Transfer of Risk in Supply Chain Management with Joint Pricing and Inventory Decision Considering Shortages

Abstract

1. Introduction

2. Literature Review

3. Model Description and Preliminaries

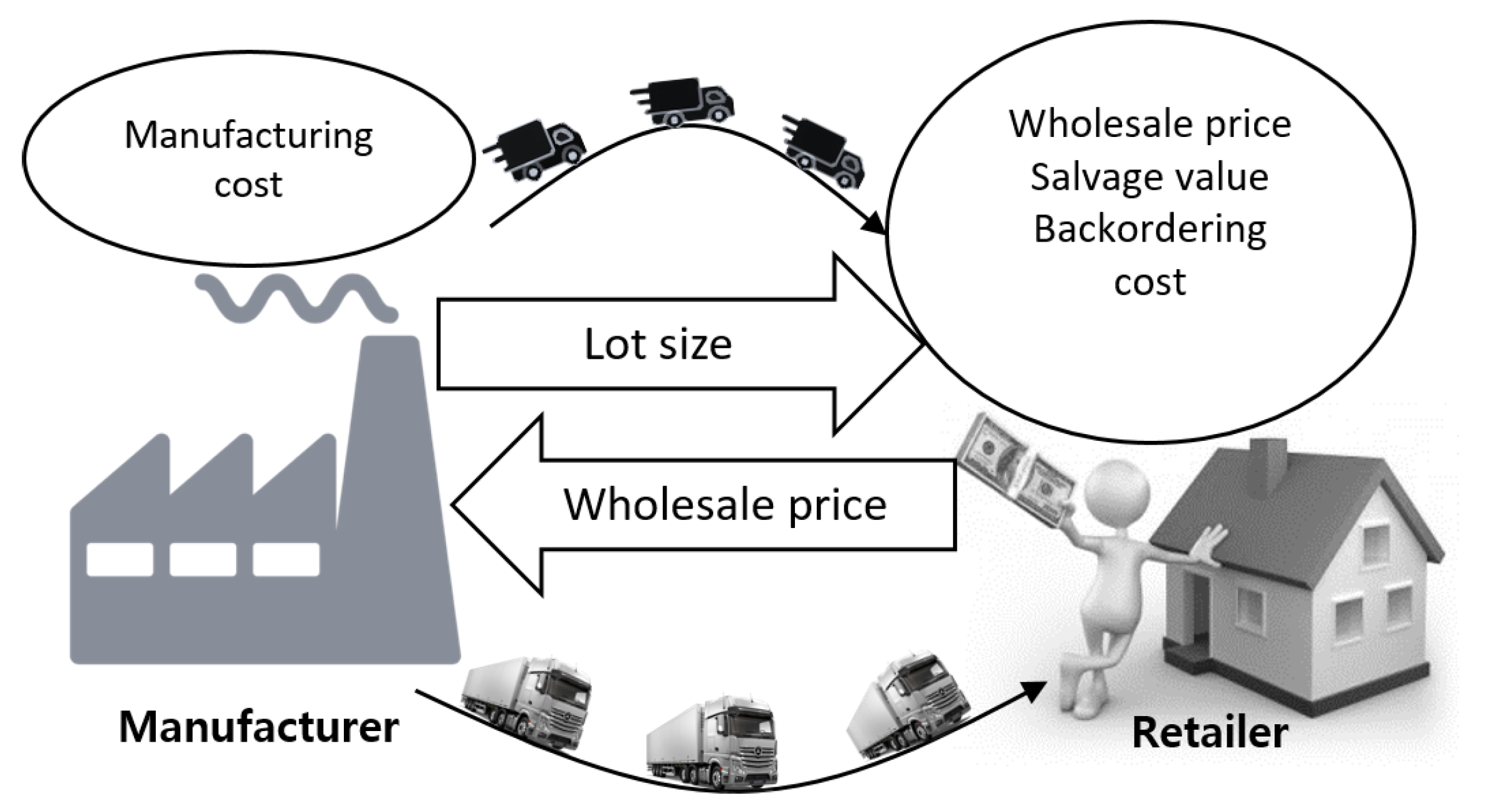

3.1. Problem Definition

3.2. Assumptions

- A single-period newsvendor model is considered with a single product. The product is assumed to be a seasonal or fashionable product.

- A newsvendor model is considered. The fixed manufacturing cost M is incurred by the manufacturer and they decide the wholesale price W. The exogenous price R is faced by the retailer, who determines the ordered quantity Q. The remaining items during the season are salvaged at a constant vale S.

- In the traditional newsboy model, random demand D is faced by the retailer, who orders a specific quantity from the manufacturer. To earn a profit, they expect to sell all products.

- In the transfer of risk model, the retailer can select a contract that permits them to buy a product at a certain time in the future. Each contract price for the retailer is c. The retailer has the right to purchase a single item at a fixed price of t, which is not essential. A contract is selected before the selling season starts.

- Stochastic demand is considered without any specific probability distribution. Demand distribution underlies a class of probability distributions function. The only available data is the mean and variance of demand.

- Shortages are allowed in this model and can be fulfilled with a back-ordering price that is high compare to the wholesale price.

4. Mathematical Model

4.1. The Emergency Back-Ordering Options

4.2. Traditional Newsvendor Model

4.3. Transfer of Risk

4.3.1. Retailers Model

4.3.2. Manufacturer Model

4.3.3. Centralized Supply Chain Model

4.4. Supply Chain Analysis

4.5. Optimal Policies

4.5.1. Decentralized Supply Chain (Stackelberg Approach)

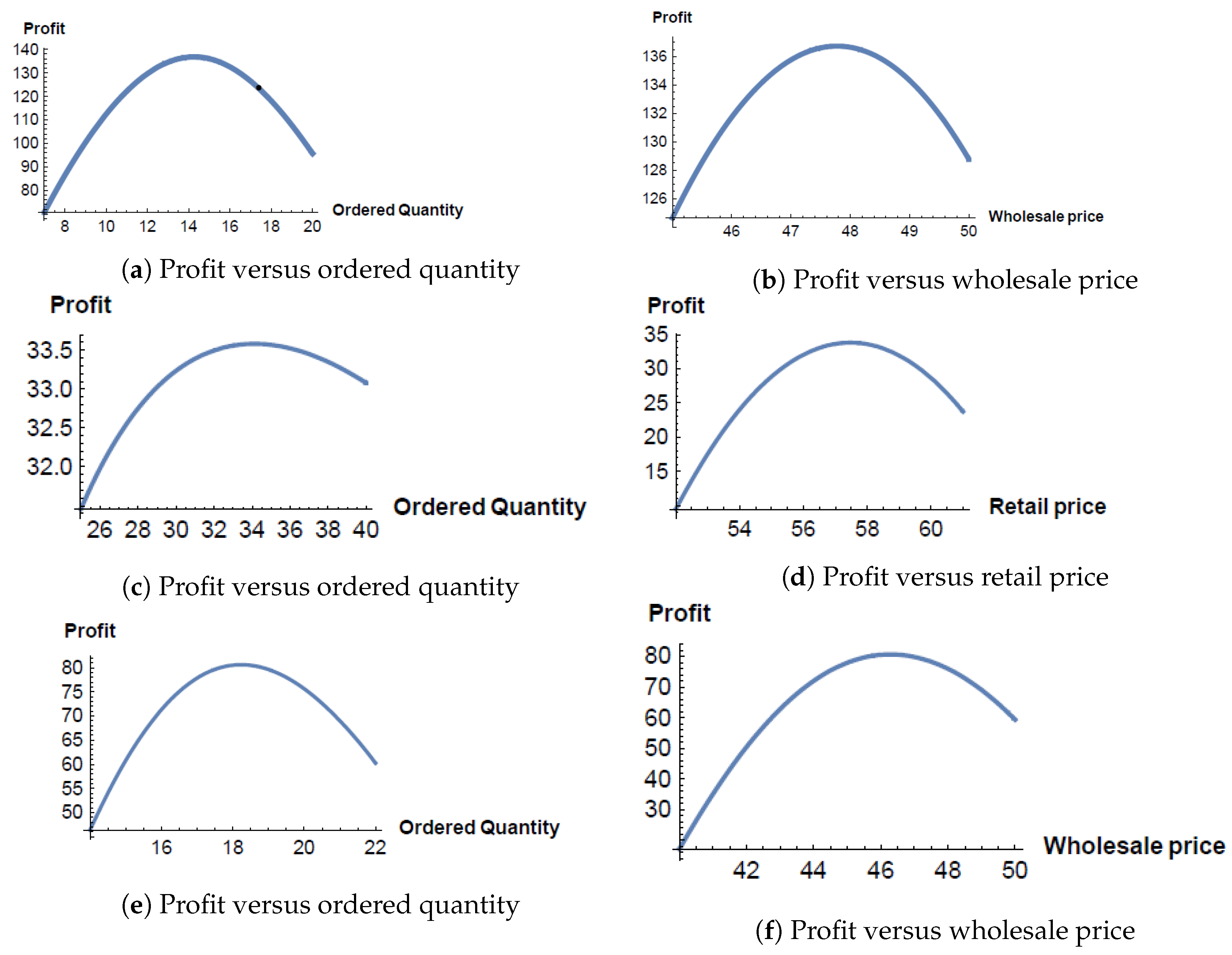

Case 1

Case 2

5. Numerical Experiment

Sensitivity Analysis

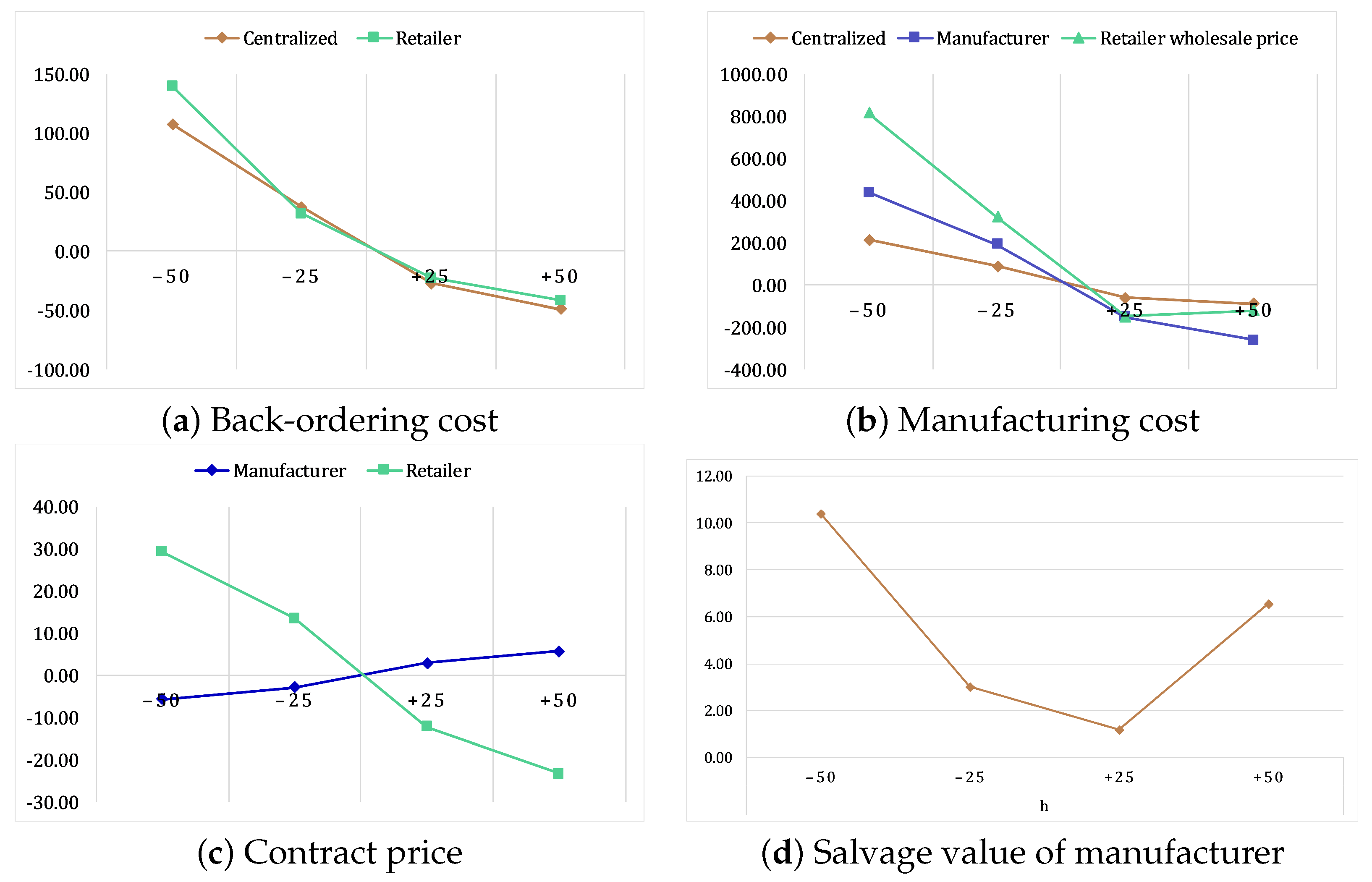

- Among all key parameters, manufacturing cost possesses a significant influence over the manufacturer and the centralized supply chain profitability. If the manufacturing cost is reduced by 50%, the increase in profit is 440%; respectively, if manufacturing cost is increased by 50%, profit is reduced by up to 260% for the manufacturer. In a centralized supply chain, the 50% cost reduction increases profit by 215%. If the same amount is increased, profit is reduced by up to 90%. Thus, a negligible reduction in the manufacturing cost has more impact over an increase. Therefore, a manager must concentrate on manufacturing cost reduction by all means to maximize system profit.

- For a retailer, the most sensitive parameter is wholesale price. If the wholesale price is reduced by 50%, profit is increased by up to 820%. If the wholesale price is increased by 50%, profit is reduced up to 118%.

- The unit contract price possesses a symmetrical effect over the profit of the manufacturer. There is almost a symmetrical effect for retailer profit when the contract price is varied in the range of 50%.

- A 50% decrease in back-ordering cost for a centralized system increases profit by up to 107%. A 50% increase counts for a 49% reduction in the overall profit of the system. The results are alike for the decentralized system, if the retailer back-ordering cost is reduced by 50%, profit increases by 140%. If cost is increased by the same amount, the profit shrinks by 41%.

- The salvage value is the least effective parameter among all other parameters for the manufacturer, a 50% cost reduction increases profit by 10%. A 50% increase counts for a 6% increase in profit.

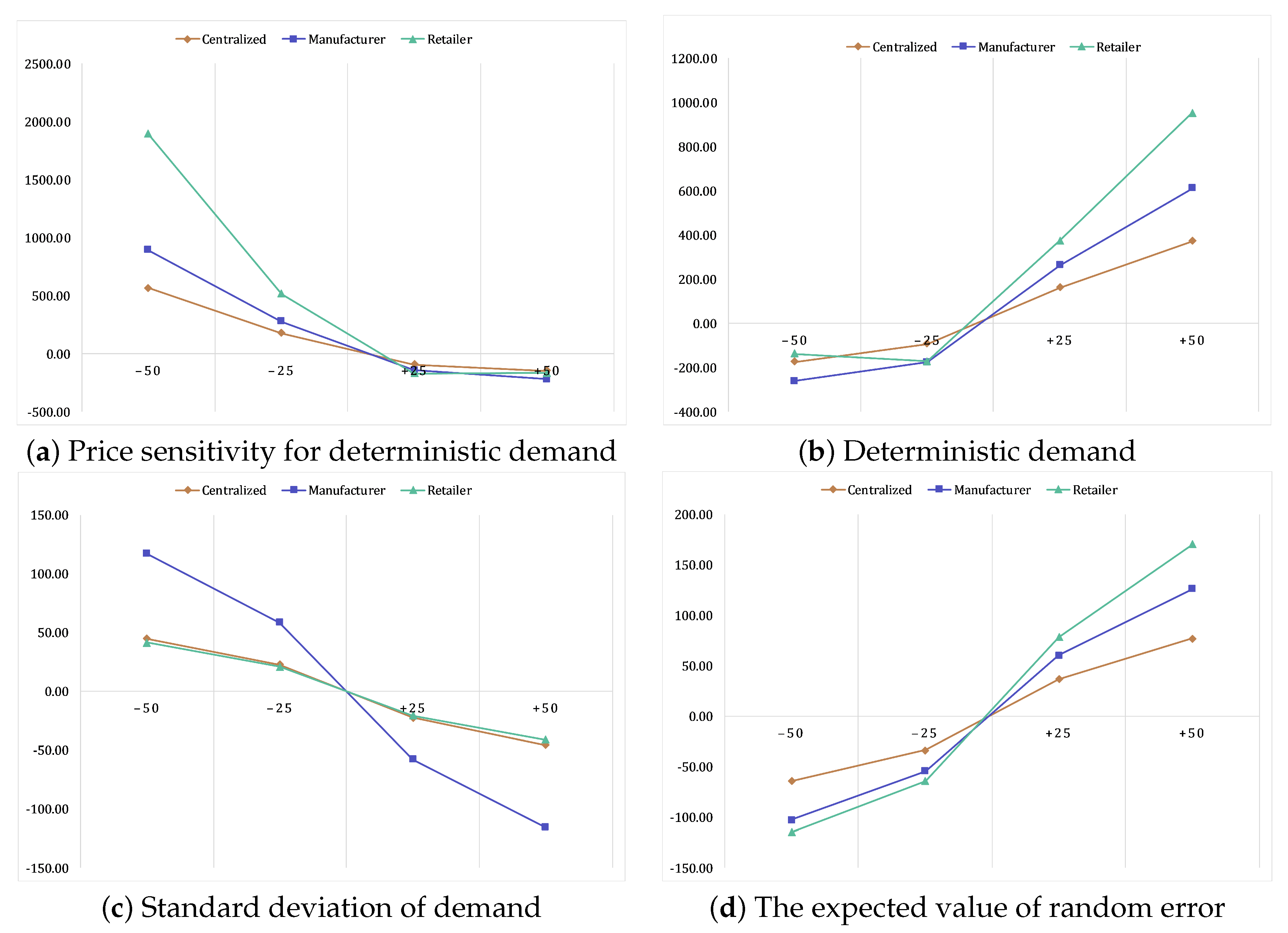

- The expected value of random error for demand possesses a symmetrical impact on the centralized, manufacturer, and retailer profit percentages.

- The retailer is the most sensitive among all, a 50% decrease accounts for 114% reduction, and a 50% increase accounts for a 170% rise in profit. For the manufacturer, a 50% decrease leads to a 102% reduction in the profit. A 50% increase raises profit by 126%. In the centralized case, profit is reduced by 64% with a reduction in the random error of demand and increases by 77% with the rise of random error in demand.

- The standard deviation of demand has a perfectly symmetrical effect in all the cases when the variation is made between positive 50% and negative 50% on the profit of the centralized and decentralized system.The variation in market share is a very sensitive parameter. It is highly sensitive in the manufacturer case, where a 50% reduction accounts for a 261% reduction in the total profit, and a 50% increase enhances profit by 611%. For the retailer, a 50% decrease results in a 137% reduction in profit, and a 50% increase raises profit by 952%. Similarly, for the centralized system, a 50% decrease accumulates a 174% reduction in profit, and a 50% increase shows a 362% rise in profit.

- The price sensitivity for cumulative deterministic demand is the most sensitive demand parameter. Retailer profit is greatly affected by this parameter a 50% reduction counts for an 1895% increase in profit. A 50% increase decreases profit by 165%, which means the reduction is highly sensitive to the negligible change. For a manufacturer, a 50% rise accumulates for an 895% increase in profit, and a 50% increase reduces profit by 218%. For the centralized system, a 50% decrease generates 565% more profit compared to a 50% increase, which reduces profit by 145%.

6. Managerial Insights

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Notation

| W | Wholesale price ($/unit) |

| D | Price dependent stochastic demand (units) |

| M | Fixed manufacturing cost ($/unit) |

| R | Retail price ($/unit) |

| Q | Order quantity (units) |

| P | Centralized supply chain price ($/units) |

| h | Salvage value ($/unit) |

| r | Price of one contract |

| t | Unit price in transfer of risk model ($/unit) |

| β | Back-order rate |

| y | Maximum perceived cumulative deterministic demand or riskless demand—i.e., market share (units/unit time) |

| X | Random error in demand |

| bi | Back-order cost associated with the emergency replenishment option ($/unit) |

| a(t) | Price-dependent deterministic demand during the season for decentralized supply chain (units) |

| a(P) | Price-dependent deterministic demand during the season for centralized supply chain (units) |

| l | A lost sale cost that can be estimated financially ($/unit) |

| Πr | Expected profit of retailer ($) |

| Πm | Expected profit of manufacturer ($) |

| Πchain | Expected profit of supply chain ($) |

| z | Cumulative deterministic demand price sensitivity |

References

- Khouja, M. The single-period (news-vendor) problem: Literature review and suggestions for future research. Omega 1999, 27, 537–553. [Google Scholar] [CrossRef]

- Dai, J.; Meng, W. A risk-averse newsvendor model under marketing-dependency and price-dependency. Int. J. Prod. Econ. 2015, 160, 220–229. [Google Scholar] [CrossRef]

- Rosenfield, D.B. Optimal management of tax-sheltered employee reimbursement programs. Interfaces 1986, 16, 68–72. [Google Scholar] [CrossRef][Green Version]

- Eeckhoudt, L.; Gollier, C.; Schlesinger, H. The risk-averse (and prudent) newsboy. Manag. Sci. 1995, 41, 786–794. [Google Scholar] [CrossRef]

- Edgeworth, F.Y. The mathematical theory of banking. J. R. Stat. Soc. 1888, 51, 113–127. [Google Scholar]

- Arrow, K.J.; Harris, T.; Marschak, J. Optimal inventory policy. Econom. J. Econom. Soc. 1951, 19, 250–272. [Google Scholar] [CrossRef]

- Petruzzi, N.C.; Dada, M. Pricing and the newsvendor problem: A review with extensions. Oper. Res. 1999, 47, 183–194. [Google Scholar] [CrossRef]

- Sarkar, B.; Zhang, C.; Majumder, A.; Sarkar, M.; Seo, Y.W. A distribution free newsvendor model with consignment policy and retailer’s royalty reduction. Int. J. Prod. Res. 2018, 56, 5025–5044. [Google Scholar] [CrossRef]

- He, H.; Wang, S. Cost-benefit associations in consumer inventory problem with uncertain benefit. J. Retail. Consum. Serv. 2019, 51, 271–284. [Google Scholar] [CrossRef]

- Sana, S.S. Price competition between green and non green products under corporate social responsible firm. J. Retail. Consum. Serv. 2020, 55, 102118. [Google Scholar] [CrossRef]

- Scarf, H. A min-max solution of an inventory problem. In Studies in the Mathematical Theory of Inventory and Production; Stanford University Press: Palo Alto, CA, USA, 1958. [Google Scholar]

- Gallego, G.; Moon, I. The distribution free newsboy problem: Review and extensions. J. Oper. Res. Soc. 1993, 44, 825–834. [Google Scholar] [CrossRef]

- Govindarajan, A.; Sinha, A.; Uichanco, J. Distribution-Free Inventory Risk Pooling in a Multilocation Newsvendor. Manag. Sci. 2020. [Google Scholar] [CrossRef]

- Moon, I.; Choi, S. The distribution free continuous review inventory system with a service level constraint. Comput. Ind. Eng. 1994, 27, 209–212. [Google Scholar] [CrossRef]

- Liao, Y.; Banerjee, A.; Yan, C. A distribution-free newsvendor model with balking and lost sales penalty. Int. J. Prod. Econ. 2011, 133, 224–227. [Google Scholar] [CrossRef]

- Raza, S.A. A distribution free approach to newsvendor problem with pricing. 4OR 2014, 12, 335–358. [Google Scholar] [CrossRef]

- Sarkar, B.; Chaudhuri, K.; Moon, I. Manufacturing setup cost reduction and quality improvement for the distribution free continuous-review inventory model with a service level constraint. J. Manuf. Syst. 2015, 34, 74–82. [Google Scholar] [CrossRef]

- Moon, I.; Yoo, D.K.; Saha, S. The distribution-free newsboy problem with multiple discounts and upgrades. Math. Probl. Eng. 2016, 2016, 2017253. [Google Scholar] [CrossRef]

- Castellano, D.; Gallo, M.; Santillo, L.C. A periodic review policy for a coordinated single vendor-multiple buyers supply chain with controllable lead time and distribution-free approach. 4OR 2020, 1–42. [Google Scholar] [CrossRef]

- Guchhait, R.; Pareek, S.; Sarkar, B. How Does a Radio Frequency Identification Optimize the Profit in an Unreliable Supply Chain Management? Mathematics 2019, 7, 490. [Google Scholar] [CrossRef]

- Xu, X.; Wang, H.; Dang, C.; Ji, P. The loss-averse newsvendor model with backordering. Int. J. Prod. Econ. 2017, 188, 1–10. [Google Scholar] [CrossRef]

- Khan, I.; Jemai, J.; Lim, H.; Sarkar, B. Effect of electrical energy on the manufacturing setup cost reduction, transportation discounts, and process quality improvement in a two-echelon supply chain management under a service-level constraint. Energies 2019, 12, 3733. [Google Scholar] [CrossRef]

- Sarkar, B.; Dey, B.K.; Pareek, S.; Sarkar, M. A single-stage cleaner production system with random defective rate and remanufacturing. Comput. Ind. Eng. 2020, 150, 106861. [Google Scholar] [CrossRef]

- Taleizadeh, A.A.; Shokr, I.; Konstantaras, I.; VafaeiNejad, M. Stock replenishment policies for a vendor-managed inventory in a retailing system. J. Retail. Consum. Serv. 2020, 55, 102137. [Google Scholar] [CrossRef]

- Kouvelis, P.; Zhao, W. The newsvendor problem and price-only contract when bankruptcy costs exist. Prod. Oper. Manag. 2011, 20, 921–936. [Google Scholar] [CrossRef]

- Ghosh, D.; Shah, J. A comparative analysis of greening policies across supply chain structures. Int. J. Prod. Econ. 2012, 135, 568–583. [Google Scholar] [CrossRef]

- Guchhait, R.; Pareek, S.; Sarkar, B. Application of distribution-free approach in integrated and dual-channel supply chain under buyback contract. In Handbook of Research on Promoting Business Process Improvement Through Inventory Control Techniques; IGI Global: Pennsylvania, PA, USA, 2018; pp. 388–426. [Google Scholar]

- Hovelaque, V.; Viviani, J.L.; Ait Mansour, M. Trade and bank credit in a non-cooperative chain with a price-sensitive demand. Int. J. Prod. Res. 2021, 1–16. [Google Scholar] [CrossRef]

- Wu, C.; Liu, X.; Li, A. A loss-averse retailer–supplier supply chain model under trade credit in a supplier-Stackelberg game. Math. Comput. Simul. 2021, 182, 353–365. [Google Scholar] [CrossRef]

- Yadav, R.; Pareek, S.; Mittal, M. Stackelberg models in two-level supply chain with imperfect quality items with allowable shortages. Sci. Iran. 2021. [Google Scholar] [CrossRef]

- Fan, Y.; Feng, Y.; Shou, Y. A risk-averse and buyer-led supply chain under option contract: CVaR minimization and channel coordination. Int. J. Prod. Econ. 2020, 219, 66–81. [Google Scholar] [CrossRef]

- Afshar-Nadjafi, B. The influence of sale announcement on the optimal policy of an inventory system with perishable items. J. Retail. Consum. Serv. 2016, 31, 239–245. [Google Scholar] [CrossRef]

- Olbrich, R.; Jansen, H.C.; Hundt, M. Effects of pricing strategies and product quality on private label and national brand performance. J. Retail. Consum. Serv. 2017, 34, 294–301. [Google Scholar] [CrossRef]

- He, R.; Lu, Y. A Robust Price-Setting Newsvendor Problem. Prod. Oper. Manag. 2021, 30, 276–292. [Google Scholar] [CrossRef]

- He, X.; Khouja, M. Pareto analysis of supply chain contracts under satisficing objectives. Eur. J. Oper. Res. 2011, 214, 53–66. [Google Scholar] [CrossRef]

- Kim, J.S.; Jeong, W.C. A model for buyer and supplier coordination and information sharing in order-up-to systems. J. Ind. Manag. Optim. 2012, 8, 987. [Google Scholar]

- Sarkar, B.; Dey, B.K.; Sarkar, M.; Hur, S.; Mandal, B.; Dhaka, V. Optimal replenishment decision for retailers with variable demand for deteriorating products under a trade-credit policy. RAIRO-Oper. Res. 2020, 54, 1685–1701. [Google Scholar] [CrossRef]

- Jörnsten, K.; Nonås, S.L.; Sandal, L.; Ubøe, J. Mixed contracts for the newsvendor problem with real options and discrete demand. Omega 2013, 41, 809–819. [Google Scholar] [CrossRef]

- Park, J.H.; Kim, J.S.; Shin, K.Y. Inventory control model for a supply chain system with multiple types of items and minimum order size requirements. Int. Trans. Oper. Res. 2018, 25, 1927–1946. [Google Scholar] [CrossRef]

- Sarkar, B.; Dey, B.K.; Sarkar, M.; AlArjani, A. A Sustainable Online-to-Offline (O2O) Retailing Strategy for a Supply Chain Management under Controllable Lead Time and Variable Demand. Sustainability 2021, 13, 1756. [Google Scholar] [CrossRef]

- Noh, J.S.; Kim, J.S.; Sarkar, B. Stochastic joint replenishment problem with quantity discounts and minimum order constraints. Oper. Res. 2019, 19, 151–178. [Google Scholar] [CrossRef]

- Maihami, R.; Ghelehkhondabi, I.; Ahmadi, E. Pricing and Inventory Planning for Non-Instantaneous Deteriorating Products with Greening Investment: A Case Study in Beef Industry. J. Clean. Prod. 2021, 295, 126368. [Google Scholar] [CrossRef]

- Lodree, E.J., Jr.; Kim, Y.; Jang, W. Time and quantity dependent waiting costs in a newsvendor problem with backlogged shortages. Math. Comput. Model. 2008, 47, 60–71. [Google Scholar] [CrossRef]

- Lee, H.; Lodree, E.J., Jr. Modeling customer impatience in a newsboy problem with time-sensitive shortages. Eur. J. Oper. Res. 2010, 205, 595–603. [Google Scholar] [CrossRef]

- Lee, C.M.; Hsu, S.L. The effect of advertising on the distribution-free newsboy problem. Int. J. Prod. Econ. 2011, 129, 217–224. [Google Scholar] [CrossRef]

- Jörnsten, K.; Nonås, S.L.; Sandal, L.; Ubøe, J. Transfer of risk in the newsvendor model with discrete demand. Omega 2012, 40, 404–414. [Google Scholar] [CrossRef]

- Brito, A.J.; de Almeida, A.T. Modeling a multi-attribute utility newsvendor with partial backlogging. Eur. J. Oper. Res. 2012, 220, 820–830. [Google Scholar] [CrossRef]

- Andersson, J.; Jörnsten, K.; Nonås, S.L.; Sandal, L.; Ubøe, J. A maximum entropy approach to the newsvendor problem with partial information. Eur. J. Oper. Res. 2013, 228, 190–200. [Google Scholar] [CrossRef]

- Pando, V.; San-José, L.A.; García-Laguna, J.; Sicilia, J. A newsboy problem with an emergency order under a general backorder rate function. Omega 2013, 41, 1020–1028. [Google Scholar] [CrossRef]

- Kwon, K.; Cheong, T. A minimax distribution-free procedure for a newsvendor problem with free shipping. Eur. J. Oper. Res. 2014, 232, 234–240. [Google Scholar] [CrossRef]

- Ahmed, M.T.; Kwon, C. Optimal contract-sizing in online display advertising for publishers with regret considerations. Omega 2014, 42, 201–212. [Google Scholar] [CrossRef]

- Pando, V.; San-José, L.; García-Laguna, J.; Sicilia, J. Some general properties for the newsboy problem with an extraordinary order. Top 2014, 22, 674–693. [Google Scholar] [CrossRef]

- Pal, B.; Sana, S.S.; Chaudhuri, K. A distribution-free newsvendor problem with nonlinear holding cost. Int. J. Syst. Sci. 2015, 46, 1269–1277. [Google Scholar] [CrossRef]

- Ma, L.; Xue, W.; Zhao, Y.; Zeng, Q. Loss-averse newsvendor problem with supply risk. J. Oper. Res. Soc. 2016, 67, 214–228. [Google Scholar] [CrossRef]

- Shi, J.; Du, Q.; Lin, F.; Li, Y.; Bai, L.; Fung, R.Y.; Lai, K.K. Coordinating the supply chain finance system with buyback contract: A capital-constrained newsvendor problem. Comput. Ind. Eng. 2020, 146, 106587. [Google Scholar] [CrossRef]

- Bi, C.; Zhang, B.; Yang, F.; Wang, Y.; Bi, G. Selling to the Newsvendor through Debt-Shared Bank Financing. Eur. J. Oper. Res. 2021. [Google Scholar] [CrossRef]

- Lodree, E.J., Jr. Advanced supply chain planning with mixtures of backorders, lost sales, and lost contract. Eur. J. Oper. Res. 2007, 181, 168–183. [Google Scholar] [CrossRef]

- Ullah, M.; Khan, I.; Sarkar, B. Dynamic Pricing in a Multi-Period Newsvendor Under Stochastic Price-Dependent Demand. Mathematics 2019, 7, 520. [Google Scholar] [CrossRef]

| Author(s) | Newsvendor | Back-Order | Transfer of Risk | Distribution-Free Approach | Stackelberg Game |

|---|---|---|---|---|---|

| Lodree, Jr. et al. [43] | √ | √ | |||

| Lee and Lodree, Jr. [44] | √ | √ | |||

| Lee and Hsu [45] | √ | √ | |||

| Jörnsten et al. [46] | √ | √ | √ | ||

| Brito and de Almeida [47] | √ | √ | |||

| Andersson et al. [48] | √ | √ | |||

| Jörnsten et al. [38] | √ | √ | √ | ||

| Pando et al. [49] | √ | √ | |||

| Kwon and Cheong [50] | √ | √ | |||

| Ahmed and Kwon [51] | √ | √ | |||

| Pando et al. [52] | √ | √ | |||

| Pal et al. [53] | √ | √ | √ | ||

| Ma et al. [54] | √ | ||||

| Xu et al. [21] | √ | √ | |||

| Sarkar et al. [8] | √ | √ | |||

| Castellano et al. [19] | √ | √ | |||

| Shi et al. [55] | √ | √ | √ | ||

| Govindarajan et al. [13] | √ | √ | |||

| Fan et al. [31] | √ | √ | √ | ||

| Wu et al. [29] | √ | √ | |||

| Bi et al. [56] | √ | √ | |||

| This paper | √ | √ | √ | √ | √ |

| Option | ||

|---|---|---|

| 0.95 | 40 | |

| 0.70 | 43 | |

| 0.60 | 47 | |

| 0.50 | 51 | |

| 0.40 | 55 | |

| 0.30 | 60 | |

| 0.25 | 65 |

| Options | Q | P | |

|---|---|---|---|

| 14 | 47.73 | 145.95 | |

| 14 | 47.85 | 139.51 | |

| 15 | 47.90 | 127.72 | |

| 15 | 47.97 | 116.12 | |

| 16 | 48.01 | 104.78 | |

| 16 | 48.05 | 90.97 | |

| 17 | 48.07 | 77.77 |

| Stackelberg | Leader | Follower | Price $/Units | Quantity Units | $ | $ | Total Profit $ |

|---|---|---|---|---|---|---|---|

| Case I | Manufacturer | Retailer | 42.97 | 34 | 24.66 | 33.89 | 58.55 |

| Case II | Retailer | Manufacturer | 58 | 18 | 80.61 | 25.6 | 106.21 |

| Parameter | Percent Change | Centralized | Manufacturer | Retailer |

|---|---|---|---|---|

| Percent Change in Profit | Percent Variation in Profit | Percent Variation in Profit | ||

| −50 | −64.09 | −102.50 | −114.68 | |

| −25 | −33.70 | −54.25 | −64.26 | |

| +25 | +36.98 | +60.25 | +78.51 | |

| +50 | +77.23 | +126.48 | +170.86 | |

| −50 | +44.74 | +116.92 | +41.35 | |

| −25 | +22.51 | +58.30 | +20.62 | |

| +25 | −22.77 | −57.98 | −20.66 | |

| +50 | −45.80 | −115.63 | −41.35 | |

| y | −50 | −174.09 | −261.51 | −137.59 |

| −25 | −93.74 | −174.81 | −170.69 | |

| +25 | +161.54 | +262.20 | +374.50 | |

| +50 | +372.32 | +611.36 | +952.82 | |

| z | −50 | +564.25 | +894.45 | +1894.94 |

| −25 | +177.37 | +277.07 | +514.75 | |

| +25 | −93.55 | −142.41 | −168.59 | |

| +50 | −145.09 | −218.11 | −164.13 |

| Centralized | ||

|---|---|---|

| Percent Change in Value | Parameter | Percent Change in Profit |

| −50 | M | +215.14 |

| −25 | +89.93 | |

| +25 | −59.97 | |

| +50 | −89.21 | |

| −50 | b | +107.50 |

| −25 | +37.59 | |

| +25 | −26.90 | |

| +50 | −48.84 |

| Manufacturer | Retailer | |||

|---|---|---|---|---|

| Percent Change in Value | Parameter | Percent Change in Profit | Parameter | Percent Change in Profit |

| −50 | M | +440.14 | W | +817.63 |

| −25 | +191.94 | +322.01 | ||

| +25 | −149.43 | −147.13 | ||

| +50 | −260.52 | −118.67 | ||

| −50 | S | +10.38 | b | +140.15 |

| −25 | +3.00 | +32.24 | ||

| +25 | +1.17 | −22.56 | ||

| +50 | +6.54 | −41.27 | ||

| −50 | c | −5.63 | c | +29.18 |

| −25 | −2.82 | +13.53 | ||

| +25 | +2.83 | −12.17 | ||

| +50 | +5.68 | −23.37 | ||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Khan, I.; Sarkar, B. Transfer of Risk in Supply Chain Management with Joint Pricing and Inventory Decision Considering Shortages. Mathematics 2021, 9, 638. https://doi.org/10.3390/math9060638

Khan I, Sarkar B. Transfer of Risk in Supply Chain Management with Joint Pricing and Inventory Decision Considering Shortages. Mathematics. 2021; 9(6):638. https://doi.org/10.3390/math9060638

Chicago/Turabian StyleKhan, Irfanullah, and Biswajit Sarkar. 2021. "Transfer of Risk in Supply Chain Management with Joint Pricing and Inventory Decision Considering Shortages" Mathematics 9, no. 6: 638. https://doi.org/10.3390/math9060638

APA StyleKhan, I., & Sarkar, B. (2021). Transfer of Risk in Supply Chain Management with Joint Pricing and Inventory Decision Considering Shortages. Mathematics, 9(6), 638. https://doi.org/10.3390/math9060638