Incorporating Portfolio Uncertainty in Decision Rules for Healthcare Resource Allocation

Abstract

1. Introduction

2. Methods

2.1. The Case of Certainty

2.2. The Case of Uncertainty

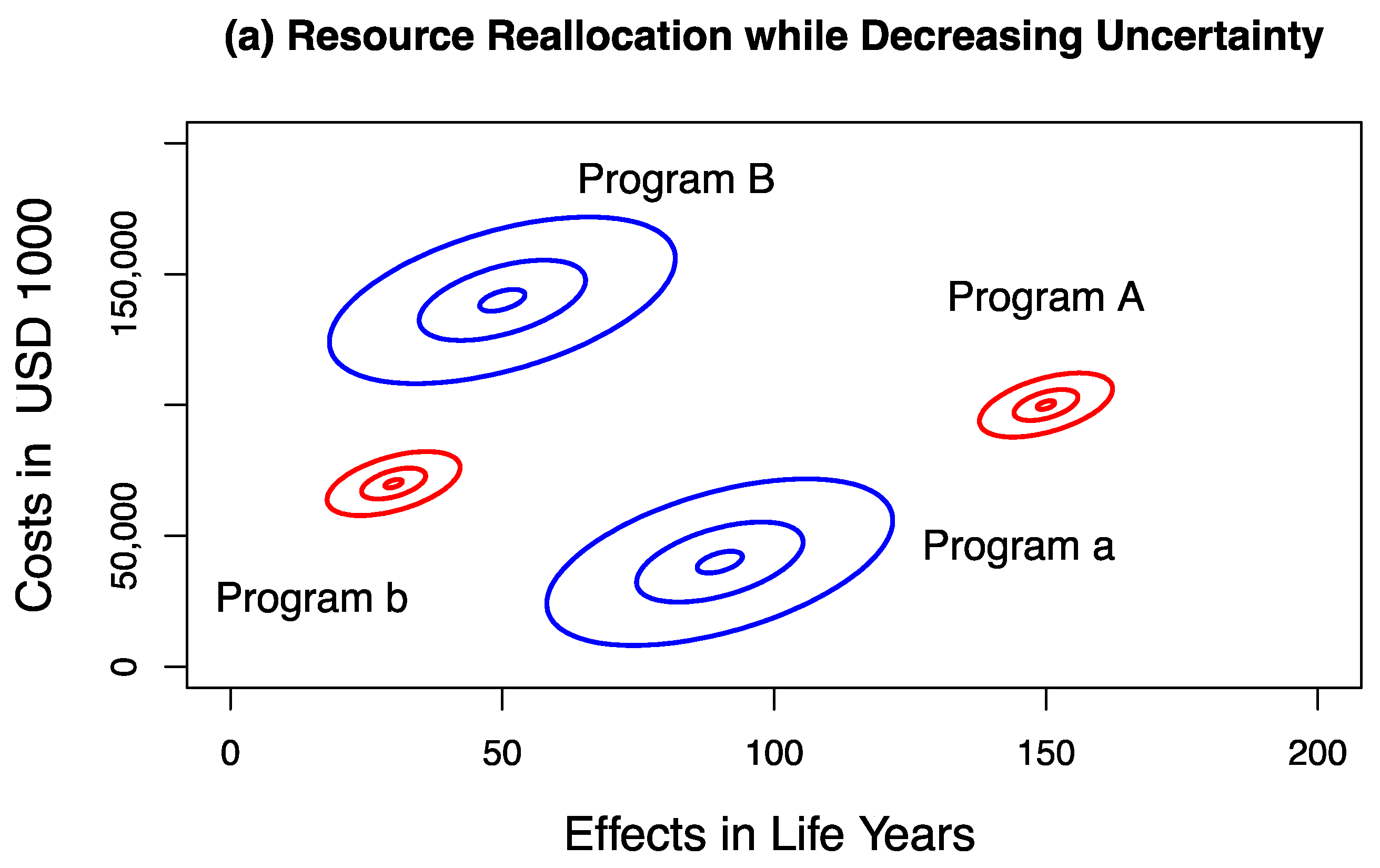

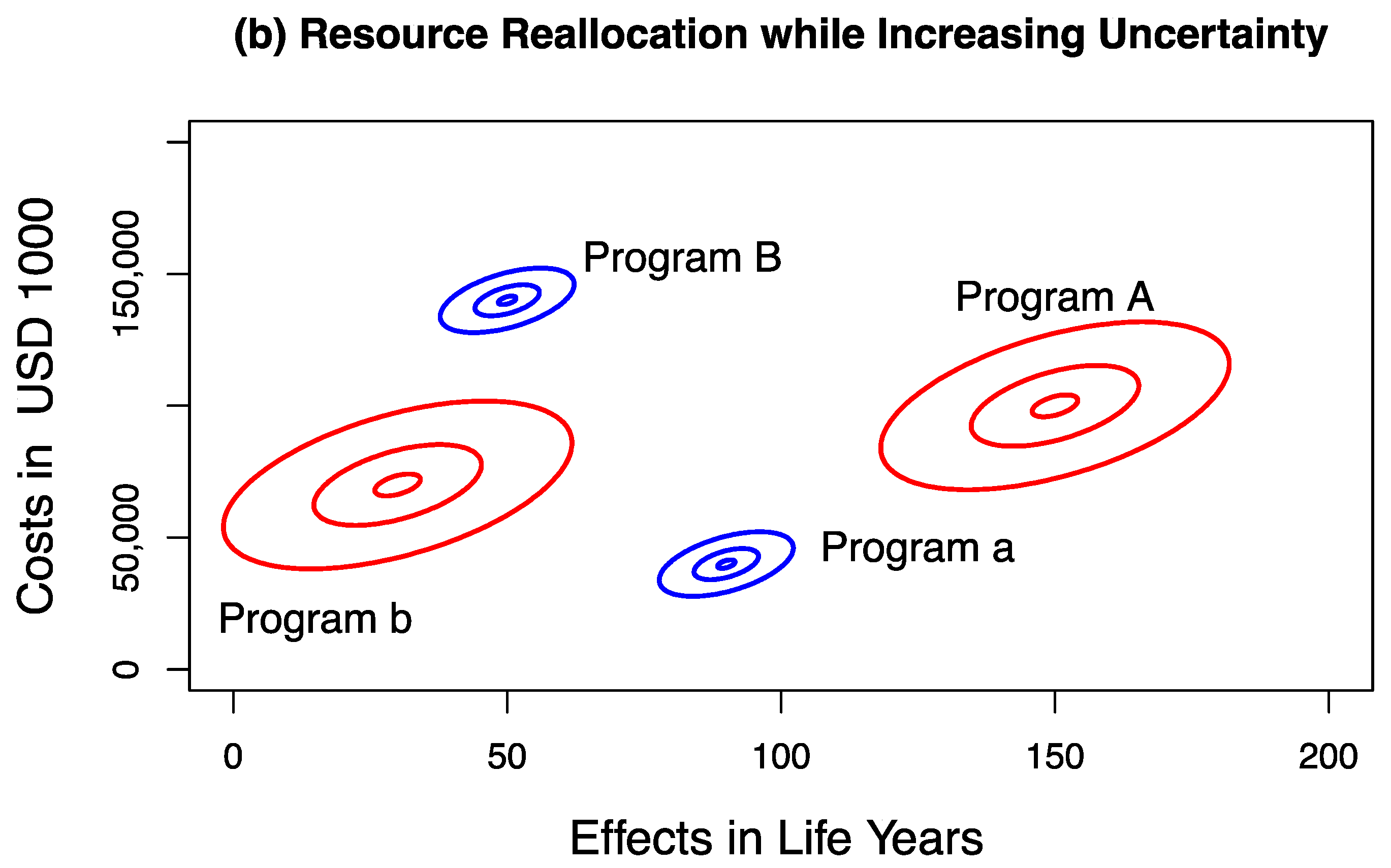

3. Results

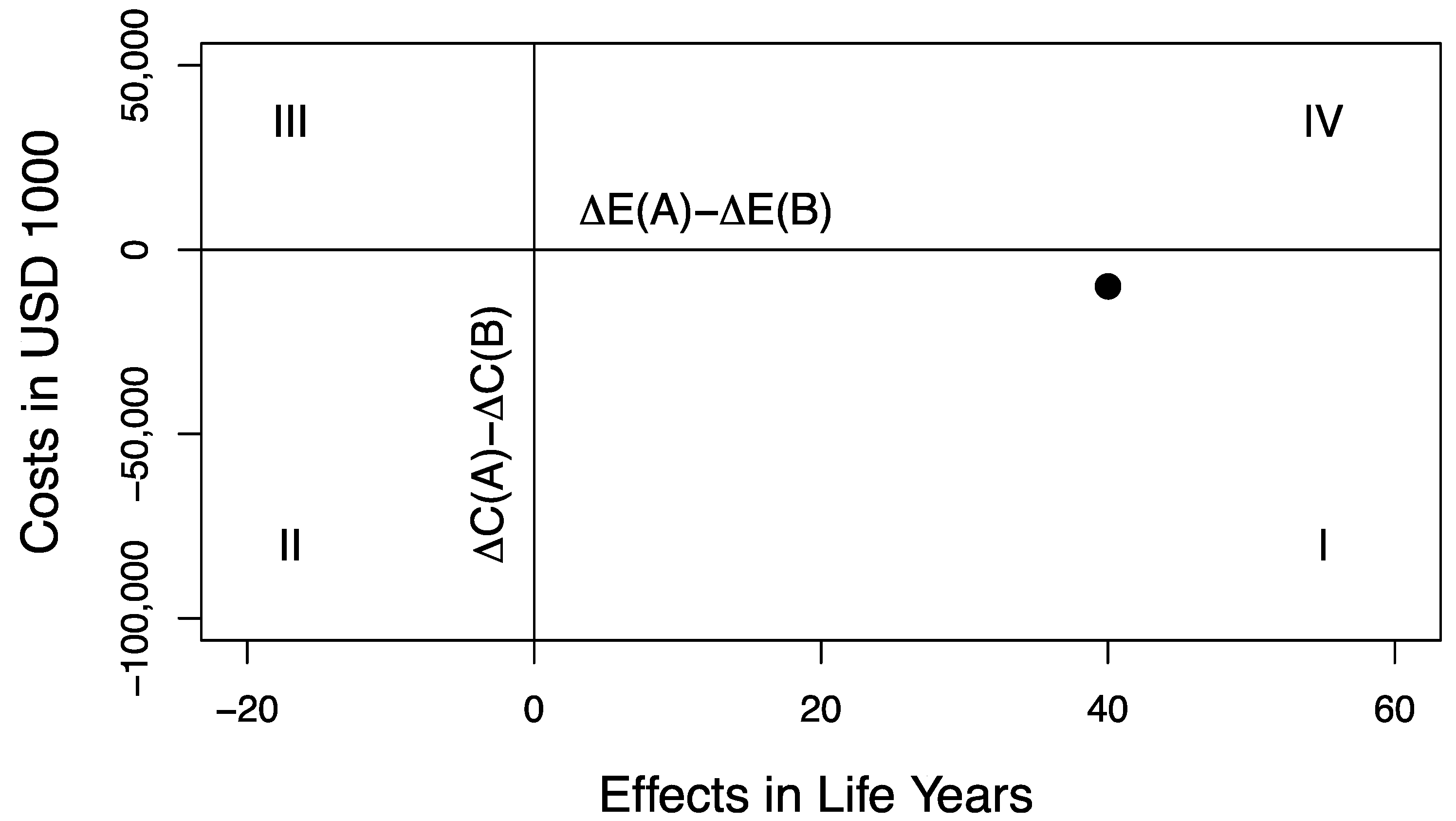

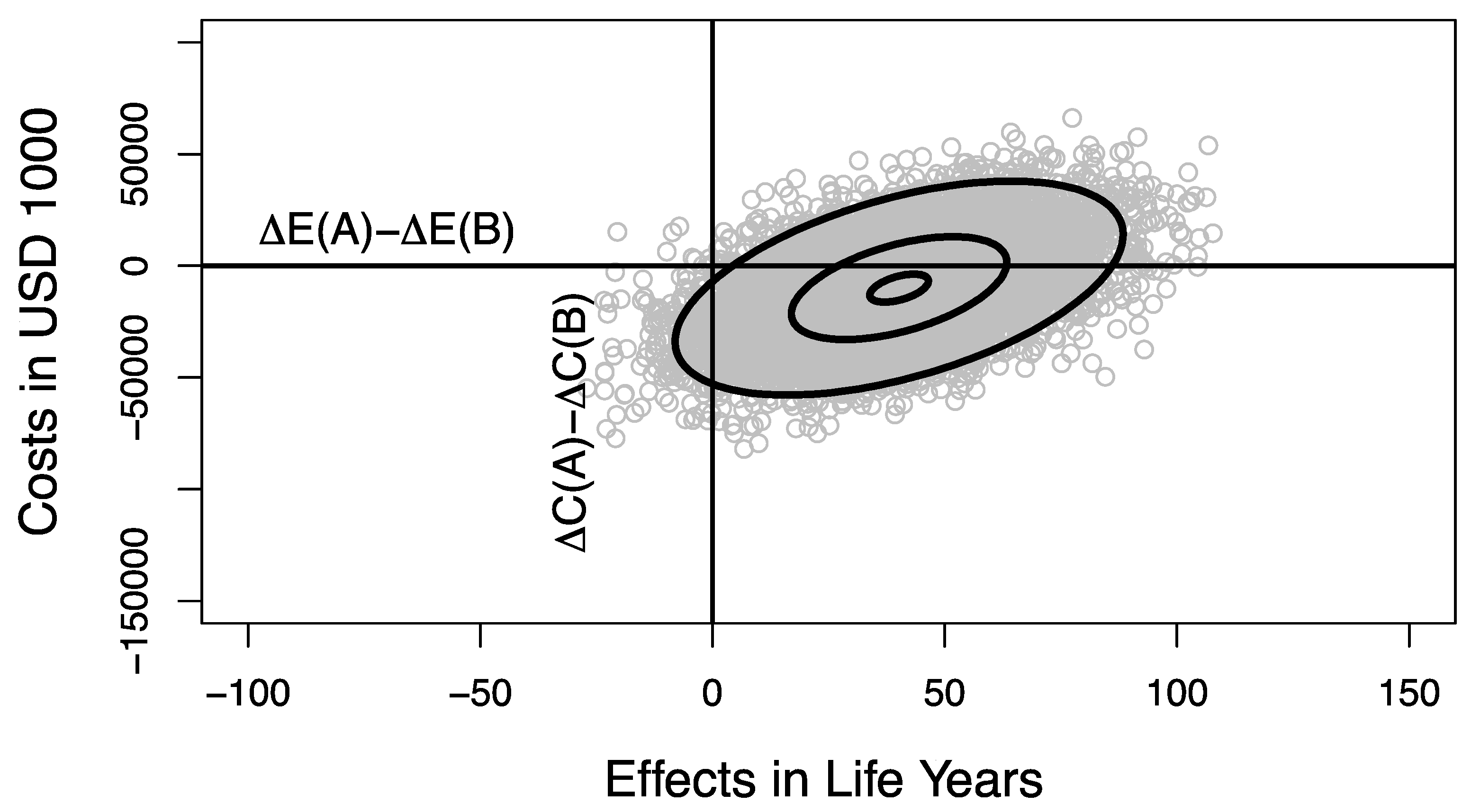

Valuing Outcomes on the Decision-Making Plane

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Birch, S.; Gafni, A. Cost effectiveness/utility analyses. Do current decision rules lead us to where we want to be? J. Health Econ. 1992, 11, 279–296. [Google Scholar] [CrossRef]

- Gafni, A.; Birch, S. Guidelines for the adoption of new technologies: A prescription for uncontrolled growth in expenditures and how to avoid the problem. CMAJ 1993, 148, 913–917. [Google Scholar]

- Birch, S.; Gafni, A. Information created to evade reality (ICER): Things we should not look to for answers. Pharmacoeconomics 2006, 24, 1121–1131. [Google Scholar] [CrossRef]

- Williams, A. The economic role of health indicators. In Measuring the Social Benefits of Medicine; Teeling Smith, G., Ed.; Office of Health Economic: London, UK, 1983; pp. 63–67. [Google Scholar]

- Weinstein, M.C.; Stason, W.B. Foundations of cost-effectiveness analysis for health and medical practices. N. Engl. J. Med. 1977, 296, 716–721. [Google Scholar] [CrossRef]

- Weinstein, M.; Zeckhauser, R. Critical ratios and efficient allocation. J. Public Econ. 1973, 2, 147–157. [Google Scholar] [CrossRef]

- Eichler, H.-G.; Kong, S.X.; Gerth, W.C.; Mavros, P.; Jönsson, B. Use of cost-effectiveness analysis in health-care resource allocation decision-making: How are cost-effectiveness thresholds expected to emerge? Value Health 2004, 7, 518–528. [Google Scholar] [CrossRef]

- Gafni, A.; Birch, S. Incremental cost-effectiveness ratios (ICERs): The silence of the lambda. Soc. Sci. Med. 2006, 62, 2091–2100. [Google Scholar] [CrossRef]

- Sendi, P.; Gafni, A.; Birch, S. Opportunity costs and uncertainty in the economic evaluation of health care interventions. Health Econ. 2002, 11, 23–31. [Google Scholar] [CrossRef]

- Gafni, A.; Walter, S.; Birch, S. Uncertainty and the decision maker: Assessing and managing the risk of undesirable outcomes. Health Econ. 2013, 22, 1287–1294. [Google Scholar] [CrossRef]

- O’Brien, B.J.; Sculpher, M.J. Building uncertainty into cost-effectiveness rankings: Portfolio risk-return tradeoffs and implications for decision rules. Med. Care 2000, 38, 460–468. [Google Scholar] [CrossRef]

- Al, M.J.; Feenstra, T.L.; Hout, B.A.V. Optimal allocation of resources over health care programmes: Dealing with decreasing marginal utility and uncertainty. Health Econ. 2005, 14, 655–667. [Google Scholar] [CrossRef]

- Groot Koerkamp, B.; Hunink, M.G.M.; Stijnen, T.; Hammitt, J.K.; Kuntz, K.M.; Weinstein, M.C. Limitations of acceptability curves for presenting uncertainty in cost-effectiveness analysis. Med. Decis. Mak. 2007, 27, 101–111. [Google Scholar] [CrossRef] [PubMed]

- Ben-Zion, U.; Gafni, A. Evaluation of public investment in health care. Is the risk irrelevant? J. Health Econ. 1983, 2, 161–165. [Google Scholar] [CrossRef]

- Sendi, P. Dealing with Bad Risk in Cost-Effectiveness Analysis: The Cost-Effectiveness Risk-Aversion Curve. Pharmacoeconomics 2021, 39, 161–169. [Google Scholar] [CrossRef]

- Elbasha, E.H. Risk aversion and uncertainty in cost-effectiveness analysis: The expected-utility, moment-generating function approach. Health Econ. 2005, 14, 457–470. [Google Scholar] [CrossRef] [PubMed]

- Zivin, J.G.; Bridges, J.F. Addressing risk preferences in cost-effectiveness analyses. Appl. Health Econ. Health Policy 2002, 1, 135–139. [Google Scholar]

- Phelps, C.E. A New Method to Determine the Optimal Willingness to Pay in Cost-Effectiveness Analysis. Value Health 2019, 22, 785–791. [Google Scholar] [CrossRef]

- Sendi, P.; Gafni, A.; Birch, S. Ethical economics and cost-effectiveness analysis: Is it ethical to ignore opportunity costs? Expert Rev. Pharmacoecon. Outcomes Res. 2005, 5, 661–665. [Google Scholar] [CrossRef]

- Gafni, A.; Walter, S.D.; Birch, S.; Sendi, P. An opportunity cost approach to sample size calculation in cost-effectiveness analysis. Health Econ. 2008, 17, 99–107. [Google Scholar] [CrossRef]

- Sendi, P.; Al, M.J.; Gafni, A.; Birch, S. Optimizing a portfolio of health care programs in the presence of uncertainty and constrained resources. Soc. Sci. Med. 2003, 57, 2207–2215. [Google Scholar] [CrossRef]

- Sendi, P.P.; Bucher, H.C.; Harr, T.; Craig, B.A.; Schwietert, M.; Pfluger, D.; Gafni, A.; Battegay, M. Cost effectiveness of highly active antiretroviral therapy in HIV-infected patients. Swiss HIV Cohort Study. AIDS 1999, 13, 1115–1122. [Google Scholar] [CrossRef]

- Leidner, A.J.; Murthy, N.; Chesson, H.W.; Biggerstaff, M.; Stoecker, C.; Harris, A.M.; Acosta, A.; Dooling, K.; Bridges, C.B. Cost-effectiveness of adult vaccinations: A systematic review. Vaccine 2019, 37, 226–234. [Google Scholar] [CrossRef] [PubMed]

- Bonett, D.G. Confidence interval for a coefficient of quartile variation. Comput. Stat. Data Anal. 2006, 50, 2953–2957. [Google Scholar] [CrossRef]

- Sendi, P.P.; Craig, B.A.; Pfluger, D.; Gafni, A.; Bucher, H.C. Systematic validation of disease models for pharmacoeconomic evaluations. Swiss HIV Cohort Study. J. Eval. Clin. Pract. 1999, 5, 283–295. [Google Scholar] [CrossRef]

- Lomas, J.R.S. Incorporating Affordability Concerns Within Cost-Effectiveness Analysis for Health Technology Assessment. Value Health 2019, 22, 898–905. [Google Scholar] [CrossRef]

- Sendi, P.P.; Briggs, A.H. Affordability and cost-effectiveness: Decision-making on the cost-effectiveness plane. Health Econ. 2001, 10, 675–680. [Google Scholar] [CrossRef] [PubMed]

- Kroll, Y.; Levy, H.; Markowitz, H.M. Mean-Variance Versus Direct Utility Maximization. J. Financ. 1984, 39, 47–61. [Google Scholar] [CrossRef]

- Baron, D.P. On the Utility Theoretic Foundations of Mean-Variance Analysis. J. Financ. 1977, 32, 1683–1697. [Google Scholar] [CrossRef]

- Krucien, N.; Pelletier-Fleury, N.; Gafni, A. Measuring Public Preferences for Health Outcomes and Expenditures in a Context of Healthcare Resource Re-Allocation. Pharmacoeconomics 2019, 37, 407–417. [Google Scholar] [CrossRef]

- Krucien, N.; Heidenreich, S.; Gafni, A.; Pelletier-Fleury, N. Measuring public preferences in France for potential consequences stemming from re-allocation of healthcare resources. Soc. Sci. Med. 2020, 246, 112775. [Google Scholar] [CrossRef] [PubMed]

| Programs | Costs (C) (In USD 1000) | Effects (E) (In Life Years) | ΔC (In USD 1000) | ΔE (In Life Years) |

|---|---|---|---|---|

| Program A | 100,000 | 150 | 60,000 | 60 |

| Program a | 40,000 | 90 | ||

| Program B | 140,000 | 50 | 70,000 | 20 |

| Program b | 70,000 | 30 |

| Scenario | Programs | Mean Costs (In USD 1000) | SD of Costs (In USD 1000) | Mean Effects (In Life Years) | SD of Effects (In Life Years) |

|---|---|---|---|---|---|

| Sc. 1 | Program A | 100,000 | 5000 | 150 | 5 |

| Program a | 40,000 | 13,000 | 90 | 13 | |

| Program B | 140,000 | 13,000 | 50 | 13 | |

| Program b | 70,000 | 5000 | 30 | 5 | |

| Sc. 2 | Program A | 100,000 | 13,000 | 150 | 13 |

| Program a | 40,000 | 5000 | 90 | 5 | |

| Program B | 140,000 | 5000 | 50 | 5 | |

| Program b | 70,000 | 13,000 | 30 | 13 |

| Portfolio Costs and Effects | Variance-Decreasing Scenario 1 | Variance-Increasing Scenario 2 |

|---|---|---|

| Costs (A + b) | 0.028 | 0.074 |

| Effects (A + b) | 0.026 | 0.070 |

| Costs (a + B) | 0.069 | 0.027 |

| Effects (a + B) | 0.089 | 0.034 |

| Quadrant | Loss | Gain |

|---|---|---|

| SE (I) | fSE = 0 | gSE= |y|α2β1 + |x|α1β1 |

| SW (II) | fSW = |x|α1β2 | gSE = |y|α2β1 |

| NW (III) | fNW= |y|α2β2 + |x|α1β2 | gNW = 0 |

| NE (IV) | fNE = |y|α2β2 | gNE = |x|α1β1 |

| Exponent | Scenario 1 Decreasing Uncertainty | Scenario 2 Increasing Uncertainty | ||

|---|---|---|---|---|

| Net Gain | Net Loss | Net Gain | Net Loss | |

| β1 = β2 = 1 | 23.99 | 0.82 | 23.96 | 0.84 |

| β1 = 0.9, β2 = 1.1 | 17.50 | 1.03 | ||

| β1 = 1.1, β2 = 0.9 | 33.04 | 0.69 | ||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sendi, P.; Gafni, A.; Birch, S.; Walter, S.D. Incorporating Portfolio Uncertainty in Decision Rules for Healthcare Resource Allocation. Healthcare 2021, 9, 325. https://doi.org/10.3390/healthcare9030325

Sendi P, Gafni A, Birch S, Walter SD. Incorporating Portfolio Uncertainty in Decision Rules for Healthcare Resource Allocation. Healthcare. 2021; 9(3):325. https://doi.org/10.3390/healthcare9030325

Chicago/Turabian StyleSendi, Pedram, Amiram Gafni, Stephen Birch, and Stephen D. Walter. 2021. "Incorporating Portfolio Uncertainty in Decision Rules for Healthcare Resource Allocation" Healthcare 9, no. 3: 325. https://doi.org/10.3390/healthcare9030325

APA StyleSendi, P., Gafni, A., Birch, S., & Walter, S. D. (2021). Incorporating Portfolio Uncertainty in Decision Rules for Healthcare Resource Allocation. Healthcare, 9(3), 325. https://doi.org/10.3390/healthcare9030325