The Effects of Index Futures Trading Volume on Spot Market Volatility in a Frontier Market: Evidence from Ho Chi Minh Stock Exchange

Abstract

1. Introduction

2. Literature Review

3. Data and Methodology

3.1. Data Sources

3.2. Methodology

- -

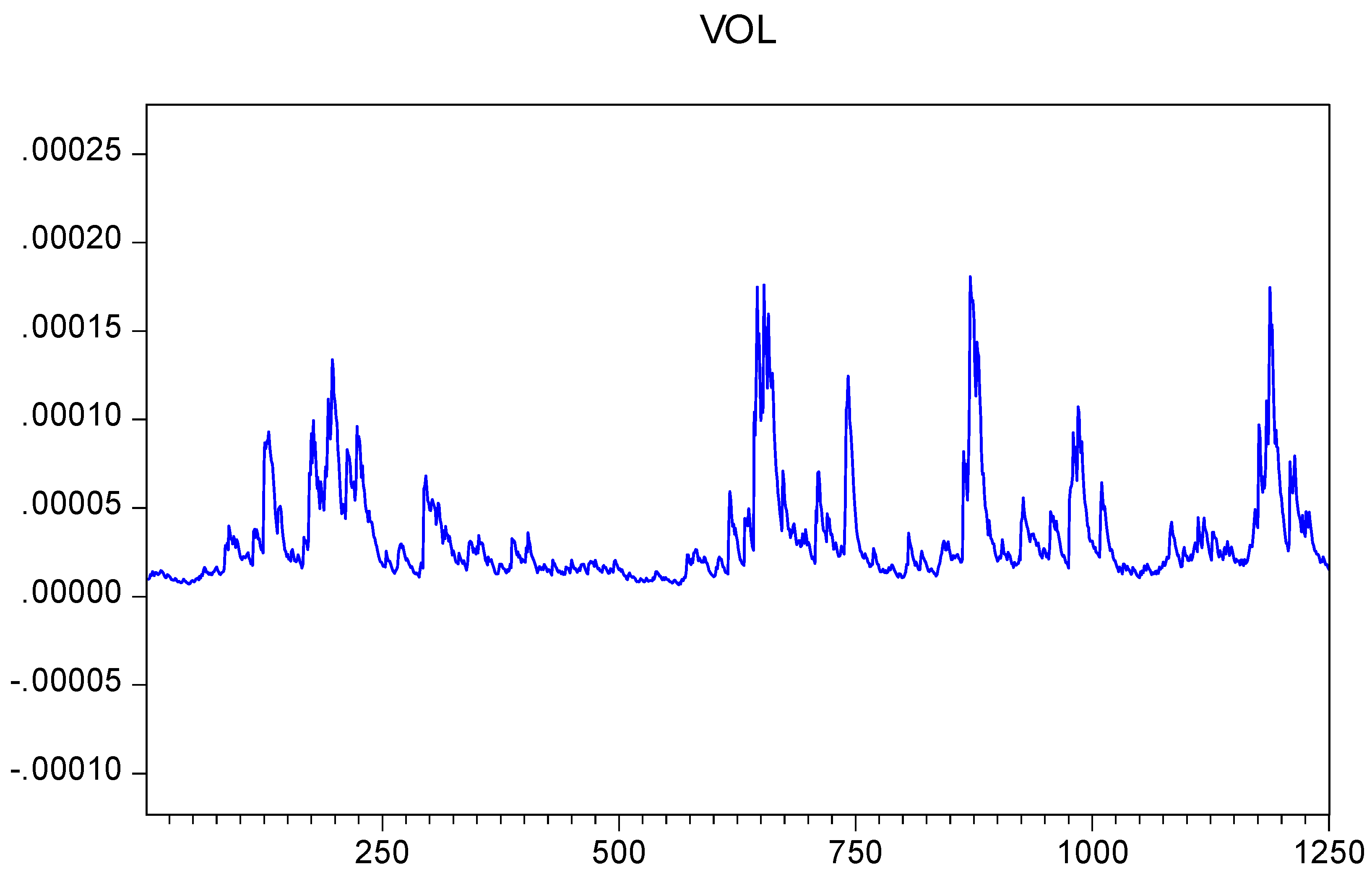

- VOL: Volatility of spot market returns generated from the EGARCH(1,1) model. Specifically, the EGARCH(1,1) employed in this study takes the following form:

- -

- LNFTV: The natural logarithm of index futures trading volume.

3.2.1. Unit Root Test

3.2.2. ARDL Bound Test for Cointegration

- -

- q1, q2 represent the optimal number of lags.

- -

- ECM stands for Error Correction Model; ECMt−1 measures how quickly the dependent variable responds to a deviation from the equilibrium relationship in one day (period).

4. Empirical Results

4.1. Descriptive Statistics from the Sample

4.2. Results of Unit Root Tests

4.3. ARDL Bounds Test for Cointegration

4.4. Short-Run and Long-Run Effects of Index Futures Volume on Spot Market Volatility

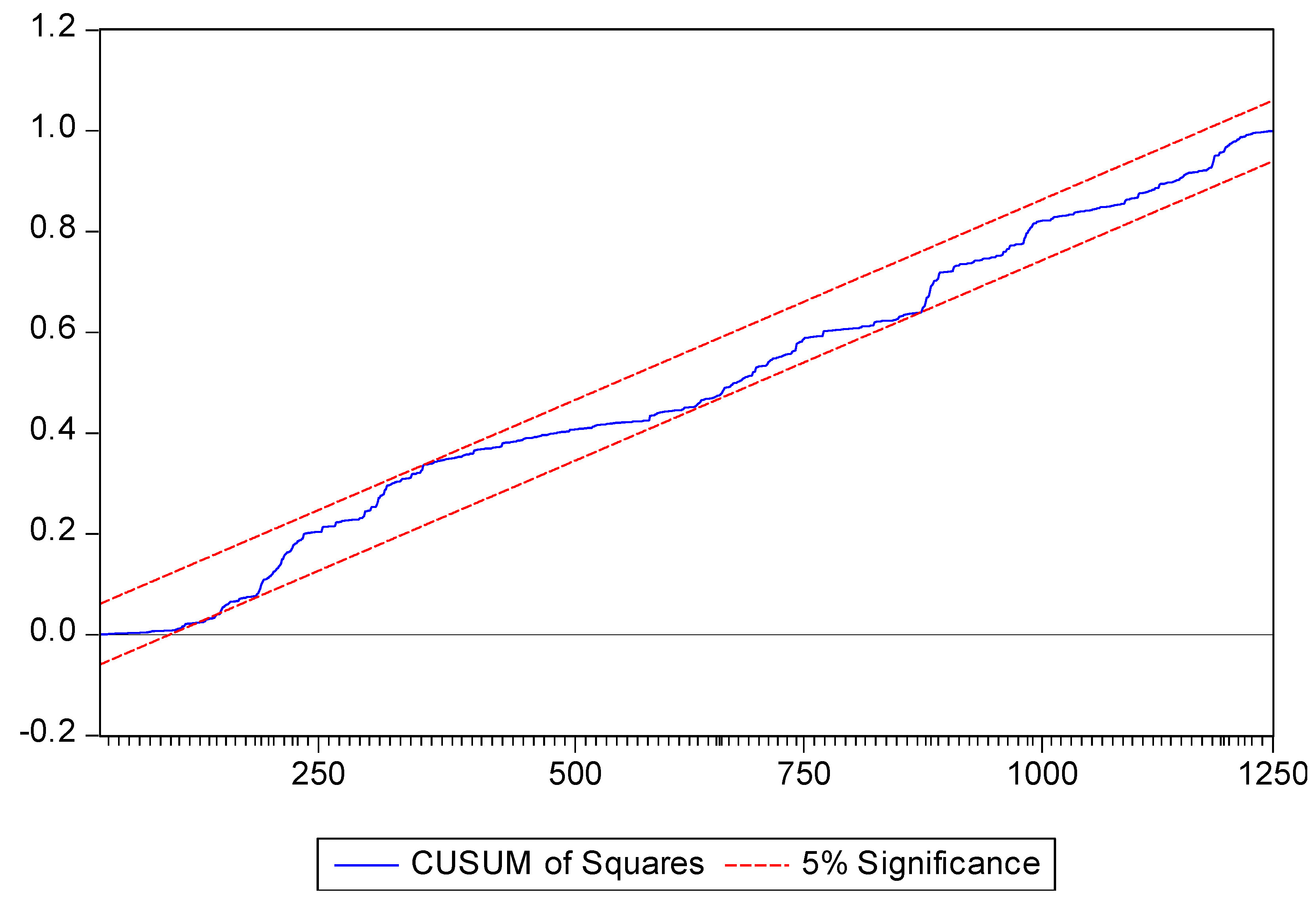

4.5. Structural Stability Tests

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A. Results of Diagnostic Tests

| Diagnostic Test | Statistics | p-Value | Conclusions |

| Autocorrelation (Breusch–Godfrey test) H0: No serial correlation | 1.22 | 0.294 | Fail to reject H0 |

| Heteroskedasticity (ARCH test) H0: No ARCH effects | 20.10 | 0.000 | Reject H0 |

References

- Ando, Ai, and William J. Scheela. 2005. The development of the stock market in Vietnam: An institutional perspective. Journal of Asian Business 21: 53–63. [Google Scholar]

- Antonakakis, Nicolaos, Christos Floros, and Renatas Kizys. 2016. Dynamic spillover effects in futures markets: UK and US evidence. International Review of Financial Analysis 48: 406–18. [Google Scholar] [CrossRef]

- Apostolakis, George N., Christos Floros, Konstantinos Gkillas, and Mark Wohar. 2021. Political uncertainty, COVID-19 pandemic and stock market volatility transmission. Journal of International Financial Markets, Institutions and Money 74: 101383. [Google Scholar] [CrossRef]

- Ausloos, Marcel, Yining Zhang, and Gurjeet Dhesi. 2020. Stock index futures trading impact on spot price volatility. The CSI 300 studied with a TGARCH model. Expert Systems with Applications 160: 113688. [Google Scholar] [CrossRef]

- Bae, SungC., Taek Ho Kwon, and Jong Won Park. 2004. Futures trading, spot market volatility, and market efficiency: The case of the Korean index futures markets. Journal of Futures Markets 24: 1195–228. [Google Scholar] [CrossRef]

- Bahmani-Oskooee, Mohsen, and Abera Gelan. 2018. Exchange-rate volatility and international trade performance: Evidence from 12 African countries. Economic Analysis and Policy 58: 14–21. [Google Scholar] [CrossRef]

- Bessembinder, Hendrik, and Paul J. Seguin. 1992. Futures trading activity and stock price volatility. The Journal of Finance 47: 2015–34. [Google Scholar] [CrossRef]

- Board, John, Gleb Sandmann, and Charles Sutcliffe. 2001. The effect of futures market volume on spot market volatility. Journal of Business Finance and Accounting 28: 799–820. [Google Scholar] [CrossRef]

- Bohl, Martin T., Jeanne Diesteldorf, and Pierre L. Siklos. 2015. The effect of index futures trading on volatility: Three markets for Chinese stocks. China Economic Review 34: 207–24. [Google Scholar] [CrossRef]

- Bohl, Martin T., Jeanne Diesteldorf, Christian A. Salm, and Bernd Wilfling. 2016. Spot market volatility and futures trading: The pitfalls of using a dummy variable approach. Journal of Futures Markets 36: 30–45. [Google Scholar] [CrossRef]

- Brown, Robert L., James Durbin, and James M. Evans. 1975. Techniques for testing the constancy of regression relationships over time. Journal of the Royal Statistical Society 37: 149–92. [Google Scholar] [CrossRef]

- Brown-Hruska, Sharon, and Gregory Kuserk. 1995. Volatility, volume and the notion of balance in the S&P 500 cash and futures markets. Journal of Futures Markets 15: 677–89. [Google Scholar] [CrossRef]

- Chen, Haiqiang, Qian Han, Yingxing Li, and Kai Wu. 2013. Does index futures trading reduce volatility in the Chinese stock market? A panel data evaluation approach. Journal of Futures Markets 33: 1167–90. [Google Scholar] [CrossRef]

- Darrat, Ali F., and Shafiqur Rahman. 1995. Has futures trading activity caused stock price volatility? Journal of Futures Markets 15: 537–57. [Google Scholar] [CrossRef]

- Dungore, Parizad Phiroze, and Sarosh Hosi Patel. 2021. Analysis of volatility volume and open interest for Nifty Index futures using GARCH analysis and VAR model. International Journal of Financial Studies 9: 7. [Google Scholar] [CrossRef]

- Edwards, Tim, and C. J. Lazzara. 2016. Realized volatility indices: Measuring market risk. In Research: S&P Dow Jones Indices. New York: McGraw Hill Financial. Available online: https://www.spglobal.com/spdji/en/documents/research/research-realized-volatility-indices-measuring-market-risk.pdf?force_download=true (accessed on 19 August 2022).

- Guan, Xueling, Min Zhou, and Ming Zhang. 2015. Using the ARDL-ECM approach to explore the nexus among urbanization, energy consumption, and economic growth in Jiangsu Province, China. Emerging Markets Finance and Trade 51: 391–99. [Google Scholar] [CrossRef]

- Gulen, Huseyin, and Stewart Mayhew. 2000. Stock index futures trading and volatility in international equity markets. Journal of Futures Markets 20: 661–85. [Google Scholar] [CrossRef]

- Günay, Samet, and Mahfuzul Haque. 2015. The effect of futures trading on spot market volatility: Evidence from Turkish Derivative Exchange. International Journal of Business and Emerging Markets 7: 265–85. [Google Scholar] [CrossRef]

- Hunegnaw, Fetene Bogale, and Soyoung Kim. 2017. Foreign exchange rate and trade balance dynamics in East African countries. The Journal of International Trade & Economic Development 26: 979–99. [Google Scholar] [CrossRef]

- Illueca, Manuel, and Juan Angel Lafuente. 2003. The effect of spot and futures trading on stock index volatility: A non-parametric approach. Journal of Futures Markets 23: 841–58. [Google Scholar] [CrossRef]

- Jain, Anshul, Pratap Chandra Biswal, and Sajal Ghosh. 2016. Volatility–volume causality across single stock spot–futures markets in India. Applied Economics 48: 3228–43. [Google Scholar] [CrossRef]

- Kao, Yu-Sheng, Hwei-Lin Chuang, and Yu-Cheng Ku. 2019. The empirical linkages among market returns, return volatility, and trading volume: Evidence from the S&P 500 VIX Futures. The North American Journal of Economics and Finance 54: 100871. [Google Scholar] [CrossRef]

- Nguyen, Anh Thi Kim, and Loc Dong Truong. 2020. The impact of index futures introduction on spot market returns and trading volume: Evidence from Ho Chi Minh Stock Exchange. Journal of Asian Finance, Economics and Business 7: 51–59. [Google Scholar] [CrossRef]

- Pesaran, M. Hashem, Yongcheol Shin, and Richard J. Smith. 2001. Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics 16: 289–326. [Google Scholar] [CrossRef]

- Pok, Wee Ching, and Sunil Poshakwale. 2004. The impact of the introduction of futures contracts on the spot market volatility: The case of Kuala Lumpur Stock Exchange. Applied Financial Economics 14: 143–54. [Google Scholar] [CrossRef]

- Rastogi, Shailesh, and Chaitaly Athaley. 2019. Volatility integration in spot, futures and options markets: A regulatory perspective. Journal of Risk and Financial Management 12: 98. [Google Scholar] [CrossRef]

- Rastogi, Shailesh, Vikas Tripathi, and Sunaina Kuknor. 2021. Informational role of futures volume for spot volatility. Pacific Accounting Review 34: 49–69. [Google Scholar] [CrossRef]

- Sharma, Arpita, and Shailesh Rastogi. 2020. Spot volatility prediction by futures and option: A Indian scenario. International Journal of Modern Agriculture 9: 263–68. [Google Scholar] [CrossRef]

- Smit, E. vd M., and H. Nienaber. 1997. Futures-trading activity and share price volatility in South Africa. Investment Analysts Journal 26: 51–59. [Google Scholar] [CrossRef]

- Truong, Loc Dong, Anh Thi Kim Nguyen, and Dut Van Vo. 2021. Index future trading and spot market volatility in frontier markets: Evidence from Ho Chi Minh Stock Exchange. Asia-Pacific Financial Markets 28: 353–66. [Google Scholar] [CrossRef]

- Truong, Loc Dong, Ha Hoang Ngoc Le, and Dut Van Vo. 2022. The asymmetric effects of exchange rate volatility on international trade in a transition economy: The case of Vietnam. Bulletin of Monetary Economics and Banking 25: 203–14. [Google Scholar] [CrossRef]

- Xie, Shiqing, and Jiajun Huang. 2014. The impact of index futures on spot market volatility in China. Emerging Markets Finance and Trade 50: 167–77. [Google Scholar] [CrossRef]

- Yiheyis, Zelealem, and Jacob Musila. 2018. The dynamics of inflation, exchange rates and the trade balance in a small economy: The case of Uganda. International Journal of Development Issues 17: 246–64. [Google Scholar] [CrossRef]

- Yilgor, Ayse Gul, and Claurinde Lidvine Charbelle Mebounou. 2016. The effect of futures contracts on the stock market volatility: An application on Istanbul stock exchange. Journal of Business, Economics and Finance 5: 307–17. [Google Scholar] [CrossRef]

| Data | Unit of Measurement | Data Source |

|---|---|---|

| VN30-Index | Points | The HOSE (https://www.hsx.vn (accessed on 25 September 2022)) |

| Trading volume of future contracts | Contracts |

| Variables | Obs. | Mean | Min. | Max. | Std. Dev. |

|---|---|---|---|---|---|

| Volatility of spot market returns (VOL) | 1249 | 0.00003 | 0.00001 | 0.00018 | 0.00003 |

| Daily index futures trading volume (FTV) (contracts) | 1250 | 128,571 | 487 | 505,677 | 81,603 |

| Variable | Constant without Trend | Constant with Trend |

|---|---|---|

| VOL | ||

| Level | −5.65 *** (0) | −5.65 *** (0) |

| FTV | ||

| Level | −4.61 *** (4) | −5.34 *** (4) |

| Model | k | F-Statistic | Significance Level | Critical Value | |

|---|---|---|---|---|---|

| Lower Bounds I(0) | Upper Bounds I(1) | ||||

| ARDL (1,4) | 1 | 18.86 *** | 10% | 4.04 | 4.78 |

| 5% | 4.94 | 5.73 | |||

| 1% | 6.84 | 7.84 | |||

| Variables | Coefficients | t-Statistics |

|---|---|---|

| 0.000010 | 5.67 *** | |

| 0.000003 | 1.77 * | |

| 0.000002 | 1.87 * | |

| 0.000003 | 2.76 *** | |

| ECM(−1) | −0.055417 | −3.29 *** |

| Variables | Coefficients | t-Statistics |

|---|---|---|

| Constant | 0.000118 | 2.12 ** |

| LNFTV | 0.000013 | 2.58 *** |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Truong, L.D.; Friday, H.S.; Nguyen, A.T.K. The Effects of Index Futures Trading Volume on Spot Market Volatility in a Frontier Market: Evidence from Ho Chi Minh Stock Exchange. Risks 2022, 10, 234. https://doi.org/10.3390/risks10120234

Truong LD, Friday HS, Nguyen ATK. The Effects of Index Futures Trading Volume on Spot Market Volatility in a Frontier Market: Evidence from Ho Chi Minh Stock Exchange. Risks. 2022; 10(12):234. https://doi.org/10.3390/risks10120234

Chicago/Turabian StyleTruong, Loc Dong, H. Swint Friday, and Anh Thi Kim Nguyen. 2022. "The Effects of Index Futures Trading Volume on Spot Market Volatility in a Frontier Market: Evidence from Ho Chi Minh Stock Exchange" Risks 10, no. 12: 234. https://doi.org/10.3390/risks10120234

APA StyleTruong, L. D., Friday, H. S., & Nguyen, A. T. K. (2022). The Effects of Index Futures Trading Volume on Spot Market Volatility in a Frontier Market: Evidence from Ho Chi Minh Stock Exchange. Risks, 10(12), 234. https://doi.org/10.3390/risks10120234