Abstract

The main function behind the conceptualization of creative accounting is maintaining the quality of financial reporting practice. This phenomenon has attracted the attention of researchers for decades, especially in the banking sector, concerning its wide implications and indications for stakeholders, investors, policy makers and competitiveness. However, the practice of creative accounting is accompanied by some undesirable implications resulting from manipulation procedures. Detailed investigations in the previous literature found limited implications of creative accounting determinants on this practice. Thus, the present study investigated the moderation impact of the audit committee in enhancing the impacts of creative accounting determinants and financial reporting quality in the context of commercial banking. A deductive research approach driven by a survey questionnaire was used as the methodology to attain the designed objectives. The analysed data contributed to providing theoretical conceptualization and practical validation of the moderation impacts of the audit committee on creative accounting determinants and financial reporting quality of the banks regarding designed advantages. In addition, the present findings showed that the audit committee highly moderates the determination of creative accounting regarding financial reporting quality in the commercial banking sector. Lastly, the present study introduces the necessity to use such corporate practice for the beneficial parties as the defense line to reduce manipulation practices and enhance the quality of financial reporting.

1. Introduction

It is worth noting that literature involving creative accounting does not explicitly specify if the auditor is obliged to reveal those creative accounting aspects that are permitted and legal (Suer 2014). Herein, the audit committee plays a significant role in improving creative accounting practices and financial reporting quality. Based on this fact, the present study attempts to evaluate the creative accounting practices in Iraq and the subsequent impact on the banking sector and enhancement of financial reporting quality. In reality, auditing standards require that the processes formulated by the auditors must be able to ascertain whether the accounting practices followed by the business entities can record financial information appropriately (Mutuc et al. 2019). Basically, creative accounting is the practice of influencing financial indicators through accounting knowledge without explicitly violating accounting policies, rules, and laws. Creative accounting is practiced to demonstrate the financial status desired by the company management wherein the stakeholders are informed what the management wants them to perceive (Susmuş and Demirhan 2013). It facilitates the manipulation of financial information in its proper and accurate form in which the preparer uses the existing rules or in many cases ignores one or more rules (Idris et al. 2012; Mulford and Comiskey 2012).

Previous research indicates that creative accounting has four fundamental determinants: ethical issues, disclosure quality, internal control and ownership structure (Škoda et al. 2017). Thus, it is important to determine whether these determinants are properly practiced in the financial reporting of Iraq. In this regard, the current study intends to evaluate creative accounting practices influencing financial reporting in the banks of Iraq with regard to quality improvement. On top of this, this study determines the causative factors that motivate Iraqi banks to indulge in creative accounting practices for the betterment of overall performance (Yaseen et al. 2019). To make decisions related to the efficient operations of banks, financial reports must provide reliable, timely and accurate data needed by the stakeholders (Chang et al. 2019). Nevertheless, the main purpose of financial reporting by the banks is to present financial data to their users for better awareness and continuous updating of decisions. However, the current secretarial policy provides some choices regarding accounting practices and objective judgments to define the measurement strategies, recognition criteria and in some cases the characterization of the accounting bodies. The capacity to select varied accounting aspects enables administrators to deliberately manipulate the information or to practice concealment. Consequently, these manipulations can enhance the apparent attractiveness of the businesses, thereby projecting better profits and financial stability. In addition, such practices can sometimes mislead the users and investors, causing a significant hindrance to corporate growth and investment mobilization (Campello et al. 2011; Farhan Jedi and Nayan 2018; Abed et al. 2020c). It has been asserted that the financial reports of the bank can provide a reliable direction to users for objective decision-making (Mutuc et al. 2019). Essentially, the reports used for financial decision-making must be understandable, comparable, relevant, and realistic.

As aforementioned, a strong audit committee plays a paramount role in creative accounting practices and financial reporting quality. An inadequate governance structure provides an impetus to manipulative activities (Tassadaq and Malik 2015; Abed et al. 2020a). In fact, a poor audit committee displays a strong correlation to the manipulation of accounting (Mudel 2015; Trisanti 2016). Conversely, organizations with a strong audit committee framework have a low probability of exploiting creative accounting, and of misrepresentation of earnings and assets, as well as other deceptions (Ababneh and Aga 2019). Researchers found that numerous stakeholders can adversely be affected due to creative accounting practices (Brauweiler et al. 2019). These stakeholders include the customers, creditors, suppliers, equity investors, and regulators, among others. A comprehensive literature survey revealed that studies concerning creative accounting practices in Iraq and the Middle East remain deficient because these regions are less focused on this issue. In fact, the provisions for formulating effective systems to monitor and check creative accounting practices in Iraqi banks have been lacking. In contrast, intensive investigations have been conducted regarding creative accounting practices in developing nations. In this regard, (Qian et al. 2015) focused on several developing nations and formed three groups to compare creative accounting practices used to protect investors. It was concluded that although one group had little investor protection, the creative accounting practices were numerous and aggressive.

Considering the impact of corporate governance on creative accounting practices and financial reporting quality improvement, this study aimed to achieve an in-depth understanding of both empirical and theoretical viewpoints in this domain in the context of Iraqi banks. A basic framework has been developed to provide hands-on support for the regulators and investors related to the banking sector in Iraq. It attained a new perspective regarding creative accounting practices in Iraqi banks, thus contributing significantly to the existing state-of-the-art knowledge. The primary goal was to enrich the literature related to creative accounting practices from four perspectives: first, to evaluate the primary determinants of creative accounting practices such as ethical issues, internal control, disclosure quality and ownership structure; second, to determine the effectiveness of a strong audit committee for eliminating creative accounting practices in the banking sector of Iraq; third, to utilize information regarding the commercial banks in Iraq to establish the extent to which the creative accounting practices are entrenched in the national banking system; finally, to assess the quality of financial reporting practiced by the Iraqi commercial banks from the perception of the regulatory agencies, audit committee and others. Based on this research background, the following problems need to be resolved.

However, there is limited evidence on how the impact of determinants of creative accounting on financial reporting quality is affected by the audit committee in the banking sector of Iraq. This study aims to examine the joint influence of determinants of creative accounting and the audit committee on financial reporting quality in Iraq. It concentrates on two questions:

- What are the effects of creative accounting determinants on financial reporting quality in the banking sector?

- To what extent does the audit committee impact the relationship between creative accounting determinants and financial reporting quality?

Finally, the findings of this study will be useful to policymakers, researchers, and managers. In particular, they provide current knowledge on the impact of the audit committee, creative accounting and financial reporting quality, contributing to the literature on performance from a bank-based view. Thus, the present research is designed to attain the following objectives that contribute to limit the practice of creative accounting and the increasing of the quality of financial reports in the banking sector.

- To examine the effects of creative accounting determinants on financial reporting quality in the banking sector.

- To examine the impacts of the audit committee on the relationship between creative accounting determinants and financial reporting quality.

2. Literature Review

2.1. Creative Accounting Determinants and Financial Reporting Quality

It is generally seen that top management pressurize the accounting personnel in their banks to overestimate the financial state of their companies (Salome et al. 2012). As a result, accounting managers often manipulate the financial and accounting information to maximize the earnings of banks. These dishonest and manipulative practices benefit the shareholders since an increase is noted in the share prices of these listed banks. However, creative accounting practices can often lead to self-destruction, as a false disclosure of financial reports regarding the company’s debt can mislead the public (Kardan et al. 2016). The different accounting engineering techniques which are implemented by the bank can help them present a desirable public image and portray a financial performance based on their specified preferences. This is done by exploiting legislative ambiguities. All these practices decrease financial data reporting quality. Hence, the banks that implement a higher level of creative accounting practices tend to possess a low or poor quality of financial reporting (Tri Wahyuni et al. 2020). The accounting managers of these banks, who carry out creative accounting practices, project a higher financial performance, better earnings, stock, and share prices (Goel 2014). In this study, the researchers have attempted to define some determinants which can affect financial reporting quality. This study can also explain the various manipulative practices which are implemented during the presentation of financial reports and their effect on the banking industry.

Ethical issues refer to right or wrong practices, based on an ethical viewpoint. The ethical issues implemented in an organization are important for the rejection or adoption of creative accounting practices. It has been argued that the tendency of some managers to focus on short-term gains is mainly responsible for an unethical environment in the bank, which further encourages poor financial reporting (Tassadaq and Malik 2015). However, when managers adopt ethical behaviour, accounting transparency in the bank can increase (Butala and Khan 2011). The acceptability and implementation of ethical behaviour had been examined amongst accountants, treasurers, and institutional investors (Cernusca et al. 2016). They observed that the treasurers significantly implemented creative accounting practices, whereas regulators and public accountants rarely carried out creative accounting practices (Ezeagba and Chidoziem Abiahu 2018). Charles et al. proposed a direct approach that suggested that managerial and corporate ethics affect the quality of financial reporting (Akenbor and Tennyson 2014). Thus, it can be concluded that an ethical environment and ethical management affect the quality of financial reporting.

The agency theory suggested that managers, who represent shareholders often indulge in creative accounting practices to maximize shareholder wealth. This theory stated that control mechanisms need to be carried out for protection of the shareholders against any conflict that affects their profit (Tommasetti et al. 2019). Hence, an information asymmetry is noted due to the profit conflicts occurring between the shareholders and managers. The people who follow the capital market seek reliable financial reports and data to decrease the information asymmetry occurring between the external investors and company management. Various researchers who investigated accounting practices stated that information asymmetry can be decreased by obtaining high disclosure quality (Song et al. 2013). Thus, disclosure quality was regarded as a major concept which helped in significantly decreasing profit and information asymmetry conflicts, thereby leading to an increase in the bank value (Yasser et al. 2016). A negative relationship is noted between information asymmetry and disclosure quality. Studies indicated that many banks do carry out creative accounting practices (Abed et al. 2020b).

Despite this, it is observed that a defined and an established internal control can decrease the auditing fees and improve the integrity and reliability of the financial reporting presented by the organization (Rozidi et al. 2015). These results showed that a weak, or lack of, internal control decreases the objectivity and quality of the financial reporting presented by the management. A positive correlation is seen between financial reporting quality and strong internal control (Ayagre et al. 2014). Furthermore, (Brauweiler et al. 2019) stated that the adoption of internal control is vital for improvement of the quality of financial reporting. The primary correlation occurs between the need for effective internal control and financial reporting quality (D’Mello et al. 2017). They explained the statements made by the former Chairman of the US Securities and Exchange Commission (SEC), who stated that the quality of financial reporting was determined by internal control. Thus, it could be concluded that an inefficient internal control causes a misstatement in financial reporting.

However, (Nagata and Nguyen 2017) noted that a better ownership structure can improve the external control on management, thereby improving the quality of the financial reporting. An ownership structure decreases the creative accounting practices; however, this effect is dependent on the size of the bank (Sahasranamam et al. 2019). According to (Alzoubi 2016), the ownership structure affects the quality of financial reporting in banks which use creative accounting indicators. In these banks, the agents use novel creative accounting techniques, which further decreases the quality of financial reporting. Furthermore, they stated that the ownership structure improves the financial reporting quality in organizations which use an accrual creative accounting indicator. Many earlier researchers have observed that the ownership structure of the banks showed a low efficiency when monitoring their agents (Kao et al. 2019). Other researchers also observed a positive effect of the ownership structure on bank performance (Bao and Lewellyn 2017). Additionally, the ownership structure positively affected the financial reporting quality (Qawqzeh et al. 2019). Based on these arguments, the present study hypothesized the following:

Hypothesis 1a (H1a).

The low consideration of ethical issues indicates a high level of creative accounting which results in a low level of financial reporting quality.

Hypothesis 1b (H1b).

A low level of disclosure quality indicates a high level of creative accounting which results in a low level of financial reporting quality.

Hypothesis 1c (H1c).

A low level of internal control indicates a high level of creative accounting which results in a low level of financial reporting quality.

Hypothesis 1d (H1d).

A low level of ownership structure indicates a high level of creative accounting which results in a low level of financial reporting quality.

2.2. The Moderating Impacts of the Audit Committee

The impacts played by the audit committee have encouraged researchers to concentrate on financial reporting quality (Qian et al. 2015). Manipulation of the accounts causes an alteration in the share prices, and thereby the market capital of the company, which increases the risk of losing investors. In the past few years, the audit committee has played a vital role in the corporate governance mechanism (Saleem 2019). Some researchers have investigated the electiveness and competencies of the audit committee. However, many others believed that the existence of the audit committee was essential, as it can improve financial reporting quality (Buallay 2018; Al-Shaer et al. 2020). The audit committee had an impact on the determination of creative accounting (Inaam and Khamoussi 2016). It was significantly related to the quality of abnormal returns, accruals, financial restatements, and fraud.

Thus, ethics play a significant role in financial reporting as they are based on accounting standards. The ethical behavior of the employees in the organizations help to ensure that the organizations can gain the trust of the users with regard to the bank’s services. Ethics allow organizations to determine right and wrong values. Following the right ethics ensures that organizations are not in crisis (Cernusca et al. 2016). It further indicates that organizations need to consider professional and societal ethics, and investigate how much the auditor can ethically detect creative accounting practices. Ethical issues related to creative accounting practices allow the audit committee to enhance their accuracy and efficiency in detecting fraudulent practices (Al Momamani and Obeidat 2013; de Jesus et al. 2020). Hence, the audit committee discourages any manipulation occurring in financial accounts. Thus, it was concluded that ethical issues regarding creative accounting practices were essential for financial reporting. Therefore, a fair and just attitude was essential while carrying out financial reporting (Voinea and Dimitriu 2014).

The organizations which are vulnerable owing to their industry and size are more likely to disclose information voluntarily to manage legitimacy, as audit committees vary due to the company size and sector, and can significantly affect the disclosure quality content (Mutuc et al. 2019). The effect of individual aspects of the audit committee characteristics can be seen in financial reporting quality (Saleem 2019). The audit committee promoted financial disclosure and its expert abilities promoted efficient financial reporting quality (Yekini and Jallow 2012; Mudel 2016). An independent audit committee was generally selected since this type of committee improved financial reporting quality (Qian et al. 2015). Hence, it is essential to investigate the effect of an audit committee on the correlation between the disclosure quality and the quality of the financial reporting presented by the organization.

An audit committee needs to regularly review the conclusions presented by the internal control department and ensure that the management of the company is acting on the recommendations of the internal control department in a diligent manner (Inaam and Khamoussi 2016). The internal control department is responsible for developing annual plans, and also submitting annual reports to the audit committee or company board (Brauweiler et al. 2019). Hence, the audit committee and internal control department are motivated to release high-quality financial reporting. Moreover, it is believed that the audit committee and internal control department executed high-quality audit reports to prevent legal liabilities and maintain reputation. The primary function of an audit committee is to supervise the financial reporting quality and monitor the inclination of the company’s management to implement creative accounting practices (Buallay 2018). Thus, organizations need to establish an internal control department using skills and resources which are vital and applicable to their size, complexity, and nature (Richman and Richman 2012). Based on the above logic, we propose the following interaction hypothesis.

Audit committees played a vital role in limiting creative accounting practices even though the ownership structure was controlled by a few people (Bajra and Čadež 2018). However, it was stated that the efficiency of these audit committees decreased if the ownership structure members belonged to or dominated the corporate boards. The influence of auditing committee characteristics on financial reporting quality has been examined (Saleem 2019). It was noted that the independence of the audit committee was related to a strong ownership structure function. An audit committee restricted aggressive creative accounting practices (Buallay 2018). An active audit committee provided effective monitoring, which improved the quality of the bank’s financial reports (Deng et al. 2018). Banks with a concentrated ownership structure acquire good-quality financial reporting from an effective audit committee (Mutuc et al. 2019). Based on the above logic, we propose the following interaction hypothesis:

Hypothesis 2a (H2a).

The audit committee positively moderates the relationship between ethical issues and financial reporting quality.

Hypothesis 2b (H2b).

The audit committee positively moderates the relationship between disclosure quality and financial reporting quality.

Hypothesis 2c (H2c).

The audit committee positively moderates the relationship between internal control and financial reporting quality.

Hypothesis 2d (H2d).

The audit committee positively moderates the relationship between ownership structure and financial reporting quality.

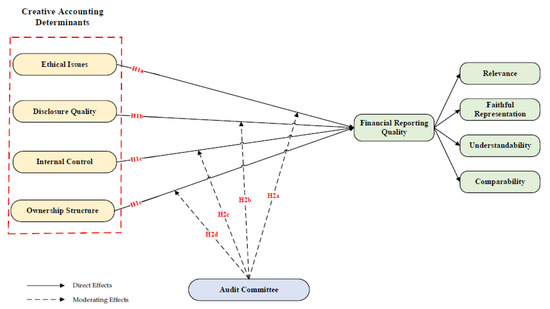

The conceptual framework of the current study contains one independent variable, ‘creative accounting’, one moderating variable, ‘audit committee’, and one dependent variable, ‘financial reporting quality’, as shown in Figure 1.

Figure 1.

Conceptual framework of the current study.

3. Research Method

3.1. Sampling Size

The ever-growing demand for research has given rise to the necessity for an effective technique for defining the required sample size in a given population. The methodological investigations of the relevant area indicated that no additional calculations are required to identify the sample size in quantitative research (Krejcie and Morgan 1970). In addition, (Krejcie and Morgan 1970) developed a standard table for calculating the sizes of samples required for studies. The present research population encompassed 24 Iraqi commercial banks in the year 2020. The research aimed to investigate a population of 7000 employees from 24 commercial banks. It is worth mentioning that the user-friendliness and flexible nature of these cited banks allowed the researchers to select them as the primary financial population. In addition, Iraqi commercial banks view such flexible attributes as visibility to external auditors. On top of this, the accessibility and collection of data through the proper approval process from other banks in Iraq were complicated, which was the main reason for choosing the Iraqi commercial banks as the target population in this research. Thus, a sample size of 364 participants was required to investigate current phenomena. As such, a total of 500 questionnaires were distributed to employees in banks. This took into consideration that the larger the study sample, the more the results can be generalized to the target population. The selected sampling method enables the gathering of accurate information from the population concerning creative accounting, financial reporting quality, and audit committee.

3.2. Sampling Technique

Purposive sampling of the estimated population was considered to be more suitable for the present research. Bank accountants who are experienced and familiar with the preparation of financial reports are expected to possess and reflect expert knowledge, and they are able to give the relevant data the research requires. Thus, the respondents for the present research were bank accountants who were involved in the banking business, regardless of their rank or job position. Hence, an individual-level analysis was chosen for the present study in order to evaluate the correlation between creative accounting, financial reporting quality, and audit committee. Furthermore, the respondents used for the study comprise accountants serving in commercial banks. The selection of accountants is a planned decision: accountants communicate the most with commercial banks. Therefore, they possess a strong understanding of the support required by banks for ‘value creation’. These reasons established the researcher’s position to measure variables and to precisely forecast the correlation between the specified variables.

3.3. Data Collection Procedures

The study questionnaire was prepared considering the primary objective and customized for specific fundamental aspects. The questionnaire permits rapid data collection (Pearlson et al. 2019) and immediate questioning regarding respondents’ doubts (Sekaran and Bougie 2016). Data collection began on 10 September 2020 and was concluded on 10 December 2020, which is roughly three months. Bank branches are scattered across different areas in Iraq; hence, much time was allocated for data collection. The banks were informed before the research team’s arrival for questionnaire distribution. The data collection process was indicated in advance. Some banks also required permission from the authorities through in-person or email-based approval before they could disclose data. This process consists of bank managers seeking permission to communicate with respondents individually. After permission is obtained, respondents are informed about the research and are provided ample time to answer all questions. In case respondents face challenges, they are assisted so that they understand the context precisely. It is required that respondents answer the survey and hand over the responses directly to enhance the response rate. Data collection ended with researchers having 392 responses.

3.4. Response Rate

To achieve the appropriate response rate, 500 questionnaires were distributed to employees in selected commercial banks in Iraq. Out of the 392 questionnaires that were returned to the researcher, 28 questionnaires were excluded as they had incomplete responses or missing data. This is a safe and easy method that is most commonly used in any statistical study to avoid bias due to incomplete questionnaires and cases of missing data. Thus, 364 responses were used for the analysis. The distribution of the questionnaires and the response rate are shown in Table 1.

Table 1.

Response rate of the data collected.

3.5. Measures

Creative accounting: measures’ determinants of CA were developed based on various studies, such as the five items used to measure ethical issues adapted from (de Jesus et al. 2020). Another five items have been adapted from (Aifuwa et al. 2018) to measure the disclosure quality. Internal control adapted five items from (Salameh 2019). Ownership structure adapted five items from (Adebiyi and Olowookere 2016). For the audit committee, the five items are mainly based on adapted items from (Suprianto et al. 2017). For inancial reporting quality, this study measured FRQ using 20 items based on the research of (Rashid 2020) (see Appendix A). Responses were made on a 5-point scale ranging from 1, strongly disagree, to 5, strongly agree.

3.6. Analysis and Results

There were two main stages to the data analysis. The first stage was conducted using SPSS.v25 to provide information about the data distribution, response rate, multicollinearity, and coding. This was followed by the screening of the data to ensure there were no missing data and outliers. The second stage of the data analysis in the current study was conducted in two phases using AMOS.v24. The first phase was a confirmatory factor analysis (CFA) to assess the overall measurement model, while the second phase involved structural equation modelling (SEM), which included testing the hypothesis of the study.

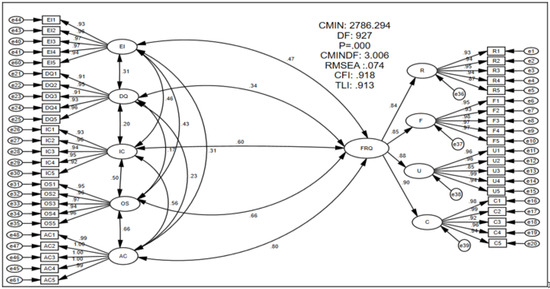

3.6.1. Assessment of Measurement Model

The measurement model shows how latent variables have been measured through their observed variables and assesses their measurement properties. In addition, before proceeding to the structural equation modelling (SEM), the measurement model properties need to be satisfied. Furthermore, in the present study, nine reflective variables were used, namely ethical issues, disclosure quality, internal control, ownership structure, corporate social responsibility, transparency and disclosure, audit committee, and financial reporting quality. These variables were measured through 48 items. The CFA for all reflective variables was performed in AMOS.v24. The assessment of the measurement model is usually carried out for reliability and validity. Through CFA, the reliability and validity of all scales can be examined. Furthermore, the factor loading estimates for all the items were between 0.85 and 0.100, above the minimum cut of point. Therefore, the model fit indices revealed that there was adequate fitness between the model and the data, whereas the outcomes showed that the CMIN statistic was 2786.294, DF = 927, and CMIN = (CMIN/DF = 2786.294/927 = 3.006). The p-value was associated with this result (p < 0.000), CFI = 0.918, TLI = 0.913, RMSEA = 0.074. These indices achieved an acceptable fit. The model is shown in Figure 2 displaying the variables with circles, while the items shown by rectangles are used to measure these variables.

Figure 2.

Assessment of measurement model.

The second kind of reliability is internal consistency; once the model has been successfully built on AMOS.v24 software, the assessment process starts with measurement model evaluation, in order to assess the reliability of the items with outer loading analysis.

However, the values above 0.60 are also acceptable. Furthermore, the factor loading estimates for all the items were between 0.69 and 0.99, above the minimum cut-off point. Overall, the results showed satisfactory indicators of reliability as shown in Table 2.

Table 2.

Loadings and cross-loadings.

Convergent validity is a type of variable validity. It is the extent to which scale items are presumed to be representing a variable based on a range of facts about the same variables. The result of Cronbach’s alpha (α) for all the variables was between 0.96 and 0.97. These values were greater than the value of 0.70. Furthermore, the result of Composite Reliability (CR) for all the variables was between 0.88 and 0.98. These values were greater than the value of 0.70. In addition, the result of the average variance extracted (AVE) for all the variables was between 0.65 and 0.92. These values were greater than the value of 0.50. Furthermore, the result of maximum shared variance (MSV) for all the variables was between 0.07 and 0.57. These values were less than the value of AVE. Furthermore, the result of maximal reliability (MaxR-H) for all the variables was between 0.88 and 0.98. These values were greater than the value of 0.80. Therefore, based on these results, the present research acquired the recommended levels of convergent validity. Furthermore, the results presented acceptable indicators of reliability and convergent validity as shown in Table 3.

Table 3.

Convergent validity for the overall measurement model.

The discriminant validity is the extent to which scores on a measure are not correlated with measures of variables that are conceptually distinct. The bold items in Table 4 show that the square root of AVE exceeded the off-diagonal values in rows and columns. In addition, the discriminant validity criterion has been met. Overall, the reliability and validity criterion assessment showed that the measurement model was satisfactory and fulfilled the requirement of validity to procced with the estimation of the parameter of the structural equation model.

Table 4.

Constructs Correlation for the overall measurement model.

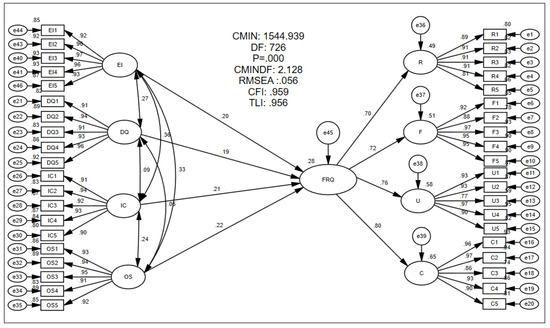

3.6.2. Assessment of Structural Equation Modeling

Structural equation modeling (SEM) is very useful in examining the interdependent relationship among some latent variables (Hair et al. 2013). It is designed to assess how good a proposed conceptual model can fit the data collected and also to ascertain the structural relationships between the sets of latent variables (Byrne 2016). The direction of the relationship between the variables showed that there was a direct relationship between independent variables and dependent variables. In this study, the measurement and structural models were generated and estimated using SPSS.v25 and AMOS.v24. The goodness-of-fit of the structural equation model indicated an acceptable fit, where specifically the CMIN statistic was 1544.939, DF = 726, CMIN = (CMIN/DF = 1544.939/726 = 2.128). The p-value associated with this result was p < 0.000, CFI = 0.959, TLI = 0.956, RMSEA = 0.056. These indices were an acceptable fit. Figure 3 shows the SEM that included all the study variables.

Figure 3.

Assessment of structural equation modelling.

This section shows the direct relationships between the determinants of creative accounting and financial reporting quality. The results of H1a show a positive and significant relationship between ethical issues and financial reporting quality (β = 0.200; t = 3.328; p < 0.000). Therefore, the relationship between ethical issues and financial reporting quality was supported. The result illustrates that H1b indicates a positive and significant relationship between disclosure quality and financial reporting quality (β = 0.185; t = 3.427; p < 0.000). Therefore, the relationship between disclosure quality and financial reporting quality performance was supported. Furthermore, the result indicates that H1c has a positive and significant relationship between internal control and financial reporting quality (β = 0.207; t = 3.640; p < 0.000). Therefore, the relationship between internal control and financial reporting quality was supported. The results of H1d have a positive and significant relationship between ownership structure and financial reporting quality (β = 0.219; t = 3.912; p < 0.000). Therefore, the relationship between ownership structure and financial reporting quality was supported as displayed in Table 5.

Table 5.

Relationship between creative accounting and financial reporting quality.

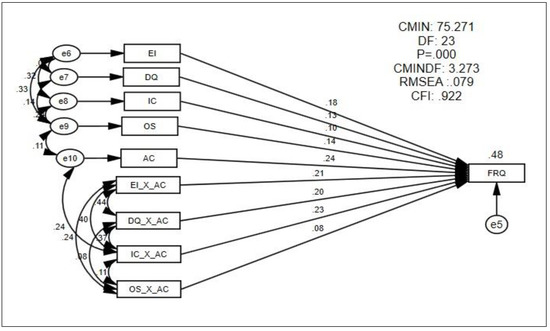

Thus, SEM was applied to detect and estimate the strength of the moderating effect of the audit committee on the relationship between the determinants of creative accounting (ethical issues, disclosure quality, internal control, ownership structure) and financial reporting quality. The goodness-of-fit of the moderating factor audit committee indicated an acceptable fit, where specifically the CMIN statistic was 75.271, DF = 23, CMIN = (CMIN/DF = 75.271/23 = 3.273). The p-value associated with this result was p < 0.000, CFI = 0.922, RMSEA = 0.079, while the R Square was 0.484. These indices were an acceptable fit. Figure 4 shows that the audit committee had an effective impact on the relationship between creative accounting and financial reporting quality within the interactive practice.

Figure 4.

Statistical model of moderating factor of the audit committee.

Therefore, the result shows that H2a indicates that the audit committee has a positive and significant moderating effect on the relationship between ethical issues and financial reporting quality (β = 0.212; t = 4.677; p < 0.000). Therefore, the moderating effect of the audit committee on the relationship between ethical issues and financial reporting quality was supported. The result shows that H2b indicates that the audit committee has a positive and significant moderating effect on the relationship between disclosure quality and financial reporting quality (β = 0.201; t = 4.631; p < 0.000). Therefore, the moderating effect of the audit committee on the relationship between disclosure quality and financial reporting quality was supported. The result displays that H2c shows that the audit committee has a positive and significant moderating effect on the relationship between internal control and financial reporting quality (β = 0.228; t = 5.156; p < 0.000). Therefore, the moderating effect of the audit committee on the relationship between internal control and financial reporting quality was supported. The results illustrate that H2d, on the audit committee, has a negative and insignificant moderating effect on the relationship between ownership structure and financial reporting quality (β = 0.084; t = 1.162; p < 0.031). Therefore, the moderating effect of the audit committee on the relationship between ownership structure and financial reporting quality was unsupported. Table 6 enumerates the results of the moderating effect of the audit committee on the relationship between creative accounting and financial reporting quality.

Table 6.

Moderating effect of the audit committee on creative accounting and financial reporting quality.

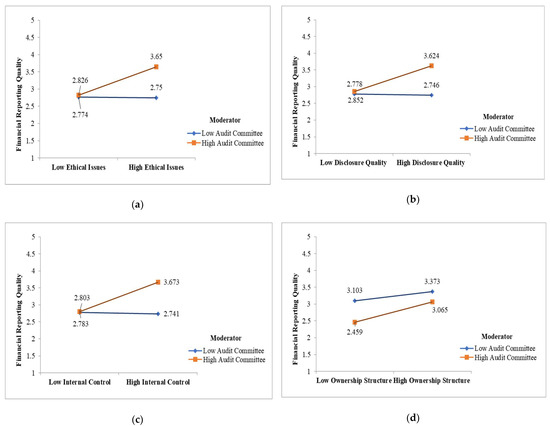

The audit committee effectively impacted the relationship between creative accounting and financial reporting quality within the interactive practice. While the audit committee strengthens the positive relationship between ethical issues and financial reporting quality as shown in Figure 5a, the slope for high ethical issues is a steeper gradient as compared to that for low ethical issues. This shows that the positive relationship between ethical issues and financial reporting quality is stronger when the audit committee is high in comparison to the lower audit committee. Moreover, the audit committee strengthens the positive relationship between disclosure quality and financial reporting quality. As shown in Figure 5b the slope of high disclosure quality has a steeper gradient as compared to that of low disclosure quality. This shows that the positive relationship between disclosure quality and financial reporting quality is stronger when the audit committee is high in comparison to the that of the lower audit committee.

Figure 5.

This figure is contained four graphs which are: (a) A two-way interaction of the AC on the EI and FRQ; (b) A two-way interaction of the AC on the DQ and FRQ; (c) A two-way interaction of the AC on the IC and FRQ; (d) A two-way interaction of the AC on the OS and FRQ.

Additionally, the audit committee strengthens the positive relationship between internal control and financial reporting quality. As shown in Figure 5c the slope of high internal control has a steeper gradient as compared to that f low internal control. This shows that the positive relationship between internal control and financial reporting quality is stronger when the audit committee is high in comparison to that of the lower audit committee. Finally, the audit committee has a negative and insignificant effect on the relationship between ownership structure and financial reporting quality. As shown in Figure 5d the slope for high ownership structure has a steeper gradient compared to that of low ownership structure. This shows that the relationship between ownership structure and financial reporting quality is stronger when the audit committee is low in comparison to the higher audit committee. All the above-mentioned indications are shown in Figure 5.

4. Discussion and Conclusions

The present research findings confirmed the moderation impact of the audit committee on ethical issues, discourse quality, internal control and ownership structure together with financial reporting quality. This moderation relationship is proposed in three hypotheses that described the impact of the audit committee on each of the determinants of creative accounting practice. The obtained results showed that the role of creative accounting determinants in commercial banks can be enhanced and considered as a value-relevant property to acquire high reporting quality through the moderation of the corporate aspect of the audit committee. Accordingly, the result for hypotheses H1a was (t = 3.328) which aligned with the assumptions provided by the agency theory, whereas, the hypothesis indicated significant impacts of the maintenance of ethical issues on the quality of financial reporting. Furthermore, the results reaffirmed that ethical aspects lead to the establishment of higher quality of financial reporting practice as shown in the context of Iraqi commercial banks. Besides, the results acknowledged the findings in the previous studies presented by (Tassadaq and Malik 2015; Gras et al. 2016; de Jesus et al. 2020; Shafer et al. 2013) that demonstrate limited consideration of ethical issues on creative accounting practice in the context of commercial banks.

In addition, the result of H1b (t = 3.427) indicated a significant relationship between the constructs with the limited operation of disclosure procedures in the context of commercial banks. This determination designated the higher implications of creative accounting practice on the quality of financial reporting in the banking sector, which was found to be consistent with previous literature reviews (Mutuc et al. 2019; Qian et al. 2015; Tri Wahyuni et al. 2020). The implementation of the new-institutional theory contributed to explaining the underlying preposition that limited disclosure practice in the context of commercial banks was due to the pressure exerted by the institutional setup that related to the ownership structure. These results are found to be in good agreement with numerous studies in the literature which display the significance of linkage between this determinant and accounting practice (Mutuc et al. 2019; Qian et al. 2015; Mudel 2016; Udin et al. 2017). However, the present research findings are contradicted by other studies that proposed a limited controlling role of disclosure quality in creative accounting practice (Cooray et al. 2020; Yasser et al. 2016; Gerwanski et al. 2019). In brief, disclosure quality is found to be one of the essential determinants of institutional transparency that increase the trust of the public in the financial reporting quality of the bank. This finding is approved by its high consistency with previous claims cited in (Zaman et al. 2018) on maintaining ethical concerns through disclosure quality.

The findings of the last two hypotheses related to the first research question are H1c (t = 3.640) and H1d (t = 3.912). As mentioned earlier, the present research findings showed a significant inter-correlated relationship between the determinants of creative accounting i.e., each of the determinants has an effect on others. The origin of this relationship is clearly identified in the previous literature, and is verified in the present research findings. Thus, the limited consideration of ethical issues and disclosure quality resulted in the limited implementation of internal control. These procedures enable the practice of creative accounting to take place in the commercial banking sector at various levels according to the ownership structure of the bank. Thus, the present findings are consistent with previous studies that indicated poor internal control which may lead to higher errors and inaccurate financial disclosure regarding the financial reporting quality in banks (Lim et al. 2017; Muraina and Dandago 2020).

It is worth declaring that the outcomes of this research supported the existing literature concerning the correlation between the determinants of creative accounting in detecting fraud practice, but these determinants fall to control this practice to safe levels (Al-Hashemi 2020; Ibrahim et al. 2017; Ndebugri and Tweneboah Senzu 2017; Cernusca et al. 2016). These findings are applied to the context of Iraqi commercial banks, although dedicated efforts are constantly made to retain, and establish healthy relations with the outside shareholders as one of the major resources, but additional enhancements re required to reduce Fraud practice within creative accounting in order to present high quality financial reports. This in turn implies that the internal banking system should maintain ethical issues, disclosure to the public, and implement qualified internal control for a faithful representation of the financial reporting practice in Iraqi commercial banks.

So far, the results obtained showed that the role of creative accounting determinants in commercial banks can be enhanced and considered as a valuerelevant property in acquiring high reporting practice through the moderation of the audit committee. Briefly, the findings regarding the audit committee supported the hypotheses H2a, H2b and H2c through the indicated value of t = 4.677, 4.622, and 5.094. In addition, the comprehensive analysis of the results illustrated some important correlations among the determinants of creative accounting and financial reporting quality moderated by the audit committee. In contrast, the findings did not support hypothesis H2d due to the absence of any significant value among the audit committee and ownership structure—t = 1.152. In this respect, the findings validated the previous research of (Qian et al. 2015; Mutuc et al. 2019; Mudel 2016; Suprianto et al. 2017) concerning the impacts of ownership structure on audit practice and financial reporting quality in the banking sector.

Furthermore, the present results contributed by examining the moderating role of the audit committee theoretically, whereas the agency and neoinstitutional theories could partially explain the present trends. In the content of commercial banks, the argument of neoinstitutional theories emphasizes exterior pressure as a significant driver of the audit committee structure at specific conditions, which make it independent from the ownership of the banks (Trisanti 2016). Personal relationships can cause suspicious complications because they will result in cooperation or conflict of interest which highly impacts the maintenance of the independence of audit practice in the banks. The most interesting finding is that moderation of the audit committee monitors the quality and flow of information between shareholders, managers of banks and board members, which can identify any problem in the business, as addressed in the previous study of (Brauweiler et al. 2019).

In addition, the present findings demonstrated that the audit committee highly moderates the determination of creative accounting on financial reporting quality in the commercial banking sector. Thus, it highlighted the intensive auditing practice embedded in the bank, posited to be directly related to financial reporting quality (Rozidi et al. 2015; Aifuwa et al. 2018; Suprianto et al. 2017; Salehi et al. 2018). In addition, the agency theory, or in other words information asymmetry between owners and managers, opportunistic behaviour of managers, and the failure of the principals to control the desired action of the agent. provides a theoretical framework to expand the present understanding of how such banks collapsed, a faithful representation of the findings in consistent view with previous works of (Muraina and Dandago 2020; Sharma et al. 2020; Farhan et al. 2019).

As discussed in the previous sections, most of the earlier reports concluded that creative accounting determination generally depends on the framework, idiosyncrasies and interconnectivity (Mahboub 2017; Rozidi et al. 2015; Lim et al. 2017; Alzeban 2020). It was indicated that a perfect solution is impossible for all financial sectors, wherein creative accounting might be inappropriate and dependent on the contexts. Therefore, the level of creative practice may vary appreciably from one sector to another (Goel 2014). The present findings contributed by presenting concurrent evidence on the flexibility of creative accounting determinants with a higher degree of implication of corporate aspects and financial reporting quality. The obtained findings also strongly emphasized the significant impacts of the moderator on the enhanced determination of creative practice, as well as the strength and the quality of financial reporting within Iraqi commercial banks.

The findings showed the importance of implementing an audit committee to moderate the relationships among the determinants and financial reporting quality in the banking sector of Iraq. Thus, entrepreneurial administration is needed connected to the identification of the scope and recognition of the problem, as well as trends in the commercial banks. This process enabled the management to contribute to the adjustment and upgrading of daily schedules, largely tactical acts for transforming the reporting systems of the banks into a higher level of qualified reporting practice (Brauweiler et al. 2019; Haji and Anifowose 2020). This identification has been shown in the findings of this study which supports required reform through the moderation of corporate aspects for financial reporting quality. In conclusion, this study showed harmony with the views demonstrated in most of the previous studies in the literature on the determination of creative practice that influences the preparation of financial reports as mentioned by (Al-Olimat 2020; Farhan Jedi and Nayan 2018; Jadah 2016; Kazem 2012).

5. Recommendation for Future Studies

Despite several notable contributions made by this study, some limitations have been encountered. Thereby, acknowledging these limitations contributes to the trustworthiness of the present research findings. This research is concerned with the variables defined in the conceptual design which aims to maintain a balanced view in the diagnostic and interactive use of the model in the Iraqi commercial banks. Such a design for different banking sectors, concerning factors like the determinants of creative accounting and audit committee changes, may vary, according to the contemporary environmental opportunities or threats, in investigating the profitability of the data in the specific banking sector that may not be completely applicable. Thus, the examination of these factors in different research contexts can offer a more inclusive perception of the mechanism and condition of the model and how it might fit in various banking sectors. Besides, new investigations can contribute to the generalization of the present research framework.

Therefore, the present study may serve as the platform on which further studies might be performed to enhance the field knowledge. As discussed in the previous sections, the present study conflicted with some previous studies and was consistent with others. However, the present study’s limitations can be avoided in future research. Besides, further research can be associated with the market valuation controversies. Further, to explain and address such a debate regarding banking markets, it may be essential to carry out further studies to understand how the deployment of the audit committee may affect determination of creative accounting practice in estimating market valuation of competitiveness. Therefore, the main area for future research is represented in adjusting the present conceptual model in multidimensional agreement with the International Accounting Standard Board 215 (IASB) in various research contexts. This must be observed by both internal control and the audit committee for a better presentation of financial reporting practice. Finally, it is recommended that future longitudinal studies must include the opinions of multiple sources of information from management and other auditing levels to confirm their impacts on developing the determination of creative accounting and financial reporting quality.

Author Contributions

Conceptualization, I.A.A. and N.H.; methodology, I.A.A. and N.H.; formal analysis I.A.A., N.H., H.H., N.M.A.-R. and M.A.A.; investigation, I.A.A., M.A.A. and N.H.; resources, I.A.A. and N.H.; writing—original draft preparation, I.A.A.; writing—review and editing, I.A.A., M.A.A. and N.H. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no funding.

Acknowledgments

The authors are grateful to the Middle East University, Amman, and Zarqa University, Zarqa, Jordan for the financial support granted to cover the publication fee of this article. The authors also are grateful to the editor and the anonymous reviewers for providing very constructive and useful comments that enabled us to make additional efforts to improve the clarity and quality of our research.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A. Measurement Items

| Audit Committee |

|

|

|

|

|

| Creative Accounting Determinants |

| Ethical Issues |

|

|

|

|

|

| Disclosure Quality |

|

|

|

|

|

| Internal Control |

|

|

|

|

|

| Ownership Structure |

|

|

|

|

|

| Financial Reporting Quality Dimensions |

| Relevance |

|

|

|

|

|

| Faithful Representation |

|

|

|

|

|

| Understandability |

|

|

|

|

|

| Comparability |

|

|

|

|

|

References

- Ababneh, Tha’er Amjed Mahmoud, and Mehmet Aga. 2019. The Impact of Sustainable Financial Data Governance, Political Connections, and Creative Accounting Practices on Organizational Outcomes. Sustainability 11: 5676. [Google Scholar] [CrossRef]

- Abed, Ibtihal A., Nazimah Hussin, and Mostafa A. Ali. 2020a. Piloting the Role of Corporate Governance and Creative Accounting in Financial Reporting Quality. Technology Reports of Kansai University 62: 2–7. [Google Scholar]

- Abed, Ibtihal A., Nazimah Hussin, Mostafa A. Ali, Nada Salman Nikkeh, and Mohammed A. Mohammed. 2020b. Creative Accounting Phenomenon in the Financial Reporting: A Systematic Review Classification, Challenges. Technology Reports of Kansai University 62: 1–10. [Google Scholar]

- Abed, Ibtihal A., Nazimah Hussin, Mostafa A. Ali, Rafidah Othman, and Mohammed A. Mohammed. 2020c. A Systematic Critical Review of Creative Accounting and Financial Reporting. Technology Reports of Kansai University 62: 5113–30. [Google Scholar]

- Adebiyi, Waidi Kareem, and Johnson Kolawole Olowookere. 2016. Ownership Structure and the Quality of Financial Reporting: Evidence from Nigerian Deposit Money Banks. International Journal of Economics, Commerce and Management IV: 541–52. [Google Scholar]

- Aifuwa, Hope Osayantin, Keme Embele, and Saidu Musa. 2018. Ethical Accounting Practices and Financial Reporting Quality. EPRA International Journal of Multidisciplinary Research (IJMR) 4: 31–44. [Google Scholar]

- Akenbor, Cletus O., and Oghoghomeh Tennyson. 2014. Ethics of Accounting Profession in Nigeria. Journal of Business and Economics 5: 1374–82. [Google Scholar]

- Al Momani, Mohammed Abdullah, and Mohammed Ibrahim Obeidat. 2013. The Effect of Auditors’ Ethics on Their Detection of Creative Accounting Practices: A Field Study. International Journal of Business and Management 8: 118–36. [Google Scholar] [CrossRef]

- Al-Hashemi, Hassan Taher. 2020. The effect of creative accounting practices on measuring and presenting accounting information in the financial statements—A comparative analytical study on a sample of the financial and industrial sectors listed on the Iraq Stock Exchange. Journal of Ma’aen VII: 818–39. [Google Scholar]

- Al-Olimat, Nofan Hamed. 2020. The Impact of Cognitive Creativity in Accounting among Jordanian Internal Auditors on Detecting Creative Accounting Practices, A Field Study. International Journal of Business and Social Science 10: 149. [Google Scholar] [CrossRef]

- Al-Shaer, Habiba, Aly Salama, and Steven Toms. 2020. Audit committees and financial reporting quality: Evidence from UK environmental accounting disclosures. Managerial Auditing Journal 35: 1639–62. [Google Scholar] [CrossRef]

- Alzeban, Abdulaziz. 2020. Influence of internal audit reporting line and implementing internal audit recommendations on financial reporting quality. Meditari Accountancy Research 28: 26–50. [Google Scholar] [CrossRef]

- Alzoubi, Ebraheem Saleem Salem. 2016. Ownership structure and earnings management: Evidence from Portugal. International Journal of Accounting & Information Management 24: 135–61. [Google Scholar] [CrossRef]

- Ayagre, Philip, Ishmael Appiah-Gyamerah, and Joseph Nartey. 2014. The effectiveness of Internal Control Systems of banks. The case of Ghanaian banks. International Journal of Accounting and Financial Reporting 4: 377. [Google Scholar] [CrossRef]

- Bajra, Ujkan, and Simon Čadež. 2018. Audit committees and financial reporting quality: The 8th EU Company Law Directive perspective. Economic Systems 42: 151–63. [Google Scholar] [CrossRef]

- Bao, Shuji Rosey, and Krista B. Lewellyn. 2017. Ownership structure and earnings management in emerging markets—An institutionalized agency perspective. International Business Review 26: 828–38. [Google Scholar] [CrossRef]

- Brauweiler, Hans-Christian, Aida Yerimpasheva, and Zerma Bagalbayeva. 2019. Avoiding creative accounting: Corporate governance and leadership skills. Zeszyty Teoretyczne Rachunkowości 12: 9–19. [Google Scholar] [CrossRef]

- Buallay, Amina. 2018. Audit committee characteristics: An empirical investigation of the contribution to intellectual capital efficiency. Measuring Business Excellence 22: 183–200. [Google Scholar] [CrossRef]

- Butala, Amy, and Zafar U. Khan. 2011. Accounting Fraud at Xerox Corporation. SSRN Electronic Journal 16: 81–89. [Google Scholar] [CrossRef]

- Byrne, Barbara M. 2016. Structural Equation Modeling with AMOS: Basic Concepts, Applications, and Programming. Multivariate Applications Series; New York: Taylor & Francis Group, vol. 396, p. 7384. [Google Scholar]

- Campello, Murillo, Erasmo Giambona, John R. Graham, and Campbell R. Harvey. 2011. Liquidity management and corporate investment during a financial crisis. The Review of Financial Studies 24: 1944–79. [Google Scholar] [CrossRef]

- Cernusca, Lucian, David Delia, Cristina Nicolaescu, and Bogdan Cosmin Gomoi. 2016. Empirical Study on the Creative Accounting Phenomenon. Studia Universitatis Vasile Goldiș Arad—Economics Series 26: 63–87. [Google Scholar] [CrossRef]

- Chang, Weng Foong, Azlan Amran, Mohammad Iranmanesh, and Behzad Foroughi. 2019. Drivers of sustainability reporting quality: Financial institution perspective. International Journal of Ethics and Systems 35: 632–50. [Google Scholar] [CrossRef]

- Ezeagba, Charles Emenike, and Mary-Fidelis Chidoziem Abiahu. 2018. Ezeagba, Charles Emenike, and Mary-Fidelis Chidoziem Abiahu. Influence of Professional Ethics and Standards in Less Developed Countries: An Assessment of Professional Accountants in Nigeria. Asian Journal of Economics, Business and Accounting 6: 2–6. [Google Scholar]

- Cooray, Thilini, A. D. Nuwan Gunarathne, and Samanthi Senaratne. 2020. Does corporate governance affect the quality of integrated reporting? Sustainability 12: 4262. [Google Scholar] [CrossRef]

- D’Mello, Sheetal R., Celia N. Cruz, Mei-Ling Chen, Mamta Kapoor, Sau L. Lee, and Katherine M. Tyner. 2017. The evolving landscape of drug products containing nanomaterials in the United States. Nature Nanotechnology 12: 523–29. [Google Scholar] [CrossRef] [PubMed]

- de Jesus, Tânia Alves, Pedro Miguel Pinheiro, Catarina Kaizeler, and Manuela M. Sarmento. 2020. Creative Accounting or Fraud? Ethical Perceptions Among Accountants. International Review of Management and Business Research 9: 58–78. [Google Scholar] [CrossRef]

- Deng, Xin, Yen Teik Lee, and Zhengting Zhong. 2018. Decrypting coin winners: Disclosure quality, governance mechanism and team networks. Governance Mechanism and Team Networks. [Google Scholar] [CrossRef]

- Farhan, Najib H. S., Eissa Alhomidi, Faozi. A. Almaqtari, and Mosab I. Tabash. 2019. Does corporate governance moderate the relationship between capital structure and firm performance?: Evidence from The Netherlands. Academic Journal of Interdisciplinary Studies 8: 144–57. [Google Scholar] [CrossRef]

- Farhan Jedi, Firas, and Sabri Nayan. 2018. International Journal of Economics and Financial Issues The Effect of Oil Price Volatility, Board of Directors Characteristics on Firm Performance of Iraq Listed Companies: A Conceptual Framework. International Journal of Economics and Financial Issues 8: 342–50. [Google Scholar]

- Gerwanski, Jannik, Othar Kordsachia, and Patrick Velte. 2019. Determinants of materiality disclosure quality in integrated reporting: Empirical evidence from an international setting. Business Strategy and the Environment 28: 750–70. [Google Scholar] [CrossRef]

- Goel, Sandeep. 2014. The quality of reported numbers by the management: A case testing of earnings management of corporate India. Journal of Financial Crime 21: 355–76. [Google Scholar] [CrossRef]

- Gras, Ester, Mercedes Palacios Manzano, and Joaquín Hernández Fernández. 2016. Investigating the relationship between corporate social responsibility and earnings management: Evidence from Spain. BRQ Business Research Quarterly 19: 289–99. [Google Scholar] [CrossRef]

- Hair, Joseph F., William C. Black, Barry J. Babin, and Rolph E. Anderson. 2013. Multivariate Data Analysis. Setagaya City: Always Learning Education. [Google Scholar]

- Haji, Abdifatah Ahmed, and Mutalib Anifowose. 2020. Audit committee and integrated reporting practice: Does internal assurance matter? Managerial Auditing Journal 35: 1639–62. [Google Scholar]

- Ibrahim, Hadi Adam Muhammad, Majeed Abdul Hussain, and Qasim Muhammad Abdullah. 2017. The Impact of Creative Accounting Methods on the Quality of Accounting Information: A Field Study on the Financial Reports of Companies Listed in the Iraq Stock Exchange. Journal of Management Sciences 7: 283–91. [Google Scholar]

- Idris, Adekunle Abiodun, James Sunday Kehinde, Sunday Stephen A. Ajemunigbohun, and Justin M. O. Gabriel. 2012. The nature, techniques and prevention of creative accounting: Empirical evidence from Nigeria. Canadian Journal of Accounting and Finance 1: 26–31. [Google Scholar]

- Inaam, Zgarni, and Halioui Khamoussi. 2016. Audit committee effectiveness, audit quality and earnings management: A meta-analysis. International Journal of Law and Management 58: 179–96. [Google Scholar] [CrossRef]

- Jadah, Hamid Mohsin. 2016. Board Characteristics and Bank Performance: Evidence from Iraq. Journal of Independent Studies and Research: Management, Social Sciences and Economics 14: 29–41. [Google Scholar] [CrossRef]

- Kao, Mao-Feng, Lynn Hodgkinson, and Aziz Jaafar. 2019. Ownership structure, board of directors and firm performance: Evidence from Taiwan. Corporate Governance: The International Journal of Business in Society 19: 189–216. [Google Scholar] [CrossRef]

- Kardan, Behzad, Mahdi Salehi, and Rahimeh Abdollahi. 2016. The relationship between the outside financing and the quality of financial reporting: Evidence from Iran. Journal of Asia Business Studies 10: 20–40. [Google Scholar] [CrossRef]

- Kazem, Hatem. 2012. Corporate governance and its role in reducing the effects of creative accounting (field study of a sample of Iraqi companies). The IRAQI Magazinje for Managerial Sciences 8: 1–20. [Google Scholar]

- Krejcie, Robert V., and Daryle W. Morgan. 1970. Determining sample size for research activities. Educational and Psychological Measurement 30: 607–10. [Google Scholar] [CrossRef]

- Lim, Si Jie, Gregory White, Alina Lee, and Yuni Yuningsih. 2017. A longitudinal study of voluntary disclosure quality in the annual reports of innovative firms. Accounting Research Journal 30: 89–106. [Google Scholar] [CrossRef]

- Mahboub, Rasha. 2017. Main determinants of financial reporting quality in the Lebanese banking sector. European Research Studies Journal 20: 706–26. [Google Scholar] [CrossRef][Green Version]

- Mudel, Sonia. 2015. Creative Accounting and Corporate Governance: A Literature Review. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Mudel, Sonia. 2016. A Study to Show the Relation between Creative Accounting and Corporate Governance. SSRN Electronic Journal 2: 193–99. [Google Scholar] [CrossRef]

- Mulford, Charles W., and Eugene E. Comiskey. 2012. Creative accounting and accounting scandals in the USA. Creative Accounting, Fraud and International Accounting Scandals, 407–24. [Google Scholar]

- Muraina, Saheed Adekunle, and Kabiru Isa Dandago. 2020. Effects of implementation of International Public Sector Accounting Standards on Nigeria’s financial reporting quality. International Journal of Public Sector Management 33: 323–38. [Google Scholar] [CrossRef]

- Mutuc, Eugene Burgos, Jen-Sin Lee, and Fu-Sheng Tsai. 2019. Doing Good with Creative Accounting? Linking Corporate Social Responsibility to Earnings Management in Market Economy, Country and Business Sector Contexts. Sustainability 8: 4568. [Google Scholar] [CrossRef]

- Nagata, Kyoko, and Pascal Nguyen. 2017. Ownership structure and disclosure quality: Evidence from management forecasts revisions in Japan. Journal of Accounting and Public Policy 36: 451–67. [Google Scholar] [CrossRef]

- Ndebugri, Haruna, and Emmanuel Tweneboah Senzu. 2017. Analyzing the Critical Effect of Creative Accounting Practice in the Corporate Sector of Ghana. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3236965 (accessed on 7 December 2021).

- Pearlson, Keri E., Carol S. Saunders, and Dennis F. Galletta. 2019. Managing and Using Information Systems: A Strategic Approach. Hoboken: John Wiley & Sons. ISBN 111956056X. [Google Scholar]

- Qawqzeh, Hamza Kamel, Wan Anisah Endut, Norfadzilah Rashid, and Mohammad Mustafa. 2019. Ownership structure and financial reporting quality: Influence of audit quality evidence from Jordan. International Journal of Recent Technology and Engineering (IJRTE) 8: 2212–20. [Google Scholar] [CrossRef]

- Qian, Wei, Jacob Hörisch, Stefan Schaltegger, Fatma Baalouch, Salma Damak Ayadi, Khaled Hussainey, and Ben Kwame Agyei-Mensah. 2015. A study of the determinants of environmental disclosure quality: Evidence from French listed companies. Journal of Management and Governance 22: 1608–19. [Google Scholar]

- Rashid, Md Mamunur. 2020. Financial Reporting Quality and Share Price Movement-Evidence from Listed Companies in Bangladesh. Journal of Financial Reporting and Accounting 18: 425–58. [Google Scholar] [CrossRef]

- Richman, Vincent, and Alex Richman. 2012. A Tale of Two Perspectives: Regulation Versus Self-Regulation. A Financial Reporting Approach (from Sarbanes-Oxley) for Research Ethics. Science and Engineering Ethics 18: 241–46. [Google Scholar] [CrossRef] [PubMed]

- Rozidi, Muhammad Syafiq Razelin Anis, Nor Aime Mohd Nor, Nuraini Abdul Aziz, Nur Amalina Rosli, and Norlaila Mazura Hj Mohaiyadin. 2015. Relationship between Auditors’ Ethical Judgments, Quality of Financial Reporting and Auditors’ Attitude towards Creative Accounting: Malaysia Empirical Evidence. International Journal of Business, Humanities and Technology 5: 81–87. [Google Scholar]

- Sahasranamam, Sreevas, Bindu Arya, and Mukesh Sud. 2019. Ownership structure and corporate social responsibility in an emerging market. Asia Pacific Journal of Management 37: 1165–92. [Google Scholar] [CrossRef]

- Salameh, Rafat Salameh. 2019. What is the Impact of Internal Control System on the Quality of Banks’financial Statements in Jordan? Academy of Accounting and Financial Studies Journal 23: 1–10. [Google Scholar]

- Saleem, Khalil Suleiman Abu. 2019. The Impact of Audit Committee Characteristics on the Creative Accounting Practices Reduction in Jordanian Commercial Banks. Modern Applied Science 13: 113–23. [Google Scholar] [CrossRef]

- Salehi, Mahdi, Nasrin Ziba, and Ali Daemi Gah. 2018. The relationship between cost stickiness and financial reporting quality in Tehran Stock Exchange. International Journal of Productivity and Performance Management 67: 1550–65. [Google Scholar] [CrossRef]

- Salome, Ezeani Nneka, Martin Ifeanyi Ogbonna, Ezemoyih Chuks Marcel, and Okonye Ekendu Echezonachi. 2012. The effect of creative accounting on the job performance of accountants (auditors) in reporting financial statementin Nigeria. Kuwait Chapter of the Arabian Journal of Business and Management Review 33: 1–30. [Google Scholar]

- Sekaran, Uma, and Roger Bougie. 2016. Research Methods for Business: A Skill Building Approach. Hoboken: John Wiley & Sons. ISBN 1119165555. [Google Scholar]

- Shafer, William E, Margaret C C Poon, and Dean Tjosvold. 2013. Ethical climate, goal interdependence, and commitment among Asian auditors. Managerial Auditing Journal 28: 217–44. [Google Scholar] [CrossRef]

- Sharma, Vineeta D., Divesh S. Sharma, and Umapathy Ananthanarayanan. 2020. Client importance and earnings management: The moderating role of Audit Committees. Iranian Journal of Finance 30: 125–56. [Google Scholar] [CrossRef]

- Škoda, Miroslav, Tomáš Lengyelfalusy, and Gabriela Gabrhelová. 2017. Creative Accounting Practicies in Slovakia after Passing Financial Crisis. Copernican Journal of Finance & Accounting 6: 71–86. [Google Scholar]

- Song, Dan-Bee, Ho-Young Lee, and Eun-Jung Cho. 2013. The association between earnings management and asset misappropriation. Managerial Auditing Journal 28: 542–67. [Google Scholar] [CrossRef]

- Suer, Ayca Zeynep. 2014. The Recognition of Provisions: Evidence from BIST100 Non-financial Companies. Procedia Economics and Finance 9: 391–401. [Google Scholar] [CrossRef][Green Version]

- Suprianto, Edy, Suwarno Suwarno, Henny Murtini, Rahmawati Rahmawati, and Dyah Sawitri. 2017. Audit Committee Accounting Expert and Earnings Management with “Status” Audit Committee as Moderating Variable. Indonesian Journal of Sustainability Accounting and Management 1: 49–58. [Google Scholar] [CrossRef]

- Susmuş, Türker, and Dilek Demirhan. 2013. Creative accounting: A brief history and conceptual framework. Paper presented at the 3rd Balkans and Middle East Countries Conference on Accounting and Accounting History, Istanbul, Turkey, June 19–22, vol. 20. [Google Scholar]

- Tassadaq, Fizza, and Qaisar Ali Malik. 2015. Creative accounting and financial reporting: Model development and empirical testing. International Journal of Economics and Financial Issues 5: 544–51. [Google Scholar]

- Tommasetti, Roberto, Marcelo Á. da Silva Macedo, Frederico A. Azevedo de Carvalho, and Sergio Barile. 2019. Better with age: Financial reporting quality in family firms. Journal of Family Business Management 10: 40–57. [Google Scholar] [CrossRef]

- Tri Wahyuni, Ersa, Gina Puspitasari, and Evita Puspitasari. 2020. Has IFRS improved Accounting Quality in Indonesia? A Systematic Literature Review of 2010–2016. Journal of Accounting and Investment 21: 19–44. [Google Scholar] [CrossRef]

- Trisanti, Theresia. 2016. Did the corporate governance reform have effect on creative accounting practices in emerging economies? The case of Indonesian listed companies. Journal for Global Business Advancement 9: 52. [Google Scholar] [CrossRef]

- Udin, Shahab, Muhammad Arshad Khan, and Attiya Yasmin Javid. 2017. The effects of ownership structure on likelihood of financial distress: An empirical evidence. Corporate Governance: The International Journal of Business in Society 17: 589–12. [Google Scholar] [CrossRef]

- Voinea, Maria-Mădălina, and Otilia Dimitriu. 2014. Manipulating User Behavior through Accounting Information. Procedia Economics and Finance 15: 886–93. [Google Scholar] [CrossRef][Green Version]

- Yaseen, Ali Taha, Ahmed Kadhim Idam, and Mohammed Jabbar Fashakh. 2019. Creative Accounting Standards and Its Techniques. Opcion 34: 1611–42. [Google Scholar]

- Yasser, Qaiser Rafique, Abdullah Al Mamun, and Irfan Ahmed. 2016. Quality of financial reporting in the Asia-Pacific region: The influence of ownership composition. Review of International Business and Strategy 26: 543–60. [Google Scholar] [CrossRef]

- Yekini, Kemi, and Kumba Jallow. 2012. Corporate community involvement disclosures in annual report: A measure of corporate community development or a signal of CSR observance? Sustainability Accounting, Management and Policy Journal 3: 7–32. [Google Scholar] [CrossRef]

- Zaman, Rashid, Stephen Bahadar, Umar Nawaz Kayani, and Muhammad Arslan. 2018. Role of media and independent directors in corporate transparency and disclosure: Evidence from an emerging economy. Corporate Governance: The International Journal of Business in Society 16: 593–608. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).