [CrossRef]

- Bernardelli, Michał, Zbigniew Korzeb, and Paweł Niedziółka. 2022. Does Fossil Fuel Financing Affect Banks’ ESG Ratings? Energies 15: 1495. [Google Scholar] [CrossRef]

- Bernstein, Asaf, Matthew T. Gustafson, and Ryan Lewis. 2019. Disaster on the Horizon: The Price Effect of Sea Level Rise. Journal of Financial Economics 134: 253–72. [Google Scholar] [CrossRef]

- BFG (Bankowy Fundusz Gwarancyjny). 2022. Sytuacja Finansowa w Sektorze Bankowym i Bankach o Podwyższonym Ryzyku wg Stanu na 28 Lutego 2022 r. Available online: https://www.bfg.pl/wp-content/uploads/informacja-miesieczna-2022.02.pdf (accessed on 10 May 2022).

- Birindelli, Giuliana, Graziella Bonanno, Stefano Dell’Atti, and Antonia Patrizia Iannuzzi. 2022. Climate Change Commitment, Credit Risk and the Country’s Environmental Performance: Empirical Evidence from a Sample of International Banks. Business Strategy and the Environment 31: 1641–55. Available online: https://onlinelibrary.wiley.com/doi/10.1002/bse.2974?af=R (accessed on 15 March 2022). [CrossRef]

- BIS (Bank for International Settlements). 2021. Climate-Related Risk Drivers and Their Transmission Channels. Available online: https://www.bis.org/bcbs/publ/d517.htm (accessed on 12 February 2022).

- Bolton, Patric, Morgan Despress, Luis A.Pereira da Silva, Frederic Samama, and Romain Svartzman. 2020. The Green Swan. Central Banking and Financial Stability in the Age of Climate Change. Available online: https://www.bis.org/publ/othp31.pdf (accessed on 16 January 2022).

- Bunten, Devin Michelle, and Matthew E. Kahn. 2014. The Impact of Emerging Climate Risks on Urban Real Estate Price Dynamics. NBER Working Paper Series 20018: 1–21. [Google Scholar] [CrossRef]

- Caby, Jérôme, Ydriss Ziane, and Eric Lamarque. 2022. The impact of climate change management on banks profitability. Journal of Business Research 142: 412–22. [Google Scholar] [CrossRef]

- Carney, Mark, François Villeroy de Galhau, and Frank Elderson. 2019. The Financial Sector Must Be at the Heart of Tackling Climate Change. Available online: https://www.theguardian.com/commentisfree/2019/apr/17/the-financial-sector-must-be-at-the-heart-of-tackling-climate-change (accessed on 11 February 2022).

- Christian, Hennig, Meila Marina, Murtagh Fionn, and Rocci Roberto. 2015. Handbook of Cluster Analysis. New York: Chapman and Hall/CRC. [Google Scholar]

- Cymerman, Joanna, and Wojciech Cymerman. 2017. Zastosowanie analizy skupień do klasyfikacji województw według rozwoju rynków nieruchomości rolnych. Świat Nieruchomości 3: 55–62. [Google Scholar]

- Dafermos, Yannis, and Maria Nikolaidi. 2021. How can green differentiated capital requirements affect climate risks? A dynamic macrofinancial analysis. Journal of Financial Stability 54: 100871. [Google Scholar] [CrossRef]

- Dafermos, Yannis, Maria Nikolaidi, and Giorgos Galanis. 2018. Climate Change, Financial Stability and Monetary Policy. Ecological Economics 152: 219–34. Available online: https://www.sciencedirect.com/science/article/pii/S0921800917315161 (accessed on 22 October 2020). [CrossRef]

- de Netto A. C. Schneider, Maria, Rodrigo Pereira Porto, Maria Chiara Trabacchi, Signi Schneider, Sara Harb, and Diana Smallridge. 2020. A Guidebook for National Development Banks on Climate Risk. Available online: https://publications.iadb.org/publications/english/document/A-Guidebook-for-National-Development-Banks-on-Climate-Risk.pdf (accessed on 12 February 2022).

- EBA (European Banking Authority). 2020. EBA Discussion Paper on Management and Supervision of ESG Risks for Credit Institutions and Investment Firms. EBA/DP/2020/03. 30 October 2020. Available online: https://www.eba.europa.eu/eba-launches-consultation-incorporate-esg-risks-governance-risk-management-and-supervision-credit (accessed on 19 October 2021).

- ECB (European Central Bank). 2021. The State of Climate and Environmental Risk Management in the Banking Sector. Report on the Supervisory Review of Banks’ Approaches to Manage Climate and Environmental Risks. Available online: https://www.bankingsupervision.europa.eu/ecb/pub/pdf/ssm.202111guideonclimate-relatedandenvironmentalrisks~4b25454055.en.pdf (accessed on 11 February 2022).

- Eckstein, David, Vera Künzel, and Laura Schäfer. 2021. Global Climate Risk Index 2021. Who Suffers Most from Extreme Weather Events? Weather-Related Loss Events in 2019 and 2000–2019. Available online: https://www.germanwatch.org/sites/default/files/Global%20Climate%20Risk%20Index%202021_2.pdf (accessed on 11 February 2022).

- Everitt, Brian S., Sabine Landau, Morven Leese, and Daniel Stahl. 2011. Cluster Analysis. New York: Wiley & Sons. [Google Scholar]

- Faiella, Ivan, and Filippo Natoli. 2018. Natural Catastrophes and Bank Lending: The Case of Flood Risk in Italy. Occasional Paper Bank of Italy 457. Available online: https://www.bancaditalia.it/pubblicazioni/qef/2018-0457/index.html?com.dotmarketing.htmlpage.language=1 (accessed on 12 February 2022).

- Figueiredo Filho, Dalson Britto, Enivaldo Carvalho da Rocha, José Alexandre da Silva Júnior, Ranulfo Paranhos, Mariana Batista da Silva, and Bárbara Sofia Félix Duarte. 2014. Cluster Analysis for Political Scientists. Applied Mathematics 5: 2408–15. [Google Scholar] [CrossRef] [Green Version]

- Gatnar, Eugeniusz, and Marek Walesiak. 2004. Metody Statystycznej Analizy Wielowymiarowej w Badaniach Marketingowych. Wrocław: Wydawnictwo Akademii Ekonomicznej im. [Google Scholar]

- Giglio, Stefano, Bryan T. Kelly, and Johannes Stroebel. 2021. Climate finance. The Annual Review of Financial Economics 13: 15–36. [Google Scholar] [CrossRef]

- Giuzio, Margherita, Dejan Krušec, Anouk Levels, Ana Sofia Melo, Katri Mikkonen, and Petya Radulova. 2019. Climate change and financial stability. Financial Stability Review 1: 1–15. [Google Scholar]

- Grigore, Bogdan, Jaime Peters, Christopher Hyde, and Ken Stein. 2016. A comparison of two methods for expert elicitation in health technology assessments. BMC Medical Research Methodology 16: 1–11. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Grippa, Pierpaolo, Jochen Schittmann, and Felix Suntheim. 2019. Climate Change and Financial Risk. Washington: International Monetary Fund, Finance&Development, pp. 26–29. Available online: https://www.imf.org/external/pubs/ft/fandd/2019/12/climate-change-central-banks-and-financial-risk-grippa.htm (accessed on 10 December 2020).

- Haug Kaja D., Lisa K. Reiakvam, Haakon Solheim, Lars-Tore Turtveit, and Og B.H. Vatne. 2021. Climate Risk and Banks’ Loans to Firms. Norges Bank, Financial Stability No. 7. Available online: https://www.norges-bank.no/contentassets/244023305b474ca4a7fc4f82d766b46f/staff-memo-7-2021_en.pdf?v=12/17/2021133156&ft=.pdf (accessed on 28 February 2022).

- Hosono, Kaoru, Daisuke Miyakawa, Taisuke Uchino, Makoto Hazama, Arito Ono, Hirofumi Uchida, and Iichiro Uesugi. 2016. Natural disasters, damage to banks, and firm investment. International Economic Review 57: 1335–70. [Google Scholar] [CrossRef] [Green Version]

- Ilhan, Emirhan, Philipp Krueger, Zacharias Sautner, and Laura T. Starks. 2020. Climate risk disclosure and institutional investors. Swiss Finance Institute Research Paper 661: 19–66. [Google Scholar]

- IPCC. 2019. Global Warming of 1.5 °C An IPCC Special Report on the Impacts of Global Warming of 1.5 °C above Pre-Industrial Levels and Related Global Greenhouse Gas Emission Pathways, in the Context of Strengthening the Global Response to the Threat of Climate Change, Sustainable Development, and Efforts to Eradicate Poverty. Available online: https://www.ipcc.ch/site/assets/uploads/sites/2/2019/06/SR15_Full_Report_High_Res.pdf (accessed on 11 February 2022).

- Javadi, Siamak, and Abdullah-Al Masum. 2021. The impact of climate change on the cost of bank loans. Journal of Corporate Finance 69: 102019. [Google Scholar] [CrossRef]

- Jo, Hoje, Hakkon Kim, and Kwangwoo Park. 2015. Corporate Environmental Responsibility and Firm Performance in the Financial Services Sector. Journal of Business Ethics 131: 257–84. [Google Scholar] [CrossRef]

- Khan, Habib Zaman, Sudipta Bose, Benedict Sheehy, and Ali Quazi. 2021. Green banking disclosure, firm value and the moderating role of a contextual factor: Evidence from a distinctive regulatory setting. Business, Strategy and the Environment 30: 3651–70. [Google Scholar] [CrossRef]

- Klomp, Jeroen. 2014. Financial fragility and natural disasters: An empirical analysis. Journal of Financial Stability 13: 180–92. [Google Scholar] [CrossRef]

- KNF (Komisja Nadzoru Finansowego). 2021. Informacja na Temat Sytuacji Sektora Bankowego w 2020 Roku. Warszawa. Available online: https://www.knf.gov.pl/?articleId=74222&p_id=18 (accessed on 11 February 2022).

- Kozińska, Magdalena. 2021. Banki Centralne Unii Europejskiej Jako Element Sieci Bezpieczeństwa Finansowego w Czasie Pandemii COVID-19. Warsaw: CeDeWu. [Google Scholar]

- Lamperti, Francesco, Valentina Bosetti, Andrea Roventini, Massimo Tavoni, and Tania Treibich. 2021. Three green financial policies to address climate risks. Journal of Financial Stability 54: 100875. [Google Scholar] [CrossRef]

- Makower, Joel. 2019. The Growing Concern over Stranded Assets. Available online: https://www.greenbiz.com/article/growing-concern-over-stranded-assets (accessed on 18 November 2021).

- McGlade, Christophe, and Paul Ekins. 2015. The Geographical Distribution of Fossil Fuels Unused When Limiting Global Warming to 2 °C. Nature 517: 187–90. [Google Scholar] [CrossRef]

- Młodak, Andrzej. 2020. k-means, Ward and probabilistic distance-based clustering methods with contiguity constraint. Journal of Classification 38: 313–52. [Google Scholar] [CrossRef]

- Mourouzidou-Damtsa, Stella, Andreas Milidonis, and Konstantinos Stathopoulos. 2019. National culture and bank risk-taking. Journal of Financial Stability 40: 132–43. [Google Scholar] [CrossRef] [Green Version]

- NGFS (Network for Greening the Financial System). 2019. NGFS Calls for Action by Central Banks, Supervisors and All Relevant Stakeholders for grEening the Financial System. Available online: https://www.ngfs.net/en/communique-de-presse/ngfs-calls-action-central-banks-supervisors-and-all-relevant-stakeholders-greening-financial-system-0 (accessed on 1 February 2022).

- Niedziółka, Paweł. 2020. Polish banking sector facing challenges related to environmental and climate protection. Problemy Zarządzania 18: 32–47. [Google Scholar] [CrossRef]

- Niedziółka, Paweł. 2021. Zielona (R)ewolucja w Polskiej Bankowości. Finansowanie Projektów Lądowej Energetyki Wiatrowej Oraz Fotowoltaicznej w Polsce z Wykorzystaniem Metody Project Finance. Warsaw: Difin. [Google Scholar]

- Nieto, Maria J. 2019. Banks, climate risk and financial stability. Journal of Financial Regulation and Compliance 27: 243–62. [Google Scholar] [CrossRef]

- Noth, Felix, and Ulrich Schüwer. 2018. Natural Disaster and Bank Stability: Evidence from the US Financial System; Beijing: State Administration of Foreign Exchange.

- Ouazad, Amine, and Matthew E. Kahn. 2021. Mortgage Finance and Climate Change: Securitization Dynamics in the Aftermath of Natural Disasters. NBER Working Paper Series 26322: 1–56. Available online: http://www.nber.org/papers/w26322 (accessed on 10 May 2022). [CrossRef]

- Pereira da Silva, Luiz A. 2019. Research on Climate-Related Risks and Financial Stability: An Epistemological Break? Based on Remarks at the Conference of the Central Banks and Supervisors Network for Greening the Financial System (NGFS). Available online: https://www.bis.org/speeches/sp190523.htm (accessed on 22 December 2021).

- Pyka, Irena, and Aleksandra Nocoń. 2021. Banks’ Capital Requirements in Terms of Implementation of the Concept of Sustainable Finance. Sustainability 13: 3499. [Google Scholar] [CrossRef]

- Reghezza, Alessio, Yener Altunbas, David Marques-Ibanez, Costanza Rodriguez d’Acri, and Martina Spaggiari. 2021. Do Banks Fuel Climate Change? European Central Bank Working Paper Series 2550: 1–39. Available online: https://www.ecb.europa.eu/pub/pdf/scpwps/ecb.wp2550~24c25d5791.en.pdf (accessed on 2 March 2022). [CrossRef]

- Roncoroni, Alan, Stefano Battiston, Luis OL Escobar-Farfán, and Serafin Martinez-Jaramillo. 2021. Climate risk and financial stability in the network of banks and investment funds. Journal of Financial Stability 54: 100870. [Google Scholar] [CrossRef]

- Salah, U-Din, Mian Sajid Nazir, and Aamer Shahzad. 2021. Money at risk: Climate change and performance of Canadian banking sector. Journal of Economic and Administrative Sciences. ahead-of-pirint. [Google Scholar] [CrossRef]

- Schoenmaker, Dirk, and Rens Van Tilburg. 2016. What role for financial supervisors in addressing environmental risks? Comparative Economic Studies 58: 317–34. [Google Scholar] [CrossRef]

- Stanisz, Andrzej. 2007. Przystępny Kurs Statystyki z Zastosowaniem STATISTICA PL na Przykładach z Medycyny. Tom 3. Analizy Wielowymiarowe. Kraków: Statsoft. [Google Scholar]

- Urban, Michael A., and Dariusz Wójcik. 2019. Dirty Banking: Probing the Gap in Sustainable Finance. Sustainability 11: 1745. [Google Scholar] [CrossRef] [Green Version]

- Ward, Joe H., Jr. 1963. Hierarchical Grouping to Optimize an Objective Function. Journal of the American Statistical Association 58: 236–44. [Google Scholar] [CrossRef]

- WEF (World Economic Forum). 2022. The Global Risks Report 2022. Available online: https://www3.weforum.org/docs/WEF_The_Global_Risks_Report_2022.pdf (accessed on 11 February 2022).

- Zaleska, Małgorzata. 2021. Reakcja sieci bezpieczeństwa finansowego na wybuch pandemii COVID-19. In Wpływ COVID-19 na Finanse. Polska Perspektywa. Edited by Małgorzata Zaleska. Warsaw: Difin. [Google Scholar]

- Zegadło, Monika. 2021. Ryzyko klimatyczne w sektorze bankowym a inicjatywy regulacyjne. In Współczesne Nurty Badawcze w Dziedzinie Nauk Społecznych. Edited by Janusz Ostaszewski and Olga Szczepańska. Warszawa: Difin, pp. 118–35. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).