1. Introduction

Emerging sanctions have caused an increase in the cost of goods and services directly or indirectly related to insurance (

Demkina et al. 2019;

Serebryakova et al. 2020). Firstly, there is a negative and steady trend of the ruble weakening against the US dollar. Secondly, there is a decline in economic development. On the one hand, the reserve capacity of insurance companies themselves has reduced, and the structure and liquidity of assets are changing. On the other hand, since they have been forced to put a lot of effort into maintaining their direct activities, Russian companies are reducing insurance costs, which further slows down the development of the industry in the context of digitalization.

The emerging pandemic has spurred the development of insurance companies. It accelerated the digitalization of processes in the insurance market and the current trend towards the advanced development of IT projects. Insurers faced challenges caused by regulatory changes, as well as an increase in unprofitability and a decrease in income from investment activities.

Recently, sanctions against the largest Russian banks and their subsidiaries in connection with recent events have not affected the conduct of insurance operations in Russia. The existing insurance contracts will not be affected in any way by the introduced restrictions, both those denominated in rubles and those denominated in foreign currencies, including dollars and euros.

The purpose of this article is to substantiate approaches to financial risk management and profitability in Russian insurance companies in the context of digitalization. This goal can be achieved by solving two major tasks: investigating the nature and scope of the financial risks of insurance companies and their impact on the financial results of insurers and determining approaches to the management of the financial risks of insurers in the context of digitalization.

The main scientific result of this study is the systematization of approaches to calculate the average profitability of activities, substantiate the structure of insurance portfolios, profitability, and the risk of insurance companies, and to determine the optimal insurance portfolio according to the criteria of maximum profitability for a given level of risk in the context of digitalization.

2. Literature Review

Several works of economists have been devoted to the study of various aspects of risk in general and financial risk in particular, as well as approaches to anticipating risk events and reducing their negative consequences in the activities of business entities.

Christensen et al. (

2021) note that the type of risk is influenced not only by socio-economic but also political and administrative factors.

Ettlin et al. (

2020) and

Olarewaju and Msomi (

2021) believe that an economic system that is formed based on competition, although it does not protect everyone from inevitable risks and accidents, creates the preconditions for an enterprise when it is independently and fully responsible for its actions and results. This directly applies to both production and non-production areas. They understand financial risk as an integral part of any financial activity, which is an inevitable financial relationship. It has various manifestations through the occurrence of objectively existing insufficiency, inaccuracy, or redundancy of economic information regarding certain events or accidents. It is calculated based on the assessment of the probability of losses due to implementation in the context of digitalization of some economic activity.

Sharma et al. (

2018) and

Tone et al. (

2018) refer to financial risks as risks characterized by the likelihood of the loss of financial resources (cash) in business. They define the concept of financial risk using the concept of commercial (entrepreneurial) risk.

The first drawback of the aforementioned definition is that the concepts are classes within the same classification system. Moreover, the concept of financial resources is defined using the concept of money, which is a fundamental mistake in understanding financial resources in the context of digitalization.

Besides, financial risk is the likelihood of unpredictable financial losses (a decrease in expected profit or income, or a loss of part or all of the capital) in a situation of uncertainty in the conditions of financial activity.

The financial risk of insurance companies can be understood as the risk arising in the course of financial relations between insurance companies and policyholders, the state, other business entities, and individuals regarding the accumulation of insurance premiums and payment of insurance indemnities, the allocation of insurance reserves, and the implementation of other financial transactions. It is characterized by the probability, the amount of capital losses, financial reliability, and incomplete receipt of income and profits in the future in the conditions of digitalization (

Agamirova et al. 2017;

Blokhina et al. 2018;

Häusler 2004).

Research shows that it is advisable to classify insurers by using the type of activity as the basis for effective financial risk management because the financial risks that manifest themselves in relation to a certain type of activity are characterized by certain specifics. Considering the features of insurance, the greatest attention should be paid to risk management which accompanies the main (direct insurance and reinsurance) investment activities.

Risk management has become an independent scientific area and field of activity in the course of genesis, ensuring the financial reliability of insurance companies (

Demkina et al. 2019;

Ibragimov 2018;

Yusupova 2019). Therefore, the main elements of the financial risk management system of insurance companies in the context of digitalization include identification, i.e., revealing risk and risky areas of insurers’ activity, quantification, i.e., analysis and quantitative assessment of risk; control, i.e., setting limits and acceptable levels of financial risks; and constant monitoring of the level of financial risks providing feedback mechanisms.

In the conditions of digitalization, a generalized system of criteria for assessing the level of acceptability of dynamic and static risks allows us to make decisions on the choice of mechanisms for the manageability of the financial risks of insurance companies (

Drobysheva et al. 2018;

Illichevskyi 2011;

Serebryakova et al. 2020). Moreover, the study has shown the presence of a wide range of both universal and specific methods that are suitable for managing only certain types of risks and the financial risks of business entities of a certain predetermined area.

In particular,

Turgaeva et al. (

2020) emphasize that one of the most important ways to implement the stage of neutralizing financial risks is their insurance. The task of this strategy is to determine the feasibility of maintaining a particular financial risk in the digital economy.

Fields et al. (

1998) refer to financial risks as the risks of non-payment and risks associated with bank loans and investments. Insurance companies need to make non-standard decisions that reduce the degree of financial risk.

Authors, such as

Ayton et al. (

2022), break down risks into pure and speculative. The main difference is that the first group (pure) leads to situations of obtaining only a loss, and the second group (speculative) leads to situations of the formation of both negative and positive results in the context of digitalization.

Cheng et al. (

2021) identified the main features of risk: alternativeness, inconsistency, and uncertainty. A variant approach to risk elimination, according to them, implies such a feature of risk as alternativeness. In the absence of variation, there is no risk.

Quan et al. (

2021) noted that inconsistency manifests itself in the acceleration of socio-technical progress and a decrease in social progress. This occurs in cases where considering the objective patterns of the evolution of a phenomenon does not correspond to the choice of an alternative in a crisis.

Sekścińska et al. (

2021) emphasizes that the impact of risks on the financial condition of an organization is large, and the possibility of their occurrence does not depend on the size of the business (small, medium, or large enterprises), which is especially evident in the digital economy.

Zhu et al. (

2022) note that the possibility of an attack, growth, and impact strength are determined by the following factors: the dynamics of the general economic situation; transformations in market conditions; the development and application of modern financial instruments and approaches (technologies); and the formation of financial relationships, etc.

Thus, the theoretical and empirical material on the theory of financial risk management, developed by these scientists, is the scientific basis, prerequisite, and theoretical and methodological basis of the present study. At the same time, several issues related to the theoretical and methodological foundations of financial risk management of insurance companies in the context of digitalization require further in-depth research.

In particular, the following issues are insufficiently studied and covered in the economic literature: determining the economic essence and classification of financial risks of insurance companies; justifying the methods for their identification, measurement, analysis, evaluation, control, and monitoring; selecting and justifying methods for managing investment risks of insurers, and developing methodological approaches to the formation of the insurance rate strategy of insurance companies in the digital economy.

Currently, different approaches are used to manage risk, differing in the ways of describing the sources of occurrence and risk factors, the mathematical models used, and the reliability of the estimates obtained. The methods of forming the optimal insurance portfolio, taking into account property, personal, and liability insurance using profitability indicators, are considered to be the most accurate and reliable.

Therefore, the working hypothesis of this study is as follows: the optimal insurance portfolio is achieved with the optimal ratio of property, personal, and liability insurance according to the criteria of maximum profitability at a given level of risk in the context of digitalization.

3. Materials and Methods

The working hypothesis of this study includes the question of whether the optimal insurance portfolio is achieved with an optimal ratio of property, personal insurance, and liability insurance according to the criteria of maximum profitability at a given level of risk.

The statistical and information base of the research consists of materials from the Federal State Statistics Service of the Russian Federation (Rosstat), reporting data from the Ministry of Finance of the Russian Federation, and the Central Bank of the Russian Federation. Legislative and regulatory acts, recommendations of international and Russian experts on financial risk management, analytical publications of international institutions and organizations, publications, and analytical studies of leading insurance offices are also used widely.

Structurally, the study consisted of a comprehensive analysis of the insurance market in the Russian Federation, as well as the identification of the components of the risk management process of insurance companies in the context of digitalization. Documents containing key features of the risk management system were selected for the study.

In the first stage, based on the analysis and generalization of various scientific concepts and standpoints, the category of financial risk was systematized and justified, clarifying the scope of its occurrence and existence and determining the role of financial risk in economic processes in general and in insurance activity in the context of digitalization.

In the second stage, based on the conducted studies of the macroeconomic parameters, and indicators that affect the insurance market condition and development, as well as the effectiveness of the activities of insurance companies in the Russian Federation, positive aspects of insurance formation and trends in development risk events in insurance activities were identified.

In the third stage, the receipt of insurance premiums was determined, the number of existing insurance contracts was revealed, the average profitability was calculated, and the structure of insurance portfolios with a digital focus was determined.

Because the basis for calculating insurance premiums is the probability of an insured event, it is proposed to calculate the risk premium taking, instead of the relative frequency (

) of the occurrence of an insured event, the probability value (

), which we propose to define using the formula:

where

n is the number of insurance contracts and

is the solution of the Laplace equation.

4. Results

Based on the analysis of the insurance market condition and its dynamics, the following conclusions can be drawn:

The insurance market of the Russian Federation during 2016–2020 was characterized by positive development dynamics, despite its functioning in the context of digitalization;

The number of insurance companies decreased, which at the end of 2020 amounted to 177 units. The monopolization of the insurance market increased. The volume of insurance premiums increased;

The volume of insurance indemnities increased, which led to an increase in the level of insurance payouts to 42.9% in 2020, although this value is very low compared to the traditional one in developed countries (about 70%).

However, the results obtained by insurance companies were affected by digitalization, and are characterized by an increase in the financial risks of their activities. The volumes of gross and net insurance premiums received decreased. The volumes of insurance indemnity payments decreased, with a simultaneous increase in their level, which poses a threat to the financial stability of insurers. The number of concluded insurance contracts, as well as the volume of reinsurance, decreased.

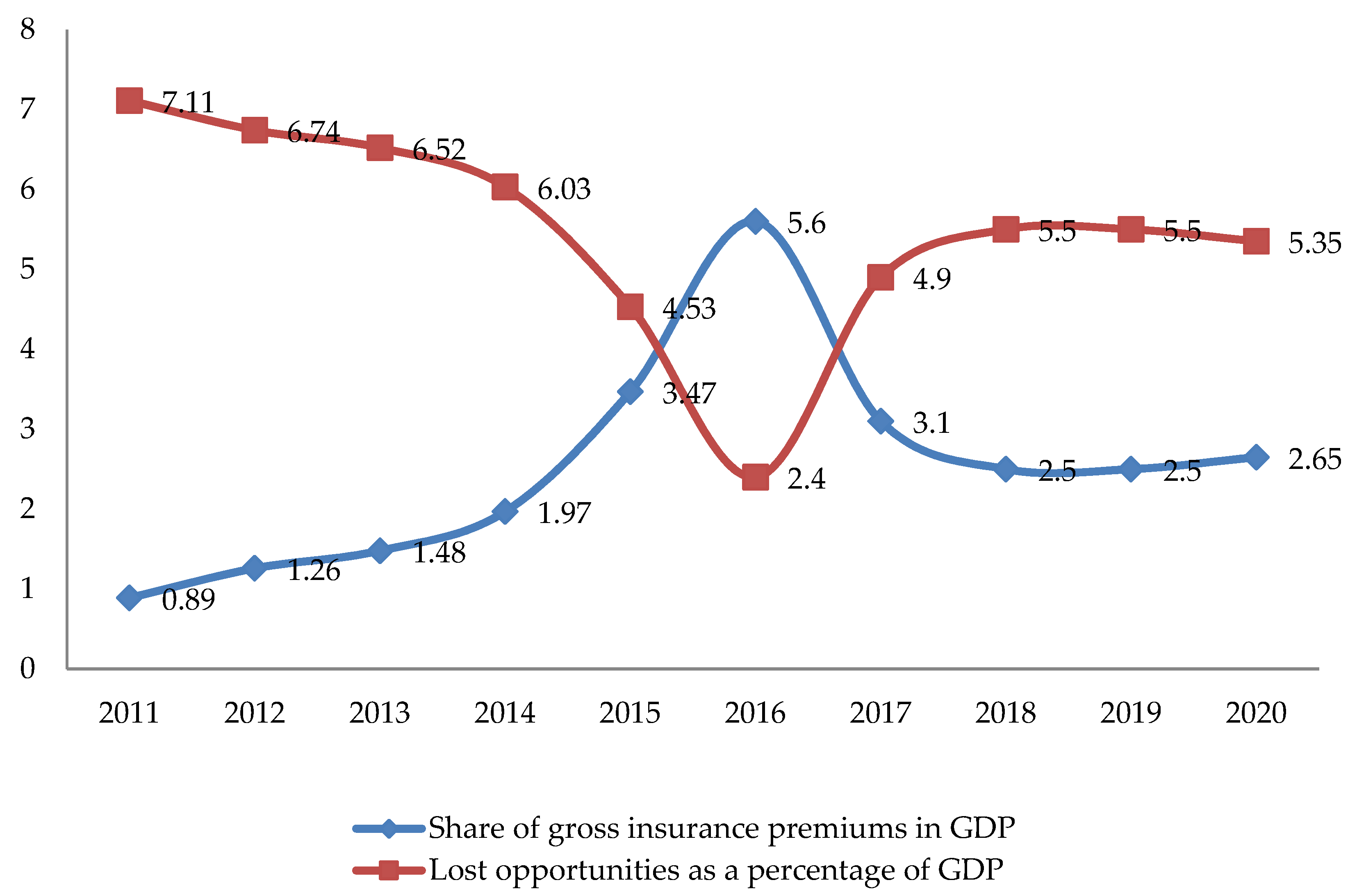

The study of current trends in the development of the insurance market in the Russian Federation indicates that, despite its significant potential, the ratio of insurance premiums to GDP is still significantly lower than in developed countries (

Figure 1).

Despite the nominal growth of the insurance market from 2011–2020, the share of insurance premiums in GDP was declining: in 2020, the industry provided a redistribution of only 2.65% of GDP (the same indicator for developed countries is 8–12%). This indicates that the insurance market currently does not fully accumulate available investment resources and is characterized by a significant risk of missed opportunities.

The analysis of the specific structure of insurance premiums has shown that the insurance market is dominated by voluntary property insurance; the share of corresponding insurance premiums in 2020 was 76.7% of all insurance premiums. A positive aspect is a growth in the volume and share of insurance premiums for the insurance of the person.

The analysis of the main indicators of the reinsurance market in the Russian Federation allowed the drawing of the following conclusions:

The volume and level of payments in reinsurance have increased, which indicates the approval of real reinsurance in the country for the analyzed period;

Despite the growth in the volume of reinsurance, its share in gross insurance premiums is gradually decreasing;

The share of premiums transferred to non-residents for reinsurance decreased, while domestic reinsurance in 2020 has shown a relatively high level (33.4%), which confirms the growth of confidence in Russian reinsurers, the recognition of reinsurance activities in the country as a full-fledged segment of the insurance market;

Insurance companies paid more for reinsurance than they received insurance payments from policyholders, although this indicator has slightly decreased in recent years.

According to the results of the research, it was revealed that the dynamics of the financial reliability of insurers in the context of digitalization show rather unstable and often unfavorable trends. This indicates an increase in the risks of their financial unreliability and requires the search for reserves to improve their financial condition.

In this case, the analysis of the profitability of the insurance companies made it possible to identify, for most of them, the major risk events in their activities. They are:

A decrease in the level of rendered services profitability in terms of net operating profit;

A decrease in return on assets;

A return on equity indicator for 60% of the insurance companies studied is below 10%, which characterizes a low level of return on capital invested by investors.

All of this allows the reduction of the risk of short-receipt of insurance premiums by reducing the expected level of short-received risk premiums. In particular, at reliability and relative frequency γ = 0.99, by 10% for a portfolio of one thousand contracts, and by 3.1% for a portfolio of ten thousand insurance contracts. The significance of using the proposed value instead of the relative frequency as the probability of an insured event is especially high for small portfolios of contracts in the context of digitalization.

The calculation of the net premium value under the same conditions for a portfolio of one thousand contracts allows for the reduction of the expected level of net premiums lost by 9.3%, while for a portfolio of ten thousand insurance contracts the expected level of net premiums lost is reduced by 3.1%. It should be noted that for large portfolios of contracts (for example, ten thousand contracts), the expected levels are the same.

The conducted analysis shows that a group of insurance companies with a higher level of payouts is characterized by typically large values of net profit and return on equity. Accordingly, the application of the methodology for calculating the net premium will increase the performance of insurance companies. At the same time, the structure of the capital allocation of insurance companies is an important factor in financial risks, and, certainly, affects the financial results of their activities in the context of digitalization (

Malyugina et al. 2020;

Shakhmametyev et al. 2018;

Tsvetkova et al. 2019). In this case, factors, such as the volume of long-term and current financial investments, have a significant impact (

Markaryan and Snetkova 2015;

Stafievskaya et al. 2015;

Tsvetkova et al. 2019).

Thus, current financial investments are a significant stimulating factor for the growth of net profit. In this regard, to optimize the structure of financial investments according to the criterion of maximizing net profit, it is advisable to allocate a large amount of funds to purchase short-term securities.

Among the main optimization areas of investment risk management of insurance companies, the following can be distinguished:

- -

Using multi-level diversification, considering the restrictions established by law regarding the investment of insurance reserves to reduce the risks of investing in securities, such as stocks and bonds;

- -

In cases of a positive correlation between the yields of securities, it is advisable to purchase derivative financial instruments, namely, futures contracts and options, which will allow insurance companies to protect themselves against rapid changes in the prices of securities on the stock market in the context of digitalization.

A characteristic feature of the operational activities of insurance companies is also the formation and use of insurance reserves. The main source of their formation and replenishment is the receipt of insurance premiums by the types of insurance and reinsurance, income from investment, and placement of temporarily available funds, as well as other income not prohibited by the current insurance legislation.

Insurance reserves are intended to ensure future payments of insurance proceeds and insurance compensation, depending on the types of insurance (reinsurance). Let us analyze the volume and structure of insurance premium receipts in Renaissance Insurance (Moscow) during 2018–2020 and determine the factors that determined their dynamics (

Table 1).

Analyzing the data presented in

Table 1, one can note that between 2018–2019, the company’s insurance fees decreased from 14,641.3 thousand rubles to 11,382.4 thousand rubles (i.e., fees decreased by 3258.9 thousand rubles), which is evidence of increased competition. However, in 2020, their increase was observed to 15,378.4 thousand rubles (a fee increase of 3996 thousand rubles). At the same time, the growth in the volume of insurance premiums from the insurer indicates the effective conduct of insurance operations over the past year.

Having considered the structure of insurance receipts in Renaissance Insurance between 2018–2020, one can find out the factors that affect the dynamics of the main source of forming insurance reserves and income from the operating activities of the insurer, i.e., insurance premiums. It is important to note that the structure of insurance receipts for proven types of insurance has been changing in the insurance company for three years. In particular, the largest part of insurance premiums comes from property insurance, which slightly decreased from 94.1% in 2018 to 91.3% in 2019 and grew to 93.4% in 2020.

The determining factor of the noted trend is the decrease in the volume of insurance premiums for property insurance transactions from 13,771.6 to 10,394.2 thousand rubles, and their increase to 14,361.6 thousand rubles at the expense of voluntary property insurance. At the same time, it is important to note the essential development of voluntary property insurance in the company, which has about 10 types and characterizes the dynamics of its insurance receipts.

Accordingly, personal insurance (1.4% in 2018, 2.4% in 2019, 1.9% in 2020) and liability insurance occupy an insignificant share with an upward trend over three years. (4.5, 6.2, and 4.7%, respectively). At the same time, the factor causing such dynamics in an insurance company is the size and structure of the insurance portfolio (

Table 2).

Accordingly, the number of property insurance contracts decreased from 13,638 in 2018 to 9658 in 2019 and increased to 14,026 in 2020, which characterizes a similar trend regarding the dynamics of insurance receipts for these insurance operations. At the same time, the number of liability insurance contracts grew (from 2543 in 2018 to 2902 in 2020), as well as personal insurance contracts (from 19,192 to 21,335). Besides, having considered the insurance portfolio of Renaissance Insurance, it is necessary to note the opposite trend in its structure relative to the structure of insurance receipts; personal insurance occupied the largest share with a slight increase over three years amounting to 54.3% in 2018, 61.8% in 2019, and 55.8% in 2020.

The conducted analysis of the insurance income volume and structure in Renaissance Insurance between 2018–2020 indicates that the determining factor in the insurance premiums dynamics in the context of digitalization is changes in the size and structure of the insurance portfolio. Therefore, the problems and tasks of financial risk management of this company are associated with the insurance portfolio as the main element of management.

When determining the profitability of insurance operations, it should be taken into account that for Renaissance Insurance, the level of business expenses is approximately 30–35% for property insurance and 15–20% for personal insurance and liability insurance. Therefore, we calculated the average profitability for the types of insurance carried out in Renaissance Insurance from 2018–2020, as shown in

Table 3.

Consequently, the highest level of profitability of the insurance portfolio in Renaissance Insurance was observed in 2019. The determining factor of the noted trend is the high profitability of personal insurance, while its share in the portfolio structure is insignificant.

Table 4 shows the structure of the insurance portfolio of Renaissance Insurance from 2018–2020, as well as its profitability and risk, respectively.

Therefore, the optimal insurance portfolio is achieved at the optimum ratio of property, personal insurance, and liability insurance according to the criteria of maximum profitability at a given level of risk in the context of digitalization, which confirms the hypothesis we put forward.

5. Discussion

The significance of the research is confirmed by the developed approaches to a comprehensive study of the risk management system of insurance companies. The novelty of the research lies in the systematization of indicators that affect the state and development of the insurance market and the efficiency of insurance companies in the Russian Federation.

Our findings are consistent with the results of

Christensen et al. (

2021),

Fields et al. (

1998),

Häusler (

2004),

Nerovnya et al. (

2018),

Pompella (

2013),

Tsvetkova et al. (

2019), and

Yusupova (

2019), who also found that the main problem for insurance companies in the context of digitalization is the lack of liquid assets to fulfill their insurance obligations and carry out effective investment activities, which is due to a decrease in the volume of insurance premium receipts and the introduction of temporary administration in banks, as well as an increase in the risk of non-fulfillment of obligations by reinsurers. In this case, several risky events may occur in the main and investment activities of insurance companies, whose negative impact on the results of their business is amplified in the context of digitalization.

They also offer the following main stages of forming an insurance rate strategy and recommendations for their implementation by insurers in the context of digitalization:

Determining general goals and objectives;

Analyzing the actual level of insurance rates;

Analyzing the potential and features of the insurance market;

Differentiating the goals of the insurance rate strategy in the context of specific types of insurance, taking into account the market opportunities and the level of operating costs;

Choosing a calculation model for insurance rates (premiums) for certain types of insurance services;

Forming a specific level of insurance rates for certain types of insurance services;

Assessing the effectiveness of the implementation of the chosen insurance rate strategy;

Forming a mechanism for timely adjustment of insurance rates.

Christensen et al. (

2021) found that with voluntary property insurance (except for financial risk insurance), there is an exponential distribution, and with accident insurance, there is normal distribution.

Fields et al. (

1998) note that the calculation of the net premium, considering the distribution law, shows that insurers have overestimated the amount of insurance premiums for voluntary property insurance, medical insurance, and accident insurance.

Pompella (

2013) writes that it is in the development of voluntary risk insurance that there are hidden reserves for the growth of insurance volumes.

Häusler (

2004) emphasizes that one of the most effective factors affecting the effectiveness of the insurance business in the field of voluntary insurance is the use of a reliable actuarial calculation system, which is the basis for determining insurance rates, premiums, reserves, optimizing the financial risks of insurers, as well as the formation of their cash receipts and profits.

Yusupova (

2019) notes that to analyze the liquidity of an insurance company as a legal entity engaged in business activities for the provision of financial services, standard liquidity ratios can be used, in particular, such as the coefficient of the total, current, or absolute liquidity.

However, while evaluating the liquidity of an insurance company from the perspective of its ability to perform direct functional duties related to the completeness and timeliness of the payment of insurance indemnities for insurance events, then it is necessary to adjust the calculation of liquidity coefficients taking into account the specifics of insurance activities, in particular, the formation of insurance reserves. At the same time, the insurance company has the opportunity to reduce the amount of the net premium. This, in turn, will allow an increase in the level of insurance indemnity payments without threatening financial liquidity.

In addition, the main problem for Russian insurance companies in the context of digitalization is the lack of liquid assets to fulfill their insurance obligations and carry out effective investment activities, which is due to a decrease in the volume of insurance premium receipts and the introduction of temporary administration in banks, as well as an increase in the risk of non-fulfillment of obligations by reinsurers.

6. Conclusions

We established that the effective management of financial risks of insurers should be based on their classification by the type of activity since the financial risks that manifest themselves in each of them are characterized by their own specifics. The greatest attention, considering the peculiarities of insurance, should be paid to the management of risks that accompany the main (direct insurance and reinsurance) investment activities.

The performed research and the results obtained in the case of a complex application in insurance companies contribute to the increase in their efficiency. Thus, insurance companies increase their chances in the competition, resulting in savings in time and money.

The conducted analysis of the main indicators of the reinsurance market in the Russian Federation allowed us to assert that the payments volume and level in reinsurance have increased. All this testifies to the approval of real reinsurance in the country from 2018–2020. Despite the growth in reinsurance volumes, its share in gross insurance premiums is gradually decreasing. The proportion of premiums transferred to non-residents for reinsurance decreases as well. A relatively high level of domestic reinsurance (33.4%) in 2020 confirms the growth of confidence in Russian reinsurers in the context of digitalization.

To optimize the structure of the insurance portfolio, the insurer must regulate its portfolio by increasing the share of insurance receipts for personal insurance, which is highly profitable but occupies a meager share in the insurance portfolio. To do this, it is necessary to carry out active work to expand the insurance field, in particular, in relation to voluntary personal insurance, attracting a significant number of policyholders by conducting explanatory mass work by holding advertising events, and developing agency-broker networks regarding the need and effectiveness of such insurance.

Further research prospects should include proposals for replenishing the insurance portfolio with new types of personal insurance, making adjustments to the tariff policy of insurers for all types of voluntary personal insurance, determining optimal tariffs, that is, those that will be affordable and profitable for policyholders and highly profitable for insurers in the context of digitalization.

Author Contributions

Conceptualization, S.V.I., E.Y.L., N.V.M., P.P.R., N.N.D. and A.V.B.; methodology, S.V.I., E.Y.L., N.V.M., P.P.R., N.N.D. and A.V.B.; software, S.V.I., E.Y.L., N.V.M., P.P.R., N.N.D. and A.V.B.; validation, S.V.I., E.Y.L., N.V.M., P.P.R., N.N.D. and A.V.B.; formal analysis, S.V.I., E.Y.L., N.V.M., P.P.R., N.N.D. and A.V.B.; investigation, S.V.I., E.Y.L., N.V.M., P.P.R., N.N.D. and A.V.B.; resources, S.V.I., E.Y.L., N.V.M., P.P.R., N.N.D. and A.V.B.; data curation, S.V.I., E.Y.L., N.V.M., P.P.R., N.N.D. and A.V.B.; writing—original draft preparation, S.V.I., E.Y.L., N.V.M., P.P.R., N.N.D. and A.V.B.; writing—review and editing, S.V.I., E.Y.L., N.V.M., P.P.R., N.N.D. and A.V.B.; visualization, S.V.I., E.Y.L., N.V.M., P.P.R., N.N.D. and A.V.B.; supervision, S.V.I., E.Y.L., N.V.M., P.P.R., N.N.D. and A.V.B.; project administration, S.V.I., E.Y.L., N.V.M., P.P.R., N.N.D. and A.V.B.; funding acquisition, S.V.I., E.Y.L., N.V.M., P.P.R., N.N.D. and A.V.B. All authors have read and agreed to the published version of the manuscript.

Funding

This study did not receive external funding.

Data Availability Statement

Data can be provided and please send the request to the corresponding author.

Conflicts of Interest

The authors declare that there is no conflict of interest.

References

- Agamirova, Ekaterina Valerievna, Elizaveta Valerievna Agamirova, Olga Yevgeniena Lebedeva, Kostyantyn Anatol’evich Lebedev, and Sergey Viktorovich Ilkevich. 2017. Methodology of Estimation of Quality of Tourist Product. Quality—Access to Success 18: 82–84. [Google Scholar]

- Ayton, Julie, Natalia Krasnikova, and Issam Malki. 2022. Corporate social performance and financial risk: Further empirical evidence using higher frequency data. International Review of Financial Analysis 80: 102030. [Google Scholar] [CrossRef]

- Blokhina, Olga Anatolyevna, Olga Nikolaevna Beketova, Evgenia Evgenyevna Kuzmina, Olga Yevgenievna Lebedeva, and Marina Ivanovna Podzorova. 2018. Improving the Technology of Innovation Systems Management at an Enterprise. International Journal of Civil Engineering and Technology 9: 137–43. [Google Scholar]

- Cheng, Xueqi, Shenghua Liu, Xiaoqian Sun, Zidong Wang, Houquan Zhou, Yu Shao, and Huawei Shen. 2021. Combating emerging financial risks in the big data era: A perspective review. Fundamental Research 1: 595–606. [Google Scholar] [CrossRef]

- Christensen, Bent Jesper, Juan Carlos Parra-Alvarez, and Rafael Serrano. 2021. Optimal control of investment, premium and deductible for a non-life insurance company. Insurance: Mathematics and Economics 101: 384–405. [Google Scholar] [CrossRef]

- Demkina, Nadezhda I., Pavel A. Kostikov, and Kostyantyn A. Lebedev. 2019. Formation of Professional Competence of Future Specialists in the Field of Information Environment. Espacios 40: 3. [Google Scholar]

- Drobysheva, Nataliya Nikolaevna, Elena Petrovna Zvyagintseva, Elena Alekseevna Fedorova, Nataliya Aleksandrovna Kindrya, and Olga Evgenievna Lebedeva. 2018. Development of Crisis Phenomena in Social and Economic Systems in Conditions of Globalization. International Journal of Engineering & Technology 7: 131. [Google Scholar] [CrossRef]

- Ettlin, Nicolas, Walter Farkas, Andreas Kull, and Alexander Smirnow. 2020. Optimal risk-sharing across a network of insurance companies. Insurance: Mathematics and Economics 95: 39–47. [Google Scholar] [CrossRef]

- Fields, Joseph A., Linda S. Klein, and Edward G. Myskowski. 1998. Lloyd’s Financial Distress and Contagion within the US Property and Liability Insurance Industry. Journal of Risk and Uncertainty 16: 173–85. [Google Scholar] [CrossRef]

- Häusler, Gerd. 2004. The Impact of Insurance Accounting on Business Reality and Financial Stability. The Geneva Papers on Risk and Insurance—Issues and Practice 29: 63–70. [Google Scholar] [CrossRef]

- Ibragimov, Kamal Mirsahib. 2018. Problems of Risk Management Influencing Financial Stability in Insurance Companies. Theoretical & Applied Science 62: 264–68. [Google Scholar] [CrossRef]

- Illichevskyi, Sergiy O. 2011. Combination of Actuarial Models and Artificial Neural Networks for Estimation of Financial Risks and Bankruptcy Probabilities for Insurance Companies. Actual Problems of Economics 115: 253–58. [Google Scholar]

- Malyugina, Nadezhda Mihailovna, Rauza Ildarovna Polyakova, Elena Alekseevna Fedorova, Elena Borisovna Tretyak, and Irina Gennad’evna Shadskaja. 2020. The Specifics of Discourse Modeling in Intercultural Communication. Revista Inclusiones 7: 486. [Google Scholar]

- Markaryan, Sergei Eduardovich, and Tatiana Anatolyevna Snetkova. 2015. Purpose and Application Peculiarities of Management Accounting in Insurance Companies. Mediterranean Journal of Social Sciences 6: 375–78. [Google Scholar] [CrossRef]

- Nerovnya, Yulia V., Dmitry G. Romanov, and Vladimir Yu Shirshov. 2018. Development Trends for the Insurance Industry in Russia. European Research Studies Journal 21: 474–84. [Google Scholar]

- Olarewaju, Odunayo Magret, and Thabiso Sthembiso Msomi. 2021. Intellectual capital and financial performance of South African development community’s general insurance companies. Heliyon 7: e06712. [Google Scholar] [CrossRef] [PubMed]

- Pompella, Maurizio. 2013. The Mysterious Ways of Structured Insurance. Cross-Section Risk Transfer and Crises, from Financial to Pure Risk Securitization. Bulletin of the Lobachevsky University of Nizhni Novgorod 3: 9–15. [Google Scholar]

- Quan, Lanji, Amr Al-Ansi, and Heesup Han. 2021. Assessing customer financial risk perception and attitude in the hotel industry: Exploring the role of protective measures against COVID-19. International Journal of Hospitality Management 101: 103123. [Google Scholar] [CrossRef]

- Sekścińska, Katarzyna, Joanna Rudzinska-Wojciechowska, and Petko Kusev. 2021. How decision-makers’ sense and state of power induce propensity to take financial risks. Journal of Economic Psychology 89: 102474. [Google Scholar] [CrossRef]

- Serebryakova, Tatyana Yu, Ludmila P. Fedorova, Olga G. Gordeyeva, and Natalya V. Malinovskaya. 2020. Risks and Internal Control in the Organization Management. Journal of Advanced Research in Dynamical and Control Systems 12: 322–31. [Google Scholar] [CrossRef]

- Shakhmametyev, Alexey Alimovich, Irina Aleksandrovna Strelets, and Kostyantyn Anatolevich Lebedev. 2018. Strategic Mechanisms for the Future Development of the International E-Commerce Market. Espacios 39: 2018. [Google Scholar]

- Sharma, Abhijit, Diara Md Jadi, and Damian Ward. 2018. Evaluating financial performance of insurance companies using rating transition matrices. The Journal of Economic Asymmetries 18: e00102. [Google Scholar] [CrossRef]

- Stafievskaya, Maria, Tatyana Sarycheva, Lidia Nikolayeva, Rose A. Vanyukova, Oksana A. Danilova, Olesya A. Semenova, and Tatiana A. Sokolova. 2015. Risks in Conditions of Uncertainty. Mediterranean Journal of Social Sciences 6: 107–14. [Google Scholar] [CrossRef]

- Tone, Kaoru, Qian Long Kweh, Wen-Min Lu, and Irene Wei Kiong Ting. 2018. Modeling investments in the dynamic network performance of insurance companies. Omega 88: 237–47. [Google Scholar] [CrossRef]

- Tsvetkova, Liudmila, Tatiana Yurieva, Larisa Orlaniuk-Malitskaia, and Tatiana Plakhova. 2019. Financial Intermediary and Insurance Companies: Assessing Financial Stability. Montenegrin Journal of Economics 15: 189–204. [Google Scholar] [CrossRef]

- Turgaeva, Aksana A., Liudmila Kashirskaya, Yulia A. Zurnadzhyants, Olga A. Latysheva, Irina V. Pustokhina, and Andrei V. Sevbitov. 2020. Assessment of the Financial Security of Insurance Companies in the Organization of Internal Control. Entrepreneurship and Sustainability Issues 7: 2243–54. [Google Scholar] [CrossRef]

- Yusupova, Ol’ga A. 2019. Analysis of Credit Institutions’ Risks in the Bancassurance Market. Digest Finance 24: 3–12. [Google Scholar] [CrossRef]

- Zhu, Weidong, Tianjiao Zhang, Yong Wu, Shaorong Li, and Zhimin Li. 2022. Research on optimization of an enterprise financial risk early warning method based on the DS-RF model. International Review of Financial Analysis 81: 102140. [Google Scholar] [CrossRef]

| Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).