1. Introduction

Risk fluctuates across time. It increases as volatility increases, such as in times of a pandemic or a financial crisis. There are many examples, such as the Great Depression in 1929, the sub-prime crisis from 2008 to 2010, COVID-19 in 2020 and the very recent Ukraine–Russia War, during which huge volatility is seen due to the fear factor. The implied volatility index of the Indian stock market is denoted as ticker ‘India VIX’, while the implied volatility index of the Chicago Board Options Exchange (CBOE) is denoted as ‘CBOE VIX’ or ‘VIX’.

The VIX Index is the implied volatility of options prices written on the underlying index and the most important risk indicator in the stock market. For the CBOE VIX Index, the underlying index is the S&P 500 Index (SPX), and for the India VIX Index, the underlying index is the Nifty 50 Index. Changes in the volatility index suggest how perceptions change across time and are an essential tool for investment risk management. Some researchers (

Carr 2017;

Onan et al. 2014;

Sarwar 2012) believe that VIX is a fear index, while others (

Bantwa 2017;

Chandra and Thenmozhi 2015) propose a risk hedging technique.

In 1993, CBOE Global Markets announced the CBOE Volatility Index, denoted as ticker ‘VIX’. It was initially constructed to assess the 30-day market’s anticipation, based on the implied volatility of the at-the-money options trading at the S&P 100 Index. It was later updated, in 2003, to incorporate a new methodology to measure the expected implied volatility of the S&P 500 Index options. This new volatility index computes anticipated volatility by gathering the weighted prices of the SPX calls and puts options over a wide range of strike prices.

The India VIX was created by the National Stock Exchange (NSE) of India, in 2008, and is based on the prices of the Nifty 50 Index options. It uses the same construction methodology (

India VIX White Paper 2008) as that of the CBOE VIX Index (

CBOE VIX White Paper 2003), licensed from CBOE. While some of the implied volatility indices are computed by the methodology standardised by the CBOE, other implied volatility indices outlined by

Siriopoulos and Fassas (

2013) are still computed using the Black–Scholes–Merton formula, derived by

Black and Scholes (

1973) and

Merton (

1973).

A high level of VIX creates uncertainty, and a low level of VIX builds confidence in the stock market. Some researchers (

Bantwa 2017;

Chandra and Thenmozhi 2015) highlighted that the implied volatility index and its underlying index move in opposite directions, and that this opposite movement is even stronger when the market is moving in a downward direction. Other researchers (

Onan et al. 2014;

Sarwar 2012) revealed that a high level of the VIX Index negatively influences the global stock market in addition to the US stock market. It could be seen during the sub-prime crisis in 2008 and 2009 and the COVID-19 catastrophe in 2020 that the implied volatility index rose sharply and stock markets bled. Such trends were also observed when adverse news spread throughout the world. For example, when news about Omicron, a variant of COVID-19, broke out in South Africa on 26 November 2021, there was a sharp upward spike in implied volatility indices and the stock market significantly decreased, as shown in

Table 1.

Considering the vulnerability of the Indian stock market to the global market, it is important to examine the influence of the global implied volatility indices on the Indian volatility index. Generally, Indian traders keep their eyes only on the India VIX, but it would be a better idea if Indian traders kept their eyes on the global volatility indices, so that the multidimensional risk in the Indian market is anticipated. This study’s outcomes are an important tool for investors and traders of Indian economies in anticipating the risk level in their local stock market. Ultimately, it provides a set watch list of implied volatility indices for traders and investors of Indian economies.

To anticipate feature variables’ influencing powers, a classification problem was constructed, and to build the classification model, a standard classifier, called Logistic Regression, and advanced classifiers, called Random Forest and Extreme Gradient Boosting (XG Boost), were applied. Logistic Regression (

Aliyeva 2021, August;

Zhang et al. 2022) helps detect directional relationships. Random Forest (

Sadorsky 2021) and XGBoost (

Wang and Guo 2020;

Vuong et al. 2022;

Han et al. 2023) were applied because, like stock market forecasting, VIX forecasting is a time-series forecasting in which variables reveal temporal dependencies and the relationship is likely to be non-linear.

In the next section, past studies consisting of implied volatility indices, feature importance and a few machine learning techniques are reviewed. Subsequently, the research design and methodology are discussed, and the outcome of the findings is analysed. Finally, the study’s findings are concluded.

2. Literature Review

By employing a dynamic conditional correlation (

Engle 2002;

Chaudhary et al. 2020a);

Siriopoulos and Fassas (

2013) investigated spill-over impacts in the international financial market with respect to publicly available implied volatility indices. Their outcomes indicate a strong integration of investors’ expectations about future uncertainty. Additionally, conditional correlations of market expectations change over the horizon. The conditional correlations of all reviewed implied volatilities only slightly increased over the years. Conditional correlations across implied volatility indices increase during a panic-like situation in the market.

Shaikh and Padhi (

2014) compared the prediction accuracy of ex-ante, ex-post and volatility predictions to realise the return volatility of different periods. The implied volatility, GJR-GARCH (Glosten-Jagannathan-Runkle Generalized AutoRegressive Conditional Heteroskedasticity), and RiskMetrics competed in volatility forecasts. Their results revealed that implied volatility was predominant, and that ex-ante volatility was best for describing upcoming market volatility with in-sample forecasting. For the non-overlapping sampling procedure, implied volatility predictions of all horizons appeared to be positive, unbiased forecasters of historical volatility.

Shaikh and Padhi (

2016) and

Chaudhary et al. (

2020b) applied ordinary least squared (OLS) regression to analyse the concurrent association between the volatility index and the stock index, during calendar years and sub-periods, for robust results. Their results revealed an asymmetry between the Nifty stock index and the India VIX Index. Simultaneously, the magnitude of asymmetry was not the same. The findings revealed that variations in the India VIX Index were stronger for negative return jolts than for positive return jolts.

Using Artificial Neural Network models formulated on various backpropagation algorithms,

Chaudhuri and Ghosh (

2016) estimated the volatility in India’s stock market. The India VIX Index, the CBOE VIX Index, the volatility of DJIA (Dow Jones Industrial Average) returns, the volatility of Hang Seng returns, the volatility of Nikkei returns, the volatility of crude oil returns and the volatility of Deutscher Aktien Index returns were taken as input variables. The volatility of Nifty returns and the volatility of Gold returns were taken as output variables. Their results showed that when the model experimented with the data from 2013 to 2014, the model satisfactorily forecast volatility for 2015. However, when asked to predict market volatility in 2008, the prediction accuracy decreased with the same sets of training data.

Using quantile regression and neural network methods,

Shaikh (

2019) studied the association between the crude oil implied volatility (OVX) index and crude oil prices (WTI & USO) by incorporating the estimation parameters, including volumes traded of the commodity, and open, high, low and closing daily prices of the commodity and found that the neural network could foretell the expected prices of the WTI and USO, and the implied volatility index, with minimal error. The asymmetrical relationship between the OVX and WTI and USO showed that the volatility feedback effect stood right for the OVX market.

Using various statistical techniques, including autoregressive conditional heteroskedasticity (ARCH), the Granger causality test, the Jarque Bera test and the Correlogram test,

Ramasubramanian and Sophia (

2017) examined the association between the India VIX and the implied volatility indices of the US, China and Brazil over two years. They found that a change in the Indian stock market was reflected in a change in the Brazilian stock market, indicating that volatility in the Indian stock market was influenced by volatility in the Brazilian stock market.

To examine whether the CBOE VIX Index is a fear index,

Sarwar (

2012) studied the intertemporal association between the CBOE VIX Index and returns on the stock market in the US, India, China, Russia and Brazil from 1993 to 2007. From this, Sarwar found that a negative association existed during the period investigated and that when the CBOE VIX Index was higher and more volatile, the negative association was stronger. The findings uncovered that the CBOE VIX Index also plays an important role in portfolio diversification and that CBOE VIX India is not just a fear index in the US but also a fear index in India, China, Brazil and Russia.

To eliminate irrelevant features,

Rogers and Gunn (

2005, February) applied hypothesis testing on a set of features before feeding them into the Random Forest algorithm and found that when it was trained with important features, the simulation converged faster and proved to have enhanced accuracy. On the other hand, irrelevant features used in training increased computational cost, unexpectedly caused the tree to grow larger and slowed the convergence rate.

To select the most relevant features and enhance identification performance,

Zhou et al. (

2014) introduced Random Forest recursive feature elimination (RF–RFE) and a structural damage detection method, based on wavelet packet decomposition (WPD), and adopted a two-phase feature selection technique after WPD. In the beginning, Random Forest was utilised to arrange damaged features according to their importance, and thereafter, RF–RFE was utilised to eliminate the least relevant features and provide a new set of arranged feature lists according to their importance. The outcomes revealed that fewer most important features selected by the introduced technique helped in model building with low computational cost and enhanced identification accuracy.

Cheng et al. (

2006) employed logistic regression for feature reduction, as well as for classifying remotely sensed data from hyperspectral images, and found that, trained with fewer selected important features, the model did not sacrifice classification performance for both hard and soft classifications.

Wang and Ni (

2019) trained the XG Boost algorithm to classify business risk and compared its performance with logistic regression. Redundant features were eliminated using feature selection techniques, which were weight by correlation, Chi-square, Gini, information and hierarchical variable clustering. The hyperparameters of the XG Boost were optimised using a Bayesian Tree-structured Parzen Estimator (TPE) and random search (RS). The effectiveness of the feature selection and the hyper-tuning process was assessed by the Wilcoxon signed-rank test. The outcomes depicted that, to eliminate redundant features, Chi-square worked best with XG Boost, while hierarchical clustering worked best with logistic regression. The performance of the XG Boost, hyper-tuned using TPE and RS, surpassed the performance of logistic regression, while the model hyper-tuned with TPE outperformed the model hyper-tuned with RS. Ranking feature importance using XG Boost hyper-tuned with TPE improved the model’s interpretability and could be an important tool for business risk modelling.

By incorporating price variables and a set of technical indicators derived from price variables,

Dixit et al. (

2013) built an artificial neural network, and a feed-forward neural network, for foretelling the day-to-day upward and downward trends in the India VIX Index, which is an implied volatility of option prices written on the Nifty 50 Index. The findings suggested that this light model could predict the day-to-day upward and downward trends in the India VIX Index. Overall, the model achieved an accuracy score of around 60%.

Alvarez Vaccine (

2019) presented a fundamental analysis stock screening and ranking system to compute the performance of various supervised machine learning algorithms. First, Graham’s criterion was compared with the classification model in a stock screening scenario trading allowing a long position only. Second, the performance of regression was distinguished against classification models by also allowing a short position. Last, the regression model was used to perform stock ranking, instead of just stock screening. Several fundamental variables were chosen as featured variables, and simple returns and categorical variables (buy, hold and sell based on returns) were selected as target variables for regression and classification, respectively. The results revealed that tuning the hyperparameters was crucial for improving the performance of the model. On the other hand, most models outperformed both Graham’s criteria and the index, and the best-calibrated model multi-folded the initial investment in stock screening.

Sokolova and Lapalme (

2009) examined 24 performance matrices to evaluate machine learning classifiers with binary, multi-labelled, multi-class and hierarchical classification tasks. The examination linked a group of changes in a confusion matrix to traits of data for each classification task. Later, the examination focused on the type of variations in a confusion matrix that did not vary a measure. They concluded that the invariance classification required reference to all related label distribution changes in a classification task.

In a classification problem, the model’s performance was studied by a performance matrix.

Ferri et al. (

2009) experimentally analysed 18 different performance measurement parameters, known as performance metrics, in various situations, recognizing relationships between measures and clusters. The authors also carried out a sensitivity analysis for all the following different traits: calibration performance, separability, ranking quality, class threshold choice and sensitivity to changes in prior class distribution. The authors conducted a detailed study on the relationships among metrics from the definitions, experiments and classification and alignment of them according to the previous traits.

Banerjee (

2020) believed the India VIX Index to be a traders’ sentiment and forecast it using an autoregressive integrated moving average (ARIMA) model. The outcomes revealed that ARIMA (1-0-2) worked best for forecasting the India VIX Index, and the findings were useful for a trading strategy associated with India VIX in hedging and estimating risk.

To examine whether the Gold and India VIX Indices are considered risk hedging or safe-haven instruments against the INR–USD exchange rate, Nifty 50 Index and Crude,

Shahani and Bansal (

2020) utilised OLS regression and quantile regression. They found that, based on OLS regression, the India VIX Index moderately appeared to be a safe haven against the Nifty Index, while Gold failed to account for its influence. Admittedly, the quantile regression result stated that Gold might work as a rescue asset in weak form against three asset classes and as a hedging instrument against return on the Nifty Index, while the India VIX Index could be a proper hedge against Crude.

With the help of various machine learning techniques,

Milosevic (

2016) built binary classification models, and the target variable was taken as ‘Good’ when the stock price increased by 10%, and otherwise, it was considered ‘Bad’. Among the algorithms used, Random Forest achieved the highest performance with an f1-score of 75.1%. The performance of the same model improved to 76.5% after applying the feature selection procedure. The author used 10-fold cross-validation but did not limit the training data.

For forecasting the movement in stock price, the classifier based on Random Forest (

Khaidem et al. 2016) was applied to feature variables prepared from a set of technical indicators, and the predictability of the classifier was judged by computing the accuracy score, the precision score, the recall score, the f1-score and specificity, in addition to depicting the ROC (receiver operating characteristics) curve. The outcomes suggested that the model achieved a higher accuracy in the 85–90% range.

To judge the impact of trading volume on estimating trends in stock, logistic regression (

Kambeu 2019) was trained and the significance of the previous five days’ trading volume for the selected stock tested.

Kambeu (

2019) found that the current day’s stock market trend was statistically influenced by the third most recent day’s trading volume. The investigation emphasised the importance of incorporating the trading volume in day-to-day movement in stock market trends.

Dey et al. (

2016) applied XGBoost to feature variables derived from a set of technical indicators to forecast the movement in stock and compared its performance with the non-ensemble estimator. The outcomes revealed that performance measured by an accuracy score and an AUC (area under the ROC curve) score surpassed the performance of the non-ensemble estimator. Additionally,

Bruni (

2017) developed a binary classification model for day trading by incorporating the stock market index and technical indicators. The binary label is ‘one’ for the following period favourable for intraday trading and ‘zero’ otherwise. The author stated that the given datasets might be utilised to assess the behaviour of different strategies in rectifying the intraday trading problem.

Elagamy et al. (

2018, April) presented a new technique that joined text mining and the Random Forest algorithm. This technique was applied for the selection of crucial indicators and the categorisation of similar news. The analysis expanded present-day categorisation of crucial indicators from three to eight classes. Additionally, it showed that the Random Forest algorithm had the capability to surpass other classifiers in terms of precision, producing high precision.

Ullah et al. (

2021) proposed building trading models based on machine learning techniques to generate significant profit in the US stock market. The Quantopian platform, which is available free of cost, was utilised to train and test the introduced models. Ensemble learnings of the following four classifiers were used in this approach to decide whether to take a long or short position on a stock; stochastic gradient descent, logistic regression with L1-regularisation, Gaussian Naive Bayes and decision tree.. The highest profit generated by the models was 54.35% when traded between July 2011 and January 2019. Results also showed that a mix of weighted classifiers outperformed an individual classifier in generating trading decisions.

By using a plain linear autoregressive model with monthly volatility data from 2000 to 2017,

Dai et al. (

2020) explored the foretelling association between stock volatility and implied volatility in the stock market of five economically advanced nations: the UK, Japan, France, Germany and the US. Results from the sample revealed that very significant causality occurred from implied volatility of the stock market to stock volatility. However, results outside of the sample showed that implied volatility of the stock market was more crucial for stock volatility than for oil price volatility.

Sakowski and Slepaczuk (

2020) intended to contrast the performance of VIX futures trading strategies built across various GARCH (Generalized AutoRegressive Conditional Heteroskedasticity) model volatility prediction methods. By comparing next-day volatility forecasts with current historical volatility, long and short signals for VIX futures were generated. Their results depicted that, when using day-to-day data from 2013 to 2019, the model based on the fGARCH-TGARCH and GJR-GARCH techniques performed better than those of the GARCH and EGARCH models, but performed worse than the ‘buy-and-hold’ S&P 500 strategy.

Blair et al. (

2010) fitted the ARCH model using daily data of the VIX index, the daily return on the index and the sum of squares of the 5-min index return. Their results from in-sample data revealed that the VIX index provided all relevant information; hence, a high-frequency index return did not provide any additional information. For out-of-sample prediction, the VIX index provided a better forecast.

Prasad et al. (

2022) applied logistic regression, XG Boost and Light GBM (Light Gradient Boosted Machine) on US macroeconomic variables to examine the effect of these predictors on the CBOE Volatility Index. Their outcome suggested that the decision based on XG Boost and Light GBM was preferred over logistic regression. It was further revealed that the USD Index, Gold Price, Crude Oil Price and the Economic Policy Uncertainty Index were strong predictors.

Considering the pandemic’s negative impact and the lack of a standardised index for COVID-19,

Salisu and Akanni (

2020) built a composite index called the global fear index (GFI) which incorporates reported cases, death cases, recoveries etc. To validate the usability of the index, the Organisation for Economic Co-operation and Development data was used to predict stock return from the GFI. Their results revealed that the GFI was an important predictor of stock return during an epidemic and that incorporating macro factors enhanced the predictability of the GFI.

To predict stock price,

Wang and Guo (

2020) proposed a hybrid model consisting of a discrete wavelet transform for splitting a dataset, ARIMA for processing approximate partial data and an improved XG Boost for handling error partial data. As a result, they found significant improvement in performance.

Vuong et al. (

2022) applied XG Boost to extract features and trained LSTM (Long Short-Term Memory) for stock price forecasting.

Han et al. (

2023) proposed N-period Min–Max labelling and XG Boost to automate the trading system.

In today’s era, it is not only the US which impacts the rest of the world, including the Indian economy, but rather it is a complex structure. Many FIIs are investing in India, as India is a potential market for them, and their investment is dependent on economic conditions of their own economies, thereby influencing the Indian economy (

Kapoor and Sachan 2015;

Nandy and Chattopadhyay 2019). Furthermore, many companies are operational across multiple countries, resulting in more exposure to more volatility. The present literature review reveals that a few researchers (

Ramasubramanian and Sophia 2017) have examined the association between the India VIX and the VIX of the US, China and Brazil, and that others (

Sarwar 2012) have analysed the association between the CBOE VIX Index and returns on the stock market index of the US, India, China, Russia and Brazil. However, no researcher has conducted a significance test on a comprehensive set of implied volatility indices. Furthermore, while reviewing past studies, it was noted that they mostly tested the significance of predictors in the regression setting and none focused on constructing classification problems to judge the importance of predictors. In a classification problem, the target labels would indicate the day-to-day movements of the India VIX, unlike in the regression problem.

To address the problem at hand, the change in all implied volatility indices, including the India VIX Index, were considered predictor variables, and the target was the labels indicating whether the India VIX Index would go up or down the next day in sequence. Since the model was constructed as a classification problem, logistic regression, Random Forest and XG Boost were applied to test the importance of the predictor variables in predicting the binary movements of the India VIX Index. Thus, the main aim of this study was to find the role of the global volatility indices in predicting the volatility index of the Indian economy

4. Findings

As mentioned in

Section 3, validations were performed, and the captured results from the testing dataset are displayed in

Table 5,

Table 6,

Table 7,

Table 8,

Table 9 and

Table 10. Though the primary focus of this study was to analyse the influencing factors in forecasting the day-to-day changes in the India VIX Index, the various performance measurement parameters, these being accuracy score, ROC AUC score and classification report, were also captured.

Table 5 depicts the accuracy score and the ROC AUC score, and

Table 6 displays the classification report for all three models.

Table 7 and

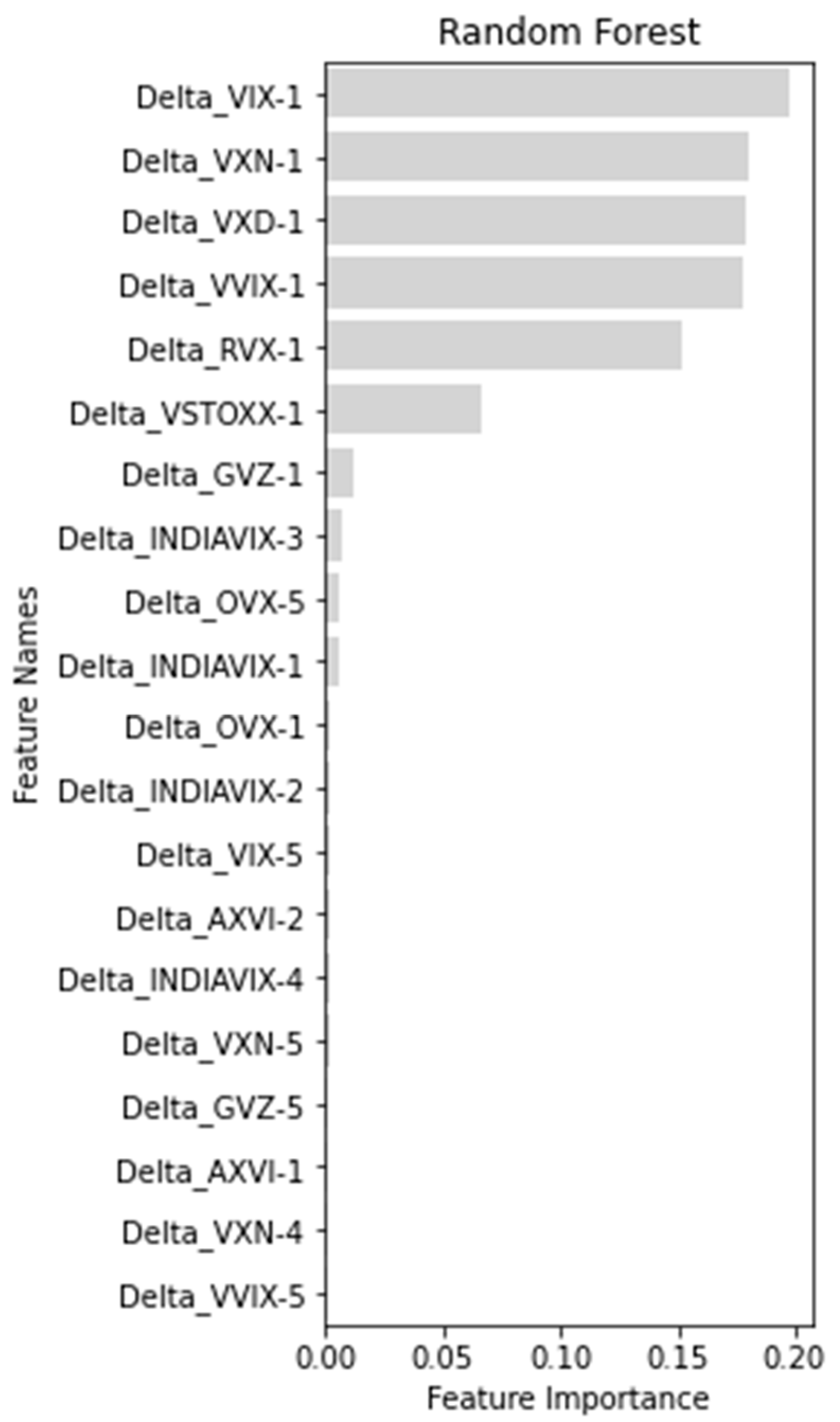

Figure 2 display the ranked feature scores, according to their importance from the Random Forest algorithm.

Table 8 and

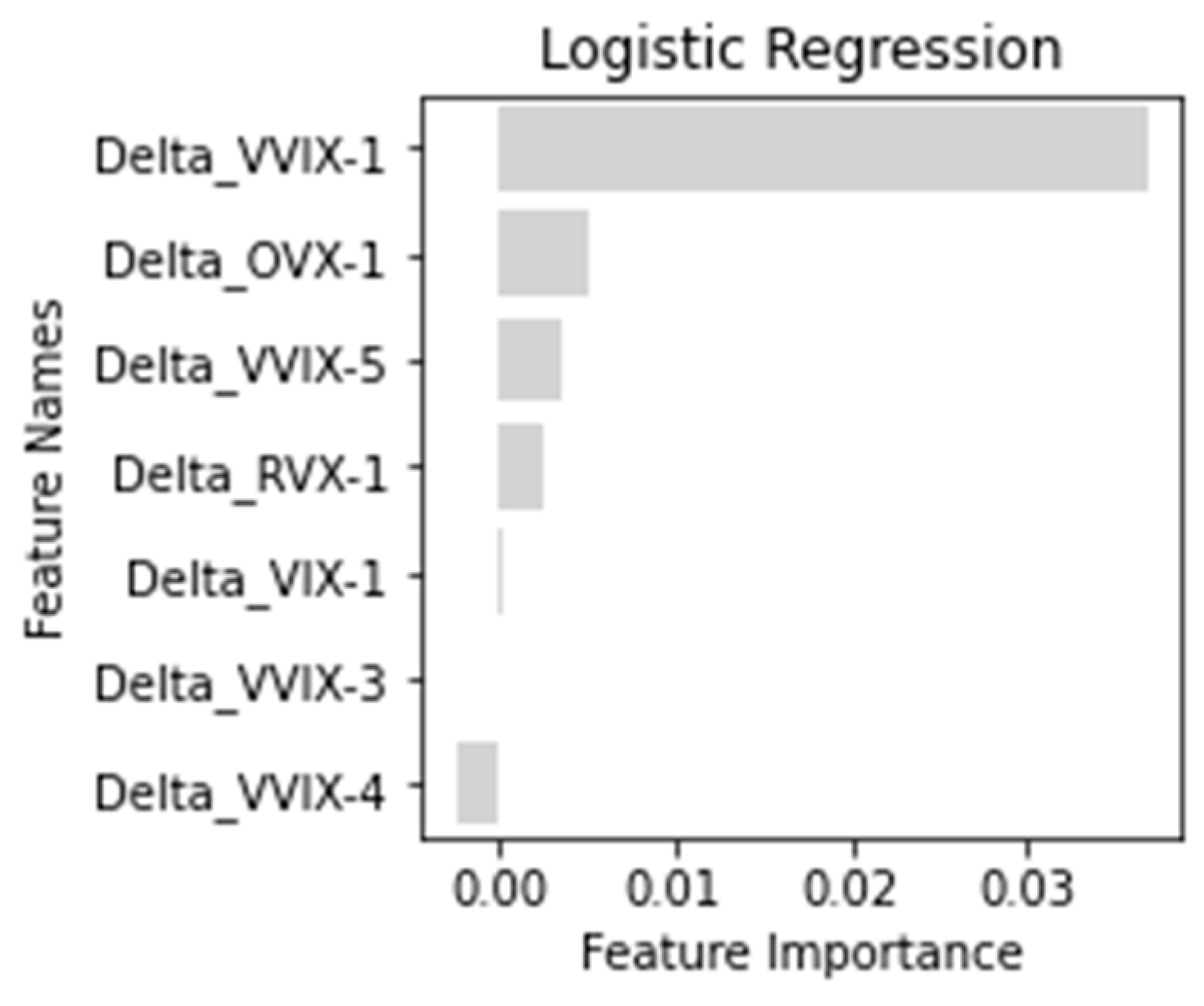

Figure 3 show the feature coefficients from the logistic regression.

Table 9 and

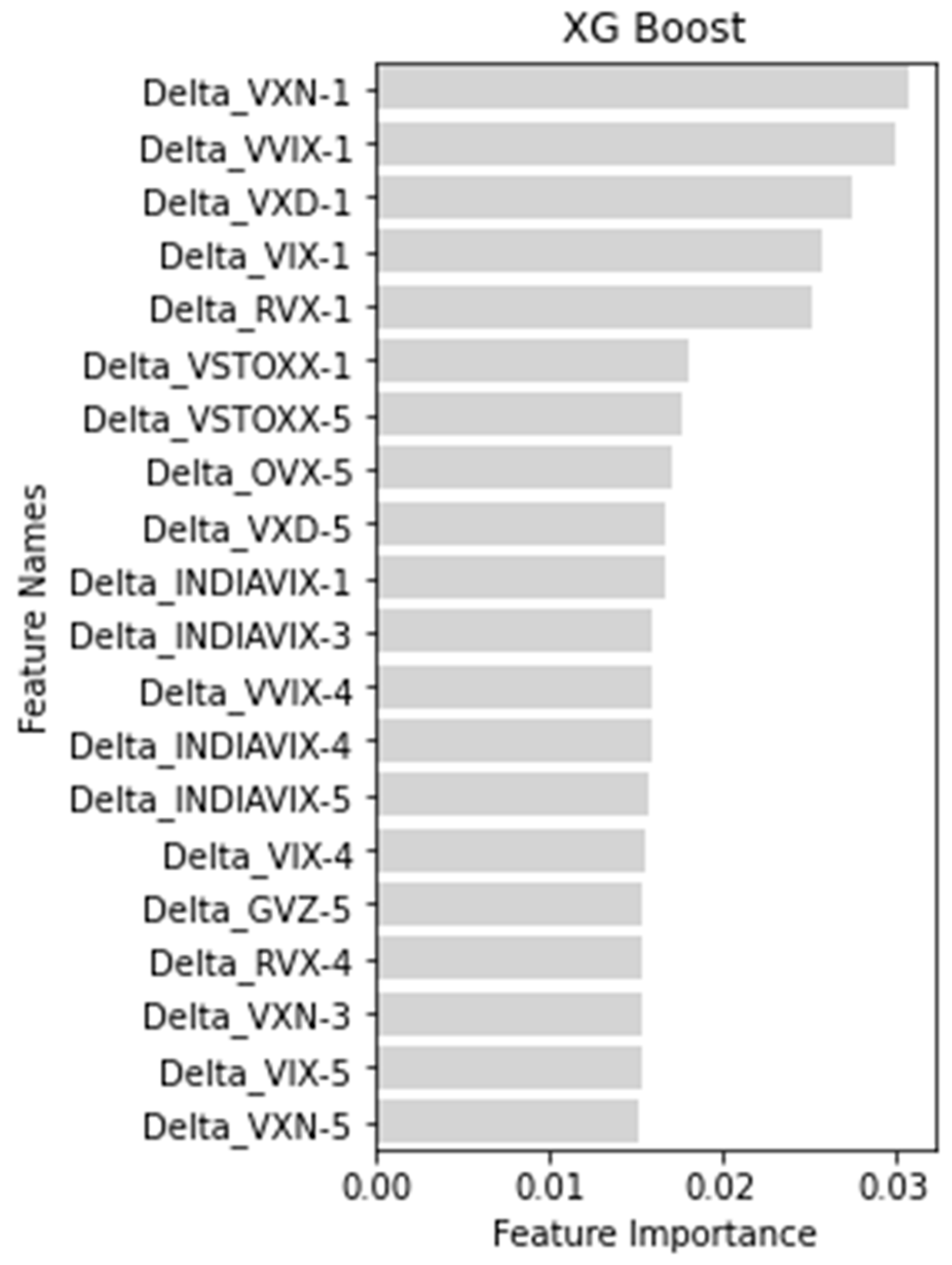

Figure 4 depict the top-twenty feature scores, ranked according to their importance from XG Boost, and

Table 10 shows the complete set of ranked feature variables from XG Boost. With the given set of feature variables, as XG Boost achieved the highest accuracy score, as well as the ROC AUC score, XG Boost’s feature variables ranking would be most reliable.

Logistic Regression: The logistic regression model achieved an accuracy score of 56.47% and an ROC AUC score of 56.71%. Its l1_ratio (

L1 and

L2 mixing parameter), as seen in

Table 3, was 0.95. Due to a higher l1_ratio, which was indicative of more

L1 regularisation, most of the coefficient of redundant feature variables were set to zero and only seven were set to non-zero, which are stated in

Table 8. Since these were coefficients, their absolute values were compared. According to

Table 8, the coefficient of Delta_VVIX-1 was the most significant. Hence, it can be said that change in volatility of the CBOE VIX Index on the previous day is one of the most influential factors in predicting the present day’s binary movements of the India VIX Index. The top seven influencing factors, from highest to lowest in order, were Delta_VVIX-1, Delta_OVX-1, Delta_VVIX-5, Delta_RVX-1, Delta_VVIX-4, Delta_VIX-1 and Delta_VVIX-3. This clearly indicated that most of the US implied volatility indices had the predictive power in forecasting the India VIX Index. Most importantly, 1-day, 3-day, 4-day and 5-day prior changes in the volatility of the CBOE VIX Index (VVIX) were accountable, but the India VIX’s previous values did not count as an influencing factor.

Random Forest: The Random Forest model achieved an accuracy score of 51.76% and an ROC AUC score of 55.49%.

Table 7 and

Figure 2 display the ranked feature variables from most to least important. There were only 20 feature variables set to non-zero; the rest were set to 0. From the top five ranked features, Delta_VIX-1, Delta_VXN-1, Delta_VXD-1, Delta_VVIX-1 and Delta_RVX-1 were the most significant, because their scores were significantly higher. These were the 1-day prior to changes in the US implied volatility indices, which affected the binary movement in the India VIX the most. As Delta_VSTOXX-1 was ranked 6th, the 1-day prior to changes in the Eurozone implied volatility index was also important. However, changes in the India VIX, as feature variables, were ranked 8th, 10th, 12th and 15th, among the top 20. Hence, changes in India VIX were not so important, but changes in the US implied volatility indices were most important in predicting the India VIX Index.

XG Boost: The XG Boost model achieved an accuracy score of 60% and an ROC AUC score of 60.98%. It is evident from

Table 9 that the top five features, Delta_VXN-1, Delta_VVIX-1, Delta_VXD-1, Delta_VIX-1 and Delta_RVX-1, were most significant because their scores were significantly higher. Additionally, they were all US implied volatility indices. Hence, a change in US implied volatility indices had a greater impact than other implied volatility indices on the binary movements of the India VIX Index. Unfortunately, among the top 20 features ranked in

Table 9, changes in India VIX ranked 10th, 11th, 13th and 14th in predicting its own movements. The 1-day and 5-day prior changes in the Eurozone implied volatility index placed 6th and 7th. From

Table 10, the 1-day prior changes in the Australian implied volatility index (AXVI), the 4-day prior Hang Seng implied volatility Index (VHSI), and the 5-day prior Japan implied volatility index (JNIV) ranked 23rd 27th and 32nd, respectively.

Considering the importance of feature variables decided by all three models, the previous day’s closing value of the US implied volatility indices, except for the CBOE Eurocurrency Volatility Index, were the most influential factors in predicting the present day’s binary movement of the India VIX Index. The Eurozone implied volatility index and India VIX were roughly placed thereafter. AXVI, VHSI and JNIV ranked after the US, Eurozone and India implied volatility indices. The findings revealed that the XG Boost performed best, compared to random forest and the most trusted traditional logistic regression, when finding the role of the global volatility indices in forecasting the volatility index of the Indian economy.

5. Conclusions

To achieve the stated goal, logistic regression, Random Forest and XG Boost classifiers were applied on feature variables derived from changes in implied volatility indices across the globe, including the India VIX, and the target derived from the day-to-day upward and downward trend of the India VIX. XG Boost (

Wang and Ni 2019) and Random Forest (

Sadorsky 2021) were considered in this study because, like stock forecasting, volatility furcating is a time series forecasting, where variables exhibit temporal dependency and the relationship between target and features is likely to be nonlinear. Additionally, it provides a ranking for the complete list of features fed into the model, rather than eliminating redundant features, as is shown in

Table 10. For a varied level of results, logistic regression and Random Forest were also considered. Logistic regression (

Aliyeva 2021, August;

Cheng et al. 2006;

Zhang et al. 2022) was applied because its working mechanism is easily interpreted in eliminating redundant features without sacrificing accuracy. The fitted algorithms provided ranked feature variables that were fed into the models, and, following this, the models predicted binary labels for the testing datasets.

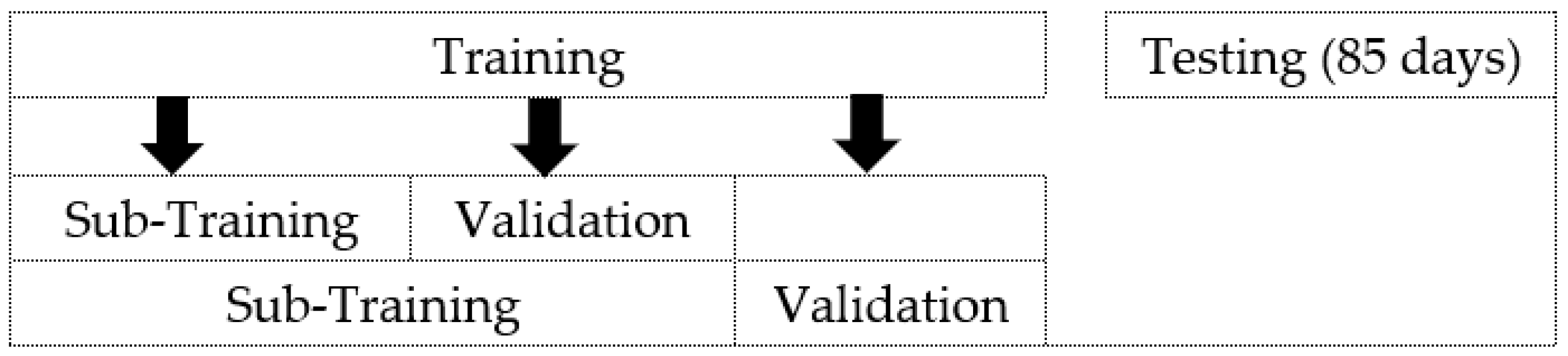

To analyse their significance, changes in the global implied volatility indices, including the India VIX, were taken as predictor variables, and binary labels, as the target variables, were created from changes in the closing value of the India VIX. Then, logistic regression, Random Forest and XG Boost were utilised on the data sample prepared from 18 September 2009, to 2 December 2021, to rank the feature variables. After performing 2-fold time series cross-validation, the ranked feature variables were captured, and the models predicted for the testing dataset.

It was evident from the results that the previous day’s changes in closing value of the US implied volatility indices, except for the CBOE Eurocurrency Volatility Index, were the most influential factors in predicting the present day’s binary movements of the India VIX. The Eurozone implied volatility index and the India VIX were placed thereafter. AXVI, VHSI and JNIV ranked after the US, Eurozone and Indian implied volatility indices.

It can be concluded that the India VIX was impacted most by the previous day’s changes in the closing value of the US implied volatility indices, except for the Chicago Board Options Exchange (CBOE) Eurocurrency volatility index. Additionally, the Eurozone implied volatility index was also important. However, the implied volatility indices of Australian Hang Seng and Japan were the least important.

Implication: It is important for traders and investors of emerging economies, like India’s economy, to know the influencing power of various global implied volatility indices in predicting the movement of the volatility index of the emerging economy, which, in turn, estimates the risk in that economy’s stock market. The outcome of this research is crucial for traders and investors of Indian economies in estimating risk in the stock market by creating a watch list of the most crucial global implied volatility indices. Hedgers, risk-averse investors, portfolio managers, and options and volatility traders are more interested in minimising risk over maximising return and the predicted value of the VIX Index could be very useful to them.

Contribution: Generally, to analyse the significance of independent variables (features), a regression technique is used, while considering features and target variables in the same timeline, and, subsequently, hypothesis testing is performed. However, this study considered a different approach to investigate the significance of feature variables for forecasting volatility, while considering features and target variables in a different timeline. Hence, this study provides another technique for significance testing.

Limitation and future scope: This study is restricted to the India VIX Index, but similar implied volatility indices of other emerging economies could be investigated in the future. In addition to the Random Forest and XG Boost, other ensemble learning algorithms, required to rank the set of feature variables, could be used in future studies.