Abstract

This paper seeks to identify the most important global drivers of credit-to-GDP gaps for 35 countries. The analysis is performed on a country-by-country basis for the sub-periods 2000Q1:2007Q2, 2007Q3:2013Q4, and 2014Q1:2021Q1 and is based on two state-of-the-art methods for variable selection in the time series framework: the one covariate at a time multiple testing (OCMT) and adaptive least absolute shrinkage and selection operator (LASSO). We find that the number of salient global factors tends to increase over time, reaching its maximum during the post-crisis period. This period is also marked by a pronounced role of the global factors capturing the stance of the US monetary policy, while in the preceding sub-periods, the most significant factors are global credit conditions (the TED spread) and world industrial production, respectively. Regardless of the sub-periods, advanced economies’ credit-to-GDP gaps appear more dependent on the global factors than the gaps in emerging markets. In addition, we identify country-specific variables which shape the susceptibility of the national credit-to-GDP gaps to the global factors.

1. Introduction and Theoretical Background

Excessive credit growth has long been recognized as a salient factor of banking crises. A credit-to-GDP gap is a well-entrenched proxy of the extent to which credit growth is excessive (Borio and Lowe 2002; Drehmann and Tsatsaronis 2014). According to the definition of the gap proposed by the Basel Bank for International Settlements (BIS), this indicator measures the deviations of the credit-to-GDP ratio from its trend extracted by means of a one-sided Hodrick–Prescott (HP) filter. The credit-to-GDP gap performs a two-fold function. First, it assesses the magnitude of credit overhang in the economy and, second, triggers the implementation of countercyclical capital buffers to avert a banking crisis, which can arise from the excessive credit growth. Thus, this indicator is of paramount importance as an early warning indicator of banking crises and as a quantitative benchmark for macroprudential policy implementation. Against this backdrop, knowing what determines the dynamics of credit-to-GDP gaps would be helpful from the policymaking standpoint.

The dynamics of credit-to-GDP gaps can be driven by the factors which manifest themselves at the national, regional, and global levels. By default, national and regional factors underlying the gaps can be tackled more easily with a conventional policy toolkit encompassing monetary, fiscal, and macroprudential policies. However, the effects of global factors may be partly or fully beyond control at the national level. Moreover, a great number of global factors which potentially underlie the gaps have been proposed recently. These plausible determinants may overlap and confound with each other, thereby creating uncertainty for the policymakers responsible for safeguarding financial stability and seeking to track the most relevant indicators at the global level. Are there any global factor(s) which consistently outperform(s) the rest in determining the credit-to-GDP gaps? Are the global factor(s) which underpin national credit-to-GDP gaps time-varying? Do financial factors matter more than real ones? How important are composite factors building on a set of financial and real indicators? To our knowledge, these questions have not been addressed in the academic literature on credit-to-GDP gaps.

In this study, we aim to contribute to the literature by identifying the pivotal global determinants of the gaps provided by the BIS for 35 advanced and emerging market economies. Our analysis is carried out on the country-by-country basis for the period 2000–2021. In order to account for potential variation of the determinants over time, we perform the analysis for the following sub-periods: 2000Q1:2007Q2, 2007Q3:2013Q4, and 2014Q1:2021Q1, considering the global financial crisis and related European financial crisis as a threshold. We employ a novel methodological approach involving the use of state-of-the-art methods for variable selection in the time series framework: the one covariate at a time multiple testing (OCMT) by Chudik et al. (2018) and adaptive least absolute shrinkage and selection operator (LASSO). The techniques are used to select the most salient indicators out of 15 global factors and are particularly suited to the time series setting where the number of observations is small. Our taxonomy of the candidate factors includes five categories: (i) proxies of global credit conditions, (ii) indicators capturing the global financial cycle, (iii) measures underlying the global trade and commodity cycle, (iv) global systemic risk and financial stress indices, and (v) composite measures of global economic activity derived from various financial, real variables, and textual sources.

We document that the impact of global factors on the national credit-to-GDP gaps is heterogeneous across sub-periods and countries. Their relevance appears rather limited before and during the global financial crisis, while increasing in a notable manner in the post-crisis period. Namely, during the sub-period 2000Q1:2007Q2, only nine countries’ gaps in our sample are driven by at least one global factor. This number slightly increases during 2007Q3:2013Q4, totaling 12 countries. In the sub-period spanning 2014Q1:2021Q1, it already reaches 24 countries.

In the pre-crisis years, the TED spread, capturing global credit conditions, appears the most salient determinant of the gaps. World industrial production takes the lead during the crisis period. In the aftermath of the crisis, the most influential determinants are the US monetary policy proxied with the effective federal funds rate, US Fed Office of Financial Research worldwide financial stress index (Monin 2019), the index of risk aversion (Bekaert et al. 2022), as well as the index of global economic conditions (Baumeister et al. 2022). On the country level, the dynamics of the credit-to-GDP gap in Italy exhibits the highest sensitivity to global factors in the pre-crisis period. During the period encompassing the global and European financial crises, China appears the most susceptible to the global determinants. In the post-crisis years, the global factors exert the most pronounced influence on the dynamics of credit-to-GDP gaps in Japan, France, Spain, and Canada.

Overall, we uncover the importance of the variables related to the global financial cycle, though it is found mainly for the post-crisis period. This result withstands a robustness check based on Boruta, a generalized random forest algorithm, which ranks all the candidate global determinants of the gaps on the basis of their importance scores rather than by performing variable selection. It is also worth noting that in comparison with emerging market economies, advanced countries’ credit-to-GDP gaps appear more dependent on the global determinants, regardless of the sub-period.

Since the sample countries’ gaps are not uniformly exposed to the global determinants, we extend our baseline analysis by investigating which economic and institutional variables tend to predict the sensitivity of the national gaps to such global factors. To this end, we code the countries whose credit-to-GDP gaps are driven by the global factors with one and assign zero to the rest. On the basis of the adjacent literature on the drivers of cross-border capital flows, i.e., push and pull factors, credit cycles, and credit booms, e.g., Fratzscher (2012), Hannan (2018), Kang and Kim (2019), Koepke (2019), Wang and Yan (2022), Castro and Martins (2019), and Nguyen et al. (2020), as well as our heuristic considerations, we compile a dataset of 18 potential predictors of such sensitivity, which account for macroeconomic conditions, various dimensions of financial development, institutional quality, as well as economic openness. In order to avoid endogeneity concerns, these predictors are averaged across the time spans preceding our sub-periods, e.g., we take the averages for 1993–1999 to assess the sensitivity of the gaps to the global factors during 2000Q1:2007Q2. Then, for each of the sub-periods, we run Bayesian logit regressions to distil the most robust predictors of the gaps’ sensitivity to the global determinants. Across the sub-periods, we find that higher inflation in 1993–1999 and 2007–2013 dampens the sensitivity in the pre- and post-crisis years, respectively, while an elevated GDP per capita growth in 2000–2007 makes the countries’ gaps more susceptible to the global factors during the global financial crisis. A higher level of democracy, proxied with the well-known POLITY variable and observed in 1993–1999 and 2000–2007, respectively, consolidates the impact of global factors before and during the crisis. A higher aggregate quality of institutions embedded in the first principal component from the World Bank governance indicators and observed in 1993–1999 and 2007–2013 produces the opposite effect, which holds before and in the aftermath of the crisis.

Our empirical findings are useful for the conduct of macroprudential policy in the sample countries, as they reveal which global factors matter for the dynamics of credit-to-GDP gaps. From the operational standpoint, the identification of such factors can contribute to creating more efficient early warning systems (EWS) of indicators aimed at averting banking crises. The time-varying effects of global factors on the gaps suggest that the usefulness of such indicators within the EWS needs constant scrutiny. In addition, by underscoring certain country-specific variables which shape the sensitivity of national credit-to-GDP gaps to the global factors, we inform policymakers how to mitigate the dependence of national credit growth on such factors. For example, our estimations suggest that improving the quality of institutions should be one of such policy options. In the research context, our results enrich the closely related literature on cross-border capital flows, credit booms, and credit cycles by highlighting the variables which may improve the empirical models seeking to explain these phenomena but which have received insufficient attention, e.g., the index of risk aversion by Bekaert et al. (2022).

2. Data

Our dependent variables are national credit-to-GDP gaps provided by the BIS. They are computed on a quarterly basis, representing the deviations of the credit-to-GDP ratio from its trend extracted by means of a one-sided Hodrick–Prescott (HP) filter with a large smoothing parameter. Despite certain methodological drawbacks associated with these measures, the gaps perform well in various empirical horse races, thereby largely retaining their superiority over alternative indicators of excessive credit. This conclusion holds for large country panels (Drehmann and Yetman 2021) and for standalone economies, e.g., the UK (Giese et al. 2014) and Switzerland (Jokipii et al. 2021). In this study, we compile a sample of 35 national credit-to-GDP gaps from 2000Q1 to 2021Q1, containing no missing values in the series (Table 1). In order to account for potentially time-varying effects of the global determinants on the gaps, the entire observation period is divided into three sub-periods, 2000Q1:2007Q2, 2007Q3:2013Q4, and 2014Q1:2021Q1. Such splitting is largely motivated by the assumption that the global financial crisis as well as the European financial crisis could significantly alter the set of global factors affecting national credit-to-GDP gaps.

Table 1.

List of countries.

The candidate global factors are grouped into five categories. The first sub-group encompasses the indicators gauging global credit conditions, namely the TED spread (TED), US yield curve (YIELD), and excess bond premium (GZ) proposed by Gilchrist and Zakrajšek (2012). The TED spread, the differential between short-term interbank lending rates and risk-free US Treasuries, reflects the level of counterparty default risk in the interbank lending market. An increase in the TED spread indicates a surge in the default risk of banks. The US yield curve is calculated as the difference between interest rates on 10-year US treasury bonds and 3-month US Treasuries and is often included into the systems of early warning indicators (EWS) of financial crises. Finally, excess bond premium represents a measure of investors’ risk appetite in the corporate bond market and exhibits considerable predictive power for future economic downturns.

The second sub-group consists of the indicators related to the global financial cycle. We include the VIX and VSTOXX indices into this group to account for volatility in the major stock markets, a set of variables capturing the stance of the US monetary policy, i.e., effective federal funds rate (EFF_FED), shadow rate (SH_RATE) introduced by Wu and Xia (2016), US monetary policy shocks (BRW) computed by Bu et al. (2021), and the indicator of risk aversion (RA) proposed by Bekaert et al. (2022). As shown by Miranda-Agrippino and Rey (2020), the above-mentioned indicators of the US monetary policy stance determine strong co-movements in the global financial variables, shaping the global financial cycle (GFC). We exclusively focus on the proxies of the US monetary policy, given its superior effects on international financial markets compared with other central banks engaged in unconventional monetary policy (Brusa et al. 2020).

The third sub-group includes two variables, oil price and world industrial production index (WIP) computed by Baumeister and Hamilton (2019), which capture the global trade and commodities cycle.

The worldwide conditional capital shortfall (SRISK) introduced by Brownlees and Engle (2017) and US Fed Office of Financial Research worldwide financial stress index (Monin 2019) constitute the fourth sub-group, indicating the level of systemic stress in financial markets.

Finally, the fifth sub-group covers two composite indicators of global economic activity derived from multiple real and financial inputs or measuring economic sentiment. The first of these is the composite indicator of global economic conditions (GEKON), building on 16 real and financial sector variables (Baumeister et al. 2022). The second indicator, the global economic policy uncertainty (GEPU) index, is a GDP-weighted average of 21 national EPU indices which measure the proportion of own-country newspaper articles discussing economic policy uncertainty (Baker et al. 2016).

All the candidate global factors are first-differenced series to ensure stationarity, which is a prerequisite for the correct implementation of the variable selection techniques in our study. Table A1 in the Appendix A introduces the sources of the data, and Table A2 and Table A3 contain descriptive statistics for the credit-to-GDP gaps and candidate global factors, respectively.

3. Methodology

In our variable selection exercise, we exploit two state-of-the-art methods for variable selection in the time series framework: the one covariate at a time multiple testing (OCMT) by Chudik et al. (2018) and adaptive least absolute shrinkage and selection operator (LASSO). Unlike, for example, the Bayesian model averaging (BMA), which is a primary option for cross-sectional data but usually does not apply to time series, these two techniques are well-suited to time series data.

The OCMT represents a multi-step process of variable selection. It is often regarded as an alternative to penalized regression, outperforming the latter in computational speed, ease of interpretation, and yielding better results for smaller samples.

Suppose there is a target variable and a subset of possible predictors . In the OCMT, a data-generating process can be represented in the following form:

where is a target variable; is the vector of pre-selected variables, which can be deterministic variables (constants, trends, and indicator variables), stochastic variables (lags of and common factors), or some variables whose relevance is supported by theoretical assumptions; is the set of k unknown signal variables, ; is an error term; and is the number of observations.

The multi-step selection process in the OCMT is performed as follows. First, it estimates statistical significance of each independent variable through an OLS regression of on a full set of predictors and selects those whose t-statistics exceed the threshold:

where is a standard normal distribution function, for and (positive constants), and is called a critical value exponent. The variables selected in the first step are included in the model as k true signals.

In the second step, the OCMT uses specification identified on the previous step and tests statistical significance of other variables which have not been selected before. The algorithm continues until no variable from the set is found to be statistically significant. Thus, the algorithm relates all the variables to one of three categories: k signals, which collectively generate ; pseudo-signals, which are correlated with signal variables but are not included in the data generating model; or ( noise variables, which are not correlated with signals.

The alternative method used for variable selection in our research is adaptive LASSO. A standard LASSO approach (Zou 2006) imposes the same penalty on all regression coefficients, which may overpenalize some important coefficients and lead to biased estimators. Adaptive LASSO extends the conventional approach by applying adaptive weights for penalizing different coefficients in a loss function:

where are adaptive weights, which are usually set to , where are consistent estimators to , e.g., OLS-estimators or maximum likelihood estimators . When for every i, this leads to a general LASSO penalty. is a tuning parameter for the penalty term and is chosen by minimizing BIC criterion.

In our particular case, a general specification to which we apply the OCMT and adaptive LASSO algorithms is represented as follows:

where stands for credit-to-GDP gap, is the first lag of credit-to-GDP gap, is the set of 15 global factors, and is an error term.

4. Results and Discussion

4.1. Determinants of Credit-to-GDP Gaps Based on the OCMT and Adaptive LASSO

The heatmaps below (Table 2, Table 3 and Table 4) graphically summarize our results. They indicate that the factors determining credit-to-GDP gap dynamics selected by the OCMT and adaptive LASSO differ across the sample countries. They are also unevenly distributed across the sub-periods. Most significant factors relate to the post-crisis period, whereas before and during the crisis, their number is rather limited. During the sub-period 2000Q1:2007Q2, there are 9 countries whose credit-to-GDP gap dynamics is affected by at least one of the candidate global factors excluding its own lag, with this number reaching 12 and 24 during 2007Q3:2013Q4 and 2014Q1:2021Q1, respectively. Thus, it appears that over time, global determinants of credit-to-GDP gaps in the sample countries become more potent.

Table 2.

Global determinants of credit-to-GDP gaps in 2000Q1:2007Q3.

Table 3.

Global determinants of credit-to-GDP gaps in 2007Q4:2013Q12.

Table 4.

Global determinants of credit-to-GDP gaps in 2014Q1:2021Q1.

Before the global financial crisis, the TED spread appears the most salient factor explaining the dynamics of credit-to-GDP gap. It exerts a negative impact on the gaps in Italy and Sweden. Hence, the tightening of global credit conditions in 2000Q1:2007Q2 involves a squeeze in credit-to-GDP gaps, thereby decreasing the odds of a credit boom in the above-mentioned countries. During the crisis period, the most influential variable is the WIP, negatively influencing the gaps in Canada, China, and Germany. This finding is likely to capture the intensity of deleveraging in these economies, i.e., the decline (rise) in private credit occurs faster (slower) than the deceleration (acceleration) in real economic activity. In the aftermath of the global financial crisis, the set of salient global determinants becomes more diverse, now encompassing the US monetary policy proxied with the effective federal funds rate, US Fed Office of Financial Research worldwide financial stress index (Monin 2019), the index of risk aversion (Bekaert et al. 2022), as well as the index of global economic conditions (Baumeister et al. 2022). The OFR FSI, the index of risk aversion, and the GEKON index enhance credit-to-GDP gaps. Meanwhile, the tightening of the US monetary policy produces the opposite effect. Overall, the results for the post-crisis period emphasize the increased significance of financial variables, including those related to the global financial cycle, i.e., the effective federal funds rate and the index of risk aversion. These findings are consistent with other studies which uncover the increasing impact of the US monetary policy on global credit in the aftermath of the global financial crisis, e.g., Avdjiev et al. (2020). Our conclusions are also in line with Amiti et al. (2019), who argue that the effect of global factors on credit is time varying, gaining prominence in the non-crisis years but turning less important compared with the idiosyncratic determinants affecting demand for credit and its supply during the periods of financial stress.

The countries whose credit-to-GDP gaps are impacted by the global factors in the post-crisis period include both advanced economies, e.g., the USA, Canada, the UK, Spain, Portugal, France, and emerging markets, e.g., China, South Africa, Greece, Chile, Thailand, and Malaysia. However, Japan, France, Spain, and Canada are the most susceptible of these. Taking stock of all the three sub-periods, the list of the countries exhibiting the highest proneness to the global factors comprises Italy, China, Japan, France, Spain, and Canada. The dominance of advanced economies in the list is in accordance with the literature. These countries tend to perform central roles in the networks of cross-border bank claims, being significant global lenders and/or borrowers. Namely, Cerutti et al. (2020) provide such evidence for China, while Atyabi et al. (2020) also includes Japan and France in the cohort of top drivers of the global banking network. Spain and Italy are still recognized as top lenders/borrowers, though their positions in the global banking network have not consolidated after the global financial crisis (Cerutti and Zhou 2017). Cerutti and Zhou (2017) also consider Canada an emerging central node in the global banking network, whose importance is on the rise in the aftermath of the global financial crisis. Hence, for these central countries, incoming and outgoing capital flows affect the dynamics of domestic credit in a presumably rather strong manner. Since credit flow is a component of the global financial cycle, changes in the proxies of the latter may be particularly salient for the dynamics of domestic credit in the above-mentioned countries. Barrot and Servén (2018) as well as Lafuerza and Servén (2019) confirm our conjecture by providing empirical evidence that high-income countries are more exposed to the global factors shaping capital flows, including credit ones, than emerging market economies and developing countries. A similar conclusion is derived from the literature comparing the relevance of push (global) and pull (domestic) factors for capital flows, e.g., Fratzscher (2012) and Shirota (2015).

Our analysis also reveals that across the sub-periods, volatility indicators (VIX and VSTOXX), credit spreads (GZ and YIELD), US monetary policy shocks (BRW), global economic policy uncertainty (GEPU), financial systemic risk (SRISK), and oil prices (OIL) are of minor importance in predicting credit-to-GDP gaps. These global factors lead the gaps in not more than three countries in each of the sub-periods. The findings suggest that despite the increased importance of the global financial cycle for the gaps, not all of its proxies are equally informative. For example, it is worth noting that the VIX index, widely acknowledged as a fear gauge, appears less important than the index of risk aversion by Bekaert et al. (2022), especially in the post-crisis period. Our result regarding the limited impact of the VIX index on credit-to-GDP gaps is consistent with the studies uncovering a decline in the VIX index importance for financial markets, which becomes more pronounced in the post-Brexit period, e.g., Tsuji (2016), Zhu et al. (2019), and Lu et al. (2022).

Overall, we inform policymakers in the sample countries which global factors are particularly relevant to model credit-to-GDP gaps before, during, and after the global financial crisis. The identification of such factors allows for the fine-tuning of early warning systems (EWS) of indicators aimed at averting banking crises. The time-varying impact of the global factors on the gaps emphasizes the need to examine the performance of such indicators within the EWS on a regular basis and after major financial shocks, in particular.

4.2. Drivers Shaping the Impact of Global Factors on National Credit-to-GDP Gaps

We further investigate the differential sensitivity of countries’ credit-to-GDP gaps to the global factors. In this extension to the baseline analysis, our dependent variable is binary, taking the value of one in cases where the credit-to-GDP is affected by a global factor and zero otherwise. On the basis of the adjacent literature on the drivers of cross-border banking flows, credit cycles, and credit booms, e.g., Fratzscher (2012), Hannan (2018), Kang and Kim (2019), Koepke (2019), Wang and Yan (2022), Castro and Martins (2019), and Nguyen et al. (2020), as well as our heuristic considerations, we put forth a set of 18 explanatory variables, characterizing different aspects of the economies in our sample. In order to avoid endogeneity, the explanatory variables are the averages for the time spans commensurate in length but preceding our sub-periods. For example, we exploit the averages for the period 1993–1999 to assess the sensitivity of the credit-to-GDP gaps to the global factors during 2000Q1:2007Q2. The explanatory variables are divided into four sub-categories and described in Table 5. Given the large number of potential predictors vs. the number of observations in each of the sub-periods, we estimate Bayesian logit models to identify the variables shaping the sensitivity of national credit-to-GDP gaps to the global factors.

Table 5.

Predictors for Bayesian logit model.

Table 6.

Results for the Bayesian logit model for 2000Q1:2007Q3.

Table 7.

Results for the Bayesian logit model for 2007Q3:2013Q4.

Table 8.

Results for the Bayesian logit model for 2014Q1:2021Q1.

We document that higher inflation in 1993–1999 and 2007–2013 decreases the sensitivity of the countries’ gaps to the global factors in the pre- and post-crisis years, respectively1. Conversely, a higher level of bank concentration in 1993–1999 and higher rates of GDP per capita growth in 2000–2007 increase the susceptibility of the sample countries’ gaps to the global factors before and during the global financial crisis, respectively. A higher level of democracy proxied with the POLITY variable and observed in 1993–1999 and 2000–2007 also strengthens the impact of the global factors before and during the crisis. A higher aggregate quality of institutions embedded in the first principal component from the World Bank governance indicators and observed in 1993–1999 and 2007–2013 exerts the opposite effect, which holds before and in the aftermath of the crisis. Since some country-specific factors appear to influence the magnitude of the impact by the global ones, domestic policy measures can be adopted to mitigate their effect. For instance, this can be accomplished by improving the quality of institutions. As shown in Table 6 and Table 8, such a measure appears effective, at least in financially tranquil periods.

5. Robustness Check

To examine the robustness of our baseline results, we apply an alternative methodology, ranking all the global determinants of credit-to-GDP gaps on the basis of their importance scores rather than by identifying only significant factors and dismissing the rest. Such an approach can be regarded as an alternative to the variable selection techniques we use in the baseline analysis. The most widespread method generating variable importance rankings is the random forest. However, the importance scores may vary with each new run of this technique. In order to generate stable rankings, we adopt a generalized random forest algorithm the Boruta algorithm.

The Boruta algorithm performs an iterative top-down search of relevant predictors comparing original variables’ importance with that of latent factors derived by shuffling the original ones. The variables whose importance is significantly lower than that of the latent ones are excluded by the algorithm. These latent factors are re-generated under each iteration of the algorithm. It stops when only confirmed, statistically significant attributes remain or when it reaches the maximum of iterations specified by the user.

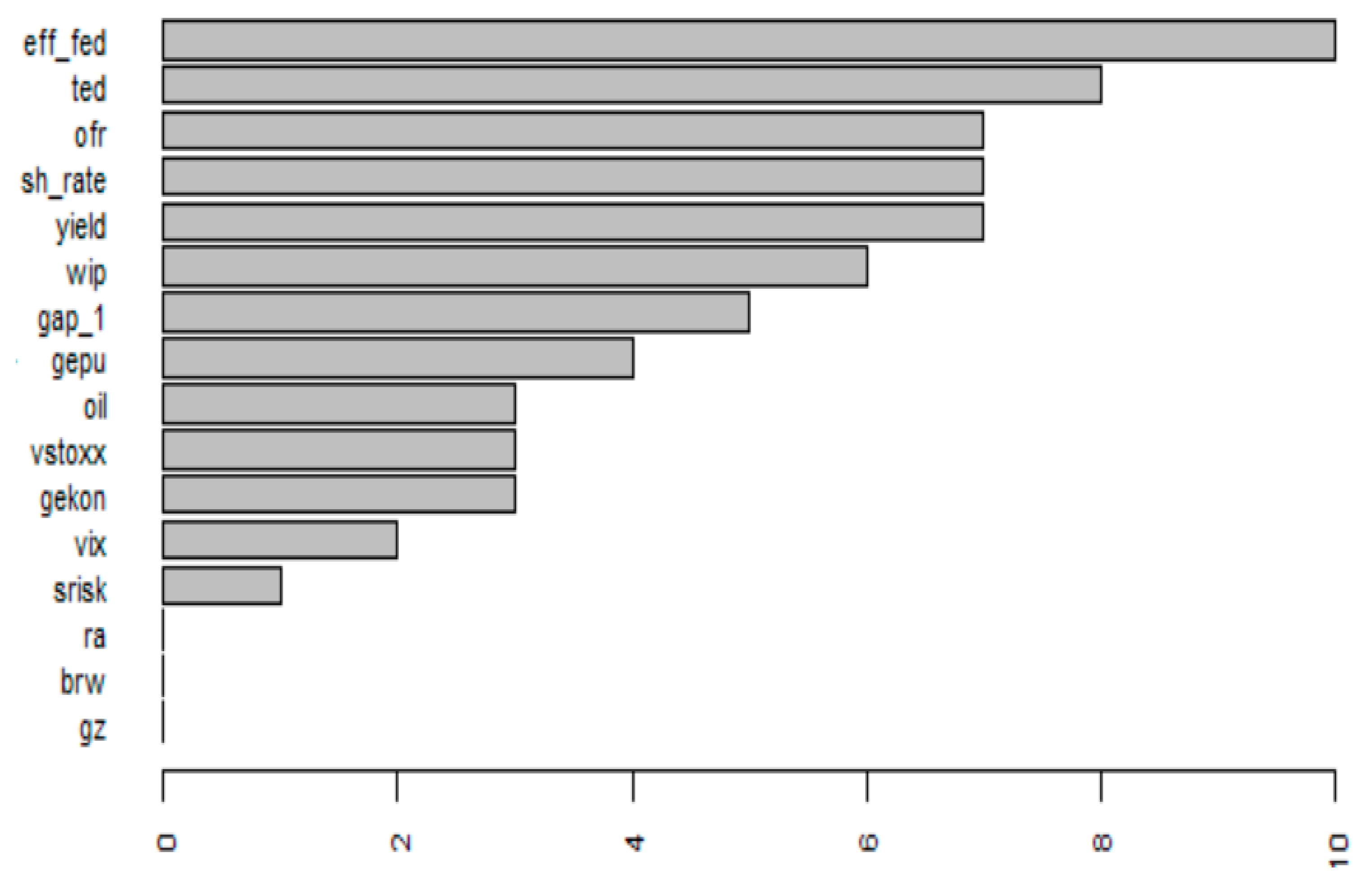

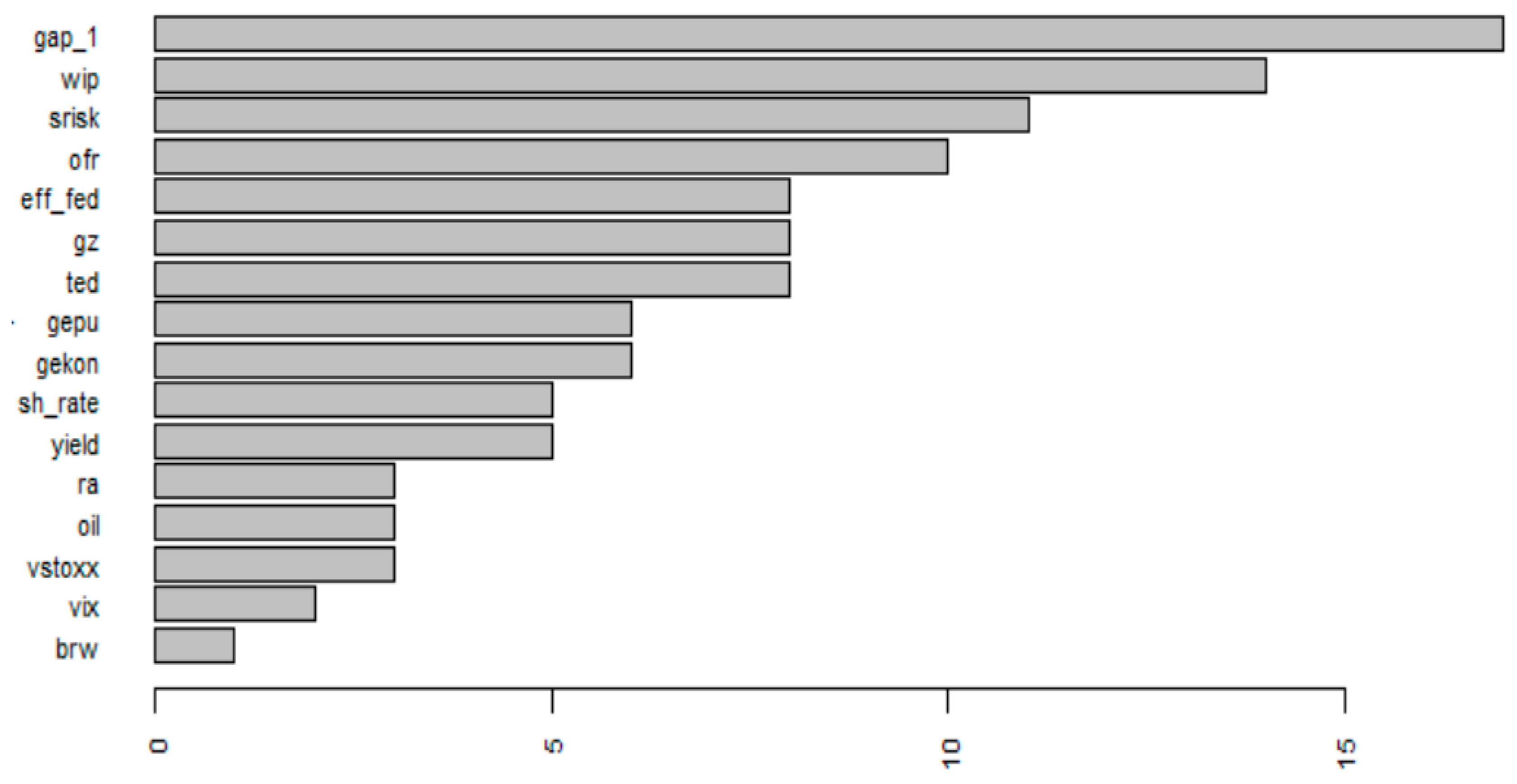

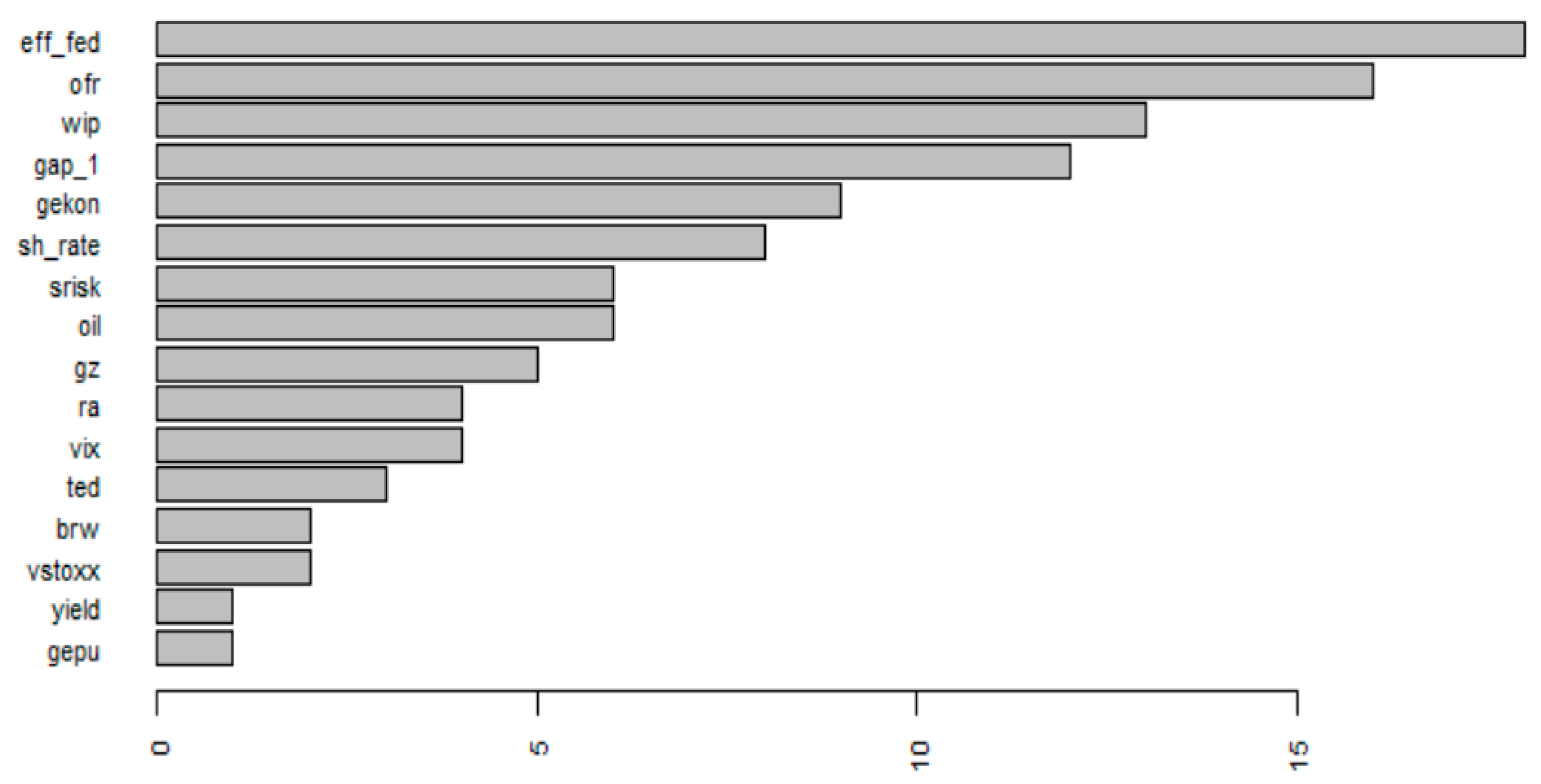

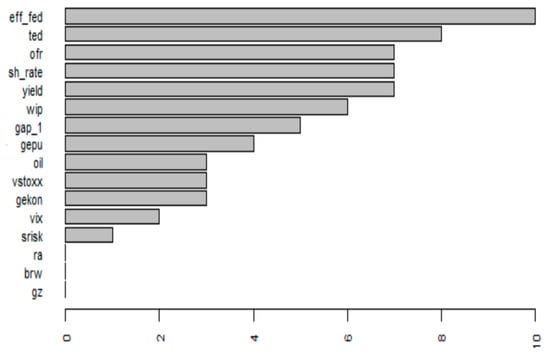

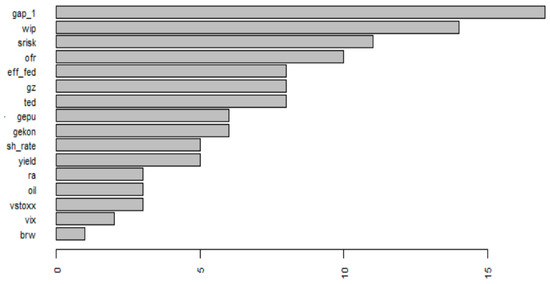

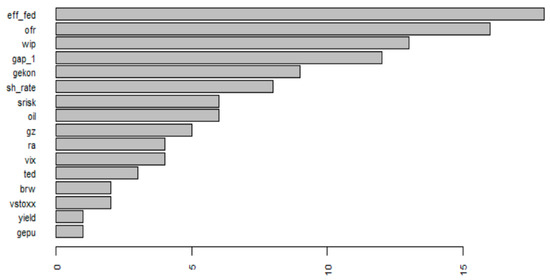

In our robustness check, we compute an average importance rank for each candidate global determinant across all the sample countries. The calculations are drawn for each sub-period. The results of the Boruta algorithm are represented below (Figure 1, Figure 2 and Figure 3).

Figure 1.

Variable importance ranking for 2000Q1:2007Q3.

Figure 2.

Variable importance ranking for 2007Q3:2013Q4.

Figure 3.

Variable importance ranking for 2014Q1:2021Q1.

These results are largely consistent with the results obtained by means of the OCMT and adaptive LASSO techniques. Namely, we confirm that during the crisis period, WIP appears the most potent in predicting national credit-to-GDP gaps. In the aftermath of the crisis, we observe the increased importance of the US effective federal funds rate, Office of Financial Research Financial Stress Index, and the GEKON index. Although the Boruta algorithm indicates that the US effective federal funds rate plays the primary role for the period 2000Q1:2007Q3, the TED spread, identified as the most salient determinant in our baseline estimation, is among the most influential factors.

6. Conclusions

This paper aims to find the most influential global factors driving national credit-to-GDP gaps provided by the BIS in 35 advanced and emerging market economies before, during, and in the aftermath of the global financial crisis. As potential regressors, we use a set of 15 candidate global factors, capturing credit conditions, financial cycle, trade and commodity cycle, financial stress, and worldwide economic conditions.

In order to conduct a search of the most impactful factors, we apply two state-of-the-art variable selection methods, namely, the one covariate at a time multiple testing (OCMT), and adaptive least absolute shrinkage and selection operator (LASSO).

The most salient factors for national credit-to-GDP gaps are heterogeneous across the sub-periods and countries. Before the crisis, the TED spread appears to be the major global determinant for the future path of national gaps. During the global crisis, the WIP becomes the most influential variable, while after the crisis, the number of factors underlying credit-to-GDP gap dynamics substantially increases. Of these factors, the US monetary policy proxied with the effective federal funds rate, US Fed Office of Financial Research worldwide financial stress index, the index of risk aversion, as well as the index of global economic conditions drive the gaps in most of the countries. The OFR FSI, the index of risk aversion, and the GEKON index enhance credit-to-GDP gaps. Meanwhile, the tightening of the US monetary policy produces the opposite effect. Overall, the results for the post-crisis period make a case for the increased significance of financial variables, including those related to the global financial cycle.

We extend our analysis by attempting to explain why some countries appear sensitive to the global factors while others are largely cushioned from their impact. Considering the dependence on the global factors as a binary dependent variable, we estimate a Bayesian logit model with a set of 18 explanatory variables which capture macroeconomic and institutional environment, trade, and financial openness as well as financial development in our sample countries. Before and after the global financial crisis, inflation and the quality of governance dampen the impact of global factors on national gaps. Meanwhile, during the crisis, GDP per capita growth and the level of democracy strengthen the sensitivity of the gaps to global factors. In the pre-crisis years, the level of democracy and concentration in the banking sector make the gaps more prone to global factors.

Overall, the analysis sheds more light on the selection of the most important global determinants to forecast the dynamics of national credit-to-GDP gaps and, thus, can contribute to elaborating more accurate early warning systems (EWS) of indicators aimed at averting banking crises. Thus, from the policymaking perspective, our analysis can help fine tune the implementation of macroprudential policy. This can be accomplished through better forecasts of credit-to-GDP gaps and, therefore, more precise and timely calibration of macroprudential measures. Second, since our study also reveals the factors which shape the dependence on the global factors, it can help policy-makers elaborate specific policies to mitigate the degree of such dependence. From the academic point of view, our results add to the literature on credit-to-GDP gaps as well as to the adjacent literature on cross-border capital flows, credit booms, and credit cycles.

Our analysis has objective limitations, as over time, new global factors potentially leading credit-to-GDP gaps are certain to appear. For instance, Ahir et al. (2022) have recently proposed the World Uncertainty Index, which aims to encapsulate various dimensions of uncertainty (economic, political, environmental, etc.) in a single indicator. With the spread of big data, similar composite indices will emerge. Including them in the list of potential drivers of credit-to-GDP gaps looks to be a promising avenue for future research.

Author Contributions

Conceptualization, M.S. (Mikhail Stolbov); methodology, M.S. (Maria Shchepeleva); writing, M.S. (Mikhail Stolbov) and M.S. (Maria Shchepeleva). All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

List of variables.

Table A1.

List of variables.

| Short Name | Full Name | Description | Source | URL |

|---|---|---|---|---|

| GAP | Credit-to-GDP gap | Deviation of the credit-to-GDP ratio from a one-sided HP-filtered trend | BIS | https://www.bis.org/statistics/c_gaps.htm (accessed on 28 October 2022) |

| Global Credit Conditions | ||||

| TED | TED spread | Spread between 3-month LIBOR and Treasury bills | Federal Reserve Economic Data, FRED, St. Louis Fed | https://fred.stlouisfed.org/series/TEDRATE (accessed on 28 October 2022) |

| GZ | Excess bond premium | Measures investors’ sentiment in the corporate bond market | Gilchrist and Zakrajšek (2012) | https://www.aeaweb.org/articles?id=10.1257/aer.102.4.1692 (accessed on 28 October 2022) |

| YIELD | US yield curve | 10-Year Treasury Constant Maturity minus 3-Month Treasury Constant Maturity | Federal Reserve Economic Data, FRED, St. Louis Fed | https://fred.stlouisfed.org/series/T10Y3M (accessed on 28 October 2022) |

| Global Financial Cycle | ||||

| VIX | Chicago Board of Options Exchange volatility index | Measures market expectation of near-term volatility conveyed by stock index option prices | Federal Reserve Economic Data, FRED, St. Louis Fed | https://fred.stlouisfed.org/series/VIXCLS (accessed on 28 October 2022) |

| VSTOXX | EURO STOXX 50 Volatility Index | Measures the 30-day implied volatility of the EURO STOXX 50 | MarketWatch | Download V2TX Data, EURO STOXX 50 Volatility (VSTOXX) Index EUR Price Data, MarketWatch (accessed on 28 October 2022) |

| EFF_FED | Effective Fed Funds rate | Calculated as the effective median interest rate of overnight fed funds transactions during the previous business day | Federal Reserve Economic Data, FRED, St. Louis Fed | https://fred.stlouisfed.org/series/TEDRATE (accessed on 28 October 2022) |

| SH_RATE | Shadow Federal Funds Rate | Captures effects from unconventional monetary policy | Wu and Xia (2016) | Wu-Xia Shadow Federal Funds Rate—Federal Reserve Bank of Atlanta (atlantafed.org) (accessed on 28 October 2022) |

| BRW | US monetary policy shock series | Unified measure for the US FED monetary policy shocks | Bu et al. (2021) | https://www.federalreserve.gov/econres/feds/a-unified-measure-of-fed-monetray-policy-shocks.htm (accessed on 28 October 2022) |

| RA | Index of risk aversion | Measures changes in consumer confidence, building on a number of observable financial asset prices | Bekaert et al. (2022) | https://www.nancyxu.net/risk-aversion-index (accessed on 28 October 2022) |

| Global Trade and Commodities Cycle | ||||

| OIL | Oil price | Prices for WTI crude oil | Federal Reserve Economic Data, FRED, St. Louis Fed | https://fred.stlouisfed.org/series/DCOILWTICO (accessed on 28 October 2022) |

| WIP | World Industrial Production Index | A proxy for world real economic activity | Baumeister and Hamilton (2019) | https://sites.google.com/site/cjsbaumeister/research (accessed on 28 October 2022) |

| Global Systemic Risk and Financial Stress Indices | ||||

| OFR | Office of Financial Research Financial Stress Index | A daily market-based index, reflecting the level of stress in global financial markets | Office of Financial Research | https://www.financialresearch.gov/financial-stress-index/ (accessed on 28 October 2022) |

| SRISK | SRISK Index | SRISK measures the capital shortfall of a firm conditional on a severe market decline | Brownlees and Engle (2017) | https://vlab.stern.nyu.edu/srisk (accessed on 28 October 2022) |

| Composite Measures of global economic activity | ||||

| GEKON | Global Economic Conditions Indicator | Measures global economic activity using a diverse range of variables tied to future energy demand | Baumeister et al. (2022) | https://sites.google.com/site/cjsbaumeister/research (accessed on 28 October 2022) |

| GEPU | Global economic policy uncertainty index | Weighted average of national economic policy uncertainty indices for 21 countries | Baker et al. (2016) | https://www.policyuncertainty.com/research.html (accessed on 28 October 2022) |

Table A2.

Descriptive statistics for national credit-to-GDP gaps.

Table A2.

Descriptive statistics for national credit-to-GDP gaps.

| Mean | Median | Maximum | Minimum | Std. Dev. | Skewness | Kurtosis | |

|---|---|---|---|---|---|---|---|

| 2000Q1:2007Q3 | |||||||

| ARG | 0.00 | 0.03 | 16.62 | −36.33 | 8.46 | −2.48 | 13.99 |

| AUS | −0.15 | 0.02 | 3.46 | −6.52 | 1.99 | −0.91 | 5.03 |

| AUSTR | 0.11 | 0.02 | 4.34 | −4.14 | 2.38 | 0.13 | 1.91 |

| BELG | 0.03 | −0.16 | 3.95 | −2.89 | 1.42 | 0.63 | 4.23 |

| CAN | 0.09 | −0.12 | 5.06 | −5.59 | 3.07 | −0.12 | 1.95 |

| CHILE | 0.09 | 0.16 | 8.23 | −11.28 | 3.84 | −0.65 | 4.71 |

| CHIN | −0.08 | −0.20 | 14.75 | −12.63 | 5.33 | 0.18 | 4.22 |

| DEN | −0.01 | 0.11 | 7.08 | −6.29 | 3.29 | 0.27 | 2.51 |

| FIN | −0.20 | 0.15 | 10.01 | −11.86 | 3.91 | −0.41 | 5.35 |

| FRA | −0.07 | −0.22 | 2.49 | −2.99 | 1.33 | −0.13 | 2.46 |

| GER | 0.01 | −0.19 | 6.39 | −5.66 | 2.00 | 0.45 | 6.70 |

| HK | −0.01 | 0.78 | 7.15 | −8.81 | 4.13 | −0.43 | 2.47 |

| GREE | 0.02 | 0.14 | 3.64 | −5.10 | 1.77 | −0.50 | 4.05 |

| HUNG | 0.10 | −0.07 | 6.11 | −6.45 | 3.06 | −0.01 | 2.62 |

| IND | 0.05 | 0.73 | 4.62 | −8.11 | 3.13 | −0.71 | 3.27 |

| INDON | 0.04 | −0.05 | 3.99 | −4.05 | 1.95 | −0.06 | 2.92 |

| IRE | 0.19 | −0.67 | 9.49 | −11.90 | 5.30 | −0.07 | 2.46 |

| ITA | −0.02 | 0.07 | 2.58 | −3.01 | 1.39 | −0.31 | 2.45 |

| JAP | 0.01 | −0.52 | 4.56 | −3.86 | 2.07 | 0.31 | 2.66 |

| KOR | −0.03 | −0.27 | 3.40 | −3.01 | 1.63 | 0.19 | 2.59 |

| MALAY | 0.12 | 0.08 | 5.03 | −3.46 | 2.31 | 0.36 | 2.16 |

| MEX | 0.06 | 0.12 | 1.55 | −0.99 | 0.66 | 0.47 | 2.55 |

| NETHER | −0.04 | 0.24 | 6.83 | −11.37 | 3.82 | −0.76 | 4.11 |

| NORW | −0.22 | −1.12 | 11.62 | −11.69 | 4.86 | 0.23 | 3.42 |

| NZ | 0.00 | −0.17 | 9.26 | −8.07 | 3.57 | 0.30 | 4.13 |

| PORT | −0.02 | 0.07 | 4.14 | −4.91 | 2.47 | −0.17 | 2.48 |

| SA | 0.01 | 0.47 | 5.01 | −6.27 | 2.21 | −0.59 | 4.38 |

| SINGA | −0.14 | 0.46 | 11.99 | −11.96 | 4.78 | −0.53 | 4.72 |

| SP | −0.09 | −0.56 | 5.25 | −6.64 | 2.89 | −0.09 | 2.42 |

| SW | 0.07 | −0.02 | 5.19 | −6.44 | 2.63 | 0.03 | 3.08 |

| SWE | −0.03 | 0.64 | 4.03 | −6.44 | 2.87 | −0.64 | 2.56 |

| THAI | 0.25 | 0.51 | 12.75 | −13.08 | 5.42 | −0.29 | 3.64 |

| TURK | 0.03 | 0.13 | 4.44 | −5.14 | 2.64 | −0.27 | 2.30 |

| UK | 0.13 | −0.15 | 5.03 | −5.36 | 2.27 | −0.16 | 2.99 |

| US | 0.04 | 0.02 | 3.11 | −2.44 | 1.33 | 0.37 | 2.93 |

| 2007Q4:2013Q4 | |||||||

| ARG | 0.00 | −0.06 | 1.27 | −1.34 | 0.68 | −0.12 | 2.38 |

| AUS | 0.14 | 0.31 | 4.49 | −2.76 | 1.66 | 0.47 | 3.10 |

| AUSTR | −0.07 | −0.21 | 3.09 | −3.84 | 1.87 | −0.04 | 2.27 |

| BELG | −0.11 | −0.27 | 7.59 | −10.63 | 3.95 | −0.16 | 3.80 |

| CAN | −0.06 | −0.45 | 4.27 | −4.32 | 2.21 | −0.08 | 2.45 |

| CHILE | 0.03 | −0.35 | 8.74 | −6.25 | 3.92 | 0.40 | 2.20 |

| CHIN | 0.02 | −0.58 | 13.41 | −7.20 | 3.76 | 1.59 | 7.79 |

| DEN | −0.28 | −0.20 | 6.03 | −4.88 | 2.96 | 0.10 | 2.44 |

| FIN | 0.04 | 0.18 | 6.29 | −8.30 | 3.29 | −0.53 | 3.52 |

| FRA | −0.05 | −0.32 | 2.50 | −2.13 | 1.39 | 0.37 | 2.00 |

| GER | 0.02 | −0.24 | 3.58 | −1.72 | 1.30 | 0.71 | 3.28 |

| GREE | −0.07 | −0.30 | 5.90 | −7.72 | 3.03 | −0.22 | 3.76 |

| HK | −0.33 | −1.07 | 14.27 | −13.48 | 8.06 | 0.11 | 1.91 |

| HUNG | −0.26 | 2.05 | 11.22 | −26.00 | 8.33 | −1.19 | 4.71 |

| IND | −0.02 | 0.50 | 6.11 | −7.18 | 3.39 | −0.36 | 2.32 |

| INDON | 0.04 | −0.08 | 3.60 | −2.49 | 1.64 | 0.20 | 2.40 |

| IRE | −0.01 | −1.37 | 24.59 | −16.39 | 8.30 | 0.68 | 4.74 |

| ITA | −0.03 | 0.09 | 3.30 | −5.00 | 1.81 | −1.12 | 4.87 |

| JAP | −0.06 | −0.35 | 4.72 | −3.59 | 1.80 | 0.74 | 4.11 |

| KOR | −0.03 | 0.18 | 3.14 | −3.48 | 1.67 | −0.05 | 2.53 |

| MALAY | −0.03 | 0.66 | 9.06 | −8.50 | 3.80 | −0.16 | 3.20 |

| MEX | 0.00 | 0.00 | 1.74 | −1.80 | 0.89 | 0.12 | 2.48 |

| NETHER | −0.02 | −0.31 | 4.93 | −3.92 | 2.40 | 0.26 | 2.26 |

| NORW | 0.10 | 0.46 | 10.82 | −16.24 | 5.26 | −0.85 | 5.26 |

| NZ | −0.06 | −0.21 | 3.12 | −3.10 | 1.37 | 0.32 | 3.31 |

| PORT | −0.02 | −0.31 | 6.07 | −4.66 | 2.49 | 0.08 | 2.97 |

| SA | −0.06 | 0.03 | 2.21 | −3.07 | 1.27 | −0.53 | 2.81 |

| SINGA | 0.31 | −0.11 | 10.83 | −8.58 | 4.86 | 0.38 | 2.87 |

| SP | 0.06 | −0.18 | 7.74 | −6.04 | 2.86 | 0.45 | 4.37 |

| SW | 0.04 | −0.12 | 5.66 | −6.08 | 2.74 | −0.34 | 3.28 |

| SWE | −0.14 | −0.12 | 10.60 | −9.65 | 4.76 | 0.00 | 2.97 |

| THAI | 0.16 | −0.04 | 5.34 | −4.00 | 2.63 | 0.23 | 2.16 |

| TURK | −0.03 | 0.01 | 3.01 | −2.88 | 1.70 | 0.02 | 1.98 |

| UK | −0.20 | −0.16 | 6.77 | −6.64 | 3.80 | 0.07 | 2.04 |

| US | −0.03 | −0.06 | 2.17 | −2.94 | 1.12 | −0.30 | 3.57 |

| 2014Q1:2021Q1 | |||||||

| ARG | −0.06 | −0.15 | 10.28 | −10.25 | 4.43 | 0.02 | 3.89 |

| AUS | 0.01 | 0.00 | 5.39 | −5.58 | 2.29 | −0.30 | 3.35 |

| AUSTR | −0.04 | −0.04 | 5.15 | −4.39 | 1.97 | 0.50 | 3.75 |

| BELG | 0.13 | 0.08 | 16.31 | −19.77 | 7.43 | −0.18 | 3.83 |

| CAN | −0.12 | −0.08 | 6.60 | −10.29 | 3.96 | −0.24 | 3.06 |

| CHILE | −0.07 | 0.27 | 9.15 | −12.46 | 4.53 | −0.37 | 4.18 |

| CHIN | −0.03 | 0.56 | 12.33 | −9.78 | 3.96 | 0.56 | 5.44 |

| DEN | 0.22 | 0.09 | 7.30 | −9.66 | 3.95 | −0.28 | 3.14 |

| FIN | 0.00 | −0.10 | 5.94 | −6.37 | 2.57 | −0.04 | 3.38 |

| FRA | 0.05 | −0.09 | 11.00 | −16.05 | 4.15 | −1.40 | 10.35 |

| GER | 0.04 | −0.18 | 6.02 | −4.33 | 1.97 | 0.71 | 4.86 |

| GREE | 0.02 | −0.04 | 4.51 | −5.67 | 1.83 | −0.67 | 5.65 |

| HK | 0.20 | −1.89 | 19.08 | −29.03 | 11.68 | −0.22 | 2.65 |

| HUNG | 0.26 | 0.70 | 5.29 | −5.16 | 2.84 | −0.18 | 2.35 |

| IND | 0.07 | 0.66 | 4.92 | −6.11 | 2.61 | −0.50 | 2.61 |

| INDON | 0.02 | −0.02 | 2.97 | −3.13 | 1.69 | 0.00 | 1.90 |

| IRE | −0.35 | 0.16 | 91.82 | −136.39 | 33.01 | −1.72 | 12.96 |

| ITA | 0.03 | −0.09 | 4.04 | −5.20 | 1.82 | −0.21 | 4.11 |

| JAP | −0.02 | 0.24 | 10.19 | −11.37 | 3.11 | −0.47 | 10.93 |

| KOR | 0.02 | −0.10 | 2.16 | −2.16 | 1.32 | 0.11 | 1.81 |

| MALAY | −0.05 | 0.17 | 8.01 | −7.28 | 2.91 | 0.05 | 4.31 |

| MEX | −0.01 | −0.05 | 5.45 | −4.03 | 1.84 | 0.54 | 4.45 |

| NETHER | 0.17 | 0.46 | 10.62 | −11.68 | 4.76 | −0.22 | 3.35 |

| NORW | −0.10 | −0.26 | 4.97 | −6.17 | 2.72 | −0.05 | 2.34 |

| NZ | 0.11 | 0.41 | 2.42 | −3.38 | 1.25 | −0.34 | 3.65 |

| PORT | 0.03 | −0.10 | 7.54 | −10.44 | 2.77 | −1.18 | 9.78 |

| SA | 0.01 | 0.25 | 3.66 | −3.30 | 1.76 | 0.04 | 2.23 |

| SINGA | −0.35 | 0.47 | 8.96 | −13.88 | 5.04 | −0.48 | 3.29 |

| SP | −0.04 | 0.01 | 11.21 | −14.01 | 4.15 | −0.59 | 7.07 |

| SW | 0.28 | 0.89 | 10.78 | −11.64 | 4.73 | −0.51 | 3.99 |

| SWE | 0.36 | 0.06 | 8.11 | −8.33 | 4.39 | −0.18 | 2.19 |

| THAI | −0.11 | 0.14 | 3.42 | −4.15 | 2.10 | −0.26 | 2.03 |

| TURK | 0.00 | 0.12 | 13.55 | −18.68 | 5.49 | −0.97 | 6.80 |

| UK | −0.01 | −0.30 | 6.15 | −7.57 | 3.28 | −0.31 | 2.87 |

| US | −0.02 | 0.16 | 3.68 | −6.22 | 1.78 | −1.15 | 6.60 |

Table A3.

Descriptive statistics for global factors.

Table A3.

Descriptive statistics for global factors.

| Mean | Median | Maximum | Minimum | Std. Dev. | Skewness | Kurtosis | |

|---|---|---|---|---|---|---|---|

| 2000Q1:2007Q3 | |||||||

| GEKON | 0.01 | −0.02 | 1.24 | −1.20 | 0.56 | −0.05 | 2.72 |

| GEPU | −0.63 | 0.38 | 33.49 | −39.62 | 17.25 | −0.16 | 2.94 |

| TED | −0.01 | 0.00 | 0.25 | −0.27 | 0.11 | −0.27 | 4.06 |

| GZ | −0.04 | −0.11 | 1.21 | −0.71 | 0.37 | 1.40 | 6.21 |

| YIELD | −0.01 | −0.11 | 1.42 | −0.76 | 0.55 | 0.84 | 3.16 |

| VIX | −0.40 | −0.75 | 13.43 | −8.49 | 4.02 | 1.22 | 6.83 |

| VSTOXX | −0.33 | −0.84 | 22.66 | −13.48 | 6.15 | 1.56 | 8.67 |

| EFF_FED | −0.05 | 0.01 | 0.73 | −1.33 | 0.51 | −0.94 | 3.54 |

| SHADOW | −0.05 | −0.01 | 0.66 | −1.66 | 0.60 | −1.43 | 4.51 |

| BRW | 0.00 | −0.01 | 0.05 | −0.03 | 0.02 | 0.35 | 1.97 |

| OIL | 1.29 | 1.42 | 10.20 | −10.54 | 4.43 | −0.53 | 3.49 |

| WIP | 0.85 | 0.96 | 1.91 | −0.77 | 0.78 | −0.91 | 2.89 |

| RA | −0.01 | −0.02 | 0.65 | −0.69 | 0.29 | −0.16 | 3.81 |

| OFR | −0.11 | −0.20 | 4.40 | −2.72 | 1.36 | 1.43 | 6.46 |

| SRISK | 0.04 | 0.05 | 0.37 | −0.16 | 0.10 | 0.86 | 5.64 |

| 2007Q4:2013Q4 | |||||||

| GEKON | 0.00 | −0.01 | 3.24 | −2.67 | 1.08 | 0.59 | 5.56 |

| GEPU | 2.52 | 0.97 | 80.56 | −35.39 | 26.87 | 0.91 | 4.04 |

| TED | −0.02 | −0.02 | 1.03 | −1.42 | 0.42 | −0.85 | 7.39 |

| GZ | 0.02 | −0.06 | 3.51 | −1.51 | 0.96 | 1.67 | 8.38 |

| YIELD | 0.11 | 0.11 | 0.79 | −0.77 | 0.43 | −0.23 | 2.31 |

| VIX | 0.02 | −0.70 | 33.49 | −13.59 | 9.26 | 1.81 | 8.07 |

| VSTOXX | 0.07 | −1.61 | 31.78 | −13.08 | 9.30 | 1.60 | 6.66 |

| EFF_FED | −0.21 | −0.03 | 0.05 | −1.73 | 0.44 | −2.31 | 7.53 |

| SHADOW | −0.27 | −0.14 | 0.22 | −1.67 | 0.39 | −1.91 | 7.66 |

| BRW | 0.00 | −0.01 | 0.08 | −0.07 | 0.04 | 0.33 | 2.07 |

| OIL | 1.63 | 6.32 | 25.92 | −59.61 | 15.83 | −2.31 | 10.14 |

| WIP | 0.38 | 0.87 | 3.19 | −5.95 | 2.22 | −1.71 | 5.76 |

| RA | 0.01 | −0.10 | 3.16 | −2.47 | 0.92 | 0.94 | 8.38 |

| OFR | −0.12 | −0.16 | 14.02 | −8.47 | 4.18 | 1.13 | 6.99 |

| SRISK | 0.06 | 0.09 | 0.73 | −0.73 | 0.32 | −0.11 | 3.11 |

| 2014Q1:2021Q1 | |||||||

| GEKON | 0.00 | −0.02 | 8.52 | −3.58 | 1.90 | 2.92 | 15.76 |

| GEPU | 7.21 | 6.43 | 106.42 | −69.64 | 34.19 | 0.27 | 4.49 |

| TED | 0.00 | 0.01 | 0.14 | −0.32 | 0.09 | −1.42 | 5.83 |

| GZ | −0.01 | −0.04 | 0.89 | −0.57 | 0.30 | 0.76 | 4.66 |

| YIELD | −0.07 | −0.12 | 0.44 | −0.49 | 0.24 | 0.31 | 2.77 |

| VIX | 0.39 | −0.27 | 17.24 | −8.68 | 4.78 | 1.52 | 6.79 |

| VSTOXX | 0.20 | −0.48 | 20.71 | −9.80 | 5.13 | 2.05 | 10.15 |

| EFF_FED | 0.00 | 0.02 | 0.31 | −0.78 | 0.27 | −1.68 | 5.36 |

| SHADOW | 0.06 | 0.04 | 0.89 | −0.77 | 0.39 | 0.03 | 2.45 |

| BRW | 0.00 | 0.00 | 0.04 | −0.06 | 0.03 | −0.36 | 2.16 |

| OIL | −2.18 | 0.08 | 12.93 | −24.73 | 9.64 | −0.71 | 3.12 |

| WIP | 0.43 | 0.41 | 9.69 | −9.03 | 2.88 | −0.27 | 9.01 |

| RA | 0.02 | 0.01 | 1.80 | −0.75 | 0.41 | 2.67 | 13.83 |

| OFR | −0.03 | −0.33 | 2.90 | −4.13 | 1.37 | −0.20 | 4.68 |

| SRISK | 0.07 | 0.02 | 944.50 | −944.73 | 252.46 | 0.00 | 14.50 |

Note

| 1 | We considered including several measures of fiscal sustainability into our set of macroeconomic variables, e.g., public debt/GDP, general government debt/GDP, and fiscal balance/GDP, departing from the premise that fiscal space matters considerably for the banking system stability. The effect is mainly through the government ability to curb banks’ losses in bad states (Silva 2021). However, there are multiple missing observations for the first period we consider, i.e., 1993–1999. As for the remainder of the periods, the results are qualitatively close to our baseline estimations, with GDP per capita growth rate and inflation shaping a country’s credit-to-GDP gap sensistivity to global factors. |

References

- Ahir, Hites, Nicolas Bloom, and Davide Furceri. 2022. The World Uncertainty Index. NBER Working Paper No 29763. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Amiti, Mary, Patrick McGuire, and David E. Weinstein. 2019. International Bank Flows and the Global Financial Cycle. IMF Economic Review 67: 61–108. [Google Scholar] [CrossRef]

- Atyabi, Farzaneh, Olga Buchel, and Leila Hedayatifar. 2020. Driver Countries in Global Banking Network. Entropy 22: 810. [Google Scholar] [CrossRef] [PubMed]

- Avdjiev, Stefan, Leonardo Gambacorta, Linda S. Goldberg, and Stefano Schiaffi. 2020. The Shifting Drivers of Global Liquidity. Journal of International Economics 125: 103324. [Google Scholar] [CrossRef]

- Baker, Scott, Nicolas Bloom, and Steven J. Davis. 2016. Measuring Economic Policy Uncertainty. Quarterly Journal of Economics 131: 1593–636. [Google Scholar] [CrossRef]

- Barrot, Luis-Diego, and Luis Servén. 2018. Gross Capital Flows, Common Factors, and the Global Financial Crisis. World Bank Policy Research Working Paper 354. Washington, DC: World Bank. [Google Scholar]

- Baumeister, Christiane, and James D. Hamilton. 2019. Structural Interpretation of Vector Autoregressions with Incomplete Identification: Revisiting the Role of Oil Demand and Supply Shocks. American Economic Review 109: 1873–910. [Google Scholar] [CrossRef]

- Baumeister, Christiane, Dimitris Korobilis, and Thomas K. Lee. 2022. Energy markets and global economic conditions. Review of Economics and Statistics 104: 828–44. [Google Scholar] [CrossRef]

- Bekaert, Geert, Eric C. Engstrom, and Nancy R. Xu. 2022. The Time Variation in Risk Appetite and Uncertainty. Management Science 68: 3975–4753. [Google Scholar] [CrossRef]

- Borio, Claudio, and Philip Lowe. 2002. Asset Prices, Financial and Monetary Stability: Exploring the Nexus. BIS Working Paper No 114. Basel: BIS. [Google Scholar]

- Brownlees, Christiano, and Robert F. Engle. 2017. SRISK: A conditional capital shortfall measure of systemic risk. Review of Financial Studies 30: 48–79. [Google Scholar] [CrossRef]

- Brusa, Francesca, Pavel Savor, and Mungo Wilson. 2020. One Central Bank to Rule Them All. Review of Finance 24: 263–304. [Google Scholar]

- Bu, Chunya, John Rogers, and Wenbin Wu. 2021. A Unified Measure of Fed Monetary Policy Shocks. Journal of Monetary Economics 118: 331–49. [Google Scholar] [CrossRef]

- Castro, Vitor, and Rodrigo Martins. 2019. Political and Institutional Determinants of Credit Booms. Oxford Bulletin of Economics and Statistics 85: 1144–79. [Google Scholar] [CrossRef]

- Cerutti, Eugenio, and Haonan Zhou. 2017. The Global Banking Network in the Aftermath of the Crisis: Is There Evidence of De-Globalization? IMF Working Paper 17/232. Washington, DC: IMF. [Google Scholar]

- Cerutti, Eugenio, Catherine Koch, and Swapan-Kumar Pradhan. 2020. Banking across Borders: Are Chinese Banks Different? IMF Working Paper 2020/249. Washington, DC: IMF. [Google Scholar]

- Cerutti, Eugenio, Ricardo Correa, Elizabetta Fiorentino, and Esther Segalla. 2017. Changes in Prudential Policy Instruments—A New Cross-Country Database. International Journal of Central Banking 13: 477–503. [Google Scholar]

- Chinn, Menzie, and Hiro Ito. 2008. A New Measure of Financial Openness. Journal of Comparative Policy Analysis 10: 309–22. [Google Scholar] [CrossRef]

- Chudik, Alexander, George Kapetanios, and M. Hashem Pesaran. 2018. A One Covariate at a Time, Multiple Testing Approach to Variable Selection in High-Dimensional Linear Regression Models. Econometrica 86: 1479–512. [Google Scholar] [CrossRef]

- Claessens, Stijn, and Neeltje van Horen. 2015. The Impact of the Global Financial Crisis on Banking Globalization. IMF Economic Review 63: 868–918. [Google Scholar] [CrossRef]

- Dincer, Nergiz, Barry Eichengreen, and Petra Geraats. 2022. Trends in Monetary Policy Transparency: Further Updates. International Journal of Central Banking 18: 331–48. [Google Scholar]

- Drehmann, Mathias, and James Yetman. 2021. Which Credit Gap is Better at Predicting Financial Crises? A Comparison of Univariate Filters. International Journal of Central Banking 17: 225–55. [Google Scholar]

- Drehmann, Mathias, and Kostas Tsatsaronis. 2014. The Credit-to-GDP Gap and Countercyclical Capital Buffers: Questions and Answers. BIS Quarterly Review, 55–73. [Google Scholar]

- Fernandez, Andres, Michael Klein, Alessandro Rebucci, Martin Schindler, and M. Uribe. 2016. Capital Control Measures: A New Dataset. IMF Economic Review 64: 548–74. [Google Scholar] [CrossRef]

- Fratzscher, Marcel. 2012. Capital Flows, Push versus Pull Factors and the Global Financial Crisis. Journal of International Economics 88: 341–56. [Google Scholar] [CrossRef]

- Giese, Julia, Henrik Andersen, Oliver Bush, Christian Castro, Marc Farag, and Sujit Kapadia. 2014. The Credit-to-GDP Gap and Complementary Indicators for Macroprudential Policy: Evidence from the UK. International Journal of Finance and Economics 19: 25–47. [Google Scholar] [CrossRef]

- Gilchrist, Simon, and Egon Zakrajšek. 2012. Credit Spreads and Business Cycle Fluctuations. American Economic Review 102: 1692–720. [Google Scholar] [CrossRef]

- Hannan, Swarnali A. 2018. Revisiting the Determinants of Capital Flows to Emerging Markets—A Survey of Evolving Literature. IMF Working Paper 2018/214. Washington, DC: IMF. [Google Scholar]

- Jokipii, Terhi, Reto Nyffeler, and Stephane Riederer. 2021. Exploring BIS Credit-to-GDP Gap Critiques: The Swiss Case. Swiss Journal of Economics and Statistics 157: 7. [Google Scholar] [CrossRef]

- Kang, Tae Soo, and Kyunghum Kim. 2019. Push vs. Pull Factors of Capital Flows Revisited: A Cross-country Analysis. Asian Economic Papers 18: 39–60. [Google Scholar]

- Koepke, Robin. 2019. What Drives Capital Flows to Emerging Markets? A Survey of Empirical Literature. Journal of Economic Surveys 33: 516–40. [Google Scholar]

- Lafuerza, Luis F., and Luis Servén. 2019. Swept by the Tide? The International Co-Movement of Capital Flows. World Bank Policy Research Working Paper 8787. Washington, DC: World Bank. [Google Scholar]

- Léon, Florian. 2018. The Credit Structure Database. CREA Discussion Paper Series 2018–07; Luxembourg: University of Luxembourg. [Google Scholar]

- Lu, Xinjie, Feng Ma, Pan Li, and Tao Li. 2022. Newspaper-based Equity Uncertainty or Implied Volatility Index: New Evidence from Oil Market Volatility Predictability. Applied Economics Letters. [Google Scholar] [CrossRef]

- Miranda-Agrippino, Silvia, and Helene Rey. 2020. US monetary policy and the global financial cycle. Review of Economic Studies 87: 2754–76. [Google Scholar] [CrossRef]

- Monin, Philip J. 2019. The OFR financial stress index. Risks 7: 25. [Google Scholar] [CrossRef]

- Nguyen, Canh Phuc, Christope Schinckus, Su Dinh Thanh, and Felicia Hui Ling Chong. 2020. Institutions, Economic Openness and Credit Cycles: An International Evidence. Journal of International Studies 13: 229–47. [Google Scholar] [CrossRef]

- Shirota, Toyoichiro. 2015. What is the major determinant of cross-border banking flows? Journal of International Money and Finance 53: 137–47. [Google Scholar] [CrossRef]

- Silva, Felipe Bastos Gurgel. 2021. Fiscal Deficits, Bank Credit Risk, and Loan-Loss Provisions. Journal of Financial and Quantitative Analysis 56: 1537–89. [Google Scholar] [CrossRef]

- Svirydzenka, Katherina. 2016. Introducing a New Broad-Based Index of Financial Development. IMF Working Paper No 16/5. Washington, DC: IMF. [Google Scholar]

- Tsuji, Chikashi. 2016. Does the Fear Gauge Predict the Downside Risk More Accurately Than Econometric Models? Evidence from the US Stock Market. Cogent Economics & Finance 4: 1220711. [Google Scholar]

- Wang, Xichen, and Cheng Yan. 2022. Does the Relative Importance of the Push and Pull Factors of Foreign Capital Flows Vary across Quantiles? IMF Economic Review 70: 252–99. [Google Scholar] [CrossRef]

- Wu, Jing Cynthia, and Fan Dora Xia. 2016. Measuring the Macroeconomic Impact of Monetary Policy at the Zero Lower Bound. Journal of Money, Credit, and Banking 48: 253–91. [Google Scholar] [CrossRef]

- Zhu, Sha, Qiuhong Liu, Yan Wang, Yu Wei, and Guiwu Wei. 2019. Which Fear Index Matters for Predicting US Stock Market Volatilities: Text-counts or Option-based Measurement? Physica A: Statistical Mechanics and its Applications 536: 122567. [Google Scholar] [CrossRef]

- Zou, Hui. 2006. The Adaptive Lasso and Its Oracle Properties. Journal of the American Statistical Association 101: 1418–29. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).